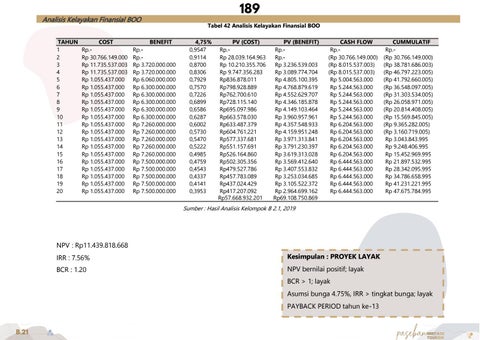

Tabel 42 Analisis Kelayakan Finansial BOO TAHUN 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

COST Rp.Rp 30.766.149.000 Rp 11.735.537.003 Rp 11.735.537.003 Rp 1.055.437.000 Rp 1.055.437.000 Rp 1.055.437.000 Rp 1.055.437.000 Rp 1.055.437.000 Rp 1.055.437.000 Rp 1.055.437.000 Rp 1.055.437.000 Rp 1.055.437.000 Rp 1.055.437.000 Rp 1.055.437.000 Rp 1.055.437.000 Rp 1.055.437.000 Rp 1.055.437.000 Rp 1.055.437.000 Rp 1.055.437.000

BENEFIT Rp.Rp.Rp 3.720.000.000 Rp 3.720.000.000 Rp 6.060.000.000 Rp 6.300.000.000 Rp 6.300.000.000 Rp 6.300.000.000 Rp 6.300.000.000 Rp 6.300.000.000 Rp 7.260.000.000 Rp 7.260.000.000 Rp 7.260.000.000 Rp 7.260.000.000 Rp 7.260.000.000 Rp 7.500.000.000 Rp 7.500.000.000 Rp 7.500.000.000 Rp 7.500.000.000 Rp 7.500.000.000

4,75% 0,9547 0,9114 0,8700 0,8306 0,7929 0,7570 0,7226 0,6899 0,6586 0,6287 0,6002 0,5730 0,5470 0,5222 0,4985 0,4759 0,4543 0,4337 0,4141 0,3953

PV (COST) Rp.Rp 28.039.164.963 Rp 10.210.355.706 Rp 9.747.356.283 Rp836.878.011 Rp798.928.889 Rp762.700.610 Rp728.115.140 Rp695.097.986 Rp663.578.030 Rp633.487.379 Rp604.761.221 Rp577.337.681 Rp551.157.691 Rp526.164.860 Rp502.305.356 Rp479.527.786 Rp457.783.089 Rp437.024.429 Rp417.207.092 Rp57.668.932.201

PV (BENEFIT) Rp.Rp.Rp 3.236.539.003 Rp 3.089.774.704 Rp 4.805.100.395 Rp 4.768.879.619 Rp 4.552.629.707 Rp 4.346.185.878 Rp 4.149.103.464 Rp 3.960.957.961 Rp 4.357.548.933 Rp 4.159.951.248 Rp 3.971.313.841 Rp 3.791.230.397 Rp 3.619.313.028 Rp 3.569.412.640 Rp 3.407.553.832 Rp 3.253.034.685 Rp 3.105.522.372 Rp 2.964.699.162 Rp69.108.750.869

CASH FLOW Rp.(Rp 30.766.149.000) (Rp 8.015.537.003) (Rp 8.015.537.003) Rp 5.004.563.000 Rp 5.244.563.000 Rp 5.244.563.000 Rp 5.244.563.000 Rp 5.244.563.000 Rp 5.244.563.000 Rp 6.204.563.000 Rp 6.204.563.000 Rp 6.204.563.000 Rp 6.204.563.000 Rp 6.204.563.000 Rp 6.444.563.000 Rp 6.444.563.000 Rp 6.444.563.000 Rp 6.444.563.000 Rp 6.444.563.000

CUMMULATIF Rp.(Rp 30.766.149.000) (Rp 38.781.686.003) (Rp 46.797.223.005) (Rp 41.792.660.005) (Rp 36.548.097.005) (Rp 31.303.534.005) (Rp 26.058.971.005) (Rp 20.814.408.005) (Rp 15.569.845.005) (Rp 9.365.282.005) (Rp 3.160.719.005) Rp 3.043.843.995 Rp 9.248.406.995 Rp 15.452.969.995 Rp 21.897.532.995 Rp 28.342.095.995 Rp 34.786.658.995 Rp 41.231.221.995 Rp 47.675.784.995

Sumber : Hasil Analisis Kelompok B 2.1, 2019

NPV : Rp11.439.818.668 IRR : 7.56%

Kesimpulan : PROYEK LAYAK

BCR : 1.20

NPV bernilai positif; layak BCR > 1; layak

Asumsi bunga 4.75%, IRR > tingkat bunga; layak PAYBACK PERIOD tahun ke-13