1 minute read

2022, Q1 Review

from CIC Yearbook 2022

by Consilium

On the April 2022 monthly adviser call, the Consilium Investment Committee reported on the first quarter of 2022. A summary is included below, and the graphics on the following pages are an excerpt of that presentation.

A full recording of this presentation is available on the Consilium Portal under ‘Quarterly Reporting’.

Advertisement

With the outbreak of war in the Ukraine, inflationary pressures ratcheted up to levels not seen in decades forcing central banks to take swift action. Yields shot up causing losses in fixed income securities while the heightened uncertainty contributed to losses for equities as well.

Western nations took retaliatory economic action to the Russian invasion, and the Russian sharemarket was, for all intents and purposes, wiped of the investment map.

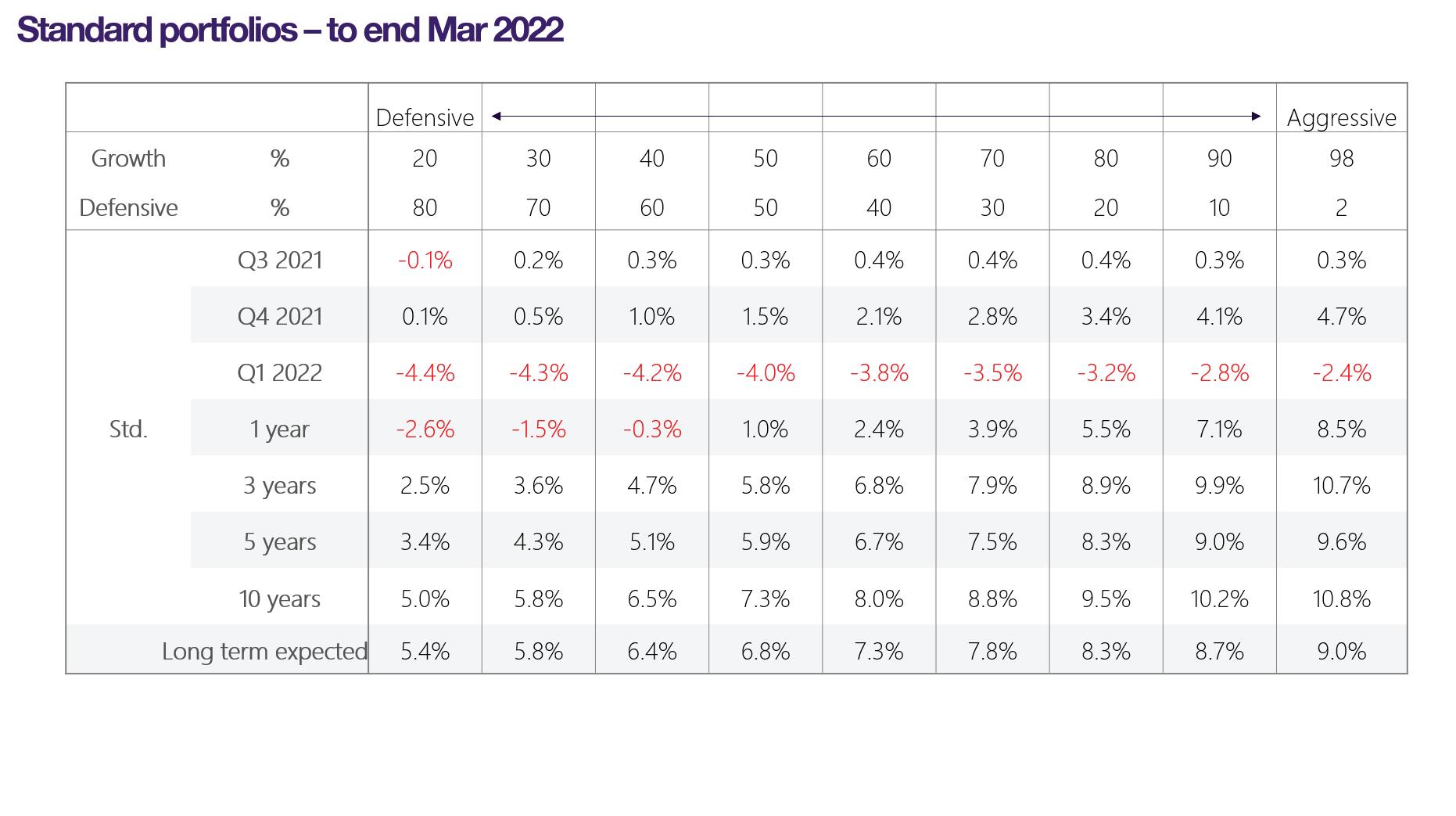

Model portfolio returns ranged from -5.7% to -2.4% for the quarter, with aggressive portfolios losing less than more defensive portfolios, the SRI suite underperformed unscreened portfolios.

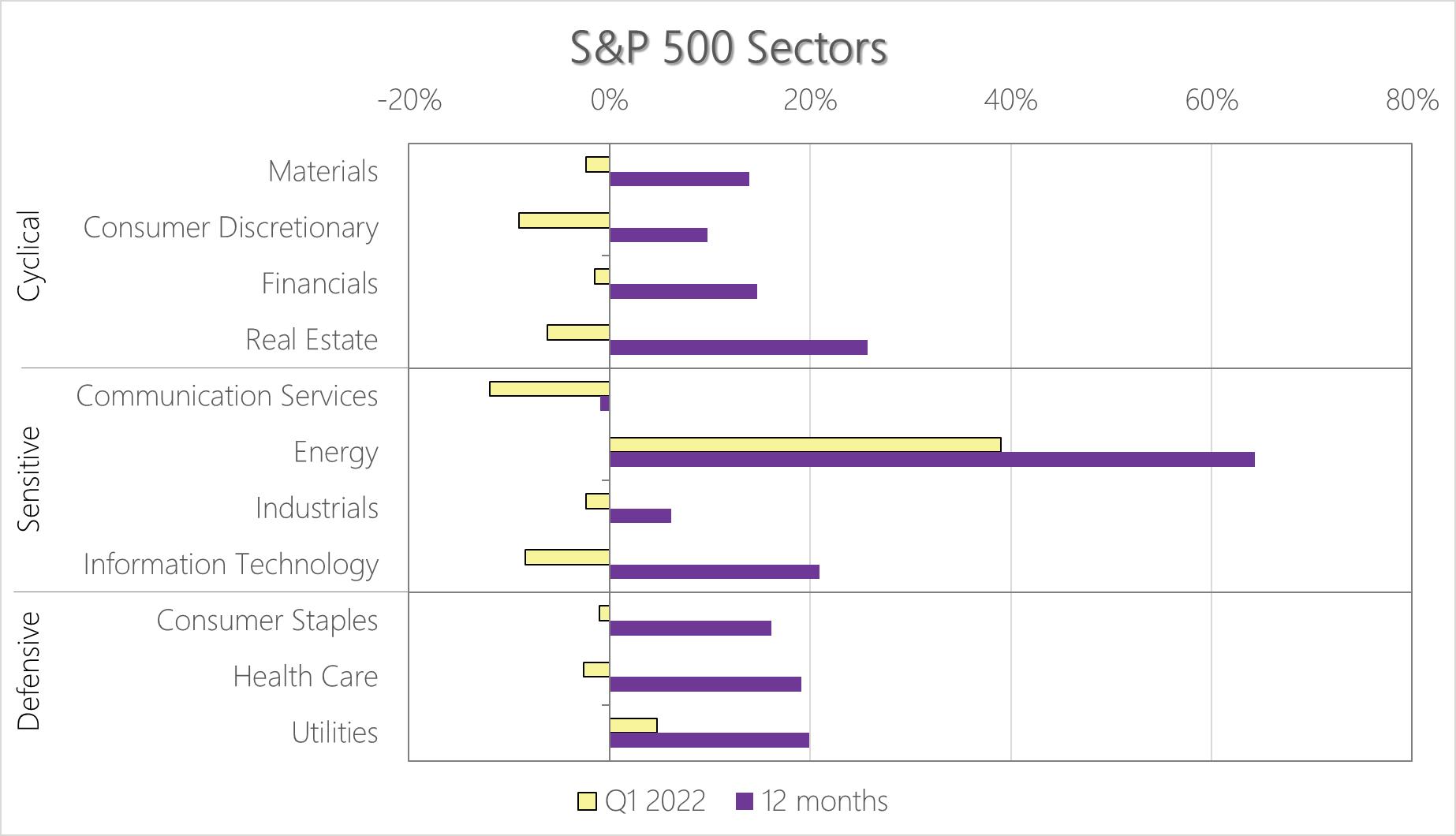

In equities, Australian shares were the only asset class to return a positive return, while New Zealand, Developed and Emerging Market equities were all negative. Fixed interest was again negative in New Zealand, while internationally returns were also negative for the quarter.

Risk tilts were mixed across the quarter. The value factor was positive within Australia, Developed and Emerging markets. Large caps edged out small caps across the board. On the fixed income side, the term and credit premium were negative.

Yields sharply up for the quarter, up for the year

Devel oped m ar k ets per f or m ance (MSCI l arge cap i n di ces, l ocal cu r rency) 12 m on ths Q1 2022

Source: https://www msci com/end-of-day-data-country

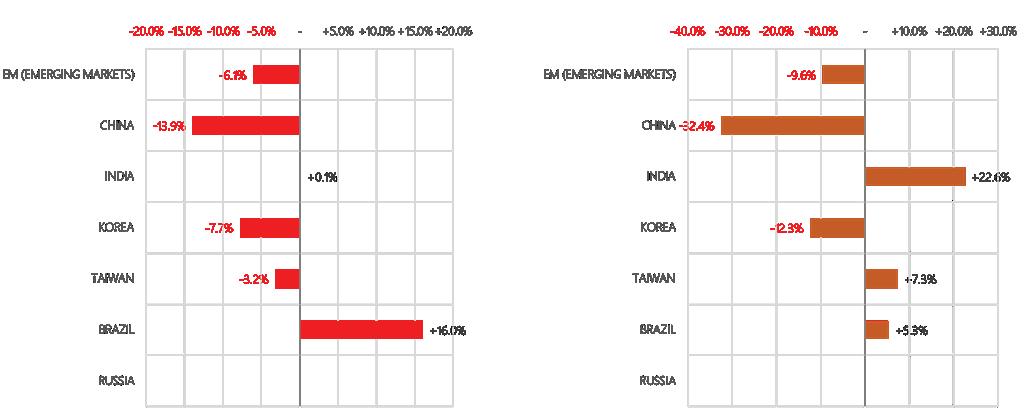

E m ergi ng m ar k ets per f or m ance (MSCI l arge cap i n di ces, l ocal cu r rency)

12 m on ths Q4 2021

Source: https://www msci com/end-of-day-data-country

Global bonds suffer through Q1 2022

Rolling 3m returns

Rolling 12m returns

Key:

New Zealand

Australia

Developed Markets (hedged)

Developed Markets (unhedged)

Emerging Markets

Unscreened f und retur ns rel ati ve to mar k et and styl e – to end Mar 2022