7 minute read

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

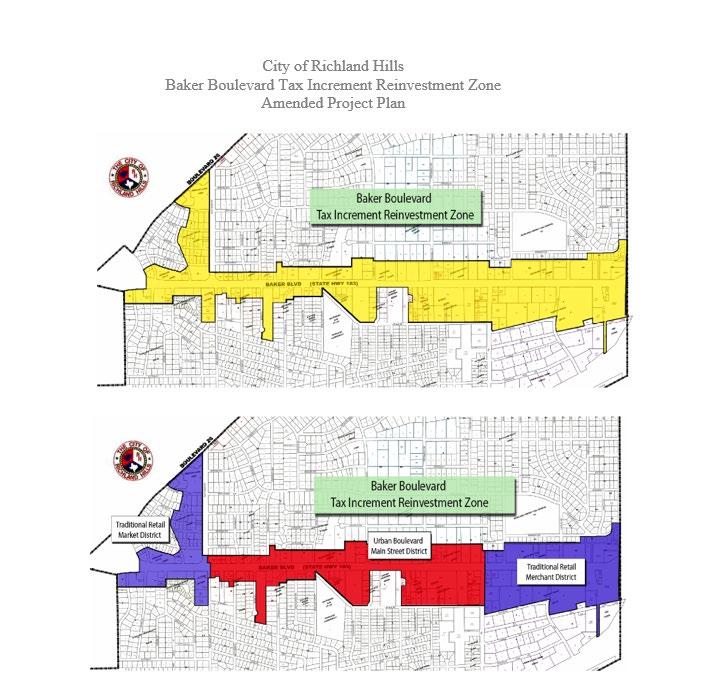

The TIF fund derives its revenue mainly from property taxes that are transferred from the General Fund once per year and sales taxes also transferred in from the General Fund based on total sales taxes received for the fiscal year.

The TIF does not have personnel allocated to it. Major budget items are: Capital Projects $460,000 for the Animal Services Improvement project and $90,000 for backlit street signs along Baker Boulevard.

There is also $30,000 for a façade grant to businesses within the TIF.

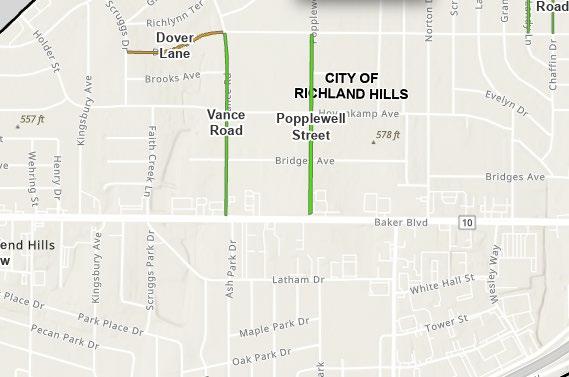

Below are trends for the TIF fund for both sales tax and property tax revenues:

Businesses along Baker Boulevard

Link Replacement Fund

Fund Summary

The LINK Replacement Fund is a new fund created during FY22. It was created to account for transfers in from the General Fund for the purpose of capital replacements in the LINK Event & Recreation Center. There are no personnel budgeted in this fund. The City expects to accumulate funds from year to year to pay for capital equipment or improvements necessary to keep the LINK center running.

Emergency Operations Management Fund

Fund Summary

This new fund was created mid-year FY2022 to account for transfers in from the General Fund for expenses related to the Emergency Operations Center. The amounts will increase from year to year depending on circumstances such as winter weather and other severe weather occurrences. There are no personnel budgeted in this fund.

Capital Projects Funds are used to account for all major capital improvements that are financed by the City’s general obligation bonds, certificates of obligation, intergovernmental grants, interfund transfers and other designated sources

Capital Improvements Plan

CIP Budget Summary

Impact of Capital Projects on Operating Budget

Oil and Gas Fund

Capital Projects Fund

Road & Street Fund

Vehicle Replacement Fund

ARPA Fund

Strategic Initiative Fund

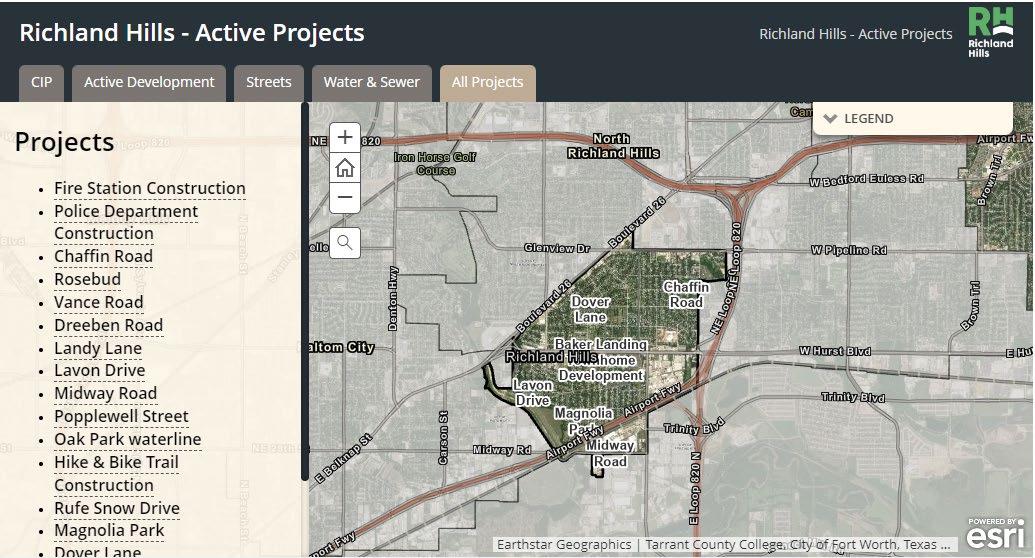

Capital Improvements Program Description

Richland Hills is committed to improving its aging infrastructure. Unlike other cities to the north of the Metroplex, the City of Richland Hills is landlocked with its proximity to several other communities, including the City of Fort Worth. New development is forthcoming, however, not at the exponential rate that its neighbors to the north are experiencing. A critical component of growth management is providing adequate infrastructure and facilities for current residents as well as new citizens and new business development. The Capital Improvements Program (CIP), a five-year plan for funding of major capital improvements, is structured to meet those needs while maintaining a strong fiscal policy. In addition to the five-year plan, the City will begin forecasting debt capacity and operational cost over a ten-year period.

The Capital Improvements Program is developed by identifying and prioritizing capital project needs, then balancing those needs with available funding sources. Many projects are identified from previously approved master plans for water, wastewater, parks, streets, facilities, etc. Other projects are recommended by Council, citizen boards, staff, and community input.

CIP Financing

The Capital Improvements Program is funded from several sources, including General Obligation Bonds, Certificates of Obligation, Revenue Bonds, RHDC (4B) funds, grants, and contributions. The largest single source of funding is General Obligation and Certificates of Obligation Bonds. The City did not issue debt during fiscal year 2022, but plans to issue debt during the 2023 fiscal year to address issues with drainage and streets. The amount for those debt issues is under consideration.

Capital Project Funds

Various capital project funds have been created to account for proceeds from bond sales, transfers, specific grants, or other funds earmarked for capital projects. A description of capital project funds, associated projects and the annual budget element for each fund are listed on the following pages. Information on projects, funding sources and funding years is detailed in the CIP Five-year Financial

Plan at the end of this section. A current listing and map of CIP projects can be found on the City’s website here: CIP Projects

CIP Budget Summary

Impact of Capital Projects on Operating Budget

The City of Richland Hills prepares an operating budget and capital budget which are closely linked. The operating budget is prepared annually for the operational needs of the budgeted year. The capital improvement program (CIP) budget is for the acquisition, expansion, or rehabilitation of infrastructure, fixed assets, or productive capacity of city services. The CIP, unlike the operating budget, is a five-year financial plan and is updated annually. Only those projects with expenditures during the current year of the plan are financed and adopted as part of the City’s annual budget.

Many of the capital projects are non-recurring, or one-time projects, which will impact the city’s operating budget at some point in time. Each project in the plan is reviewed to assess the impact it will have on the operating budget. Projects providing new infrastructure will typically require additional expenditures each year for operation and maintenance. Projects that replace or rehabilitate existing infrastructure will typically reduce operating costs; however, this does not generally result in an overall reduction of operating costs as the other aging City infrastructure not replaced are progressively more expensive to operate and maintain. Below is the City’s 5 year Capital Improvement Plan.

Richland Hills 5 Year Cip Plan

The majority of these projects are rehabilitative and therefore will have an overall decrease in expenses as it relates to impact on the general fund/water fund. The park improvement projects do include the addition of bathrooms which necessitates personnel to maintain them.

In FY23 one Park Maintenance Technician I was added and the total cost to the general fund and RHDC is $58,906 with an additional FTE projected in FY23-27 for a total impact of $559,110. The Water Meter Replacement Project in the Water/Sewer Fund has an operational impact of $365,767.

RICHLAND HILLS 5 YEAR CIP PLAN CONT.

*SIF- Strategic Initiative Fund TIF – Tax Increment Fund RHDC – Richland Hills Development Corporation

Control District of Governments ARPA

Rescue Plan Act

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

Oil and Gas Fund

Fund Summary

The Oil and Gas Lease Fund is to account for the revenues derived from oil and gas leases that City of Richland Hills holds and for capital expenses approved by the City Council.

Major Budget Items include $95,000 earmarked for park improvements.

This fund does not have any personnel allocated to it.

Capital Projects Fund

Fund Summary

The Capital Projects Fund accounts for capital projects expenses and for capital lease payments related to the fire department. This fund receives most of its revenue through interfund transfers from the General Fund, RHDC, CCPD, intergovernmental contributions and grants.

Completed projects as of FY22

P01 Parks Hike and Bike Trail

B03 Police Station Covered Parking

PK03 2022 Green Ribbon Project

Projects in progress as of FY23

B05 Law Enforcement Bldg. Improv.

P05 2023 Green Ribbon Median Improvements

P06 Kate Baker Park Improvements

P07 Creek Trail Park Improvements

PW Masonry Fence (transfer from W/WW fund)

Current capital leases paid out of the Capital Projects Fund (Annual Payment):

Fire Engine $73,539 New Ambulance $$66,000 Opticom System: $18,772

There are no personnel allocated to this fund.

Project details, funding sources, budget, and fiscal years active can be found in the 5-year CIP plan section.

Road and Streets Fund

Fund Summary

The Road and Streets Fund was established for the improvement and construction of roads and streets within the City. It is funded with a .375% sales tax. This is a restricted fund

Completed projects as of FY22 Projects in progress as of FY23

ST02-FY2022 Street Improvement Projects

ST03-Rufe Snow Reconstruction

ST04-FY23 Street Improvement Projects

Street projects for FY23 include construction of Dover Lane and Norton and design of Magnolia Park Drive

The Road and Street Fund has no personnel.

To view all past and current CIP projects you can click here: Street Projects

Vehicle Replacement Fund Fund Summary

The Vehicle Replacement Fund was established to account for the revenue generated by the sale of city vehicles, insurance claim reimbursements and the expenses related to the vehicle lease program.

The Enterprise Vehicle Lease program kicked off during the fiscal year 2022.

All city vehicles are included in this fund except for major equipment such as fire engines and ambulances that are accounted for in the fire department budget.

There is no personnel allocated to this fund. Revenues are derived from the sale of old city vehicles as they are replaced via leases. Starting in FY24, the General Fund and Water/Sewer fund and their respective departments will begin annual transfers into the Vehicle Replacement Fund to fund the capital lease payments. All lease payments are allocated to the respective department.

During FY22 a total of 17 new vehicles were acquired via leases from Enterprise.

ARPA Fund

Fund Summary

The ARPA Fund is used to account for the funds from the American Rescue Plan Act that the City of Richland Hills was awarded. The funds were received in the summer of 2021 and 2022. The funds were to be used for aging water insfrastructure, premium pay for essential employees during the 2020 pandemic and broadband expansion. This is a restricted fund.

ARPA funds are not recognized as revenue until funds are expensed. The City plans to expense all funds by the end of fiscal year 2023 and shows the revenue for budgeting purposes.

There are no personnel allocated to this fund.

Projects started in FY22

W2201-Water Line Improvments

Projects in progress as of FY23

W2201-Water Line Improvements (cont.)

Equipment-City Hall Emergency Generator Broadband Project

Premium Pay (1st disbursement)

Premium Pay (2nd disbursement)

Strategic Initiative Fund

Fund Summary

The Strategic Initiative Fund (SIF) was created under the direction of City Council during the FY23 Budget Workshop. This is a designated fund in which the excess General Fund balance is transferred to at the end of each fiscal year The concept is simple: each year, staff will evaluate the required 25% unassigned reserve and “sweep” the excess into the new fund. Projects cannot include Water/WW or Drainage.

Major Budget Items:

ERP Implementation $111,000, City Hall Improvements $50,000, Strategic Plan $30,000, Fire Administration Building Design $20,000, Comprehensive Plan Zoning Update $225,000, Council Chamber Upgrades $40,000, and Animal Services Parking $215,000

There are no personnel costs in this fund.

Fund Summary

The debt service fund is used to account for the revenue of property taxes levied by the City. The resources in the fund are used for payment of principal, interest and related costs on general longterm debt incurred by the City.

Debt Policies

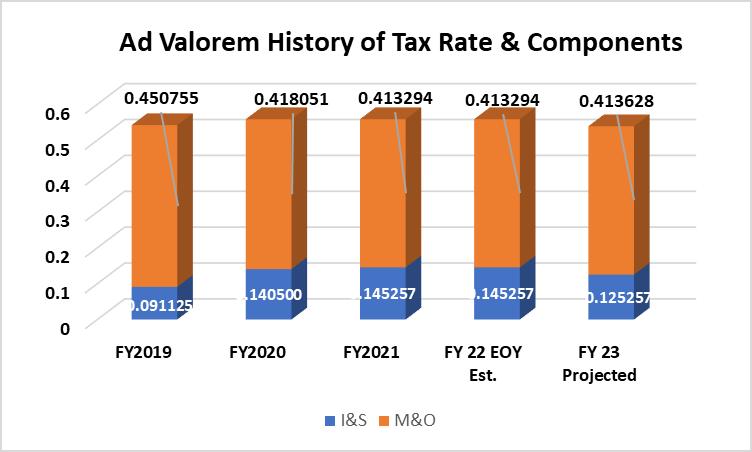

History of Ad Valorem Tax Rate and Components

Debt Service Graphs

Total Outstanding Debt

Debt Policies can be found in the City’s Financial Policy found in Appendix A

History of Ad Valorem Tax Rate and Components