16 minute read

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

COMBINED BUDGET SUMMARY-ALL FUNDS

Fund Summaries

Major Governmental Funds

General Fund is the operating fund of the City. This fund is used to account for all financial resources not accounted for in other funds.

Debt Service Fund is used to account for the accumulation of financial resources for the payment of principal, interest and related costs on general long-term debt paid from taxes levied by the City.

Capital Projects Fund is used to account for the acquisition or construction of streets, facilities and other infrastructure projects being financed from general obligation bond proceeds, grants, impact fees, or transfers from other funds.

NON-MAJOR - Other Governmental Funds is a summarization of all non-major governmental funds and consists of Special Revenue funds, Richland Hills Development Corp., and Other Governmental Funds.

COMBINED SUMMARY OF REVENUES AND EXPENDITURES AND CHANGES IN FUND BALANCE

Fiscal Year 2022-23 Annual Budget (with Comparisons to 2021-22 Budget, 2020-21 & 2019-20 Actual)

Funds

*Adjustments are transfers out from fund balance

CITY OF RICHLAND HILLS ANNUAL BUDGET FY2022-23

Combined

SUMMARY OF REVENUES AND EXPENDITURES AND CHANGES IN FUND BALANCE

Fiscal Year 2022-23 Annual Budget (with Comparisons to 2021-22 Budget, 2020-21 & 2019-20 Actual)

*Adjustments are transfers out from fund balance

Major Proprietary Funds

Water and Sewer Fund is used to account for the operations of the water and sewer system.

Drainage Fund is used to account for the operations of the drainage system.

REVENUES, EXPENDITURES & CHANGES IN FUND BALANCES

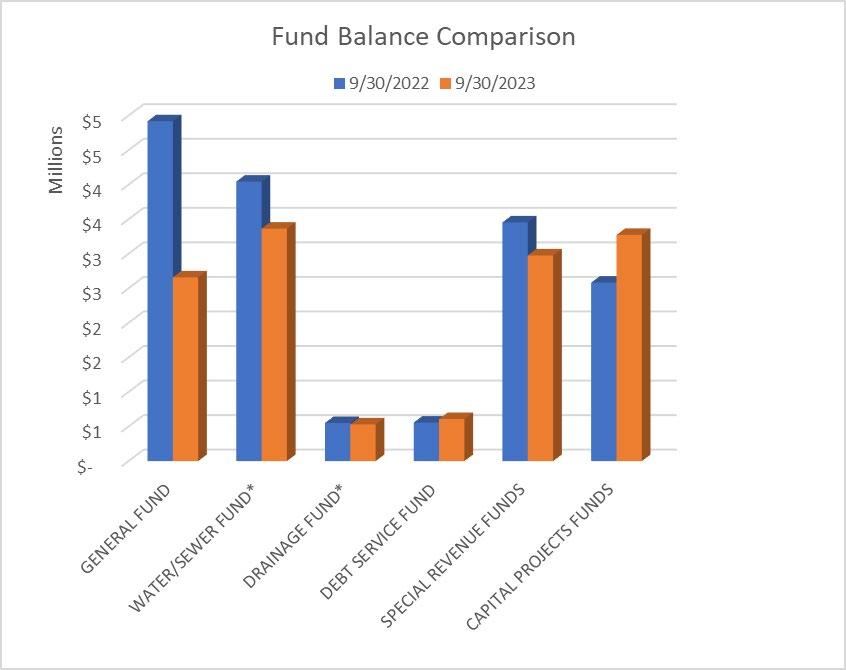

Changes in Fund Balance

General Fund- Management’s intention is to keep the fund balance above the reserve requirement of 25%. This fiscal year, Council approved a one-time transfer of $2.4M out of this fund balance into the newly created Strategic Initiative Fund. The $2.4M transfer out will not affect the minimum reserve requirement balance in the General Fund. More information is available in the individual fund descriptions.

Water/Sewer Fund- Council approved a transfer out from the Water/Sewer Fund balance in the amount of $1M to fund the water meter replacement project scheduled this fiscal year. Management strives to keep 90 days reserve in this fund as per City policy. This one time, transfer from fund balance, will not affect that requirement as this fund has more than 90 days cash in reserves.

Drainage Fund- slight decrease and no major expenses budgeted from this fund. This fund does have debt service payments budgeted.

Debt Service Fund- slight increase to the fund balance based on higher property tax collections for FY23.

Special Revenue Funds- a decrease in fund balance due to transfers out for capital projects in FY23.

Capital Projects Funds- increase in fund balances due to transfers in, mainly from general fund for the Strategic Initiative Fund However, as capital projects are completed, the fund balance will decrease significantly.

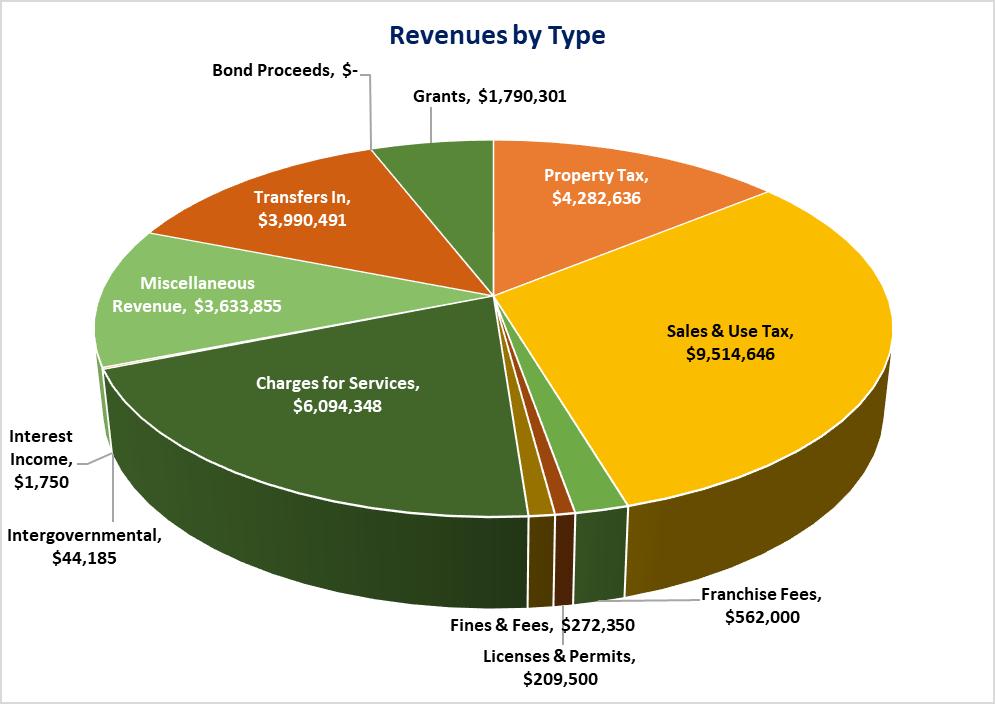

WHERE THE MONEY COMES FROM - BY REVENUE TYPE

FY2022-23 Total Revenues $30,396,062

Changes in Major Revenue Type

Property taxes and Sales and Use Taxes present an upward trend with the continued increase in property tax valuations and major sales tax payers within the City. More information regarding revenue trends can be found in each funds’ description section.

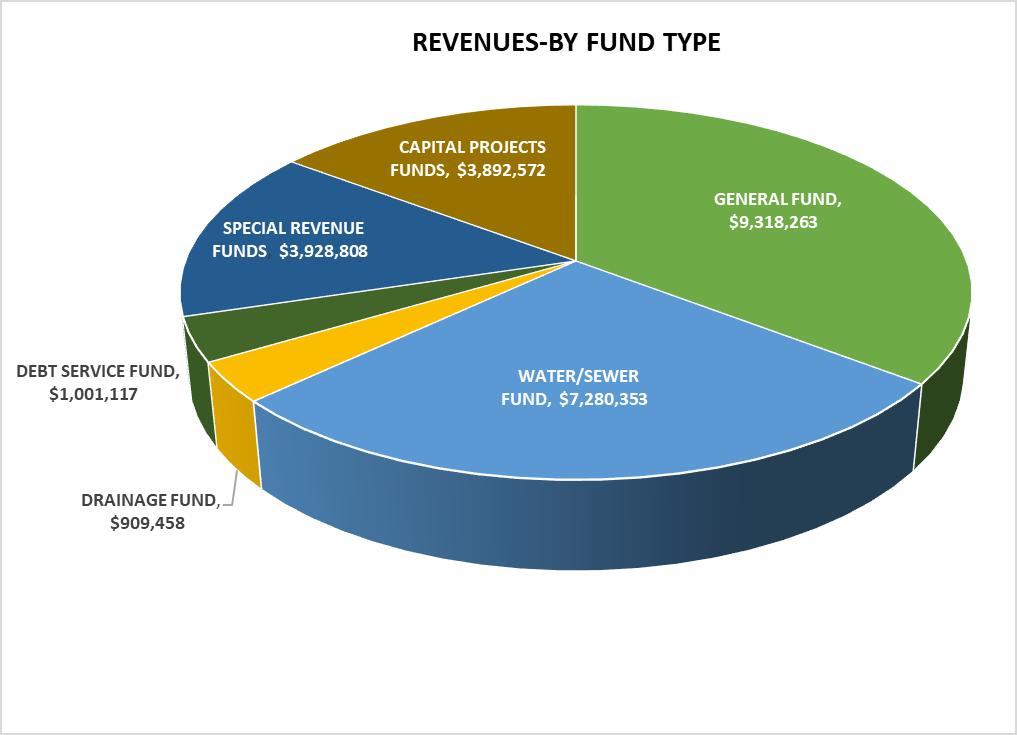

WHERE THE MONEY COMES FROM - BY FUND TYPE

Changes in Major Fund Type

**Total excludes transfers in/out

General Fund is the City’s operating fund. This fund provides a broad spectrum of programs and critical public safety services, such as police and fire. In addition, it provides funding for parks and recreation, public works and administrative services. Most of the revenue is obtained from property taxes and sales taxes. The 11% growth is due to an increase in property tax revenues and sales tax revenues.

Water/Sewer Fund provides water and sewer services to the city. Most of the revenues are obtained via charges for services. The 43% revenue increase is due to a $1,000,000 transfer in from fund balance for the Water Meter Replacement Project approved by Council.

Drainage Fund is for drainage fees collected through a customer’s water bill. The drainage fund provides funding for the maintenance of the City’s drainage system and for major capital items as necessary. The change is negligible.

Debt Service Fund is used to collect property taxes and to pay the City’s debt service relating to Certificate of Obligations, General Obligation Bonds and Tax Notes and any debt secured by property tax revenues. There is a slight decrease in revenues due to a lowered tax rate and lowered I&S rate. The rate was lowered to $0.125257 from $0.145257.

Capital Projects Funds are funds used to account for all major capital improvements that are financed by the City’s general obligation bonds, revenue bonds, intergovernmental grants, transfers from other funds and other designated resources. The 51% increase in revenues is due to an increase in transfers from other funds including, ARPA funding, the new Strategic Initiative Fund transfer in and remaining life-to-date budgets that were rolled over from the prior fiscal year. Funds include the Road & Street Fund, Oil & Gas Fund and others.

Special Revenue Funds include the Richland Hills Development Corporation (RHDC), Hotel/Motel Occupancy Tax fund, Crime Control District Fund (CCPD), Tax Increment Fund and others. The 8% increase is mostly due to an increase in sales tax revenue projections for the RHDC and CCPD Funds.

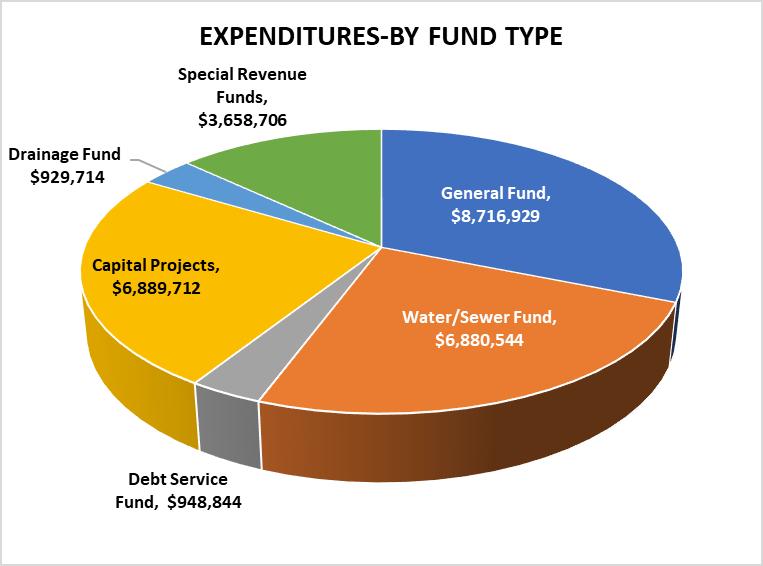

WHERE THE MONEY GOES - BY FUND TYPE

**Total excludes transfers in/out

Changes in Major Fund Type

General Fund – Expenditures increased by 15% due to increased personnel costs. A 5% COLA increase was approved for all civilian employees, and a three STEP pay increase was approved for sworn public safety personnel to keep up with market pay. In addition, there is a 3% medical insurance increase and several increases in supplies due to inflation.

Water/Sewer Fund – The 65% increase in this fund is due to the water meter replacement project which is budgeted to cost $2.4 million. This project is partly funded with the $1 million transfer from fund balance and the rest is financing via private lending. This fund also approved a 5% COLA increase and there are increased costs to supplies due to inflation.

Drainage Fund has a 10% decrease in expenses due to the lack of capital purchases this fiscal year.

Debt Service Fund has a 3% increase in expenditures due to an increase in debt service payments over last fiscal year. No new debt was issued last fiscal year.

Capital Projects Funds are funds used to account for all major capital improvements. Capital Funds include the Road & Street Fund, Oil & Gas Fund and others. Total increase is 167% over FY22 due to the continuation of ARPA funded water line improvements and the Strategic Initiative Fund projects. More information on these projects is available in the fund descriptions in the Capital Funds section.

Special Revenue Funds include the Richland Hills Development Corporation (RHDC), Hotel/Motel Occupancy Tax fund, Crime Control District Fund (CCPD), Tax Increment Funds (TIF) and others. The 26% increase over last fiscal year is due to transfers out for capital projects from RHDC, CCPD and TIF funds. More information on these projects is available in the fund descriptions in the Special Revenue Funds section.

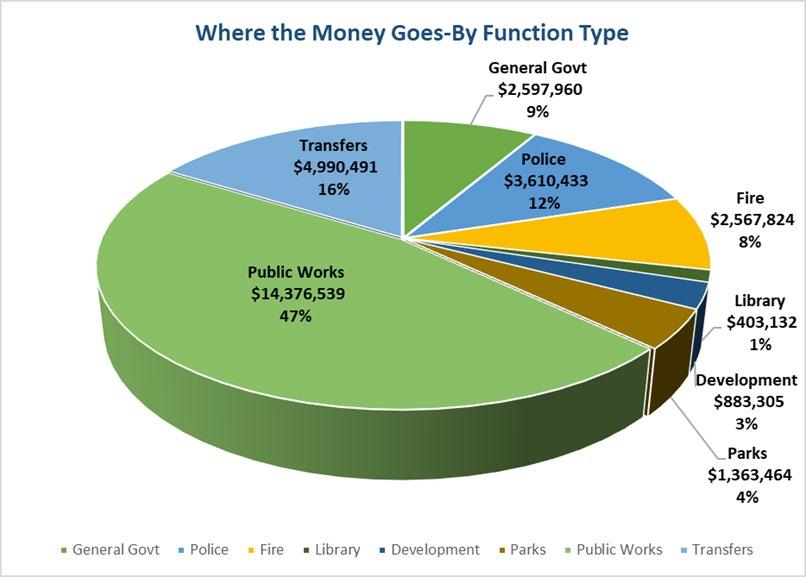

WHERE THE MONEY GOES - BY FUNCTION

*Transfers total includes $1M transfer in from Enterprise Fund Balance (excludes Debt Service)

Changes in Major Functions

General Government- the increase in this function is mainly due to salary increases, where civilians received 5% increase, the addition of one position in the administration department (Assistant to the City Manager) that is split with two other funds, a Full Time Custodian, that is a shared expense with the Link Fund, and general increase in operations costs due to inflation.

Police - this includes the Crime Control District expenditures, and the increase is mainly due to increases in personnel costs. An increase of approximately 15% was budgeted for sworn officers to keep up with market pay in the Dallas-Fort Worth area. The rest are normal inflationary increases in operational costs.

Fire - Sworn personnel were allotted an approximate 15% increase in salaries to keep up with market pay in the Dallas-Fort Worth area. The rest are normal inflationary increases in operational costs.

Library – this department received a 5% salary increase along with general government employees. Development – this function includes the RHDC fund’s costs along with the Community Development department. The 47% increase is mainly due to personnel vacancies in FY 22 and the addition of a Parks Maintenance Technician position that is shared with the Parks department.

Parks – the 12% increase is mostly due to the new Parks Maintenance Technician that is shared with the RHDC. It is also due to the 5% increase in pay to civilian employees.

Public Works - the large increase of 107% is due to the following:

• the creation of the Strategic Initiative Fund which includes funding for several capital projects

• water line improvements funded with ARPA funds

• continuation of capital projects that are carried over from FY22 which include street improvements and parks projects

• the water meter replacement program that was approved during FY22 and will be complete during FY23.

Transfers – During FY23, Council approved a transfer out from the General Fund to the newly created Strategic Initiative Fund (SIF) in the amount of $2.4 million. This is a result of an initiative by City Council to take excess, unreserved fund balance in the General Fund and utilize it in the new SIF fund for one-time expenses. It allows for excess funds to work as one time revenue to fund needed projects and avoid borrowing money for these projects. These projects can include such items as capital acquisition, community enhancements, infrastructure maintenance, renovations, and technology. The 506% increase over FY22 also includes transfers out from CCPD, RHDC and the Water/Sewer Fund for additional capital projects.

The pie chart shows the totals, and percentage of grand totals, by function The table below summarizes each function.

*Transfers total includes $1M transfer in from Enterprise Fund Balance

Major Revenue Sources

Major revenue sources, assumptions and trend analysis for all funds are provided in the following pages. The revenues in aggregate can be found in the Fund Summaries and the Revenues by Type pages.

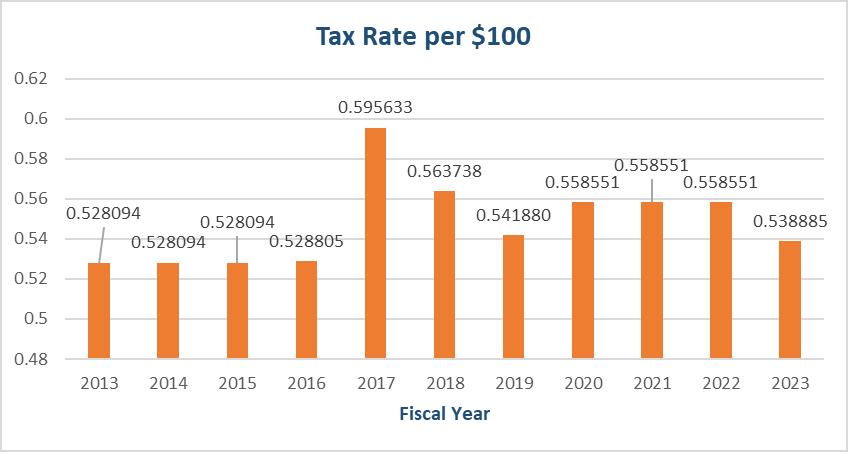

Property Tax

The City’s property tax is levied based on appraised value of property as determined by the Tarrant Appraisal District. The Tarrant County Tax Assessor bills and collects the property taxes for the city.

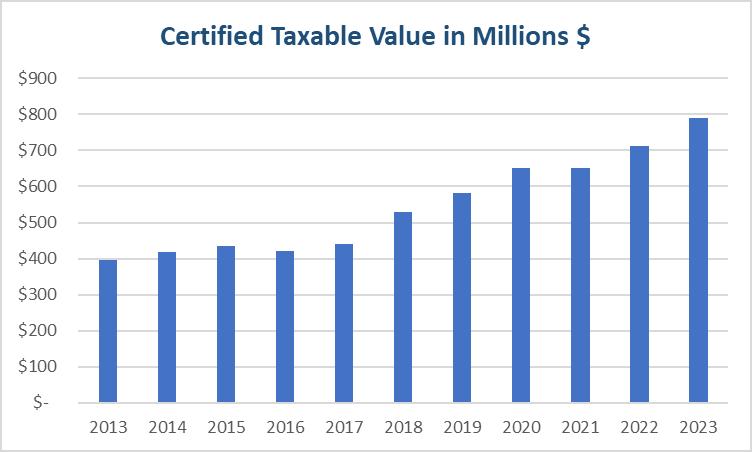

The property tax rate for fiscal year 2022-2023 is $0.538885 per $100 assessed valuation, which consists of $0.413628 for operating and maintenance costs recorded in the General Fund and Tax Increment Fund (TIF) and $0.125257 to fund principal and interest payments on bond indebtedness recorded in the Debt Service Fund. The property tax rate is two cents lower that the fiscal year 2021-2022 rate of $0.558551. Historical rates and valuations are shown in the previous page.

Outlook

Total property tax revenues are projected to increase over the prior year by $319,391 or 11% primarily because of an 11% increase in certified values and new properties added, according to the certified tax roll from the Tarrant appraisal district. The outlook for future years is positive as more properties are built due to the two townhome developments currently in progress along with an increase in area certified values. Property taxes account for 34% of the City’s total revenue.

Major Influences

Factors affecting property tax revenues include population, development, property value, tax rate and tax assessor appraisal

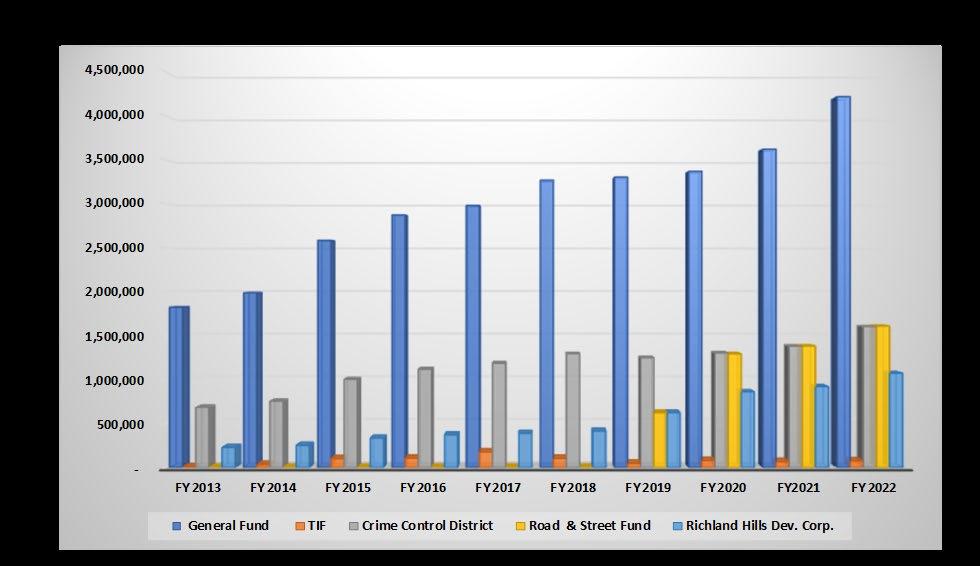

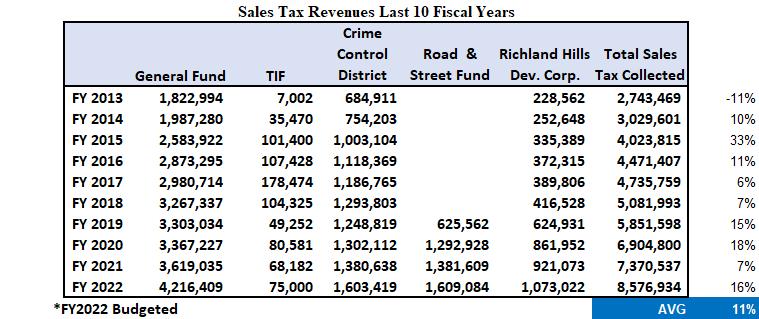

SALES AND USE TAX

The total sales tax collected in the City of Richland Hills is 8.25%. The City receives 2% of sales tax with the following allocations: 0.25% is allocated to the Richland Hills Development Corporation, 0.37% is allocated to the Crime Control Prevention District and 0.37% goes to the Street and Road Improvement Fund.

The city imposes a local hotel occupancy tax of 7 percent of the cost of a hotel room. The state hotel occupancy tax rate is 6 percent.

Outlook

Sales and use tax revenues are projected to increase over the prior year by $495,807 or 12% because of increased sales in the industrial and commercial sectors within the City. Sales and use taxes account for 31% of the City’s total revenue. Growth is anticipated to continue in future years.

Major Influences

Factors affecting sales & use tax revenues include manufacturing, retail sales, economy, and consumer price index.

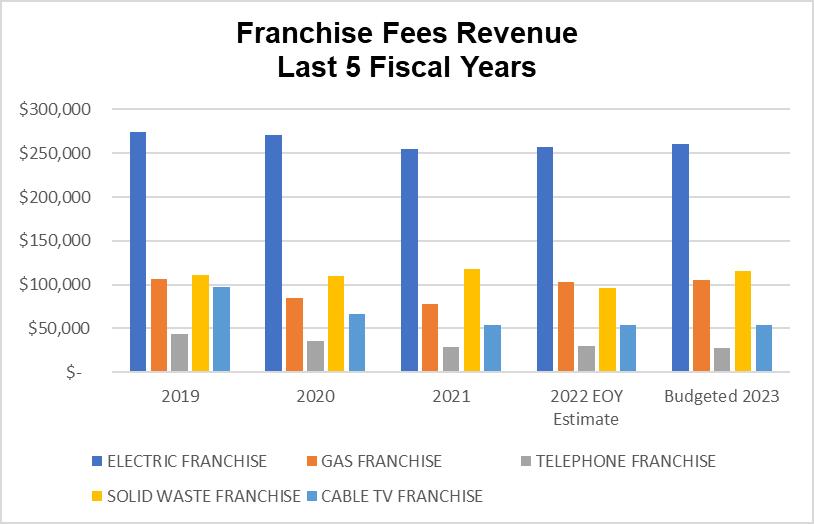

Franchise Fees

The City imposes a 5% franchise fee on utility companies for rights-of-way use. These include gas, electricity, telephone, and cable television. The City collects an 8% solid waste franchise fee from the current solid waste provider.

Outlook

Franchise fees revenues are projected to remain stable for the foreseeable future and are dependent on each utility company’s annual gross revenues. Franchise fees account for 2% of the total City’s revenues.

Major Influences

Factors affecting franchise fees include population, utility gross sales, rate of charges and weather fluctuations, which affect electricity, gas, cable tv and solid waste revenues.

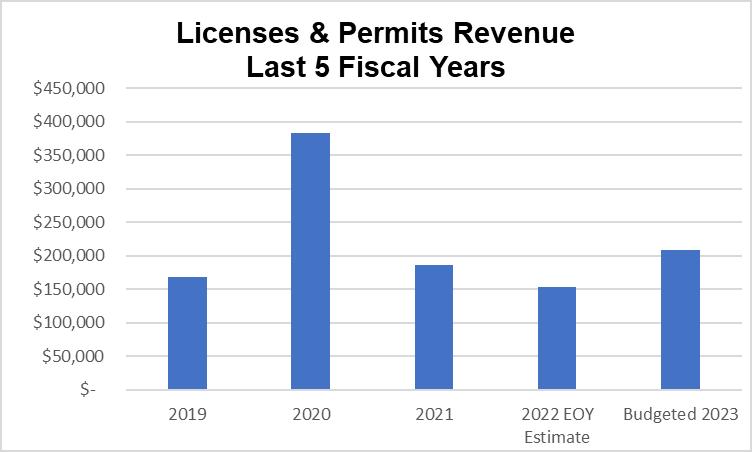

Licenses And Permits

Licenses and permits are required of any business or person conducting certain activities within the city.

Major licenses and permits include building permits, fire code permits, building registration fees and electrical permits.

Outlook

Licenses and permits account for 0.8% of the total revenues for the City of Richland Hills. The highest year for permits revenues, occurred in FY 2020 when an elementary school was built. The City anticipates an increase in building permits beginning in FY 2023 due to the two townhome developments that are slated to start construction in the latter part of the fiscal year.

Major Influences

Factors affecting licenses and permits revenues include population, development, construction, rate of charges and other activities.

Fines And Fees

Fines and fees include traffic and non-traffic fines, warrants, arrest fees, library fees, animal control fees and the school crossing guard fees used to pay for the crossing guard at the local elementary school.

Outlook

Fines and fees account for 1% of total City revenues. Total revenues from fines and fees are budgeted to be lower by 4.9% due to a decrease in traffic fines. During fiscal year 2019 and 2020, there were more traffic citations issued than in subsequent years.

Major Influences

Major factors affecting fees are population and traffic activities.

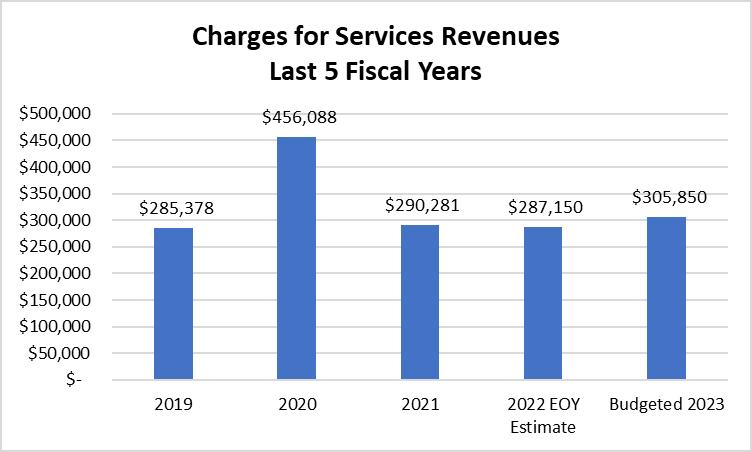

Charges For Services

Charges for services in governmental funds include all charges for services provided by the City such as ambulance, reports, animal vaccinations, and other miscellaneous charges. Charges for services account for 1.16% of total city revenues.

Outlook

Revenue from charges for services in budgeted to increase by 7% mainly due to an increase in EMS fees and a small grant that is projected to be received during FY23.

Major Influences

Factors affecting revenues in this section are rate of charges, EMS runs, population and general activity levels.

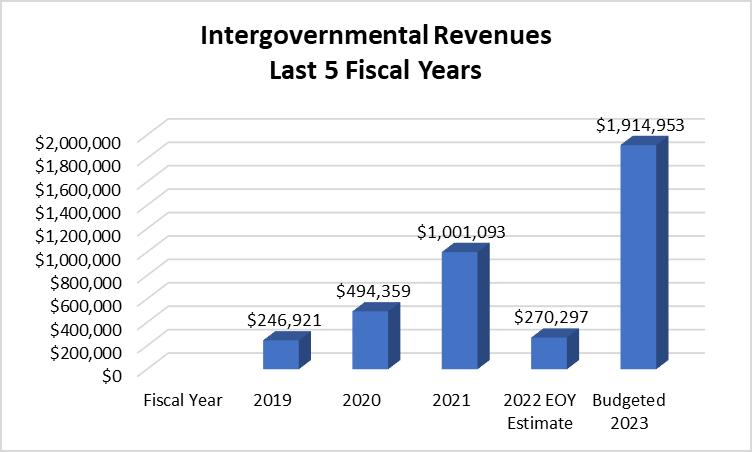

Intergovernmental

Intergovernmental revenues are grants from other governmental entities. The City receives grants for public safety, including the school resource officer, bullet proof vest grant, STEP traffic grant and community development projects, as well as federal grants, such as the ARPA grant. Revenues are recorded in various funds.

Outlook

Total intergovernmental revenues are projected to be $1.9 million during FY23. This is mostly due to the ARPA funds that were received during FY 21 and FY 22 and will be expensed and recorded as revenue during fiscal

2023. The ARPA grant is slated to cover water infrastructure and broadband projects, amongst other approved uses. Intergovernmental revenue accounts for 11% of the total City revenue during FY 23. This amount will vary from year to year based on available resources.

Major Influences

Major factors affecting grants are availability, as well as funding from the different granting agencies.

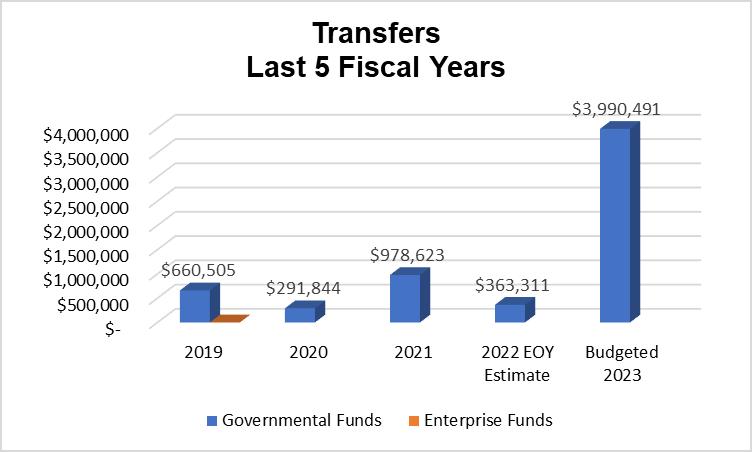

Transfers

Transfers are transactions between funds of the primary government. They are repayments from the funds responsible for the expenditures to the funds that initially paid for them. These repayments can include general and administrative fees, capital replacements, facility improvements/renovations, debt service requirements, grant matches, and subsidies for capital projects.

Outlook

Total transfer revenues are projected to be $3,990,491 for fiscal 2023. This includes the $2.4 million transfer from the General Fund to the new Strategic Initiative Fund. More information about this fund can be found in that fund’s section in the budget. The rest of the transfers include transfers into the Capital Projects funds to fund the Law Enforcement Center remodel, the annual Link operations fund transfer, parks, and community projects as well as a transfer from the Water/Sewer fund for a masonry fence around the public works building in the amount of $80,000. The increase in transfers this fiscal year is due mainly to carryover of CIP projects from the previous fiscal year, the ARPA transfer for the commencement of the water line project, and the creation of the new Strategic Initiative Fund.

Major Influences

Factors affecting transfers are capital projects, debt, and rates of charges.

The General Fund is the general operating fund of the City of Richland Hills. This fund provides for a variety of programs and critical services such as police, fire, library, parks and recreation, streets department, municipal court, animal control and administrative services.

The General Fund derives most of its revenue from property taxes and sales and use taxes along with other miscellaneous revenue described below.

Fund Description and Summary

Statement of Revenues and Expenditures

Overview of Revenues and Expenditures

General Fund Departments

General Fund Description And Summary

Fund Summary

The General Fund is the main fund of the city and is used to account for all revenues and expenditures not accounted for in other designated funds It receives a varied amount of revenues, and it finances a wider range of governmental activities than any other fund. The General Fund is primarily supported by property tax, sales & use tax, franchise fees, license and permit fees, and court fines. General Fund expenditures support the following major functions of the City: public safety, community development, public works, parks, library, and administration.

Statement of General Fund Revenues

Fiscal Year 2022 End of Year Financial Performance

The FY22 Adopted Budget compared to the EOY estimate shows an overall positive change in the amount of $735,413 or an 11% increase in budgeted revenue vs. EOY estimates. This is mostly due to an increase in sales tax revenues collected during the year, which exceeded budgeted revenues by $716,409. The increase in sales tax revenues is mostly due to commercial and industrial sales within the City. Sales tax forecasting for FY23 is equally positive with budgeted sales tax revenue and projections to increase by 12%. The industrial and commercial sales tax collections continue to rise year over year due to the construction industry and especially where electrical and plumbing suppliers are concerned.

Fiscal Year 2023 Budget

For the Fiscal Year 2023, total revenues for the General Fund are budgeted at $8.4 million. That is an increase of 11% over FY22 end of year estimates. The main reason for the increase is an increase of 11% in certified property values and a projected 12% increase in sales tax revenue.

Statement of General Fund Expenditures

Fiscal Year 2022 End of Year Financial Performance

End of Year (EOY) estimates for the General Fund Expenditures are 3.5% higher than the original budgeted numbers. This is mostly due to the increase in overtime hours in public safety and an extra pay period that had to be accrued to FY22. General fund balance remains strong at year end at $4,918,360 which represents 65% of estimated expenditures. Current City policy requires a 25% fund balance.

Fiscal Year 2023 Budgeted Expenditures

For the FY 2023, the total budgeted expenditures are $ 8,716,929 or a 15% increase in expenditures as compared to FY 2022. The main budgetary items are a 5% salary increase to all civilian personnel and a 15% increase and adjustment to the STEP plan to all sworn public safety to keep the City competitive for public safety salaries as compared to surrounding cities. The General Fund also created three new positions for FY23:

Assistant to City Manager Dept. 12 Administration (funding shared with Water/Sewer Fund)

Parks Maintenance Tech Dept. 19 Parks Grounds (funding shared with RHDC)

Full time Custodian Dept. 30 Shared Services (funding shared with LINK Fund)

Transfers out to other funds total $2,860,491 are due to the creation of the new Strategic Initiative Fund ($2.4M) and other transfers out as shown below:

Fund balances at the end of FY2023 are projected to be $2,659,203 or 31% of budgeted expenditures. This is well above the 25% requirement per city policy.

General Fund Departments

MUNICIPAL COURT

ADMINISTRATION

POLICE

FIRE

STREETS

LIBRARY

PARKS AND RECREATION

PARKS - GROUNDS

COMMUNITY DEVELOPMENT

ANIMAL CONTROL

LEGISLATIVE

SHARED SERVICES

Mission Statement

The mission of the Richland Hills Municipal Court is to provide equal and impartial justice under the law; and to ensure that all defendants are treated in a professional, courteous, and efficient manner.

FY 2021-2022 Accomplishments

Collected $406,931 in fines/court costs

Filed 2,274 new cases; disposed 2,475 cases

Issued 1,828 warrants; cleared 1,404 warrants

Transitioned court operations from a remote environment back to an in-person environment

Eliminated the backlog of cases due to COVID-19

All required training completed by staff

Completed destruction of closed cases filed prior to October 2021

Significantly reduced collection cases by age purging, dismissing, and re-working cases

FY 2022-2023 Objectives

Implement Tyler Payments merchant processing and reducing credit card fee expense

All staff to complete required training

Marshal to complete warrant audit

The Administration department consists of the City Manager’s Office (CMO), Human Resources and the Finance department Mission statements for each of the departments are below. Goals and accomplishments and staffing grids are presented as a whole department

Mission Statement-City Manager’s Office

The City Manager serves under the direction of the City Council and is responsible for making recommendations to the Council regarding programs and policies and developing methods to ensure an effective and efficient operation of City services. The City Manager’s Office is responsible for the following core services:

• Facilitate good governance and provide strategic leadership to the municipal organization

• Ensure a strong and sustainable financial condition for the City

• Promote citizen involvement and governmental transparency

• Develop a high performance organization

• Create an employee value proposition that supports the City's mission and strategic goals

Mission Statement-Human Resources

The City of Richland Hills Human Resources department is deeply committed to providing quality services to the community; creating a culture of professionalism, respect, dignity, and trust; and promoting honesty, integrity, commitment, and teamwork.

Mission Statement-Finance Department

The mission of the Finance department is to maintain the financial integrity of the City and to provide sound financial management and policies to internal as well as external customers and residents of the City of Richland Hills.

Director of Finance and Administration Svcs

Accounts Payable Tech (P/T)

Administration

FY 2021-2022 Accomplishments

Successfully completed the implementation of new STEP program for sworn public safety personnel

Successfully completed the new implementation of new pay plan for non-sworn personnel

Awarded the Government Finance Officers Association (GFOA) “Certificate for Excellence in Financial Reporting” for the 11th consecutive year

Achieved an unmodified (“clean”) opinion on the financial statements and single audit

Implemented 50/50 benefits match for all dependent health insurance plans

Maintained over 25% of fund balances in all funds

Implemented and deployed “Employee Navigator” self-service portal for employees’ onboarding, open enrollments and updating employees’ files

Begin design of new City website

Begin City branding project

FY 2022-2023 Objectives

Conduct new compensation plan study

Issue RFP for new City-wide software (ERP)

Begin implementation of new City-wide software (ERP)

Award new bank depository contract to increase investment revenues

Compile a comprehensive budget book/document and publish to the web

Submit new budget book to GFOA for award

Receive a “clean” audit for FY 2022

Maintain high level of financial reporting to obtain the GFOA award for “Excellence in Financial Reporting” for FY 2022

Maximize the City’s return on investments in accordance with adopted investment policies

Complete City branding project and complete implementation

Complete and implement new city website design