The Universal Platform for Unlimited Digital Transformation

Unlimited

Add as many devices, clients, tags, and users as you need — no extra cost. Ignition’s flat rate keeps you on budget.

Universal

No matter what OS or IT

device is being used, Ignition will run on it

Learn more at

All-In-One

Ignition is an ambidextrous tool that can aggregate data, build applications & instantly web-deploy clients, all from one login.

ia.io/digitaltransformation

structure or interface

smoothly & efficiently. October 2022

The Plant Floor in Your Pocket

your SCADA with a swipe.

See the live demo now.

phone

Get an overview of your process at a glance.

Control

Scan this QR code with your

demo.ia.io/automationor visit

3 Big Industrial Networking Developments Wearable Safety in the Warehouse Peer-to-Peer FAQ: Big Data Robots Ensure Zero-Defect Tire Pressure Sensor Assembly Top Sustainability Trends in Manufacturing New Products 06 08 30 35 42 37 24 THE INTELLIGENT WAREHOUSE OCTOBER 2022 / www.AutomationWorld.com

StrideLinx VPN Routers starting at $385.00 (SE-SL3001) 'RQ

W�OHW�D�VLPSOH�VXSSRUW�FDOO EHFRPH�D�FRVWO\�VLWH�YLVLW Research, price, buy at: www.automationdirect.com/stridelinx With StrideLinx remote access you can securely connect with remote systems in an instant, troubleshooting and correcting issues without the hassles, delays and costs of traveling. StrideLinx VPN routers provide 10GB of FREE monthly bandwidth to securely monitor, program and/or troubleshoot your remote systems. Optional services are available to maximize your remote access capabilities, including: • Cloud-based Data Logging - Unlimited cloud data storage for up to 7 years with active subscription • Cloud Notify/Alarming - provides customized “alarm” email and push notifications when control limits are exceeded on HMI / PLC devices connected to the StrideLinx VPN router • White Labeling allows users to re-brand the platform, mobile app and hardware Linx the #1 value in automation Order Today, Ships Fast! * See our Web site for details and restrictions. © Copyright 2022 AutomationDirect, Cumming, GA USA. All rights reserved. 1-800-633-0405

The Intelligent Warehouse 24

Autonomous mobile robots, storage and retrieval systems, and scheduling tools get an artificial intelligence boost to improve material movement e ciencies and keep workers safe.

Peer-to-Peer FAQ: Big Data 30

In this research project, Automation World highlights the technologies that comprise industrial Big Data and showcase insights from your end user peers and system integrators about how they’re using these technologies to improve decision-making around business and production operations.

Robots Ensure Zero-Defect Tire Pressure Sensor Assembly

MMS Modular Molding Systems created a system using Stäubli robots to fully automate a tire pressure sensor assembly capable of producing a complete sensor every six seconds.

EDITORIAL

David Greenfield Director of Content/Editor-in-Chief dgreenfield@automationworld.com / 678 662 3322

Stephanie Neil Senior Editor sneil@automationworld.com / 781 378 1652

Victoria Sanchez Managing Editor vsanchez@pmmimediagroup.com / 571-612-3200 x9298

Mike Prokopeak Senior Director, Content & Brand Growth James R. Koelsch, Lauren Paul, Jeanne Schweder and Beth Stackpole Contributing Writers

ART & PRODUCTION

Filippo Riello Marketing & Digital Publishing Art Director friello@pmmimediagroup.com / 312 222 1010 x1200

George Shurtle Ad Services & Production Manager gshurtleff@pmmimediagroup.com / 312 222 1010 x1170

ADVERTISING

Kurt Belisle Publisher kbelisle@pmmimediagroup.com / 815 549 1034

West Coast

Jim Powers Regional Manager jpowers@automationworld.com / 312 925 7793 Midwest, Southwest, and East Coast Kelly Greeby Senior Director, Client Success & Media Operations Alicia Pettigrew Director, Product Strategy

AUDIENCE & DIGITAL

Elizabeth Kachoris Senior Director, Digital & Data Jen Krepelka Director, Websites + UX/UI

PMMI MEDIA GROUP

David Newcorn President, PMMI Media Group

Kurt Belisle Publisher kbelisle@pmmimediagroup.com / 815 549 1034

Reed Simonsis Brand Operations Manager rsimonsis@pmmimediagroup.com / 312 205 7919

Sharon Taylor Director of Marketing staylor@pmmimediagroup.com / 312 222 1010 x1710

and Rockwell Automation Expand Cybersecurity Protections with Dragos

Amber Miller Senior Marketing Manager amiller@pmmimediagroup.com / 312 222 1010 x1130

Janet Fabiano Financial Services Manager jfabiano@pmmimediagroup.com / 312 222 1010 x1330

All Automation World

including

Automation

3 OCTOBER 2022 | VOLUME 20 | NUMBER 10

AW OCTOBER 2022 CONTENTS

editorial is copyrighted by PMMI Media Group, Inc.

printed or electronic reproduction. Magazine and Web site editorial may not be reproduced in any form without thewritten permission of the publisher.

World | PMMI Media Group 401 N. Michigan Avenue, Suite 1700, Chicago, IL 60611 Phone: 312 222 1010 Fax: 312 222 1310 www.automationworld.com PMMI The Association for Packaging and Processing Technologies 12930 Worldgate Dr., Suite 200, Herndon VA, 20170 Phone: 571 612 3200 • Fax: 703 243 8556 www.pmmi.org ONLINE 4 FEATURES CASE STUDY 35 INDUSTRY DIRECTIONS 6 BATCH OF IDEAS 8 NEWS 18 PERSPECTIVES 10 NEW PRODUCTS 37 KEY INSIGHTS 46 Exclusive content from AutomationWorld.com: videos, podcasts, webinars, and more Automated Valve Choice Considerations Wearable Safety in the Warehouse Emerson

3 Big Industrial Networking Developments PMMI News Global Growth in Robotics Expected to Hit Major Milestone by 2024 PMMI Announces Fifth Annual On the Rise Awards Winners Automation Use Expected to Surge with Reshoring and Legislative Support Robot Vision System Options How Self-Service Analytics Aid Continuous Improvement 3 Steps for Secure, Reliable Wireless Mobile Robot Networks NEW PRODUCT SPOTLIGHT: Unmanaged Power Over Ethernet Switches Servo Drive Intelligent CAD Plug-in Photoelectric Sensors and more... INDUSTRY VIEW 42 Top Sustainability Trends in Manufacturing By Dick Slansky INTEGRATOR VIEW 43 IT/OT Convergence: More Than Just Connecting Networks By Luigi De Bernardini ENTERPRISE VIEW 44 Turbocharging Speed to Market By Brian R. May

PODCAST SERIES

How Does an Information Digital Twin Democratize Industrial Data?

Sean Gregerson, VP of asset management at Aveva, explains Information Digital Twins, data democratization and what it means for industrial use of operations data; and why the gap between collected data and analyzed data remains so large at most companies.

Peer-to-Peer FAQ: Cybersecurity

Explosive Robot Growth Expected, New DIY Robot Tech Emerges

Beckho introduces a new modular, customizable robot technology amid dramatic increases in robot use to address workforce, quality, and throughput issues.

AUTOMATION WORLD TV TECHNOLOGY MATTERS

The State of Big Data Collection and Analysis

A look at key insights gathered recently from Automation World’s research into industry’s use of Big Data collection and analytics technologies.

AUTOMATION WORLD E-BOOK

Learn how to protect your company against bad cyber actors.

4 AW OCTOBER 2022 ONLINE

SYSTEM INTEGRATOR BLOGS • Rapidly Changing Market Demands Impact Industry • Migrate to Industry 4.0 with the Right Plan • 6 Common Automation Mistakes to Avoid • E ectively Training New Employees During a Labor Shortage • An Alternative to On-Site Service Technicians

By David Greenfield

By David Greenfield

Automated Valve Choice Considerations

mately, with a control valve, you’re trying to size and select a valve that has a characteristic that allows the system to be linear with an installed gain of .5 to 2,” Turbiville said.

Like so many of the core technologies integral to automated industrial operations— such as motors, drives, and I/O—valves don’t always receive the attention they deserve in the automation arena. Despite this, their functionality is no less critical to the safe and effective control of fluid movement. Also, as basic as valves may seem, the technology surrounding them has not remained static.

To help answer a reader question about how to select the right valve for an application, we connected with Ross Turbiville of Emerson Automation Solutions for a recent episode of the “Automation World Gets Your Questions Answered” podcast series. In this podcast we discussed the different types of commonly available automated valves; how to determine valve sizing and performance based on flow, pressure, and temperature characteristics of the fluid to be controlled; the impact of piping systems on valve choice; and the effect a valve’s construction materials can have on its performance.

Valve type, size, performance

Our discussion began by looking at the different types of commonly available automated valves based on their function and how the media to be controlled by the valve impacts a user’s selection decision.

Turbiville noted two major valve type distinctions: 1) automated on/off valves; and 2) automated control valves. He noted that, when considering automated control valves, end users should be sure to consider the kind of control resolution they’ll need for the application. “Ulti-

With regard to valve sizing and performance based on flow, pressure, and temperature characteristics of the media moving through the piping system, Turbiville explained that, first and foremost, users need to consider this from a safety perspective. More specifically, he said users should carefully consider the valve’s “material capability from a corrosion/erosion perspective with the media that you’re flowing…[as well as] the pressure and temperature limitations of a given material to ensure that the material and the pressure class rating you select for the valve meets code requirements.”

Piping considerations

Explaining how the type of piping system used can impact valve choice, Turbiville noted that when considering a control valve, realize that the capacity of the valve is dictated by IEC 60534-2-3. This standard “defines the number of straight runs of pipe upstream and downstream of the valves, as well as sensor locations to allow measuring the capacity of the valve in a lab environment. Any time you get into a potential piping system that is compressed, there is also a risk the capacity of the valve could be different than the published values. [That’s why] it’s also good to realize that, with the published values, the standards allow a margin of error in the capacity dictated by the industry codes. When looking at a piping system, understand what the piping system looks like, and then consult with your valve vendor if you have a very tight piping system to understand the impacts.”

Electric, pneumatic,or hydraulic

To help users navigate their valve choice among electric, pneumatic, or hydraulic valves to determine which one is the best fit for their operation, Turbiville said there are two ways to approach this determination.

“First and foremost, look at it from a perfor-

mance perspective—how quickly a valve needs to respond to process changes. Whether it’s a control valve or an on/off valve, make sure the process is addressed [by the valve in] the way it’s intended in the design.”

If you need quicker response to a process change or command, Turbiville recommends looking at pneumatic or hydraulic operating valves. In applications where response time is less critical, he said valves with electric actuation can be considered.

Beyond deciding among electric, pneumatic, and hydraulic valve types, Turbiville stressed careful consideration of the valve’s cost. From a pure cost perspective, hydraulic actuators are typically the most expensive, followed by electric actuators, said Turbiville, with the most economical actuators being pneumatic.

Turbiville noted that, when considering the cost of a valve, user should look beyond the vendor price and evaluate overall cost impacts, such as maintenance and environmental safety and health considerations. You also need to look at what emissions could look like, depending on the media being handled.

“In the upstream oil and gas world, if you’re using gas to drive a pneumatic actuator, that may make less sense with changing regulations, [leading you to] go electric. Hydraulics can provide extremely high-resolution control as they can move very quickly. But they also have an oil reservoir that needs to be considered,” he said.

Editor-In-Chief/ Director of Content dgreenfield@automationworld.com

INDUSTRY DIRECTIONS 6 AW OCTOBER 2022 EDITORIAL

Hear the complete valve choice podcast discussion with Emerson’s Ross Turbiville

ON-DEMAND

ACCESS

CONTENT TODAY If you missed PACK EXPO International in Chicago or didn’t see everything while you were there, don’t worry! Content is still available on demand through November 30, 2022. Discover innovative solutions for packaging and processing, automation, sustainability, e-commerce and more. LEARN MORE & ACCESS NOW TO LEARN MORE ABOUT UPCOMING EVENTS, VISIT PACKEXPO.COM. This access is offered 24/7 from the comfort of your computer. YOUR ON-DEMAND EXPERIENCE INCLUDES: • Educational Sessions • Exhibitor Online Showrooms • Videos from the Show Floor

BATCH OF IDEAS

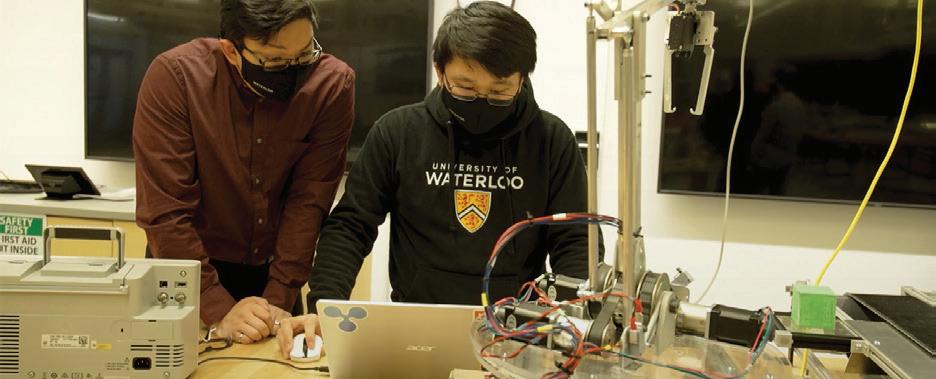

Wearable Safety in the Warehouse

By Stephanie Neil Senior Editor

sneil@automationworld.com

vidual’s shoulder blades, it collects data measuring a variety of inputs at a rate of 12.5 times per second and analyzes all the moves of the wearer’s torso. That information provides real-time alerts to the wearer—which Petterson calls the “industrial athlete”—to tell them when they are doing something that could compromise their safety.

This past August, the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) launched an initiative aimed at protecting workers in warehousing, storage, and distribution facilities who are at more risk of injury as a result of an increase in e-commerce. This regional five-year initiative will focus on the hazardous conditions workers face every day.

The program follows a Bureau of Labor Statistics’ (BLS) 2020 finding that the injury rate for workers in warehousing and storage is higher than the U.S. average among all private industries. In addition, from 2017 to 2020, BLS reported 93 work-related fatalities nationally in the industry.

That’s just not okay. And nobody understands how devastating these numbers are more than Sean Petterson, whose father passed away while on a construction job.

It was that experience that prompted Petterson to study industrial design and engineering to find ways stop injuries and fatalities in industrial settings. He started by developing exoskeletons to strengthen human capabilities, building an algorithm for kinematic movement. But the exoskeleton model was limited to specific applications, so Petterson pivoted to create wearables that can predict the potential of injuries, ultimately resulted in something more sustainable and datadriven than exoskeletons.

Petterson’s company, StrongArm Technologies, delivers IoT safety wearables designed to prevent injuries before they happen. Consisting of a sensor that sits on a hip clip or strapped between an indi-

It calculates the most common predictors of injury, such as twisting velocity, and other factors that weigh into a safety score. If the worker enters into an unsafe range of movement, the sensor will send a vibrational or light-based alert that prompts the person to modify behavior. “If there are too many unsafe movements, the safety score begins to drop and if it drops below a threshold, [the system] gives feedback, like a tap on the shoulder [urging them] to rethink things before completing the task.”

When the wearer returns the sensor to StrongArm’s SafetyWork system dock, the information is sent to a cloud-based platform providing managers with actionable insights over time. Logged events are mapped each day and a proprietary algorithm populates the dashboard for individualized safety metrics, customized reports, and industry benchmarks. Taken together, these insights enable proactive intervention and facility-wide risk engineering.

“We are not trying to engineer around something but, rather, create a baseline to engineer out all of the risks,” Petterson said. “It was complicated to get here, but in practice we’ve made it simple.”

The SafetyWork system processes the data into profiles so industrial athletes can see where they can improve. But it also gives managers actionable insight to do predictive injury analysis and correlate how a change in safety score may result in injury, giving them information to adjust the work environment for improvement. For example, if someone’s safety score drops, the manager can identify underlying causes. Perhaps they need training, or they’ve worked too many shifts and need a break. “Most injuries happen over time and get worse with indicators, so we are finding the way movement leads to early indicators to be ahead of the curve before an injury happens,” Petterson explained.

According to Petterson, it’s a call to action. And

it pays off, especially in the current environment of high employee turnover. Many companies operate on pay incentive, offering a bonus for every unit fulfilled above the 100% threshold. But overworking employees in the warehouse often leads to injuries which results in added costs to the company. “We found you can incentivize up to 2%, but anything over that there is so much risk that the ROI is backwards.” And employees often respond favorably to companies that encourage them to go home when they are done with their shift. “You can retain about 50% of the workforce just by keeping them safe.”

And let’s not forget that the government is watching. OSHA’s Regional Emphasis Program for Warehousing Operations is currently focusing on employers in Pennsylvania, Delaware, the District of Columbia, and West Virginia, and it will include on-site inspections that will hold employers accountable for providing a safe environment. StrongArm Technologies offers a way to mitigate risk, making worker safety a priority.

8 AW OCTOBER 2022 EDITORIAL

The SafetyWork system processes the data into profiles so workers can see where they can improve. But it also gives managers actionable insight to do predictive injury analysis and correlate how a change in safety score may result in injury.

PMMI Media Group Custom Research can help! We offer: •Brand & Competitive Analysis •Value Proposition & Product Development Insights •Thought Leadership Research Need to know the trends to guide future go-to-market strategies? Looking to develop new products? Want to know where you t into the competitive landscape? Learn more about custom research for the packaging and processing industry! pmmimediagroup.com/custom-research Questions? Contact:Jorge Izquierdo, vice president, Market Development, PMMI jizquierdo@pmmi.org | 571.612.3199

Automation Use Expected to Surge with Reshoring and Legislative Support

By David Greenfield Editor-in-Chief, Director of Content

U.S. manufacturing reshoring initiatives gained steam several years ago as overseas shipping and labor costs began to eat into the healthy margins once commonly associated with o shore manufacturing. Even in the face of such negative financial impacts, however, reshoring e orts were limited and evidence did not indicate widespread reshoring actions.

Then came COVID-19 and the realization that about half of the world’s disposable masks were pro duced in China. For many, this proved to be a broadbased and easily understood reason for reducing o shore manufacturing operations. On top of that are the ongoing supply chain impacts caused by over seas manufacturing slowdowns, shipping delays, and issues with unloading goods at ports due to COVID and other, often associated, e ects.

Amid these supply chain disruptions, we’re beginning to see more solid evidence of reshoring plans that will likely increase even further with the recent passage of the CHIPS and Science Act.

Automation and robotics research

ABB recently conducted a study based on responses from 1,610 executives in the U.S. and Europe regarding their planned use of various automation technologies. Their study revealed that 70% of U.S. businesses are planning changes in their operations, with 37% planning to bring production back home and 33% looking to nearshore and shift their operations to a closer location.

Sami Atiya, president of ABB’s Robotics & Discrete Automation Business, said industrial companies’ increasing need for flexibility and resilience in production is driving the interest in reshoring/nearshoring and, as a result, the demand for more automation. In particular, he noted the role of robotics in facilitating reshoring or nearshoring e orts, both to address supply chain concerns and maintain the global competitiveness of U.S. businesses.

According to the ABB study, American companies are relying more on automation to solve supply chain issues, with 43% of respondents saying they are expanding their use of robotics and automation specifically to address supply chain and customer demand issues.

In its report, ABB noted that automation and ro botics technologies, which have long been associated with use in the automotive industry, have now signifi cantly expanded across multiple industries, including logistics, food and beverage, retail, and healthcare.

Robotics use spreads

Research by PMMI, Automation World’s parent organization, backs up ABB’s assertion about the spread of robotics beyond the automotive industry, with data showing 84% of consumer-packaged goods companies now use robots somewhere on their production lines. PMMI says this number is expected to rise to 93% in the next five years. Respondents to PMMI’s research study say improvements in robot functionality, such as vision, self-learning, and artificial intelligence are spurring manufacturers to purchase and use more robots in processing and packaging applications.

Looking across all manufacturing and processing industry sectors, recent research conducted by Automation World shows similar high growth trends for robots. In Automation World’s research, 83% of respondents said they are looking to add

robots in the next two years. Helping drive this figure is the fact that 29% of respondents currently don’t use any robots at all, and only 12% note that more than 50% of their production operations involve the use of robots.

According to the International Federation of Robotics, the increase in robot density per 10,000 workers in North America, jumped 28% in Q1 2022 compared to first quarter of 2021, the highest rate of growth recorded by the federation.

This trend is not isolated to the U.S. ABB reports a greater near-term demand for robotics in Europe, where 74% of European businesses indicate they will invest in robotics and automation in the next three years, compared to 62% in the U.S.

Legislative support

With the CHIPS and Science Act now signed into law by President Joe Biden, the U.S. is expected to see significant reshoring e orts around semiconduc tor manufacturing considering the $39 billion slated to be spent on expanding this industry domestically over the next five years. A new 25% tax credit for companies investing in semiconductor manufactur

10 AW OCTOBER 2022 PERSPECTIVES

President Biden signs CHIPS and Science Act.

ing equipment or the construction of manufacturing facilities is also included in the legislation.

As with the face mask issue highlighted during COVID, the chip shortage encountered during the peak of COVID underscored the need for reshoring or near shoring of semiconductor manufacturing. That industry largely moved to Asia in the 1980s and 1990s. Funding from the CHIPS and Science Act is expected to incentivize the return of semiconductor manufacturing to the U.S. to help prevent future supply chain disruptions.

According to The White House, “Spurred by the passage of the CHIPS and Science Act of 2022, companies have announced nearly $50 billion in additional investments in American semiconductor manufacturing.”

Two examples cited by The White House include:

• Micron’s $40 billion investment in memory chip manufacturing, which will create up to 40,000 new jobs in construction and manufacturing. “This investment alone will bring the U.S. market share of memory chip production from less than 2% to up to 10% over the next decade,” says The White House.

• Qualcomm and GlobalFoundries have formed

a new partnership that includes $4.2 billion to manufacture chips in an expansion of GlobalFoundries’ upstate New York facility. Qualcomm has also announced plans to increase semiconductor production in the U.S. by up to 50% over the next five years.

A few weeks after passage of the CHIPS and Science Act, First Solar announced plans to spend “as much as $1.2 billion to boost its manufacturing capacity” in the U.S. by around 75%, according to The Wall Street Journal. In its article on First Solar’s decision, The Wall Street Journal reported: First Solar Chief Executive Mark Widmar said, until recently the company had been eager to boost its manufacturing footprint, but high costs and a lack of policy support meant it was considering adding capacity in Europe or India rather than at home [in the U.S.].

“With the new investments, First Solar now expects to have around 10.6 gigawatts of panel-making capacity in the U.S. by 2025—up from an expected 6 gigawatts next year.”

For over 90 years, Telemecanique Sensors has developed quality sensor products, helping engineers ensure their machines are safe; meeting all the applicable safety standards. Who, then, should you trust for all your safety sensor solutions?

11 AW OCTOBER 2022 PERSPECTIVES

...because just ONE workplace accident is too many...

www.tesensors.com/Safety (product images not to scale)

XCSR RFID Safety Sensor & XUSL4M Light Curtains with muting for automated machine shutdown, XCSLF switch for entry prevention, & XY2CED Double-sided Cable Pull Switch for fast emergency manual shutdown.

Simply

easy!

Read more about the automation, supply chain, reshoring connection.

Learn more about the role of automation in reshoring initiatives.

Robot Vision System Options

By David Greenfield Editor-in-Chief, Director of Content

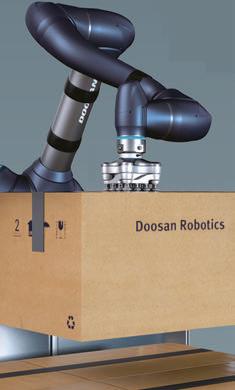

One of the first real-world applications of IoT (Internet of Things) technologies that provided tangible benefits to manufacturers of all sizes involved optimizing equipment maintenance via the addition of sensors to gather more data. Similarly, the addition of vision systems to robots is rapidly advancing the use of robots beyond their initial areas of application.

But understanding how vision technologies can expand robot capabilities is just one important as pect of this automation technology combination. Two other factors are: How to determine if you real ly need robot vision technologies and how to choose the right kind of camera for your system if you do.

In any consideration of vision system technology, the first thing to understand is how much easier the incorporation of vision technologies into robotic systems has become. Not so long ago, vision systems were often viewed as being complex, expensive, and di cult to integrate. However, several new vision technologies have emerged in the past few years that are notable for their reduced cost factors and ease of integration and use, especially for cobot (collaborative robot) applications.

Why add vision to robots?

If you’ve ever been to an industry trade show featuring robots, you know that robots can work very

e ectively without vision capabilities. However, if you need a robot to be able to pick and place different objects or handle objects in di erent orientations, the addition of vision technology is critical.

In such scenarios, OnRobot (a supplier of cobot systems, end e ector tools, sensors, and software) recommends the addition of a camera and associated software to your production lines. According to the company, vision systems can bring “flexibility to your operations, enabling you to switch between di erent products easily. And vision dramatically reduces the time required to move between one product and another.”

But with so many di erent types of robot vi-

12 AW OCTOBER 2022 PERSPECTIVES

sion systems on the markets, how do you determine which one is right for your application?

Understanding camera types

According to OnRobot, robot cameras are most commonly 2D, 3D or 2.5D.

Though 2D cameras are the cheapest of the three types, OnRobot notes that they are reliable, but also the least versatile. “Typically, 2D cameras determine length and width (X and Y axis), but are unable to determine height, which limits the number of applications they can support,” says OnRobot.

3D cameras provide all the visual information a robot could possibly need, covering all three axes and incorporating object rotation. OnRobot notes that this functionality does, of course, come with a higher price tag. The company adds that 3D vision systems can also be more di cult to integrate and operate than 2D or 2.5D cameras.

2.5D cameras occupy a space between 2D and 3D cameras, both in terms of cost and capabilities, say OnRobot. These cameras are capable of determining the height of objects, which can be useful in applications where items need to be stacked. They are also less expensive than 3D cameras while being

more capable than 2D cameras.

If a 2.5D camera seems appropriate for your application, OnRobot recommends exploring the set up and calibration requirements of the cameras you’re choosing among. “Some 2.5D cameras must be attached directly to your cobot, which restricts their capabilities,” and some come with sub-optimal software.

Eyes is OnRobot’s 2.5D camera and vision system that can be used on most collaborative and light industrial robot arms.

According to OnRobot, Eyes can be mounted anywhere within the production cell rather than requiring integration into the robot arm or attached to the robot's wrist, as is required with some robot vision systems. This external mounting capability eliminates the issue of cables running alongside your robot, which can potentially restrict movement. The company says this external mounting option also allows users to “optimize cycle time, because Eyes can take care of image capture and processing while your robot is working on another operation. In addition, Eyes can be calibrated using just one picture.”

Hear from your industry peers about how they’re using machine vision and other sensor technologies, along with AI, to improve operations.

How can di erent types of robots be used to streamline processes and improve productivity.

13 AW OCTOBER 2022 PERSPECTIVES

How Self-Service Analytics Aid Continuous Improvement

By David Greenfield Editor-in-Chief, Director of Content

All the activity around Industry 4.0, the Industrial Internet of Things, and Digital Transformation is ultimately about one thing—analyzing large amounts of data to improve production and overall business operations. And while most discussions about Big Data and data analytics focus on overcoming obstacles associated with the aggregation and analysis of operations data, another challenge involves making the resulting ana lytics accessible and understandable to workers and management without the need for data scientists.

Self-service analytics (SSA) is designed to help businesses overcome this challenge.

According to technological research and consult ing firm Gartner: Self-service analytics is a form of business intelligence (BI) in which line-of-business professionals are enabled and encouraged to per form queries and generate reports on their own, with nominal IT support. Self-service analytics is often characterized by simple-to-use BI tools with basic analytic capabilities and an underlying data model that has been simplified or scaled down for ease of understanding and straightforward data access.”

Applying SSA forcontinuous improvement Lean Six Sigma is a common method employed by industrial manufacturing and processing companies for continuous improvement. Perhaps the biggest challenge in achieving success with Lean Six Sigma is getting everyone in the company actively involved in continuous improvement programs.

“Most companies have multiple ongoing projects, but generally there are only a handful of trained team members proficient enough in the required statistical methods for improvement projects,” says Nick Petrosyan, customer success manager at TrendMiner (a provider of web-based self-service analytics technology). “With few experts in this field, bottlenecks quickly arise. Additionally, many projects aim at addressing production performance issues, which require input from busy process and asset experts. As continuous improvement experts need to rely on subject matter experts (SMEs) for elaboration on process intricacies, many projects go unfinished or unaddressed due to these SME’s lim

ited availability for deep dive analysis.”

Petrosyan says these issues can be addressed when pre-work is completed by SMEs who can analyze the production data themselves and contribute to improvement projects or reduce the number of projects by finding improvements on their own.

“Allowing process and asset specialists to contribute to these projects dramatically increases the operational improvements needed to meet the expected organizational goals,” he says. “By fully leveraging captured time-series data and more e ciently utilizing the operation expertise of process experts, companies establish a cornerstone to maximize organizational continuous improvement.”

Following are two case study examples provided by TrendMiner that showcase how SSA technology is being used to aid industrial continuous improvement programs.

Huntsman Corp.

A global manufacturer of specialty chemicals, Hunts man Corporation has been using analysis of time-se ries data as a key aspect of its digital transformation.

Petroysan notes that Hunstman’s operational data was kept in separated silos, which added to the company’s challenge of improving operational excellence. Using SSA, Huntsman was able to overcome this challenge.

“For years, a Huntsman continuous isocyanate plant had been collecting and storing daily process and o ine-created lab analysis data in a historian database,” explains Petroysan. “In 2016, the company’s teams used self-service analytics to build soft sensors based on operating conditions to predict product quality for certain isocyanates. Process experts used these sensors to make micro-

14 AW OCTOBER 2022 PERSPECTIVES

Lightweight ropes made with DyneemaXBO match or outperform the bending performance of specialty steel wire rope. Source: Dyneema

adjustments to process setpoints to pro-actively minimize impurity levels. For example, one of the monitors predicted o -spec hydrolysable chloride levels in the final product. By adjusting vacuum pressure conditions, product quality was ensured. In addition, monitors were set up to send out early warnings alerting operators not to load trucks, thus preventing o -spec material from going out to a customer.”

With the aid of SSA, Huntsman process experts established 24/7 quality control compared to quality control with lab analyses that had previously only been available during regular weekday work hours.

“With trucks being sent out seven days a week, the soft sensors eliminated 75% of the expensive o -spec transportation cases which occurred on the weekends,” says Petroysan. “As a result, a significant positive impact on lead time was achieved as unnecessary wait hours for in-spec product were eliminated, with the average lead time being reduced by several hours. Finally, the extra insights into product quality also reduced the demand on lab resources as the number of uncertain situations for this specific product was reduced by as much as 10%.”

DSM Dyneema

Dyneema is an ultra-high molecular weight polyethylene invented and manufactured by DSM Dyneema, which claims Dyneema is the world's strongest fiber.

Petrosyan says DSM Dyneema focuses on the use of Six Sigma and the DMAIC (define, measure, analyze, improve, control) cycle as their “go-to approach for improvement projects.” The company had set a target to increase the number of Six Sigma projects, with the average Six Sigma project duration being 5-6 months.

“By mapping the self-service industrial analytics functionalities to the different phases of the DMAIC cycle, it became clear that the tool could be applied to most of the phases and considerably reduce the time needed to complete each phase,” says Petroysan. “In a first test case, the define and measure phases were completed with self-service industrial analytics in two afternoons, instead of two weeks.”

Slide into Success

Whether

standard

Fabco-Air

linear slides

performance in many industrial applications, from packaging to medical imaging.

Choose from a wide range of standard units, which guarantee precise, repeatable operation and excellent load-handling capabilities.

can also modify units to deliver higher forces, faster speeds and longer

15 AW OCTOBER 2022 PERSPECTIVES www.fabco-air.com

you stay

or go custom — we’ve got you covered. MADE IN GAINESVILLE FLORIDA

pneumatic

combine reliability, robustness and a low-maintenance design for superior

We

strokes. Options include: • Many styles: single and dual bearing block, rodless and more • Anodized aluminum toolbars and bearing blocks • Stainless steel bearing materials • 9DULRXV�PRXQWLQJ�FRQą�JXUDWLRQV� • Many accessories and sensing options $QG��ZH�ZLOO�GHVLJQ��SURWRW\SH�DQG�GHOLYHU�FXVWRP�VROXWLRQV�WR�PHHW�\RXU�VSHFLą�F�DSSOLFDWLRQ�UHTXLUHPHQWV�

A member of Festo Group

FABCO-AIR

Huntsman Taiwan aromatic polyester polyols plant. Source: Huntsman

Learn how to make sense of the industrial analytics market.

3 Steps for Secure, Reliable Wireless Mobile Robot Networks

By David Greenfield Editor-in-Chief, Director of Content

By David Greenfield Editor-in-Chief, Director of Content

In a recent research study about robotics use across industry, Automation World found that 100% of the integrators responding to the survey have seen an uptick in interest for AMRs (autonomous mobile robots) among their clients over the past five years. In terms of real-world application of AMRs, 22% of end users responding to the survey say they are looking to implement AMRs in the very near term.

If you’re unfamiliar with AMRs, they are robotic carts that can navigate through an environment without the need for human guidance to carry a variety of materials between locations. AMRs are frequently replacing automated guided vehicles (AGVs), which were commonly used to automate movement of materials in the past. An AGV navigates by following wire strips or magnetic tracks along the floor. In contrast AMRs use a sensor technology called light detection and ranging (LiDAR) instead.

To build reliable connectivity platforms for AMR operation in warehouses and factories, fast and stable wireless connectivity is a fundamental requirement. The biggest challenge can be in determining how to build the right kind of wireless communications network.

Moxa, a supplier of edge connectivity, industrial computing, and network infrastructure technologies, recommends following three key steps to build robust communication networks for AMRs. These steps are also recommended for development of communications for automated storage/ retrieval systems.

Step 1: Focus on industrial-grade designs

In any industrial application of wireless communication, electrical interference is an issue that must be addressed. This interference can stem from ground loops to the basic use of conveyor belts to

move products. Also, the constant vibration created when an AMR is moving can also a ect wireless performance.

Industrial-grade wireless products are commonly “reinforced with RF (radio frequency) and power isolation to protect the device against electrostatic discharge damage and sudden inrush currents generated by motors,” says Calvin Chuko, product manager at Moxa. “They also have a wider operating temperature range and feature high ingress protection to ensure that your wireless connections remain stable, even in environments with heavy ambient interference. Through these enhancements, industrial-grade devices are designed to last longer as well.”

Step 2: Deploy seamlesswireless connectivity

Wherever AMRs will be used, wireless roaming capability will be needed. According to Chuko, roam-

16 AW OCTOBER 2022 PERSPECTIVES

Su cient Wi-Fi coverage and roaming technology are needed to ensure seamless wireless connections. Source: Moxa

technology enables wireless clients to constantly search for and switch to the nearest access point with the strongest signal before the wireless connection is lost.

Wi-Fi coverage can also impact the quality of wireless connections because it “determines how quickly the wireless device can identify nearby access points and thus roam more reliably,” he says. “Opting for wireless devices with MIMO (multiple-input and multiple-output) capability can further multiply the capacity of a radio link to enlarge Wi-Fi coverage. This also improves wireless performance and eliminates the need to install additional access points.”

Chuko also recommends determining if the wireless communication device you’re considering can be equipped with millisecond-level roaming technology and evaluating the use of external antennas for more flexible network deployment to achieve broader Wi-Fi coverage.

“You can use wireless sni er tools within the area to trace various Wi-Fi spots to map out the actual profile of the radio coverage,” advises Chuko. “More often than not, you will need to finetune the network design after an on-site survey. Even when the Wi-Fi coverage is good and the RF

signal is strong, you may not get good throughput. Physical obstacles, such as walls, may be preventing some access points and clients from ‘hearing’ each other, leading to a collision of Wi-Fi signals.”

Step 3. Look for built-insecurity and managementsoftware

Chuko cautions that even basic Wi-Fi network management tasks can pose cybersecurity risks.

“For instance, if wireless clients can connect to access points without any authorization or authentication mechanism, this kind of unwarranted access may cause network breaches and even shut down the AMR system. That’s why we highly recommend securing all wireless communication devices after configuration and deny unauthorized devices access to the wireless network to create an additional layer of network security,” he says.

To ease the process of securing your wireless network, Chuko recommends focusing on networking technologies that feature management software to visualize the network environment and control the security of all node connections.

“Moxa has helped machine OEMs and system

integrators worldwide to augment AMR and automated storage/retrieval systems for optimal reliability and e ciency,” he adds. “Moxa’s AP (access point)/bridge/client solutions combine a rugged design with high-performance Wi-Fi connectivity to deliver secure and reliable wireless connectivity. And with Moxa MXview network management software and AeroMag technology, customers can easily configure, manage, maintain, and troubleshoot their network.”

Learn more about the use of robots, cobots, and AMRs in a Peer-to-Peer FAQ on the topic.

better products. better solutions.

Conveyor Solutions for All of Your Automation Needs

Belt Conveyors – Flat, Cleated & Plastic Modular

Timing Belt Conveyors

Roller Chain Conveyors

Roller Conveyors

Since

Up to 610 mm wide

For heavy

17 AW OCTOBER 2022 PERSPECTIVES

(860) 769-5500 info@mknorthamerica.com www.mknorthamerica.com

–

–

loads

– Straight & Curve

1988 we’ve been providing not only a better product, but also a better solution. Learn More Today! ing

Emerson and Rockwell Automation Expand Cybersecurity Protections with Dragos

By David Greenfield Director of Content, Automation World

As industrial companies of all sizes get serious about securing their enterprise and control system networks in the wake of increasing cyber-attacks, automation tech nology suppliers are partnering with recognized cybersecurity technology companies to bolster protection of their technologies in the field. Recently, Emerson and Rockwell Automation

made announcements about their partnership with Dragos Inc., a supplier of cybersecurity technology for industrial controls systems (ICS)/ operational technology (OT) environments. Dra gos says its OT Security Platform is designed to “provide visibility into assets and their vulnerabil ities, detect cyber threats to industrial systems, and enable efficient response through forensic investigation and OT-specific playbooks.”

An existing agreement between Emerson and Dragos involved the integration of Dragos’s threat detection technology into Emerson’s

Ovation automation platform and Power and Water Cybersecurity Suite.

The new agreement between the two compa nies validates use of the Dragos Platform within Emerson’s DeltaV distributed control system (DCS). According to Dragos and Emerson, the extended agreement between the two compa nies helps protect industrial control systems and operational technologies for power and water utilities, as well as oil and gas, chemical, petro chemical, food and beverage, pharmaceutical, pulp and paper, and metals and mining.

Rockwell Automation’s incident response retainer program. Source: Rockwell Automation

18 AW OCTOBER 2022 NEWS

Dragos notes that it is also incorporating DeltaV DCS platform-specific capabilities into the Dragos platform, including protocol dissectors, asset characterizations, threat behavior analytics, and investigation playbooks to expand Emerson’s cybersecurity assessment capabilities and enhance threat detection and response for process industries.

Incident response

Rockwell Automation’s work with Dragos involves use of dedicated ICS incident responders from Dragos as part of Rockwell’s incident response retainer program. According to Rockwell, this program is designed to help industrial companies develop an action plan using proven methods to contain the incident and minimize damage. Rockwell notes that its back-up and recovery services, which are part of this program, keep near real-

time records of production and application data, allowing businesses to recover quickly and return to production. “Following system recovery, our industrial security services team also investigates the incident to help identify root causes and strengthen your resilience,” Rockwell says.

Matt Cowell, vice president of business development at Dragos, says, “By growing our agreement and bringing industrial cybersecurity to an even wider group of industries, we are able to reach and protect a wider array of organizations, many of whom are just embarking on the path of digital transformation and have immediate needs to reduce risk as they expand connectivity.”

Other Dragos partners in the industrial space include: Amazon Web Services, Deloitte, Fortinet, GE, Juniper Networks, Schweitzer Engineering Laboratories, Splunk, IBM Security, ServiceNow, OSISoft (now part of Aveva), ISA

19 AW OCTOBER 2022 NEWS

Global Security Alliance, Waterfall Security Solutions, Owl Data Diode, and MxD.

Listen to this podcast about determining how much cybersecurity protection you need.

Emerson's Ovation controller. Source: Emerson

3 Big Industrial Networking Developments

By David Greenfield

of Content,

Notable advances in industrial network ing technology are not rare, but they usually arrive one at a time. Occa sionally, however, we see a cluster of new developments, as we did in late 2018 when the OPC Foundation announced its work to bring Time-Sensitive Networking (TSN) to field level devices, CC-Link announced the availability of CC-Link IE TSN, and ODVA announced the ability to integrate HART communication

protocol devices into an EtherNet/IP archi tecture. All of these major developments were announced at one event—the annual SPS event in Nuremberg, Germany.

There now seems to be another wave of new industrial networking announcements, this time surrounding Ethernet-APL, the Process Automation Device Information Model, and the Instrumentation Device Profile for OPC UA Field eXchange.

Ethernet-APL

Members of the APL Project, which includes the OPC Foundation, Profibus & Profinet

International, FieldComm Group, and ODVA, announced the official availability of 10Mbit Ethernet-APL technology—the new twowire, intrinsically safe Ethernet physical layer. This announcement was made to emphasize that Ethernet-APL technology now meets all requirements of the process industry.

APL Project participants worked closely with TüV, the certification body for intrinsic safety, to validate the developed explosion protection concepts and prepare for standardization of Ethernet-APL in the IEC.

As a single physical layer, Ethernet-APL supports EtherNet/IP, HART-IP, OPC UA, Profinet, or any other higher-level network protocol, according to the APL Project.

To support implementation of EthernetAPL technology in industrial automation and networking products, the APL Project worked with semiconductor manufacturers to bring 10BASE-T1L Phy chipsets for Ethernet-APL to market. With the successful completion of the project, the APL Project says all interested companies can now integrate Ethernet-APL into their products.

The APL Project announcement notes that Ethernet-APL can be applied at multiple power levels with and without explosion hazardous area protection. Information about engineer ing guidelines and best practices for planning and installation, and conformance test speci fications and test tools are available at www. ethernet-apl.org

PA-DIM

The Process Automation Device Information Model (PA-DIM) allows for communication of common process automation instrument parameters across any industrial networking protocol. This protocol agnostic approach is key to the integration of IT and OT (operations technology) systems.

Since 2017, FieldComm Group and OPC Foundation, the original co-owners and codevelopers of PA-DIM, have been working with standards organizations and users to ensure the PA-DIM specification can address the requirements of the NAMUR Open Archi tecture (NOA). This was seen as a necessary step because the growing use of smart sensors, mobile devices, and IT equipment in industrial

20 AW OCTOBER 2022 NEWS

Director

Automation World Ethernet-APL depiction. Source: Phoenix Contact

operations generate more data than the traditional NAMUR automation pyramid can handle. The NOA reportedly addresses this issue by “transmitting this data over a second communication channel without affecting the widely accepted advantages of traditional automation structures and with no impact on the automation system,” according to NAMUR.

Ownership of PA-DIM has now been expanded beyond FieldComm Group and the OPC Foundation to include ISA100 WCI, ODVA, Profibus/Profinet International, NAMUR, VDMA, and ZVEI. This move to expand ownership to these organizations was done to support the adoption of the OPC UA-based standard model for core field device information in process automation technologies.

The first version of the PA-DIM specification, published in 2020, includes an information model and semantic identifiers for common process automation instrument types including pressure, differential pressure, temperature, level, flow, and valve positioners. Current activity within the working group is focused on extending the model to include process analyzers.

OPC UA controller-todevice standard

To further multi-vendor interoperability of instrumentation devices based on OPC UA and the OPC UA FX (Field eXchange) extensions, the OPC Foundation and FieldComm Group have begun working together to develop a single standard for an interoperable interface between PLC (programmable logic controllers) and/or DCS (distributed control systems) and instrumentation devices such as transmitters, instruments, and actuators.

To support this work, the two organizations are developing an OPC UA Instrumentation Working Group, which is open to members of the OPC Foundation and the FieldComm Group. This group will focus on developing a new instrumentation device profile specification for OPC UA FX which will incorporate:

• commonly used interfaces and data types, including functional safety;

• diagnostic information specific to instrumentation devices;

• operation modes of instrumentation devices; and

• state machines and timing models for instrumentation-specific functionality.

The profile specification will use pub/sub communication and can be combined with underlying communication protocols, such as UDP/IP, and physical layers such as Ethernet-APL to support use in both discrete and process manufacturing applications. According to the OPC Foundation, this will address safety instrumentation based on OPC UA Safety and deterministic data exchange based on Ethernet Time-Sensitive Networking (TSN), where appropriate. The instrumentation facet of the specification will be complementary to PA-DIM.

Read about the last big grouping of industrial networking announcements around device and system interoperability.

Read more about the benefits of Ethernet-APL.

Learn what pub/sub means for industrial networks.

21 4BZ�IFMMP�UP�UIF UIF�POMZ�DPCPU�XJUI�B� ��LH�QBZMPBE�BOE�B� ����NN�SFBDI� *UsT�UJNF�UP�NFFU�ZPVS� OFX�IFBWZ�EVUZ� CFTU�GSJFOE� )�4&3*&4�

AW OCTOBER 2022 NEWS

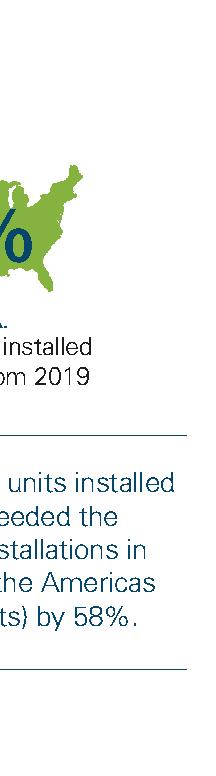

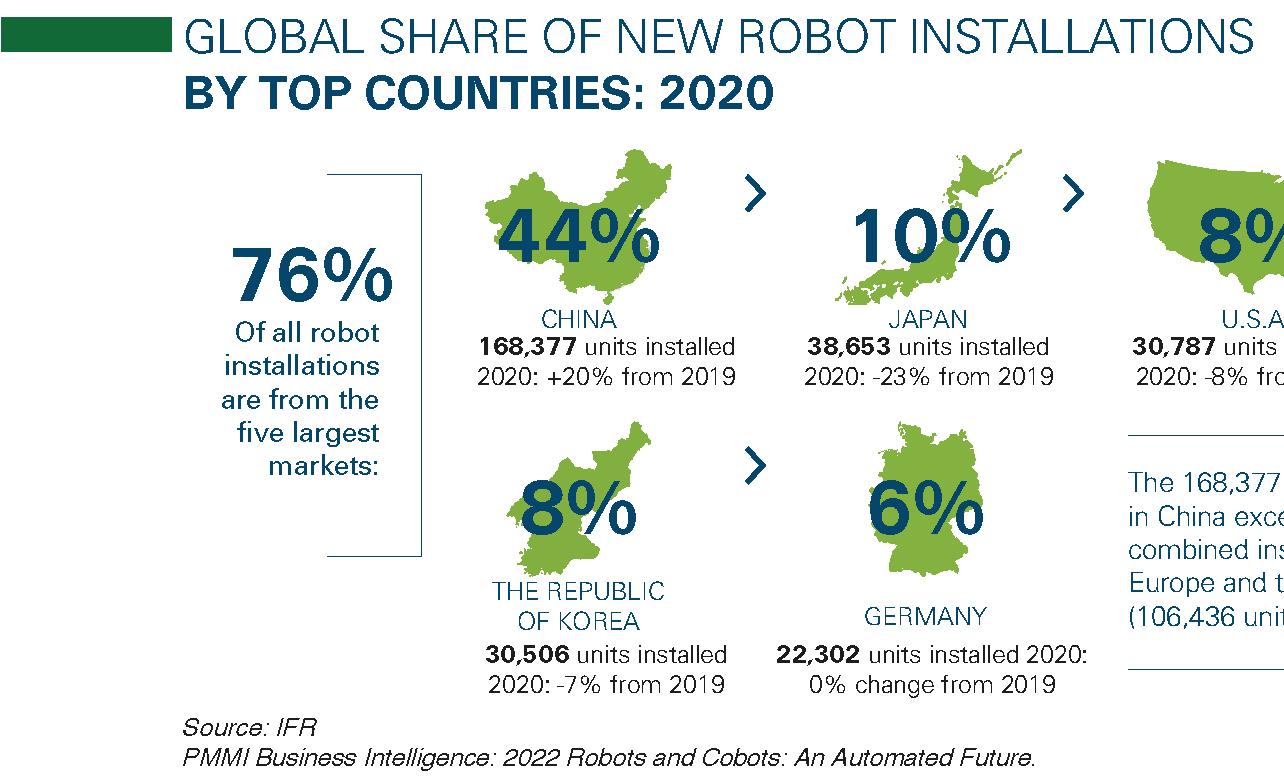

Global Growth in Robotics Expected to Hit Major Milestone by 2024

By Casey Flanagan editorial assistant, PMMI Media Group

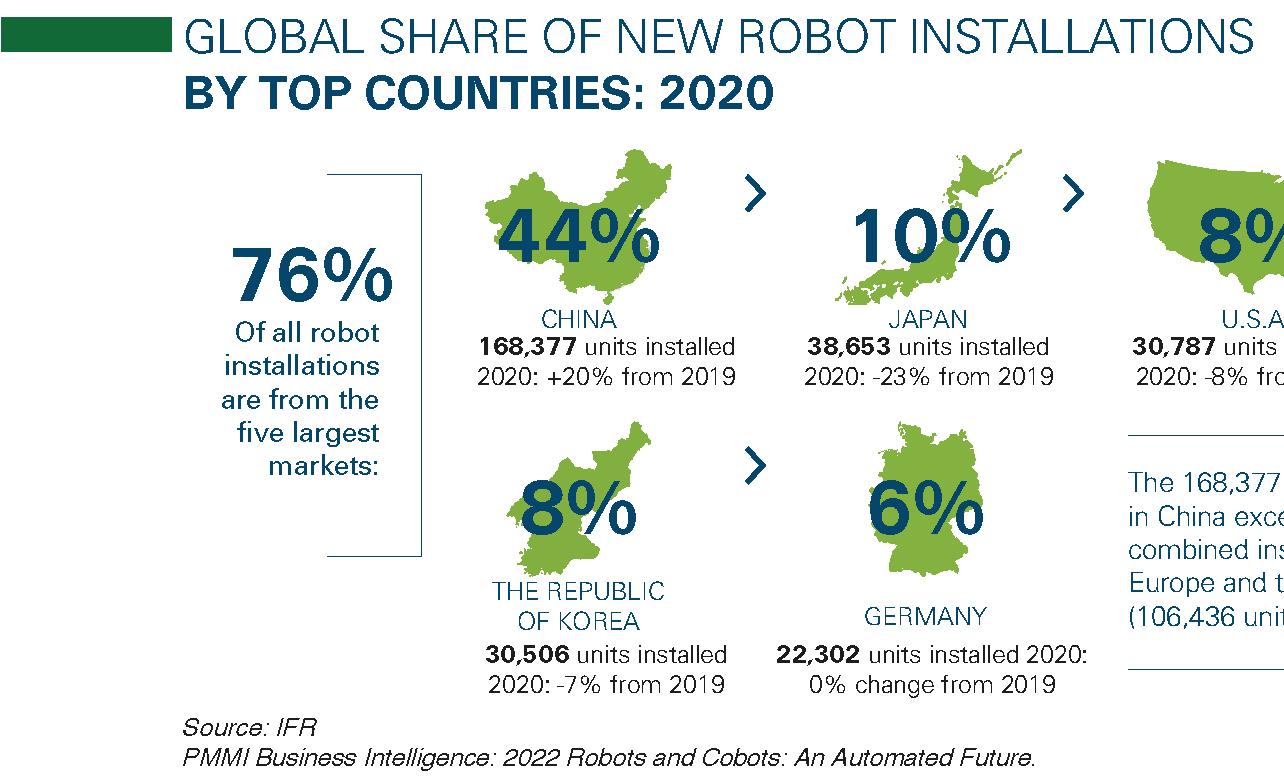

Robot installs are predicted to surpass a significant benchmark by 2024, reaching 500,000 installs in a single year, according to PMMI’s 2022 report “Robots and Cobots— An Automated Future.”

This prediction comes after some fluctuation in recent years, including the COVID-19 pandemic and other factors that brought turbulent CAGRs (compound annual growth rates) to the robot industry.

Global annual robot installations increased by a CAGR of 9% from 2015 to 2020, driven primarily by additions enabled through the growth of robotics technology into new capabilities and applications. As one industry expert says in the report, “the advancements in sensors, AI vision systems, and machine learning are opening up huge opportunities for robotics around the world.”

Installations grew slightly to 383,545 in 2020, exhibiting a CAGR of 0.5% from 2019-2020. This increase marked a recovery from the 10% decline experienced during 2019.

Preliminary data for 2021 shows the total value of new global robot installations reached $13.2 bil-

lion in that year, with more than 3 million robots operating in factories around the world.

Global CAGRs for new installs are predicted to level out in the medium single-digit range for 2021 to 2024, eventually reaching the 500,000 single-year milestone.

New robot installations by country/region

Global 2020 data shows Asia (including Australia and New Zealand) is now the single largest robotics market, occupying 70% of the global share of new installations. More than 266,000 units were installed in 2020, up 7% from 249,598 units the year before. Asia outpaced the global 2015-2020 CAGR with a CAGR of 11% in that timeframe. China leads this region with 168,377 units installed in 2020, a 20% increase from the year before.

Growth in Asia is predicted to remain strong, likely creeping into the high single-digit or low double-digit range. Asia will remain the dominant regional market for installs during the forecast period.

Europe holds the next largest share of new robot installations in 2020, at 17%. European installations decreased by 8% in 2020 to 67,700 units, driven by steep drops in Italy (-23%) and

France (-20%). Despite this, the EU exhibited 6% CAGR from 2015-2020. Germany, which accounted for 33% of all installs in the European market, represented 6% of global robot installations at 22,302 in 2020.

Installation growth for Europe is predicted to slow, dropping below the global average into the low single-digit range. Central and Eastern Europe are expected to perform stronger than Western Europe during the forecast period.

The Americas comprised 10% of new installations in 2020. Installs in the Americas dropped by 17% in 2020, with declines in the U.S. (-8%), Mexico (-26%), and Canada (-29%). Effective CAGR for the robot industry in the Americas was 0% from 2015-2020. The U.S. represented 8% of global installations with 30,787 in 2020, down 8% from 2019.

The North American market is predicted to exhibit slightly stronger growth than the global average at a CAGR of 10% for the forecast period.

Source: PMMI Business Intelligence, 2022 Robots and Cobots: An Automated Future.

22 PMMI NEWS AW OCTOBER 2022

PMMI Announces Fifth Annual On the Rise Awards Winners

Andersen

PMMI On the Rise winners meet the follow ing nomination criteria: young professional 35 years of age or younger employed by a PMMI member company for at least one year, displays leadership potential at the company, and demonstrates a desire to advance his/her career in packaging and processing.

“This year’s On the Rise winners are making an impact on the future of our industry, contributing

to everything from enhanced sales and marketing efforts, to new and improved processes and solu tions, to attracting and retaining new talent,” says Jackie Sessler, North America marketing director of Beumer Group and chair of the PMMI Emerg ing Leaders Committee. “PMMI and the Emerg ing Leaders Committee are pleased to recognize these extraordinary leaders and hope that the On the Rise Award provides an opportunity to further

their professional development in packaging and processing.”

Award winners were honored at PMMI’s Annual Meeting on Sept. 12, in Oak Brook, Ill., and received free airfare, event registration, and hotel stay. The winter issue of OEM Magazine, the official publica tion of PMMI, will feature profiles of the winners.

23PMMI NEWS AW OCTOBER 2022

The winners of the 2022 On the Rise Awards are: Alison Zitzke Senior Product Manager Orbis Corp. Ravi Patel Controls Engineering Manager ID Technology/ProMach Inc. Allison Wagner Business Development Manager Morrison Container Handling Solutions Samantha Hoover Mechanical Design Engineer Spee-Dee Packaging Machinery Caitlin Eargood Service Project Manager Mettler Toledo Taz Lombardo Content Marketing, Senior Specialist Barry-Wehmiller Packaging Systems Eric

Marketing Manager Delkor Systems Inc.

Tom Lex

Director of Engineering TechniBlend

Nancy Garza-Castaneda

Administrative Manager Formers International William

Reese

Director

of

Engineering Garvey Corp. Developed by PMMI’s Emerging Leaders Committee, the awards recognize 10 young professionals who have demonstrated leadership potential in packaging and processing.

24 AW OCTOBER 2022 WAREHOUSE AUTOMATION

Manufacturing technology advances have extended the realm of automation beyond plant floor sensors, controllers, vision systems, and robotics into closely connected data collection and analysis using artificial intelligence. These technologies enable a “smart factory” to self-optimize and adapt to conditions in real-time. Despite these advances, warehouse and related material moving operations tend not to be nearly as modernized as plant floor operations.

“If you look inside the most modern environment, warehouse or factory, material handling, broadly speaking, is mostly analog,” says Matthew Rendall, CEO of Otto Motors, a maker of autonomous mobile robots (AMRs). “Any place where a forklift truck is driving something around, it is highly analog. That means the amount of data you have at your fingertips to analyze is limited. For decades, operators have been grasping at low accuracy, low frequency, and expensive-to-capture data trying to figure out how to run a continuous improvement program.”

For example, you can go into a factory or a warehouse today and still see industrial engineers sitting in lawn chairs at an intersection in the plant with a clip board, pencil, and stopwatch to monitor material flows, says Rendall. “It is an expensive thing to request of a highly trained industrial engineer, so it doesn’t get done frequently,” he says.

Which means the process, by its nature, is not as exact as it should be; plus, it’s rarely updated.

But this antiquated, analog surveying method is shifting in response to the decreasing cost of computer storage, increasing compute power, and new tools that target warehouse and distribution operations.

The roaming robot

Otto Motors is delivering tools to help industrial engineers automate the study of time and motion—and it comes in the form of the AMR. “The remarkable contrast that an AMR brings to the table is that we have sub-inch and sub-second level accuracy, and the marginal cost to collect an additional survey is zero,” Rendall explains. “So you are able to run industrial engineering time and motion studies on steroids at all times.”

The AMRs from Otto Motors are designed for material handling in the manufacturing and warehouse operations in a free-movement manner. In an automotive warehouse, for example, there could be 30,000 parts moving across the facility.

“It’s a symphony of motion,” Rendall says. “[With data from the AMRs] we are able to harness insights about how those 30,000 parts are moving in order to create a smarter tra c network.”

The foundation of Otto Motors’ AMR is a

25 AW OCTOBER 2022 WAREHOUSE AUTOMATION

proprietary version of the simultaneous localization and mapping (SLAM) algorithm, which relies upon cameras and laser scanners to develop a photorealistic floorplan.

“Think of an AMR as having a photographic memory. As it’s driving around it is constructing a picture-perfect representation of that environment in its memory,” Rendall says. Using that underlying localization and mapping, you can plot out where a vehicle has traveled. “As a result, the

side benefit [of an AMR] is that we have one of the most sophisticated data collection machines a factory or warehouse has ever seen, patrolling the floor 24/7,” Rendall says.

The AMRs operate with fleet management software which includes a feature called “factory replay,” providing a time-lapse recap of the entire day’s production. The software can take a 16-hour operation and collapse it down to five minutes, which provides an industrial engineer with a birds-

eye view of the floor and the ability to rewind, fast-forward, and zoom in to a certain time during an incident—as well as before and after—to extract insights about ultimate root causes of problems on the floor.

Another company, 634AI, o ers an AI-driven technology called Maestro, which is designed to safely orchestrate the movement of AMRs and coordinate situational reactions to create a more e cient and safer environment. Using o -the-

26 AW OCTOBER 2022 WAREHOUSE AUTOMATION

shelf, Power-over-Ethernet ceiling-mounted cameras, and proprietary computer vision technology, Maestro pulls video streams from di erent cameras to create a grid on the floor.

Those videos are stitched together to create a real-time map of the facility. Then, deep learning AI coupled with computer vision algorithms draw semantic analytics from data on the factory floor. “This data can be productivity-related information providing real-time safety alerts, near-miss

analyses, task allocation, and the ability to instigate and navigate a robot’s autonomous capabilities live on the factory floor,” says Shlomi Hatan, 634AI’s vice president of business development and operations.

Every factor in the process is identified, classified, tracked, and managed by Maestro, including raw materials, mobile robots, forklifts, boxes, and even people. “Designed to be hardware-agnostic, Maestro is interoperable with other systems to

enhance company workflows on a universal scale,” Hatan explains. “The general rule is, if Maestro sees it, it can be tracked and controlled in real time.”

Hatan adds that Maestro’s control capabilities can be extended to deliver custom, AI-generated productivity propositions. For example, Maestro can display forklift slow zones to locate bottlenecks and interferences for vehicles and workers, informing them of obstacles to help shorten travel times. It can also track the traveled distance and driving hours of forklifts and robots to identify underutilized resources or assure timely maintenance of equipment. It can even alert operators of incorrectly positioned materials and pallets.

Collecting all this information internally and creating a map of material movement can also help companies with supply chain struggles.

“There’s an interesting relationship between transparency and automation,” Rendall says. “We can’t influence what time the parts arrive on the loading dock. But if we are responsible for all the material handling that happens once the materials hit the receiving dock, we can use a QR code or RFID tag to scan the inventory. That inventory is only touched by a machine, and when that’s the case, you should be able to see within inch- and second-level accuracy where every nut, bolt, and screw is inside the operation. So you have a much better handle of what inventory you are working with inside your operation to more intelligently use the resources available to you.”

Automated storageand retrieval

Industrial control suppliers are also adding intelligence to automated storage and retrieval systems (AS/RS) used in warehouses and distribution centers.

Beckhoff Automation, for example, offers a shuttle control system for AS/RS applications in compact form factors. This system includes TwinCAT Machine Learning software to reduce energy consumption while optimizing acceleration and deceleration of the shuttles. “The machine learning (ML) functionality automates this so there is no human intervention required to achieve the process improvements,” says Doug Schuchart, Beckhoff’s global material handling and intralogistics manager.

In addition, the EtherCAT communication protocol used in this system allows information to be collected in large quantities and stored in a database on a Beckho controller. That data can then be transmitted to the cloud.

“Once at the enterprise level or the cloud, data science software can be used to develop ML inferences for equipment optimizations and predictive

27 AW OCTOBER 2022 WAREHOUSE AUTOMATION

The Otto 1500 autonomous mobile robot for heavy payloads includes front and rear 3D cameras for advanced obstacle avoidance and continuous mapping for a real-time visual of the facility.

maintenance applications. These ML inferences can then be deployed using TwinCAT Machine Learning to be executed in the PLC in real time,” Schuchart explains.

Dealing with dock delays

AMRs coupled with AI can increase productiv ity and safety inside operations. And machine learning coupled with PLCs can improve order fulfillment and throughput. But what happens when the truck doesn’t show up at the receiving dock? Traditional warehouse management sys tems (WMS) don’t have the ability to recalculate everything when there are shipping delays, or if there are too many shipments and not enough docks, or if inventory is in the wrong building.

To address such issues, AutoScheduler.AI has developed a cloud-based intelligent warehouse orchestration platform that integrates with ex isting WMS, ERP, and even yard management systems to provide dynamic dock scheduling, proactive cross-docking, and prescriptive ana lytics that balance inventory flow and drive labor efficiencies. “Our goal is to be the brain of the

warehouse,” says AutoScheduler.AI CEO and co-founder Keith Moore.

The work started as a project with Procter & Gamble (P&G). P&G operates one main plant in Ohio that uses seven nearby satellite warehous es for storage. Across this campus, the project noted more than 250 outbound full-vehicle shipments per day and, of those, 85% were drop and hook, and 15% were live load. These opera tions require manual efforts that are completed based on who is scheduled and the need for the day. But volatility in the production schedule and volume made it difficult to plan, resulting in an inefficient operation.

Using the AutoScheduler.AI technology, P&G doubled shipments from the plant directly to customers without increasing inventory, reduced shuttle moves involving outside warehouses by nearly 50%, reduced workforce planning from eight hours to 20 minutes per day.

That experience prompted Moore to turn this into a scalable system for any warehouse or dis tribution center operation to provide analytics that describe what is happening, predict what

will happen, and prescribe an optimal plan based on that information.

Every few minutes, AutoScheduler looks at the current situation and then runs “what-if” scenar ios based on inventory and constraints to maxi mize flow through the building. “We pull informa tion from the WMS and other systems, run the optimization, and push it back into the execution system. So when someone scans a pallet…our plan flows straight through to the floor, and nobody even knows we exist,” says Moore.

The AutoScheduler technology is exactly the kind of cognitive toolsets that Stephen Laaper, a principal and manufacturing strategy leader at Deloitte Consulting, says is coming to day-to-day warehouse operations.

“Supply chains will continue to be pressed and stretched in various ways for the foreseeable fu ture,” Laaper observes, noting that more action able information is imperative. “Because of that, the nature of these solutions are becoming in creasingly important.”

The Beckho EP7402—a compact, IP67rated motor-driven roller controller—can be used for AS/RS and other applications inside distribution centers.

28 AW OCTOBER 2022 WAREHOUSE AUTOMATION

Industry Training

Cost-effective,

Want a workshop tailored to your company?

Consider a PMMI in-plant workshop, customizing these workshops to meet your company’s speci c needs and goals.

Support your training through

Skills

Fundamentals of Field Service

Improve your service technician

Oct.

Chicago,

Certified Trainer Workshop

Provide better machinery training for

safety

Oct. 23-24,

& Oct. 25-26,

Chicago,

Risk Assessment Workshop

Learn risk assessment basics and how to

machine

Oct. 21-22,

Chicago,

convenient training... just for you.

the PMMI U

Fund, a workforce investment matching program. pmmi.org/skills-fund

team’s customer service skills and boost customer satisfaction (PMMI members only)

23-24, 2022 PACK EXPO International;

IL

your customers while enhancing

2022

2022 PACK EXPO International;

IL

incorporate risk assessment into

design

2022 PACK EXPO International;

IL Learn more and register at pmmi.org/industry-training

In this research project, Automation World highlights the technologies that comprise industrial Big Data and showcases insights from your end user peers and system integrators about how they’re using these technologies to improve decision-making.

By Beth Stackpole, contributing writer, and David Greenfield, director of content/editor-in-chief

By Beth Stackpole, contributing writer, and David Greenfield, director of content/editor-in-chief

30 AW OCTOBER 2022 PEER-TO-PEER FAQ

I

f they’ve used Big Data to any degree, it’s hard to find a company that doesn’t extoll its virtues for predictive and real-time insights. Industrial Big Data in particular—specifically the large and diversified time-series data emanating from Internet-connected automation equipment from sensors to plant floor machinery—has notable and demonstrable business value for companies looking to distill data into insights that drive better business and plant performance.

As trendy as it may sound, it’s only the name— Big Data—that’s of recent vintage. Companies have been collecting time series data from factory floor and field assets for decades. However, much of this data remains unused, trapped in siloed, proprietary historians and supervisory control and data acquisition (SCADA) systems that often aren’t readily accessible much less available to meld with other relevant business data to drive broad-based actionable insights. And while plant managers and maintenance workers have long analyzed data from specific plant floor assets—mostly with spreadsheets—this was rarely, if ever, done with wide business transformation in mind.

That’s all changed thanks to the scale of what’s possible fueled by technology advances in edge and cloud computing, data acquisition and historian tools, and artificial intelligence (AI) and machine learning (ML) analytics. With these technologies, manufacturers can transform siloed data and proprietary systems into flexible and intelligent facto-

ry floor and industrial operations that can be holistically automated and optimized in near-real-time. They are building next-generation systems able to sift through the volume and variety of industrial Big Data to uplevel operations and optimize performance, including reducing maintenance costs, ensuring near-zero downtime, boosting product quality, and driving additional revenue streams through the introduction of new services.

Orchestrating a successful industrial Big Data analytics program requires investment in a num ber of central technology components. Critical to the mix are:

Data acquisition systems: The first step in a Big Data initiative is identifying and capturing all relevant data. One way to do this is with a data acquisition (DAQ) system, which processes sampling signals that measure real-world physical entities and converts them to a digital form for use by various computing systems. The digital acquisition components typically comprise sensors that measure phenomena like temperature, voltage, fluid flow, strain and pressure, and shock and vibration along with signal conditioning devices and analogto-digital signal converters. The conditioning and converter devices work together to filter the analog signals from sensors, converting them to a digital formal that is compatible with standard computing resources for further analysis.

Most DAQ systems record, store, and visual

END USER SURVEY

ize the data in addition to providing some base level analysis and reporting capabilities. More recently, data acquisition systems are being integrated with real-time control applications, pairing the ability to acquire data quickly with the possibility of reacting to events using highly deterministic data. These new ca pabilities also allow manufacturers to track and mea sure current performance against historical trends.

Historians: One of the more popular data collection technologies are historians. Since their initial development in the early 1980s, data historians have found wide use across every manufacturing and processing vertical. Essentially, a data historian is software that logs production data and makes the data it collects easily accessible for analysis.

Though its function is not that di erent from a data acquisition system, the di erence lies in how they’re designed to collect data. DAQs collect both high- and low-speed data from a variety of sensors, and commonly have a very high-powered computing system either built-in or connected to them. DAQs can also handle signal conditioning— an essential capability for processing sensor data.

While historians can collect direct sensor data like DAQs, they can also collect data from larger systems and equipment; however they tend to do so at a slower rate than a DAQ system. While historians can collect data in real time, their main purpose is to collect data over longer periods of time— days, weeks, or months—rather than for specific,

31 AW OCTOBER 2022 PEER-TO-PEER FAQ

How do you collect and aggregate data from these systems/devices for analysis?

Computerized Maintenance Management System (CMMS) Manually/handwritten and then entered in spreadsheet software such as excel Historians Edge Computing Cloud computing Hybrid edge/cloud environment Other 44% 29% 3% 29% 27% 26% 23% SYSTEM INTEGRATOR SURVEY Manually/handwritten and then entered in spreadsheet software such as excel Historians Computerized Maintenance Management System (CMMS) Hybrid edge/cloud environment Cloud computing Other Edge Computing 57% 57% 0% 43% 29% 14% 14% How do your clients collect and aggregate data from these systems/devices for analysis? Automation World Big Data Survey 2022. Totals equal more than 100% as respondents could select multiple options Automation World Big Data Survey 2022. Totals equal more than 100% as respondents could select multiple options

short time periods.

The two basic types of historians used in manufacturing are:

• Time-series databases, where data are logged with time stamps to simplify tracking and monitoring; and

• Operational historians, which combine historian software and time-series databases for fast re trieval of the large amounts of data collected for Industry 4.0 and Internet of Things applications.