To the greatest extent possible, we utilise evidence when considering risk factor premia, calculating expected returns, building model portfolios, and monitoring and reporting on fund and portfolio returns.

In the short term, investment markets rarely operate in a way that is consistent with long term averages or expectations. Constant media noise, unexpected events, macro-economic issues and geo-political risks all feed into short term investor sentiment and behaviour. And, when the raw investor emotions take over, they often have a disproportionate influence over short term decision making.

When uncertainties are mounting, investors are at greater risk of doing something they might regret if there is no evidence at the core of their investment strategy, or a qualified adviser to help guide them. As the oft-quoted saying goes “If you don’t know where you are going, any road will get you there” and, without evidence acting as a counterbalance to high emotion, investors sometimes decide that doing ‘something’ is justified.

Unfortunately, these are often the moments, in hindsight, that took investors away from their plan and further away from achieving their investment goals.

Over the long term, these uncomfortable moments all fade in importance and investors are left to consider the consequences of the road they ultimately chose to take. Evidence provides both the roadmap and the driving instructions that allow investors to make the best decisions they can in pursuit of their ultimate destination.

To help you keep your clients on track through these volatile times, the CIC continues to produce and deliver a wide range of materials for you to use and share with your clients.

This includes preparing articles and information for inclusion in quarterly client commentaries, quarterly returns analyses, adviser call presentations, enhanced due diligence reports, annually updating the approved products list and contributing to white papers and client focused investment articles.

There is always a focus on the depth of portfolio monitoring and review work that is undertaken by the committee on a quarterly basis. The 2022 CIC Yearbook captures this by including much of the detailed monitoring and enhanced due diligence reporting that was completed on your behalf throughout the year.

If you have clients, prospects or regulators wanting to verify exactly what monitoring and reporting functions were undertaken over the last 12 months on the portfolios you recommend, the CIC Yearbook is an excellent resource.

Our aim is for this CIC Yearbook to give you finger-tip access to the many ways we seek to support your efforts to deliver the highest quality investment advice.

We hope this fourth edition of the CIC Yearbook becomes a convenient resource for you to access this information and becomes a valuable addition to your office library.

An overview of Consilium Investment Committee primary functions, current members and schedule of responsibilities.

Regular portfolio benchmarking and monitoring materials, including portfolio returns vs benchmarking analysis, monitoring review, quarterly review, key market movements and economic commentary extract for the quarter.

Enhanced due diligence reports.

Investment related articles published during 2022.

An overview of Consilium Investment Committee primary functions, current members and schedule of responsibilities

Members of the Committee are appointed by the Consilium Executive Management Team for a period of 12 months and may be considered for re-election annually thereafter. The current members of the Consilium Investment Committee (CIC) are:

Damon is a CFA Charterholder with over 23 years’ experience in the wealth management industry, primarily specialising in asset allocation, investment research and portfolio management. His additional qualifications include completing a degree in Commerce from Canterbury University, a Post Graduate Diploma in Business Studies (in Personal Financial Planning)

Damon is a Chartered Financial Analyst (CFA® charterholder), a member of the New Zealand CFA Society and a member of the New Zealand Institute of Directors.

Professor Ben Marshall serves on the editorial board of a number of journals and has consulted to public and private companies in a range of different areas. He holds the MSA Charitable Trust Chair in Finance at Massey University.

Professor Marshall has undertaken research in areas such as the impact of climate on financial markets, factors that influence stock returns, quantitative approaches to portfolio management, transaction cost and illiquidity measurement, and exchange traded funds.

His research has been published in leading international journals and he is a regular speaker at international finance conferences. Professor Marshall is currently ranked in the top 1% of authors based on downloads of his working papers. Professor Marshall has a particular focus on governance, analytical support and policy review.

Mitchell is a CFA Charterholder with over 15 years’ experience as a senior quantitativeanalyst and risk manager for two fund of hedge fund businesses in Hong Kong.

Mitchell has primary responsibility in areas of investment analysis, performance monitoring, supplementary fund due diligence, asset allocation and research.

Mitchell holds a Bachelor of Science (majoring in Statistics) and a Bachelor of Commerce (majoring in Management Science) from the University of Canterbury.

Lydia has been working for Consilium for over 5 years with the primary focus of her role including monitoring the model portfolio’s performance, risk and attribution, and assisting with strategic asset allocation and RFP.

Before working at Consilium, Lydia was in the managerial roles in products and services firms. In this role, Lydia was involved product development, planning, decision making and communication with internal and external sources.

Lydia has a Bachelor of Commerce majoring in Operations Research and a Master’s degree in Applied Finance and Economics from the University of Canterbury. Lydia is a candidate in the CFA® program and is bound by the CFA Institute’s Code of Ethics and Standards of Professional Conduct.

Ben is Head of Advice and has been with Consilium since the foundation of the business. Ben is responsible for Consilium Partner Services and business development, and sits on the Consilium Investment Committee.

Ben is an Accredited Investment Fiduciary (AIF) and has a degree in both History and Economics from the University of California. In 2010, he passed the United States Certified Financial Planner exam.

Ben has over 20 years’ experience in financial services, undertaking roles such as economist for the Qatar Economic Free Zones as well as senior executive roles within a large US financial advisory firm

The following table summarises the current responsibilities of the Consilium Investment Committee (CIC):

Performance monitoring

Quarterly governance

Communication/ record keeping

Research and process oversight

KiwiSaver review

Peer group review

Approved products list

Provide quarterly review of performance of each CIC approved asset and conduct further investigation as required

Independent oversight of quarterly review commentary and actions

Maintain records of all decisions and communicate to internal stakeholders or partner firms

Process enhancement recommendations and independent review of all research projects undertaken by the CIC to ensure consistency with stated policy and procedures

Annual review of recommended KiwiSaver providers in line with CIC philosophy

Annual review of Consilium Portfolios performance relative to KiwiSaver peer group

Annual update of list of Investment products approved for investment by CIC

Mid cycle SAA review Expected return update CIC portfolios

Manager review Qualitative review of investment managers and pricing

Strategic asset allocation (SAA) Review SAA every 3 years

Quarterly

Quarterly

Ongoing

Ongoing

Sep 2023

Dec 2023

Dec 2023

Dec 2024

Jun 2025

Dec 2025

Regular portfolio benchmarking and monitoring materials, including portfolio returns vs benchmarking analysis, monitoring review, quarterly review, economic commentary extract, and key market movements.

2022, Q1 (Jan 2022 – Mar 2022)

2022, Q2 (Apr 2022 – Jun 2022)

2022, Q3 (Jul 2022 – Sept 2022)

2022, Q4 (Oct 2022 – Dec 2022)

January – March 2022

P1 Market commentary

P4 Key market movements for the quarter

P7 Inflation is here, that’s why you own shares.

Headlines were dominated by the horrific war in Ukraine and the terrible humanitarian crisis continuing to unfold there. In pursuing this conflict, Vladimir Putin has surely etched his name amongst history’s most reviled.

The grave implications of the Ukraine conflict quickly fed through into increasingly volatile financial markets, with share markets declining and bond prices also generally falling over the quarter.

On the other hand, commodity prices soared. Russia is a key producer of several important commodities including oil and gas. Ukraine is an agricultural powerhouse and a significant global exporter of wheat, corn and sunflower oil. With the conflict impacting supplies from both countries, this magnified existing supply chain disruptions and added further unwanted impetus to surging global inflation.

Elsewhere, the Chinese market was negatively affected by renewed Covid-19 outbreaks in the region, leading to new lockdowns in several major Chinese cities.

Market turbulence, as unpleasant as it is, will eventually ease. In fact, to the extent that lower share prices now imply a higher expected return for owning shares, current market prices could eventually be regarded as a buying signal for longer-term investors.

Whatever the markets may have in store for us in the coming months, heightened market volatility looks set to continue for some time to come.

While it was undoubtedly a tough period for investors, this financial turbulence paled in significance when compared to the devastation and heartbreak being experienced by the Ukraine people, and by their friends, families and loved ones around the world.

Inflation has risen sharply over recent months and what was initially projected to be a transitory phenomenon has become much more widespread and persistent. Disturbingly, there are even signs that the recent acceleration in rising prices is increasingly being seen as the new norm.

That represents a real dilemma for policymakers. With inflation already much higher than forecast, central banks (including the Reserve Bank of New Zealand) have been backed into a corner and are now having to prioritise policy measures aimed at containing inflation. The primary tool at their disposal to achieve this is to raise interest rates.

The repercussions of this are already apparent in New Zealand with the Official Cash Rate (OCR) here having been raised three times (by a total of 0.75%) since 6 October 2021. With domestic interest rates already on the rise, and debt servicing costs rising along with them, this exacerbates the cost-of-living challenges already faced by many New Zealand families.

Market turbulence, as unpleasant as it is, will eventually ease.

And, in a world still trying to consolidate after the last two Covid-impacted years, the immediate outlook for economic growth suddenly looks more fragile. Whilst this adds to uncertainties in the short term, investors should still be comforted that capitalism has a way of figuring out how to survive and thrive, even in challenging environments.

We can further be comforted in the fact that markets react significantly faster than economic indicators. The fall in share prices we saw during the most recent volatile period is a result of market participants demanding a lower price for the known risks involved in these investments. This uncertainty and bad news have already been priced in and as we ease through this difficult period, we can - as long as we don’t see any further surprises - expect our investments to deliver positive returns even if the economy is somewhat subdued.

After more than two decades of successfully implementing monetary policy to carefully manage inflation expectations within a low and narrow band, central banks are now being compelled to act to ensure that inflation expectations don’t suddenly become unanchored.

However, this action is likely to have negative implications for economic activity. Central banks have become more determined to remove economic stimulus in recent weeks. In spite of acknowledging the many uncertainties within the economic outlook, including the Russian invasion, and the impact that tighter policy settings will inevitably have on growth, inflation has simply become too high for comfort.

The European Central Bank surprised markets during the quarter by presenting plans for a faster-than-expected reduction in their bond buying programme.

Their policy response suggested their concerns about inflation prevailed over all other considerations, including the war in Ukraine, and the deteriorating outlook for economic growth.

The New Zealand situation is particularly acute. With inflation expectations now above the Reserve Bank’s 1% to 3% target band and inflation itself still yet to peak, the bank is expected to progressively move the OCR to almost 3.5%; potentially using 0.5 percentage point increments in at least one of the next two meetings. Unfortunately, if delivered completely, this could be akin to slamming the economic brakes on.

Consumer and business confidence is already at rock bottom. Household cashflow is being reduced by negative real wage growth, high inflation, and the sharp rise in mortgage rates. New Zealand house prices have become ‘wobbly’ over the past three months and salesto-listings data suggests a period of housing market weakness could lie ahead. Taken together, these factors make a compelling counter argument for why the Reserve Bank’s projected tightening cycle may not be able to be delivered completely, but for now this is the outlook being anticipated by the markets.

Beyond the immense human suffering, the war in Ukraine and the sanctions imposed on Russia create broader issues related to global food production and supply.

At one end of the spectrum are countries with a significant dependency on essential commodities (including mineral products, chemicals, metals and soft commodities) that were imported from Russia and Ukraine.

At the opposite end, there are countries, many of them emerging markets, that could potentially position themselves to fill this gap by exporting more at higher prices.

Whilst this adds to uncertainties in the short term, investors should still be comforted that capitalism has a way of figuring out how to survive and thrive, even in challenging environments.

Food prices and food availability will increasingly be a global economic and political issue.

For example, the expected decrease in food production due to reduced spring plantings in Ukraine quickly lifted global wheat prices by over 15% since the start of the war. Higher grain prices will have a disproportionate impact on low-income countries, particularly some countries in Africa, and even India, where spending on food makes up a relatively high proportion of their income. Pressure will mount on these countries to either find alternate sources of supply or to ramp up their domestic production.

But, as Russia and Ukraine had been significant suppliers of fertilizer to the world, ramping up production, even by other agricultural powerhouses, may be easier said than done. For example, Brazil, which is currently the leading exporter of soybeans, corn, sugar, meat and coffee, imports about 80-85% of its fertilizer needs, with almost a third of this coming from Russia, Belarus and Ukraine. Whilst Brazil is now launching a national fertilizer plan to reduce its dependency on fertilizer imports, this will likely take several years to make a significant difference.

And even if other regions recognise an opportunity to step up their own food production in an effort to fill the void, it can take considerable time to plan, sow, grow and harvest meaningful replacement crops. Quickly replacing the 40 million metric ton supply of Ukrainian wheat would be an astronomical feat.

Maintain perspective and stay patient.

Uncertainty is a constant. We don’t know what the weather will be next week, and we certainly don’t know what might happen to change the current conflict in Ukraine, global travel and trade, supply chain pressures, concerns about inflation or the ongoing evolution of Covid-19. But we do know that all of these unknowns are factored into market prices.

And even though we may not know when or how, history tells us categorically that conflicts always end, pandemics run their course, consumerism and trade generally flourish (on average), and inflation is more commonly able to be controlled within targeted ranges. We don’t see anything in the world to suggest that this time is any different.

In fact, if we took the Ukraine conflict out of the picture, we would have been looking at a world that was beginning to emerge from the Covid shadow, in which travel and trade were picking, up and people and businesses were making longer term spending and investment plans again. All of this will return, even if Vladimir Putin may have pushed the delivery date out a little.

While the returns this quarter have been poor, they (thankfully) bear no relation to the returns of the comparable quarter in March 2020 when Covid first arrived in the world.

It’s useful to look back at that time because the best strategy then was the same as it is today – ‘don’t panic and stick to your plan’.

We can quickly see the outcome of that approach from the table below:

The third column shows how three key market indices performed (in total returns in their local currencies) during that awful first quarter in 2020. Sadly, a number of unadvised investors unfortunately exited the markets at this point.

The fourth column shows the performance of those same indexes over a longer period (note: this longer period includes both the dismal returns in the first three months of 2020 and the poor returns in the recent quarter).

Holding on to your investments through these periods of heightened market volatility wouldn’t have felt like much fun, but the overall outcome was well worth the effort.

If history is any guide, that’s a conversation we will be having with you again in the future.

We don’t see anything in the world to suggest that this time is any different.

With the prospect of US interest rate hikes and simmering tensions at the Russia/Ukraine border, there were few places for investors to hide in January, as bond yields spiked and share markets waned. Growth-tilted sectors such as information technology and consumer discretionary bore the brunt of the pain, while the energy sector generally performed strongly.

Following Russia’s invasion of Ukraine in late February, investors became increasingly concerned. Markets tumbled as investors reassessed the potential economic impact of sanctions on Russia and on further supply chain upheavals.

With this adding further fuel to a developing global inflation problem, bond yields rose markedly over the quarter as central banks quickly signalled their intention to not let inflation expectations get out of control.

Unfortunately, with equity markets generally falling and bond yields rising (meaning falling bond prices), the first quarter of 2022 was a challenging environment.

Russia’s invasion drew widespread condemnation and elicited significant economic sanctions from democratic nations. This amplified existing concerns over inflation pressures, particularly in energy and food products.

-4.9% (hedged to NZD)

-6.5% (unhedged)

In the USA, the flagship S&P 500 Index (total returns in USD) declined -4.6% in spite of US economic data otherwise remaining relatively stable and unemployment reducing to a low 3.6%.

Eurozone shares fell more sharply. The region has closer economic ties with both Ukraine and Russia, particularly when it comes to a reliance on Russian oil and gas. Worries over consumer spending led to declines for retailers, while the conflict also exacerbated supply chain disruptions by stifling the availability of a wide range of parts. This impacted the information technology sector in particular.

UK equities were more resilient as investors began to price in the additional inflationary shock of the Russian invasion. Large cap equities tracked by the FTSE 100 index even managed a small gain over the quarter, driven by the oil, mining, healthcare and banking sectors.

In New Zealand dollar terms, the MSCI World ex-Australia Index delivered a quarterly return of -4.9% on a hedged basis and -6.5% unhedged. This meant the rolling 12 month return for the New Zealand dollar hedged index is still a healthy +11.3% while the unhedged index has gained +10.9%.

Source: MSCI World ex-Australia Index (net div.)

-8.0%

Emerging market equities were firmly down in the first quarter as geopolitical tensions took centre stage. US and its Western allies imposed a raft of sanctions on Russia and commodity prices moved significantly higher in response, raising concerns over the impact on inflation, the pace of policy tightening and the outlook for growth.

Trading in Russian companies (both inside Russia and on international exchanges) became fraught as investors sought to exit these exposures en-masse and their share prices crumbled. Russia was officially removed from the MSCI Emerging Markets Index on 9 March, at a price that was effectively zero.

Egypt, a major wheat importer, was one of the weakest markets in the MSCI Emerging Markets index, due in part to a 14% currency devaluation relative to the US dollar. China also lagged the index by a wide margin as daily new cases of Covid-19 spiked, and lockdowns were imposed in several major cities, including Shanghai. Regulatory concerns relating to US-listed Chinese shares also contributed to market volatility. Conversely, the Latin American markets all generated strong gains, led by Brazil. Other net commodity exporters also posted sizeable gains, including Kuwait, Qatar, the UAE, Saudi Arabia and South Africa.

In unhedged New Zealand dollar terms, the MSCI Emerging Markets Index produced a quarterly return of -8.0%, contributing to a -10.4% return over the last 12 months.

Source: MSCI Emerging Markets Index (gross div.)

-6.8%

New Zealand was again one of the poorer performing global developed share markets over the quarter with the S&P/NZX 50 Index returning -6.8%. There was a wide divergence in sectoral returns over the quarter, with utilities and financial services firms generally outperforming, while healthcare and technology companies dominated the list of poorer performers.

+3.9%

New Zealand-based travel and expense management provider Serko Ltd declined -33.4% for the quarter as business travel volumes reduced during the important December and January period. This disruption, caused by the Omicron variant, impacted Serko’s revenue expectations for the year. Healthcare companies Ryman Healthcare, Fisher & Paykel Healthcare and Pacific Edge Ltd all fell between -23.4% and -27.8%. With the generally lower respiratory intervention requirements of the Omicron variant, as well as a relatively mild flu season in the Northern Hemisphere, some of the tailwinds that had propelled Fisher & Paykel’s strong share price performance throughout 2020 and into 2021, dissipated in the first quarter of 2022.

Although the list of companies delivering positive returns were in the minority, utilities firms with greater pricing power performed relatively well. Contact Energy, Vector, Genesis Energy, Spark, Chorus and Meridian Energy all returned between +2.4% and +5.3%, to help prop up the local market index.

Source: S&P/NZX 50 Index (gross with imputation credits)

The Australian share market (ASX 200 Total Return Index) bucked the trend by eking out a +2.2% return for the quarter in local currency terms. Returns to unhedged New Zealand investors were higher at +3.9% due to an appreciation in the value of the Australian dollar over the quarter.

Once again, the dispersion in sectoral returns was a feature of the market, with the energy, materials, utilities and financials sectors all performing positively, while consumer discretionary, healthcare and information technology companies were the notable laggards.

Also notable was the generally strong performance of the large capitalisation firms, with top 20 companies Woodside Petroleum (+52.5%), BHP Group (+29.7%), Rio Tinto (+25.6%) and Santos (+24.5%) all benefiting strongly from increases in energy and/or key commodities prices.

At the other end of the spectrum, Hutchison Telecommunications fell -32.5% and Reece Group, a leading distributor of plumbing products to commercial and residential customers in Australia, New Zealand and the United States, experienced a decline of -29.2% in spite of posting a solid half year announcement.

Source: S&P/ASX 200 Index (total return)

-2.2%

The narrative that inflation was transitory began to change at the beginning of the year and central banks increasingly signalled their inflation concerns, which drove bond yields higher. While acknowledging the uncertainties related to the geopolitical situation and its economic implications, central banks have so far suggested that unless the growth outlook were to markedly deteriorate, they view inflation as the more pressing problem.

Inflation throughout Europe was revised up to 5.9% in February and inflation in the UK accelerated to 6.2%. In the US, inflation reached a 40 year high of 7.9% and is expected to remain elevated over the coming quarters.

With this backdrop, the European Central Bank confirmed that the tapering of the pandemic emergency purchase programme will now conclude in June. President Christine Lagarde also left the door open to a first interest rate hike later this year.

The US Federal Reserve, as expected, raised the Federal Funds rate by 0.25%, making it clear that further increases will be appropriate. Committee members now expect seven hikes this year, and four next year, implying interest rates could end this cycle higher than the committee’s perceived neutral rate of 2.4%.

After an initial rate hike in December, the Bank of England raised its policy rate by 0.25% twice in the first quarter, reaching 0.75%. At their March meeting, the Bank described geopolitical risks as having accentuated its prior expectations for weak growth and high inflation this year, before noting that their monetary policy “will act to ensure that longer-term inflation expectations remain well anchored”.

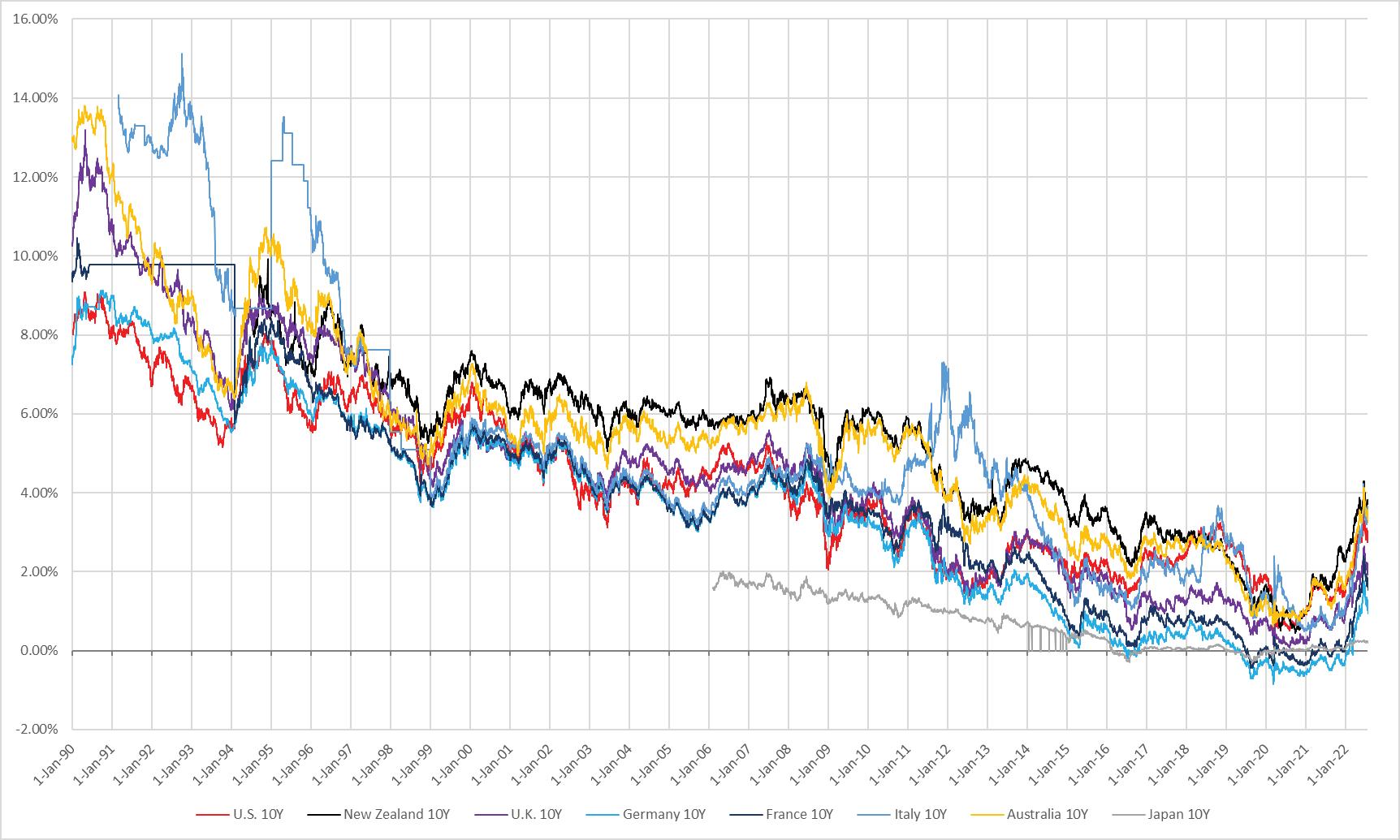

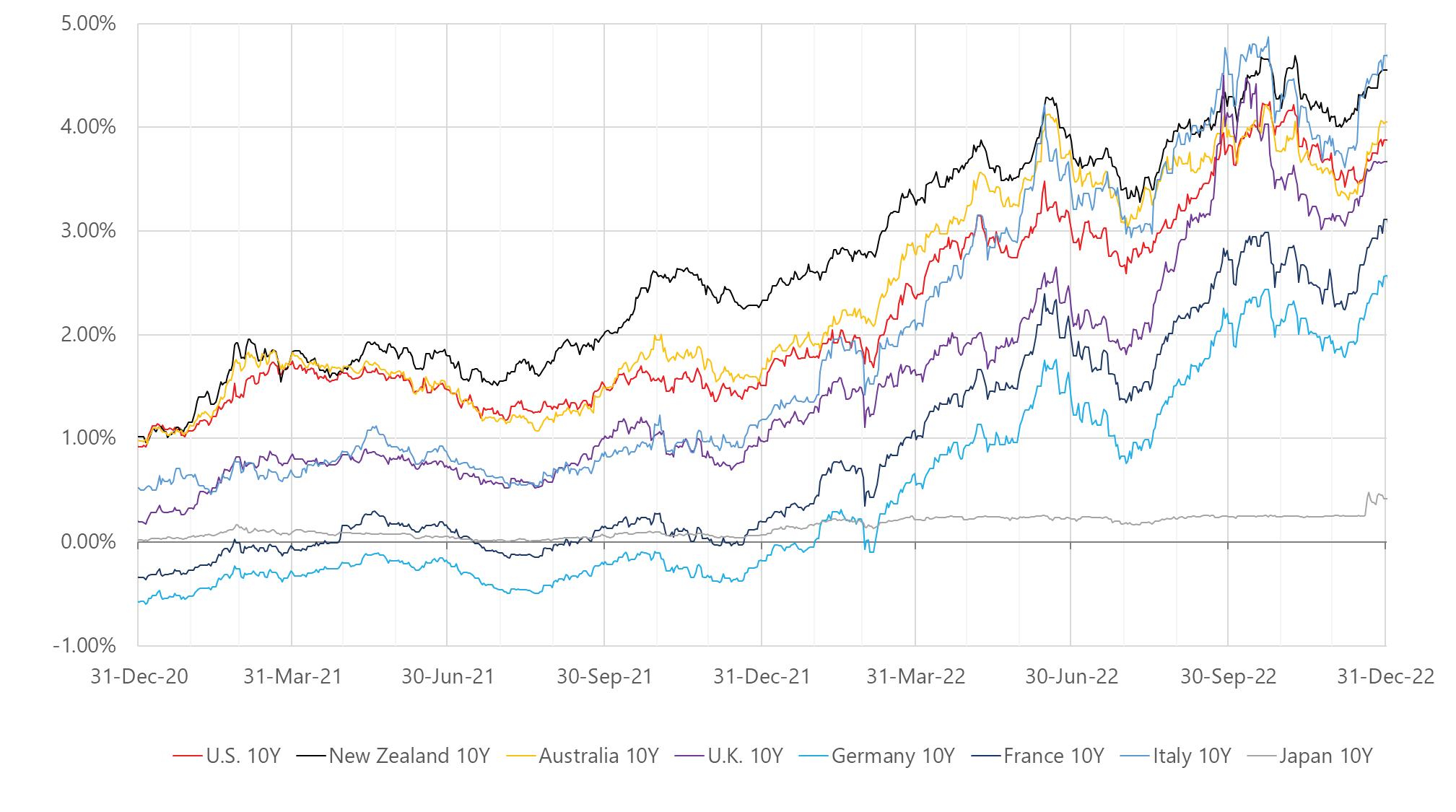

With investors now expecting rate hikes at a swifter pace, global bond yields rose notably through the quarter. The US 10year Treasury yield increased from 1.51% to 2.35%, while the UK 10-year yield climbed from 0.97% to 1.61%.

While rising yields are a headwind for short term sovereign bond returns, corporate bonds generally performed even worse, as credit spreads widened due to a worsening economic outlook.

The FTSE World Government Bond Index 1-5 Years (hedged to NZD) returned -2.2% for the quarter, while the broader Bloomberg Global Aggregate Bond Index (hedged to NZD) returned -4.8%.

Source: FTSE World Government Bond Index 1-5 Years (hedged to NZD)

-2.9%

The Reserve Bank of New Zealand (RBNZ) elected to increase the Official Cash Rate (OCR) by a further 0.25% on 23 February, moving this benchmark rate from 0.75% back to its pre-Covid level of 1.00%.

In making this adjustment, the Monetary Policy Committee noted that the most significant risk to be avoided at present was for longer term inflation expectations rising above the bank’s target and becoming embedded in future price setting.

The Committee stated that while higher interest rates are necessary, households and firms may have become more sensitive to interest rate changes as their debt levels have risen. Accordingly, the behavioural responses of household and businesses in the face of higher interest rates, will be important considerations in determining the pace of future interest rate tightening. For the time being, the RBNZ are currently projecting the OCR hitting 3.4% by late 2024, however they acknowledge the pathway towards that level could well include individual rate hikes of larger than 0.25%, if deemed necessary.

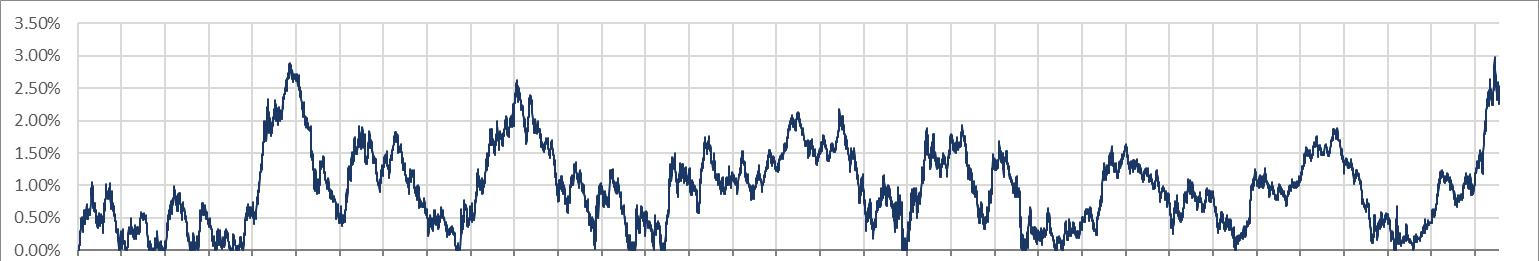

Given this outlook, the New Zealand 10 year government bond yield climbed from 2.33% at the end of 2021 to 3.25% at the end of March, an increase of 0.92% over the quarter. The New Zealand 2 year government bond yield followed a similar pattern, beginning the year at 1.98% and ending the March quarter at 2.92%, a yield increase of 0.94%.

Similar to the effects seen overseas, these rising bond yields generally resulted in negative short term returns for bonds of all durations.

The S&P/NZX A-Grade Corporate Bond Index fell -2.9% for the quarter, while the longer duration but higher quality S&P/NZX NZ Government Bond Index fell -4.3%.

Source: S&P/NZX A-Grade Corporate Bond Index

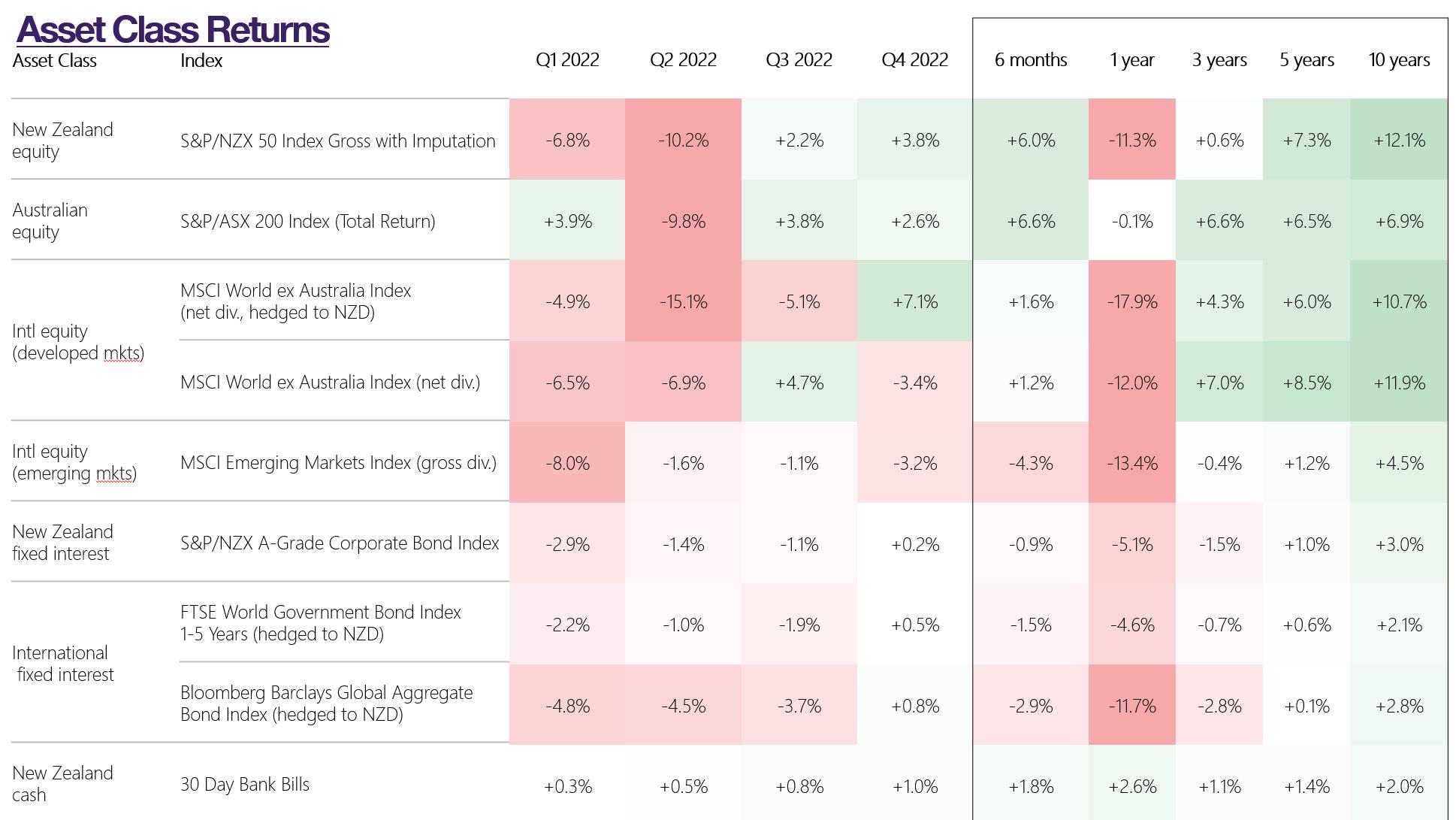

Unless otherwise specified, all returns are expressed in NZD. We assume Australian shares and emerging market shares are invested on an unhedged basis, and therefore returns from these asset classes are susceptible to movement in the value of the NZD. Index returns are before all costs and tax. Returns are annualised for time periods greater than one year.

We’re not exactly sure of the recipe required to bake fast rising prices into the economy but we’re pretty sure of the ingredients. You will commonly need -

• disruptions in free-flowing trade

• shortages in goods

• surplus money in the economy; such as that provided by financial stimulus packages

Between the effects of Covid-19, logistical challenges, worldwide massive government stimulus and now the war in the Ukraine, accompanied by sanctions, we can easily see why prices are increasing. There is just too much money chasing goods that are becoming rarer and more difficult to acquire.

The effects are everywhere and by no means unique to New Zealand. Petrol prices are up, food prices are up, rental prices are up. Interest rates have also gone up and markets are factoring in more rate increases in the months ahead.

You don’t need us to remind you that inflation is here. But if you own a diversified investment portfolio you are probably already prepared for inflation.

So, what do we mean by ‘already prepared’?

It means that unlike many Kiwis, especially many senior citizens, you are not just invested in cash and term deposits which tend to perform poorly when inflation is high. You are instead invested in a range of different assets that, over time, will generally do much better than inflation.

Just recently we were told a story of a conversation one investor had with her friend Mary, who is widowed and lives in a retirement community. Mary commented that she was worried about running out of money.

“Okay Mary,” the investor asked, “what’s your financial situation look like?”

“Well,” Mary said, “I’ve got a little less than $100,000 and it’s all in a savings account in the bank.”

“Why do you have everything in the bank Mary,” the investor responded.

“Because it’s safe….”

Mary may have thought investing in the bank was safe, and perhaps it is safe… from criminals. But if there’s one thing that demonstrates that investing in cash is not safe, it’s the corroding effects of inflation.

As we write this, inflation according to the Reserve Bank of New Zealand, is at 5.9% (Q4 2020 through 2021 Q4). But even that doesn’t tell the whole story. It’s widely reported that in Q1 2022 inflation has progressively worsened.

The graph below from Stats NZ shows that inflation is currently at its highest rate in over 20 years.

It’s clear from this data that someone like Mary, earning very little on her bank savings, is in a poor position. Her $100,000 is very precious and the amount of goods, services and daily necessities it can purchase is reducing every day.

Inflation has accurately been described as a silent thief. If Mary’s savings are earning an average return of 1.0% p.a. (before tax and fees) but the cost of the critical goods and services she needs to buy is going up by 5.9% p.a. (or more), then you can quickly see her purchasing power is eroding fast.

By contrast, our clients very rarely have the majority of their assets in cash. Extra cash is held for short term, definitive purchases. Future purchases, which are the ones most influenced by rising prices, are generally funded through a portfolio.

Inflation is here, that’s why you own shares.

Although a portfolio’s value can go up and down, it typically provides good insulation from the long-term effects of inflation for very logical reasons. If the prices that businesses charge for their goods and services increase, so do their nominal revenues. Over time, that increase in revenue pushes up the value of their share prices.

Shares, unlike cash, have a long history of outperforming inflation as the chart below demonstrates. It shows inflation in the United States back to 1927 and the data tells us that $1 in 1927 was worth the same as $16 in 2021 (i.e. $1 adjusted for inflation each year). However, $1 invested in large US companies was worth $11,182 by year end 2021 before tax and costs.

Other assets also outperformed inflation over this period, including bonds and residential property, although not by as much.

The main point, however, is that an investor that owns a diversified portfolio of shares, some bonds and property, is already well positioned to withstand inflation over any reasonable time horizon. And for that reason our investors (unlike Mary) should feel comfortable.

What about alternative investments?

We are sometimes asked about other securities that are promoted to reduce the effects of inflation.

The one brought up most often is commodities. In case you were curious, commodities present three main challenges within the context of a portfolio:

1. They are traditionally dominated by energy products such as oil, which environmentally conscience investors want to avoid.

2. Commodities are very price volatile; about 20 times as volatile as inflation itself1. Trying to dampen inflation with something 20 times more volatile is like cracking a nut with a sledgehammer. It could get messy.

3. The long term returns of commodities are usually only 3% to 4%, just a little more than the return on inflation itself2.

We aren’t sure how much longer inflation will be with us. The answer may depend on being able to predict Covid-19 mutations, the geopolitical moves of Russia, the counter measures of OPEC and NATO, and Central Bank policy - all at the same time. However, we are sure that inflation will show over time, the wisdom of owning a portfolio as opposed to other ‘safe’ alternatives, such as cash.

In today’s environment, losing purchasing power with cash is inevitable.

Even though we can’t predict the future, history tells us that beating inflation over the long term in a prudently diversified investment portfolio, is probably also inevitable.

Source: Consilium Graphica 2022. Notes: Analysis period is for June 1927 to December 2021. All returns are in US dollars. Materials are only prepared for client education purposes.

1 https://www.evidenceinvestor.com/what-to-do-if-youre-worried-about-inflation/

2 https://www.aqr.com/Insights/Datasets/Commodities-for-the-Long-Run-Index-Level-Data-Monthly

The main point, however, is that an investor that owns a diversified portfolio of shares, some bonds and property, is already well positioned to withstand inflation over any reasonable time horizon.

The indices used to calculate the index portfolio returns are as follows:

underlying manager fees, but gross of custodial and adviser monitoring fees

The indices used to calculate the index portfolio returns are as follows:

Notes:

underlying manager fees, but gross of custodial and adviser monitoring fees

In the Partner Firm Service Agreement and Consilium Investment Committee Policy and Procedures Manual, the CIC outlined the following process for reviewing underlying investments.

All investment securities are reviewed on a quarterly basis and performance is measured against appropriate benchmark indices. Where a security’s performance is consistent with its mandate and in line with broad style and/or asset class returns, no further action will generally be taken.

However, a security may be placed on an ‘enhanced due diligence’ list, and subjected to a higher degree of scrutiny, for any of the following reasons:

- A change in the primary portfolio manager

- A significant change in the fund management company’s majority owner or ownership structure

- A more than 25% fall in the fund’s assets under management over a rolling one- year period (due to outflows, not market movement)

- Total fund assets falling below our minimum fund size thresholds at any time

- A change in the fund’s investment style, diversification and/or risk factor tilting

- An increase in the fund’s fees

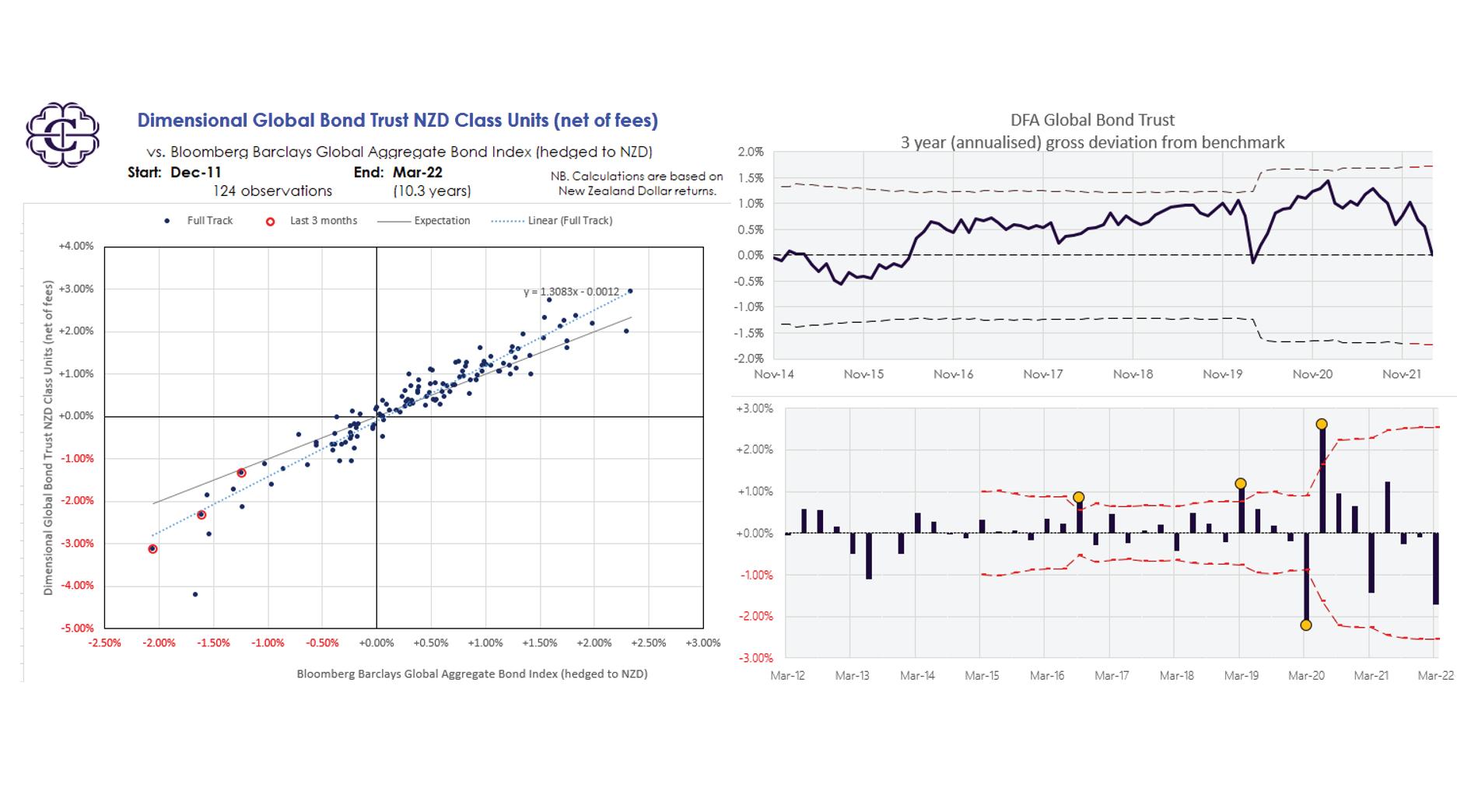

- The fund exhibited quarterly tracking error versus a relevant benchmark outside its monitoring thresholds

- The fund exhibited a persistent deviation in tracking error versus a relevant benchmark outside its monitoring thresholds, measured over a rolling three-year basis, and allowing a volatility threshold appropriate for each fund

- An extraordinary event which, in the opinion of the Investment Committee, may impact on the manager’s ability to comply with the fund mandate in future

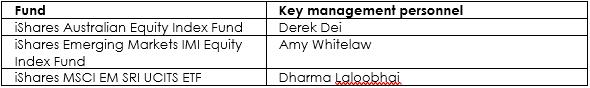

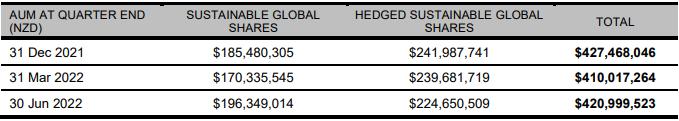

We completed the monitoring of all of the above aspects for all underlying funds in your portfolios and found the following:

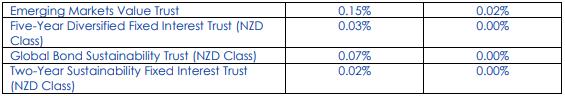

1. Dimensional Emerging Markets Value Trust: outperformance for quarter ended 31/Mar/2022

The Dimensional EM Value Trust outperformed its market benchmark by +5.41% which exceeds our monitoring bands. Our initial analysis indicates outperformance is due to the underweight of Russian securities and overweight to high profitability value stocks.

2. Dimensional Emerging Markets Value Trust: outperformance for three years ended 31/Mar/2022

The Dimensional EM Value Trust outperformed its long-term market benchmark by +4.03% which exceeds our monitoring bands. Our initial analysis indicates the trusts tilts towards the deeper value stocks contributed to outperformance.

3. Dimensional Five-Year Diversified Fixed Int. Trust (NZD Class): underperformance for quarter ended 31/Mar/2022

The Dimensional Five-Year Diversified Fixed Int. Trust (NZD) underperformed its market benchmark by -2.17% which exceeds our monitoring bands.

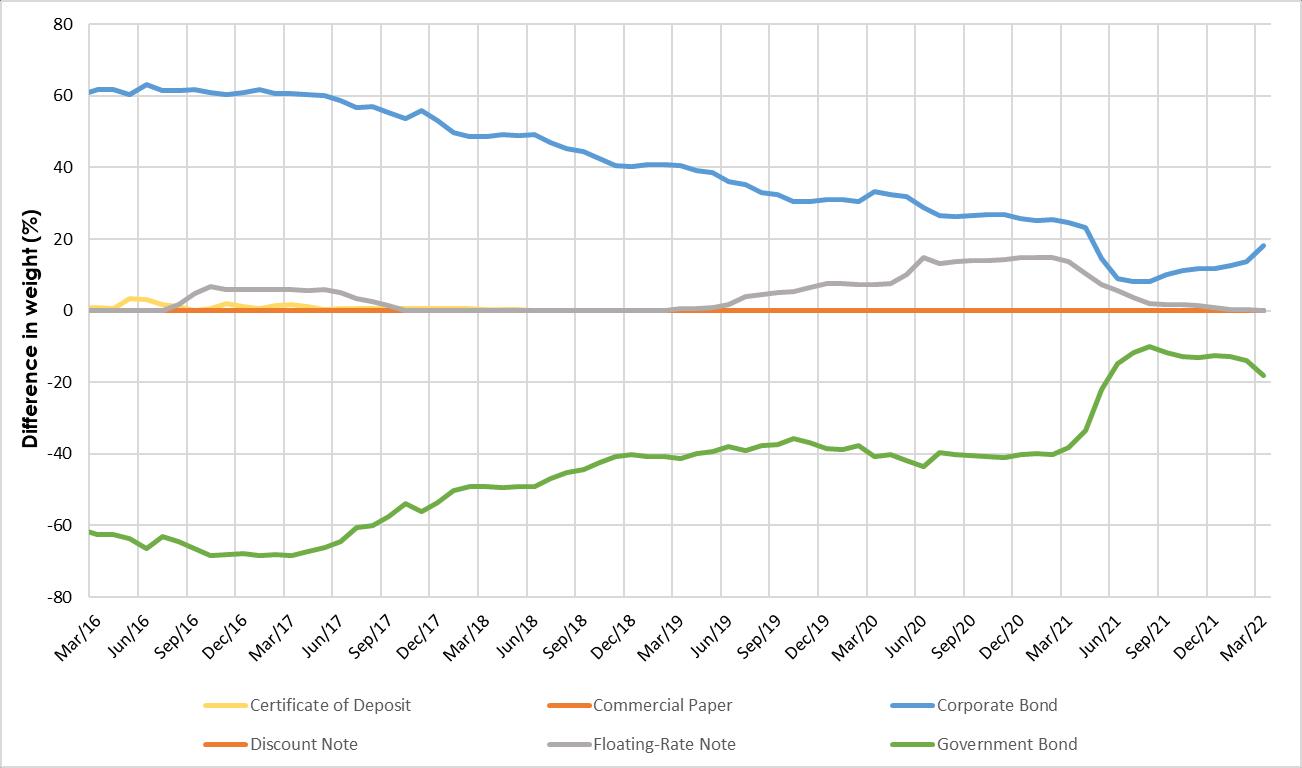

4. Dimensional Global Bond Trust/Global Bond Sustainability Trust (NZD Class): Change in mandate

The Dimensional GBT/GBST (NZD) experiences a change in mandate during Q1 2022, the upper maturity range for bonds that the trusts will primarily invest in will increase from 15 years to 20 years.

5. Dimensional Global Sustainability Trust (NZD Hedged): outperformance for quarter ended 31/Mar/2022

The Dimensional Global Sustainability Trust (NZD Hedged) underperformed its market benchmark by -2.73% which exceeds our monitoring bands.

6 Emerging Market Funds: Extraordinary event - Extraordinary event - Freezing of Russian stockmarket

All Emerging Market Funds experienced an extraordinary event with the significant disruption to the Russian stock market

7. Harbour NZ Corporate Bond Fund: 3-year outperformance

The Harbour NZ Corporate Bond Fund outperformed its long-term market benchmark by +0.40%.

8. iShares Funds: Management change

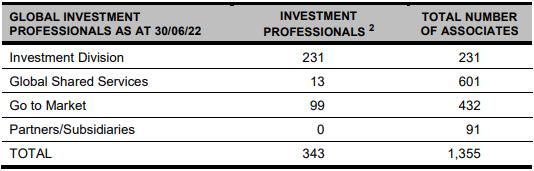

iShares informed us of two separate management changes. EM IMI Equity Index had a key management change from Jennifer Hsui to Amy Whitelaw, SUSM had a key management change from Jonathan Van Ginneken to Dharma Laloobhai.

We will be undertaking an analysis of all 8 flags over the coming weeks, and we are aiming to have completed papers summarising our findings within the next three months.

1. Dimensional Global Small Company Trust: outperformance for the quarter ended 31/Dec/2021

Investigation COMPLETE. This outperformance is resulting from the value tilts taken by the trust. We also note that the outperformance was primarily delivered by compositional differences compared to the benchmark, with allocations taken to companies not within the benchmark leading to the bulk of the outperformance. We remain satisfied that the aggregate risk exposures are consistent with the trust mandate, and we identified no unexpected or unexplained risks.

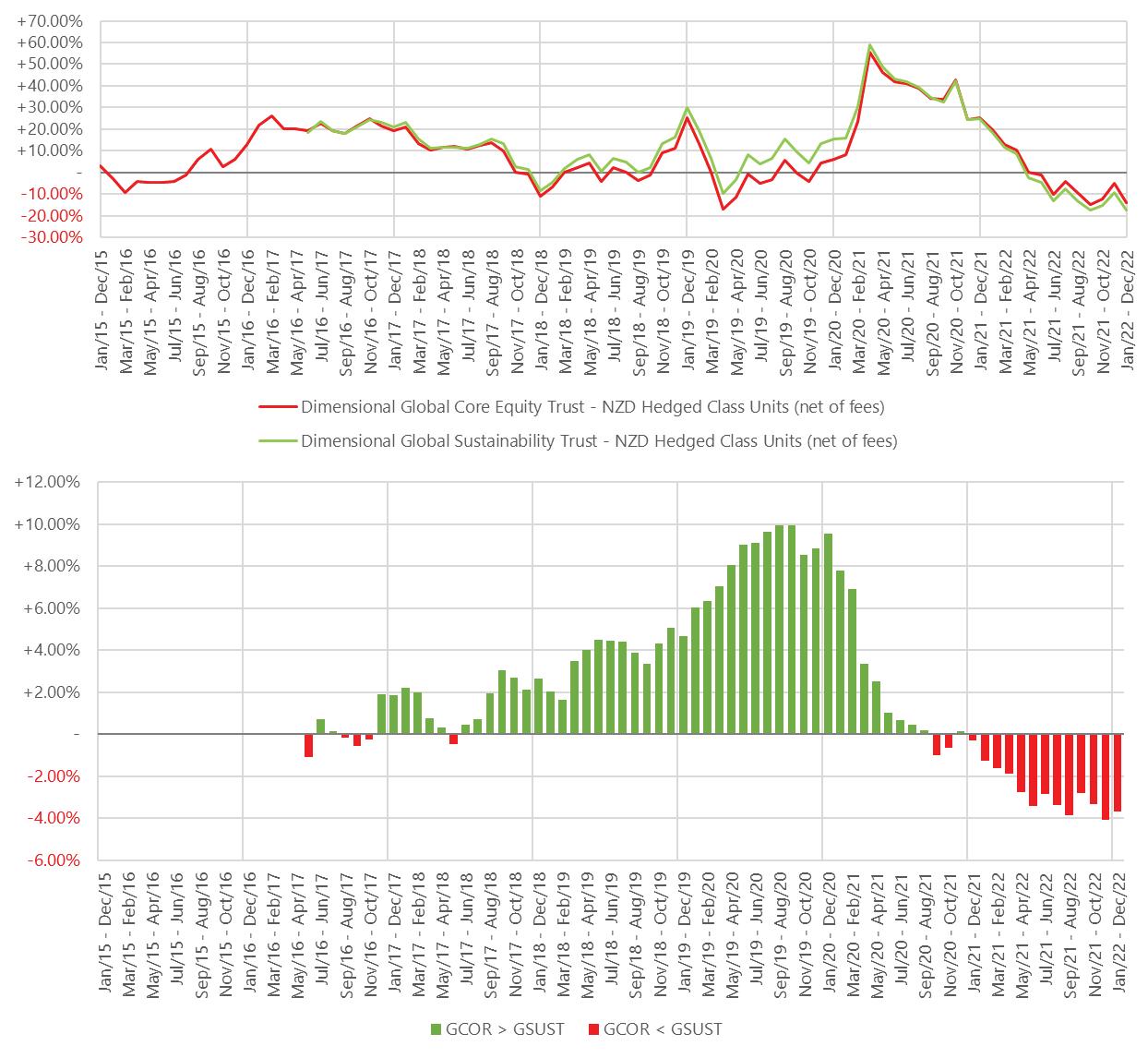

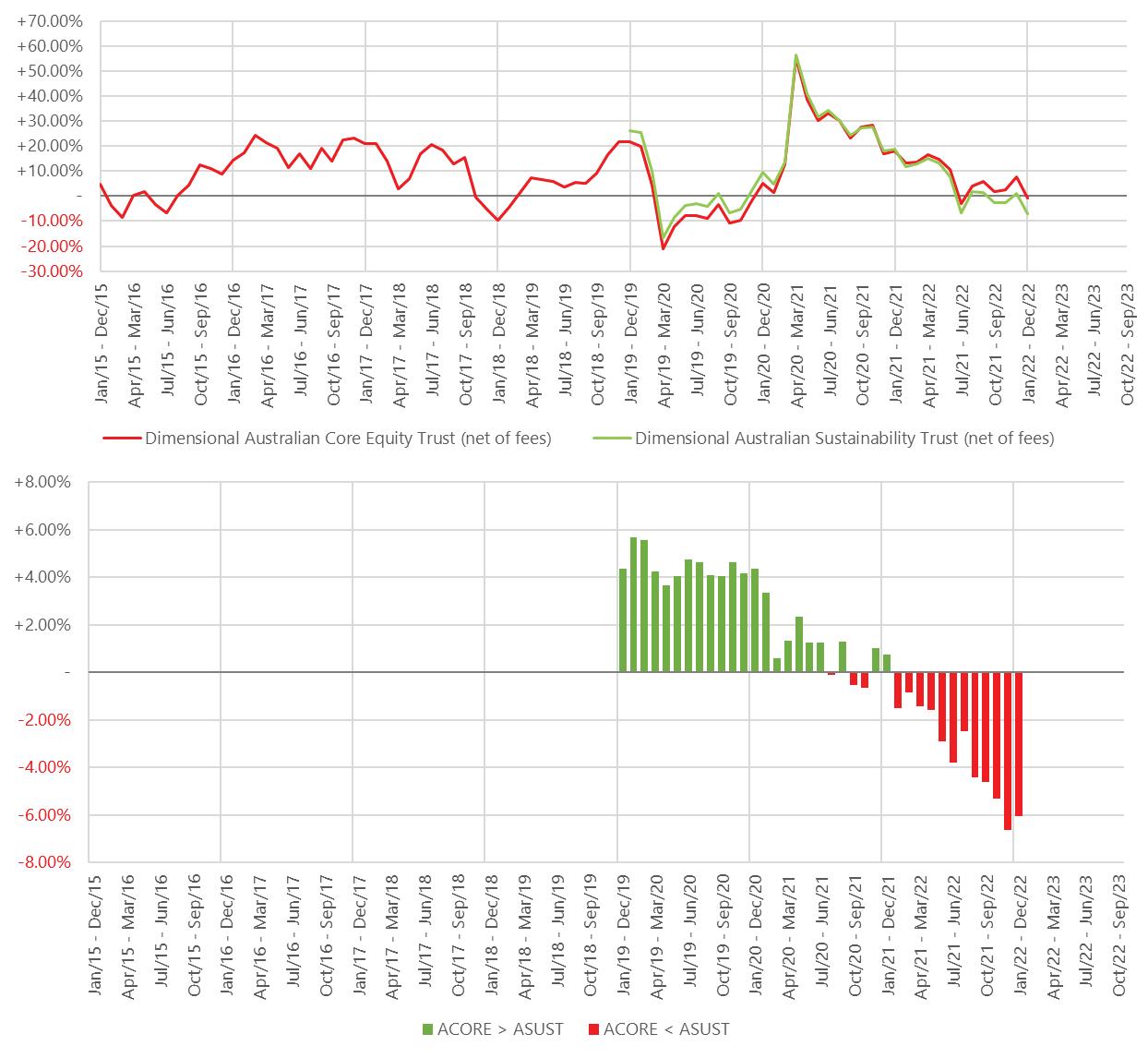

2. Dimensional Global Sustainability Trust: outperformance for three years ended 31/Dec/2021

Investigation COMPLETE. Our analysis highlighted that the outperformance in the three years to December 2021 was attributable to the trust’s compositional differences compared to the benchmark. The trust’s sustainability considerations led to significant outperformance, with a deliberate overweight to Tech giant Apple, combined with the exclusion of Energy companies, such as Exxon Mobil and BP, leading to outperformance across the three-year period. We remain satisfied the identified risk exposures are consistent with the trust mandate, and we identified no unexpected or unexplained risks.

3. Vanguard Ethically Conscious International Shares Index Fund: outperformance for three years ended 31/Dec/2021

Investigation COMPLETE. Upon reviewing this EDD flag the CIC noted that the benchmark used in our initial assessment was different to the specific benchmark used by Vanguard. This was due to past data availability constraints for the benchmark, upon further review this benchmark is now available. Following our analysis of the fund and the discovery of the correct benchmark used by the Vanguard. The CIC assesses that the fund passes this enhanced due diligence flag.

4. Dimensional Emerging Markets Value Trust: Fund outflow

Investigation COMPLETE. Dimensional informed the CIC that this flag was due to cannibalisation resulting from the introduction of the Dimensional Emerging Markets Sustainability Trust. With the introduction of this fund in July 2021, significant assets from the incumbent Dimensional Emerging Markets Value Trust transferred to the new sustainable fund. The CIC is satisfied that the reduction in the fund’s AUM had no detrimental impact on the performance received by the remaining fund investors and it is also not expected to impact Dimensional’s ability to effectively manage the fund on an ongoing basis.

Investigation COMPLETE. Our analysis highlighted that the outperformance in the December quarter relative to the custom benchmark was attributable to structural elements of the trust in particular the reduced exposure to small companies since 2020. This change occurred when the 5th factor in the Fama/French 5 factor model – reinvestment – was implemented. The custom benchmark has not been reflecting this reduced exposure and needs to be modified. However, we remain satisfied the identified risk exposures are consistent with the latest trust mandate, and we identified no unexpected or unexplained risks.

6. Funds Managed by Vanguard: Change in personnel

Investigation COMPLETE. We are satisfied that the ongoing management and support of the Vanguard funds will not be materially affected by this change, due to:

1. The fund mandates are well established, stable and remain unchanged.

2. The investment mandates all follow an index replication process which significantly minimises the degree of discretion.

3. At any point in time, the Head of Equity/Bond indexing is well supported by a large team of portfolio managers.

7. Dimensional Global Value Trust: outperformance for three years ended 31/Dec/2021

Work in progress

8. Dimensional Two-Year Sustainability Fixed Interest Trust (NZD Class): outperformance for three years ended 31/Dec/2021

Work in progress

Damon O'Brien Head of Investments and CIC ChairpersonDate: 23 September 2022

On the April 2022 monthly adviser call, the Consilium Investment Committee reported on the first quarter of 2022. A summary is included below, and the graphics on the following pages are an excerpt of that presentation.

A full recording of this presentation is available on the Consilium Portal under ‘Quarterly Reporting’.

With the outbreak of war in the Ukraine, inflationary pressures ratcheted up to levels not seen in decades forcing central banks to take swift action. Yields shot up causing losses in fixed income securities while the heightened uncertainty contributed to losses for equities as well.

Western nations took retaliatory economic action to the Russian invasion, and the Russian sharemarket was, for all intents and purposes, wiped of the investment map.

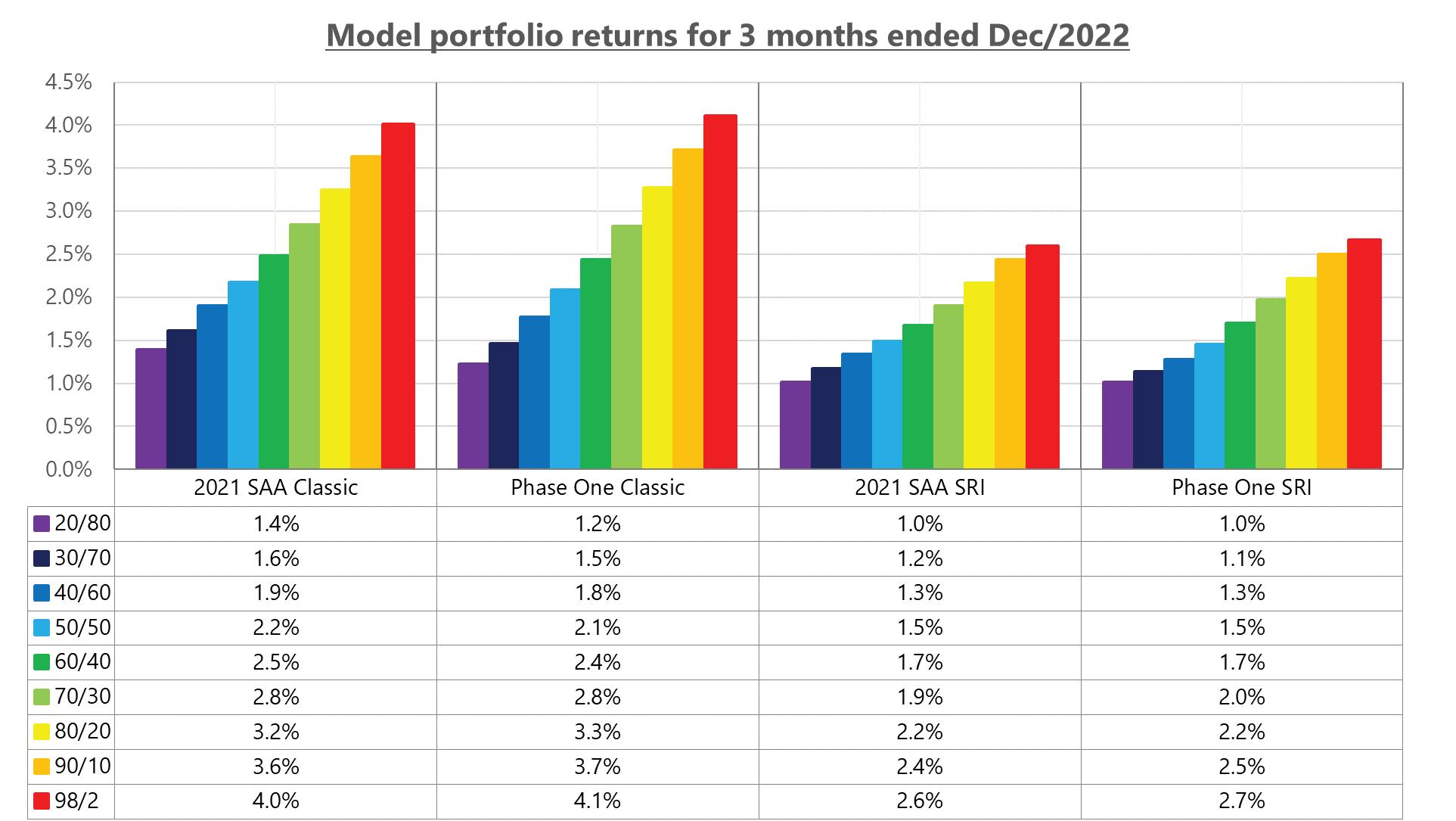

Model portfolio returns ranged from -5.7% to -2.4% for the quarter, with aggressive portfolios losing less than more defensive portfolios, the SRI suite underperformed unscreened portfolios.

In equities, Australian shares were the only asset class to return a positive return, while New Zealand, Developed and Emerging Market equities were all negative. Fixed interest was again negative in New Zealand, while internationally returns were also negative for the quarter.

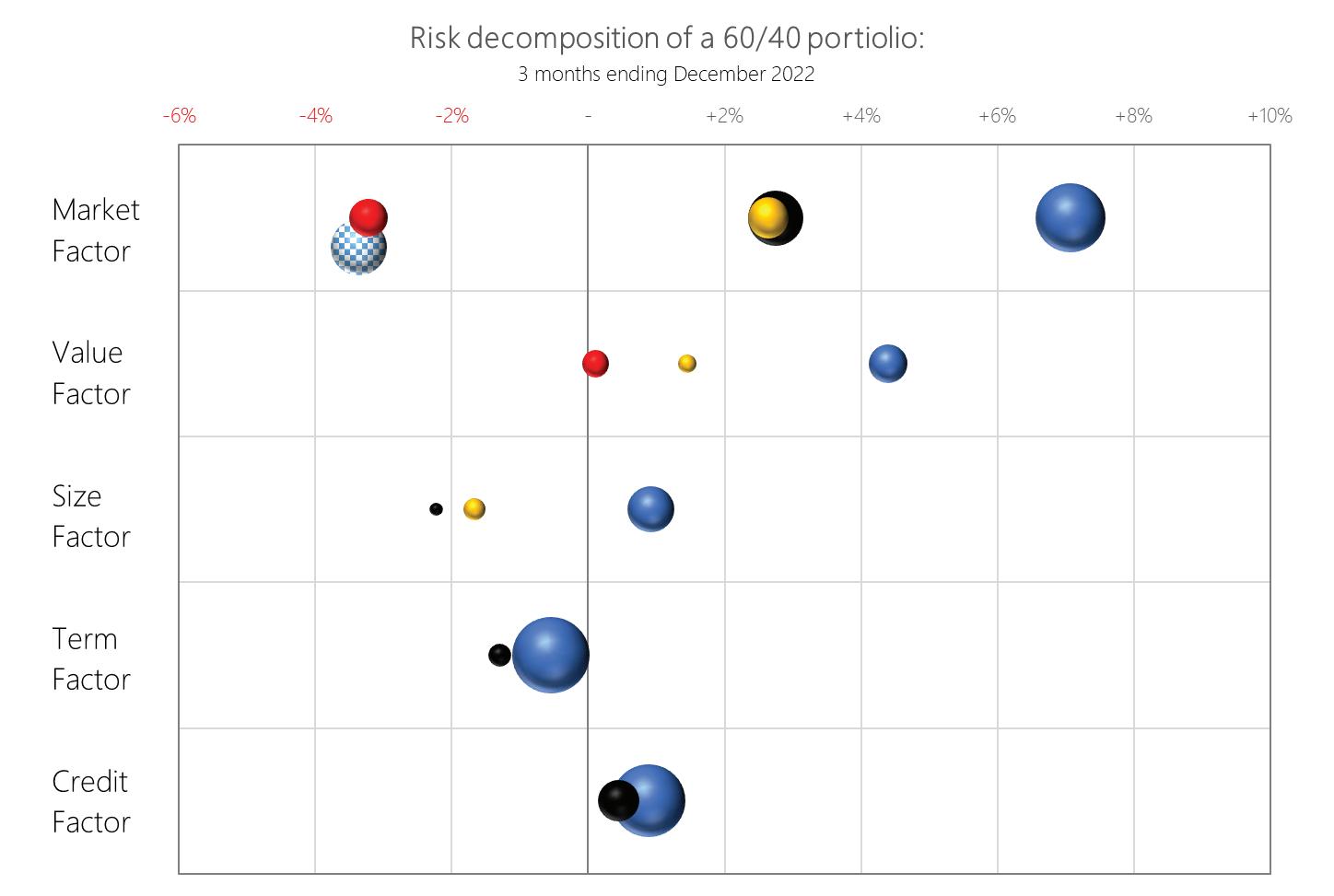

Risk tilts were mixed across the quarter. The value factor was positive within Australia, Developed and Emerging markets. Large caps edged out small caps across the board. On the fixed income side, the term and credit premium were negative.

Source: https://www msci com/end-of-day-data-country

E m ergi ng m ar k ets per f or m ance (MSCI l arge cap i n di ces, l ocal cu r rency)

12 m on ths Q4 2021

Source: https://www msci com/end-of-day-data-country

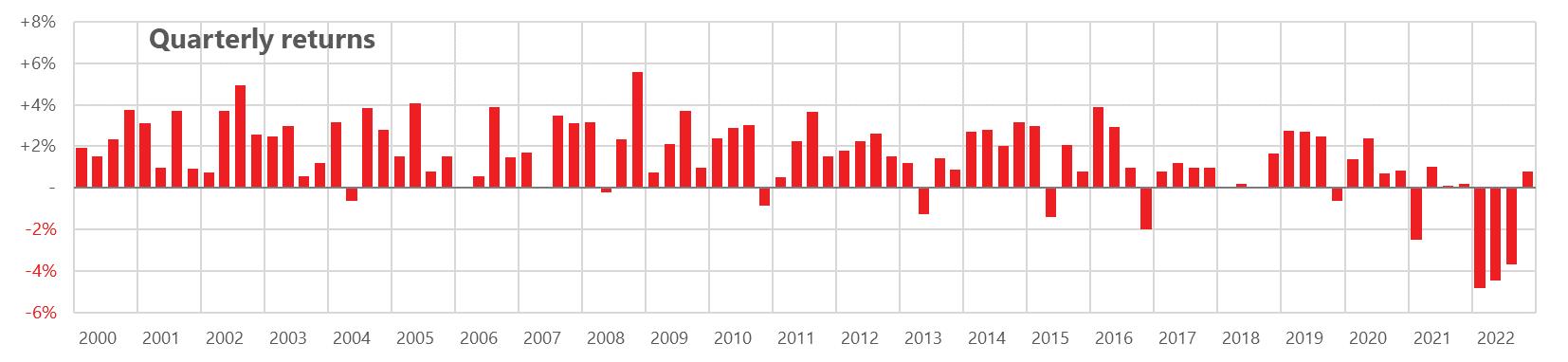

Rolling 3m returns

Rolling 12m returns

Key:

New Zealand

Australia

Developed Markets (hedged)

Developed Markets (unhedged)

Emerging Markets

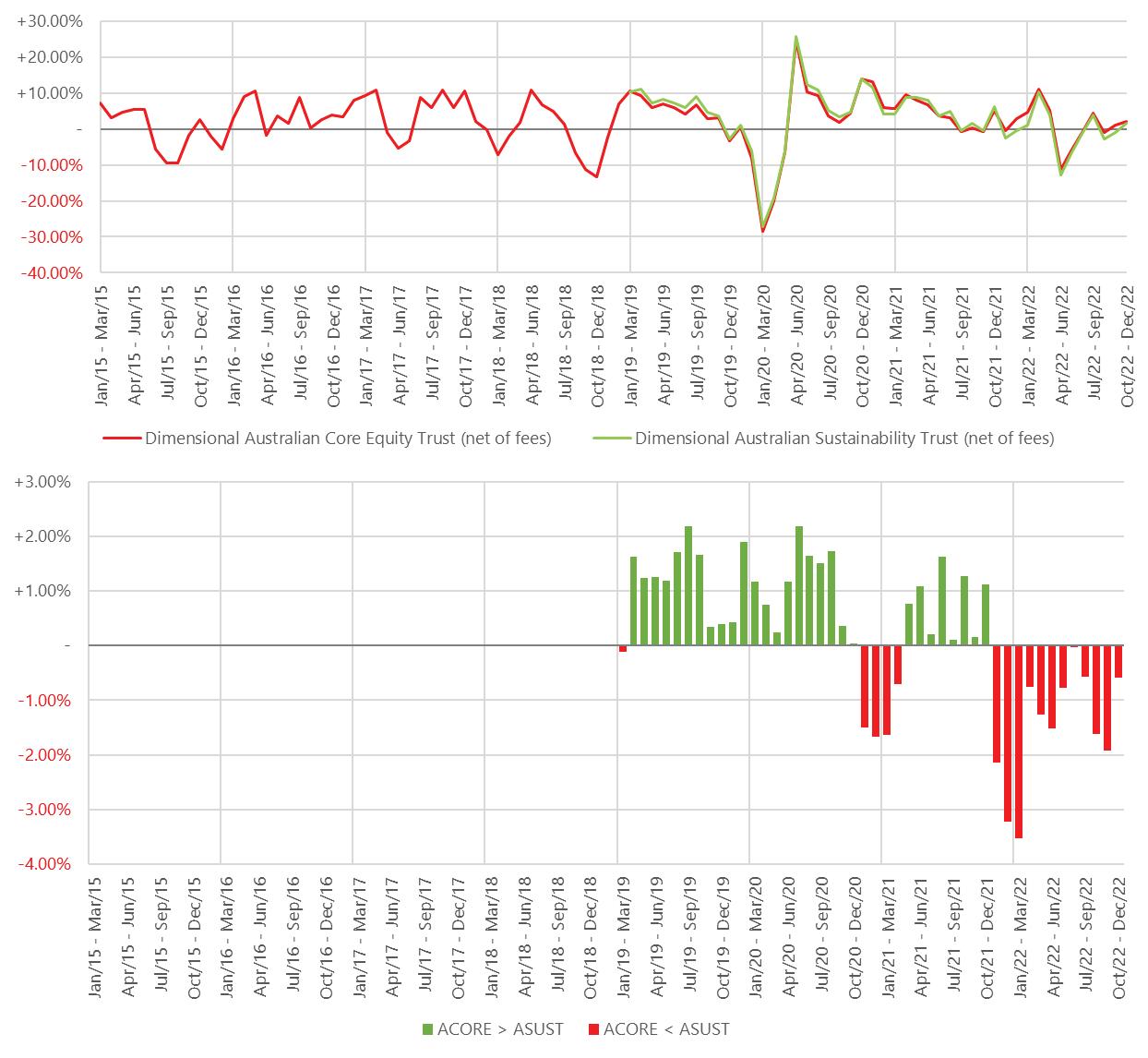

Unscreened f und retur ns rel ati ve to mar k et and styl e – to end Mar 2022

April – June 2022

P1 Market commentary

P5 Key market movements for the quarter

P8 What happened to bonds?

Whether you own a TV or radio, read a newspaper, or get your news online, it’s a fairly safe bet that the bulk of the economic news you are receiving at the moment sounds fairly gloomy.

Even if we could ignore the news, which is often more noisy than informative, we can’t easily ignore that the price of food, petrol and many other essential goods have been rising sharply in recent months, putting pressure on household budgets.

This comes at a time when New Zealand house prices also seem to have peaked. After having accelerated strongly throughout much of 2021, helping homeowners at least ‘feel’ wealthier, housing market indicators now suggest prices could be easing in many regions. And, while the housing market begins to cool, mortgage rates are heading in the other direction (higher), which will only serve to crimp discretionary spending even further.

As spending reduces across the economy, and without our border and immigration policies currently enabling enough visiting holidaymakers or migrant workers to take up the slack, the immediate economic outlook appears weaker than the post-covid global reopening world that many envisaged was awaiting us this year.

While New Zealand’s official unemployment rate is at record lows, and our exporters continue to perform fairly well supplying a world still scrambling to satisfy widespread food and commodity shortages, these appear to be isolated rays of sunshine peeking out from behind a thickening bank of economic cloud.

Consumers and businesses have shown great resilience over the last few years. But the economic environment continues to be challenging and the pathway towards a sustainable economic recovery (perhaps with an initial period of low or negative growth), is unlikely to be smooth.

One of the elements that will have a bearing on the shape and speed of the recovery will be what happens with inflation.

The roots of the current surge in global inflation can be traced all the way back to the start of the Covid-19 pandemic, when a large imbalance between the supply and demand for goods emerged.

One of the elements that will have a bearing on the shape and speed of the recovery will be what happens with inflation.

The global economy contracted sharply in the first half of 2020 as lockdowns were imposed, but what followed was a highly unusual recession as households were largely shielded from economic pain. Many were able to continue to work from home on full pay, while others had their balance sheets protected by various government payments and employment subsidies such that, in aggregate, net savings rose sharply.

With consumers relatively flush with cash and most parts of the global economy still closed, notably the services sector, this pent-up demand was directed into the goods sector and, in New Zealand’s case, the housing market.

While the supply of goods can often struggle to keep pace with demand shocks even in normal economic times, strains on production were amplified by Covid lockdowns and the simultaneous disruption to global supply chains. Shortages of goods caused supplier delivery times to lengthen, and the deteriorating imbalance between supply and demand flowed through to consumers in the form of higher prices.

More recently, the spill-over from the tragic events in Ukraine has only exacerbated these underlying inflation trends as commodity prices have soared, lifting inflation even further.

However, inflation has begun to show some tentative signs of softening, even if the official (backward looking) figures still look strong. Global shipping rates spiked during the pandemic due to supply chain constraints, and the higher freight costs were typically passed on to consumers. However, the Freightos Baltic Index (FBX) Global Container Index suggests these are now well off their highs, having fallen to around US$6,500 per container, compared with around US$11,000 per container in late 2021. It is a tangible sign that some of the recent freight congestion is finally starting to ease. Similarly, higher oil prices have been hurting consumers at the petrol pump with the international oil price rising from around US$50 per barrel in February 2020 to around US$120 per barrel by early June 2022. However, in the last few weeks the oil price has moved steadily downwards to hover around the US$100 per barrel level. Price declines have also been seen in some other key industrial commodities such as copper, which is used in building construction and electronic product manufacturing. After more than doubling in price from March 2020 to the end of February 2022, the copper price has eased over 20% since.

All of these more recent price trends help reinforce the idea that inflation, whilst continuing to be problematic now, may begin to ease over the remainder of 2022.

As central banks have been steadily revising their inflation expectations upwards, these have been accompanied by downward revisions in projections for global GDP growth.

The recent World Bank Global Economic Prospects Report highlighted this only too clearly.

In January, it forecast global growth for 2022 of 4.1%, but barely six months later, in its June update, this was cut sharply to 2.9%, a nearly one-third reduction from its earlier estimate.

Economic activity has so far been relatively robust as consumers have shown an ability to absorb higher prices, in part due to running down the savings they accumulated during the initial phase of the pandemic. The subsequent tight labour market and pick-up in wage growth has also helped. While these factors should remain supportive for a time, some cracks have begun to emerge on the demand side of the global economy.

With inflation outstripping wage growth in most countries, a squeeze on real incomes has started to erode consumer confidence. Some measures of consumer confidence in the US and UK have fallen to levels not seen since the global financial crisis, while confidence is declining in Europe. It’s the same in New Zealand with the ‘cost of living crisis’ now widely recognised as the number one issue facing households. All of this suggests that consumers may soon be less willing (or able) to tolerate higher prices in the future, and there is even a risk of outright declines in demand. In the case of recent oil, copper and other commodity price declines, this adjustment may already be underway.

Meanwhile, now that central banks are finally getting on with the job of raising interest rates and global bond markets price in additional rate hikes, there are also signs that tighter financial conditions are starting to have an impact.

All of these more recent price trends help reinforce the idea that inflation, whilst continuing to be problematic now, may begin to ease over the remainder of 2022.

In the US, 30-year mortgage rates have climbed to 5.7% in mid-June, the highest level since 2008, and this has coincided with a deterioration in US housing market.

The New Zealand housing market is also showing clear signs of having cooled from the FOMO (fear of missing out) days of late 2021/early 2022. The Reserve Bank of New Zealand was amongst the first of the global central banks to begin raising interest rates late last year, and with floating mortgage rates now nudging 5.5%, we are seeing more regular commentary suggesting a slowdown in house sales. In some regions, house prices may already be easing.

All of this makes for a very difficult environment for policymakers. Faced with widespread pricing pressures, central banks have determined that tackling inflation is their highest priority, and higher interest rates are the primary tool at their disposal to achieve it. Therefore, as long as inflation remains a concern, central banks will likely continue raising interest rates while maintaining cautionary forward guidance, in an effort to cool activity.

As if this escalating inflation and weakening economic growth environment wasn’t enough, the ongoing war in the Ukraine and the drawn-out global impact of Covid, are other factors continuing to create uncertainty or unease in the minds of many investors.

In general, when investors are feeling happy and confident, they are often more comfortable allocating to higher risk investments. However, when they are lacking in confidence, they are less inclined to take higher risks. Market commentators have a specific phrase for this general investor attitude, they refer to it as ‘investor sentiment’, either positive or negative. Recently, investor sentiment has been more consistently negative. And it is with this backdrop that global share markets have been struggling over recent months.

On 14 June, the main New Zealand share market (the S&P/NZX 50 Total Return Index) slipped into official ‘bear market’ territory. A bear market is generally defined as a decline of at least -20% from the prior market peak, which in New Zealand’s case was on 4 October 2021. At time of writing, the S&P/NZX 50 had since rallied a little, reducing the size of this decline, but nevertheless it reflects a very tough period for local share market investors.

This is not an issue unique to New Zealand. The globally significant US share market has had it even worse. The headline S&P 500 Index similarly fell into bear market territory on 13 June, while experiencing its worst first half of the year since 1970. The other high profile US index, the Nasdaq 100 which includes all the large technology companies, ended June over -30% below its peak of 27 December 2021.

These returns are reflective of markets that are facing a range of uncertainties and they are therefore pricing in a high degree of caution or pessimism. But that doesn’t mean that the returns outlook for the months ahead is necessarily poor.

When we review historical data (back to 1940) using the leading US share market index as our reference (the S&P 500 index), the chart below summarises the average one, two and three year performance of the S&P 500 after all previous bear market declines of -20%.

As the chart clearly shows, the average return after a decline of -20% is positive in all analysed time periods, and strongly positive over the subsequent two and three year periods. As challenging as things may seem now, this is a timely reminder that markets are always much more focused on where the economy is going, and not where it has been. After all, share markets are a leading indicator for the economy.

As challenging as things may seem now, this is a timelyreminder that markets are always much more focused on where the economy is going, and not where it has

been.

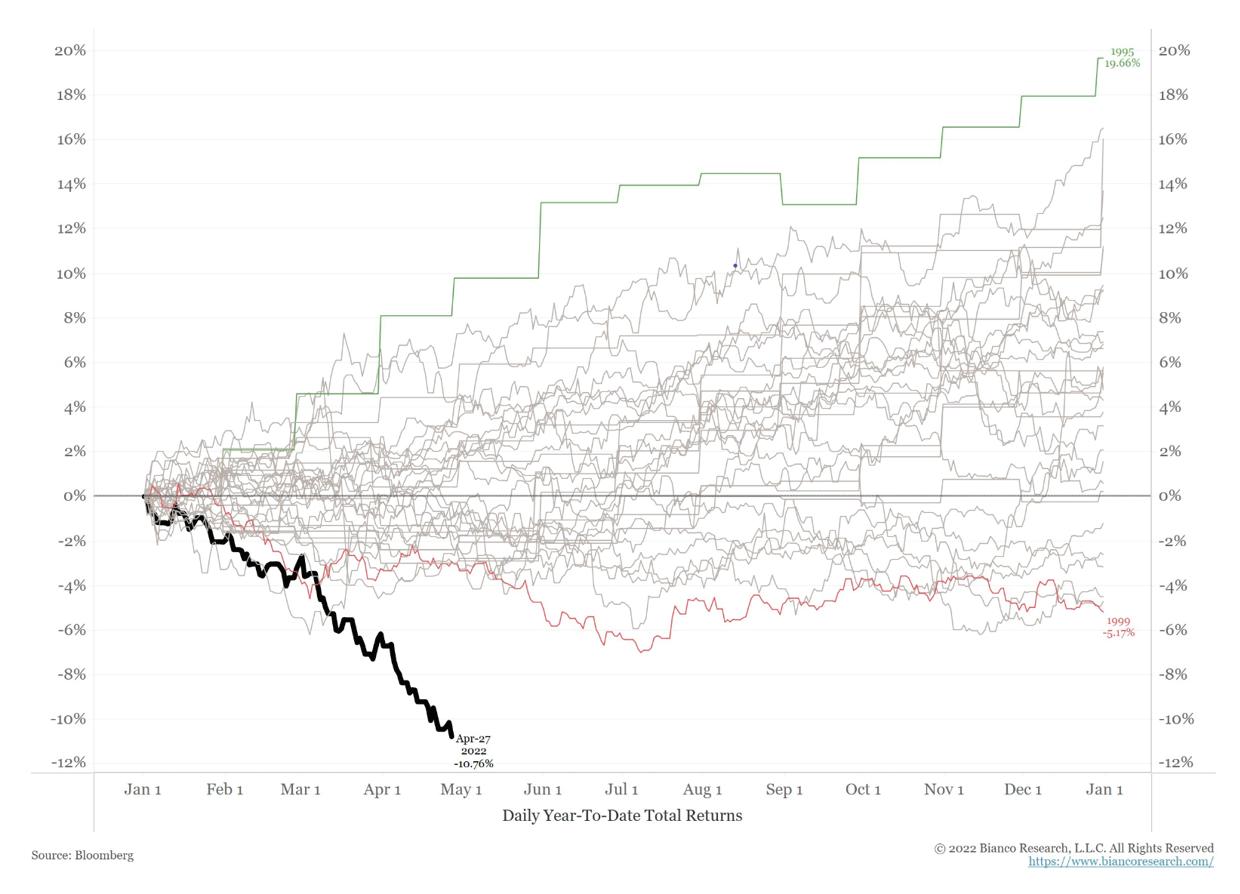

Bond markets have also experienced a poor start to the year, with interest rates in many countries having increased and with further rate rises projected. It is a unique aspect of bond pricing that when interest rates rise, two things happen –

1. The prices of existing bonds go down (which happens immediately)

2. The expected future returns of those existing bonds go up (with these higher returns being delivered over time)

In this regard, falling bond prices are felt immediately in portfolio valuations, while the higher expected future returns are only received in the months that follow. One small comfort from this is that with current bond yields now much higher than they have been for several years, the expected future returns from bonds are looking increasingly attractive.

Even if New Zealand or any other countries enter a technical recession this year (two or more consecutive quarters of negative growth), recessions don't tend to last for very long and don’t necessarily impact asset prices. As we have already noted, if demand and inflation show more obvious signs of reducing, central bank policies can also be expected to eventually pivot from fighting inflation to supporting growth.

For now, uncertainties are elevated and these uncertainties have been fully priced into markets. While this has been a big factor in the poor share market returns year to date, it doesn’t tell us anything about the returns we should expect for the remainder of this year. Markets are relentlessly forward-looking. They don’t only calibrate the information that is known today, they also calibrate all the fears, hopes and expectations of every market participant. Whilst investor sentiment has been very negative, and this has weighed heavily on market prices, we know that sentiment and markets can turn very quickly. Just as the prospect of better economic times ahead can be a catalyst that can help move markets higher, and it can happen well before the benefits are readily observable in the economy around us.

Given the current low market starting point, if sentiment was to begin to improve in the coming weeks and months around any one or more of the current uncertainties (inflation, central bank policy, economic growth, Covid or the Ukraine conflict), then share markets at these lower prices might suddenly look a lot more appealing.

As always, in periods like this where the market has been challenging, it is best not to try and ‘time’ your exposure. Whilst it might be tempting to think that you could just sit out of the markets and wait for the current storm to blow over, the forward-looking markets will always go up, and sometimes strongly, well before the economic clouds have cleared. And given the speed that markets can react, being on the sidelines and missing the recovery can often be far more detrimental to a long term plan, than absorbing the current lower valuations and higher volatility of returns.

The most reliable advice is always to maintain the risk exposure that you set, and considered appropriate, when the skies were clearer. Investing more when prices are cheaper is usually an even better option, but that may not be an option that is available to everybody. If it isn’t, just batten down the hatches and wait this one out. The skies always clear and the markets always recover. We just don’t ever quite know the timing.

Whilst it might be tempting to think that you could just sit out of the markets and wait for the current storm to blow over, the forwardlooking markets will always go up, and sometimes strongly, well before the economic clouds have cleared.

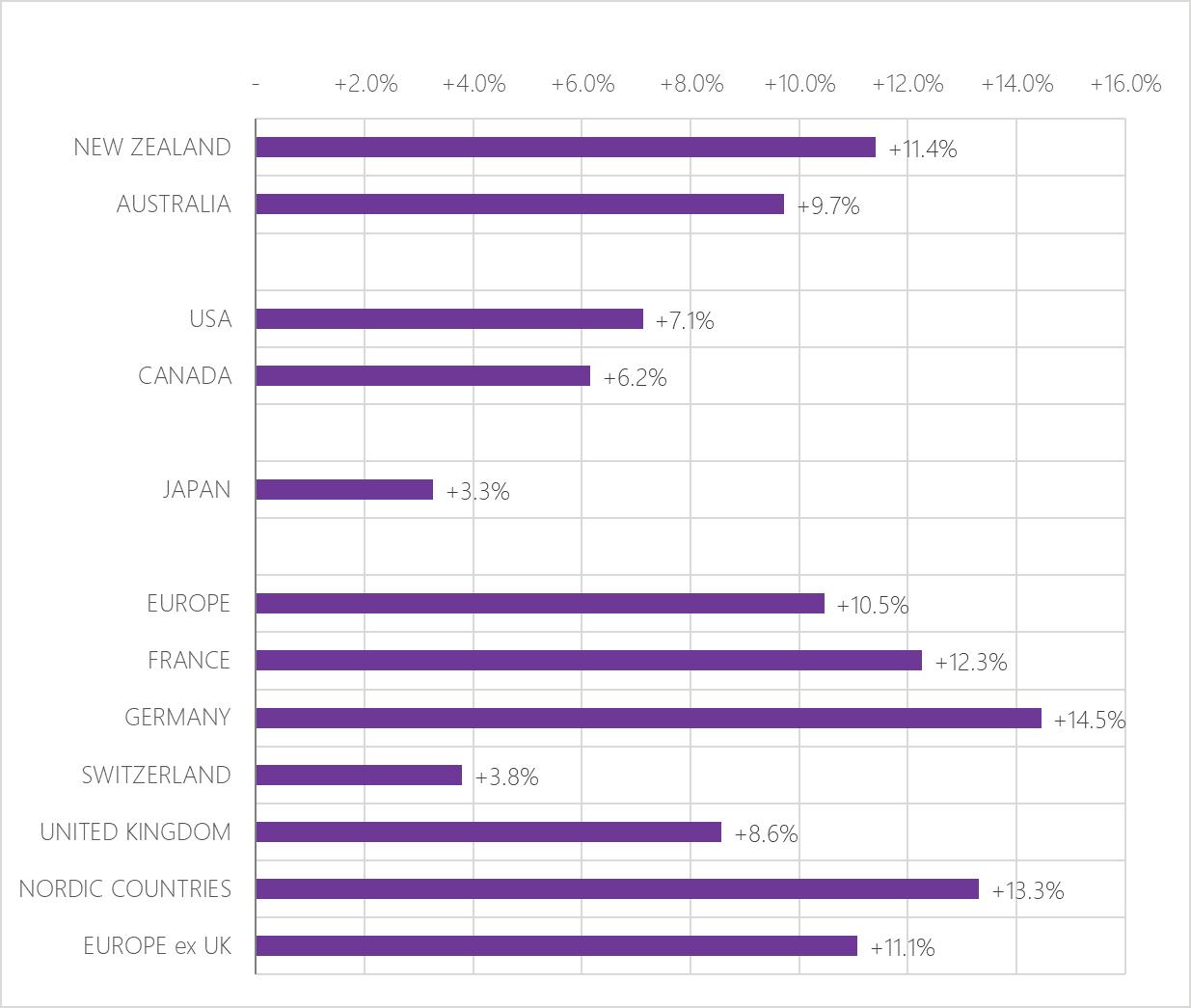

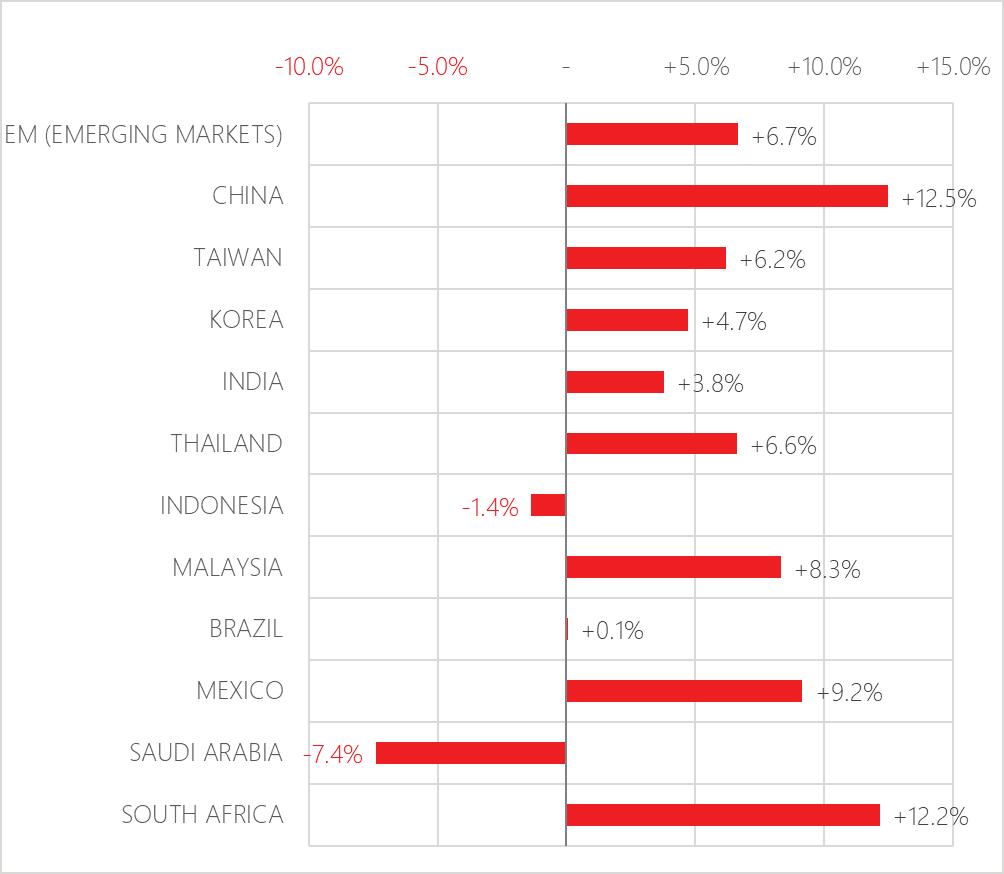

Shares and bonds across the board were under pressure in the second quarter of 2022, as markets priced in further increases in interest rates as well as an increased risk of recession. Amongst equities returns, which were generally poor, the MSCI World Value index significantly outperformed its Growth counterpart, although both registered double-digit declines. The Chinese share market provided a rare highlight as prolonged lockdowns were lifted in some major cities, allowing macroeconomic indicators there to show some improvement.

Inflation rates in major economies continued to persist at multi-decade highs, with various central banks raising interest rates and others clearly signalling their intention to do so soon. The quarter also saw mounting concerns over global economic growth prospects, with the fight to tame inflation likely to result in monetary policy settings that would be less supportive than the global economy has enjoyed in recent years.

The potential for economies to experience a recession later this year became more widely contemplated and, towards the end of the quarter, economic indicators began to reflect a general moderating or slowing in economic activity.

In the US, investor focus was on inflation and the policy response from the US Federal Reserve. The bank enacted initial rate hikes during the quarter and signalled that there would be more to come. Even so, they admitted the task of bringing inflation down without triggering a recession would be a challenging balancing act.

While weak sentiment affected all sectors, consumer staples and utilities companies were comparatively resilient. However, there were some dramatic declines for some companies, most notably in the media, entertainment and auto sectors.

Further steep declines were common for eurozone shares, as the war in Ukraine continued and concerns mounted over potential gas shortages, with supplies to Germany a particular being a point of concern. Higher inflation also dented consumer confidence, with the European Central Bank (ECB) poised to raise interest rates in July.

UK equities also fell over the quarter, with economically sensitive areas of the market performing poorly towards the end of the period amidst rising recessionary risks.

In New Zealand dollar terms, the MSCI World ex-Australia Index delivered a quarterly return of -15.1% on a hedged basis and -6.9% unhedged. This meant the rolling 12 month return for the New Zealand dollar hedged index reduced to -12.2% while the unhedged index is down -4.2%.

Source: MSCI World ex-Australia Index (net div.)

-1.6%

In a quarter where global share markets generally slumped, it was somewhat against the usual trend to see the relative outperformance of the emerging markets region (as a whole). When investors are wary of exposure to higher risk assets, emerging markets are often harder hit. But not this quarter.

That said, plenty of emerging market share markets did post declines. The South Korea share market struggled, with financials, technology and energy stocks hit particularly hard amid growing fears of a global recession. Taiwan was also significantly lower, on fears that rising inflation and global supply chain problems would weaken demand for its technology products.

The Latin American markets of Colombia, Peru and Brazil were amongst the weakest in the MSCI Emerging Markets Index. A combination of rising concerns about a global recession, domestic policy uncertainty and weaker industrial metals prices later in the quarter, all contributed to the declines.

The emerging European markets of Poland and Hungary both underperformed by a wide margin, as geopolitical risks stemming from Russia’s invasion of neighbouring Ukraine persisted.

The shining light for the region was China which managed to deliver a solid positive return for the quarter. With lockdown measures in certain Chinese cities being eased, this prompted a recovery in economic activity.

As the largest constituent in the emerging markets region, China’s positive result was a major driver to the mild loss for this asset class in the quarter, with the MSCI Emerging Markets Index producing a quarterly return of -1.6% in unhedged New Zealand dollar terms.

Source: MSCI Emerging Markets Index (gross div.)

-1.0%

The New Zealand market endured a difficult quarter with the S&P/NZX 50 Index returning -10.2%. Whilst at the individual company level there was ‘red ink’ almost across the board for the quarter, it was the industrials and health care sectors that contributed the largest drag on the performance of the index.

The two worst affected firms in the industrials sector, Air New Zealand and Freightways were down -27.9% and -25.9% respectively for the quarter, as the prospect of weaker economic growth weighed heavily on their prices. While building materials firm Fletcher Building fell -21.0% as sentiment around the domestic building and construction sector continued to cool.

With only six firms in the top 50 delivering a positive return in the quarter, it was software firm Pushpay that enjoyed the strongest performance, gaining 11.4%. This followed news that two existing shareholders (BGH Capital and Sixth Street) were intending to make a takeover bid for the firm.

Source: S&P/NZX 50 Index (gross with imputation credits)

The Australian share market (ASX 200 Total Return Index) had a similarly tough time sliding -11.9% over the quarter in local currency terms. Returns to unhedged New Zealand investors were slightly better at -9.8%, due to an appreciation in the value of the Australian dollar over the quarter.

Once again, the dispersion in sectoral returns was a feature of the market, with the utilities and energy sectors standing apart from the rest by delivering small gains. At the other end of the spectrum, the information technology sector suffered a very poor quarter as growth company valuations came under increasing pressure due to the expectation of faster rate hikes. The real estate and materials sectors were also very weak.

With only a little over one in ten companies in the ASX 200 delivering positive returns during the quarter, infrastructure firm Atlas Arteria (+23.1%) and small energy company Viva Energy Group (+23.0%) were the clear standouts.

At the other end of the standings, there were 21 companies within the ASX 200 that delivered returns of -35% or worse for the quarter. This list was littered with small capitalisation firms in the technology and basic materials sectors, as valuation concerns and general negative sentiment during the quarter impacted these companies the most.

Source: S&P/ASX 200 Index (total return)

Global bonds saw their prices continue to decline during the quarter, with yields markedly higher due to elevated inflation data, increasingly ‘hawkish’ central bank statements and rising interest rates. There was a small bond rally (price gains) towards the end of the quarter as economic growth concerns began to rise.

With inflation data in major economies at multi-decade highs, the quarter was characterised by various central banks raising interest rates and others signalling their intention to do so. The quarter also saw mounting concerns over future economic growth prospects, including the possibility of a recession later this year.

In the US, the Federal Reserve implemented a series of interest rate hikes, raising the US policy rate by 0.50% in May and a further 0.75% in June, their largest single rate hike since 1994. At the same time, Federal officials cut their 2022 growth forecasts. In response, the US 10 year bond yield rose from 2.35% to 3.02% over the quarter.

European bond yields were volatile as the European central bank indicated it would end asset purchases early in the third quarter and raise interest rates soon after. With this backdrop, the German 10 year bond yield increased from 0.55% to 1.37% over the quarter.

In the UK, the Bank of England implemented further interest rate hikes, bringing the total to five in the current cycle, as well as raising its inflation forecast to a staggering 11%. This helped push the UK 10 year bond yield up from 1.61% to 2.24%.

Corporate bonds also suffered in the broad bond market sell off, and generally underperformed government bonds as credit spreads widened markedly. With mounting concerns over the economic outlook, high yield credit securities (i.e lower credit quality) were hit particularly hard.

The FTSE World Government Bond Index 1-5 Years (hedged to NZD) returned -1.0% for the quarter, while the broader Bloomberg Global Aggregate Bond Index (hedged to NZD) returned -4.5%.

Source: FTSE World Government Bond Index 1-5 Years (hedged to NZD)

-1.4%

The Reserve Bank of New Zealand (RBNZ) elected to increase the Official Cash Rate (OCR) by a further 0.50% on 14 April and again by another 0.50% on 26 May, taking this benchmark rate from 1.00% to 2.00% by the end of the quarter.

In its accompanying statement, the RBNZ noted that “the level of global economic activity is generating rising inflation pressures that are being exacerbated by ongoing supply disruptions driven by both Covid-19 persistence and the Russian invasion of Ukraine. The latter continues to cause very high prices for food and energy commodities.”

The Monetary Policy Committee also reconfirmed it planned to continue to lift the OCR “at pace” to a level that will confidently bring consumer price inflation to within its 1-3% target range.

In effect, this confirms the expectations of the RBNZ are for interest rates to continue to rise, for the time being at least.

Given this outlook, the New Zealand 10 year government bond yield climbed from 3.25% at the end of the first quarter to 3.87% at the end of June. The New Zealand 2 year government bond yield followed an entirely similar pattern, beginning the quarter at 2.92% and ending the June quarter at 3.51%, a yield increase of 0.59%.

Similar to the effects seen overseas, these rising bond yields generally resulted in negative short term returns for bonds of all durations.

The S&P/NZX A-Grade Corporate Bond Index fell -1.4% for the quarter, while the longer duration but higher quality S&P/NZX NZ Government Bond Index fell -3.2%.

Source: S&P/NZX A-Grade Corporate Bond Index

Unless otherwise specified, all returns are expressed in NZD. We assume Australian shares and emerging market shares are invested on an unhedged basis, and therefore returns from these asset classes are susceptible to movement in the value of the NZD. Index returns are before all costs and tax. Returns are annualised for time periods greater than one year.

On November 15, 2020, the New Zealand Herald ran an article titled, ‘What negative interest rates would mean for borrowers and savers’. It said that the Central Bank was seriously considering negative interest rates as an option to stimulate the economy in the post COVID recovery.

A mere 18 months later, the Central Bank raised the OCR to 2.5%, and indicted further upward moves were likely as outlined in its May Monetary Policy Statement1

The Reserve Bank Governor’s comment at the time was succinct and accurate, “We’re in a different world now.”

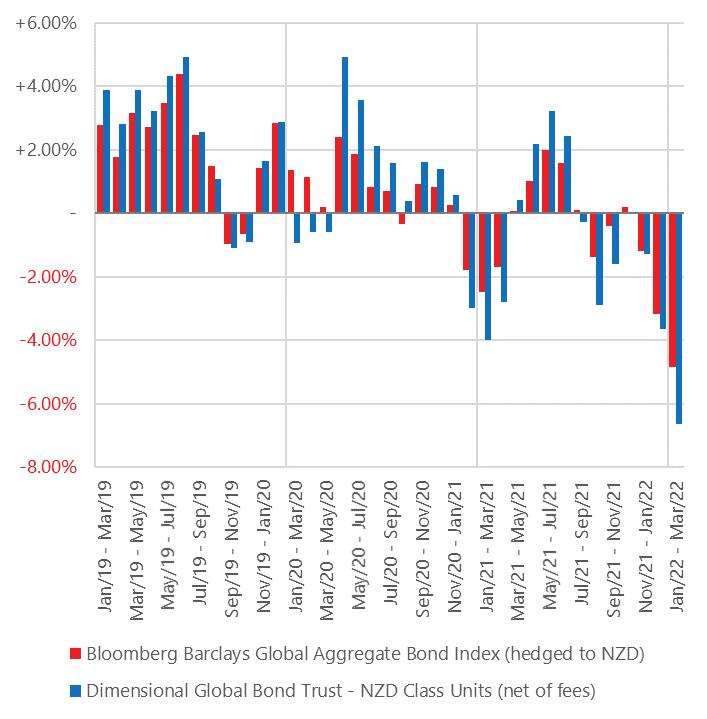

Not unsurprisingly, financial markets had priced lower interest rates into bond prices in 2019 and 2020 and investors got higher than normal returns as a result. In both 2019 and 2020, bonds provided investors very attractive returns. The Global Sustainability Bond Trust by Dimensional earned investors 8.64% in 2019 and 7.66% in 2020.

Since those heady days, market expectations about interest rates have changed dramatically. Markets no longer consider negative rates a possibility. Now markets are focused on inflation. Supply shortages, logistics problems and workforce constraints, combined with international energy disruptions, have pushed prices higher across many goods and services. Bond markets have absorbed this information and investors are now seeking a higher return on bonds. In response, bond prices have gone down and many investors received negative returns.

It’s important to point out that the poor recent bond returns are not the result of fund management or the credit worthiness of the underlying bonds themselves.

Poor returns are due to investors expecting inflation and requiring a higher yield as a result.

While that explains what happened, the question remains; should you still own bonds in your portfolio?

The answer in general is yes, although we always need to consider individual circumstances. It is worthwhile to provide some context and evidence for our position, especially considering recent returns.

Historically, bonds have been an excellent diversifier to shares. Since 1993 (as far back as we have NZ data at our disposal), there has been only one other calendar year where bond prices and share prices were both negative; in 1994 which we have circled below. By contrast we can look at 1998, 2000 and 2008 and see where bond prices went up while share prices that went down providing that diversification benefit investors are looking for.

Another illustration of the below chart is the narrower range of returns. While returns from shares can range from +50% to -40%, returns from bonds have never exceeded 20% in either direction. An appropriate allocation to bonds will reduce the volatility risk for your portfolio, which is especially important if you have a shorter investment time horizon.

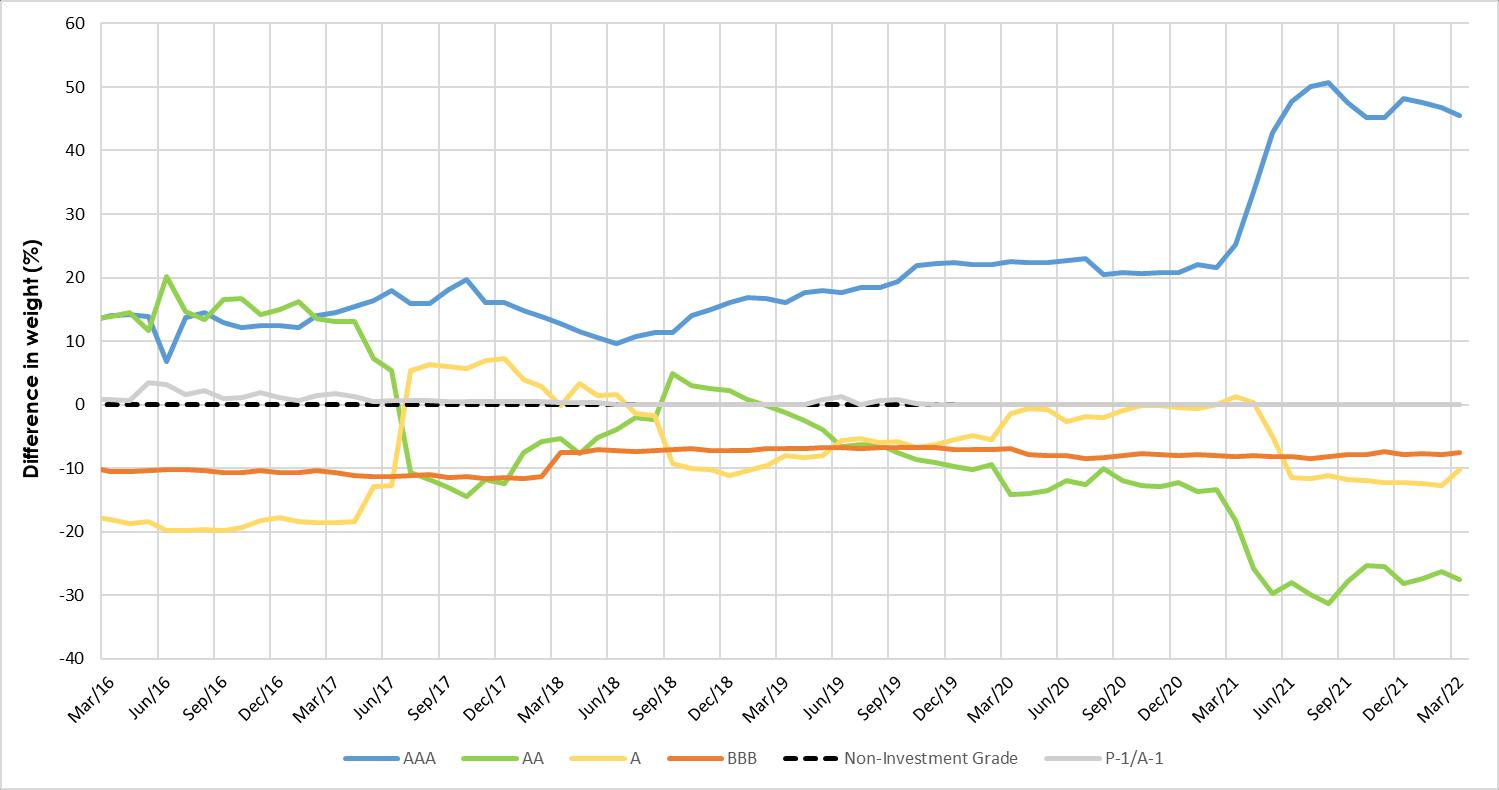

The bond funds used in our portfolios are overwhelmingly comprised of bonds selected from

Historically, bonds have been an excellent diversifier to shares.

borrowers that are investment grade rated (BBB, A, AA, and AAA). Those borrowers, which include the New Zealand Government, are very likely to pay back the bonds. If investors hold on for the long run, they will likely receive the positive return that comes from those borrowers making their scheduled payments.

4. Increasing rates are priced in

But what if interest rates go up more from here? Won’t that lead to lower bond returns? Not necessarily. The expectation is that interest rates will go up, and those expected increases are already priced in by the market. The reason they are priced in is because there is substantial, publicly available information about the intentions of central banks with future interest rate movements. One source is the projections made by US Federal Open Market Committee Members. Those projections are in the chart summarised below. Each dot represents the opinion of a member on where interest rates will be for the years 2022 – 2024 and then longer term. This chart shows that some members, called ‘doves’, believe interest rates will be lower than the median projection, while others, called ‘hawks’ believe they will be higher than the median projection. The median position is plotted in a line in the chart above. The question for bond prices will not be whether rates go up, but rather how much they go up by and whether the hawks or the doves are closer to the truth. This is a question that markets adjust for everyday making the answer a 50/50 guess. After all, prices must fairly include all known expectations for both a buyer and seller to willingly trade.

On a positive note, bonds are yielding more than in previous years. The Dimensional Global Bond Sustainability Trust, as of the date of writing, is yielding 4.77%2. That number was closer to 1.0% 18 months ago.

What that means for investors is that bonds now have a much higher expected return. Even if prices go down, investors could still earn a positive return because they are starting from a 4.77% yield rather that 1.0% yield. To summarise, over the next year:

ࠠ If yields do not change, investors win.

ࠠ If yields go down, investors win.

ࠠ If yields go up, prices will fall, but investors are starting from around a 4.77%3 return rather than a 1% return. Therefore, they could still earn a net positive return over the next 12 months.

We understand that it has been a very difficult 12 months for bond holders, as markets have adjusted from the possibility of negative interest rates to watching the Reserve Bank move to fight inflation. Markets have moved quickly, as they should, to reflect this change. The way markets do that is through prices. So, while the returns over the past six months have been painful, they do make economic sense.

From here, the question is about the long-term place of bonds in investor’s portfolio. We strongly believe they still have a place. They remain a good diversifier, they are issued by investment grade borrowers, interest rate increases are factored in, and yields are much higher than they were 18 months ago.

If you have any concerns, please let us know. As always, we want you to be comfortable with your long-term investment strategy.

1 https://www.rbnz.govt.nz/hub/publications/monetary-policy-statement/ monetary-policy-statement-may-2022

2 https://au.dimensional.com/funds/global-bond-sustainability-nzd-class

3 In the global sustainability bond fund

The indices used to calculate the index portfolio returns are as follows:

Notes:

All returns are in New Zealand dollars

Model portfolios are designed and supplied by the Consilium Investment Committee (CIC)

Growth assets refer to investments in shares and property

Income assets refer to investments in cash and fixed interest

Model portfolio returns are net of underlying management fees, but gross of custodial and adviser monitoring fees