1 minute read

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23 CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

CITY OF RICHLAND HILLS - CRIME CONTROL DISTRICT FUND (FUND 065)

Major Budget Items: A transfer out to the Capital Projects Fund for the Law Enforcement Center improvements $50,000, Flock Camera Grant Lease match $12,200, and Breaching/Shields Equipment $31,925.

*Public Information Officer/Asst. to the CM is budgeted in both the CMO budget and the CCPD The number of sworn positions in CCPD did not increase

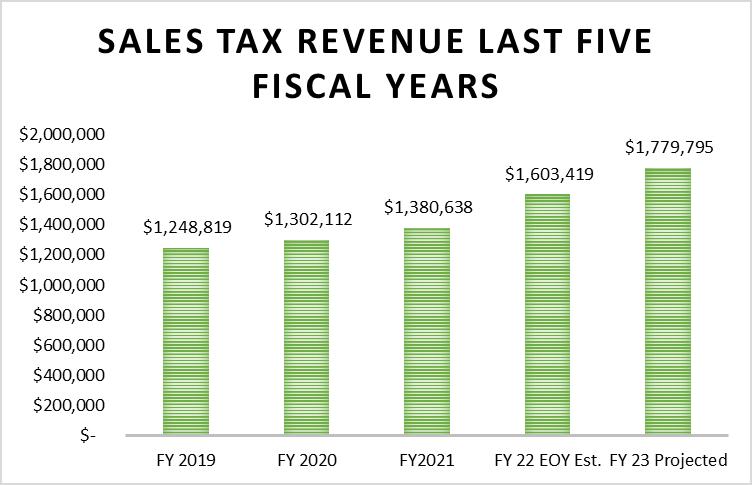

Below is the sales tax revenue history and projections for FY 23 for the CCPD:

HOTEL/MOTEL FUND Fund Summary

The Hotel/Motel Fund accounts for the proceeds of a 7 percent hotel occupancy tax and expenditures related tourism.

There is only one FTE employee in the Hotel/Motel Fund. Costs of this position are shared with the General Fund while the fund builds up enough resources to fully fund this full-time position.

The Hotel/Motel Fund pays its own debt service derived from the hotel occupancy tax revenues. This fund shares the debt service with the RHDC fund. The following is the fund’s debt service schedule:

CITY OF RICHLAND HILLS, TEXAS

$4,705,000 Combination Tax and Revenue Bonds, Series 2016 (Hotel Occupancy Tax) $1,465,000 - Hotel Occupancy Tax Revenue Supported Annual

Total outstanding debt for Hotel/Motel Fund is $1,436,484

TAX INCREMENT FUND (TIF)

Fund Summary

The Tax Increment Fund or TIF is used to account for the receipts of the Baker Boulevard TIF zone and the green ribbon and intersection projects. In 2009 the City of Richland Hills established a Tax Increment Refinancing Zone (TIRZ) along the Baker Boulevard corridor. The purpose of the TIRZ is to dedicate the incremental tax increases generated within the Zone to the public improvements required to improve the appearance and accelerate economic development within the Zone.