3 minute read

Appendix: Supporting analysis

from CIC Yearbook 2022

by Consilium

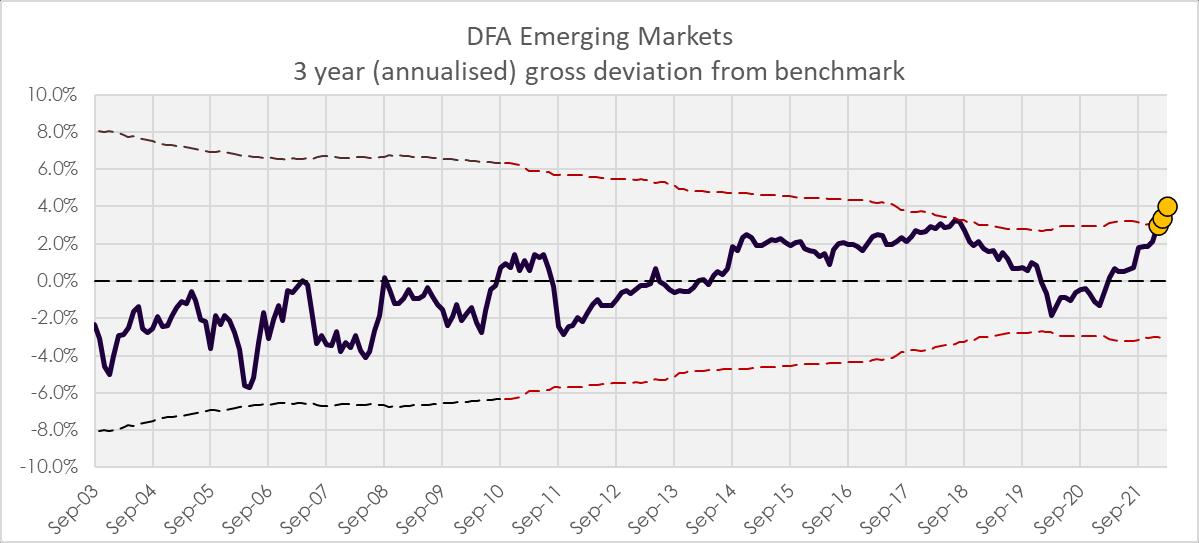

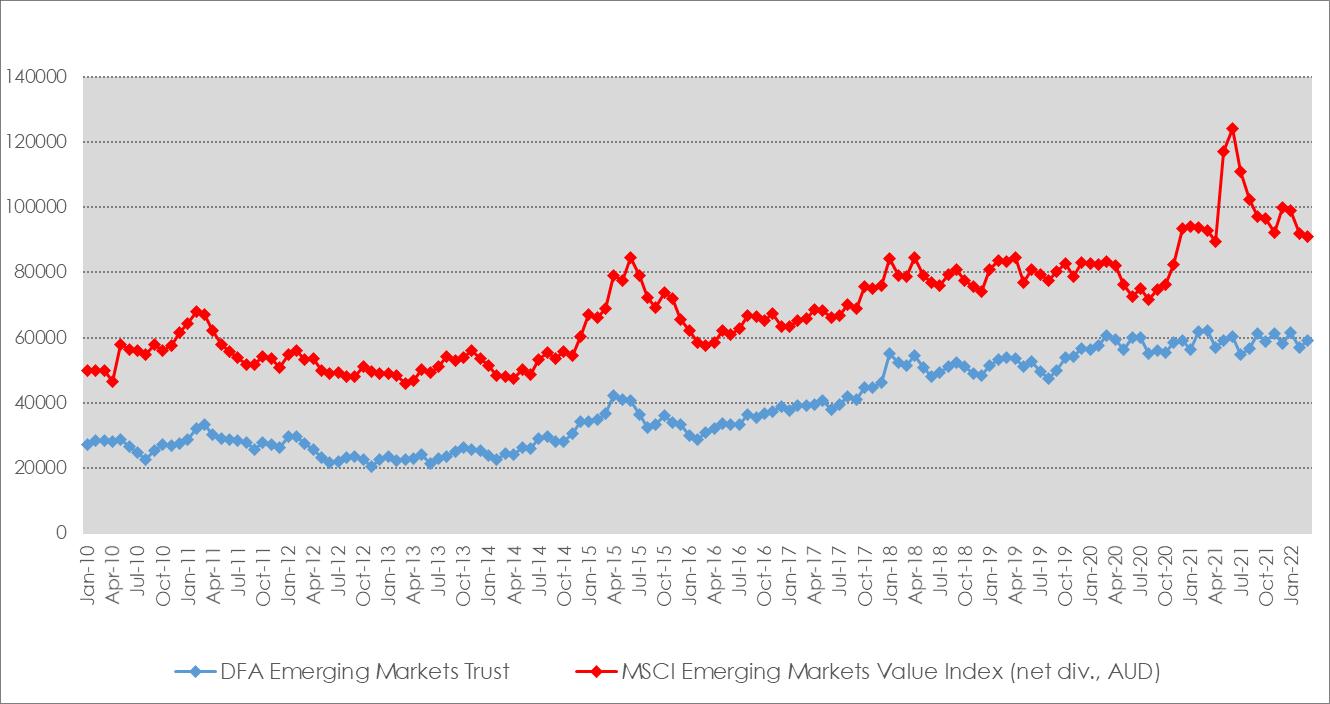

1. Tracking error chart

Figure 1: 3-year (annualised) deviation from benchmark

Advertisement

Source: Consilium

2. Review of the investment mandate

The Dimensional product disclosure statement (PDS) applicable to Q1 2022 was dated 02 August 2021. The stated objective of the trust is:

The investment objective of the Trust is to provide long-term capital growth by gaining exposure to a diversified portfolio of Value Companies associated with approved emerging markets.

The Trust is not managed with the objective of achieving a particular return relative to a benchmark index. However, to compare the performance of the Trust with a broad measure of market performance, reference may be made to the MSCI Emerging Markets Index (net div.).

The CIC has frequent dialogue with the fund manager, and we are satisfied there has been no change to the strategy/mandate without our knowledge.

3. Investigation with the fund management team

The trusts performance commentary (in AUD) for the quarter states:

The trust returned -1.3% for the quarter (or 5.84% (per annum) over three years), leading the MSCI Emerging Markets Value Index by 3.32% (per annum) over the period The focus on value stocks, particularly those with higher profitability, drove outperformance

While equities fell broadly, value stocks outperformed, with the MSCI All Country World IMI Value Index beating the growth index by 9%. Low profitability growth stocks were particularly hard hit. Despite a negative size premium, value stocks offered some respite for small cap investors as value paid off within small caps as it did within large caps.

In emerging markets, value stocks with higher profitability gained 1.1%, outperforming growth stocks by over 16%. The portfolio held 24% more weight in value stocks with higher profitability than the MSCI Emerging Markets Value Index. Additionally, as Russian stocks plummeted, the portfolio’s 2% underweight to Russian stocks further contributed to outperformance.

The stated Portfolio Structure for the trust is as follows:

Dimensional’s Emerging Markets Value Trust is designed to capture the returns associated with the value premium in emerging markets by investing in stocks with relative prices in the lowest 33% when ranked by price to book across all market capitalisations. Within this universe, the trust is designed to target higher expected return securities by overweighting smaller market capitalisations, lower relative price stocks, and higher profitability stocks The trust uses information in market prices every day to systematically pursue higher expected returns while managing risks and controlling costs.

4. Attribution Analysis

Allocation attribution of all regional exposure shows a cumulative impact of +625bps A reduced exposure to China, reduced allocations to Russia and a sizable overweight allocation to Taiwan all contributed to a strongly positive regional attribution over the period.

Allocation attribution of all industry exposure shows a cumulative impact of -266bps This analysis demonstrates that the value tilt contributed to an overweight allocation to energy and an underweight allocation to IT companies, both of which delivered significant negative attribution over the period in question.

Allocation attribution by size finds a cumulative impact of +364bps. This analysis helps explain majority of the trusts outperformance relative to the index and is consistent with Dimensional’s fund commentary highlighting a positive small cap premium.

Allocation attribution by book to market ratio shows a cumulative impact of +90bps This is consistent with the value tilt (or more noticeably the underweight exposure to unprofitable growth companies) delivering a small positive performance over the three years.

Tables 3 and 4 ultimately demonstrate the stated portfolio structure was able to deliver positive premia from investments in smaller market capitalisation, lower relative priced, high profitability companies.

Collectively, the attributions explain significantly more outperformance than the gross EDD flag of 4.03% implies. However, this is due to an element of double counting between the various attributions and the fact that this three-year attribution required particularly volatile average returns be attributed to a simple average of segment weights. Any differences in timing between when the weights were held and the volatile returns were delivered, magnifies the likelihood of distortions in the attribution outputs (particularly when segment weights are small).

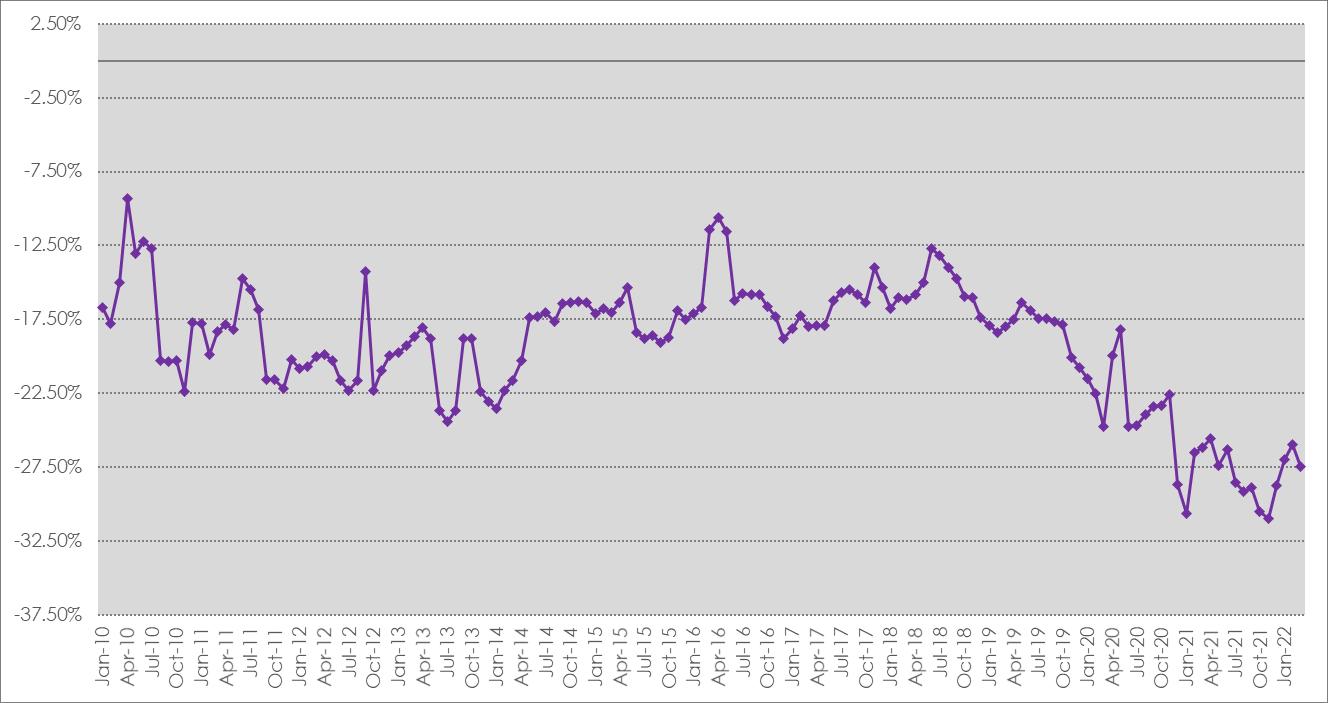

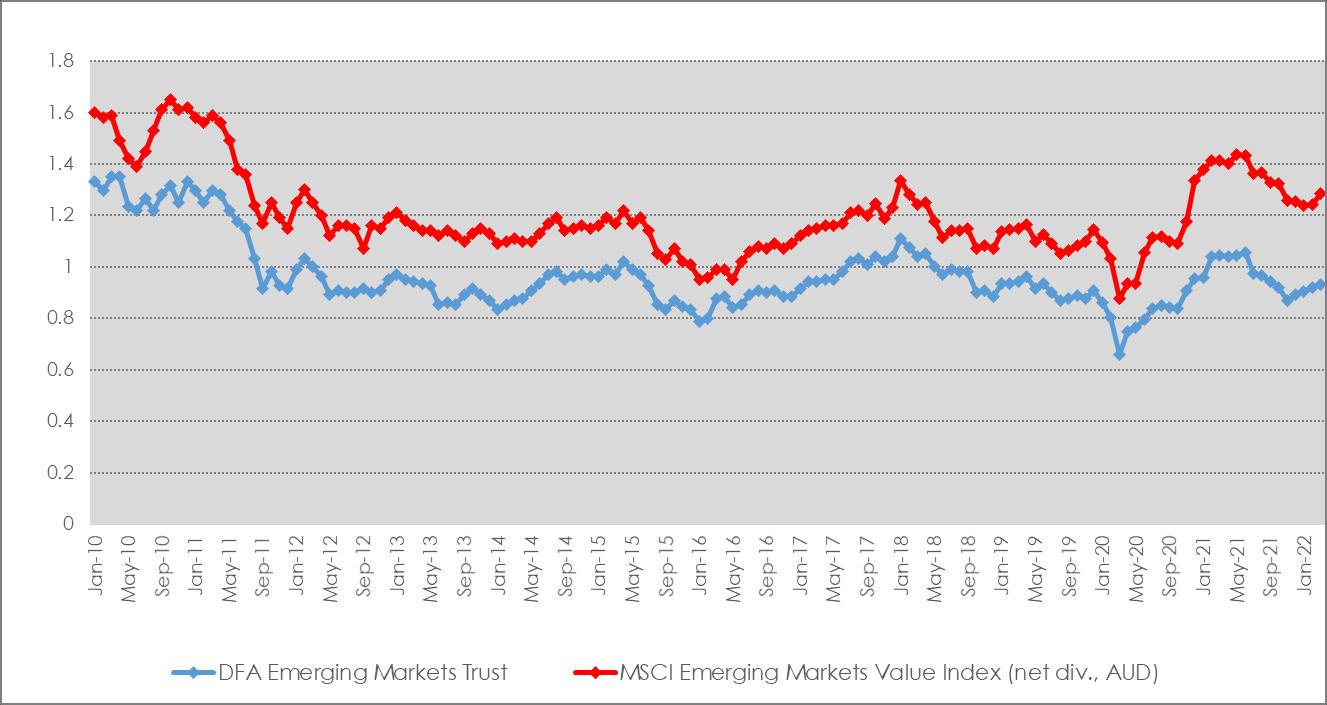

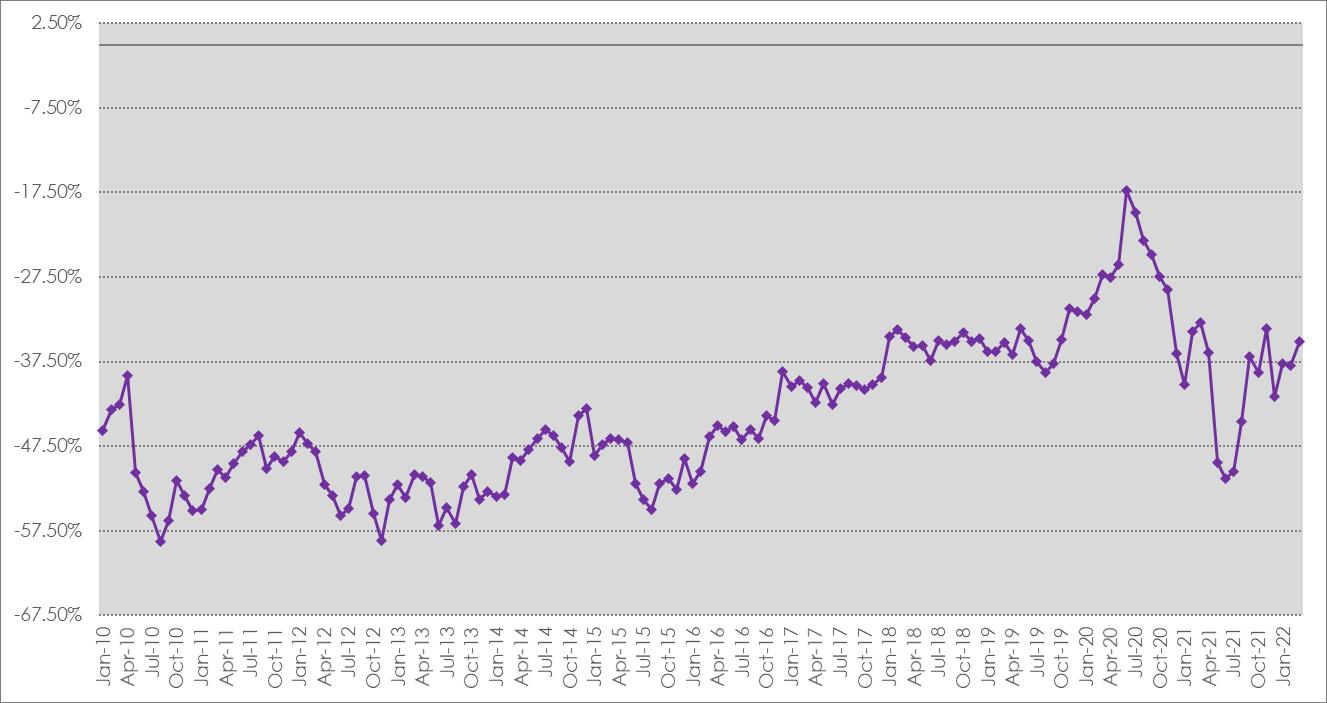

5. Analysis of risk exposure

Source: Consilium

Source: Consilium

We note the fund’s relative price to book ratio remains low in comparison to previous periods, however the deeper value allocation while still within the funds mandate has been a source of outperformance in recent quarters.

Figure 4

Weighted average total market capitalisation (NZD million) of trust and benchmark

Source: Consilium

Figure 5 – Weighted average total market capitalisation of trust relative to benchmark

Source: Consilium

Aside from some Covid related volatility, we note the weighted average market capitalisation of the trust versus the benchmark has otherwise been relatively stable since 2018.

Disclaimer: The material contained in or attached to this report has been prepared based upon information that Consilium NZ Limited believes to be reliable, but may be subject to typographical or other errors. Consilium has taken every care in preparing this information, which is for client education purposes only. Although the data has been sourced from publicly available information and/or provided by the investment managers, we are not able to guarantee its accuracy. Past performance, whether actual or simulated, is no guarantee of future performance. This document does not disclose all the risks of any transaction type described herein, and the recipient should understand any terms including relevant risk factors and any legal, tax and accounting considerations applicable to them.

One or more of the author(s) of this report invest in the analysed security. The author(s) do not know of the existence of any conflicts of interest that might bias the content or publication of this report. Compensation of the author(s) of this report is not based on any outcome of this report.