4 minute read

Appendix: Supporting analysis

from CIC Yearbook 2022

by Consilium

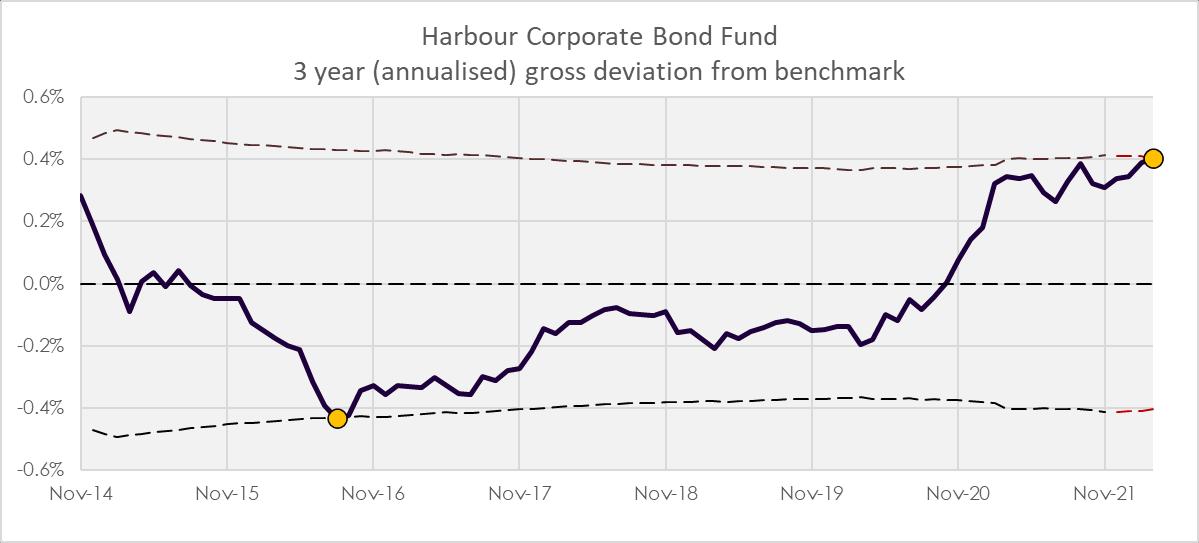

1. Tracking error chart

2. Review of the investment mandate

Advertisement

The Harbour product disclosure statement (PDS) applicable to Q1 2022 was dated 21 March 2021. The stated objective of the trust is:

The Fund provides access to favourable income yields through a diversified portfolio of primarily investment grade corporate bond fixed interest securities.

The CIC has frequent dialogue with the fund manager, and we are satisfied there has been no change to the strategy/mandate without our knowledge.

3. Review of material quarters

During Q3 of 2020 the fund produced 28bps of outperformance relative to the benchmark After discussions with Harbour, we were able to satisfactorily conclude the outperformance was attributable to observable factors. Stock selection for the quarter contributed 31bps, with its largest contributor being an early position in the 2050 Auckland council bond The fund’s position in government inflation-linked securities positively contributed 8bps, it also experienced diversification benefits from holding exposure greater than 5% to six sectors, compared to the benchmarks three. Please see here for further details.

During Q4 of 2020 the fund produced 42bps of outperformance relative to the benchmark Again, after discussions with Harbour we were able to largely attribute this outperformance to the following factors The fund held 0.25 (years) less duration than the benchmark over the quarter, contributing to 14bps of outperformance. This duration positioning was well within its allowable ±0.5 years duration (vs benchmark), however, given sharp market movements it resulted in meaningful attribution. During the quarter, credit also tightened resulting in some lower grade credit outperformance, this benefited the fund as compared to the benchmark it has held on average 10.3% exposure to BBB rated securities. Please see here for further details.

During Q1 of 2021 the fund produced 51bps of outperformance relative to the benchmark Harbour acknowledged that the fund signalling for three consecutive quarters may be of concern to the CIC but were able to show it was directly proportional to the increased volatility in markets and their compositional differences to the benchmark. Significant contributors to outperformance this quarter were again duration positioning and exposure to both government inflation-linked securities and BBB rated securities. Please see here for further details.

The additive effect of these three quarterly outperformances (all explained and within mandate) can clearly be seen by comparing the 3 year annualised deviation of the fund from its benchmark (Figure 2, top chart), with the quarterly deviations (Figure 2, bottom chart). These three quarters explain almost the entire aggregate three yearly outperformance.

Harbour Corporate Bond Fund 3 year (annualised) gross deviation from benchmark

4. Investigation with the fund management team

Harbour have a very strong internal fund compliance process and it is highly unusual for the fund to ever be in breach of its investment guidelines. Certificates confirming mandate compliance are supplied to Consilium each quarter. Historically, instances of any mandate breaches have been very rare, generally very minor, and always remediated promptly (ensuring no disadvantage to investors in the fund). No significant breaches were reported over this three year period.

We are in regular communication with Harbour and monitor a range of different fundamental data as part of our ongoing monitoring process. In some ways, the most restrictive constraint within the investment guidelines relates to the allowable duration, as the fund is required to maintain duration at ±0.5 years of the underlying duration of the S&P/NZX A Grade Corporate Bond Index.

As per Figure 3 (next page), we can confirm this particular guideline has not been breached.

Source: Consilium

Relative Yield to Maturity

Whilst the Harbour Corporate Bond Fund is not an index tracking fund (i.e. it has some discretion around various entity and credit exposures) the broad aim is to deliver a broadly comparable investment outcome to anyone with a theoretical exposure to the S&P/NZX A Grade Corporate Bond Index.

We can confirm the fund has always been maintained within these issuer and credit limits

The granular verification of this would require a significant and detailed deconstruction of individual holdings over time (which we believe is unnecessary in this case when we are already clear about the source of the current three year performance flag). However, a much simpler comparison we can provide is a comparison of the relative yield to maturity of the fund versus the S&P/NZX A Grade Corporate Bond Index.

As highlighted in Figure 4 (below), the fund has consistently maintained an average yield to maturity of around 10 - 25bps higher than the index over the last decade.

Relative Yield to Maturity

Source: Consilium

Quite clearly, although the composition of the fund holdings will usually be different (by design), the historical duration and yield characteristics of the fund both confirm the fund mandate is being managed consistently in line with the index.

Disclaimer: The material contained in or attached to this report has been prepared based upon information that Consilium NZ Limited believes to be reliable but may be subject to typographical or other errors. Consilium has taken every care in preparing this information, which is for client education purposes only. Although the data has been sourced from publicly available information and/or provided by the investment managers, we are not able to guarantee its accuracy. Past performance, whether actual or simulated, is no guarantee of future performance. This document does not disclose all the risks of any transaction type described herein, and the recipient should understand any terms including relevant risk factors and any legal, tax and accounting considerations applicable to them.

One or more of the author(s) of this report invest in the analysed security. The author(s) do not know of the existence of any conflicts of interest that might bias the content or publication of this report. Compensation of the author(s) of this report is not based on any outcome of this report.