The Superyacht Refit Report

A REPORT WORTH READING

Lürssen, the new-build and refit giant, adds commercial conversions to its porfolio

The introduction of hybrid technology on 29-year-old sailing yacht Juliet

Seawolf 3.0: the refit of one of the fleet’s most iconic classic yachts

SPONSORED BY

The trend behind the purchase of US refit yards by huge, publicly traded corporations

215 Q4/2022

•

•

•

•

•

•

•

•

•

A world-class full-service superyacht refit and servicing facility

General maintenance

All types of paint, filler, and teak work

A 180-meter-long floating dock

720t Travel lift

Major

conversion

refits and

operations

Exceptional location in the safe harbor of Boka Bay

Excellent

yachting infrastructure surrounding

• Superyacht marina Porto Montenegro is 3 NM away

An active program for captains and crew

We’re your new home for refit

• Three major international airports close by T. +382 (0) 31 340 691 | E. contact@adriatic42.com A. Bijela 85343, Montenegro | W. adriatic42.com

ACCENTUATING THE POSITIVES

BY MAX STOTT

It was once said that the job of an editor is to separate the wheat from the chaff and then print the chaff. It’s something of an old-school journalism saying, but that doesn’t necessarily mean it isn’t still relevant today. We’ve already seen that the majority of journalists operating in the current media landscape are more than happy to adopt this mantra, even when they are reporting on something as complex as the superyacht industry.

That said, we trust that the majority of our readership is well aware of all the ‘chaff’ in the superyacht industry that gets watered down and regurgitated through the yachting news cycle every year. I, for one, feel mentally bruised and battered from having to read so much surface-level journalism about the negative aspects of the industry.

If there’s is one thing our newsdesk doesn’t do, it’s follow in the footsteps of predictable narratives. So feel free to consider this issue to be a direct counterpunch to all the clickbait we’ve had to endure over the past 12 months.

We want to really focus on the positive trends in the industry without necessarily ‘championing’ or ‘promoting’ anyone in particular, and to highlight some of the impressive strides being made in refit, one of the most vital sectors of the market.

The overarching aim of this issue has been to uncover and broadcast technical insight from people at the coal face; that is those who really know what they are talking about. We figured

that there really was no point asking people who spend most of their time in air-conditioned offices pie-in-the-sky questions about future outcomes that probably won’t be implemented any time soon.

That’s why this issue is absolutely choc-full of the most fascinating refit case studies that have been completed in recent years. In last year’s Refit Report, there was a lot of talk about the lifecycle concept and the need to upgrade the existing fleet to meet modern standards. It’s been encouraging to see the work that has been done since then and it’s worthwhile noting that sometimes words are indeed backed up by action.

The efforts that are being made by the shipyards mentioned in this report should be recognised not only for their economic and aesthetic values but also for their environmental and social impact.

The breadth and depth of the refit sector is massively underrepresented. At Lürssen, during the busy periods, there were around 150 people at a time working on the refit of 110m M/Y Kaos. At Huisfit, the conversion of 62m S/Y Athos regularly employed up to 50 skilled workers for more than 12 months. At Oceanco, some of the original team who took part in the building of 63m M/Y Lucky Lady more than 20 years ago were able to revisit an old project and turn it into a futureproof vessel.

These little nuggets of information alone prove that there’s room to paint a truer, more inspiring picture of the superyacht industry as a whole.

MS

EDITOR’S LETTER

Efforts made by shipyards on stellar refit projects should be recognised not only for their aesthetic values, but also for their environmental and social impact, says Max Stott.

The Superyacht Refit Report ISSUE 215 1

ph: SP & Loredana Celano

ph: SP & Loredana Celano

BENETTIYACHTS.IT

The HOUSE of YACHTING.

Guest column

Continuity, stability … and a healthy dose of reality 8 Daniel Küpfer, chair of the MYBA Yacht Management Committee, explains why providing clarity to owners can help them consider refit as a journey worth taking.

Opinion

We’re starkly under the world’s spotlight 10 The industry urgently needs a stronger mandate for sustainable growth, says Jack Hogan.

Why the human element matters 12 There’s a serious lack of appreciation for all workers and craftsmen in the superyacht industry, says Max Stott.

Features

The refit conundrum: stick or twist? 15 Tanguy Ducros, chief commercial officer at Monaco Marine, explains that without access to full-service refit facilities owners face addiitonal costs in the event of errors.

Behind the scenes at Orams Marine 21 We take a tour of the yacht facility in downtown Auckland as it is in the midst of a substantial expansion.

When ‘praying for the best’ is not always best 25 Xavier Ex, business unit manager yachting at EXMAR Yachting, says upfront costs for refit surveys are offset in the long run for their clients.

The art of the commercial conversion 30 Lürssen adds commercial conversions to its portfolio. How does a new-build and refit giant see this side of the market?

Features

4 CONTENTS

Revamped Juliet at the vanguard of modern refit 38 Stefan Coronel, refit manager at Huisfit, explains the process behind the introduction of hybrid technology on a 29-year-old sailing yacht.

Huisfit transforms 62-metre S/Y Athos 44 Her owner had chartered the vessel for a year –then completely rebuilt it.

How Oceanco restored the charms of Lucky Lady 53 The Dutch yacht builder gutted then put back together the 20-year-old vessel after she returned to her original creators.

Photo: Guy Fleury

Photo: Huisfit

Features

Reports

Turning back the tide of time 80 The 51-metre explorer-yacht project that came to fruition in just a matter of months.

Going, going, gone! 86 Marinas and refit yards in America are being bought by massive, publicly traded corporations. We look at the factors behind this trend.

GYG Ltd ‘stronger than ever’ despite leaving AIM 92 Remy Millott, CEO of GYG, says the decision to de-list from the Alternative Investment Market of the London Stock Exchange was the right one for the business.

Are we finally realising that Eastern Promise? 96 Adriatic42’s new specialist yard in Montenegro will be a “beacon of opportunity“ for the country and may untap the potential of a separate yacht cruising and refit cycle.

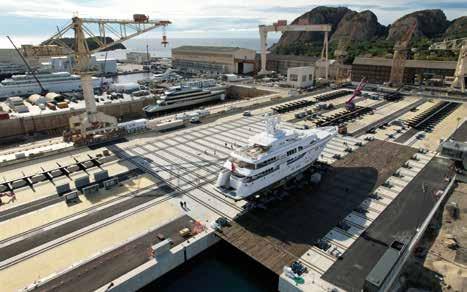

Dubai deal enhances MB92 portfolio 101 The refit experts have built a 4,300-tonne shiplift in La Ciotat as well as completed a deal to expand into the Middle East.

The rebirth of a past master 64 ICON Yachts’ latest conversion, Project MASTER, is being transformed from a rescue and support vessel into a highly capable world cruiser.

The new voyage of discovery 104 Genoa, the birthplace of Christopher Columbus, has a long history with the sea which now has a new chapter ... the one about the superyacht hub.

STP on standby for expansion go-ahead 111 Joan Rosselló, general manager of STP Shipyard Palma, speaks about the potential for expansion for this company and the positive impact this would have on the Balearic economy.

Taking the plunge for a king-size … 71 Lürssen is adding to its rich 147-year-old history of new builds by gaining a reputation for refitting yachts up to well over 100 metres.

The Superyacht Refit Report ISSUE 215 5

CONTENTS

Seawolf 3.0: The reincarnation of an icon 56 The fascinating story behind the repurposing of the former tug vessel and expedition superyacht.

Photo: Guy Fleury

Photo: Klaus Jordan

The Superyacht Report

Q4/2022

For 30 years The Superyacht Report has prided itself on being the superyacht market’s most reliable source of data, information, analysis and expert commentary. Our team of analysts, journalists and external contributors remains unrivalled and we firmly believe that we are the only legitimate source of objective and honest reportage. As the industry continues to grow and evolve, we are forthright in our determination to continue being the market’s most profound business-critical source of information.

Front cover image: Octopus in Lürssen refit dock.

Editor-In-Chief Martin H. Redmayne martin@thesuperyachtgroup.com

Editor Jack Hogan jackh@thesuperyachtgroup.com

Deputy Editor Max Stott maxs@thesuperyachtgroup.com

News Reporter Simone Bateson simone@thesuperyachtgroup.com

Contributing Editor Bryony McCabe bryony@thesuperyachtgroup.com

INTELLIGENCE

Head of Intelligence

Charlotte Gipson charlotteg@thesuperyachtgroup.com

Data Analyst Trevor Seymour trevor@thesuperyachtgroup.com

Junior Research Analyst Isla Painter isla@thesuperyachtgroup.com

Data Research Assistant Amanda Rogers amanda@thesuperyachtgroup.com

DESIGN & PRODUCTION

Production Editor Felicity Salmon felicity@thesuperyachtgroup.com

ISSN 2046-4983

The Superyacht Report is published by TRP Magazines Ltd Copyright © TRP Magazines Ltd 2022 All Rights Reserved. TRP Magazines is a division of The Redmayne Publishing Company. The entire contents are protected by copyright Great Britain and by the Universal Copyright convention. Material may be reproduced with prior arrangement and with due acknowledgement to TRP Magazines Ltd. Great care has been taken throughout the magazine to be accurate, but the publisher cannot accept any responsibility for any errors or omissions which may occur.

The Superyacht Report is printed sustainably in the UK on Printspeed, which is a FSC® certified paper from responsible sources. The printers of The Superyacht Report are a CarbonNeutral® company with FSC® chain of custody and an ISO 14001 certified environmental management system recycling more than 99 per cent of all dry waste.

6

Information

Our complementary digital platform, SuperyachtNews, is the most trusted source of well-researched and honest journalism for the industry’s top professionals.

Superyachtnews.com

Intelligence

We were the first to understand the importance of fleet and market data, and have been curating intelligence for 30 years. As a result, we have learnt that binary data is of little use to the key stakeholders of the industry; what they require is analysis that helps to inform their business strategies, encompassing everything from refit cycles to migratory patterns.

Superyachtnews.com/intel/

Events

Over two decades, The Superyacht Forum – our flagship event – has firmly established itself as the industry’s leading business-to-business conference. The Superyacht Forum Live extends the concept into a perennial conference programme, broadcast throughout the year to a local live audience and a global online audience. Superyachtnews.com/thesuperyachtforum

Follow The Superyacht Report and Intelligence content

@SuperyachtNews

SuperyachtNews

Join The Superyacht Group Community

By investing in and joining our inclusive community, we can work together to transform and improve our industry. Included in our Essential Membership is a subscription to The Superyacht Report, access to SuperyachtIntel and access to high-impact journalism on SuperyachtNews.

Explore our membership options here: www.superyachtnews.com/shop/p/MH

ADVERTISING With over 20 years experience as paint consultants in the superyacht market, we offer the highest quality consulting services from conception through to implementation and aftercare. We are your trusted and reliable partner for all coating requirements –not just once, but for life. HAMBURG • BREMEN • LA CIOTAT • BARCELONA • PALMA VIAREGGIO • ROTTERDAM • SOUTHAMPTON • SOUTH FLORIDA YOUR COATING SOLUTION INFO@WREDE-CONSULTING.COM +49 40 8816745-0 WWW.WREDE-CONSULTING.COM EXPERTISE YOU CAN TRUST WRE-21-00009-Anzeige_TSYR_02.21_106x224mm_RZ.indd 3 28/04/2022 09:47 The Superyacht Refit Report ISSUE 215 7

Guest Column with Daniel Küpfer

Continuity, stability … and a healthy dose of reality

Superyachts undergo a wide variety of refit activities, from regular Class inspections to complete restorations that may take several years. Regardless of the scale of the project, a refit is a significant undertaking, and its success depends on several parties working together harmoniously.

Many shipyards have the necessary skills and resources to carry out refits. The captain and his management team of the yacht have an in-depth knowledge of the vessel they are in control of, making their contribution indispensable. Nevertheless, more is needed to ensure a refit project is completed successfully.

The captain and crew require support as, very often, a refit period follows an active charter or cruising season with the owner. The crew need time to recover before the next season, and captains need a partner to discuss the yacht’s technical requirements and how to turn the owner’s wishes into reality, while also adhering to strict budget control.

The role of yacht management is to put in place the right structure so all parties can deliver their best, in the interest of the owner. Although the involvement

of captains and their teams is crucial, it’s imperative they are also given the opportunity to recover before the next season.

The human factor is often overlooked in the sustainability discussions that are currently taking place within our industry but this lies at the heart of most matters, including refits. Crew suffering from exhaustion won’t be able to perform when called upon, and the ensuing turnover will contribute to a longer worklist when the yacht goes for its next refit after a couple of seasons. Therefore, it’s important that they have a competent partner at their side who can offer expert guidance, lighten the load and relieve the stress.

Yacht managers bring to the table their experience with other yachts at other shipyards, and sometimes even at the same yard. As the wheel doesn’t always have to be reinvented, managers can make decisions faster and often more competently due to the fleet knowledge available to them. They are able to secure better fleet discounts and, among other things, should be able to negotiate warranty works with shipyards due to their experience with other yachts, which can sometimes be from the same builder.

For owners, a refit can be a frustrating experience. The reward seems small, costs are uncertain and, due to the technical complexity of such projects, can easily exceed those anticipated at the outset. With captains and crew often under pressure to keep running and maintenance costs low, as well as minimising downtime, the outside view of a broker and yacht manager will help to give the owner a more realistic estimate as far as the time required and money to be spent are concerned.

The broker’s role is to understand, provide clarity to the owner, smooth the relationship between the parties involved and offer valuable insight about the project from a commercial and customer experience perspective. The ultimate objective is to help the owner believe in the project and to consider it as a journey worth taking.

At MYBA, we encourage brokers to guide their owners in large refit projects from a commercial perspective. This includes a sharp analysis of return of investment of a refit, the yacht’s lifetime considerations and the possible resale value of the yacht, as the day of sale will inevitably arrive. DK

8

Daniel Küpfer, chair of the MYBA Yacht Management Committee, explains the role of experienced brokers and yacht managers in refit projects.

www.abeking.com

WELCOME TO THE WORLD OF GREAT EVENTS.

with Jack Hogan

WE’RE STARKLY UNDER THE WORLD’S SPOTLIGHT

The industry has become the target of unprecedented negative public opinion, and it urgently needs a stronger mandate for sustainable growth, says Jack Hogan.

The peaceful protest and demonstration at this year’s The Superyacht Forum from a group affiliated with the Extinction Rebellion movement carried a simple message – there’s no future for the superyacht industry. The full transcript can be read on SuperyachtNews. This demonstration, along with a smaller protest at Port Vauban during the Monaco Yacht Show in September, should be taken seriously. Laughed off or disregarded by some, they are infallible indicators of simmering negative public opinion towards superyachts and what they represent.

Catalysed by the conflict in Ukraine and the focus on the assets of sanctioned Russian oligarchs, the attention of a diverse set of media channels has been intensifying. The image we have reflected back has been incomplete, crass and mostly true.

Our humble-by-comparison newsdesk has been inundated with calls from top journalists from across the world in 2022. I’m sure the same can be said for my yachting media colleagues. Instead of superyacht stories being sporadic pieces of celebrity-affiliated filler for the inside pages, editors have started to commission full features from skilled journalists with time and resources.

The voluminous ‘The Haves and the Have-Yachts’, by The New Yorker’s Evan Osnos, was one such piece. Sweeping and largely accurate, it inflated the image of hedonistic excesses and outof-touch industry heads. Similar pieces from the BBC, FT and Reuters have started lifting up the rug and having a peak underneath. We’ve been illprepared for the scrutiny.

At the opposite end of the spectrum, the perennially popular TV show Below Deck feeds a caricatured image of the industry to a wide audience. The result, as evidenced by a simple Google trends analysis, is that superyachts have never been more prominent in the public discourse.

Against the gloomy backdrop of the war in Ukraine, economic downturn, an unfolding energy crisis in Europe and a dire prediction from COP27, the already precarious position of justifying the existence of these superyachts and the industry that they support will become harder.

These yachts are built and operate, by and large, within liberal democracies. If their construction and operation become a political issue, the position of these shipyards, marinas and supporting

networks, no matter how storied, may become untenable.

A point made by Extinction Rebellion at The Forum – that nobody needs a superyacht – is one that has been lightheartedly repeated in the industry echo chamber for decades. The fact that we are in on the joke is now irrelevant.

We sit in a privileged position of influencing the world’s wealthiest individuals. Zero-carbon yachts, with diverse crews and conscientious owners championing scientific agendas, will survive the court of public opinion, but they are still some time away. The most pressing issue is what to do with the existing fleet; much of this weight of responsibility rests with the refit sector.

The Forum and the protests were a wake-up call. The increased attention is here, the protests are likely to increase in scale and intensity, whether we’re ready or not. The protests will return in 2023. The superyacht industry needs a stronger mandate in the face of such criticism to continue to grow sustainably. JH

OPINION

10

with Max Stott

with Max Stott

WHY THE HUMAN ELEMENT MATTERS

The physical toll of building, maintaining and operating yachts under current conditions is just not sustainable, says Max Stott.

This summer has seen an unusual number of fires on superyachts, causing them to sink or run aground. The overwhelming majority of stakeholders are pointing towards lithium batteries as being the source of many of these incidents, even when there’s no hard evidence to back this up.

Lithium batteries are a problem, and they do sometimes cause fires, but in the absence of official reports, they are also being used as an excuse to avoid taking a step back and looking at the bigger picture. There’s a human element to the superyacht industry that has long been disregarded, and it wouldn’t be wildly inappropriate to suggest that this is consequently having some effect on the condition of the fleet.

I’m not saying stakeholders are to blame, but I do think more consideration should be given to the people who are literally working tooth and nail to keep the industry afloat. The number one justification for the very existence of these giant hunks of floating machinery is that they provide a lot of costly work for a lot of people who will gladly make a career out of cleaning bilges, applying antifoul and fairing surfaces. The market is tightening daily and you could argue that this increase in pressure on the industry’s already struggling workforce is starting to cause some cracks in the system.

On the crew side, you have an increase in the number of charters per season and an increase in the number of superyachts joining the fleet, but there’s not enough

quality crew to sustain these increases. Superyacht crews are trained to pass exams, not to maintain superyachts. They often work 18-hour days, live in tiny cabins and are under a lot of pressure to meet the owner’s demands. Many yachts are a breeding ground for mistakes and miscalculations.

Following on from the global pandemic, the world is now staring down the barrel of an economic recession – another event that will hit the poorest the hardest. Statistics have revealed that hospitality workers are struggling more with mentalhealth problems now than they were during the height of the pandemic. A new survey by Censuswide and hospitality marketing firm Flipdish reveals that 80 per cent of hospitality staff had experienced mental-health issues as a result of their work, with antisocial hours and performance pressure cited as the cause. It has already been proven that this statistic is being reflected in the superyacht industry. [See Jack Hogan’s article ‘Quay Crew and MHSS publish stark crew mental health report’ on Superyacht News.]

If a refit project is condensed while it’s in a shipyard, and the vessel is having to go straight out for a charter, then it’s the crew who will have to deal with any issue out at sea, but that doesn’t necessarily mean any issue is their fault. People cause accidents, but when incidents occur there’s often a long line of those who share the blame. The industry, unfortunately, tends to prefer short-term profit to pausing and making calculated

moves that consider the long-term effects.

On the shoreside, workers in shipyards are being pushed to make compromises and find solutions for ludicrous designs that favour extravagance over seaworthiness and functionality. This problem isn’t exclusive to yachting. Renowned car companies such as Chevrolet have had to recall vehicles due to the risk of their high-voltage battery packs catching fire. The bid to become sleeker, slimmer and higher performing pushes manufacturers to come up with more compact designs that ultimately have a higher risk of causing an accident.

There’s a serious lack of appreciation and recognition for all the workers and craftsmen in the superyacht industry, especially towards junior crew and blue-collar workers at the coalface. They are the ones who are bearing the brunt, working ridiculously long hours and putting themselves at risk while trying to meet tight deadlines. These are the people who are paying for the lack of foresight from those above them.

One dreads to think how many millions of pounds worth of assets have gone up in smoke or sunk to the bottom of the ocean, or how much oil and fuel have seeped into the ecosystem over the past couple of months. But when we see accidents proliferating, there should be more consideration for the human element of the industry and the lives it is putting at risk. The boundaries have been pushed far enough. MS

OPINION

12

5 6 M | B L U E I I Y O U R Y A C H T , D E S I G N E D , E N G I N E E R E D , C R A F T E D f o r E X P L O R A T I O N Y O U R W O R L D o f D I S C O V E R Y I S T A N B U L M O N A C O F T L A U D E R D A L E t u r q u o i s e y a c h t s c o m

Seamless worklist management for yachting professionals

Why the superyacht industry is turning to Pinpoint Works for refit and maintenance planning.

There’s no doubt the superyacht industry is booming, and during this growth period of the global fleet, demands on yacht service, maintenance and refit resources are increasing.

To adapt, it will be imperative for the industry to revisit and revise practical working processes. This shift will be particularly important for companies reluctant to swap to more modern, efficient practices – ‘adapt or die’, as the saying goes.

With most yachts undergoing a shipyard maintenance period annually or biannually, substantial time and money are dedicated to the upkeep and preventative maintenance in their lifetime. Terms such as ‘lifecycle management’ –how to optimise each stage of a yacht’s life – will be increasingly heard in conversations as the industry searches for more pragmatic yacht-management practices.

Given the extensive material and personnel resource allocation for these projects, Pinpoint Works’ founder James Stockdale sums it up: “Seamless worklist management is critical to successful communication and collaboration between specialist teams. It’s become an essential commodity of the superyacht industry.”

So how can processes be improved to facilitate effective communication and collaboration during these refits and shipyard periods to optimise both the asset and our time?

Old ways of working with notepads, Excel sheets and email chains are still regularly being used because of a reluctance to move to more advanced systems. But, in this digital age, these methods are outdated, unprofessional and costly due to their inherent inefficiencies. Pinpoint Works was created to challenge these methods by improving communication and

organisation of tasks through a simple and user-friendly platform – a true upgrade in worklist management for the yachting industry.

The chief officer on board 75m M/Y Huntress says of his experience with Pinpoint Works: “Pinpoint has been an absolute game-changer on board Huntress, and I believe it has revolutionised the yachting industry in terms of monitoring shipyard works, general ships’ maintenance and helping departments communicate efficiently and effectively on board.”

By using Pinpoint Works to define a detailed scope of works before a refit or general yard period, stakeholders can document, facilitate and coordinate the required work using a vessel’s GA (general arrangement), creating a realtime, interactive worklist. One simple platform replaces the historical ways of working.

Adding photos, videos and documents helps to clarify the detail with a precise location of works on the yacht’s unique GA, making it clear to contractors where they’re needed when on board.

This scope of work can be used to source reliable cost comparisons

between shipyards, allowing for better budgeting. Keeping communication open and transparent means crew, management, owners, contractors and project managers can work together more efficiently.

Pinpoint Works has been adopted and implemented by more than 350 superyachts, hundreds of smaller pleasure yachts and dozens of companies within the superyacht industry, including some of the largest, most prestigious shipyards in the world.

There are numerous benefits of having one place where everyone can see up-to-date information in real time. However, the time/cost savings based on improved communication and fast implementation make using Pinpoint Works a worthy investment for captains, operational crew and project managers.

If you’re not already leveraging an intuitive digital solution to project manage your refits and shipyard periods, it’s time to get started.

Pinpoint Works uses the latest technology in web and mobile apps and can be used during all lifecycles of a yacht: build, warranty, operation, refit, repaint and surveys.

PARTNER CONTENT 14

The refit conundrum: stick or twist?

Ducros, chief commercial officer at Monaco Marine, reflects on factors of differentiation within the refit market and explains how a realignment of UHNW rhetoric may paint a clearer picture.

BY GUEST AUTHOR

‘Refit’ as a term is often bandied around as a catch-all phrase used to describe the process of making amendments, updates or significant changes to a superyacht. However, all refits are different and not all businesses operate the same model.

Tanguy Ducros, CCO of Monaco Marine, one of the industry’s leading refit specialists, has his own views on why one particular model is superior to others, and also why owning a superyacht is not necessarily the be-all and end-all of the boating experience.

“You have to look at the refit market from a number of different angles,” says Ducros. “There are two typical approaches in terms of refit. You have the full-service refit facility, through which infrastructure, project managers and subcontractors are all provided and managed, as well as being liable for time, quality and cost. Alternatively, you have the model through which a client rents space in a shipyard and bears far greater responsibility for the project. Monaco Marine is the former. After this distinction, there is another axis of positioning that relates to whether or not the facility provides only refit or both refit and new-build services.”

When considering the first distinction between a full-service shipyard and a facility for hire, Ducros is quick to point out that the latter model can be effective in the right location, such as STP Palma, while making it clear that he believes this model to be generally inferior. With the greater responsibility taken on by full-service refit yards, guarantees related to time, quality and cost are more realistic.

“I don’t think that I’m a professional captain but in the same vein I don’t think captains are professional project managers and, as such, they should not necessarily be leading refits. It’s a different job, simple as that,” adds Ducros. “When I see a captain, for instance, going into a shipyard to supervise the work themselves, they have excellent technical and operational knowledge but it is not their core business. What then are the advantages of using a full-service shipyard? I would simply say that there are no disadvantages.”

Ducros explains that without the additional amenities provided by fullservice refit facilities, owners are leaving themselves open to additional costs in the event of errors. With the full-service model, any additional costs due to an

Tanguy

A report on the benefits of fullservice yards

The Superyacht Refit Report ISSUE 215 15

“The difference between the refit specialists and the new-build shipyards that do refit is that we are not trying to sell the owner another boat, simple.”

error on the part of the yard will have to be met by the yard in some instances. This is not the case where the ownership has total control of a build from start to finish. Indeed, Ducros believes that while the initial cost of using a fullservice shipyard may be higher (if only marginally), cost savings will be made over the medium and long term.

“I am still trying to rack my brain and understand why, when an owner has a superyacht worth €15 to €30 million, that they wouldn’t go to a full-service shipyard. It makes absolutely no sense from my perspective,” says Ducros. “Only when location and capacity come into play can I understand perhaps taking the riskier approach, or in the event that the works are minor and easily managed by even the most rudimentary facilities.”

At this juncture it’s important to make the distinction between ‘maintenance’ and ‘refit’. Over the years, the two terms have been, at times, used interchangeably or at least with a grey area between them. However, Ducros is clear about the differences between the two. Maintenance, he explains, keeps the boat like for like; it only fixes or updates existing systems, including paintwork. Refit, by contrast, denotes significant changes to the superyacht, whether that be new systems, extensions, layout changes, interior changes and all other types of works that go beyond merely fixing or maintaining. Maintenance, aside from paintwork, can be carried out by facilities the world over while refit, according to Ducros, should be left to the specialists.

“The difference between the refit specialists and the new-build shipyards that do refit is that we are not trying to sell the owner another boat, simple,” says Ducros. “The new-build/refit model has been designed to encourage owners to buy new superyachts and, in this regard, I believe there is a conflict of interest. The best service is only on offer until a new superyacht is off the cards.”

Competition between refit-only ship-

yards and those that do both new build and refit is entirely understandable. This competition, until relatively recently, was non-existent because the possibilities of refit were little understood and one can appreciate the grievance on the part of some specialist yards in so far as they worked tirelessly to make refit a legitimate alternative to new build and show the market what the possibilities of refit are, at which point some new-build yards decided to step into the market.

Grievances aside, it must be said that focusing on refit as well as new build has proved to be successful for some shipyards. At the very least, this transition into a more competitive market is testament to the evolution of the refit market over the past 10 years.

“The refit market is almost unrecognisable from where it was 10 years ago. In people’s minds they had a fixed and unshakable idea of maintenance, but today we are seeing so many more high-value refits with significant changes,” explains Ducros. “The vessels can be completely changed and what the client is left with is almost an entirely new boat.

“This transition is inextricably tied to the professionalisation of the refit market. Quite simply, 10 years ago the contractors were not at the level that they are today, and the technology and systems to manage projects was night and day from where it is now. The old way of thinking concluded that it was just easier to just build a new boat. That is no longer considered to be the case.”

As ever, the discussion around how to get the most out of a refit persists, especially where pre-planning, yard and team selection are concerned. However, the arguments can be neatly summarised by that well-used adage ‘fail to prepare, prepare to fail’. This will continue to be the case until owners, captains and any other engaged stakeholders hear the message loud and clear. In fact, with more high-quality work expected in

shorter periods of time, this admittedly cheesy expression is becoming even more important for the superyacht community.

When speaking about the levels of preparedness within the refit industry, and indeed the wider superyacht market, Ducros points to an all too often overlooked fact about the industry – it’s underfunded. “If the industry were to be perfect, then significantly higher degrees of investment would be needed at all stages. The proper investment in refit preparation, for instance, to ensure that absolutely nothing unexpected would be found during the process itself, would be many times higher than it is now.

“Let me put the problem in context. The R&D that goes into a new production superyacht from one of the major brands is around €100,000. By contrast, the R&D investment for only the lights in the newest Ferrari was around €50 million. This number stretches into the billions when you start looking at the aviation market. If you put the same level of investment from these industries into superyachts, you could add a zero to the price of every boat, but the market is not elastic enough to support it. Thus, while the assets are complex and already high in value, we are not in an R&D-friendly environment.”

While the superyacht world may continue to struggle to meet the levels of R&D required to perfect the model, Ducros believes that, at times, the superyacht industry is a little harsh on itself. Rightly or wrongly, the industry often looks at itself in isolation. There are, of course, a variety of valid reasons for this, whether it’s a size boundary for the sake of analysis or a qualitative boundary that ensures distinctions can be drawn between the best products and those that aren’t so super.

However, while we often repeat the statistic that only around two per cent of UHNWIs own superyachts, are we being a little too ‘woe is me’ with regards to the broader view of yachting and boating,

16

Tanguy Ducros.

Tanguy Ducros.

The Superyacht Refit Report ISSUE 215 17

“The refit market is almost unrecognisable from where it was 10 years ago ... The vessels can be completely changed and what the client is left with is almost an entirely new boat.”

given that superyachts are a niche within this much-loved pastime?

“Superyachts are a small but incredible part of a much wider market. It takes a particular type of client to want a superyacht and, contrary to what some might think, the cost is not the only boundary,” says Ducros. “In our marina, we have yachts that are below 30 metres and owned by billionaires simply because they do not want crew.

“They want the experience of being on board to be completely private and family-orientated and, furthermore, the owners don’t want to feel like they are the boss while they are on their boat because it is downtime away from their commercial interests. However, if a UHNWI or billionaire chooses not to buy a superyacht, people often assume that this means they don’t like yachting or boating full stop, which is an oversimplification.”

Ducros lays out a hypothetical situation. If a wealthy individual doesn’t own a Ferrari, it doesn’t mean that they don’t like cars. Indeed, this scenario could be stretched even further, with the wealthy person in question owning a whole collection of cars.

“Superyachts carry a particular size, cost and status, but the utility of any boating experience is really in the emotional value that it carries, whether it’s a superyacht or a much smaller boat,” adds Ducros. “Perhaps when speaking with UHNWIs we should be less concerned about whether or not they

own a superyacht and more concerned with whether or not they own a boat. Whether they have a small boat on Lake Como or a yacht that doesn’t meet the dizzying dimensions of the superyacht fleet, I believe that the two per cent statistic provides an unbalanced view of UHNWI interests.”

There are reasons aplenty to own a superyacht but it’s undeniable that as far as assets go, superyachts can be one of the more complicated and costlier. For some people, it’s just too difficult to swallow the cost and complexity, but this doesn’t mean that they don’t choose to engage with the wider boating market in some shape or form, and the superyacht industry should take solace from that.

Yes, superyachts are expensive and complex, but the market is reaching a level of professionalism where many of the headaches associated with them are being mitigated or removed and, consequently, issues of cost are being resolved as fewer errors and poor decisions are made. Nevertheless, leading shipyards are available to provide high-quality refits where necessary.

Superyachting will never be for everyone – it’s a niche market, after all, that requires obscene levels of wealth to be a part of. However, as the difficulties are gradually reduced, it will be better placed than ever before to attract new ownership from the vast pools of individuals who already love boating in its various forms.

n

18

“Perhaps when speaking with UHNWIs we should be less concerned about whether or not they own a superyacht and more concerned with whether or not they own a boat.”

Many facilities. One brain. LÜRSSEN refit.

Safe hands, synchronized by heart and brain: Whether your yacht was born a LÜRSSEN or not, you can trust on class-leading engineers, facilities and highly skilled craftsmen ready to refloat your dreams. Discover the difference.

BEHIND THE SCENES AT ORAMS MARINE

How the yacht facility in downtown Auckland has evolved to become a world-class refit centre.

BY JACK HOGAN

BY JACK HOGAN

The Superyacht Refit Report ISSUE 215 21

Westhaven Marina has come a long way in the 13 years since I was a student divemaster working there between lectures at university. Built in 1940, it’s now home to 1,800 recreational boats, four yacht clubs and a wide variety of marine businesses and hospitality. It also holds the title of the largest recreational marina in the Southern Hemisphere.

Central to its evolution has been Orams Marine. In the midst of a substantial expansion of the facilities, I caught up with Craig Park, Orams Marine’s managing director, to have a look around and see how far the Auckland refit sector has come.

Something that was hard not to notice upon my return to Auckland, and reiterated in many conversations with stakeholders, is the number of mid-range semi-production yachts that are based here and ostensibly owned by Kiwis. Park explains that this has kept his team active through the pandemic-affected years.

“We have stayed surprisingly busy,” says Park. “Realistically, we are targeting a return to a full refit season in the summer of 2023/24. The lack of clarity around the [maritime border restrictions] means that many yachts are already booked up for the next season, which is a shame.”

Park reiterates that there is still lingering frustration, from Kiwi-owned yachts as well as international ones, that despite intentions they are still unable to commit their yachts to Auckland due to these maritime border restrictions. Additionally, with the strong growth in the domestic market, and the expected return of international vessels, the region may reach capacity unless there is expansion.

In recognition of the growing demand, Orams Marine has installed a custom-built 85-metre, 820-tonne travel lift. Park explains that his initial projections for the use of the system were biweekly, but even accounting for the decrease in international visitors, it has seen three times that number of haul-outs. The slipway itself faces the large building site that will eventually house the new painting sheds and office complex, due for completion late this year or early 2023.

Walking around the Orams facility is reminiscent of visiting the large

specialist yards in Europe in terms of scope of works, and Park explains that Orams Marine has identified its niche. “We know that the meat of the market is 45 to 65 metres, so that is how we have set up our shipyard for haul-outs,” says Park. “We can take larger for in-water works but this size range represents a lot of the yachts that have the capabilities and desire to come down to New Zealand, as well as the size range of an increasing number of Kiwi-owned yachts.”

This increase in capacity means that Orams Marine has nearly tripled its large-yacht haul-out and workspace capacity, from four to 11 yachts. Offering a full refit service option, the inclusion of the two 60 x 40-metre painting sheds marks a significant growth

By international standards, Waitematā Harbour is relatively pristine. Not many waterways are as centrally located within a major metropolitan city where one can catch the legal limit of table fish a stone’s throw from the commercial port. Part of this is down to the environmental controls implemented in the area by the local marine industry.

The water-treatment system at Orams Marine is hard to miss. The massive purpose-built steel holding tanks are part of an in-built water treatment plant that separates and treats wastewater and stormwater collected across hardstand and covered work areas. The Orams

22

Orams Marine’s dry stack and tender storage.

Marine team worked with sustainability experts prior to the build’s start, with the goal of setting a new shipyard industry standard of discharge water quality, protecting Waitematā Harbour and New Zealand’s environment long term.

All too often in yards, the water run-off is an uncontrolled by-product of shipyard operations. To tackle this issue, Orams Marine designed the hardstand area to channel water into two separate sub-catchments. Wash water passes through a filtration system, with solid contaminants removed and sent to landfills and the water recycled for marina operations or public sewer. Residual contaminants from stormwater run-offs go through a two-stage treatment for suspended solids, and dissolved heavy metals are removed.

Orams Marine operates with a subcontractor model for its works. The Kiwi boat-building trade skills and intel-

lectual property were not lost when the likes of Alloy Yachts shut down in 2016 but instead were assimilated into residential and specialist companies. Park and others have stressed that this quality of craft is still readily available and reflected in the standard of works undertaken.

Park asserts that refit yards are highly reliant on word of mouth – and this is especially true for a yard that is offering full resprays of topsides. Not many owners and guests comment on the engine rebuild or the antifoul, but a section of orange peel that catches the light during an Antiguan sunset can be highly damaging to the reputation of the yard where it was painted.

“With a recent respray, we actually decided we were not happy with its finish, even after the captain had signed off on it,” says Park. “We want it to be perfect and are willing to take on the cost

to do it. It is a long way for boats to come down here, and we want to deliver the best possible service.”

Auckland, with my biases placed somewhat to one side, has a unique offering for refits. Yachts that spend the Southern Hemisphere winter cruising the Pacific can then head south for more warm weather during the summer refit season in New Zealand. The first cruises and sea trials take place among the many islands of the Hauraki Gulf, and the New Zealand cruising season extends through March and into April, allowing charters to still take place.

The South Pacific refit programme is a perfect counterbalance to the long Mediterranean winter and traditional refit schedule. Orams Marine has created a world-class facility in downtown Auckland, adding to the growth and maturation of the region’s superyacht infrastructure. JH

Jack Hogan (left) and Craig Park (right), watch the new travel lift hoist the 34-metre Royal Huisman Sassafras

The Superyacht Refit Report ISSUE 215 23

We craft your refit with care 80 YEARS OF UNINTERRUPTED HISTORY REFIT & REPAIR SHIPYARD

When ‘praying for the best’ is not always best

Xavier Ex, business unit manager yachting at EXMAR Yachting, shares his thoughts on the need for the refit survey after completing a project in Seychelles.

BY JACK HOGAN

Forward planning and streamlining the overall refit process is a vital topic, and one discussed extensively at YARE and The Superyacht Captains Forum 2021. Efficient use of the yacht’s time and maximising the refit process are paramount, but the twin factors of time and cost seem to work against each other.

Busy yachts cannot commit early and, equally, busy yards may find that the quotation process and eventual inaccuracies leave the owner with a bad taste in the mouth after the refit is complete.

The loss of data accrued by a vessel over its lifecycle is a major sticking point – collecting and disseminating the data as needed, regardless of the crew changeovers, reflagging or change of ownership. This was also a key discussion point at the RINA breakaway session at The Superyacht Forum Live 2021.

Discerning who actually owns this data, and in what way it can be used, is an ongoing debate. Adding a refit survey is another dimension to the refit cycle, and it comes with its own considerations.

Having a refit survey is an obvious benefit for forward planning and efficiency. Commercial ships count every minute they are in dry dock as profits lost and this approach is at odds with

the frequently drawn-out ‘let’s pray for the best’ attitude that undermines some superyacht refit projects.

Professional yards have systems in place to make the most of the refit period, and it’s in their best interests to maximise the number of projects they can fit into a busy winter, but can yachts and management do more to streamline the process?

Xavier Ex, business unit manager yachting at EXMAR Yachting, says, “I met Rory Marshall [Superyacht Paint Consultant] at YARE in 2018, who then introduced me to Alex Fassbender from Optimar. There, we discussed how it would be interesting to develop a more hands-on approach from the owners and managers to the refit and painting process.”

Referring specifically his the most recent project, the 42m sailing yacht Douce France, where the paint was the priority, Ex further elaborates the rationale behind completing the survey. “Most shipyards will say ‘we have our painters’ [who are usually contractors], and by the time they are looking at the project, often the pricing has only been ballparked in advance and the extra costs start creeping in.”

The EXMAR Yachting representatives, along with Fassbender and a rep-

Xavier Ex, BU manager yachting, EXMAR Yachting.

The Superyacht Refit Report ISSUE 215 25

Forward planning in the refit process

26

42m S/Y Douce France .

resentative from the NAUTECH Group Shipyard, flew out to meet the yacht in the Seychelles to conduct a three-day refit survey and pre-paint assessment.

“From a management perspective, we are always encouraging crew to supply work lists well in advance,” says Ex. “Of course, we understand that these are dynamic situations and the scope of work will evolve, but we try to look at the big picture and get the crew involved early. By then, having consultants on board who can also communicate directly with the shipyard helps create the most accurate scope of works, and we will then have the detailed report on file. In this case, the paintworks chapter of the report is 21 pages long.

“The ideal situation is when you build and commission the vessel for a client and manage it from day one, following up with all maintenance, Class and Flag surveys. This makes it very easy. All of the vessel’s history and data is available and your PMS system is up to date. But it does not often happen like that. The difficulty comes when there are

gaps in data from the lifecycle.” When these gaps appear is when Ex believes pre-refit surveys become even more important to avoid spiralling costs and time constraints.

One potential solution is to integrate third-party software as a conduit between the different stakeholders. The dreaded Excel spreadsheet elicits strong memories of never-ending tabs and easily misplaced decimal points. However, Ex still sees value in centralising and keeping things relatively traditional.

“An Excel spreadsheet is something universal, and it takes time to build properly. But having all the other contractors and supplies integrated creates an information hub. Shipyards will use their own software and will be unlikely to change because a vessel has something different. In order to avoid the different parties working off different systems, I don’t think having a thirdparty software in-between is the answer in the short to medium term.”

Fitting a refit survey into an already busy schedule is one barrier to entry;

the other is cost and whose responsibility it is to cover. The hypothesis that the vessel will save €75,000 on a refit versus the €15,000 that the survey will cost is an oversimplification. The reality is that, as Ex explains, in all likelihood the quote may actually match the estimation. The differentiation is that the scope is unlikely to grow and the time frame can be communicated with relative assuredness.

The cost upfront is significant, as Ex explains. “Including travel, we spent a full week on this survey, plus the time the crew spent showing us around and providing information. You do need to invest time and, of course, who’s going to pay for that? That depends on your discussion and negotiation with the yard, the subcontractors, the surveyors and the owner.”

In conclusion, Ex stresses that these costs are offset in the long run for their clients and that, as asset managers for the yachts they represent, refit surveys are the most efficient solution to effectively refitting a superyacht.

JH

The Superyacht Refit Report ISSUE 215 27

“The ideal situation is when you build and commission the vessel for a client and manage it from day one, following up with all maintenance, Class and Flag surveys ... all of the vessel’s history and data is available and your PMS system is up to date. But it does not often happen like that.”

Refit & Repair

www.lusben.com

SEVEN ICONIC REFITS

The refit market is barely recognisable from where it was even just a decade ago. Yachts can be completely gutted or even rebuilt. Here we reveal the fascinating stories behind some of the biggest – and most notable – refit projects over the past few years.

29 The Superyacht Refit Report ISSUE 215

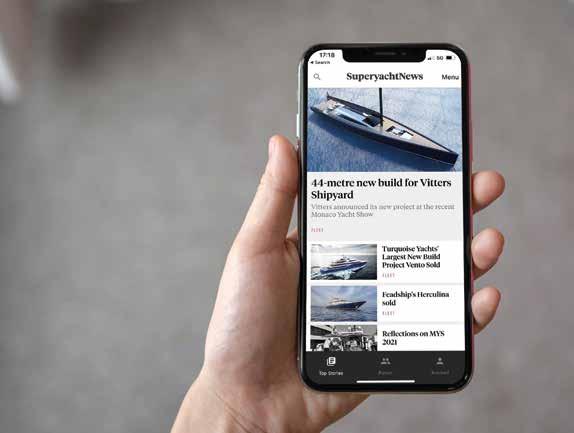

A new market for Lürssen

The art of the commercial conversion

BY JACK HOGAN

Lürssen adds commercial conversions to its extensive portfolio. How does a new-build and refit giant see this side of the market?

30

Delivering large custom yacht projects is a multi-year process. A new-build 50-metre or longer motoryacht is likely to take about four or five years from conception to launch. These lead times are now stretching towards 2027/28 and beyond. The compounding pressures of supply chain issues and uncertain economic outlooks are driving more clients towards alternative yards and avenues to ownership.

The practice of converting commercial vessels into luxury motoryachts is nothing new. Iconic projects such as the 58-metre Seawolf at Pendennis and Astilleros de Mallorca have shown what is possible when enough time, innovation and investment are made into rebuilding and repurposing commercial vessels.

These projects take time and require patient and passionate owners to see through. Once thought of as a niche project that may be sporadically commissioned by adventurous owners and undertaken at specialist yards, the discord is becoming more mainstream. The topic inspired one of the most intriguing keynote sessions at The Superyacht Forum 2022.

Lürssen, synonymous with the largest superyachts in the world, is diversifying. It was therefore fascinating to hear how the team in Germany would approach the growing segment that is commercial conversions and incorporate it into its comprehensive refit division. Alberto Perrone, sales director of Yacht Refit at Lürssen, outlined the vision.

“We did not want to come here and discuss conventional refit, which is still our main area of activities, as we have done that many times. There are some great refit yards here, and we all know what needs to be done. The opportunity that we have decided to pursue is that of commercial ship conversions. There has been an alignment of factors that

make this a fantastic avenue. Are we the first? Of course not. I am sure that it is something we as shipyards will all end up doing in some capacity.”

To strengthen its service and refit activities Lürssen founded its own refit company, Lürssen Yacht Refit and Services. Perrone goes on to explain that it has been conceived as a space to undertake all post-new-build projects, ranging from warranty periods to major refits. Therefore, Lürssen Yacht Refit and Services is also perfectly placed to apply the Lürssen philosophy to the slowly growing market of commercial conversions.

The post-pandemic boom in yacht purchases has extended across all size ranges. This market pressure is driving a reframing of the traditional pathways to ownership. Crucially, clients are also exploring the options that can deliver a project faster, and the substantial commercial fleet is an enticing option.

“In the past some have opted, just like old country houses in Chianti, to buy a ruin and go from there,” says Perrone. “This might be fun and entertaining, and of course still valid, but at Lürssen Yacht Refit and Services we will focus only on conversions from strong and ‘healthy’ donor vessels.”

Lürssen’s vision is to start with a highly capable and operational donor, such as an offshore support vessel. Perrone outlines why Lürssen Yacht Refit and Services sees these as the best option: “They are stable, they are quiet and are comprehensively outfitted. A good example is that many of these vessels operate with high-precision machinery, often with cables hanging a thousand metres down. They incorporate activeheave compensation, allowing them to remain stable in large seas, supporting this machinery. Building on this stable platform is ideal for the conversions that Lürssen are looking to undertake.”

The typical donor vessels that Lürssen is looking for in a ‘go anywhere’

The Superyacht Refit Report ISSUE 215 31

There is a significant pool to choose from, with the active fleet of global offshore vessels currently comprising 3,200 vessels, while approximately 1,200 were decommissioned in 2021.

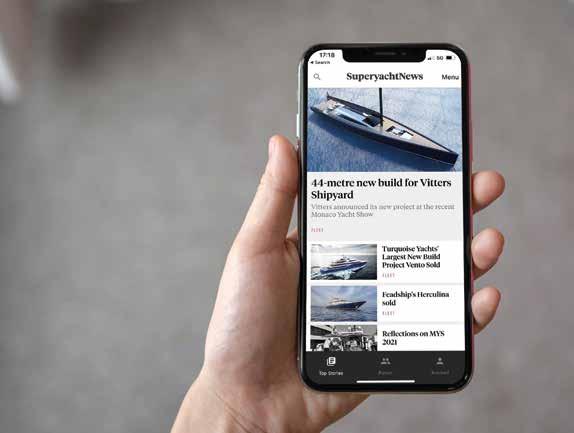

Lürssen conversion refit yard.

32

conversion are Crew Supply Vessels (CSV), Anchor Handling Tug (AHTS), Offshore Supply Vessels (OSV) and Offshore Construction Vessels (OCV). There is a significant pool to choose from also, with the active fleet of global offshore vessels currently comprising 3,200 vessels, while approximately 1,200 were decommissioned in 2021.

Looking to the oil and gas sector for such vessels has many downstream advantages. While the price to charter and purchase may have increased as demand rose in the face of the current energy crisis, there is still an active market of potential donor vessels.

Lürssen envisages this renewed market as a potential opportunity. Clients can purchase an operational vessel and charter it out for conventional offshore operations while Lürssen Yacht Refit and Services begins the preliminary and planning stages of the build, and when all these factors are in alignment the vessel can be pulled from service and taken to the facility. Perrone even goes as far as to say that if the owner has a change of heart, the vessel can be sold back to the offshore company with relative ease.

The perfect candidate outlined for the prototypical Lürssen conversion is a 120-metre OCV. The key features that underpin this designation are a hull built according to ice class B, accommodation for 130 PAX (meaning that no major conversion is expected by Class), a safe manning requirement of 13, and a ≥ 90day operational endurance. Some of the other key characteristics of an ideal conversion candidate include:

• Deadweight - 4,750 tons

• Deck cargo max - 2,400 tons

• Fuel oil - 1,300 cubic metres

• Ballast water - 5,380 cubic metres

• Freshwater - 900 cubic metres

• Helideck D-value - 21.0m and 12.8t take-off weight, second helicopter operations possible.

The aesthetics of these support vessels imply capability. This ‘offshore look’ is in no small part a driver of their popularity. It is worth reflecting on just how much can be supported by a 2,400t cargo weight. Coupled with the high fuel capacity and operational endurance, this style conversion really can carry everything, anywhere.

While still using conventional propulsion systems at this stage, there is another way to frame its sustainability credentials. By upcycling an existing platform instead of constructing from new, the total carbon emissions saved have been allocated at around 30,000t. Perrone frames this as “starting with 30,000 credits in the carbon bank”.

Although a long way from being sustainable, the comparatively huge technical spaces and carrying capacity give a conversion such as this the room to innovate and incorporate lower and zero-emissions technology, Lürssen envisions that these conversions, with the right client attached, will look to use the same fuel-cell technology and methanol-based main propulsion that it has pioneered for its new-build sector.

Although developed to serve the oil and gas sector, the dynamic positioning system that so effectively holds its position while surveying or supplying an offshore platform theoretically allows vessels such as this to greatly reduce the amount of harmful anchoring practices that it undertakes.

As the oil and gas market dropped in recent years, more and more of these vessels entered the market and prices were driven down. For the highly capable and operational vessels such as those highlighted by Lürssen, that market has risen again as the global energy crisis has driven more conventional oil and gas exploration. Still, a conservative estimate for the style 120-metre that Lürssen highlighted is around 75 million euros.

The realistic timeframe for delivery is the standout feature of this project. Lürssen foresees that a project such as

The realistic timeframe for delivery is the standout feature of this project. Lürssen foresees that a project such as this will be available within 24 months after vessel purchase.

The Superyacht Refit Report ISSUE 215 33

POTENTIAL PERFECT DONOR VESSEL

34

The Superyacht Refit Report ISSUE 215 35

“In the past some have opted, just like old country houses in Chianti, to buy a ruin and go from there. This might be fun and entertaining, and of course still valid, but at Lürssen Yacht Refit and Services we will focus only on conversions from strong and ‘healthy’ donor vessels.”

this will be available within 24 months after vessel purchase. The cost is still relatively high – not at the level of a new build of comparable size, but at 190 million euros for an estimated project cost, still a significant investment. Additionally, in a relatively nascent sector of the market, and with each project carrying with it its idiosyncrasies and challenges, it will take more intrepid owners to realise more of these projects.

There is still a key set of drawbacks that need to be addressed and discussed openly. These vessels were not designed with comfort in mind. Their form follows function, and while they have the carry-ing capacity and operational flexibility to fit the role of an expedition superyacht, the comparisons are not like for like.

As Terry Allen, technical director at McFarlane Ship Design, highlights, “There are a lot better choices in the commercial world than using something with a block coefficient* of about 0.85, unlike what we are used to in yachting. As well as the examples that Lürssen has highlighted, there are offshore research vessels, and tuna fishing vessels; the diversity is out there.”

“The price tag of 190 million [euros] is significant also,” continues Allen. “Any vessel that gets purchased for this kind of project will need to be very carefully selected for passenger comfort

*Block coefficient: the ratio of the volume of displacement to the volume of a rectangular block whose sides are equal to the breadth extreme, the mean draught and the length between perpendiculars.

by looking at the hull form and stability calculations.”

Brendan O’Shannassy echoed the sentiments, highlighting the need to address the comfort levels associated with conversions such as this. “They’re a bit brutal [commercial conversions] and that block coefficient factor matters. There are acceleration forces at play that can affect onboard comfort and those need to be addressed. But when I look at the price, there is a research vessel sitting in the north of England right now with a price tag of four million [euros], 3,000gt and desperate to be repurposed,” concludes O’Shannassy.

“It is great to start these conversations and look at these boats. Every time I am in the Pacific I see the tuna boats that Terry mentioned, and think, wow, they look great. And I am sure their time will come and they will be repurposed in due course.”

By casting a wider net across the commercial market, significantly cheaper options exist. The entrance of a yard as storied as Lürssen into the conversion sphere is a significant show of force. There are many thousands of potential conversions, as highlighted at The Superyacht Forum.

Lürssen has taken the high road in looking to convert the top end of the offshore market. The headline figures look enticing, but the economics of a build often do on paper. As Lürssen and the other new-build giants look to the specialist fields such as conversions to increase their capacity and cater to evolving markets, what can be called the ‘typical yacht’ may become harder to define. JH

The entrance of a yard as storied as Lürssen into the conversion sphere is a significant show of force.

36

Outfitting & Decor for Luxury Properties www.fionasatelier.com info@fionasatelier.com Ph: (+34) 933 157 941 Contact us to get our catalogue THE BOOK with all the indispensables Sin título-1 1 19/4/22 16:14 Outfitting & Decor for Luxury Properties www.fionasatelier.com info@fionasatelier.com Ph: (+34) 933 157 941 Contact us to get our catalogue THE BOOK with all the indispensables Sin título-1 1 19/4/22 16:14 Outfitting & Decor for Luxury Properties www.fionasatelier.com info@fionasatelier.com Ph: (+34) 933 157 941 Contact us to get our catalogue THE BOOK with all the indispensables Sin título-1 1 19/4/22 16:14

38

Revamped Juliet at the vanguard of modern refit

BY MAX STOTT

BY MAX STOTT

Sailing yacht Juliet defines the emerging era of ‘the new classic’ type of yachts. Here, we speak with Stefan Coronel, refit manager at Huisfit, about how they were able to implement hybrid technology on to an ageing vessel to ensure it could sail for years to come.

Future-proofing a yacht built in 1993

The Superyacht Refit Report ISSUE 215 39

Photo: Captain Jonathan Allan

Last year, Royal Huisman’s Huisfit relaunched the 29-year-old 44-metre sailing yacht Juliet with some brand-spanking new technology and engineering. It was a refit case study that made headlines for all the right reasons and proved to the rest of the market that it’s possible to redefine the classic fleet.

Juliet now features the latest hybrid technology benefits, including silent operation, peak-shaving, shaft-generated power under sail and reduced fuel consumption, combined with enhanced operational flexibility and redundancy.

The centrepiece of Juliet’s hybrid conversion is a new gearbox, aligned with a new electric motor/generator. This facilitates indirect electric propulsion, either generated by the main engine or drawn from the new battery bank or generator. Conventional shaft drive directly from the engine also remains an option. The system enables the main engine to meet the yacht’s hotel-load requirements by means of the electric motor/generator, while the power management set-up provides additional silent options via the battery bank.

With the main engine becoming the primary source of power generation, the system is configured to deliver peak shaving from the battery bank, such as during sail hoisting and manoeuvring. The thrusters are electrically, rather than hydraulically, propelled. The same battery bank will enable silent-ship operation, including air-conditioning and hotel-load consumers.

Under sail, electrical power will be generated by the propeller’s rotation. Rapid recharging of the battery bank is provided by the electric motor/generator driven by the main engine or generator. At anchor, battery power replaces the gensets as the main power supply, eliminating the noise and atmospheric pollution.

These are, of course, some pretty major engineering upgrades for a yacht that was built before the turn of the millennium. Refit manager Stefan Coronel says he anticipated some initial challenges even before the yacht entered the yard.

“Juliet was delivered by Royal Huisman in 1993. The number of systems in a contemporary engine room is much larger and the technical requirements are of a very different, much higher level,” says Coronel. “That made it rather challenging to start designing a modern hybrid-based engine room within the existing space of this yacht, which was built almost 30 years ago.

“With the recent Huisfit project of Foftein [Royal Huisman, 1999], the team had gained experience with the conversion from conventional drive to hybrid drive. So the refit of Juliet was based on a tested concept, and lessons learned [such as improved interface and controls] could be applied as improvements in the refit of Juliet. Also, the rapid development of this technology led to further improvements.”

All the upgrades mentioned above mean there’s much less dependency on the main generators in their traditional role. They will offer a high level of

redundancy, both for the propulsion via the diesel-electric system and as an alternative source of electrical power generation. In the latter role, the main engine’s generator would typically be the first choice for recharging the batteries after hours of zero-emission mode.

The Huisfit shipyard team has also reported that since this project, it is seeing an increasing interest in hybrid conversions. Owners and captains not only recognise the benefits in terms of on-board comfort, but also anticipate the requirements of future worldwide environmental regulations.

This vessel really is the ideal asset for many owners – a beautiful, classic sailing yacht that is also green and futureproofed; not many exist. So what does the industry have to do to make this refit/rebuild process more appealing to current owners?

“The hybrid conversion offers owners much more versatility and possibilities, amongst others more range and more

“A refit such as this very much suits visionary owners and captains who, like the owners and captain of Juliet, also acknowledge and embrace the great benefits of a hybrid conversion.”

40

Juliet on the hardstand during its refit.

Juliet on the hardstand during its refit.

The Superyacht Refit Report ISSUE 215 41

Photo: Huisfit

available power,” says Coronel. “Despite the various additional options, the system must, above all, remain simple in order to make the end result attractive for the owners.

“A refit such as this very much suits visionary owners and captains who, like the owners and captain of Juliet, also acknowledge and embrace the great benefits of a hybrid conversion. Prior to a conversion like this, it is important to properly define both the current and the anticipated sailing profile so that a tailored corresponding system can be developed.”

Coronel explains that the process wasn’t all plain sailing for the refit team. As with any large-scale refit project, there’s inevitably going to be at least one issue arising that means either the strategy or the timescale of the job needs to be adapted.

“Some initial problems, such as cooling and limited power, could not be solved right away,” reveals Coronel. “We started testing the solutions for these problems extensively before integrating them as an improvement.”

The keel was laid for Juliet almost 35

years ago, and some of the original build team, who were junior engineers at the time, are now the senior managers who were responsible for its conversion. This combination of heritage and experience meant that the conversion of Juliet could be carried out without deliberation and concern.

Coronel concludes, “In the past years, the shipyard team has gained a lot of experience with hybrid systems, for example during the construction of Ethereal [the world’s first hybrid superyacht] and NextGEN ketch Elfje. The team’s experience with those two yachts was directly applied to Juliet’s conversion project.

“During the refit of Juliet [when the keel was also replaced] the larger part of the vessel turned out to be still in perfect shape thanks to the execution and quality that back in the day were already of a high level. This made a financial investment and the effort worthwhile. Post-refit, Juliet is still a beautiful classic and state-of-the-art yacht which, thanks to the modern hybrid system, can sail on for many years to come. She is now ready to sail into a greener future.” MS

Juliet’s hybrid controls.

42

Photo: Huisfit

Study of a complete rebuild

Photo: Guy Fleury

Photo: Guy Fleury

44

HUISFIT TRANSFORMS 62M S/Y ATHOS

This conversion project regularly employed up to 50 skilled workers for more than a year …

45 The Superyacht Refit Report ISSUE 215

BY MAX STOTT

Before acquiring the 62m Hoekdesigned, Holland Jachtbouwbuilt Athos (2010), the new owner had chartered the vessel for around a year. Although he’d enjoyed the yacht, he saw many ways in which it would be possible to optimise and enhance the amenities and user experience.

As the project evolved in his mind, the refit list grew, and what started as a large refit project soon came to embrace all aspects of the Huisfit proposition: Refit, Rebuild and Renewal.

The stern overhang needed to be extended and, on deck, cockpit layouts had to be redesigned and a new forward navigation deckhouse had to be added. New booms, new sails and carbon rigging would ensure improved sail management and performance. All systems were to be updated and a considerable amount of the interior was to be replaced or reconfigured and updated.

Hoek Design was, once again, involved in all naval architecture work to accommodate these changes as well as the interior styling and layout of the new owner’s cabin, one of the guest cabins, the main salon, the new crew service area and the navigation deckhouse. Peter Mikic Interiors was responsible for the layout and styling of the main deckhouse and for the overall guest interior decoration.

Athos’s stern has been extended by 1.25 metres, a seemingly modest size increase, yet the concave and convex curves of the new section called for exceptional skills in the design and build of the aluminium structure in order to fit it perfectly into the aluminium hull. The extension, with a relocated pushpit, provides a new two-metre area for sunbeds behind the owner’s private cockpit.

The cockpit itself has been reconfigured for easier access and now features extra amenities, including a fridge and icemaker. The interior layout and furnishing of the owner’s deckhouse have been updated and, as a finishing touch, the new stern section has been complemented by a fine teak transom.

The main cockpit and deckhouse, aft of the mainmast, have been extensively modified to offer a true social hub for meeting and greeting, al-fresco dining and relaxed leisure activity. The new cockpit is wider and longer and can comfortably provide dining for 12 people. There’s also informal seating for guests to meet in smaller groups or find a quiet corner to enjoy a read.

Coffee tables are flexibly designed to adjust to also becoming dining tables. A bar with a fridge and icemaker has been installed. Just aft of the main cockpit, redesigned dashboard consoles sit on the port and starboard of the ship’s wheel.

The main deckhouse floor has been raised to one level and provides an enhanced outlook. The entire interior, including the navigation station, was taken out and a new design was installed. The deckhouse looks much larger, the traffic flow is better and the natural light has improved. A new classic-looking bar has been built on the portside and a couch occupies the space of the navigation station, while smaller dining tables and casual seating maximise flexibility.

More forward, the former crew companionway, which gave access to the crew quarters, has been replaced by a larger, third deckhouse, crafted in the same style as the other deckhouses. This encompasses a new navigation and secondary steering station and provides additional social space for the crew and access below. At the same time, the new design of the crew deckhouse improved the flow of the engine-room ventilation system and reduced the subsequent noise considerably.

The owner’s suite has been totally stripped out, redesigned and refitted. An additional porthole was made on either side and wasted space was eliminated to make full use of idle space. There are now two bathrooms in place of one and a new walk-in closet. Hard panelling has been replaced by subtle fabrics and the plank flooring has been carpeted to create a warm and tranquil ambience.

Just forward of the owner’s suite,

46

The main cockpit and deckhouse, aft of the mainmast, have been extensively modified to offer a true social hub for meeting and greeting, al-fresco dining and relaxed leisure activity.

Athos before refit (top left), the stern (top right), interior during refit (middle) and forward deckhouse (bottom).

Photo: Wynne Projects

Photo: Huisfit

Photo: Wynne Projects

Photo: Wynne Projects

Athos before refit (top left), the stern (top right), interior during refit (middle) and forward deckhouse (bottom).

Photo: Wynne Projects

Photo: Huisfit

Photo: Wynne Projects

Photo: Wynne Projects

The Superyacht Refit Report ISSUE 215 47

Photo: Wynne Projects

Athos’s layout and sailplan after refit (right) and in 2010 (below).

48

a day head has been removed. The space subsequently obtained has been incorporated into the aft port guest cabin, where a fixed queen bed and a sofa have been added. Along with the three other guest cabins, the floor has been carpeted and the fielded panels have been upholstered.