12 minute read

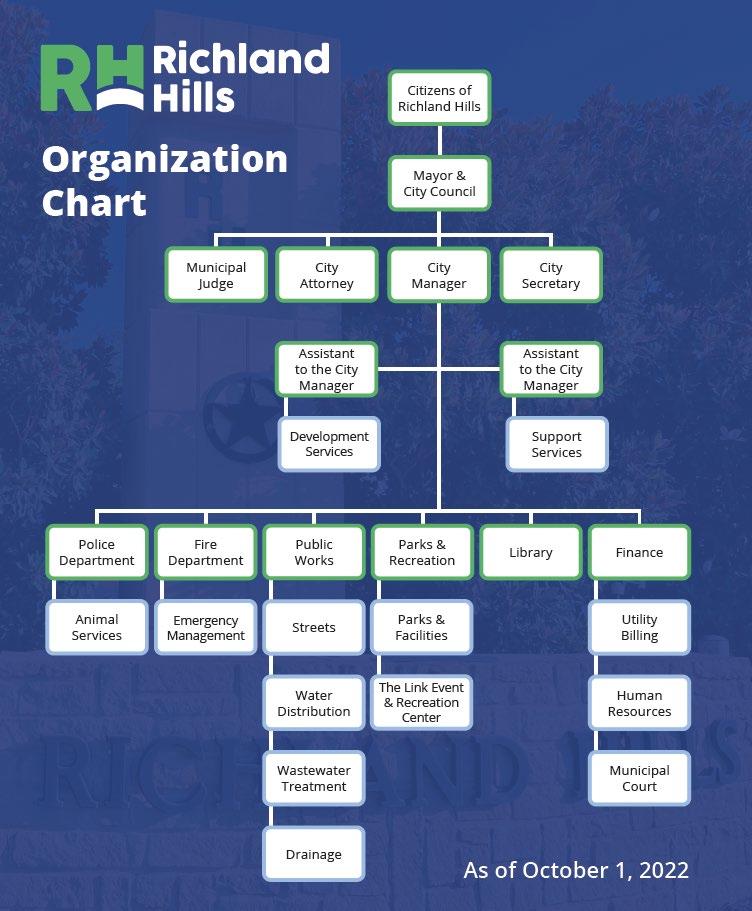

ORGANIZATIONAL STRUCTURE

Budget Introduction

An introduction to the Adopted Annual Budget is presented in a series of narrative sections designed to give the reader relevant information regarding the City of Richland Hills’ budget process and fiscal environment.

City Manager’s Budget Message

Budget Summary

Financial Assessment

Goals and Strategies

Core Values

Budget Process and Calendar

City Manager’s Budget Message

September 27, 2022

To the Honorable Mayor, City Council and Citizens of Richland Hills, When we started the budget process in April, the goal was to develop a budget that maintained the City’s strong financial position, addressed strategic goals and priorities, and supported quality service delivery for ongoing programs and services. I am pleased to present a budget that touches on all these initiatives and continues to advance our community forward through strategic, thoughtful development.

The FY 2023 budget represents a collaboration between our elected officials, city staff and citizens. Public input was sought throughout the process beginning with a budget public forum in January, during the Council budget workshop in April and thru the four (4) budget discussions and public hearings held in August and September. We appreciate everyone who took the time to share their thoughts and ideas on the proposed FY 2023 budget. City Council also guided the development of the budget by expressing their goals and priorities for the coming year. The message was clear that City Council wanted this budget to prioritize infrastructure improvements, economic development, strategic capital investments, community engagement and workforce development.

Infrastructure Improvements

Routine maintenance and replacement of public infrastructure – streets, water, wastewater, and storm drain – has been a long-term goal for the City. In November 2018, Richland Hills voters approved a 3/8 cent sales tax dedicated to the repair, replacement and maintenance of municipal streets and sidewalks. The sales tax was reauthorized by the voters in May 2022 demonstrating the citizens’ desire for continued progress on street improvements Since the inception of the sales tax, ten (10) streets have been reconstructed including necessary upgrades to underground utilities.

The FY 2023 budget includes funding for three (3) more street improvement projects:

• Reconstruction of Dover Lane, including water and storm drain improvements, from Scruggs Drive to Vance Road

• Design and reconstruction of Norton Drive from Richland Road to Evergreen Road

• Design of Magnolia Park Drive, including water, sewer and storm drain improvements, from Rosebud Lane to Mimosa Park Drive

With an estimated annual collection of $1.3 million, the Street Improvement Fund will support ongoing street replacement efforts for years to come. Future street projects are selected during the annual budget process based on street and underground utility conditions as identified on previous pavement and water/wastewater assessment reports.

In addition to street improvements, the FY 2023 budget will make significant contributions to upgrading City water infrastructure. With funds received through the American Rescue Plan Act, the City will spend $1.5 million dollars to add auxiliary power to well sites. This will enable the City of Richland Hills to provide water service to customers in the event power is lost at these sites. The improvements also bring the City’s water system into compliance with Texas Senate Bill 3 which requires water providers to maintain 20 psi system wide and the ability to provide a minimum of 24-hours of redundant power in the event of an electric grid failure.

The FY 2023 budget also includes implementation of an Advanced Metering Infrastructure System (AMI) to replace the City’s mechanical water meters. With the new Advanced Metering System, water meter accuracy will increase, apparent water losses will decrease and the need for staff to manually read meters should be nearly eliminated. In addition, the new software system will create better tracking of actual water usage and make billing more consistent. Funding in the amount of $2,406,753 is included in the Utility Fund for the AMI project.

Economic Development

The main goal of economic development is to improve the economic well-being and quality of life in a community. When the local economy is strong, more jobs are generated, poverty decreases, tax bases increase, public services expand and quality of life improves. With this in mind, the City Council has placed a strong emphasis on economic development now and into the future. In FY 2023 the City will be initiating two (2) key planning projects.

The first project is a focused development plan for the Glenview Drive corridor. Glenview Drive is one of the City’s primary commercial corridors and a major thoroughfare connector for the region. In 2022, the City was awarded funding from Tarrant County to complete road improvements on Glenview Drive that would enhance mobility and connectivity. The Glenview Drive Corridor Master Plan will expand on the proposed road improvements by providing a strategy to create a marketbased revitalization plan within the corridor.

The second initiative is an update of the City’s Comprehensive Plan which was adopted in 2014. A comprehensive plan is a long-range planning document that expresses the overarching vision, goals, objectives, policies and strategies for the future development, growth, and preservation of a community. It allows a community to be proactive to issues and changes over time and provides the overall foundation for land use regulations. Comprehensive Plans should be updated every 10 years and more frequently if a community is experiencing significant economic, social, or demographic changes. An updated Comprehensive Plan will incorporate the most current population, economic and financial trends affecting the City to guide future development.

Capital Investments

The City Council understands the strong correlation between economic growth and quality public facilities. The FY 2023 budget provides the necessary funding to complete several capital improvement projects including:

• Renovations to the Animal Services Center

• Continued implementation of the parks master plan

• Improvements at City Hall, Richland Hills Public Library, Law Enforcement Center and The Link Event and Recreation Center

• Construction of a masonry fence at the Public Works facility

• Completion of a space needs assessment and design for future use of the Public Works facility and Fire Administration Building

• Expansion of broadband at city parks and facilities

Implementation of a new ERP system

With over $2.3 million dollars dedicated to capital improvements in FY 2023, the City is continuing its efforts to provide excellent facilities and services that enhance the quality of life in Richland Hills.

Community Engagement

A top focus area for the City is enhancing communication and engagement with the community. The FY 2023 budget supports several initiatives aimed at increasing communication and engagement for both residents and businesses. Over the course of the year, the City will be launching a new community brand, upgrading its website platform, creating a digital monthly newsletter, increasing communication using multiple channels and offering quarterly business networking opportunities. The City will also be hosting its first State of the City meeting to highlight past accomplishments and discuss priorities for the upcoming year.

One of the most significant community engagement initiatives the City will implement this year is its citizen survey. A citizen survey is used to gain residents’ perspectives on local issues such as quality of life, development/growth, services provided by the City and future priorities by asking residents to:

• prioritize the City services and benefits they care about most

• rate current services and benefits provided by the City

Results from the citizen survey will be used to refine the City’s comprehensive master plan, evaluate future projects, and shape the City’s annual budget.

Workforce Development

The services provided to the community are only as strong as the people providing the service. With a declining workforce and increased competition in the labor market, the City is doing a number of things in FY 2023 to attract and retain a qualified workforce Starting October 1, 2022, non-emergency city services will move to a compressed work schedule offering most employees a 4-day work week. The City will also be conducting a market survey to ensure our salaries and benefits are currently aligned with the City’s adopted compensation strategy. The FY 2023 budget provides for an increase in public safety salaries and offers certification pay for qualifying employees. The budget also supports staff training and development and the City’s tuition reimbursement program.

Conclusion

The FY 2023 adopted budget has been developed in adherence to the City’s established financial principles and with the City’s strategic goals in mind. It prioritizes infrastructure improvements and capital investments. It implements initiatives to provide for long-term planning and financial sustainability. It emphasizes the importance of communication and community engagement. It addresses employee compensation and benefits to ensure that Richland Hills continues to be an employer of choice. The staff looks forward to the new fiscal year and all the opportunities that it provides.

Sincerely,

Candice Edmondson

Budget Priorities

The priority for this fiscal year has been to maintain quality service while observing prudent spending practices and providing employees with an equitable compensation plan. The following highlights for the upcoming year that will help us accomplish this are:

• A balanced budget, with total revenues equal to or greater than total expenditures

• Property tax rate reduction from $0.558551 to $0.538885 cents per $100 assessed value

• Total City budget $28 million

• General Fund budget $8.7 million

• Increased and sustained funding for facilities improvements

• Increased and sustained funding for employee compensation

• Budgeted supplemental funding of $1.6 million ($248,960 for 3 new positions and certification pay, $1.4 million for one-time costs) to accommodate citywide departmental needs and operating impacts from Capital Improvement Program

Service Level Changes

Despite the ongoing challenges due to the pandemic and supply chain issues, the City’s property tax base and sales tax revenues continue to be strong, and this budget is presented with no material service reductions. Overall, services have been maintained, and in some instances, expanded, while reducing the property tax rate from $0.558551 to $0.538885 cents per $100 of property valuation. Examples of service level increases include the addition of a full-time custodian, a parks maintenance technician, and an assistant to the City Manager in charge of IT and communications. The budget funds a total of 94 full-time equivalent (FTE) positions, a 5% cost of living adjustment for general government employees, market adjustments and step increases for sworn personnel, and significant funding for increased infrastructure maintenance. Most of these staffing and service level increases are to meet the demands of our growing population, operational impact due to capital projects and the city’s vibrant growing economy.

Pension Plan

Texas Municipal Retirement System: The city is required to contribute to the Texas Municipal Retirement System (TMRS). Effective January 1, 2023, the city’s new monthly contribution rate will be 16.40%, an increase from the current rate of 16.36%.

Major Operating Budget Items

The total budget for all funds is $28 million. As illustrated by the data below, personnel costs are a major budget item for the City of Richland Hills. As a local government, the city is a service business which is highly dependent on personnel to deliver services to the public Major budget items include:

Changes Between Proposed Budget And Adopted Budget

The major changes between the general fund proposed budget and general fund adopted budget were increases in salaries for public safety to keep up with the changing climate in public safety salary costs in the Metroplex (Dallas-Ft. Worth). There were also some costs that were finalized for insurance coverage from the City’s carrier, Texas Municipal League, that came in after the proposed budget was presented. The total cost difference was a $317,864 increase. Other funds changed as follows: Enterprise Fund proposed to adopted increased by $1,261 due to adjustments to the new certification pay costs, the Crime Control District Fund had a change of $4,232 mainly due to certification pay adjustments The TIF fund had an increase to the budget of $90,000 due to the addition of backlit street sign program along Baker Blvd. The Road & Street Fund had an increase of $40,000 from the proposed to final budget due to finalized costs for several street projects.

The ARPA fund had a decrease from proposed to final in the amount of $171,768 due to finalized EOY projections; and the Strategic Initiative Fund had an increase of $215,000 in the adopted budget due to the addition of the Animal Shelter Parking Lot Project. All other funds remained unchanged.

Financial Program

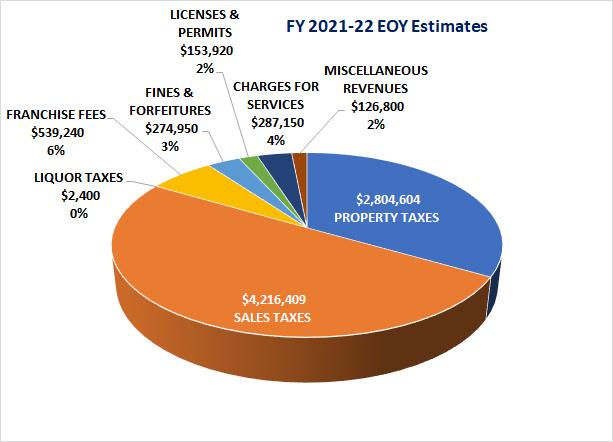

Total Combined Revenues: The total combined revenue budget for fiscal year 2022-23 totals $26,330,571 which is a $4.7 million or 22% increase from the prior fiscal year and is due in large part to higher property tax and sales tax revenues, multi-year capital projects, which include their remaining life-to-date funding in the prior year (EOY) and only new funding in the current year’s budget and funding from the American Rescue Plan.

Revenues

Total Combined Expenditures: The total combined expenditure budget for fiscal year 2022-23 totals $28,024,449, which is a $8,870,981 or 46% increase from the prior fiscal year and is due to budgeting of capital expenditures from the American Rescue Plan Funds and the newly created Strategic Initiative Fund. This total also includes multi-year capital projects which are due for completion in FY2023. Expenditures are budgeted to be $1,693,878 more than revenues, primarily due to use of unassigned fund balance for capital projects. Operating budgets are balanced for fiscal year 2022-23.

Additional information on these budgeted numbers can be found in the individual funds’ page summary.

*General Fund expenditures do not include transfers to other funds from fund balance.

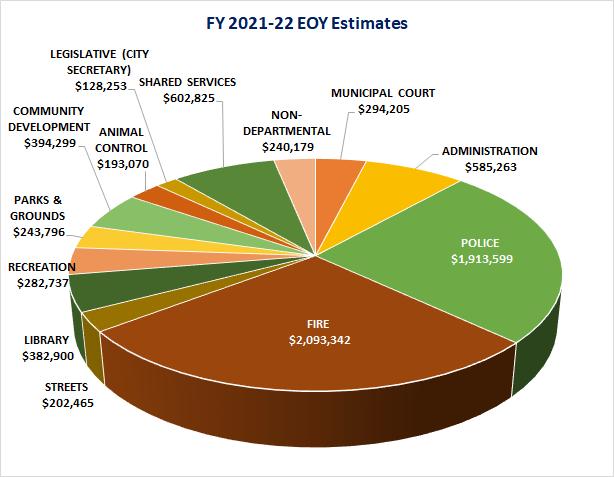

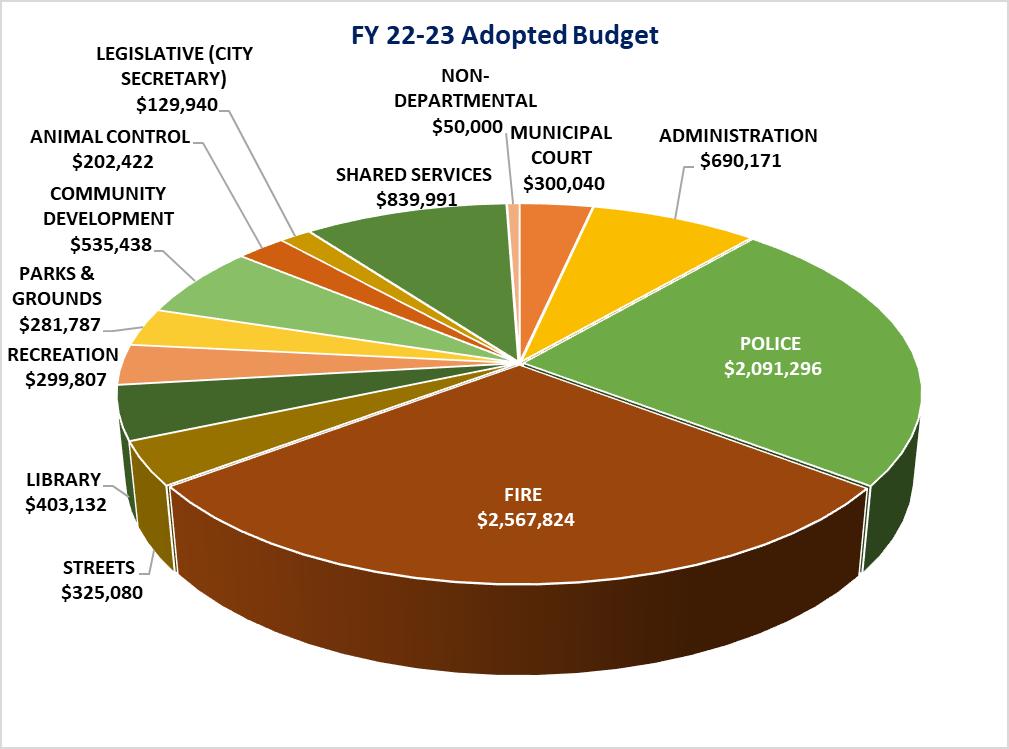

Expenditures

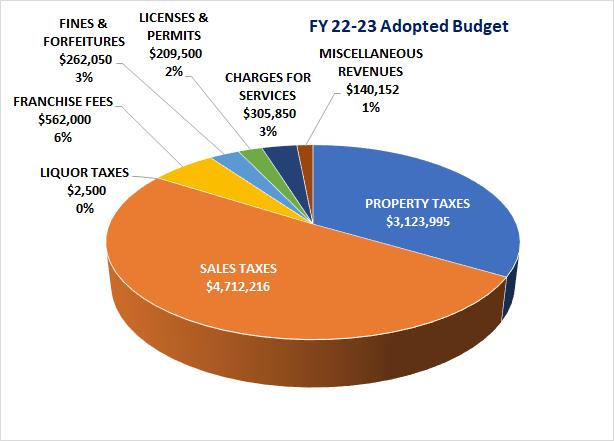

General Fund Revenues: General Fund revenues for fiscal year 2022-23 are expected to total $9,318,263, an 11% increase from last fiscal year primarily due to growth in property tax and sales tax base. More details can be found in the General Fund section.

General Fund Expenditures: The General Fund is the general operating fund of the City. General Fund expenditures for fiscal year 2022-23 are projected to be $8,716,929, which is a 15% increase from last fiscal year 2022 end of year estimates. The overall increase is primarily due to several personnel vacancies in the Streets and Community Development departments, as well as a 5% salary increase in FY23.

*General Fund expenditures do not include transfers to other funds from fund balance.

Property Tax

General Fund property tax revenues for fiscal year 2022-23 are forecasted to total $3,123,995, an 11% increase over prior fiscal year (EOY), due to growth in the assessed property valuation. According to the Tarrant Appraisal District, the 2022 certified taxable value for the City of Richland Hills is $791,107,294. This represents an 11% increase in valuation over the 2021 certified taxable value. The overall property tax rate was decreased from $0.558551 to $0.538885 cents per $100 of property valuation.

Sales and Use Tax

General Fund sales & use tax revenues for fiscal year 2022-23 are forecasted to total $4,712,216, an increase of 12% over the prior fiscal year (EOY).

The City imposes a local sales tax of 2% on all retail sales, leases, rentals of most goods, as well as taxable services. Out of the 2%, 1% is for general purposes.

The Richland Hills Development Corporation recognizes 25% of sales tax as revenue, with the Crime Control District receiving another 0.37% and lastly, 0.37% going to the Road & Street Improvement Fund.

Water and Sewer Fund

The Water & Sewer Fund expenses for fiscal year 2022-23 are projected to be $6,880,544, a 65% increase over fiscal year 2022 EOY estimates. This is primarily due to a major project that is set to commence during FY 23. The water meter replacement project was approved by Council during FY 2021-22 as a much-needed improvement to the City's water metering system. This water meter replacement project will cost approximately $2.4 million. More details on the Water and Sewer Fund can be found in that fund's summary page.

Water and sewer rates will remain the same and no rate increases are planned for next fiscal year.

Drainage Fund

The Drainage fund expenses are forecasted to be $929,714, a 10.8% decrease over FY22 EOY. This is primarily due to a capital equipment purchase during FY 22

No major drainage capital projects are projected for FY 2022-23 from this fund.

Capital Projects Fund

The Capital Improvement Program (CIP) is an indication of the City’s priority to fund capital projects, ensuring Richland Hills will be positioned to meet the demands of its population and economic investment in our community. The CIP project expenditures for fiscal year 2022-23 are projected to be over $8,461,141 and are expected to exceed $5 million over the next 5 years. Project funding will address such areas as street improvements, repairing and replacing aging water and sewer infrastructure, a city-wide water meter replacement program, and continued improvement of our parks. More information, including listing of CIP projects can be found in the Capital Projects section.

Strategic Initiative Fund

The Strategic Initiative Fund is a newly created fund during fiscal year 2022-23. Council approved the creation of this fund to designate General Fund balance reserves in excess of the City required fund balance level and using them for one-time expenditures, for one time projects, such as infrastructure improvements, strategic planning, technology and capital acquisition.

The Strategic Initiative Fund (SIF), is a part of the Capital Improvements Program. Several projects are slated to be funded from the SIF such as, City Hall improvements, a new City wide ERP system and re-design of the old fire administration building amongst others. Total project expenditures are projected to be $691,000 during FY 23.

ARPA Fund

The ARPA Fund was established during FY 2021 to manage and record revenues received via the American Rescue Plan Act. Several projects were approved by Council during FY21 that aligned with the ARPA funding goals such as water infrastructure improvements, premium pay for essential employees during the pandemic and broadband projects amongst others. Total project appropriation during FY 23 is $1,596,773.