A consultancy report by Superyacht Intelligence

THE SUPERYACHT CEO REPORT

The Industry Leadership Survey

March 2025

The Superyacht Agency

The Superyacht Agency does not work in isolation, but rather operates as a collective where our core team draws on the wider expertise within The Superyacht Group as and when needed. The Superyacht Group’s editorial, intelligence, events and support divisions represent the global elite – the finest journalists, editors, analysts and event planners in the industry, coupled to market-leading publications, digital portals and global events.

For more than two decades, The Superyacht Group has dedicated its global media channels to educating, informing and advising all sectors of the superyacht market. The Group’s team of industry experts consistently deliver on our mantra ‘building a better superyacht market’.

The Superyacht Agency is here to meet the need for superior data-driven decisions in the superyacht market.

Through a tailored service and long-standing relationships with industry business leaders, we understand what the superyacht market needs –and the tools needed to deliver it.

EXECUTIVE SUMMARY

The following commentary provides a clear summary of the findings in the report, allowing readers to digest the key takeaways and build an understanding of the principal ideas and trends that need to be recognised.

1. Survey Demographics

Service companies, suppliers and shipyards formed the top three sector demographics in the respondent pool for the CEO survey. Companies with 1 to 10 employees accounted for the largest proportion of the survey sample. On the whole, a large proportion of the company respondents reported employee stability, with 62.4 per cent of respondents reporting that the number of employees in their company stayed the same in the past 12 months.

2.

Revenue, Turnover and Cost

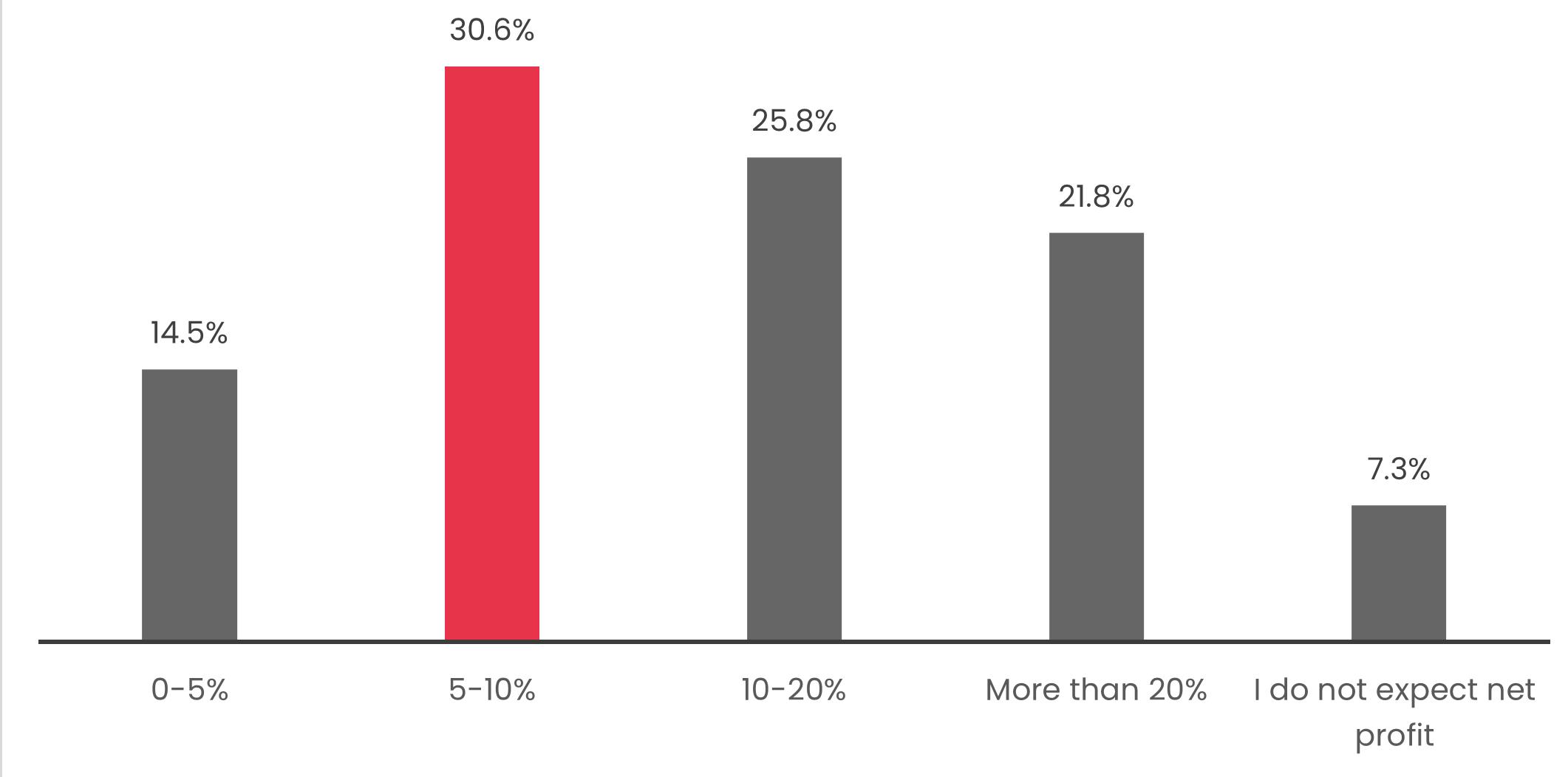

The majority of respondents reported a revenue/ turnover bracket of €500,000 to €1 million, closely followed by less than €500,000. 30.6 per cent of respondents predicted a 5 to 10 per cent net profit expectation for 2024; however, when segmented by industry sector, this net profit expectation varied. Respondents on the whole indicated that operating costs have increased over the past two years, ranging from increases of more than 30 per cent to no noted increases.

3. Growth, Investment & Challenges

More than half of the respondents indicated that their commercial expectations were for consistent and stable growth. The biggest commercial concern highlighted amongst the CEO respondents was the current global uncertainty – highlighted across the board by CEOs from different sub sectors from within the industry. There was also a good level of confidence amongst CEOs to sustain growth over the next 10 years. Investment in human capital and potential challenges that may arise from employment limitations and skills shortages were also highlighted over the course of various questions.

4. CEO Perspectives on the Industry

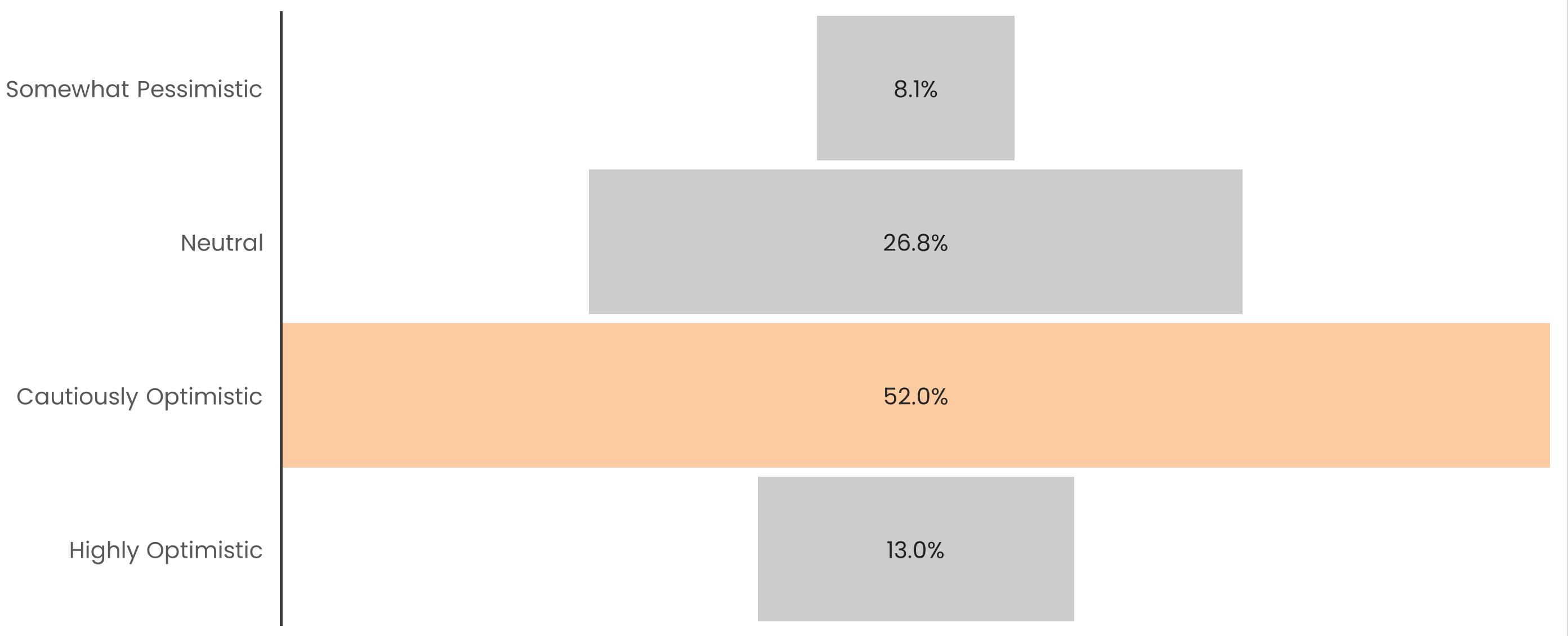

The CEO respondents were for the most part in agreement that refit and rebuilding of the fleet was one of the most significant areas of growth for the industry. In terms of the biggest threat or challenges for the industry, CEOs were quite clear that they felt that geopolitical and fiscal instability was the largest industry threat/challenge. Just over half of the CEOs were cautiously optimistic about the growth prospectives for the industry over the next 12 months.

5. Innovations & Strategic Changes

A large proportion of CEOs indicated that they felt that technological innovations were important for the future growth of the industry moving forwards. Sentiments regarding sustainability/ESG issues were mixed, with some CEOs explaining in great detail about how their companies are trying to tackle this issue, whereas some CEOs said this was still something they had yet to plan initiatives for.

SURVEY DEMOGRAPHICS

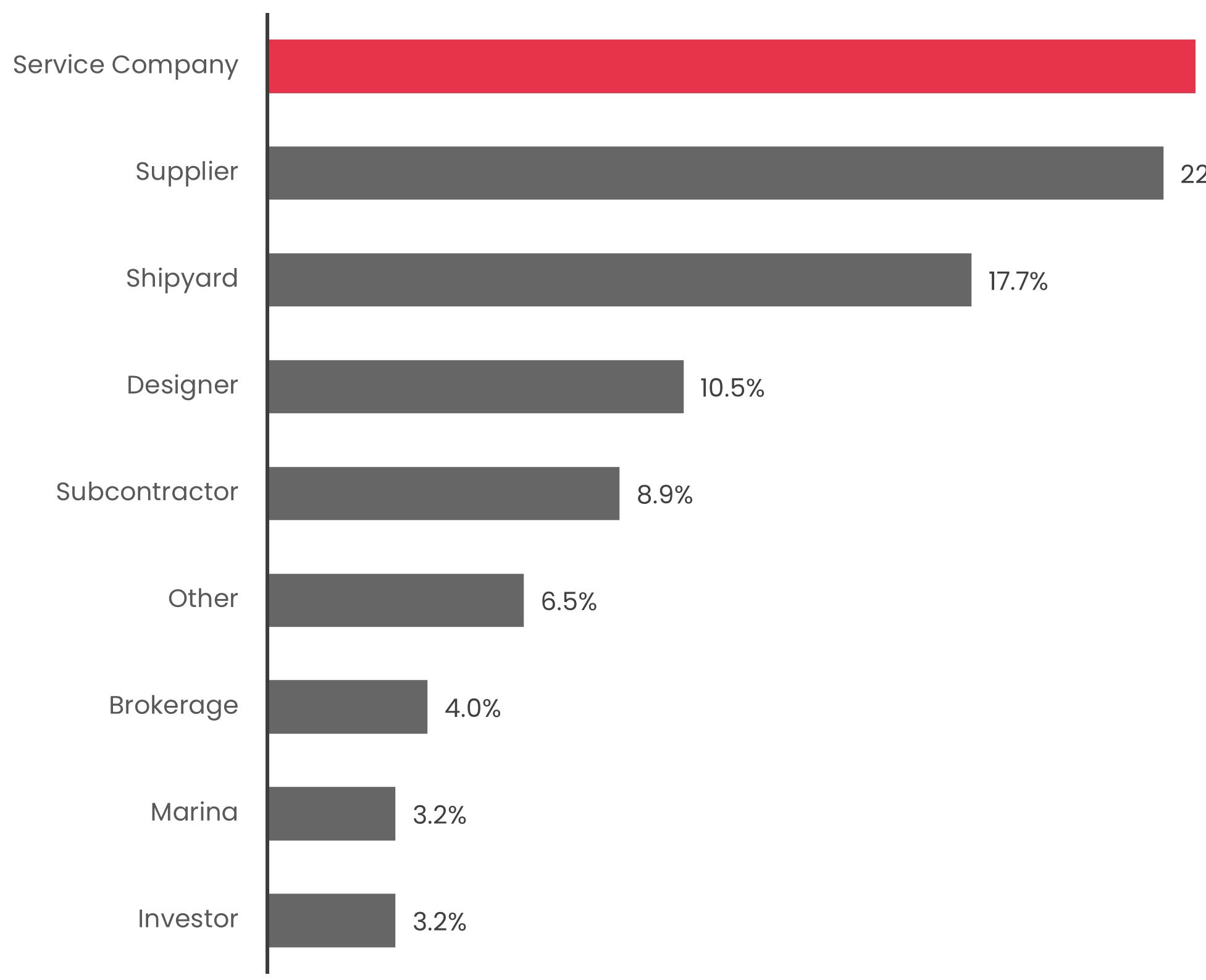

The demographic breakdown of the CEO survey highlighted the broad spectrum of companies within the industry and the multi-faceted approach that different individuals can utilise to join the yachting space. Companies represented ranged from brokerage firms to shipyards and suppliers. In fact, service company CEOs accounted for 23.4 per cent of our survey respondents, followed by suppliers at 22.6 per cent and shipyards at 17.7 per cent. In terms of the ‘other’ category, this included CEOs from companies involved in media, marketing consultancy and ocean marine research.

Interestingly, the size of the companies represented in our survey varied along the spectrum, ranging from one to 10 employees all the way up to more than 200 (Figure 2). The largest proportion represented came from the 1-to-10 employee category, with 39.2 per cent of respondents indicating this was the direct number of employees that they currently employ. This was followed by the 10-to-25 employee category at 23.2 per cent, with the over200 employee category taking the third highest spot

at 15.2 per cent. This highlights the variety and wide spectrum of CEOs who took part in the survey and provided their valuable input into this market piece.

In terms of employee retention and stability, our CEO respondents indicated how the number of people they employ had changed over the past 12 months (Figure 3). Some 62.4 per cent said their employee numbers had stayed the same, suggesting a fair level of stability within the industry, while 26.4 per cent indicated they had significantly grown in numbers which, again, is encouraging for industry staffing figures. However, 7.2 per cent of CEOs in our survey admitted that they wanted to hire but were struggling. There could be a number of reasons for this: a lack of awareness about the industry to recruit new talent, the shortage of skills being passed on from master craftsmen to the next generation or individuals struggling to bridge the gap from offshore to on-shore work. This is where the importance of specialist recruitment firms and the acknowledgement of so many transferrable skills that can be applied to our industry need to be recognised.

REVENUE, TURNOVER AND COSTS

Revenue is at the heart of all business practices and our CEOs very candidly shared which revenue/ turnover bracket they felt their company was placed in (Figure 4). Some 18.2 per cent of CEOs indicated that the revenue bracket for their company was €500,000 to €1 million; however, the next three top-rated revenue brackets differed quite significantly. The next largest revenue/turnover bracket was less than €500,000, which accounted for 14.1 per cent of respondents.

However, following this is where we see the differing responses, both accounting for 12.4 per cent of CEO representation in the €1million to €2.5 million and €5 million to €10 million brackets. This variance

in revenue is interesting in many ways, signifying the large success of many companies within the industry and also how much that success can vary.

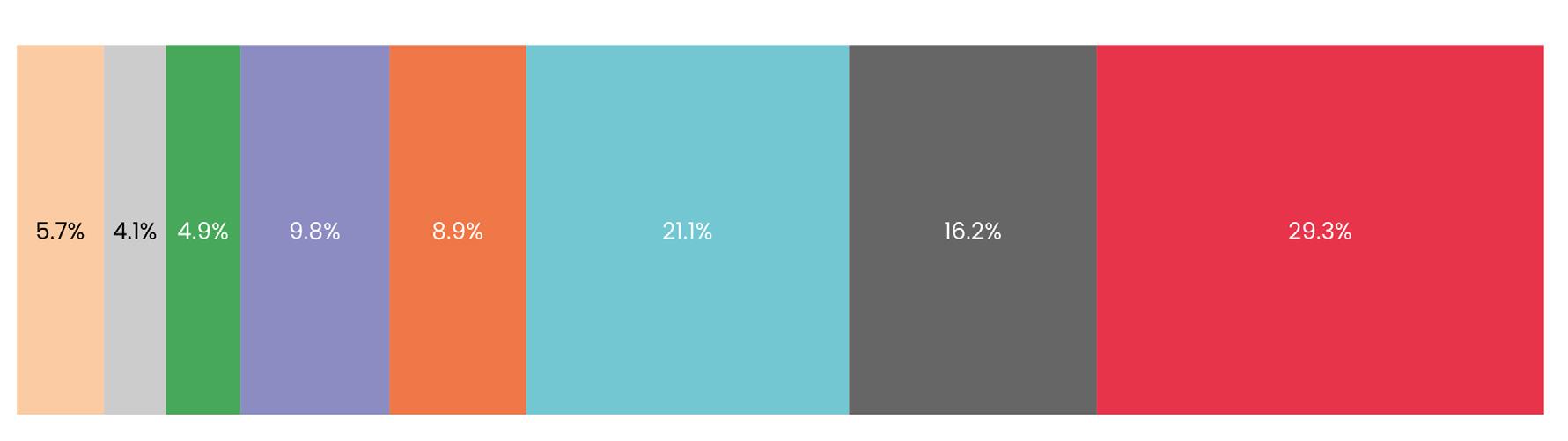

When asked about the percentage change in turnover/revenue their companies had seen over the past three years, 29.3 per cent of CEOs said it had increased by more than 15 per cent; increases of five to 10 per cent were given 21.1 per cent of responses, closely followed by 16.2 per cent of responses indicating an increase of 10 to 15 per cent. This further highlights the success and growth for many companies within the superyacht industry in recent years.

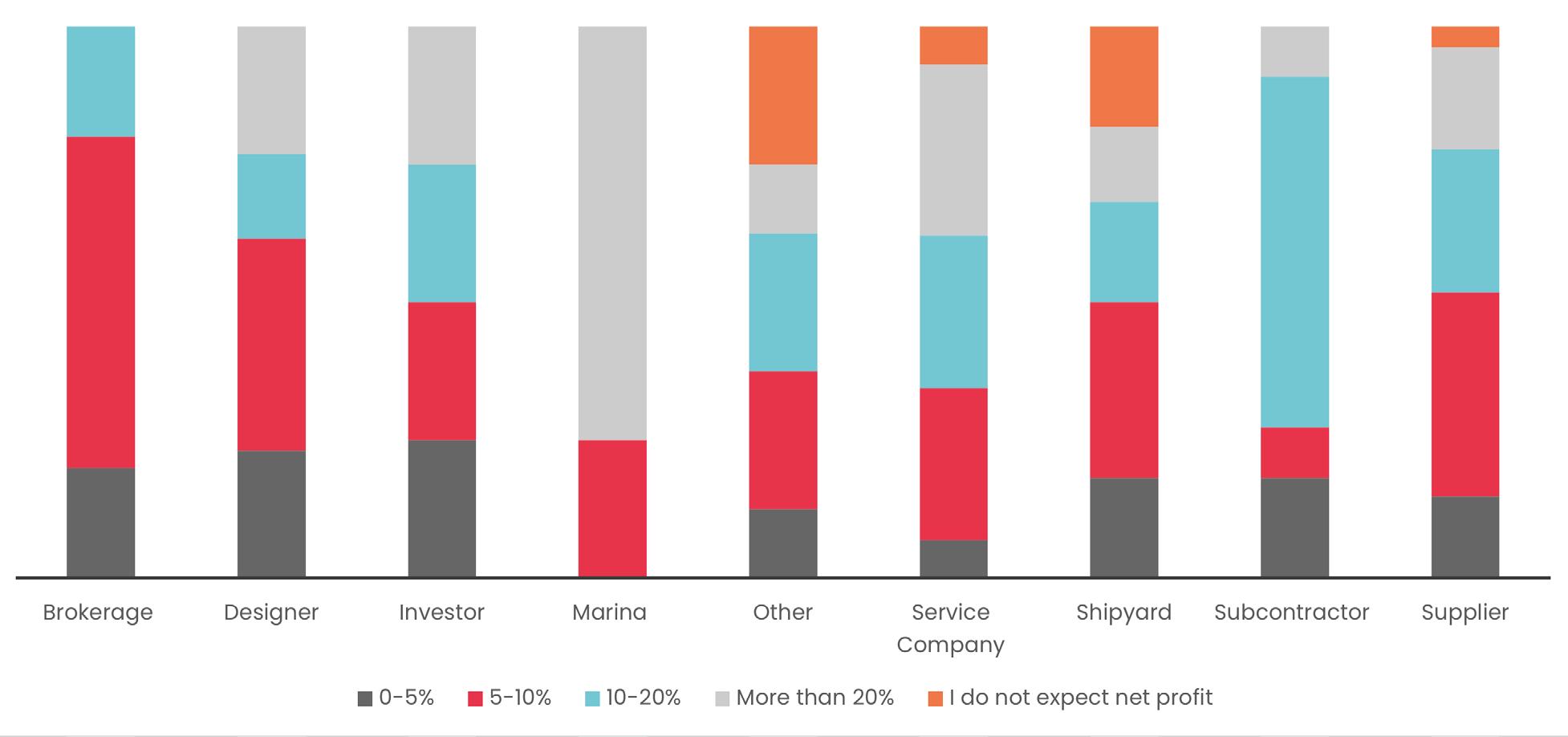

This theme of financial productivity is reflected further in the various net profit expectations for 2024, with 30.6 per cent of CEOs expecting to make a net profit of between five and 10 per cent and a further 25.8 per cent predicting that their net profit for this year will be between 10 and 20 per cent. This analysis became even more interesting when The Superyacht Agency segmented the various net profit expectations by the sector of the CEO

respondents. For example, the majority of marina CEOs indicated that they expected a net profit of more than 20 per cent, whereas the responses from shipyard CEOs painted a very different picture, with respondents opting for each choice from expecting no net profit all the way up to expecting more than 20 per cent net profit, indicating a varied level of profitability within the shipbuilding market.

GROWTH, INVESTMENT AND CHALLENGES

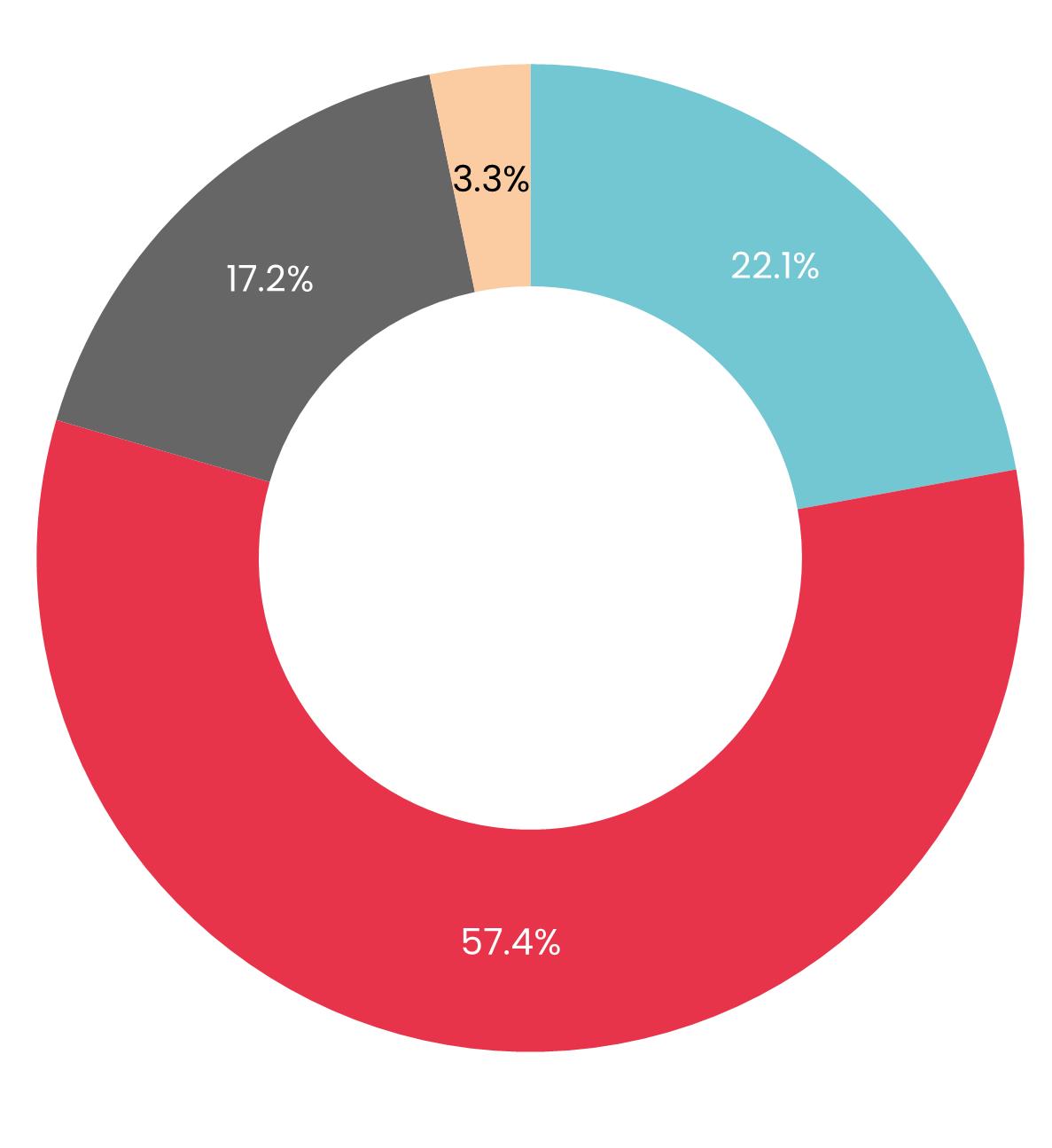

Commercial expectations among our CEO survey pool revealed an overwhelming majority of 57.4 per cent of respondents sharing that in the next five years their commercial expectations were for consistent and stable growth (Figure 10). Stability and growth were key sentiments among respondents, as only 3.3 per cent indicated that they were concerned about uncertainty with potential market declines. However, it should also be noted that 22.1 per cent of CEOs foresaw excellent positive growth in the next five years, highlighting an industry confidence in growth.

Something worth noting when analysing the commercial expectations of the market is that when The Superyacht Agency investigated the 3.3 per cent of responses who indicated “uncertainty with potential market decline”, there was a split in respondent company sizes. Of those that made up that 3.3 per cent group, half were from companies with over 200 employees and a quarter from companies with 1-10 employees, highlighting that market uncertainty is not exclusive to any particular company size and is a sentiment being felt in differing subsets within the industry.

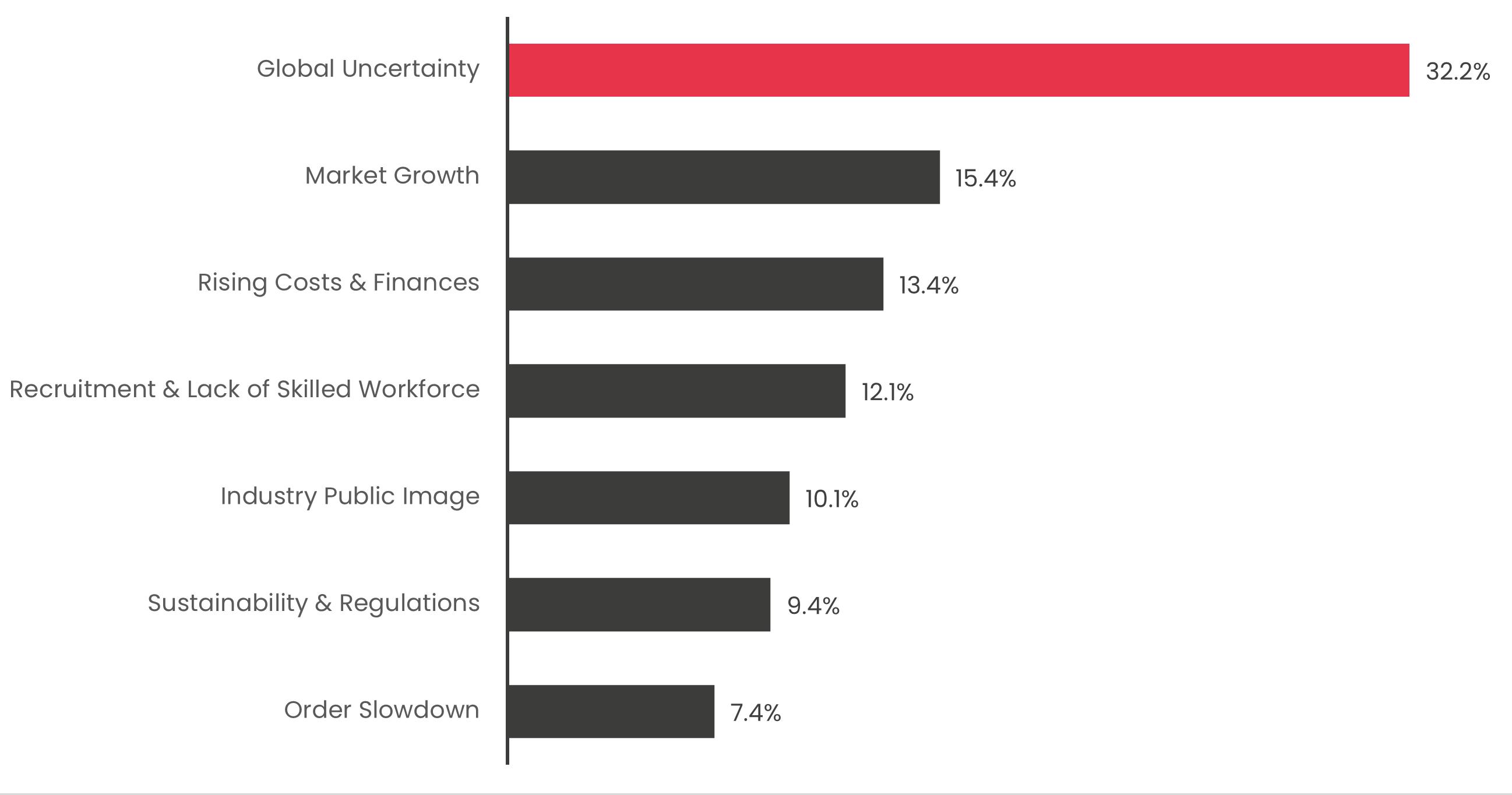

In terms of potential commercial concerns (Figure 11), our CEO respondents were clear: 32.2 per cent revealed that their biggest commercial concern was current uncertainty in the world. This was by far the most highly rated concern reflecting the response to current global issues from our industry leaders. These concerns are valid and expected, with the geopolitical issues around the world such as the Russian invasion of Ukraine, the Gaza-Israel conflict and the continuing uncertainty from the new presidential term in the US.

The analysis also revealed other key commercial concerns: 15.4 per cent of CEOs were concerned about market growth rates and 13.4 per cent of respondents believed that their biggest worries were both rising costs/finances. The topic of public image, accounting for 10.1 per cent, has long been a point of discussion, with the perception being that of extreme opulence and wild times at sea, whereas many in the industry know this is far from the reality. This distorted public image is understandable in terms of commercial concerns as companies that may wish to expand outside the yachting sector may face unfounded doubts and rebuttal from those who do not truly understand the nature and nuances of the market.

“ANOTHER PANDEMIC OR WAR” – BROKERAGE

“INSTABILITY IN GENERAL, UNPREDICTABILITY, UNPREDICTABILITY OF RUNNING COSTS, LACK OF QUALIFIED LACK OF LABOUR, FUTURE INFLUENCE OF AI” – DESIGNER

“OVER REGULATION BY ENVIRONMENTAL AGENCIES” – MARINA

“THE SLOWDOWN OF NEW ORDERS AND THE KNOCK ON EFFECT OF STAFFING GROWTH AMONGST MY CLIENTS” – SERVICE COMPANY

“MY COMMERCIAL CONCERN IS FINDING AND RETAINING QUALIFIED LABOUR GLOBALLY. SKILLED TALENT IS ESSENTIAL FOR DRIVING INNOVATION, ENSURING OPERATIONAL EXCELLENCE, AND MEETING GROWTH OBJECTIVES” – SHIPYARD

“SHIPYARDS AND THEIR SUPPLY CHAIN ARE STRUGGLING TO APPROACH THEIR WAY OF WORKING IN A DIFFERENT WAY DESPITE THE CONTINUOUS INCREASE IN SIZE AND COMPLEXITY OF PROJECTS” – SUBCONTRACTOR

“SHORTAGE OF WELL-EDUCATED STAFF AND INCREASED PURCHASE PRICES VS COMPETITIVE MARKET SITUATION, FEWER NEW-BUILD ACTIVITIES CAUSING LOWER FREQUENCY VS INCREASED FIX-COSTS” – SUPPLIER

GROWTH, INVESTMENT AND CHALLENGES (CONTD)

CEOs were next asked to indicate how confident they felt in their company’s ability to sustain growth over the next 10 years. 50.8 per cent of CEOs responded that they felt confident in terms of growth rates, followed by 28.2 per cent of leaders who responded that they were very confident in growth rates. Only 3.2 per cent of CEOs indicated that they felt little confidence in their ability to grow, further highlighting the growth potential and market trajectory of the superyacht industry.

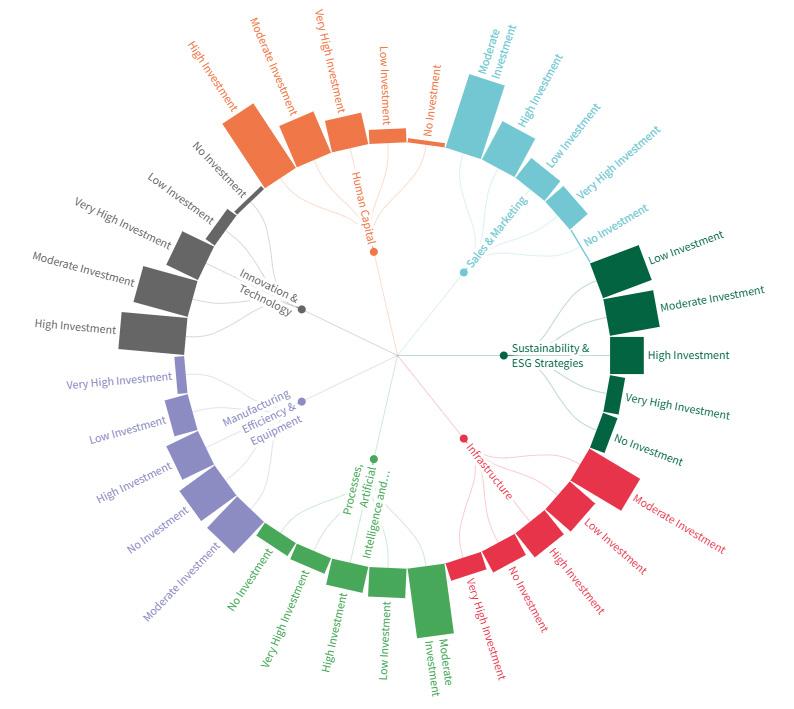

When it comes to investment from the leaders of our industry, there was a wide range of responses (Figure 13). Both Innovation and Technology and Human Capital were selected as the most frequent areas to receive high levels of investment by CEOs, emphasising the response from the industry towards the growth and evolution of technology, and the way it can change and overhaul certain elements within operations, marketing, design and much more.

Figure 12: Confidence in company’s ability to sustain growth over the next 10 years

The investment in human capital is also crucial. As reported above, the majority of companies in the industry have maintained the same level of employees for the past 12 months, while others want to hire but are struggling, all of which links to the need for investment in human capital. The low/ moderate levels of investment towards sustainability & ESG strategies highlight the continued need for more awareness in this area, and particularly trying to understand from our industry CEOs why this important investment area continues to be underinvested, as indicated by our respondents.

GROWTH, INVESTMENT AND CHALLENGES (CONTD)

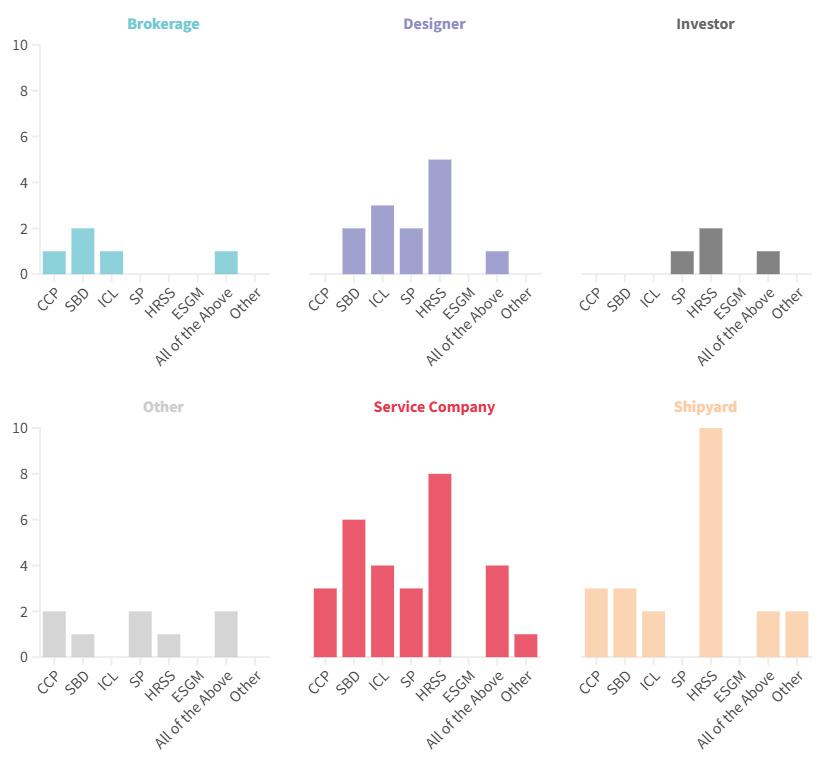

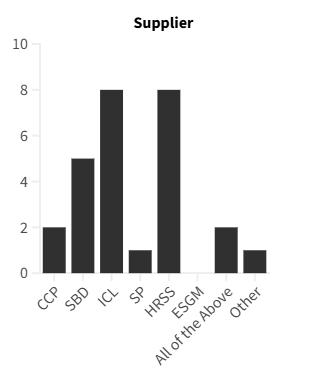

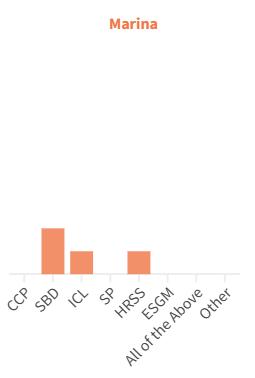

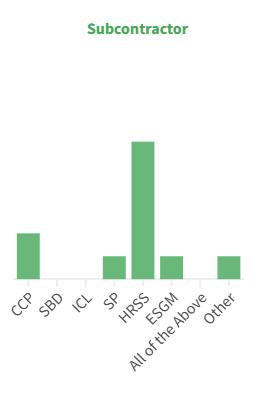

The Superyacht Agency has taken the analysis of this question even further, segmenting the biggest challenges companies believe they will face in the next five years by the sector that the CEO respondents are from (Figure 16). Unsurprisingly, shipyards, suppliers and service companies were among the top respondents highlighting the potential challenges of human resources and skills shortages, particularly when considering the continuing sentiment about a lack of a skilled workforce in the industry. Service companies were also the largest respondents of having challenges in terms of succession planning and were joint highest with suppliers for challenges concerning sales and business development. Suppliers were also the most concerned with an increased competitive landscape in the next five years.

KEY

CCP = Changing consumer preferences

SBD = Sales and business development

ICL = Increased competive landscape

SP = Succession planning

HRSS = Human resource and skills shortages

ESGM = ESGM management and reporting

CEO PERSPECTIVES ON THE INDUSTRY (CONTD)

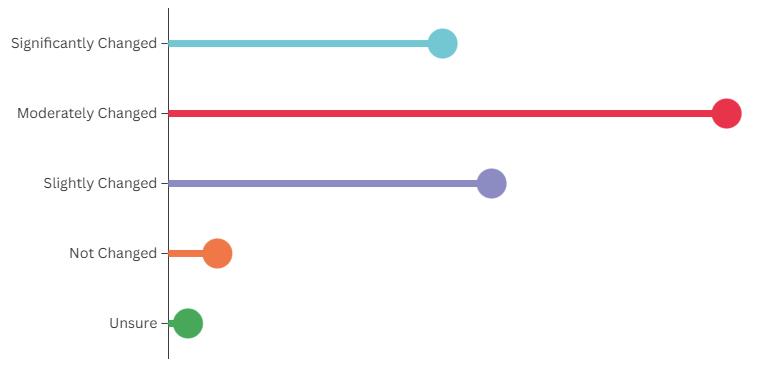

Continuing the theme of CEO thoughts on the wider industry, the CEO respondents were asked to what extent they thought that client/consumer preferences in the industry had changed over the past five years. The majority vote was that client/

consumer preferences had moderately changed, accounting for 45.6 per cent of the responses. 22.4 per cent were of the belief that preferences had significantly changed and only 4 per cent felt that nothing had changed in the last five years.

Sentiments about growth prospects over the next 12 months were for the most part positive, with 52 per cent of CEOs agreeing that they were cautiously optimistic regarding the growth of the industry. This is understandable considering the earlier responses relating to geopolitical instability and concerns regarding rising costs. However, this cautious optimism is encouraging because it shows the overall mindset of the leaders of the industry and how they believe that the market will continue to

grow and develop in the coming years. 26.8 per cent of CEOs were neutral in terms of growth, and this can be equally attributed to the current circumstances facing the global economy and political stations. This neutrality signals the shrewdness of certain business leaders in their approach to business development and their potential patience to see how particular situations unfold in the coming months and years.

CEO PERSPECTIVES ON THE INDUSTRY (CONTD)

Figure 22 represents what our CEOs held as their reasoning behind their perspectives on the industry’s future growth potential. Sustainability and innovation were the top two key words mentioned by the CEOs when discussing growth potential, and this is represented by their slightly larger presence within the graphic. Following on from this, environmental and geopolitical were the next two most commonly utilised terms, therefore continuing a core theme throughout this report regarding the CEOs of this

industry and their concerns for outside influences on the industry such as the geopolitical situation the world currently finds itself in. AI, technology and infrastructure were also mentioned, highlighting the continued need to innovate and look for new solutions and technologies within the market, especially with the awareness from regulations and environmental bodies about some of the essential changes that need to take place in the coming years.

22: CEOs’ reasoning behind their perspectives on the industry’s future growth potential

SKILLS OWNERS CLIENTS

INNOVATIONS AND STRATEGIC CHANGES (CONTD)

The quotes here present a snapshot of CEO opinions about what fundamental changes they would like to see within the industry by 2030 to help improve business performance and ensure long-term market resilience. The thoughts from some of the industry leaders ranged from the ever-green topic

of sustainability to the evolution of the overall public image of the yachting industry. The responses for this were wide and all-encompassing and the full list of quotes is published as an appendix towards the end of this report.

“A SHIFT AWAY FROM EXCLUSIVITY AND LUXURY TOWARDS SOCIAL RESPONSIBILITY AND LEADERSHIP”

“ADOPT OPERATIONAL EXCELLENCE IN EVERY ASPECT OF THE NEW BUILD AND REFIT PROCESS. THE INDUSTRY IS NOWHERE CLOSE TO WORLD-CLASS MANUFACTURING AND WOULD BENEFIT FROM OTHER INDUSTRY SUCCESS BLUEPRINTS. THIS WILL SUBSEQUENTLY TACKLE OTHER CHALLENGES TOO, E.G. SUSTAINABILITY, INNOVATION, SKILLED LABOUR SHORTAGE, ETC”

“BETTER TRAINING AND PROFESSIONALISM STANDARDS ACROSS EVERY PROFESSION IN THE INDUSTRY”

“BY 2030, I ENVISION THE ENTIRE SUPPLY CHAIN OF INDUSTRY AND ALL CLIENTS EMBRACING SUSTAINABLE PRACTICES AND ADVANCED TECHNOLOGIES TO ENHANCE EFFICIENCY, SECURITY AND INNOVATION. ADDITIONALLY, FOSTERING FLEXIBLE WORKFORCE MODELS, ROBUST CYBERSECURITY MEASURES, ENSURE LONG-TERM MARKET RESILIENCE AND ADAPTABILITY TO FUTURE CHALLENGES”

“CREATE NEW GLOBAL MARKETS WITH A NEW APPROACH ON ENTRY LEVEL CUSTOMER… THE CUSTOMER BASE THAT SUSTAIN THE INDUSTRY IS TO OLD AND UNLIKELY WILL HAVE MANY MORE PRODUCTS CYCLES (ONE NEW VESSEL EVERY THREE TO FOUR YEARS)”

“GETTING MORE PEOPLE TO WORK IN THE INDUSTRY AND DO MANUAL LABOUR, BECOMING SKILLFUL CRAFTSMEN AND WOMEN”

“IMPROVED QUALITY IN SERVICE AND OPERATION; INCREASE IN WORKFORCE; INCREASE AND IMPROVEMENT IN INFRASTRUCTURE”

“MORE COMPLIANCE AND REGULATORY REQUIREMENTS TO IMPROVE THE OPERATIONAL STANDARDS, BECOME MORE CUSTOMER CENTRIC AND IMPROVE REPUTATION OF THE INDUSTRY BY MEANINGFUL SUSTAINABILITY INNOVATIONS AND EFFORTS” “PROFESSIONALISM , TECHNOLOGY, ENVIRONMENT”

“STABLE GEO-POLITICAL SITUATION”

“THE INDUSTRY NEEDS TO ACCEPT THAT WE ARE UNNECESSARY. WE NEED TO PROVIDE BETTER SERVICE, BETTER VALUE AND BETTER QUALITY TO ENSURE SUPERYACHT OWNERS CONTINUE TO VALUE THEIR YACHTS. IN ORDER TO DO ACHIEVE THIS WE NEED TO SEE MORE COLLABORATION, INNOVATION A ND CREATIVE THINKING. DON’T GET STUCK IN A RUT AND WONDER WHERE IT ALL WENT WRONG WHEN IT’S TOO LATE”

“THE SUPERYACHT INDUSTRY NEEDS TO GET AN UPDATED PUBLIC IMAGE. INSTEAD OF BEING KNOWN FOR SERVING A LITTLE GROUP OF UHNWIS, IT SHOULD BE KNOWN FOR EMPLOYING THOUSANDS OF COMPANIES AND WORKERS WORLDWIDE AND ITS UNIQUE CHANCE OF CREATING BUSINESS WITH THE HIGHEST QUALITY OF CRAFTSMANSHIP”

APPENDICES

APPENDIX 1: WHAT CEOS ARE DOING TO TACKLE SUSTAINABILITY/ ESG ISSUES FROM A STRATEGIC PERSPECTIVE (CONTD)

Environmental friendly materials, alternative fuels, cyber security

Environmentally friendly engines

Expanded cruising destinations and marina facilities

Finding the evironmental solutions together as an industry

For building, a concentration on minimalism. For people and planet, a concentration on the ocean as the key stakeholder

Further growth in best-value solutions and partnerships vs low-cost solutions

Gaining market share, improving buying power and economies of sale

Get rid of the cowboys through regulation and qualification requirements!

Getting more people to work in the industry and do manual labour, becoming skillful craftsmen and women

Greater market share in Asia/China

Having regulations that are correct for the operational profile of yachts

Hydrogen propulsion vessels

I don’t have the right answer yet, but I am focused on staying adaptable and continuously evaluating the best strategies for ensuring long-term market resilience and improved business performance

I would like the industry to be strategically steadfast while adopting new technologies and knowledge

Improved quality in service and operation; increase in workforce; increase and improvement in infrastructure

improving how the beneficial end users can contribute to global society

In the naval architecture, marine engineering and crewing fields, greater cross-pollination between the yacht market and the commercial shipping field. We are one greater maritime industry. There is strength in unity to overcome challenges of design and engineering of vessels and their systems, as well as those of nurturing and securing capable mariners. Greater openness and willingness to listen and to understand each other is needed between designers and naval architects to overcome the dichotomy that occasionally arises between these professions. Again, complementary professions where in unity there is strength

Increased infrastructure- we need new marinas quickly

Innovation, ethics and transparency

integrated approach in the value chain]

Investing in staff, client relationships

Larger lifting capacity

Less brokers

Less bureaucracy between jurisdictions

Lobby up, bring shipyards together to be stronger in appeals to government

Long-term strategies over short-term financial gain

Long-term thinking of all involved

Make smart, not politically correct, decisions on environmental issues

More care about climate

More compliance and regulatory requirements to improve the operational standards, become more customer centric and improve reputation of the industry by meaningful sustainability innovations and efforts

More fuel efficient and more sailing yachts

More investment in research and development of new models and technology with principles of flexibility for clients, along with more optionality in the commercial arrangments for aquisition

More openness to new technology and the entire industry working to support and implement it

More professionality and better provision of the demand

More research by companies like The Superyacht Agency to help US and other countries understand where the opportunities lie

More shipyard and berthing facilities for superyachts in the western Mediterranean

More stability in the workforce, especially the key players

Much more cooperation between shipyards and co-makers

Honest price levels/demands

On all fronts, improving good-quality technical staff is necessary. Currently, this is very poor and this will certainly not improve in the coming years, rather be getting worse

Open to less traditional methods

Open to new companies and ideas

Our superyacht industry must better market to the whole world all the works performed by us, the players, to be sustainable and that some owners are willing to improve. Also, it becomes foremost to better train the crews in order to increase their skill. It is not only a matter of keeping in perfect condition the asset for their owner but also a matter of safety at sea in general

Pay crew more and then some

People (clients and service providers) who see the bigger picture in this industry, and are not guided by the idea of take the money and run

Positive image building

Professionalism, technology, environment

Radical improvement in software to improve the customer experience

Realistic fossil fuel (energy) alternatives. Technological advances in ocean maneuvering that lesson our ecological footprint but increase access. We need a lot more science to support more informed decision making for technology and for policy

Refining production procedure

Respect the professionals get rid of pirates and support those with experience

Seriousness, ability to research best product and best workers (that be crew, workers or subcontractors, which is the field)

Setting industry standards on much wider level than available at the moment

Simplify the cruising and entry plans to make it easier on captains and agents

Stabilisation of economy and geopolitical situation

Stable geo-political situation

APPENDIX 2: THE FUNDAMENTAL STRATEGIC CHANGES CEOS WOULD LIKE TO SEE IN THE INDUSTRY BY 2030 TO IMPROVE BUSINESS

PERFORMANCE AND ENSURE LONG-TERM MARKET RESILIENCE

Absolutely key

Addressing sustainability and environmental, social and governance (ESG) issues strategically involves a multi-faceted approach that integrates sustainability into core business operations, investment decisions and organisational culture

AI platforms can dramatically enhance the overall footprint of the superyacht and we are focusing on the development of such an integrated solution

Applying strategies for reducing our carbon footprint

As a designer we have limited possibilities

As a timber trader, sustainability is required by law - therefore just fulfilling the law in the moment

As an independent copywriter, content writer and marketer, try to engage clients who are sustainability- and ESG-aware and compliant; indeed, I help such clients broadcast their message of the benefits of their ESG-compliant practices to their markets

As much as possible

At the moment I am still in the process of understanding the individual processes and interrelationships. I have booked external consultants for this purpose, with whom we will develop an appropriate strategy next year

Attention to all possible ways to reduce impact

Be in line with market requirements

Bringing awareness to the clients and involving our employees in finding sustainable solutions and alternatives

Constantly increasing our % investment into ESG and maximising the affordability of ESG solutions for our clients

Create an ESG report

Develop sustainable solutions and present those to the industry

Developing ESG rating and assessment for the yachting supply chain

Developing products with a major impact on fuel saving and energy transition

Diversification

Diversity

Educating clients/promoting policies

Electrification and fuel cells are very high on the list of items required to achieve sustainability. This is the foundation and very core of our business to promote and develop clean energy

ESG-awareness training of all associates

ESG is quickly falling out of favour in the US, and we have always been diverse employers with many women and minorities, so we continue doing what we have done for 85 years

ESG reporting to markets, and implementing/integration in all aspects of business

Explore various options which are available

Feed the team with new and bright brains

First architecture and interior design studio in the world to be accredited with the butterfly kitemark from positive luxury. Carbon neutral as a business, developing big data collection from the industry suppliers to assist other design companiesSigned Architecture and Interior Design Delares Whole business events are run as carbon positive

Flying less. I still cringe when see posts like ‘3rd flight this week’. With video/AI this should cut people’s travel. We have produced no additional merchandise for years, no cheap pens etc

Full transformation of our business model

Greener vessels, more efficiency, lower operating costs encourage micro-renovations as a smart alternative to complete overhauls, offering a way to refresh yachts while minimising waste and unnecessary resource consumption This approach aligns with our commitment to sustainability, allowing us to contribute to a more eco-conscious industry while still meeting client expectations

try to maintain stable relationships with strategic partners

I’m strategically addressing sustainability by mapping the carbon footprint of my services, providing long-lasting, sustainable solutions, and ensuring we get it right from the start. Fixing wrong choices is not sustainable

Identify and priotise, set goals and targets, develop policies and practise, measure and report progress, continuous improvement

Implement these values into the complete process of each project, from the first contact with the client until the re-delivery of his yacht after her refit

Improving packaging materials, reducing power consumption, enabling users to contribute to global efforts

In our new-build contracts we include tech that improves sustainability. In our fleet operations we guild the ships on how to improve the ship’s impact

Incorporating wind into propulsion mix

Innovate or early adopt

Invest without restraint

Investing and providing solutions

Investing in eco-friendly infrastructure, supporting ocean conservation initiatives, and promoting sustainable practices within our operations

Investing in studies and statistics-based research

Investment in technology, education employer and clients

It’s been the 100% focus of our business strategy for 10 years

It is in the core of our development, and we invest in research. We include our leadership in our sales efforts

It is primary in our strategic perspective being one of the business pillars

Keep product attractive

Keeping an eye on all new technologies applicable and introduce them where possible

Keeping an eye on what is happening in this field

Keeping it in view, but not drastically changing

Key part of our business strategy

Knowlege

Learning more and cooperate with right partners for complete innovation

Listen to the market and the opinion

APPENDIX 2: THE FUNDAMENTAL STRATEGIC CHANGES CEOS WOULD

LIKE TO SEE IN THE INDUSTRY BY 2030 TO IMPROVE BUSINESS

PERFORMANCE AND ENSURE LONG-TERM MARKET RESILIENCE (CONTD)

Make it better for less to keep cost on same level – this is what we try for years now

Material selection in fabrication

Meet requirement

Minimal impact to our sector

Minimal travel, paper free

Move as fast as we can!

New production technologies and materials

Not a lot currently

Not going corporate! We need to keep the businesses a float and support the little guys as much as we can!

Not much

Not much from our perspective

Not so much in this moment

Not very much - at the moment

Nothing

Nothing more than usual. ESG was our focus long before it became a clickbait acronym The industry is generally still in the dark when it comes to software-driven efficiency throughout the life of the boat. We are designing tools to streamline through-life support and give shipyards a deeper stake in the operational phase - to encourage them to better understand the client and build what is needed, rather than build impractical over-complicated wasteful designs”

Observe evolution

Ongoing environmental initiatives in production and manufacturing

Our biggest impact is with the people we employ and work with therefore we work hard to treat them in the best possible way

Our DNA embraces sustainability and ESG issues

Partnerships, R&D with user/market validation. Flows directly into our product development

Promoting practical solutions that will increase efficiencies and lower costs

Provide support [for] these changes

Purchasing from more sustainable sources, upcycling waste where possible

Reducing waste and investing in longevity of products

Researching and also asking what people want

Since 16 years we are involve in a “responsible” hybrid yacht manufacturing long before it was “fashionable”

Social governance has been at the heart of our company for over 20 years, it is our DNA and how we look after our employees

Stay on top of things!!

Strategic partnerships such as B Corp and prime to focus our impact work and visibility

Sustainability has been a theme in our company since 2014 – today in 2024 the rest of the industry is catching up

Sustainabilty /ESG issues are a reality and are driving regulations and we need to adapt and be proactive where we can

Taking common sense measures now and mentoring our team to continue as well as to capture new technologies that will develop in our organisation’s mission plan

Teaching more about sustainability

This goes throughout the company from the lowest level to the yachts we built

This has only just come on our radar so we are taking our time to introduce this in our business rather than just jumping on board and ‘greenwashing’ to tick a box

Try to implement the latest technology to keep ahead of the future requirements

Trying to be as environmentally efficient as possible

Unfortunately, very little

Very little if any

We actively support those initiatives when given a chance yet the final decisions are made by the owners

We adapt to the requirements

We are donating 1% of our revenues to direct impact initiatives for ocean conservation

We are leading

We are using AI and developing new software for the superyacht industry to reduce carbon footprint

We are working to ensure all marinas in the UK have the correct infrastructure to support superyachts visiting the UK, such as net zero shore power

We do everything we can to eliminate the use of plastics

We endeavour to make our yachts consume less energy and prepare the yachts for future energy sources

We have a 5-year strategy with goals to reach

We have a very robust environmental programme. We partner with universities, colleges and grade K-12 schools to host research, education and innovation testing and development. We run a tight ship when it comes to employing strict operational environmental policies. We host education sessions with our customers and also offer “citizen science” experiences. We share with others in the industry and watch for ideas from others. We do not continue unsustainable business practices (environmental, social or financial). We seek continued improvement by reviewing practices regularly.

We actively work to improve the ecology of our local physical environment

We have continuously invested in sustainability and energy-saving equipment in recent years We will continue to explore this in the coming years

We try to push al the companies around as to use the most sustainability products

With our yacht management software we provide tools to manage yachts more efficiently and effectively and reducing resources, time and costs

You can only help from abundance

DISCLAIMER

(1) Introduction

This disclaimer governs the use of this report.

(2) Credit

This disclaimer was created using an SEQ legal template.

(3) Extra Services

Any additional services perceived as falling outside the deliverables will be chargeable. If the client becomes aware that such work is needed, it is their responsibility to inform The Superyacht Group/The Superyacht Agency – Intelligence. Upon reaching an agreement with the client, extras will be billed and charged according to the additional time required.

(4) Data Protection Clauses

Any information collected and/or data provided by the client to The Superyacht Group/The Superyacht Agency – Intelligence and used by the company directly or indirectly in the performance of this agreement shall remain at all times the property of The Superyacht Group/The Superyacht Agency – Intelligence. It shall be identified, clearly marked and recorded as such by the client on all media and in all documentation. However, confidential data will be used for statistical purposes only. All data passed to the client as part of this project, may be used by the client at its own discretion, while citing the source as The Superyacht Group/The Superyacht Agency – Intelligence.

(5) No advice

The information is not advice, and should not be treated as such. You must not rely on the information in the report as an alternative to financial advice from an appropriately qualified professional. If you have any specific questions about any financial matter you should consult an appropriately qualified professional. You should never delay seeking legal advice, disregard legal advice, or commence or discontinue any legal action because of information in the report.

(6) No Representations or Warranties

To the maximum extent permitted by applicable law and subject to section 6 we exclude all representations, warranties, undertakings and guarantees relating to the report. Without prejudice to the generality of the foregoing paragraph, we do not represent, warrant, undertake or guarantee that the information in the report is correct, accurate, complete or non-misleading; that the use of guidance in the report will lead to any particular outcome or result; or, in particular, that by using the guidance in the report you will choose the best model to meet your business needs.

(7) Limitations and Exclusions of Liability

The limitations and exclusions of liability set out in this section and elsewhere in this disclaimer: are subject to section 6 below; and govern all liabilities arising under the disclaimer or in relation to the report, including liabilities arising in contract, in tort (including negligence) and for breach of statutory duty. We will not be liable to you in respect of any losses arising out of any event or events beyond our reasonable control. We will not be liable to you in respect of any business losses, including without limitation, loss of or damage to profits, income, revenue, use, production, anticipated savings, business, contracts, commercial opportunities or goodwill. We will not be liable to you in respect of any loss or corruption of any data, database or software. We will not be liable to you in respect of any special, indirect or consequential loss or damage.

(8) Exceptions

Nothing in this disclaimer shall: limit or exclude our liability for death or personal injury resulting from negligence; limit or exclude our liability for fraud or fraudulent misrepresentation; limit any of our liabilities in any way that is not permitted under applicable law; or exclude any of our liabilities that may not be excluded under applicable law.

(9) Severability

If a section of this disclaimer is determined by any court or other competent authority to be unlawful and/ or unenforceable, the other sections of this disclaimer continue in effect. If any unlawful and/or unenforceable section would be lawful or enforceable if part of it were deleted, that part will be deemed to be deleted, and the rest of the section will continue in effect.

(10) Law and jurisdiction

This disclaimer will be governed by and construed in accordance with English law, and any disputes relating to this disclaimer will be subject to the exclusive jurisdiction of the courts of England and Wales.

(11) Our details

In this disclaimer, ‘we’ means (and ‘us’ and ‘our’ refer to) TRP Magazines Limited, a company registered in England and Wales under registration number 2728298.

THE SUPERYACHT INTELLIGENCE CONSULTANCY

We deliver custom and bespoke intelligence for the superyacht industry’s entrepreneurs, investors, senior management, yacht owners & key decision makers