61 minute read

Russell Investment Funds

from CIC Yearbook 2022

by Consilium

Russell Investments' ownership is composed of a majority stake held by funds managed by TA Associates, with a significant minority stake held by funds managed by Reverence Capital Partners.

Russell Investments' employees, independent directors, and Hamilton Lane Advisors, LLC also hold minority, noncontrolling, ownership stakes.

Advertisement

Vanguard Vanguard Group of Investment Companies (VGI) is owned by Vanguard’s US-domiciled funds and ETFs. VGI has created various wholly owned subsidiaries to provide services to Vanguard shareholders, including Vanguard Investments Australia Ltd.

Follow up items – None

Staff

On March 30, 2021, Russell Investments and Hamilton Lane entered into a strategic partnership

Vanguard has had no significant organisational changes in either the past 12 months or three years.

In this category we are looking for significant turnover, especially in situations outside of organic growth, in the professional or service staff of the investment company

These percentages generally reflect good growth. The 12 month equity t/over number equates to one staff member in a team of nine, so is not a concern

BlackRock There are currently 19,887 employees at Blackrock, of this there are 2,816 Investment Professionals, 1,302 Portfolio Managers and 219 Traders.

Staff turnover below:

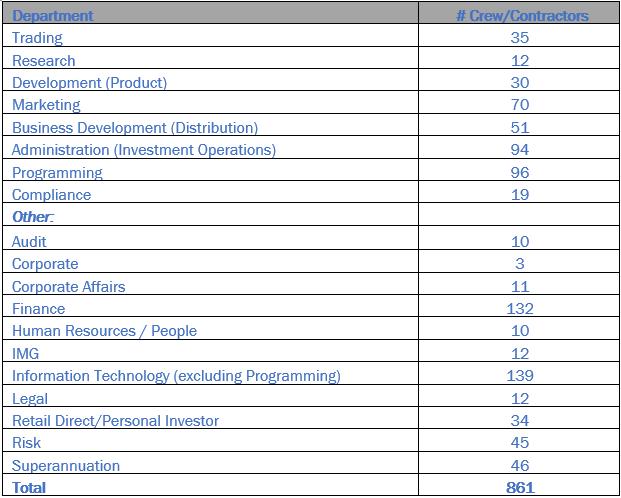

Dimensional As at 30 September 2022, the Global Group had 1,504 employees, 295 of whom were investment professionals. Dimensional Australia had 120 employees, 26 of whom were investment professionals.

Average of annual turnover rates from 2019-2021 is 13%.

Dimensional’s voluntary turnover rate has been on the lower end of

Staff turnover is very consistent and within expected levels.

While DFA does not provide department level turnover figures, their annual turnover figures are in line with peers

Macquarie Asset Management (MAM) the industry with a three-year average (three years ended 31 December 2021) of 10.6%.

As of 30 June 2022, there were over 2,200 full-time equivalent (FTE) staff at Macquarie Asset Management operating across 33 countries. The New Zealand business currently consists of 27 FTE staff, broken down as follows:

Russell Investment Funds

All the New Zealand team from AMP Capital Investors, apart from those in the direct property side of the business, transferred across to Macquarie Asset Management (NZ) Limited. This included the NZ Fixed Income team, relationship managers and client services team. In addition, we have hired three new people since completion.

As of 30 June 2022, Russell had 343 Investment Professionals which help make up 1,355 total Associates at the firm. Russell has noted that an Investment Professional is an associate who is involved in the investment process and may either implement or construct investment products and/or investment advisory solutions. Breakdown of personnel is as follows:

The further changes expected (i.e. the transition to Mercer (N.Z) Limited), is likely to lead to additional consolidation in the current Macquarie staff numbers. Up to twothirds of existing staff will possibly be made redundant. As a result, we do not consider it useful to analyse the historical turnover rates of Macquarie in great detail. We retain a watching brief on the developments with the current merger process.

Overall, we are comfortable with the Russell staff turnover figures, particularly in recent years.

Turnover:

Russell has noted that as an organisation they like to have a mix between associates with long firm tenure, and individuals who bring experience from different organisations and bright minds that are fresh to the labour market. To accommodate this, they are comfortable to have some turnover within the firm while also making sure that they retain the right talent.

Vanguard The staff breakdown of Vanguard Investments Australia (VIA) is as follows: Vanguard’s global turnover rate remains at the lower end of industry averages.

Please note this includes inbound expats (excludes outbound),and includes contractors while excluding other contingent workers.

Vanguard’s turnover rate of approximately 10.0% as of December 31, 2021, compares favourably with the financial services industry’s average of approximately 18.6% as reported by the Bureau of Labour and Statistics (November 2021).

On average, Vanguards turnover for their top talent - those receiving the highest performance-management rating - is less than 5.0% annually.

Follow up items – None

Adviser support services provided

In this category we are looking for whether the investment manager provides the same or better level of service than is available in the marketplace for comparable fees.

Fund manager Services provided - summary Comments

Harbour Harbour is a specialist funds management company and provide ongoing support and information which includes:

• Meeting with key investment professionals for portfolio performance reviews as required

• Access to their extensive qualitative and quantitative research

• Access to their monthly and quarterly webinars hosted by fund managers

• Invitations to thought leadership roundtable events and seminars

Regular meetings in person or virtually Consilium has the opportunity to meet with key investment professionals for portfolio performance reviews regularly throughout the year, generally quarterly or as required.

Investment research available

Harbour is an active supplier of good content and services to advisers and Consilium

All investment decisions made by Harbour are driven by research. Portfolio managers and research analysts undertake extensive research using independent providers as well as proprietary data sources, visit companies or issuers, and compile quantitative research. They often publish notes on this research, which are available to Consilium.

Portfolio managers host monthly or quarterly webinars on their respective markets and the performance of Harbour’s funds which Consilium would be welcome to join. We also hold thought leadership roundtable events and seminars which Consilium is invited to. These generally involve a mix of Harbour analysts and external experts sharing their knowledge and research.

BlackRock BlackRock is a premier provider of global investment management services. As of 31 December 2021, we have been entrusted to manage $10.01 trillion across equity, fixed income, alternatives, multi-asset, and cash management strategies for our institutional and retail clients. We collectively support millions of people around the world by working alongside institutions and financial advisors as they contribute to the financial wellbeing of those who depend on them.

Dimensional In addition to on-site meetings, conference calls and specific client requests, Dimensional offers quantitative reporting as part of their client service package.

Dimensional also offers Dimensional 360, which can help financial advisors build a more successful wealth management business through education, coaching, and a full array of resources tailored to the financial advisor firm’s needs. This holistic platform offers a comprehensive view of where an advisor’s business can go and delivers expertise and resources to bring their vision to life. Dimensional 360 is available through a deep, experienced team of specialists who connect financial advisors to the people, insights, and tools that can help transform their businesses.

Dimensional’s support begins with investments. They show financial advisors how to get the most from leading research and use Dimensional strategies to enhance their investment offering. Beyond investments, Dimensional 360 extends across other essential functions of the financial advisor business communication and strategy to help advisors elevate the client experience and position their business for higher growth and success.

Dimensional delivers a full spectrum of services through multiple channels:

• Professional Consulting: One-on-one consultations with investment specialists and client support teams

• Client Communities: Professional study groups, executive forums, and specialty peer networks

• Events: Conferences, symposiums, and focused workshops featuring Dimensional thought leaders and industry experts

• Webcasts: Live and recorded events featuring expert analysis on markets, research, and industry topics

• Professional Training: Investment education, personal skills development, and business strategy

• MyDimensional.com: Website offering exclusive access to digital resources, tools, and content

Some of the highlights include:

• Managing Your Practice: A Dimensional Podcast Series This series delivers insights based on Dimensional’s history of industry-

BlackRock generally offer less adviser support services on a proactive basis, however they are amendable to direct requests for support or information for Consilium

Dimensional provides comprehensive support to advisers and bespoke regular support for Consilium

Macquarie Asset Management (MAM) leading financial advisor benchmark studies and client surveys. We help advisors leverage those insights when making the critical business decisions successful firms face every day. This series is dedicated to providing financial professionals with best practices in key areas such as driving growth, business efficiency, and the client experience.

• Global Investor Study Through the Global Investor Study, advisors can gauge how clients perceive their firm and value offering and identify areas of opportunity and potential risk.

The MAM service suite has historically been broad and served advisers well. However, with the pending change to Mercer underway, it is not clear exactly what services can be expected in the future.

MAM has indicated that over the next 12 months, advisers and investment committees will continue to have access to the Macquarie website and the resources page for the latest insights, market commentary and product information.

Russell Investment Funds Russell provides a range of services to assist the local adviser community. This includes conducting in person meetings, events or webinars as well as distributing content (written, video, podcasts) produced by their global platform covering a range of investment and advisor-business related topics. They develop specific content to support financial advisers, including the regular Value of Advice research.

Russell has noted they are happy to make their team available to the Consilium investment committee and can call on global colleagues as required. They typically host quarterly webinars covering fund updates with their portfolio managers for New Zealand clients.

Having focused for much of the thirty-plus years on the institutional investor community in New Zealand, they have reoriented Russell Investments New Zealand in recent times to align more closely with financial advisers. Russell is continuing to look at ways in which they can work with this community to help them better service their clients.

Vanguard Vanguard offers the following adviser support services:

• Portfolio Construction Workshop: conducted on a quarterly basis, it is a 3 hour workshop with an audience of around 12 advisers come together to go through the material. Vanguard hosts the workshop and the advisers receive 3 CPD points. It involves three categories of subject matter

• building trust amongst investors

• adding value to clients with a focus on portfolio construction, and,

• sustainability of an advisory business.

• Portfolio builder tool: in partnership with Morningstar, you can analyse the construction of portfolios via an interactive tool.

• Whitepaper articles: specialised whitepaper articles constructed by our Intermediary Services Group (ISG) and available for viewing online.

If and when services are modified post the planned handover to Mercer, we will make a further assessment at that time (as part of Consilium’s qterly DD process).

We can confirm that Russell have been more active in recent months in support of Consilium requests for info and services, as per their response

• Client Roadshow: our annual roadshow event with senior leaders from the US providing a comprehensive market overview and targeted content and research.

• Roundtables: focusing on specific product streams and providing valuable insights to our clients, our roundtables occur twice a year.

Follow up items – None required. BlackRock provides the least “pro-active” support of their funds although they are generally responsive and accommodating when we provide them with a request for services/support. The other managers, to varying degrees have all demonstrated a willingness to support adviser needs directly or via Consilium, with Harbour and Dimensional generally being the most supportive.

Fund managers

In this category we are looking for the tenure of the key investment managers running the fund.

Fund manager Fund managers - summary

Harbour NZ Corporate Bond Fund (Corporate Bond Fund)

All

London Asset Management

Mark Brown has managed the Corporate Bond Fund since Harbour took over its management in 2011.

As soon as key management personnel change, Harbour makes a commitment to the client to keep them fully informed. This communication will include employees leaving, reason for departure and future course of action within Harbour to ensure clients still receive the highest level of service and attention.

BlackRock Information provided in the manager due diligence report Consilium receives qtly In general, we are less concerned about specific manager bios with established firms providing index tracking mandates.

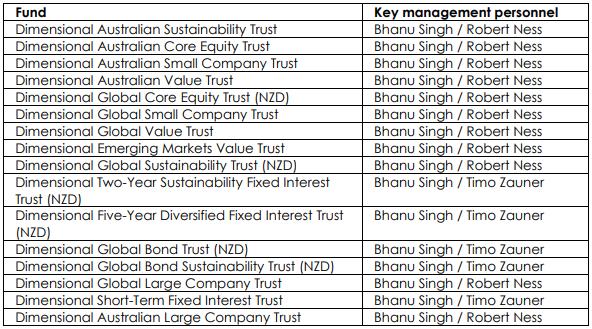

Dimensional

Bhanu Singh is Head of Asia Pacific Portfolio Management at Dimensional. He joined Dimensional in 2003 and has been in his current role since 2015. In this role, Bhanu is responsible for all portfolios managed out of the Dimensional offices in Australia, Singapore and Japan. He works closely with Dimensional’s Research team to help design and implement custom solutions that the firm can provide to help clients achieve their goals. Additionally, Bhanu is a member of Dimensional’s Investment Research Committee and serves as a Director for Dimensional Australia. Bhanu holds a BA in business economics with honours from UCLA and an MBA in analytical finance with honours from the University of Chicago Booth School of Business.

We note that on the 28th of October it was announced that Bhanu Singh will become DFA Australia’s new CEO beginning in 2023.

MAM intends to remain an Investment Manager for the funds and has indicated it will retain their local investment management presence in New Zealand.

Until such time as this Mercer transfer completes, there remains some uncertainty over the investment management personnel. Consilium models will exit remaining MAM funds at the end of March 2023.

The change is subject to approval from Guardian Trust (which is expected) with the deal set to close at the end of the March quarter next year.

Until such time as this transfer is complete, there remains some uncertainty over the investment management personnel.

As remaining funds will be exiting Consilium model recommendations at the end of Marsh 2023 we are not so concerned about assessing the outlook for MAM funds post March 2023.

James is the portfolio manager for directly managed Global equity funds. He manages in excess of A$8bn across a range of investment strategies with over NZD $3bn in global equity, decarbonisation and Australasian ESG strategies.

James has extensive global industry experience. He has been involved in global equity trading since 1998 and was Head of Trading at F&C Asset Management in London where he spent 7 years in senior portfolio management and trading positions. Prior to joining Russell Investments, James spent 6 years at Deutsche Bank working in the bank’s London, Singapore and Sydney offices in equity sales related positions. James joined the investment division at Russell in 2013.

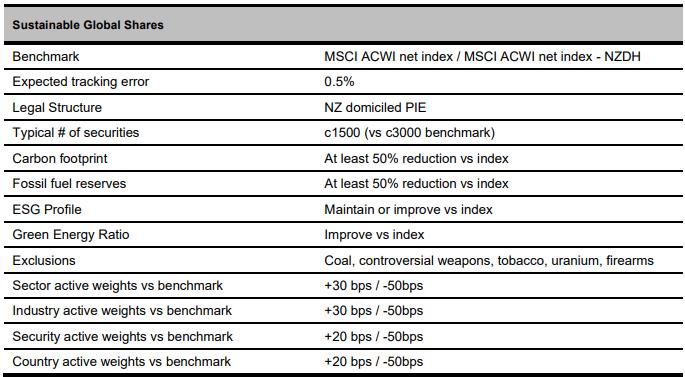

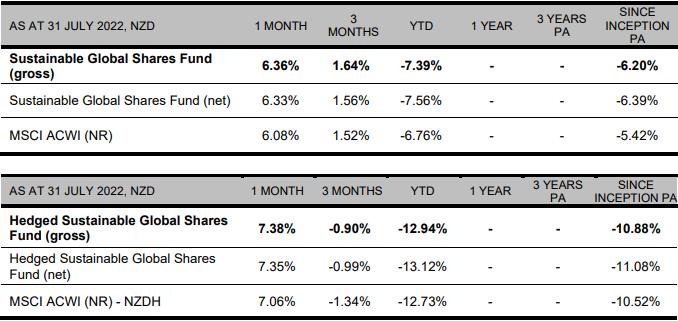

Since 15 December 2021 James has run both Russell Investments Sustainable Global Shares and Russell Investments Hedged Sustainable Global Shares Funds.

Russell Investments ensure their clients are fully informed regarding the people that make the decisions relevant to their investments. They have a Global Marketing function, which includes a specialist Client Communications team that ensures the timely production and dissemination of communications materials. Russell ensures all communications that are particularly sensitive in nature is disseminated in a manner which is fair to all unitholders. They typically notify any changes via email at least initially, outlining said changes. Typically, this will be followed up with a webinar which will go in further details and allow for any questions.

Vanguard Vanguard’s Equity and Fixed Income teams both take a team-based approach to investment management, avoiding a star manager system. Each portfolio manager is cross-trained and can carry out investment management responsibilities across all relevant portfolios. This approach ensures fund management continuity and consistency over the long term.

Furthermore, Vanguard has a global investment platform that employs the same daily, disciplined and tightly risk controlled approach. Trading desks in Australia, the United States and the United Kingdom manage and trade both equity and fixed income assets. This global platform allows Vanguard to trade assets locally; for instance, the Melbourne desk handles portfolio management and trading functions for Asia-Pacific stocks and bonds. Regardless of location, the portfolio management teams use the same investment philosophy and approach, which is supported by a single, global investment management platform that combines portfolio management, trading and operations tools. One of the many benefits of this global integration is the ability to provide contingency trading/coverage for different desks located around the globe. Vanguard traders and portfolio managers use multiple trade execution systems. If one fails, they can use an alternate

Appropriate for predominantly index-tracking mandates

Vanguard notifies its clients of any senior personnel changes within the funds management teams via email, within one month of the change.

In respect of the DFA response, we will ask for bio’s of Robert Ness and Timo Zauner to flesh out our knowledge of their full credentials, but their response on this is not considered critical to the completion of this review (their response will contribute to a brief related EDD). Otherwise, no follow-up required. Although Vanguard did not nominate individual managers for their funds, the funds themselves are all index trackers, so the relevance of a single named manager is considerably lower than for a fund where some degree of manager discretion is available. Overall, while we would have preferred to receive a clearer identification of who has primary responsibility for each fund, the non-discretionary nature of these Vanguard mandates encouraged us to accept the team management response in this instance.

Follow up items

Investment mandate

In this category we are looking at whether the investment mandate is firmly set so we can be confident of the limit on manager discretion to change risk factor allocations.

Fund manager Investment mandate - summary Comments

Harbour Each Harbour fund has its own Investment Strategy and Objective prescribed in the Statement of Investment Policy and Objectives (SIPO).

Portfolios are monitored against tolerance limits and target weights on a daily basis. Position holdings data provided by the custodian are also reconciled against expected holdings daily. All mandate rules are coded and activated to provide compliance testing of all their trading and holdings. Investment guidelines are coded and locked in the AIM system by operations, independent of the portfolio manager, and all updates are reviewed and signed off by Compliance. The best-in-class AIM system provides live, real-time checks of portfolios versus mandate restrictions.

All active and passive breaches for Harbours funds are notified to the Supervisor, New Zealand Guardian Trust, and appropriate action is taken in consultation with them. Any active breaches of a Fund’s SIPO are to be corrected as soon as possible, unless in the opinion of the Manager, it is in the interests of investors for the position to be held or sold over a longer timeframe.

BlackRock BlackRock replied that the ability of the manager to deviate from the prescribed mandate is not applicable They noted that these are index funds that aim to replicate the performance of the benchmark, therefore they are not making any autonomous active decisions. In general, each portfolio shall be invested and reinvested in a portfolio of equity securities with the objective of approximating the aggregate return of the respective benchmark. Characteristics and holdings will match the benchmark as closely as possible.

Dimensional All investment decisions are made by the Investment Committee and implemented by the Portfolio Management team. We impose specific parameters that help maintain consistent focus on the targeted asset class and premiums. Portfolios are continuously monitored for adherence to internal investment guidelines.

The daily portfolio monitoring process is overseen by Jed Fogdall, Global Head of Portfolio Management, who reports to Gerard O’Reilly, CIO and Co-CEO. In addition, Dimensional’s Compliance department administers both pre- and post-trade compliance monitoring controls to support

Harbour are extremely diligent about informing any proposed changes in mandates (revised SIPO’s) or any occasional breach

Combined with BR’s comprehensive frontend and back-end compliance checking, we are very comfortable in their consistent mandate delivery

This aligns with the results of our regular quarterly monitoring processes

Macquarie Asset Management (MAM) the Portfolio Management and Trading departments by alerting the appropriate personnel of certain issues discovered during its review of daily transactions and holdings information. Further details regarding Dimensional’s specific Pre and Post trade controls can be found in section 2.6 below.

The Fund is passively managed, meaning the investment manager buys and sells financial products to track the performance of the designated market index. MAM do not make active investment decisions in the Fund which move the Fund’s portfolio holdings significantly away from the portfolio weightings that are determined by the index. The consequence of this will be that the Fund will not sell a security because the issuer is in financial difficulty or negatively impacting the index return, unless that security is removed from the index being tracked by the Fund.

Macquarie, however, do have the ability to work with UBS to make any changes they may want to see implemented. For example, in 2019 when the New Zealand business made the decision to divest of civilian firearms, UBS would have been required to divest of any civilian firearms-related investments held in the index if applicable.

In managing the global index bonds strategy, UBS’s primary investment approach is full replication of the index. The goal of the indexed strategy is to mirror the returns and characteristics of the Bloomberg Barclays MSCI Global Aggregate SRI Select ex Fossil Fuels Index. As a result, UBS will attempt to hold each stock in the Index in approximately the same weight as it appears in the index.

Russell Investment Funds

The manager has no such ability to deviate from the mandate (strategy) as described in the Product disclosure statement. Key fund details:

The Sustainable Global Shares Fund is an index-oriented equity fund managed by the global direct implementation team. The mandate is to provide a global equity fund that closely tracks the MSCI ACWI index, while offering a lower carbon, lower reserves and improved ESG profile relative to the market. The fund also includes exclusions across several sub-industries.

Vanguard Vanguard’s philosophy emphasises rigorous and consistent portfolio construction, driven by indepth analysis, to achieve highly risk-controlled and cost-effective results. The team employs optimal portfolio construction techniques that range from full replication, to a sampling methodologies to match the risk characteristics of the strategy to those of the relevant benchmark.

Vanguards Risk Management Group (RMG) performs numerous portfolio monitoring tests to ensure compliance and propriety in relation to trading activities (e.g. trade reversals, trade overrides monitoring, derivatives as a percentage of holdings and money market stress- testing). RMG also monitors the performance and tracking error attributes of each fund at the security, asset class and fund level on a periodic basis. Again, there are controls in place to ensure the monitoring is performed on a timely basis and accurately, with appropriate escalation in place for exceptions.

Vanguard Compliance

The Vanguard Australia Compliance team receives daily reports on pretrade compliance testing (conducted by RMG) and post-trade compliance testing (conducted by the Wholesale Fund's custodian - JP Morgan). These reports are reviewed by the team and relevant incidents and issues are raised ad hoc with the other control functions, as well as front office where necessary. Once resolved, the Vanguard Australia Compliance team uses these issues and incidents as a basis for conducting risk assessments and determining additional compliance monitoring requirements.

Fund custodian

JP Morgan (JPM), the appointed custodian, uses an in-house application (HiPortfolio) to independently perform compliance testing using fund holdings information within their accounting systems. Additionally, the appointed trustee performs routine checks of fund holdings, to ensure ongoing compliance with ASIC regulations and prospectus requirements.

Further details regarding Vanguards specific Pre and Post trade controls can be found in section 2.6 below.

Follow up items – None.

Investment assets

In this category we are looking for whether investment assets are increasing so we can be confident that the manager continues to be a viable business.

Fund manager Change in AUM - summary Comments

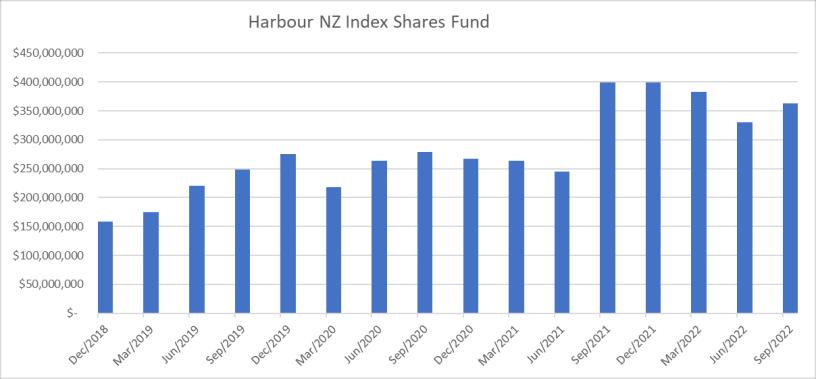

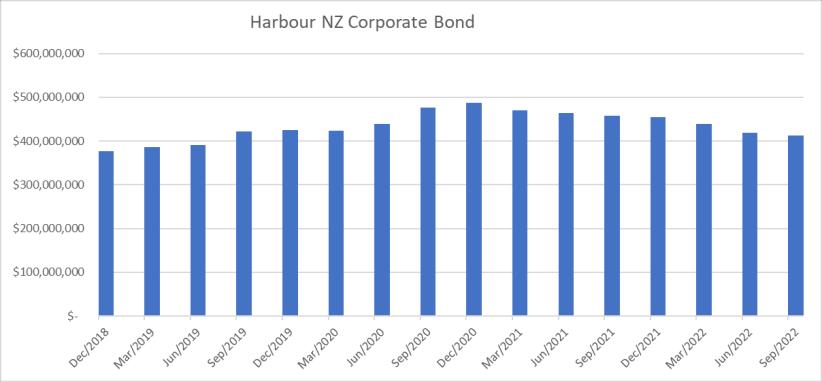

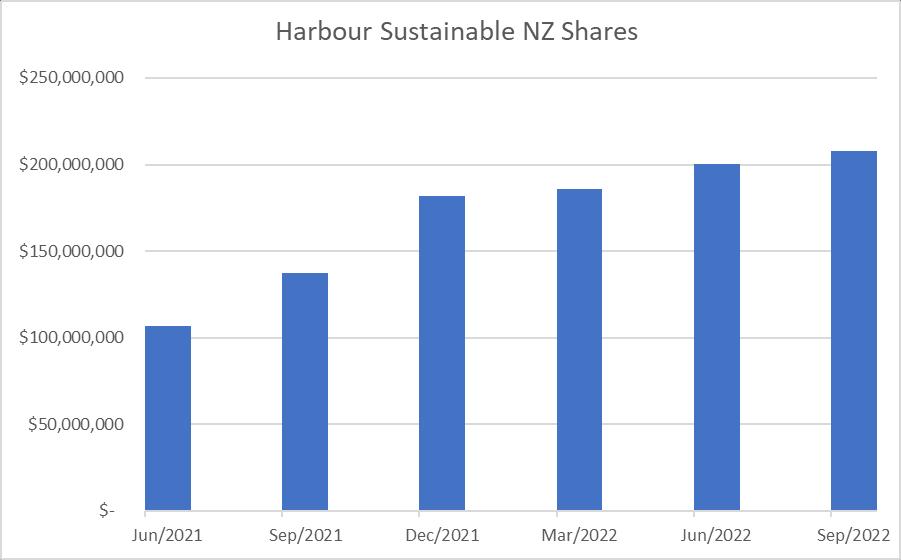

Harbour

We note the funds generally have good FUM levels and are growing, aside from the fixed income declines of the last 12 months

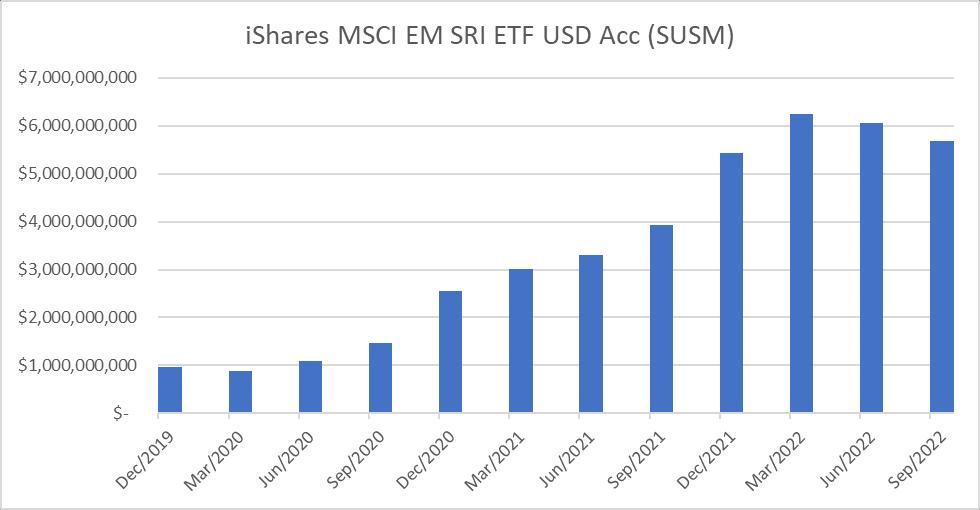

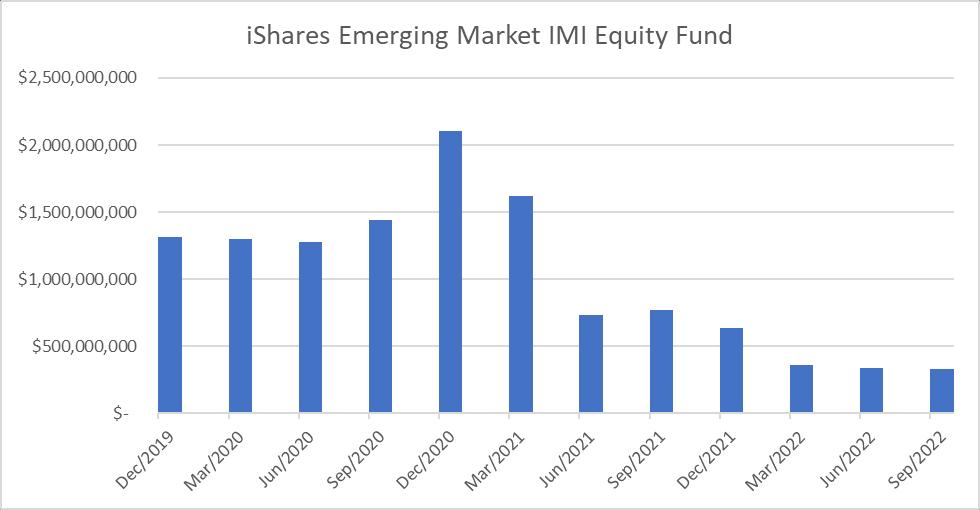

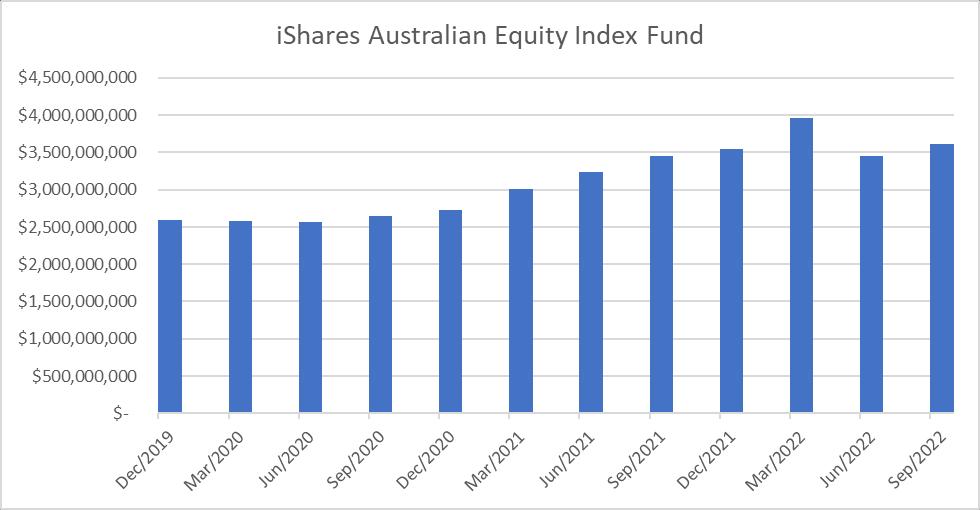

BlackRock Funds all have sufficient scale. The FUM of the iShares EM IMI Equity Fund have declined, in part, due to the global shift towards SRI (part of the reason for the growth in the iShares SUSM ETF). The iShares EM IMI FUM is still adequate to run this strategy.

DFA FUM levels are all adequate and we watch out for changes in FUM levels in our quarterly DD.

In spite of a large outflow from AIF PQ in mid-2021, the fund retains sufficient scale to be managed efficiently albeit with a slight impact on average fund costs.

This fund likely to exit remaining model portfolios in March 2023.

Russell Investment

Funds

We make note that FUM has been decreasing, with a sizeable reduction in the third quarter of 2021, as a result related fees to the fund have increased by 3 basis points

Mandate assets are stable/growing, which is acceptable in the current market environment.

Follow up items – None

Performance

In this category we are looking for how the performance compared vs their documented benchmarks and if variations are due to risk exposure

Fund manager Performance - summary Comments

Harbour Gross returns (excluding fees and tax). All numbers are annualised

Sharpe ratio comparisons:

BlackRock Returns gross of fees and denominated in AUD. All numbers are annualised.

Blackrock did not provide SUSM returns, or Sharpe ratios. However, we can assess very little deviation from benchmarks without reference to Sharpe ratios.

Performance below is shown on Net Asset Value (NAV) basis, with gross income reinvested where applicable. Performance is denominated in USD.

DFA did not provide Sharpe ratios. However, we monitor relative and riskadjusted tracking error very closer throughout our quarterly monitoring, so the absence of Sharpe ratios is not critical.

Returns and ratios are as of 31 August 2022.

The fund’s first full month was December 2017

The performance target for our passive fund mandates is to track as closely as possible the index on which the fund is based in order to provide investors in the fund the same performance relative to the market underlying the index (gross of fees). The strategy is to buy and hold non-restricted securities, trading only when there is a change to the index or cash flows, or to reinvest cash from dividend income, tax reclaims or corporate actions.

On a monthly basis the returns are within 3-5 bps, which is what we would expect. However, there are times when full replication of the index is not possible. At times this has gone in our favour, but there are other times where

Russell Investment Funds the difference is larger, and this coincides with months where there have been large cash flows into or from the fund.

There is also a small allocation to cash as part of the investment guidelines for settlement purposes. This can be a drag (or a gain) from time to time, depending upon market conditions.

Russell notes that the funds were only launched in December 2021, therefore return data is limited and do not yet feature a 3-year track record to provide relevant Sharpe ratios.

Fine.

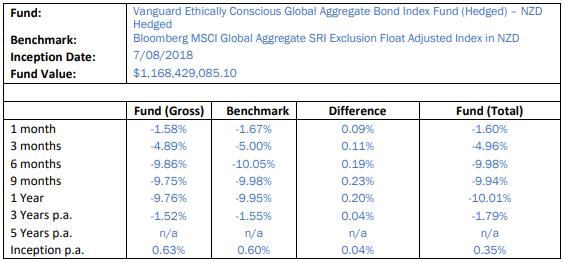

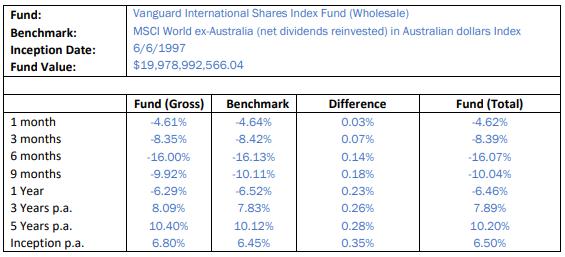

Vanguard All returns are as at 30 June, 2022. Vanguard International Shares Index Fund (Wholesale)

Low tracking differences are fine.

Vanguard Ethically Conscious Global Aggregate Bond Index Fund (Hedged)

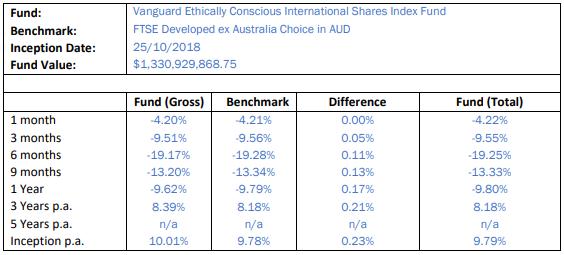

Vanguard Ethically Conscious International Shares Index

Sharpe Ratios:

None. In general, the Sharpe ratio data (when supplied) was in line with expectations. Not all firms supplied Sharpe ratios, however in general they supplied tracking differences to major benchmarks. As the Consilium investment team monitors relative and risk-adjusted tracking error very closer throughout our regular quarterly monitoring, the absence of any Sharpe ratios in these responses was not considered to be critical. In light of our detailed fund monitoring, we may consider removing the request for Sharpe ratio calculations next time.

Follow up items

Best execution

In this category we are looking for whether trading costs are accounted for and if there are procedures for best execution being followed

Fund manager Best execution - summary Comments

Harbour For the 12-month period to 31 July 2022 the actual trading and brokerage costs were:

• Harbour Corporate Bond Fund: 0.08%

• Harbour NZ Index Shares Fund: 0.037%

• Harbour Sustainable NZ Shares Fund: 0.062%

Harbour uses its trading policies to outline the process around best trade execution.

Harbour takes all reasonable steps to execute client orders on the best available terms, taking into account the relevant market at the time of the transactions and size concerned and the characteristics of the execution venues to which the order can be directed.

Harbour follows the process outlined in the trading policy to allow it to obtain the best possible result for the client in accordance with that obligation. Harbour elects different execution venues for the execution of orders taking account of the factors affecting its choice of execution venue. Of fundamental importance, Harbour is not tied to Jarden as an execution venue and deals with a range of different execution venues to obtain on a consistent basis the best possible result for the execution of client transactions.

The best possible result for the client is determined in terms of the total consideration, representing the price of the investment / financial instrument concerned and the costs related to execution, which includes

Harbour trading and brokerage costs are reasonable (for NZ). They were unable to provide and independent verification of best execution, which is commonly the case for NZ fund managers all costs incurred by the client that are directly related to the execution of the order, including execution venue fees, clearing and settlement fees and any other fees paid to third parties involved in the execution of the order. Speed, likelihood of execution and settlement, the size and nature of the order, market impact and any other implicit transaction costs may be given precedence over the immediate price and cost consideration only insofar as they are instrumental in delivering the best possible result in terms of the total consideration to the client.

Harbour maintains a Broker Panel which and considers best execution and research provided for the benefit of client.

The Broker Panel is periodically reviewed for consistency of client outcomes.

BlackRock BlackRock’s Portfolio engineers use technology and risk models to manage portfolio tracking error. A quantitative process balances tracking error and transaction costs to consistently deliver benchmark performance.

Open market trading is executed with brokers according to BlackRocks policy of best execution. In light of this policy, BlackRock will select broker-dealers or use automated trading systems that will seek to execute securities transactions for clients in such a manner that the client’s total cost or proceeds in each transaction is the most favourable under the circumstances. In selecting broker-dealers or automated trading systems to trade securities, BlackRock will consider all factors it deems relevant, including, but not limited to: (i) BlackRock’s knowledge of pricing and liquidity currently available; (ii) the desired timing of the transaction; (iii) the nature and character of the security or instrument being traded and the markets on which it is purchased or sold; (iv) the activity existing and expected in the market for the particular security or instrument; (v) the full range of brokerage services provided; (vi) the broker’s or dealer’s capital strength and stability, as well as its execution, clearance and settlement capabilities; (vii) the quality of the research and research services provided; (viii) the reasonableness of the commission or its equivalent for the specific transaction; and (ix) BlackRock’s knowledge of any actual or apparent operational problems of a broker or dealer.

The size of BlackRock’s trading activities is substantial and this volume has allowed them to build good working relationships with the world's leading brokers and ensures that they provide them with the lowest trading rates possible and the best access to natural liquidity. BlackRocks trading professionals continuously monitor brokers’ capabilities by electronically comparing benchmark prices versus actual execution. Executions are monitored both on an individual security basis and across entire trade programs. Across all BlackRock trading activity, we leverage a proprietary tool for transaction cost analysis (TCA) to manage and monitor trading performance. Their TCA framework measures execution quality with respect to price before, during and after a trade is completed. The metrics holistically capture all trading costs which include the total impact from a broker’s order handling and routing decisions. They use this data to identify outliers which may indicate that a particular counterparty, tactic, or venue is no longer appropriate for BlackRock.

The process of evaluating execution quality is monitored and reviewed internally on a regular basis by key members of the Investments businesses. BlackRock has established an Equity Trading Oversight Committee (ETOC), which in conjunction with its Equity Policy Oversight Committee (EPOC) have oversight responsibility for implementation of BlackRock’s equity trading policies, including the firm’s best execution policy. Representatives of Trading, Portfolio Management, Risk &

BlackRock were unable to provide an independent verification of best execution.

Quantitative Analysis Group, Legal & Compliance and Operations, and other key business partners are members of the committees. ETOC and EPOC meet quarterly

Dimensional The Trusts’ transactional and operational costs are summarised below. This information can also be found in the Additional Information Guide attached, which can be found on our website: https://www.dimensional.com/au-en/document-centre

DFA refers to third party TCA providers and we are aware they do engage with these providers to benchmark their relative execution effectiveness

Dimensional's trading desks continuously evaluate the total costs of trading, attempting to minimise these costs while maintaining the highest quality execution in accordance with our investment philosophy. Dimensional reviews the costs of trading using a wide variety of internal and external trade-cost evaluation tools including third-party trade cost analysis (TCA) providers, consulting firms, and academics.

Dimensional’s Best Execution Oversight Committee meets at least quarterly to review the outputs from our internal and external monitoring efforts across all asset classes traded by Dimensional, including equity securities, foreign exchange (FX), exchange traded futures, and fixed income securities.

To aid in this evaluation and testing, Dimensional maintains a global price database that stores extensive information regarding market trades and market quotes; this database is used to analyse Dimensional’s trading behaviour and outcomes. Multiple price metrics are used for evaluation, depending on asset class. Dimensional also employs thirdparty TCA providers and academics to assist in the evaluation of trades on a global basis.

These internal and external tools and services are used to help ensure that Dimensional’s execution strategies continue to fit our investment philosophy.

In summary, the results from both the internal and external analysis have reinforced Dimensional’s philosophical position that patience and flexibility in the trading component of implementing strategies is a valuable component of the implementation process. Specific research efforts have aided decision-making around various topics including venue usage in equities, timing and location of FX execution, and commission rates.

In addition to the annual management fee, the fund incurs ‘in fund’ costs associated with its operation (eg trustee, legal, audit, unit pricing, etc). These costs are borne by the Fund and due to their nature can vary slightly from year to year.

MAM was unable to provide and independent verification of best execution, which is commonly the case for NZ fund managers

Russell Investment Funds

Actual charges are set out in the Fund Update which is published each quarter on the Macquarie New Zealand website and on the offer register at www.companiesoffice.govt.nz/disclose .

Macquarie Asset Management has a Best Execution Policy which sets out the general principles of fiduciary duty relating to dealing and the allocation of trades across client accounts. In addition, the Macquarie Deal Allocation Policy provides for the fair and equitable deal allocation among portfolios with the same or similar investment styles, risk profiles and investment guidelines, and to ensure that clients’ interests are prioritised over that of MAM.

MAM executes physical trades with an objective of minimising transaction costs and obtaining the best price execution. Generally, the highest priority will be placed on execution price, but MAM will consider and may prioritise other factors in order to achieve the best possible result for the client. MAM will determine the relative importance of execution factors with reference to a specific transaction, considering criteria such as client classification, and the characteristics of the order, financial instruments involved, and execution venues and brokers

It is the responsibility of portfolio managers and trading desks to achieve best execution, taking into account execution factors as well as client specific instructions, and portfolio specific events (such as applications or redemptions).

MAM does not actively trade assets within the portfolio. All purchases and sales are in support of changes to the strategy of the fund and not for short-term speculative activities.

One-way turnover is expected to be around 10%, or 20% 2-way. We’d expect brokerage costs to be 1- 2bp p.a. and 2-4bp for trading (impact costs), giving an approximate maximum of 5bp p.a.

Best execution verification

For Russell Investments, best execution does not mean simply obtaining the lowest possible transaction or commission cost, but rather whether the transaction represents the best qualitative execution considering several factors. Accordingly, in seeking best execution, the Investment Division considers the full range of a broker-dealer’s services, including the value of research provided, execution capability, spread cost, commission rate, financial responsibility, and responsiveness, among other factors.

Internally

Russell Investments Implementation Services (RIIS) seeks to achieve the best transaction terms reasonably available under the circumstances at the time of the trade. A full examination of best execution involves the qualitative and quantitative assessment of many factors beyond trade results, including, but not limited to, client trading intentions and requirements, and possible venues and trading partners.

Best execution is integral to the investment outcomes of their portfolio management activities, and they monitor counterparties on an ongoing basis for changes in their risk profile, for price quality, and for operational effectiveness. Trade allocations are adjusted based on the results of these analyses. RIIS calculates transaction costs for every trading venue, and they qualitatively monitor counterparties each quarter. This information is evaluated by the Russell Investments Trade Management Oversight Committee (TMOC). Based on this information, the TMOC recommends which relationships to terminate, which to maintain, and which to expand (and at what level). The TMOC’s evaluation considers the following information:

> Execution cost and efficiency

> Operations, settlement, and other post trade services

> Accuracy, completeness, and timeliness of trade reconciliation

> Quality of relationship and client service

> Quantitative analysis and research

> Technology including online applications, communication applications, and the visibility of pre-matched (or non-matched) trades prior to settlement

> RIIS’ best execution program.

Traders formally evaluate venues by benchmark at least twice annually, by execution quality, by operational efficiencies, and by their ability to provide market colour. We collect over 15,000 data points a period, for equity, fixed income, foreign exchange, and derivatives. Venues are ranked and placed on our semi-annual counterparty scorecard.

The scorecard evaluates everything from broker analytics to the overall relationship, client service, and technology. It is a comprehensive review by venue versus benchmark. Russell notes that it is both a quantitative and qualitative approach that we integrate with real time trading results in a way that sets us apart from our competitors.

Externally

In order to help verify best execution, Russell also hires third party vendors to perform trade cost analysis (TCA) on their trades, as detailed below:

Vanguard Vanguard, as a matter of their internal policy, cannot disclose specific trading and brokerage costs, along with peer comparisons relative to other managed funds.

Vanguard’s best execution policy is to take all the sufficient steps to obtain the best possible results for its client in terms of “total cost” (in the case of purchases) and “total proceeds” (in the case of sales) when executing transactions. Total cost and total proceeds mean the: a) price, b) cost, c) speed d) likelihood of execution and settlement, e) size, f) market impact, g) nature, or h) any other consideration relevant to the execution of an order.

While we are disappointed that Vanguard will not disclose trading and brokerage costs, these costs form part of the tracking error we identify when we monitor Vanguard index funds. Given the minimal tracking error we identify during this process we can at least be confident their trading and brokerage costs are highly competitive.

Follow up items – We will ask BlackRock if they can supply annual trading and brokerage costs for each fund.

In this category we are looking for whether the fund manager can demonstrate adequate pre and post trade compliance processes.

Fund manager Trade compliance - summary Comments

Harbour Harbour uses the compliance module in Bloomberg to monitor compliance of funds. Rules are built within the system. Prior trade execution, the portfolio manager enters orders in the system which simultaneously checks if the desired order is within the limits. If the order passes the compliance check, the orders will proceed for brokers to fill. If the order triggers a limit, an alert will be sent to Harbour Operations Team and Compliance Team for review. If the order is deemed to breach a limit, appropriate action such as cancelling or amending the order will be implemented.

The portfolio management team continuously monitors client portfolios versus investment guidelines via the Bloomberg Asset Investment Manager (AIM) system. All mandated rules are coded and activated to provide compliance testing of all our trading and holdings. Investment guidelines are coded and locked in the AIM system by operations and approved by compliance. Any potential compliance breaches are flagged immediately, and the AIM system will not allow potential trades to progress. Compliance, the Managing Director, and members of the investment team receive immediate notification of both active (if any) and passive breaches.

Pre-trade compliance:

When the portfolio manager models trade across accounts a pre-trade compliance check is run to ensure that the portfolio remains within guidelines. The modelled trade is then passed to the trader who uploads a potential trade into the Compliance Manager (CM). All trades have to pass through the CM, which ensures testing of each mandated rule/restriction before the trades are routed to the executing brokers. For example, if we model a buy trade that will either place the account overdrawn or establish a position larger than the client constraint then the trade will not be available for placing with a broker. A warning is flagged, and this warning passes to the Portfolio Manager and the Head of Compliance. Unlike many systems the pre-trade compliance uses real-time pricing, which ensures intraday relevance of the rules (i.e. the CM captures intraday market moves). All warnings created either intraday by, say, price movements or by potential trading are flagged by the CM and sent real-time to both the Compliance Officer and the Portfolio Manager.

Post-trade compliance:

Harbour’s compliance system within Bloomberg generates daily compliance reports including end of day compliance checks. These reports will include any exceptions on the limits. Harbour reviews these on a daily basis to ensure that funds are within the required limits. Any passive and active breaches are then reported to the compliance team and to clients with detailed explanation on the breach, why it occurred, and actions taken by Harbour.

On the morning following trade date the compliance team and broader investment team receive from the Bloomberg AIM system several reports. Compliance reviews the reports on a daily basis. These reports are generated and sent by an Operations Analyst, and include:

• Trade allocation report for the previous day

A comprehensive overview

• End of day compliance report checking of portfolios versus mandate rules. Where breaches of rules occur explanations will be provided and reported to clients if appropriate.

BlackRock BlackRock has a multi-layered control framework to ensure that Global Trading delivers best execution for clients. The Global Trading business manages and owns best execution as the first line of defence. Risk Management, Transaction Surveillance and Compliance provide independent oversight and challenge to the best execution process. Additionally, Internal Audit serve as the third line of defence to assess adequacy of processes and share audit results with senior management. The Best Execution processes are quantitative and qualitative, with controls pre-trade, at point of execution and post-trade.

BlackRock’s overarching goal in executing transactions is to do so in a manner and at levels that are as beneficial as possible for the client in the given market conditions. In light of this goal, BlackRock seeks to select broker-dealers and/or automated trading systems to execute transactions for clients in such a manner that the client’s total cost or proceeds in each transaction is the most favourable under the circumstances.

In selecting broker-dealers or automated trading systems to trade securities, BlackRock will consider all factors it deems relevant, including, but not limited to: (i) BlackRock’s knowledge of pricing and liquidity currently available or current and historical spreads; (ii) the desired timing of the transaction; (iii) the nature and character of the security or instrument being traded and the markets on which it is purchased or sold; (iv) the activity existing and expected in the market for the particular security or instrument; (v) the full range of brokerage services provided; (vi) the broker’s or dealer’s capital strength and stability, as well as its execution, clearance and settlement capabilities; (vii) the quality of the research and research services provided, where permitted under applicable regulation; (viii) the reasonableness of the commission or its equivalent for the specific transaction; (ix) BlackRock’s knowledge of any actual or apparent operational problems of a broker or dealer; and (x) the requested size of the transaction.

All transactions at BlackRock are routed through a proprietary order management system. The system has the functionality to manage orders on a global basis, and there are various checks and controls to monitor and manage risks, counterparty restrictions and specific order instructions (such as required benchmark targets, etc.). Furthermore, the systems interface with our credit monitoring process to ensure exposures are maintained within firm’s guidelines. On a post-trade basis, all executions can be analysed against a range of intra-day and realtime benchmarks. These results are used to assess performance and are part of a continuous feedback process which ensures that their optimization methodology correctly estimates prevailing liquidity and transaction costs.

Evaluation of BlackRock traders is a dynamic process that involves informal daily forums as well as formal weekly and monthly reviews. Leveraging their robust data management systems, traders are evaluated across various criteria, including, but not limited to, trade errors, broker-dealer utilization and best execution. Best Execution Working Groups meet to review these metrics and formally escalate any issues to the relevant Trading Oversight Committees.

Dimensional Dimensional’s Compliance department administers both pre- and posttrade compliance monitoring controls to support the Portfolio Management and Trading departments by alerting the appropriate

Macquarie Asset Management (MAM)

personnel of certain issues discovered during its review of daily transactions and holdings information.

Compliance provides pre-trade compliance support for Dimensional managed portfolios using the Charles River Investment Management Solution (CRIMS), Dimensional’s primary order management system, as its main tool. Compliance works in conjunction with Portfolio Management, Trading, and the Technology department to build and test pre-trade compliance rules in CRIMS. All approved orders are tested against pre-trade compliance rules to confirm compliance with investment guidelines and restrictions. Orders which do not pass certain pre-trade compliance tests are subsequently reviewed by investment personnel to reassess the appropriateness for the portfolio. Pre-trade override authority is strictly limited to investment personnel approved by the Global Head of Equity Trading and/or the Global Head of Portfolio Management, as well as Compliance. Compliance monitors overrides on a daily basis.

Compliance independently builds and tests rules in the system to monitor compliance with investment guidelines and restrictions applicable to each portfolio.

Transactions, holdings and other security and portfolio related information are processed overnight during a scheduled batch cycle, and portfolio compliance exceptions are made available to Compliance the next morning. Compliance personnel review each exception during the day of discovery and any potential trade issue is subsequently escalated to the appropriate Portfolio Management and/or Trading personnel for review and validation. Compliance and Risk tracks the status of each issue until resolution, and any trade error is resolved in accordance with Dimensional’s Error Correction Policy or other applicable policy.

Responsibility for monitoring the compliance of portfolio mandates falls within the front office and, independently from the former, within the Investment Risk Management (IRM) team. MAM compliance systems are a combination of proprietary systems as well as tailored external systems used to manage both pre-trade and post-trade investment compliance. Data is sourced independently from the front office systems. Macquarie’s systems have a range of compliance functions to ensure client mandate limits are adhered to. These include pre-trade and posttrade compliance on a range of investment constraints.

All limits are monitored on a daily basis. Their portfolio management system (Aladdin) is used in the pre-trade and post-trade monitoring process, and pre-trade limits are monitored throughout the day to prevent breaches occurring. Post trade limits are assessed both by Aladdin and by the investment administration system via an overnight process and reported to IRM on an exception basis on the next business day. These exceptions are investigated by IRM and then followed up with the portfolio manager.

Suitable corrective actions are determined and any negative impacts on the fund are compensated by the business. All breaches are reported in their incident reporting system (Open Pages) which includes all details of the incident, and a report is produced which is sent to senior management on a weekly basis.

Russell Investment Funds Russell Investments uses Bloomberg AIM, as well as their internal order management system, which has secure access controls and can accommodate any investment constraints, to monitor the investment guidelines at the pre-trade and post-trade level. Bloomberg AIM is also utilised to monitor for any breaches of restrictions/exclusions and sanctioned securities.

Daily monitoring of portfolio compliance with the investment guidelines, restrictions and sanctions is carried out by Russell’s portfolio managers at the pre-trade level, and at both the pre-trade and post-trade levels by their dedicated team of Guidelines Monitoring specialists who form part of the in-house Compliance function. Approximately 95% of the Guideline Monitoring team's monitoring process is conducted in an automated fashion, with around 5% (including where there is a need to manually maintain restrictions lists or watchlists) conducted manually.

The Guidelines Monitoring specialists liaise with the internal Compliance and Risk teams to ensure that regulatory and/or client obligations are met.

Fund-specific limits, thresholds and other portfolio related guidelines are coded into the order management system, which allows our portfolio managers to run additional checks for any potential “breaches” prior to trade execution. These changes further empower the portfolio managers to make timely and well-informed decisions to improve investment performance and achieve fund outcomes.

Vanguard Pre-Trade

Pre-trade compliance refers primarily to the controls implemented in the portfolio management systems to help ensure that regulatory requirements, established investment guidelines, prospectus limitations and fund mandates are adhered to. These include preventing portfolio managers from adding incorrect securities, trading with unauthorised counterparties, and from breaching concentration limits.

Coding of compliance guidelines into the order management system (OMS), and the monitoring and resolution of any exceptions, is the responsibility of the Operational Risk team within Vanguard’s Risk Management Group (RMG). Pre trade compliance guidelines are maintained in the relevant trade OMS - Charles River Development (CRD) for equity strategies, and Aladdin (Blackrock) for fixed income strategies, and must be adhered to during the portfolio construction process.

RMG is functionally separate from the portfolio management groups and is responsible for maintaining the compliance module and related rules within the order management systems, as well as for reviewing exception reports on a daily basis.

In regard to mandate guidelines and constraints, Vanguard’s Investment Risk and Compliance teams are responsible for setting these up within VIA systems. Both teams have new account checklists which include a sign off by someone independent of the person that set up the rules in the system. This is monitored by the Compliance team. Compliance rules are established for each fund specific to the requirements of the investment strategy, which operate in conjunction with generic rules that are designed to support the internal investment policies of Vanguard.

Furthermore, portfolio holdings information is provided to the pre-trade compliance system daily from the back-office. Proposed trades for the day are provided to the pre-trade compliance system to check that trades are in good order. Should any of these checks fail, the Portfolio Manager will be unable to proceed with trade unless Operational Risk (RMG) or the Head of Investments, Asia Pacific approves the trade.

Trades for Equities and Fixed Interest are sent through an automated pre-trade compliance system prior to execution. Compliance rules are established for each fund specific to the requirements of the investment strategy, which operate in conjunction with generic rules that are designed to support the internal investment policies of Vanguard.

Rules programmed into the order management system provide controls that notify investment personnel of incorrect investments that are in the process of being traded. Warning messages notify traders of the potential error before a trade can be executed; alerts systematically prevent the portfolio manager from entering inappropriate trades.

When an alert is triggered, the independent first-line risk team (the Risk Management Group) is notified and an investigation will take place before the trade is sent for execution. If the potential trade is a true breach of regulatory requirements and/or fund mandate, RMG will reject the trade so it will not be executed in the market.

Post-Trade

Prior to the commencement of a new Wholesale Fund, the Compliance team at Vanguard Investments Australia provides the custodian, JP Morgan (JPM) with the post-trade rule requirements, including a copy of the Product Disclosure Statement (PDS).

As part of JPM's process, one person will code the rule into their internal compliance system and this will be independently checked, including the test output. JPM will then send the fund rule matrix to Compliance for the validation and sign-off. This includes verifying that all rules requested have been coded and the results are as expected, and no potential exceptions are flagging once the rules are applied on the fund's go-live date. Similarly, when an existing rule is amended Compliance provides the details and JPM implement the required change.

To ensure only authorised changes are made, Compliance provides JPM with details of users who are authorised to request rule additions and changes.

The Compliance team are responsible for documenting and setting up the post-trade compliance rules. Monitoring is performed by the Internal Controls team within Fund Financial Services.

Follow up items – None

Trade Errors

In this category we are looking for whether trading errors are documented, and policies are in place to avoid reoccurrence.

Fund manager Trade errors - summary Comments

Harbour Harbour highlighted two immaterial trading errors that were identified across the three funds in the past 12 months. They occurred due to human error and third-party error. The errors were non-material or client-specific, and as such were not reported on the monthly Fund certificates. The Funds were not disadvantaged due to these errors. To avoid re-occurrence, process improvements and checks have been implemented.

In addition to this process Harbour provides compliance reports to the CIC on a monthly basis confirming that both funds operated inside their investment guidelines.

BlackRock Response was “N/A”

Dimensional

Macquarie Asset Management (MAM)

Russell Investment Funds

There have been no material trading errors in the aforementioned funds in the past 12 months.

There have been no trading errors in the Fund in the past 12 months.

The fund has experienced no trading errors in the past 12 months.

Vanguard Vanguard do not provide the number of, or monetary impact details, for any trading errors that have occurred in their Wholesale Funds, however they can confirm that trade errors are incorporated in the Vanguard Internal Events Policy. They include any error that directly impacts a fund or account. These can include but are not limited to:

• Purchase of securities not authorised by the investment guidelines for the fund/account;

• Failure to purchase/sell securities as intended;

• Purchase/sale of securities for the wrong or unintended account;

• Failure to follow specific client directives to purchase/sell/hold/wait to purchase securities;

• Allocation of the wrong or unintended amount of securities; and

• Allocation of securities to the wrong or unintended account.

Vanguard notes that it is all staff members’ responsibility to identify and escalate errors to line management, their Risk Team and Compliance. Portfolio Managers do not have discretion in regards to error correction. The trading error shall be corrected on the same day as they are discovered or as soon as practicable. The Compliance Team has the responsibility of investigating all compliance related incidents and will invoke the Internal Events Policy.

We will ask for elaboration on precisely what this means

Follow up items

While we do not believe BlackRock are high risk for generating trading errors, we will nevertheless clarify with them the meaning of their ‘N/A’ response to this question (are they saying they never make a trade error, or never can?). We are generally satisfied with the brief responses from the other managers.

Liquidity Monitoring

In this category we are looking for whether the fund manager can outline their liquidity monitoring and stress testing processes.

Harbour NZ Corporate Bond Fund Liquid asset exposure is monitored on a live basis with the mandated minimum proportion measured in the front office and compliance systems. Alerts ensure this minimum is met. More broadly, Harbour canvas their counterparties on a quarterly basis to assess market conditions (and more regularly when they

Happy with their answers on liquidity management.

Stress testing is not covered in detail perceive liquidity may have deteriorated). Finally, the fund manager must report to the risk committee on a quarterly basis which includes assessments of actual liquidity conditions and the appropriateness of liquidity settings in the fund.

Equity Funds

Cash liquidity is carefully monitored on a daily basis to ensure they remain fully invested in the two equity funds to allow performance to closely track the index return. Should there be redemptions greater than cash in the portfolio Harbour would be required to sell down equities to raise the cash. Liquidity assessments of actual market and fund liquidity conditions and the appropriateness of liquidity settings in the fund is conducted and reported to the risk committee on a quarterly basis.

BlackRock The Manager has established a Liquidity Risk Management Policy which enables it to identify, monitor and manage the liquidity risks of the Funds. Such policy, combined with the liquidity management tools available, seeks to achieve fair treatment of Unitholders and safeguard the interests of remaining Unit holders against the redemption behaviour of other investors and mitigate against systemic risk.

BlackRock has a dedicated Market Structure and Electronic Trading team. The team drives BlackRock's liquidity sourcing research and strategy with the aim to minimize transaction costs and maximize access to liquidity through multiple execution channels, in addition to defining new market structure with the goal of optimizing trading outcomes for buy-side market participants. A key research output of the Market Structure and Electronic Trading team is BlackRock's proprietary Transaction Cost Models. These models are based on BlackRock’s global execution data and forecast the cost of trading equities, FX, futures, rates and credit. They also serve as a key input into their Transaction Cost Analysis (“TCA”) framework which is used to evaluate trading costs across asset classes.

although we have had discussions within the last 12 months with the manager about this with respect to both bonds and equities markets.

Dimensional

Dimensional has decades of experience managing liquidity-sensitive portfolios for which demands can be immediate. Dimensional monitors cash flows as part of the portfolio management process. Recognising the reality of those potential demands, they construct portfolios to capture return premiums when they are expected, minimising frictional costs and enhancing returns through disciplined implementation.

Liquidity issues are incorporated into the screening process and portfolios are structured to minimise the likelihood of an illiquidity event. The trusts do not purchase securities that do not meet liquidity criteria such as minimum share price, minimum number of shares traded daily, minimum ratings requirements, etc. The trusts are also broadly diversified. Investing in a large number of securities enables Dimensional to manage a larger asset base than many of their peers and they seek to spread portfolio turnover across all the trading days of the year. Changes to portfolio holdings tend to be incremental.

They also monitor portfolio liquidity levels on a post-trade basis by a compliance system, Charles River Investment Management Solution (CRIMS).

Dimensional uses historical data to understand how their strategies would have behaved in different market and economic environments. To ensure robustness within the portfolios, the Research group performs real-time analysis on large amounts of security reference data. They conduct extensive robustness checks, using their proprietary database that includes data for over 70,000 companies from around the world. Information from these findings feeds into the portfolio design.

Additionally, Dimensional monitor the portfolio to help ensure that the portfolio follows its investment objectives. We also believe strongly in having a

Does not explicitly touch on stress testing although detailed liquidity management processes are effective in almost all market conditions. Index funds, in general, will move according to market conditions, so the stress testing aspect is somewhat less relevant here.

Macquarie Asset Management (MAM)

“human overlay” in the investment process. The tools are designed to facilitate the efforts of their highly seasoned professionals, not as a proxy.

Upon request, Dimensional can provide scenario analyses or stress testing on its portfolios. Under their rules-based and process-driven approach, scenario analyses or stress testing will not override the disciplined implementation.

UBS’s Global Risk System provides stress testing functionality with enhanced risk analysis functions across a full range of traditional and alternative assets. Both positive and negative stress scenarios are available, providing full drillthrough capability from the total portfolio to sub-portfolio, strategy or single holding level. Each scenario is presented with a narrative of the event and a list of the resulting key shifts in market factors. The scenarios are presented in three groups according to the intended use:

Core scenarios: standardized stress tests representing severe market movements over time, and for comparing between portfolios. At their simplest, these can be shifts to a single yield curve or equity market, or to all yield curves and equity markets (eg all equity markets fall by 10%). More sophisticated stress tests may shift some markets by more than others, eg countries with higher or more volatile treasury rates may be given larger basis point shifts. Global scenarios, including equity markets, interest rates, spreads, FX rates and alternative investments, may also be useful.

The scenarios are generally kept static over time, not continuously adjusted to suit the current market situation. They may be periodically updated, however, as structural changes in the markets occur. This means the core stress tests are suitable for comparing portfolio exposures over time. Factor shifts are used so that individual stocks respond to the scenarios according to their factor loadings. This means that more volatile stocks and stocks in cyclical sectors such as materials and financials tend to show larger changes in price than stocks in defensive sectors like consumer staples.

Historical scenarios: historical scenarios cover a range of past events. Most are crisis scenarios where risk assets decreased in value, but in some scenarios risk assets increase in value, or different asset classes are affected in different ways. The scenario set focuses more on recent history rather than events in the distant past, as more reliable historical data is available, and more recent scenarios may be more relevant to current market conditions.

Regional economic events: designed to capture the effects of regional economic drivers and dynamics. For example, these scenarios model the effects of Australian economic drivers on regional markets. They are forward looking economic scenarios, but also have some of the characteristics of sensitivity analysis as economic variables are shifted by a specified amount, and the response of market variables is forecast.

Liquidity adjusted scenarios: To comply with the ESMA Liquidity Stress Testing (LST) guidelines and SFC circular, LST implementation includes stress testing of a fund’s assets and liabilities across (1) historical, (2) hypothetical and (3) reverse stress tests for in-scope funds. Multiple scenarios are run for each type of stress test.

In index fixed income portfolios, the liquidity of the underlying assets is primarily driven by the index composition. However, UBS’ approach which has a strong focus on minimising transaction costs, seeks to trade more liquid issues to save costs, while ensuring that the portfolio stays in line with the headline risk-return characteristics of the benchmark. In general, the aim is to construct an optimal portfolio which efficiently replicates benchmark risk characteristics with fewer securities that are sufficiently liquid and diversified. The team continually monitors market liquidity and aim to select the most liquid securities for the portfolio.

Russell

Investment Funds

With regards to trade execution, the portfolio managers and/or centralized trading team considers overall market conditions, upcoming market events, changing liquidity conditions as well as security specific liquidity issues to assess the possible market impact of trading and timing of execution.

Russell Investments employs a liquidity risk management process and conducts stress tests which enable an assessment of the liquidity risk of the funds under exceptional circumstances. They evaluate whether the liquidity profile of the investments of the funds is appropriate to the redemption frequency of the funds, as set out in the relevant prospectus.

The firm’s Investment Risk Management (IRM) team within its independent, inhouse Global Risk Management (GRM) function is responsible for measurement, management and analysis/reporting on market and liquidity risks globally across all investments and all asset classes managed by Russell Investments. As part of the daily monitoring process, funds are subject to liquidity monitoring as a key supplementary metric. Fund liquidity assessments are presented to the relevant boards on a monthly basis.

Portfolio liquidity is assessed in prevailing (normal) as well as stressed conditions.

Vanguard Investment risk management

The investment risk management team within RMG follows an established framework that involves a series of activities related to assessing, managing, and monitoring risks. This includes conducting periodic stress tests and scenario analyses to address risks arising from potential changes in market conditions.

The framework involves analysing funds according to established risk factors. Investment risk is analysed on an ex-ante basis by measuring risk exposures and estimating risk levels and comparing them with established thresholds. Exceptions are analysed and elevated for dispositions. In addition, fund returns are analysed on an ex-post basis to validate risk factor estimates and gain deeper understanding of the impact of portfolio management decisions. The investment risk management team works closely with the portfolio management and operational risk teams.

The investment risk management team evaluates risks at the following levels:

• Individual security level.

• Factor levels such as sector weights, interest rate, credit quality market capitalization, volatility, and style.

• Full portfolio level.

Activities undertaken include:

• Identification of risk factors and setting and review of risk limits.

• Monitoring of risks against limits and investigation, communication, and resolution of exceptions.

• Performance calculation and monitoring of realized returns versus benchmark.

• Performance attribution and assessment versus targets.

• Undertaking risk reviews to identify new and emerging risks and develop mitigation strategies

On a regular basis (weekly or monthly depending on asset class) the investment risk team undertakes risk review meetings with the portfolio management and trading teams. These meetings review and analyse investment risk and performance and proactively discuss related topics including upcoming activities, market conditions, and investment strategies.

Only briefly touches on stress testing although detailed liquidity management processes are effective in almost all market conditions.

Risk management and periodic stress testing looks fine. No specific mention of liquidity management aside from the cash-flow matching worksheet

Item Description of activities

Daily risk control

Monthly risk report

The cash-flow matching worksheet shows the fund’s exposure, versus its index, to primary risk factors. We review daily index tracking reports for each portfolio versus its index benchmark, using indexing pricing sources, to detect possible tracking errors from risk mismatches.

The portfolio manager reviews a monthly report analysing security exposures versus the index, including specific limits for each portfolio based on the breadth of market securities in the index benchmark. For example, funds tracking broader indices with more securities can have a more diversified portfolio and will have more stringent security constraints than those with fewer securities

Monthly performance attribution reports

Monthly risk dashboard report

The portfolio manager reviews a performance attribution report on each fund. This report details the sources of value added or lost at the risk-factor level and provides drilldown information to the security level.

The portfolio manager reviews a custom-developed dashboard report, summarising all of the monthly risk report results.

None. Overall, we could have received a little more feedback on stress testing in particular from some managers, but this is not sufficiently concerning to warrant additional questioning. Our experience working with these funds and managers through multiple stressed market environments has highlighted no unanticipated issues

Follow up items

Proxy voting

In this category we are looking for whether proxy voting policies are being executed in shareholders’ best interests

Fund manager Proxy voting - summary Comments

Harbour Harbour’s stewardship policy is reviewed annually and is subject to Board oversight and approval.

Harbour is an active owner and believes in the value of constructive engagement with issuers to enact meaningful change. Where conflicts arise with respect to company strategic direction, remuneration, or other material issues, Harbour aims to work with senior management, the Board of Directors, and other investors to find a satisfactory outcome for all stakeholders. Harbour does not concern itself with day-to-day running of the business but focuses on strong shareholder outcomes.