OCTOBER 2025

VOLUME 8 ISSUE 9

OCTOBER 2025

VOLUME 8 ISSUE 9

For over 45 years, we’ve been at the forefront of innovation, providing advanced Sizer technology to industries around the globe. Whether it’s soft, sticky material or hard abrasive rock, our tailored Sizers and Sizer Stations, powered by cutting-edge technology, offer reliable and efficient solutions to simplify the complexities of modern mining operations.

As a turnkey provider, we bring both the expertise and the equipment to deliver end-to-end solutions—from initial concept and design, through to manufacturing, installation and ongoing aftersales support. We’re not just a supplier; we’re your partner on a sustainable journey, committed to helping you optimize performance, reduce costs and achieve long-term success.

28 The Journey Towards Underground Electrification

05 Industry

10 Australian Mining In 2025

Claire Boyd, Justin Mannolini, and David Stokes, Gilbert + Tobin, assess the current mining landscape in Australia, discussing how the sector is responding to challenges such as geopolitical volatility, market turbulence, and a shift in investment attractiveness.

14 Digging Deep: How Drones Are Moving Into Underground Mining

Eloise McMinn Mitchell, Flyability, Switzerland, explores the applications of drones in underground mining.

19 A Tipping Point In Aerial GIS Tech

Emily Loosli, Wingtra, Switzerland, evaluates the use of drones in the mining industry and considers if mining companies are losing out by not using them.

23 Why Electrification? Why Now?

Vedrana Spudic, ABB, Switzerland, delves into the mining industry’s journey towards electrification, considering both the benefits and challenges of the energy transition.

Mika Kinnunen and Samu Kukkonen, Normet, Finland, consider how the mining industry has become a pioneer of technological advancement during its journey towards electrification.

32 Maximising Underground Efficiency

AJ Householder, Getman, USA, explains the role of multi-purpose utility machines in modern mining.

36 Sustainability As A Strategic Asset

Francesco Giuseppe Lanzillotta, Klüber Lubrication, Germany, highlights how environmentally acceptable lubricants make modern mining more efficient and responsible.

40 Full Charge Ahead

Elitza Terzova, Shell Lubricant Solutions, outlines how miners can meet growing demand for critical energy transition minerals.

45 Maintenance Challenges Crushed

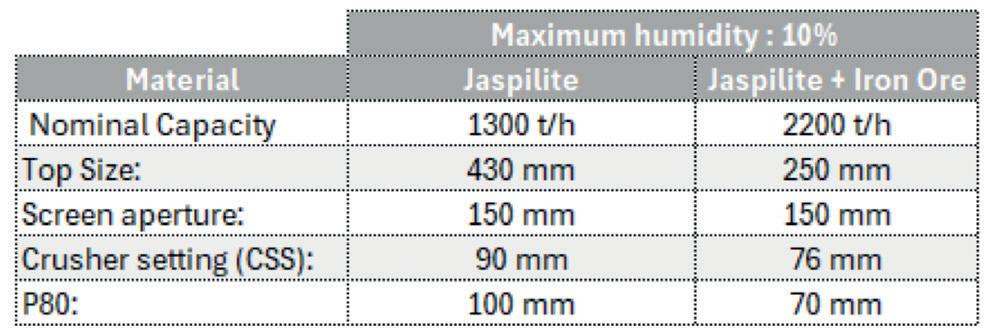

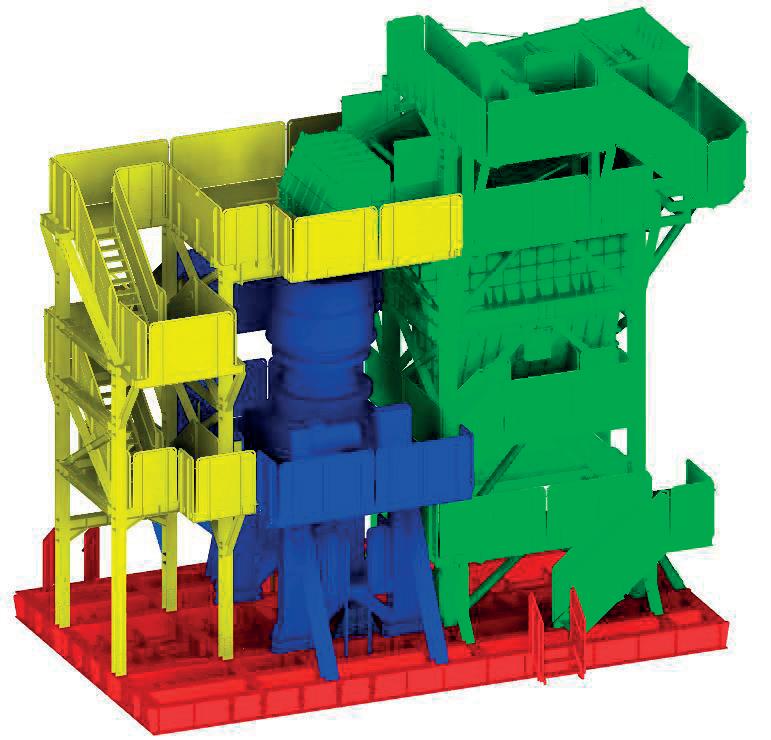

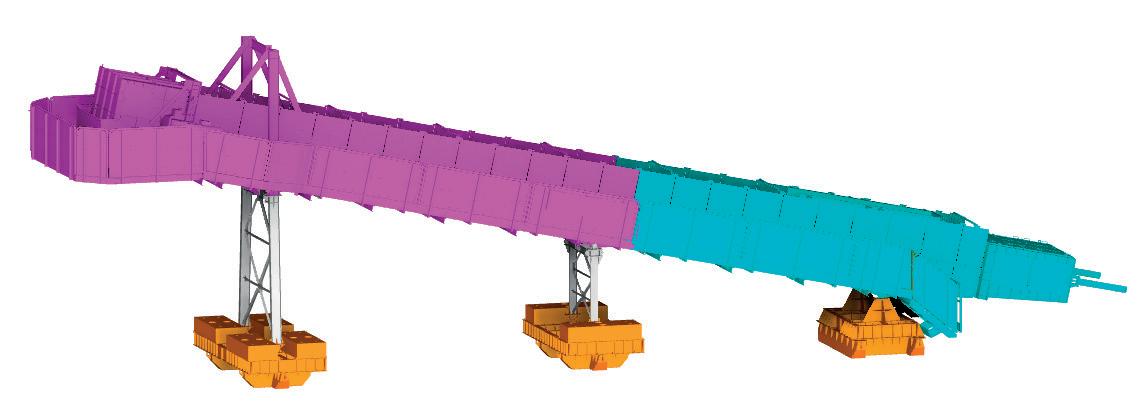

Luiz Fernando Prado Leme, Daniel Nagano da Silva, and Renato Luiz Machado, Metso, detail how a new compact solution resolved a key maintenance issue at a crushing plant with reduced implementation time.

49 Sourcing Sustainable Solutions

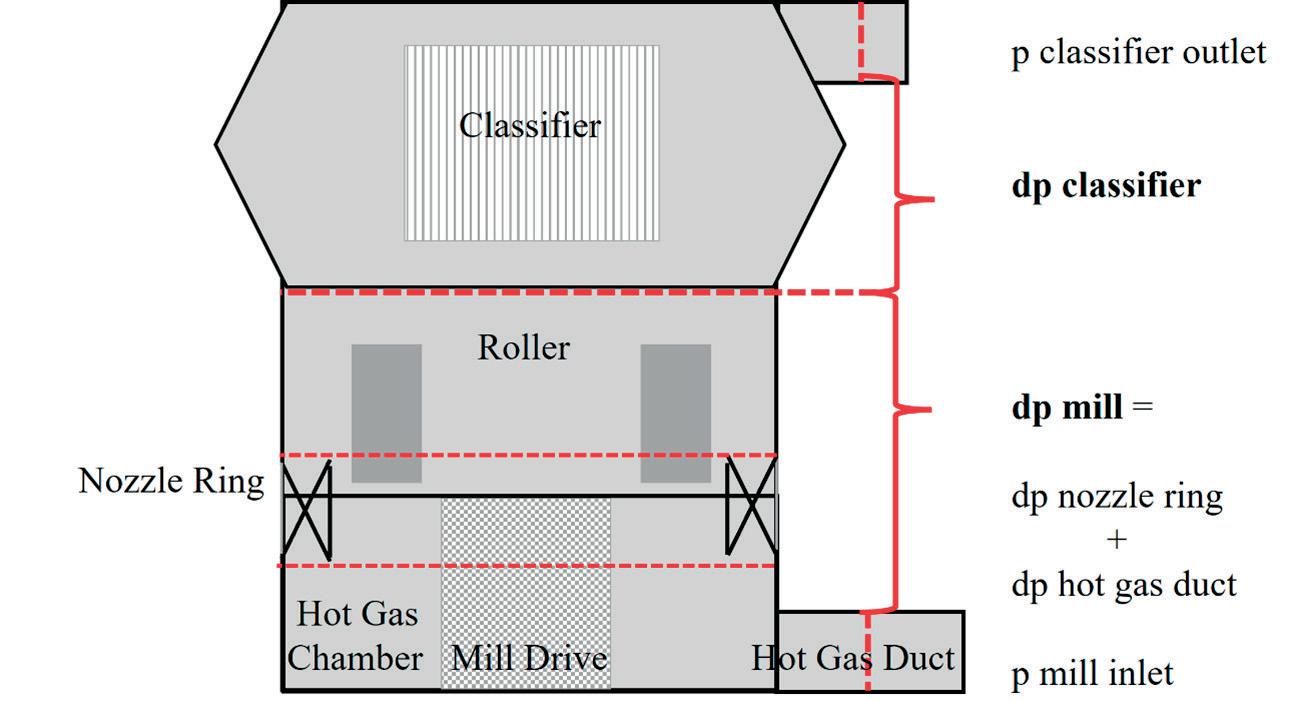

Dr. Caroline Woywadt, Gebr. Pfeiffer, Germany, weighs up some of the challenges facing the comminution sector and spotlights vertical roller mill technology as a possible solution.

53 Sustainable Strategies In Mining

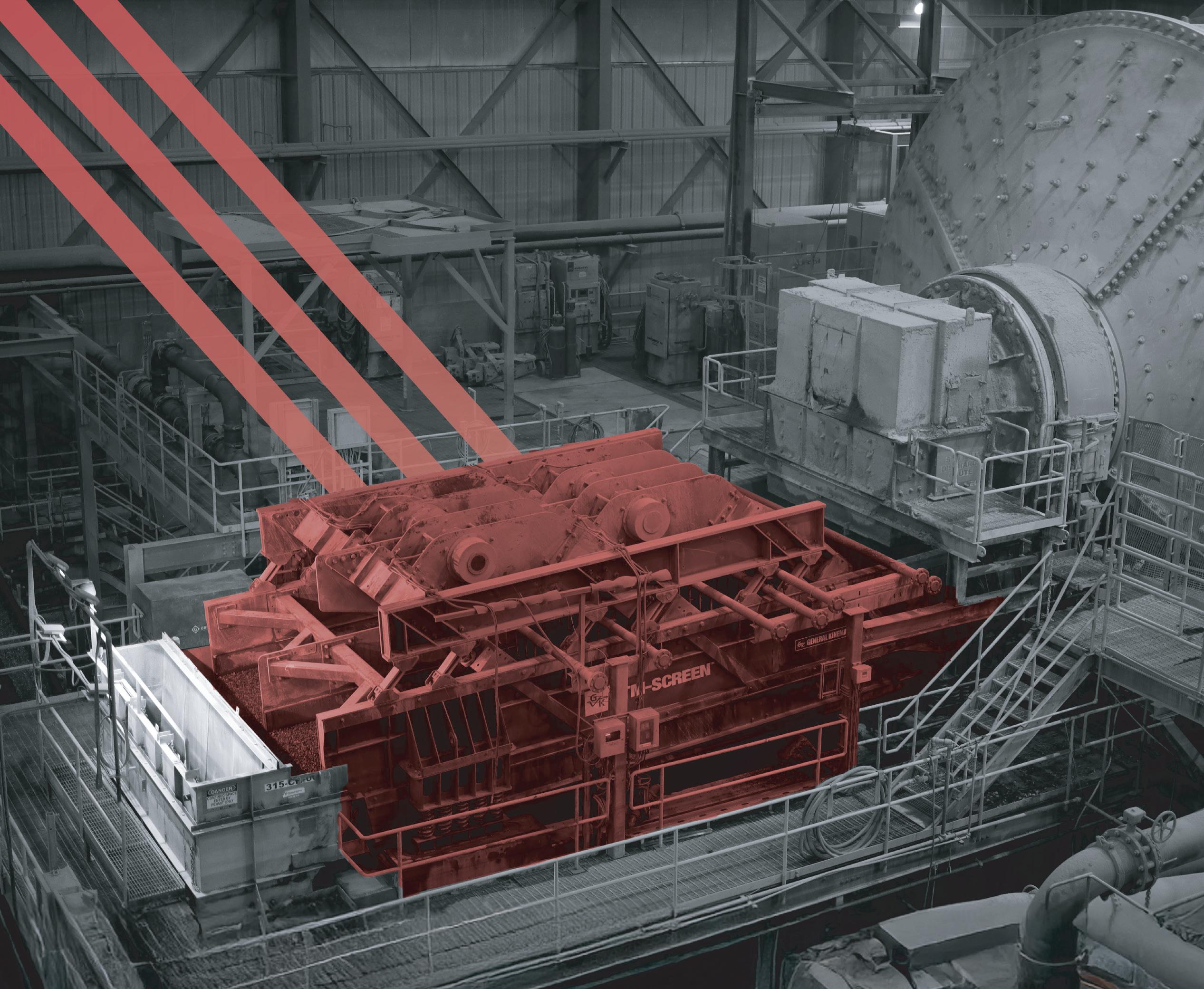

Karen Thompson, Haver & Boecker Niagara, Canada, discusses incorporating equipment, technology, and tactics for sustainability and profitability in mining.

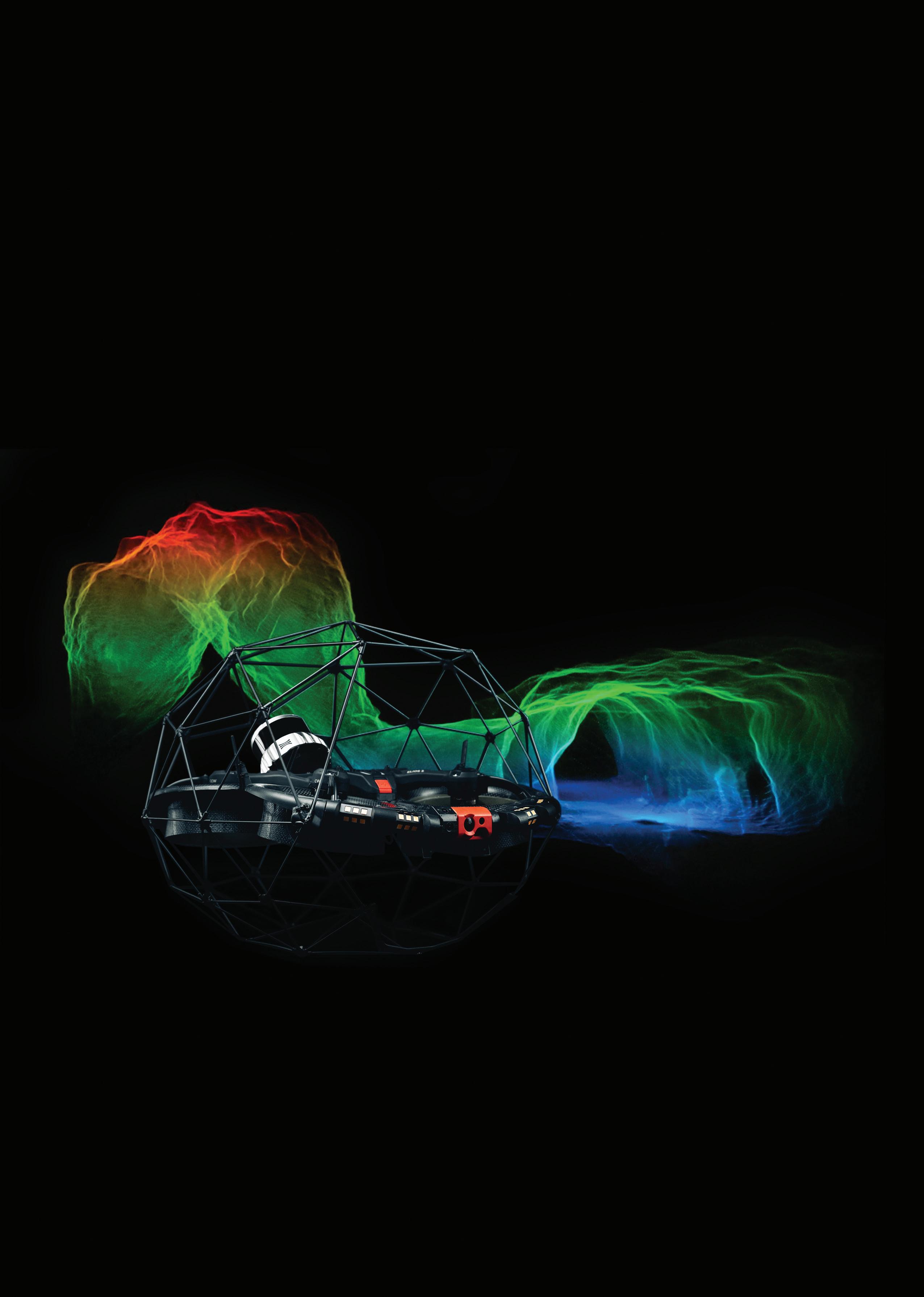

Bringing drones underground! Swiss company Flyability is deploying its Elios drones in underground mines. With a 4K camera and centimetre-accurate LiDAR sensor, the Elios 3 is already used by mines around the world, offering a safer, faster way to gather data in tricky environments.

Our commitment to you, our customers, is guided by three words; SAFETY, SERVICE, and INNOVATION. We are constantly moving forward creating products of the highest quality and providing you with the services which make the impossible possible.

At JENNMAR fabrication takes place in our numerous strategically located manufacturing facilities associated with our affiliated brands. From bolts and beams to channels and trusses, to resin and rebar, and more, JENNMAR is ideally positioned to meet the industrial fabrication demands of our customers. Our ability to provide our customers with a complete range of complementary products and services ensures quality, efficiency, and availability resulting in reduced costs, reduced lead times, and increased customer satisfaction!

From our Engineers to our Technical Sales Representatives we work tirelessly with you to ensure your safety is at the forefront. We will be with you every step of the way.

MANAGING EDITOR

James Little james.little@globalminingreview.com

SENIOR EDITOR

Callum O’Reilly callum.oreilly@globalminingreview.com

EDITOR

Will Owen will.owen@globalminingreview.com

EDITORIAL ASSISTANT

Jody Dodgson jody.dodgson@globalminingreview.com

SALES DIRECTOR

Rod Hardy rod.hardy@globalminingreview.com

SALES MANAGER

Ryan Freeman ryan.freeman@globalminingreview.com

PRODUCTION MANAGER

Kyla Waller kyla.waller@globalminingreview.com

ADMINISTRATION MANAGER

Laura White laura.white@globalminingreview.com

DIGITAL ADMINISTRATOR

Nicole Harman-Smith nicole.harman-smith@ globalminingreview.com

DIGITAL CONTENT COORDINATOR

Kristian Ilasko kristian.ilasko@globalminingreview.com

JUNIOR VIDEO ASSISTANT

Amélie Meury-Cashman amelie.meury-cashman@ globalminingreview.com

HEAD OF EVENTS

Louise Cameron louise.cameron@globalminingreview.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@globalminingreview.com

EVENT COORDINATOR

Chloe Lelliott

chloe.lelliott@globalminingreview.com

China’s exports of rare earth products, including magnets, extended their recovery in July, with volumes sold overseas rising 69% to 6422 t. A recovery that only highlights the severity of the restrictions imposed in April on seven REEs – their alloys, finished goods containing REEs (such as sputtering targets), and, of course, magnets – instituted by the Chinese government and aimed directly at damaging Western defence and automotive sectors.

The US auto industry was thrown into chaos, and it was willing to pay any price to get the materials so central to EVs, while the defence sector was the greater threat and target. It is more than anecdotal that you cannot start an F-35 without REEs; each F-35 contains approximately 900 lb.

Whilst there is some stability now due to restored exports, China continues to flex its leverage against foreign nations in warning international companies against rare earth stockpiling and releasing its 2025 REE mining quotas with no fanfare – a sign it is determined to keep control moving forward.

The US is dependent upon China for 74% of its REEs, but when it comes to midstream processing this rises to 90%. It has been working for a number of years to regain control of these critical minerals, with the DoD working, via the 1950 Defence Production Act, to build out supply chains. MP Materials, which is fast emerging as a US-based monopoly, was awarded a US$400 million equity investment (beginning to rectify one big issue with MP in that one of its largest shareholders was the Chinese Shenghe Resources) and a US$150 million loan to Mountain Pass – its REE mine and separation facility. MP has also been given an unprecedented 10-year take-off agreement and a 10-year price protection per kilogram.

Funding has also gone towards MP’s Independence plant, its first downstream process, but it is only focused on one end product, neodymium-iron-boron magnets. So how far has the US really come in securing its supply chains – particularly midstream?

Japan has been the most self-sufficient in critical materials since 2010, when China implemented REE controls. The government is a major investor in Lynas Rare Earths. Individual critical mineral-using applications – e.g. capacitors – are considered critical goods. Japan is partnering with the EU under the ‘economic two-plus-two’ dialogue, creating a collaborative sourcing channel to bypass Beijing’s dominant market position.

The UK developed its first critical mineral strategy in 2022, and the next iteration, the first from this new government, is due by the end of September, with more funding and specific policies to support the midstream anticipated. This follows the Modern Industrial Strategy published in June, which outlines eight key industries to be developed, and the critical mineral strategy is set to outline how critical mineral needs will be developed to further these.

Australia and Canada, being rich sources of critical minerals, have also stepped-up their investments and partnerships; Ontario launched a CAN$3.1 billion critical minerals plan, whilst Australia has launched an ambitious US$1.2 billion programme to purchase critical minerals, building upon the US$15 billion announced last year to boost domestic manufacturing and renewable energy.

Aside from sovereigns, commercial clients have clearly been very concerned. They want alternative, non-Chinese supply of REEs and critical minerals, and to spread their supply chain risk.

At Metalysis, we have seen an uptick in inquiries from clients in the semiconductor supply chain, hypersonics, clean energy, and other advanced industries who all want to know that there is a western midstream processor who can provide high grade advanced materials to their specific physical and chemical specifications.

At scale, Metalysis is using its technology to help address the West’s critical material needs, with the aim of doing better than a “hope for the best, plan for the worst” approach.

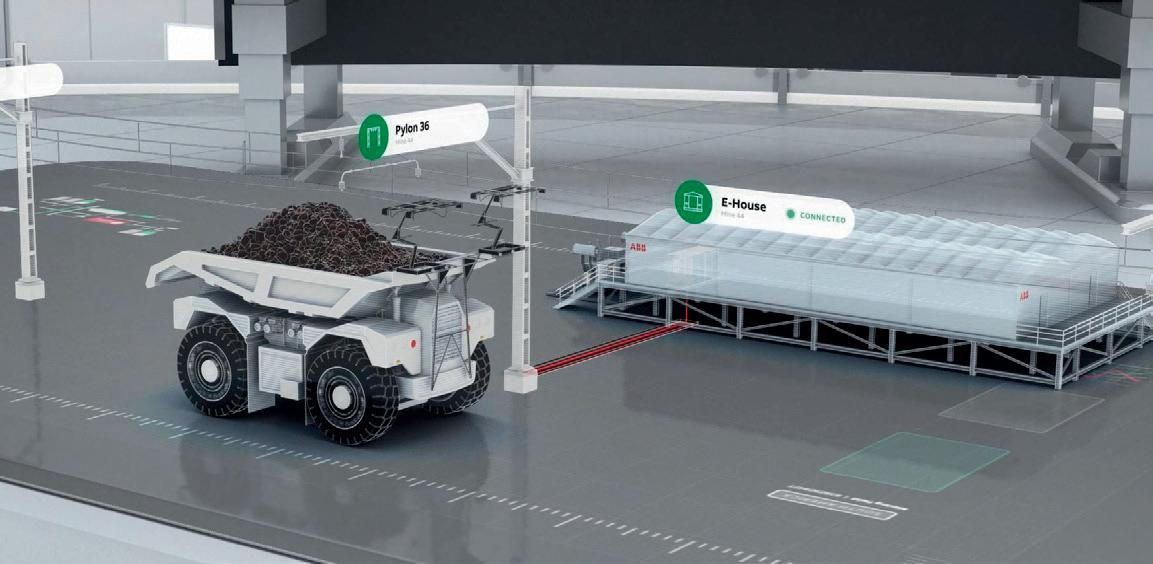

CHILE Codelco will test CAT’s innovative system for transferring electrical power to moving trucks

Codelco has announced plans to test the Cat® Dynamic Energy Transfer (DET) system with its fleet of diesel-electric haul trucks at the Radomiro Tomic Division.

This initiative is part of the company’s commitment to decarbonisation and sustainability, seeking to reduce its carbon footprint through the use of innovative technologies and electrification solutions.

The Cat® DET system is comprised of several integrated components: a power transfer module that converts power from the site’s electrical source to the required voltage, an electrified rail system to transmit the power, and a machine-connection system to transfer power to the truck’s drivetrain. This system transfers electricity directly to the machines while they are in motion, including both current and future battery-electric trucks.

By utilising Cat DET, the site will consume less fuel, reduce greenhouse gas emissions, and extend the life of the trucks’ engines.

“We are steadily advancing toward the mining of the future”, says Felipe Lagno, Codelco’s Corporate Manager of Innovation and Technology, who explains that, according to

preliminary calculations, truck emissions could be reduced by 60 – 70%.

“We have the opportunity to reduce our environmental impact and extend the useful life of our trucks without compromising productivity. Every project linked to technological innovation brings us closer to our goal of being a cornerstone of sustainable development for Chile and the world”, he adds.

The pilot is scheduled to begin in 2Q26 in opencast operations. The test, expected to last approximately one year, will involve Cat® 798 AC trucks and the installation of rails on one of the ramps where the machines operate. Cat dealer Finning SA will also contribute to the success of the trial by assisting with the installation and maintenance of the Cat DET system.

This project is a new step in Codelco’s roadmap to promote the electrification of mining equipment with the goal of decarbonising its operations. To achieve this, the corporation is actively promoting joint solutions with original equipment manufacturers (OEMs), research centres, and universities, both national and international, among other industry players.

USA The Department of Energy launches Mine of the Future initiatives to bolster the US mining industry

The US Department of Energy’s (DOE) Office of Fossil Energy (FE) has announced two new programmes under its Mine of the Future initiative, which aims to transform US mining practices and speed up the development of a secure and resilient domestic critical mineral and material supply chain by employing cutting-edge mining technologies and processes.

First, FE has announced its intent to provide up to US$80 million in federal funding for mining technology proving grounds that will support and accelerate innovative technology development and commercialisation. FE has also announced up to US$15 million in federal funding for DOE’s National Laboratories to conduct critical research, development, and demonstration activities that will

advance DOE strategies to strengthen the US’ domestic critical mineral supply chain.

Through both programmes, the Mine of the Future initiative will help deliver on President Trump’s commitment to expand the nation’s critical materials portfolio, reduce our reliance on foreign sources, and re-establish the US as a global leader in the mining sector.

“DOE is committed to fostering a new generation of skilled miners and equipping them with the tools to lead the world in mineral production and processing technology”, said Assistant Secretary of Fossil Energy, Kyle Haustveit.

“Through these new Mine of the Future programmes, DOE is making a significant investment to accelerate the development and deployment of cutting-edge solutions for the US mining sector.”

International Mining and Resources Conference

21 – 23 October 2025

Sydney, Australia www.imarcglobal.com

China Coal & Mining Expo 28 – 31 October 2025 Beijing, China www.chinaminingcoal.com

The Mining Show

17 – 18 November 2025

Dubai, UAE www.terrapinn.com/exhibition/ mining-show

Resourcing Tomorrow

02 – 04 December 2025 London, UK www.resourcingtomorrow.com

Investing in African Mining Indaba 2026

09 – 12 February 2026 Cape Town, South Africa www.miningindaba.com

SME MINEXCHANGE 2026

22 – 25 February 2026

Salt Lake City, USA www.smeannualconference.org

PDAC 2026

01 – 04 March 2026 Toronto, Canada www.pdac.ca/convention-2026

CONEXPO-CON/AGG 2026

03 – 07 March 2026

Las Vegas, USA www.conexpoconagg.com/ conexpo-con-agg-constructiontrade-show

To stay informed about upcoming industry events, visit Global Mining Review’s events page: www.globalminingreview.com/events

ABB has officially completed its acquisition of BrightLoop, a French pioneer in advanced power electronics, marking a key step in ABB’s strategy to accelerate electrification across mining, industrial mobility, and marine propulsion.

The transaction gives ABB a 93% controlling interest in BrightLoop, with the remaining 7% expected to be acquired by 2028. Financial terms were not disclosed. Founded in 2010 and based in Paris, France, BrightLoop has built a strong reputation for its high-performance DC/DC converters, originally developed for motorsports and now used in every car on the ABB FIA Formula E grid.

These compact, efficient, and scalable systems are now being deployed in sectors such as construction, mining, marine, aerospace, hydrogen mobility, and defence, where reliability, space, and weight are critical to performance.

Commenting on the announcement, Edgar Keller, President of ABB’s Traction division, said: “We’re very pleased to have successfully completed the acquisition of BrightLoop. It’s a significant milestone that strengthens our position in the electrification space and brings valuable expertise into ABB as we continue to support the transition to cleaner, more efficient transport systems.”

“This is an exciting new chapter for BrightLoop and our 90 employees. With ABB’s global scale and shared commitment to innovation, we’re looking forward to accelerating our growth and continuing to deliver cutting-edge power electronics to the industries that need them most”, said Florent Liffran, CEO of BrightLoop.

Together, ABB and BrightLoop are set to accelerate the shift to cleaner, smarter, and more efficient energy systems.

in Finland to accelerate

Metso has opened a new, state-of-the-art separation laboratory and pilot area at its research centre in Pori, Finland, bringing expanded research and development services for its customers. The opening of the laboratory supports Metso’s strategy as a leading partner in developing advanced flotation and beneficiation solutions for the global minerals industry.

“Our new separation laboratory in Pori encompasses our latest flotation technologies for the beneficiation of fine and ultrafine but also coarse particles. It has been expanded with a Concorde CellTM laboratory unit, that can be modularised for more complex test work and R&D, and auxiliary equipment for swifter sample preparation and processing. This will allow us to deliver high-quality test work faster and develop complete flowsheets for the flotation plants of tomorrow”, said Antti Rinne, Vice President, Flotation, at Metso. “With a fully integrated beneficiation and assays lab, we can handle a larger volume of testing while maintaining the highest standards.”

The latest development at the Pori Research Centre is the new coarse particle flotation (CPF) cell, which introduces a novel deep-froth pneumatic design that eliminates the need for fluidised beds. It is set for launch in 2026 following industrial-scale testing.

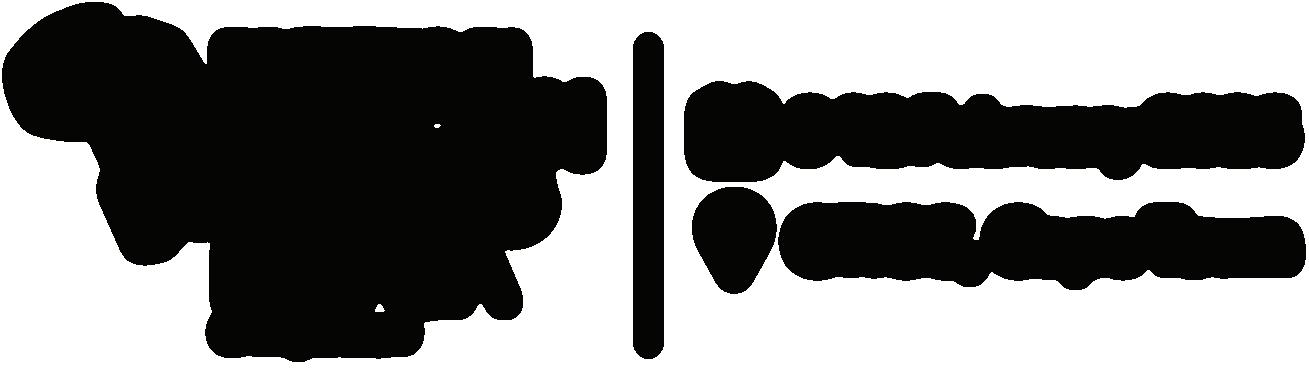

SWEDEN Weir partners with Viking Analytics to enhance digital offering for mineral processing plants

Weir, a mining technology company, has entered into a strategic collaboration agreement with Viking Analytics, a Swedish-based company specialising in AI-powered vibration analysis and condition monitoring for smarter predictive maintenance.

This partnership will significantly enhance Weir’s NEXT intelligent solutions – the company’s comprehensive digital offering designed to transform mineral processing through real-time data, predictive analytics, and process optimisation.

By integrating Viking’s advanced machine learning technology, it will facilitate predictive maintenance solutions, ensuring uptime and production are maximised. Viking Analytics’ solution is AI enabled, designed to learn equipment behaviour and detect early signs of machine failure. It provides automatic anomaly

detection and intelligent diagnostics, without the need for labelled data or manually set thresholds.

Ole Knudsen, Weir, Senior Director – Digital said: “Weir is committed to building a more sustainable future in mining through strategic partnerships with companies that share our vision. Viking’s customised AI software will be exclusively integrated into our NEXT intelligent solutions, delivering predictive analytics that enhance uptime and streamline maintenance for our customers.”

Dr Rajet Krishnan, Viking Analytics’ CEO, said: “We are proud to partner with Weir on this important step in their digital journey. Together, we will combine Weir’s deep domain expertise in mining with Viking’s AI-driven condition monitoring technology to unlock new value for Weir’s customers worldwide. ”

ZIMBABWE Sandvik fleet to drive efficiency at Zimplats’ Ngezi underground mines

Zimplats, the largest platinum group metals producer in Zimbabwe, has selected Sandvik to supply 28 pieces of underground equipment for its Ngezi mines.

The order, to be booked in 3Q25, includes 12 Toro® LH209L loaders, six Sandvik DD211L development jumbos, five Sandvik DS211L-V bolters, three Toro TH545i trucks, and two Sandvik TH430L trucks.

Deliveries are scheduled between 3Q25 and 2Q26. The agreement also covers parts and services kits to support long-term equipment performance.

Located in the Hartley Geological Complex on the Zimbabwean Great Dyke, the Ngezi complex is a major platinum group metals (PGM) operation that has transitioned from opencast to underground mining. The new Sandvik fleet will further strengthen Zimplats’ underground expansion and operational efficiency initiatives.

“We are proud to partner with Zimplats on this significant investment in the Ngezi underground

operations”, said Mats Eriksson, President of Sandvik Mining. “This order reflects our strong commitment to providing reliable, fit-for-purpose equipment and services that help our customers achieve their productivity, safety, and sustainability targets.”

Zimplats, 87% owned by Impala Platinum Holdings Ltd (Implats), owns and operates the Ngezi underground mines. The company continues to invest heavily in expanding underground mining capacity at Ngezi, including the development of new mines and concentrators.

“This new Sandvik fleet is a strategic step in enhancing our underground capabilities and ensuring we continue to operate safely, efficiently and sustainably”, said Alexander Mhembere, CEO of Zimplats. “Partnering with Sandvik gives us the confidence that our operations will be supported by proven equipment and dependable service.”

Claire Boyd, Justin Mannolini, and David Stokes, Gilbert + Tobin, assess the current mining landscape in Australia, discussing how the sector is responding to challenges such as geopolitical volatility, market turbulence, and a shift in investment attractiveness.

In 2025, A ustralia’s mining sector is being defined by its ability to balance the uncertainty caused by complex geopolitical dynamics against the frenzy of the soaring gold prices; the promise of critical and battery minerals opportunities against the realities of volatile markets; and the impact of high costs and over regulation against the continually evolving ESG and community expectations.

While gold has been a stand out, and iron ore and coal are still the biggest numbers on Australia’s export receipts, the centre of gravity is slowly moving back towards critical minerals and other energy-transition inputs, favouring those with a stable enough balance sheet to ride out the low-price cycle.

Gold M&A remains the shining example

The gold industry has emerged as one of the few bright spots in an otherwise subdued resources and M&A

landscape in 2025. Elevated gold prices have buoyed the balance sheets, and cashed-up producers are directing that liquidity towards acquisitions focused on extending asset life and augmenting reserve inventories.

A marquee transaction of 2025 so far has been Northern Star Resources’ acquisition of De Grey Mining for AUS$6.1 billion. The transaction hands Northern Star the flagship Hemi deposit in Western Australia’s Pilbara region, offering both a clear growth runway and a meaningful reduction in development risk for what is widely regarded as a tier-one project.

Northern Star’s move, the largest Australian gold deal of 2025, has proven catalytic. Its announcement was quickly followed by Gold Fields’ proposal to acquire its joint-venture partner Gold Road, Ramelius Resources’ pursuit of Spartan Resources, and asset level consolidations by Genesis Minerals. The pattern is unmistakable: well-capitalised producers, many already generating robust margins, are willing to transact at scale to offset declining

grades at mature operations and position themselves for sustained demand in the bullion market.

In short, consolidation is becoming the strategy of choice for gold miners seeking both immediate reserve replacement and longer-term optionality, and the sector shows little sign of loosening its grip on the deal-making crown.

In the critical minerals space, consistent with global trends, the downturn in M&A has continued – most notably in lithium, rare earths, and other battery metals. Despite the opportunity presented by critical minerals, heightened price volatility has prompted a more cautious approach from prospective buyers, lenders, and offtake partners, resulting in a slowdown in deal flow.

Lithium hydroxide prices have harshly corrected throughout 2025, straining several Australian junior developers. While a handful of opportunistic buyers have pursued counter-cyclical acquisitions in

critical minerals projects, the jury is still out on whether these moves will ultimately prove successful.

The Australian Government continues its efforts to encourage diversification in the mining sector, in line with its Critical Minerals Strategy 2023 – 2030. In addition to its expansion of the Critical Minerals Facility and the introduction of a refundable 10% Critical Minerals Production Tax Incentive, a Critical Minerals Strategic Reserve programme was announced in May.

Unsurprisingly, investment follows incentive. In Western Australia, Iluka’s AUS$1.2 billion Eneabba rare-earths refinery reached full construction finance in June and is on track to become the first fully integrated separation facility outside China. Separately, two mid-tier producers in Queensland have taken final investment decisions on battery-grade vanadium processing trains after qualifying for critical minerals tax incentives.1 On the demand side, Korean and Japanese interest in Australian exports is only increasing as China’s controls make it less attractive, with the Australian-Japan Critical Minerals Partnership serving as an example of effective diversification.2

Supply-chain security continues to dominate Australia’s bilateral dialogue with its allies, especially amidst the tumult of President Trump’s international tariff warfare. Canberra’s June communiqué with Washington elevated critical-mineral cooperation to a standing item alongside defence procurement, while Australian relations with Beijing remain brittle despite the Albanese Government’s efforts to strengthen the partnership.3 Chinese steel mills continue to purchase Australian iron ore, yet the numbers are starting to decline as stockpiles in China grow and all global powers look to diversify their imports.4

Domestic scrutiny on foreign investment is intensifying despite the government’s acceptance that this investment is crucial to national prosperity. The Treasury’s revised guidance, released in April, subjects any acquisition of 10% or more in an entity holding critical-minerals tenure to a mandatory national-interest test, regardless of transaction value. Acquirers from countries deemed ‘strategic competitors’ must now wait six months for the review clock to run out, prompting parties to incorporate conditionality and reverse-break fees in their contracts, which do not encourage firm investment commitments.

Despite its natural advantages in the minerals sector, there was a sober message sent to Australian governments and regulators mid-year.

The Fraser Institute’s Annual Survey of Mining Companies is widely known as the global benchmark for mining investment attractiveness, combining both geological potential and policy factors. The results of the latest survey (conducted in 2024) were released in May 2025 and revealed a sharp decline from previous years, when Australia regularly dominated the top spots. For the first time in recent memory, no Australian jurisdiction ranked in the global top 10 for investment attractiveness.

Reasons identified for the decline included:

Increased complexity and unpredictability in land access, environmental approvals, and policy changes at both state and federal levels.

Delays and duplication between state and federal requirements, making project timelines less predictable.

Higher labour, energy, and compliance costs, which have eroded Australia’s traditional competitive advantage.

For some years now, a mix of new laws, market changes, and community pressures concerning environmental, social, and governance standards has been changing the landscape for developing Australian resources projects. The recent survey results show the toll this has taken on the resource industry and Australian governments have been quick to respond.

Last month, the Federal minister for the environment confirmed the current government will fast track its national environmental law reforms, with plans to introduce the legislation to Parliament before the end of the year. The reforms will be focused on implementing some of the core principles of a review in 2021, including:

More efficient and robust project assessments.

Greater accountability and transparency in decision-making.

Most recently, the Western Australian State Government introduced a new bill to enhance productivity and improve how projects and precincts of strategic importance to Western Australia are identified, coordinated, and delivered.

While these reforms seek to streamline project approvals, other regulatory obligations will soon require Australian companies to publish detailed information about their climate plans, making directors legally responsible for this data, just like financial statements. The climate-related financial disclosure regime currently being phased in requires many large mining and resources companies to prepare annual sustainability reports in addition to their standard financial reporting.5 These financial reports must include information on governance, strategy, and risk management, on top of detailed metrics and targets related to climate risks and opportunities. The phase-in process has begun, with the largest entities currently in the throes of their first reporting period, and new assurance and audit requirements on the horizon until July 2027.6

The outlook for Australian miners is being moulded by a convergence of geopolitical volatility, market turbulence, and a shift in investment attractiveness as Australia seeks to find the right balance between development incentives and ESG expectations.

Success will depend on an ability to stay ahead of geopolitical risks, diversify funding and operations, and integrate sustainability and stakeholder engagement into core strategy along-side profitability.

References

Available on request.

There is plenty of equipment that we expect to see in an underground mine – from bulldozers to wheel loaders, reamers, excavators, and more. We are used to supersized machinery, which is instrumental to ensuring safety and efficiency. Compared to the giant machinery typically used underground, the new tools creating a buzz – drones – are somewhat unexpected. Measuring as small as 60 x 60 cm, drones are driving innovation in massive ways, reminding us that even smaller equipment can have a profound impact.

Surface mines have been deploying drones for years, typically for overground maps or to track excavations. The underground environment presents unique challenges which have, until recently, made it borderline impossible to use drones. Over the past few years, drones have been deployed underground with great success. These drones have to be robust and highly specialised, capable of operating without GPS. In many mines, the selected underground mine drone is the Elios 3 by Flyability.

The Elios 3 is a unique surveying drone. It can simultaneously gather multiple forms of data, permitting multi-function inspections with custom processing software for detailed analysis. The solution features a 4K camera and thermal camera, as well as a centimetre-accurate LiDAR payload designed by FARO. By comparing LiDAR scans and visual inspections, inspectors can see the exact condition of a tunnel, machine, or asset as well as the location of any defects they identify.

More recently, the solution has integrated an ultrasonic thickness payload, allowing it to also measure the thickness of materials, with these measurements localised within the LiDAR point cloud. The drone’s modular design, payload portfolio, and tailored software give it the flexibility needed to operate underground and in confined spaces.

Mine operators have areas that are challenging to access but must be surveyed. The solution? Drones that deliver quality data safely without compromising data quality. This newer technology piques interest with its accurate results, and the safety benefits make it irresistible. A drone inspection can be carried out in minutes and eliminates the need for human entry into a dangerous space or any risk exposure. In cases where human entry is necessary later, the drone can provide critical situational awareness to better inform safety protocols.

In underground mines, there are four typical applications for drones like the Elios 3. They are surveying, volume calculations, equipment monitoring,

and progress mapping. Various drones are more or less capable of each of these tasks, but these are the benefits drones offer to each application:

The benefits of drones for surveying in underground mines stem from greater access and safety standards. Drones, when equipped with a LiDAR payload, can provide total coverage of a space with detailed laser scans. This can be for anything from routine scans to investigating hang-ups in ore passes. Where a traditional laser scanner must be manually positioned and calibrated, drones can simply fly and collect the data even when it is not safe for human access. This ensures there are no gaps in the data and gives operators a clear picture of a mine’s condition.

Clarity of information is similarly vital to monitoring stockpiles. Volume calculations with a drone can be done in minutes and be used to track inputs versus outputs, informing site managers about which stocks have been depleted and which are ready for transport. The steps for volume calculation with a drone are simple – take off, fly around the stockpile, and then land. The data is then processed, and results can be ready within an hour. This is quick and can be done while operations continue around the stockpile, reducing any disruption or downtime that would be associated with traditional methods. It is a faster and safer means of tracking material.

The next application of drones underground is equipment monitoring. The process of using a drone, manoeuvrable and airborne, instead of people having to clamber over or inside equipment, is straightforward. A drone inspection can also offer a digital record of an asset’s condition, which can be revisited in the future to monitor changes. This optimises overall equipment management, solving two problems with a single drone flight.

Finally, progress mapping is also improved by drone use. A drone can be quickly deployed to collect records of before-and-after an action, such as shotcrete application or a blast. Quick, remote access to a space makes it easy to move on to the next task while the drone’s data serves as a long-term record. It can also be used to explore an old working before it is backfilled or repurposed, sharing accurate information ahead of work. This use of technology to digitise mines fits in with a growing trend to bring cutting-edge tools, including AI, to the forefront of extreme environments to improve operational efficiency and safety.

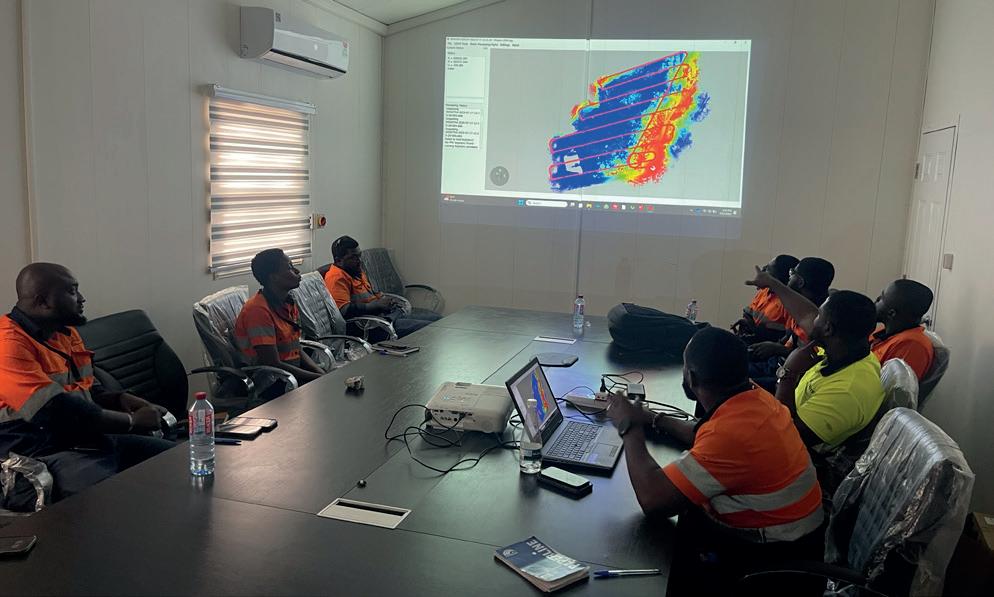

So, who is using this technology? The Elios 3 drone was recently used at AngloGold Ashanti’s Obuasi Mine in Ghana to tackle two unique operational challenges that had previously been impossible to resolve using conventional methods. The drone’s ability to capture high-resolution video and perform detailed 3D scanning in confined and hazardous environments proved instrumental in resolving these issues safely and efficiently.

The first challenge involved a blocked rock pass, which had disrupted the transfer of mined rock and constrained rock-moving operations. Before deploying the Elios 3, the location and nature of the blockage were inaccessible and obscured from view. The drone enabled the team to

visually inspect and scan the rock pass, enabling them to assess the impact of previous blasting attempts. The scans confirmed that the blasts had been ineffective.

Further reconnaissance with the Elios 3 revealed the surrounding ground conditions and the precise nature of the obstruction. This data supported a decision to manually clear the blockage, a strategy that was successfully executed, restoring functionality to the rock pass.

The second challenge centered on a 140 t raise bore reamer and string, that had become wedged in a 6.5 m diameter ventilation shaft during boring. Due to the weight and positioning of the equipment, human access below the reamer was impossible.

By deploying the Elios 3, operators obtained clear video footage and 3D scans from below, besides, and above the reamer. These visuals provided critical insights into the reamer’s orientation and the surrounding ground conditions. Based on this information, a targeted recovery plan was developed and executed, successfully releasing the reamer with minimal damage.

In both cases, the Elios 3 delivered a significant operational advantage. Its ability to navigate confined spaces and deliver precise visual and spatial data enabled safe and informed decision-making. These applications highlight the drone’s value in routine inspections at Obuasi and solving high-risk challenges in its underground mining environment.

Another example of using drones underground comes from Oman. IFDC, a specialised inspection company, works across multiple industries, including mining. They use various drones to survey and inspect equipment as a means of safe, efficient data collection.

An underground mine engaged IFDC to carry out a visual inspection of a stope with the objective of calculating its volume without physical entry. Using drones, a high-resolution point cloud was captured and accurately georeferenced, which enabled precise

volumetric calculations. The georeferenced dataset also allowed the client to assess the stope orientation after blasting and review the spatial distribution of broken ore within the area. This method reduced inspection time and eliminated the need for personnel entry, additional ground support, or safety gear.

The success of this project prompted the mine operators to collaborate further with IFDC to identify additional applications for remote survey technology. The mine operates across three levels with a vertical drilling system and ongoing blasting. IFDC was tasked with deploying the Elios 3 to carry out post-blast surveys in areas where unstable ground conditions or dust and gas make conventional entry and inspection difficult before the next round of drilling and blasting. Using the drone, post-blast surveys were completed within minutes. The LiDAR data collected was processed and exported to third-party software for alignment. This final output was then used to calculate the blasted void volume, identify cut deviation, and determine material displacement. Across multiple blasting cycles, IFDC’s drone-based survey workflow has delivered savings of over US$500 000, achieved by eliminating the time required for securing the roof, preventing safety hazards, and enabling safe and effective proactive decision making. The method consistently achieved results within 0.3% of ground truth, providing LiDAR scans with an accuracy of ±5 mm in confined, GPS-denied underground conditions.

Soon, the IFDC team became regular visitors to this mine for volumetric surveys. Later, after a localised ground collapse, the mine asked IFDC if they could confirm the cause. It was suspected to be from an underlying water-bearing soft formation, but access was incredibly complex and dangerous due to limited information. The Elios 3 drone was selected for this mission, and it confirmed what the mine theorised: water ingress from a fractured bedding plane. In the past, this would have been a long, arduous investigation. With the drone survey, the IFDC reduced the expected inspection time by over 60%.

IFDC’s work with drones at this mine has drastically improved inspection times, efficiency, and costs while reducing safety risks to mine staff. Their initial work at the mine quickly expanded to other applications, further demonstrating the variety of uses for drones in underground mines – and the technology’s immediate impact.

The foothold of drones in mining is rapidly gaining popularity – and with the rise of AI, drones are well-positioned to become a standardised tool. Now that industry giants, such as AngloGold Ashanti, and specialised service providers are leaning into this technology, its spread is inevitable. The growing interest will catapult the mining side of the drone industry to new heights (and depths) of research as manufacturers race to meet the intensive demands of mines. Altogether, it offers an exciting means to digitising the ground beneath our feet without putting people at risk. Expect to hear the buzz of a drone underground at a mine near you soon.

Emily Loosli, Wingtra, Switzerland, evaluates the use of drones in the mining industry and considers if mining companies are losing out by not using them.

It was nice to see an update from AngloGold Ashanti concerning the wrapping up of drone LIDAR training at its 137 km2 Iduapriem Mine site in southwest Ghana this summer. A globally-respected mining firm with locations all over the world, it was interesting to note how the company has continued to upskill and adapt according to the latest drone tech. In fact, this site alone has been flying three

WingtraOne GEN IIs with RX1R II payloads for high-efficiency and high-resolution detail capture and more data-driven operations.

For five years now, sometimes weekly, and at least monthly, AngloGold Ashanti Iduapriem Mine has captured photo-realistic views and analytics of all activities across its Iduapriem site. In fact, the company has developed a trust in

drone technology to the point where it no longer puts its traditional ground-based surveyors in unsafe or inaccessible areas.

Considering that most sites have to pay a lot for high risk insurance for each surveyor, this is a considerable per-annum cut in overhead. There is also the bonus of no incidents, site shutdown, and lawsuits should someone fall on a rock face or be in the wrong place at the wrong time when some rocks decide to fall.

The other nice side effect of these remote surveys is that activity on the ground can continue as usual. Especially when using a fixed-wing vertical take-off and landing (VTOL) drone, a single-man crew can squeeze a whole site survey into a tight weather window or get some on-demand update without any machinery or work downtime.

are

using drone data for these days, besides the obvious?

Mines have always needed surveys to scout locations, plan and track earthwork, monitor pre and post drill and blast, and check in on highwall stability and haul road profiles. This is all not to mention checking the integrity of tailings dams and tunnels. Whether they be multirotors for close

vertical asset inspection, tunnel drifting indoor drones, or fixed-wing VTOLs like Wingtra, drones today put surveys on steroids – availing millions of data points to analyse anything from rock faces to haul-road stability to post-blast efficacy.

The LIDAR drone payload integration AngloGold Ashanti’s Iduapriem Mine just completed highlights even more ways that this data saves time and resources, however. Training with Wingtra partner TerraCam, the company focused on the benefits of LIDAR capture across targeted areas to monitor assets such as power line sagging, vegetation encroachment, village encroachment, and nearby illegal mining.

Drone LIDAR is at a state of maturation now where it is reliable. For mines surrounded by vegetation, it picks up the information needed to keep infrastructure functioning safely and sites secure.

The technology is mature, its implementation is becoming increasingly common, and, as commodity prices surge, its value is likewise soaring. Crucially, it is contributing to the cutting of overheads and maintaining clean safety records –critical goals across mining operations worldwide.

As more and more companies are discovering, it is now possible to undertake surveys of whole active pits, strips, and even tunnels on a more regular basis, with improved accuracy, and for far less overhead than airborne or boots on the ground require. Today, companies can fly, process, and run analytics on the same day.

The uptick in drone survey turnaround speed is driven by the dawn of end-to-end survey workflows inside intuitive software ecosystems. Wingtra is the pioneer of this, and the company has developed its solutions with mines like Freeport MacMoRan as innovator customers. This close collaboration with mines – customers who directly test and help advance solutions – has led Wingtra to produce a system that is responsive to the real, everyday needs of modern miners.

How best to imagine this? It is probably best to start with the issues faced when mines first begin adopting drones as a solution. Specifically, lost time and hassle with the technology can cause hesitation and doubt regarding the efficiency of drones as a solution and their ability to deliver on their potential. Working with its mine operator partners, Wingtra has discovered that there are key issues common to a lot of drone platforms, including fragmented ground setup and processing. However, developments in the last two years have bolstered users’ ability to overcome them.

Mines are, for good reason, among the most risk averse operations on Earth, so it is no wonder site managers might hesitate to send an aerial robot into a windy sky. It has already been mentioned here that taking the surveyor out of the active area or the stockpile is a big win, but if they are flying something over a site there is still the risk it could fall on someone or something causing injury or damage.

Wingtra just released a fixed-wing VTOL that features both obstacle avoidance and an FAA certified parachute. It also has fine controls for pausing, relocating, and resuming the flight should air traffic or obstacles enter the space when flying or landing. This – along with its workhorse reliability and wind robustness – promotes a higher sense of confidence around operations.

Limit: Multirotors offer fine control but do not offer the resolution or the coverage to cut overheads on a whole site survey

Huge mines require a lot of coverage to get return of investment out of a drone. If a pilot has to send it down into a pit to capture the floor and fly back up, they will not cover much. Even if the drone carries a high-res payload, the operator is in for days of flying and stitching flight data that might feature different accuracies and qualities –depending on wind levels, time of day, etc.

Figure 3. Wingtra has released an end-to-end ecosystem for drone data. The system was developed in close conjunction with innovative customers, who informed the research and development team of the major time sinks across their drone workflows, so that these could be reduced by the solution.

Figure 4. A good distributor and system make all the difference when integrating and scaling drone data on a mine. TerraCam has provided empowering training for all new payloads and solutions as Wingtra has developed them. AngloGold Ashanti’s Iduapriem Mine has adapted its workflows around these new capabilities to garner maximum benefits and return on investment from the technology.

Fixed-wing VTOL techology combined with planning software that allows sophisticated yet intuitive plan sections based on surface pitch, drone terrain following features, and GSD requirements. These flight plan sections run back to back, so the drone captures an entire site in just hours and minimal battery changes. And that is without a need to refly for better data: the results are consistent and high-quality on every zoom-in and measurement.

Limit: Drone scaling introduces lots of learning curves, manual tasks, and tool switching that opens the process to errors, backtracking and reflights

Planning a flight and flying it is just one step. And before that, an experienced team member needs to set ground control. If the pole height is off or any of the markers are out of alignment, the data will not come out right and the work gets more than doubled with troubleshooting and reflight. Planners also need to set the right coordinate system for each flight, a manual process that is tedious and can cause issues if not done exactly right. This requires expertise.

Wingtra recently introduced a single aerial survey toolchain that integrates planning, ground control confirmation (with fixed pole heights), flight, coordinate system assignment, and data processing. Now surveyors with minimal experience can go out with one kit and set up their ground control, get confirmation, choose a coordinate system, confirm a flight with their boss back in the office, fly, and send the data to the same app and software to process.

Simply put, you now have a team on a prestigious, high-throughput gold mining site winning over their safety auditors; enjoying frequent, high-detail views of all their mining operations, volumes and structural changes, and monitoring the greenfields around for encroachment and illegal activity – all with a very low overhead solution and a good safety record.

While it adopted the technology earlier than most, AngloGold Ashanti leads a huge wave of mining firms that are now looking seriously at this latest evolution in drones with the all-in-one solutions that they offer. Proof of concept is not even a question. Drones were delivering return on investment (ROI) before, now they are delivering even more and are easier and safer to adopt.

The expectations around operations will change as more firms adopt this technology. It will become the norm. Now is the time to start researching and learn what is available.

The right distributor and platform are key to maximising the potential of these drones and the speed at which mining companies experience ROI. According to TerraCam, this cycle is getting shorter and shorter, since the efficiency and the frequency of capture is rising.

Vedrana Spudic, ABB, Switzerland, delves into the mining industry’s journey towards electrification, considering both the benefits and challenges of the energy transition.

As the world races to decarbonise, mining is under mounds of pressure to provide the necessary materials. However, it is also uniquely positioned to lead. The industry is critical to the energy transition, supplying the raw materials essential for wind turbines, electric vehicles, batteries, and solar infrastructure.

Demand for lithium, copper, cobalt, and rare earths is only increasing. Yet, supplies continue to fall short of what is needed to support the energy transition at scale. According to the International Energy Agency, demand for lithium alone

grew by 30% in 2024, with overall demand expected to increase fivefold by 2040 under current policy trends. Copper, essential for EVs and renewables, is also projected to see a similar rise in demand over the same period.

While mining companies grapple to meet supply for growing demand, the industry also faces growing scrutiny over its own energy use. The mining industry, which is traditionally diesel-heavy, is currently responsible for around 7% of global greenhouse gas emissions.

As pressure mounts, approximately 30% of mining leaders are struggling to stay on track with decarbonisation goals.

This explains why electrification has rapidly moved from concept to implementation. In just a few years, mining companies have progressed from trial pilots to full-scale rollouts, supported by tangible results in terms of productivity, emissions, and cost. ABB’s recent white paper, ‘Building the all-electric mine’, explores how leading operations are navigating this transition, and what practical steps are enabling scalable, site-specific electrification. The question is no longer whether to electrify, but how.

Ore grades are falling, the supply of critical metals is at risk, energy costs are climbing, and investors are pushing for more transparent, measurable progress on ESG.

Electrification offers a pathway to lower emissions and stronger operational resilience, but the transition must be realistic, modular, and grounded in each mine’s unique conditions.

This is not about flipping a switch. It is about enabling a smarter, more phased transformation.

Decarbonisation is clearly a major driver, however the case for electrification is also operational. Electric systems offer higher performance and reliability. Haul trucks powered by electric or hybrid drivetrains, for example, can deliver faster cycle times, smoother acceleration, and lower maintenance requirements. Meanwhile, underground, electric equipment can dramatically reduce exposure to

diesel particulate matter, noise, and heat – benefiting both worker safety and ventilation costs.

There is also the strategic benefit of energy predictability. Fleets that can be powered by renewable energy or self-generated electricity reduce exposure to volatile fuel markets. Over time, this translates into greater cost stability and lower lifetime operating costs.

These benefits are not going unnoticed. In fact, 68% of mining companies worldwide are planning to electrify at least 25% of their fleets by 2030. This is a clear signal that electrification is becoming a mainstream operational strategy, not just a sustainability initiative.

Today, we are no longer in the realm of theory. The mining industry is gaining confidence in electrification through pilot projects and commercial deployments. Success is being achieved through close collaboration between mining companies, OEMs, utilities, and technology partners.

Trolley-assist systems, for example, are already delivering proven gains in both productivity and emissions. Not only are they capable of reducing carbon emissions by up to 90%, trolley-assisted fleets see a twofold increase in haul truck speed on uphill sections. For example, Boliden has deployed electric trolleys at its Aitik mine in Sweden, one of Europe’s largest copper mines. There, haul trucks using electric assist on uphill ramps have cut diesel consumption by 800 000 l annually, while also reducing CO2 emissions and operating costs.

Stationary fast-charging systems are also proving viable, particularly for shuttle routes or production areas with predictable duty cycles. Engineered for high-throughput mining operations where idle time is minimal, they enable opportunity charging – a method where equipment is charged in short bursts during scheduled stops such as loading or dumping. Since the systems use DC power and automated connectors, they can help reduce both charging time and manual intervention, improving safety and operational consistency.

The takeaway is clear: we already have proven technologies. Electrification is not confined to new mines, but can be retrofitted into existing operations with clear benefits. The real challenge is tailoring the right mix for each site’s geography, power infrastructure, and operational profile. Innovation in this space is moving fast. One area that shows major potential is automated charging. This involves systems that connect heavy vehicles to power automatically, removing the human element and elevating safety. The capability to autonomously connect vehicles to charging stations, even under extreme UV exposure and arctic temperatures, hints at a future where charging is fast, hands-free, and seamlessly integrated into operations.

Looking ahead, electrified systems will likely blend multiple technologies. These systems will not only move ore and materials more effectively,

but they will simultaneously contribute to higher energy efficiency. As these technologies mature, their true potential will be unlocked through seamless integration – where automated charging, energy storage, and dynamic power routing converge to support round-the-clock operations with minimal downtime.

Electrification is not as simple as swapping out diesel for batteries. It is a complex, multi-layered transformation. It requires careful power system planning, especially in remote locations. Infrastructure must be built to support both stationary and in-motion charging, while the integration of renewable energy and energy storage systems may also be needed to ensure power availability and reliability.

Then there is the operational layer. This involves aligning charging infrastructure with haul routes, shift schedules, and production plans. A deep understanding of the mine’s layout, production cycles, and constraints is essential. Each mine site needs a custom strategy.

This also means aligning electrification with broader digital transformation initiatives. Data-driven asset management, smart energy monitoring, and predictive maintenance all become increasingly important as fleets electrify. Planning in

silos can create bottlenecks, so a system-level view is key to capturing full value.

Importantly, concern about risk and interoperability are valid. Mines do not want to be locked into proprietary ecosystems or stuck with tech that will not scale. That is why open, flexible, vendor-agnostic systems are so important to get right from the start.

Technology alone will not drive this transition. Electrification requires new ways of thinking about mine design, fleet management, and workforce development. Planning needs to start early, particularly during fleet replacements, new mine development, or site expansions. The earlier electrification is considered, the easier and more cost-effective it is to integrate.

There is also a significant human dimension. Transitioning to electric operations may require training and reskilling, but it also opens up new roles, for example in digital systems, automation, and energy management. The emerging workforce, especially those focused on sustainability and innovation, are increasingly drawn to technologically advanced and lower-impact workplaces. Electrification can support both talent attraction and long-term workforce evolution.

Every mine is different, but there are universal principles that can guide a successful electrification journey:

Start where you are: Rather than waiting for the ‘perfect’ solution, begin with hybrid fleets, targeted retrofits, or the electrification of specific haul routes.

Plan with flexibility: Build charging and power infrastructure that can scale and adapt as needs change.

Choose open systems: Prioritise interoperability to ensure long-term choice and integration options.

Think long-term: Energy stability, lower maintenance, and emissions reduction can all strengthen the economic case over the life of a project.

The all-electric mine will not look the same everywhere, and that is a strength, not a flaw. Each operation will follow its own electrification path at its own pace, shaped by geography, resources, and ambition. What unites the leaders in the mining industry is not radical reinvention, but thoughtful innovation. They are balancing ambition with practicality, leveraging proven technologies, and building systems that keep people – the operators, engineers, and communities – at the centre.

Electrification is already taking shape across the mining world. The smartest path forward is one built on clarity, collaboration, and a readiness to act.

Mika Kinnunen and Samu Kukkonen, Normet, Finland, consider how the mining industry has become a pioneer of technological advancement during its journey towards electrification.

Deep beneath the earth’s surface, where the noise of diesel engines reverberates through tunnels and the air is filled with exhaust fumes, a quiet revolution is taking place. The underground mining industry, long- associated with heavy machinery and large diesel engines, is transforming into something cleaner, quieter, less polluting, and sustainable. The transition to fully electric machinery is already in progress.

In the heart of the mine, fully electric drill rigs are using precise movements to perforate the ground, without the release of emissions or the roar of diesel engines. Moreover, the power required for this process is now being supplied by modern batteries, often Li-Ion, or by direct grid connection. Similarly, all-electric explosive charging rigs are already inprogressing

the next phase of development, performing explosives charging. The latest of these machines is not only fully electric, but also fitted with robotics to perform the explosives charging semi-autonomously with robotic arms. No longer is it necessary for miners to manually handle explosives at the front of the tunnel face. With advanced automation and robotics, human exposure to risk can be minimised, demonstrating a significant leap forward in terms of both safety and efficiency.

The shift towards fully electric mining machinery extends far beyond drilling and explosives charging. The largest underground machinery is pushing the limits of what modern battery and electrification technologies can achieve, hauling rock and ore out of the mine cost effectively, quietly, and emission-free – a testament to what Li-Ion batteries can achieve today. Combined with autonomous driving systems, these machines are up-to-date with high-tech solutions. All of a sudden, mining machinery is pioneering the adoption of the latest and greatest technologies.

Next, the tunnel is cleaned with fully electric scaling machinery before being reinforced. Fully electric concrete spraying machines and heavy concrete transportation machinery work continuously to reinforce the mine tunnels. The elimination of emissions is especially useful in this instance, since these machines are typically operated at the end of a tunnel face. No longer does the operator of the concrete spraying rig or the agitator need to work in an environment polluted by diesel fumes. Regarding concrete transportation agitators or transmixers, these are optimal targets for electrification in underground mining. In most cases, these machines transport concrete from the surface back down into the mine. The machinery is heavy when it descends and considerably lighter when it trams back up. A heavy machine recovers a significant amount of energy through regenerative braking, charging the Li-Ion batteries on the way down. Moreover, the lighter machine does not consume much energy when ascending. For an underground mining machine carrying out a perpetual motion, approximately 15 minutes of fast charging per trip may suffice.

Behind the scenes, the machines and technologies inside the mines are being carefully monitored. A fully electric machine is a treasure trove of data. The data produced and

sent through the mine network to backend systems is being used continuously – not only to track the health of the machinery, but also to provide insights helpful for the optimisation of mining processes. Predictive analytics help to detect potential issues before they become major problems, ensuring that maintenance is carried out proactively rather than reactively. With less downtime, the electric fleet can operate even more efficiently than before, and with fewer parts that wear out over time, maintenance is less frequent, and the overall cost of operation is dramatically reduced.

Perhaps the most significant transformation pertains to the overall work environment itself. The shift to fully electric machinery eliminates the oppressive heat, noise, and exhaust fumes to which the mine workers have long been exposed. The air is fresher, cooler, and cleaner, and the roar of engines is replaced with quieter whirrs. This transformation enables a marked improvement in the overall well-being of miners, some of whom have already stated that they feel less fatigued after a shift when operating fully electric machinery. This improvement in the working environment translates into tangible benefits for both workers and employers. With a happier and healthier workforce, mining companies should see fewer sick days and lower turnover rates. The reduction in physical strain and exposure to harmful conditions leads to fewer long-term health issues, particularly those related to respiratory problems and hearing loss.

These benefits are already a reality for the mines embracing electrification – how did we get here? Electric machinery is not a new phenomenon, but the technology has previously posed limitations. Tethered loaders have been around for decades, enabling fully electric operations, but were limited by the length of the cable behind. Lead-acid and molten-salt battery machines have also existed for a while, but were always held back by their low power and slow battery charging. Traction motors on these machines –of the induction motor variety – were big and bulky, offering only modest power. Technology has been restrictive, therefore these types of machines have not gained widespread adoption.

Perhaps the tipping point was somewhere in the late 2000s to early-2010s when the public received the first mass produced electric cars, such as the Nissan Leaf and the high performing Tesla Roadster. These electric cars were important, because they were among the first widely adopted cars to use modern Li-Ion batteries and other key technologies, such as permanent magnet motors in the Nissan Leaf, and fast-charging capabilities. These cars and technologies were inspirational. In Finland, where a significant amount of mining machinery is developed, the early-2010s was a very active period regarding the research effort dedicated to electrification technologies, and this has continued to be the case ever since. Normet conducted electrification feasibility studies during the early 2010s, which reached the positive conclusion that technology had in fact reached a maturity point where electrification of mining machinery was feasible. Nevertheless, it took time to put research into practice.

The electrification of mining machinery was theoretically possible in the early-2010s, but in practice it proved very difficult. Componentry still needed to mature, fast-charging standards (such as CCS) needed to be created, and even though Nissan Leafs and Tesla Roadsters were on the road, there were hardly any companies who manufactured bigger versions of the componentry required for mining machinery. However, a few years later, both new and existing companies suddenly started coming out with components suitable for mining technology. It was at that point when the practical development of fully electric mining machinery took off.

Certainly for Normet, the latter half of the 2010s was a busy and exciting time – the development of fully electric Normet SmartDrive® machinery was being conducted at full speed; the company was undergoing the process of electrification; progress was being made; the first prototypes were working; and the excitement of the engineers and employees was palpable. A sense of can-do attitude was in the air. The hard work paid off, and Normet released a portfolio of fully electric Normet SmartDrive machinery at bauma exhibition in Münich in April 2019. Since then, Normet has been ramping up production, improving their products, and releasing new models – other OEMs likely share similar stories.

In parallel to developing and releasing fully electric machinery, mines have also studied new technologies and researched ways to implement them in practice. Of high importance is the charging infrastructure, which has now become a focus for many mines. The electric grid and

charging infrastructure need to be developed in advance, in order to provide the necessary charging power for the fully electric fleets deployed. This is one of the most important enablers of electrification. Also, OEMs are well underway in setting up service networks globally to serve the electric fleets being deployed. New skills are required; people are being trained to operate and maintain fully electric machinery. The industry is well into ramping up fully electric operations. The only question mark remaining is how fast the transition from diesel powered operations to fully electric operations will be.

Underground mining appears to be in a favourable position. Technology has reached a level where fully electric mining operations are feasible. Furthermore, the constant availability of electric grids in many underground mines makes setting up charging infrastructure relatively easy. This is not the case in other industries, such as forestry or agricultural machinery, where electrification is much more difficult with the current state of technology. Perhaps, in the same way that the technological evolution of electric cars served as an inspiration and necessary catalyst for fully electric mining machinery, developments in mining technology could kick-off electrification in other industries. If that is the case, then the mining industry can indeed be considered a pioneer of electrification. Hopefully the advancements in mining can be utilised to help other industries reach the ultimate collective goal: sustainability.

AJ Householder, Getman, USA explains the role of multi-purpose utility machines in modern mining.

In underground mining, efficiency, safety, and adaptability are essential to success. While attention is often focused on primary production equipment, utility machines play an equally critical, though less visible, role in daily operations. These machines support underground operations through modular cassettes designed for high-flow fuel and lube delivery, zoned water spraying, hydraulic vacuum waste removal, and material transport.

Among them, mining-focused and multi-functional platforms such as the Getman A64 cassette handler are proving to be vital. They help reduce downtime, improve safety, and simplify the complexity of underground logistics.

Utility machines in underground mining: A critical support role

Underground mining presents unique challenges, including limited space,

uneven terrain, and the need for uninterrupted service and maintenance of key systems. Utility machines are essential in this context. They support daily operations by delivering fuel, water, lubrication, tools, and other critical resources exactly where they are needed.

Among these, mining-focused utility machines such as the Getman A64 cassette handler stand out. Engineered specifically for the underground mining environment, they offer enhanced operator visibility, improved safety, and adaptability to a wide range of tasks. The A64 platform exemplifies this approach, providing a versatile solution that can be rapidly reconfigured to meet evolving operational needs.

At the core of the A64 cassette handler’s value is its modular cassette system. This system enables a single machine chassis to perform multiple roles, simply by switching out application-specific cassettes. These include configurations for fuel and lubrication service,

water spraying, sump vacuuming, personnel transport, flat deck hauling, and more. The platform accommodates a payload of up to 5450 kg (12 000 lb), ensuring that it can transport significant loads without compromising safety or performance.

Each cassette is designed to be mounted and dismounted by a single operator from the safety of the cab. The process is supported by a hydraulic motor, double roller chain, shuttle hook system, and indicator lights that show the stage of cassette loading or unloading. Quick-connect hydraulic fittings are available for modules that require hydraulic flow.

This modular approach offers several operational benefits. Firstly, it eliminates the need for a dedicated machine for each utility function. Instead, a single A64 cassette handler can be reconfigured as needed, optimising equipment use and simplifying maintenance. Secondly, the high commonality of parts across the A64 product line simplifies inventory management and supports a streamlined approach to spare parts logistics.

From a cost-control perspective, this modularity reduces capital expenditures while also lowering maintenance overhead. With fewer machines to maintain and repair, workshops can focus on proactive servicing and reduce unscheduled downtime.

The range of available cassettes allows the A64 platform to support numerous underground functions:

Fuel and lube cassettes deliver critical fluids for mobile equipment maintenance, with flow rates up to 189.3 l/min. (50 gpm) for diesel services.

Water spray cassettes with tanks up to 4540 l (1200 gal.) are equipped with zoned spray controls for dust suppression and road conditioning.

Sump and vacuum cassettes enable efficient removal of liquid and chemical waste using hydraulic-driven vacuum systems.

Flat deck and explosive transport cassettes provide general utility transport and support specialised material movement.

Each cassette is built with features such as sight gauges, bulkheads with visibility cutouts, and winch tie-downs to facilitate safe and efficient use underground.

The A64 platform includes several integrated safety and operational features that make it well-suited for the underground mining environment. The operator compartment is ROPS/FOPS certified and includes mechanical suspension seats, three-point access, and optional enclosed cabins with HVAC. The machine also features automatic brake engagement upon loss of hydraulic or electrical power and is equipped with fire suppression system tied to engine shutdown.

Filters, sight gauges, and service points are designed for accessible servicing to minimise risk, with many reachable from ground level. Hydraulic circuits are configured with hot/cold side engine layouts, and electrical components are fully sealed and oil-resistant.

With its load capacity and robust build, the A64 cassette handler maintains dimensions suitable for underground navigation. The machine width of 2085 mm (82 in.) and turning radius as low as 4236 mm (167 in.) allow it to manoeuvre in confined tunnels. Optional crane attachments expand the utility of the platform further, enabling precision lifting and placement of heavy materials within a defined working radius.

As underground mining operations continue to emphasise safety, productivity, and cost-efficiency, multi-purpose utility platforms like the A64 cassette handler are becoming indispensable. By enabling a single machine to fulfill a diverse set of operational roles, these machines reduce fleet complexity, lower maintenance costs, and support the uninterrupted function of primary mining systems.

The Getman A64 cassette handler illustrates how mining-specific design, when combined with modular flexibility, can transform utility support underground.

By offering a single platform capable of adapting to a wide range of operational roles, the A64 helps mining operations meet today’s performance and safety expectations – while positioning themselves for the demands of increasingly integrated and efficient mine sites.

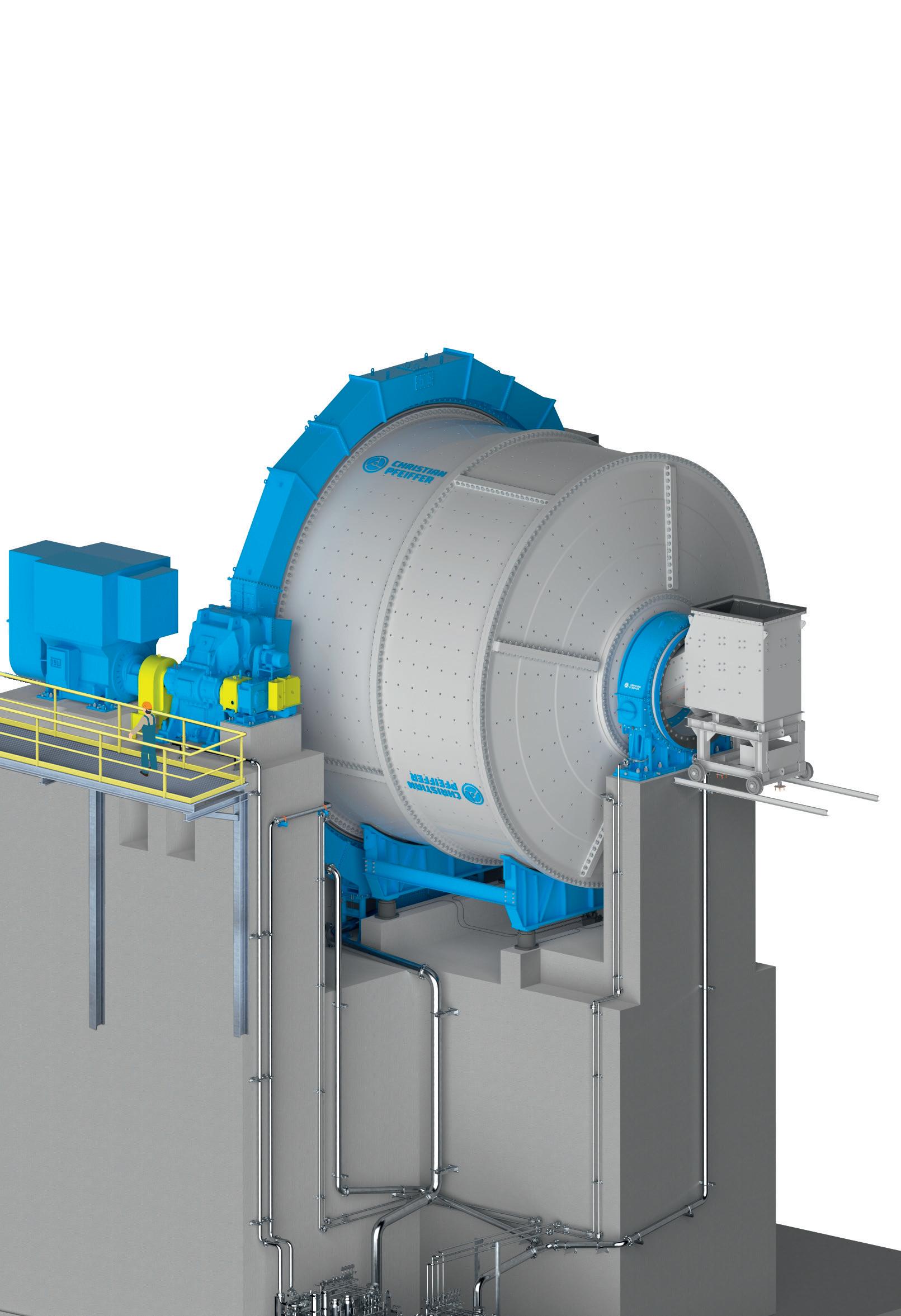

Christian Pfeiffer specializes in producing customized AG/SAG mills and ball mills that are designed to meet the specific requirements.

We also offer the flexibility to adapt the design to existing foundations making it easier to replace existing mills.

Contact us today for more information on our tailored mill solutions.

Francesco Giuseppe Lanzillotta, Klüber Lubrication, Germany, highlights how environmentally acceptable lubricants make modern mining more efficient and responsible.

The mining industry is undergoing a profound transformation. While securing productivity and operational reliability remains essential, there is an increasing emphasis on environmental responsibility, stakeholder trust, and long-term business resilience. Today’s mining companies are aligning with ESG goals, responding to public expectations, and preparing for more stringent environmental regulations that are likely to emerge in many regions. Environmentally acceptable lubricants (EALs) offer a double dividend in this context: minimising environmental risks while maximising technical performance. Crucially, the decisions made today – such as switching to more sustainable lubricant technologies – will shape the long-term viability and reputation of mining operations. The following article

shows how EALs can become a strategic asset for modern mining operations.

Mining is a key enabler of modern technology, supplying raw materials essential for everything from electronics to electric vehicles and renewable energy systems such as solar panels and wind turbines. Still, it often faces prejudice due to a lack of public understanding. The mining industry has evolved significantly in recent years, with a strong focus on extracting resources with minimal environmental and community impact.

EALs are, now and in the future, crucial for helping mining companies achieve their sustainability objectives.

They support compliance with environmental regulations, especially in sensitive ecosystems and regions with strict waste disposal laws. In addition, EALs contribute to brand value and stakeholder trust by offering visible and credible proof of sustainable practices. Prominent OEMs have also endorsed the use of EAL technologies, reinforcing their relevance and impact.

For many mining companies, sustainability starts with clear targets: reducing emissions, minimising resource consumption, and aligning with growing environmental and stakeholder expectations. EALs are biodegradable,

non-bio accumulative, and non-toxic – reducing the risk of leaks, especially in ecologically sensitive mining areas. However, they also offer technical benefits. Modern EALs demonstrate excellent stability, which can extend the oil change intervals up to four times, reduce component energy consumption by up to 3%, and, in the case of greases, reduce the required quantity by up to 30%. This not only cuts costs but also increases equipment uptime.

Klüber Lubrication offers a growing portfolio of EAL solutions that address not only environmental concerns but also key operational challenges.

These high-performance lubricants are designed to enhance the reliability of mobile mining equipment such as haul trucks, excavators, and loaders. By providing superior wear protection and resistance to harsh environmental conditions, they help reduce mechanical stress under extreme loads and temperatures.

Some of these solutions are already successfully in use across demanding mining operations, while others are currently under development, reflecting Klüber’s

ongoing commitment to innovation. The tribology expert consistently focuses on delivering solutions that balance environmental responsibility with economic performance.

Another important objective is to help operators improve equipment efficiency by reducing maintenance requirements and minimising unplanned downtime. In many cases, EALs also support lower fuel and energy consumption, making them a cost-effective investment with measurable impact on total cost of ownership.