tR ,A

the lumber, building materials ana home improvement markets - since 1922

the lumber, building materials ana home improvement markets - since 1922

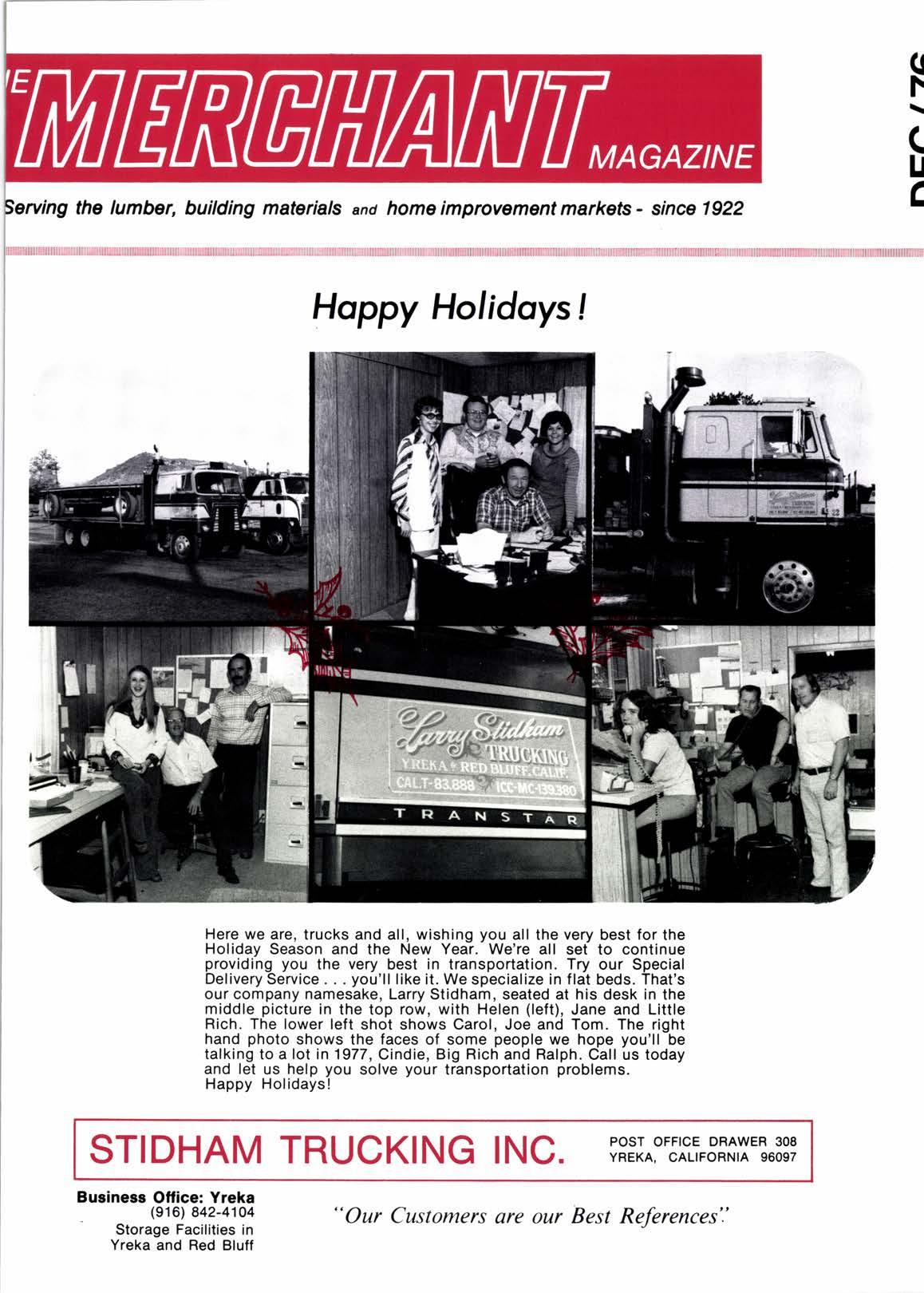

Here we are, trucks and all, wishing you all the very best for the Holiday Season and the New Year. We're all set to continue providing you the very best in transportation. Try our Special Delivery Service. you'll like it. We specialize in flat beds. That's ourcompany namesake,Larry Stidham, seated at his desk in the middle picture in the top row, with Helen (left), Jane and Little Rich. The lower left shot shows Carol, Joe and Tom. The right hand photo shows the faces of some people we hope you'll be talking to a lot in1977, Cindie, Big Rich and Ralph. Call us today and let us help you solve your transportation problems. Happy Holidays!

Sening tha lumbel buikting matarials end home imptovement markefls - sincf, 1922 lormerly Weslatn Lumber & Building Materials Merchant

DECEMBER, 1976 VOLUME 55, NO.6

0R NEWS and FEATURES

ANNUAL BUSINESS FORECAST ISSUE

AN ECONOMIC AND CONSTRUCTION OVERVIEW

HARDWARE INDUSTRY IS BULLISH OVER '7J

PLYWOOD INDUSTRY SEES "BEST YEAR EVER" A POSSIBLE PAUSE SEEN BY DISTRIBUTOR

LESS NATIONAL LUMBER DISTRIBUTION SEEN

STOCKING DISTRIBUTOR'S ROLE IS GROWING

Publisher Emeritus A. D. Bell, Jr.

Editor-Publisher David Cutler

Contributing Blitor Dwight Curran

Contributing Editor Gage McKinney

Contributine Editor Al Kerper

Advertising Production Mgr. Ms. D. Hamil

Art Director Martha Emery

Stafr Artist Terry Wilson

Circulation Marsha Kelley

The Merchant Magazine is published monthlv rt 4Y)0 CamDus Dr., suite 476, l{ewport Beach. Ca.92660, Phone (714) 549-8393 or {714) 549-8394 by The Merchant Masazine. lnc. Secondclass nostuqe ratels naid ot NewDort Beach. Ca..-and addiiional offices.'Advertising rates upon request.

ADVERTISING OFFICES

NORTHERN CALIFORNIA & PACIFIC NORTHWEST 4500 Campus Dr., suite 476, Newport Beach, Ca. 92660. Phone (714) 5498393.

SOUTHERN CALIFORNIA

& THE COST/PUSH

THE NATIONAL DEALER OUTLOOK BY NLBMDA FOREST PRODUCTS

WHOLESALERS FEAR '7J WILL BE TOO GOOD

A SOLID GROWTH SEEN FOR HOME CENTERS

REDWOOD ASSOCIATION FORESEES BIG YEAR

WEYERHAEUSER: ..LOOKING BETTER EVERY DAY',

HARDWOOD PLYWOOD: FEELINGS MIXED FOR '77

HARDWOOD POPULARITY AT RETAIL GROWING

Carl Vann, 1385 Westwood Blvd., Los Angeles, Ca. 90024. Phone (213) 477-7593 or (714) 549-8393,

Change of AddressSend suhscriPtion orders irnd uddress chilnges to Circuletion Dent.. The Merchant Masazine,4500 Camnus Dr., suite 4761 Newnort Beach, Ca.92660. lnclude ad<iress label from recent issue if possible, plus new address and zip cooe.

Subscription RatesU.S.. Canada. Mcricu and Latin America: $5-one 1-ear: $8-two years: $l l-three years. Overseas: $7-one vear: $l l-two years. Sinsle copies $1.00. Back copies-$1.50 whe'n av:iilable.

The Merchant Magazine serves the members of the: Aiizona Lumber & Builders Supplt Assn., Phoenix; Lumber Merch'ahti Assn. of Northern California, Los Altosl Montana Buildins Material Dealers Assn., Helena; Mo-untain States Lumber Dealers Assn., Salt Lake City and Denver; Lumber Assn. of Southern California. Los Angelesl Western Building Material Assn.. Olympia. Wa.

THE MERCHANT MAGAZINE

i.s an independent nwga:ine lbr the retail, xhole,sale and di.strihtion levels of the lunther and huildins nuterial.s and honte imnrorenrcnt industrr in the l3 Western slate.\, concenlroting on nerchandising, ,nonoge,rrcnt and acatrote, fadual nexs report ing and interfelalion.

DIRECT MILL SPECIALISTS LOCAL INVENTORY

Redwood Doug Fir Cedar.... Pine Hem-Fir

Redwood Timbers Cedar . Fence Material Handsplit Rustic Posts and Rails

FEATURING R & R OUALITY MACHINE

SPLIT CEDAR FENCE PALINGS

CUSTOM CEDAR PATIO TIMBERS

3700 Newport Boulevard Ncwport Beach, Ca. 92663

(7r4) 540-6940

Distribution Yard: lll Eust Goctz Ave. Santa Ana. Ca.

-I HE lumber and building materials business generally tends to be so cyclical at times that it almost seems a perpetual round trip from Euphoria to Despair, with side trips to Apathy, Concern and Over Reaction. But with the Monongahela mess quieted down, at least for now, and housing starts soaring, home improvement moving inexorably upward and the general industry morale at a high level, there seems to be a remarkably low level of crisis proportion problems. Sure, there are problems, but none at the moment seem to be of the "will-we-all-still-be-here-next-year" type. It's a nice change from some recent years, to say the least.

The concensus of all the forecasts that appear in this annual Business Forecast Issue you're reading now is that business will generally be good in 1977. As we are coming into the year with such strong momentum from l976,it seems,barring the unforeseen, to be as safe as predictions can be.

Yet there is an increasingly voiced concern about 1978, a worry seemingly aggravated by the election of Jimmy Carter. Generally, this usually takes the form of the following scenario: the cur-

rent government budget is pretty well locked in for 1977, but by 1978 President Carter will have been in office long enough to put into effect the inflationary spending measures necessary to come through on his promises made during the election. Given how widespread this theory is, we wonder that if too many people believe too much in it, that it will take the form of a self-fulfilling pro. phecy. That is, everyone thinks we are going to go into a recession in 1978, plans accordingly and bang, there we are in a 1978 recession.

Perhaps all the present concern about a period two years removed is just another example of the old axiom that some people just have to have something to worry about.

But if the recession/inflation forecasters are correct, we suggest to all to keep cool and remember the words of Sir Winston Churchill, spoken at Royal Albert Hall, London, September 29,1943.

"I have no fear of the future. kt us go forward into its mysteries, let us tear aside the veils which hide it from our eyes, and let us move onward with confidence and couraqe."

- Chris Cornett - Boger Cornett - Fred Couture -

John Govington - Bill Cowlinn, Jr. - Lloyd Crandall - 0z Crenshaw

- Bing Crorby - Durne Crow - Jim Crumpacker - Rick Curb -

Grroge Cudworth - Eddio Guellar - Dwight Curran - Dave Cutler

- Frod Dallos- Georgo Oavid - Bill Davidson - Don Lee Davidson

- Milos Davidson - Sam 0avis - Bill Deon - Glenn Dietz - Vic

Ddrunnti - Joa Derrah - Ken Oietel - Clyde Dickerson - Ed

Difrni - Bob DiMeco - Jrck Dollar - Paul Dougan - Bill Dougherty

- Hrnk Drcckmrn - Phil Dubaldi - Graham Dupray - Bud Eastman

- Stevr Erstmrn - Dick Eggleton - Stan Eisner - 8ob Eldredge -

Gah Ellingston - Tom Embreo - Dick Emison - Jetry Esley - Ben

Evanr - Jim Frir - Jrck Fairfield - Eill Fallert - Lyle Farris - Bob

Frsol - Tony Feiger - Bamsey Fendall - John Ferguson - Jim Forrein - Rry Finucan - Glenn Forney - Henry Foss - Grew of tug M/V HEiIRY F0SS - Ed Fountain - Charlie Fox - Ewen

Frascr - Frank Freidenbaugh - 8ob Fremd - Jim Frodsham - Bob

Fuiiimoto - Tony Gallegher - Bob Gallegher - Pete GanahlWayne Gardner - Ben Gardiner - Max Garmon - Gene GauthierJim Gruthier - Bob Gaylod - George Geib - Pete Geib - Tom

Goiisbook - Phil Gilbsn - Denny Gilchrist - Jim Gilchrist - Gene

Gind - Drlo Goodwin - John Gray - Richard Gray - Len Green - Ev Gurrnsry - Ahn Hale, Jr. - John Halsted - Bob Halvorsen - John Hrmpton - Bill Hanen - Ben Hansberger - Bob Hansen -

Gaptain Kds Hansen - John Harmer - Ronnie Harnew - Frank

Hrrrington - Jim Hanington - Stuart Harris - Ralph Harison -

lvrn Hart - Hap Hasty - Bob Hathaway - Norton Hathaway -

Bob Heberls - Butch Hobode - Jay Hebert - Don Helming - Jim

Hrndrick - Eill Herndon - Denny Hes - Frank Higgins - Ann

Hignran - Dan Higman - Jerry Higman - Bon Hite - Bert Holdren

- Jrrry Holdrsn - Frod Holmes - John Holstein - Ron Hopkins -

Eill Hormuth - Jom llormuth - Dick Hotrling - Sherm Hoyt -

Jock Hughoy - Bill Hunter - George Hunter - Hugh Hurth - Cy

lrving - Frank lvrnovich - Bob Jacobsen - Dick Jahraus - Mike

Jameson - Chuck Jenkins - Hank Jensen - Johnny Johnson -

Scrap lron Johnson - Leonard Jones - Dennis Juniper - Stan Kaufman - Drn Kaller - Tim Keller - John Kelly - Buss Kelts -

Phil Kelty - A. L. Kerper - Mead Kibbsy - Godon King - Bill

Knudsen - Bill Koffrrd - Lowell Kolb - Manos Koulouris - Carl

Kufforath - John Kyncy - Walloy Lai - Floyd Laier - G us "C ookie"

Lamrrtino -

0'Kelly - Jim 0lson - Lloyd 0lson -

Oliver 0lson - Boger 0'Neil - Francis O'Sullivan - George 0tto -

Al 0wen - Tony Pacheco - Satchel Paige - Bob Pallow - Ernie

Parcher - Golly Pare - Virgil Partch - Art Penberthy - Frank Pendola - Bill Perkins - Gunnar Petersen - Jack Peterson - Pete

Peterson - Ray Peterson - Joe Petrash - Bob Peyton - Frosty

Phillips - Harry Phillips - Les Pierce - Pitt Pittman - Smokey

Pittman - Tommy Poole - Carl Porter - Seth Potter - JimPottratz

- Tom Powell - Carl Poyner - Mel Prawitz - Sam Preble - Dave

Price - Denver Pyle - Smiley Ouick - Larry Ouinlan - Harry

Ouentmeyer - Carl Bamstrom - Bill Randall - Eill Rau - Bil! Ray

- Jack Rea - Bob Reed - Hal Reeve - Capt. Jerry Reily - Bud

Reitz - lon Beynolds - Tom Reynolds - Verl Rhine - Frank

Rhoades - Jim Richardson - Chuck Riemann - Darrell Robinson

- Cy Rodakowski - Bob Rodecker - George Rodecker - Russ

Roepke - Bill Rogers - John Ronten - Ken Rose - Jim Rossman

- John Rudbach - Bill Rugg - Bob Bushing - Clint Rygel - Bob

Sanders - Grover Saunders - Paul Sause - Fred Scaife - Harlan

Schroeder - Claude Scott - Bill Sharp - Bob Sheperd - Dean

Short - Jake Shugrue - Ed Shuman - George Schmidbauer -

Norm Siefken - Bob Sievers - Charlie Sifford - 8ob Siltainen -

Gil Sissons - Clark Smith - Don Smith - Harold Smith - Bay

Smith * Walter Smith - Cliff Smoot - Ek Snopes - Flem Snopes

- Stark Sowers - Paul Sparso - Duke Speer - Boy Spencer - Pete

Speek - Bob Spry - Gale Stafford - Paul Stake - Frank Stanger

- Stan Stenlake - Don Stobaugh - Ed Stoner - Capt. Bob Storck

- Bob Sullivan - John Sullivan - Don Sundstrom - Tom Supple

- Fred Suverkrup - Herb Suverkrup - John Suverkrup - Wally

Swanson - Don Swart2endruber - Merl Tanner - Phil Taylor -

John Tennant - Harry Terrel! - Fred Thomson - Al Thrasher -

Tim Timmerman - John Tranberg - Keith Vogett - Bex Vowell

- Hal Wagner - Mitch Wagner - Maury Walker - Gil Ward - Terry

Ware - John Weaver - Jim Webber - Bob Wells - Harley Werner -

Herm West * Frank Westlake - John Weston * Warren Wexler -

Hal White - Harry White - Cayce Whitten - Jim Whitty - Hugh

Wilhoit - Dick Williams - George Williams - Dave Willis - Chet

Wilson - Cece Wingard - Sam Wingate - Bud Wimberly - Sam

Witzel - Sterling Wolfe - Gordon Woolard * Ted Wood - Tim Wood - Pat Young - Jack Zalaha.

F\su.qNl for Ywood products will accelerate during 1977 as the entire U.S. and most free world countries continue to experience basic economic improvement. Currently the American economy has slowed somewhat during the summer months but is expected to move ahead slowly through the balance of 1976. The ground for continued economic growth is solid through 1977. The following factors tend to support this view.

ECONOMIC INDICATORS

Gross National Product 1976 1977 Change

19'12 $

$1,696.0 1,880.s +10.9 1.268.0 1.332.7 + 5.1

Real growth in GNP will run close to 5% over 1976 and inflation on the same level will be held under 6%. Although unemployment is current-

Solid growth thru '77 starts at 1.65 million mortgage rates steady around 9%; 1OO,OO0 more apartment starts . repair and remodeling continues to be an impressive growth area.

ly running at the rate of 7 9% this was caused in part by the large increase (2.3 million) of new people added to the labor pool this year. Our civilian labor force is now over 95 million and 93% or more should be gainfully employed through most of 1971. The magnitude of this many people at work will of itself provide a healthy base to encourage consumer spending and subsequent consumption of goods and services.

Plant and equipment spending is now beginning to show signs of strength however and expectations are for a 15% gain in current dollars during 1977. Much of this spending will be prompted by a recognized need to upgrade equipment if we are to increase productivity and remain internationally competitive.

At this point, housing starts for 1976 and, n 1977 are projected to develop near the following levels:

AUR CURVTRENT research calls for a 20 billion dollar industry by 1979

our current Management Report reflects that the 20 billion dollar year might arrive before 1979.

Even considering inflationaty factors, the report reflects a most healthy condition in net return, sales per square foot and increased profit percentage, making 1977 a reflection of a very solid market for the retail hardware store and the home improvement center.

With a greater spendable income, American consumers will beat a so(Please turn to next page)

Housing this year will show a gain of about 26% over 1975's 1,171,000 starts. Next year should see another 12% improvement over the 1,475000 units expected by the end of 1976.

Conventional mortgage rates are going to remain inthe8.85%to9.35% rapge during 1977 and will tend to encourage home ownership for those who can qualify at this level. The (Please turn to next page)

A $20 Billion hardware industry by 1979 or sooner higher net return, sales per sq. ft. and increased prof it percentage seen in '77 industry is donning rose colored glasses for next year.

Throughout this issue oppeor business ond economic forecosts by some of the besf minds in the business on whot you con expect for the coming yeor. The boftom line: 1977 looks iust fine from here.

Co.

OSWALD

(Continued from page 9 ) median price of single family houses have leveled off nationally at $43,000 in recent months and shouldn't move more than 2-3% above this figure next year. Money placed with S&Ls has continued at record high levels again this year and will help to support the financing needed for 1977 mortgage commitments.

Although apartment construction has been depressed for the past two years, it now looks as though rental and vacancy rates in a number of metropolitan areas have changed enough to justify starting at least 100,000 more units next year.

Mobile homes still offer the lowest cost housing per square foot of floor area and will continue to show production increases as the economy improves.

The high cost of moving to a new or different house has caused a significant increase in home remodeling and/ or repair. Although this construction segment has historically been difficult to assess on a qualitative or quantitative basis, it is safe to assume that a deceptively large volume of wood products are consumed by professional remodelers and do-it-yourselfers each year.

Recent studies would indicate that remodel and repair, sometimes referred to as the "after market" is steadily growing. Figures are impressive enough to encourage geater emphasis on market development programs directed at the professional remodeler and doit-yourself segment of the residential construction industry.

With excess capacity gradually brought back into use this year, amore normal share of corporate funds will be budgeted for commercial and industrial buildings through 1977.

GRIGG

(Continued from page 9 ) called path to hardware home centers as more single projects become easier by greater product development.

Better trained sales people will deliver more dollar sales in handling customers in a more professional manner.

Better designed stores will attract more family business as shopping atmosphere will be more "delightful toned."

The retail hardware-home center business for 1977 already has donned rose colored slasses.

sales floor. easier for customers to buy and dealers to sell.

expecting record production of 189 billion square feet in 1977 as the national economy recovery.

Improving economic conditions pushed plywood production to a healthy level of roughly 18.1 billion sq. ft. during 1976-up over 12% from the previous year's lackluster showing of 16.1 billion feet.

Concentrated promotion to nonhousing markets helped the industry survive the near-total collapse of home building activity during the recession of 1974-75.

This market diversification program is now paying additional benefits: the home building industry, the largest outlet for plywood, is now moving ahead briskly, while nonhousing markets such as commercial and industrial roof decks, are maintaining the strong demand established during the downturn in residential construction.

The booming home improvement market, now plywood's second largest, is the target of a major promotional drive that began this year and will continue through 1977.

Homeowners increased plywood consumption by roughly 250,000 sq. ft. this year to an estimated total of 3.5 billion, APA analysts expect 100 million sq. ft. increases from this market in each of the next two years.

Due to the diverse, widespread nature of the home improvement segment, the plywood industry is concentrating its promotional efforts on building materials dealers, who account for 97% of sales to this market.

One APA program to help home centers move more plywood is the "Profit With Precut" campaign. Already in use by over 200 of the nation's leading dealers, it's designed to make plywood more visible on the

The "Profit With Precut" package contains a prefabricated display rack of construction drawings for a choice of two displays with ready-to-apply graphicsl an initial supply of APA handyman plans and "how to" brochuresl special sales sessions conducted by APA field representatives: and a new project kit every three months, which includes a plan, written copy and suggestions for window or in-store displays, and reproducible art for dealer advertisements.

Test marketed in the Eastern U.S., the "Profit With Precut" package increased plywood sales as much as 2J7o.

Another promising approach to increasing dealers' plywood sales is the "Anyone Can" program, which is now being test-marketed in cooperation with the Palmer G. Lewis Co., a major Pacific Northwest building materials chain.

"Anyone Can" features an attractive six-foot-high display rack with 10 copies of 48 different plywood Handy Plans,for the do-it-yourselfer, graphics, price stickers, and advertising art.

APA has also developed three training programs for dealers. They can be borrowed for up to 30 days or purchased for $25 each. All include 35mm color slides, scripts, literature, and prerecorded cassettes that fit any standard cassette player,

To sum up, the coming year will probably be the best in the history of the plywood industry. We hope it will be the same for dealers and distributors.

Record plywood production of 18.9 billion sq. ft. emphasis on home improvement markets, now plywood's second largest, to continue . . story details dealer sales program and aids builder information kit explains systems.

first of all, from an overall viewpoint, we defnitely expect 1977 ta be arother good year for distributors. Most distributors had a mighty fine year in 1976, and we're betting that 1977 will offer a continuation of the trends that have developed during 1976.

On the other hand, based upon all of the economic forecasts that we read, we're accepting the possibility that business could begsn to soften by the fourth quarter of next year. Whether it does or not is anybody's guess. In our own company's case, however, we're going to keep the possibility of a slight downturn, by the fourth quarter of '77 , in the back of our mind.

The specific reasons for our business optimism, regarding 1977 , lie within the following areas:

(l) Inflation The USA inflation rate has been coming down steadily

for the past two years. In 1975, it fell all the way from 12% at the end of '74 to about 7% at the end of '75. ln 1976, it has worked even lower, down to about 5-ll2%, which is its current level. This is an extremely favorable development for everyone in this nation. It's my own personal guess that our national inflation rate will stay at about its current level in the near future. I doubt that we will see a recurrence of that horrendous 12% rate, which was primarily caused by the OPEC oil embargo and subsequent oil price increases, and was also due to the mess that developed during our national price control era. Let's hope that neither one reoccurs.

(2) Money. Money seems to be more available, right now, than it has been for years. This applies to both business and personal loans, for both large and small projects. As a result of record savings flowing into S&Ls, it certainly appears that there will be plenty of money available for housing. Furthermore, we can expect stable

Richard P. Neils Divisional Director of Marketing Lumber & Plywood Division St Regis Paper Co.

Richard P. Neils Divisional Director of Marketing Lumber & Plywood Division St Regis Paper Co.

Iooinion business conditions for 1977 will have a steady improvement over 1976. We don't feel that it will be a fantastic increase, but just a good steady increase over what we have experienced so far in 1976.

The strength of the single family unit that was so strong in 1976 will continue on n 1977 which should help the sale of lumber and plywood as it did this year.

We look for a good demand for the single family units to continue for several years yet.

The remodeling business, which we estimate uses about 2O% of the total consumption of lumber and plywood, will continue on through 1977 which

A steady increase in '77 . . single family housing starts to continue strong for several years.. .. increasing freight rates will cause more lumber to be sold closer to where it is produced, which is happening more and more in the West.

mortgage rates. All of this bodes well for the general housing industry and it also bodes well for the general building materials industry.

(3) Interest rates. Interest rates have also been working slightly lower for some time. The prime rate, currently at 6-112%, is lower than it has been in almost four years. It ran at 9-11% all during 1974, and even reached 12% in that year. I doubt very

Another good year for distributors, but with a possible 4th quarterslowdown inflation will stay about the same, mortgage rates stable lower prime rate unlikely . some flattening in Alaska business.

much that it will go much lower than its current level. Most crystal ball gazers expect to see it higher by the end of 1977, but probably not much higher than 8%. This is still a very favorable rate compared to those horrendous rates of a few years ago.

(4) Housing starts. They are currently running at an annual rate of about 1.5 million for 1976. At this point in time, the economists are predicting starts of approximately 1.65 ( Please turn to page 46 )

will give the wood industry a good boost. This is good steady business for the retailer, the distribution yard and the manufacturer as it is a steady volume with good continuity of species, sizes and grades.

Increasing freight rates are causing more and more lumber to be sold closer to the producing area. We are finding that more of our Western produced lumber is being sold in the West, and there is a decided increase in the volume of lumber being produced in the South that is sold in the S0uth.

We are finding that the amount of Western lumber sold in the Southeast has diminished considerably. I am sure we will find more lumber being produced in the Northeast as time goes on as the consumer cannot afford to pay the freight from the West Coast to the Northeast.

All in all, I feel that 1977 is not going to be a run away year, but should be a good year for the wood industry.

f HEmajority

I of NBMDA members have experienced significant sales increases in 1976 as their {ealer customers rblied on local distributor inventories to a much greater degree.

It was a good housing year, particularly for single family residences, and consumer-oriented retailers continued to grow in importance throughout the country. This combination of activity

High level of distributor sales wilf continue into '77 more services being required of the stocking wholesale distributor wholesale margins may have to go up to compensate him.

built both sales and profits ceeded the previous year wholesale distributors of materials.

that exfor most building

It appears that this high level of distributor sales will continue in l97l Housing starts are projected to slightly exceed 1976, and the retail sales of lumber and building materials for remodeling, home repair, and do-ityourself projects remains the fastest growing segment of total retail sales in the U.S. All of these are prime markets for the building products stocked by wholesale distributors.

The record turn-out at NBMDA's 25th Annual Convention in November (a solid 35% increase over the previous year) indicated a much more optimistic evaluation of the 1977 business climate. The prevailing strategy will be to cover strong sales with satisfactory inventory levels without over-investing or speculating on [uture price increases.

There is genuine concern on the part of wholesalers about the high unit

costs of their product lines, most of which have also been expanded with new items. The cost of realistically "stocking a line" has risen so dramatically that many retailers are purchasing in smaller quantities in order to increase cash flow and accelerate their inventory turnover ratios. This creates both additional opportunities and responsibilities for local wholesale distributors.

In order to exploit these new sales

opportunities, wholesale distributors are aggressively reviewing overall operations to battle impending cost increases and to eliminate any operating costs that have lost priority with their retail dealer customers. Service remains the No. I need of the sophisticated retailer, but the nature, type and frequency of these services continues to change. Providing such services at the lowest possible cost remains the distri butor\s p rimary challenge.

As the trend continues in which the stocking wholesale distributor will have a greater role to play in the total distribution system from manufacturer to consumer, it seems clear that wholesale margins must be increased in order to compensate the "middle man" for services currently provided.

"The laborer is worthv of his hire."

by Richard D. Snyder CAE Executive Vice President National Lumber & Building Material Dealers Assn.

by Richard D. Snyder CAE Executive Vice President National Lumber & Building Material Dealers Assn.

stal ball for 1977 brings into focus substantial progress and growth for the industry, much more predictable than that which was visible as we moved into 1976. The facts speak for themselves

(a) Sales of existing (old) homes, which put a substantial dent in our large housing inventory, neared a peak rate of an estimated 3.7 million units in 197 6.

(b) New home starts are at their highest level since February of 1974, with many predicting an even higher level over the next l2-18 months.

(c) Issuance of building permits is the highest seen since March of 1974.

Record dollars are flowing into insured savings and loan associations, topping levels set in 1972.

The average effective interest rate is down from the exorbiIant 12% to between 8-ll2% to 9%, with most recent data indicating a continuation of the trend in 1977.

Sales from the do-it-yourself market will be up almost 2O%

over 1975 and, as we move into 1977, we see a $30 billion dollar home improvement business.

All barometers indicate souncl, continued growth in the industry, at least for the next l2-18 months. However, in spite of these positive signs, we must also be aware of some other factors that could have an influence on business and any continued resurgence of the economy and the housing market.

(a) A new Congress and the uncertainty of the political environment. Hard choices will have to be made with respect to a number of economic and social issues, such as inflation, re(Please turn to page46 )

Despite strong indications of sound, continued growth in next 12-18 months, problem areas exist in the uncertainty of a new President and Congress, slow economic growth, capital demand, unemployment, and increasing government regulations.

lf you're on the West Coast, chances are we can put garden grade redwood in your yard within a day and a half. As much of it as you want. In practically any grade or size. Because at Louisiana-Pacific we have a tleet of trucks right in the heart of redwood country. Righl at the center of our manufacturing operalions. And no one in the world can bring you more volume or greater selection than L-P We'll bring you boards, from 1 x 4's to 1 x 12's. We'll bring you dimension lumber, anything from 2 x 3',s to 2 x12',s. we'll bring 4 x 4's, 4 x 6'S, 6 x 6's, even timbers. And we will bring ii to you rough sawn or surfaced four sides. So if you want garden grade redwood, and want it quick, call (213J 945-3684 in Whittier, or (415) 638-2322 in Oakland, or QA7) 443'7511 in Samoa, or (707)462-479i in Ukiah, California or GA4)724-9941 in Augusta, Georgia, or (612) 925-47 7 O in M inneapolis, M innesota. Then see for yourself how we turn the common into somethrng extraordinary.

THE annual I guesslng game on next year's housing starts, a major key to the coming building ma" terial market, indicates improvement is more cerr -

.._I taln tnan rt nas been manv trmes past. Our own studies confirm this with conventional starts expected to total somewhere between 1.6 million and 1.7 million.

Much depends on the growth in real Gross National Product (GNP). We are peggrng that at between 4%5%, which would mean continuing inflow of lending funds to the s&l's with lending rates down slightly from 1976 fall levels, then plateauing for the major part of the 1977 building

season before moving up to some extent. This will be reflected in a substantial increase for multiples with single-family starts holding near their 197 6 near -r ecord levels.

The probable increase in manufactured home shipments to over 300,000, possibly 350,000, is somewhat misleading because there will be a much greater increase in the percentage of doubles (counted as one unit) with their substantially larger volume of building materials because of higher construction standards as well as size.

A good increase in home remodeling, conservatively at least $33 billion and leaning heavily toward major additions requiring substantial use of plywood, lumber, gypsum drywall and other building materials, also adds considerably to what should be an excellent building materials market in 1977.

,All this would bring upward pressure on prices, particularly on the supply"demand controlled lumber and plywood markets which are always the most volatile, both up and down.

However, it now appears the biggest factor in forest product prices will be cost-push because of the high price collected by the federal government for its timber as a result of huge volumes of ripe timber held off the

Strong business plus federal government restrictions in the supply of forest products will create cost-push situation good increase in home remodeling, at least $33 billion.

market. This creates an artificial shortage that has been reflected in highgr tax appraisals on privatelygrown timber.

The cost-push factor becomes even more of a factor as starts approach I .5 million, the point where additional supplies come largely from the Far West where the federal government controls up to 75% of all the commercial-type timber available. This is the year the non-timber-owning segment of the industry, which is most of the industry irt the Westr must rely heavily on this over-priced federal stumpage purchased in the past three or four years, much of it at several times appraised value.

This will be directly reflected in higher costs to manufacturers, wholesalers, retailers, builders and home buvers.

EDY ,qLr inlJd i cations.

1977 should be a pretty good year for the forest products industry. Wood products demand in almost every important market should improve next year over 1976 figures.

Our organization foresees a 1.6 million conventional housing start year for 1977 , and a mobile home unit year of approximately 300,000 units. Other prognosticators are estimating even higher figures, and we must admit that our 1976 forecast was on the conservative side.

The remodeling market was very strong in 1976,and we see a continuation of even more activity in this area in the coming year.

At the same time, our export of wood products to overseas outlets should continue on an uptick.

Industrial wood markets should also be slightly better in 1977. Therc will likely be a boost in commercial and industrial construction, and demand at the factory level for wood will remain strong.

Conversely, the increase in housing starts should be in the apartment sector rather than single-family. This translates into less footage per unit versus a lO% increase in starts. In our view, single-family starts will approximate the I million level next year.

The "experts" predict that the inflationary spiral of the cost of housing will moderate somewhat in 1977. Whether they are correct or not, a proper evaluation of much publicized statistics diminishes this factor considerably. If the high cost of singlefamily homes has "priced 85% of the home buyers out of the market", just what group of home buyers are we talking about? Certainly not all those present owners of existing homes. Nor those people who are opting for

H. M. Niebling, western manager North American Wholesale Lumber Association

H. M. Niebling, western manager North American Wholesale Lumber Association

the mobile home unit.

Last year, we forecast the possibility of disintermediation of mortgage money, and it didn't occur. The fact that the federal deficits remain high along with the recent report of many corporations underpaying their current taxes due to our tax laws could mean some money needs by mid-year (Please turn to page26)

Convention housing starts at 1.6 million, mobile homes, 300,000 units remodeling to continue strong, as will export and industrial wood markets government involvement in housing may be a factor by '78.

nomists, with all their education, facts, computers and other sophisticated tools cannot agree on the future of the U.S. economy, so it would be foolhardy for me to try and predict where the U.S. economy is going.

I will, however, hazard some predictions based mainly on the fact that we will have a new administration in Washington next January. Undoubtedly, the Carter administration will be economically more activist. I'm sure we will see the following things happen all of which will have an economic effect on us as Americans and as businessmen: Carter will act to stimulate employment, he will also attempt to restructure many federal agencies and bureaucracies, in the process creating fewer but more powerful agencies. These super agencies will be more environmentally and consumer oriented and less open to pressure by business.

The preceding, while socially positive, will most probably act to increase our already high rate of inflation, as will the expected OPEC oil increase. If inflation does increase rapidly, moving into double digit figures, I would not be surprised to see the Carter adminislration impose some type of price controls.

If what I've said above is an accurate prediction then I think we can expect to see higher sales because of increased employment, and higher cost due to the hisher rate of inflation.

Strong sales increases for home centers, followed by an increase in inflation resulting in higher expenses and perhaps price controls the home center industry will continue its strong growth in the future.

Now as to my specific industry, the home center industry, that is retailers who are all or nearly 100% consumer oriented. For the past 10 to I 5 years, our industry has seen an explosive growth, in California and within the last five years nationally. Our industry is only slightly related to the construction industry and as such has not been subjected to the recent building recession.

In the forseeable future. I continue to see a strong, steady growth for the home center industry. I think this is particularly true because of these four factors:

( I ) As costs of new home construction and financing continues to skyrocket, more people are spending money to improve their own homes and more of those people are doing it themselves.

(2) The high cost oflicensed tradesmen have encouraged more people to make all types of home repairs themselves.

(3) Growing leisure time has given people more time to spend working around their homes.

(4) More and more women have learned that work around the home is something they can do as well as men.

I expect to see all areas of our industry, that is, hardware, plumbing, electrical, paint, garden, building materials. etc.. continue to show strong growth.

I would hope to see building materials and lumber manufacturers and distributors pay more attention to the particular needs of the home center industry.

During the past two or three years, as construction has fallen, we have seen more interest expressed in our industry. I would hope to see this continue. The building materials and lumber industry has to pay particular attention to our needs in the fields of packaging, advertising and distribution.

I would sum up my expectations for 1977 as follows: I expect to see a strong sales increase, followed by an increase in the rate of inflation, resulting in an increase in our expenses and perhaps price controls. The home center industry will continue its strong growth in the forseeable future and hopefully more building material suppliers will take the needs of our industry into their future plans.

mand for durable, natural, energysaving building materials will boost all redwood lumber markets in Redwood shipments, up 28% in over | 975. will also increase 1977's expected rise in housing gains and the ever-expanding improvement market.

1976 with start home

Redwood lumber dealers throughout the West will enjoy a longer redwood selling season this year as do-ityourselfers acquire more leisure time for home improvement, and professional builders continue construction through winter weather.

Next year's housing start rate, estimated to reach 1.7 million units, offers great potential for redwood. Redwood amenities providing contemporary design and gracious outdoor living will be popular sales assets for 1977 single- and multi-unit builder developments.

Custom building, redwood's strongest, steadiest market, is expected to surge ahead in 1977. For the first time in two years, CRA consumer advertising and publicity will promote architectural grades for distinctive custom interior and exterior applications, part of a new trend in artistic house design.

Home remodeling, expected to top $32 billion in 1977, will boost demand for room additions, residing and paneling. Many do-it-yourselfers in 1977 will design and install their own redwood lumber paneling to complement plants, antiques, and art objects.

All redwood markets are expected to be up in'77, helped bV 1.7 million housing starts . uppers will get new promotional push as custom home building, redwood's strongest market, is expected to surge ahead.

The next time the storms are fierce in the mountains just above us, and your regular supplier is only slightly more accessible

than the top of Mount Everest. be glad Kimberly-Clark chose to build its thoroughly modern, fully automated, completely computerized mill down where the birds still sino and the roads

are passable. lf at f irst you don't succeed, turn back to Kimberly-Clark. Chances are we can load you up even before your frostbite recedes.

We don't mind being second choice once in a while.

Many of our "drop-ins" decide to make Kimberly-Clark first choice everv time.

President-elect Jimmy Carter is expected to take quick action after inauguration to revitalize housing nationally.. the building trades figure he "owes" them this after their strong support in the campaign.

Despite lack of a clearly stated policy at this time, futures trading analysts anticipate stronger prices over the long term for a wide variety of wood products because of the previously-voiced Carter intention to aid hous. ing..

, Recent strong advances in housing starts may make it problematical whether housing will need any assistance after Carter takes office. manv of the campaign promises were made before home building demonstrated its recent strength.

A likely area of Carter administration involvement in housing is expected to be homes for the poor and low-income groups. more emphasis in providing energy-efficient buildings are seen by some as getting more stress by the feds. .

Carter is not expected to begin a new wave of housing prograrns, more likely he will work wtthin existing frameworks, refine and revamp on-going prograrns. reported targets during his term: a 6% mortgage and 2 million housing starts. .

Most predictions for new housing rn '77 fall between 1.61,7 million new units started, a. wrprisingly rufirow range of glres*timates. record inflows of savings into s&ls (the source for most home mortgages) should provide the bucks to make housing go.

Multi-unit starts are expected to be up appreciably in '77, with single family starts up or down slightly, depending on whom you believe. construction contracts will be up l2%, says McGraw-Hill, a higher level than that area of the market has seen for,years. ..

Repair & remodeling, a $30 billion a year business that continues to pick up momentum,has been stimulated recently by rt iW sales of existing hames. . ,Sunset trtugazine says single fam- ily homeowners in the West spent an average of $463 on home improyement in'75, ZWo rnore than the U.S. average. .

Housing starts in Oct. slowed a &it, starts down 3.67o, permits down 4.6% from Sept.; annual rate |.79 million, with single family rates at 1,329,000 highest since the boom days of Feb. '73,. - lst l0 mos. of '76 almost equalled the entire total of last year's housrng starts. .

"Charn$ian Buitding Products is the'new name for U.S. Plywood, effective Jan. l; USP merged with Champion Papers (now Charnpion International) in '67. .CI has completed its sale qf Raberts Consolidated for $?9 million and has sold its Drexel Heritage furniture div. ta Dorntnick International for $53 million.

Beachwood Forest Products is a new wholesale firm begun by Alan Lee, based in Huntington Beach, Ca., that is specializing in hardboard, particleboard and plywood. Summit Wood Prodttcts, Inc. has opened a new wholesale distribution vard in Wilmington, Ca. .

Willamette Industries plans to buy Tigard Lumber, Tigard, Ot,, (no amount revealed). Mt. hood Building Supply, Aloha area of Greater Portland, was severely damaged in a recent 3alarm blaze.. -8. A. Nord Co., has acquired | 5 additional acres adjacent to its Everett, Wa., plant, tho it has no immediate plans for it.

Red Cedar Shingle & Handsplit Shake Bureau has moved to suburban Bellevue after 6l years in downtown Seattle. Pacific States Transport has moved its Newport Beach, Ca., office to their two acre terminal at Pico Rivera. . Home Lumber Co., Yuba City, Cd., has been sold to local contractor Paul Young.

Portland Road Lumber Yard. Salem. Or. has been thoroughly refurbished and much needed parking has been added north of the store, according to owner Cameron Kyle.. .,Palmer G. Lewis Co., Auburn Wa., now has a sales rep. covering the Middle Eastern Countries for it. .

Columbia Corp. has sold its Columbia Plywood Corp. to a group which includes key management for about $10 million, CP did $27 rnillion in '75.. Arcata Natianal, Louisiana-Pacific and:Sirnpsan Timber have successfully worked out an agreement for logging near the Redwood National Park in No. Ca. with the feds. .

National Gymsum has closed its Pomona, Ca., glazed tile plant and now sells the West from its new Roseville, Ca., facility. Congoleum Corp. say s Armstrong Cork has agreed to an out-ofcourt settlement of $35 million to settle a patent-infringement suit begun in 1966. .

Federal Timber Purchasers Assn. new officers are: pres., Walter W. Black; v.p., Bob Stermitz; sec., Gary F. Tucker; treas., James S. Whitney; exec. v.p. "Nick" Kirkmire.

When Cyndi Ledesma is blasting over a sand dune at high speed in the desert, she has to give a damn. And, she gives the same damn aboul your lumber need$ tnhen she's in lhe office.

Cyndi is represenlalive of ALL-COAST and its entire staff; all aclive people, performance-proven in both business and pleasure activities.

ALL-COAST FOREST PRODUCTS may be a young company, bul we have a combined experience of seventy-six years. ALL-COAST can handle your needs whether they are cargo schedules, carloads, truck and trailers, or a unit or lwo from our local inventory of Douglas Fir and Redwood- Add to this the reliability of Hampton Lumber Sales Company's "timber to mill resources" and you have a successful company that is proud to say "We g ive a damn ! "

Dubs, Ltd., - Dec. 10, golf Country Club, Pleasanton, Ca.

Shasta Hoo-Hoo Club (place to be announced).

tournament, Castlewood

Dec. 10, Christmas Party

Los Angeles Hoo-Hoo-Ette Club - Dec. 13, dinner meeting & Christmas party, Taix Restaurant, Los Angeles.

JANUARY

Shasta-Cascade Hoo-Hoo Club - Jan. 14, Concat, (place to be announced).

Lumber Merchants AssociationJan. 14- 15, annual management seminar, Asilomar, Ca.

National llousewares Manufacturers Assn.Jan. l7-2O, National Housewares Exposition, McCormick Place, Chicago.

Los Angeles Hoo-Hoo ClubJan. 28, Transportation Nite (golf & dinner), (place to be announced). Orange County Hoo-Hoo Club members invited.

FEBRUARY

National Home Improvement Council - Feb.4-6,6th annual convention, Fairmont Hotel, San Francisco.

National Woodwork Manufacturers Assn.Feb. 5-9. 5Oth annual meeting, Royal Lahaina Hotel, Maui, Hawaii.

When we say fencing, we mean a complete fencing program. A fu11 line of cedar: pecky boards, rough boards, posts and rails, grape stakes. A full line of redwood: rough boards, posts and rails, bender stock and lath. Everything you need to put together a fencing package for a customer or to round out your own inventory.

Not just what you need, but when you need it and how you need it, that's our concern at Crown. Custom.loads are

our specialty. Whether you need a truckload or a unit, give us a call, we'll ship it today.

We'll even mix your fencing in with the other materials you need. Plywood, plywood sidings, Masonite sidings, pine commons, timbers, roofing, we've got it all. And it's as close as yourtelephone.

Remember, plywood is only the beginning of the Crown Plywood story.

714-530-3924

213-598-9675

@bzfE*,

products industry

T[?;:',l*n 1977 is looking better every day.

But it may come as some surprise that the reason for that increased optimism is at the expense of a lower growth outlook for other sectors of the economy. The economy has weakened .more than expected from the rapid pace established early in the recovery.

The slow recovery in investments and weaker economy have removed the threat of an early clash between a strong growth in the economY and FRB policy. Short-term interest rates have actually declined, so that 1977 now looks like a good year for housing and the building materials industries. The inflows of funds into thrift institutions have remained strong and should continue strong well into 1977. Funds should be adequate for 1.25 million single-family units in 1977 and possibly more than 13. That is a very strong market that can be compared only .with the all-time peak year of l.3l million in 1972.

More uncertainty remains on the multi-family side, but continued gains in employment and higher occupancy rates should mean continued improvement in the attractiveness of apartment investment.

Total housing starts of 1.8 million or almost 2U/o above 1976 now looks

like a good bet with a chance of being above that range if multi's recover fast. Although the chances of an early falloff have declined, some weakening in 1978 should still be expected.

The outlook for several key markets other than housing is also favorable. Offshore demand is picking up and should increase .further as most of the countries in Europe, plus Canada, and Japan appear headed for continued economic recovery after an upsetting pause in growth this summer. As business operating rates pick up and investment is pushed higher, nonresidential construction markets will improve: and with real GNP and income growth averaging close to 5% for the year, furniture, home improvement and other nonconstruction markets look good.

Total production up 11% in current dollars, consumer prices will rise 5%% while employment will increase 2 million . . . new housing starts: 1.75 million . . . "pretty good year" for construction suppliers.

This translates into an overall wood products demand level 6-7% above 1916 and only 2-3% below the banner year of 1973. Let's not forget 1976 didn't turn out to be all that bad even if it was only the big recovery in single-family housing that provided the boost.

Route

Bor 459-A 7O7-'125.5L23

Fortuna, California 95540

In brief, 1977 looks like a good year with strong demand early in the year, with some leveling and probably falling off as we enter 1978.

COMPLETE UTILIZATION MILLS ..SMALL ENOUGHTO GIVE YOU FRIENDLY PERSONAL SERVICE, LARGE ENOUGH TO HANDLE ALL YOUR NEEDSFORDOUGLAS FIRAND OLD GROWTH REDWOOD LUMBER AND STUDS."

Pope & Talbot is one of America's largest and most self-sufficient quality lumber producers with:

r a company-owned timber base of 1.2 billion board feet

. lumber mills with some of the most modern equipment in the industry

r perhaps the best lumber stress rating system in North America

When you add them all up, Pope & Talbot's vast resources and modern facilities mean one important thing. We don't have to depend on others to help us provide the materials and services you need. You can depend on us. For a complete file folder on our lumber capabilities, write Sy Rodakowski at Pope & Talbot, 1700 S.W. Fourth Avenue, Portland, Oregon 97201, or phone (503)228-9161.

f T'S gooO to have your wife on I your team to help you in guidance when you have had a rough or frustrating day; to settle you down or remind you that certain things go with a job.

My wife, Maye, an educator, is a lot of help to me in doing a better job for my association. One thing she does is clip from the paper little tid-bits that might apply to me. The following is anonomous, but appeared on my desk one day from her. It read as follows:

"We place so much emphasis on gaining recognition becoming president of a statewide organiza- tion, being star player on the college football team, winning a national writing contest. But nobody really cares about it the day after it happens.

"Many people try to live on these past glories. They tell over and over of the time they won the baseball championship, of the committee they chaired that changed a state law, of the national company they once presided over.

"No one really listens. The world is not interested in what vou

tlor.rrauA'S Lien Law has, over lUlthe vears. withstood numerous assaults in-the Legislature which have sought to weaken or redirect its provisions to the disadvantage of the materialman.

These attacks have been rather broadly repelled and the Lien Law maintains its essential character in providing necessary protection to the dealer.

Recent activity on the federal scene may bring still another attempt on the Lien Law. The National Con-

ference of Commissioners on Uniform State Laws has approved and recommended for adoption by the various state legislatures a proposed Uniform Simplification of Land Transfer Act, which may be up for consideration in state legislatures within the next two to four years. This act includes Article 5, Construction Liens, which is directed toward establishing substantially the same lien law in every state.

As of now there are hurdles which may require clearing before the recommended changes can be effectuated. The commissioners are seeking approval of the act by the American Bar Association, but have apparently

did yesterday. It's only interested in who's who and what's what today.

"The water of time closes quickly over the things we get our names in the paper fbr-the accomplishments that add length to our obituaries.

"It's the understanding and affection we give friends, family and people around us that leave a gap in the fabric of lives when we go. It is these things that make people remember us."

In any case, to some extent, one must understand that getting new members is a continual rebuilding job. People in an association must be enthusiastic, sold on association work, and dedicated to it.

Continual rebuildjng goes on, since general managers and key personnel change. The last person who made the decision to continue membership in an association is sold: the new decision maker sometimes does not believe in, or understand the services received from an association; the rebuilding job begins all over again. Therefore, members must be continually reminded of the value of an association.

When management sells, retires, or changes jobs they should pass on to their successor the knowledge of the value of continuing membership.

encountereo an expresslon oI concern on the part of ABA. ABA is now considering a redraft of the commissioners' proposal in the hope of an improved version. While ABA endorsement of the act is not essential, without it there would be reduced chances for acceptance by the state legislatures.

NLBMDA is currently trying to provide the American Bar Association with information which will help strengthen existing lien laws and, at least, provide desirable compromise in Article 5. There is much to be accomplished in this vital area in the next several years for the sake of dealers everywhere.

tWe 're growing because you're growing and we're all set to serve vou be tter.

Our new )Vz acre distribution yard was custom designed from the ground up for more efficient operation, which means continuing be nefits for you.

With 10,000 square feet of dry lumber srorage, a rail spur and a location close to Interstate Highway ), we can do an even better job of serving your forest products' needs.

\When you're by our way, be sure to check out our beautiful new 3,000 square foot office, done 100o/o in \Testern Red Cedar of various grades and patterns.

Remember, our Christmas present this year means better service for you for years to come. Call us today for all your softwood needs.

13024 MOLETTE

SANTA FE SPRINGS, CA. 90670

Tffi

deserves the bad press it has received' this year. Only if measured against overblown expectations of a quick fix of ills accumulated over several years can recent history be labeled disappointing. First off, the rate of inflation has dropped by half in just two years; a remarkable improvement, attained, incidentally , without resort to tinkering with broad-based price controls.

By Belinda K. Pearson Vice President and Asst. Economist Seattle First National BankMore important for the future, the stiff-backed resistance of both consuniers and business to price hikes, the willingness of business to shorten buying commitments and live with modest inventories, and the relative moderation of current-year wage settlements all suggest a ratcheting down of infl ation expectations.

Healthy, broad-based econom ic growth in 1977 with the foundations in place for a sustained expansion matching the 1960s.

THE members of the Fine HardI woods/American Walnut Association have described 1976as "perhaps a normal year." New orders for lumber and veneer were received on a rather steady basis. Shipments were also steady. Business, ofcourse, could have been better, but it was sufficient to permit full employment at most mills. Log supplies were adequate, but timber owners still needed to be encouraged to do more timber stand improvement work, so the quality of the timber being grown could be improved.

(Continued frorn page 15 )

1911 ln our view, the time lag in any credit crunch means that if this occurs. it will have a much stronger effect on 1978 than on 1977.

On balance Ihen,1917 looks pretty bright for lumbermen. There are really only two negative factors at this point in time.

First, the inventory of unsold homes is rising slightly after months of steady decline. It bears watching over the next six months or so.

Secorrdly, housing wasn't doing all that well last spring. Subsequently, North American embarked on a study of how it could be stimulated. The

We.'expanded our efforts in the hardwood promotion field in l976by embarking on a special promotion

Caution marks Fine Hardwoods/American Walnut Assn. and its members . housing starts, furniture purchases and politics are keys to next year.

National Association of Homebuilders have been doing the same thing. The politicians have decried the low level of activity of this basic industry. While all this has been going on, housing has continued to improve to the point that there is a question of the advisability of stimulation. A tax treatment or a government interest rate subsidy now could very well mean boom times for 1971 and a resulting downturn in 1978. Hopefully, the industry and government will move carefully in this area during the first part of the new year.

The election of James Earl Carter to the Presidency indicates that we have an electorate which prefers government activism. It remains to be seen just how quickly President Carter

The real surprise of the last few months is not that real growth slowed but rather that the economy proved so resistent to shocks, maintaining a growth rate as high as 4% thtough summer and into fall.

The multi-family component of residential building at long last shows signs of coming to life: recent surveys indicate that the upward momentum in capital spending observed during 1976 will carry forward into 1977: and business will need to build inventories to meet higher sales volume.

To sum up, we can have healthy, broad-based economic growth n 1977l. indeed the foundations are in place for a sustained expansion matching that of the 1960 s. The main ingredient required is just a little more patience in letting the economy work through its problems.

program telling the story of the character marked hardwoods.

The use of veneer and lumber lines containing such natural markings into our promotional activity has blended nicely with the current ecological trend to use more-wisely, our natural resources. After all, as much as twothirds of the many trees grown contain the character marked grades. The socalled upper or cleaner grades of veneer and lumber have always represented the smaller percentage of the total trees harvested.

The FH/AWA and its members are cautious about 1971. Housing starts and furniture purchases hold the keys to the next year, and last, but not least, the political horizon.

can implement his vision of what our country should be doing economically. In our view, a more active government will probably not take effect in 1917 but could be a factor in 1978. Certainly Carter would likely move faster than Ford if there was a substantial downturn in housing. The likelihood of lower interest rates and a potentially higher inflation rate exists with a Democratic administration. If the latter occurs, we can also expect some sort of controls, selective or otherwise, by late 1977 or early 1978.

Five years from now, 1976 will probably be judged a "normal" year for wood products demand. An increase of 10-12% in demand in 1977 should make it a very good year. If that is (Please turn to page 45)

Forecasters for the housing industry have predicted a reasonably good year for housing production in 1977 ,with consumer demand remaining high, mortgage money in good s-upply, and mortgage loan rates stable at least through the first half of the year.

The most optimistic of the housing seers appearing on a panel sponsored by the National Council for the Housing Industry at the National Housing Center was William Smolkin, New Orleans-based housing consultant. He foresaw actual starts for 1977 as being 1.9 million units, well above the 1.73 million predicted by Michael Sumichrast, chief economist for the National Association of Home Builders, co-sponsor of the conference.

Against the cautions of Sumichrast, Smolkin said, "I am more optimistic about the outlook for housing starts next year than the figures give me a right to be. My optimism is based on my belief that the numbers now being used to forecast 1977 starts are not in step with the realities of the market. The good housing year thit everybody expected in 1976 wrll happen in 1977 ;'

Smolkin was especially high on the prospects for multifamily construction, predicting some 400000 apartment starts next year. Among his reasons:

. Rents and costs are "moving in the right direction" which would justify investment.

Cautious return of mortgage lenders to the apartment market is being noted.

Government programs are picking up steam and in the months ahead will be leading the upswing in apartment construction. The flow of Brooke-Cranston funds and Section 8 commitments for new housing will reach the market soon.

. There has been extreme "underbuilding" of apartment units. For example, in August, l5 large metropolitan areas issued permits to build fewer than 100 apaitment units each.

. The tax reform act may, after all, prove to be a boon to the apartment construction industry because certain real estate shelters were retained while other types of tax shelters were removed

"Real estate is the hot item today," he said.

For the balance of the decade, Sumichrast predicted a decline in starts in 1978 to 1.44 million units. with a recovery in 1919 to 1.6 million and a continuing increase to 1.79 million in 1980 and up to 1.87 in 1981.

Predicting a continued high level of single family production in l97l , John Weicher, HUD Deputy Assistant Secretary for Economic Affairs, foresaw a continuing weakness in the multifamilv sector.

The next dip in housing production will come in 1978, National Association of Home Builders economists have predicted. In the familiar pattern of housing cycles, starts will continue upward through 1977, dip slightly in 1978, and rebound in 1979 through 1981 to relatively high levels of production.

Most business planning for the manufacturing element of the housing industry is on a five year basis,NAHB says.

E'CONOMISTS are "guardedly" or E "cautiously" optimistic about business conditions in general for the coming year, pointing out that the 8%-9% GNP rate enjoyed early in the year was bound to drop back anyway, and that even the current 4Vr5% rate represents an improvement over the past couple ofyears.

The housing industry which directly affects the sales of hardwood plywood products looks somewhat stronger than the economy as a whole, partly because it fell more sharply during 1974 and 1975 and, therefore, has farther to recover.

Total shipments of prefinished hardwood plywood paneling, accounting for two-thirds of annual consumption, may reach the 3.5 billion square feet mark, compared with less than 3.0 billion last year. Most of this improvement is attributable to conventional housing starts and the late-season recovery in mobile homes, but it also reflects a substantial increase in professional and do-it-yourself remodeling as property owners opt for upgrading what they have rather than buying something else. This trend should give the building products merchant special cause for "selective" optimism for the

future, provided over-zealous federal and state .regulators don't "dampen" the trend through all-encompassing fl amespread requirements.

The furniture and cabinet market, primary users of stock panels and cutto-size hardwood plywood, also seem to have weathered a mid-year slump and should end up at least 25% ahead of 1975. One industry source cites a release of pent-up demand by consumers as the economy relaxes anxieties

Increased remodeling means "selective" optimism for the building products merchant . . . furniture shipments to be up 1O% 1.625 million conventional housing starts, no mortgage money shortage likely.

Clark E. McDonald Managing Director Hardwood Plywood Manulacturers Assn.somewhat, and estimates furniture shipments reaching $8 billion dollars n 1977, up an additional l0% over 1976.

The outlook for construction and related industries looks solid through l9l7 . Industry estimates are for I,625,000 conventional starts and 325.000 mobile homes over the next twelve months. We feel that singlefamily starts will increase to 'about I,400,000 (a more normal l0% of all starts) which implies .sorne improvement in apartment construction and rehabilitation after a couple of sour years.

This jibes with furniture and cabinet forecasts, as well as less-clearlydefinable trends in remodelinq. Both parties recognize the importan*ce of a strong housing industry in strengthening the economy. and cutting unemployment, so fiscal policy is likely to encourage building and buying,

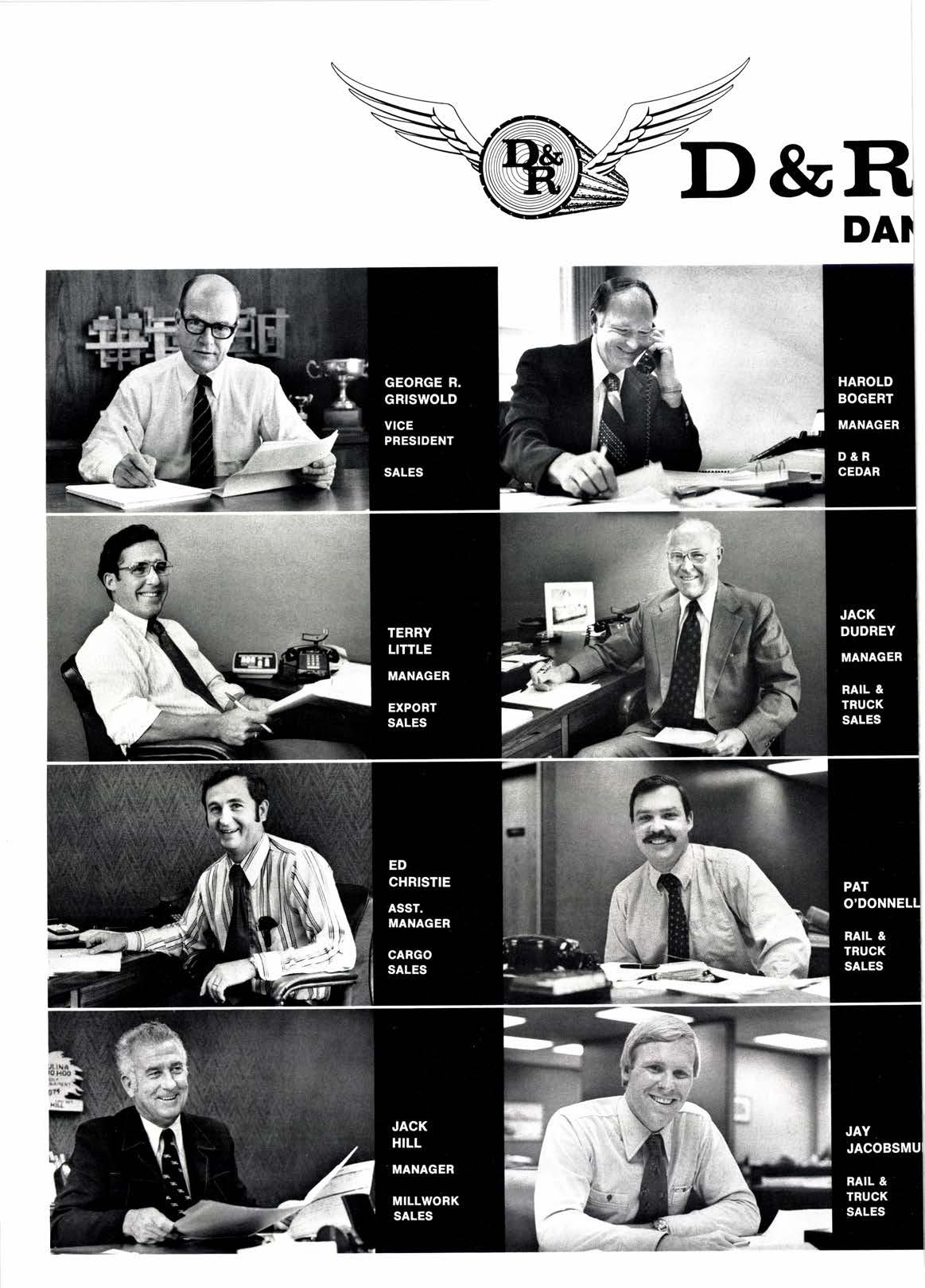

Western lumber and forest products users and buyers have been looking to Dant & Russell to supply them with quality products for over 72 years!

More important to you, however, are the number of years of experience and service of the D & R people you see on this page. Possibly you talk to one or more of these men and women at D & R frequently.

They're just about the most helpful and resourceful people you can find.

lf you haven't talked to D & R recently, why not call the person you know. or would like to know. We'd llke to thank you for your business. . . and find out what we can do for you now! The toll-free number is 800/547-1943.

Bill Johnson

John Polach

Larry Hansen

Walt Hjort

Bill Robinson

Ruby Spoor

Sonia Mastriana

Ghristine Miller

Glaudia Tynes

and all the folks at Hobbs Wqll Lumber Co., Inc.

Weyerhaeuser Co. plans an early 1977 completion for a major new wood products wholesale distribution facility in Kent, Wa., to serve the Puget Sound area, Western Washington and Alaska.

Northern district sales manager L. R. Hornbeck said land acquisition and construction costs would be more than $1 million. It will provide expanded inventories of lumber, plywood, siding and other wood building materials for wholesale distribution to retail lumber dealers and industrial users.

The new customer service center will include a35,200 sq. ft. warehouse, a 6,800 sq. ft. storage shed and three acres of outside storage. The new facility replaces a smaller, leased distribution center which is also in the Kent area.

The complex will also include a 2,000 sq. ft. office for sales and clerical staff.

ARIZ0NAt very active Wood Promotion Committee, looks up here for a photograph: John King, Southwest Forest Industries; Dean Drake, 0'Malley Companies' retail div.; Frank Davis, exec. v.p., Arizona Lumber & Builders Supply Assn.; Carl Bastian, Weyerhaeuser Co.; Don Hossack, 0'Malley BMC, "Charlie" Ray, Ray Lumber Co. Among their programs has been the promotion of their energy saver home (MESH home) and two sales construction seminars that emphasized energy conservation (see The Merchant, May p. 8).

gFAFfiFfiFfiXfiF*F*FfiX*F*F*IAFAFfiFfiFfiF*F*}TfiXfiFfiFfiF#F*T*F*F*F*F*F'ETAFftFftF*F*F*FAFfiF*FfiFfi}

lr(!f,(lxl*{H?*(tf,(!t(!*(KHKtr(!t(!fi(urr(rxpslS*lr(!fi(K?i(!r(Ixt*(Ifi{K?fitll(?r$*(K!fi(g*(!x?*ffs(lfiixfi(}rg

H. R. "Bob" Roberts, exec. v.p., Western Wood Products Assn., is back in Portland recuperating from a heart attack suffered while on a trip to Switzerland.

Dale Fleshman has joined Portland's West Coast Lumber Sales.

Vince Stout is now in plywood sales for Neely-Nelson Lumber, Medford, Or.

Mary E. Lanigar has been elected to the board of The Pacific Lumber Co.

Doug Gendron is the new sales mgr. at Summit Wood Products, Los Angeles.

Jim Frodsham and Dennis Richardson are back at their South Bay Redwood offices, Orange, Ca., after a Vancouver and Portland business trip.

Tom Paarmann is the new marketing mgr. at Nical Inc., Holister, Ca.

Robert H. Cook is now gen. mgr and sales mgr. for Medford Veneer & Plywood Corp., White City, Or., according to Everett Christian.

Leon Lauderbach, who retired last summer from Orange Coast Lumber Co., Tustin, Ca., is back from an extensive round-the-world trip.

Fred Pueringer has joined Oregon Pacific, Concord, Ca., as a trader.

Jim Webber has joined Minton's Lumber & Supply, based in Mountain View, Ca., in an executive capacity, according to bossman Herb Eaton. He had been with Hubbard & Johnson.

Bob Greenwell, A & G Lumber Co., Culver City, Ca., and his wife, Beverly, are back from a vacation to Monaco and Vienna.

Sig K. Ohlemann is now regional mgr., bldg. products div., Eagle Forest Products, Sacramento, Ca., according to Richard S. Snider.

Tom Brinton and Joe Shopmeyer have joined the sales force at Summit Creek Plywood Co., Lake Oswego, Or.

Harry Wood has retired from Oregon Lumber Export Co., Portland. He had been exec. v.p.

Al Dunn is now district mgr. for the Grays Harbor (Wa.) area for Herr Lumber, Wade Nash moves up to dispatcher. Hector Rochon, West Seattle office, is the new purchasing director, Jim Strimple is a new purchasing agent. Bob Negrin has been promoted to merchandising director.

James P. Hilferty is the new director of marketing services for American Forest Products, replacing Jim Duart, now with Crown Zellerbach.

Jay S. Eiger is now gen. mgr. of Eichrome Building Materials Co., Redwood City, Ca.

Dave Lebec, Rounds Lumber, Cloverdale, Ca., is back from vacation.

Ronda Howe is now in sales full time for Oakley Plywood, Morgan Hill, Ca.

Bud Chenoweth, Chenoweth Lumber, Bodega, Ca., got in a recent Colorado hunting trip.

Fred Holmes, G-P, Fort Bragg, Ca., is an optimist who took his trailer to Colorado hunting to bring back the haul. Rusty Tamagno hunted for l0 days in Wy.

Al Stockton, San Bruno Lumber, San Bruno, Ca., vacationed for a week in Palm Springs.

Jim Crump has joined G-P, San Leandro,. Ca., as lumber sales mgr., according to Carol Rourke, asst. regional lumber sales mgr.

Jack Berutich, American Forest Products, Cerritos, Ca., vacationed for a week recently.

Ed Garrett, Weyerhaeuser, has transferred to the Burlingame office as asst. mgr., West Coast allocation.

D.M. Shepard is the new v.p., market and product management for Masonite's newly consolidated hardboard div., according to J. L. McMaken, v.p.-marketing.

Dawn Werner is new to the sales staff at Timber Products Sales Co., Springfield, Or., according to Larry Moore.

Phil Fields, Alder Creek Lumber Co., Portland, has added the responsibilities of sales mgr. to those of production mgr.

Paul Nobmann, Old Adobe Timber Products, Petaluma, Ca., recently rafted down the Colorado River for five days. "Best trip I ever took," Paul notes.

Bernie Sloop is now geni mgr of the national sales div., American Forest Products, according to Jack Ford, exec. v.p.

B.L. "Brook" Bruckert is the new district sales mgr. for the Southwest district, Pioneer Div., Flintkote Co., according to Joe Askins, sales and promotion mgr.

Jared Ingwalson is now marketing mgr., manufactured housing, for Johns-Manville's resid ental products marketing div.

Wyman Hammer, president of Hammer Lumber, Eugene, Or., is among the organizers of the proposed Valley State Bank.

William P. Rund is now with Pope & Talbot's industrial lumber marketing force, according to Cy Rodakowski.

Fritz Quirin, still associated with C-Q Trucking, Lynwood, Ca., bought a new Kenworth, named it "Little Auga," after his wife, and is in business as H.F. "Fritz" Quirin Trucking.

Patricia Penney is a new sales rep with Eckstrom Plywood Corp., L.A.

Keith W. Harris is the new plant mgr. of Crestline's Corning, Ca., operation.

Jobe B. Morrison is now v.p., gen. mgr. of Southwest Forest Industries' Snowflake Paper & Pulp div.

Tom Supple, v.p.-regional services mgr., National Building Centers, El Segundo, Ca., celebrates his birthday this month on Christmas Day, as do two of his five boys. Happy Everything, Tom!

Brannon Vincent, recently retired from Fleming Lumber, L.A., is back from a 4500 mile Midwest vacation.

Ted Hanson is the new sales mgr. at Sequoia Supply's Wilsonville, Or., office. Tom Heilpern is new as Western regional mgr.

Charles W. McKennell recently joined Treated Pole Builders, Inc., Ontario Ca., as director of marketing and sales.

Jerry Bruce is now gen. sales mgr. of Brunswick Timber Co.. Grass Valley, Ca. He had been with DregonPacific in Portland.

Harold M. Frodsham, chairman of the board, South Bay Redwood Co., Orange, Ca., is now visiting the Middle East for the umpteenth time.

Kurt Gelbard is back at it at Robert S. Osgood, Inc., Los Angeles, after a vacation in Israel.

Mike Wells has been namecl new v.p.gen. mgr. of Al Disdero Lumber, Portland.

Ken Gresham is now specializing in Southern Yellow pine sales for Contact Lumber Co.. Portland.

Wally Bonesteele, Cascade Warehouse Co., Salem, Or., has been elected City Councilman (Ward 7) in Salem.

Ken Tinckler, Stahl Lumber Co., Los Angeles, is now on the board of directors of the National Hardwood Lumber Assn.

Dennis Kida is now in charge of sales for the Peniflex door line Continental Forest Products, Lake Oswego, Or., is repping.

Dan Tucker is the new nt'I. sales mgr. of Michael-Regan Div., Mansion Industries, City of Industry, Ca.

Donald R. Bays is the new director of internal audit, Southwest Forest Industries, Phoenix, according to Raymond P. Elder, v.p. and controller.

Thomas Lackey is the new real property mgr. for Champion International timberlands, according to West Coast planning mgr. Thomas Hill.

Bruce D. Pooley is a new tech rep for the American Institute of Timber Construction, Englewood, Co. Berry L. Odean is now mgr., tech. promotion.

Bill Barber has joined the sales force of Wood Master Wholesale, Lakewood, Co., working out of Wheatridge, covering Western Co.

Two beautitul and timely examples of merchandisinq excellence are available from K-S-H Plastics (K-LUX) . . . a kdy PGL/pyS supplier.

(1) NEW K-LUX IN-SIGHT SHELVING & PUT-UP PLASTIC SHELVING MERCHANDISER CENTER - a unique product with many uses and alteady a proven seller!

(2) NEW K-LUX INSIDE STORM WINDOW MERCHANDISERmakes it a "snap" for the home owner to conserve heat with this easy to apply inexpensive molding and SAFE-T-VUE combination.

These are proven tools tor selling the walk-in customer, partner. Are you en.ioying the benefits of K-LUX products?

Jim Cameron

Bud Fekete

Harry Cary

Bob Garcia

Bob "Sixpac" Martin

L. A. Roberts

Teri Forkner

Alice Tannler

Cameron

TO THE surprise of many, hardI woods are becoming a retail item. For some years retailers, accustomed to dealing with softwoods, have been reluctant to carry hardwoods because of their unfamiliarity with the product and what they viewed as inadequate demand. Now that is beginning to change in selected markets.

The do-it-yourself trade has changed from an all-thumbs group to a more daring, more sophisticated, and more confident group of consumers who are now beginning to look beyond the most simple home improvement or repair projects.

They are now toying with building all types of furniture, built-ins, and special design features into their homes. And they are beginning to become fascinated by hardwoods.

Even traditional softwood buildins supply dealers are beginning to admii that hardwoods offer a new product resource and potential high profits as a specialty item.

Some retailers are in touch with hardwood distribution yards in their areas and are obtaining selected species in different widths and lengths and are running hardwood special promotions. The volume is not large at the moment, but like other products that suddenly take off, hardwoods look like a good bet.

One reason for the current interest is the shift away from the Mediterranean style of furniture into something more rustic, and "character marked" woods are beginning to attract nation wide attention. Years ago, wormy chestnut and pecky pecan were the only important hardwoods that had these character marks. Today, there is a great deal ofsupply available.

Some retailers, unfamiliar with how to go about buying hardwoods are turning to their wholesalers who also often are inexperienced. The best source for working out arrangements is with your nearest hardwood distribution yard. For those who are unfamiliar with hardwood distribution setups, write to me at the Hardwood Institute, 230 Park Ave., New York. N.Y. 10017.

Hardwoods are increasingly becoming a retail item . a good bet to suddenly take off . consumer acceptance continues to grow.