2 minute read

Dimensional Global Bond and Global Bond Sustainability Trust

from CIC Yearbook 2022

by Consilium

Enhanced due diligence for the quarter ended 31 March 2022

Enhanced due diligence trigger

Advertisement

Consistent with its written policies and procedures, the Consilium Investment Committee (CIC) reviews all recommended investments on a quarterly basis against a combination of investment performance and quantitative fund metrics.

In the first quarter of 2022, the below named Dimensional trusts (“the trusts”) were flagged for enhanced due diligence (EDD) due to an advised change in fund mandate

▪ Dimensional Global Bond Trust (NZD)

▪ Dimensional Global Bond Sustainability Trust (NZD)

Background

On 16 February 2022, Dimensional Fund Advisers (DFA) announced a change in the mandate of the two trusts The specific change in relation to the underlying trust strategy(s) was that “the upper limit of the maturity range of bonds that the trusts will primarily invest in will increase from 15 years to 20 years”.

Through our regular monitoring discussions with Dimensional we were able to confirm that the investment strategies are entirely unchanged, this is merely a widening of the investable universe and has been introduced in response to the increased issuance of long duration bonds over the last few years.

Impact on Expectations

Although both trusts hold exposures to long duration bonds, their investment mandates prevent Dimensional from introducing significant additional duration tilts into the trusts because trust duration must be maintained within the limits of -0.5 years to +1.5 years of the duration of the underlying index. Having an ability to allocate to bonds with maturities of up to 20 years (as opposed to the previous maximum of 15 years) will simply allow Dimensional fund managers a greater choice of security combinations as they look to deliver these mandates.

Whilst individual bonds that mature further in the future are exposed to a higher risk of unexpected changes in interest rates, within the diversified bond trusts these longer duration bonds will be blended with shorter duration bonds to ensure the overall trust duration guidelines continue to be met

And, as these trust guidelines are not changing and we do not anticipate any change in the way the mandates will be managed, we also do not anticipate any change in the expected risk and return of the trusts to result from this widening of the investible universe

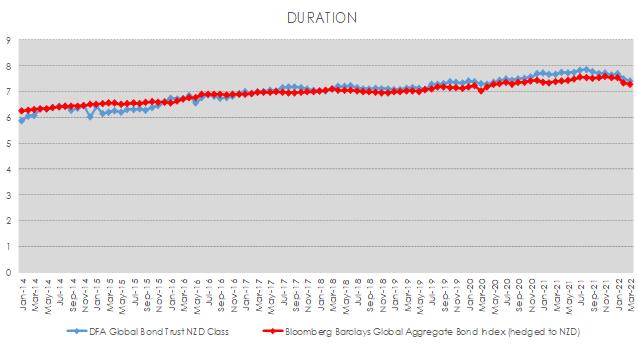

These expectations are reinforced when we review the respective duration histories of the two trusts versus their benchmark over time (as per Figures 1 and 2 on the following page)

Fundamental Characteristics

Figures 1 and 2 below illustrate that both trusts have closely tracked the duration of the benchmark Bloomberg Global Aggregate Bond Index, and we do not expect this to change.

Conclusion

The CIC are satisfied that the DFA Global Bond Trust and DFA Global Bond Sustainability Bond Trust have both passed this EDD review.

August 2022

Disclaimer: The material contained in or attached to this report has been prepared based upon information that Consilium NZ Limited believes to be reliable but may be subject to typographical or other errors. Consilium has taken every care in preparing this information, which is for client education purposes only. Although the data has been sourced from publicly available information and/or provided by the investment managers, we are not able to guarantee its accuracy. Past performance, whether actual or simulated, is no guarantee of future performance. This document does not disclose all the risks of any transaction type described herein, and the recipient should understand any terms including relevant risk factors and any legal, tax and accounting considerations applicable to them.

One or more of the author(s) of this report invest in the analysed security. The author(s) do not know of the existence of any conflicts of interest that might bias the content or publication of this report. Compensation of the author(s) of this report is not based on any outcome of this report.