2 minute read

2022, Q3 Review

from CIC Yearbook 2022

by Consilium

On the October 2022 monthly adviser call, the Consilium Investment Committee reported on the third quarter of 2022. A summary is included below, and the graphics on the following pages are an excerpt of that presentation.

A full recording of this presentation is available on the Consilium Portal under ‘Quarterly Reporting’.

Advertisement

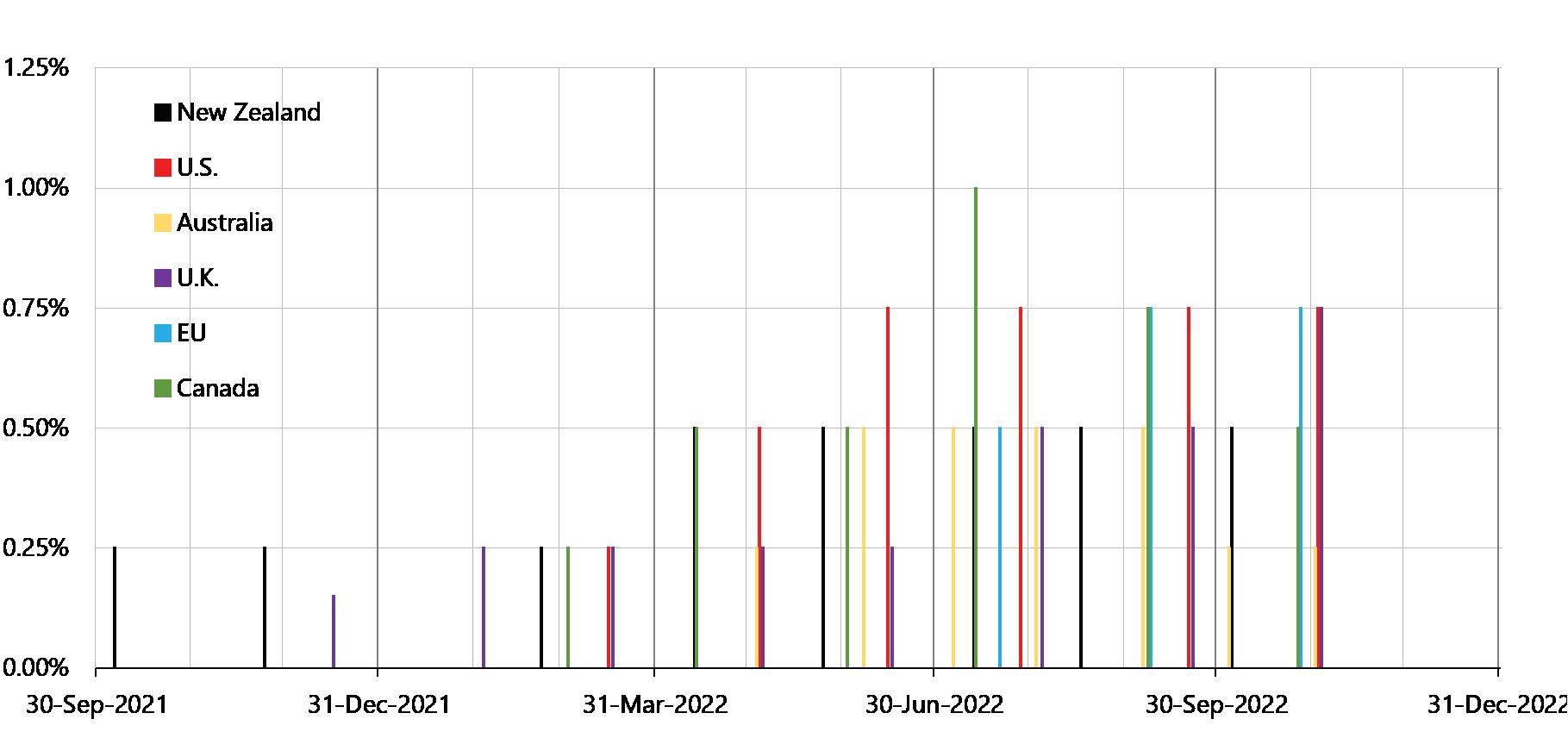

The September quarter offered a little respite even in the face of ongoing concerns around inflation and the war in the Ukraine. Rates continued to be hiked across developed markets, but investors began to look through these immediate changes, to find optimism and expectations that this hiking cycle may conclude soon.

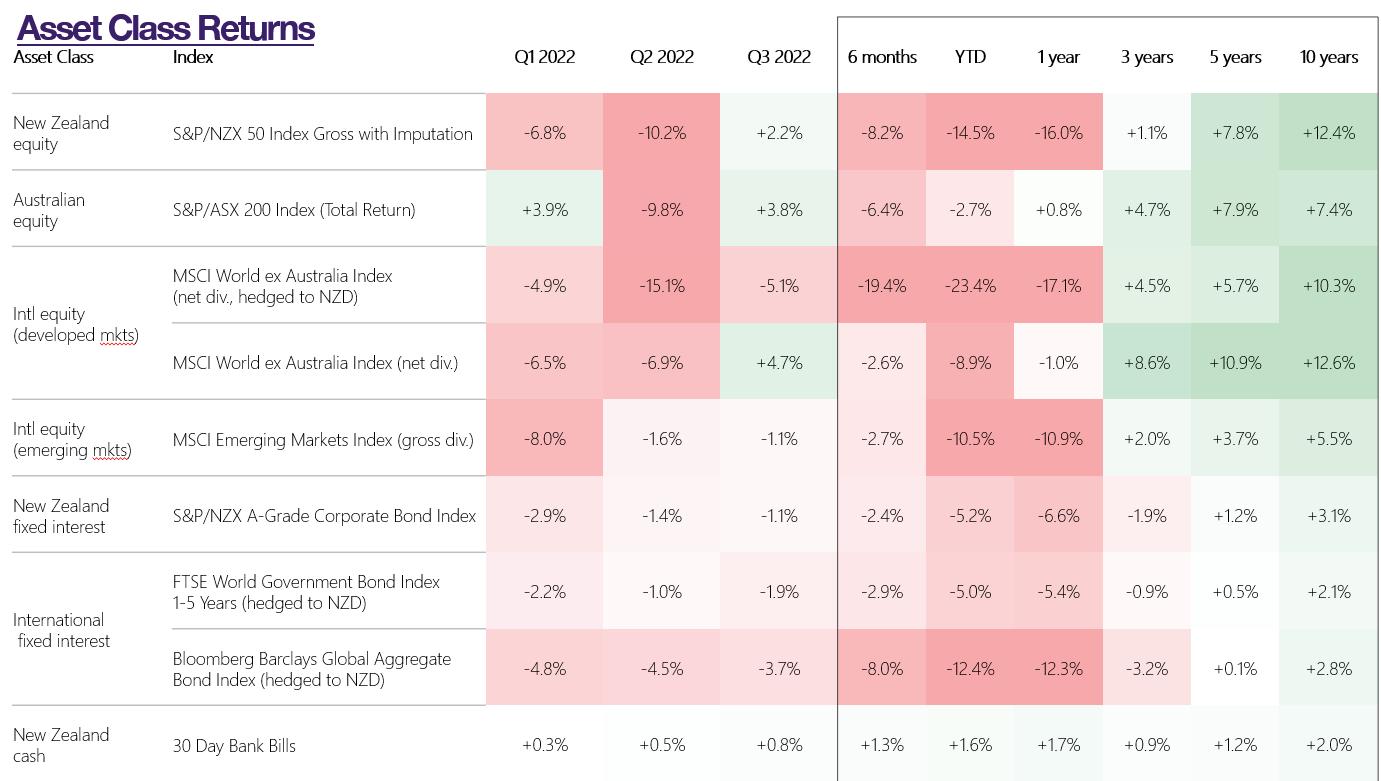

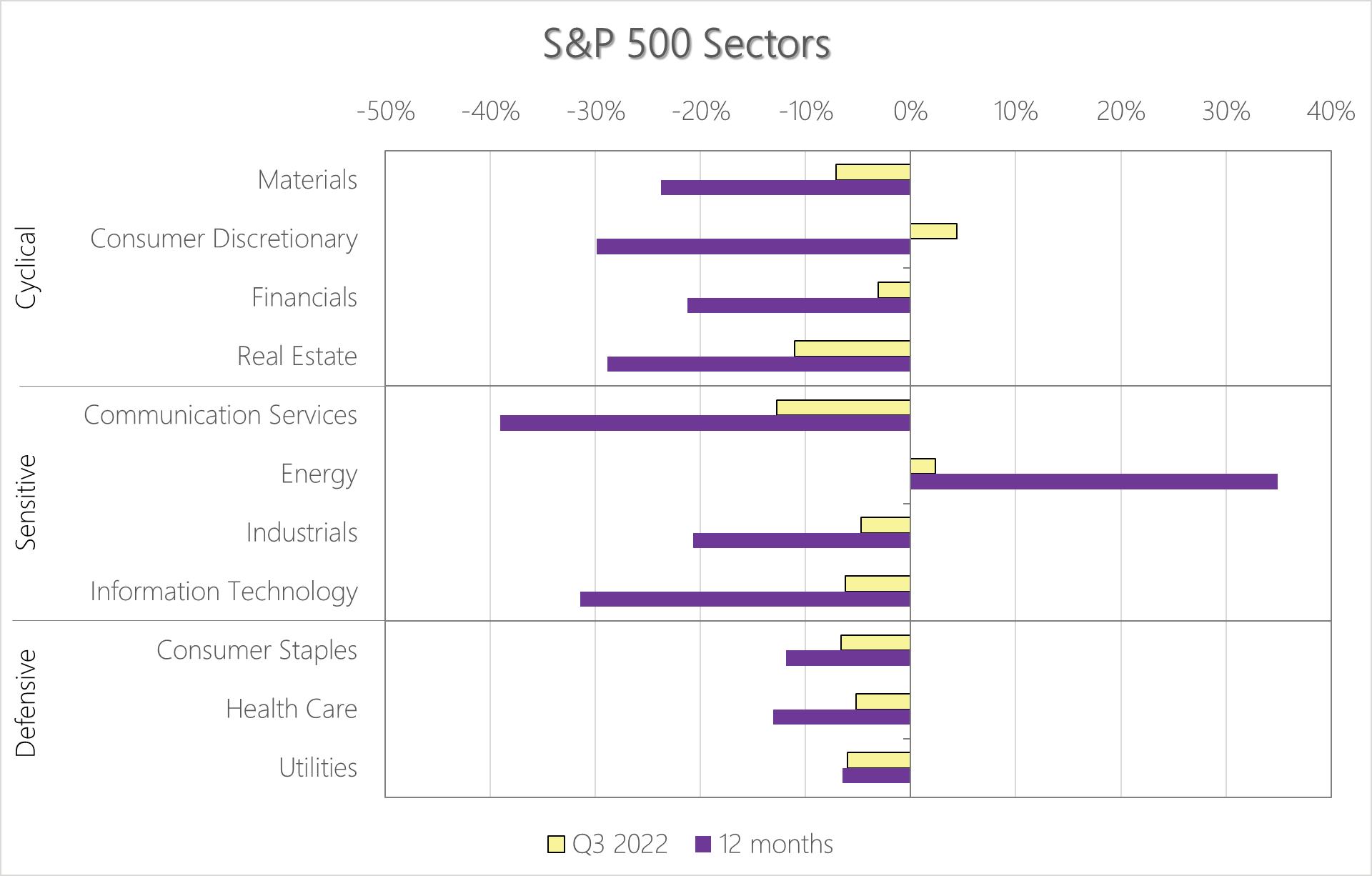

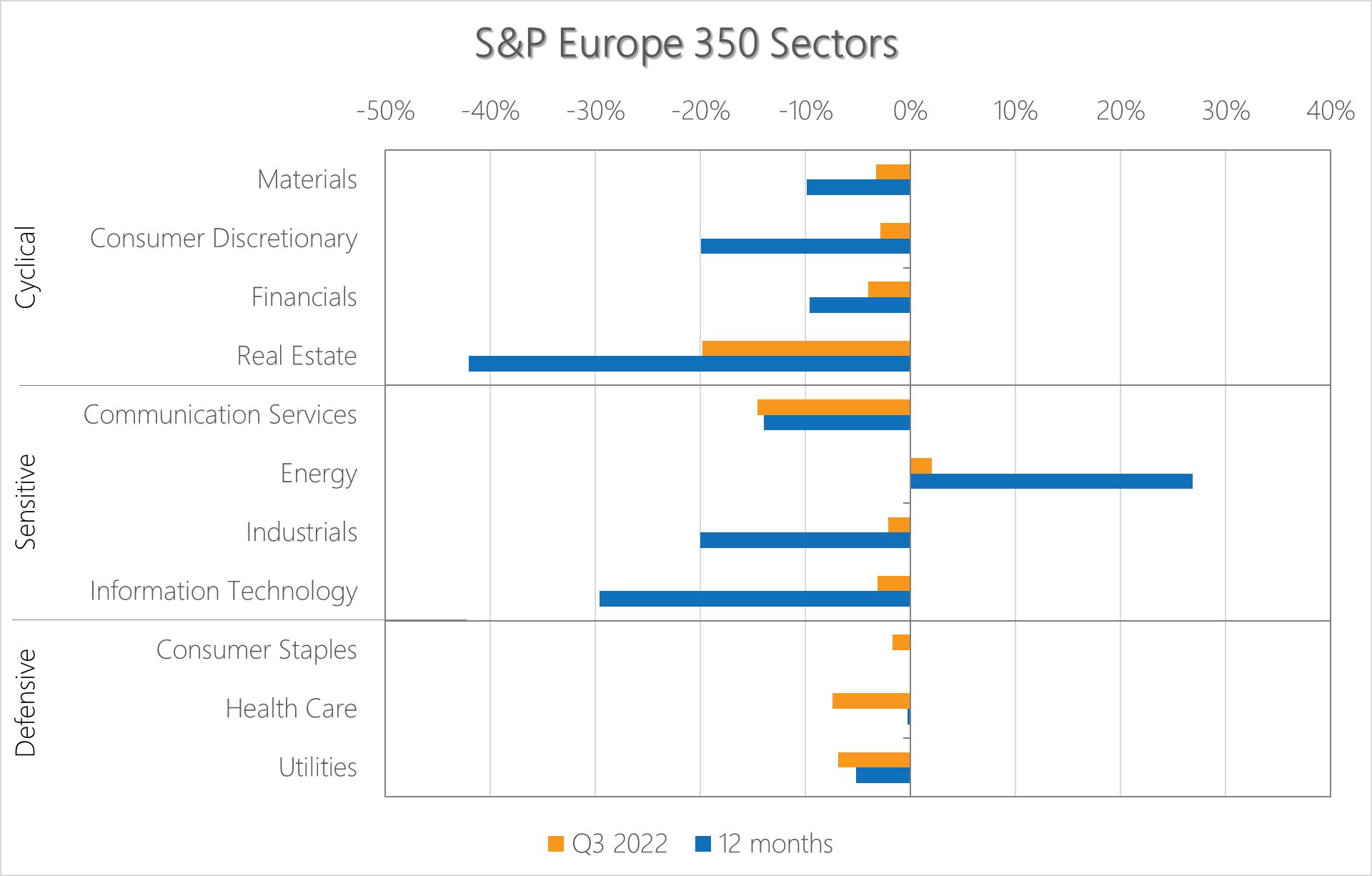

Ultimately the 2022 September quarter delivered mixed returns. New Zealand, Australian and unhedged Developed Markets equities were up, while hedged Developed Markets equities, Emerged Markets equities and fixed income were down.

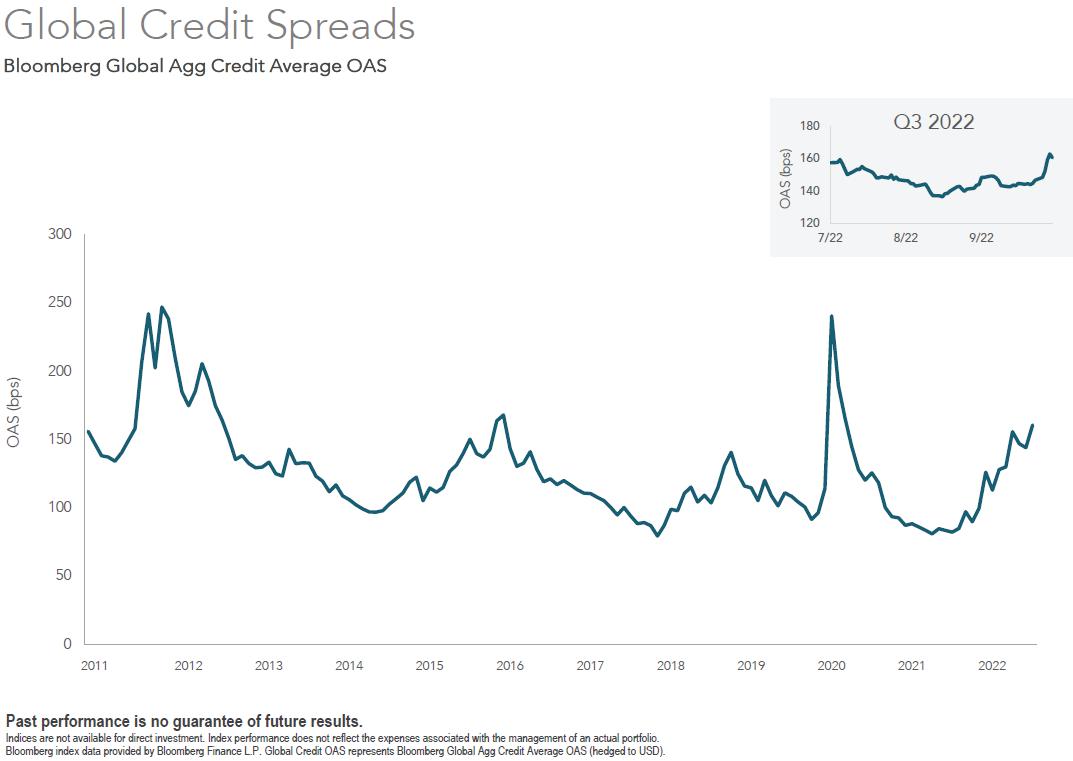

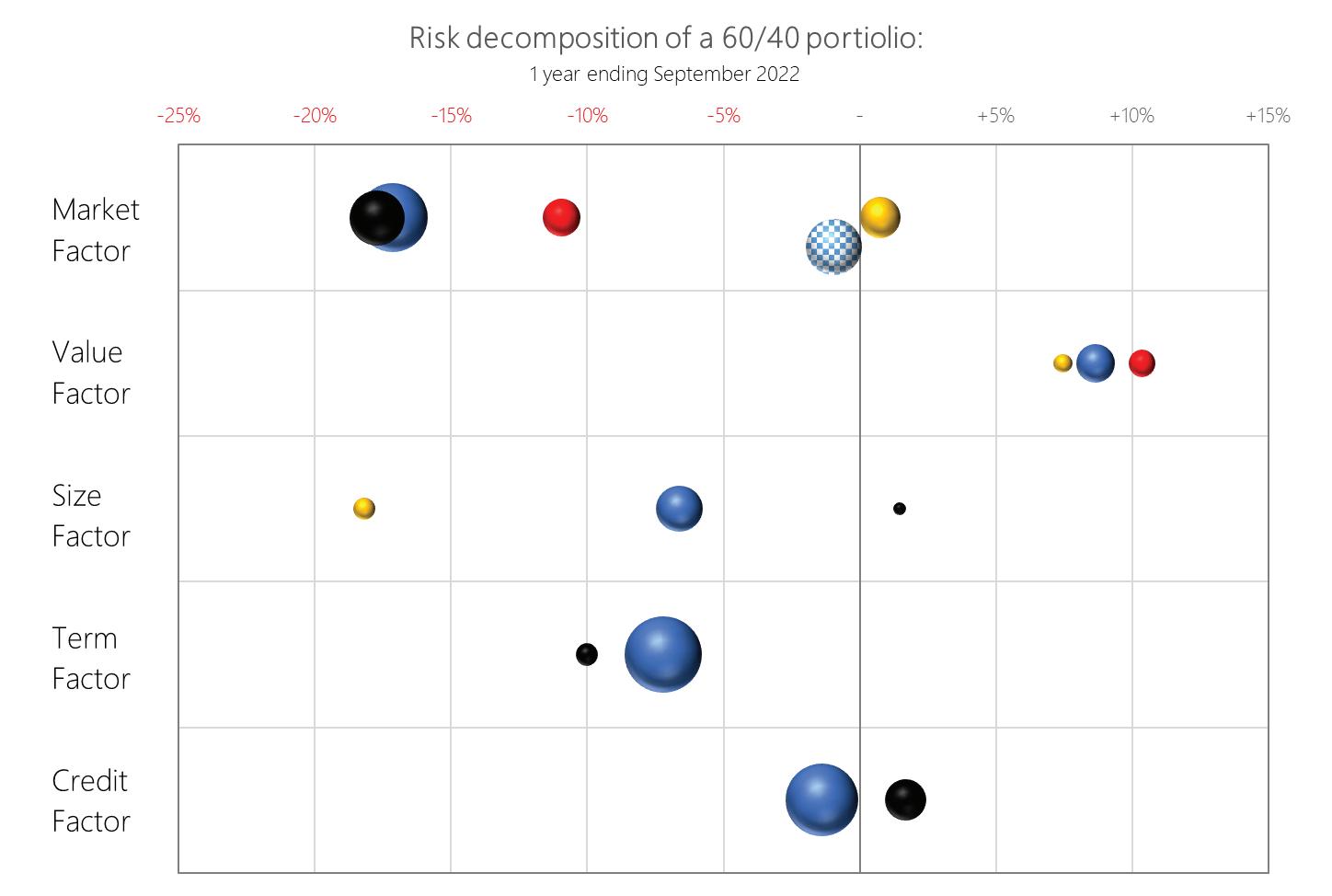

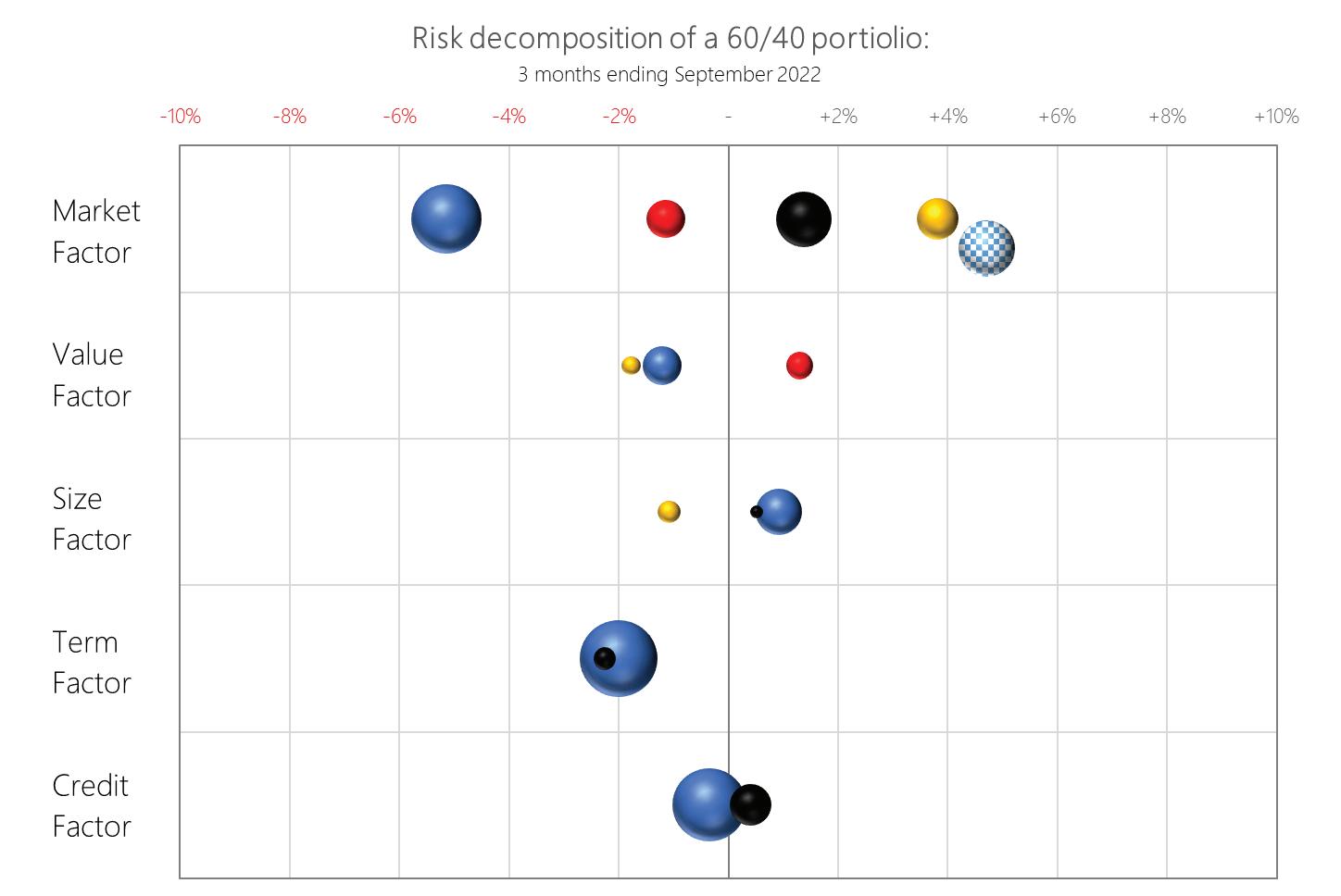

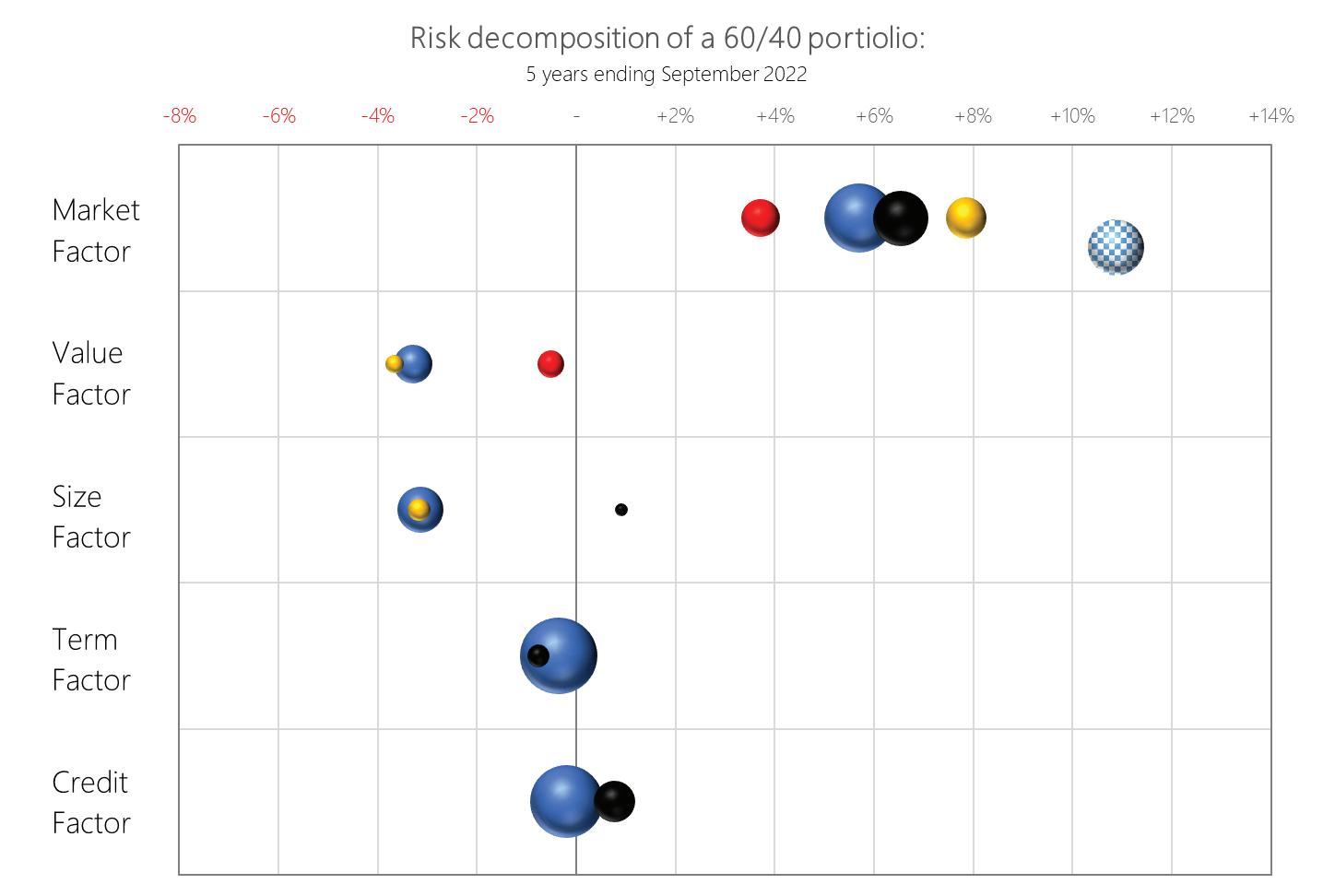

There was no consistent pattern in the premiums. Value was positive emerging markets, but negative in other developed markets and flat in Australia. Small caps generally outperformed large caps in all regions while the profitability tilts, term and credit were negative across the board.

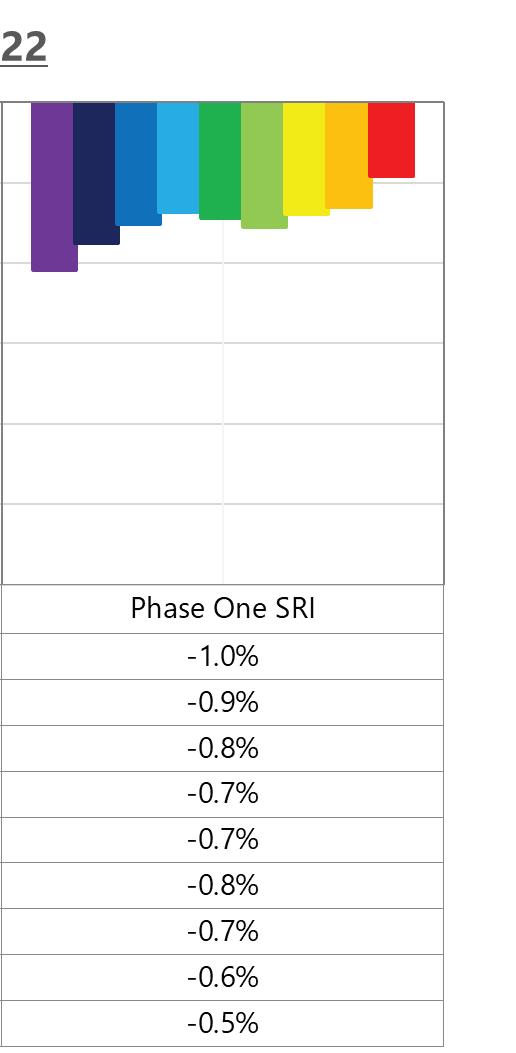

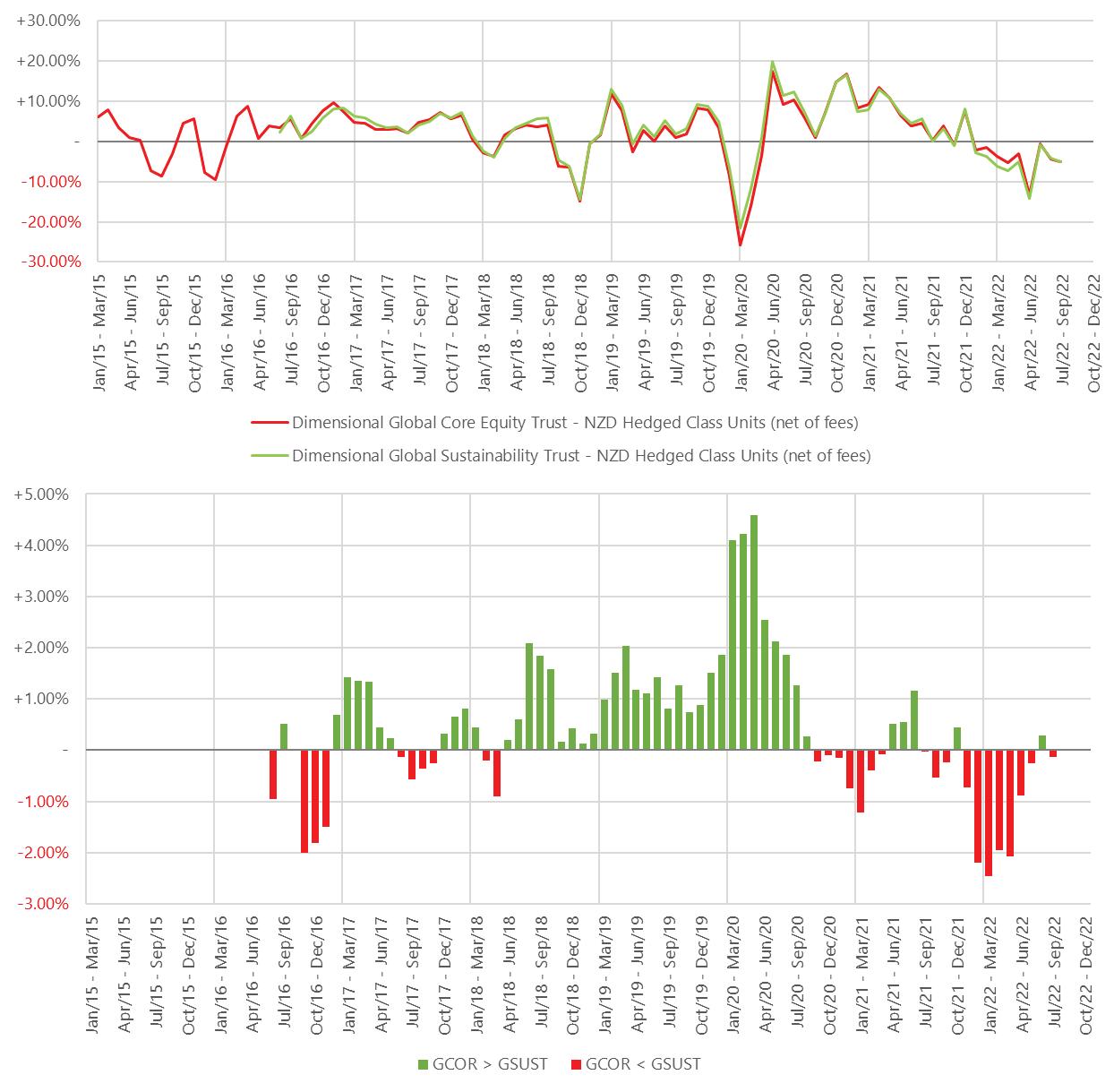

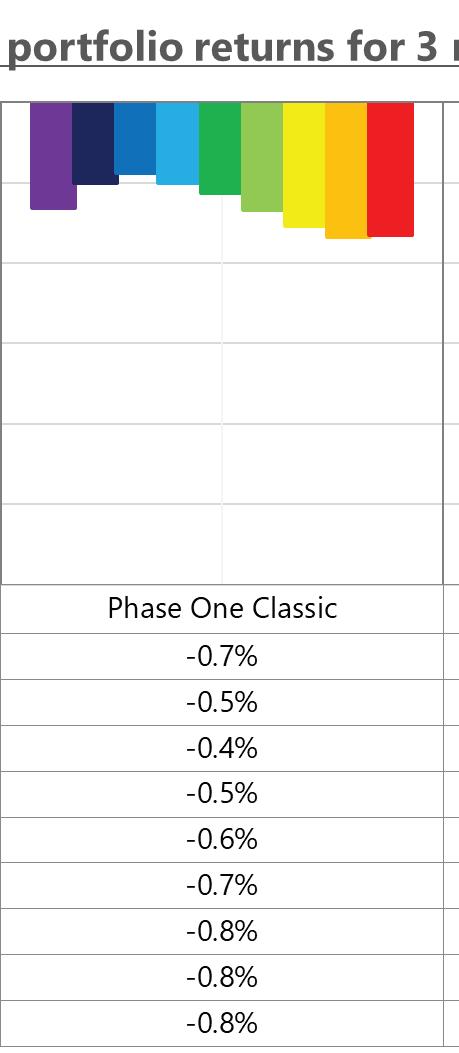

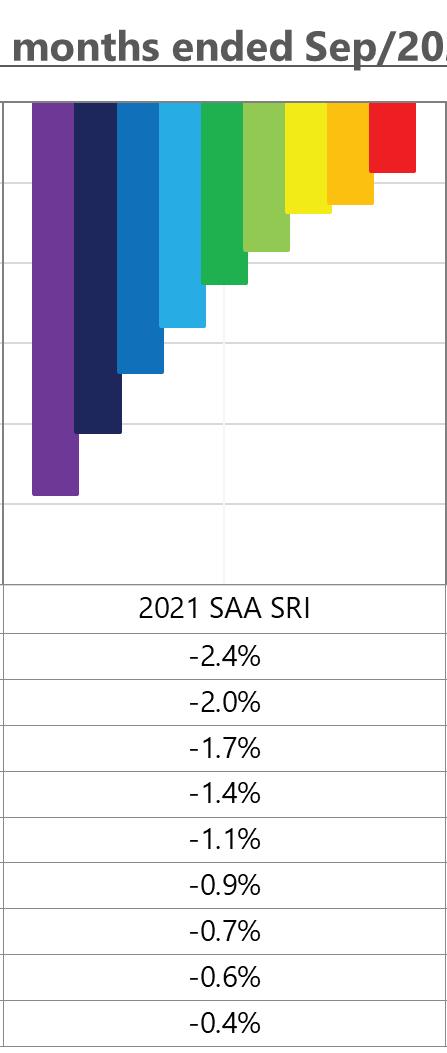

Phase one classic model portfolio returns ranged from -0.4% to -0.8% for the quarter, with the 40/60 portfolio losing the least. Phase one SRI model portfolio returns ranged from -1.0% to -0.5%, with defensive portfolios losing more than aggressive portfolios. The phase one SRI suite underperformed the classic suite on the defensive end while outperforming on the aggressive.

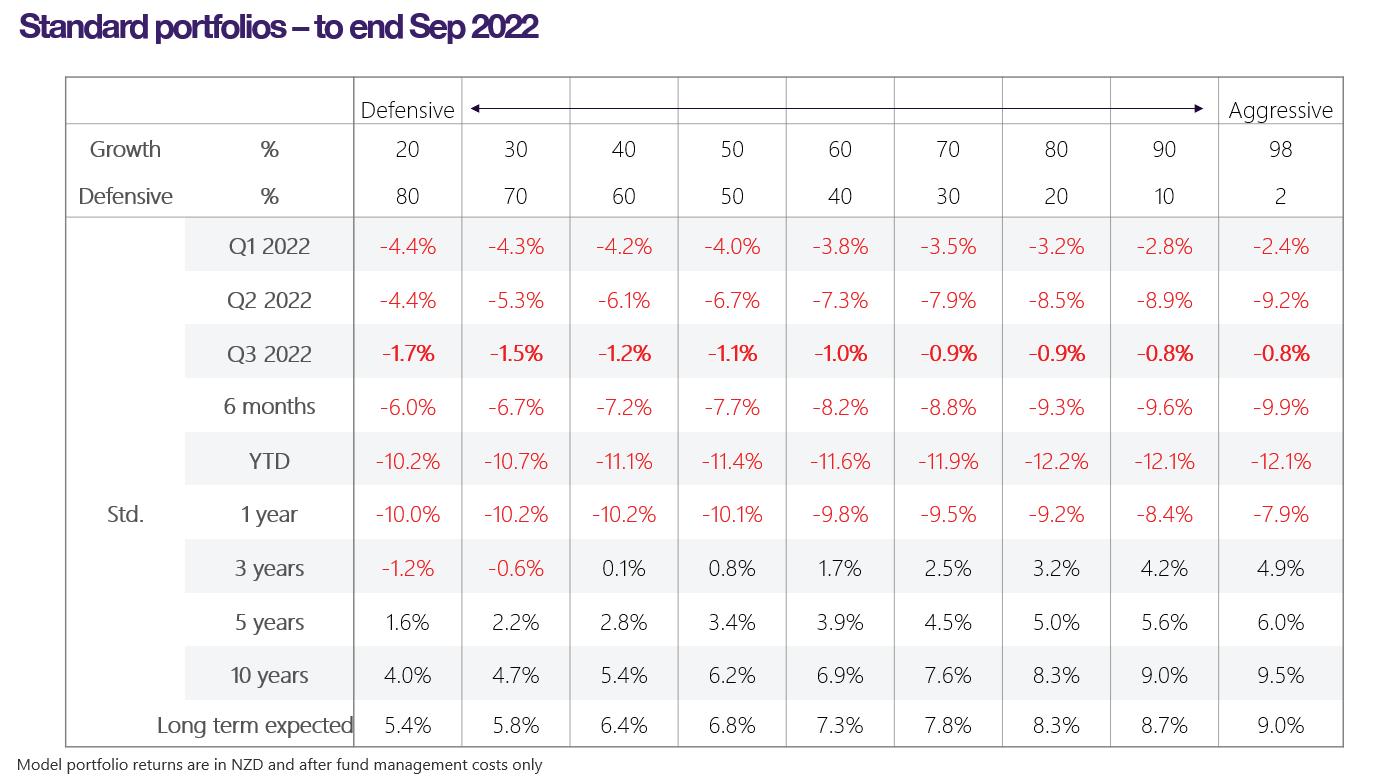

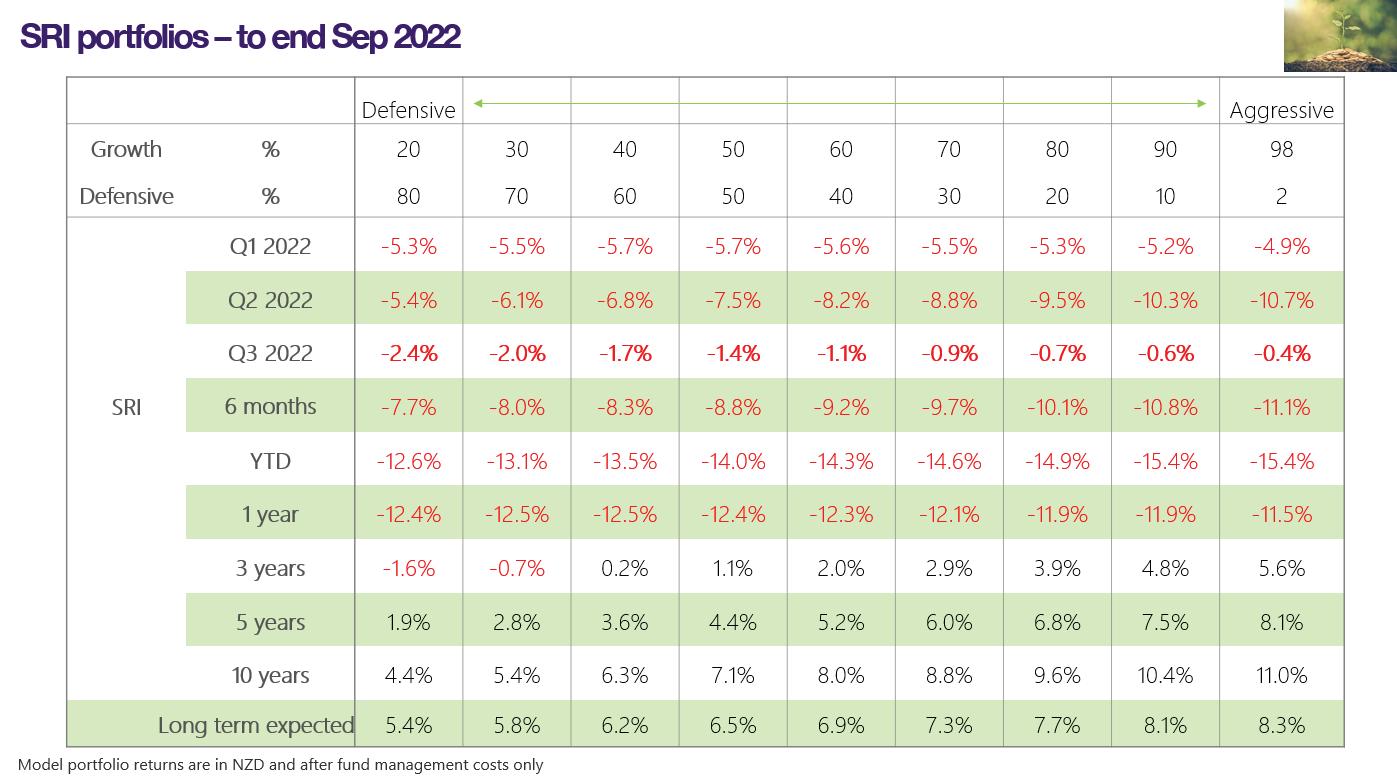

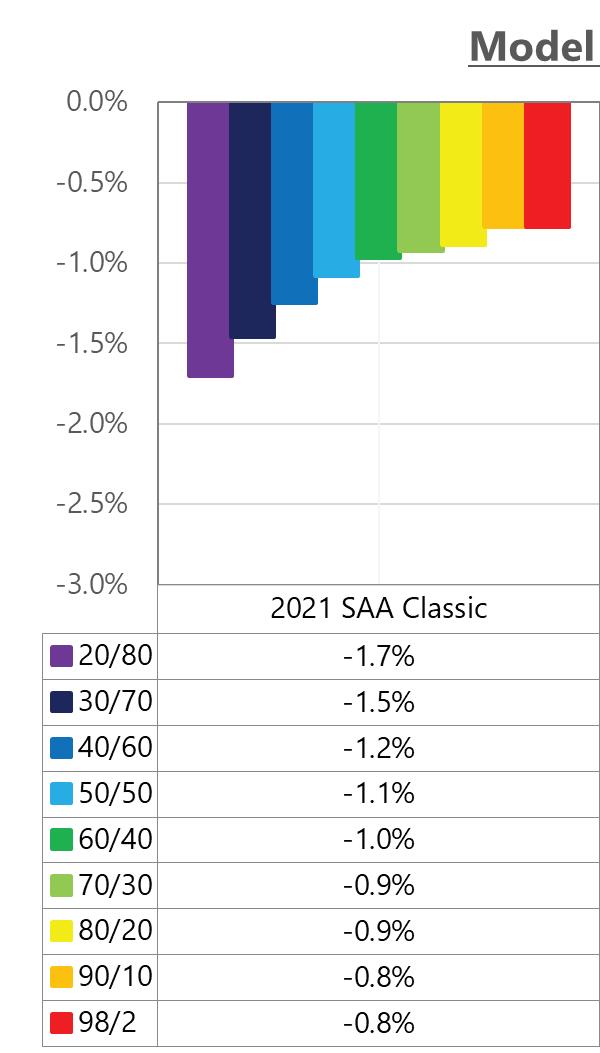

The 2021 SAA classic model portfolio returns ranged for the quarter from -1.7% to -0.8% while SRI ranged from -2.4% to -0.4%. Defensive lost more than aggressive portfolios in both suites.

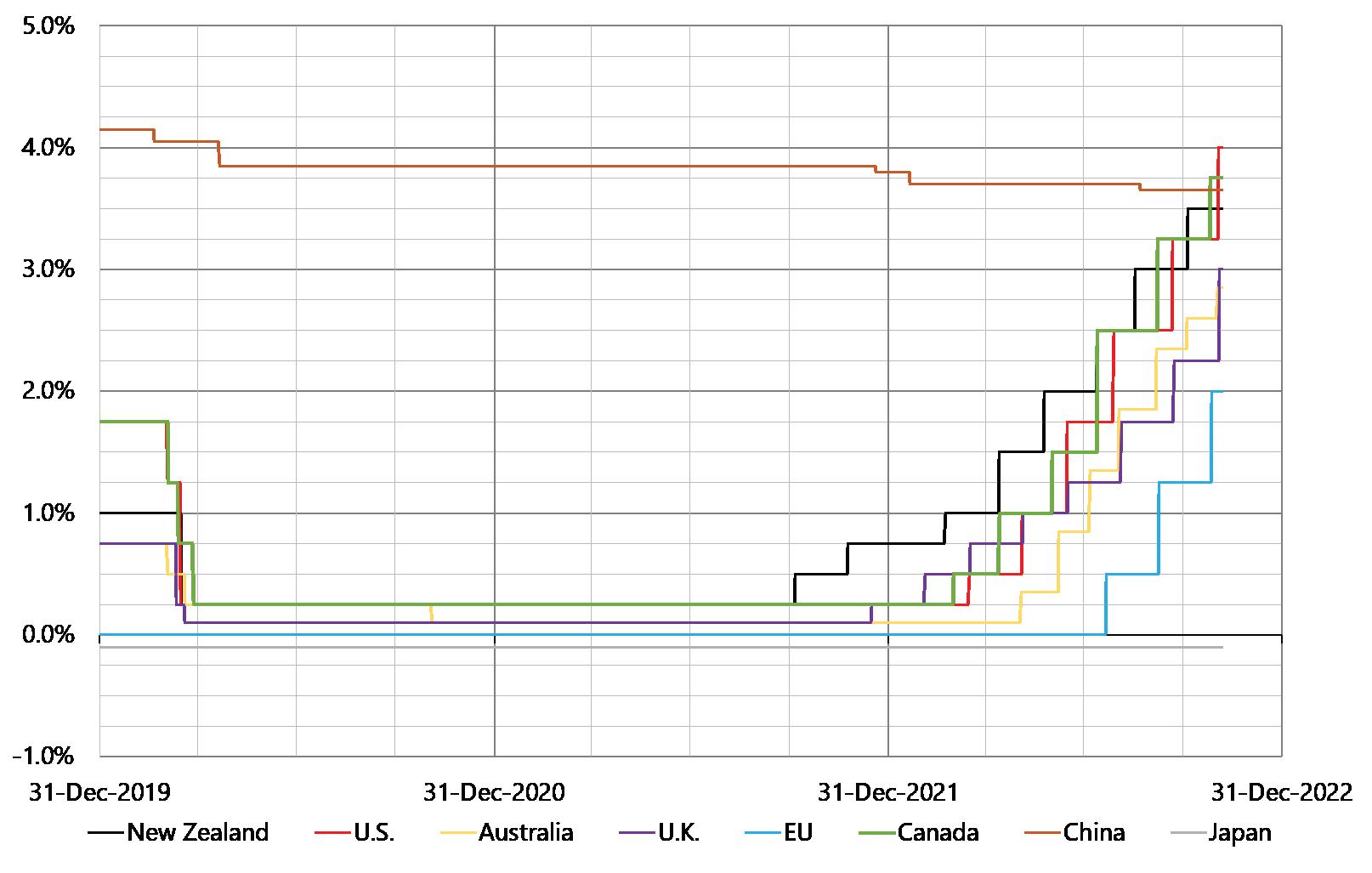

Monetary tightening cycle continues/acceler ates!

Source: globa -rates com

Monetary tightening cycle

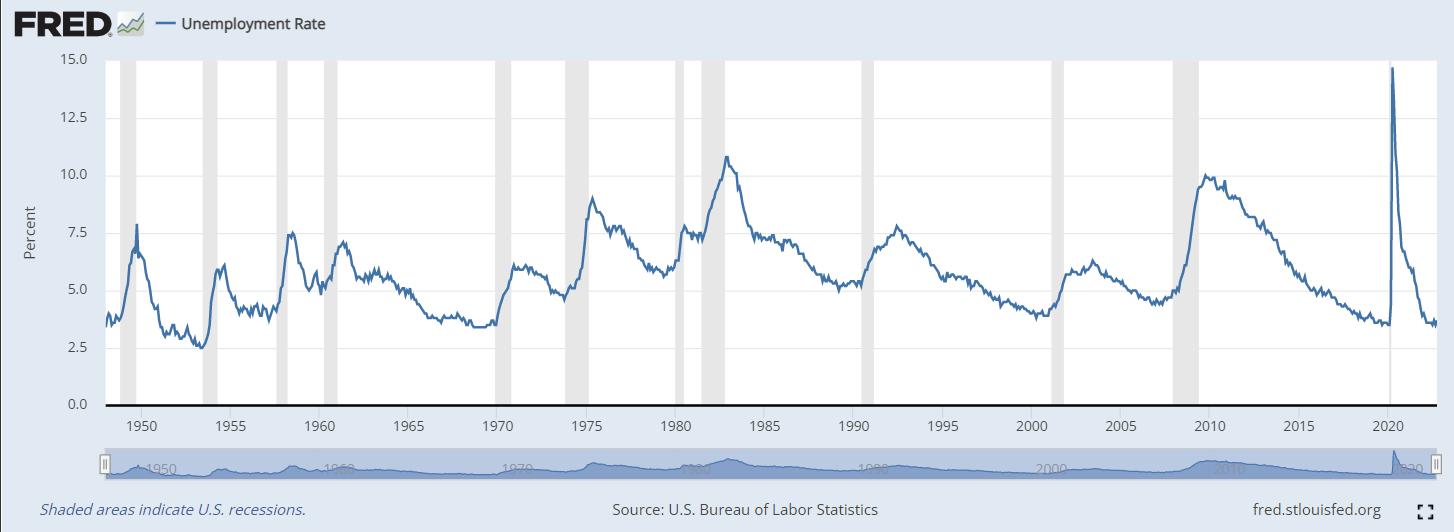

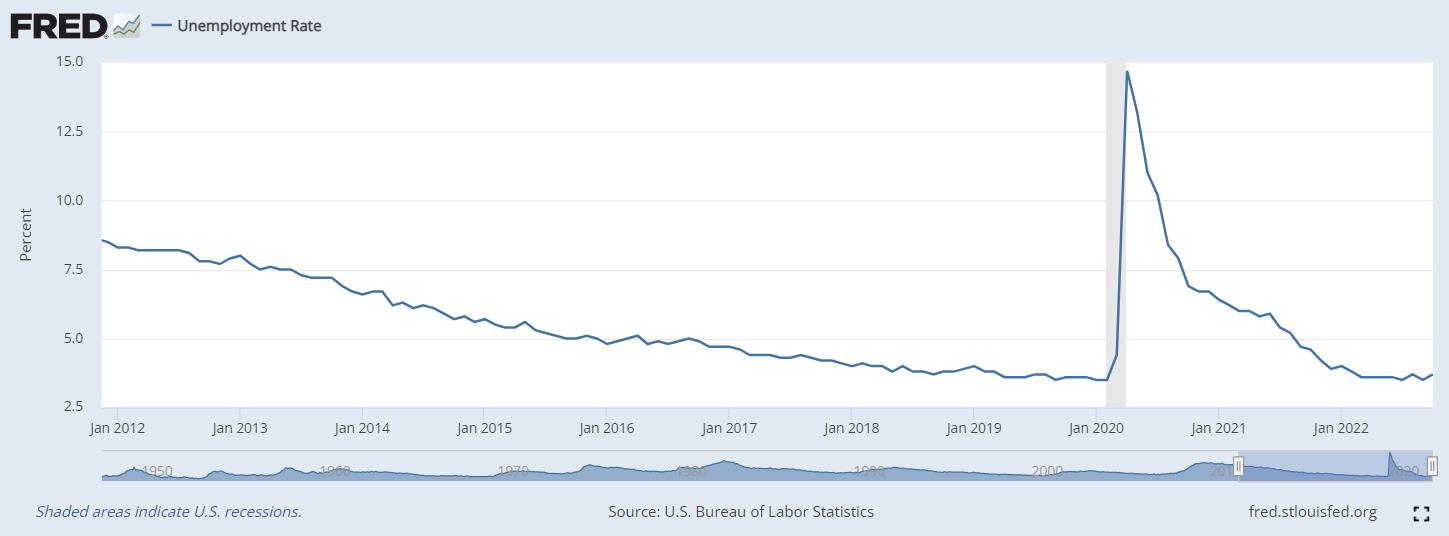

but, Labour mark et stable

Source: U S Bureau of Labor St atistics, U nemployment Rat e [U NRATE], ret rieved from FRED, Federal Reserve Bank of St Louis; https://fred stlouisfed org/series/U NRATE

but, Labour mark et stable, and at historical lows

Source: U S Bureau of Labor St atistics, U nemployment Rat e [U NRATE], ret rieved from FRED, Federal Reserve Bank of St Louis; https://fred stlouisfed org/series/U NRATE

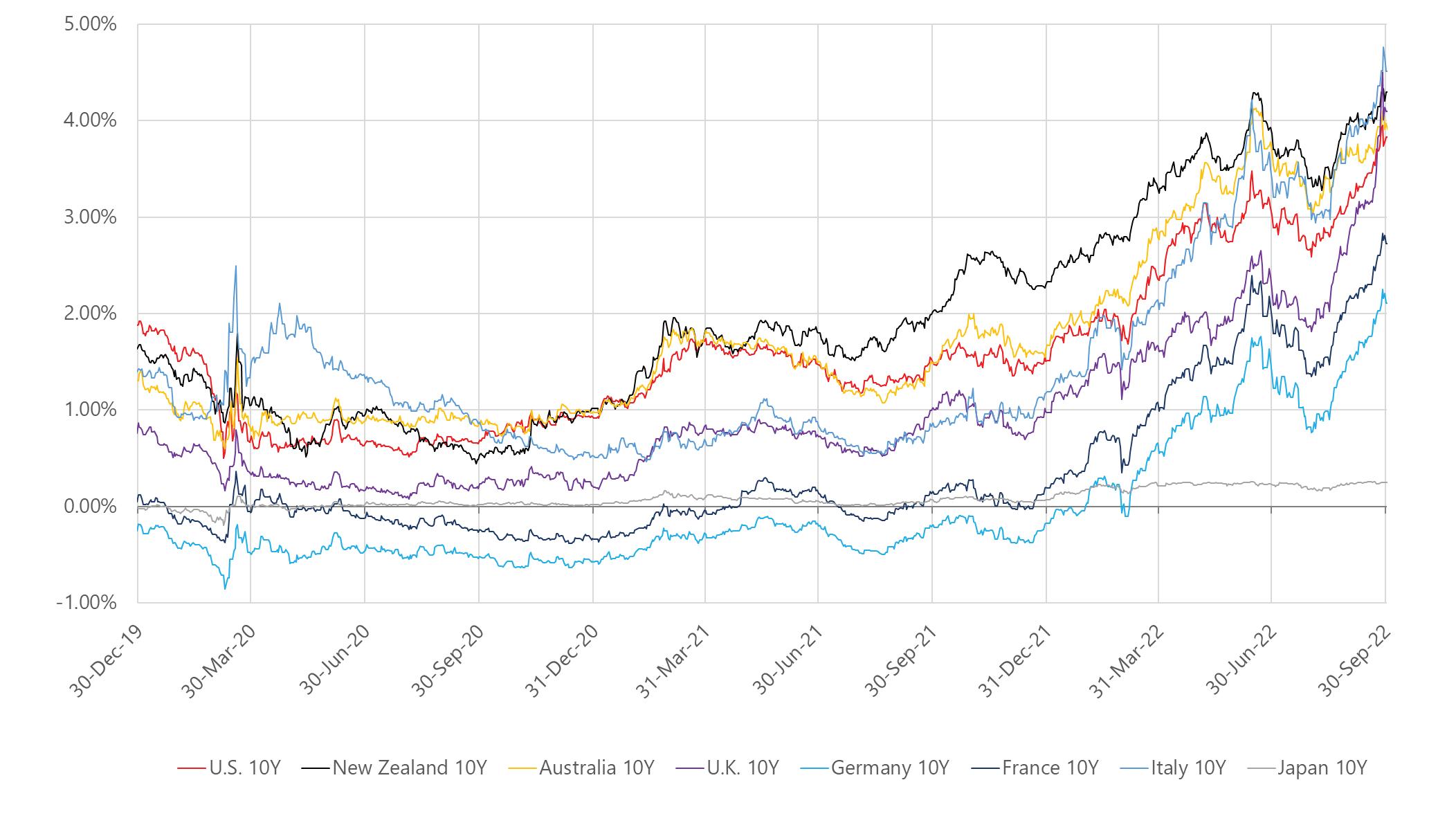

Yields sharply up for the quarter, up for the year

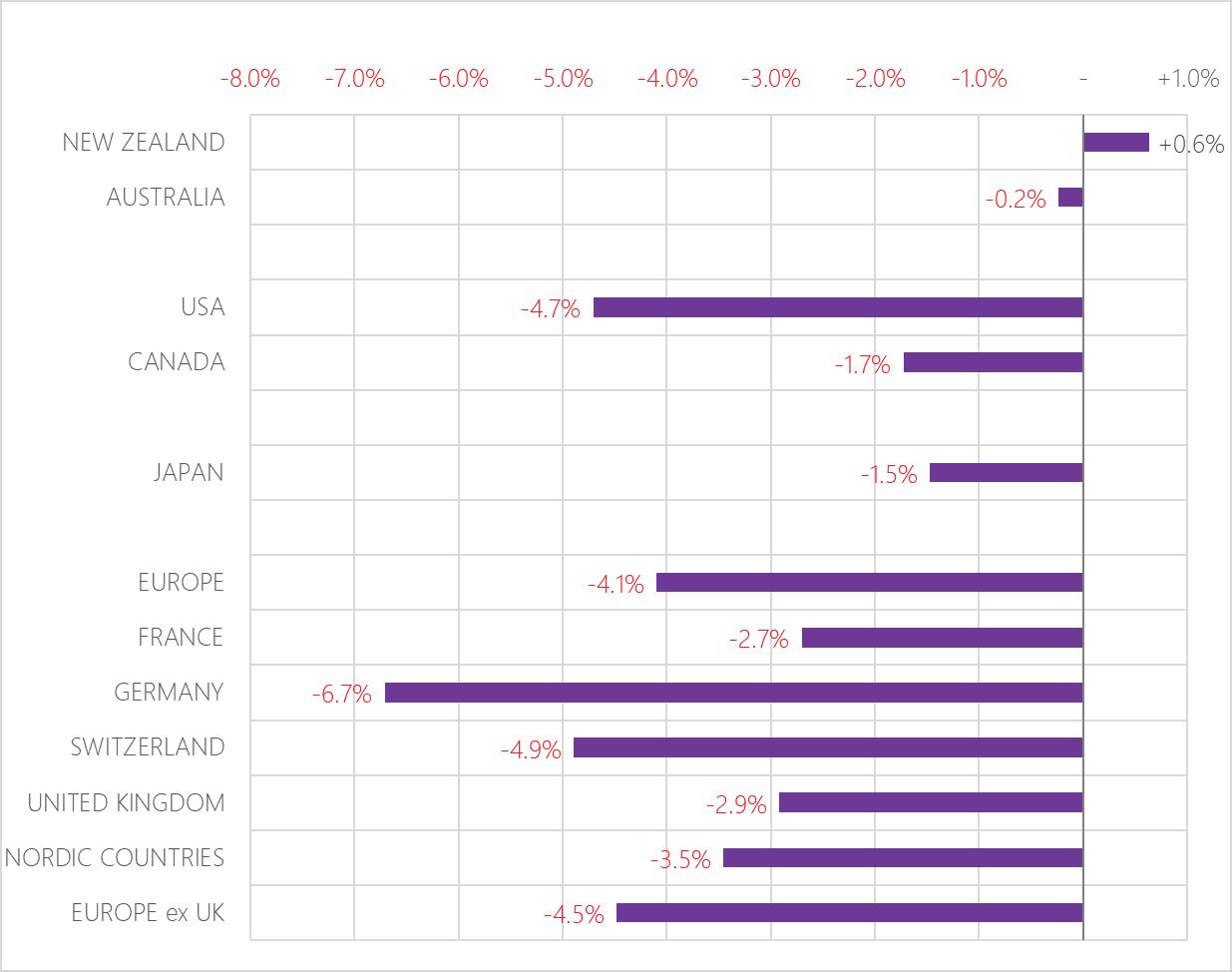

Devel oped m ar k ets per f or m ance (MSCI l arge cap i n di ces, l ocal cu r rency) 12 m on ths

Q3 2022

Source: https://www msci com/end-of-day-data-country

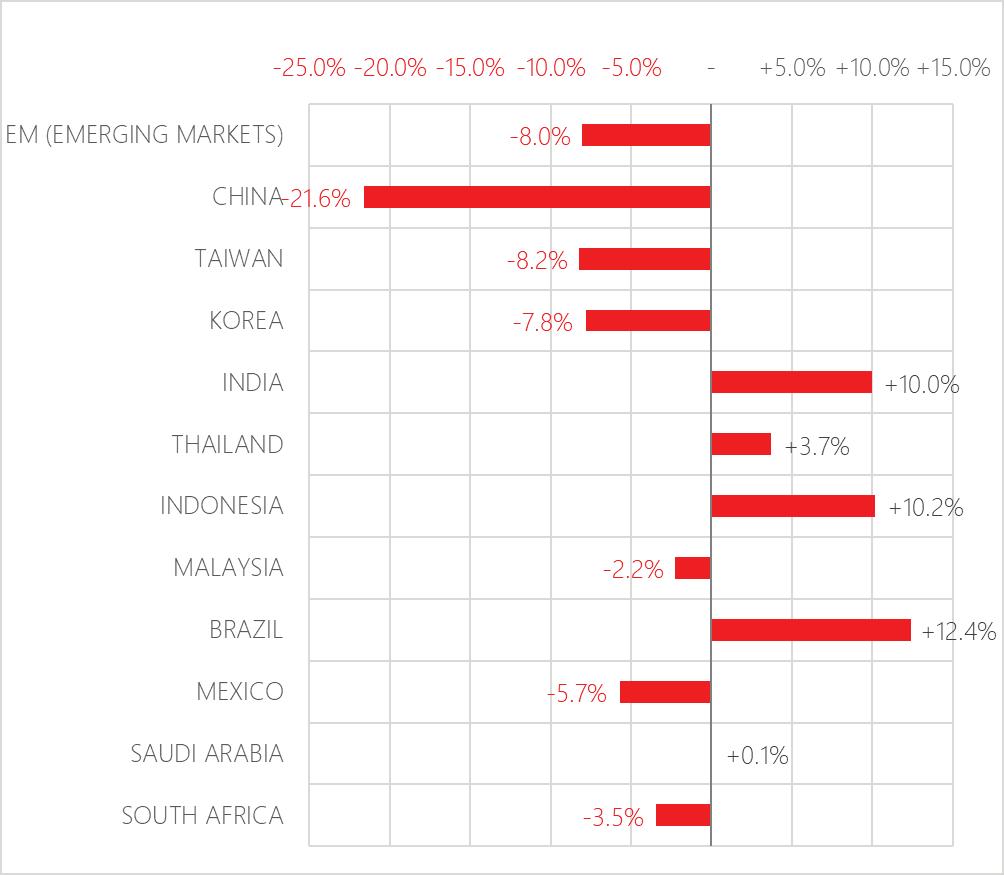

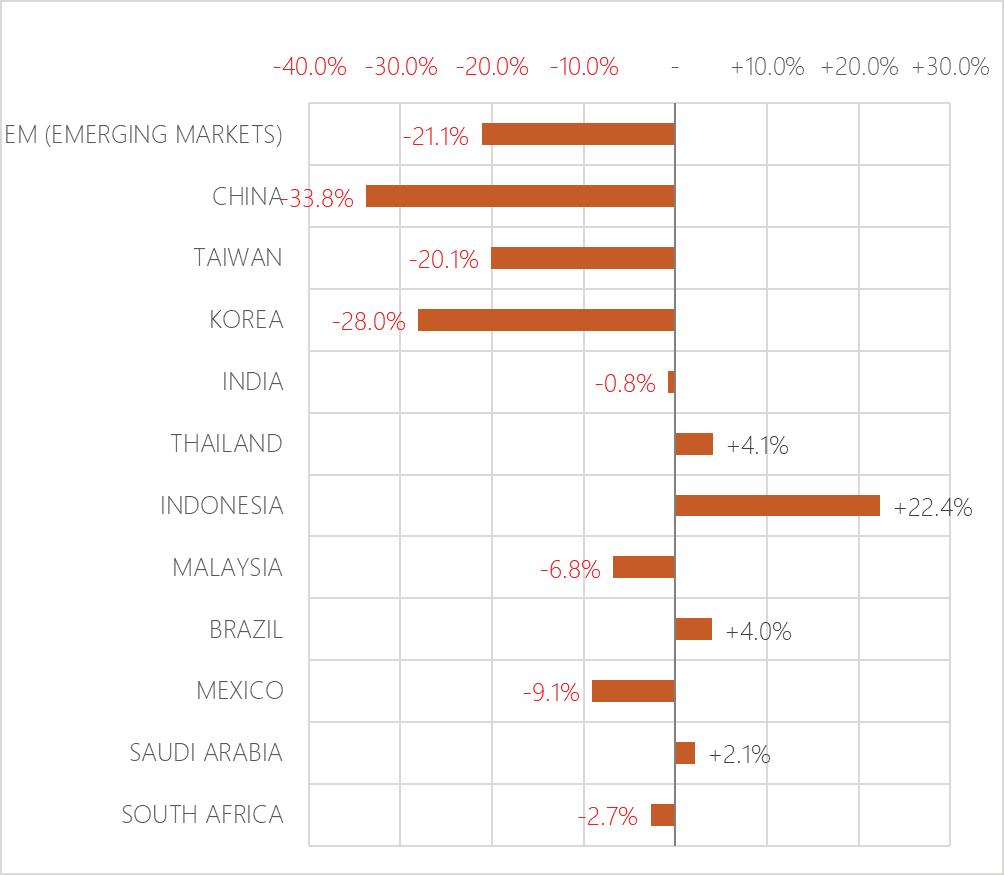

E m ergi ng m ar k ets per f or m ance (MSCI l arge cap i n di ces, l ocal cu r rency) 12 m on ths

Q3 2022

Source: https://www msci com/end-of-day-data-country

Relative flag sizes represent approximate exposure in model portfolios

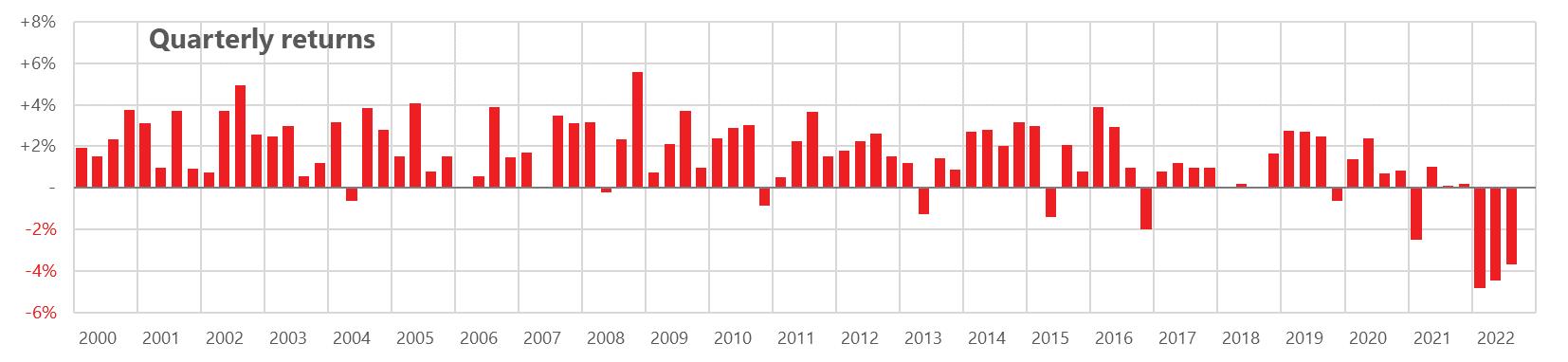

Global bonds suffer again in Q3 2022

Key:

New Zealand

Australia

Key:

Developed Markets (hedged)

Developed Markets (unhedged)

Emerging Markets

New Zealand

Australia

Developed Markets (hedged)

Developed Markets (unhedged)

Emerging Markets

Key:

New Zealand

Australia

Developed Markets (hedged)

Developed Markets (unhedged)

Emerging Markets

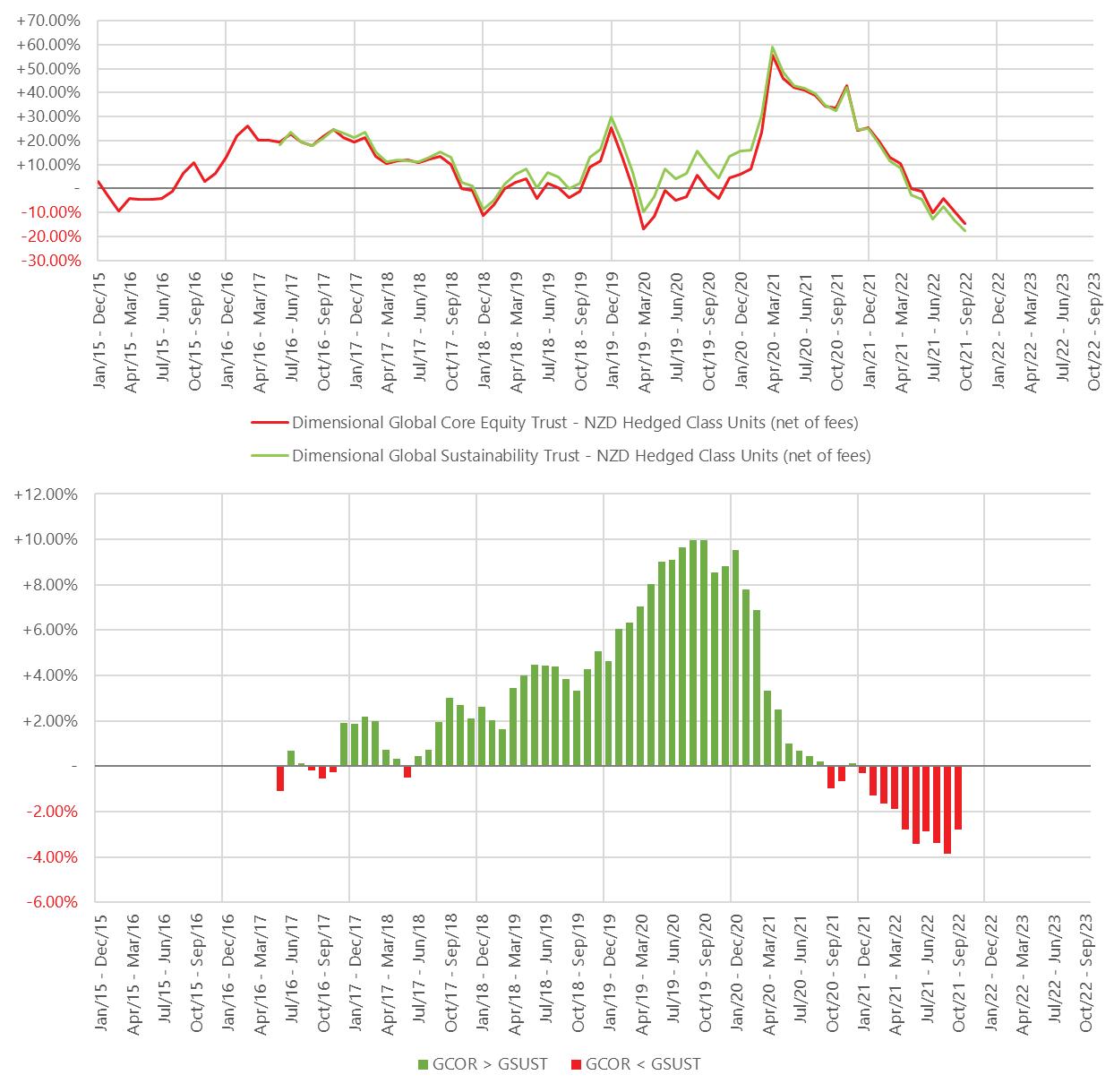

Sustainability overlay negligible through quarter, lagging over last 12m

Phase One models lost less

Unscreened f und retur ns rel ati ve to mar k et and styl e – to end Sep 2022

Key: Positive risk tilt Negative risk tilt Positive tracking error Negative tracking error