Volume 25 Number 11 - November 2025

www.trentoncorp.com

Volume 25 Number 11 - November 2025

www.trentoncorp.com

03. Editor's comment

05. Pipeline news

Updates from Phillips 66, AMPP, STATS Group, ABB, Pembina Pipeline Corp., and more.

MIDSTREAM INSIGHTS

10. A one year assesment of policy changes affecting the midstream sector

Jim Noe, Elizabeth Craddock, and Kamran Mohiuddin, Holland & Knight LLP, assess how recent US federal policy, legislative, and judicial developments are reshaping the pipeline industry, and influencing infrastructure development, investment, and operations.

KEYNOTE ARTICLE

15. Pipeline cybersecurity: we're not even half way there yet Hector Perez, Global Head of Strategy – Industrial Cybersecurity, Black & Veatch.

PIPELINE SERVICES

19. Powering the digital age

Sanna Silander, Energy Business Director, North America, Wärtsilä Energy.

COATINGS AND CORROSION

23. Little details are a big deal for pipelines fuelling the AI boom

Holly Tyler, Specialty Polymer Coatings (SPC) – a division of Carboline – Tulsa, Oklahoma, USA.

HYDROGEN PIPELINES

28. A new generation of hydrogen pipelines

Robert H. Shelton, President and CEO of H2C Safety Pipe Inc.

COVER STORY

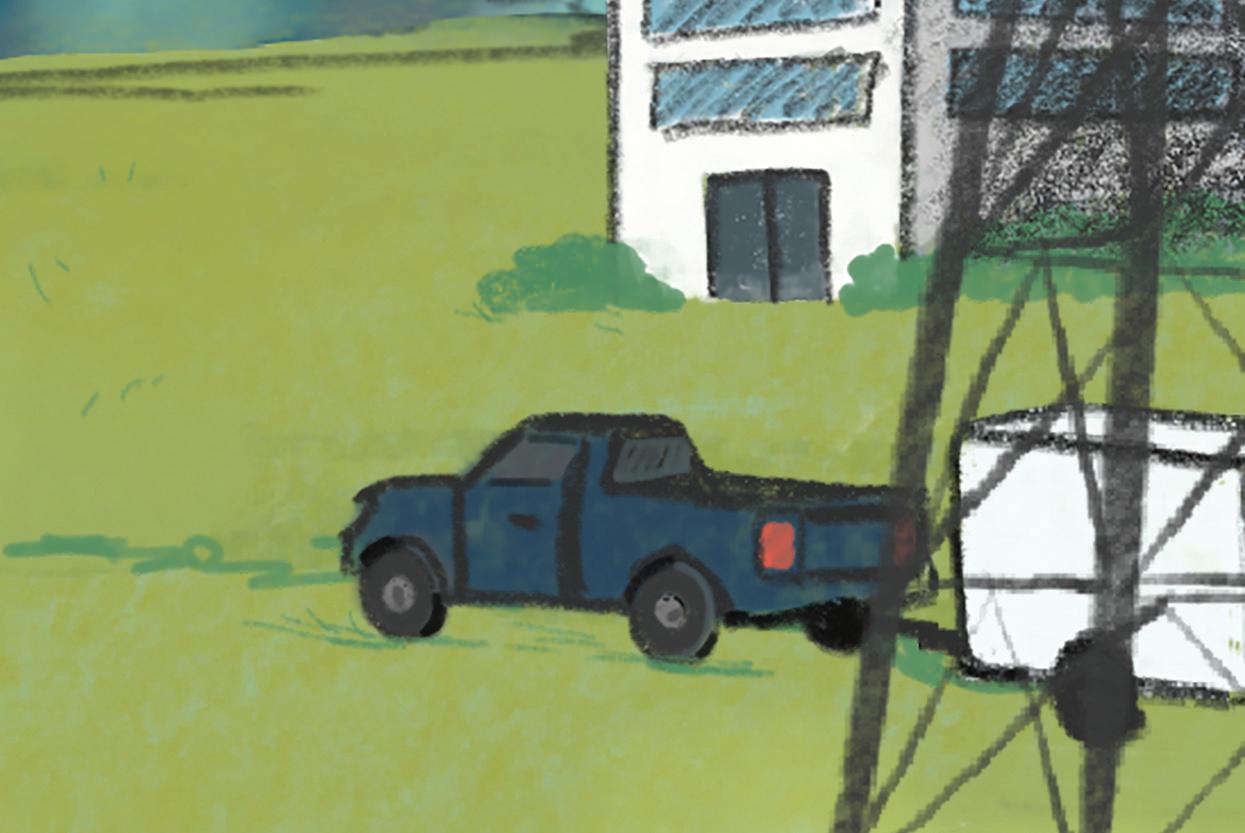

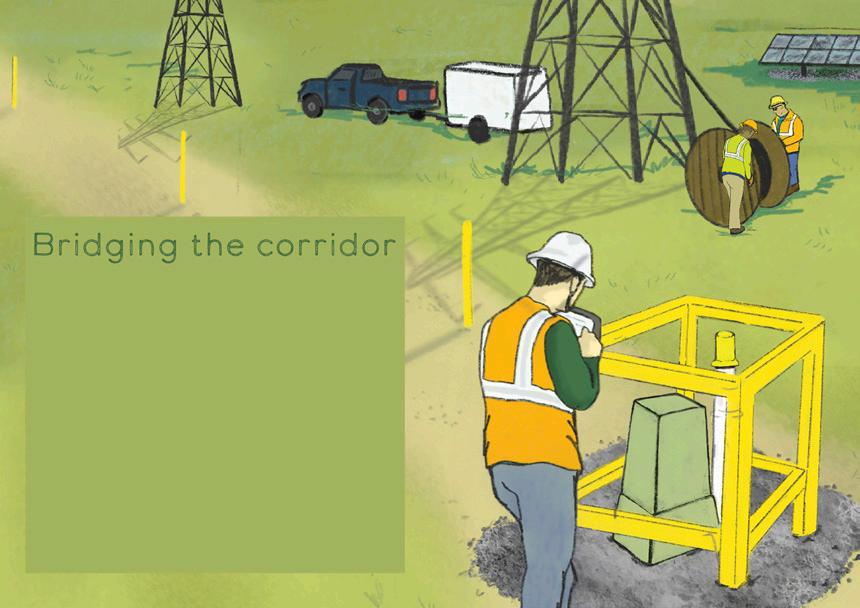

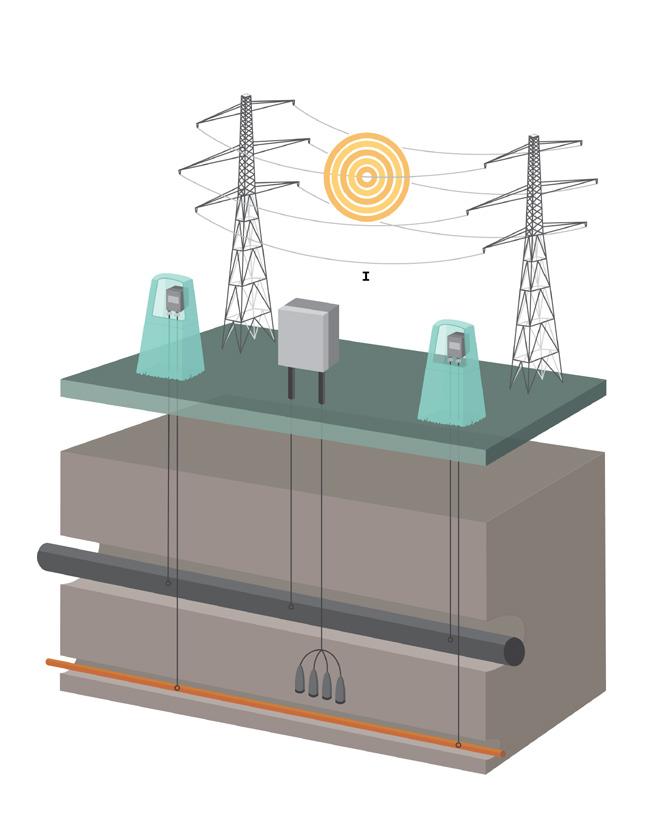

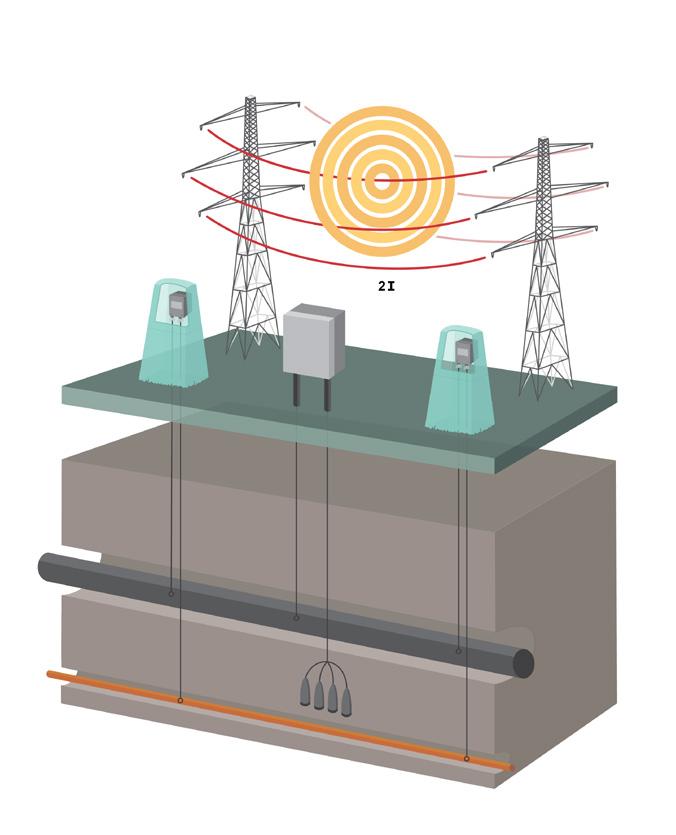

34. Bridging the corridor Jarret Brelsford, Dairyland Electrical Industries, USA.

39. The case for scope 4 thinking Brendan Hegerty, Director of Growth and Sustainability at Oxford Flow.

REPAIR AND REHABILITATION

43. Elastic fantastic Edwin Welles, Vice President - Viscotaq.

ROVS AND UNDERWATER INSPECTION

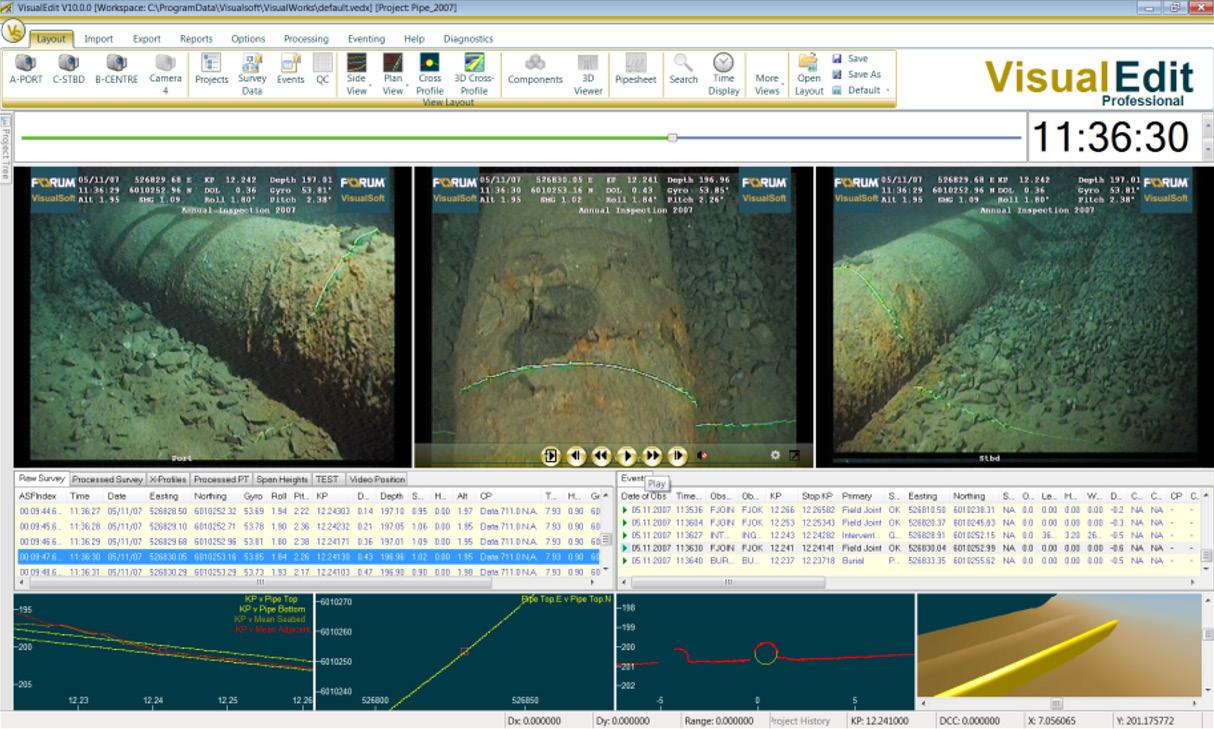

47. The role of advanced ROVs Matt Simpson, Systems Support Manager at Forum Energy Technologies.

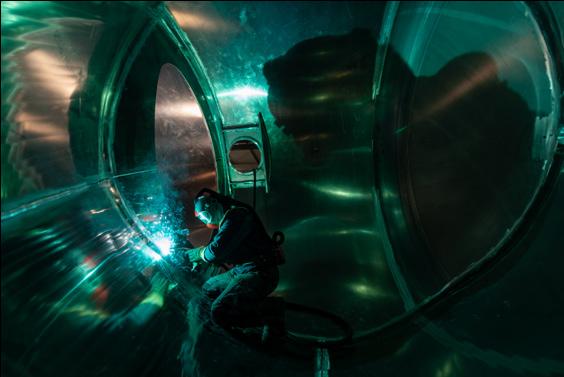

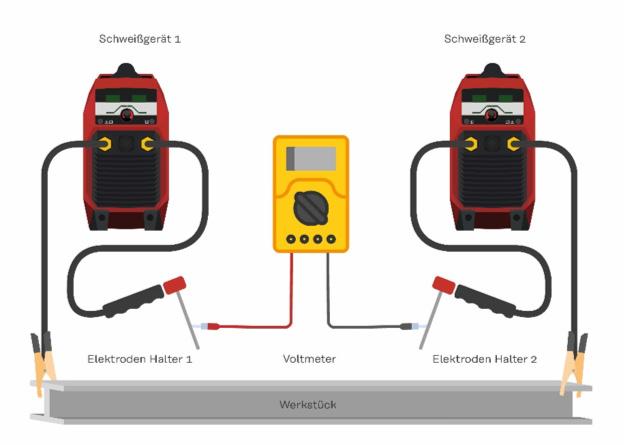

WELDING AND MATERIALS

51. The unseen hazard of welding Thomas Roob, Fronius International GmbH, Austria.

[www.worldpipelines.com]

Dairyland Electrical Industries works closely with both utility and pipeline sectors, providing them a unique view of the changes being played out across shared corridors. In this article, Bridging the Corridor, Dairyland offers a field-informed perspective on how reconductoring is changing the AC interference risk profile for buried pipelines. By elevate the conversation, Dairyland aims to help prevent future problems through early, cross sector coordination. Learn more at www.dairyland.com

MANAGING EDITOR

James Little james.little@worldpipelines.com

ASSISTANT EDITOR

Emilie Grant emilie.grant@worldpipelines.com

SALES DIRECTOR

Rod Hardy rod.hardy@worldpipelines.com

SALES MANAGER

Chris Lethbridge chris.lethbridge@worldpipelines.com

SALES EXECUTIVE

Daniel Farr daniel.farr@worldpipelines.com

PRODUCTION DESIGNER

Siroun Dokmejian siroun.dokmejian@worldpipelines.com

HEAD OF EVENTS

Louise Cameron louise.cameron@worldpipelines.com

EVENTS COORDINATOR

Chloe Lelliott chloe.lelliott@worldpipelines.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL CONTENT COORDINATOR

Kristian Ilasko kristian.ilasko@worldpipelines.com

JUNIOR VIDEO ASSISTANT

Amélie Meury-Cashman amelie.meury-cashman@worldpipelines.com

SENIOR WEB DEVELOPER

Ahmed Syed Jafri ahmed.jafri@worldpipelines.com

DIGITAL ADMINISTRATOR

Nicole Harman-Smith nicole.harman-smith@worldpipelines.com

ADMINISTRATION MANAGER

Laura White laura.white@worldpipelines.com

Palladian Publications Ltd, 15 South Street, Farnham, Surrey, GU9 7QU, UK

Tel: +44 (0) 1252 718 999 Website: www.worldpipelines.com Email: enquiries@worldpipelines.com

Annual subscription £60 UK including postage/£75 overseas (postage airmail). Special two year discounted rate: £96 UK including postage/£120 overseas (postage airmail). Claims for non receipt of issues must be made within three months of publication of the issue or they will not be honoured without charge.

Applicable only to USA & Canada: World Pipelines (ISSN No: 1472-7390, USPS No: 020-988) is published monthly by Palladian Publications Ltd, GBR and distributed in the USA by Asendia USA, 701C Ashland Avenue, Folcroft, PA 19032. Periodicals postage paid at Philadelphia, PA & additional mailing offices. POSTMASTER: send address changes to World Pipelines, 701C Ashland Avenue, Folcroft, PA 19032.

SENIOR EDITOR Elizabeth Corner elizabeth.corner@worldpipelines.com

The Northern Endurance Partnership (NEP) was the UK’s first carbon capture and storage (CCS) network to achieve Final Investment Decision (FID), in December 2024. Project partners Equinor, bp, and TotalEnergies will gather, compress, and transport carbon emissions from industry in the north east of England, for storage in the Endurance saline aquifer, located in the Bunter Sandstone Formation of the UK Southern North Sea. Some 4 million tpy of CO2 will be stored, with the possibility for expansion up to 23 million tpy. The NEP forms the offshore backbone of the East Coast Cluster, and the FID is a huge milestone for the UK CCS industry.

The UK government has adopted a cluster-based approach to CCS, designed to decarbonise entre industrial regions rather than isolated plants. The clever cluster system connects multiple emitters (be they steelworks, power stations, chemical plants, or cement facilities) to shared CO2 transport and offshore storage infrastructure. Each cluster comprises of capture projects, onshore and offshore pipelines, and storage sites (depleted gas fields or aquifers under the North Sea). This way, the UK is creating a national network of CCS pipelines, a bit like the way it once built its natural gas system.

The key clusters so far are: the East Coast Cluster, located around Teesside and the Humber (bringing together the Northern Endurance Partnership, Net Zero Teesside, and Zero Carbon Humber); HyNet North West, covering industrial sites in the North West of England and North Wales (linked to the Liverpool Bay CCS storage site); Viking CCS, centred on the Humber and operated by Harbour Energy; and Acorn CCS in north-east Scotland, which will use the re-purposed Goldeneye pipeline and the new SCO2T Connect system to move CO2 from emitters at St Fergus to offshore storage.

A complex, energy-intensive, and multi-stage process exists to get the CO2 ready for transport through pipelines. The gas must be compressed to a dense, supercritical phase for pipeline transport (above 74 bar, >31˚C).

Everllence (formerly MAN Energy Solutions) is providing the CO2 compression systems for the Net Zero Teesside Power and NEP projects in the East Coast Cluster. Everllence will supply five centrifugal compressor trains to compress over 370 000 kg of CO2/h for permanent offshore storage.

Looking west, Baker Hughes is providing compression technology for HyNet North West’s CO2 projects, specifically for the Liverpool Bay CCS Project. It will supply three CO2 centrifugal compressor trains with electric motors for the Point of Ayr compression station, which will form the backbone of the HyNet cluster’s transportation and storage system.

John Crane is providing six of its Type 28XP Dry Gas Seals for centrifugal compressors at a new CO2 compression facility in North Wales. This facility will act as a central hub to transport captured emissions from industrial plants in North Wales and the North West of England for permanent storage beneath the seabed.

As the projects, and contracts, stack up, we have launched the World Pipelines CCS Forum – a one day CO2 pipeline focused conference. The event will take place on 18 March 2026 at the Park Plaza London Riverbank. We’ll welcome senior representatives and technical experts from across the UK pipeline, energy, and CCS sectors, to discuss CO2 pipeline transport at a pivotal moment for UK decarbonisation.

CCS Forum delegates will also benefit from a mid-morning session – co-located with our sister magazine World Cement’s EnviroTech 2026 – on Peak Cluster, the world’s largest cement decarbonisation project. We believe that the convergence of cement and pipeline industry figureheads in one room for this session will offer a unique opportunity for cross-sector collaboration.

If you’d like to join us next March, visit https://www.worldpipelines.com/ccsforum2026

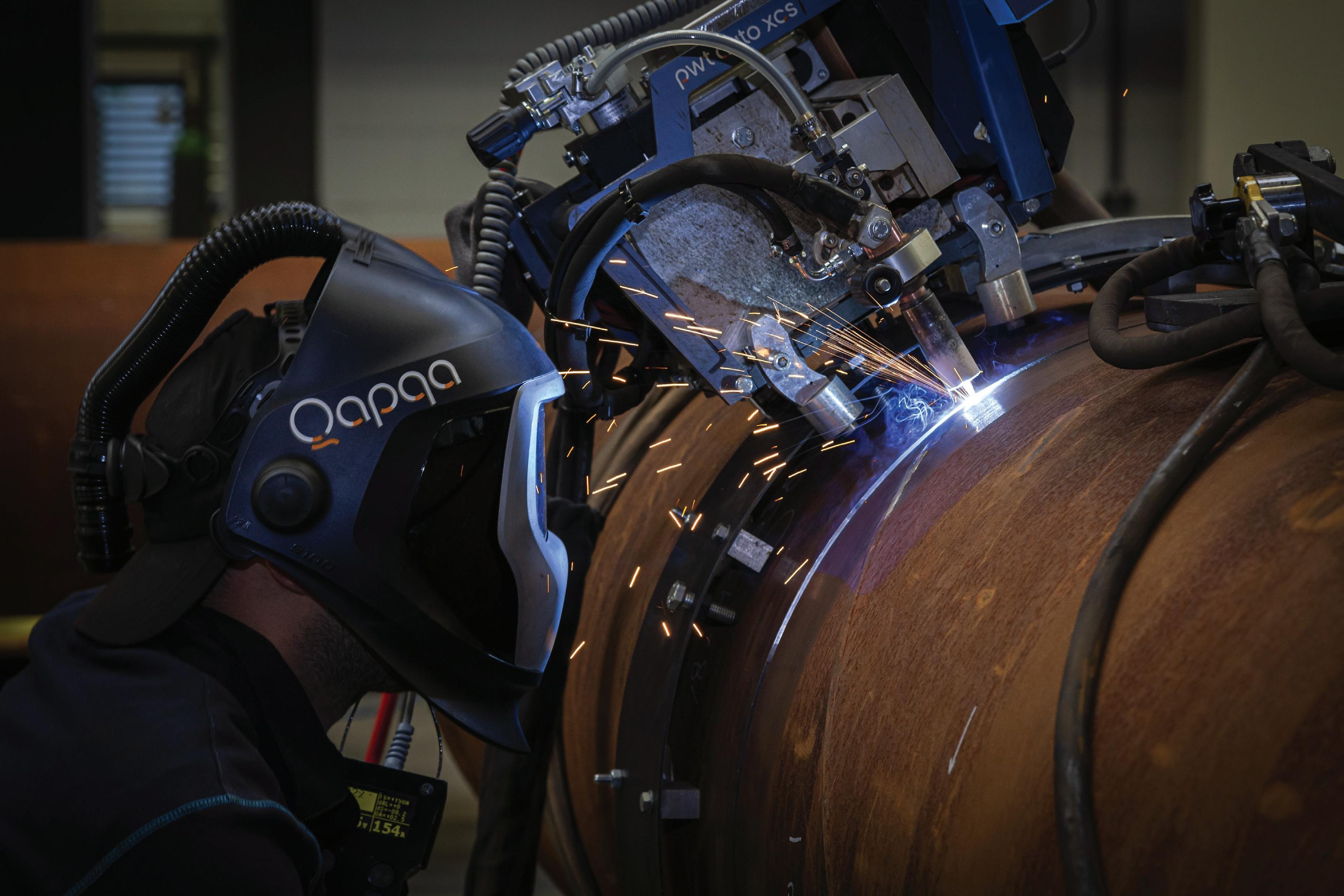

Across energy and critical infrastructure, we bring expertise where complexity is highest, partnering with globally local teams and leveraging unrivalled proprietary technologies. Like the M-500 Single Torch External Welding System, seamlessly integrated with Data 360 our cloud-based digital platform that analyses, and visualises your project performance data in real time. We move projects forward, no matter the challenge.

We’re here to partner on how our specialist welding and coating solutions can help you power tomorrow.

Phillips 66 and Kinder Morgan, Inc. announce binding open season for Western Gateway Pipeline

Phillips 66 and Kinder Morgan, Inc. has announced the commencement of a binding open season for transportation service on the Western Gateway Pipeline (Western Gateway), a newly proposed refined products pipeline system.

The Western Gateway project will facilitate the transportation of refined products from origin points in Texas to key downstream markets in Arizona and California, with connectivity to Las Vegas, Nevada via Kinder Morgan’s CALNEV Pipeline.

The open season commenced at 12:00 pm Central Time on 20 October 2025, and will close at 12:00 pm Central Time on 19 December 2025.

The Western Gateway Pipeline will be a partnership between Phillips 66 and Kinder Morgan to create incremental capacity for refined products from Borger, Texas to Arizona and California.

The Western Gateway Pipeline will consist of a newbuild pipeline from Borger, Texas to Phoenix, Arizona, combined with Kinder Morgan’s existing SFPP, L.P. pipeline from Colton, California to Phoenix, Arizona, which will be reversed to enable east to west product flows into California. The Western Gateway Pipeline will be fed from supplies connected to Borger, Texas as well as supplies already connected to SFPP’s system in El Paso, Texas. The Gold Pipeline, operated by Phillips 66, which currently flows from Borger to St. Louis, will be reversed to enable refined products from midcontinent refineries to flow toward Borger and supply the Western Gateway Pipeline.

The Western Gateway Pipeline will connect Midwest refinery supply to Phoenix and California, with connectivity to Las Vegas, Nevada via Kinder Morgan’s CALNEV Pipeline.

The Association for Materials Protection and Performance (AMPP), the world’s leading authority on corrosion control and protective coatings, has announced the rollout of an updated version of its Coating Inspector Program (CIP) Level 2 course, beginning mid October.

The revised course incorporates targeted enhancements to better align with current industry standards, modern inspection practices, and evolving learner needs.

Key updates include:

) Enhanced practical exam: new evaluation criteria and standardised procedures for greater consistency across instructors.

) Updated equipment: modern inspection tools replace outdated equipment to match today’s industry practices.

) Expanded hands-on activities: More interactive exercises to reinforce critical skills and increase real-world application.

) Revised case studies: updated scenarios reflecting realworld corrosion challenges that promote critical thinking.

) Improved course flow and clarity: streamlined content, simplified documentation, and improved pacing for stronger learner retention.

The rollout occurred earlier this month at AMPP training centres in Houston, Pennsylvania, and Dubai, with all public English courses transitioning to the new version by 1 January 2026. Translations into other languages will begin in April 2026.

“Our goal is continuous improvement,” said Jennifer Rogers, AMPP Senior Director of Education. “Even small adjustments to our courses can significantly impact the learning experience and skill application. These updates ensure our inspectors are trained using the most relevant tools and methods, keeping pace with the changing demands of the coatings industry.”

The CIP Level 2 course builds on foundational knowledge from CIP Level 1, focusing on advanced inspection techniques, standards, and safety practices. Completing the course is a key requirement toward earning the Certified Coatings Inspector (Level 2) Certification, a globally recognised credential within the coatings and corrosion-control industry.

McKinsey: energy transition momentum may be slowing

McKinsey & Co. has launched its tenth annual Global Energy Perspective, which offers a comprehensive analysis of the forces shaping the energy sector and projects energy demand and supply trends across a range of fuel types and regions through 2050.

The report reveals that the world may be moving closer towards a slower energy transition across all scenarios, as governments and policymakers increasingly emphasise energy affordability and security amid geopolitical uncertainty.

The Global Energy Perspective aims to highlight the gap between the world’s current trajectory and what would be needed to avoid the worst effects of climate change as defined by the Paris Agreement. It describes three plausible scenarios for

how a transition to a system of lower carbon energy could play out: slow evolution, continued momentum, and sustainable transformation.

A system-wide view could offer a faster and more cost-effective path to emission reduction: The final 5% decarbonisation of the power sector could cost US$90 - 170/t of CO2, compared to US$20/t for 45 - 70% decarbonisation.

The report shows that there is no silver bullet for decarbonisation and that different countries and regions will increasingly follow distinct trajectories based on their local economic conditions, resource endowment, and the realities facing particular industries.

Rockwell Automation, Inc. recently released a commissioned report by GlobalData on key technologies in the oil and gas industry.

According to the Oil and Gas Technology Outlook for 2030 and Beyond, oil and gas companies are undergoing a seismic shift, driven by rapid digitalisation and the integration of advanced technologies.

A summer of extensive activity within the Norwegian Continental Shelf (NCS) has resulted in Denholm Pipetech, the flow remediation solution specialist, experiencing its best quarter for over a decade.

Global engineering and energy services consultancy Penspen has announced record-breaking performance in the Middle East and Africa, securing project management consultancy and engineering contracts worth more than US$400 million so far this year.

A global shortage of gas turbines is likely to exacerbate delays and drive up costs for new gas-fired power projects in Vietnam and the Philippines, according to a new report from the Institute for Energy Economics and Financial Analysis (IEEFA).

Oil shipments through the IraqTurkiye pipeline resumed on Saturday after two and a half years, in a move expected to strengthen Turkiye’s energy supply and add diversity to global markets.

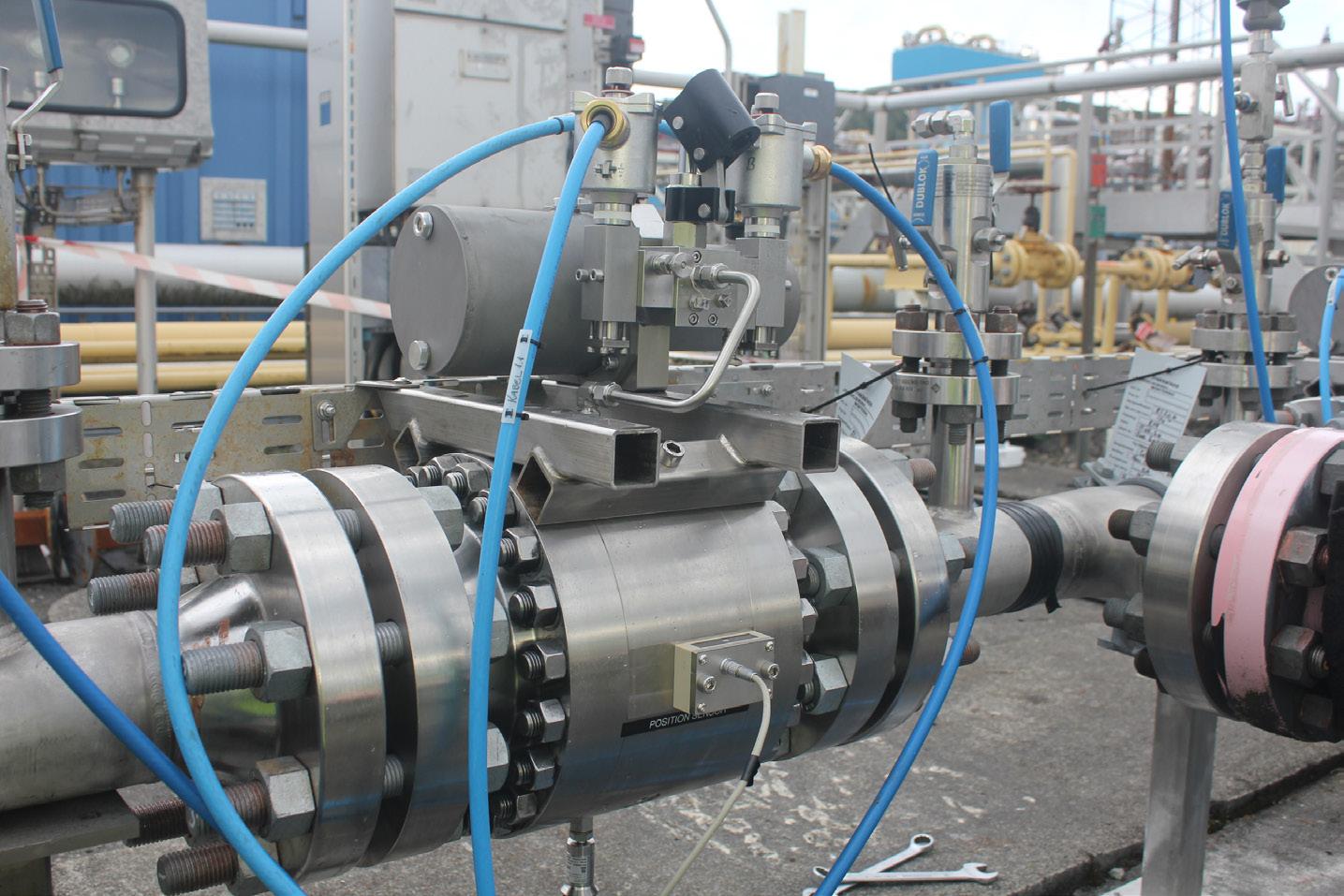

STATS Group completes world-first high pressure hydrogen pipeline isolation

STATS Group, has played a role in SGN’s LTS Futures project where a live 18 in. high pressure hydrogen pipeline was safely isolated.

STATS patented BISEP® tool – which is widely deployed on global oil and gas assets – was successfully deployed and has been proven as a leak-tight line stopping technology which is safe to use on high pressure hydrogen pipelines.

Meeting UK net zero targets will be one of the toughest modern-day challenges. The SGN LTS Futures project investigated the potential of repurposing the Local Transmission System (LTS) from natural gas to hydrogen to drive forward this target.

The success of the trial is a significant development in the drive to meet net-zero emission targets and could lead to the repurposing of SGN’s 11 600 km UK gas network from transporting hydrocarbons to hydrogen.

The project was part of SGN’s successful LTS Futures trial carried out on a representative 30 km stretch of pipeline which runs from Grangemouth to Granton in Edinburgh.

SGN was delighted with the outcome and said the lessons learned on LTS Futures would “create a blueprint” for repurposing the entire LTS to hydrogen and provide a “resilient backbone” for a net zero energy system.

The scope of work included the installation

of a DNV proprietary Grouted Tee, to provide access for STATS to perform hot tapping, line stopping, swarf (drill cuttings) dispersal, and completion plug installation. As part of the Live Trial, the STATS BISEP line stopping tool, delivered a fail-safe, 100% leak-tight double block and bleed isolation.

The BISEP had to be validated to operate safely and leak-tight in high pressure hydrogen, which presented unique operational parameters. Unlike traditional line stopping technology, BISEP guarantees zero-leakage isolation, significantly increasing safety and reducing environmental risks.

STATS worked closely with DNV who provided a Grouted Tee to provide a branch offtake and suitable for use with hydrogen –which provides an alternative to live welding.

The safe isolation and modification of pipelines like the one used in the LTS Futures trial is essential to the entire hydrogen transition. Until now, no proven hot tapping or line stopping method existed which could ensure that repair, maintenance or modifications can take place safely and efficiently. Not least the reduced emissions from the use of BISEP technology whether in use for hydrocarbon gas or hydrogen.

ABB: Industrial downtime costs up to US$500 000/h and can happen every week

A new global report from ABB, developed in partnership with Sapio Research and based on a survey of 3600 senior decision-makers across multiple sectors, finds that just over half of respondents (55%) have a strategic and proactive plan to modernise facilities and manage out obsolete components like old motors and drives. Despite growing awareness, the data highlights that 44% of leaders experience equipment-related interruptions at least monthly, with 14 % reporting stop-pages every single week – implying major financial and operational risks. The majority estimate these sudden disruptions cost anywhere from US$10 000 up to US$500 000/h. For 7%, the figure climbs even higher.

The report reveals key gaps between planning and execution. While 55% of industry players claim to have a proactive modernisation strategy, only one in five of those grappling with weekly interruptions actually implement such a plan. Likewise, among the 30% who are dealing

with monthly issues, just one third (34%) actively manage life-cycle processes for their facilities and assets.

Communication gaps remain. Despite the strikingly high hourly cost of un-planned downtime, over a third of respondents find it somewhat difficult or very difficult to articulate the return on investment (ROI) of modernisation projects to senior leaders. Meanwhile, 17% of businesses “rarely or never” include the impact of lost productivity in their capital investment decisions.

Cost remains the top barrier to modernisation for 28% of industrial players. Among the 66% who have undertaken an upgrading and retrofitting project in the last two years, just over one quarter explicitly did so to reduce stoppage risks – highlighting that the link between continuous life-cycle management and operational reliability is still not fully understood or acted upon, even by many modernisation proponents.

PROTECTIVE OUTERWRAPS

3 - 6 November 2025

ADIPEC

Abu Dhabi, UAE

https://www.adipec.com/

11 - 13 November 2025

The Shah Deniz consortium has announced the award of three major offshore contracts to advance the Shah Deniz Compression (SDC) project. The contracts, with a combined value of approximately US$700 million, have been awarded to the Saipem/BOS Shelf joint venture.

1st Pipeline Technology Conference

Asia

Kuala Lumpur, Malaysia

https://www.pipeline-conference.asia/

19 - 23 January 2026

PPIM 2026

Houston, USA

https://ppimconference.com/

10 - 11 February 2026

AMI Pipeline Coating 2026

Vienna, Austria

https://www.ami-events.com/event/d7ee7978d036-4457-a67b-78d5343495b9/home

11 - 15 February 2026

78th Annual PLCA Convention

Phoenix, Arizona

https://www.plca.org/annual-convention-events

18 March 2026

World Pipelines CCS Forum - London London, UK

https://www.worldpipelines.com/events/worldpipelines-ccs-forum--london-2026/

15 - 19 March 2026

AMPP Annual Conference + Expo

Houston, USA

https://ace.ampp.org/home

27 - 30 April 2026

Pipeline Technology Conference (PTC)

Berlin, Germany

https://www.pipeline-conference.com/

4 - 7 May 2026

Offshore Technology Conference

Houston, USA

https://2026.otcnet.org/ 4 - 7 May 2026

The scope of work under the contracts includes:

) Transportation and installation of the entire SDC platform – a new 19 000 t facility to be installed in the Caspian Sea.

) Engineering, procurement, construction and installation of subsea structures, including approximately 26 km of new offshore pipelines, to connect the SDC platform with existing Shah Deniz infrastructure.

) All onshore construction activities will be carried out at Baku Deep Water Jacket Factory, operated by BOS Shelf.

Offshore construction and installation will be executed using two of Azerbaijan’s flagship vessels:

) The Khankendi, a subsea construction vessel owned by the Shah Deniz consortium.

Alliance Pipeline portion receives Canada Energy Regulator approval

Pembina Pipeline Corp. has announced that the Canada Energy Regulator (CER) has approved the negotiated settlement between Alliance Pipeline Ltd Partnership and shippers and interested parties on the Canadian portion of the Alliance Pipeline.

“We are pleased that the CER has approved the settlement between Alliance and the Shipper Committee, resulting in a just and reasonable tolling structure for the next ten years,” said Scott Burrows, Pembina’s President and Chief Executive Officer. “

The Alliance Pipeline delivers an average of 1.7 billion ft3/d of liquids rich gas and consists of an approximately 3850 km integrated Canadian and US natural gas transmission pipeline, from the WCSB and the Williston Basin in North Dakota to natural gas markets in the Chicago, Illinois area. The Canadian portion consists of a 1561 km natural gas mainline pipeline and related lateral pipelines connected to natural gas receipt locations, primarily in northwestern Alberta and northeastern British Columbia.

) The Israfil Huseynov pipelay barge owned by the Azerbaijan Caspian Shipping Company (ASCO).

) Both vessels will be operated by Saipem under the terms of the new contracts.

Matt Kirkham, bp Vice President, Projects, for the Azerbaijan, Georgia and Türkiye region, Middle East and Africa, said: “With the award of these new contracts for major construction and installation works, we are making significant progress on the SDC project. The contracts will fully leverage local fabrication yards and infrastructure, engaging the local workforce. This once again demonstrates that Azerbaijan possesses world-class onshore fabrication and offshore installation capabilities that fully meet international standards. Just one example –between 2026 - 2028, a total of 3040 t of subsea structures will be fabricated and installed as part of the SDC project. It’s a remarkable piece of activity that highlights the scale and ambition of what we are delivering. I would like to thank everyone who was involved in finalising these important contracts.”

Offshore activities are expected to commence with pin pile installation in 3Q26, with completion targeted for 2029.

• Underground gas storage: a critical pillar for energy security

• Wood Mackenzie: CCU technology development lags behind CCS

• OGCI annual report marks further progress reducing emissions and driving momentum

Follow us on LinkedIn to read more about the articles linkedin.com/showcase/worldpipelines

Jim Noe, Elizabeth Craddock, and Kamran Mohiuddin, Holland & Knight LLP, assess how recent US federal policy, legislative, and judicial developments are reshaping the pipeline industry, and influencing infrastructure development, investment, and operations.

The US pipeline industry operates within a complex regulatory and policy environment that directly influences infrastructure development, operations and investment decisions. Over the last 12 months, significant federal energy policy changes have created new

dynamics for the midstream sector. Though broader policies around energy production, permitting, trade, public land use, and regulation carry important implications for midstream stakeholders, two recent legislative developments have provided direct pipeline-specific measures:

) The Promoting Cross-border Energy Infrastructure Act (H.R.3062), which passed the US House of Representatives in September 2025 and establishes a new statutory framework for international pipeline permitting.

) The Promoting Innovation in Pipeline Efficiency and Safety (PIPES) Act of 2025 (H.R.5301), which reauthorises the Pipeline and Hazardous Materials Safety Administration (PHMSA) through 2029, with enhanced safety provisions for emerging fuels, including CO2 and hydrogen pipelines.1

A review of executive orders (EOs), regulations and legislation since January 2025 shows that few measures have been directed specifically at pipelines. Instead, federal attention has focused on deregulation, expanding energy production, and streamlining permitting processes broadly.

The expectation appears to be that pipeline construction and expansion will follow upstream activity rather than be driven by direct government intervention. H.R.3062 addresses a key infrastructure concern by transferring cross-border pipeline permitting from executive branch discretion to a statutory framework managed by specialised agencies, while H.R.5301 seeks to modernise pipeline safety oversight for traditional and emerging fuels.2

Environmental and project permitting presents a complex landscape where sweeping administrative reforms intersect with ongoing legal challenges and implementation hurdles. The Trump Administration has launched the most comprehensive federal permitting reform initiative in decades, combining executive action, technological modernisation, and favourable judicial precedent to accelerate infrastructure development.

The US Supreme Court’s unanimous 29 May 2025, decision in Seven County Infrastructure Coalition vs Eagle County, Colorado fundamentally reshaped environmental review obligations under the National Environmental Policy Act (NEPA), which also has impacts on reviews for pipeline and infrastructure projects. The Court held that the Surface Transportation Board properly limited its Environmental Impact Statement (EIS) to direct effects of an 88 mile crude oil railway, rejecting requirements to analyse indirect or upstream drilling and downstream refining impacts that fell outside the agency’s regulatory authority.3 In short, the Supreme Court eschewed the requirement for agencies to analyse all the ‘what if’ follow-on or indirect implications of allowing a targeted project to continue.

The Court’s opinion established that federal agencies are entitled to “substantial deference” when determining the scope of environmental reviews, reversing years of US Court of Appeals for the District of Columbia Circuit precedent requiring expansive analysis of indirect effects.3 The decision directly impacts pipeline permitting by clarifying that agencies need not consider “separate projects” that are “geographically”

distinct or outside the agency’s jurisdiction.3 The Court emphasised that even if an EIS “falls short in some respects”, this does not automatically require vacating project approvals unless the deficiency affected the agency’s ultimate decision.3

The US Department of the Interior has implemented reforms to expedite NEPA reviews for energy infrastructure projects, aligning its permitting processes with recent legislative changes to accelerate environmental assessments and approvals.4 The Trump Administration’s presidential memorandum on Updating Permitting Technology for the 21st Century (15 April 2025) directs agencies to “make maximum use of technology” in environmental review processes, supported by the Permitting Technology Action Plan that establishes government-wide strategies for digital permitting platforms.5

There is a number of legislative efforts underway in US Congress that would attempt to reign in the scope of environmental reviews, impose deadlines on reviewing agencies, streamline multi-agency review processes, establish tightened statute of limitations on lawsuits attacking permitting approvals and direct agencies to remand defective environmental reviews to agencies for improvement rather than vacating agency actions based on deficient environmental reviews. Given the slim majorities held by Republicans in both the House and Senate and the need for bipartisan action in the Senate combined with the complexities posed by the looming November 2026 midterm elections, it is uncertain whether any of these legislative efforts will successfully lead to new law. However, given the importance of these efforts on the midstream industry, the efforts should be closely followed by the industry.

Two EOs issued on the first day of the Trump Administration have framed the government’s approach to energy policy. EO 14154, Unleashing American Energy, directs agencies to reduce regulatory barriers and expedite permitting processes.6 EO 14156, Declaring a National Energy Emergency, invokes broad presidential powers under the National Emergencies Act.7

The national emergency declaration activates more than 100 statutory authorities, including the potential suspension of certain environmental regulations, acceleration of approvals and invocation of Defense Production Act authorities.7, 8 In theory, these tools could be applied to accelerate pipeline projects facing delay – though so far, they have not been deployed in this way.

For midstream stakeholders, the key point is that federal agencies are under pressure to act quickly on permit reviews advancing traditional energy projects and, though extraordinary emergency powers remain available, their use has thus far been restrained. The practical effect has been modestly shorter timelines for environmental reviews and somewhat improved interagency coordination.

The Trump Administration reinforced its energy policy with the creation of the National Energy Dominance Council through EO 14213.9 This Council, a White House interagency council chaired by the Interior Secretary, brings together senior

officials from across the federal government to coordinate strategies for energy production, transportation and distribution.9, 10 The Council has yet to deliver major pipelinespecific initiatives.

The most consequential legislative development so far in 2025 is the passage of the One Big Beautiful Bill Act (OBBB), a nearly 900 page reconciliation package enacted in July.11 Although the legislation does not contain pipeline-specific mandates, its provisions on leasing, royalties, and revoking methane fees carry clear downstream implications for infrastructure demand. OBBB mandates quarterly oil and gas lease sales on public lands for 10 years, requiring the Bureau of Land Management (BLM) to offer at least 50% of nominated parcels for development. Offshore, the Bureau of Ocean Energy Management (BOEM) must hold at least two Gulf of America lease sales annually for 15 years, each covering 80 million acres.11 The bill requires BOEM to hold at least six offshore oil and gas lease sales in the Cook Inlet Planning Area in Alaska, with a minimum of one lease sale in each calendar year from 2026 to 2032, with each sale offering at least 1 million acres.11

The law also makes upstream projects more attractive economically. It restores federal onshore royalty rates to 12.5%, reversing the 16.67% minimum imposed by the Inflation Reduction Act.11 It eliminates the methane fee on federal leases that had threatened to add hundreds of dollars per ton of emissions to project costs.11 Together, these measures improve the economics of drilling, creating a likely increase in production that will require expanded gathering systems, trunklines and export pipelines.

While regulatory and legislative policy has reduced certain barriers, trade policy has raised new ones. On 30 May 2025, the Trump Administration doubled tariffs on imported steel and aluminium, raising duties from 25% to 50%.12 The scope of coverage was expanded to more than 400 product categories, many directly relevant to pipeline construction.13 Analysts estimate the steel and aluminium tariffs now affect more than US$320 billion in imports, a 68% increase in coverage.13

For an industry as steel-intensive as pipeline construction, these changes translate directly into higher costs. Line pipe, fittings and specialty machinery are all affected. Contractors report that tariffs of this magnitude are rarely absorbed and typically passed through to project sponsors, increasing capital costs across the board. The pipeline industry – along with other oil and gas trade associations – continue to engage with the Trump Administration on tariffs that directly impact the continued health and growth of the industry, but the administration appears to be content to allow the tariffs to remain largely in place.

The Federal Energy Regulatory Commission (FERC) continues to play a central role in pipeline approvals despite experiencing leadership changes throughout 2025. In its June 2025 action,

FERC adopted a suite of reforms aimed at expediting the development of natural gas infrastructure.14 These measures include streamlining the certificate application process, clarifying the scope of environmental review and increasing the cost threshold for automatic approval of routine projects.14 FERC also emphasised its commitment to removing unnecessary regulatory barriers, with the stated goal of facilitating timely construction of new facilities to meet market demand.14 The commission’s latest actions are expected to reduce permitting bottlenecks and provide greater certainty for project sponsors while maintaining core environmental protections.

Although partisan shifts on the commission can affect project timing, FERC’s independence and established procedures provide continuity. For midstream developers, the key is to monitor procedural adjustments that affect how quickly certificates can be obtained and projects advanced.

One year after the 2024 elections, US energy policy presents both opportunities and challenges for the pipeline sector. On the supportive side are expanded leasing mandates, permitting reform and regulatory streamlining, along with coordinated interagency efforts. On the challenging side are rising material costs, ongoing litigation and evolving FERC procedures.

In short, pipelines remain policy-adjacent rather than policy-driven. Yet, the evolving US energy landscape ensures that midstream infrastructure will continue to be shaped indirectly by the broader currents of national energy policy. No doubt that continued vigilance and engagement by the industry during this dynamic time remains vital.

1. H.R.3062, Promoting Cross-border Energy Infrastructure Act, 119th Cong. (2025); H.R.5301, Promoting Innovation in Pipeline Efficiency and Safety (PIPES) Act of 2025 (2025). Note: The PIPES act has been ordered reported out of committee and is yet to pass the House.

2. US House of Representatives Committee on Transportation and Infrastructure, “T&I Approves Bipartisan Bill to Reauthorise Federal Pipeline Safety Programmes,” Sept. 17, 2025.

3. Seven Cnty. Infrastructure Coal. vs Eagle Cnty., Colorado, 145 S. Ct. 1497 (2025).

4. “DOI Implements Unprecedented 14-Day NEPA Review Process Under National Energy Emergency EO”, Holland & Knight alert (April 24, 2025), https://www.hklaw. com/en/insights/publications/2025/04/doi-implements-unprecedented-14-daynepa-review-process.

5. Presidential Memoranda, Updating Permitting Technology for the 21st Century, April 15, 2025.

6. EO 14154, Unleashing American Energy.

7. EO 14156, Declaring a National Energy Emergency.

8. “Executive Order: Declaring a National Energy Emergency,” Holland & Knight Eyes on Washington Blog (Jan. 20, 2025), https://www.hklaw.com/en/insights/ publications/2025/01/executive-order-declaring-a-national-energy-emergency.

9. EO 14213, Establishing the National Energy Dominance Council.

10. “New Executive Action Aims to Streamline Environmental Reviews Through Digital Modernisation,” Holland & Knight alert (May 15, 2025), https://www. hklaw.com/en/insights/publications/2025/05/new-executive-action-aims-tostreamline-environmental.

11. One Big Beautiful Bill Act, Pub. L. No. 119-21, 139 Stat. 72 (2025).

12. Presidential Proclamation 10896, Adjusting Imports of Steel Into the US.

13. “Trump Extends Steel and Aluminium Tariffs to Hundreds of Products,” Institute for Energy Research (Aug. 28, 2025), https://www.instituteforenergyresearch.org/ international-issues/trump-extends-steel-and-aluminum-tariffs-to-hundreds-ofproducts/.

14. Federal Energy Regulatory Commission, News Release: FERC Takes Action to Remove Barriers to Building Natural Gas Facilities (June 18, 2025), https://www. ferc.gov/news-events/news/ferc-takes-action-remove-barriers-building-naturalgas-facilities.

Hector Perez, Global Head of Strategy –Industrial Cybersecurity, Black & Veatch, says that securing critical infrastructure means facing the risks already in your systems, and building cyber in from the start.

We used to believe that isolating pipeline control systems from networks was enough to keep them safe. We were wrong. The cyber threats facing energy companies don’t look anything like they did early in my career. When I first entered the workforce, I worked for a small company doing control system configuration management. Our job was to catch unauthorised changes to control logic and alert customers. When cybersecurity heated up, we shifted the company in that direction.

That’s when I started travelling to industry conferences around the world. I’ll never forget the first time someone in Shanghai asked me, “Why do I need cyber if my system is islanded?” I heard that question a lot.

Back then, we assumed air-gapping solved everything. Nobody believes that anymore. We’ve all heard the stories:

criminals leaving malware-infected USB drives around parking lots, labelled something like ‘Employee Pay Raises’, counting on curiosity to do the rest.

One pipeline operator told me how a package showed up one day at their maintenance shop filled with wireless mice, all stamped with their company logo.

It looked harmless, so the team handed the mice out around the facility. What they didn’t know was that the attackers had tampered with the devices to accept remote commands wirelessly.

Those were the early days. Now attackers are far more skilled at pulling off elaborate breaches. Headline-grabbing attacks, such as Triton and Colonial Pipeline, remind everyone what’s at stake. Awareness of the risks to pipeline OT infrastructure has gone up. But awareness doesn’t translate into action. If I had to put a number on it, I’d say we’re not even halfway there yet.

Compliance isn’t security

I still see operators celebrate because they passed an audit. That just means you’ve cleared the lowest bar. Attackers don’t care about your compliance report: they go after the gaps you didn’t close.

The biggest barrier I run into is human nature. We just don’t worry about problems we can’t see. That’s how people are wired. Nobody lies awake at night thinking about invisible threats.

But cybersecurity risks are sitting in your systems right now, whether you’re looking for them or not. Those systems were built 20 or 30 years ago and the lack of industrial cybersecurity measures means vulnerabilities were baked right in during construction. Pretending they’re not there doesn’t make them disappear. That kind of thinking becomes dangerous when you’re managing critical infrastructure that sophisticated attackers are actively targeting. Pipeline operators need to move beyond awareness and compliance checking toward meaningful action.

But where do you start? First, keep in mind that when OT cybersecurity isn’t baked into planning, you’ll spend time later fixing problems that shouldn’t have happened.

Systems that go back decades may contain vulnerabilities that were built into them from the start. While you may not see those residual risks, that doesn’t mean they don’t exist.

The best way to cut through this uncertainty is to quantify your risks. Let’s say your organisation faces US$5 million in cyber risks annually. If spending US$1 million can prevent US$4 million of those potential losses, isn’t that money well spent? Looking at the trade-offs gives you a good sense of whether it’s better to start over, upgrade what you have or simply bolt on some controls.

And don’t assume old systems are harmless just because they’re familiar. Hard as it is to imagine, some pipeline facilities still run Windows XP or Windows 7 because their organisations remain reluctant to buy newer operating systems. A full rip-and-replace is costly and disruptive, but inaction only extends an invitation to trouble.

That doesn’t mean you need to throw everything away. Even modest steps – placing intrusion detection at network

bottlenecks or running security scans on operational technology – can close dangerous gaps.

And don’t ignore training; it remains one of the cheapest, if not most effective, ways to help your employees avoid falling victim to scams. Segmentation is another high-value, cost-effective step, especially when compared to full system overhauls. When systems aren’t segmented, one breach can cascade through everything. But if you’ve divided things up properly, you can contain any damage to one section and restore the rest much faster.

Deploying the right technology is only half the battle. You’ve also got to think about who’s going to take responsibility for OT cybersecurity. More often than not, this gets tossed back and forth between IT and OT, with everyone assuming the other team has it covered. That’s the perfect recipe for turning a minor hiccup into a full-blown disaster.

The answer is getting both groups to clarify ownership and maintain regular communication. Companies that succeed here refuse to allow IT and OT work in isolation. They make joint decisions and hold each other accountable.

I’m often asked whether to redesign or retrofit, or add controls. The answer is: it all depends on the numbers.

In some cases, you can retrofit what’s there and add a few controls to get most of what you need without major disruption. Sometimes, though, the existing system is beyond practical repair and there’s no choice but to rebuild it from the ground up. Or you might split it into phases and implement what you can today and wait for your next planned outage to do the bigger changes. Just make sure to compare options in terms of cost and risk reduction, not gut feel.

I’ve watched strong cyber initiatives crash because management skipped the basics. One client wanted every project done according to ‘secure by design’ principles. That made sense, but they tried to roll it out everywhere at once with zero training or transition planning. Engineers weren’t sure what was expected while managers didn’t know how to back them up. We got the plan back on track by phasing the rollout and making sure teams had the right tools and support.

Secure by design only sticks if you handle it like a real business priority, with the planning and resources to match. The same discipline applies to day-to-day operations, which is where the most successful pipeline operators are setting themselves apart.

These organisations run regular assessments as part of normal operations, not just to pass audits. They use the assessments to build business cases that connect their security measures to real risk reduction. These operators also integrate cyber into every new build, expansion and major retrofit. And they use planned outages as windows to implement cyber improvements. After going through this process a few times, cybersecurity isn’t seen as an add-on anymore – it just becomes part of how they operate.

Insurance and regulation changes also factor in. Some insurers won’t write policies unless you can prove cybersecurity

is built in. They want validated methodology, clear criteria and evidence.

Risk quantification helps here, too. Show them the baseline risk, the steps you took and the resulting reduction and you’re speaking their language. On the regulatory side, TSA’s Pipeline Security Guidelines are part of a broader trend: what used to be best practice becomes a standard, then a requirement.

Meanwhile, tools are getting better and so are adversaries. Machine learning can help you focus on what matters by filtering out irrelevant alerts in operational systems, where false positives drain critical resources. But attackers are using AI, too. This is increasingly a world of AI vs AI and there’s little excuse for not using it aggressively enough on our side.

The push to integrate OT security operations with asset management is encouraging. If you’re already tracking asset health, mean time between failures and maintenance schedules, you’re tracking the same equipment whose security posture matters.

But why manage reliability in one silo and cyber risk in another? We’re talking about one fleet of assets, so treat it that way.

The direction of travel is toward more granularity and transparency. We’ve gone from tracking vulnerabilities at the system vendor level, to the card level, to the component level and now to software bills of materials that detail every library

It’s supply-chain visibility applied to software and embedded systems. Every time I think we’ve reached peak detail, we go deeper.

There’s also a tendency to underestimate how fast risk grows when we bolt on connectivity in the name of modernisation. Every new analytics feed, remote-access point or edge device is an expanded attack surface. If security isn’t built into those projects up front, you’re actually importing risk. We model this for clients: here’s your exposure today; here’s the spike if you connect without controls; here’s the curve if you build them in. Seeing that chart changes the conversation.

If I had to leave pipeline executives with one thought, it’s this: residual risk is real. It’s in your systems today and it’s growing every time you add connectivity. Risk never goes down by itself.

The way forward is to get an honest inventory and quantify the exposure. Pick the highest-value reductions per dollar and schedule them within your maintenance windows. Make IT and OT work as one team and build cyber in from the start. Then train your people on simple behaviours that block the easiest attacks and get help if you don’t have the muscle in-house.

The longer you wait and the more connected your environment becomes, the harder it is to untangle later. Indeed, the cost of repairing a flat network after an incident is always higher than segmenting it before.

You don’t have to know everything on day one. But you do

Subscribe online at: www.lngindustry.com/subscribe

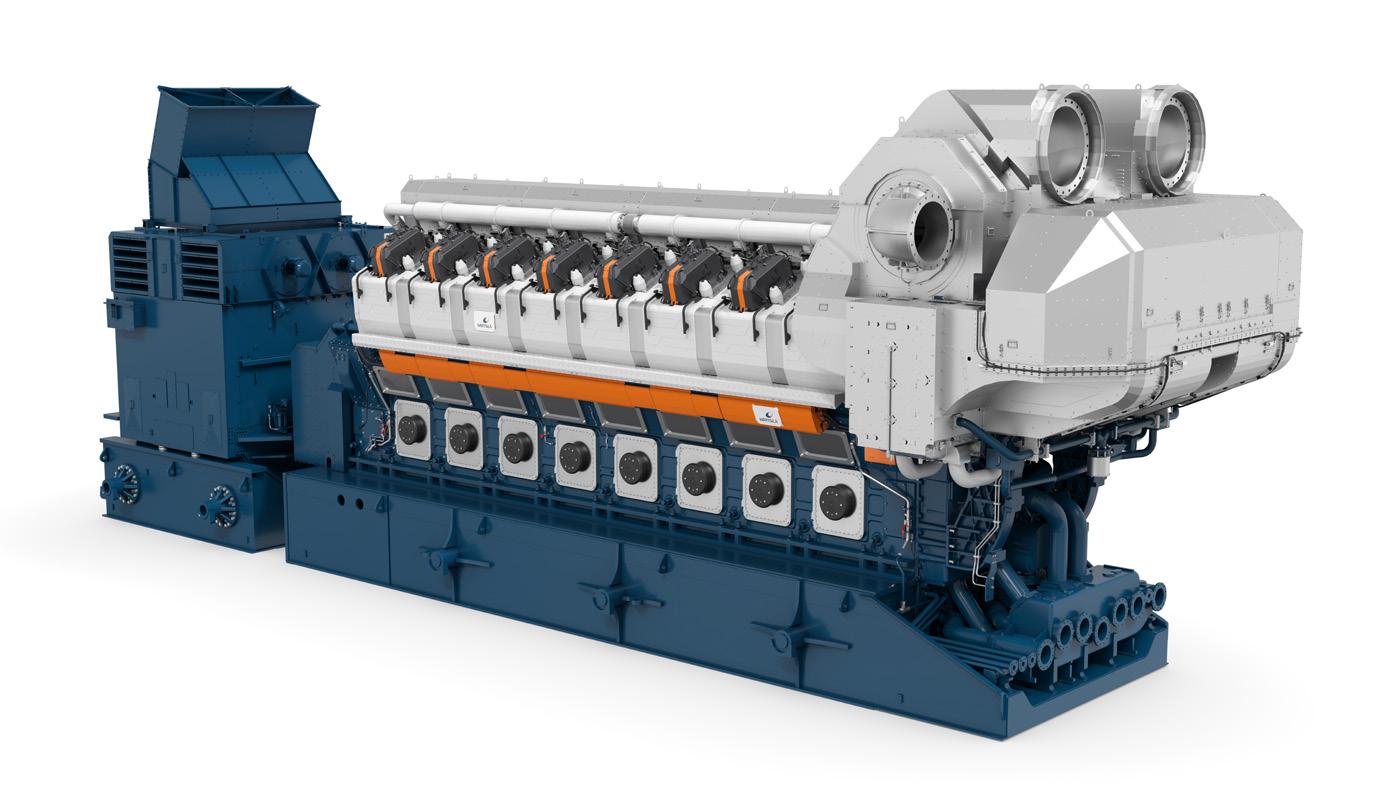

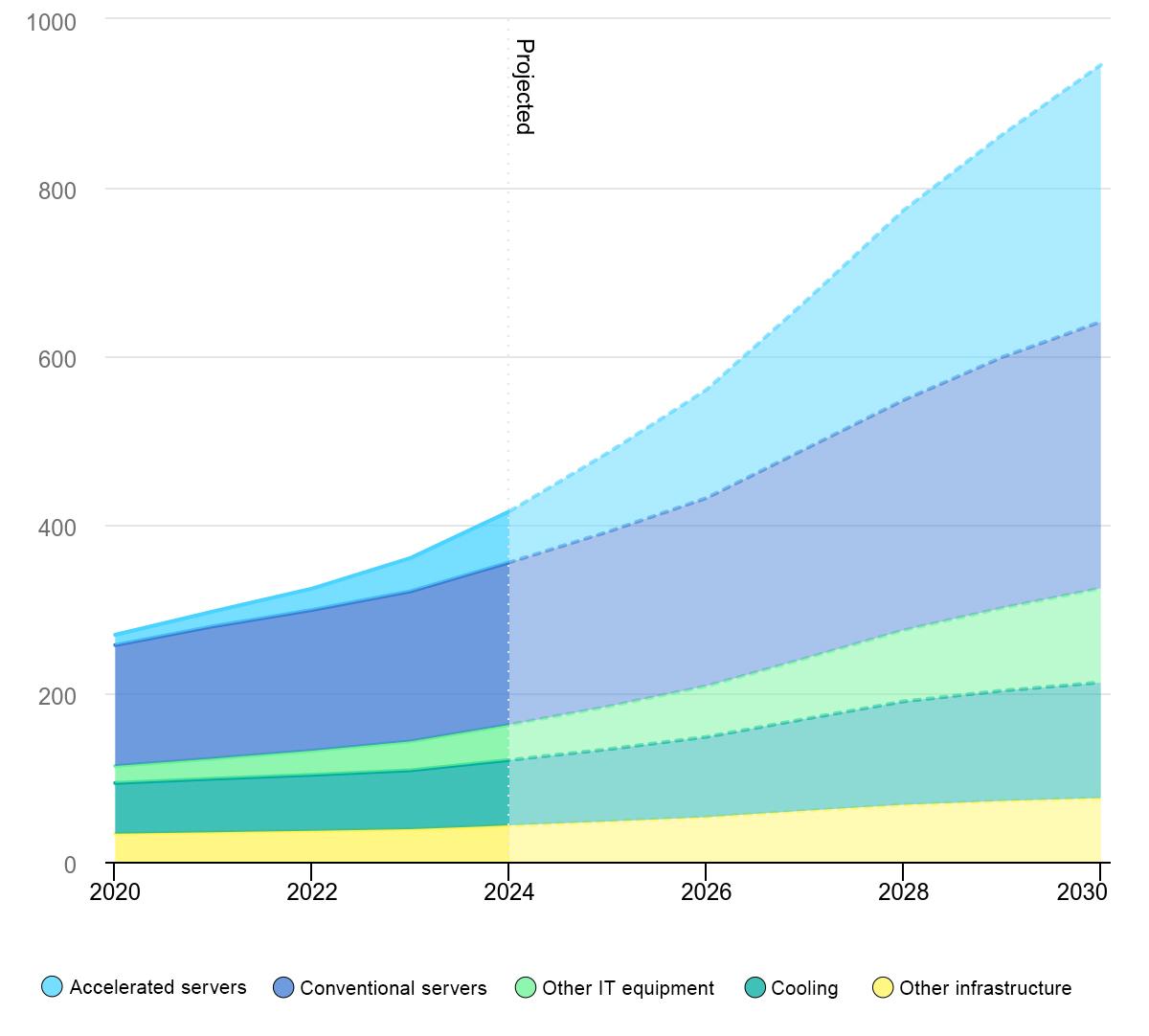

Sanna Silander, Energy Business Director, North America, Wärtsilä Energy, describes the important task of providing reliable energy solutions for data centres.

The world’s demand for data is limitless. As the global economy becomes more digital, data centres are at the core of this transformation, much like the crucial role pipelines played during the industrial age. Data centres have become the factories of the digital world. Artificial intelligence, cloud computing, streaming, e-commerce, and the Internet of Things (IoT) are driving exponential growth in global data centre capacity; the demand for secure and uninterrupted digital services is increasing at a rate the world has never experienced before. Their economic importance is vast. Various reports from multiple organisations, including Ericsson, GSMA Intelligence,

and the International Telecommunication Union, predict a significant increase in global data traffic by 2030, requiring an equally substantial expansion of digital infrastructure. Key enablers to this growth are hyperscale data centres, facilities that can need anywhere from 100 to 1000+ MW of reliable, high-quality electricity.

Furthermore, the rapid expansion of data centres continues to reshape global energy demand, posing unprecedented challenges for reliability and sustainability. This expansion presents a significant problem: how to maintain a stable, efficient, and sustainable power supply for facilities that cannot tolerate even a moment’s outage.

Wärtsilä, with its extensive experience in flexible power generation, provides a solution through engine power plants that combine reliability, fuel flexibility, and renewable integration.

We see strong similarities between the current data centre sector and the oil, gas, and pipeline industry over the last century. Both are essential, both require resilience, and both rely on sturdy infrastructure. Just as hydrocarbons formed the backbone of industrial progress, data centres –forming the backbone of the digital economy – now need an equally dependable energy foundation.

Data centres are the digital lifelines of modern society, and their operators can face immense pressure to deliver absolute reliability while transitioning to cleaner energy solutions. Wärtsilä’s flexible engine technology is tailored specifically for this purpose. It guarantees an uninterrupted power supply, offers market-leading efficiency, and provides future-proof flexibility. Wärtsilä’s engines can already run on various gas and liquid fuels and can be converted to run on more sustainable fuels whenever they become available. Wärtsilä’s engine technology enables the integration of renewables, always with reliability at the forefront.

Why Wärtsilä

In July 2025, Wärtsilä announced a significant project: the company will supply 282 MW of flexible engines to operate a new data centre project in Ohio, USA. The onsite power

facility, providing power directly to the data centre, will operate with fifteen Wärtsilä engines. The Wärtsilä 50SG gas engine offers high efficiency in a small footprint combined with great reliability and flexibility.

This project demonstrates why Wärtsilä engines are an excellent choice for data centre operations. With the ability to synchronise with the grid quickly and reach full load in under two minutes, our technology provides the rapid, reliable performance that operators require in environments where every millisecond of generation counts. Data centres often agree to servicelevel commitments demanding 99.9% uptime, and the repercussions of failure can be disastrous.

These challenges are intensified in emerging markets, where data growth is rapid, but grid infrastructure remains fragile. In Africa, for instance, less than half the population has dependable electricity, yet the demand for cloud and AI services is swiftly increasing. Developers must therefore incorporate their energy resilience into every project.

Wärtsilä provides the reassurance that even in the face of grid outages or volatility, operations will remain secure. Off-grid energy solutions, such as Wärtsilä engines, are an essential answer to meeting power needs.

We have delivered 6000 MW of engine capacity across the US, supporting critical infrastructure from hospitals to industrial clusters. Worldwide, Wärtsilä’s engine power plants already underpin essential industries in remote, urban, and hybrid environments. Data centres are simply the latest – and one of the most demanding – frontiers for our proven technology.

Risto Paldanius, Vice President for the Americas at Wärtsilä Energy, notes: “Data centre developers are facing increasing time-to-power challenges due to grid connection delays. Wärtsilä’s short lead time for engine manufacturing provides data centre customers with faster power solutions than others. Plus, our modular engine design enables efficient construction and integration, allowing customers quick access to power. What makes Wärtsilä engines the ideal power supply for data centres is quick access to power combined with high reliability, fuel efficiency and exceptional heat resilience, which enables optimal engine operation under high temperatures.”

Wärtsilä’s approach brings several benefits:

) Stable supply: the engines provide consistent, uninterrupted power in island mode.

) Efficient performance: electrical efficiency of 50%. This high efficiency translates into lower fuel costs and emissions – both key factors to support data centre profitability.

) Rapid deployment: Wärtsilä engines provide faster access to power than alternative solutions.

Dairyland decouplers are critical to cathodic protection systems — keeping workers and valuable assets safe from AC faults, lightning, and induced AC voltage — all while optimizing your CP systems.

We were the first company to introduce solid-state decoupling products to the industry, replacing the unreliable and dangerous polarization cells that exposed workers to shock hazards and highly caustic chemicals. In the decades that have followed, our solution-focused team ha s continued to deliver innovative decoupling products, solving critical problems across numerous applications and industries.

For more than forty years, Dairyland has pioneered new technologies and set new standards in the market. And we’re not done yet. If a solution to your problem does not yet exist, we’ll work to find one.

Let us help you find the right solution to your problem.

Unlike many industrial loads, data centres require a continuous power supply. Even brief interruptions can disrupt cloud services, financial markets, or online security.

Wärtsilä’s engine technology has been specially engineered for this challenge, and the reasons our technology appeals so strongly to data centre operators are clear:

) Reliability and availability: our engine plants are designed for continuous prime power, operating independently of the grid if needed.

) Efficiency: Wärtsilä engines can achieve electrical efficiencies above 50%, delivering savings in fuel costs and reducing carbon intensity.

) Scalability: with modular blocks of 10 - 20 MW, our power plants can scale seamlessly as data centre campuses grow.

) Low water use: closed-loop cooling requires only minimal volumes of demineralised water (under 5 l/h), avoiding the heavy consumption seen in many thermal technologies. In water-stressed regions, this is a decisive advantage.

) Dynamic operation: engines have a fast start-up and ramp-up time to 100% load and can cycle unlimited times; a critical advantage for variable demand and renewable integration.

) Fuel flexibility: engines can operate on natural gas, biogas, synthetic methane, and hydrogen blends, with a clear pathway toward decarbonisation.

) Lifecycle reliability: through predictive maintenance, remote monitoring, and Wärtsilä’s global service network, operators benefit from guaranteed availability throughout the plant’s lifecycle.

Data centres can only succeed if their power supply is reliable. At the same time, many operators are preparing for a future of lower-carbon fuels and increasing renewable integration. Wärtsilä engines are designed to provide both unmatched uptime today and the flexibility to run on hydrogen, biofuels, and synthetic fuels tomorrow. It’s a solution that gives data centre operators confidence at every stage of their growth journey.

In summary, Wärtsilä engines are not just backup systems; we offer data centres something they cannot afford to compromise – confidence in their energy supply today and certainty about its future development. These qualities make Wärtsilä engines ideally suited to the demand of reliability which characterises the data centre industry.

Energy-intensive industries, which now include data centres, are under increasing pressure to reduce their environmental footprints. Many operators have set ambitious targets for sourcing power from renewables. The challenge, however, is that solar and wind are inherently unpredictable.

This is another area where Wärtsilä engines deliver unique value. Our power plants can operate seamlessly with renewable energy, providing flexible power that

compensates when weather-dependent generation falls short. Instead of being tied to inflexible baseload power, data centre operators can develop portfolios that maximise renewable procurement while trusting Wärtsilä to maintain stability.

Looking ahead: the future of digital energy

The story of data centre power is only beginning. Several trends will shape the sector in the coming decade:

) AI acceleration: generative AI workloads are exponentially increasing computing power requirements.

) Edge computing: smaller, distributed data centres will emerge closer to end-users, requiring modular, fastdeployable power solutions.

) Hydrogen transition: as hydrogen infrastructure develops, Wärtsilä engines will be ready to operate entirely on zero-carbon fuels. Wärtsilä has launched world’s first large-scale 100% hydrogen-ready engine power plant

) Energy-market participation: large data centres may play an active role in balancing national grids, exporting flexibility when renewables fluctuate.

Data centres don’t just consume power; they can also accelerate the energy transition. By adopting flexible generation, they support renewables, enable hydrogen adoption, and create resilience for themselves and the wider grid.

At Wärtsilä, we believe that powering the digital economy requires more than just delivering megawatts. It requires a deep understanding of the dual imperatives driving data centres: the need for absolute reliability and sustainability. Our mission is to provide power solutions that are not only resilient but also ready for the fuels and systems of tomorrow. We design and deliver technology that enables operators to build confidence in their energy supply today while preparing for a lower-carbon future.

The rise of data centres represents one of the defining infrastructure challenges of the coming decade. As the digital economy expands, energy stability will define which data centres thrive. For the oil and gas sector, it is both a signal of new energy demand and an opportunity to play a pivotal role in enabling the digital economy. For data centre operators, it is a challenge to secure energy that is reliable, cost-efficient, and aligned with sustainability commitments. Wärtsilä stands at the intersection of these needs. Our engines provide the unmatched reliability that data centres demand, the flexibility to work in harmony with renewables, and the readiness to operate on the fuels of the future.

As the digital era accelerates, Wärtsilä will continue to deliver the resilient, efficient, affordable and sustainable power solutions that keep the world connected, without compromise.

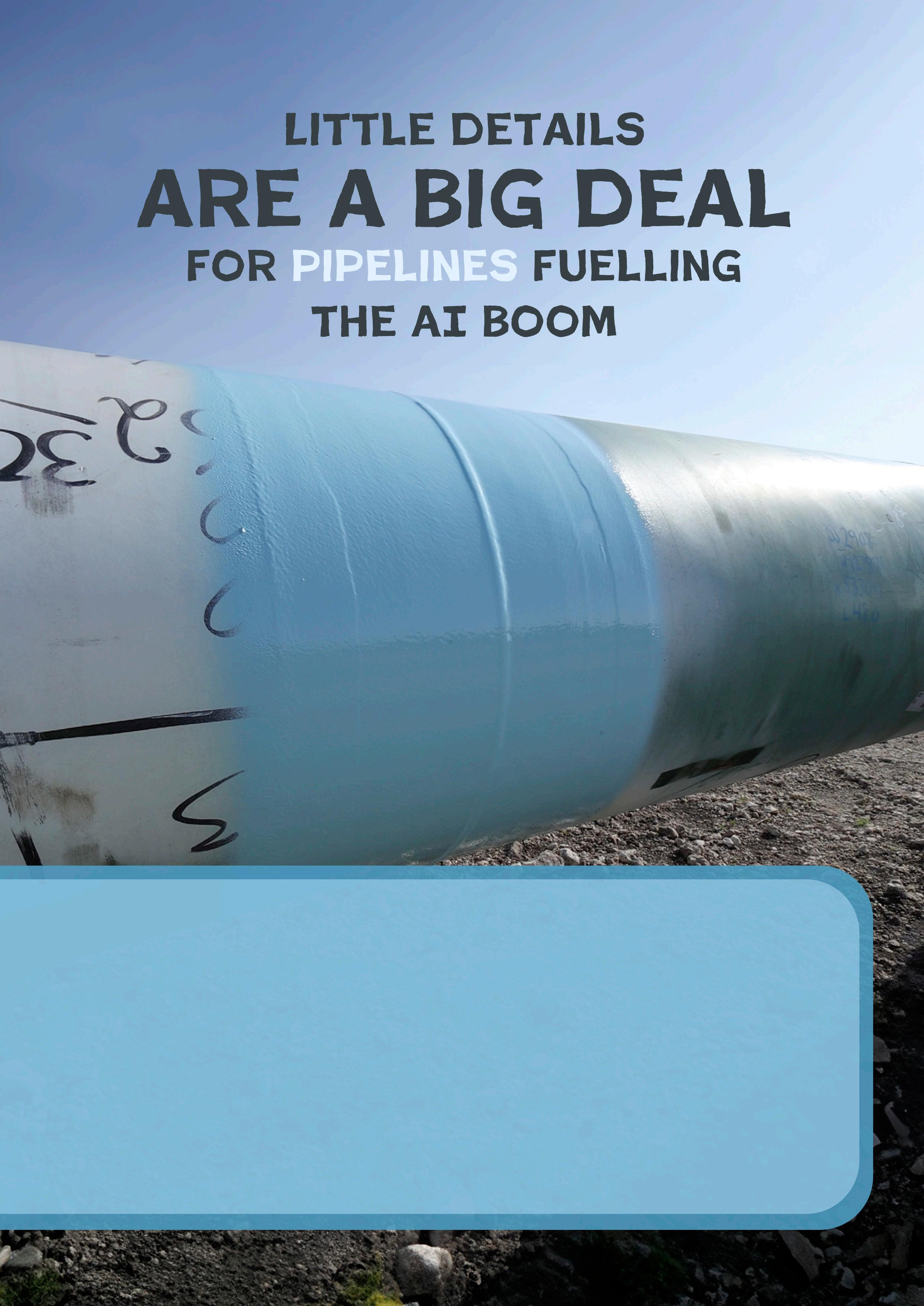

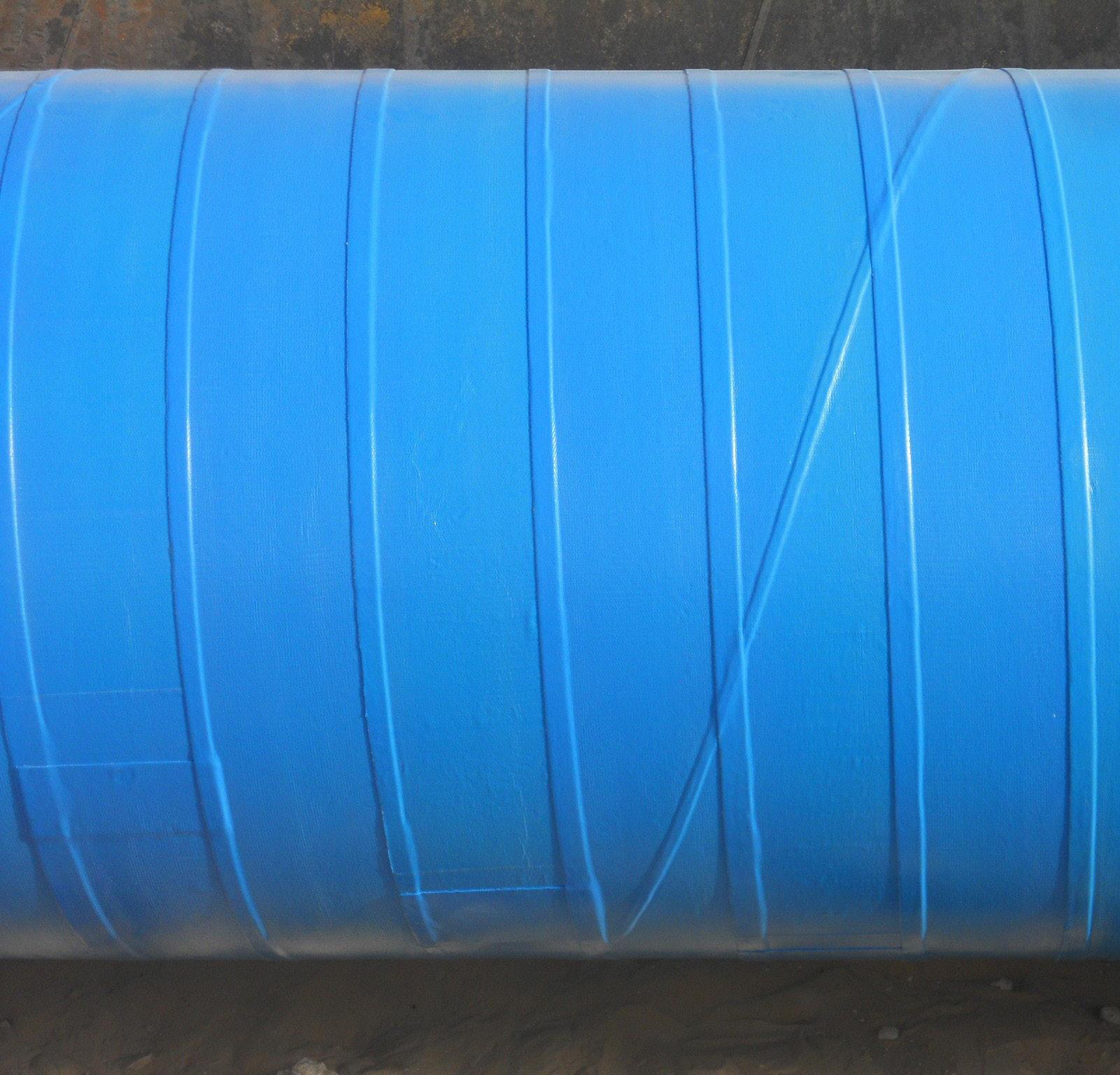

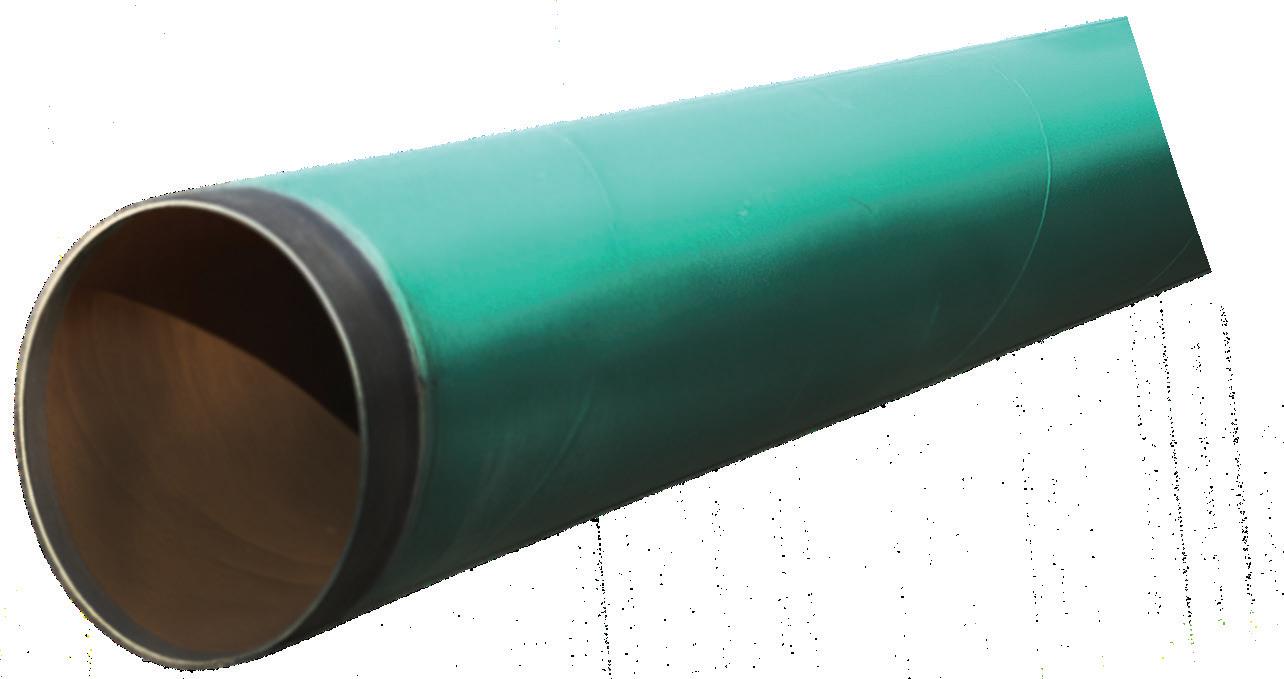

Holly Tyler, Specialty Polymer Coatings (SPC) – a division of Carboline – Tulsa, Oklahoma, USA, explains how a detail as obscure as the cure speed of a coating for girth welds can accelerate the completion of a new pipeline fuelling energy-hungry AI data centres.

It’s not the biggest pipeline in west Texas. It’s not the longest, it’s not the highest capacity, and it wasn’t especially difficult to lay down. But it might be one of the region’s most important, and it is certainly a sign of the times.

Owned by Enterprise Products Partners, the Bahia Pipeline begins at Enterprise’s gas plant just south of Orla, Texas, USA and stretches 885 km (550 miles) before terminating at the company’s sprawling processing complex in Mont Belvieu, near Houston. It is 30 in. (76 cm) in diameter

and will transport 610 000 bpd of natural gas liquids (NGL) once in service.

And depending on what AI programme you prefer, when you ask it to wordsmith your next email or draw a funny picture, it may be thanks to energy the Bahia Pipeline carried. (This article, though? 100% human.)

A lot needed to go well – and quickly – to make that happen. One of those was the application of girth weld coatings that provide the pipeline essential corrosion protection.

Why AI targets Texas Enterprise is among the many energy industry players expanding extraction operations in the Permian Basin and processing capacity across their networks. The Bahia Pipeline is just one of the company’s plays. Others include:

) Conversion of the 708 km (440 mile), 210 000 bpd Seminole Red Pipeline from crude oil to NGL.

) Construction of two new natural gas processing plants.

) Construction of an NGL fractionator at the Mont Belvieu complex.

The construction activity reflects Enterprise’s and others’ bullish outlook on both domestic and foreign energy demand. The booming artificial intelligence (AI) and data centre sectors represent the most energetic source of demand domestically, according to an Enterprise investor deck distributed in May 2025. Texas is right in the middle of that boom: favourable policies, lowcost land, and abundant energy delivered by mature infrastructure attract tech giants like moths to light bulbs.

Indeed, as NGLs travel east along the Bahia Pipeline toward Mont Belvieu, they pass within 16 km (10 miles) of a 70 000 m2 (750 000 ft2) data centre that Facebook’s parent company Meta is currently building on 386 acres on the outskirts of the city of Temple.

Following refining, much of the fuel will head back west, where the generation sector is experiencing a boom of its own. The future energy needs of all these data centres now under construction have spurred the frantic construction of new power stations. And in some cases, the AI companies are building these power stations exclusively for themselves. They bypass the existing power grid to perform just one job: keep the data centre running.

A case in point is in Abilene, where a joint venture composed of AI finance and infrastructure firms is busy building the backbone of the ambitious Stargate I AI project. Blue Owl Capital, Primary Digital Infrastructure, and Crusoe had already begun building two large data centre buildings on grounds northwest of town when they announced plans this spring to build six more there.

When the dust settles, the eight buildings on the sprawling complex will total 371 600 m2 (4 million ft2) and require 1.2 GW of power at peak operation. A good chunk of that will come from the US$500 million natural gas

power plant the joint venture is building on the site.

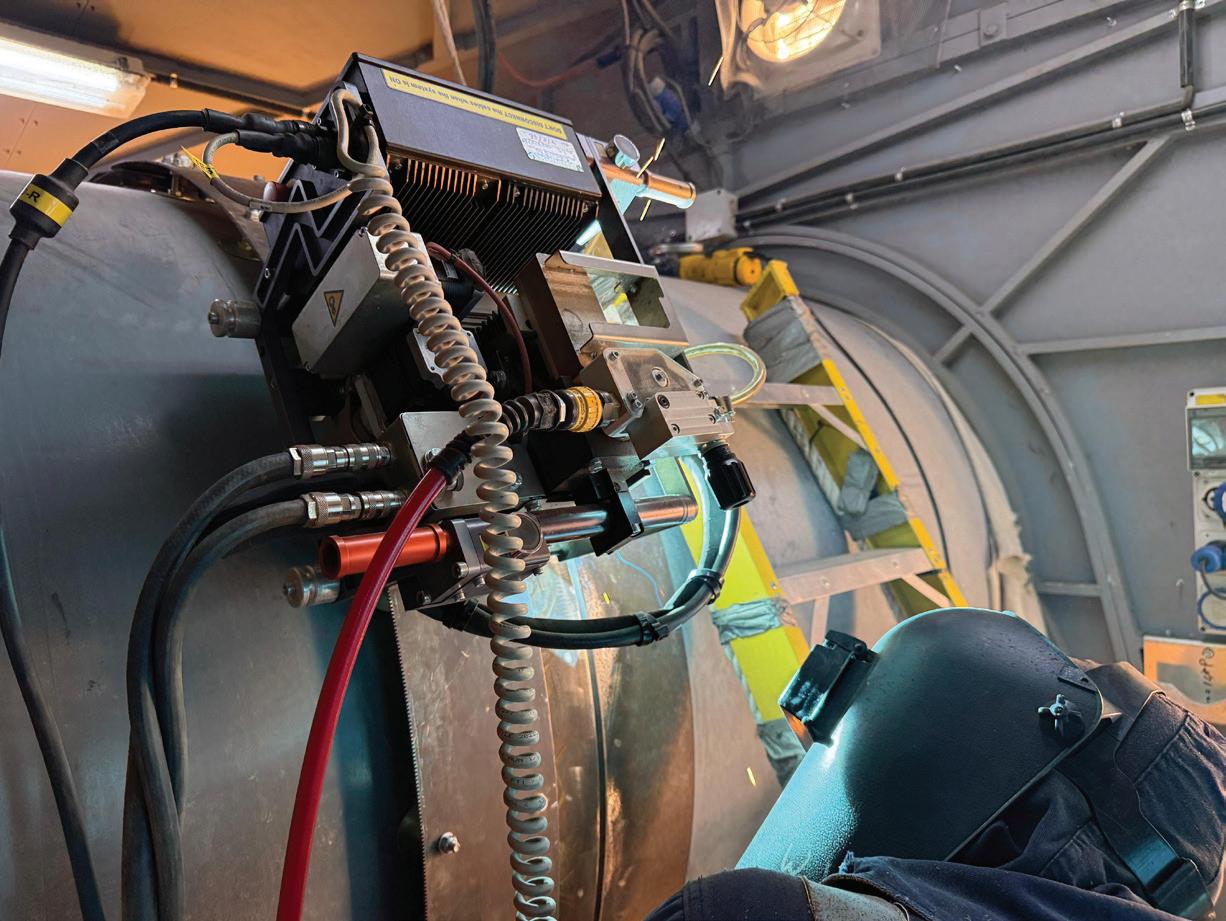

When work must move swiftly, stakeholders go with what they know will work. It’s why Stargate I is centred on Abilene and its mix of abundant solar, wind, and fossil energy. It’s why veteran pipeline constructor PumpCo was chosen to build the Bahia Pipeline, and why CRC Evans was selected to perform weld joint coating. And it’s why something so comparatively trivial as CRC Evans’ preferred coating for the work was what it was.

Anyone who knows pipeline coatings knows SP-2888 RG. The highperformance hybrid epoxy/polyurethane is famed for its strong performance in service in environments as opposite as the frozen, rugged Canadian Rockies and sunbaked west Texas.

CRC Evans is so familiar with the product that the company designed its patented ring-type spray application machine with it specifically in mind.

SP-2888 RG boasts many features important for pipeline exteriors: great corrosion protection; excellent resistance to impact, abrasion, and chemicals; high flexibility; and excellent adhesion to both fusion bond epoxy (FBE) and abrasive blasted steel.

But its most critical feature is a very fast cure speed. That cure speed is further accelerated by CRC Evans’ use of heating coils that wrap around pipeline segment joints to preheat the steel.

This makes girth weld coating go extremely quickly: once heated, the heating coil is taken off the pipe and the spray machine replaces it. It takes 40 sec. for the machine to apply the correct thickness of coating around the joint. SP-2888 RG fully cures in 16 min. over joints preheated to 50˚C (122˚F). At 70˚C (158˚F), that interval is reduced to just 3 min.

The progress a crew can make when a weld joint coating cures completely every four minutes or so adds up over 885 km (550 miles). On the Bahia Pipeline, CRC Evans crews were able to inspect, preheat, and coat up to 150 welds per day. Pipeline sections are 12.8 m (42 ft) long, so a single coating crew would finish close to 2 km (1.2 miles) of pipeline per day at that pace.

Such speed is critical at this stage of pipeline construction. When girth weld coatings cure faster, the crew burying the line in its trench can follow more closely behind the painters. The sooner a line is in the ground, the sooner it can be charged up for revenue service.

That can’t come soon enough: the worst and most costly kind of delay for a brand new, multi-billion dollar AI data centre is not being able to turn it on.

More than a sign of the times, perhaps the Bahia Pipeline is a sign of how times have changed, and a sign of more change yet to come. What if the AI tech giants do bring the amount of computing power online that they’ve said they want to? They’ll need an order of magnitude more energy to feed it, which will only be available if the required pipeline and other infrastructure can be built up in time.

That’s a lot of little details our industry must get right. If it does, what appears today like another oil and gas boom in Texas might in hindsight look like a distant candle’s flicker. Are we ready?

Note

All images are courtesy of Specialty Polymer Coatings (SPC).

Park Plaza London Riverbank, UK

A full day event dedicated to the UK’s CO2 pipeline build-out: uniting pipeline operators, engineers, contractors, and policy-makers.

The programme will cover the UK’s rapidly evolving CCS infrastructure plans, proposed and confirmed projects, safety codes, technical challenges, international case studies, and the technologies enabling safe, efficient CO2 transport.

Delegate takeaways from this exclusive one day conference:

Learn

Hear from industry leaders on planning, safety, design, construction, and environmental considerations for CO2 pipelines.

Be informed

Updates on key UK CCS projects, with sessions on buildout and delivery, integrity, and international insight.

Understand

Understand government support, regulatory frameworks, and permitting processes.

Network

Meet the companies driving the UK’s CCS pipeline future.

Rod Hardy - Sales Director

Robert H. Shelton, President and CEO of H2C Safety Pipe Inc. discusses designing and financing a new generation of hydrogen pipelines

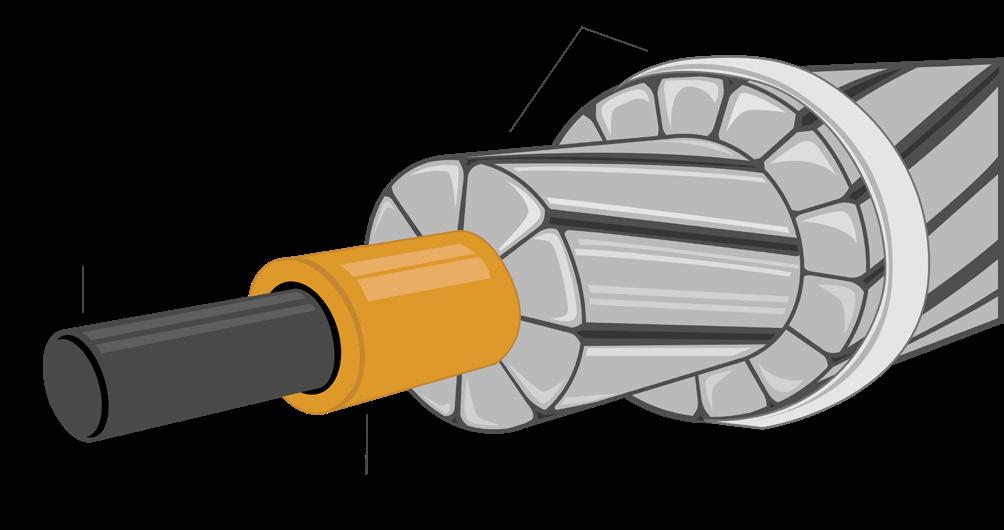

In a previous World Pipelines article, Robert H. Shelton, CEO of H2C Safety Pipe Inc., explored how the historical development of natural gas pipelines and underground petroleum storage tanks offers a roadmap for building a safe and scalable hydrogen infrastructure. This follow-up article focuses on what that future must look like in practice. As the hydrogen economy accelerates, traditional approaches to pipeline safety, monitoring, and financing are proving increasingly inadequate for the demands of this unique, low-carbon, and highly versatile energy carrier.

This article presents a technical and financial blueprint for a new class of hydrogen pipelines conceived from the ground up. It introduces dual-containment pipe architectures, continuous annular monitoring systems, and financing models designed to mitigate risks in early-stage deployments. These innovations are not just theoretical – they are being actively advanced through real-world projects by H2C Safety Pipe (H2CSP) and its partners in North America and Europe.

Before diving into the details of this technical and financial approach, it’s important to ask a more fundamental

question: why must hydrogen pipelines be reimagined from the ground up; and why now?

The reason is simple: reliable and cost-effective delivery and storage remain the Achilles’ heel of transitioning to hydrogen. Everyone familiar with energy systems understands that hydrogen’s ability to store energy over days, weeks, or entire seasons; to fuel buses, heavy-duty vehicles, and massive data centres; and to provide high-temperature heat for industrial processes such as cement, steel, and chemical manufacturing, makes it one of the most versatile tools for both resiliency and deep decarbonisation. But versatility alone doesn’t guarantee viability.

Without affordable, highly reliable delivery systems, hydrogen will remain geographically stranded. It will continue to offer enormous potential in regions where low-cost natural gas wind, solar, or hydro power make it inexpensive to produce. But unless and until it can be transported safely, efficiently, and at scale, hydrogen will remain economically uncompetitive in the very places where clean energy is most urgently needed.

Pipelines are the only scalable solution to this distribution challenge. Yet in practice, many hydrogen projects still default to truck-based delivery. While this may seem prudent for the flexibility it offers in early-stage deployments, this makes small volumes of hydrogen even less economically viable; and becomes both logistically and economically unsustainable at scale.

At its core, this is a logistics problem. Consider the case of delivering 65 tpd of hydrogen to an industrial off-taker located 25 miles away. This volume is sufficient to achieve production-

scale economies when produced using low-cost electricity or natural gas reforming, but the economics break down without a reliable, cost-effective transport solution.

Using compressed hydrogen (GH2) tube trailers requires 325 deliveries per day, involving a fleet of 39 cabs and more than 170 trailers, along with drivers, depot infrastructure, and extended loading times. This contributes to a delivery cost of US$1.63/kg. Liquid hydrogen (LH2) reduces the number of trips to just 18 per day, but raises the cost to US$1.71/kg, due to energy-intensive liquefaction and cryogenic storage requirements.

Now compare both to a dedicated 4 in. (100 mm) hydrogen pipeline rated at 2250 psi (155 bar). The same 65 tpd can be supplied continuously at an estimated cost of just US$0.24/kg – with no trucks, no liquefaction, no cryogenic handling, and no need to put drivers on the road 24 h a day. This represents an 85% reduction in delivery cost compared to compressed hydrogen and even greater savings over liquid hydrogen, while eliminating hundreds of truck movements each week. For longer distances or higher capacities, the advantages become even more pronounced.

Figure 1 illustrates this contrast in both cost and operational burden, reinforcing why pipelines – despite permitting and right-of-way challenges – are not just a better option. They are the only viable option at scale.

Why traditional pipelines also fall short

But building pipelines for hydrogen, especially in ways that address leakage risk, right-of-way limitations, and capital market expectations, demands a clean-sheet approach. Simply retrofitting old petroleum pipelines or relying on design practices developed for methane is no longer sufficient. Hydrogen embrittles metals, escapes through microcracks, cannot be odorised, and is invisible to conventional aerial

plume detection – making traditional leak detection methods ineffective, as PHMSA concluded in its 2025 Final Rule on gas pipeline leak detection and repair.

Moreover, hydrogen has one of the widest flammability ranges of any fuel and, when mixed with air in enclosed or semi-enclosed spaces, poses a significant risk of explosion that concerns communities. Also, recent studies by the Environmental Defense Fund, MIT, and others have raised concerns that hydrogen leakage into the atmosphere may contribute to global warming more significantly than CO 2 on a per-molecule basis. Together, these safety and environmental concerns make even low-level hydrogen leaks unacceptable, particularly in densely populated or industrial areas, and anywhere that ignition sources may be present.

California’s hydrogen pipeline safety act

Legislators are beginning to acknowledge this reality. California’s Hydrogen Pipeline Safety Act (SB 804) directly targets the unique risks associated with dedicated hydrogen pipelines.

Co-authored by State Senator Bob Archuleta, Chair of the

Senate Select Committee on Hydrogen Energy, and Assembly Member Cottie Petrie-Norris, Chair of the Assembly Utilities and Energy Committee, the bill was supported by industry, environmental groups, and organised labour, and has faced no formal opposition. It was unanimously approved by members of both political parties in all five Senate and Assembly committees in which it has been heard, as well as on the Senate Floor. The bill is scheduled for a vote in the full Assembly when the Legislature reconvenes in January 2026. The bill lays out five core standards for dedicated hydrogen pipelines:

) Design and construct pipelines to minimise hydrogen leakage to the lowest technically feasible level.

) Employ continuous measurement and monitoring systems to detect deviations from normal operating conditions.

) Use of materials that are hydrogen-compatible and resistant to degradation such as corrosion and embrittlement.

) Submit annual reports demonstrating compliance with recordkeeping and safety standards.

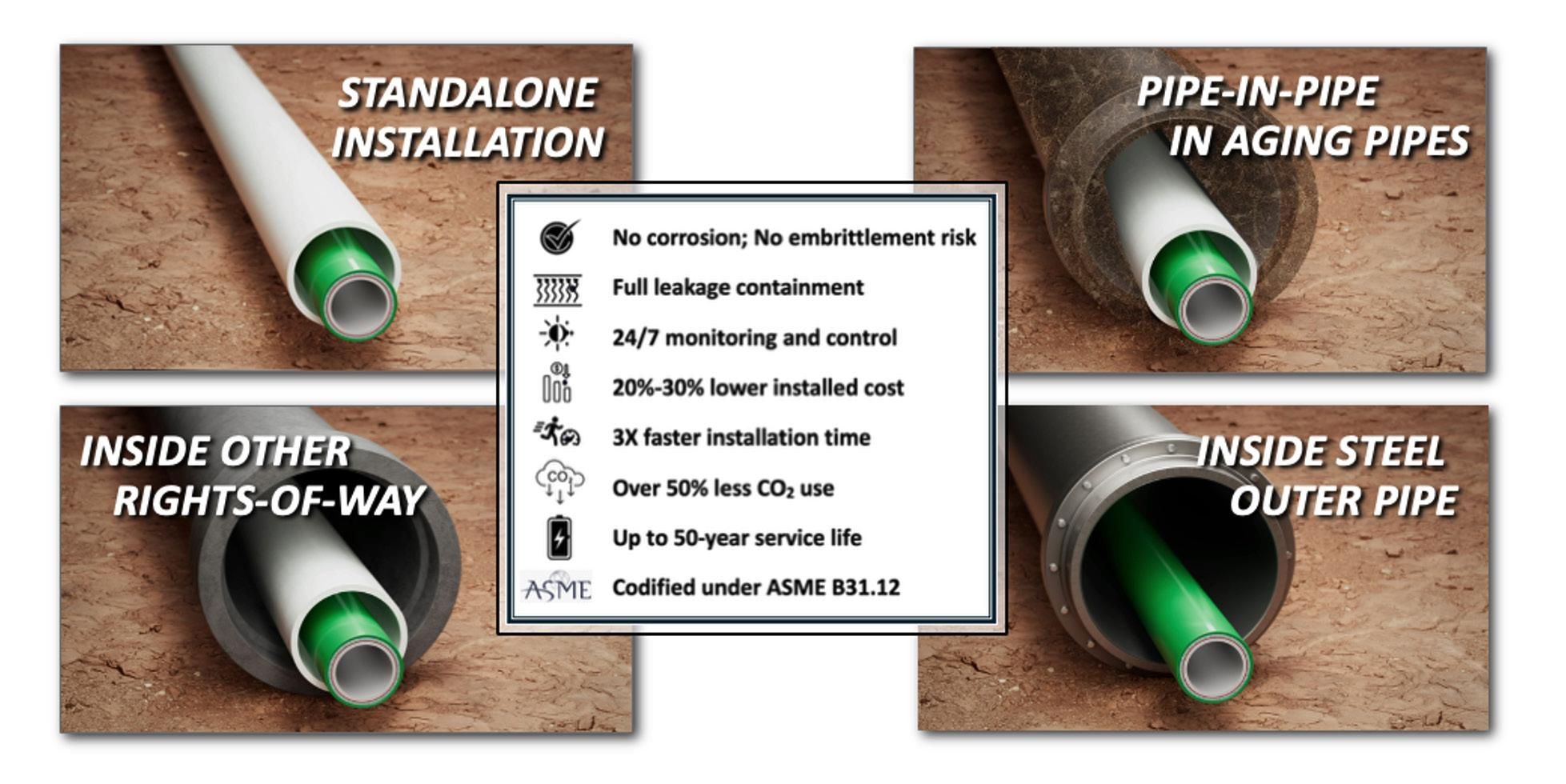

for flexible deployment as a standalone pipe for

trench installation or capable of being inserted inside aging legacy pipelines; run through other rights-of-way such as storm drains, sewer lines, and utility vaults; and within natural gas pipelines. Multiple benefits include codification under ASME B31.12 at up to 2500 psi (173 bar).

) Ensure consistent enforcement across all jurisdictions in the state, with periodic updates reflecting evolving technologies and best practices.

Together, these provisions establish a new regulatory baseline for hydrogen pipeline development – not only in California, but in any jurisdiction serious about catalysing safe, scalable hydrogen deployment. SB 804 is more than a safety statute. It reflects a shift in pipeline design philosophy to one that starts with hydrogen’s unique properties and builds from the ground up to accommodate them.

A next-generation technical architecture

Even as this direction becomes clearer, there is still no global standard for what constitutes a ‘bankable’ hydrogen pipeline. As a result, any pipeline planned today must meet two critical tests: compliance with evolving safety regulations tailored to hydrogen’s unique characteristics, and alignment with the expectations of lenders, insurers,

and commercial off-takers. In short, hydrogen pipelines must be designed not only to operate safely, but to attract capital more effectively.

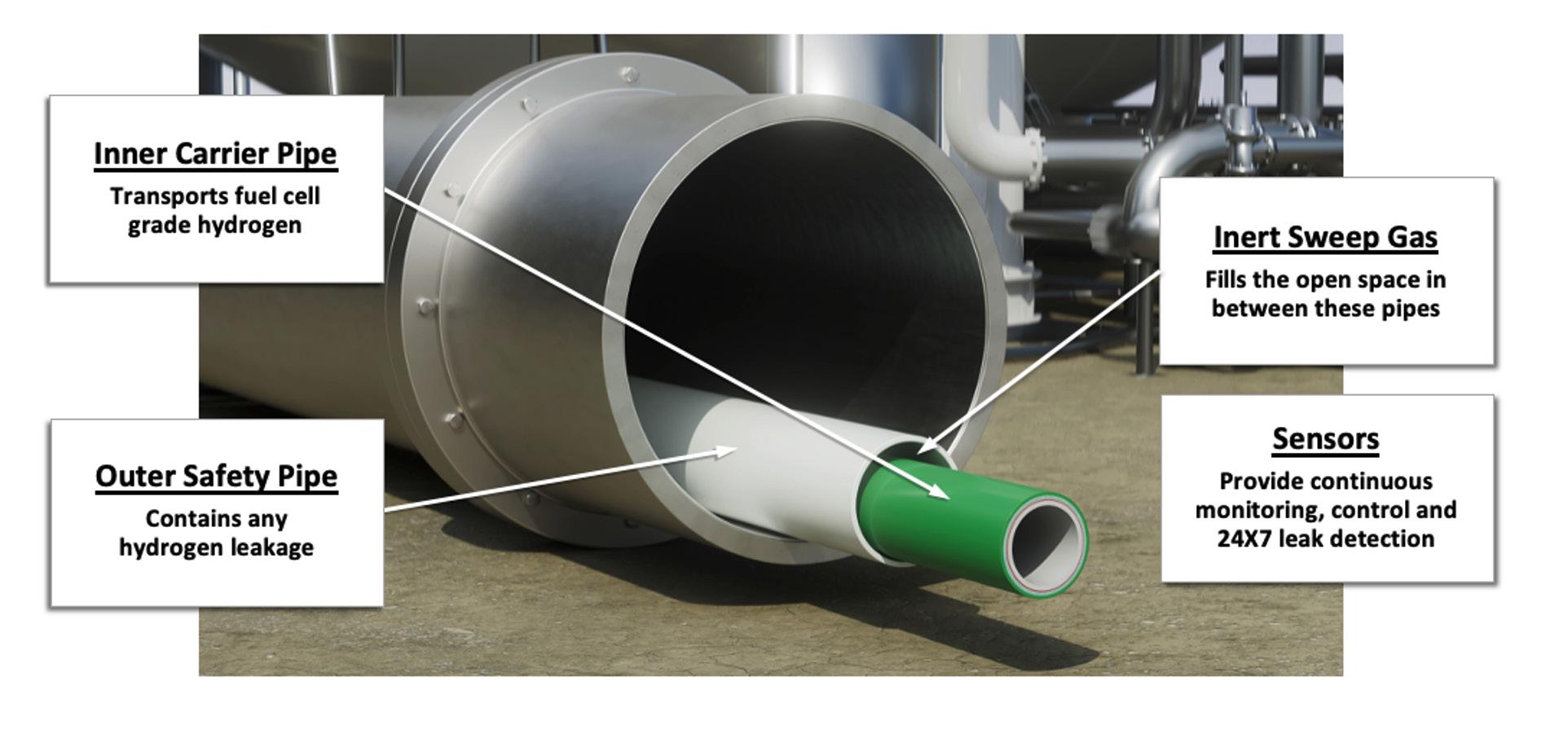

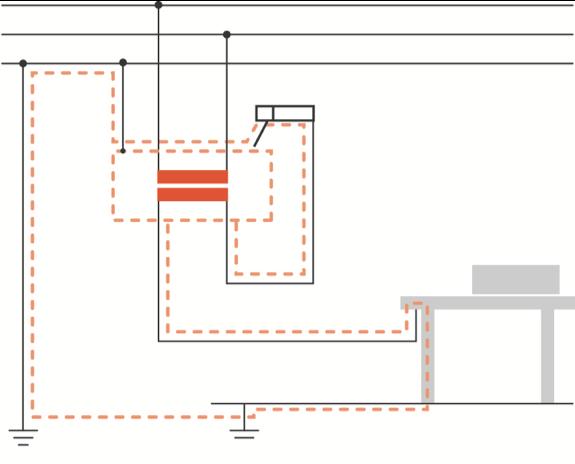

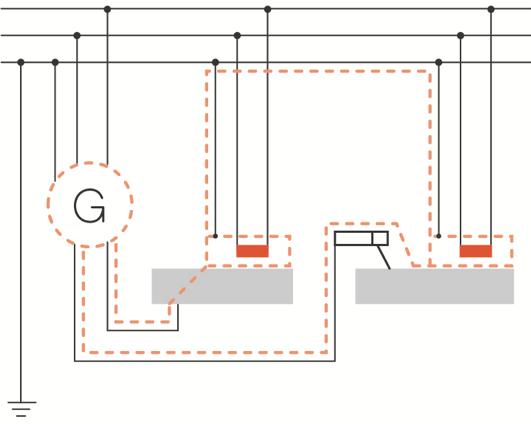

This is precisely the gap that next-generation architectures such as H2CSP’s Safety Pipe™ system are designed to fill. The system (see Figure 2) uses a dualcontainment pipe-in-pipe configuration, with a sweep gas circulating through the annular space to enable 24/7/365 leak detection. Hydrogen sensors continuously monitor this sweep gas stream, enabling real-time detection, localisation, and reporting of any deviations – while also building a dataset that can be analysed using pattern recognition and AI tools to predict future points of concern.

This continuous monitoring approach replaces not only the snapshot-in-time model of legacy in-line inspection, but also the reactive, ‘report it when you smell it’ or ‘respond when the pressure drops’ paradigms that have long characterised leak detection in conventional gas networks. In place of periodic pigging, patrols, and human-dependent alerts, it provides digital oversight with continuous visibility, early warning of emerging threats, and actionable diagnostics.

Equally important, this architecture enables a broader range of materials and deployment strategies. It supports the use of hydrogen-compatible non-metallic pipe materials such as HDPE and fibreglass reinforced polymer (FRP), which allow for faster installation, fewer welds and connections, and lower installed cost, while minimising the risks of embrittlement and corrosion. Using modern linepull technology, these lightweight materials can be installed inside existing pipelines, along public rights-of-way, within shared utility corridors, or in new trenches; and completed in weeks rather than months.

This deployment flexibility (Figure 3) translates into real-world benefits, including 20 - 30 % lower installed cost, three-times faster installation timelines, and reduced community concerns about hydrogen safety.

In 2024, H2CSP completed a prototype deployment of the Safety Pipe system at a client site in Houston, Texas. The project validated the system’s core functions of continuous leak detection, sweep gas circulation, real-time hydrogen sensing, and automated system response. It also confirmed the viability of the dual-containment design under real-world installation conditions.

Building on this foundation, several commercial-scale projects are now being advanced by H2CSP in California, Spain, and Canada. These initiatives aim to support midstream hydrogen delivery from producers to off-takers using both retrofitted and newly constructed pipeline segments. In each case, the goal is to deploy systems that are safer, faster to place in service, easier to monitor, and aligned with the financial and regulatory expectations of today’s hydrogen markets.

While large-scale ‘build-it-and-they-will-come’ trunk line projects may ultimately play an important role in the hydrogen