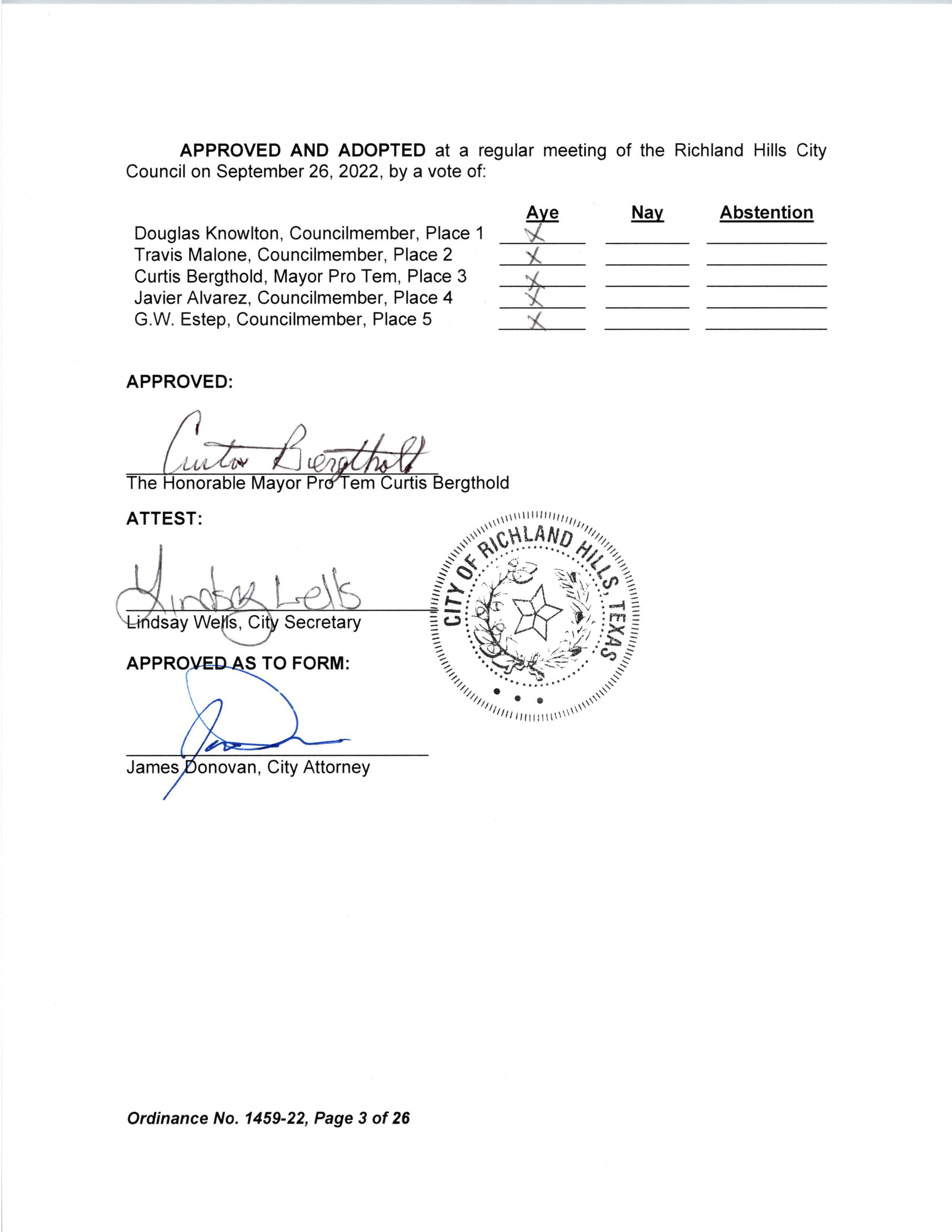

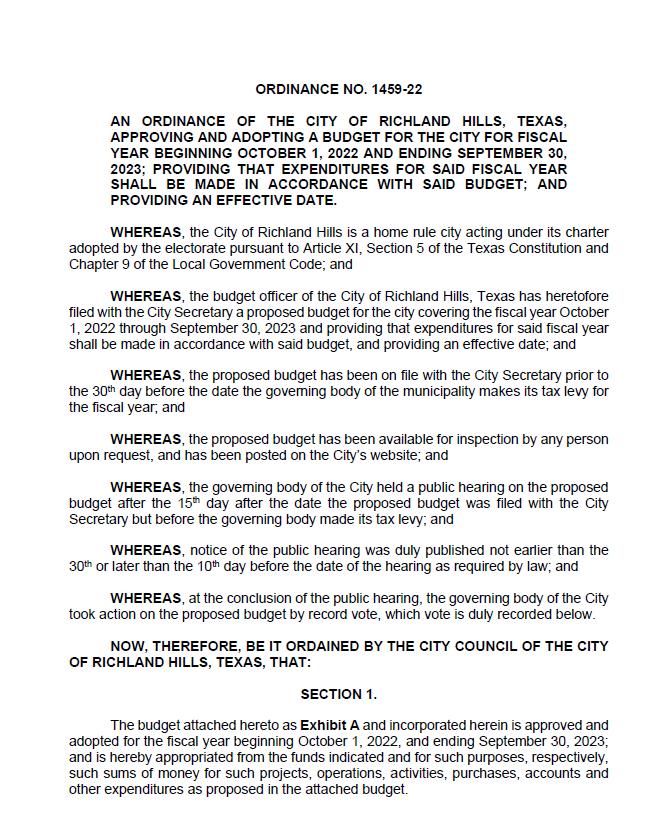

ADOPTED

CITY OF RICHLAND HILLS, TEXAS FY 2022-23

BUDGET FY 2022-23

Budget Cover Page 1 City Council 2 Management Staff 3 Recognition 4 Organizational Structure 5 BUDGET INTRODUCTION 6 City Manager’s Budget Message 7 Budget Summary 10 Financial Assessment 15 Our Vision & Values 20 Budget Process & Calendar 21 BUDGET OVERVIEW 22 Fund Structure 22 Combined Budget Summary – All Funds 23 Fund Summaries 24 Revenues, Expenditures and Fund Balances 27 Where the Money Comes From – By Revenue Type 28 Where the Money Comes From – By Fund Type 29 Where the Money Goes – By Fund Type 30 Where the Money Goes – By Function 31 Property Tax Valuation and Tax Rates 33 Major Revenue Sources 34 Property Tax 34 Sales & Use Tax 34 Franchise Fees 35 TABLE OF CONTENTS

Fines & Fees 35 Licenses & Permits 36 Charges for Services 37 Intergovernmental 38 Transfers 39 GENERAL FUND 40 General Fund Description & Summary 41 Statement of General Fund Revenues 41 Statement of General Fund Expenditures 41 General Fund Departments 43 Municipal Court 44 Administration 45 Police 48 Fire 51 Streets 55 Library 57 Parks and Recreation 60 Parks-Grounds 62 Community Development 64 Animal Services 68 Legislative 71 Shared Services 72 LINK FUND 73 ENTERPRISE FUNDS 78 Water & Sewer Fund 78 Fund Summary 78 Shared Services 80 Utilities Administration 80 Water Production & Distribution 81 WW Collection & Treatment (Sewer) Department 81 CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

Water & Sewer Debt 82 Drainage Fund 86 Drainage Debt 87 SPECIAL REVENUE FUNDS 91 Municipal Court Security Fund 92 Municipal Court Technology Fund 92 Richland Hills Development Corporation 93 Crime Control District Fund 95 Hotel/Motel Fund 96 Tax Increment Financing Fund 98 LINK Replacement Fund 101 Emergency Operations Management Fund 102 CAPITAL PROJECTS FUNDS 103 Capital Improvements Plan 104 CIP Budget Summary 104 Impact of Capital Projects on Operating Budget 107 Oil and Gas Fund 107 Capital Projects Fund 108 Road & Street Fund 109 Vehicle Replacement Fund 110 ARPA Fund 111 Strategic Initiative Fund 112 DEBT SERVICE FUND 113 APPENDICES 116 A-Financial Policies 116 B-Community Profile 129 C-Long-Term Financial Plans 131 D-Total Authorized Positions 133 E-Ordinances 134 F-Glossary of Terms and Acronyms 141 G-Top Ten Lists 146 CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

1

CITY COUNCIL

Edward Lopez Mayor

Curtis Bergthold Mayor Pro Tem Place 3

Douglas Knowlton

Councilmember Place 1

GW Estep

Councilmember Place 5

Javier Alvarez

Councilmember Place 4

Travis Malone

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 2

Councilmember Place 2

MANAGEMENT STAFF

City Manager

Department Heads

Director of Finance and Administration Services………………………………. Patricia Albrecht

Director of Public Works................…………………………………………………...Scott Mitchell

Library Director…………………………………………………………..……….Chantelle Hancock

Chief of Police………………………………………………………………..…...Kimberly Sylvester

Fire Chief……………………………………………… …..…Russell Shelley

Director of Parks and Recreation……………………………………………………..Jason Brown

City Secretary…………………………………………………………………….Lindsay Rawlinson

City Manager’s Office

Assistant to the City Manager-Development Services ………..………….Logan Thatcher (Code Compliance, Permits, Planning, and Economic Development)

Assistant to the City Manager-Support Services…………………………….Sheena McEachran (Communications and IT Services)

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

Candice Edmondson

3

This document was prepared by the FINANCE DEPARTMENT

Patricia Albrecht Director of Finance and Administration Services

Bernadette Gendron Senior Accountant

Bernadette Gendron Senior Accountant

The Finance Department expresses its appreciation to all City departments for their assistance and cooperation in the preparation of this budget document

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 _______________________________________________________________________________________________ RECOGNITION _______________________________________________________________________________________________ 4

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 ORGANIZATIONAL STRUCTURE 5

BUDGET INTRODUCTION

An introduction to the Adopted Annual Budget is presented in a series of narrative sections designed to give the reader relevant information regarding the City of Richland Hills’ budget process and fiscal environment.

City Manager’s Budget Message

Budget Summary

Financial Assessment

Goals and Strategies

Core Values

Budget Process and Calendar

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 6

City Manager’s Budget Message

September 27, 2022

To the Honorable Mayor, City Council and Citizens of Richland Hills, When we started the budget process in April, the goal was to develop a budget that maintained the City’s strong financial position, addressed strategic goals and priorities, and supported quality service delivery for ongoing programs and services. I am pleased to present a budget that touches on all these initiatives and continues to advance our community forward through strategic, thoughtful development.

The FY 2023 budget represents a collaboration between our elected officials, city staff and citizens. Public input was sought throughout the process beginning with a budget public forum in January, during the Council budget workshop in April and thru the four (4) budget discussions and public hearings held in August and September. We appreciate everyone who took the time to share their thoughts and ideas on the proposed FY 2023 budget. City Council also guided the development of the budget by expressing their goals and priorities for the coming year. The message was clear that City Council wanted this budget to prioritize infrastructure improvements, economic development, strategic capital investments, community engagement and workforce development.

INFRASTRUCTURE IMPROVEMENTS

Routine maintenance and replacement of public infrastructure – streets, water, wastewater, and storm drain – has been a long-term goal for the City. In November 2018, Richland Hills voters approved a 3/8 cent sales tax dedicated to the repair, replacement and maintenance of municipal streets and sidewalks. The sales tax was reauthorized by the voters in May 2022 demonstrating the citizens’ desire for continued progress on street improvements Since the inception of the sales tax, ten (10) streets have been reconstructed including necessary upgrades to underground utilities.

The FY 2023 budget includes funding for three (3) more street improvement projects:

• Reconstruction of Dover Lane, including water and storm drain improvements, from Scruggs Drive to Vance Road

• Design and reconstruction of Norton Drive from Richland Road to Evergreen Road

• Design of Magnolia Park Drive, including water, sewer and storm drain improvements, from Rosebud Lane to Mimosa Park Drive

With an estimated annual collection of $1.3 million, the Street Improvement Fund will support ongoing street replacement efforts for years to come. Future street projects are selected during the annual budget process based on street and underground utility conditions as identified on previous pavement and water/wastewater assessment reports.

In addition to street improvements, the FY 2023 budget will make significant contributions to upgrading City water infrastructure. With funds received through the American Rescue Plan Act, the City will spend $1.5 million dollars to add auxiliary power to well sites. This will enable the City

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

7

of Richland Hills to provide water service to customers in the event power is lost at these sites. The improvements also bring the City’s water system into compliance with Texas Senate Bill 3 which requires water providers to maintain 20 psi system wide and the ability to provide a minimum of 24-hours of redundant power in the event of an electric grid failure.

The FY 2023 budget also includes implementation of an Advanced Metering Infrastructure System (AMI) to replace the City’s mechanical water meters. With the new Advanced Metering System, water meter accuracy will increase, apparent water losses will decrease and the need for staff to manually read meters should be nearly eliminated. In addition, the new software system will create better tracking of actual water usage and make billing more consistent. Funding in the amount of $2,406,753 is included in the Utility Fund for the AMI project.

ECONOMIC DEVELOPMENT

The main goal of economic development is to improve the economic well-being and quality of life in a community. When the local economy is strong, more jobs are generated, poverty decreases, tax bases increase, public services expand and quality of life improves. With this in mind, the City Council has placed a strong emphasis on economic development now and into the future. In FY 2023 the City will be initiating two (2) key planning projects.

The first project is a focused development plan for the Glenview Drive corridor. Glenview Drive is one of the City’s primary commercial corridors and a major thoroughfare connector for the region. In 2022, the City was awarded funding from Tarrant County to complete road improvements on Glenview Drive that would enhance mobility and connectivity. The Glenview Drive Corridor Master Plan will expand on the proposed road improvements by providing a strategy to create a marketbased revitalization plan within the corridor.

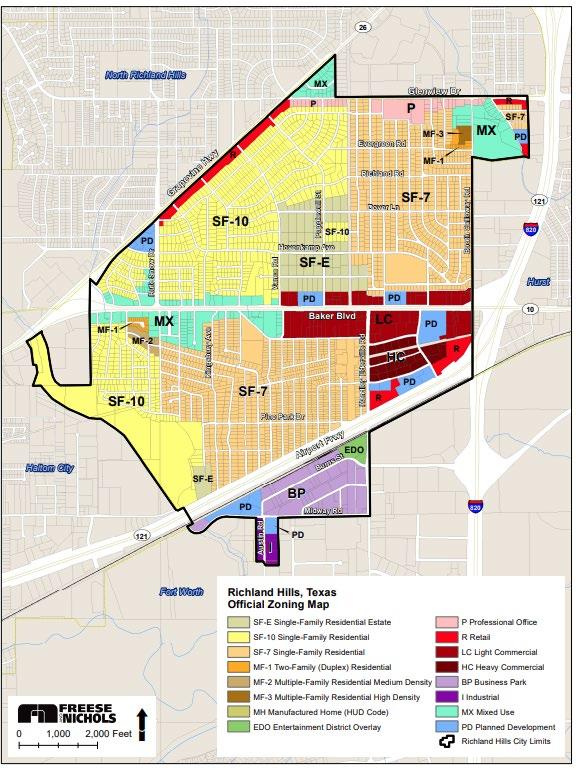

The second initiative is an update of the City’s Comprehensive Plan which was adopted in 2014. A comprehensive plan is a long-range planning document that expresses the overarching vision, goals, objectives, policies and strategies for the future development, growth, and preservation of a community. It allows a community to be proactive to issues and changes over time and provides the overall foundation for land use regulations. Comprehensive Plans should be updated every 10 years and more frequently if a community is experiencing significant economic, social, or demographic changes. An updated Comprehensive Plan will incorporate the most current population, economic and financial trends affecting the City to guide future development.

CAPITAL INVESTMENTS

The City Council understands the strong correlation between economic growth and quality public facilities. The FY 2023 budget provides the necessary funding to complete several capital improvement projects including:

• Renovations to the Animal Services Center

• Continued implementation of the parks master plan

• Improvements at City Hall, Richland Hills Public Library, Law Enforcement Center and The Link Event and Recreation Center

• Construction of a masonry fence at the Public Works facility

• Completion of a space needs assessment and design for future use of the Public Works facility and Fire Administration Building

• Expansion of broadband at city parks and facilities

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 8

Implementation of a new ERP system

With over $2.3 million dollars dedicated to capital improvements in FY 2023, the City is continuing its efforts to provide excellent facilities and services that enhance the quality of life in Richland Hills.

COMMUNITY ENGAGEMENT

A top focus area for the City is enhancing communication and engagement with the community. The FY 2023 budget supports several initiatives aimed at increasing communication and engagement for both residents and businesses. Over the course of the year, the City will be launching a new community brand, upgrading its website platform, creating a digital monthly newsletter, increasing communication using multiple channels and offering quarterly business networking opportunities. The City will also be hosting its first State of the City meeting to highlight past accomplishments and discuss priorities for the upcoming year.

One of the most significant community engagement initiatives the City will implement this year is its citizen survey. A citizen survey is used to gain residents’ perspectives on local issues such as quality of life, development/growth, services provided by the City and future priorities by asking residents to:

• prioritize the City services and benefits they care about most

• rate current services and benefits provided by the City

Results from the citizen survey will be used to refine the City’s comprehensive master plan, evaluate future projects, and shape the City’s annual budget.

WORKFORCE DEVELOPMENT

The services provided to the community are only as strong as the people providing the service. With a declining workforce and increased competition in the labor market, the City is doing a number of things in FY 2023 to attract and retain a qualified workforce Starting October 1, 2022, non-emergency city services will move to a compressed work schedule offering most employees a 4-day work week. The City will also be conducting a market survey to ensure our salaries and benefits are currently aligned with the City’s adopted compensation strategy. The FY 2023 budget provides for an increase in public safety salaries and offers certification pay for qualifying employees. The budget also supports staff training and development and the City’s tuition reimbursement program.

CONCLUSION

The FY 2023 adopted budget has been developed in adherence to the City’s established financial principles and with the City’s strategic goals in mind. It prioritizes infrastructure improvements and capital investments. It implements initiatives to provide for long-term planning and financial sustainability. It emphasizes the importance of communication and community engagement. It addresses employee compensation and benefits to ensure that Richland Hills continues to be an employer of choice. The staff looks forward to the new fiscal year and all the opportunities that it provides.

Sincerely,

Candice Edmondson City Manager

•

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

9

BUDGET PRIORITIES

The priority for this fiscal year has been to maintain quality service while observing prudent spending practices and providing employees with an equitable compensation plan. The following highlights for the upcoming year that will help us accomplish this are:

• A balanced budget, with total revenues equal to or greater than total expenditures

• Property tax rate reduction from $0.558551 to $0.538885 cents per $100 assessed value

• Total City budget $28 million

• General Fund budget $8.7 million

• Increased and sustained funding for facilities improvements

• Increased and sustained funding for employee compensation

• Budgeted supplemental funding of $1.6 million ($248,960 for 3 new positions and certification pay, $1.4 million for one-time costs) to accommodate citywide departmental needs and operating impacts from Capital Improvement Program

SERVICE LEVEL CHANGES

Despite the ongoing challenges due to the pandemic and supply chain issues, the City’s property tax base and sales tax revenues continue to be strong, and this budget is presented with no material service reductions. Overall, services have been maintained, and in some instances, expanded, while reducing the property tax rate from $0.558551 to $0.538885 cents per $100 of property valuation. Examples of service level increases include the addition of a full-time custodian, a parks maintenance technician, and an assistant to the City Manager in charge of IT and communications. The budget funds a total of 94 full-time equivalent (FTE) positions, a 5% cost of living adjustment for general government employees, market adjustments and step increases for sworn personnel, and significant funding for increased infrastructure maintenance. Most of these staffing and service level increases are to meet the demands of our growing population, operational impact due to capital projects and the city’s vibrant growing economy.

Pension Plan

Texas Municipal Retirement System: The city is required to contribute to the Texas Municipal Retirement System (TMRS). Effective January 1, 2023, the city’s new monthly contribution rate will be 16.40%, an increase from the current rate of 16.36%.

MAJOR OPERATING BUDGET ITEMS

The total budget for all funds is $28 million. As illustrated by the data below, personnel costs are a major budget item for the City of Richland Hills. As a local government, the city is a service business which is highly dependent on personnel to deliver services to the public Major budget items include:

General Fund Salaries and Benefits 6,142,740 $ CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 BUDGET SUMMARY 10

CHANGES BETWEEN PROPOSED BUDGET AND ADOPTED BUDGET

The major changes between the general fund proposed budget and general fund adopted budget were increases in salaries for public safety to keep up with the changing climate in public safety salary costs in the Metroplex (Dallas-Ft. Worth). There were also some costs that were finalized for insurance coverage from the City’s carrier, Texas Municipal League, that came in after the proposed budget was presented. The total cost difference was a $317,864 increase. Other funds changed as follows: Enterprise Fund proposed to adopted increased by $1,261 due to adjustments to the new certification pay costs, the Crime Control District Fund had a change of $4,232 mainly due to certification pay adjustments The TIF fund had an increase to the budget of $90,000 due to the addition of backlit street sign program along Baker Blvd. The Road & Street Fund had an increase of $40,000 from the proposed to final budget due to finalized costs for several street projects.

Water & Sewer Fund Salaries and Benefits 995,839 $ Water Purchase & Delivery 561,270 Water Meter Repl. Project 2,406,753 Sewer Treatment Charges 752,263 Debt Service Payments 455,832 Drainage Fund Salaries and Benefits 155,965 $ Debt Service Payments 483,439 $ Debt Service Fund Principal Payments 484,500 $ Interest Payments 457,444 Capital Projects Funds Project Appropriations 1,130,000 $ Vehice Replacement Fund Vehicle Lease Costs 244,240 $ Road & Street Fund Project Appropriations 2,829,388 $ Strategic Initiative Fund Project Appropriations 691,000 $ ARPA Fund Project Appropriations 1,596,773 $ CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 11

The ARPA fund had a decrease from proposed to final in the amount of $171,768 due to finalized EOY projections; and the Strategic Initiative Fund had an increase of $215,000 in the adopted budget due to the addition of the Animal Shelter Parking Lot Project. All other funds remained unchanged.

FINANCIAL PROGRAM

Total Combined Revenues: The total combined revenue budget for fiscal year 2022-23 totals $26,330,571 which is a $4.7 million or 22% increase from the prior fiscal year and is due in large part to higher property tax and sales tax revenues, multi-year capital projects, which include their remaining life-to-date funding in the prior year (EOY) and only new funding in the current year’s budget and funding from the American Rescue Plan.

REVENUES

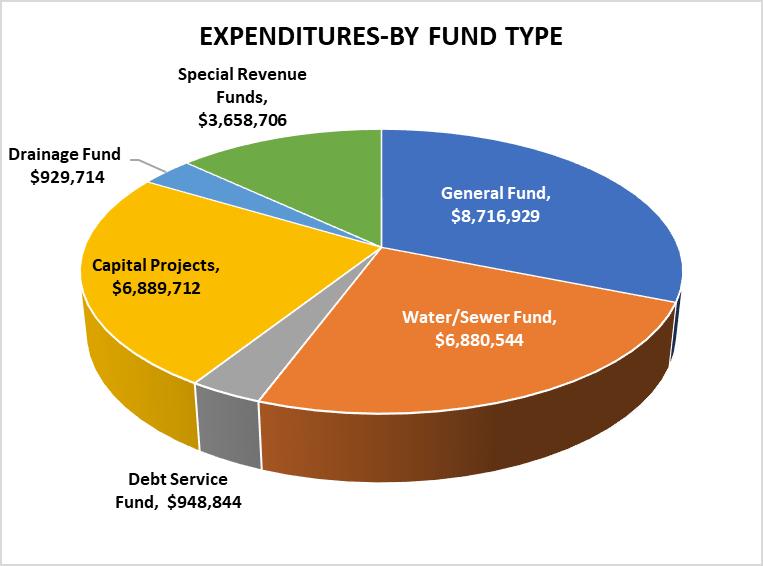

Total Combined Expenditures: The total combined expenditure budget for fiscal year 2022-23 totals $28,024,449, which is a $8,870,981 or 46% increase from the prior fiscal year and is due to budgeting of capital expenditures from the American Rescue Plan Funds and the newly created Strategic Initiative Fund. This total also includes multi-year capital projects which are due for completion in FY2023. Expenditures are budgeted to be $1,693,878 more than revenues, primarily due to use of unassigned fund balance for capital projects. Operating budgets are balanced for fiscal year 2022-23.

Additional information on these budgeted numbers can be found in the individual funds’ page summary.

*General Fund expenditures do not include transfers to other funds from fund balance.

EXPENDITURES

EOY Estimate Budget % Change Fund FY 2021-22FY 2022-23 to Prior Yr General Fund 8,405,473 $ 9,318,263 $ 11% Water/Sewer Fund 5,093,286 7,280,353 43% Debt Service Fund 1,032,085 1,001,117 -3% RHDC Fund 1,073,022 1,178,054 10% Capital Projects 2,570,524 3,892,572 51% Drainage Fund 910,785 909,458 -0.15% Special Revenue Funds 2,563,163 2,750,754 7% Strategic Initiative Fund - - 0% TOTAL 21,648,339 $ 26,330,571 $ 22%

EOY Estimate Budget % Change Fund FY 2021-22FY 2022-23 to Prior Yr General Fund 7,557,271 $ 8,716,929 $ 15% Water/Sewer Fund 4,162,220 6,880,544 65% Debt Service Fund 916,803 948,844 3% RHDC Fund 435,058 576,530 33% Capital Projects 2,577,145 6,198,712 141% Drainage Fund 1,036,823 929,714 -10.33% Special Revenue Funds 2,468,148 3,082,176 25% Strategic Initiative Fund - 691,000 0% TOTAL 19,153,468 $ 28,024,449 $ 46% CITY OF RICHLAND HILLS ANNUAL BUDGET 12 FY2022-23

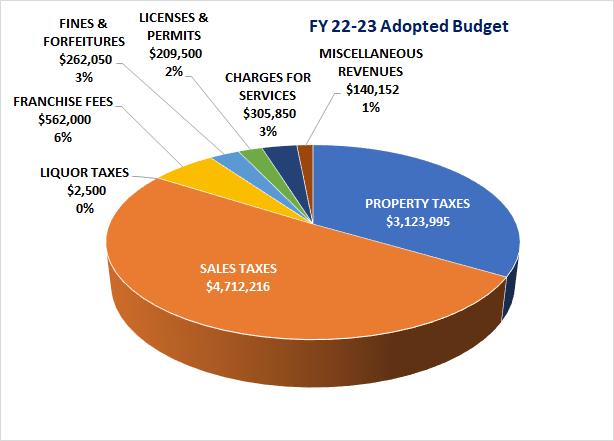

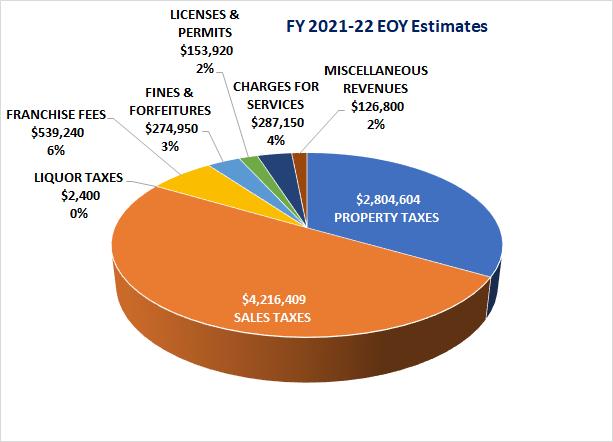

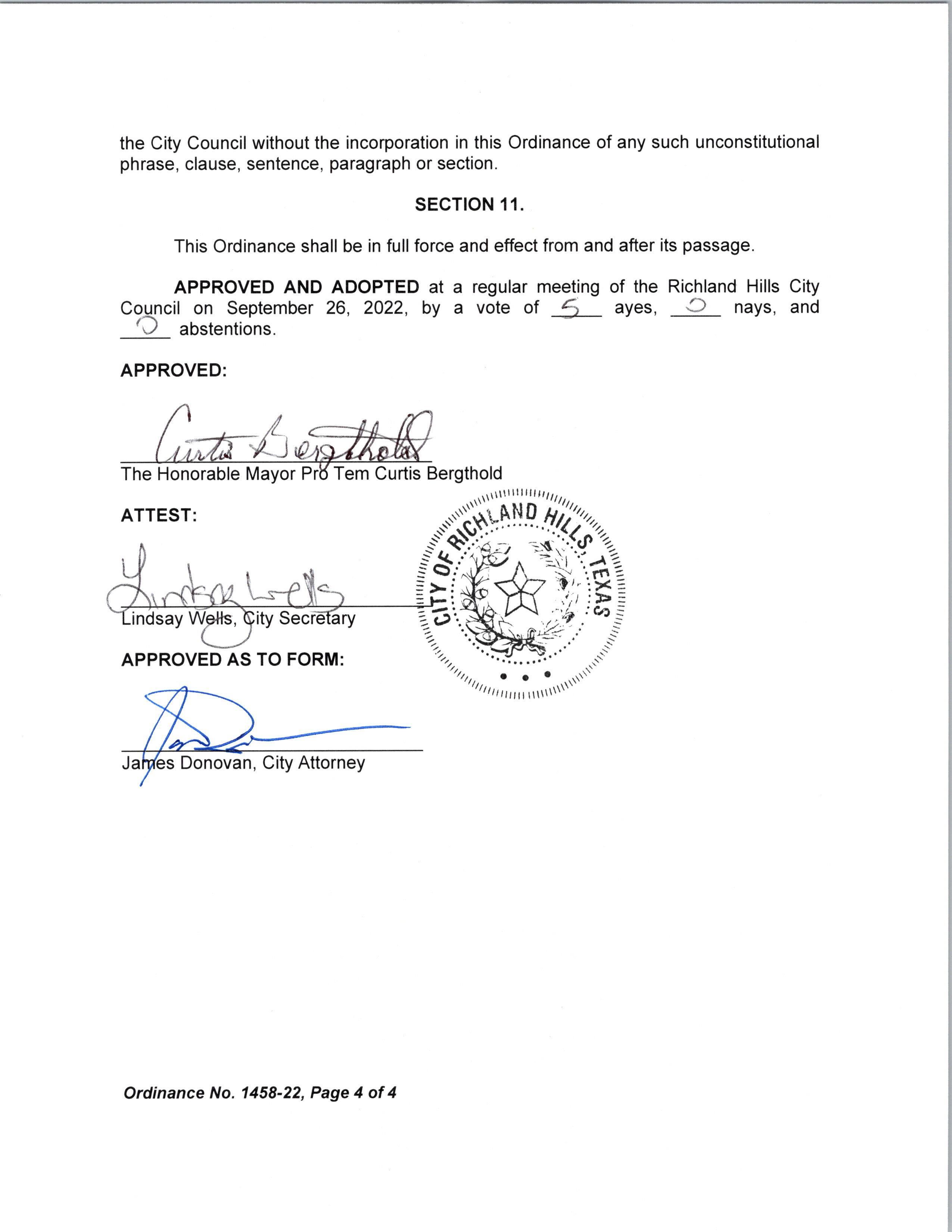

General Fund Revenues: General Fund revenues for fiscal year 2022-23 are expected to total $9,318,263, an 11% increase from last fiscal year primarily due to growth in property tax and sales tax base. More details can be found in the General Fund section.

General Fund Expenditures: The General Fund is the general operating fund of the City. General Fund expenditures for fiscal year 2022-23 are projected to be $8,716,929, which is a 15% increase from last fiscal year 2022 end of year estimates. The overall increase is primarily due to several personnel vacancies in the Streets and Community Development departments, as well as a 5% salary increase in FY23.

*General Fund expenditures do not include transfers to other funds from fund balance.

Property Tax

General Fund property tax revenues for fiscal year 2022-23 are forecasted to total $3,123,995, an 11% increase over prior fiscal year (EOY), due to growth in the assessed property valuation. According to the Tarrant Appraisal District, the 2022 certified taxable value for the City of Richland Hills is $791,107,294. This represents an 11% increase in valuation over the 2021 certified taxable value. The overall property tax rate was decreased from $0.558551 to $0.538885 cents per $100 of property valuation.

CITY OF RICHLAND HILLS ANNUAL BUDGET 13 FY2022-23

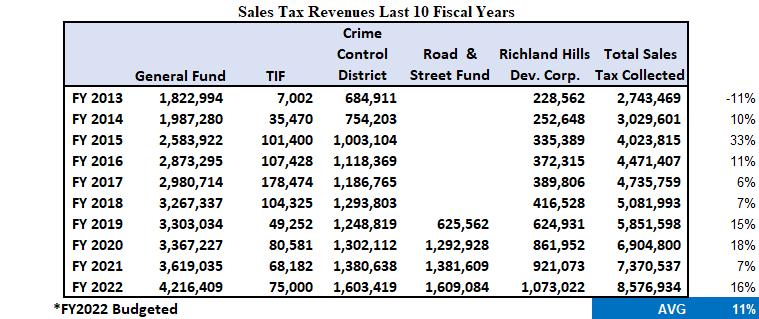

Sales and Use Tax

General Fund sales & use tax revenues for fiscal year 2022-23 are forecasted to total $4,712,216, an increase of 12% over the prior fiscal year (EOY).

The City imposes a local sales tax of 2% on all retail sales, leases, rentals of most goods, as well as taxable services. Out of the 2%, 1% is for general purposes.

The Richland Hills Development Corporation recognizes 25% of sales tax as revenue, with the Crime Control District receiving another 0.37% and lastly, 0.37% going to the Road & Street Improvement Fund.

Water and Sewer Fund

The Water & Sewer Fund expenses for fiscal year 2022-23 are projected to be $6,880,544, a 65% increase over fiscal year 2022 EOY estimates. This is primarily due to a major project that is set to commence during FY 23. The water meter replacement project was approved by Council during FY 2021-22 as a much-needed improvement to the City's water metering system. This water meter replacement project will cost approximately $2.4 million. More details on the Water and Sewer Fund can be found in that fund's summary page.

Water and sewer rates will remain the same and no rate increases are planned for next fiscal year.

Drainage Fund

The Drainage fund expenses are forecasted to be $929,714, a 10.8% decrease over FY22 EOY. This is primarily due to a capital equipment purchase during FY 22

No major drainage capital projects are projected for FY 2022-23 from this fund.

Capital Projects Fund

The Capital Improvement Program (CIP) is an indication of the City’s priority to fund capital projects, ensuring Richland Hills will be positioned to meet the demands of its population and economic investment in our community. The CIP project expenditures for fiscal year 2022-23 are projected to be over $8,461,141 and are expected to exceed $5 million over the next 5 years. Project funding will address such areas as street improvements, repairing and replacing aging water and sewer infrastructure, a city-wide water meter replacement program, and continued improvement of our parks. More information, including listing of CIP projects can be found in the Capital Projects section.

Strategic Initiative Fund

The Strategic Initiative Fund is a newly created fund during fiscal year 2022-23. Council approved the creation of this fund to designate General Fund balance reserves in excess of the City required fund balance level and using them for one-time expenditures, for one time projects, such as infrastructure improvements, strategic planning, technology and capital acquisition.

The Strategic Initiative Fund (SIF), is a part of the Capital Improvements Program. Several projects are slated to be funded from the SIF such as, City Hall improvements, a new City wide ERP system and re-design of the old fire administration building amongst others. Total project expenditures are projected to be $691,000 during FY 23.

ARPA Fund

The ARPA Fund was established during FY 2021 to manage and record revenues received via the American Rescue Plan Act. Several projects were approved by Council during FY21 that aligned with the ARPA funding goals such as water infrastructure improvements, premium pay for essential employees during the pandemic and broadband projects amongst others. Total project appropriation during FY 23 is $1,596,773.

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 14

FINANCIAL ASSESSMENT

The City of Richland Hills, Texas continues to be financially strong. Over the years, through sound fiscal management, the City has positioned itself well to cope with growth, create a positive atmosphere for its residents and employees, and provide greater flexibility on budgetary issues. The city can balance revenues and expenses and continue to maintain a high level of services.

FUND BALANCE

One measure of a city’s financial strength is the level of its fund balance. The City’s estimated fund balance in the General Fund is projected to be approximately $2.7 million as of September 30, 2023. This balance exceeds the City’s required fund balance reserve of 25% of total General Fund expenditures. The City’s Enterprise Funds (Water/Wastewater & Drainage) are projected to have a combined cash and investments balance of approximately $3.9 million at the end of fiscal year 2022-23. The cash and investments balance in the Water/Wastewater Fund exceeds the 90-day reserve requirement established by the City’s financial policies. All other funds, meet or exceed the reserve requirements as set forth in the financial policies.

BOND RATINGS

The City’s bond ratings are further evidence of its financial strength. The City has received AA ratings by Standard & Poor’s Rating Services.

DEBT MANAGEMENT PLAN

The City of Richland Hills enjoys favorable bond ratings due not only to solid fund balances, but also from adoption of, and adherence to, the debt management plan adopted by the City Council. The target length of maturity of the City’s long-term debt is not to exceed 20 years or the life of the asset In addition, the total debt service requirements in any fiscal year should not generally exceed twenty five percent (25%) of total expenditures/expenses. Details can be found in the Debt Service and Financial Policies section.

ECONOMIC GROWTH & OUTLOOK

The City of Richland Hills is enjoying the benefits of strong economic growth in the North Texas region and the state. Despite the uncertainty of the pandemic and supply chain issues, the City has continued to increase its sales tax and property tax revenues year over year. City staff worked hard to balance the budget and develop a fiscally prudent plan, which will continue to provide a wide range of quality public services for the community and continue with the commitment to quality of life through improvements to infrastructure and its parks system.

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

15

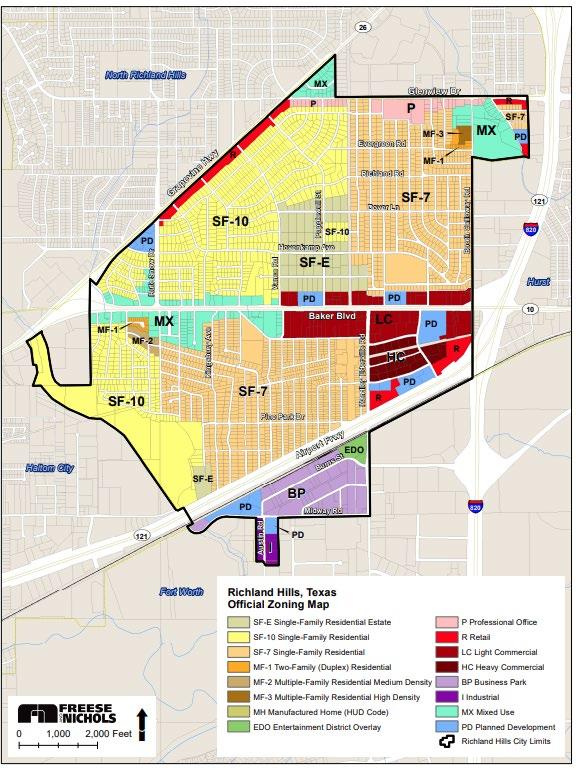

The City of Richland Hills, Texas enjoys an unmatched location. It is located in the highly sought-after, “MidCities”, in the middle of Dallas and Fort Worth. Encompassing approximately 3.14 square miles in Northeast Tarrant County, the city borders the NE corner of Fort Worth, is less than 20 miles from DFW International Airport and less than 30 miles from downtown Dallas. The city fronts State Highway 183, State Highway 121 and State Highway 26 Easy access is provided to each via Interstate 820. Railroad access is currently available to the city's largest industrial park and commuter rail connects Richland Hills to downtown Fort Worth and Dallas. Very few other communities in the Metroplex can offer this combination of intermodal access to the Dallas/Fort Worth Metroplex.

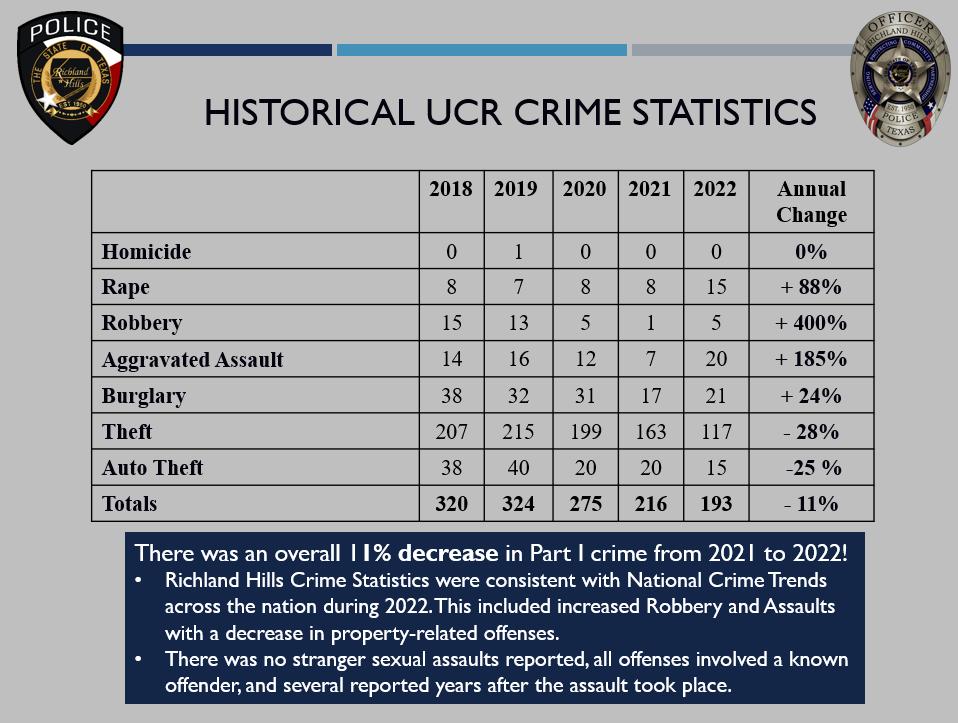

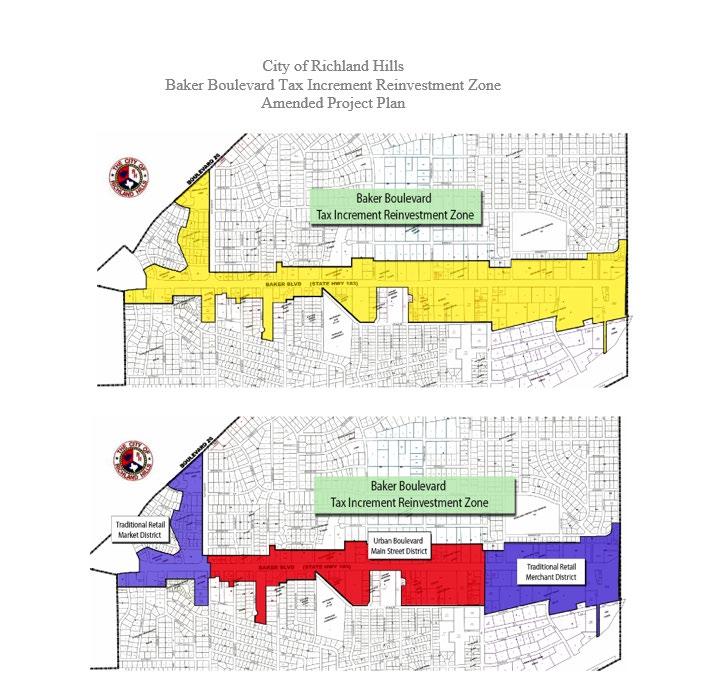

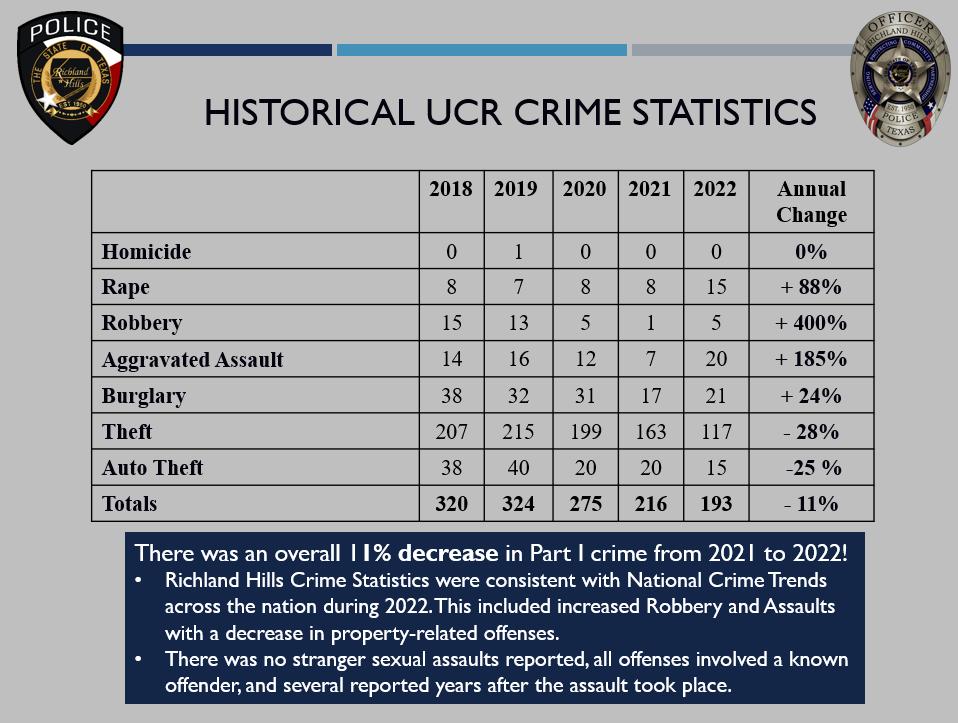

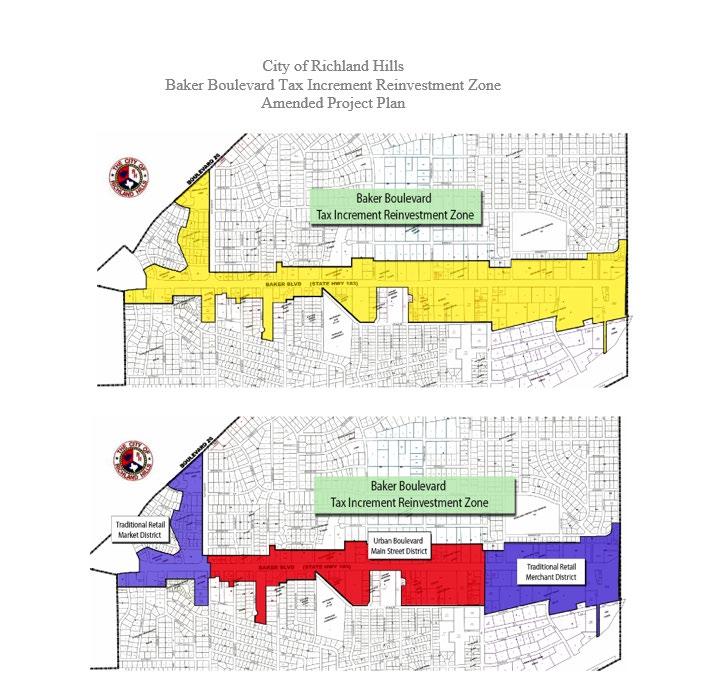

Quality of life, economic development, and a safe community are some of the most important elements for the City of Richland Hills. During fiscal year 2022, two new townhome developments were approved by Council along Baker Boulevard, the City’s Tax Increment Fund or TIF. The Baker Landing Townhome development is a 69 unit single-family development. Another townhome project is RC51 Townhomes. This project will include 51 single-family homes in the TIF. These new housing developments will bring additional property tax and water/sewer revenues to the City, in addition to providing a much needed “face lift” to the boulevard.

Several new businesses made their start in the City during the past fiscal year, including a new health manufacturing company, locally owned Mexican restaurant, a new donut shop and a locally owned laundromat. The City prides itself on the small town feel with big city convenience.

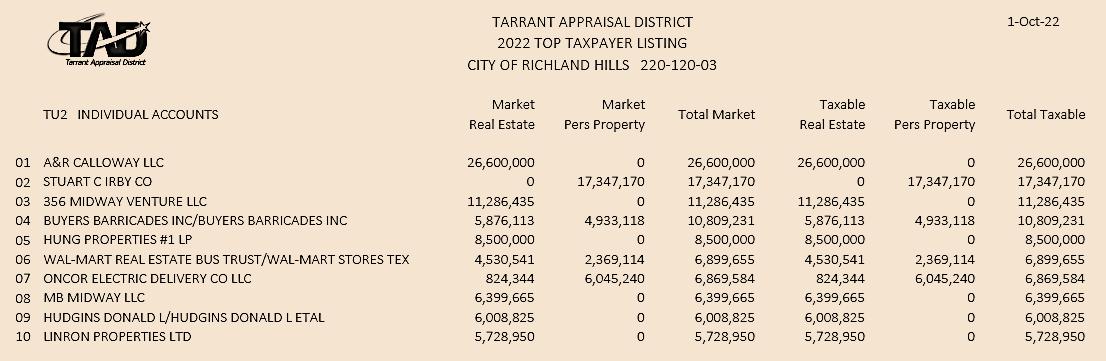

Major businesses within the City of Richland Hills

TOP 10 COMPANIES

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 16

Richland Hills is located within the Birdville Independent School District with one elementary school and one middle school serving Richland Hills residents.

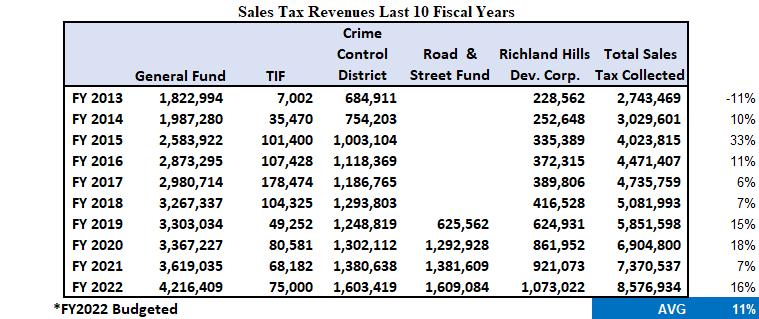

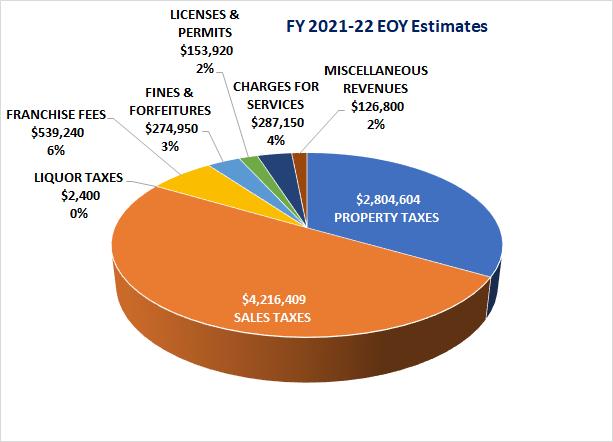

MAJOR SOURCES OF REVENUE

Sales Tax Revenue Trends

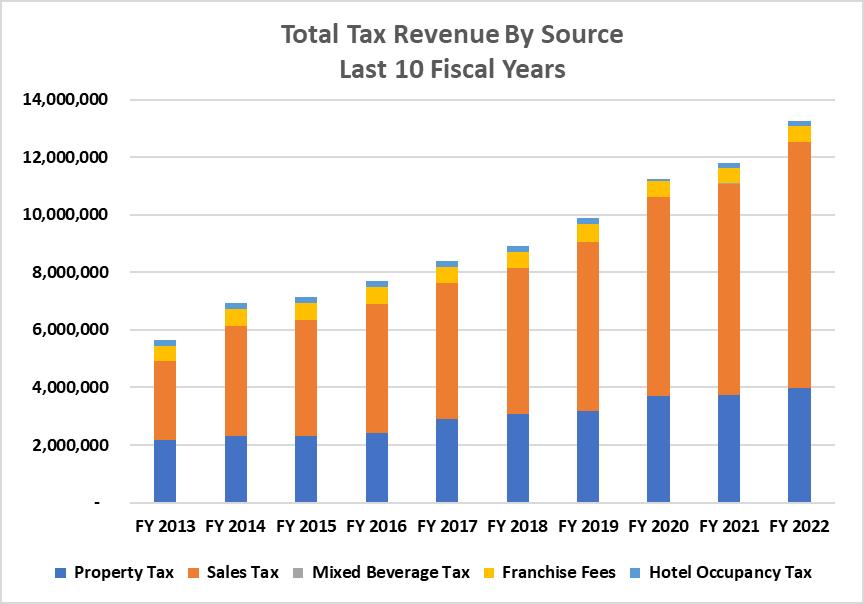

One major source of revenue for the City is sales tax. The city has a healthy sales tax base due to manufacturing, industrial and retail businesses within Richland Hills. Below is an illustration of sales tax revenue for all funds for the last ten fiscal years. It shows it broken down by fund with an average increase of 11% year over year:

Following are the General Fund sales tax revenue trends for the last 10 fiscal years:

SALES TAX REVENUES LAST 10 FISCAL YEARS-ALL FUNDS500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 4,000,000 4,500,000 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY2021 FY 2022 General Fund TIF Crime Control District Road & Street Fund Richland Hills Dev. Corp. Sales Tax Revenues Last 10 Fiscal Years General Fund TIF Crime Control District Road & Street Fund Richland Hills Dev. Corp. Total Sales Tax Collected FY 2013 1,822,994 7,002 684,911 228,562 2,743,469 -11% FY 2014 1,987,280 35,470 754,203 252,648 3,029,601 10% FY 2015 2,583,922 101,400 1,003,104 335,389 4,023,815 33% FY 2016 2,873,295 107,428 1,118,369 372,315 4,471,407 11% FY 2017 2,980,714 178,474 1,186,765 389,806 4,735,759 6% FY 2018 3,267,337 104,325 1,293,803 416,528 5,081,993 7% FY 2019 3,303,034 49,252 1,248,819 625,562 624,931 5,851,598 15% FY 2020 3,367,227 80,581 1,302,112 1,292,928 861,952 6,904,800 18% FY 2021 3,619,035 68,182 1,380,638 1,381,609 921,073 7,370,537 7% FY 2022 4,216,409 75,000 1,603,419 1,609,084 1,073,022 8,576,934 16% *FY 2022 Budgeted AVG 11%

17

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

Sales Tax

*FY22 are budgeted numbers

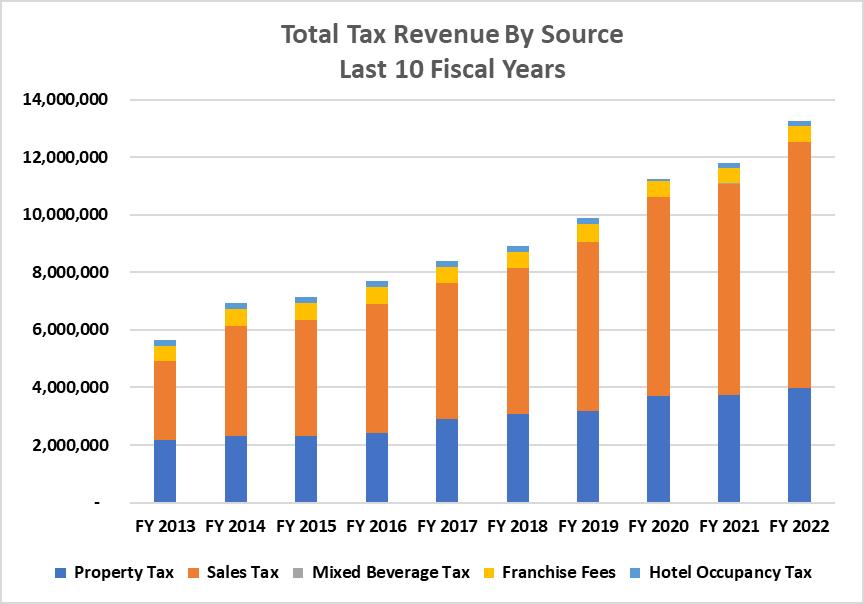

Property Tax Revenue Trends

Another major source of revenue is property tax. The City has experienced tremendous growth in its property tax valuation. Situated in the northern part of the State of Texas, Richland Hills, joins other Texas cities in popularity of migration to the city from other states. Below is the last 10 years of total property tax revenue and total General Fund revenue:

General Fund and Interest & Sinking Fund

*FY2022 are budgeted numbers

General Fund FY 2013 1,822,994 FY 2014 1,987,280 FY 2015 2,583,922 FY 2016 2,873,295 FY 2017 2,980,714 FY 2018 3,267,337 FY 2019 3,303,034 FY 2020 3,367,227 FY 2021 3,619,035 FY 2022 4,216,409 CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

18

Other Sources of Revenue

Other sources of revenue for the city include mixed beverage taxes, franchise fees and hotel occupancy taxes. The table below lists the actuals for the last 10 fiscal years, along with budgeted numbers for EOFY 2022.

LONG TERM FINANCIAL PLANNING

City Council adopted the City’s financial policy that includes long term financial planning. This document serves as a guideline for budgeting and for managing the resources of the City. It is essential to keep focus on the long-term financial plan to monitor and adjust fiscal policies as needed and plan for needed capital and service demands. City staff prepares and updates this five-year financial plan annually in preparation for developing suggested budget policies for City Council consideration and to ensure alignment with City Council goals. It is intended to provide a frame of reference to help evaluate the City’s financial condition and help assess financial implications of current and proposed budgets, programs, and assumptions. The City’s official financial policy is included in the Appendices section. The financial policy includes a section on the Capital Improvement Program. The Capital Improvements Program (CIP), a five-year plan, funds major capital improvements that will provide adequate infrastructure and facilities for new citizens and new business development.

CONCLUSION

As the City’s needs continue to grow, the focus remains on maintaining a long-range financial plan and managing the demand to the City’s operations. The budget for fiscal year 2022-23 is committed to Council’s policy of preserving Richland Hills’ strong financial position by maintaining strong fund balances and reserves, recommending a balanced budget, maintaining current programs, and making decisions within the context of our long-range financial capacity and debt management plan. The Fiscal Year 2022-23 Annual Budget highlights the City’s commitment to meet and exceed the community’s highest priority expectations while continuing to meet its citizens’ needs at the lowest possible cost.

VISIT US

Information on the City’s finances, budget, debt, performance, and other items can be found on the web https://www.richlandhills.com/170/Finance

Learn more about our city by also visiting us at: Facebook: https://www.facebook.com/RichlandHillsCityHall/

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

19

In Richland Hills, our vision and values encompass Service, Teamwork, Integrity, and Respect = S.T.I.R. _______________________________________________________________________________________________ CITY OF RICHLAND HILLS ANNUAL BUDGET

20 FY2022-23

VISION & VALUES

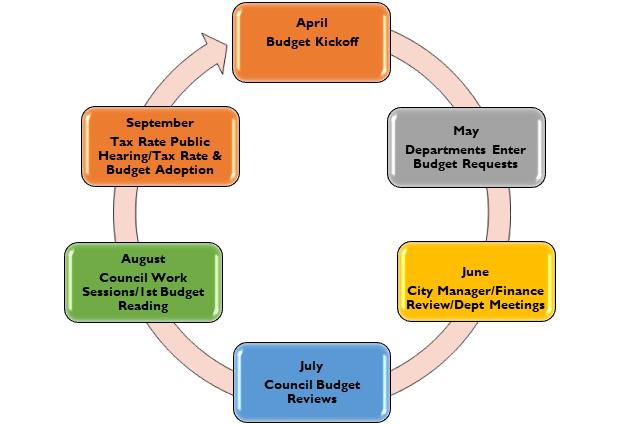

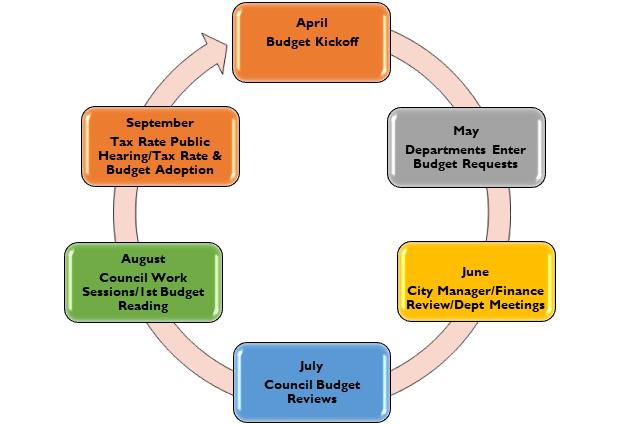

BUDGET PROCESS & CALENDAR

The City’s budget is a complex document and represents the culmination of months of preparation and discussion among Council, City Manager, Director of Finance and Administration Services, and the departments regarding the best ways to provide services to the community at the greatest value. This budget was developed to be consistent with the City’s high performing philosophy, which strives to simultaneously deliver high product and service quality, outstanding customer value and sound financial performance. City departments worked very closely with the Finance Department to draft a budget that fit within revenue expectations and key departmental goals.

As required by the City’s Charter, the proposed budget was provided to the city council by July 30th. Concurrently, copies of the proposed budget are made available to the public on the City’s website and on file at the City Secretary’s Office. The City Council considers the proposed budget and provides public hearings where public input regarding the budget programs and financial impact is heard.

The budget is formally adopted by the City Council during the regular City Council meeting in September. The budget goes into effect on October 1.

Budget Key Dates

Performance Measurement

The management of the City of Richland Hills believes that it is important to not only plan for and provide adequate levels of quality service, but to also provide a means of measuring and reporting the result of its efforts. The Finance Department provides monthly reports that discuss how each department is performing which ultimately can determine the value of programs and opportunities for improvements.

CITY OF RICHLAND HILLS ANNUAL BUDGET 21 FY2022-23

Due to the nature and complex operation of each department, it is next to impossible to provide a single or even a few statistical measures. However, funding comparisons provide a broad view of changes in level of service for the departments. Past year accomplishments and current FY23 Objectives are clearly stated in each department’s section.

BUDGET OVERVIEW

An overview of the Annual Budget is presented in a series of tables, charts and graphs designed to give the reader an overall understanding of the budget.

Fund Structure

Combined Budget Summary

Fund Summaries

Revenues, Expenditures and Fund Balances

Where the Money Comes From – By Revenue Type

Where the Money Comes From – By Fund Type

Where the Money Goes – By Fund Type

Where the Money Goes – By Function

Property Tax Valuation and Tax Rates

Major Revenues

FUND STRUCTURE

• Court Security Fund

• Court Technology Fund

• Crime Control District Fund*

• Hotel Occupancy Tax Fund

• KRHB Fund

• Tax Increment Fund

• LINK Operations Fund

• LINK Replacement Fund

• Emergency Mgmt. Fund

• Oil & Gas Fund

•Capital Projects Fund*

•Road & Street Fund*

•Vehicle Replacement Fund

•ARPA Fund

•Strategic Initiative Fund

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

_______________________________________________________________________________________________

22

April

*Indicates major fund, all others considered non-major funds

Governmental funds use the modified accrual form of accounting, while Enterprise Funds are full accrual funds.

COMBINED BUDGET SUMMARY-ALL FUNDS

FUNDS SUBJECT TO APPROPRIATION

All funds, both governmental and proprietary, are subject to appropriation. The City's financial policy requires a 25% reserve on expenditures for the General Fund and 90 days for the Water and Wastewater Fund. The fund balances for General Fund and Water and Wastewater Fund for FY 2022-23 are estimated to be $2,659,203 and $3,364,218 respectively. The unassigned fund balance for General Fund and Water and Wastewater Fund are $2,659,203 and $3,364,218. All projected changes in fund balances are considered as normal.

Fund Structure - Continued

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

23

CITY OF RICHLAND HILLS ANNUAL BUDGET

COMBINED BUDGET SUMMARY-ALL FUNDS

FUND SUMMARIES

Major Governmental Funds

General Fund is the operating fund of the City. This fund is used to account for all financial resources not accounted for in other funds.

Debt Service Fund is used to account for the accumulation of financial resources for the payment of principal, interest and related costs on general long-term debt paid from taxes levied by the City.

Capital Projects Fund is used to account for the acquisition or construction of streets, facilities and other infrastructure projects being financed from general obligation bond proceeds, grants, impact fees, or transfers from other funds.

NON-MAJOR - Other Governmental Funds is a summarization of all non-major governmental funds and consists of Special Revenue funds, Richland Hills Development Corp., and Other Governmental Funds.

9/30/2022 9/30/2023 FUND ESTIMATED TOTAL TOTAL TRANSFERS ESTIMATED FUND TITLE NO. TYPE FUND BALANCE REVENUES EXPENDITURES IN/(OUT) FUND BALANCE GENERAL FUND 01 GOVT 4,918,360 $ 9,318,263 8,716,929 (2,860,491) 2,659,203 $ WATER/SEWER FUND* 02 PROP 4,044,409 7,280,353 6,880,544 (1,080,000) 3,364,218 DEBT SERVICE FUND 10 DEBT 556,761 1,001,117 948,844 - 609,034 OIL AND GAS FUND 12 GOVT 258,393 77,000 95,000 - 240,393 CAPITAL PROJECTS FUND 20 CIP 313,811 - 1,288,311 1,288,311 313,811 DRAINAGE FUND* 22 PROP 551,370 909,458 929,714 531,114 COURT SECURITY 24 GOVT 28,977 5,500 - - 34,477 ROAD & STREET FUND 25 CIP 1,946,973 1,767,081 2,929,388 - 784,666 RICHLAND HILLS ECONOMIC DEV. FUND 26 GOVT 1,513,421 1,178,054 576,530 (1,000,000) 1,114,945 VEHICLE REPLACEMENT FUND 30 GOVT 59,613 279,950 289,240 - 50,323 COURT TECHNOLOGY 39 GOVT 9,685 4,800 - - 14,485 CRIME CONTROL DISTRICT 65 GOVT 728,133 1,801,555 1,519,137 (50,000) 960,551 KEEP RICHLAND HILLS BEAUTIFUL (KRHB) 67 GOVT 54,238 15,000 15,000 54,238 HOTEL OCCUPANCY TAX FUND 77 GOVT 164,020 180,000 198,669 - 145,351 TAX INCREMENT FINANCING FUND- TIF 89 GOVT 955,926 201,709 580,000 75,000 652,635 LINK OPERATIONS FUND* 98 GOVT 542,190 741,870 199,680ARPA FUND 101 GOVT 4,000 1,768,541 1,596,773 - 175,768 LINK REPLACEMENT FUND 103 GOVT - - 25,000 25,000EMERGENCY MANAGEMENT FUND 104 GOVT - 2,500 2,500STRATEGIC INITIATIVE FUND 107 GOVT - $ - 691,000 2,400,000 1,709,000 $ TOTAL PRIMARY GOVERNMENT 16,108,090 $ 26,330,571 $ 28,024,449 $ (1,000,000) $ 13,414,212 $ NET TOTAL PRIMARY GOVERNMENT 16,108,090 $ 26,330,571 $ 28,024,449 $ (1,000,000) $ 13,414,212 $

WATER/SEWER FUND

TRANSFER

GF FUND BALANCE

NEW STRATEGIC

FUND

*FUND BALANCE IS CASH AND INVESTMENTS (PROPRIETARY FUNDS) **$1,000,000 TRANSFER OUT IS FROM

BALANCE AND $2,400,000 IS A

OUT FROM

INTO THE

INITIATIVE

24

FY2022-23

COMBINED SUMMARY OF REVENUES AND EXPENDITURES AND CHANGES IN FUND BALANCE

Fiscal Year 2022-23 Annual Budget (with Comparisons to 2021-22 Budget, 2020-21 & 2019-20 Actual)

FUNDS

*Adjustments are transfers out from fund balance

PROPRIETARY

FY 2022-2023 General Debt Service Capital Funds Other Governmental Water/Sewer Drainage Beginning Fund Balance $4,918,360 556,761 $ 2,582,790 $ 3,454,400 $ 4,044,409 $ 551,370 $ REVENUES Property Tax $3,123,995 1,001,117 $ 157,524 $ Sales & Use Tax 4,714,716 1,767,081 2,957,849 Franchise Fees 562,000 Licenses & Permits 209,500 Fines & Fees 262,050 10,300 Charges for Services 305,850 542,190 4,337,000 909,308 Intergovernmental 44,185 Interest Income 1,600 150 Miscellaneous Revenue 140,152 356,950 195,000 2,941,753 Transfers In 3,688,311 302,180 Bond Proceeds Grants 1,768,541 21,760 Total Revenues $9,318,263 1,001,117 $ 7,580,883 $ 4,230,988 $ 7,280,353 $ 909,458 $ EXPENDITURES General Government $2,212,564 96,156 $ Police 2,091,296 1,519,137 Fire 2,567,824 Library 403,132 Community Development 535,438 377,867 Parks & Recreation 581,594 781,870 Public Works 325,080 6,889,712 550,000 6,960,544 446,275 Debt Service 948,844 333,676 483,439 Transfers Out 460,491 1,050,000 Total Expenditures $9,177,420 948,844 $ 6,889,712 $ 4,708,706 $ 6,960,544 $ 929,714 $ Adjustments* 2,400,000 1,000,000 Net Change in Fund Balance (2,259,157) 52,273 691,171 (477,718) (680,191) (20,256) Ending Fund Balance $2,659,203 609,034 $ 3,273,961 $ 2,976,682 $ 3,364,218 $ 531,114 $ CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 25

GOVERNMENTAL FUNDS

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

COMBINED

SUMMARY OF REVENUES AND EXPENDITURES AND CHANGES IN FUND BALANCE

Fiscal Year 2022-23 Annual Budget (with Comparisons to 2021-22 Budget, 2020-21 & 2019-20 Actual)

*Adjustments are transfers out from fund balance

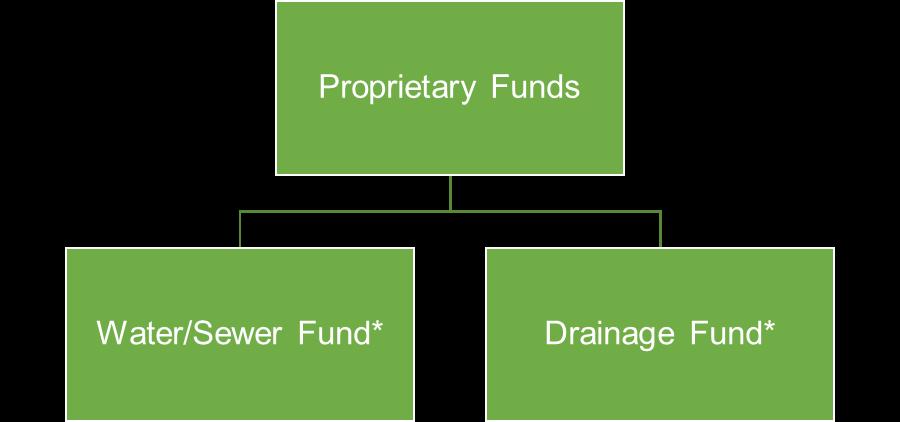

Major Proprietary Funds

Water and Sewer Fund is used to account for the operations of the water and sewer system.

Drainage Fund is used to account for the operations of the drainage system.

TOTAL ALL FUNDS Budget FY2022-23 EOY Estimate FY2021-22 Actual FY2020-21 Actual FY2019-20 Beginning Fund Balance 16,108,090 $ 14,251,353 $ 17,503,238 $ 8,102,199 $ REVENUES Property Tax 4,282,636 $ 3,967,161 $ 3,721,221 $ 3,702,393 $ Sales & Use Tax 9,439,646 8,579,334 7,370,537 6,908,090 Franchise Fees 562,000 539,240 533,360 547,312 Licenses & Permits 209,500 153,920 186,174 383,037 Fines & Fees 272,350 285,350 293,125 420,245 Charges for Services 6,094,348 5,670,680 5,501,842 5,511,545 Intergovernmental 44,185 39,102 761,521 Interest Income 1,750 12,950 2,698 12,709 Miscellaneous Revenue 3,633,855 1,236,491 1,112,078 1,090,577 Transfers In 3,990,491 578,651 922,432 405,763 Bond ProceedsGrants 1,790,301 215,600 1,742 4,995 Total Revenues 30,321,062 $ 21,278,479 $ 20,406,730 $ 18,986,666 $ EXPENDITURES General Government 2,308,720 $ 2,405,266 $ 1,933,946 $ 1,718,603 $ Police 3,610,433 3,206,160 3,988,791 2,972,599 Fire 2,567,824 2,323,094 6,573,501 2,383,508 Library 403,132 382,900 360,307 342,273 Community Development 913,305 615,294 594,920 779,156 Parks & Recreation 1,363,464 551,533 1,427,522 342,500 Public Works 15,171,611 6,715,492 5,256,201 4,273,262 Debt Service 1,765,959 2,297,944 2,229,898 1,859,391 Transfers Out 1,510,491 824,128 978,623.0 725,915 Total Expenditures 29,614,940 $ 19,321,811 $ 23,343,709 $ 15,397,207 $ Adjustments* 3,400,000 Net Change in Fund Balance (2,693,877) 1,956,668 (2,936,979) 3,589,459 Ending Fund Balance 13,414,213 $ 16,208,021 $ 14,566,259 $ 11,691,658 $ 26

REVENUES, EXPENDITURES & CHANGES IN FUND BALANCES

Changes in Fund Balance

General Fund- Management’s intention is to keep the fund balance above the reserve requirement of 25%. This fiscal year, Council approved a one-time transfer of $2.4M out of this fund balance into the newly created Strategic Initiative Fund. The $2.4M transfer out will not affect the minimum reserve requirement balance in the General Fund. More information is available in the individual fund descriptions.

Water/Sewer Fund- Council approved a transfer out from the Water/Sewer Fund balance in the amount of $1M to fund the water meter replacement project scheduled this fiscal year. Management strives to keep 90 days reserve in this fund as per City policy. This one time, transfer from fund balance, will not affect that requirement as this fund has more than 90 days cash in reserves.

Drainage Fund- slight decrease and no major expenses budgeted from this fund. This fund does have debt service payments budgeted.

Debt Service Fund- slight increase to the fund balance based on higher property tax collections for FY23.

Special Revenue Funds- a decrease in fund balance due to transfers out for capital projects in FY23.

CITY OF RICHLAND

FY2022-23 9/30/2022 9/30/2023 NETPERCENT ESTIMATED TOTAL TOTAL TRANSFERS ESTIMATED INCREASE CHANGES IN FUND TITLE FUND BALANCE REVENUES EXPENDITURES IN/(OUT) FUND BALANCE (DECREASE) FUND BALANCE GENERAL FUND 4,918,360 $ 9,318,263 8,716,929 (2,860,491) 2,659,203 $ (2,259,157) $ -46% WATER/SEWER FUND* 4,044,409 7,280,353 6,880,544 (1,080,000) 3,364,218 (680,191) -17% DRAINAGE FUND* 551,370 909,458 929,714 531,114 (20,256) -4% DEBT SERVICE FUND 556,761 1,001,117 948,844 - 609,034 52,273 9% SPECIAL REVENUE FUNDS 3,454,400 3,928,808 3,658,706 (747,820) 2,976,682 (477,718) -14% CAPITAL PROJECTS FUNDS 2,582,790 3,892,572 6,889,712 3,688,311 3,273,961 691,171 27% TOTAL 16,108,090 $ 26,330,571 $ 28,024,449 $ (1,000,000) $ 13,414,212 $ (2,693,878) $ -17% *FUND BALANCE IS CASH AND INVESTMENTS (PROPRIETARY FUNDS) **$1,000,000 TRANSFER OUT FROM WATER/SEWER FUND BALANCE REVENUES, EXPENDITURES AND FUND BALANCES

HILLS ANNUAL BUDGET

27

Capital Projects Funds- increase in fund balances due to transfers in, mainly from general fund for the Strategic Initiative Fund However, as capital projects are completed, the fund balance will decrease significantly.

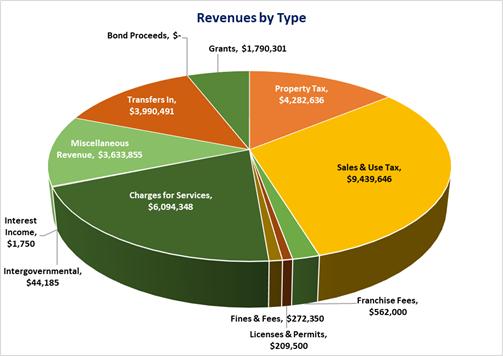

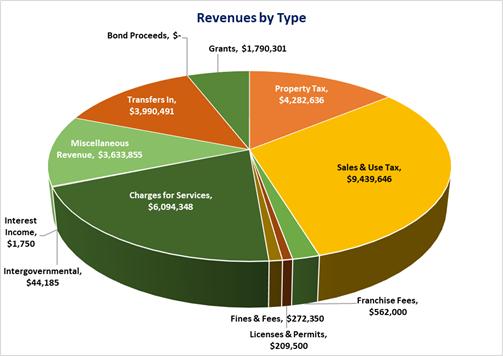

WHERE THE MONEY COMES FROM - BY REVENUE TYPE

FY2022-23 Total Revenues $30,321,062

_______________________________________________________________________________________________

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 TOTAL ALL FUNDS Budget FY2022-23 EOY Estimate FY2021-22 Actual FY2020-21 Actual FY2019-20 Beginning Fund Balance 16,108,090 $ 14,251,353 $ 17,503,238 $ 8,102,199 $ REVENUES Property Tax 4,282,636 $ 3,967,161 $ 3,721,221 $ 3,702,393 $ Sales & Use Tax 9,439,646 8,579,334 7,370,537 6,908,090 Franchise Fees 562,000 539,240 533,360 547,312 Licenses & Permits 209,500 153,920 186,174 383,037 Fines & Fees 272,350 285,350 293,125 420,245 Charges for Services 6,094,348 5,670,680 5,501,842 5,511,545 Intergovernmental 44,185 39,102 761,521 Interest Income 1,750 12,950 2,698 12,709 Miscellaneous Revenue 3,633,855 1,236,491 1,112,078 1,090,577 Transfers In 3,990,491 578,651 922,432 405,763 Bond ProceedsGrants 1,790,301 215,600 1,742 4,995 Total Revenues $ 30,321,062 $ 21,278,479 $ 20,406,730 $18,986,666 28

Changes in Major Revenue Type

Property taxes and Sales and Use Taxes present an upward trend with the continued increase in property tax valuations and major sales tax payers within the City. More information regarding revenue trends can be found in each funds’ description section.

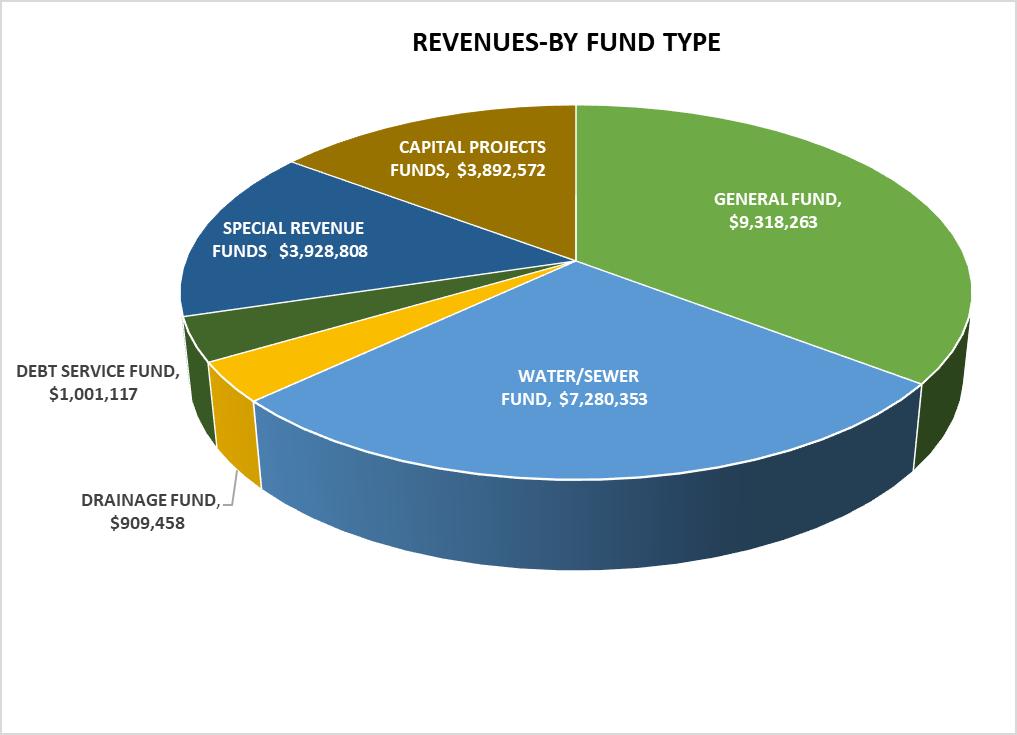

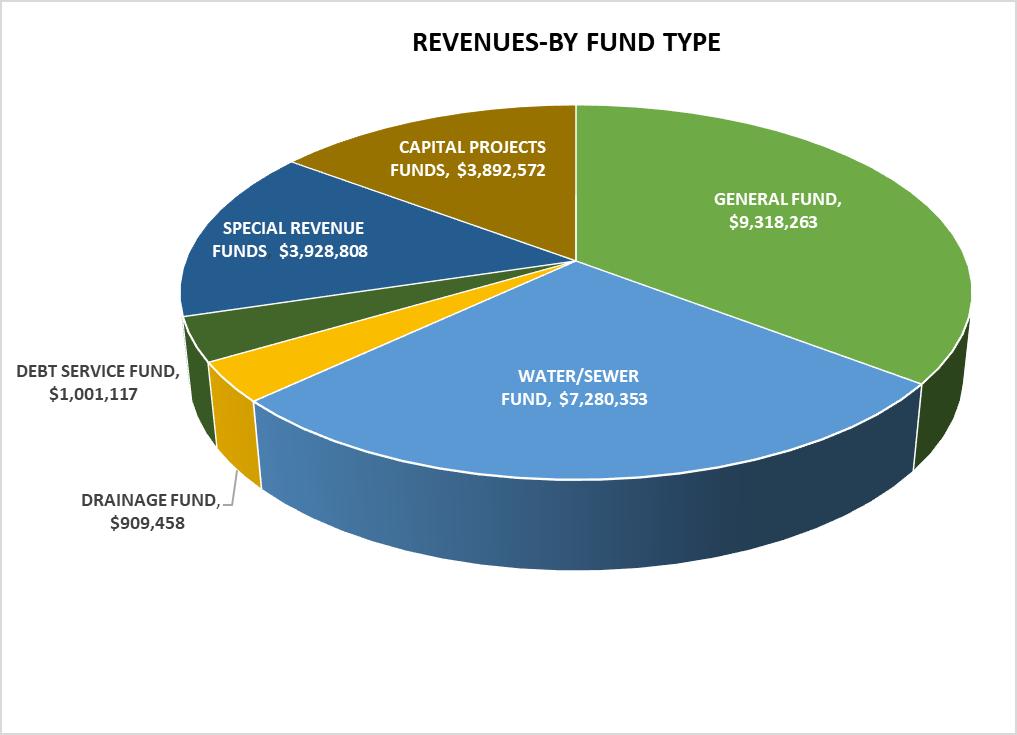

WHERE THE MONEY COMES FROM - BY FUND TYPE

Changes in Major Fund Type

**Total excludes transfers in/out

General Fund is the City’s operating fund. This fund provides a broad spectrum of programs and critical public safety services, such as police and fire. In addition, it provides funding for parks and recreation, public works and administrative services. Most of the revenue is obtained from property taxes and sales taxes. The 11% growth is due to an increase in property tax revenues and sales tax revenues.

Water/Sewer Fund provides water and sewer services to the city. Most of the revenues are obtained via charges for services. The 43% revenue increase is due to a $1,000,000 transfer in from fund balance for the Water Meter Replacement Project approved by Council.

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

29

Drainage Fund is for drainage fees collected through a customer’s water bill. The drainage fund provides funding for the maintenance of the City’s drainage system and for major capital items as necessary. The change is negligible.

Debt Service Fund is used to collect property taxes and to pay the City’s debt service relating to Certificate of Obligations, General Obligation Bonds and Tax Notes and any debt secured by property tax revenues. There is a slight decrease in revenues due to a lowered tax rate and lowered I&S rate. The rate was lowered to $0.125257 from $0.145257.

Capital Projects Funds are funds used to account for all major capital improvements that are financed by the City’s general obligation bonds, revenue bonds, intergovernmental grants, transfers from other funds and other designated resources. The 51% increase in revenues is due to an increase in transfers from other funds including, ARPA funding, the new Strategic Initiative Fund transfer in and remaining life-to-date budgets that were rolled over from the prior fiscal year. Funds include the Road & Street Fund, Oil & Gas Fund and others.

Special Revenue Funds include the Richland Hills Development Corporation (RHDC), Hotel/Motel Occupancy Tax fund, Crime Control District Fund (CCPD), Tax Increment Fund and others. The 8% increase is mostly due to an increase in sales tax revenue projections for the RHDC and CCPD Funds.

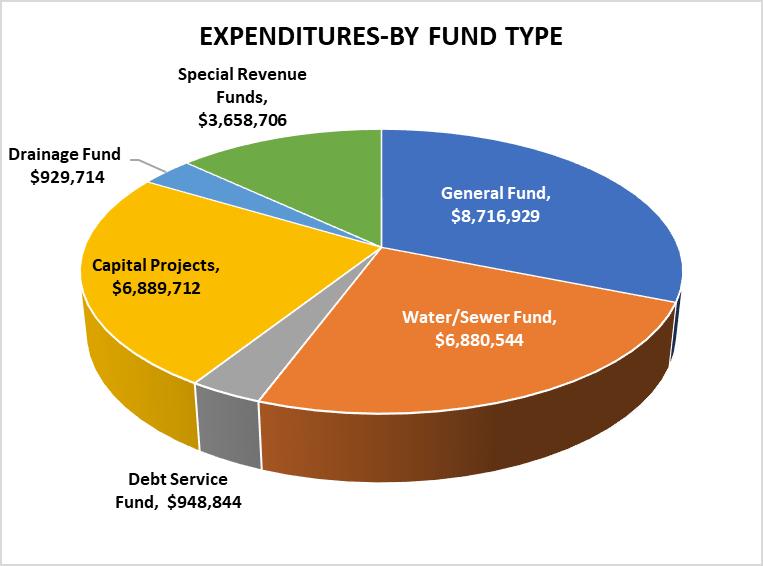

WHERE THE MONEY GOES - BY FUND TYPE

**Total excludes transfers in/out

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

30

Changes in Major Fund Type

General Fund – Expenditures increased by 15% due to increased personnel costs. A 5% COLA increase was approved for all civilian employees, and a three STEP pay increase was approved for sworn public safety personnel to keep up with market pay. In addition, there is a 3% medical insurance increase and several increases in supplies due to inflation.

Water/Sewer Fund – The 65% increase in this fund is due to the water meter replacement project which is budgeted to cost $2.4 million. This project is partly funded with the $1 million transfer from fund balance and the rest is financing via private lending. This fund also approved a 5% COLA increase and there are increased costs to supplies due to inflation.

Drainage Fund has a 10% decrease in expenses due to the lack of capital purchases this fiscal year.

Debt Service Fund has a 3% increase in expenditures due to an increase in debt service payments over last fiscal year. No new debt was issued last fiscal year.

Capital Projects Funds are funds used to account for all major capital improvements. Capital Funds include the Road & Street Fund, Oil & Gas Fund and others. Total increase is 167% over FY22 due to the continuation of ARPA funded water line improvements and the Strategic Initiative Fund projects. More information on these projects is available in the fund descriptions in the Capital Funds section.

Special Revenue Funds include the Richland Hills Development Corporation (RHDC), Hotel/Motel Occupancy Tax fund, Crime Control District Fund (CCPD), Tax Increment Funds (TIF) and others. The 26% increase over last fiscal year is due to transfers out for capital projects from RHDC, CCPD and TIF funds. More information on these projects is available in the fund descriptions in the Special Revenue Funds section.

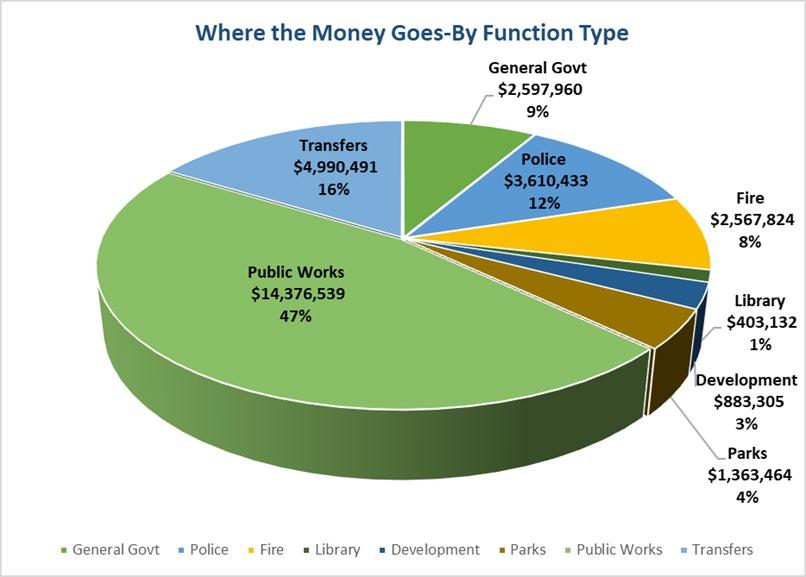

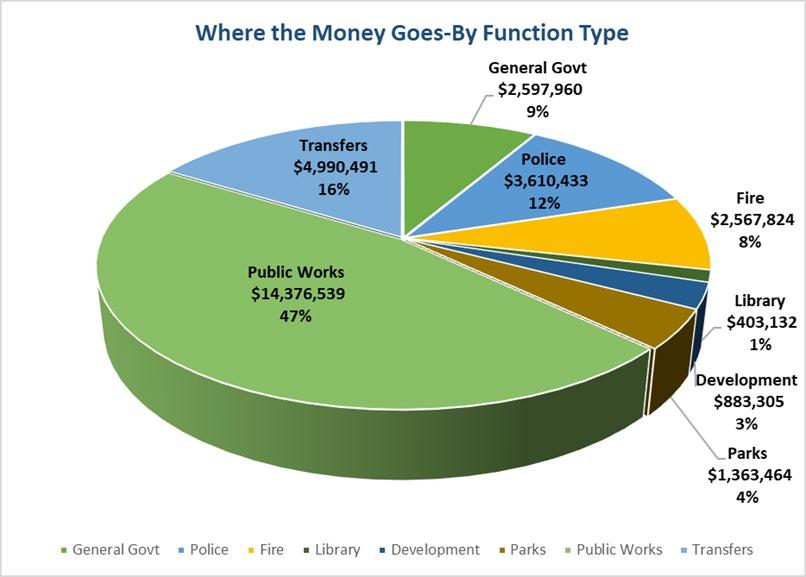

WHERE THE MONEY GOES - BY FUNCTION

*Transfers total includes $1M transfer in from Enterprise Fund Balance (excludes Debt Service)

Changes in Major Functions

General Government- the increase in this function is mainly due to salary increases, where civilians received 5% increase, the addition of one position in the administration department (Assistant to the City Manager) that is split with two other funds, a Full Time Custodian, that is a shared expense with the Link Fund, and general increase in operations costs due to inflation.

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

FY 21-22 EOY Estimates FY 2022-23 Adopted Budget % Change to Prior Yr General Govt 2,293,766 $ 2,597,960 $ 13% Police 3,206,160 3,610,433 13% Fire 2,323,094 2,567,824 11% Library 382,900 403,132 5% Development 600,294 883,305 47% Parks 1,221,207 1,363,464 12% Public Works 6,940,491 14,376,539 107% Transfers 824,128 4,990,491 506% 17,792,040 $ 30,793,149 $ 73% 31

Police - this includes the Crime Control District expenditures, and the increase is mainly due to increases in personnel costs. An increase of approximately 15% was budgeted for sworn officers to keep up with market pay in the Dallas-Fort Worth area. The rest are normal inflationary increases in operational costs.

Fire - Sworn personnel were allotted an approximate 15% increase in salaries to keep up with market pay in the Dallas-Fort Worth area. The rest are normal inflationary increases in operational costs.

Library – this department received a 5% salary increase along with general government employees.

Development – this function includes the RHDC fund’s costs along with the Community Development department. The 47% increase is mainly due to personnel vacancies in FY 22 and the addition of a Parks Maintenance Technician position that is shared with the Parks department.

Parks – the 12% increase is mostly due to the new Parks Maintenance Technician that is shared with the RHDC. It is also due to the 5% increase in pay to civilian employees.

Public Works - the large increase of 107% is due to the following:

• the creation of the Strategic Initiative Fund which includes funding for several capital projects

• water line improvements funded with ARPA funds

• continuation of capital projects that are carried over from FY22 which include street improvements and parks projects

• the water meter replacement program that was approved during FY22 and will be complete during FY23.

Transfers – During FY23, Council approved a transfer out from the General Fund to the newly created Strategic Initiative Fund (SIF) in the amount of $2.4 million. This is a result of an initiative by City Council to take excess, unreserved fund balance in the General Fund and utilize it in the new SIF fund for one-time expenses. It allows for excess funds to work as one time revenue to fund needed projects and avoid borrowing money for these projects. These projects can include such items as capital acquisition, community enhancements, infrastructure maintenance, renovations, and technology. The 506% increase over FY22 also includes transfers out from CCPD, RHDC and the Water/Sewer Fund for additional capital projects.

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 32

The pie chart shows the totals, and percentage of grand totals, by function The table below summarizes each function.

*Transfers total includes $1M transfer in from Enterprise Fund Balance

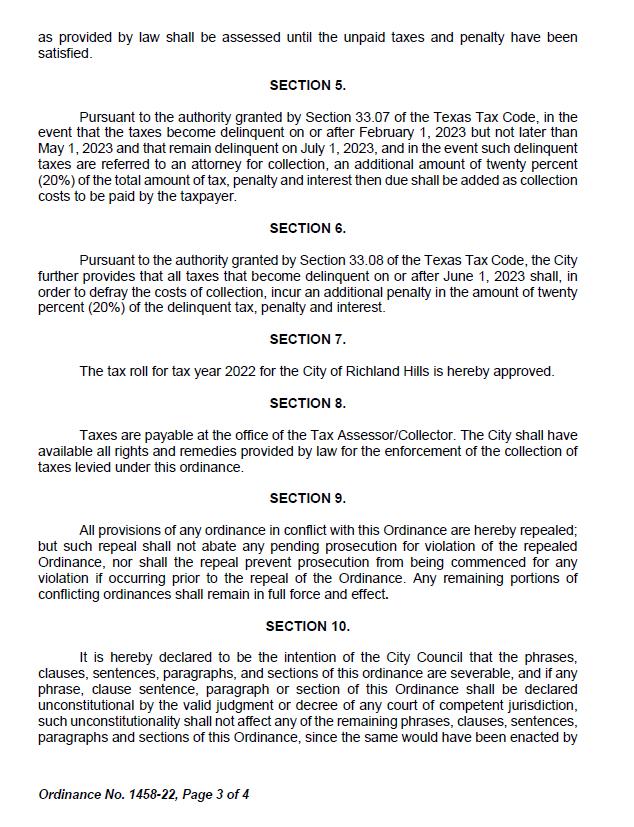

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 PROPERTY TAX VALUATION AND TAX RATES Fiscal Year Tax Year Certified Taxable Value Percent Increase M&O Rate per $100 I&S Rate per $100 Tax Rate per $100 Avg. Home Taxable Value Average Property Tax 20132012396,161,999 $ 0.0%0.465214 $ 0.062880 $ 0.528094$ 77,584 $ 410 $ 2014 2013416,611,053 5.2%0.467694 0.060400 0.52809481,985 433 20152014436,205,014 4.7%0.469092 0.059002 0.52809483,675 442 20162015419,959,165 -3.7%0.470680 0.058125 0.52880584,303 446 20172016439,923,135 4.8%0.471433 0.124200 0.59563395,890 571 20182017528,320,580 20.1%0.460847 0.102891 0.563738108,181 610 20192018582,103,720 10.2%0.450755 0.091125 0.541880120,739 654 20202019651,881,712 12.0%0.418051 0.140500 0.558551136,493 762 20212020651,935,836 0.0%0.418051 0.140500 0.558551145,047 810 20222021710,674,835 9.0%0.418051 0.140500 0.558551160,805 898 20232022791,107,294 $ 11.3%0.413628 $ 0.125257 $ 0.538885$ 181,334 $ 977 $ 33

MAJOR REVENUE SOURCES

Major revenue sources, assumptions and trend analysis for all funds are provided in the following pages. The revenues in aggregate can be found in the Fund Summaries and the Revenues by Type pages.

PROPERTY TAX

The City’s property tax is levied based on appraised value of property as determined by the Tarrant Appraisal District. The Tarrant County Tax Assessor bills and collects the property taxes for the city.

The property tax rate for fiscal year 2022-2023 is $0.538885 per $100 assessed valuation, which consists of $0.413628 for operating and maintenance costs recorded in the General Fund and Tax Increment Fund (TIF) and $0.125257 to fund principal and interest payments on bond indebtedness recorded in the Debt Service Fund. The property tax rate is two cents lower that the fiscal year 2021-2022 rate of $0.558551. Historical rates and valuations are shown in the previous page.

Outlook

Total property tax revenues are projected to increase over the prior year by $319,391 or 11% primarily because of an 11% increase in certified values and new properties added, according to the certified tax roll from the Tarrant appraisal district. The outlook for future years is positive as more properties are built due to the two townhome developments currently in progress along with an increase in area certified values. Property taxes account for 34% of the City’s total revenue.

MAJOR INFLUENCES

Factors affecting property tax revenues include population, development, property value, tax rate and tax assessor appraisal

SALES AND USE TAX

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

34

The total sales tax collected in the City of Richland Hills is 8.25%. The City receives 2% of sales tax with the following allocations: 0.25% is allocated to the Richland Hills Development Corporation, 0.37% is allocated to the Crime Control Prevention District and 0.37% goes to the Street and Road Improvement Fund.

The city imposes a local hotel occupancy tax of 7 percent of the cost of a hotel room. The state hotel occupancy tax rate is 6 percent.

OUTLOOK

Sales and use tax revenues are projected to increase over the prior year by $495,807 or 12% because of increased sales in the industrial and commercial sectors within the City. Sales and use taxes account for 31% of the City’s total revenue. Growth is anticipated to continue in future years.

MAJOR INFLUENCES

Factors affecting sales & use tax revenues include manufacturing, retail sales, economy, and consumer price index.

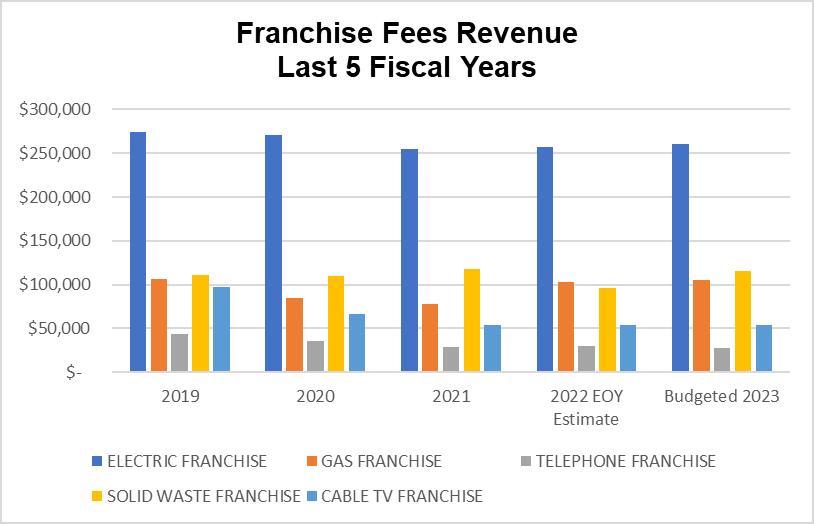

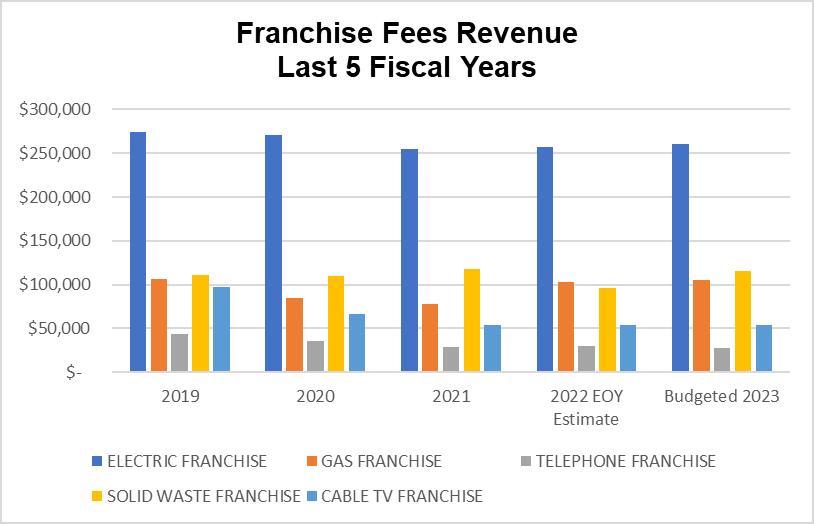

FRANCHISE FEES

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 Fiscal Year 201920202021 2022 EOY Estimate Budgeted 2023 ELECTRIC FRANCHISE 274,435 $ 270,336 $ 254,338 $ 257,000 $ 260,000$ GAS FRANCHISE 106,092 84,276 78,214 102,640 105,000 TELEPHONE FRANCHISE 43,501 35,753 28,789 30,000 28,000 SOLID WASTE FRANCHISE 111,270 109,873 117,739 95,600 115,000 CABLE TV FRANCHISE 97,814 66,509 54,280 54,000 54,000 633,112 $ 566,748 $ 533,360 $ 539,240 $ 562,000$ 35

The City imposes a 5% franchise fee on utility companies for rights-of-way use. These include gas, electricity, telephone, and cable television. The City collects an 8% solid waste franchise fee from the current solid waste provider.

OUTLOOK

Franchise fees revenues are projected to remain stable for the foreseeable future and are dependent on each utility company’s annual gross revenues. Franchise fees account for 2% of the total City’s revenues.

MAJOR INFLUENCES

Factors affecting franchise fees include population, utility gross sales, rate of charges and weather fluctuations, which affect electricity, gas, cable tv and solid waste revenues.

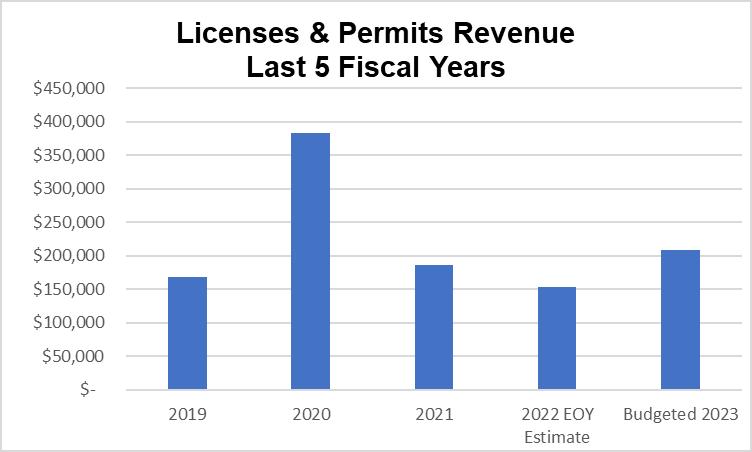

LICENSES AND PERMITS

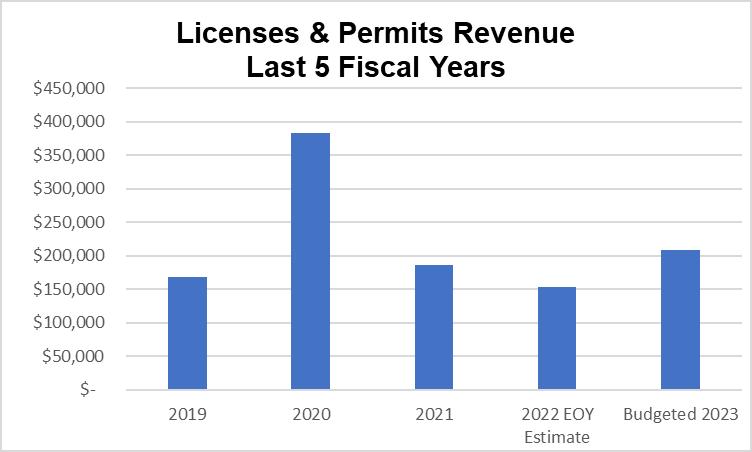

Fiscal Year 201920202021 2022 EOY Estimate Budgeted 2023 CONTRACTOR REGISTRATION FEES 21,305 $ 26,355 $ 24,000 $ 14,600 $ 25,000 $ ELECTRICAL PERMITS 8,071 12,080 16,126 16,200 15,000 ANIMAL LICENSE 88 - 255 200 200 BUILDING PERMITS 115,124 292,696 101,938 81,750 125,000 BUILDING REGISTRATION FEES 8,823 22,820 28,675 26,600 25,000 LIQUOR SALE PERMIT 30 350 150 70 300 MISCELLANEOUS PERMITS 1,998 3,410 5,440 5,000 4,000 FIRE CODE PERMITS 13,326 25,326 9,590 9,500 15,000 168,765 $ 383,037 $ 186,174 $ 153,920 $ 209,500 $ CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 36

Licenses and permits are required of any business or person conducting certain activities within the city.

Major licenses and permits include building permits, fire code permits, building registration fees and electrical permits.

OUTLOOK

Licenses and permits account for 0.8% of the total revenues for the City of Richland Hills. The highest year for permits revenues, occurred in FY 2020 when an elementary school was built. The City anticipates an increase in building permits beginning in FY 2023 due to the two townhome developments that are slated to start construction in the latter part of the fiscal year.

MAJOR INFLUENCES

Factors affecting licenses and permits revenues include population, development, construction, rate of charges and other activities.

FINES AND FEES

Fines and fees include traffic and non-traffic fines, warrants, arrest fees, library fees, animal control fees and the school crossing guard fees used to pay for the crossing guard at the local elementary school.

OUTLOOK

Fines and fees account for 1% of total City revenues. Total revenues from fines and fees are budgeted to be lower by 4.9% due to a decrease in traffic fines. During fiscal year 2019 and 2020, there were more traffic citations issued than in subsequent years.

MAJOR INFLUENCES

Major factors affecting fees are population and traffic activities.

CHARGES FOR SERVICES

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 Fiscal Year 201920202021 2022 EOY Estimate Budgeted 2023 MUNICIPAL COURT FINES 360,640 $ 300,404 $ 215,154 $ 190,000 $ 200,000 $ LIBRARY FEES 497 20 33 50 50 DLQ MUNICIPAL CT FINES 103,122 70,316 37,979 55,000 38,000 JUDICIAL EFFICIENCY FINES 768 428 118 100 250 WARRANTS 27,930 18,924 10,473 16,000 10,500 COURT DELINQUENT COLLECTIONS 435 784 1,442 7,000 6,000 ANIMAL CONTROL FINES 16,533 13,258 16,120 6,000 6,000 SCHOOL CROSSING GUARD REV 2,304 1,276 1,520 800 1,250 512,229 $ 405,410 $ 282,839 $ 274,950 $ 262,050 $ Fiscal Year 201920202021 2022 EOY Estimate Budgeted 2023 PLAN REVIEW - $ 180,589 $ 27,307 $ 22,000 $ 22,000 $ COPY MACHINE 3,071 $ 1,568 $ 2,292 $ 2,600 $ 2,600 $ EMERGENCY MEDICAL SERVICE 281,972 $ 273,841 $ 260,427 $ 262,500 $ 280,000 $ ANIMAL VACCINATIONS 335 $ 90 $ 255 $ 50 $ 1,250 $ 285,378 $ 456,088 $ 290,281 $ 287,150 $ 305,850 $ 37

Charges for services in governmental funds include all charges for services provided by the City such as ambulance, reports, animal vaccinations, and other miscellaneous charges. Charges for services account for 1.16% of total city revenues.

OUTLOOK

Revenue from charges for services in budgeted to increase by 7% mainly due to an increase in EMS fees and a small grant that is projected to be received during FY23.

MAJOR INFLUENCES

Factors affecting revenues in this section are rate of charges, EMS runs, population and general activity levels.

INTERGOVERNMENTAL

Intergovernmental revenues are grants from other governmental entities. The City receives grants for public safety, including the school resource officer, bullet proof vest grant, STEP traffic grant and community development projects, as well as federal grants, such as the ARPA grant. Revenues are recorded in various funds.

OUTLOOK

Total intergovernmental revenues are projected to be $1.9 million during FY23. This is mostly due to the ARPA funds that were received during FY 21 and FY 22 and will be expensed and recorded as revenue during fiscal

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 38

2023. The ARPA grant is slated to cover water infrastructure and broadband projects, amongst other approved uses. Intergovernmental revenue accounts for 11% of the total City revenue during FY 23. This amount will vary from year to year based on available resources.

MAJOR INFLUENCES

Major factors affecting grants are availability, as well as funding from the different granting agencies.

TRANSFERS

Transfers are transactions between funds of the primary government. They are repayments from the funds responsible for the expenditures to the funds that initially paid for them. These repayments can include general and administrative fees, capital replacements, facility improvements/renovations, debt service requirements, grant matches, and subsidies for capital projects.

OUTLOOK

Total transfer revenues are projected to be $3,990,491 for fiscal 2023. This includes the $2.4 million transfer from the General Fund to the new Strategic Initiative Fund. More information about this fund can be found in that fund’s section in the budget. The rest of the transfers include transfers into the Capital Projects funds to fund the Law Enforcement Center remodel, the annual Link operations fund transfer, parks, and community projects as well as a transfer from the Water/Sewer fund for a masonry fence around the public works building in the amount of $80,000. The increase in transfers this fiscal year is due mainly to carryover of CIP projects from the previous fiscal year, the ARPA transfer for the commencement of the water line project, and the creation of the new Strategic Initiative Fund.

MAJOR INFLUENCES

Factors affecting transfers are capital projects, debt, and rates of charges.

GOVERNMENTAL FUNDS FUND TRANSFERS NO. IN/(OUT) GENERAL FUND 01(2,860,491) SPECIAL REVENUE FUNDS COURT SECURITY 24COURT TECHNOLOGY 39CRIME CONTROL DISTRICT 65 (50,000) KRHB FUND 67 HOTEL OCCUPANCY TAX FUND 77TAX INCREMENT FINANCING FUND 89 75,000 LINK OPERATIONS FUND* 98 199,680 LINK REPLACEMENT FUND 103 25,000 EMERGENCY MANAGEMENT FUND 104 2,500 COMPONENT UNIT RICHLAND HILLS DEV. CORP. 26(1,000,000) DEBT SERVICE FUND 10CAPITAL PROJECTS FUNDS OIL AND GAS FUND 12CAPITAL PROJECTS FUND 201,288,311 ROAD & STREET FUND 25VEHICLE REPLACEMENT FUND 30ARPA FUND 101 STRATEGIC INITIATIVE FUND 1072,400,000 ENTERPRISE FUND FUND TRANSFERS NO. IN/(OUT) TRANSFER TO FUND 20 CAP PROJ 2 (80,000) CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 39

The General Fund is the general operating fund of the City of Richland Hills. This fund provides for a variety of programs and critical services such as police, fire, library, parks and recreation, streets department, municipal court, animal control and administrative services.

The General Fund derives most of its revenue from property taxes and sales and use taxes along with other miscellaneous revenue described below.

Fund Description and Summary

Statement of Revenues and Expenditures

Overview of Revenues and Expenditures

General Fund Departments

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

40

GENERAL FUND

GENERAL FUND DESCRIPTION AND SUMMARY

Fund Summary

The General Fund is the main fund of the city and is used to account for all revenues and expenditures not accounted for in other designated funds It receives a varied amount of revenues, and it finances a wider range of governmental activities than any other fund. The General Fund is primarily supported by property tax, sales & use tax, franchise fees, license and permit fees, and court fines. General Fund expenditures support the following major functions of the City: public safety, community development, public works, parks, library, and administration.

Statement of General Fund Revenues

Fiscal Year 2022 End of Year Financial Performance

The FY22 Adopted Budget compared to the EOY estimate shows an overall positive change in the amount of $735,413 or an 11% increase in budgeted revenue vs. EOY estimates. This is mostly due to an increase in sales tax revenues collected during the year, which exceeded budgeted revenues by $716,409. The increase in sales tax revenues is mostly due to commercial and industrial sales within the City. Sales tax forecasting for FY23 is equally positive with budgeted sales tax revenue and projections to increase by 12%. The industrial and commercial sales tax collections continue to rise year over year due to the construction industry and especially where electrical and plumbing suppliers are concerned.

Fiscal Year 2023 Budget

For the Fiscal Year 2023, total revenues for the General Fund are budgeted at $8.4 million. That is an increase of 11% over FY22 end of year estimates. The main reason for the increase is an increase of 11% in certified property values and a projected 12% increase in sales tax revenue.

Statement of General Fund Expenditures

Fiscal Year 2022 End of Year Financial Performance

End of Year (EOY) estimates for the General Fund Expenditures are 3.5% higher than the original budgeted

FY 2023 TOFY 2023 TO GENERAL FUND REVENUES FY 2019FY 2020FY 2021 FY2022 FY 2023 FY22 EOYFY22 EOY SUMMARY ACTUALACTUALACTUAL EOY ESTIMATE BUDGET $ CHANGE% CHANGE BEGINNING FUND BALANCE 2,955,804 $ 2,966,213 $ 4,042,677 $ 4,433,131 $ 4,918,360 $ PROPERTY TAXES 2,561,434 $ 2,624,551 $ 2,629,066 $ 2,804,604 $ 3,123,995 $ 319,391 $ 11% SALES TAXES 3,303,034 3,367,227 3,616,110 4,216,409 4,712,216 495,807 12% LIQUOR TAXES - 1,640 2,925 2,400 2,500 100 4% FRANCHISE FEES 633,112 566,748 533,360 539,240 562,000 22,760 4% FINES & FORFEITURES 511,734 405,410 282,806 274,950 262,050 (12,900) -5% LICENSES & PERMITS 168,765 383,037 186,174 153,920 209,500 55,580 36% CHARGES FOR SERVICES 694,494 456,088 290,313 287,150 305,850 18,700 7% MISCELLANEOUS REVENUES 197,603 857,746 130,394 126,800 140,152 13,352 11% TOTAL REVENUES 8,070,176 $ 8,662,447 $ 7,671,148 $ 8,405,473 $ 9,318,263 $ 912,790 $ 11%

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

41

numbers. This is mostly due to the increase in overtime hours in public safety and an extra pay period that had to be accrued to FY22. General fund balance remains strong at year end at $4,918,360 which represents 65% of estimated expenditures. Current City policy requires a 25% fund balance.

Fiscal Year 2023 Budgeted Expenditures

For the FY 2023, the total budgeted expenditures are $ 8,716,929 or a 15% increase in expenditures as compared to FY 2022. The main budgetary items are a 5% salary increase to all civilian personnel and a 15% increase and adjustment to the STEP plan to all sworn public safety to keep the City competitive for public safety salaries as compared to surrounding cities. The General Fund also created three new positions for FY23:

Assistant to City Manager Dept. 12 Administration (funding shared with Water/Sewer Fund)

Parks Maintenance Tech Dept. 19 Parks Grounds (funding shared with RHDC)

Full time Custodian Dept. 30 Shared Services (funding shared with LINK Fund)

Transfers out to other funds total $2,860,491 are due to the creation of the new Strategic Initiative Fund ($2.4M) and other transfers out as shown below:

Fund balances at the end of FY2023 are projected to be $2,659,203 or 31% of budgeted expenditures. This is well above the 25% requirement per city policy.

FY 2023 TOFY 2023 TO GENERAL FUND EXPENDITURES FY 2019FY 2020FY 2021FY2022FY 2023 FY22 EOYFY22 EOY SUMMARY ACTUALACTUALACTUALEOY ESTIMATEADOPTED$ CHANGE% CHANGE MUNICIPAL COURT 263,590 $ 248,936 $ 266,107 $ 294,205 $ 300,040 $ 5,835 $ 2% ADMINISTRATION 863,230 497,501 576,080 585,263 690,171 104,908 18% POLICE 1,672,773 1,696,307 1,867,927 1,913,599 2,091,296 177,697 9% FIRE 1,788,683 2,383,508 1,860,854 2,093,342 2,567,824 474,482 23% STREETS 240,481 158,081 231,511 202,465 325,080 122,615 61% LIBRARY 351,404 342,273 360,307 382,900 403,132 20,232 5% RECREATION 159,011 179,574 234,952 282,737 299,807 17,070 6% PARKS & GROUNDS 178,125 162,926 138,268 243,796 281,787 37,991 16% COMMUNITY DEVELOPMENT 275,783 461,422 415,953 394,299 535,438 141,139 36% ANIMAL CONTROL 194,229 163,586 178,610 193,070 202,422 9,352 5% LEGISLATIVE (CITY SECRETARY) 188,208 168,891 166,943 128,253 129,940 1,687 1% SHARED SERVICES 669,331 547,726 $ 652,168 $ 602,825 839,991 237,166 39% NON-DEPARTMENTAL 603,960 240,179 50,000 (190,179) -79% TOTAL EXPENDITURES 7,448,808 $ 7,010,731 $ 6,949,680 $ 7,556,933 $ 8,716,929 $ 1,159,996 $ 15% Transfers Out 610,959 $ 711,404 $ 331,014 $ 363,311 $ 2,860,491 $ N/A 687% BEGINNING FUND BALANCE 2,955,804 $ 2,966,213 $ 4,042,677 $ 4,433,131 $ 4,918,360 $ ENDING FUND BALANCE 2,966,213 $ 4,042,677 $ 4,433,131 $ 4,918,360 $ 2,659,203 $ 90 DAYS RESERVE AMOUNT 1,836,692 $ 2,041,219 $ 1,713,620 $ 1,863,353 $ 2,149,380 $ OVER/(UNDER) RESERVE REQUIREMENTS 1,129,521 $ 2,001,458 $ 2,719,511 $ 3,055,007 $ 509,824 $ CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 TRANSFER TO CAPITAL PROJECTS 158,311 $ TRANSFER TO EOC 2,500 $ TRANSFER TO TIF SALES TAX 75,000 $ TRANSFER TO LINK FUND 199,680 $ TRANSFER TO LINK REPL FUND 25,000 $ 42

GENERAL FUND DEPARTMENTS

MUNICIPAL COURT

ADMINISTRATION

POLICE

FIRE

STREETS

LIBRARY

PARKS AND RECREATION

PARKS - GROUNDS

COMMUNITY DEVELOPMENT

ANIMAL CONTROL

LEGISLATIVE

SHARED SERVICES

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 43

Mission Statement

The mission of the Richland Hills Municipal Court is to provide equal and impartial justice under the law; and to ensure that all defendants are treated in a professional, courteous, and efficient manner.

FY 2021-2022 Accomplishments

Collected $406,931 in fines/court costs

Filed 2,274 new cases; disposed 2,475 cases

Issued 1,828 warrants; cleared 1,404 warrants

Transitioned court operations from a remote environment back to an in-person environment

Eliminated the backlog of cases due to COVID-19

All required training completed by staff

Completed destruction of closed cases filed prior to October 2021

Significantly reduced collection cases by age purging, dismissing, and re-working cases

FY 2022-2023 Objectives

Implement Tyler Payments merchant processing and reducing credit card fee expense

All staff to complete required training

Marshal to complete warrant audit

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 FY 2023 TOFY 2023 TOFY 2023 TO FY 2019FY 2020FY 2021FY 2022FY 2022FY 2023 FY22 EOY EST FY 2022 FY22 EOY EST DESCRIPTION ACTUALACTUALACTUAL ADOPTED EOY ESTIMATE ADOPTED $ CHANGE$ CHANGE% CHANGE PERSONNEL 230,906 $ 226,721 $ 228,551 $ 236,529 $ 254,870 $ 254,216 $ (654) $ 17,687 $ 0% MATERIALS AND SUPPLIES 29,190 $ 19,250 $ 34,242 $ 33,614 $ 36,643 $ 42,492 5,849 8,878 $ 16% OTHER OPERATING EXPENSES 3,494 $ 2,965 $ 3,314 $ 2,907 $ 2,692 $ 3,332 640 425 $ 24% TOTAL - MUNICIPAL COURT 263,590 $ 248,936 $ 266,107 $ 273,050 $ 294,205 $ 300,040 $ 5,835 $ 26,990 2%

DEPARTMENT 11 MUNICIPAL COURT Staffing Grade Actual FY2019 Actual FY2020 Actual FY 2021 Original FY 2022 EOY Estimate FY 2022 Adopted FY 2023 Municipal Court Judge NA 111111 City Marshal C21 111111 Court Administrator 27 000111 Court Clerk C24 111000 44

MUNICIPAL COURT

CITY OF RICHLAND HILLS - GENERAL FUND (FUND 001)

The Administration department consists of the City Manager’s Office (CMO), Human Resources and the Finance department Mission statements for each of the departments are below. Goals and accomplishments and staffing grids are presented as a whole department

Mission Statement-City Manager’s Office

The City Manager serves under the direction of the City Council and is responsible for making recommendations to the Council regarding programs and policies and developing methods to ensure an effective and efficient operation of City services. The City Manager’s Office is responsible for the following core services:

• Facilitate good governance and provide strategic leadership to the municipal organization

• Ensure a strong and sustainable financial condition for the City

• Promote citizen involvement and governmental transparency

• Develop a high performance organization

• Create an employee value proposition that supports the City's mission and strategic goals

Mission Statement-Human Resources

The City of Richland Hills Human Resources department is deeply committed to providing quality services to the community; creating a culture of professionalism, respect, dignity, and trust; and promoting honesty, integrity, commitment, and teamwork.

Mission Statement-Finance Department