1 minute read

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

DRAINAGE UTILITY FUND (FUND 022)

The City does not follow GAAP when budgeting for the Drainange Fund, however, the annual financial reports follow GAAP. Any net loss on the income statement is covered by fund balance.

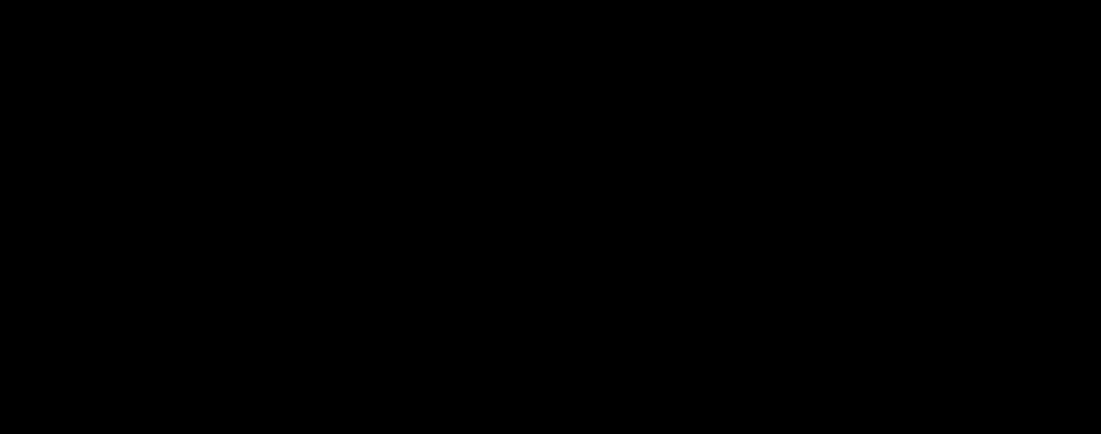

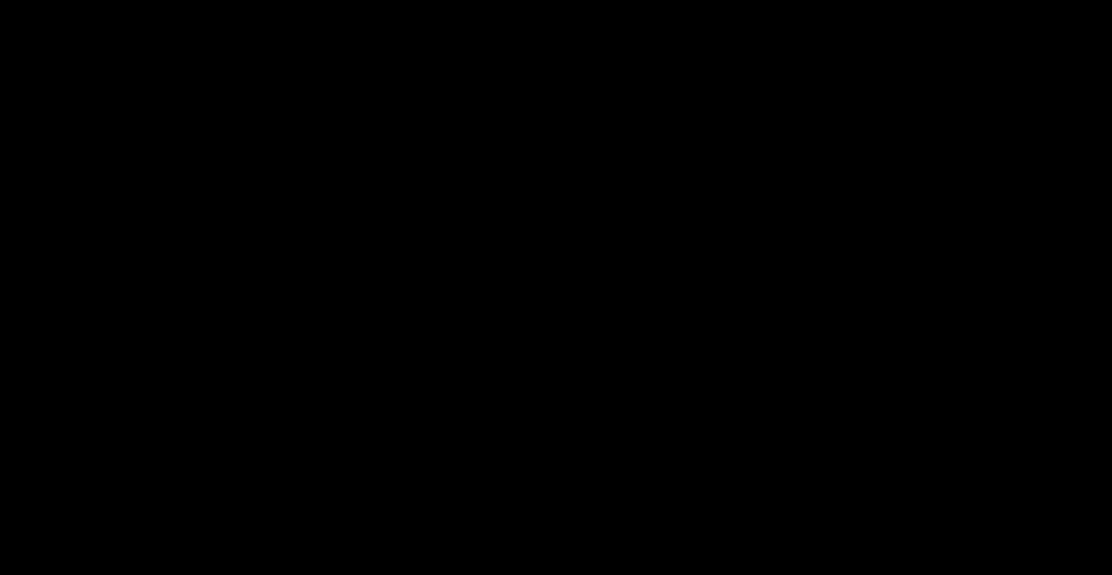

Debt

The Drainage Fund pays for its own debt service. The following tables show outstanding debt attributed to the Drainage Fund:

CITY OF RICHLAND HILLS, TEXAS

$5,730,000 Combination Tax & W/S Revenue Bonds, Series 2013 (DRAINAGE)

$2,865,000 Drainage Payments Remaining

100% Drainage Supported - FUND 022

Special Revenue Funds

The City of Richland Hills has several funds that are governmental funds and are classified as special revenue funds in the budget. The revenues for these funds are derived from restricted court fees, sales taxes, hotel/motel taxes and interfund transfers.

The following are Special Revenue Funds in the City’s budget:

Municipal Court Security Fund

Municipal Court Technology Fund

Richland Hills Development Corporation (RHDC)

Crime Control Prevention District Fund (CCPD)

Hotel/Motel Fund

Tax Increment Financing Fund (TIF)

Link Replacement Fund

Emergency Operations Management Fund

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

Municipal Court Security Fund

Fund Summary

The Municipal Court Security Fund is a restricted fund that is used to account for the security needs of the City of Richland Hills’ Court. Revenue is derived from citations and is kept in a restricted fund to be used only for court security expenses. This fund has no personnel costs.

Municipal Court Technology Fund

Fund Summary

The Municipal Court Technology Fund is a restricted fund that is used to account for the technology needs of the City of Richland Hills’ Court. Revenue is derived from citations and is kept in a restricted fund to be used only for court technology expenses. This fund has no personnel costs.