5 minute read

CITY OF RICHLAND HILLS BUDGET

The City of Richland Hills, Texas enjoys an unmatched location. It is located in the highly sought-after, “MidCities”, in the middle of Dallas and Fort Worth. Encompassing approximately 3.14 square miles in Northeast Tarrant County, the city borders the NE corner of Fort Worth, is less than 20 miles from DFW International Airport and less than 30 miles from downtown Dallas. The city fronts State Highway 183, State Highway 121 and State Highway 26. Easy access is provided to each via Interstate 820. Railroad access is currently available to the city's largest industrial park and commuter rail connects Richland Hills to downtown Fort Worth and Dallas. Very few other communities in the Metroplex can offer this combination of intermodal access to the Dallas/Fort Worth Metroplex.

Quality of life, economic development, and a safe community are some of the most important elements for the City of Richland Hills. During fiscal year 2022, two new townhome developments were approved by Council along Baker Boulevard, the City’s Tax Increment Fund or TIF. The Baker Landing Townhome development is a 69 unit single-family development. Another townhome project is RC51 Townhomes. This project will include 51 single-family homes in the TIF. These new housing developments will bring additional property tax and water/sewer revenues to the City, in addition to providing a much needed “face lift” to the boulevard.

Several new businesses made their start in the City during the past fiscal year, including a new health manufacturing company, locally owned Mexican restaurant, a new donut shop and a locally owned laundromat. The City prides itself on the small town feel with big city convenience.

Major businesses within the City of Richland Hills

Richland Hills is located within the Birdville Independent School District with one elementary school and one middle school serving Richland Hills residents.

Major Sources Of Revenue

Sales Tax Revenue Trends

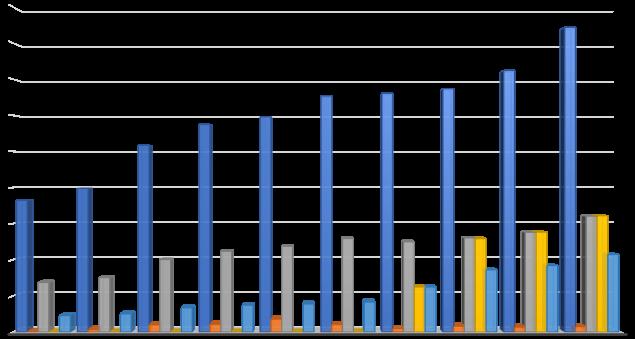

One major source of revenue for the City is sales tax. The city has a healthy sales tax base due to manufacturing, industrial and retail businesses within Richland Hills. Below is an illustration of sales tax revenue for all funds for the last ten fiscal years. It shows it broken down by fund with an average increase of 11% year over year:

Following are the General Fund sales tax revenue trends for the last 10 fiscal years:

Sales Tax

*FY22 are budgeted numbers

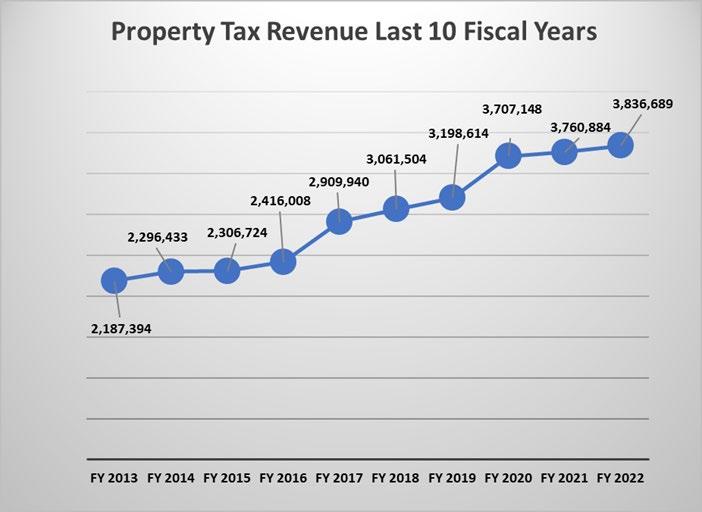

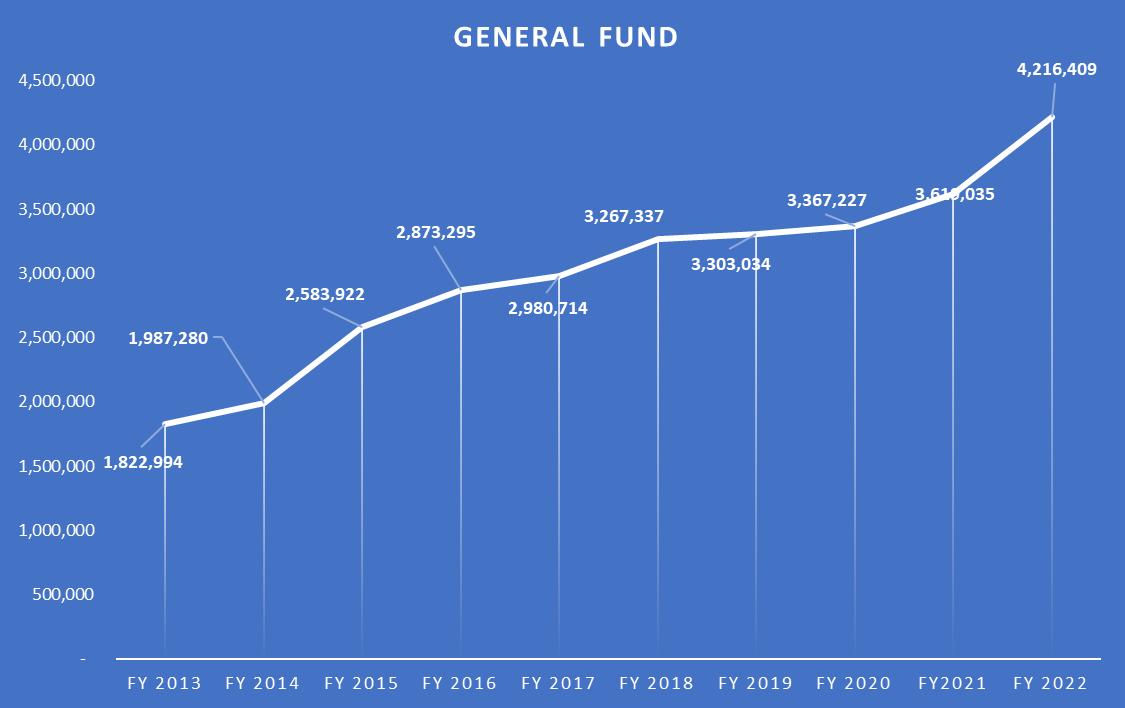

Property Tax Revenue Trends

Another major source of revenue is property tax. The City has experienced tremendous growth in its property tax valuation. Situated in the northern part of the State of Texas, Richland Hills, joins other Texas cities in popularity of migration to the city from other states. Below is the last 10 years of total property tax revenue and total General Fund revenue:

General Fund and Interest & Sinking Fund

*FY2022 are budgeted numbers

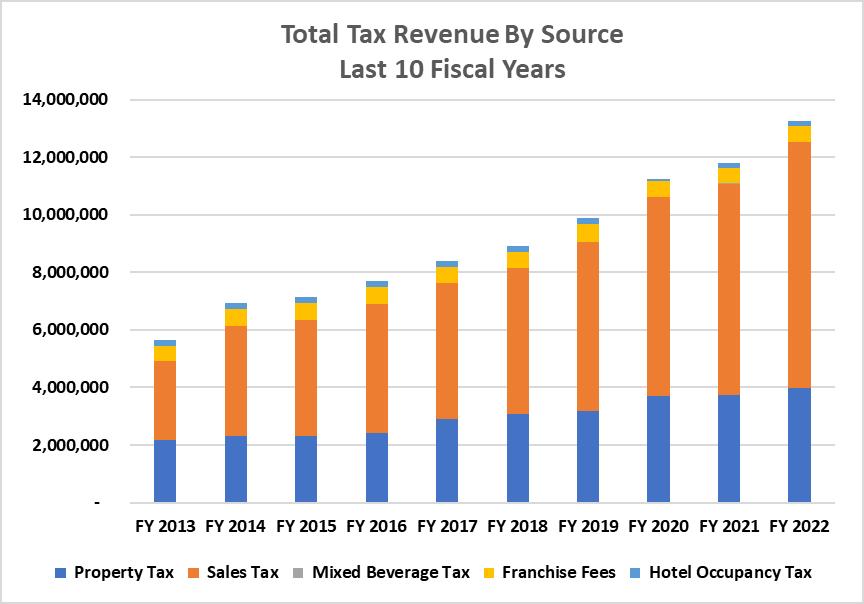

Other Sources of Revenue

Other sources of revenue for the city include mixed beverage taxes, franchise fees and hotel occupancy taxes. The table below lists the actuals for the last 10 fiscal years, along with budgeted numbers for EOFY 2022.

Long Term Financial Planning

City Council adopted the City’s financial policy that includes long term financial planning. This document serves as a guideline for budgeting and for managing the resources of the City. It is essential to keep focus on the long-term financial plan to monitor and adjust fiscal policies as needed and plan for needed capital and service demands. City staff prepares and updates this five-year financial plan annually in preparation for developing suggested budget policies for City Council consideration and to ensure alignment with City Council goals. It is intended to provide a frame of reference to help evaluate the City’s financial condition and help assess financial implications of current and proposed budgets, programs, and assumptions. The City’s official financial policy is included in the Appendices section. The financial policy includes a section on the Capital Improvement Program The Capital Improvements Program (CIP), a five-year plan, funds major capital improvements that will provide adequate infrastructure and facilities for new citizens and new business development.

Conclusion

As the City’s needs continue to grow, the focus remains on maintaining a long-range financial plan and managing the demand to the City’s operations The budget for fiscal year 2022-23 is committed to Council’s policy of preserving Richland Hills’ strong financial position by maintaining strong fund balances and reserves, recommending a balanced budget, maintaining current programs, and making decisions within the context of our long-range financial capacity and debt management plan. The Fiscal Year 2022-23 Annual Budget highlights the City’s commitment to meet and exceed the community’s highest priority expectations while continuing to meet its citizens’ needs at the lowest possible cost.

Visit Us

Information on the City’s finances, budget, debt, performance, and other items can be found on the web https://www.richlandhills.com/government/city-services/city-budget-finances

Learn more about our city by also visiting us at: Facebook: https://www.facebook.com/RichlandHillsCityHall/

CITY OF RICHLAND HILLS ANNUAL BUDGET

VISION & VALUES

In Richland Hills, our vision and values encompass Service, Teamwork, Integrity, and Respect = S.T.I.R.

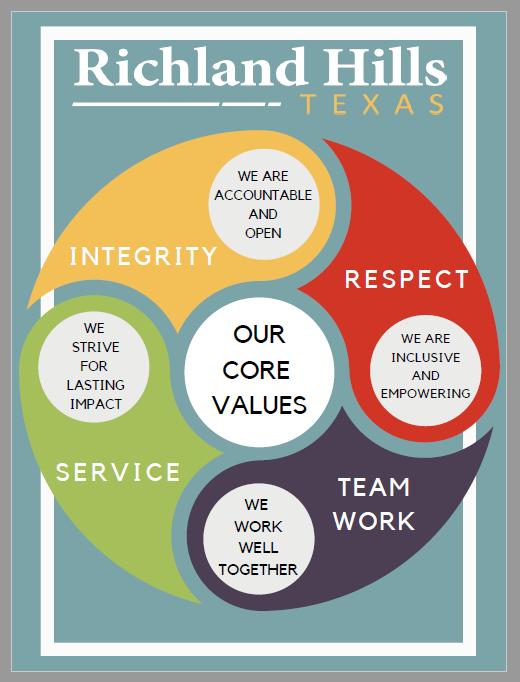

BUDGET PROCESS & CALENDAR

The City’s budget is a complex document and represents the culmination of months of preparation and discussion among Council, City Manager, Director of Finance and Administration Services, and the departments regarding the best ways to provide services to the community at the greatest value. This budget was developed to be consistent with the City’s high performing philosophy, which strives to simultaneously deliver high product and service quality, outstanding customer value and sound financial performance. City departments worked very closely with the Finance Department to draft a budget that fit within revenue expectations and key departmental goals.

As required by the City’s Charter, the proposed budget was provided to the city council by July 30th. Concurrently, copies of the proposed budget are made available to the public on the City’s website and on file at the City Secretary’s Office. The City Council considers the proposed budget and provides public hearings where public input regarding the budget programs and financial impact is heard.

The budget is formally adopted by the City Council during the regular City Council meeting in September. The budget goes into effect on October 1.

Budget Key Dates

Performance Measurement

The management of the City of Richland Hills believes that it is important to not only plan for and provide adequate levels of quality service, but to also provide a means of measuring and reporting the result of its efforts. The Finance Department provides monthly reports that discuss how each department is performing which ultimately can determine the value of programs and opportunities for improvements.

Due to the nature and complex operation of each department, it is next to impossible to provide a single or even a few statistical measures. However, funding comparisons provide a broad view of changes in level of service for the departments. Past year accomplishments and current FY23 Objectives are clearly stated in each department’s section.

Budget Overview

An overview of the Annual Budget is presented in a series of tables, charts and graphs designed to give the reader an overall understanding of the budget.

Fund Structure

Combined Budget Summary

Fund Summaries

Revenues, Expenditures and Fund Balances

Where the Money Comes From – By Revenue Type

Where the Money Comes From – By Fund Type

Where the Money Goes – By Fund Type

Where the Money Goes – By Function

Property Tax Valuation and Tax Rates

Major Revenues

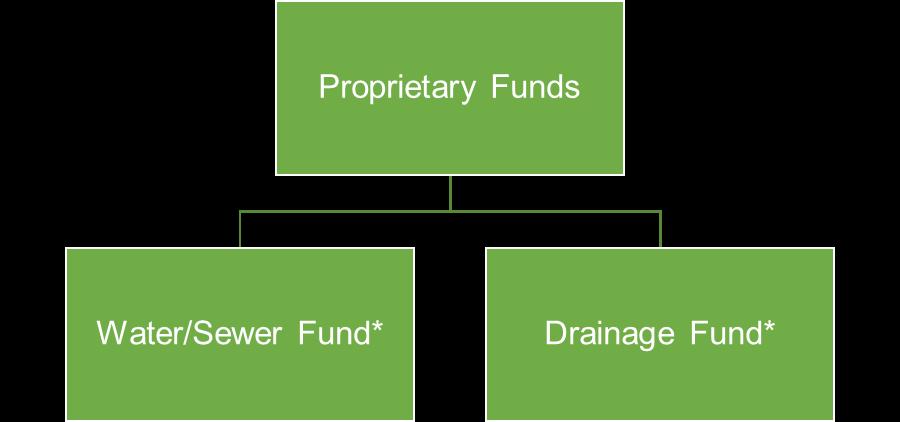

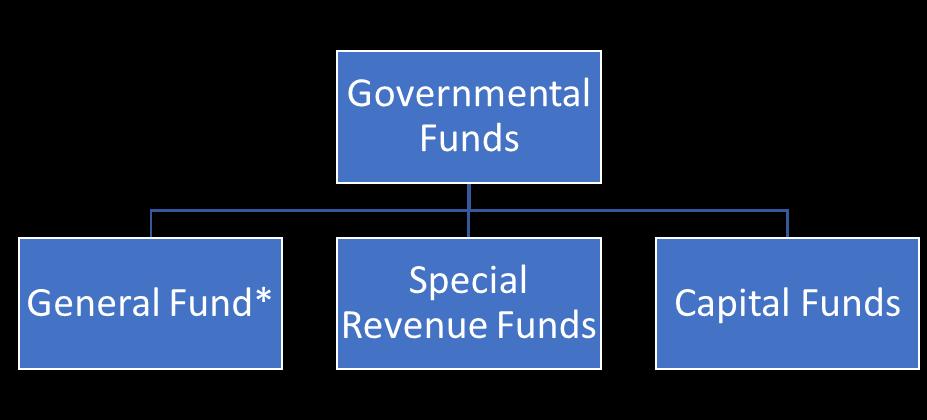

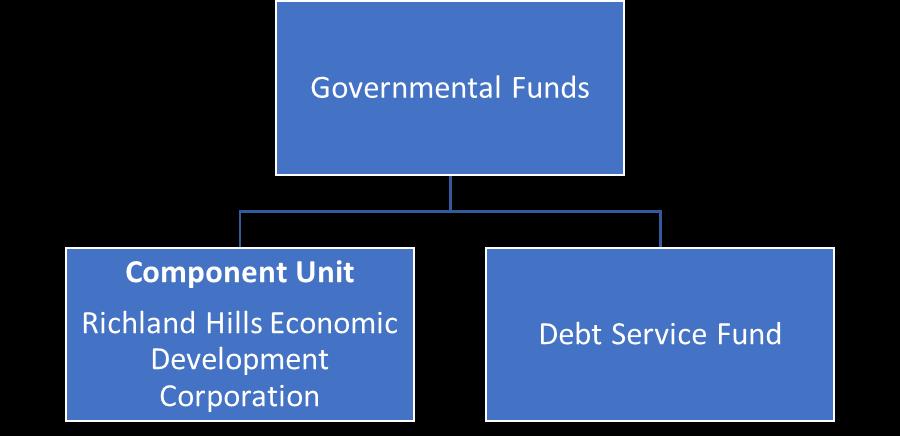

Fund Structure

• Court Security Fund

• Court Technology Fund

• Crime Control District Fund*

• Hotel Occupancy Tax Fund

• KRHB Fund

• Tax Increment Fund

• LINK Operations Fund

• LINK Replacement Fund

• Emergency Mgmt. Fund

• Oil & Gas Fund

•Capital Projects Fund*

•Road & Street Fund*

•Vehicle Replacement Fund

•ARPA Fund

•Strategic Initiative Fund

April

*Indicates major fund, all others considered non-major funds

Governmental funds use the modified accrual form of accounting, while Enterprise Funds are full accrual funds.

COMBINED BUDGET SUMMARY-ALL FUNDS

Funds Subject To Appropriation

All funds, both governmental and proprietary, are subject to appropriation. The City's financial policy requires a 25% reserve on expenditures for the General Fund and 90 days for the Water and Wastewater Fund. The fund balances for General Fund and Water and Wastewater Fund for FY 2022-23 are estimated to be $2,659,203 and $3,364,218 respectively. The unassigned fund balance for General Fund and Water and Wastewater Fund are $2,659,203 and $3,364,218. All projected changes in fund balances are considered as normal.