3 minute read

APPENDIX B – COMMUNITY PROFILE

History of Richland Hills

The City of Richland Hills was incorporated into the “town of Richland Hills” on September 23, 1950, by a total of 35 votes (34 votes for incorporation and 1 voided vote). The residents of Richland Hills named the town because of its rich soil, rolling land and hills. The location of the town was desirable because of its proximity to Highway 183 and the cities of Dallas and Fort Worth. However, the town of Richland Hills was sought after because it was far enough away from the big cities to provide with a quiet, country- like lifestyle.

Richland Hills was incorporated as a General Law city. On October 21, 1950, the citizens of Richland Hills elected its first Mayor, A. F. Gracy. Richland Elementary school opened on September 1, 1953 with a total student capacity of 480. In early September 1953, property from the Mathews subdivision (Diana Drive) was deeded to the Town for city usage and the first City Hall was constructed Richland Junior High School opened in 1956 with a total student capacity of 780.

On August 17, 1973, groundbreaking ceremonies began for the construction of a new 6,000 sq. ft. City Hall on Diana Drive. A Home Rule Charter was adopted in 1986 by the citizens of Richland Hills, which provides for a Council-Manager form of government. The Council is composed of a Mayor and five council members. Richland Hills is conveniently located near Fort Worth with 3 State Highways that pass through the City: Texas State Highway 183 (Baker Blvd.), State Highway 121 (Airport Freeway) and State Highway 26 (Boulevard 26). There are 6 parks in Richland Hills: Kate Baker Park, Rosebud Park, Creek Trail Park, LINK Plaza Park, Hike & Bike Trail and Windmill Park.

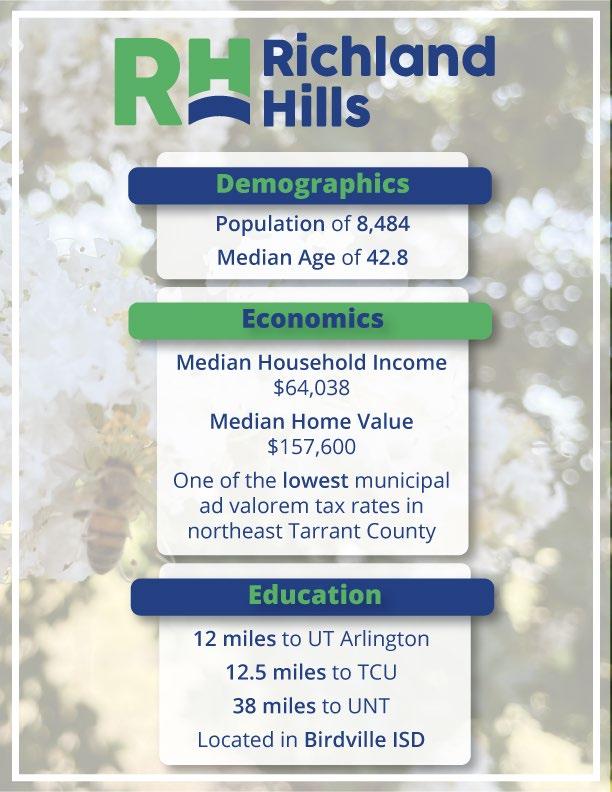

The City is served by the Birdville Independent School District. The City has a total area of 3.14 square miles.

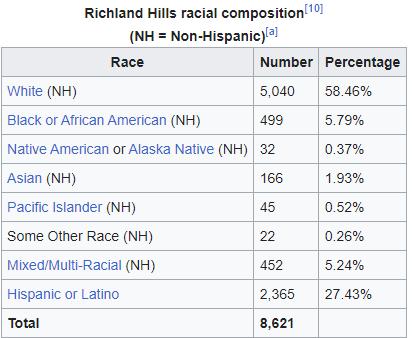

As of the 2020 census, there were 8,621 people in Richland Hills.

(a)Non-Hispanic(10) data.census.gov

APPENDIX C – LONG TERM FINANCIAL PLAN

The General Fund Long-term Financial Plan accounts for the future operating needs of the General Fund. It is a planning document that serves as a guideline for budgeting and for managing the resources of the city. City staff prepares and updates this five-year financial plan annually in preparation for developing suggested budget policies for City Council consideration and to ensure alignment with City Council Goals and Strategies. It is intended to provide a frame of reference to help evaluate the City’s financial condition and help assess financial implications of current and proposed budgets, programs, and assumptions.

The General Fund Long-term Financial Plan takes into consideration increased operational demands because of Richland Hills’ anticipated population growth, as well as the operational impact of capital projects. Projections of future revenues and expenditures are estimated based on the City’s current sources of revenue and level of service at the time the plan is developed. Projections may not occur or may occur differently from the amounts planned because of changes to the many assumptions. Projections include five years of operational costs related to the Capital Improvement Program (CIP), which are listed in the Capital Projects section under Impact of Capital Projects on Operating Budget. Adjustments and other operating expenditures are also included, but endorsement of the plan for general management and financial purposes requires authorization by proper actions of the City Council.

Revenues for the plan are projected at conservative levels and are compared to expenditure increase estimates. The primary variables are the rate of increase in revenues, and new projects or programs planned during the projection period. The City’s General Fund revenue primarily comes from property taxes, sales tax, and franchise fees. The remainder comes from licenses/permits, charges for service, fines, and interest income.

This financial plan does not consider planned debt issuance. Council anticipates issuing debt during the FY2023 budget year; however, the final numbers were not available at the time this budget was prepared.

Five Year Long Term Financial Plan

These projections do not take into account the issuance of new debt.

The long-term financial plan assumes that the property tax values will increase by 5%. Sales tax revenues are assumed to increase an average of 9% as has been historically. All other revenues are projected to increase between 3-5%. Expenditures per department consider the addition of positions that are affected by the addition of new capital projects. They do not consider the addition of any other personnel including public safety. Pay increases of 3% have been added to the projections. An average increase in operational costs of 8% is assumed across all departments, except for Shared Services which averages a 5% increase for 5 years.

These projections are subjective and will change from year to year as new positions are created and new debt is issued. A new five-year financial plan will be created as circumstances change.