Introducing the HDUE ™ holdown and SABR ™ anchor bolt solution from Simpson Strong-Tie.

Now you can give customers a stronger, faster way to secure shearwall end studs to concrete foundations in residential and light-frame commercial projects.

Engineered for higher loads, our new HDUE is ideal for modern structures with more windows and smaller areas for shearwalls. As a direct replacement to our HDU holdown, the HDUE comes packaged with fasteners and washers. Builders attach it to the foundation with our new SABR anchor bolt. The SABR, a cast-in-place bolt also made for higher loads, replaces our SB and SSTB anchor bolts. With just one diameter for each length, the SABR is simpler to order and stock. The HDUE holdown and SABR anchor bolt are code listed, widely available in several sizes, and backed by our expert service and support.

To learn more, contact your representative or visit go.strongtie.com/hdue-sabr.

PRESIDENT/PUBLISHER

Patrick Adams padams@526mediagroup.com

VICE PRESIDENT

Shelly Smith Adams sadams@526mediagroup.com

PUBLISHER EMERITUS

Alan Oakes

MANAGING EDITOR

David Koenig dkoenig@526mediagroup.com

SENIOR EDITOR

Sara Graves • sgraves@526mediagroup.com

COLUMNISTS

James Olsen, Claudia St. John, Dave Kahle

CONTRIBUTORS

Matt Brown, Joe K. Elling, Paige McAllister, Bill Parsons, Belinda Remley

ADVERTISING SALES (714) 486-2735

Chuck Casey • ccasey@526mediagroup.com

John Haugh • jhaugh@526mediagroup.com

Nick Kosan • nkosan@526mediagroup.com

DIGITAL SUPPORT

Katherine Williams kwilliams@526mediagroup.com

CIRCULATION/SUPPORT info@526mediagroup.com

151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626 Phone (714) 486-2735

CHANGE OF ADDRESS Send address label from recent issue, new address, and 9-digit zip to address below.

POSTMASTER Send address changes to The Merchant Magazine, 151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626. The Merchant Magazine (ISSN 7399723) (USPS 796-560) is published monthly at 151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626 by 526 Media Group, Inc. Periodicals

Postage paid at Santa Ana, CA, and additional post offices. It is an independently-owned publication for the retail, wholesale and distribution levels of the lumber and building products markets in 13 western states. Copyright®2025 by 526 Media Group, Inc. Cover and entire contents are fully protected and must not be reproduced in any manner without written permission. All Rights Reserved. We reserve the right to accept or reject any editorial or advertising matter, and assumes no liability for materials furnished to it. Opinions expressed are those of the authors or persons quoted and not necessarily those of 526 Media Group, Inc. Articles are intended for informational purposes only and should not be construed as legal, financial or business management advice.

Volume 104 • Number 7

APA

•

•

• EWP

•

------------ BY PATRICK ADAMS

WHEN WE FIRST STARTED camping as a family, my daughter was still little, and my son hadn’t even been born. I wanted something we could do together—a way to unplug and reconnect, even if only for a weekend at a time.

Those early trips were something special. We camped with a large group of friends—all law enforcement and military families. During the day, we’d explore with the kids, teach them basic survival skills, and go on adventures that, by today’s standards, might raise eyebrows (or trigger child endangerment hotlines). At night, once the kids were asleep, we’d gather around the fire, swapping stories—the kind that grow bigger and braver with each retelling, our own version of “fish tales.”

We started out with a small trailer. It was simple, cozy, and gave us just what we needed. As our adventures expanded, so did our family—first with the birth of our son, then with the addition of another dog. That meant a bigger trailer, and eventually another one after that. But while our trailers got larger, our circle got smaller. With every trip, another friend would quietly admit it was their last. Their kids had outgrown it, sports schedules were too hectic, and keeping an RV for one or two trips a year just didn’t make sense anymore.

Those rowdy campfire circles shrank until, one year, it was just us. The past couple of years, we’ve camped alone as a family. Still fun, but different. The kids no longer have a pack to run with. Most of our time is now spent doing—prepping, cooking, cleaning—no more shared tasks or helping hands. The community that made it feel like something more had faded.

This spring, over dinner, I asked the usual question: “Where are we camping this summer? Back to our

favorite spot?” But this time, there were no eager smiles or excited recollections. Just silence. My son eventually muttered, “Sure.” My daughter asked if she could bring a friend. My wife simply shrugged. For me, it felt like hearing about a death for the first time.

And I get it—they’re right. My daughter’s now in high school and volleyball has become a year-round commitment. At 14, her social life seems to outrank even the most important plans. My son is only 8, and just starting to really enjoy camping. And my wife—well, she’s been a saint for going along with it all these years, even if her idea of “roughing it” leans more toward room service than roasting marshmallows.

So this summer will be our final trip. A short drive to a quiet beach in central California, one last outing before I put the RV up for sale. It’s a bittersweet goodbye. Camping has been my therapy—and sharing nature with my family has been one of the greatest gifts of my life. I’m not sure what the next chapter looks like, but I’m guessing it’ll involve fewer pine needles and more plush pillows.

Still, whatever the next chapter holds, I’m grateful we get to turn the page together. People always say time goes fast, but I don’t think anything makes it speed by quite like being a parent.

So this summer, wherever you are—take a moment to slow down. Listen to the wind in the trees. Breathe deep. Count your blessings. And treasure the chapter you’re in.

As always, I’m humbled and grateful to serve this great industry.

PATRICK S. ADAMS, Publisher/President padams@526mediagroup.com

ROSBORO X-BEAM® IS NOW 2.0E!

Your stock glulam program just got better

The beam that revolutionized glulam in 2010 as the industry’s first fullframing-width architectural beam just got an upgrade. Introducing X-Beam® 2.0E—engineered with a 2.0E true modulus of elasticity to span farther and deflect less than any other 24F-V4 stock glulam. Rosboro X-Beam® 2.0E; there is no match.

------------ BY SARA GRAVES

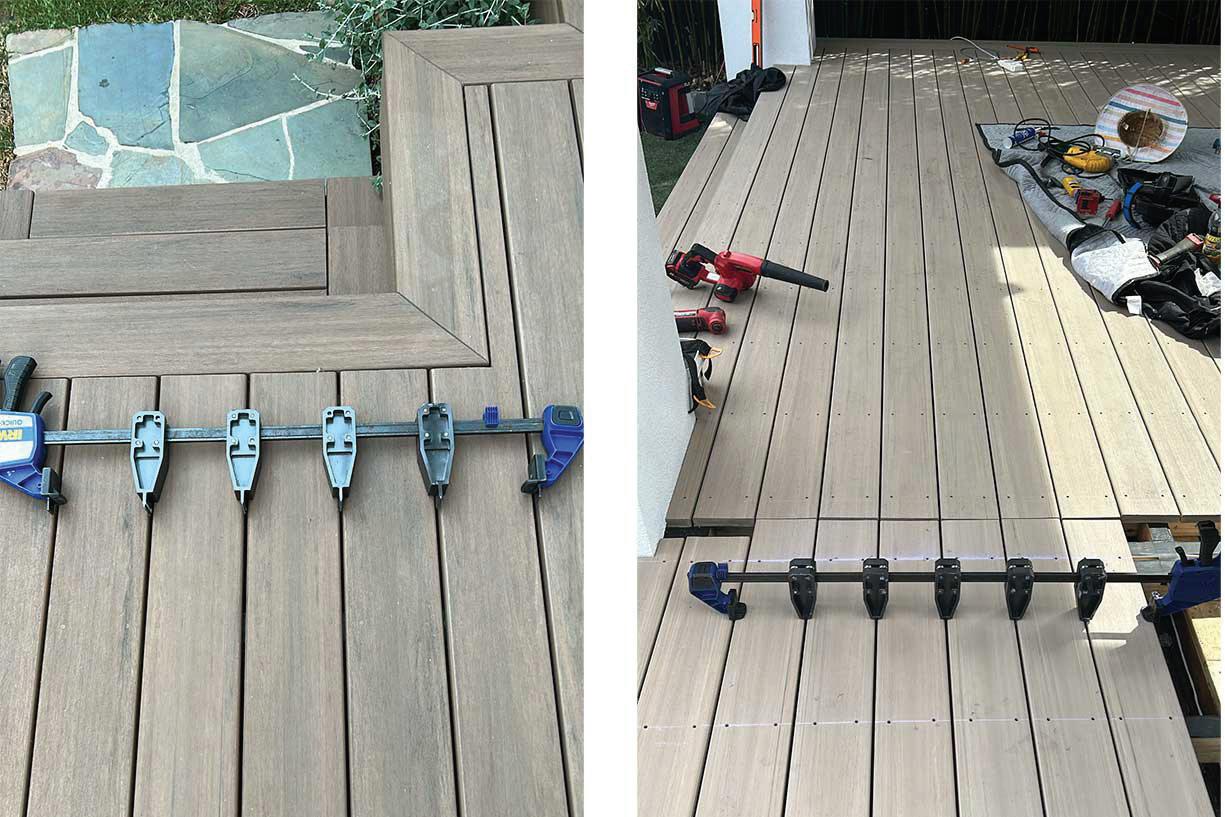

ONCE CONSIDERED a fringe product, modified wood is gaining new traction in the building materials supply chain. As the outdoor living sector grows and consumer demand shifts toward natural, sustainable alternatives, distributors and dealers are taking a second look at modified wood.

“There is a heavy increase in the thermally modified lumber market,” says Claus Staalner, owner of American Wood Technology in Jefferson, Ga., a company that manufactures hydro-thermo modification equipment. He notes a growing interest among North American lumber producers.

“We have seen in the past predominantly hardwood being thermally modified, which obviously lent itself very well to the North American market from a raw material standpoint,” continues Staalner, who has been involved with thermal modification for over 25 years. “However, we are now seeing a trend toward softwood being used.”

“We’re crushing it in the Northeast,” adds Steve Getsiv, CEO of Nova USA Wood Products, Forest Grove, Or. He says it’s mostly been siding, paneling, soffit, trim—anywhere you’d normally see western red cedar being used—but not decking.

Thermally modified wood is incredibly stable, contends Lawrence van Kleef, product manager of Nova’s thermally modified Ambara line. “You can wrap posts and beams, and it stays dead flat. I’ve wrapped 12x12 posts with 3/8”-thick thermally modified wood. It’s just incredible.”

Many retailers and wholesalers are already sold. “Every board is clean, flat, and straight. It installs very easily,” says Ed Mikowski, owner of Windsor, Ca.-based Mount Storm Forest Products, which has carried Thermory products for over a decade. “It is very stable and does not shrink.”

Yet, some suppliers remain leery. Chris Brown, executive vice president at Culpeper Wood Preservers, acknowledges the buzz but remains cautious. “Thermally treated wood is slow to gain momentum. Right now, it’s a very small part of the market,” he says, adding that builders continue to prioritize performance, cost, and availability—areas that he believes pressure-treated wood offers “the most practical and proven choice.”

Brown notes that price continues to be a sticking point: “Modified wood typically costs more than both

PIONEER MILLWORKS just introduced Abodo Vulcan thermally modified decking and siding—durable, sustainable alternatives to vinyl and cement, crafted from FSC-certified radiata pine with Class 1 durability.

composite and pressure-treated wood.”

Van Kleef says there’s a misconception that thermally modified wood is always expensive, but now the category includes affordable options that compete with both composites and high-grade softwoods.

NOVA USA Wood Products’ thermally modified Ambara is used here as post and beam wrap. The 1x8 and 1x10 boards are screwed, plugged and then finished with ExoShield Clear, providing a more stable replacement for cedar.

Kevin Kilpatrick, chief marketing officer at Lumber Plus, argues that thermally modified wood like its Maximo Thermowood “has more stability and workability in cutting and fastening—all with a natural aesthetic that

MCMINNVILLE, OR | ELKCREEKFOREST.COM 503-474-4446 | sales@elkcreekforest.com

Our Select Dex line features premium, solidsawn V-groove products with an exposed face, carefully kiln-dried and heat-treated to a moisture content of 19% or less. Manufactured from Douglas-fir, these products are crafted to deliver exceptional quality. Custom patterns and commercial grades available.

is difficult to mimic by composites and pressure-treated wood.”

Still, the broader market signals potential growth. According to DataHorizzon Research, the global deck modified wood market was valued at $0.8 billion in 2024 and is expected to reach $1.95 billion by 2033, with a projected compound annual growth rate (CAGR) of 9.5% from 2025 to 2033. Driving this trend are sustainability preferences, new technologies, and code updates focused on performance and environmental impact.

Kilpatrick believes there will be very strong growth in this category especially with more technology advancements, accessibility and affordable options. He notes cladding, soffits and ceilings will help contractors diversify their offerings.

“The challenges are becoming less and less in terms of logistics as more modification manufacturers are coming out of the woodwork each year in North America,” says Jon Witt, business development executive and technical advisor for CUTEK, which specializes in wood protection products. “As more enter into the category, everyone will work harder to capture a bit more of the market share, making pricing a little more competitive.”

“We’ve had a huge ‘mushrooming’ explosion of people promoting various products,” says van Kleef. “It’s going to narrow down to a healthy number, whatever that is, of varying products that are actually holding the market and then you’ll get a stable market.”

Chris Bouchard, director of North American ThermoWood sales for BPWood, believes modified wood products will grow significantly over the next five to 10 years, as sustainability continues to be a key consumer preference and construction practice. Ongoing strategic partnerships in the market will also support this shift. He says education, awareness campaigns, and proof points will be essential in driving adoption, addressing misconceptions about costs, and highlighting modified wood’s long-term value.

“It’s not about replacing tropical hardwoods altogether,” adds Getsiv. “They’re definitely going to take a good spot in the market as things kind of crystallize—which brands and which products are the most suitable for distribution and do the best in the market.”

Increased demand may also result in expanded distribution channels, positioning modified wood as a staple in home improvement retailers and builder supply chains, Bouchard says.

Architectural appeal plays a role, too. As seen with brands like ThermoWood from Belgium-based LDCwood, modified wood brings a design-forward aesthetic that fits modern builds and biophilic design trends. New profiles, colors and grain patterns allow dealers to present the material as a premium alternative that stands out among tropical hardwoods, standard cedar, or pressure-treated boards.

“ThermoWood provides the strength and elegance typically associated with tropical hardwoods without the related concerns,” says Bouchard.

Van Kleef adds that as builders become more aware of the product’s stability and sustainability, it will become a viable option, even for customers who previously preferred composite.

With the summer building season in full swing and consumers more attuned to sustainability and design than ever before, the question may not be whether modified wood deserves shelf space, but whether you’re prepared to sell it when your customers ask. MM

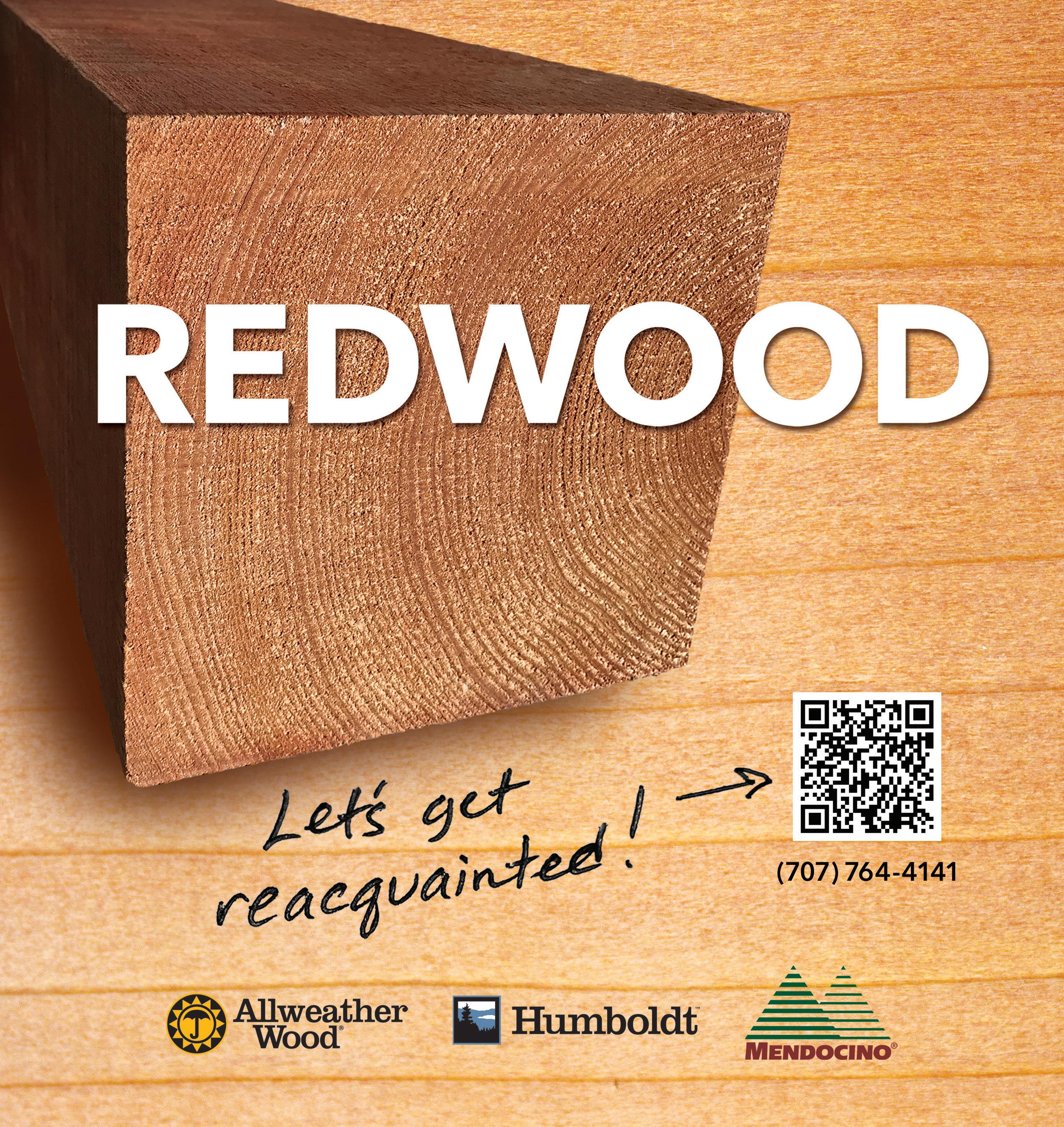

Like the foods we buy, when it comes to decking, we want natural and real. Redwood is always available in abundance of options. So stock the shelves! Unlike mass-produced and inferior products, Redwood is strong, reliable and possesses many qualities not found in artificial products. They maintain temperatures that are comfortable in all climates.

Redwood Empire stocks several grades and sizing options of Redwood.

------------ BY BELINDA REMLEY

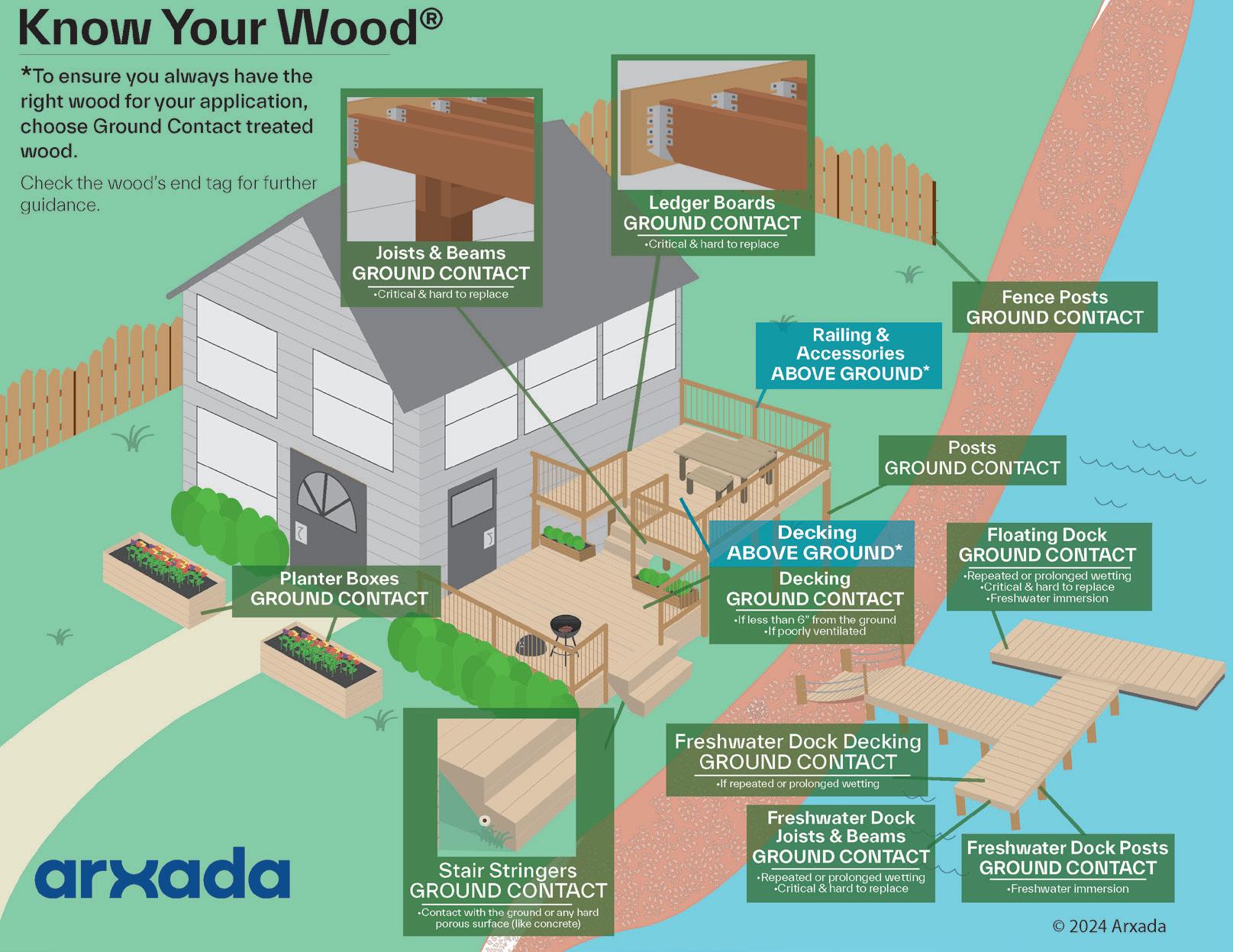

EVEN THOUGH two decades have passed since the wood treating industry voluntarily chose to move wood treatments for residential applications away from the traditional preservative called chromated copper arsenate (CCA) to newer preservatives such as micronized copper azole (MCA), there remains confusion about how to properly choose wood treated to match with its intended application. The question of whether to use Above Ground or Ground Contact treated wood has been ongoing for all of those 20+ years of new innovation.

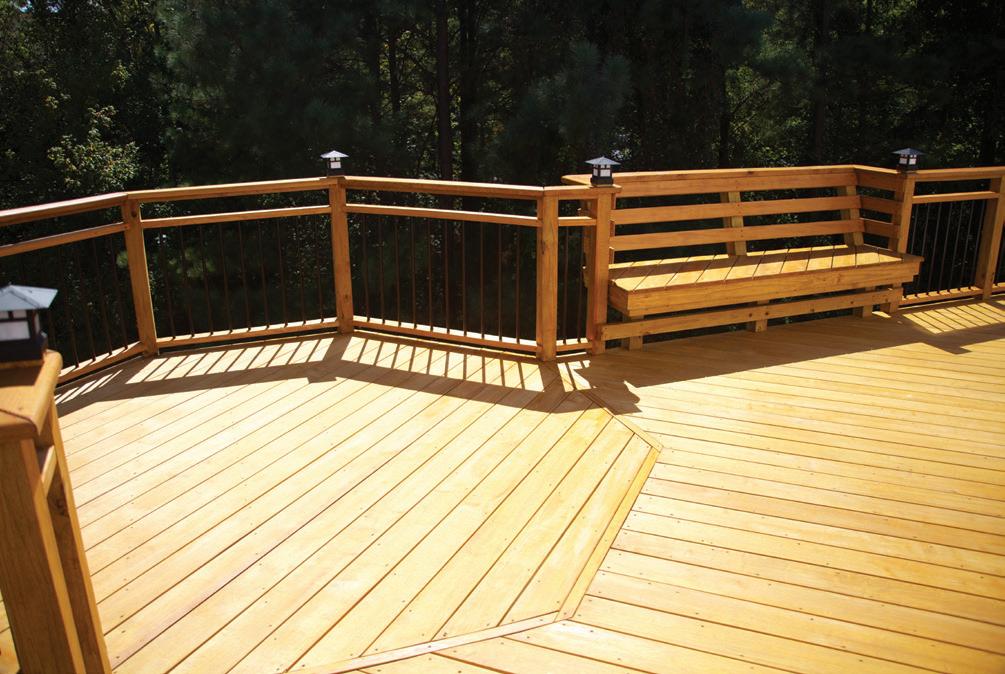

Yet even though they may be daunted by the choice of which to buy, consumers still overwhelmingly pick beautiful, natural preserved wood for many outdoor living projects. Hundreds of thousands of preserved wood decks, fences, and other structures adorn backyards from coast to coast, giving homeowners extra space to play, relax and entertain.

“Pressure-treated lumber is chosen for its durability and its natural beauty, which is often mimicked by manufactured backyard materials,” says Jay Hilsenbeck, global product director and North American marketing director for Arxada. “But, why build with something that can only aspire to be wood, when you can build affordable, beautiful and long-lasting projects with the real thing?”

With backyard contractors choosing pressure-treated lumber for nearly 60% of their projects, it’s clear that

professionals and do-it-yourselfers agree—preserved wood is the way to go. The most popular of those outdoor living projects is decks, but consumers also seek to build smaller, less involved projects such as picnic tables, benches, fences, landscape features, and raised beds for gardens.

Customers, whether they are seasoned contractors or novice DIYers, need guidance to choose the right treated wood for their projects. That purchase is the key to building outdoor projects that stand the test of time, but choosing can be daunting. How does a buyer know what kind of treated wood is appropriate for their intended application?

Whether building a deck’s understructure or adding the final touches such as railing or built-in seating to a project, selecting the right treated wood for each application will help it last longer. In recent years, the treated wood industry led by the American Wood Protection Association (AWPA) has worked together to defined more clear guidelines for choosing the right wood for each application. Those guidelines, indicated on end tags found on every piece of treated lumber, inform the buyer of the retention level (0.060 and 0.15 pcf) and the use category (Above Ground or Ground Contact). The required retention depends upon the severity of the exposure conditions of the wood during its service.

According to Hilsenbeck, choosing the right wood for its intended use is imperative. “Most consumers are in the market to purchase either Above Ground or Ground Contact preserved wood for their project. Ground Contact preserved wood is treated to a higher retention level than Above Ground,” he explains. “That simply means Ground Contact preserved wood has more preservative in it to offer necessary protection for more demanding end uses like raised beds, landscape retaining walls, or the structural components of a deck. While it’s possible to use Ground Contact treated wood in above ground applications, the reverse is not true. Because of this, it’s reliable advice to consider Ground Contract treated wood to be suitable as a general use product. That’s why some retailers carry only Ground Contact wood.”

Wood treated for Above Ground use is intended for parts of a project that are at least 6" above the ground, where wood dries easily, and where the wood is well-ventilated around all boards. Examples are elevated decking, railings, built-in deck benches, and fence pickets.

As Hilsenbeck explains, Ground Contact treated wood is versatile enough to be used in any application; however, it must be used in applications where the wood

• will come in contact with or be within 6" of the ground or fresh water

• is critical to the structure and/or it would be difficult to repair or replace

• is exposed to harsh conditions (even if above ground)

such as prolonged contact with soil, vegetation, sprinklers, etc.

Examples include deck joists, beams, posts, stair stringers, landscaping items, and raised bed gardens.

“An easy rule of thumb is to remember if the project is in contact with the ground or fresh water or built in a manner that does not allow the wood to easily dry, Ground Contact treated wood must be used,” Hilsenbeck says.

Once the right wood is chosen, building can begin. Pressure-treated lumber can be used in construction at any time of the year. Wood is a versatile material that can be easily cut and shaped on site. And, the leftover wood from a large project can be repurposed for an additional, small project.

So, when your deck project is complete, what happens to the leftover wood? For the cost of just a little time, a contractor can add value to a customer’s project. Because wood is flexible and adaptable, the extra pressure-treated lumber from a larger project can be used to create an additional perk for customers, giving them the finishing touch on their outdoor oasis.

A raised bed garden, for example, is the second most popular backyard project. This can be completed quickly and easily as an added bonus for a homeowner to cultivate and enjoy for many years to come. MM

– Belinda Remley has been promoting the wood industry for more than 30 years. She is a marketing communications professional with Arxada, a leader in wood preservation and the preservative manufacturer behind Wolmanized Outdoor Wood (www. wolmanizedwood.com).

------------ BY JOE K. ELLING

PROJECTIONS OF homebuilding and other end-use markets driving the demand for wood products always carry a degree of uncertainty. The uncertainty arises from assumptions concerning the decisions of policymakers at all levels of government and the Federal Reserve.

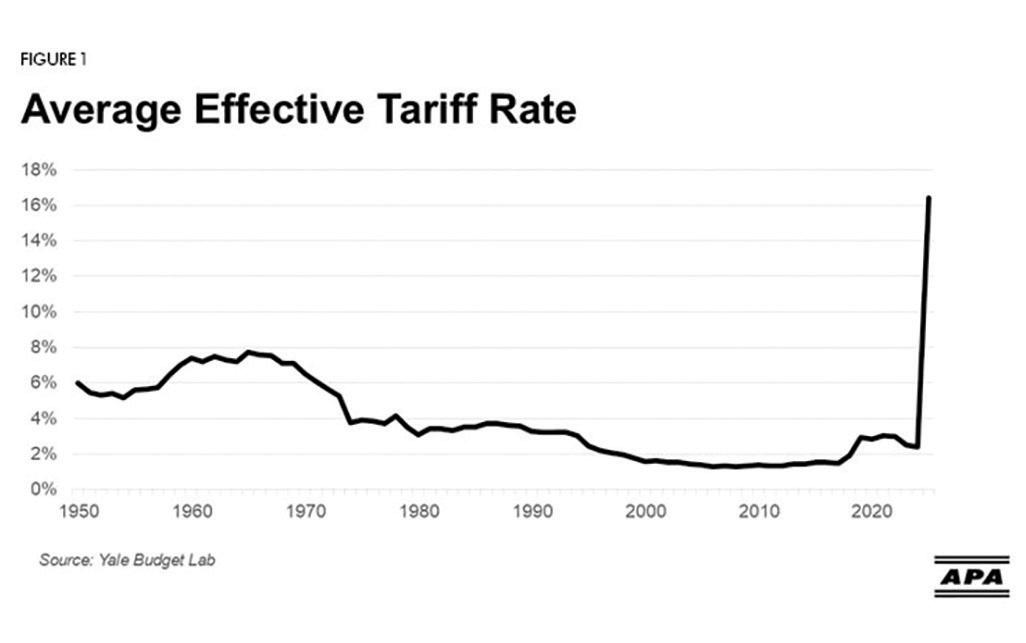

With this in mind, the degree of uncertainty for the next two years is high. The high level of uncertainty stems from the new administration’s decision to impose tariffs at levels not seen in close to 100 years and the on-and-off nature of their implementation. In fact, since 1950, the U.S. trade policy has been to reduce tariffs (see Figure 1 below). As of mid-May, the average effective tariff rate on imported goods stands at 16.4%.

Compounding the disruption to trade is U.S. fiscal policy, with the bond market signaling concerns about deficits.

The broad-based tariffs create uncertainty for several reasons. For example, there is a risk of retaliatory actions taken by foreign nations to limit U.S. exports to their countries. The esoteric nature of the administration’s implementation of its trade policy compounds the uncertainty, as it is challenging to develop and execute long-term plans due to the lack of clarity on the desired outcome.

Additionally, there is uncertainty surrounding the exten-

sion of the 2017 tax cuts and the implications for federal government deficits in 2026 and beyond. Through April, the budget deficit is on a path to exceed nearly $2 trillion for fiscal year 2025, which ends on September 30.

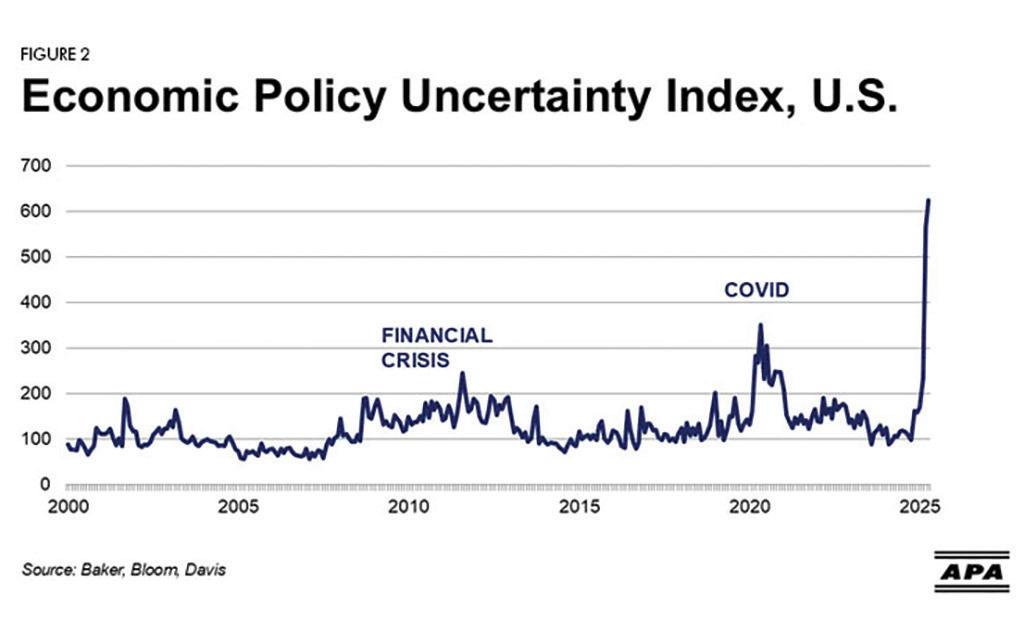

We regularly see forecasts in the business media that state the probability of an event occurring with respect to the economy. It is unclear how that probability number is derived. Three economists have developed an Economic Policy Uncertainty Index to help the business media and the general public understand the degree of uncertainty surrounding policy discussions at a given point in time and how that uncertainty will impact the economy. The methodology for constructing the index is solid.

As shown above in Figure 2, the confusion created by the imposition of tariffs and the debate in Congress regarding taxes and spending is substantial.

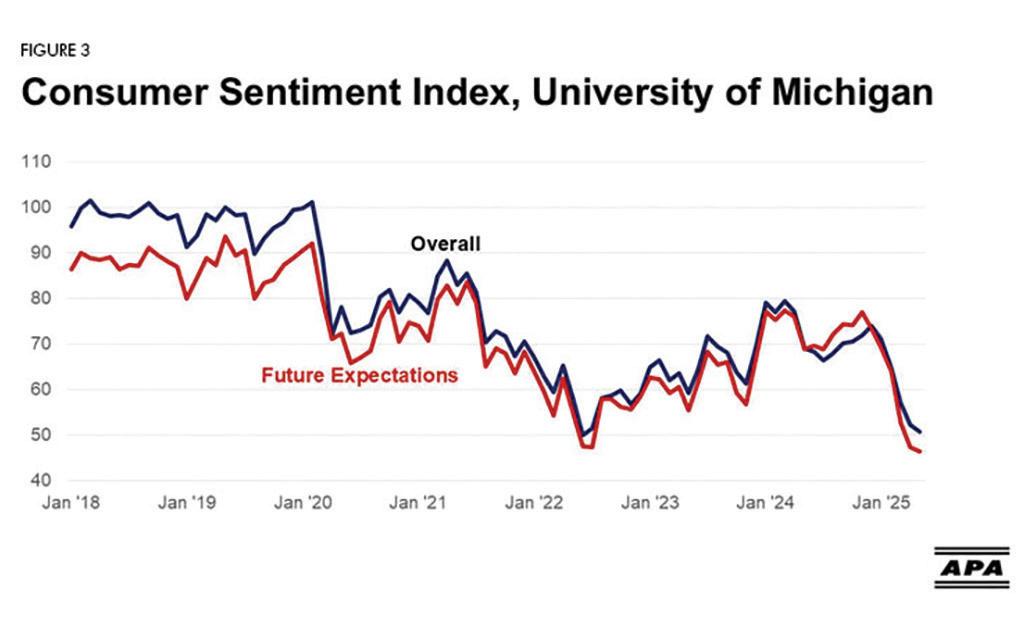

The surge in uncertainty impacts the economic outlook because many businesses are taking a wait-and-see stance in making major investments in plant and equipment. The same holds for households. Since the discussion of tariffs began, consumer sentiment has returned to the level last

seen in 2020, driven by the COVID-19 outbreak (Figure 3 above). Survey respondents believe that imposing tariffs will put upward pressure on prices, and incomes will not keep pace. In turn, consumers believe it is best to delay making big-ticket purchases.

Weaker business and consumer sentiment is expected to weigh on the economy through the rest of 2025 and carry into 2026. Weaker sentiment suggests economic growth of 1% or less for the next two years and rising unemployment.

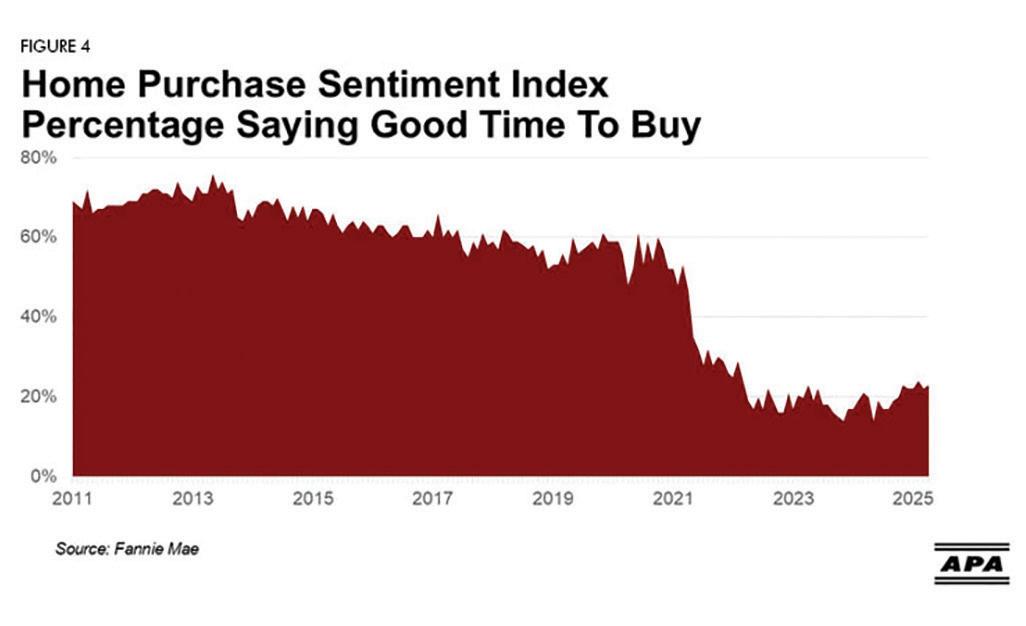

Consistent with the uncertainty seen by the respondents to the University of Michigan consumer sentiment survey, respondents to Fannie Mae’s survey on homebuying conditions say it is not a good time to buy a home. As shown above in Figure 4 (at top right), less than 25% said it is the right time to buy a home for a home purchase. This

has been the case since March 2022, when the rate on a 30-year fixed-rate mortgage started its climb to the 6.5% to 7% range.

(Continued on next page)

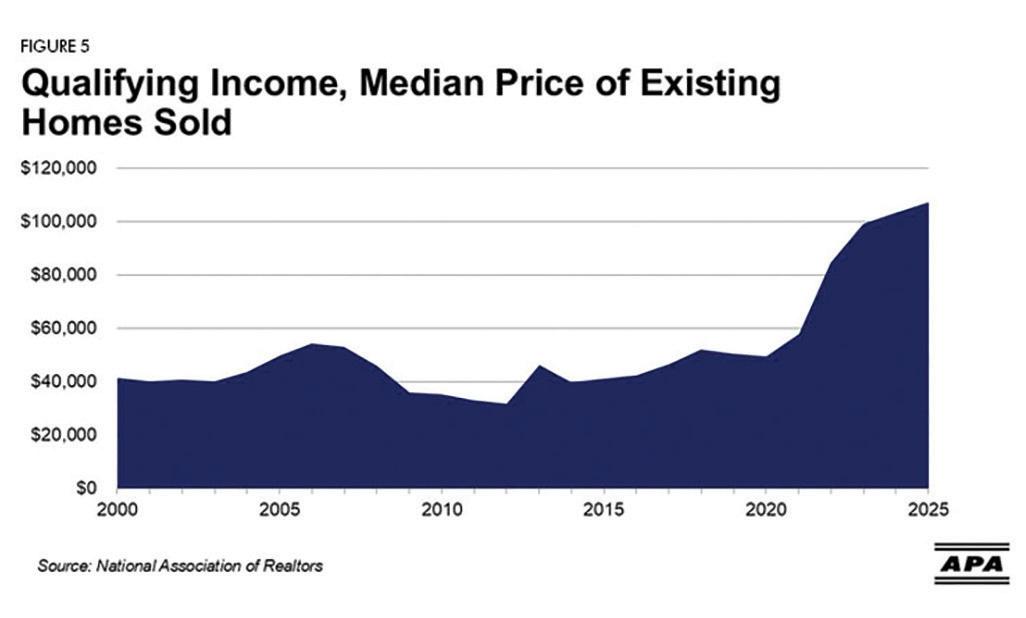

The primary driver of the belief that it is not a good time to buy is the affordability challenge potential homebuyers face. From 2021 to 2025, rising home prices combined with higher 30-year fixed mortgage rates have doubled the income required to qualify for a mortgage for a median-priced existing home under traditional lending rules (Figure 5 on previous page). In 2026, the rate on a 30year fixed-rate mortgage is likely to run at or above 6.5%, indicating there will not be meaningful improvement in the near term.

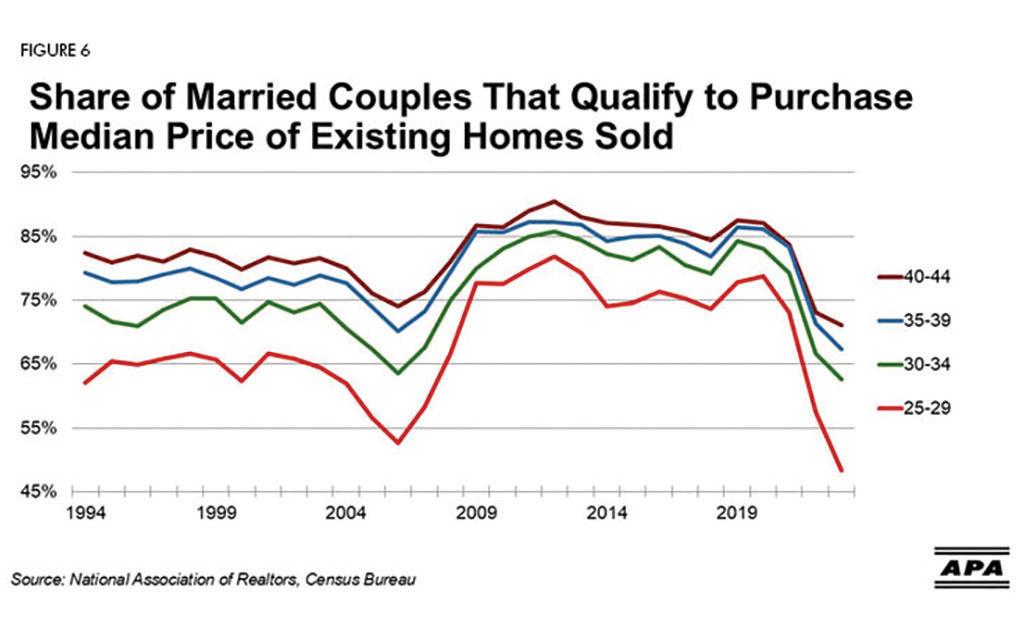

Figure 6 (top left) shows the share of married couples in first-time homebuying age groups who qualify to buy a median-priced home. The data runs through 2023, as the household income data from the Census Bureau is not available until later this year. Average hourly earnings in 2024 and 2025 through April have not kept pace with the increase in home prices, meaning there has not been a meaningful increase in qualifying married couples. The trend is expected to hold in 2026. Moody’s downgrade of U.S. government debt adds upside risk to long-term interest rates.

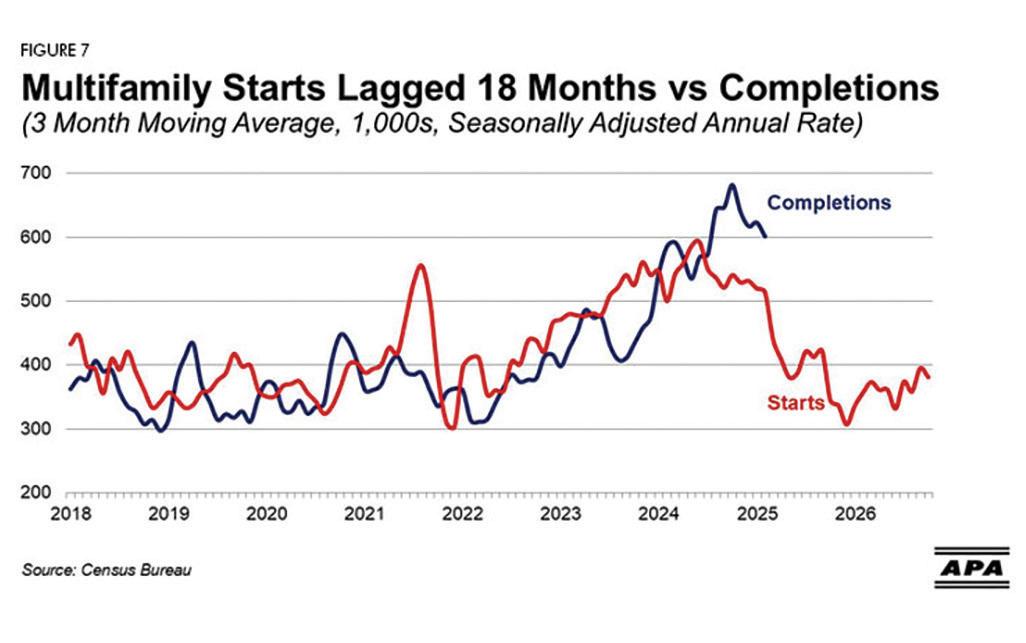

Lagging the boom in multifamily starts, completions since July 2024 have averaged a seasonally adjusted annual rate of 613,000 units (Figure 7 at lower left). Completions have exceeded the absorption rate of new units, leading to a rise in the vacancy rate. The Census Bureau estimates the rental vacancy rate in the first quarter of 2025 was 8.2%, up from the 6.4% low for this cycle in fourth quarter 2021.

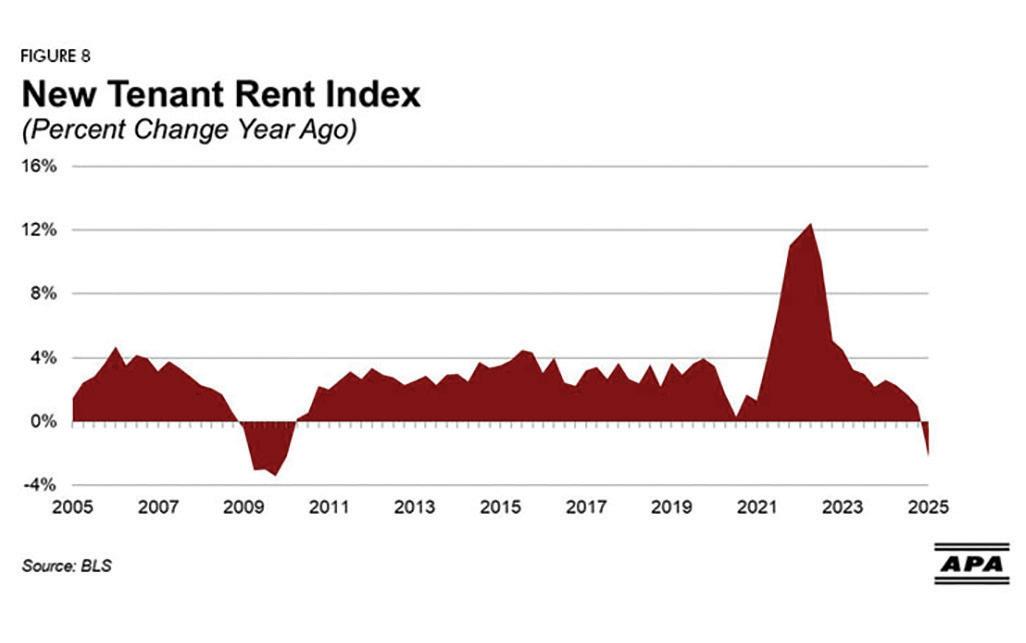

The rise in the vacancy rate has driven apartment owners to offer incentives to attract new tenants. As shown in Figure 8 (upper right), rents to attract new tenants in the first quarter of 2025 have fallen 2.2% compared with the first quarter of 2024. Seeing the relative weakness in rents, lending officers have been tightening their standards for issuing new multifamily construction loans. Combined with higher interest rates, this has led to a decline in multifamily starts, which will result in a decline in completions into 2026.

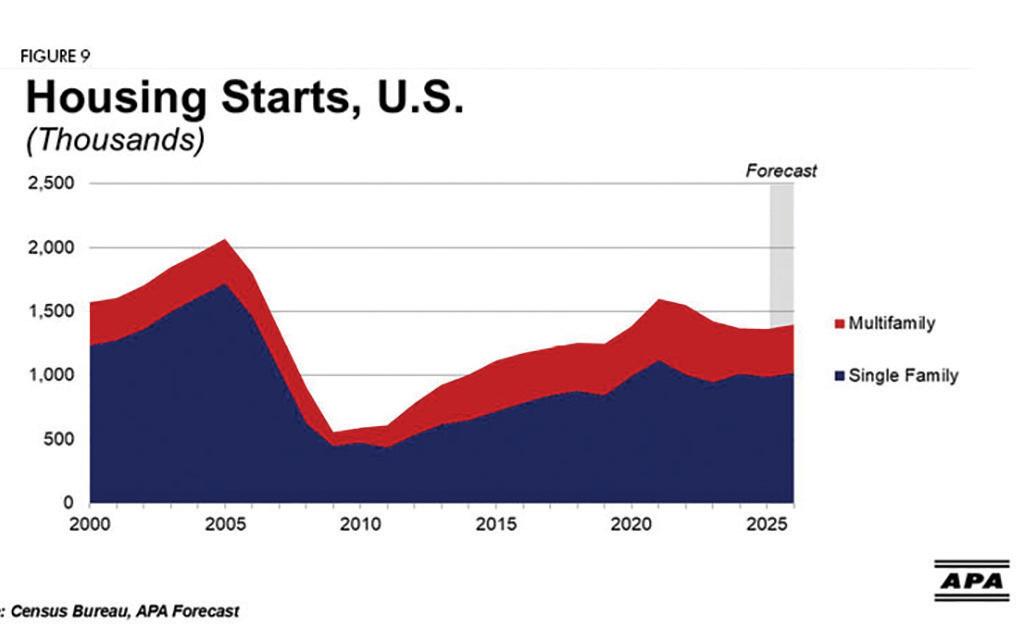

In 2024, housing starts totaled 1.367 million units, including 1.013 million single-family homes and 354,000 multifamily units. The affordability challenge will weigh on the demand for new homes, driving homebuilders to continue reducing the size of their homes and offering incentives to generate sales. Single-family starts are expected to be at or below 1 million units in 2025 and 2026. Multifamily starts are projected to average 375,000 in 2025 and 2026 (Figure 9 lower right). The sum is less than 1.4 million units, so 2025 and 2026 will feel a lot like 2024 in terms of wood products demand.

This level of construction will be insufficient to make a significant dent in the 3 million- to 7 million-unit housing shortage. It is not evident what steps policymakers at all levels of government will take to alleviate the shortage over the next five to 10 years. MM

– Economist Joe K. Elling is APA market research director. He has over three decades of experience providing valuable insights to business decision-makers. Contact him at joe.elling@apawood.org.

------------

BY BILL PARSONS

MASS TIMBER is moving beyond early adoption and making its mark across a wide range of building types in the U.S. What was once a niche construction approach is now being considered more widely—especially in commercial, multi-family, and institutional sectors. As of March 2025, WoodWorks is tracking 2,427 mass timber projects in the U.S., 1,244 of which have been constructed1. That activity reflects more than curiosity—it signals a maturing market increasingly willing to invest in mass timber’s performance, aesthetics, and environmental advantages.

This growth includes an increasing number of repeatable, scalable models for design that streamline the development and construction process while adapting to regional needs. A standout example is the T3 office series from developer Hines. Short for Timber, Transit and Technology, T3 buildings follow a replicable model distinguished by sustainability, urban connectivity, and high-performance design. Hines has 27 T3 projects2, either built or in the pipeline, in cities including Minneapolis, Atlanta and Denver, helping to normalize mass timber for commercial office use and create a precedent for future projects. This kind of

repeatable concept reduces risk and uncertainty for supply chain partners, developers and design teams alike.

Additionally, major cities like New York, Boston and Atlanta have now supported multiple cohorts of mass timber accelerator programs, helping projects move from concept to construction and facilitating a pool of shared knowledge and best practices in their respective jurisdictions.

Establishing a prototype for mass timber commercial design is significant as interest grows across sectors. While early mass timber adoption was concentrated in office buildings, the trend has expanded into education, student housing, industrial facilities, and more. Many developers are also exploring hybrid systems—e.g., mass timber floor and roof systems with light-frame wood walls or a combination of wood and non-wood systems—to meet cost, code, or performance goals.

Transparency and data will remain essential as mass timber projects grow in numbers. WoodWorks tracks projects (updated quarterly on woodworks.org), distinguishing

(Continued on page 23)

BUILT IN 1969, APA – The Engineered Wood Association’s 42,000-sq. ft. facility has long been recognized as one of North America’s top engineered wood research centers. In 2019, the association made significant upgrades to the research and testing capabilities at its Tacoma, Wa., laboratory.

The upgrades ensure that it maintains that reputation while continuing to serve the industry as a leader in supporting the innovative design, development and end-use of code-compliant, energy-efficient structures built with engineered wood, mass timber and wood structural panels.

The lab expansion was built as an engineered wood showcase, with laminated veneer lumber purlins and studs, and glulam columns supporting a roof framed with long-span curved glulam beams. The glulam columns are also designed as dual function to support crane rails. The wall and roof diaphragm are sheathed with wood structural panels, while OSB lap siding makes up the exterior cladding.

The significant lab enhancements provide numerous benefits for the engineered wood industry, according to Eric Gu, vice president of APA’s Technical Services Division.

“The expansion of APA’s Tacoma laboratory represents a transformative moment for the association and the engineered wood industry as a whole,” Gu said. “With cutting-edge capabilities for full-scale structural testing and performance evaluation, we are empowering innovation in timber product development and design. These upgrades underscore APA’s leadership in advancing resilient, sustainable building systems that meet the demands of modern codes and construction practices.”

The project was extensive. As part of the renovations, a section of the laboratory’s existing ceiling was raised from 24 ft. to 40 ft. in height. The near doubling in height enables APA staff to leverage the strong wall to test taller specimens and vertical assemblies.

“This update allows for full-size structure testing. That’s significant,” Gu said. “It provides a state-of-the-art research facility that supports structural testing from small-scale all the way to whole-house testing.” Results of these tests provide insight for APA staff to understand the performance of engineered wood products at the element, assembly and system levels.

The laboratory has a 4-ft.-thick reinforced strong floor, which provides a precision-level surface for reaction support and instrumentation mounting. The floor is reinforced with 28 tons of rebar. It’s made of 830 tons of concrete with 868 anchors at 2 ft. on center. Each anchor has a 100,000-lb.-force capacity, which means staff can coordinate tests simultaneously if needed.

“The strong floor is 70 by 75, for a total of 5,250 sq. ft. The large format of the strong floor, coupled with dual overhead cranes, improves our lab testing efficiency,” Gu said. “And we have the versatility of coordinating multiple tests at the same time in the same area—thanks to its large size.”

APA’s lab also has 10 strong wall blocks with anchors. Gu said that was another improvement made possible by the near doubling of the ceiling height to almost 40 ft.

The lab is equipped with two 5-ton overhead cranes. These cranes make moving, lifting and maneuvering test objects much safer and more efficient, facilitating full-scale structural assembly testing.

“The two cranes allow for efficient flow of materials,” Gu said, “in receiving, assembly and final disassembly after testing. It’s all about safety and efficiency.”

The lab’s hydraulic actuator was upgraded from 55,000 lb.-force to 220,000 lb.-force. Gu said it’s another way APA expanded its testing capability for the industry.

“The larger capacity actuators and longer stoke cylinders allow us to test taller walls that require more stroke,” he said. “It also permits us to test more flexible walls like foam over wood structural panel wall assemblies.”

(Continued from page 20)

between projects in design and built to give a realistic view of market progress and avoid confusion between what’s proposed and what’s complete. This clarity is essential in a market where many proposed projects stall due to financing, shifting priorities, or lack of experience with the materials. While not all projects move forward, the steady increase in completed buildings shows that mass timber is gaining traction.

To facilitate open access to project data and build a robust network of professionals, WoodWorks hosts the WoodWorks Innovation Network (WIN), a user-generated platform of mass timber and innovative light-frame projects in North America (and beyond), as well as product manufacturers and suppliers. In Q1 of 2025 alone, 122 new projects were added to the WIN map3. This level of public access to real-time market information helps the industry coordinate, plan, and scale. It also builds confidence, ensuring that interest in mass timber is matched by a realistic understanding of the learning curve associated with these projects.

Opportunities for support and education are essential. WoodWorks provides free project assistance to support project teams considering wood and has worked with over 60 training centers and universities to educate tradespeo-

One aspect of the lab that hasn’t changed: its staff comprised of highly educated engineered wood experts. Among the APA lab employees are PEs, doctorates in timber engineering, master’s in wood science and PhDs in civil engineering. Their collective knowledge brings tremendous value to association members and the greater engineered wood products industry. MM

– For additional details on the testing capabilities of APA’s research center, visit the APA website (www.apawood.org).

ple and construction managers on mass timber installation and coordination. In addition, WoodWorks continues to grow the body of publicly available technical design resources and project data to help the industry understand what’s possible with wood, plan strategically, and demonstrate market viability to decision-makers.

Ultimately, mass timber is gaining momentum not just because of what it offers structurally, but because it meets the needs of modern construction. Mass timber offers a compelling solution in a market looking for sustainable alternatives, regional economic development opportunities, and design flexibility. With stronger supply chains and proven project models, it’s poised to become a long-term staple of American construction. MM

– Bill Parsons, PE, is the chief operating officer at WoodWorks – Wood Products Council, a non-profit organization providing free project support for commercial and multi-family mass timber and light-frame wood buildings, a nationwide education program, and a wide range of published resources.

[1] Market Trends Map: Snapshot of Mass Timber Projects in the U.S. WoodWorks – Wood Products Council, 2025. Retrieved from https://www. woodworks.org/resources/mapping-mass-timber

[2] T3: Timber, Transit, Technology. Hines. Retrieved from https://www. hines.com/t3

[3] WoodWorks Innovation Network (WIN) Project Map. WoodWorks – Wood Products Council. https://www.woodworksinnovationnetwork.org/projects

------------ BY MATT BROWN

IT SEEMS NOT that long ago, energy efficiency was far from top-of-mind among professionals in the construction community. Builders were more concerned about homebuyer-pleasing amenities and other issues, that at the time, were likely more important to clients.

But that focus has changed in recent decades. Today, numerous surveys show that energy efficiency is a top concern for builders and their clients. Energy-efficiency requirements are being added to state and local construction codes, making their use mandatory.

However, energy-efficiency improvements can add costs to construction projects. And the payback for efficiency upgrades can, in some cases, take years, if not decades.

But there is a cost-effective and energy-efficient building option available on most projects: wood structural panels.

Plywood and oriented strand board (OSB) structural panels offer builders flexibility when it comes to meeting the requirements of the 2024 International Energy Conservation Code (IECC). The 2024 IECC puts options into the code for how developers design the building thermal envelope. It allows builders to more easily use wood structural panel walls compared with the 2021 version.

Walls fully sheathed with wood structural panels deliver strength and performance, often times at a lower cost than installing continuous insulation. Continuous insulation has been a part of the IECC since 2012, and APA led efforts to

have the ability to use wood structural panels inserted into the 2024 code.

Builders’ organizations—and their members—are starting to get the message. The National Association of Home Builders (NAHB) and the Leading Builders of America (LBA) have worked to spread the word about these options. In fact, NAHB and LBA are encouraging state and local officials to consider updating code requirements to follow the 2024 IECC because of its flexibility.

Builders prefer the 2024 IECC over the 2021 version, because of the flexibility it allows in the design of the building thermal envelope. With wood structural panels, and often unlike continuous insulation, builders don’t have to add window and door extension jams or change foundation widths to allow airspace for brick walls. These all help mitigate the extra costs often associated with following the requirements of advanced energy codes like the IECC.

This newfound focus on options and flexibility comes as builders and code officials switch from the longstanding “prescriptive path” to the “performance path” for code compliance. The prescriptive path dictates construction practices and materials when it comes to the structure’s thermal envelope. Under it, builders have few options in how they meet the code’s requirements. In contrast, the performance path provides builders with more choices—

such as wood structural panels—that may be less expensive. The only requirement is that structures still meet or exceed state or local efficiency and code requirements. More information is available in the APA publication The Performance Path to Energy Code Compliance

Builders are taking notice and changing their approach. According to LBA officials, a majority of U.S. new-home construction uses the performance path, not the prescriptive path, for code compliance. And that’s a major change from a decade or so ago, when only about 30% of builders in the market used the performance path.

The switch allows builders to mitigate costs while delivering superior energy efficiency in the homes they erect. Today, it’s not uncommon to see 3,000-sq. ft. or larger homes built to updated code standards that generate an average utility bill of only around $100 a month.

The 2024 IECC provides credits for HVAC systems and

other high-efficiency improvements that builders can use to install wood structural panel walls without continuous insulation.

It’s always tricky to predict where building codes and regulations will go from here. However, future code bodies will likely focus on renewable energy and net zero, which refers to the greenhouse gases put into the atmosphere being “zeroed out” by the greenhouse gas emissions removed from it. There’s not much more efficiency that can be rung out of the building thermal envelope.

But any time a building code has flexibility, it’s good for the industry, and maintaining that flexibility is key to helping builders keep costs down. MM

– Matt Brown is APA director of energy policy and code in the association’s Market Access and Development Division. Contact him at matthew.brown@apawood.org.

THE AMERICAN Wood Council (AWC) has led adoption and acceptance for mass timber across the U.S. through resources, education and participation in the code development process. AWC was a key leader in the original research and development process that first led to the recognition of cross-laminated timber in the International Code Council’s (ICC) 2015 I-codes, and eventually the first recognition of mass timber construction types in the 2021 I-codes.

After the inclusion of mass timber construction types in the I-codes, AWC continued their efforts leading engagement and education for building officials and the fire service. AWC has led presentations on fire testing, mass timber codes and construction fire safety to fire service members across the nation and supported the work of the Construction Fire Safety Coalition.

The mass timber provisions have now been adopted in 40 states with AWC having directly supported adoption in many of them.

In the latest continuation of AWC’s work in mass timber, AWC released a Mass Timber Alternative Materials and Methods (AMM) Guide for use with the 2018 International Building Code (IBC). The AMM Guide helps clarify and support the review, permitting and approval of mass timber projects in jurisdictions that are using the 2018 IBC and have not yet adopted mass timber provisions of later editions of the IBC.

The AMM Guide is designed to help bridge the gap between the codes adopted in each state and the newer mass timber provisions in the 2024 IBC. Adopting the most recent edition of the Building Code, like the 2024 IBC, can be a slow multi-year process for states or jurisdictions. As a result, there is sometimes a gap between what is included in the currently

adopted code in a state and what is allowable based on the latest available ICC I-codes. The AMM Guide serves to fill that space by offering code provisions for jurisdictions without mass timber specific guidance.

According to AWC vice president of codes and standards Philip Line, this resource is for jurisdictions that have not yet adopted the latest I-codes, to help code officials establish clear requirements for approval of new mass timber building construction types (Type IV-A, IV-B, and Type IV-C) as AMM projects.

The new nationwide guide comes after the 2024 release of the Florida Mass Timber Alternative Materials and Methods (AMM) Guide, which was specifically designed to support mass timber projects under the 8th Edition of the Florida Building Code. The success of that guide and support for it by code officials in Florida led to the creation of the general Mass Timber AMM Guide

The Mass Timber AMM Guide joins the many other resources AWC has created along with their education programs that provide essential resources to code officials and promote timber as the sustainable and versatile building material it is.

The Mass Timber AMM Guide and the Florida AMM Guide are available on AWC’s website (awc.org) MM

------------ BY MATT BROWN

IT SEEMS NATURAL disasters—tornadoes, hurricanes, floods—are increasing in frequency and intensity every year. Even a “minor” incident can cause millions of dollars in damages. Architects, engineers, builders and communities seek construction practices that can help buildings withstand and adapt.

At APA – The Engineered Wood Association, we know that resilient construction techniques using engineered wood products can help meet these goals by incorporating our four resiliency pillars: structural resilience, hazard mitigation, sustainability/stewardship, and energy efficiency.

APA and our industry partners offer designers and builders numerous resources that provide guidance on incorporating these pillars.

Structural Resilience, which also encompasses seismic resilience, demonstrates the need for high-performance buildings that can withstand severe wind or seismic events. APA has information on installing bracing for high-wind events and how to maximize wall bracing using wood structural panels for continuously sheathed walls. Additionally, APA has resources on wall bracing for seismic incidents using force transfer around openings (FTAO) design methods.

Hazard Mitigation: For flood prevention, a part of hazard mitigation, APA offers information on raised wood floor systems, including case studies on their use. We explain how using flood dampers and crawl spaces can allow living

areas to stay dry even if a crawl space takes on water. The American Wood Council (AWC) offers several educational resources on structural and construction fire prevention.

Sustainability and Stewardship efforts in the construction industry date to the late 1980s and early 1990s. Sometimes called “green building,” there are programs that provide a way to quantify buildings’ environmental impacts. Examples include the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED) building rating program, National Green Building Standard (NGBS), and International Energy Conservation Code (IECC).

At APA, we offer Green Verification Reports that help designers and building officials determine which engineered wood products qualify for points under these environmental building programs, which are increasingly mandated in public and private projects. Other good industry resources include WoodWorks’ Carbon Calculator, which helps designers estimate the amount of carbon stored in wood and greenhouse gas emissions avoided by not using steel or concrete. AWC has environmental product declarations (EPDs)—publications that help determine a wood product’s environmental performance through its lifecycle.

Energy Efficiency: As part of an overall push for greater energy efficiency, energy codes are growing in importance, with a focus on issues such as structural performance. APA is constantly expanding its resources in this area. We offer The Performance Path to Energy Code Compliance, a publication highlighting alternative ways of approaching construction requirements than the traditional prescriptive route, which dictates how code requirements should be met.

APA’s website, www.apawood.org, has information on all these topics and more. From engineering calculators to CAD details, APA has a wealth of complimentary tools and knowledge to share. Plus, it offers free technical support and guidance from engineered wood specialists who are experts in building and designing resilient structures with engineered wood products.

Among the free tools available at apawood.org are a Wall Bracing Calculator; Advanced Framing Method publications, case studies and a webinar; and Building for High Wind Resistance in Light-Frame Wood Construction Design Guide MM

– Matt Brown is APA director of energy policy and code in the association’s Market Access and Development Division. Contact him at matthew.brown@apawood.org.

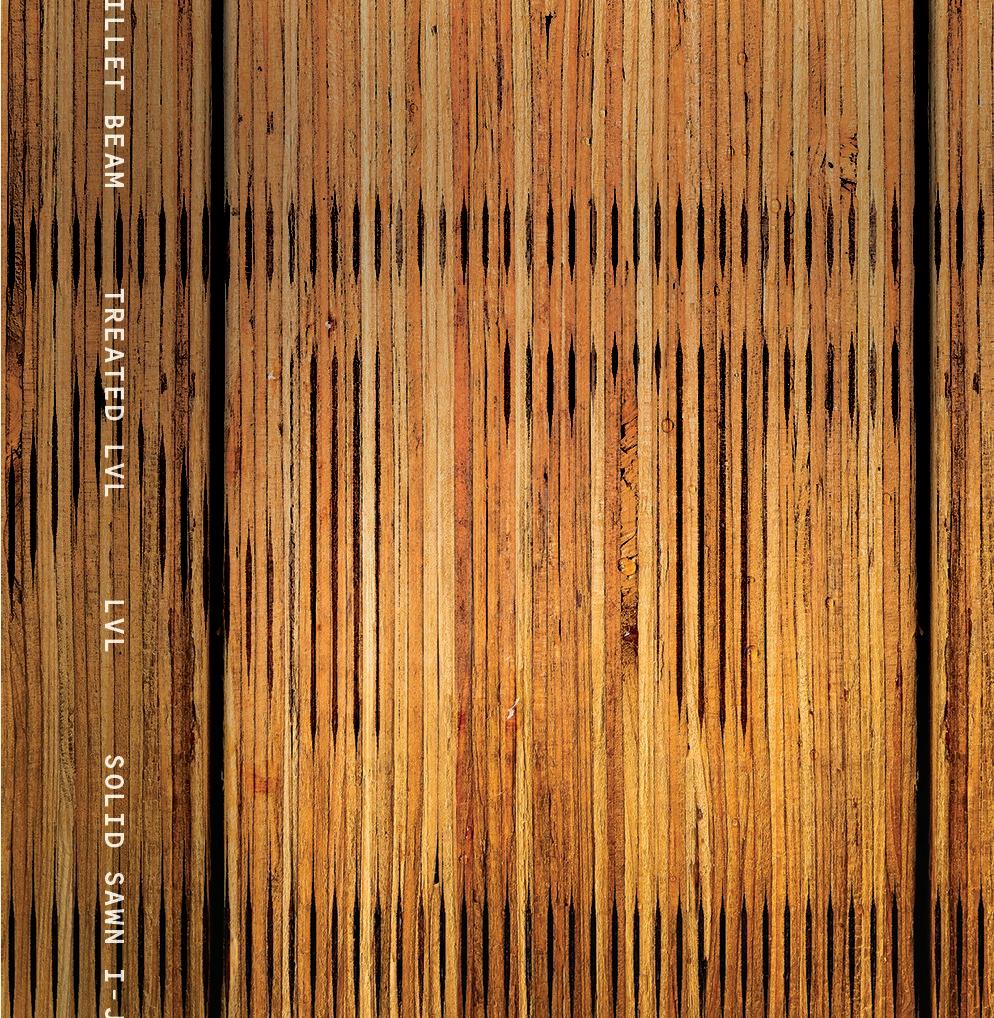

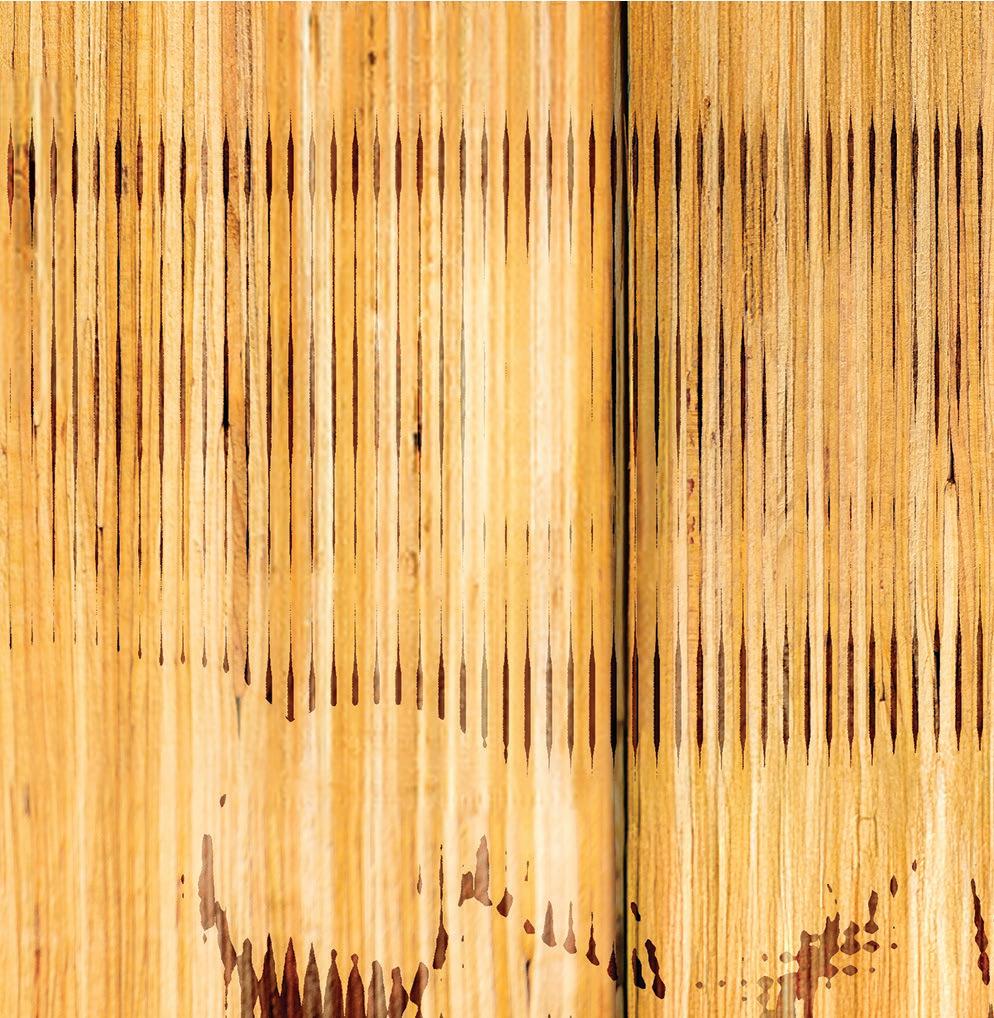

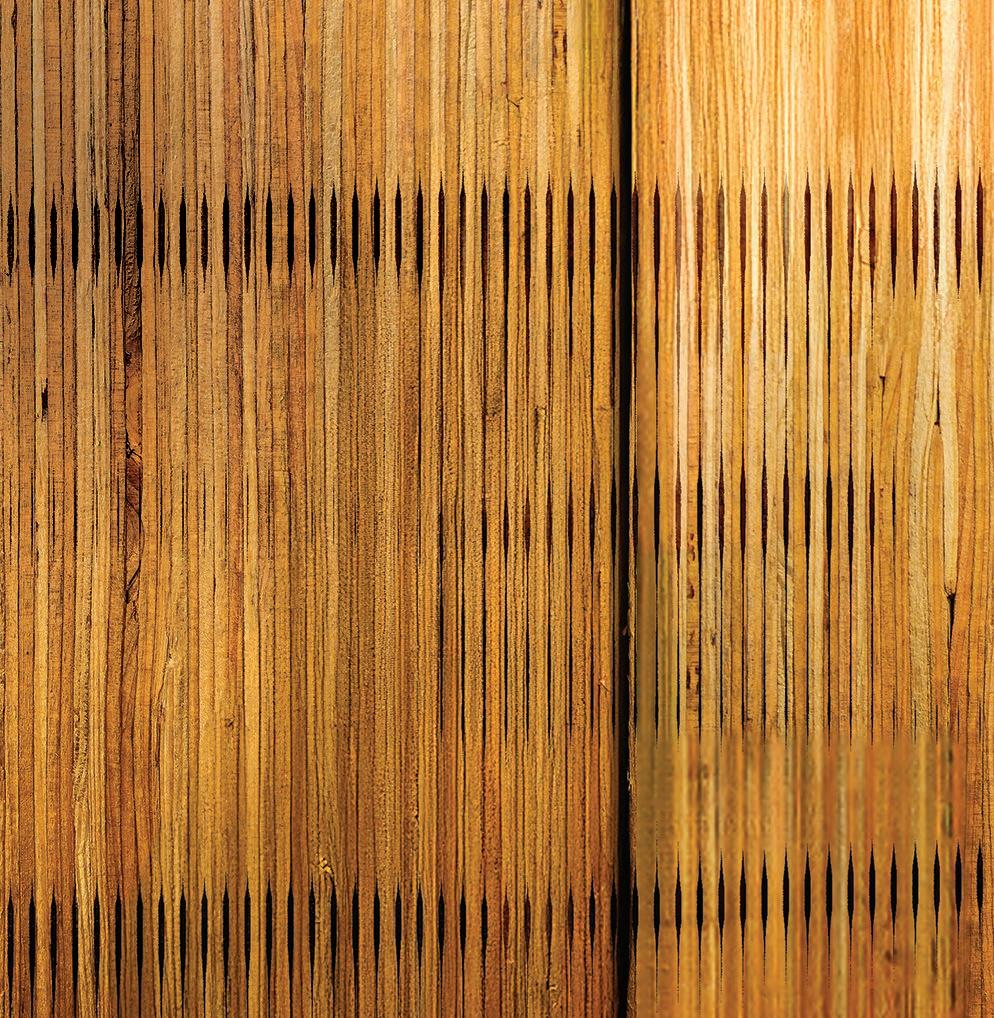

Made from Oregon’s natural fiber, featuring small, closed knots typical of trees responsibly thinned from dense forests. Ripped into 9.5-inch boards to evoke the familiar, solid-sawn look of conventional CLT.

Have you seen the edge grain on LVL? Now imagine an appearance that showcases the rich complexity of the veneer layers that make up Mass Ply.

Clear veneer is carefully selected and assembled for a cleaner aesthetic. With a mostly knot-free face, it is puttied, sanded, and then ripped into 9.5-inch boards, recreating the solid-sawn look of conventional CLT — but without the knots.

A traditional Japanese wood preservation technique, where the wood’s surface is charred to enhance durability and resistance to rot, insects, fire, and weather.

Things are looking good for next-gen Mass Ply building materials. Stronger by weight than concrete and steel, offering carbon sequestering benefits and versatile in both application and appearance, Freres’ Mass Ply is the smart choice any way you look at it.

FOR MOST of this year, one of the main challenges has been “The market is tough right now,” or some version of that statement. Having been in commission sales for 40 years, I have lived through some difficult markets. I have developed and lived the philosophy of “We don’t participate in down markets” and have been teaching it for 30 years.

My father was a sweet man, but as a child of the Great Depression, he always worried about it happening again and was very negative about the economy. At 10 years old, I asked, “Dad, why are you so negative all the time?” He said, “I am not negative. I am realistic.” I said, “Well, if you are so realistic, how come you never talk about positive things, because positive things happen, too.” He then started talking about the Great Depression (again!).

I asked, “OK, during the Depression, what was the unemployment rate?” He said, “About 30%.” (In fact, it was 25% at its peak). I said, “So I only have to beat the bottom 30%. I think I can do that.” Although my parents were negative about a lot of things, they always told us, “You are head and shoulders above all the kids on this block. You can accomplish anything you put your mind to.”

My personal philosophy that I live and teach is similar to the number one rule expressed in the great movie Fight Club. The number one rule of Fight Club is “We don’t talk about Fight Club.” I feel the same about tough times.

------------ BY JAMES OLSEN

One of my students asked me, “If our customers really want to talk about how tough the market is, should we discuss it with them?” My answer, “Absolutely not! We can commiserate for one sentence, and then we change the subject to something positive.”

For example:

Customer: “This market is terrible.”

Master Seller: “It is tough right now, but because of that the mills are very receptive, and we are making some crazy deals on 2x4 16’s, which you burn through. Print shows 16’s at $650/MBF, but we put a block of 20 together at $595/MBF. How many can you use?”

To quote Baron Rothchild, “When there’s blood in the streets, there’s money to be made, even if the blood is your own.”

Another good thing about tough markets is a lot of salespeople get discouraged and give up. A positive attitude alone won’t save us. We stay positive, put our heads down, and work! It’s an old but true statement: “When the going gets tough, the tough get going.”

I know salespeople in many different markets that killed it from 2010-2019 because they had the playing field to themselves after so many commission salespeople gave up and moved to salaried jobs.

The Psychology of Positive Denial

We must tell ourselves that we are great and that we are going to kill it

every day. Is this realistic? I tell my students, “The world and the markets are not ruled by the realistic!” Kenny Smith of the great show Inside the NBA says, “To play in the NBA you have to think you are better than you are.”

As a 5’ 10”, 175-lb. basketball player, I used to sit in my car outside the gym and repeat the mantra, “I’m the best shooter in the gym,” over and over until I believed it. Based on that mantra and hours of practice I often (sometimes!) was. My philosophy holds true of commission sales.

As commission salespeople, we are playing without a net. We must save more money than the average salaried person so that we can weather the storm when it comes.

Commission sales is not for the faint of heart. If you have chosen this career, you have to think long term. Some of our best relationships will be built in tough markets. Customers will remember and be loyal to the salesperson who stayed with them in tough times. MM

JAMES OLSEN

NOT JUST WORDS, OUR WAY OF DOING BUSINESS!

The building materials industry is undergoing a significant transformation due to advances in technology, sustainability demands, and changes in global economics and regulation. LP SmartSide ExpertFinish is one product expected to shape the next decade in the building materials industry. With a complete LP SmartSide catalog in-stock and adding the ExpertFinish Naturals collection to our inventory, J.M. Thomas is prepared to take on any job. Whether you’re seeking modern design options, environmentally friendly materials, or durable finishes, LP SmartSide offers a range of products to meet diverse building and design needs, and J.M. Thomas can help you bring you project to life!

------------

BY PAIGE McALLISTER

SUMMER MAKES us think of sun, vacation, relaxation and human resources…wait, what?!?!

The summer months are often a slower time operationally, which can allow management to proactively and strategically focus on other critical aspects of running a successful business, such as human resources. If summer is your busy season, consider these activities during your business’ slower season.

Most companies have been impacted by changes in the economy, labor market, legal regulations, and other factors, as well as variations in their internal structure, demands, operations, and so forth. While every year experiences fluctuations of this kind, successful businesses take the time to reflect and reevaluate along the way. Dedicating time during these quieter months of summer can have a significant impact for the rest of the year.

Review your year-to-date progress. Consider achievements, budget, goals, and key metrics at the company, department, team, and individual levels and adjust your strategies and plans as needed to stay on track. If you made your 2025 plans six months ago, it’s likely that things have changed, including new challenges, different personnel, increased expenditures, and evolving priorities. Take the time to honestly evaluate where you are and where you need to be—what has been accomplished or should be adjusted, delayed, or canceled, and how does that impact everything and everyone else? Look not only at your own goals but those of the company, your department, and your employees to ensure everyone is moving in the right direction to finish the year strong.

Conduct mid-year check-ins with employees. Just like you should be taking the time to see where you are

year-to-date, you should expect your employees to do the same. Are they on track with their professional and personal goals? Are they ahead of target and need to focus on another goal? Do their aspirations still align with the organization? Are they happy? Do they have concerns? Take the time to talk with them and plan what is needed to advance your stars, resolve your problems, and retain everyone else as a cohesive team.

Assess your employment strategy. Your workforce needs and composition may change due to fluctuations in operations or sales, employee personal needs, budgetary restrictions, or regulatory requirements. Now is a great time to review your workforce to plan for the rest of the year proactively. Do you have the correct number of employees? Are any employees expected to leave your workforce either permanently or temporarily? Are your recruiting methods, starting salary, benefits, hiring process, and other factors attracting the right candidates for the jobs you have or want to have?

Review your handbook, policies and procedures, and update them as needed. Changing regulations and best practices often necessitate updates to your policies and procedures. Have your handbook reviewed and updated now to ensure it is compliant on Jan. 1, when many new laws go into effect. Assess what other regulatory changes (i.e., pay transparency, ban-the-box, paid leave, paid sick time, marijuana legalization, etc.) may require updating your procedures, forms or documents or notifying employees either directly or through updated posters and notices. Review employee files, especially I-9s. A regular review of employee files can ensure compliance with regulations, as well as ensure you have complete files on

every employee and that active and terminated files are handled appropriately. With the recent urgency for Form I-9 compliance, it is a great time to do an internal audit of those forms and procedures, even if you do not have time to review the entire employee file.

Provide employees with updates on their paid time off. Paid time off (often referred to as PTO, vacation, sick, and/ or personal time) is a valuable benefit that most companies offer either voluntarily or as mandated by state laws. Remind employees of how much PTO they have used so far and have to use for the remainder of the year, as well as what will happen if they do not use all of their PTO by the end of the benefit year (Will it be carried over, paid out, lost?). Recommend they submit PTO requests as soon as possible, especially for time off around holidays or for known medical procedures. This will help you better plan for upcoming workforce fluctuations.

Begin planning for the upcoming major initiatives scheduled for later in the year. Take time now to start preparing for the big projects you know are coming, to save time and stress at the deadline. You can start working on open enrollment documents now. Review employee compensation to begin planning for raises and bonuses; even better, have a market analysis and/or pay review done so you know you are where you want and need to be to compete in today’s labor market and retain top talent. Consider introducing a Total Rewards Statement into your year-end process which will be easier if you start planning now. Allow employees some flexibility to refocus for the upcoming year and challenges. While not a permanent

fix to any problems and not possible in every organization, consider offering your employees some flexibility or relaxation during this time. Consider flexible scheduling options, such as four-day workweeks, shorter workdays on Mondays or Fridays, or alternating between remote and in-office workdays. Relax the dress code to allow jeans, capris or dress shorts with nice sneakers or dress sandals. Plan fun days such as potlucks, picnics, outings, community service, or family days. Using this time to build goodwill with your employees can pay big dividends for the busier times to come.

Take advantage of some “me time” to recharge. Once the summer wraps up, we will still have four often-hectic months to finish out the year. Use some of this quieter time to focus on you. Take time off, in either whole or partial days. Plan time with family and friends, or do something you enjoy. Look for professional development opportunities to further your knowledge and recharge your passion for your work. MM

Paige McAllister, SPHR, SHRM-SCP, is vice president for compliance with The Workplace Advisors, Inc. Reach her at (877) 660-6400 or paige@theworkplaceadvisors.com.

The Swiss Krono Group agreed to acquire Collins Pine Co.’s particleboard and engineered wood siding manufacturing facilities in Klamath Falls, Or. The sale includes the TruWood Siding & Trim brand name.

The acquisition marks a strategic expansion for Swiss Krono in North America, complementing its existing operations in Barnwell, S.C.

Peter Wijnbergen, CEO of Swiss Krono, said, “We view this acquisition as a strategic step to strengthen our position in the North American market. The Klamath Falls site fits well with our existing operations and will allow us to expand our presence in the Western U.S. As we move forward together, our primary goal is to continue and grow the Klamath Falls business in partnership with the people who know it best—its employees, management, customers and suppliers.”

The decision by Collins to divest the facilities supports its strategic focus on its core business of timberlands management and softwood and hardwood lumber manufacturing.

Tom Insko, CEO of Collins, said, “This decision was made with the best long-term interests of our employees and stakeholders in mind. Swiss Krono shares our values and vision for the future, and we are confident that this transition will open new doors for growth and sustained success for the Klamath Falls team.”

Both Collins and Swiss Krono are family-owned companies with deep roots in the wood products industry and a shared dedication to sustainable practices.

The transaction is subject to customary regulatory approvals and closing conditions. Financial terms of the deal and anticipated closing date have not been disclosed. Other Collins business units are not affected by this transaction.

Founded in 1966 and based in Switzerland, Swiss Krono Group is one of the world’s leading manufacturers of wood-based materials for flooring, interiors and building materials. It now employs around 4,800 people at 11 production sites in eight countries around the globe.

84 Lumber set a November opening date for its new store in La Mirada, Ca., and is expanding its location in Beaumont, Ca.

S-Bar-S Building Center held a grand opening on May 17 for its new retail store in Billings, Mt.

Miller Lumber is refreshing its showroom in Redmond, Or.

SRS Distribution has opened a new branch in Billings, Mt., managed by Eric Linterman.

Flagler Ace Hardware, Flagler, Co., recently remodeled.

Artie’s Ace Hardware, Phoenix, Az., has added a branch in Mesa, Az.—Ellsworth Ace Hardware.

San Lorenzo Lumber Co held a grand reopening sale April 25 at its newly remodeled yard in Felton, Ca.

Pacific Lumber & Truss held a grand opening celebration on May 15 for its relocated truss plant in Donald, Or.

UFP Factory Built acquired the Twin Falls, Id., facility of Robert Weed Corp.

Home Depot opened a new store June 12 in Spokane, Wa.

Weyerhaeuser Co., Seattle, Wa., broke ground June 18 on a new Timberstrand laminated strand lumber plant in Monticello, Ar.

Weyerhaeuser also agreed to buy 117,000 acres of timberlands in North Carolina and Virginia from Roanoke Timberlands LLC, a subsidiary of Roseburg.

Feeney, Inc., Oakland, Ca., had its DesignRail Custom railing line certified through the latest Comprehensive Certification and Regulatory Report.

Bloedorn Lumber, Fort Morgan, Co., was recognized as Business of the Month by the local Chamber of Commerce.

Johnson Manley Lumber Co., Tucson, Az., was honored as Trade Partner of the YearVertical Construction by the Southern Arizona Home Builders Association.

Boise Cascade Co., Boise, Id., was named one of America’s Most Trustworthy Companies of 2025 by Newsweek.

Building materials distributor BMD, Inc., Galt, Ca., has opened new engineered wood product (EWP) distribution operations in Southern California. The strategic expansion will provide robust solutions to lumberyards serving both single- and multi-family builders and framers across the region.

The new Riverside EWP yard will carry top-tier brands, including PWT I-joists, LVL and Treated LVL; QB Corp. stock and custom glulam beams; and Tolko LSL. EWP will be delivered to dealers on BMD’s fleet of company-owned trucks alongside its full range of building products. BMD is adding trucks and drivers to increase scheduled delivery frequency throughout the region.

“This new location is a significant step in BMD’s commitment to delivering high-performance engineered wood products to the building community,” said Matt Blair, senior vice president of distribution for BMD, Inc., “With access to trusted brands like Pacific Woodtech, Tolko and QB Corp., we are equipping lumberyards and their customers with the products and solutions needed to execute projects of any scale with precision and efficiency.”

The new location will have no impact on BMD’s existing facility in Riverside.

Building Material Distributors, Inc. (BMD) is an employee-owned company that has been providing premium building materials and trusted solutions for more than 80 years. BMD partners with the industry’s top brands to deliver innovative products across millwork, engineered wood products, building materials, and home improvement solutions.

A new wholesale trading company that combines lumber industry experience with cutting-edge AI technology has been formed by the team behind Yesler Building Materials Marketplace.

Lumber Runner Trading, Seattle, Wa., has assembled a team of expert “lumber runners,” who leverage proprietary technology to sell loads for mills, source loads for buyers, and drive efficiency throughout the supply chain.

Backed by new private investors, the firm was founded and is led by CEO Matthew Meyers, who founded Yesler in 2019 and served as CEO; chief revenue officer Michael Welch, formerly VP of sales for Yesler; and David Helmers, previously executive VP for Yesler.

Yesler made the decision to wind-down its software platform and the company operations in February after

nearly five-and-a-half years offering various software solutions in the lumber vertical.

Lumber Runner’s sales team is headed by two former traders from Pelican Bay Forest Products—Max Heller, who will sell primarily KD Douglas fir, and Steve Ashley, who will specialize in green Doug fir.

The staff is supported by Amanda Matasick as operations success coordinator.

For mills, Lumber Runner can act as an extension of their sales teams with aligned incentives, offer flexible pricing (flat fee, fixed percentage, or margin share), and can provide traditional trading to prove its value.

For buyers, Lumber Runner can supply advanced inventory planning, automated replenishment, flexible relationship structures, and the option to start with traditional trading.

“We are a wholesale trading company. The tech we build is only for our use, but we’ll use it to create efficiency for our suppliers and customers,” says Matt Meyers. “When we ask ourselves, ‘Can technology solve this?,’ the answer is usually ‘Yes, with AI.’“

At its core, Meyers says, “We are building a supply chain company, starting with wholesale trading. We don’t really consider ourselves a tech company. We’re just doing what any company should do to attract talent, compete and win today and in the future.”

Fire officials are investigating the cause of an explosion at a storage facility at McLendon Hardware, Woodinville, Wa., on the afternoon of May 26.

The fire was mostly contained by a sprinkler system. No injuries were reported.

In response to continued growth and a sharpened focus on enhancing the member experience, Do it Best has formed a new member care team.

This newly established team is designed to streamline member support across the company and serve as a strategic partner to Do it Best members. Its primary goal is to make it easier than ever for members to do business with the co-op by improving responsiveness, consistency, and clarity across all points of the member experience.

To lead this initiative, Do it Best has appointed Jared Hufford as director of member care.

This fall, Wahiawa Design Lab is partnering with The Albizia Project to open their own lumberyard in Wahiawa (Oahu), Hi.

They describe Nahele Lumber Co. as Hawaii’s first regenerative lumber supply and building materials marketplace.

WDL is a wood innovation workshop that turns local, invasive and reclaimed timber into beautiful products, including boards, panels and ceilings.

The mission of the Albizia Project is to turn invasive albizia trees into beautiful products to help restore native ecosystems.

Jason Godfrey, ex-UFP, is now a Murrieta, Ca.-based executive account mgr. for Bear Forest Products, Riverside, Ca. Thomasyne “TC” Salazar, also ex-UFP, is a new sales coordinator with Bear.

Todd Dame, president of the Woodgrain Distribution Division, will assume the role of CEO of Woodgrain, Fruitland, Id., by September. Kelly Dame, CEO since 2009, will remain actively involved as chairman of the board and trusted advisor. Steve Prado was promoted to vice president for the newly established Southwest region of the Distribution Division, overseeing the Woodgrain and Kelleher distribution centers in California and Hawaii. He is based in Ontario, Ca.

Luke Eiffert, ex-Knudson Lumber, is new to contractor sales at Lincoln Creek Lumber, Tumwater, Wa.

Reynaldo Salas, ex-National Wood Products, rejoined the outside sales team for Peterman Lumber, Phoenix, Az.

Pablo Benavidez, ex-UFP, is a new account mgr. with Capital Lumber, Portland, Or.

Rob Johnson has been appointed senior vice president of manufacturing for the Wood Products division of Boise Cascade Co., Boise, Id. He replaces Chris Seymour, who has left the company after 25 years. Philip Johnson, ex-UFP, is now with Boise Cascade, as senior EWP area sales mgr., based in Fort Collins, Co.

Michael Gottschling, ex-Stile & Rail Design Studio, is new to Arizona Building Supply, Phoenix, Az., specializing in sales and design of cabinets, windows and doors.

Matt Holt has been promoted to VP of manufacturing & services and Alexandre Ouellette to VP of manufacturing & engineering at Roseburg Forest Products, Springfield, Or. They assume new, expanded manufacturing leadership roles with the departure of chief operations officer Tony Hamill, who has moved to LP Building Solutions, Nashville, Tn., as senior VP, COO.

Ryan Hookland, ex-Builders FirstSource, has moved to BlueLinx, as territory mgr. in Moses Lake, Wa.

Vince Welch has been named president of Sun Mountain Doors, Denver, Co., a division of Kodiak Building Partners, Englewood, Co.

Ted Osterberger was promoted to chief executive officer of RedBuilt, Boise, Id. He succeeds Don Schwabe, who will retire Sept. 1 after 10 years of leadership.

Paul Teran, 84 Lumber, Escondido, Ca., has moved into outside lumber sales.

Cory Mclellan, ex-Vantage Homes, is a new account coordinator with Foxworth-Galbraith/Colorado Building Supply, Colorado Springs, Co.

Erick Reyes, ex-American Building Supply, has moved to OrePac Building Products, Denver, Co., as a territory sales rep.

Joe Burdge, ex-Henry Co., has joined Benjamin Obdyke, Horsham, Pa., as market development mgr. serving California and northern Nevada. Ryan Parkes, ex-Lansing Building Products, is Obdyke’s new sales associate for Washington State.

Jason Wargo, ex-Capital Lumber, is a new inside sales rep with Hall Forest Products, Frederickson, Wa.

Allison Young, ex-LP, is now a western regional account mgr. with 84 Lumber, Denver, Co.

Josh Bishop, ex-Milwaukee Tool, is now an account mgr. with Ganahl Lumber, Anaheim, Ca.

Adam McCartie, ex-Builders FirstSource/Alpine Millwork, has joined Colorado Building Supply, Denver, Co., as market VP of sales.

Richard Madariaga is store mgr. of the new Home Depot in Moscow, Id.

Roee Lachmish, ex-Brazilian Lumber, has been named general mgr. of tropical hardwood/TMW importer Beyond Lumber, Gardena, Ca.

Michael Pirrami, mgr., ABC Supply, Denver, Co., was recognized as a managing partner, along with fellow ABC branch mgrs. Kevin Mode, Everett, Wa.; Addam Soule, Snohomish, Wa.; and L&W Supply mgr. Fernando Sanchez Springs, Co.

Gayatri Narayan was appointed to the newly created role of presi dent, technology & digital solu tions for Builders FirstSource, Irving, Tx.

James A. Sullivan president and chief transformation officer of Koppers Holdings.

Angie Brown has been promoted to executive VP and chief information officer for The Home Depot.

Tony Miner is now director of strate gic initiatives for Do it Best Group.

John Barkhouse will become CEO of GAF, Parsippany, N.J., on Jan. 1, 2026, succeeding who will transition to the role of executive chairman.

Suzanne Stefany PJT Partners, joined the board of Cornerstone Building Brands.

Gabriel Farias, VP of OSB manu facturing at LP, Nashville, Tn., was appointed to the APA – The Engineered Wood Association board of trustees.

Maggie Hardy, owner/CEO of 84 Lumber, was honored by the Senator John Heinz History Center—the Smithsonian’s home in Pittsburgh—as a 2025 History Maker during the venue annual award dinner.

Hugo Furst has resigned from the volunteer team at Mungus-Fungus Forest Products, Climax, Nv., report co-owners Hugh Mungus and Freddy Fungus

Central Oregon’s LBM community is ready to come together once again and launch a new regional chapter of Hoo-Hoo International.

The proposed Central Oregon Hoo-Hoo Club is open to lumber wholesalers, builders, retailers and other industry professionals.

“In their prime, Central Oregon’s Hoo-Hoo chapters were dynamic hubs where industry professionals connected, shared expertise, and drove innovation in the lumber and plywood markets,” noted Ryan Stembridge, Pelican Bay Forest

Products, Bend, Or. “By rebuilding a unified chapter, we can create a powerful network to support industry growth, foster new opportunities, and strengthen our community’s role in the building products sector.”

Organizers are compiling a list of interested parties to form the foundation of the chapter. Together, they will elect leaders and plan engaging events, including networking gatherings, educational workshops, golf outings, and dining events tailored to the industry’s needs.

For more information, contact Stembridge at ryan@pbfp.net.

True Value has just awarded 171 grants to stores across the U.S. and abroad through the True Value Foundation to support local stores creating and refreshing community spaces for kids and teens.

Each year, the company (through its foundation) awards paint and paint sundries to local True Value retailers partnering with schools, Boys & Girls Clubs, and youth-focused nonprofits as part of its Painting a Brighter Future program.

“This is an investment in the next generation, neighborhood by neighborhood,” said president of True Value Dent Johnson. “Painting a Brighter Future is an exceptional program we’re proud to continue offering to our stores. It allows them to strengthen their role as community leaders and address local needs, which is what True Value is all about.”

The 171 stores participating this year received 3,420 gallons of paint, which will cover 1.4 million sq. ft. of refreshed spaces to welcome children into environments designed just for them.

“These schools, Boys & Girls Clubs, and youth-focused nonprofits are all places to grow and educate our youth. Just like we want our homes to reflect us, it’s critical for these spaces to demonstrate clear commitment and support,” said John Vanderpool, senior vice president of True Value Manufacturing and head of True Value Foundation. “True Value is always so proud of our stores as the heartbeat of their communities, and these grants prove it,” he added.

For more than 75 years, True Value has empowered

independent retailers to become a recognized, trusted fixture on Main Streets everywhere through its iconic brand. From expansive product sets and market-customized assortments to innovative marketing programs and value-added services, True Value is the partner for all things hardware. Now part of the Do it Best Group, the world’s largest independent home improvement co-op, True Value continues to support thousands of stores globally while retaining an independent spirit, community focus, and its trusted legacy brand.

West Plains Building Supply, Spokane, Wa., is closing after more than 75 years.

The final day of operation for the fourth-generation family business will be Aug. 8. According to the Case family, “This decision reflects careful discussions about our business, our family, and the future, and it does not come lightly. We are deeply grateful to you—our loyal customers—for supporting us through decades of change, including our move to Airway Heights. Your trust and patronage have allowed us to thrive as the ‘little guys who get things done,’ and we will always cherish the connections we’ve built.”

The Case family had also operated nearby South Regal Lumber Yard, Spokane, until consolidating it with West Plains in 2014. Founded in 1949, the store is a member of Do it Best.

Mescalero Tribal Forest Products is working to get funding and government support to restart its longdormant sawmill in Mescalero, N.M.

The MFP facility operated from 1987 to 2012, employing about 55 workers and generating another 150 jobs in associated logging and administrative operations. At the same time, a weak lumber market also forced the tribe to close a second mill in Alamogordo, N.M., eliminating another 80+ positions.

In addition to restoring jobs, reopening the Mescalero mill would pay for thinning forests in the area to provide much-needed fire prevention.

Stephen Lance DeMaria, 84, died on March 25.

A 1963 graduate of Oregon State University, Steve spent more than 30 years in executive management and leadership roles in the forest products industry, focused on investor and corporate relations, government affairs, and general management. Stops included American Forest Properties and Bendix Forest Products Corp. (1966–1981), California Forest Protective Association (1981–1988), and Fibreboard Corp. (1989–1997).

He served on the board of the Western Forestry & Conservation Association and the California Board of Forestry.

John Cheney, retired vice president of SDS Lumber, Bingen, Wa., died on May 10 at the age of 82.

After receiving a business finance degree from the University of Colorado in 1965, John enrolled in Navy Officer Candidate School and served in the U.S. Navy until 1971, achieving the rank of lieutenant.

He then worked at SDS Lumber until retirement.

Wallace A. “Wally” Norum, longtime manager with the National Forest Products Association, Los Altos, Ca., passed away on April 23. He was 101.

A World War II Army veteran, he graduated from Cal Berkeley in 1948 with a degree in engineering. In 1989, he was named vice chairman of the Building Seismic Safety Council.

William “Jack” Baber, 91, co-owner of Sierra Mountain Mills Lumber Co., Celestial Valley, Ca., died on May 11.

He served in the U.S. Air Force during the Korean War.

Hi-bor® brand treated wood is a borate treated wood product designed for interior house framing in Hawaii. Hi-bor treated wood resists attack by Formosan and subterranean termites and numerous household insects and pests, as well as fungal decay. Hi-bor borate treated wood is also backed by a 20 year limited warranty*.