Reducing Emissions with Selective Catalytic Reduction (SCR) Technology

Recent projects deliver benefits

Williams has completed modernisation efforts and redesigned operations at two Transco facilities located in Chatham,

Aqueous

Oxygen (O2)

SCR Catalyst

Water (H2O)

Nitrogen (N2)

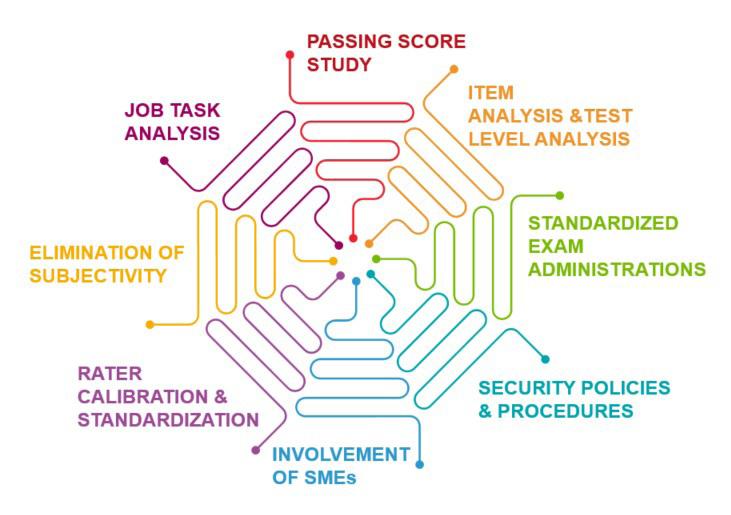

The selective catalytic reduction (SCR) process chemically reduces the nitrogen oxides (NOx) into molecular nitrogen and water vapor.

A nitrogen-based reagent such as ammonia or urea is injected into the ductwork, downstream of the combustion unit.

The waste gas mixes with the reagent and enters a reactor module containing catalyst.

The hot flue gas and reagent diffuse through the catalyst.

The reagent reacts selectively with the NOx within a specific temperature range and in the presence of the catalyst and oxygen.

A portion of the NOx is converted to water vapor (H2O) and molecular nitrogen (N2).

Gas Plant Combustion Unit Turbine Exhaust Containing NOx

Ammonia

Vaporizer Vaporized Ammonia

1 2 3 4 5

© 2022 The Williams Companies, Inc. 412/0522 Figure 2. Reducing emissions with selective catalytic reduction (SCR) technology. 6 World Pipelines / NORTH AMERICA 2022

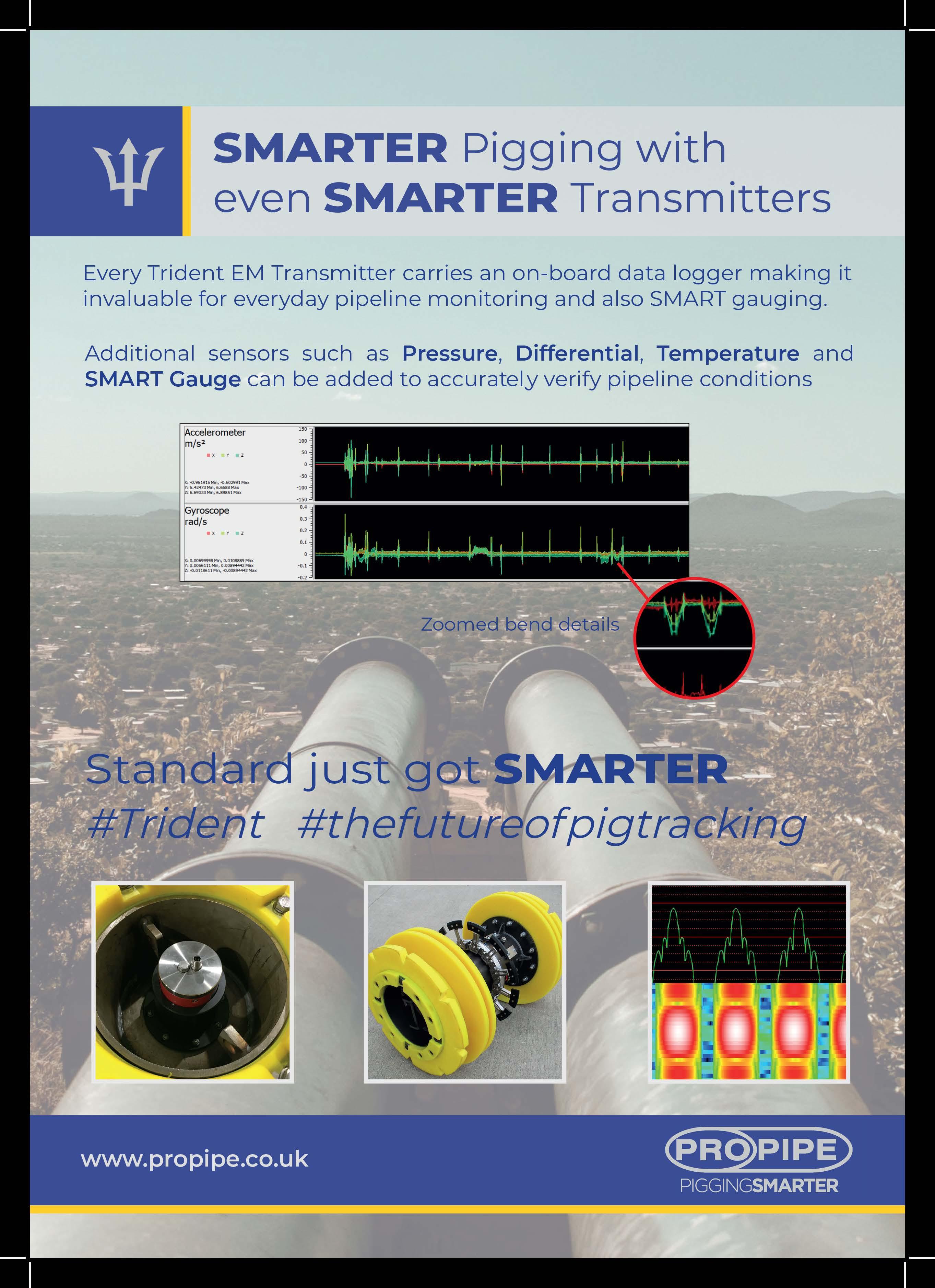

FIELD JOINT PROTECTION? WE’VE GOT THE SYSTEMS TO SUIT YOUR REQUIREMENTS BITUMEN & BUTYL TAPES VISCOELASTIC TAPES HEAT SHRINKABLE SLEEVES PETROLATUM TAPES, MASTICS & OUTERWRAPS PROTAL™ LIQUID EPOXY COATING FOR CORROSION PREVENTION DENSO™ are leaders in corrosion prevention and sealing technology. With over 135 year’s service to industry, our mainline and field joint coating solutions offer reliable and cost effective protection for buried pipelines worldwide. United Kingdom, UAE & India USA & Canada Australia & New Zealand Republic of South Africa www.denso.net www.densona.com www.densoaustralia.com.au www.denso.co.za A MEMBER OF WINN & COALES INTERNATIONAL

Virginia, and Scottsville, Virginia, to help satisfy the growing demand for reliable clean energy in the region. Transco is the nation’s largest and most reliable interstate natural gas transmission pipeline.

The work began in early 2020 with the Southeastern Trail Expansion Project. Modifications at the Chatham facility included the permanent retirement of ten legacy natural gasfired reciprocating compressor engines and the commissioning of two new advanced combustion technology turbine compressors. Modifications at the Scottsville facility included an increase in horsepower of an existing electric motordriven compressor and the addition of one new advanced combustion turbine compressor.

The new combustion turbine exhaust systems are equipped with emissions control technologies to maximise emissions reductions at levels that go above and beyond

regulations. These facilities are the first Williams’ interstate natural gas transmission assets to implement turbine post-combustion selective catalytic reduction (SCR) emissions controls, resulting in ultra-low NOx emission rates.

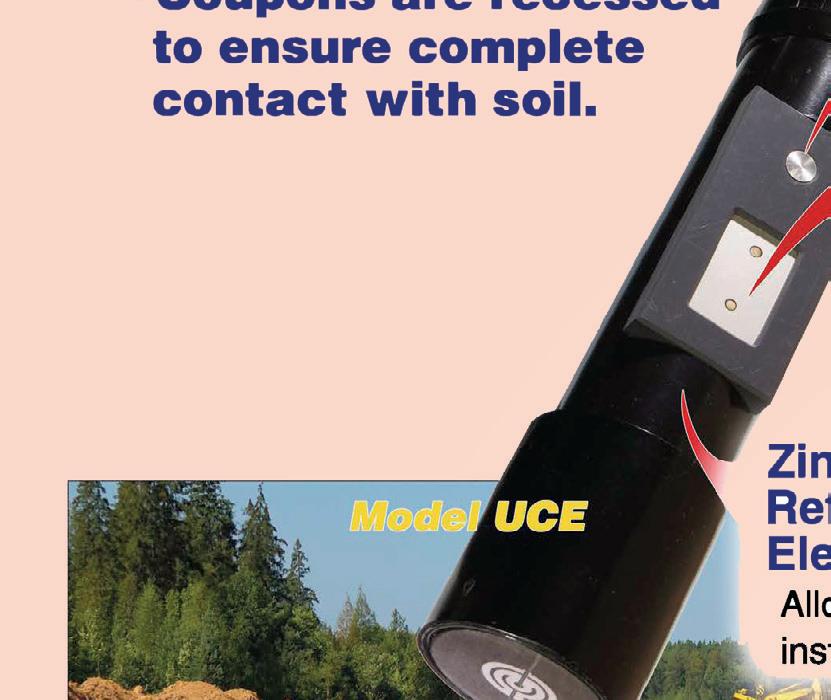

SCR systems are post-combustion emissions control technology installed on the turbine exhaust manifold. The system controls the turbine’s exhaust gas using a catalyst bed and ammonia injection grid to chemically convert nitrogen oxides (NOX) to nitrogen (N2) and water vapour (H2O).

Advancing innovative technologies

Williams recently launched New Energy Ventures to drive the commercialisation and implementation of innovative technologies and markets in the clean energy business.

By combining the company’s existing infrastructure, expertise and strategic relationships, Williams is developing such pragmatic solutions as solar installations to power company facilities, renewable natural gas interconnects from dairy farms and landfills, and digital platforms that provide market transparency for responsibly sourced natural gas.

One key initiative that Williams is investing in will overlay satellite monitors and blockchain technology on core infrastructure to provide end-to-end measured, verifiable and transparent emissions data for real-time decisionmaking capabilities.

Finally, the company is working to incorporate hydrogen and carbon capture and storage (CCS) into our existing network to serve some of the most populated areas of the US. As a result of Williams’ early entry and industry leadership into this space, Williams is being called upon by researchers and academics as well as US legislators intent on building clean energy solutions.

Natural gas is critical

Natural gas is critical for economic and climate security in the US and globally; continuous improvement is fundamental to ensuring that gas will play a positive role in both respects. ONE Future believes that industry can further lower emissions as well as energy costs, and the work that we do as a Coalition to foster innovation, improve technology, and develop cost-effective ways to find, fix, and prevent emissions is leading the industry. We are proud of the progress Williams has made and excited about their future initiatives, and we look forward to positive effects their efforts will have on both the Coalition, and the environment.

Figure 4. Williams-protected wetlands near station 240 in New Jersey.

Figure 3. Rendering of a fully developed solar site at station 610 in Pennsylvania.

8 World Pipelines / NORTH AMERICA 2022

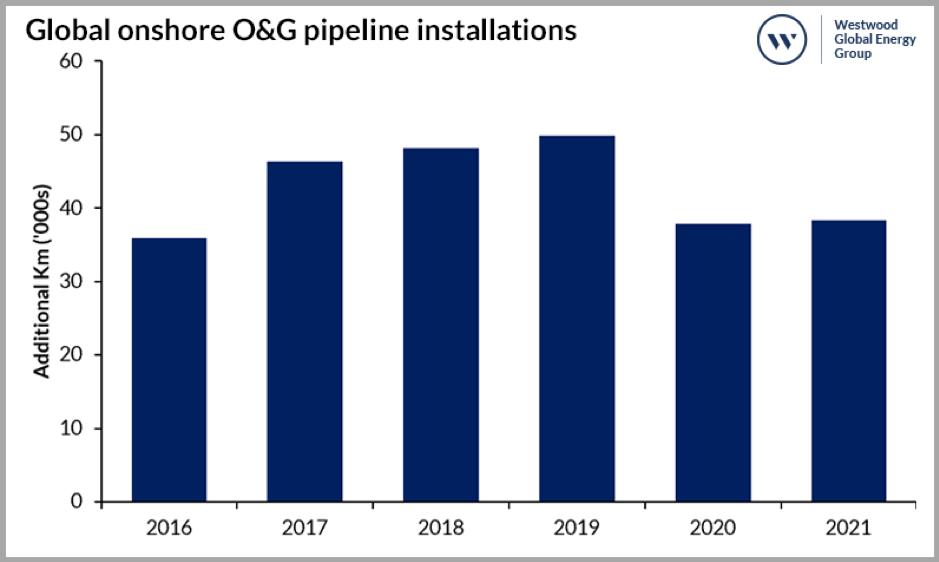

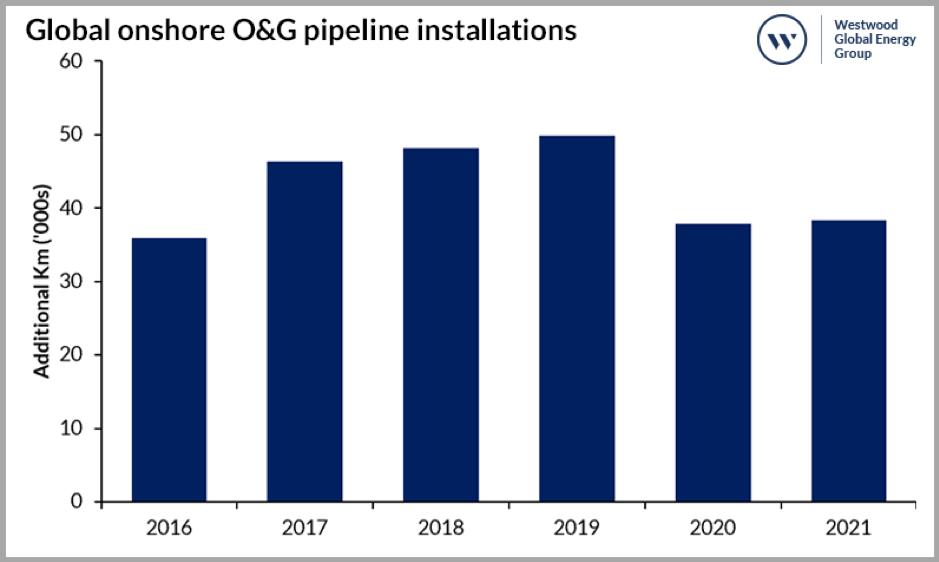

nshore pipeline installations across the globe have dropped dramatically in recent years with the industry badly impacted by public opposition, politics and depressed oil and gas prices, back to the levels seen in the last downturn (2016).

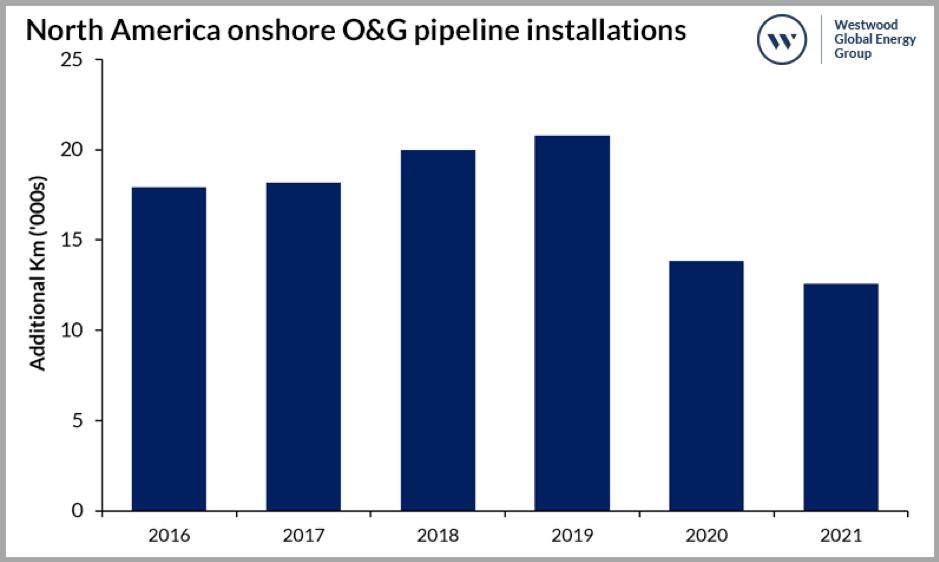

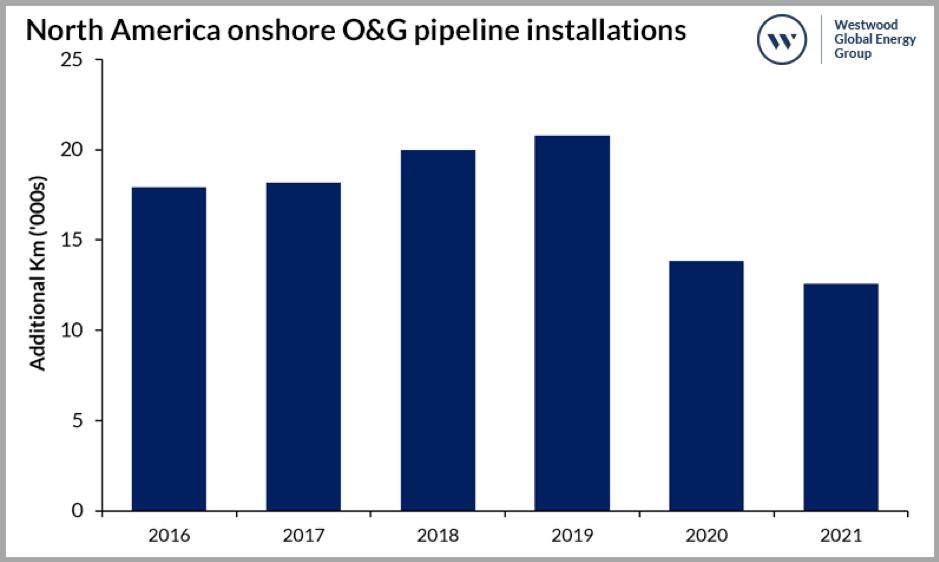

Nowhere has this decline been more pronounced than in North America, where a combination of plummeting prices and troubles with protests and permitting, has led to a stark decline in pipeline installations since 2019.

However, with more than half of 2022 behind us, the factors that caused this decline in North America are looking less relevant. The shock of oil futures trading negative in 2020 has been replaced by rocketing oil and gas prices, causing a surge in energy pricing that is reshaping some of the previous stances taken on some pipeline projects. As we look ahead to the next edition of the report,

Westwood takes stock of the current status of oil and gas pipelines in North America, as well as considering the growing demand for pipelines to support the energy transition (ET).

Potential green shoots for pipelines in North America

In North America, unprecedented demand for oil and gas pipelines saw year-on-year growth 2016 to 2019, reaching almost 21 000 km, with multiple lines installed with lengths of over 1000 km. The majority of these lines were to help ease pipeline capacity issues among the key shale plays, especially in the Permian. Similarly, in Canada a number of lines such as the Line 3 Replacement Project (>1100 km), and the Dawn Parkway System Pipeline (>200 km) were completed to help increase offtake capacity in key provinces. The majority of the lines installed were in the 24 - 41 in. diameter range.

Ben Wilby, Senior Onshore Analyst, Westwood Global Energy Group, UK, considers whether higher prices will cause a drastic shift in North American pipeline demand.

Ben Wilby, Senior Onshore Analyst, Westwood Global Energy Group, UK, considers whether higher prices will cause a drastic shift in North American pipeline demand.

9

Growing public outcry and stagnant pricing were already pressuring the market before COVID-19, and the subsequent commodity price crash led to a major decline in pipeline installations across all diameter ranges in both 2020 (13 800 km) and 2021 (12 500 km).

Onshore oil and gas activity, which saw small improvements in 2021, has rapidly started to increase over the first half of 2022. Operators are looking to capitalise on the major increase in pricing by completing many wells that were drilled previously but remained uncompleted (DUCs).

As a result of this surge in activity, the EIA has reported record levels of gas production from unconventional plays while liquids production has seen continual improvement, reintroducing the issue of offtake capacity. Earlier this year, US operators expressed concerns of a potential shortfall in pipeline capacity in 2023 to meet demand, a worry that became more pressing with natural gas becoming a potential strategic asset internationally following Russia’s invasion of Ukraine, and subsequent attempts from the EU to diversify supply.

Some of this will be met by pipelines already under construction, however, new projects will also be required to help increase offtake capacity. One example of this is the

790 km, 42 in. Matterhorn Express Pipeline, which reached Final Investment Decision (FID) earlier this year and is designed to transport 2.5 billion ft3/d of natural gas from the Permian, when it starts operations in 3Q23. Other projects, such as expansions to the Driftwood Pipeline, are also expected to start construction this year. It is worth noting that a flood of new pipeline projects (as seen in the 2010s) hasn’t appeared yet and projects remain at the mercy of approval boards, but the market is still looking significantly stronger than it was last year.

Onshore oil and gas is not the only sector in the energy industry where pipeline manufacturers are likely to see major demand. A new sector that has been slow to progress in the past looks to be becoming a major new area for demand: ET.

Carbon capture and hydrogen projects change outlook

The increasing focus on ET in recent years has added a new component to pipeline demand. The targets set by governments to reach net-zero following the Paris Agreement, as well as companies setting their own strategies to transition, has rapidly increased the number, scale and potential of these projects. North America has been at the forefront of this with numerous projects being progressed across the country to help alleviate carbon emissions from the major shale plays and Canada’s oilsands projects, potentially leading to a major increase in annual pipeline installations within the region. For example, one potential project, the Summit Pipeline which is planned to gather CO2 from across the Midwest, has a total pipeline length in excess of 3200 km.

North America has the largest existing capacity of onshore pipeline globally, with close to 1 million km of pipeline. There is the potential to reuse existing lines, potentially allowing companies to reduce costs and lessen the impact of construction activities.

However, while this is potentially a boon for the industry, not all existing infrastructure will be viable for reuse. The pressures required for CO2 transmission (up to 2600 psi) are substantially higher than natural gas (800 - 1200 psi), potentially ruling out many pipelines, with operators having to either pump carbon at lower pressures or install substantial numbers of crack arrestors to handle the higher pressures, pushing costs up significantly.

Other issues, such as age or condition, can add extra problems to repurposing pipelines. Operators are likely to come up with solutions to combat this, such as EnLink’s plan in Louisiana to mix new sections of pipeline with viable recycled natural gas pipelines. Approaches such as this, as well as newbuild projects like Wolf Midstream’s 563 km CO2 pipeline in the US, highlight that demand for new pipeline supply from carbon capture and storage (CCS) projects should be strong in the coming years, despite the potential to reconfigure the existing installed base.

With both oil and gas and ET-related pipelines expected to benefit from stronger demand, it appears the market is in a much better place for companies involved in the pipeline industry than they were this time last year.

Figure 2. Global onshore oil and gas pipeline installations. (Source: Westwood World Onshore Pipelines Market Forecast)

Figure 1. North America onshore oil and gas pipeline installations. (Source: Westwood World Onshore Pipelines Market Forecast)

10 World Pipelines / NORTH AMERICA 2022

The BISEP® with extensive track record provides industry first double block and bleed isolation while maintaining production. Hydraulically activated dual seals provide fully monitored leak-tight isolation, every time, any pressure. ZERO-ENERGY ZONE SINGLE HOT TAP POINT DUAL Leak-Tight Seals double block & bleed isolation PRODUCTION MAINTAINED BISEP® Hot Tapping & Plugging ISOLATED PIPELINE

However, it is important to highlight that numerous factors remain in play that will impact how much demand can grow.

Green shoots but plenty of threats remain Commodity price fluctuations remain a threat, with 2020 underlining how quickly markets can change and how companies are quick to respond to difficult market conditions by stopping projects. North America is at particular risk of this, with Canadian oil sands reliant on high prices for production growth while activity in the US shale plays follows commodity pricing closely. For example, rig counts in the gas basins of Appalachia and Haynesville declined recently following a decline in the natural gas price after Freeport LNG announced a multi-month outage at its Freeport facility. With CAPEX for new pipelines often reaching into the multi-billion-dollar range, any drop in activity from operators is likely to quickly disrupt pipeline projects in FEED, delaying them or even leading to cancellations.

Demand outstripping supply is also a major concern. A squeezed raw material market is pushing up prices across the energy industry, and manufacturers are reporting price increases of 15% already this year. Pipelines are far from immune to this, with material pricing delaying projects in the past when the pipeline owner re-tenders or delays FID until pricing is more favourable.

Despite these factors, the key issue remains the same as it has for many years. No matter how strong the market appears, political and social outcry are unlikely to go away anytime soon. The arduous progress through the courts of lines such as Keystone XL (eventually cancelled on Biden’s first day in office) and the Mountain Valley Pipeline which, despite being 96% complete, remains uncompleted because of a ruling that has rescinded one of the key permits, is likely to remain the primary reason pipelines cannot be installed. Even if the recent surge in prices in the US could signal a government that looks more favourably on projects, this will matter little if public outcry remains high. Even CCS and hydrogen lines are not immune to protests and legal challenges. A protest group has been set up in opposition to two CO2 pipelines (Greenway and ADM/Wolf Carbon Solutions CO2 pipeline) that are planned to run through Illinois, citing concerns over safety, environmental damage and land usage as the primary reasons for opposition. Similar issues to that of conventional oil and gas pipelines.

Despite this, the market for pipelines in North America appears to be in a much stronger place than even a year ago. The projects mentioned highlight the renewed drive to increase pipeline capacity across North America, supported by stronger oil and gas prices expected, and the continued move into ET.

Figure 4. USA wells drilled and DUCs. (Source: Westwood Energent)

Figure 3. North America onshore oil and gas pipeline installations by diameter. (Source: Westwood World Onshore Pipelines Market Forecast)

Figure 5. Current North America onshore oil and gas pipeline installed base by diameter. (Source: Westwood World Onshore Pipelines Market Forecast)

Figure 4. USA wells drilled and DUCs. (Source: Westwood Energent)

Figure 3. North America onshore oil and gas pipeline installations by diameter. (Source: Westwood World Onshore Pipelines Market Forecast)

Figure 5. Current North America onshore oil and gas pipeline installed base by diameter. (Source: Westwood World Onshore Pipelines Market Forecast)

12 World Pipelines / NORTH AMERICA 2022

ENERGY GL BAL Sign up to receive a digital copy of the magazine www.energyglobal.com/magazine Fuelled by renewable energy

Continuing to upgrade pipelines to advance safety is an ongoing priority for natural gas utilities, says Christina Sames, Senior Vice President for Safety, Operations, and Security, The American Gas Association (AGA), USA.

14

merican natural gas utilities deliver essential energy to customers and communities safely and reliably. The US Department of Energy estimates that US natural gas will remain between half and one-third the price of other fuels through 2050, ensuring that Americans have access to affordable energy to meet their needs.

Thanks to continual investment in reliability and safety by utilities, natural gas is the most dependable form of energy, with only one in 800 customers experiencing an unplanned gas outage in any given year, compared to at least one outage per year for nearly all customers of electric distribution systems. This incredible reliability is made possible by a commitment to the industry’s number one priority – safety. One of the greatest priorities of this commitment to safety is helping ensure the structural integrity of natural gas pipelines.

The continuous investment in pipeline safety, reliability and innovation has helped maintain a safe and reliable distribution system. Utilities are consistently modernising their systems to help ensure continued safe and reliable service, and in parallel driving down emissions – so much that distribution system emissions declined by more than 69% from 1990 to 2020, a trend that continues today.

Part of the modernisation process includes applying integrity management to help keep natural gas transportation systems safe and reliable. Operators consider the age and material of the pipeline, the method of construction, the characteristics of the natural gas that is transported, and the potential for corrosion or other issues.

Efforts to maintain the integrity of pipelines should be understood as having two goals: helping ensure that infrastructure can meet all demands safely, and that our infrastructure can meet the fuel needs of the future. For example, in some cases, fuel blends with a high hydrogen content can temporarily compromise metal via embrittlement whilst for other pipelines, external water or corrosive byproduct can pose a corrosion risk. These are things that utilities pay attention to as they work on maintaining the safety of systems for customers and communities.

Natural gas pipelines are made from a variety of materials. In the US, customer piping inside the house is primarily copper, while the other side of the meter is mostly polymer or steel. Pipelines buried under streets can be iron, steel, plastics or PVC, while major supply pipelines are typically carbon steel, used specifically for high pressures.

Iron pipelines

According to the US Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA), approximately 60% of the total mileage in distribution pipelines is plastic, 38% is steel, and the remainder consists of cast, wrought and ductile iron pipes. 1 With more than 3.1 million miles (5 million km) of natural gas pipelines in the US and Canada, including 2.6 million miles (4.2 million km) of local utility distribution lines, the range of materials used in the construction of pipelines means that there is no such thing as a one-size-fits-all approach to maintaining the integrity of pipelines.

15

While less than 2% of the distribution system today is made of iron pipelines, there are still segments in select parts of the US that consist of iron. Many early pipelines were made of iron with mechanically coupled joints incorporating fibrous materials to ensure an airtight seal. Natural gas utilities have invested heavily in replacing such pipes with more modern materials that incorporate advanced polymers or high-grade steel, especially in areas that are using higher pressures.

Exposure to groundwater can be an issue for some pipelines. The modern interstate system operates at significantly higher pressures than some earlier pipelines were designed for. This poses some unique challenges for some materials, like a build up of byproduct that is not present in geologic natural gas, because of the nature of the materials and casting methods. However, these unique challenges do not always mandate replacement – there are additional safety measures available. Frequently, iron pipelines will incorporate cathodic protection, where an electric current helps prevent corrosion on the surface through electro-chemistry. And for lower pressure systems, iron pipelines can continue to provide reliable supplies of natural gas safely and affordably.

‘Pipe within a pipe’

As the industry continues to modernise pipelines, many utility companies are turning to the ‘pipe within a pipe’ method. This method installs a flexible plastic liner into an existing pipeline. ‘Pipe within a pipe’ enables pipelines to operate at significantly higher pressures than otherwise possible. A higher-pressure system allows the same volume of pipeline to transport increased volumes of gas, improving the performance of the system in high demand areas.

An internal liner also allows for pipelines constructed from materials prone to hydrogen embrittlement to transport hydrogen safely and reliably. The US Environmental Protection Agency (EPA) has stated that the costs of this are significantly lower than excavating and replacing with new materials.

Continuing to upgrade pipelines to advance safety is an ongoing priority for natural gas utilities. Most existing pipeline infrastructure can operate on a gas blend containing up to 20% hydrogen without major modifications, and without incurring any significant embrittlement risks across all components of the natural gas distribution system. When hydrogen is added to a higher pressure, higher flow, steel pipeline’s fuel mix at levels above 20% of the total volume of gas within the pipeline, it increases the possibility that the pipeline could experience material embrittlement and potential leaks.

Helping ensure that these pipelines can handle increasing concentrations of hydrogen is worth the investment. Among the advantages of the US’s extensive natural gas network is that the infrastructure can be used for both geologic natural gas and other renewable sources of energy. Renewable natural gas (RNG), as well as carbon-neutral green hydrogen, will continue to be a part of the nation’s fuel mix as it works towards a cleaner energy future. The Biden Administration recently approved and started to disburse US$8 billion in funding for renewable hydrogen hubs, a move that will likely

lead to more hydrogen production and more hydrogen blending. Further, a variety of carbon-neutral synthetic natural gases (SNG) create more opportunities for using power-togas technologies. Safety will continue to be the absolute top priority as these fuels are incorporated into the gas distribution system with increasing regularity, and in greater percentages of the total blend.

When the ‘pipe within a pipe’ method is not ideal, or when more modern materials and larger capacity is beneficial, pipelines can be replaced entirely using a variety of materials. For transportation pipelines, this usually means steel. For distribution pipelines past the city gate, the replacement pipelines are typically plastic, such as PVC.

Safety and reliability

Since 1990, North American natural gas utilities have more than tripled the miles of pipelines made from more modern materials. Carbon steel or stainless-steel pipelines can be rubberised or treated with specialised corrosion and embrittlement-resistant paints. Like iron pipelines, steel pipelines also typically incorporate cathodic protection. PVC and other modern plastics do not corrode at all and are capable of operating at high pressures. This makes them excellent choices for local distribution networks, which is why polymers represent 60% of the total pipeline mileage, a percentage that is only likely to increase.

Utilities are consistently modernising their systems to help ensure continued safe and reliable service, and in parallel this is driving down emissions. One secret of the success of US natural gas utilities in providing such a safe and reliable natural gas distribution system is an extensive system of peer review, and a culture of open sharing of safety information. The American Gas Association (AGA) Peer Review Program is a voluntary safety and operational practices programme that allows participating companies to be reviewed by their peers, share leading practices, and identify opportunities to better serve customers and communities. Each review features a panel of fellow gas utility professionals from North America who provide the company with feedback to help enhance its safety and efficiency.

Natural gas is key to achieving our nation’s energy future while protecting our energy security today, and the distribution system is at the heart of it all. Efforts to help ensure system integrity are important both to continue to ensure safety, and to reach the US’s environmental goals. AGA’s study, ‘Net-Zero Emissions Opportunities for Gas Utilities’, identifies a variety of pathways to net-zero greenhouse emissions for the natural gas utility sector, and continued investment in modernising and upgrading distribution pipelines is key to those pathways.2 A safe and reliable distribution system is key to ensuring that the natural gas industry continues to deliver environmentally friendly, affordable, and reliable energy to Americans every day.

References

1. www.phmsa.dot.gov/data-and-statistics/pipeline/pipeline-mileage-andfacilities

2. www.aga.org/research/reports/net-zero-emissions-opportunities-for-gasutilities

16 World Pipelines / NORTH AMERICA 2022

Figure 1. Alkaid #2 Drilling Site. (Source: Pantheon Resources plc)

Figure 1. Alkaid #2 Drilling Site. (Source: Pantheon Resources plc)

18

hen it was built, the Trans-Alaska Pipeline was designed to deliver around 9 billion bbls of North Slope oil over a 20 year operational life. However, it has gone above and beyond expectations, celebrating the delivery of its 18 billionth barrel in December 2019 and its 45 year anniversary in June 2022. The Trans-Alaska Pipeline System (TAPS) is an 800 mile pipeline connecting Prudhoe Bay on the North Slope of Alaska to the Port of Valdez in the South. Its inception stems from the first discovery of oil in Prudhoe Bay in 1968, which led to the subsequent formation of the Alyeska Pipeline Service Co. (Alyeska) in 1970. The objectives of Alyeska were to design, construct, operate and maintain the pipeline. The Trans-Alaskan Pipeline Authorisation Act was passed in the US Senate in 1973 after Vice President, Spiro Agnew, cast a tie-breaking vote and the first section of pipe was laid two years

Recent discoveries on the North Slope could act as a solution to a reliance on foreign energy, says Jay Cheatham, CEO, Pantheon Resources, USA.

19

later. The pipeline construction project involved 70 000 workers between 1969 - 1977 and, at the time, was the largest private construction project in American history.

On 20 June 1977, first oil moved through the pipeline from Prudhoe Bay and arrived at the Port of Valdez after 38 days. Today, the pipeline is still owned and managed by the Alyeska Pipeline Service Co., which is a consortium made up of Harvest (Hilcorp), ConocoPhillips, ExxonMobil, Unocal and Koch.

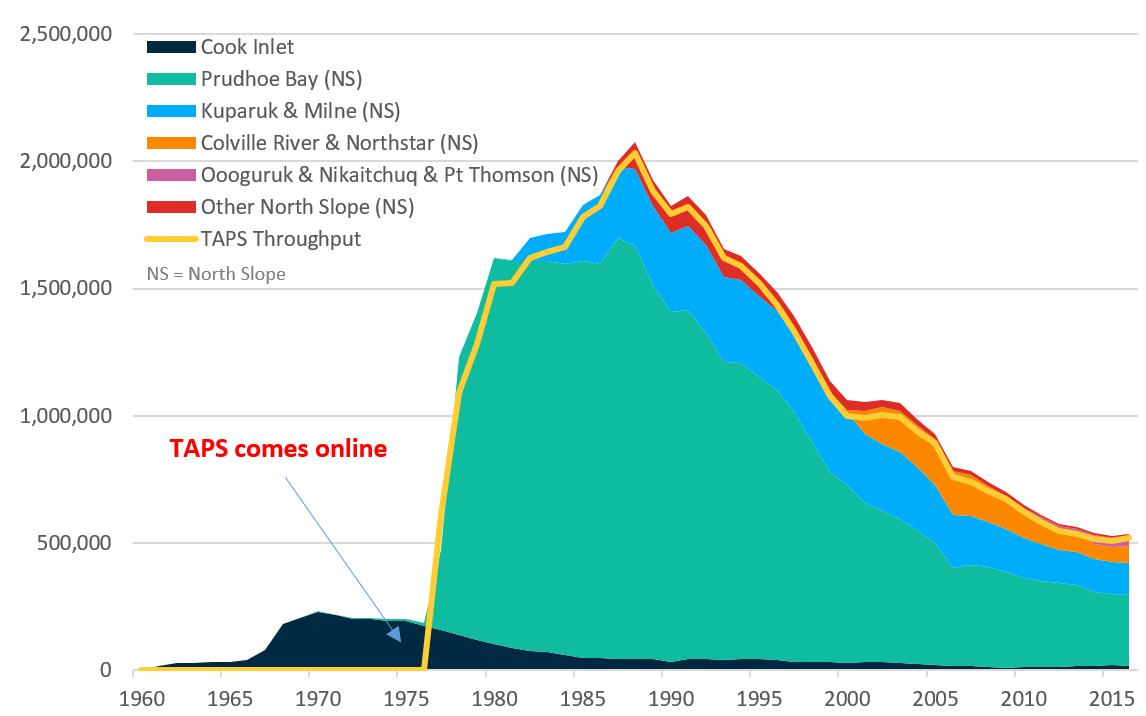

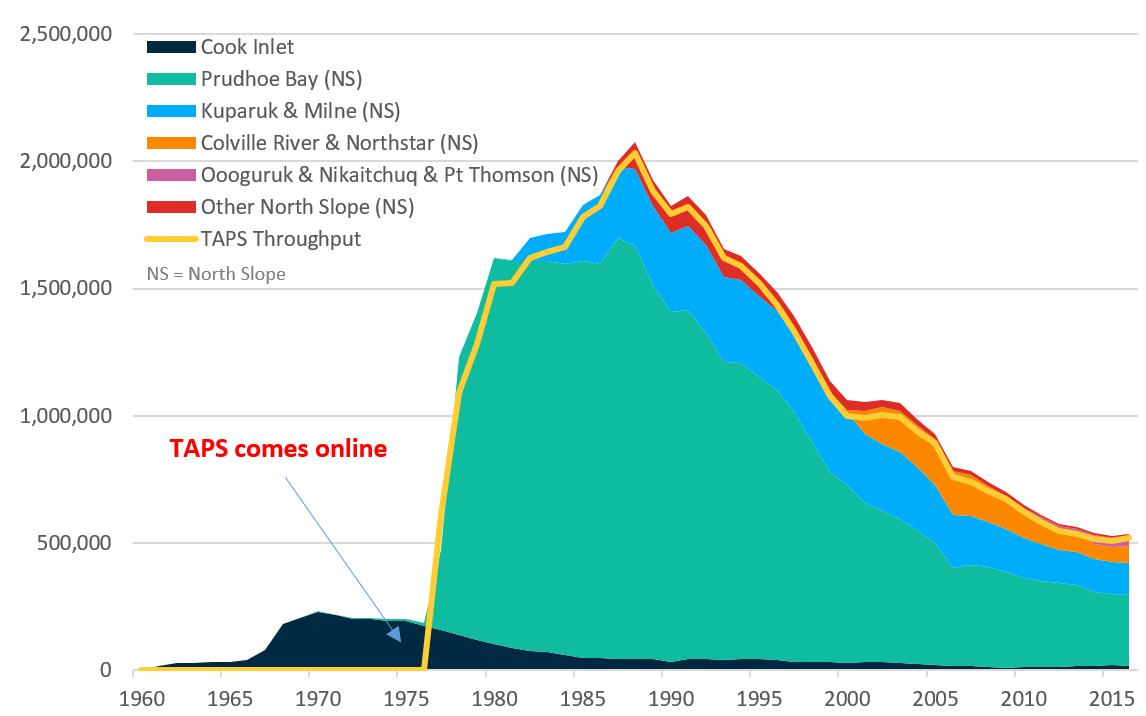

Since reaching peak capacity at around 2 million bpd in 1988, there has been a gradual decline of throughput to around 448 000 bpd in 2020. This has led to issues as, with reduced throughput, the oil can cool and thicken if it is not able to pass through the pipeline fast enough. Despite this decline, there have been a number of noteworthy discoveries in recent years, which operators claim could be of immense benefit to the pipeline. Prudhoe Bay is the largest oilfield in North America, and is amongst the top 20 discovered in the world, so it is no surprise that companies are still constantly exploring for new fields in the region. Examples of recent discoveries and estimated recoverable resources include:

) Caelus Energy (2016) – Smith Bay, 2.4 billion bbls recoverable.

) ConocoPhillips (2016) – Willow, 400 - 800 million bbls recoverable.

) Oil Search (2017) – Pikka-Horseshoe, 1.2 billion bbls recoverable.

) Pantheon Resources (2021) – Theta West, 1.7 billion bbls recoverable.

Celebrating its 45 th anniversary, Alaska Senator, Lisa Murkowski said that TAPS has been the backbone of Alaska’s economy, supported thousands of jobs and has helped generate billions of dollars of critical revenue for the State of Alaska. In 2017, BP said that since its launch, Alaska has earned US$141 billion from North Slope production and development. Murkowski also emphasised the importance of TAPS as a “vital component of America’s energy security”. TAPS has had a significant impact not only on the State of Alaska, but on the oil industry itself. According to BP, the Prudhoe Bay oilfield has been a “proving ground for advanced drilling techniques, including multi-lateral and coiled tubing, now employed by oilfields across the globe”.

How can TAPS survive and thrive in the face of challenges today?

There has been concern across the industry and media about whether TAPS has a viable future, mostly due to declining production from the ageing producing oilfields of Prudhoe Bay and Kuparuk, as well as the challenges surrounding thawing permafrost and the potential problems this can pose.

Falling production

Alaska oil production peaked in 1988 at about 2 million bpd, the only time in which the TAPS maximum capacity has been utilised. This accounted for around 25% of US oil production at the time. Throughput has declined over the decades, standing at around 560 000 bpd in 2013 and then 448 000 in 2020, accounting for 7% and 4% of total US production, respectively. In addition, TAPS was originally built with 11 pump stations, but this number now stands at four. When TAPS was carrying 2 million bpd of oil at its peak, the oil took four days to move from Prudhoe Bay to Valdez. Now, with rates around one quarter of this, it takes about two weeks to make the same journey.

The problem associated with the oil cooling and thickening is that it creates a build-up of wax, water and

Figure 2. Map of Alaska showing the route TAPS takes. (Source: Energy Information Administration)

20 World Pipelines / NORTH AMERICA 2022

ice in the pipeline, which means that Alyeska has to use a process known as ‘pigging’ to clean the walls to prevent any further issues. Pigging is just one of the various engineering approaches taken by Alyeska today to deal with reduced flow, but those in Alaska argue that these steps shouldn’t need to be taken:

“Although Alaskans continue to devise safe and innovative solutions to move the oil from matured fields every day, the best long-term solution lies in the billions of barrels of oil that are nearby and can be responsibly produced”, says Thomas Barrett, President of the Alyeska Pipeline Service Co., 2016.

To combat the decline in production, Alaskan officials and politicians have been working to open areas of the National Petroleum Reserve-Alaska and the Arctic National Wildlife Refuge (ANWR) to drilling, which has previously been prohibited. However, in 2022, five years after Congress mandated an oil and gas programme in ANWR’s 1002 nonwilderness area, this has been blocked by President Biden.

As well as the economic benefits for the State, producing oil in Alaska and transporting it through TAPS is also extremely important when considering the current geopolitical situation. Strengthening production once again in Alaska would help to bolster the US’s energy security, and reduce dependence on Russian and Middle Eastern oil given the energy crisis the world is currently facing. In her recent speech, Senator Murkowski invoked memories of how TAPS helped the US during the 1979 oil crisis, and enabled the country to insulate from OPEC and OPEC+. For Alaskan politicians, the hope is that the need to affirm the US’s energy security and energy independence will act as the impetus to revive exploration activities across the State.

North Slope – the saviour?

ConocoPhillips, the largest producer in Alaska, stated that drilling on the North Slope “is expected to continue for many years”. When production started at Prudhoe, the recovery factor for the 25 billion bbls of oil in place across the oilfield was expected to reach 40%. However, innovations in oilfield technology have allowed ConocoPhillips to increase the estimate to more than 60%. In 2021, ConocoPhillips alone produced an average of 197 000 bpd, mostly from Kuparuk and the Prudhoe Bay unit. As previously mentioned, current levels of production are not sufficient to maintain TAPS going forward.

According to ConocoPhillips, Prudhoe Bay has over 800 active oil producing wells, and several high-profile discoveries recently have provided some optimism amongst North Slope operators that TAPS will be able to thrive once again. Major discoveries have included ConocoPhillips (Willow), Oil Search (Pikka-Horseshoe) and Pantheon Resources plc (Theta West).

Willow, discovered by ConocoPhillips in 2016, has an estimated recoverable resource of 400 - 800 million bbls of oil. The Bureau of Land Management is currently working on a Supplementary Environmental Impact Statement and, if approved, Willow has an expected production rate of approximately 100 000 bpd. Oil Search announced a combined resource estimate for the Pikka-Horseshoe Units of 1.2 billion bbls of recoverable oil in 2017, with expected production around 120 000 bpd of oil.

In April 2022, after winter testing, Pantheon Resources upgraded its recoverable resource estimate for Theta West by 48% to 1.78 billion bbls. Pantheon will commence further appraisal and testing in the 2023 winter drilling season. A unique characteristic of Pantheon’s portfolio, which includes Theta West, Talitha and Greater Alkaid, is its proximity to TAPS and the adjacent Dalton Highway with oil accumulations stretching directly beneath, giving Pantheon the ability to come onstream far more quickly. Pantheon intends to commence development of Greater Alkaid in the summer of 2022 with the initial drilling and longterm production testing of the Alkaid #2 horizontal well, spudded on 6 July. Pantheon will initially truck its oil the short distance up the Dalton Highway, and once relevant permissions have been granted, intends to ultimately ‘hot tap’ oil directly into the TAPS pipeline.

Industry experts are hopeful that this resurgence of oil projects on the North Slope will lead to large quantities of

Figure 3. Alaskan Crude Oil and NGL Production and TAPS Throughput 1960-2016, in bpd. (Source: Alyeska Pipeline Service Co. and Alaska Oil and Gas Conservation Commission (AOGCC) data)

NORTH AMERICA 2022 / World Pipelines 21

oil flowing through TAPS, improving the efficiency of the pipeline, at a time when it needs it most.

Permafrost

Another area that has caused concern about TAPS is the threat of thawing permafrost. According to Inside Climate News, permafrost is found beneath nearly 85% of Alaska and is, therefore, below almost the entire pipeline. A study published in Nature Climate Change predicts that with every two degrees Fahrenheit increase, 1.5 million square miles of permafrost could be lost to thawing. This is a concern because it can undermine the structural integrity of the pipeline and ultimately increase the chance of an oil spill if supports holding up certain elevated sections get weakened.

Alyeska has worked to develop methods to futureproof the TAPS infrastructure to prevent these problems. For example, there are already about 124 000 thermosyphons along the path of the pipeline, which act to suck heat out of the permafrost and keep the ground frozen. The tubes are bored 15 - 70 ft deep in areas where warming might cause it to thaw. Michelle Egan, a spokesperson for Alyeska, claimed that changes to permafrost were considered in the original design of the pipeline, and so the pipe supports were designed and constructed accordingly to maintain the integrity of the pipeline. In this vein, out of the total 800 miles, 420 miles of the pipeline was built on elevated support systems which keeps the pipe about 6 ft off the ground. Many of these support systems have thermosyphons within the support systems to keep the permafrost frozen.

In 2021, it was reported that an area of permafrost where an 810 ft section of the pipeline is secured began to move as it thawed, causing some of the braces holding up the pipeline to twist and bend. The Alaska Department of Natural Resources approved the use of about 100 thermosyphons, which were to be free-standing and installed 40 - 60 ft in the ground to prevent the thawing slope from collapsing or sliding. Alyeska stated that the purpose of this was “to protect the integrity of the TransAlaska Pipeline from permafrost degradation”. According to records and interviews with officials, thermosyphons had never been used before in this way as a defensive safeguard. Tony Strupulis, Pipeline Coordinator for the Alaska Department of Natural Resources, said that the thawing of permafrost is a gradual process which allows time to address problems that it could cause, so there is no cause for alarm. Strupulis emphasised that the agency is “very mindful” of the permafrost in terms of the stability of the pipeline and that generally “the design philosophy is, if its frozen, keep it frozen”.

Keeping TAPS alive is imperative

As demonstrated, TAPS is no doubt facing some substantial challenges, both in terms of the changing environment surrounding it through thawing permafrost and with historically low production and throughput rates. However, with the resurgence of exploration on the North Slope, as well as increasing political pressure to prioritise domestic energy production, there is every possibility that throughput rates should increase and the pipeline can thrive once again, at the same time supporting employment and providing valuable revenues to the State.

Alaska has some of the largest oil reserves in the world, TAPS is underused and, given that the world is in an energy crisis and the US wants to regain its energy independence, the recent discoveries on the North Slope could act as a solution to a reliance on foreign energy. In addition, Alaska’s strategic location in the North Pacific would allow it to feed refineries along the US West Coast easier than the Gulf of Mexico would be able to. Given that TAPS, constructed with a 20 year lifespan in mind, just celebrated its 45 year anniversary, one can be confident that it is not going anywhere soon.

Figure 4. TAPS, Dalton Highway and Alkaid #2. (Source: Pantheon Resources plc)

22 World Pipelines / NORTH AMERICA 2022

The conflict between Russia and Ukraine has altered legal and regulatory affairs in Mexico, Canada, and the US, argues Gordon Cope.

24

ver the last century, the comprehensive regime that governs the millions of miles of oil, gas and fuel pipelines in North America has evolved, with the primary goals of gathering and delivering fossil fuel energy to consumers in a safe, cost-effective and reliable manner.

For the last several decades, however, the regulatory/ approval environment for new (and refurbished) pipelines in North America has been characterised by adversarial forces. Environmental groups, concerned with climate change, do not want major infrastructure investment in fossil fuels, including pipelines. Various administrations in both Canada and the US have been instrumental in impeding and cancelling projects, and uncertainty within the investment community has made financing more difficult and expensive.

The calculus changed dramatically in early 2022 when Russia invaded the Ukraine. In Europe, the predominant concern over climate change was overridden by energy security as the EU scrambled to replace Russian oil and gas; what would

be the inevitable repercussions around the world? Those considerations, of course, are still evolving, but ramifications are beginning to emerge in North America.

Keystone XL

For several decades, the free flow of energy between Canada, the US and Mexico has been guaranteed through bilateral agreements. When Joe Biden entered the White House in 2021, however, his first act as President was to unilaterally cancel TC Energy’s Keystone XL pipeline project. Initially proposed in 2008 as a 2000 km express line to deliver 830 000 bpd of Alberta crude to the US Gulf Coast (USGC), the Obama administration refused to approve a cross-border permit. President Trump used an executive order to reverse the decision, but Biden’s move is considered to be the nail in the coffin for the US$8 billion project.

When a post-COVID-19 rebound in demand and the Ukraine war caused gasoline prices in North America to soar, President Biden went hat in hand to Venezuela and Saudi

25

Arabia, requesting increases in output. He studiously ignored Canada; for its part, TC Energy insisted that the XL project is dead, and is seeking damages through international arbitration.

Enbridge Line 5

Crude exporters in Canada still face further pipeline complications. Enbridge Line 5 transports 540 000 bpd from Canada (and North Dakota) through Michigan to Ontario and Quebec. The line has operated safely for over 60 years, and Enbridge has been doing extensive upgrades. In late 2020, however, Michigan Governor, Gretchen Witmer ordered Line 5 to shut down operations by 13 May 2021, due to the potential for spills (from anchor strikes) where it passes under the Straits of Mackinac in the Great Lakes. Although there have never been any leaks in the Straits, and Enbridge has received approval to replace the pipeline using a tunnel to greatly increase integrity, the issue remains at a standoff. Enbridge has sought legal relief, and the case is being heard in a US federal court.

As an international pipeline between Canada and the US, Line 5 is governed by the 1977 Transit Pipelines Treaty, which contains provisions guaranteeing uninterrupted transit of light crude oil and natural gas liquids between the two countries. In October 2021, the federal government of Canada invoked Article Six of the treaty to instigate bilateral negotiations with the US federal government. The invocation of the treaty (which has never been used before), will oblige the Biden administration to become involved in the dispute. Regardless, if the pipeline were to be even temporarily closed, it would have far-reaching negative effects upon supplies to Michigan, Ontario and Quebec, precisely at a time when the energy sector is under significant stress.

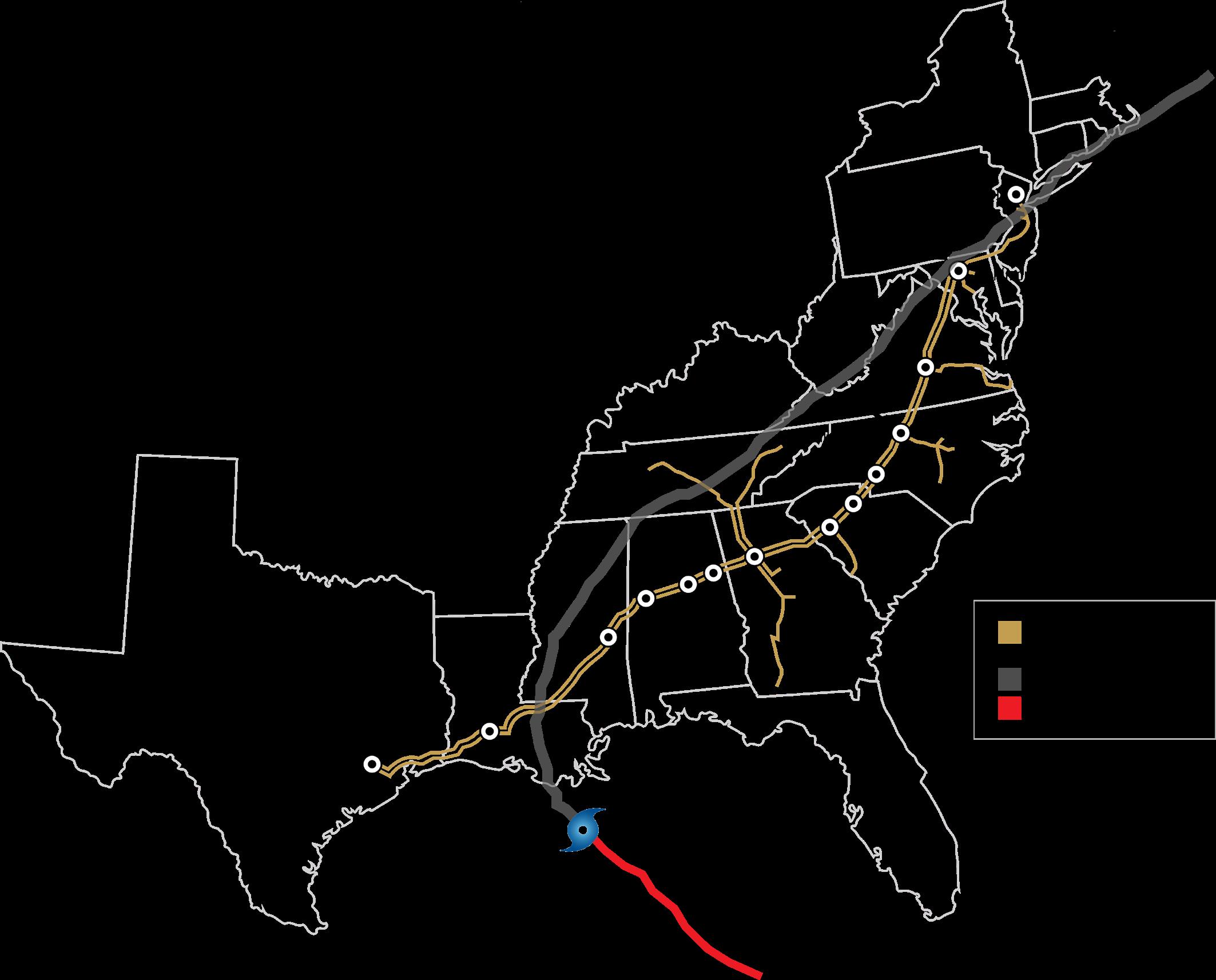

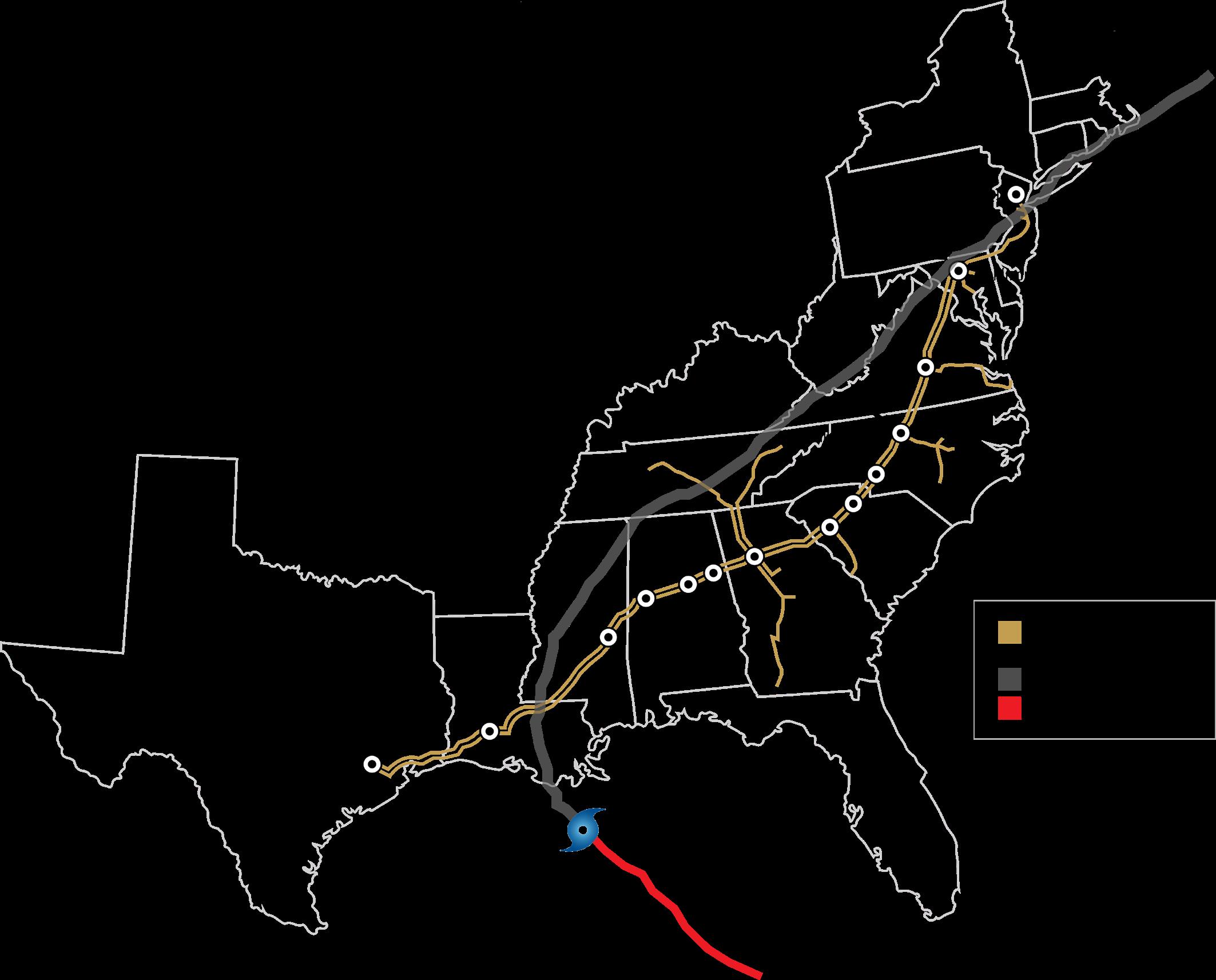

Cyberattacks

In May 2021, a ransomware attack forced Colonial Pipeline to shut down much of its network for several days. The 8900 km system delivers millions of barrels of gasoline, diesel and jet fuel every day between refineries in Texas and the Eastern Seaboard. In July 2021, the Department of Homeland Security (DHS), announced requirements for operators to implement “urgently needed protections against cyber intrusions”. The directive required midstream companies to conduct cybersecurity architecture design reviews, instigate specific mitigation measures against ransomware attacks, and implement cybersecurity and recovery plans.

While the attack was a galvanising event for North American midstream assets, the Russian invasion of Ukraine has further spurred action; the US House subcommittee on cybersecurity, infrastructure protection, and innovation subsequently passed cyber legislation and funded US$1 billion in state and local cyber grants. “I definitely think there has been a change in the tone and in the willingness to fully engage in this,” said Brandon Wales, Executive Director at the US Office of Management and Budget’s Cybersecurity and Infrastructure Security Agency (CISA).1

Mountain Valley

In early 2022, the US Court of Appeals (4th Circuit), handed the beleaguered Mountain Valley natural gas pipeline its

latest setback. The 488 km project was planned to move 2 billion ft3/d from West Virginia to Virginia; the US$3.5 billion pipeline, designed to enter service in 2018, has now seen its budget balloon to US$6.2 billion, and its service date pushed back into 2023. The crux of the dispute rests with a 5.6 km stretch that passes through Jefferson National Forest; the court vacated the US Forest Service and Bureau of Land Management decisions to allow access, and has sent the case back to the agencies. In August 2022, however, West Virginia Senator, Joe Manchin, a Democrat often at odds with the Biden administration, got the White House’s agreement to tack on an amendment to a multi-billion tax and climate bill that would streamline the completion of the pipeline.

LNG

In the ensuing scramble to replace Russian gas, Europe is looking to North America to increase LNG exports. US capacity has been climbing rapidly; it exceeded 11.4 billion ft3/d in early 2022, surpassing Australia and Qatar as the world’s largest producer. The Energy Information Administration (EIA), had previously forecast LNG exports would average 9.2 billion ft3/d in 2022, but in June 2022, it noted that exports had surged to 11.5 billion ft3/d for the first four months of the year; almost 75% of that production is now destined for Europe. While a fire at the Freeport LNG facility in Louisiana has dampened output, the Ukraine war is expected to continue an extended time, stiffening European resolve for more North American gas.

In order to deliver more LNG, however, US producers require significant further development of pipelines.

According to the Interstate Natural Gas Association (INGAA), there are over 12 billion ft3/d of major pipeline capacity already in advanced stages of approval before the Federal Energy Regulatory Commission (FERC), primarily to deliver unconventional gas from shale basins. Environmental opposition to further fossil fuel investment complicates development, however. “FERC’s approval is the imperative next step for these important projects,” notes INGAA.2

Saguenay LNG

For the last 8 years, GNL Quebec had been developing an LNG project in Port Saguenay, Quebec. The US$7.2 billion project would have exported up to 11 million tpy to Europe by 2025. The facility was designed to use gas from western Canada (using a new 500 km gas pipeline), and electricity from existing hydroelectric infrastructure to produce the world’s most climate-friendly, super-chilled gas. In addition, the LNG could then be shipped far more cheaply to Europe than LNG emanating from the Gulf of Mexico. In July 2021, however, the Quebec government rejected the proposal (based on climate change concerns), followed by the federal level in early 2022.

The Ukraine war has altered Canadian focus, however. At the behest of Germany, the federal government is now in talks with two companies in eastern Canada, discussing ways to ship energy to Europe. Spanish company Repsol operates a regasification facility in St. John, New Brunswick, where it imports natural gas for the US Eastern Seaboard. Pieridae, based in Nova Scotia, is proposing a 2.4 million tpy floating

26 World Pipelines / NORTH AMERICA 2022

LNG facility in the province. Both projects would take several billion dollars’ worth of investment and multiple years of related infrastructure construction prior to first exports, however.

In addition, Canadian Prime Minister, Justin Trudeau and German Chancellor, Olaf Scholz signed an agreement in August 2022 to promote the development of a hydrogen export facility in Newfoundland. World Energy GH2 plans to build a large scale, zero-emission plant in the deepwater port of Stephenville. The region is renowned for its wind corridor; the plant will rely on 164 land-based wind turbines to power an electrolysis production process.

Supreme Court ruling

In June 2021, the US Supreme Court ruled in favour of federal jurisdiction in a landmark test case. New Jersey, supported by 18 other states, had sought the authority to oppose the use of eminent domain to purchase land along a pipeline running through their jurisdictions. The case was ruled in favour of PennEast Pipeline, which had gained authority from the FERC, to obtain land along the ROW of a 116 mile gas line running from Pennsylvania’s Luzerne County to Mercer County in New Jersey. “This decision is about more than just the PennEast Pipeline Project; it protects consumers who rely on infrastructure projects – found to be in the public benefit after thorough scientific and environmental reviews – from being denied access to much-needed energy by narrow State political interests,” said Anthony Cox, Chair of the PennEast Board of Managers.3 While the Supreme Court decision will have profound impact on future projects, it was a pyrrhic victory for PennEast; the company subsequently announced in late 2021 that it was abandoning the project in the face of hurdles regarding wetlands permits in New Jersey.

Positive developments

Not all tales end in tears; the much-maligned Trans Mountain Expansion is finally nearing completion. The original 300 000 bpd Trans Mountain pipeline has been transporting crude from Alberta to Vancouver, British Columbia, for almost 70 years. Kinder Morgan launched a project to almost triple capacity on the 1150 km line to 890 000 bpd. The US-based company faced so much opposition from the government of British Columbia, First Nations and environmental groups, however, that it sold the project to the federal government in 2018. The result of delays has been a massive cost escalation, from CAN$7.4 billion to CAN$21.4 billion. While protests continue, construction on the line proceeds apace in both British Columbia and Alberta, and is expected to enter service in late 2023.

Enbridge Line 3

Enbridge’s Line 3 crude pipeline, built half a century ago, was designed to carry 760 000 bpd from Alberta to Superior, Wisconsin, but age and corrosion reduced capacity by 50%. A refurbishment plan has been delayed several years by environmental lawsuits. In February, 2020, the Minnesota Public Utilities Commission finally endorsed a revised environmental impact statement, and allowed the

refurbishment to proceed. Environmental and Indigenous groups filed a legal challenge; the Minnesota Court of Appeals ruled in June 2021, that the Commission’s decision was justified. Since then, protestors have periodically occupied ROW sites in an attempt to disrupt construction. In late 2021, Line 3 entered service, offering 620 000 bpd capacity vs 390 000 bpd on the old line.

Regulatory future

In 2021, the government of Canada enacted the Canadian Net-Zero Emissions Accountability Act that provides a legallybinding roadmap to achieve net-zero greenhouse gas (GHG) emissions by 2050. The Act also specifies that emissions are to be reduced up to 45% of 2005 levels by 2030. That same year, the Biden administration announced a target to reduce US GHG emissions by 50% of 2005 levels by 2030.

In addition, however, the White House set out an ambitious target of promoting hydrogen as a clean fuel source, ear-marking billions of dollars to subsidise the cost of green hydrogen and develop infrastructure. While pipeline operators are already reducing methane emissions and decreasing operational footprints, the emergence of a hydrogen economy over the next several decades could have a far more profound impact on the sector.

As a fuel source for heating, hydrogen can be mixed with existing natural gas lines up to around 25% without causing undue problems. Over that, however, it tends to make conventional pipeline steel brittle and erode valves. For transportation, a dedicated network similar to diesel and gasoline would eventually be necessary to deliver large volumes of hydrogen to retail points; such a network would require the investment of hundreds of billions of dollars. Governments would need to work hand-in-hand with refineries, pipeline companies, retailers and vehicle developers to enhance viability and reduce risks.

In conclusion, while the environmental pressures directed toward all sectors of the hydrocarbon sector remain dominant, the Ukraine war has elevated energy security back into the fore. The former faction is maintaining businessas-usual by using regulatory frameworks to stifle pipeline development; proponents of the latter have the leverage of having to deal with the turmoil that the conflict has brought to energy worldwide. Potential solutions abound; both environmentalists and fuel providers, for instance, could work toward an eco-friendly hydrogen economy that would reduce carbon emissions and simultaneously liberate many jurisdictions from the kind of threat imposed when energy is weaponised. While such a grand coalition is possible, the likelihood of success under the current adversarial environment permeating North America’s legal and regulatory regime is daunting.

References

1. thehill.com/policy/cybersecurity/3480165-colonial-pipeline-was-cyberwake-up-call-ukraine-war-is-escalator

2. oilprice.com/Energy/Natural-Gas/What-Is-Keeping-America-From-RealizingIts-LNG-Potential.html

3. stateimpact.npr.org/pennsylvania/2021/06/29/u-s-supreme-court-rulespenneast-pipeline-project-can-use-eminent-domain-to-take-n-j-state-land

NORTH AMERICA 2022 / World Pipelines 27

28

Disruptions are a constant new normal for supply chains, say Patrick Long and Michael Wohlfarth, Opportune LLP, USA. Here’s why it’s critical to plan and focus on digital transformation to prepare your organisation.

ipelines play an integral role in the overall supply chain for oil and refined products. The nation’s more than 2.6 million miles of pipelines offer an economic and dependable mode of transportation that’s used pervasively today. How reliable are supply chains? Looking at the headlines in a post-COVID-19 world shows us that you can no longer take any aspect of your supply chain for granted. Disruptions are sure to abound. You need to be prepared for them.

Planned disruptions – learning from the past The first category of supply chain disruptions is those that are planned (or they are at least known with some warning). Life along the Gulf Coast and East Coast means hurricanes from early summer through November. You can count on some disruption based on models. The National Oceanic and Atmospheric Administration (NOAA) put out a headline that reads: ’NOAA predicts above-normal 2022 Atlantic Hurricane Season’. This is the seventh consecutive season that has higher-than-normal chances for more active hurricanes.

29

What does this headline portend for the upcoming hurricane season? Based on the research, there’ll be between six to 10 hurricanes and between three to six major ones. Having lived through Tropical Storm Allison and Hurricane Harvey, the intensity of the storm doesn’t always dictate the amount of destruction that it will wreak. Major hurricanes in the future are likely to cause more damage. However, tropical storms can also be just as, if not more, destructive.

Patterns of demand – prepare for supply chain weaknesses

So, how does this relate to oil and refined products? Patterns from the past can help prepare companies to deal with the inevitable disruptions from future storms. While no one plans for the exact timing of a hurricane, you can bet on there being disruptive storms based on the models. And, when a hurricane heads towards the Gulf of Mexico the focus starts to become the ‘cone of uncertainty’. The ‘cone of uncertainty’ is the forecasted path of the storm. As it nears shore and more data is known, the cone narrows and the path becomes more definite. Since hurricanes are slow-moving forces of nature, there tends to be some time

that individuals and organisations can be prepared. For those that will evacuate, it’s critical to pack up and get moving ahead of the rush of traffic seeking to top off their tanks with gasoline and diesel. For those that choose to remain behind and ride it out, there are trips to fill gas and diesel for generators.

When individuals start to react, they generate a surge in demand for fuel and hurricane supplies. Aggregated together, these activities create a spike in demand that’s different than normal activity. Downstream trading companies rely on forecasted demand to determine how much fuel to either produce (in the case of a refiner) or how much fuel to move into a region (in the case of a wholesaler) to keep terminals and downstream gas stations supplied. If companies can recognise this spike in demand early enough, they can be ready all along the value chain to ensure that consumers aren’t faced with an empty pump.

Run-outs aren’t always avoidable

Despite the algorithms that abound and the tremendous amounts of planning, run-outs of refined products like gasoline and diesel do occasionally happen. Depending on the intensity of a particular hurricane or tropical storm, rigs in the

Figure 1. Percentage of stations without gas as a result of the 2021 hacking of the Colonial Pipeline. (Source: Michael Wohlfarth, Opportune LLP)

30 World Pipelines / NORTH AMERICA 2022

Gulf of Mexico will be shut-in and crews evacuated. Ceasing production of oil in the Gulf of Mexico reduces the available supply of crude being pumped to refineries onshore. While not a short-term issue, given the aftermath and destruction, the effects could take their toll on reduced crude and, therefore, reduced refined products like gasoline and diesel.

If the storm is intense, then pipelines could also shut-in operations for safety reasons. A pipeline disruption causes inevitable supply chain issues at destinations. There is only a fixed quantity of fuel stored at major terminals off pipelines like the Colonial Pipeline, which runs from the Gulf Coast up the East Coast to New Jersey. When news travels and concentrated populations rush to fuel their tanks, cities that aren’t located along the Gulf Coast can be caught unaware. These spikes (though predictable with 20/20 hindsight) result in headlines in local newspapers. Atlanta is usually one of the first major cities to experience temporary shortages. This is then followed by North Carolina and other cities up the East Coast, pending the storm’s path and the commensurate path of the panicked demand.

Unplanned disruptions – learn to recognise your blind spots

Many energy companies rely quite heavily on pipelines as a part of their supply chain. And, thankfully, this mode of transportation offers a high degree of dependability. However, without knowing and planning, this comfort level

can become a ‘blind spot’ for an organisation. Completely unplanned disruptions in the supply chain are the second category of disruption.

Take the hacking of Colonial Pipeline as a prime example. That news took the entire country (and the world) by surprise. It immediately created a situation of extreme panic in the localised populations. Was there any rational truth to the spike in demand? No. Consumers weren’t going to drive more in the upcoming week. Companies weren’t going to ship more products in the upcoming days. However, what happened with the shock of the news was that individuals acted in their self-interest. It was a sudden shock that was amplified by news coverage. When rumors started that gas stations were going to run out, panic ensued. The result created a self-fulfilling prophecy that caused run-outs.

Stories proliferated on the news of people filling any container they had with gasoline. The US Consumer Product Safety Commission sent out a tweet urging people not to use plastic bags with gasoline. All rational thinking seemed to evaporate overnight.

Figure 1 shows the Colonial Pipeline and the impact of the shock. Note that not all states reacted the same way. Those in the South seemed to have a larger knee-jerk reaction and, therefore, spiked demand greater than those in the North. The important takeaway is to understand your potential vulnerability and learn from it. If there are more likely to be wild swings in one part of the country, it’s

imperative to have contingency plans in place for the supply of fuel should there be an unplanned outage.

Knowledge is power

Planned and unplanned disruptions are a constant and the new normal in supply chains. At some point, there’ll be an abnormal spike in demand. Therefore, companies can plan accordingly. The first step is to digitise your supply chain. Ensure you have accurate tracking of inventory and logistical movements. Then, combine analytics on top of the data. Specifically, bring in weather data in such a way that you can utilise the forecasts to track the disruptions and anticipate them ahead of time.

In Figure 2, the weather data has been combined and overlaid on top of the Colonial Pipeline. The track of the hurricane is plotted along with key areas for terminals. The powerful combination allows you to know where to anticipate low inventory levels due to the spike in demand ahead of a storm. And, given advanced warning, most importantly, companies can act early to avert such issues.

Getting started and being prepared

Weather disruptions can affect supply chains, but there are ways to prepare for them. Opportune has the deep energy industry expertise and unique technical and business skills to help layer in solutions so that an organisation can increase its overall capabilities and not feel vulnerable to Mother Nature’s elements. Our subject matter experts can evaluate critical assets within your supply chain and implement analytics to provide the necessary visibility and insight into critical components: inventory and logistics being two of the most important.

Then, our experts can work with your organisation to implement a fit-for-purpose optimisation engine. It doesn’t need to feel daunting. Gone are the days of needing to hire a multitude of PhDs or quants for the sole purpose of implementing an optimisation tool. We’ll either guide a packaged solution implementation or customise one that fits your specific needs – no matter how complex.

It’s never too late to start. With the hurricane season underway, it’s imperative to act now and evaluate the overall health of your organisation’s energy supply chain.

Figure 2. Hurricane Ida storm path that follows closely along the Colonial Pipeline. (Source: Michael Wohlfarth, Opportune LLP)

32 World Pipelines / NORTH AMERICA 2022

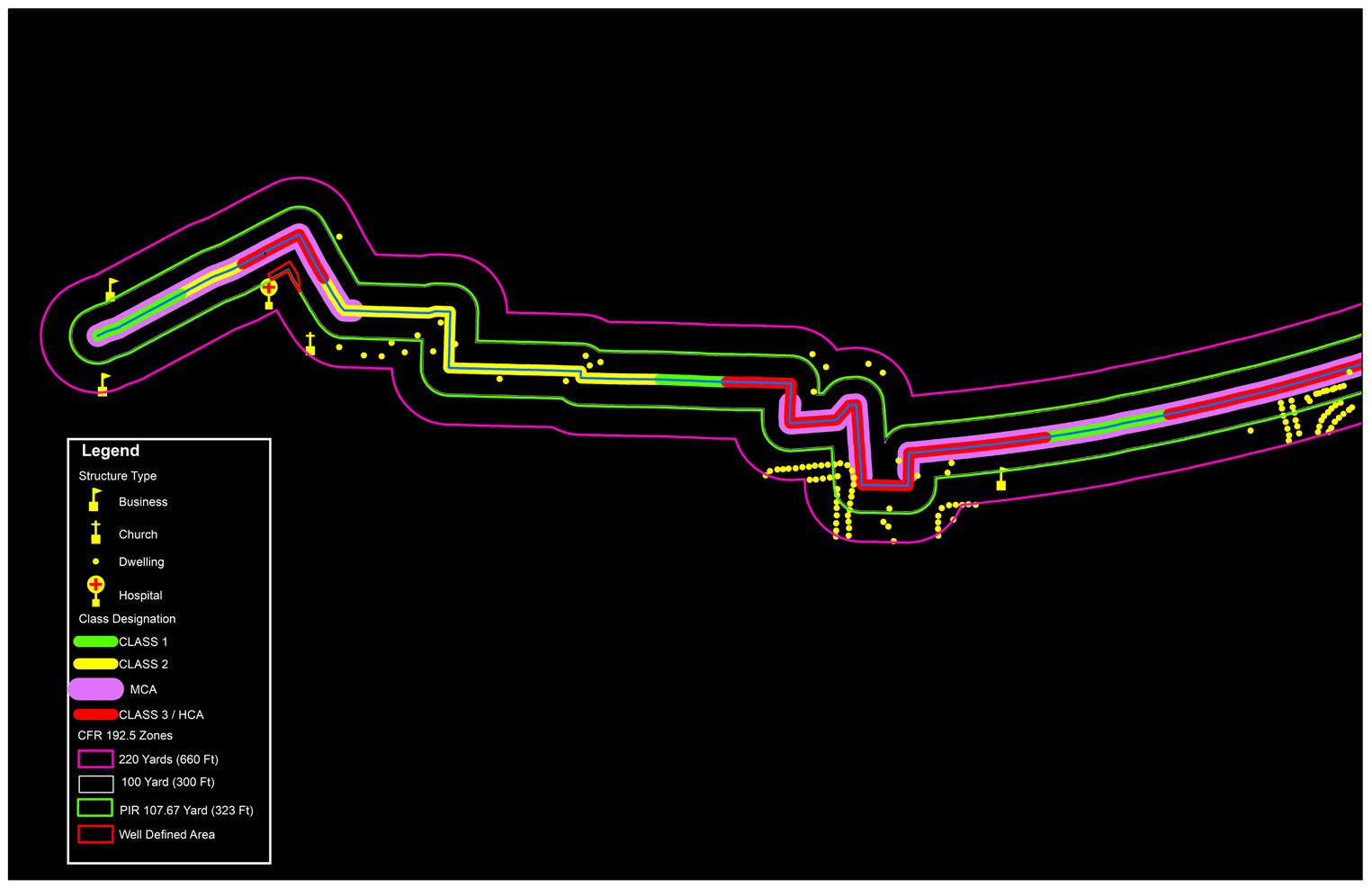

ipeline standards and regulations specifically require staff to be both competent and qualified in the tasks they perform. ASME B31.8S 2004 states, “The personnel involved in the integrity management programme shall be competent, aware of the programme and all of its activities, and be qualified to execute the activities within the programme.” Why do they need to be qualified? Is being competent not enough?

With the globalisation of our workforce, the ability to verify the competence of a person becomes more important. Individuals can claim they have the knowledge, skills and experience necessary, but how can one be sure? Organisations have no way of knowing whether educational programmes or training from different countries are equal. Does the same job title mean people have the same experience?

Most likely not – and this is where ‘qualified’ comes in. ‘Qualified’ is commonly defined as individuals that have been evaluated and can perform assigned tasks.

Often times, organisations have ‘qualified’ their workforce by only assessing their personnel’s level of education and/or experience against their own processes and criteria, omitting the formal link

between their education/experience and the knowledge and skills needed to perform a job successfully.

Competence = skills + experience + knowledge

The US National Transportation Safety Board (NTSB) concluded in their safety study ‘Integrity Management of Gas Transmission Pipelines in High Consequence Areas’ that “the professional qualification criteria for pipeline operator personnel performing IM functions was inadequate” and stated, “Only one operator listed any required training beyond a basic familiarity with the company’s IM programme and the federal IM regulations.”

Important to note here is that how a person is qualified is as important as the qualification criteria themselves. These ‘employer-based’ qualifications can lead to a variety of criteria, inconsistencies and maybe even a lack of credibility. Additionally, the integrity of these assessments is jeopardised by threats to impartiality caused by:

) Self-interest threats that arise from a person or body acting in it’s own interest to benefit itself.

Karen Collins, ROSEN USA and Ralf von Rahden, CERTivation GmbH, Germany, emphasise the importance of globally-accepted processes of assessment, especially when becoming certified in pipeline management.

33

) Subjectivity threats that result from personal bias overruling the objective evidence.

) Familiarity threats that occur when the assessor is familiar with the person being assessed, affecting their objectivity.

Although these processes, criteria and assessment results are documented, they are not usually ‘certified’ (a verification that the product, service or system in question meets specific requirements).

The terms ‘competent’, ‘qualified’ and ‘certified’ are often confused with each other; while not the same, they are interrelated. You can be competent but not qualified or certified. Similarly, you can be qualified and competent but not certified.

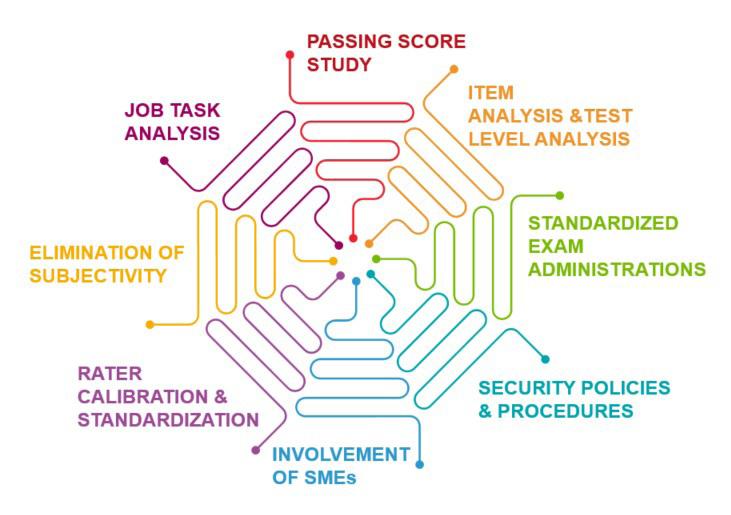

Certification can only be achieved through independent third-party assessments that provide a neutral setting to assess personnel competence, adding credibility to the results. Additionally, certification of persons can only occur when there is a certification scheme.

ANAB Accreditation

Just as individuals are certified, organisations are accredited. Accreditation is the formal recognition by an independent body, generally known as an accreditation body, that a certification body operates according to international standards.

The International Organisation for Standardisation (ISO) and the International Electrotechnical Commission (IEC) developed ISO/IEC 17024:2012 Conformity assessment – General requirements for bodies operating certification of persons “with the objective of achieving and promoting a globally accepted benchmark for organisations operating certification of persons. Certification for persons is one means of providing assurance that

the certified person meets the requirements of the certification scheme. Confidence in the respective certification schemes for persons is achieved by means of a globally accepted process of assessment and periodic re-assessments of the competence of certified persons.” 1

Certification bodies must demonstrate that their assessment process is fair, valid and reliable, giving all eligible applicants an equitable opportunity to participate in order to achieve accreditation. The 2014 Standards for Educational and Psychological Testing manual states, “The central idea of fairness in testing is to identify and remove construct-irrelevant barriers to maximal performance for any examinee.”

Validity is an indicator to establish that the process measures what it is intended to measure, and reliability shows that the test measures a person’s abilities in a consistent manner.

As of 22 December 2021, CERTivation GmbH, a wholly owned subsidiary of the ROSEN Group, received accreditation by the ANSI National Accreditation Board (ANAB), for fulfilling the requirements of ISO/IEC 17024:2012 Conformity assessment – General requirements for bodies operating certification of persons within the certification schemes Certified in Pipeline Integrity Management: CS_014F and Certified in Pipeline Defect Assessment: CS_020F.

A certification scheme details the competence (knowledge, skills and abilities) and other requirements, including such prerequisites as experience, education and mentoring. Qualification criteria, by contrast, may only define education and experience requirements. The certification scheme must be verified through a job task analysis (JTA) to ensure the job tasks reflect current industry needs.

There are several methods for conducting a job analysis, including interviews, focus groups, surveys and job observation.

CERTivation chose to use a survey to conduct the JTA. Approximately 1500 pipeline integrity engineers, operators, industry practitioners, regulators and industry consultants in 46 countries were invited to participate in the survey. Respondents could select from four different languages in which to take the survey: English, Spanish, Russian and Portuguese. The JTA is only the first of many required steps necessary to meet the requirements laid out in ISO/IEC 17024:2014.

Ensuring test fairness is a fundamental part of validity, starting with a clear definition of the construct – the knowledge, skills and abilities – intended to be

Figure 1. The ROSEN Group now offers ANAB accredited certification in Pipeline Integrity Management and Pipeline Defect Assessment.

34 World Pipelines / NORTH AMERICA 2022

Midwestern’s line of high-performance recovery winches with line pull from 30,000 to 100,000 lb, can be installed on various types of construction equipment. These winch packages tie into the machine hydraulics, use the existing cab controls, and are easy to install. Make your equipment more versatile by adding on one of our recovery winches. MIDWESTERN - built for the toughest jobs.

sidebooms.com I 918-858-4201

The print issue is distributed to a global audience of industry professionals (verified by ABC). Register to receive a print copy here: worldpipelines.com.magazine/worldpipelines/register

Wherever you are, World Pipelines is with you.

Prefer to read the issue online? The digital flipbook version is available here: worldpipelines.com/ magazine/world-pipelines

www.worldpipelines.com

measured, and the development of assessment questions (items) that are explicitly designed to assess the construct that is the target of measurement.

Each exam question was reviewed to identify and remove invalid aspects of test questions that might hinder people in various groups from performing at levels that allow appropriate inferences about their relevant knowledge and skills. The review of items was performed by individuals who are familiar with the specifications and purpose of the test, the subject matter of the test as necessary, and the characteristics of the test’s intended population. Subjectmatter experts reviewed items to identify any that were likely to be inappropriate, confusing or offensive for groups in the test-taking population. Important aspects of the review included:

) Content accuracy.

) Suitability of language.

) Match of items or tasks to specifications.

) Completeness and appropriateness of scoring rubrics.

) Appropriateness of presentation and response formats.

) Appropriateness of difficulty.

Fairness was also addressed using empirical methods; each item was beta-tested through psychometric analysis and calibrated based on the fit statistics – p-values, pt-biserials, etc. – reducing each exam to a 40 question multiple-choice exam.

Certified in Pipeline Integrity Management: CS_014F

Individuals certified in Pipeline Integrity Management can define, and distinguish between, different integrity management methods/techniques – particularly pipeline integrity management and systems – and can list the threats to pipeline safety and the consequences of pipeline failure.

The programme was designed for individuals working in pipeline integrity who either have a university degree from a recognised or accredited university, 4 years of relevant work experience in the pipeline integrity field, an engineering degree from a recognised or accredited university, or a professional engineering qualification such as PEng or CEng.

Applicants must have 100 hours of experience, 18 hours of training and 36 hours of mentoring to be eligible. Applicants must pass an online, computer-based, 40-question, multiple-choice

Pipeline Integrity Management: CS_014F certification examination under the supervision of a live invigilator to be certified in the competency. Topics covered on the exam include:

) Various approaches to pipeline integrity management.

) Standards requirements (including ASME B31.8S, API 1160, API 1173, CSA Z662, DNV RP F116, BSI 8010-4, EN 16348).

) Interpreting inspection and survey reports and inspection, testing, maintenance and surveillance options (all methods).

) Risk-reduction options, preventive measures and mitigations.

) Establishment of baseline inspection and testing intervals.

) Defect assessment, including fatigue assessment.

) Pipeline repair and rehabilitation; repair-programme design.

) Threats to pipeline integrity and consequences of pipeline failure.

) Critical data, missing data, treatment of uncertainty.

) Emergency preparedness, emergency response, site investigation.

Certified in Pipeline Defect Assessment: CS_020F

Individuals certified in Pipeline Defect Assessment can describe pipeline integrity and pipeline defect assessments (for all types of defects found in pipelines) and can summarise and give examples of fatigue assessments. The programme was designed for individuals working in pipeline integrity who either have a university degree from a recognised or accredited university, four years of relevant work experience in the pipeline integrity field, an engineering degree from a recognised or accredited university, or a professional engineering qualification such as PEng or CEng.

Applicants must have 100 hours of experience, 18 hours of training and 36 hours of mentoring to be eligible.

Applicants must pass an online, computer-based, 40 question, multiple-choice Pipeline Integrity Management: CS_020F

certification examination under the supervision of a live invigilator to be certified in the competency. Topics covered on the exam include:

) Material properties (with a detailed focus on fracture toughness).

) Fracture mechanisms (brittle, transitional, ductile) and fracture mechanics approaches (including J integral and crack-tip opening displacement).

) Assessment of corrosion using ASME B31G, assessment of cracks using API 579/BS 7910 and assessment of mechanical damage.

) Pipeline failure causes (including external interference, external forces, corrosion, fatigue ground movement, sabotage, theft, human error [including over-pressure, over-temperature] spanning, hydrodynamic loads, buckling and thermal stressing).

) Effect of hydro-testing on defect behaviour.

) Commercial, corporate, political and sabotage threats to pipelines and facilities.

) Case studies in pipeline failures, modes and mechanisms.

) Corrosion growth and fatigue-crack growth models.

References 1. www.iso.org/obp/ui/#iso:std:iso-iec:17024:ed-2:v1:en

36 World Pipelines / NORTH AMERICA 2022

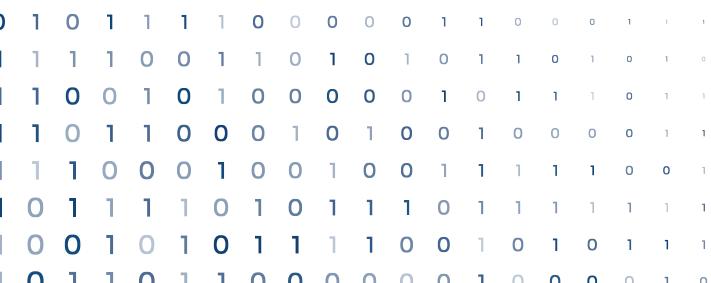

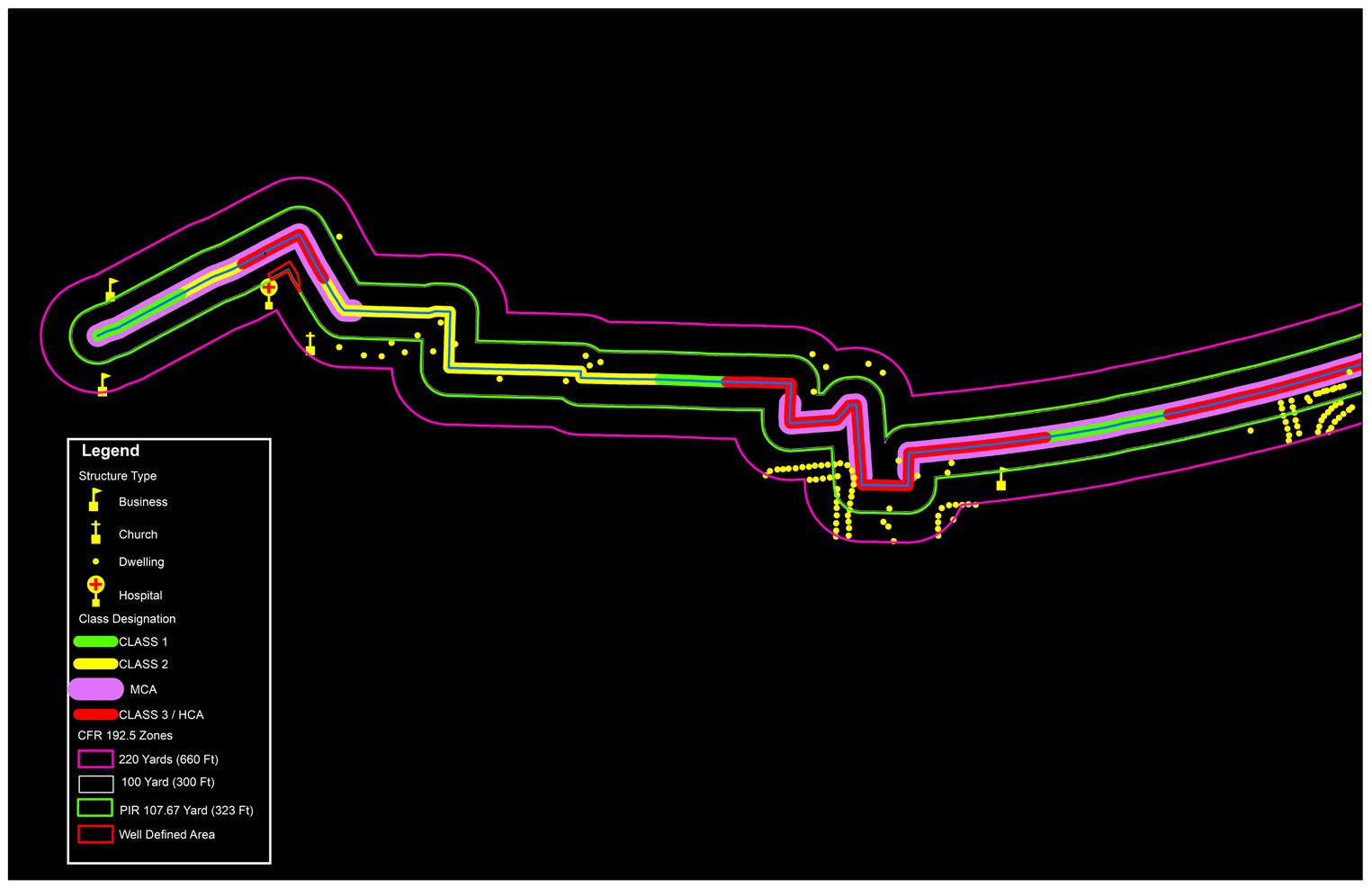

ipeline operators across the world are migrating to the concepts of geospatial data and developing a digital twin of their organisation. When you hear the name Enduro, what comes to mind? Pipeline cleaning programmes? ILI combo smart pigs? How about GIS experts? As the industry is evolving, so is Enduro. Family-owned and operated since 1988, the next generation is now bringing the next stage of growth. With this growth, Enduro is ready to offer even more services to the industry, and aid in the process of operators developing the coveted digital twin.

A long-time provider of sub-meter centrelines, Enduro now has over 25 years of combined expertise within our in-house GIS Team. Having such a well-versed team gives Enduro a unique advantage in the industry; this team uses advanced IMU navigation equipment within our ILI tools that complement our PigProg software containing specialised GIS tools. When pairing the tools available, and the team’s extensive knowledge

of the industry, clients can be confident in the centreline data produced. PigProg also connects to a geospatial system utilising ArcGIS to produce deliverables the client can integrate into their GIS database with ease. Clients will find that working with Enduro to produce submeter centrelines is a seamless process and budget-friendly. Imagine having one data set to integrate into your organisation’s GIS database, vs multiple imports that are difficult to align.

Moving towards efficiency, Enduro has developed an in-house app used for tracking and developing AGM Site Documentation. We have created a GIS tracking crew that can now multi-task in the field using our Enduro PigTrack App. This app allows our GIS crew to collect data in the field directly into a database, eliminating human errors that can occur when manually transferring data. From collecting XYZ data, to snapping the appropriate site pictures, our crews create the site documentation required while in the field. Clients will now

Vicky Laymon-Hodson, INS/GIS Analysis Team Lead and Matthew Reynolds, INS/GIS Level 4 Analyst, Enduro Pipeline Services, USA, discuss staying up-to-date with PHMSA CFR 192 and 195 requirements.

Vicky Laymon-Hodson, INS/GIS Analysis Team Lead and Matthew Reynolds, INS/GIS Level 4 Analyst, Enduro Pipeline Services, USA, discuss staying up-to-date with PHMSA CFR 192 and 195 requirements.

37

have the final deliverable within days, vs weeks with previous industry methods. When preparing for IMU services, and in order to ensure sub-meter mapping, our crew will collect additional control points while they are in the field, saving time and money for our client. Long gone are the days of sending

crews to the field multiple times to collect the extra data needed.

Tackling pipe strain

The industry now seeks the advanced services of pipe ‘bending’ strain and pipe movement.

Hiring an additional vendor to supply this data is now a thing of the past; Enduro has worked with strain experts to develop systems to accurately detect and report strain along the pipeline. Geotechnical threats, particularly landslides, have brought pipelines into the spotlight with increased pipeline construction in the Marcellus region.