7 minute read

Appendix: Supporting analysis

from CIC Yearbook 2022

by Consilium

1. Tracking error chart

2. Review of the investment mandate

Advertisement

The Dimensional product disclosure statement (PDS) applicable to Q4 2021 was dated 2 August 2021. The stated objective of the trust is:

Within the risk constraints of investing in eligible short-term, Investment Grade securities, and adjusted to take into account certain environmental and sustainability impact and social considerations, the objective of the Trust is to maximise the return of a broadly diversified portfolio of domestic and global fixed interest securities.

The Trust is not managed with the objective of achieving a particular return relative to a benchmark index. However, to compare the performance of the Trust with a cash index, reference may be made to the Bloomberg AusBond Bank Bill Index (AUD class units) or the Bloomberg NZBond Bank Bill index (NZD class units).

Investors should note that the index is referred to for comparison purposes only. The index is not intended to represent the current or targeted asset allocation of the Trust. The performance of the Trust may differ significantly from the index

The Trust may suit those investors seeking a liquid, low risk, diversified portfolio that provides exposure to the returns of short-term global fixed interest securities. In particular, the Trust may suit those investors who seek to have certain environmental and sustainability impact and social considerations taken into account in the investment decision making process of the Trust.

Dimensional’s fixed interest portfolios are based on dimensions of expected returns that have been identified by academic research. Relative performance in fixed interest is largely driven by two dimensions: bond maturity and credit quality. Bonds that mature further in the future are subject to higher risk of unexpected changes in interest rates. Bonds with lower credit quality are subject to higher risk of default. Extending bond maturities and reducing credit quality increases potential returns.

Ordinarily the Trust invests in a diverse portfolio of Investment Grade corporate and government, domestic and global fixed interest securities, with an overall maximum weighted average maturity of two years and, for any individual security, a maximum maturity of three years from the date of settlement. Dimensional generally changes the portfolio’s exposure to term premiums and credit premiums in response to changes in security prices.

During the three yearly analysis that this enhanced due diligence applies to the trust has undertaken a change in mandate; implementing a sustainability overlay in August 2021. This change triggered an EDD1 and we concluded the overlay should not have any significant impact on the manager’s ability to continue to deliver the strategy. Otherwise, the CIC has frequent dialogue with the fund manager, and we are satisfied there has been no further change to the strategy/mandate without our knowledge. The CIC also notes our chosen benchmark for monitoring purposes is not cash, but the Bloomberg Barclays Global Aggregate Bond Index 1-3 Years (hedged to NZD).

3. Attribution analysis

Although this is a flag for underperformance over three years, shorter term observations, and previously completed EDDs are insightful. In particular the March 2020 quarter and the December 2021 quarters are the dominant sources of underperformance that have contributed to this 3-yearly flag.

The March 2020 quarter underperformance occurred during the significant market dislocation during the initial market impact of the Covid-19 pandemic and this event was flagged1 in our monitoring process at the time. The subsequent analysis found the trust had been managed in line with its mandate and the significant market dislocation had resulted in wide dispersion in fixed income market returns The trust was targeting sources of higher expected return which at the time included on overweight in corporate bonds, an underweight in USD denominated securities and significantly shorter duration. We evaluated the funds exposure levels relative to historical levels and relative to risk levels and found these were fine. Ultimately, the fund passed the EDD and remained the recommended vehicle to gain access to short term bonds in developed markets

Given this event has been explained we turn our attention to the December 2021 quarter to make a similar assessment.

1 Prior enhanced due diligence papers are available on the Consilium adviser portal or on request

December 2021 quarter attribution analysis

The December 2021 quarter marked sharp increases in some yield curves as central banks began to signal intentions to enter a phase of rapidly tightening monetary policy. In such a volatile environment there was a wide dispersion of returns, and even modest over or underweights had a significant impact on relative performance. Attribution analysis showed us where the differences in exposure were which translated to the main differences in performance

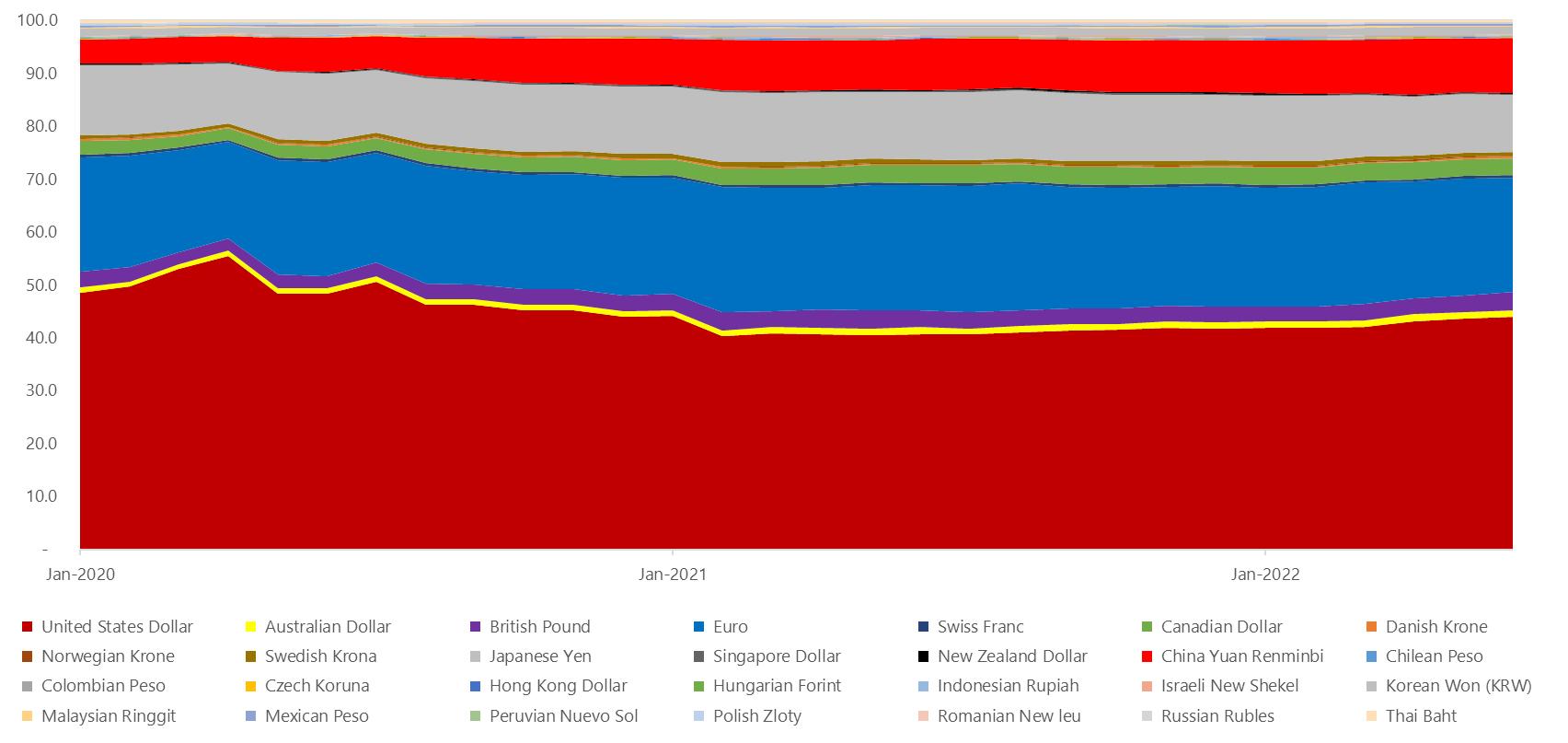

The fund takes significantly different exposure than the index when we look at the breakdown by currency, duration and credit quality.

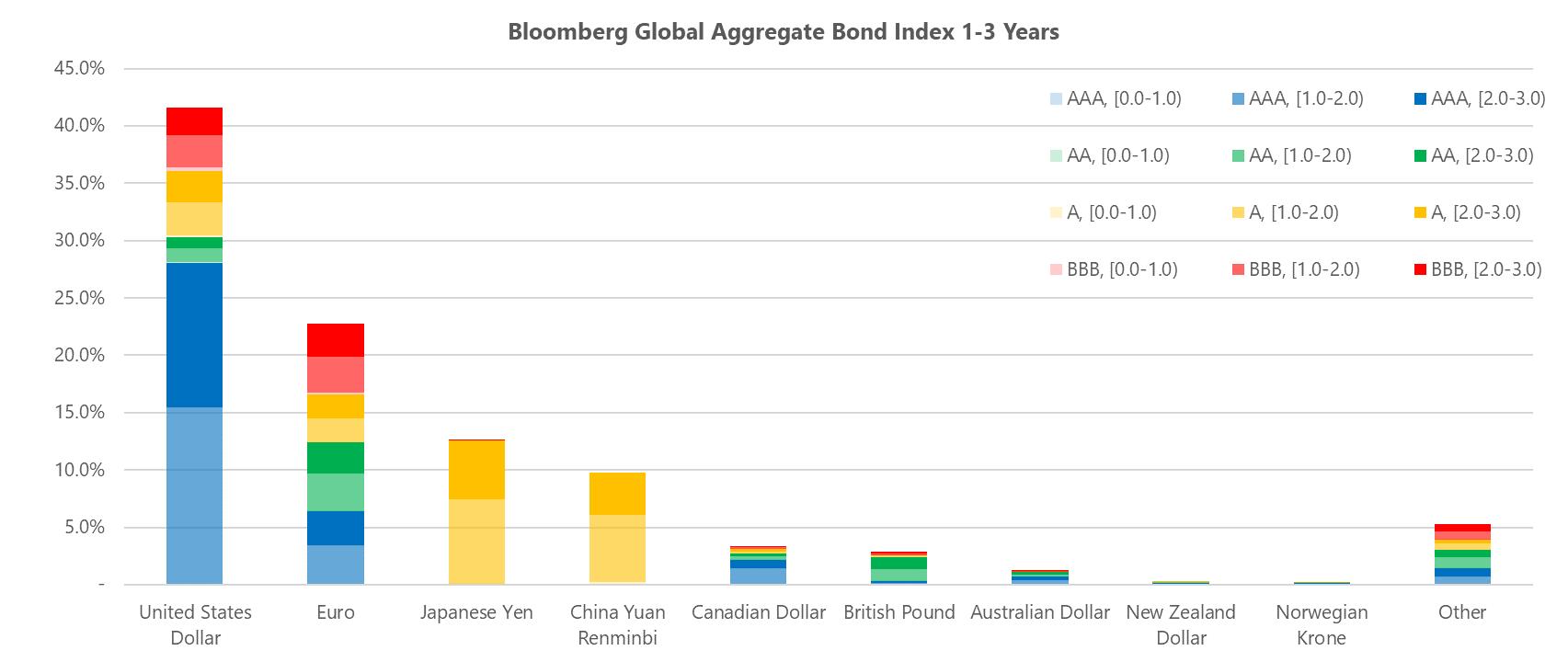

Source: Dimensional

Looking first at the index we see it is dominated by USD and Euro underlyings with variable investment grade credit (as represented by the colour), large allocations to A rated (government) securities denominated in Yen and Yuan and a close to even split between the 1-2 years, and 2-3 years duration buckets with very little allocation to anything below 1 years (as represented by the lack of palest shaded bars)

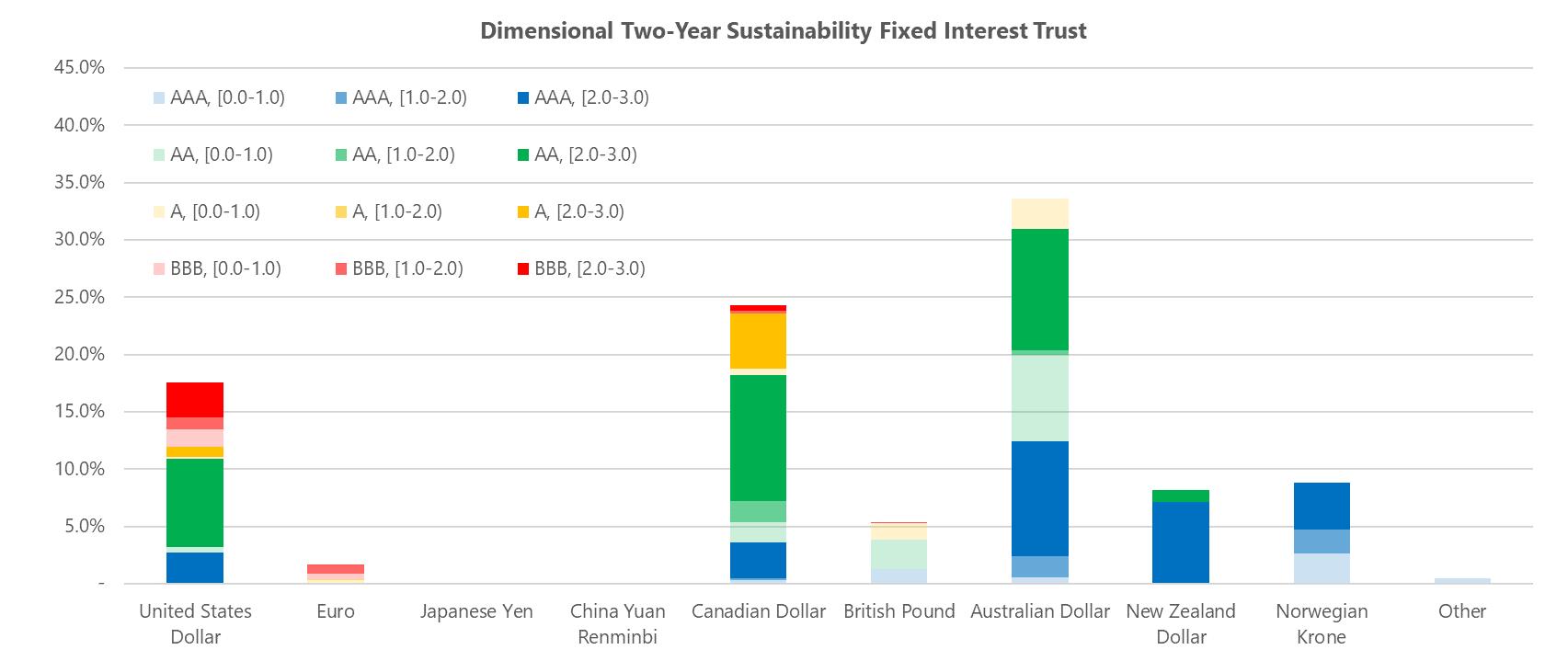

Source: Dimensional

Looking at the trust we see a very different breakdown The highest currency exposure is to the Australian dollar followed by the Canadian dollar. The New Zealand dollar and Norwegian Krone are also far higher than the index weight, while the Yen and Yuan exposures are both at zero, with Euro also very low

We also see, as represented by the colour coding, a very different credit profile. American AAA bonds (ie government bonds) are underweight, and within CAD and AUD, the AA and A rated bonds hold a higher than market weight (ie the fund tilts towards lower credit quality bonds) Finally, we also observe a shorter duration as represented by the palest shaded bars. 25% of the fund is in bonds with 12 months or less duration (in particular AUD and GBP bonds), while the US exposure is predominantly longer than 2 years. With bond yields moving higher in the period, in particular the USD, AUD & NZD yield curves, the majority of these tilts were detrimental

These selected allocation differences account for almost the entire underperformance of the strategy in the December 20211 quarter.

Every one of these relative positionings is consistent with tilting towards higher expected returns. The Australian, Canadian and New Zealand dollar yield curves were steep through this quarter, especially relative to the JPY and Euro curves.

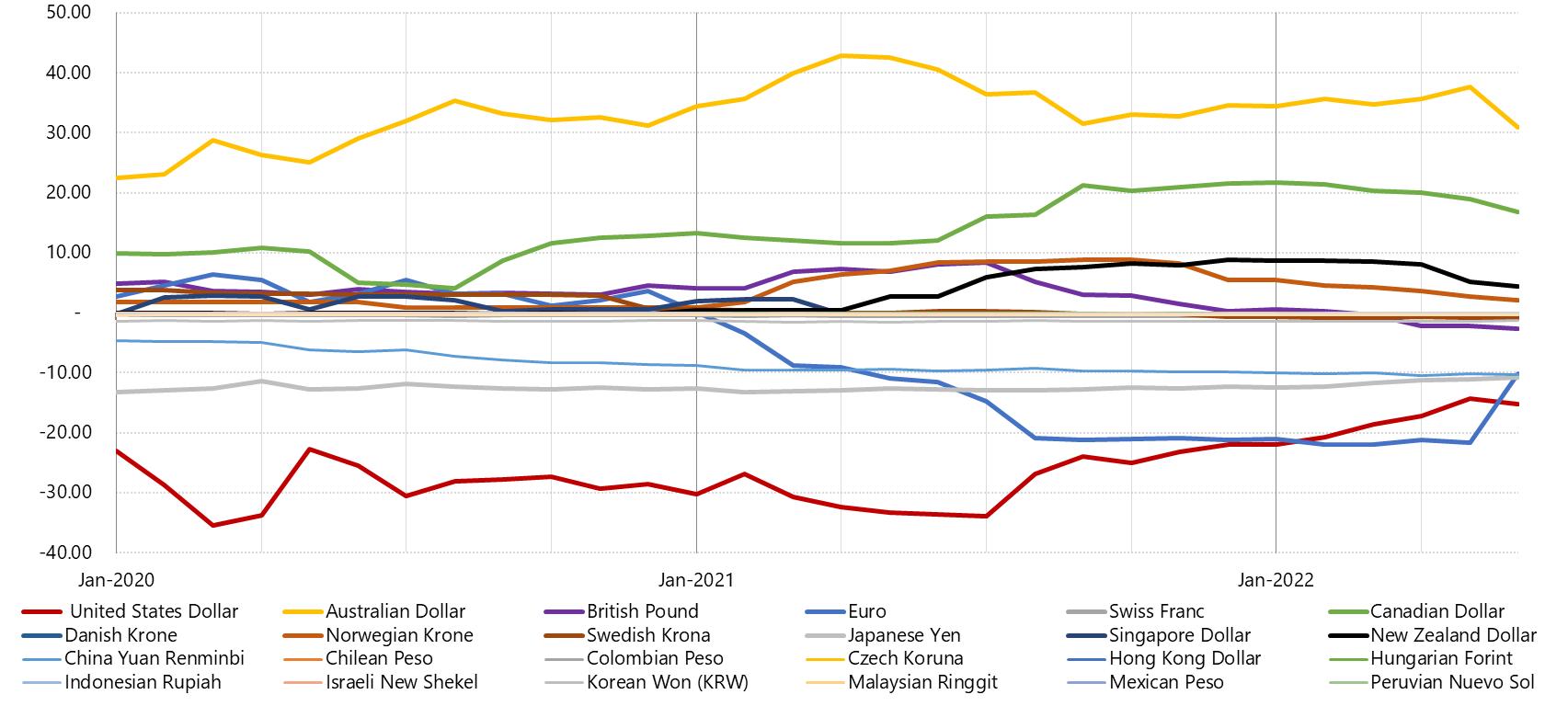

Further exposures by currency are presented on the following page

This analysis highlights the significant difference in currency exposures between the fund and the benchmark. This quarter again reinforced the significant impact that variations in positioning can have on relative performance in volatile environments

4. Analysis of risk exposure

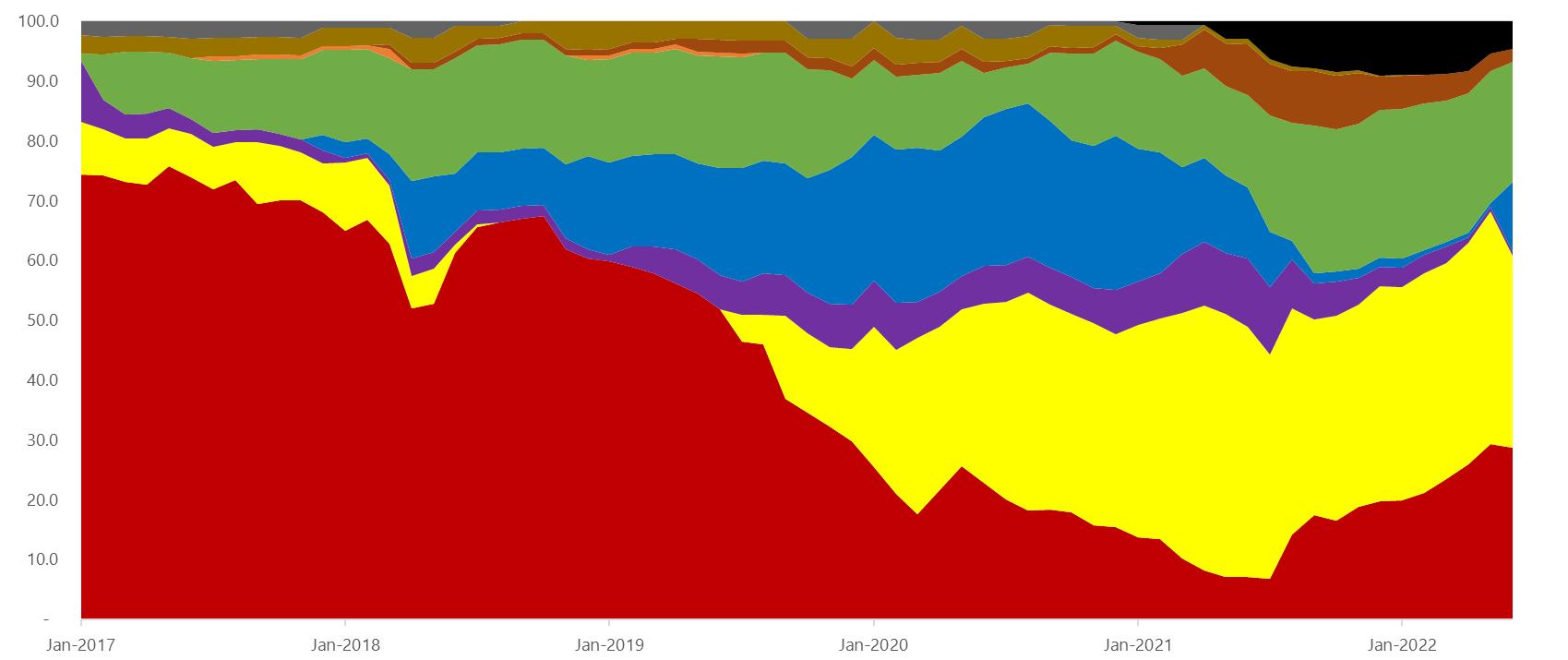

As we have established the source of the relative underperformance, we need to check the risks taken are acceptable. We first look at the historical relative exposures of the trust to the index by currency. This is illustrated in figure 6 below.

We note a very stable exposure in the benchmark, but a far more variable exposure for the trust as per its strategy. This leads to high relative over and under weights as illustrated by the last chart

This trust has no relative risk limits for either currency or issuing country, rather, the absolute limits are as follows:

- an unlimited exposure to the locally domiciled Australian dollar curve,

- a 75% maximum to the US dollar yield curve,

- a 50% maximum limit to the European Euro yield curve,

- a 30% maximum limit to the Japanese Yen yield curve,

- a 25% maximum the UK or Canada curves, and

- For smaller markets like Singapore, New Zealand and other European curves like Sweden there is a 10% portfolio limit.

- Chinese securities are not eligible.

Checking these limits versus the exposure levels provided, the committee is satisfied the trust was invested within its investment guidelines and there was no persistent relative exposure by currency that was precluded by the fund mandate

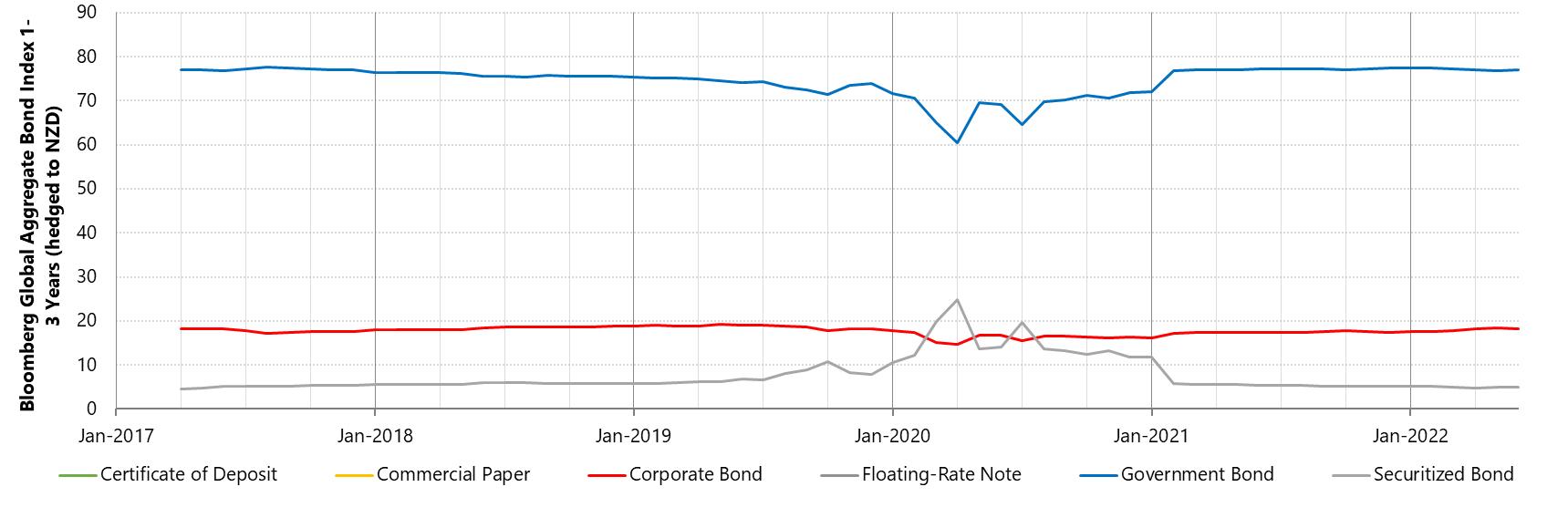

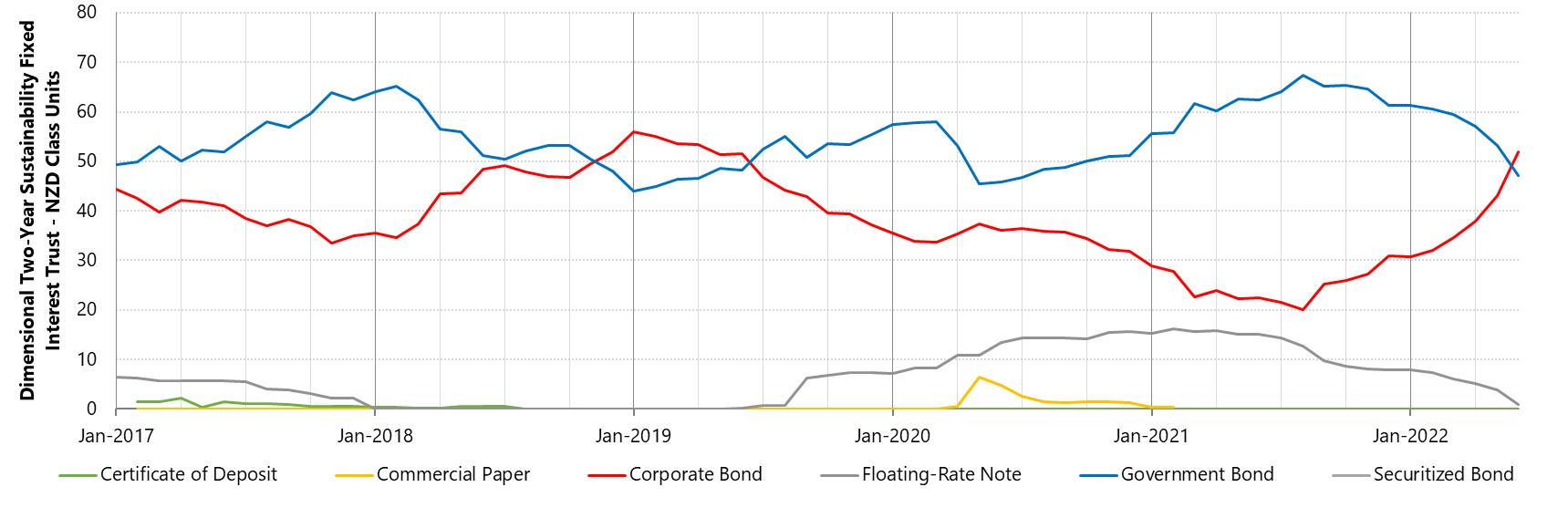

Next, we look at credit risk. The historical relative exposures by security type is summarised below in figure 7

Source: Dimensional Fund Advisors

Again, we observe a far more variable exposure level for the fund including a far greater allocation to corporate bonds. We also note that there are no relative security type constraints for the trust. The increasing exposure to corporate bonds in late 2021 and early 2022 is consistent with the mandate as credit spreads have widened during this period

Overall, both the relative and absolute positioning by security type is consistent with historical observations and mandate and the committee finds no evidence of unacceptable exposure.

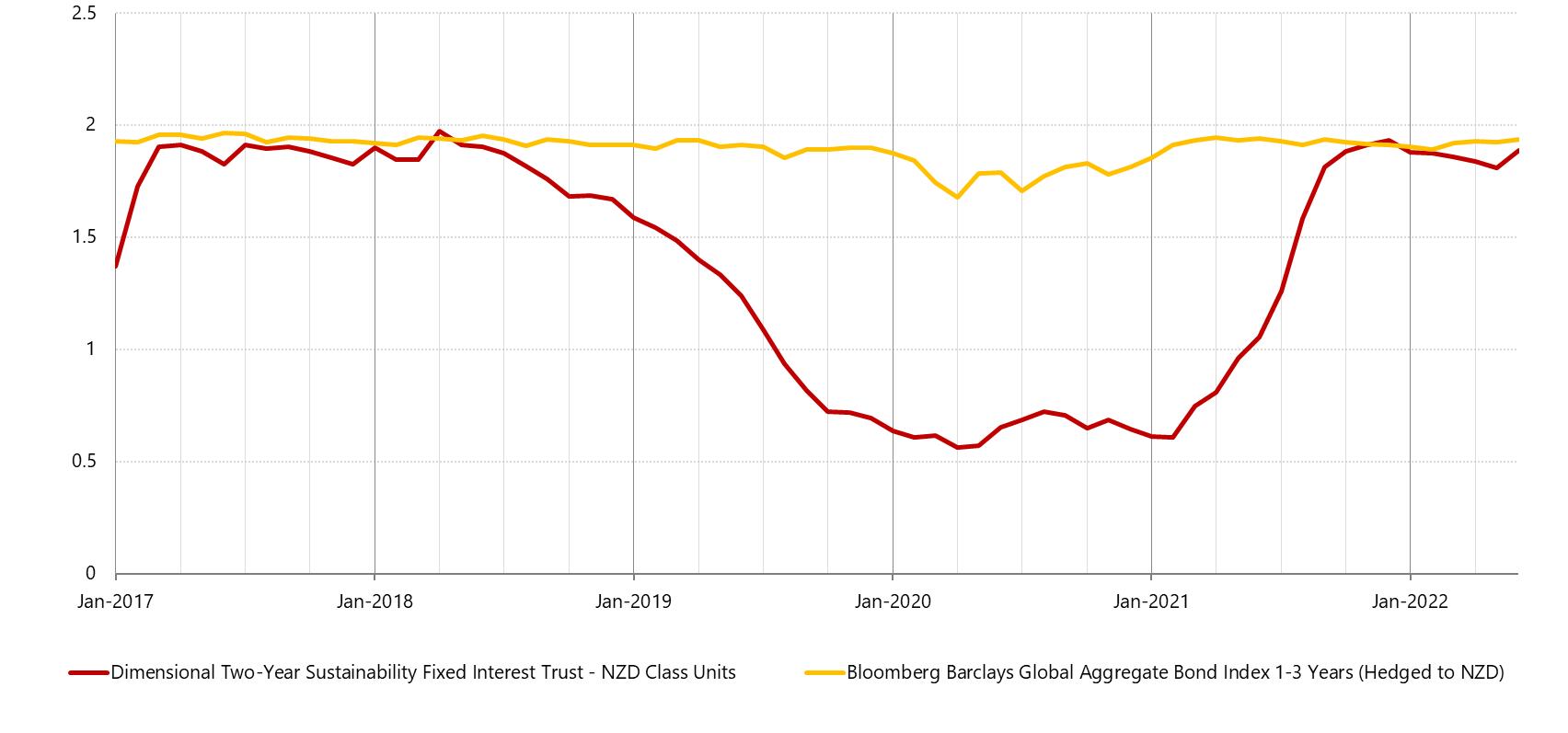

The risk limits of the trust allow a duration of up to 2 years. The trust has consistently been managed within this limit, and the trusts relative duration through the three year analysis period (shortening duration in 2019, remaining relatively short in 2020, and then lengthening again in 2021) is consistent with the mandate. This change in duration exposure was due to the flattening of yield curves around the world in 2020 reducing the expected return from increased duration, in line with the fund’s strategy.

Overall, the committee is satisfied the trust was taking acceptable currency, security type and duration risk tilts.

Peer review

The latest Approved Products List contains no approved alternative international fixed interest funds hedged to New Zealand dollars with a focus on bonds with short term duration.

Accordingly, having passed this enhanced due diligence review, the fund remains our preferred short duration vehicle to gain access to global fixed interest risk factors.

Disclaimer: The material contained in or attached to this report has been prepared based upon information that Consilium NZ Limited believes to be reliable, but may be subject to typographical or other errors. Consilium has taken every care in preparing this information, which is for client education purposes only. Although the data has been sourced from publicly available information and/or provided by the investment managers, we are not able to guarantee its accuracy. Past performance, whether actual or simulated, is no guarantee of future performance. This document does not disclose all the risks of any transaction type described herein, and the recipient should understand any terms including relevant risk factors and any legal, tax and accounting considerations applicable to them.

One or more of the author(s) of this report invest in the analysed security. The author(s) do not know of the existence of any conflicts of interest that might bias the content or publication of this report. Compensation of the author(s) of this report is not based on any outcome of this report.