7 minute read

Growing demand

Ben Wilby, Senior Onshore Analyst, Westwood Global Energy Group, UK, considers whether higher prices will cause a drastic shift in North American pipeline demand.

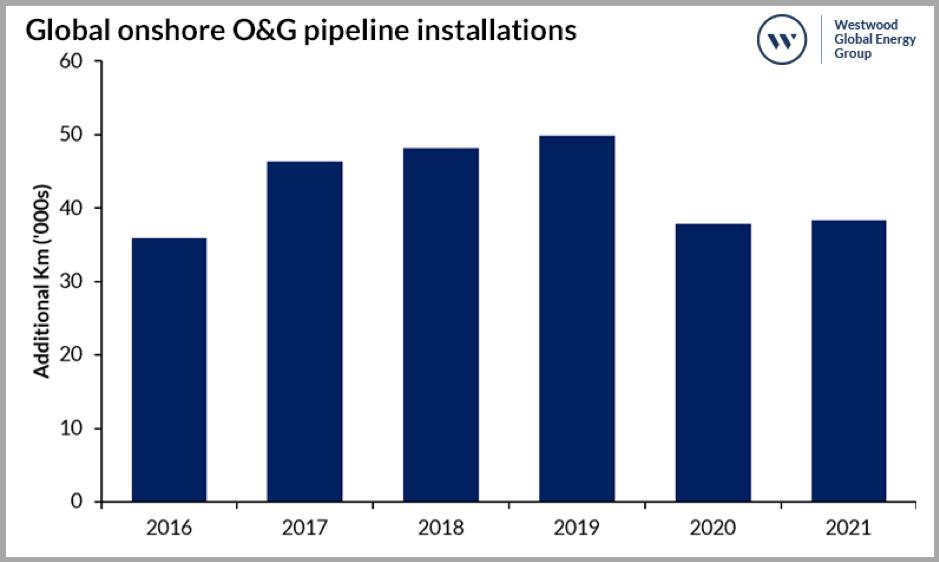

nshore pipeline installations across the globe have dropped dramatically in recent years with the industry badly impacted by public opposition, politics and depressed oil and gas prices, back to the levels seen in the last downturn (2016).

Nowhere has this decline been more pronounced than in North America, where a combination of plummeting prices and troubles with protests and permitting, has led to a stark decline in pipeline installations since 2019.

However, with more than half of 2022 behind us, the factors that caused this decline in North America are looking less relevant. The shock of oil futures trading negative in 2020 has been replaced by rocketing oil and gas prices, causing a surge in energy pricing that is reshaping some of the previous stances taken on some pipeline projects. As we look ahead to the next edition of the report, Westwood takes stock of the current status of oil and gas pipelines in North America, as well as considering the growing demand for pipelines to support the energy transition (ET).

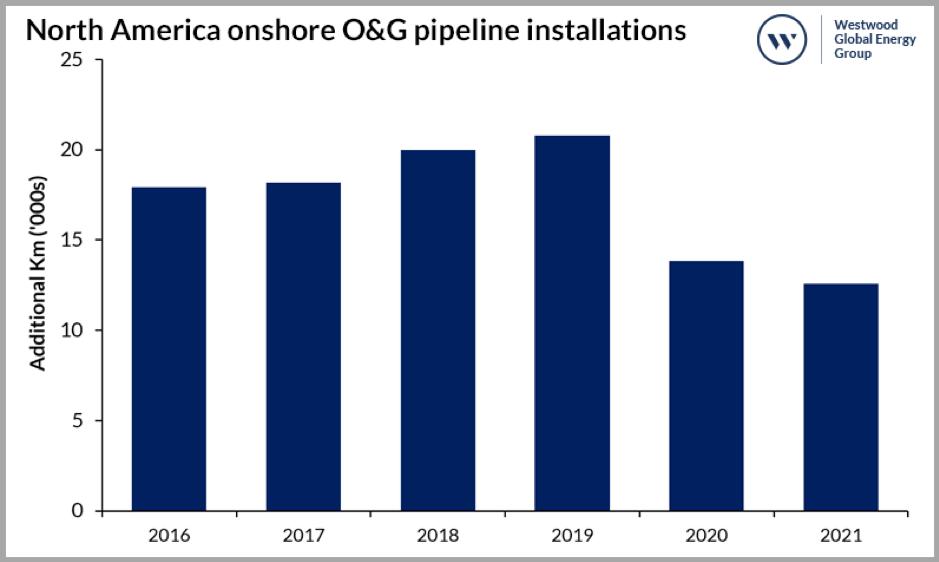

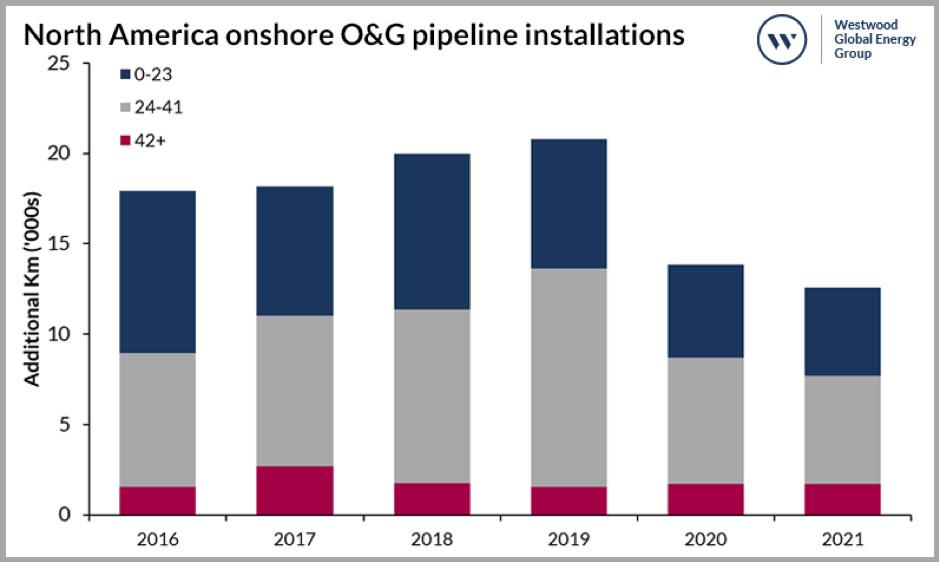

Potential green shoots for pipelines in North America In North America, unprecedented demand for oil and gas pipelines saw year-on-year growth 2016 to 2019, reaching almost 21 000 km, with multiple lines installed with lengths of over 1000 km. The majority of these lines were to help ease pipeline capacity issues among the key shale plays, especially in the Permian. Similarly, in Canada a number of lines such as the Line 3 Replacement Project (>1100 km), and the Dawn Parkway System Pipeline (>200 km) were completed to help increase offtake capacity in key provinces. The majority of the lines installed were in the 24 - 41 in. diameter range.

Growing public outcry and stagnant pricing were already pressuring the market before COVID-19, and the subsequent commodity price crash led to a major decline in pipeline installations across all diameter ranges in both 2020 (13 800 km) and 2021 (12 500 km).

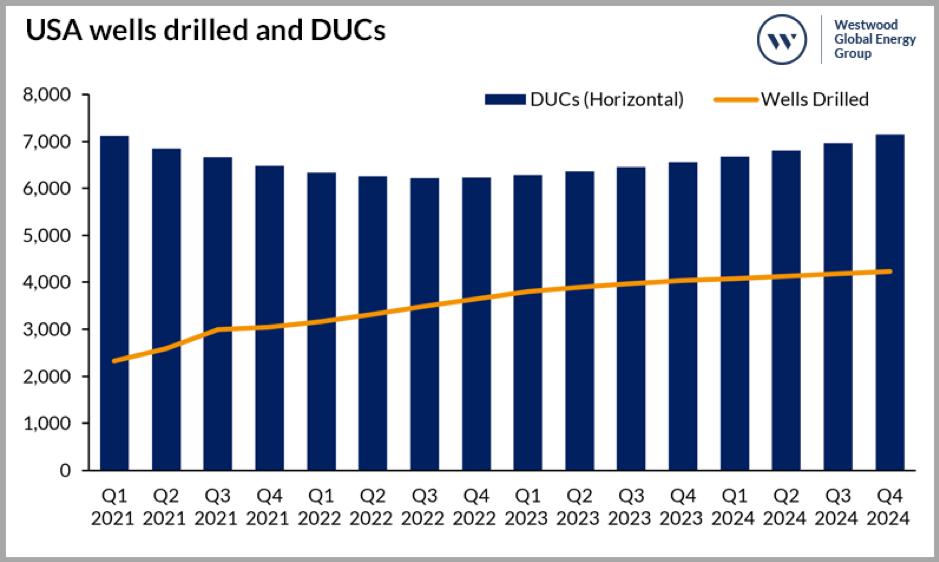

Onshore oil and gas activity, which saw small improvements in 2021, has rapidly started to increase over the first half of 2022. Operators are looking to capitalise on the major increase in pricing by completing many wells that were drilled previously but remained uncompleted (DUCs).

As a result of this surge in activity, the EIA has reported record levels of gas production from unconventional plays while liquids production has seen continual improvement, reintroducing the issue of offtake capacity. Earlier this year, US operators expressed concerns of a potential shortfall in pipeline capacity in 2023 to meet demand, a worry that became more pressing with natural gas becoming a potential strategic asset internationally following Russia’s invasion of Ukraine, and subsequent attempts from the EU to diversify supply.

Some of this will be met by pipelines already under construction, however, new projects will also be required to help increase offtake capacity. One example of this is the 790 km, 42 in. Matterhorn Express Pipeline, which reached Final Investment Decision (FID) earlier this year and is designed to transport 2.5 billion ft3/d of natural gas from the Permian, when it starts operations in 3Q23. Other projects, such as expansions to the Driftwood Pipeline, are also expected to start construction this year. It is worth noting that a flood of new pipeline projects (as seen in the 2010s) hasn’t appeared yet and projects remain at the mercy of approval boards, but the market is still looking significantly stronger than it was last year.

Onshore oil and gas is not the only sector in the energy industry where pipeline manufacturers are likely to see major demand. A new sector that has been slow to progress in the past looks to be becoming a major new area for demand: ET.

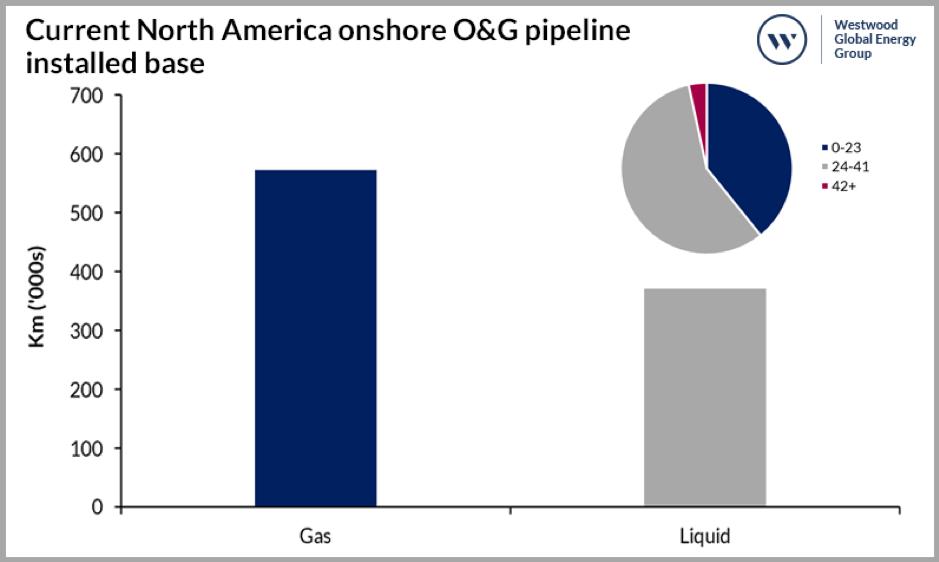

Carbon capture and hydrogen projects change outlook The increasing focus on ET in recent years has added a new component to pipeline demand. The targets set by governments to reach net-zero following the Paris Agreement, as well as companies setting their own strategies to transition, has rapidly increased the number, scale and potential of these projects. North America has been at the forefront of this with numerous projects being progressed across the country to help alleviate carbon emissions from the major shale plays and Canada’s oilsands projects, potentially leading to a major increase in annual pipeline installations within the region. For example, one potential project, the Summit Pipeline which is planned to gather CO2 from across the Midwest, has a total pipeline length in excess of 3200 km. North America has the largest existing capacity of onshore pipeline globally, with close to 1 million km of pipeline. There is the potential to reuse existing lines, potentially allowing companies to reduce costs and lessen the impact of construction activities. However, while this is potentially a boon for the industry, not all existing infrastructure will be viable for reuse. The pressures required for CO2 transmission (up to 2600 psi) are substantially higher than natural gas (800 - 1200 psi), potentially ruling out many pipelines, with operators having to either pump carbon at lower pressures or install substantial numbers of crack arrestors to handle the higher pressures, pushing costs up significantly. Other issues, such as age or condition, can add extra problems to repurposing pipelines. Operators are likely to come up with solutions to combat this, such as EnLink’s plan in Louisiana to mix new sections of pipeline with viable recycled natural gas pipelines. Approaches such as this, as well as newbuild projects like Wolf Midstream’s 563 km CO2 pipeline in the US, highlight that demand for new pipeline supply from carbon capture and storage (CCS) projects should be strong in the coming years, despite the potential to reconfigure the existing installed base. With both oil and gas and ET-related pipelines expected to benefit from stronger demand, it appears the market is in a much better place for companies involved in the pipeline industry than they were this time last year.

Figure 1. North America onshore oil and gas pipeline installations. (Source: Westwood World Onshore Pipelines Market Forecast) Figure 2. Global onshore oil and gas pipeline installations. (Source: Westwood World Onshore Pipelines Market Forecast)

However, it is important to highlight that numerous factors remain in play that will impact how much demand can grow. Green shoots but plenty of threats remain Commodity price fluctuations remain a threat, with 2020 underlining how quickly markets can change and how companies are quick to respond to difficult market conditions by stopping projects. North America is at particular risk of this, with Canadian oil sands reliant on high prices for production growth while activity in the US shale plays follows commodity pricing closely. For example, rig counts in the gas basins of Appalachia and Haynesville declined recently following a decline in the natural gas price after Freeport LNG announced a multi-month outage at its Freeport facility. With CAPEX for new pipelines often reaching into the multi-billion-dollar range, any drop in activity from operators is likely to quickly disrupt pipeline projects in FEED, delaying them or even leading to cancellations. Demand outstripping supply is also a major concern. A squeezed raw material market is pushing up prices across the energy industry, and manufacturers are reporting price increases of 15% already this year. Pipelines are far from immune to this, with material pricing delaying projects in the past when the pipeline owner re-tenders or delays FID until pricing is more favourable. Despite these factors, the key issue remains the same as it has for many years. No matter how strong the market appears, political and social outcry are unlikely to go away anytime soon. The arduous progress through the courts of lines such as Keystone XL (eventually cancelled on Biden’s first day in office) and the Mountain Valley Pipeline which, despite being 96% complete, remains uncompleted because of a ruling that has rescinded one of the key permits, is likely to remain the primary reason pipelines cannot be installed. Even if the recent surge in prices in the US could signal a government that looks more favourably on projects, this will matter little if public outcry remains high. Even CCS and hydrogen lines are not immune to protests and legal challenges. A protest group has been set up in opposition to two CO2 pipelines (Greenway and ADM/Wolf Carbon Solutions CO2 pipeline) that are planned to run through Illinois, citing concerns over safety, environmental damage and land usage as the primary reasons for opposition. Similar issues to that of conventional oil and gas pipelines. Despite this, the market for pipelines in North America appears to be in a much stronger place than even a year ago. The projects mentioned highlight the renewed drive to increase pipeline capacity across North America, supported by stronger oil and gas prices expected, and the continued move into ET.

Figure 3. North America onshore oil and gas pipeline installations by diameter. (Source: Westwood World Onshore Pipelines Market Forecast) Figure 4. USA wells drilled and DUCs. (Source: Westwood Energent) Figure 5. Current North America onshore oil and gas pipeline installed base by diameter. (Source: Westwood World Onshore Pipelines Market Forecast)