1 minute read

RICHLAND HILLS COMMUNITY DEVELOPMENT FUND

Fund Summary

The Richland Hills Community Development Fund or RHDC, is a blended component unit of the City. It is a type B Economic Development Corporation. The residents of Richland Hills voted to create this community development fund by allocating .25% of the 2% sales tax received by the City on June 28, 1996. This sales tax revenue is used to promote infrastructure improvements, parks and park facilities and economic development within the City and the State of Texas in order to eliminate unemployment and underemployment and to promote and encourage employment and the public welfare of, for and on behalf of the City by developing, implementing, providing, and financing projects. Operation of the Corporation is funded by .125 percent sales tax approved by the voters. The sales tax was increased to .25 percent effective April 2019.

The Richland Hills Community Development Corporation does not have any full-time employees; however, the fund does contribute towards personnel costs on a cost allocation basis for the following positions: City Manager, Assistant to the City Manager-Development Services, and Parks Maintenance Technician I.

Major Budget Items for the fund: $75,000 for the Glenview Drive Corridor Master Plan and the personnel costs of the new Parks Maintenance Technician in the amount of 50% of costs ($29,453) shared with the General Fund and carry over $640,000 from FY22 for various parks projects and an additional $360,000 for the continuation of the Parks Master Plan Projects.

*Completed Projects Funding to FY2023 shown above

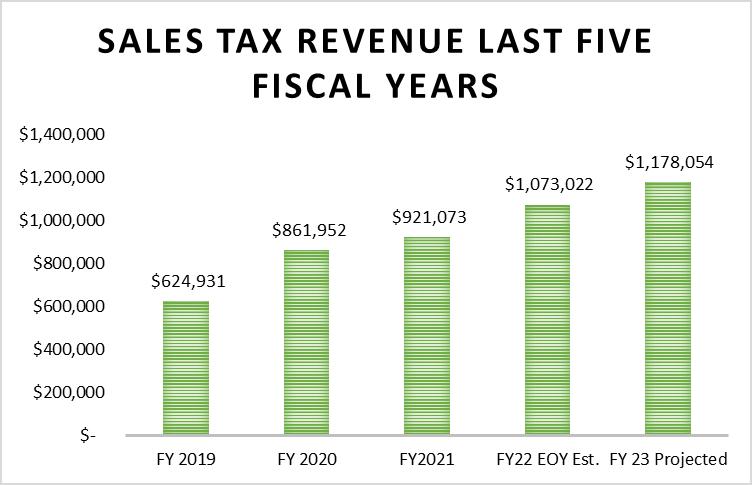

The fund’s revenue source is from sales taxes. Below you will find sales tax trends for the RHDC:

In 2016, the City entered into a contract to construct the LINK Activity Center which was funded partially by issuing $4,705,000 Certificates of Obligation. The RHDC shares the debt service with the Hotel/Motel Fund. The RHDC Fund pays for its own debt service. The debt service details are listed below:

CITY OF RICHLAND HILLS, TEXAS

$4,705,000 Combination Tax and Revenue Bonds, Series 2016 (EDC)

$3,240,000 - EDC Sales Tax Revenue Supported

Total outstanding debt for RHDC $3,226,506.

Crime Control Prevention District Fund

Fund Summary

The Crime Control Prevention District Fund (CCPD) is a special district created in November of 2005 by a vote of the citizens of Richland Hills The District is dedicated to crime reduction programs. The City Council serves as the board of directors for the District. Operation of the District is funded by .325 percent sales tax approved by the voters.

The CCPD has a total of 8 authorized FTEs. They are all part of the Richland Hills Police Department and report to the Chief of Police.

The CCPD shares costs with the General Fund for one staff member who also serves as the public information officer for the City and police department.