4 minute read

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

The ARPA fund had a decrease from proposed to final in the amount of $171,768 due to finalized EOY projections; and the Strategic Initiative Fund had an increase of $215,000 in the adopted budget due to the addition of the Animal Shelter Parking Lot Project. All other funds remained unchanged.

Financial Program

Total Combined Revenues: The total combined revenue budget for fiscal year 2022-23 totals $26,330,571 which is a $4.7 million or 22% increase from the prior fiscal year and is due in large part to higher property tax and sales tax revenues, multi-year capital projects, which include their remaining life-to-date funding in the prior year (EOY) and only new funding in the current year’s budget and funding from the American Rescue Plan.

Revenues

Total Combined Expenditures: The total combined expenditure budget for fiscal year 2022-23 totals $28,024,449, which is a $8,870,981 or 46% increase from the prior fiscal year and is due to budgeting of capital expenditures from the American Rescue Plan Funds and the newly created Strategic Initiative Fund. This total also includes multi-year capital projects which are due for completion in FY2023. Expenditures are budgeted to be $1,693,878 more than revenues, primarily due to use of unassigned fund balance for capital projects. Operating budgets are balanced for fiscal year 2022-23.

Additional information on these budgeted numbers can be found in the individual funds’ page summary.

*General Fund expenditures do not include transfers to other funds from fund balance.

Expenditures

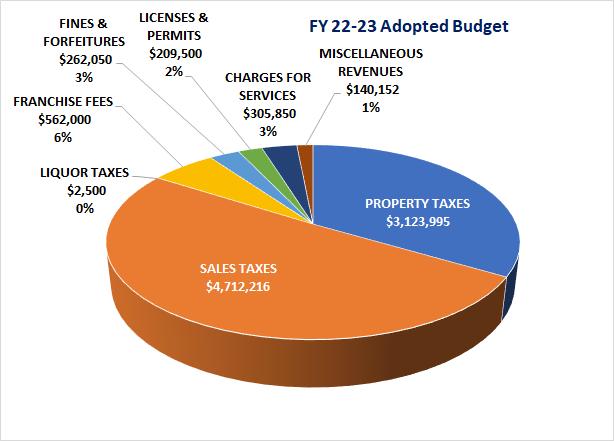

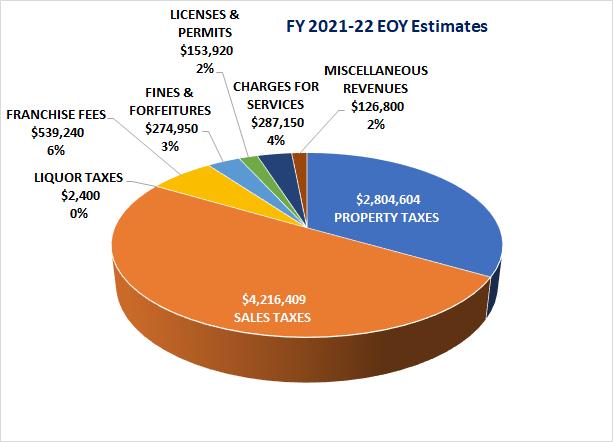

General Fund Revenues: General Fund revenues for fiscal year 2022-23 are expected to total $9,318,263, an 11% increase from last fiscal year primarily due to growth in property tax and sales tax base. More details can be found in the General Fund section.

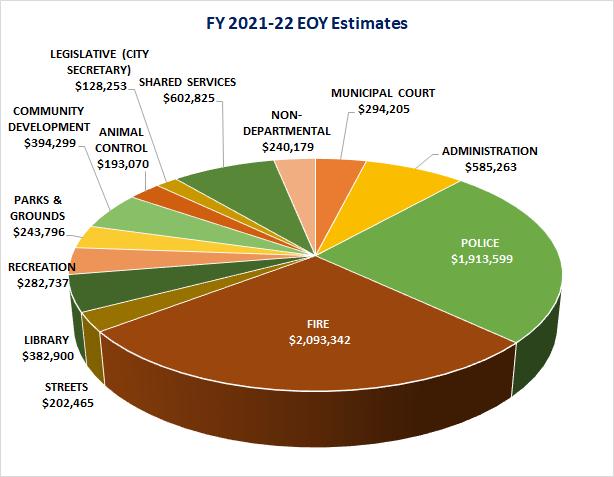

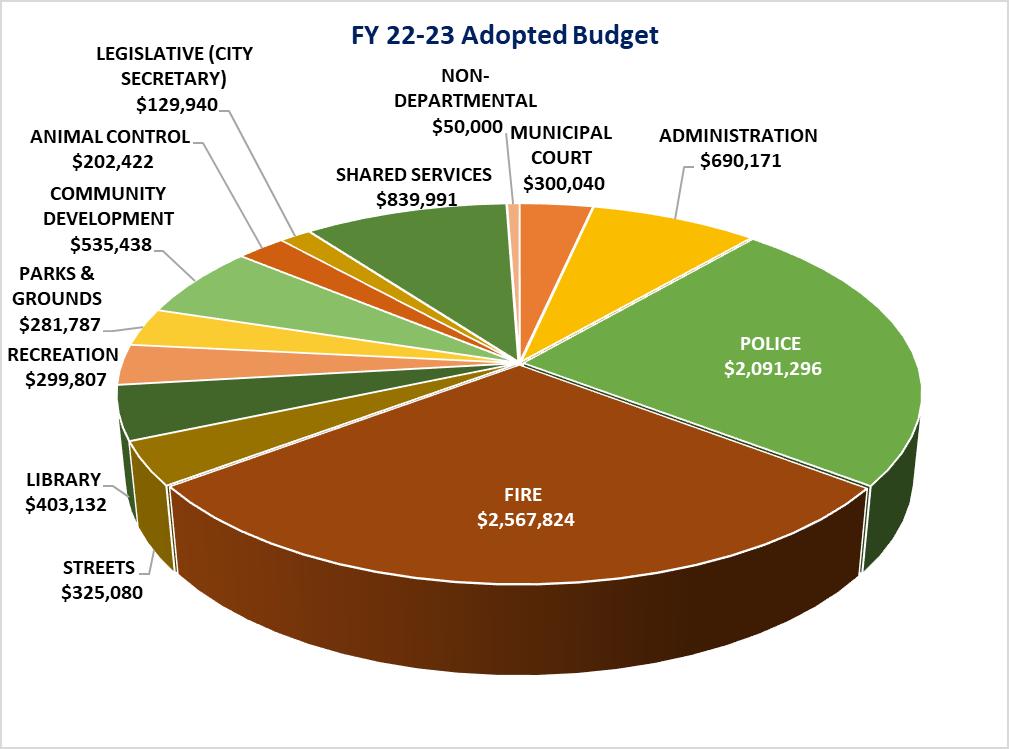

General Fund Expenditures: The General Fund is the general operating fund of the City. General Fund expenditures for fiscal year 2022-23 are projected to be $8,716,929, which is a 15% increase from last fiscal year 2022 end of year estimates. The overall increase is primarily due to several personnel vacancies in the Streets and Community Development departments, as well as a 5% salary increase in FY23.

*General Fund expenditures do not include transfers to other funds from fund balance.

Property Tax

General Fund property tax revenues for fiscal year 2022-23 are forecasted to total $3,123,995, an 11% increase over prior fiscal year (EOY), due to growth in the assessed property valuation. According to the Tarrant Appraisal District, the 2022 certified taxable value for the City of Richland Hills is $791,107,294. This represents an 11% increase in valuation over the 2021 certified taxable value. The overall property tax rate was decreased from $0.558551 to $0.538885 cents per $100 of property valuation.

Sales and Use Tax

General Fund sales & use tax revenues for fiscal year 2022-23 are forecasted to total $4,712,216, an increase of 12% over the prior fiscal year (EOY).

The City imposes a local sales tax of 2% on all retail sales, leases, rentals of most goods, as well as taxable services. Out of the 2%, 1% is for general purposes.

The Richland Hills Development Corporation recognizes 25% of sales tax as revenue, with the Crime Control District receiving another 0.37% and lastly, 0.37% going to the Road & Street Improvement Fund.

Water and Sewer Fund

The Water & Sewer Fund expenses for fiscal year 2022-23 are projected to be $6,880,544, a 65% increase over fiscal year 2022 EOY estimates. This is primarily due to a major project that is set to commence during FY 23. The water meter replacement project was approved by Council during FY 2021-22 as a much-needed improvement to the City's water metering system. This water meter replacement project will cost approximately $2.4 million. More details on the Water and Sewer Fund can be found in that fund's summary page.

Water and sewer rates will remain the same and no rate increases are planned for next fiscal year.

Drainage Fund

The Drainage fund expenses are forecasted to be $929,714, a 10.8% decrease over FY22 EOY. This is primarily due to a capital equipment purchase during FY 22

No major drainage capital projects are projected for FY 2022-23 from this fund.

Capital Projects Fund

The Capital Improvement Program (CIP) is an indication of the City’s priority to fund capital projects, ensuring Richland Hills will be positioned to meet the demands of its population and economic investment in our community. The CIP project expenditures for fiscal year 2022-23 are projected to be over $8,461,141 and are expected to exceed $5 million over the next 5 years. Project funding will address such areas as street improvements, repairing and replacing aging water and sewer infrastructure, a city-wide water meter replacement program, and continued improvement of our parks. More information, including listing of CIP projects can be found in the Capital Projects section.

Strategic Initiative Fund

The Strategic Initiative Fund is a newly created fund during fiscal year 2022-23. Council approved the creation of this fund to designate General Fund balance reserves in excess of the City required fund balance level and using them for one-time expenditures, for one time projects, such as infrastructure improvements, strategic planning, technology and capital acquisition.

The Strategic Initiative Fund (SIF), is a part of the Capital Improvements Program. Several projects are slated to be funded from the SIF such as, City Hall improvements, a new City wide ERP system and re-design of the old fire administration building amongst others. Total project expenditures are projected to be $691,000 during FY 23.

ARPA Fund

The ARPA Fund was established during FY 2021 to manage and record revenues received via the American Rescue Plan Act. Several projects were approved by Council during FY21 that aligned with the ARPA funding goals such as water infrastructure improvements, premium pay for essential employees during the pandemic and broadband projects amongst others. Total project appropriation during FY 23 is $1,596,773.