France Gasum bunkers first LNG-fuelled cruise vessel built by Chantiers de l’Atlantique

Chantiers de l’Atlantique has chosen Gasum as expert supplier of LNG bunker fuel and technical adviser to perform the initial bunkering of the first LNG-fuelled cruise vessel built in its premises. This first LNG bunkering took place on the 10 September 2022 in the French port of La Rochelle, for which it was also the first LNG bunkering operation. The choice of Gasum as partner in the preparation and performance of this delivery recognises Gasum’s unique expertise in supporting shipyards performing initial bunkerings of new-build LNG-fuelled cruise vessels.

Gasum has successfully performed the initial bunkering of the first LNG-fuelled cruise vessel to be completed by Chantiers de l’Atlantique. The LNG was delivered by Gasum’s LNG bunker vessel, Kairos

In addition to delivering LNG, Gasum has supported Chantiers de l’Atlantique in the technical preparation of the delivery, including obtaining the relevant permits and authorisations. This delivery marks a new milestone in the extension of the Gasum LNG bunkering network and underlines its ambition to grow geographically, offering its expertise to customers wherever such is requested.

Gasum and Chantiers de l’Atlantique share the ambition to improve the environmental performance of the shipping industry by promoting and demonstrating the technical and commercial availability and reliability of alternative fuels, of which LNG is undoubtedly the most mature.

8 October 2022 LNGNEWS 31 October – 03 November 2022 ADIPEC Abu Dhabi, UAE www.adipec.com 29 November – 02 December 2022 22nd World LNG Summit & Awards Athens, Greece www.worldlngsummit.com 16 November 2022 Global Hydrogen Conference 2022 Online Conference www.globalhydrogenreview.com/ghc22 14 – 16 March 2023 StocExpo 2023 Rotterdam, the Netherlands www.stocexpo.com Germany RWE and ADNOC agree

LNG delivery to

LNG import terminal

R WE

01 – 04 November 2022 Americas LNG & Gas Summit & Exhibition Louisiana, USA www.worldlngamericas.com 06 – 07 March 2023 9th International LNG Congress Düsseldorf, Germany www.lngcongress.com

BY DES IG N ®

CLEAN & SUSTAINABLE C O OLE R

C ha r t is at t he fo re f ro nt of t h e t ra nsitio n to a low carbon future through technology, equipment and ser vices delivering hydrogen, LNG and biogas for energy and transpor tation. Our carbon capture technology also removes harmful pollutants including SOx, NOx and mercur y w w w.Char tIndustries.com LNG@Char tIndustries.com

hen it comes to the movement of LNG and other energy commodities around the world, there are many sources of information that are used by organisations to ensure they have an accurate picture of the markets.

Traditional traders, for example, will typically rely on conventional market indicators and data from the likes of Bloomberg, as well as projections and official quotas released by industry bodies, such as OPEC. But they are always on a quest to find more data to gain an edge over their competitors, which is fuelling an increasing interest in alternative data.

Alternative data unlocks the ability to receive insights in real time so that market trends can be derived in advance of official data. For many energy commodities, a number of alternative data sources must be analysed to this end. Coal consumption can be ascertained by increased activity from mines, power stations, and transport operations. With regard to crude oil, global shipping movements and social media activity in Arabic – which accounts for 90% of all social media conversations on crude oil – can be analysed. Of course, tracking energy commodities flows that are largely transported through pipelines beyond what is released by

operators is impossible. However, it is possible to track the movement of oil tankers and LNG carriers, which can be used to provide significant insights on global imports and exports.

The value of shipping data

For LNG, a number of data sets can be used to deliver timely information on global shipping movements. An example of this includes automatic identification system (AIS) shipping data, which allows companies, such as QuantCube, to pinpoint the exact location of vessels at sea and track where they, and other commodities vessels, end up across the globe.

When it comes to identifying vessels, a key benefit of LNG carriers is that they are unique from a design perspective, as they typically have 4 – 6 distinctive tanks and many more features specifically designed for the storage, transportation, and delivery of LNG. For example, LNG is typically stored at a temperature of -126˚C, so the tanks are designed to ensure that the LNG remains cold enough to stay in a liquid state. By using satellite imagery, these vessels can be easily identified. For tankers, however, these vessels might just as easily be carrying

Joao Macalos, QuantCube Technology, France, explores the value of alternative data for delivering real-time insights on LNG and other energy commodities.

10

diesel as crude oil, so other data points must be used to determine what the cargo is.

Of course, tracking ships through AIS data only works when the systems are operational. In most cases, they are, as investment in the transportation of expensive commodities must be safeguarded to provide stakeholders with assurances that cargos will reach their destinations safely. However, some countries, particularly those that might be subject to sanctions, such as Iran, as well as companies operating in these countries, may choose to hide their movements. Conversely, other countries and organisations are eager to show that they are capable of exporting large quantities of LNG to increase investment and confidence in their output. In these cases, shipping-based information may be used to provide a more accurate picture of their exports.

Adapting to crises with alternativedata

Using alternative data to gain real-time insights is crucial for staying a step ahead and mitigating the effects of geopolitical and macroeconomic events. In recent months, the combination of the war in Ukraine and Europe’s deepening energy crisis has caused global LNG prices to skyrocket. Some supply chains have been severely disrupted and the lack of official data from major exporters, such as Russia, has made the situation increasingly difficult for traders, economists, and leading market analytics providers to predict. However, one thing that is certain when it comes to determining investment strategies and commodities trends is that the more data an organisation has, the better equipped it will be. The value of real-time insights on variations in the commerce of LNG, that reveal movements between the world’s leading importers and exporters, cannot be understated.

AIS data, for example, is particularly useful for detecting novel movements of LNG and other commodities as new movements between countries may reveal the opening of new routes, that may in turn reveal wider macroeconomic trends. For example, a significant increase in arrivals of LNG shipments to Italy from Algeria between April and July 2022, compared to the same period last year, reveals that the country is not just stockpiling for winter, as might be expected from many European countries at this time of year, but protecting against future scarcity. Similarly, if imports of energy commodities and, most significantly, iron ore, are seen to increase in a country, it is reasonable to assume that an increase in economic activity and growth will follow, as iron ore is the key raw material used in the production of steel, which is chiefly used in construction.

Combining alternative data sets can also reveal wider economic and political trends. Since the implementation of massive sanctions by Western countries against Russia, AIS shipping data has revealed a significant drop in import-export activity at northern-Russian ports, which are mainly used for trade between Russia and northern-European countries. Looking at the wider picture and bringing in other alternative data sets also helps understand the effect of sanctions among the population. For example, QuantCube was able to determine economic anxiety among the Russian people through examining a number of data sources, such as social media platforms, using cutting-edge natural language processing algorithms to determine economic sentiment. Using these techniques, the company discovered that economic anxiety increased by 250% in March (following the invasion of Ukraine) compared to the level recorded in January. It also found that sentiment relating to emigration spiked significantly in this period, further revealing the wider impact of the conflict.

11

Building in agility

Ultimately, long-term investment strategies cannot be based on real-time insights alone. For this purpose, they must be used in combination with traditional methods of market analysis and indicators. However, the value of alternative data for gaining immediate insights on contemporary events, and adjusting investment strategies accordingly, is significant, as they can provide additional insights to enable investors to anticipate market movements and act before their competitors.

It is no secret that the COVID-19 pandemic severely disrupted supply chains. Again, analysis of real-time AIS shipping data revealed how congestion at the largest ports in the world, including Long Beach (the US), Rotterdam (the Netherlands), and Shanghai (China) between the months of August and September 2021, affected global movements of LNG, dry bulk commodities, liquid bulk commodities, and container ships. Following the congestion, tensions in the gas market became a main driver for the increase in global gas prices, which precipitated an increase in crude oil consumption – particularly in China, as the country sought to maintain economic growth.

When the Freeport LNG facility in Texas, the US, closed due to an explosion at the beginning of June 2022, the fall in US exports was immediately clear from AIS data. Wider analysis of the global market in the immediate aftermath of

the plant’s closure was also intriguing, as US gas prices fell due to a surfeit of the resource within the country. As might be expected, the price of gas in Europe, one of the US’s export markets, rose dramatically (Figures 1 and 2).

Similarly, Russia’s invasion of Ukraine – and the subsequent sanctions it incurred – triggered an energy war between Russia and Western countries that has disrupted the energy markets. By tracking the deliveries of LNG in real time, the EU strategy of stockpiling natural gas ahead of the winter and before the full impact of the sanctions was realised was immediately obvious.

These examples reveal how alternative data can be used to predict the impact of future disruptions to supply chains around the world. The consequences of the fire in the Freeport LNG liquefaction facility should serve as a reminder of the fragility of global LNG supply chains. As recent years have shown, black swan events severely impact global supply chains. A similar crisis in the Middle East or APAC regions could have a much more disruptive effect on the global movement of LNG and other energy commodities. With real-time insights, organisations will be much better equipped to adjust their investment strategies and operations in the face of such events.

Making alternative data work forthe LNG industry

With the global alternative data market expected to reach US$143.3 billion by 2030, growing 54.4% annually from 2022 to 2030, organisations across industries are seeking to harness this resource to uncover insights that might give them an edge over competitors with their investment strategies.1

From QuantCube’s work in the commodities space, it knows investors are eager to tap into new sources of information and expects to see a rapid increase in collaboration with alternative data providers in the coming years. Real-time insights on LNG movements are a compelling example of what can be achieved through the utilisation of alternative data, and its potential to create further value and insights across the LNG industry is considerable.

References

1. ‘Alternative Data Market Size, Share, & Trends Analysis Report By Data Type (Card Transactions, Mobile Application Usage, Social & Sentiment Data), By Industry, By Region, And Segment

Forecasts, 2022 – 2030’, Grand View Research, (2017 – 2020), www.grandviewresearch.com/ industry-analysis/alternativedata-market

12 October 2022

Figure

1.

Natural gas prices in Europe and the USA.

Figure

2.

QuantCube Commodity Indicator – USA LNG exports.

Figure 1. FSRU Toscana aerial view.

Figure 1. FSRU Toscana aerial view.

14

he conflict in Ukraine has been a turning point in the European energy market. The issue of energy independence from Russia, in fact, immediately acquired centrality, prompting the European institutions and the member states of the Union to study effective solutions to achieve a rapid diversification of supply sources. The RePowerEU plan, launched in March 2022 by the European Commission, takes on great significance. The Italian government, for its part, has faced the reduction of supplies from Moscow, Russia, by increasing energy links with other supplier countries and at the same time accelerating the storage capacities deriving from its own resources.

In this complex and rapidly evolving scenario, LNG can certainly play a key role. The European Commission estimates that it will be able to replace two-thirds of Russian gas imports within the next year by mainly using LNG. Proof of this is the agreement signed in March with the US, through which Washington undertook to increase supplies to European countries, guaranteeing 15 billion m 3 in 2022, with future increases of up to 50 billion m 3

The FSRU Toscana terminal, managed by OLT Offshore LNG Toscana – a company controlled by Snam and Igneo Infrastructure Partners – can make a decisive contribution to Italian energy independence. Among the main infrastructures of national interest for the import

Giovanni Giorgi, OLT Offshore LNG Toscana, Italy, considers the role of LNG for Italian and European energy independence.

15

of LNG, the terminal currently has a maximum authorised capacity of 3.75 billion m 3/y commercially offered with 41 slots of 155 000 liquid m 3 each.

The regasification capacity is offered on annual and multi-year allocation processes in the months of May and July. If there is still available capacity in the current gas year, the latter is offered monthly during the infra-annual allocation processes through capacity product auctions, monthly and spot auctions, and first come first served (FCFS) in order to maximise the regasification capacity allocation by meeting the ever-changing needs of the energy market.

It should be noted that the auctions held last June for the gas years 2022/2023 – 2032/2033 have shown remarkable results. OLT has allocated, in fact, the entire capacity for the gas years 2022/2023 and 2023/2024. 83% of the capacity per year was then allocated until 2026/2027, which is equivalent to approximately 3.2 billion m 3/y, as well as 5% of the capacity for the gas years 2027/2028 and 2028/2029.

Faced with the energy needs that emerged as a result of the Ukrainian conflict, the authorisation for an increase in the terminal’s regasification capacity would certainly constitute an important step in the implementation of the Italian energy strategy. The studies carried out have shown that the terminal’s capacity could be expanded up to 5 billion m 3 /y in a short time. This increase, which does not involve plant modifications but only an efficiency of logistics, would help to achieve the goal of guaranteeing the security and diversification of the country’s energy supply.

OLT’s commitment is also aimed at the issue of sustainability to make the growth in company activities compatible with protecting safety and safeguarding the environment. During 2021, for example, the climate-changing emissions related to the terminal’s activity were reduced by 7%, not to mention the initiatives to offset carbon dioxide (CO 2) emissions taken by OLT in 2021, such as reforestation interventions through the recovery of woodland areas and the creation of new peri-urban green areas. Furthermore, in support of the fight against climate change, OLT is planning to define a GHG reduction plan with subsequent development of decarbonisation projects.

A key resource in the energytransition process

The changes in the energy scenario caused by the war in Ukraine have contributed to enrich the Brussels agenda with new priorities. The quick breakaway of the EU from Russian energy dependence has joined the broader goal of the energy transition, which sees its milestone in the New Green Deal of 2019. The EU has therefore outlined a clear development strategy. The goal is to become the first climate-neutral continent through total decarbonisation by 2050.

The EU’s objectives are certainly ambitious, but at the same time needed, as also highlighted by the heat and drought of the Summer of 2022. To make them credible, adequate strategic planning and the allocation of significant investments in the energy and mobility sector will have to be envisaged.

In this perspective, natural gas (gaseous or liquefied) can play an essential role, especially in the mobility sector. The gas infrastructures could be converted, in the long term, into the transport and storage of new generation gases, such as biogas or bio-LNG, synthetic methane, or be used for the transport and reception of hydrogen, in the liquid state or mixed with other gases.

LNG, in addition to providing support to the energy system stability when the low production of electricity from renewable sources occurs, thanks to its environmental performance, is one of the fuels that can guarantee the low emissions required for the reduction of CO 2 emissions, sulfur oxides, nitrogen oxides, and particulate in the maritime and heavy land transport sectors, envisaged by the new regulations that will come into force to achieve the zero-emissions targets by 2050.

In the continental context, Italy is at the centre of this change, not only from a geographical point of view. On the one hand, the country has the largest European network of LNG fuel stations for road transport; on the other hand, there are three important regasification terminals allowing to receive LNG from all over the world, providing a key contribution to the security and diversification of supplies.

After the inaugurations of the first two coastal LNG deposits in 2021, which marked a defining moment in the consolidation of the Italian small scale LNG supply chain, 2022 will be the year of the completion of the Italian supply chain: OLT will be the first Italian terminal to provide the small scale LNG service; this service means that small LNG carriers can load LNG directly at the regasification and storage terminal to refuel LNG ships or to deliver it to coastal deposits inside the Mediterranean ports.

Following the authorisation process started in March 2019, in October 2020 OLT received authorisation to implement the modifications to the terminal necessary to launch the service. Following a study on logistics that has deepened the reception capacity of the terminal, confirming the possibility of receiving a greater number of small LNG carriers than the authorised one, OLT has decided to increase the flexibility and efficiency of the terminal by undertaking a new authorisation path, in progress at the moment, to allow the berthing of up to 122 small scale LNG carriers a year.

16 October 2022

Figure 2. Ship-to-ship operations at

FSRU Toscana

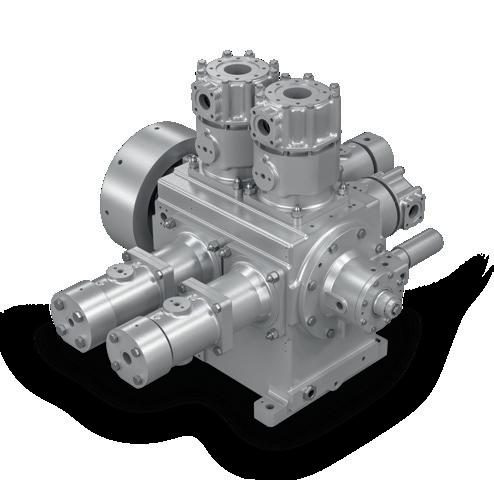

Of the LNG marine expansion

All the key role players in the marine industry have started to invest in LNG technology and infrastructures, as well as in new dual fuel or gas only engines for ships and new LNG bunkering vessels too. Vanzetti Engineering ARTIKA Series submerged pumps and VT-3 Series reciprocating pumps are the default choice for low and high pressure marine engine fuel gas systems, stripping and spray applications, booster, ship to ship bunkering, cargo and more.

VANZETTI

ENGINEERING. Widening the horizons of LNG sustainability. www.vanzettiengineering.com

FSRU Toscana will be able to receive small scale carriers with a maximum length of 120 m, corresponding to a capacity of approximately 7500 liquid m 3. The mooring system, the manifolds, and ESD will be in accordance with OCIMF and SIGTTO recommendation.

From a commercial point of view, the service will be offered, as soon as the works are completed, in a non-discriminatory manner and on an auction basis via the regasification capacity allocation platform (PAR) managed by Gestore Mercati Energetici (GME).

This service is of fundamental importance, considering that the LNG currently used in the Italian small scale LNG logistics chain is totally imported from abroad. This will allow the completion of the supply chain of LNG as a fuel, not only for maritime transport but also for land transport, as well as for civil and industrial uses in areas not supplied by the national gas grid.

The centrality of LNG in the transition towards a sustainable society therefore rests on three areas: marine, road transport, and distribution. In the marine sector, the use of LNG is compliant with the limits imposed by the International Maritime Organization (IMO) in the ‘SECA’ sulfur emission control areas; from 1 January 2020, the North Sea, the Channel, and the Baltic Sea have become part of these areas, while it has already been proposed that the Mediterranean Sea will also be part of them as soon as possible (it is expected that this proposal will come in force on 1 January 2025). The fuels used today in those areas by container ships, ferries, cruise ships, and other

merchant vessels must comply with a sulfur emission limit of 0.5%, a significant step forward compared to the previous maximum allowed value (3.5%). In land transport, the use of LNG allows considerable savings in terms of climate-changing emissions, as it does not contain particulate and contributes to noise reduction. The vehicles, as well as ships, that choose this type of power supply also have an important advantage for the future: being able to use the renewable option of LNG (bio-LNG), and not only the fossil one.

Main features of the terminal

The FSRU Toscana floating terminal, through which OLT guarantees the storage and regasification of LNG, is one of the main infrastructures of national interest for the import of LNG serving the development and autonomy of the Italian energy system.

Permanently anchored approximately 22 km off the coast between Livorno and Pisa in the Tuscany region, the terminal, which entered into commercial operation in December 2013, contributes substantially to the Italian gas system, guaranteeing the security and diversification of the country’s energy supply with approximately 5% of the national requirement covered.

The terminal is energetically self-sufficient, using the boil-off gas (BOG) to produce the energy needed for operations.

OLT is authorised to receive approximately 90% of the current LNG carrier fleet, in particular those with a cargo capacity between 65 000 m 3 and the new panamax class (approximately 180 000 m 3); Wobbe Index system installed on board, which makes it possible to correct the quality of LNG in terms of calorific value, adapting it to the specific requests of the national network, allows the reception of most of the LNG produced in the world. The contribution that FSRU Toscana provides to the diversification of supply is confirmed by the receipt of LNG cargoes arriving from the main exporting countries such as Algeria, Cameroon, Egypt, Equatorial Guinea, Nigeria, Norway, Peru, Qatar, Trinidad and Tobago, and the US.

Furthermore, users of the regasification service can take advantage of additional services such as flexibility ones. Specifically, nomination and renomination service, virtual liquefaction service, and extended storage service.

The nomination and renomination service allows the user of the regasification service to modulate, even within the same day, the quantity of LNG regasified and redelivered at the entry point of the national grid or at the virtual exchange point (PSV), according to the timing and procedures set out in the regasification code.

The virtual liquefaction service allows the users to deliver natural gas at the PSV by receiving an equivalent quantity of LNG inside the terminal tanks. Such LNG can be either received, as liquid, into small scale carriers or, as natural gas, at the entry point of the national grid.

The extended storage service consists in providing to the regasification users a temporary storage service for a quantity of LNG inside the terminal tanks, which could be redelivered as liquid onto small LNG carriers or regasified and sent into the national grid in a period other than the one in which such LNG was discharged into the terminal.

18 October 2022

Figure 3. FSRU Toscana T16.

Figure 4. Simulation of a small scale LNG carrier approaching the terminal.

here is a growing demand across the energy industry to reduce greenhouse gas (GHG) emissions, prompting governments, utilities, and consumers to seek out cleaner energy alternatives.1

Hydrogen is quickly gaining interest as a substitute for fossil fuels since its combustion produces only water with no carbon emissions. Green hydrogen is produced from water using an electrolyser with renewable electricity as the power source. Renewable electricity is often generated from solar, wind, hydropower, or even nuclear power, which is also considered a green power source.

One method to quickly integrate green hydrogen into the power grid is by displacing a percentage of natural gas in the existing natural gas distribution network with hydrogen. If the percentage of hydrogen is kept to an appropriate level, there is minimal impact to gas consumers. Utilising the existing gas infrastructure also provides a significant environmental benefit as it relates to construction

requirements associated with implementation.

CB&I recently completed a green hydrogen production and pipeline injection project in Howell, New Jersey, the US. In that particular case, green hydrogen is produced from water, an electrolyser, and solar power. The hydrogen displaces a limited percentage of the natural gas in the gas distribution network, resulting in a cleaner hybrid fuel without significant impact to the operation of standard household gas appliances.

For now, these projects are limited to smaller, locally isolated networks, but as the concept is proven, more widespread hydrogen displacement into natural gas pipelines will occur with concentrations potentially as high as 20%.

Hydrogen impacts to LNG peak shavers

Though the limited presence of hydrogen in natural gas has minimal effects on residential appliances and

Jeffery J. Baker and Randall W. Redman, CB&I, USA, detail how hydrogen can impact LNG peak shavers, outlining the solutions to keep LNG peak shavers operational.

19

industrial burners, even a small percentage of hydrogen in the feed gas to LNG peak shaving facilities will affect the liquefaction process.

Hydrogen in natural gas will change the load on the liquefier and may even limit the liquefier’s production availability. Gas utilities need to be mindful of the impacts that hydrogen injection into the natural gas grid can have on their peak shaver liquefaction operation.

This report outlines the impacts caused by hydrogen in the feed gas and what facility modifications may be required if the natural gas feed contains hydrogen. When possible, it is highly recommended that hydrogen injection be located downstream of an LNG peak shaving facility to avoid issues with liquefaction. However, given the widespread interest in the hydrogen displacement concept, it is possible that hydrogen will become a common constituent in natural gas.

Typical composition of natural gas

A typical natural gas pipeline will have a composition similar to that shown in Table 1. A phase diagram for this composition is shown in Figure 1. A standard LNG peak shaver will liquefy the natural gas at pressures between 30 atm and 55 atm (440 psia and 800 psia). Figure 1 shows

Table 1. Typical natural gas composition

Component Mole fraction

Methane 0.9381

Ethane 0.024

Propane 0.0065

i-Butane 0.0005

n-Butane 0.0005

i-Pentane 0.0002

n-Pentane 0.0002

Nitrogen 0.02

Carbon dioxide 0.01

that as a natural gas stream is cooled to 212˚K (-78˚F) at 40 atm, the gas stream begins to condense with the heavier components in the natural gas condensing first. As the stream continues to cool, more liquid is formed. At approximately 188˚K (-121˚F), the gas stream is fully condensed. A standard LNG liquefier will continue to cool the stream to a sub-cooled condition as cold as 111˚K (-260˚F).

Natural gas with varioushydrogen concentrations

Hydrogen in the natural gas stream will have a dramatic effect on the phase diagram. Figure 2 shows a natural gas stream with an increasing hydrogen content from 2% to 20% hydrogen. With an increasing amount of hydrogen in the mixture, the point where the mixture can be fully condensed occurs at lower temperatures. This alone means a liquefier requires more energy to condense a mixture containing hydrogen. However, another effect is also present.

As the temperature is lowered, the dew point line for the mixture begins to turn upwards. This means that as the mixture gets colder, it may fully condense, but continuing chilling may create vapours again at lower temperatures. This is unusual for typical liquefaction processes. Typically, once a stream is fully condensed, any further cooling will sub-cool the liquid. However, the hydrogen causes vapour to form and the mixture becomes two-phase again at lower temperatures.

As seen with a 3% hydrogen mixture in the natural gas, at the 40 atm pressure, the mixture starts to condense at a similar temperature to the typical natural gas composition of 212˚K. However, this mixture needs to be chilled to 168˚K to become fully condensed. This is much colder than the 188˚K of the typical natural gas mixture. Note from the curve that if the mixture is further chilled to 105˚K (-270˚F), vapour starts to reform. Typically, LNG peak shavers would not operate at this low of a temperature, therefore the 3% mixture should remain liquid.

Now, consider a 5% hydrogen mixture in the natural gas at the 40 atm pressure. Condensation begins at 212˚K. As this mixture is cooled, more vapour is condensed; however, regardless of how cold the mixture is, it will never achieve full condensation. In other words, there will always be vapour present at 40 atm. The mixture would need to be at a pressure of 50 atm to reach full condensation, but then at temperatures colder than 135˚K (-216˚F), vapour will form again.

At hydrogen concentrations of 20% in the feed gas, there is no pressure where this mixture will be fully condensed. There will always be vapour present.

The data in both Figures 1 and 2 has been generated using AspenTech’s HYSYS with a GERG-2008 Equation of State (EOS). The results for the low temperature effects generated by this EOS correlates with published data in the paper, ‘A Phase-Equilibrium Apparatus for Gas-Liquid Systems and the Gas Phase of Gas-Solid Systems: Application to Methane-Hydrogen From 66.88˚K to 116.53˚K and up to 125 Atmospheres’ by B. S. Kirk and W. T. Ziegler from the Georgia Institute of Technology, Atlanta, Georgia, the US. 3

20 October 2022

Figure 1. Phase diagram for natural gas.2

Challenges with hydrogen inLNG liquefiers

This inability to fully condense the hydrogen-natural gas mixture can have dramatic effects on existing natural gas liquefiers. If the process was originally designed for full liquid interfaces within the existing liquefaction equipment, then the equipment may not have the capability to handle two-phase conditions with vapour present in the streams.

For example, the fins in a brazed aluminium heat exchanger are designed for the liquid transition of the natural gas stream load curve matching the refrigerant curve. If the mixture remains two-phase at the temperature expected for full condensation, a pinch within the heat exchanger may occur that cannot be overcome. A pinch is where the load stream temperature approaches the refrigeration stream temperature such that temperatures further down the exchanger will not be as cold as originally designed. The result is that production rates may be compromised.

The presence of two-phase fluids at the bottom of the exchanger will change the heat transfer co-efficients, which will further reduce the heat transfer for the fixed sized exchanger, compounding the effects. In addition, downstream piping and valves that were designed for single-phase liquid will have large pressure drops due to two-phase flow and may not function as designed.

This indicates that for a liquefier to reach full liquid formation, the hydrogen content needs to be less than approximately 3% in the natural gas. However, even with the hydrogen content reduced to this lower value, there still may be issues with the boil-off gas (BOG) from the storage vessel.

Process simulations performed by CB&I show that an LNG mixture with 3% hydrogen will have up to 16% hydrogen in the BOG due to flash and storage vessel heat leak. This high hydrogen content in the boil-off may cause problems with BOG equipment, such as boil-off compressors or reliquefaction of the BOG. If the BOG is returned to the natural gas distribution system, the resultant tail gas may encroach on pipeline component concentration limits.

BOG compressors will be affected if the BOG contains high percentages of hydrogen. If the gas contains 16% hydrogen, then the mass flow through a compressor will be reduced for compressor volume flow due to the lower density created by the inclusion of hydrogen. For centrifugal machines that operate at a defined head, the presence of hydrogen will lower the discharge pressure. For positive displacement machines that operate at a defined pressure ratio, the discharge temperature and power will increase.

BOG compressor oil and shaft seals will need to be reviewed for compatibility with hydrogen. Due to the low mole weight of hydrogen, these seals may allow the hydrogen molecules to pass through easier than the larger methane molecules. The compressor oil may not be compatible with hydrogen. Material specifications for the compressor and downstream equipment, including piping, will need to be reviewed to ensure that the hydrogen does not cause hydrogen embrittlement or stress corrosion issues.

If it is found that the hydrogen in the BOG gas prevents the BOG compressor equipment from operating properly, then a reduction of the feed gas hydrogen to less than 3% may be required, even though the liquefaction process can

VACUUM JACKETED VPIPE ACUUM JACKETED PIPE We provide a comprehensive component offering to complete our system design, manufacture, and installation capability. www.ACMECRYO.com www.ACMECRYO.com 8800.422.2790 00.422.2790 Our application-specific accessory product lineup offers the optimum system solution for any application. Including Liquid Nitrogen, Oxygen and Cryo Liquid Piping.

handle the higher hydrogen content. Alternatively, an additional separation process will need to be added to the BOG to remove hydrogen.

If the BOG is used as fuel gas within the facility, the hydrogen will change the heating value and density of the fuel gas. Storage tank pressure relief valves will need to be checked for proper sizing with a high hydrogen content in the tank vapour space.

The effect of hydrogen on the risk of LNG rollover in the LNG tanks is not well known. Additional studies will be required to determine if the small amount of hydrogen remaining in the LNG can increase rollover effects in stratified LNG tanks.

Solutions to keep LNG peak shavers operational

The simplest solution, of course, is to avoid having hydrogen in the feed gas to a peak shaving facility when possible. Gas utilities that are considering adding hydrogen displacement into the distribution systems should carefully assess the location of the injection point to avoid the inlet of the peak shaving facility, as was done at the Howell facility.

Over time, it is possible that hydrogen will become prevalent in many of the pipelines feeding peak shaving facilities. This will require mitigations to keep these important facilities operational.

For existing liquefiers, hydrogen removal is recommended prior to the liquefaction process. The simplest arrangement may be to install a separation process prior to the gas pre-treatment system (Figure 3). A solution for an existing LNG facility is membrane separation.

With this process, the mix of hydrogen and natural gas will enter a membrane vessel where the natural gas would pass through while the hydrogen is separated and exits as a low-pressure stream. While 100% separation is not achievable, suitable separation required for LNG liquefaction to continue is likely for a properly designed and installed system.

New facilities may be able to include a separation process within the LNG liquefaction process. This may be a distillation process extracting the hydrogen gas from the liquid LNG stream. However, the refrigeration system would need to be designed for this separation within the liquefaction process. This would preclude such modifications to existing LNG peak shaver facilities.

Handling extracted hydrogen

After the hydrogen has been extracted from the natural gas, there are many ways to handle the hydrogen gas. The easiest method is to vent or flare the gas. For the membrane separation option, the separated hydrogen is at a low pressure and can be easily sent to a low-pressure flare. Hydrogen is not considered a GHG and therefore does not have the same effects on the environment as carbon dioxide or methane.

Alternatively, the hydrogen could be compressed and returned to the pipeline, provided there is enough flow-by in the pipeline so that the hydrogen does not recirculate back into the feed stream of the facility.

Depending upon the quantity of hydrogen separated, the hydrogen by-product may be a useful commodity. Hydrogen may be compressed for storage or liquefied and then sold as a revenue stream. It may also be beneficial to capture the hydrogen for resale or consume it on site as fuel gas. Other options for the hydrogen are to produce green electrical power or fuel for hydrogen vehicles. Depending on the hydrogen’s intended purpose, additional equipment may be necessary to purify the hydrogen extracted by the separation process.

Additional considerations and consultation

Figure 2. Phase diagram for natural gas with various concentrations of hydrogen.2

Although this article summarises the challenges and potential solutions to mitigate the presence of hydrogen in feed gas for peak shaving facilities, specific conditions must be evaluated before recommendations can be developed for implementation.

Companies, including CB&I, offer consultations based on the design parameters of the facility and can make recommendations that take into consideration the specific concerns of the owner and/or operator.

References

1. ‘Global Methane Initiative – Importance of Methane’, U.S. Environmental Protection Agency, (30 June 2021), www.epa.gov/gmi/importance-methane.

2. Curve data by AspenTech HYSYS Process simulation software for values from Table 1 using GERG 2008 Equation of State.

Figure 3. Diagram of hydrogen separation from natural gas feed into an LNG peak shaver.

3. KIRK, B. S., and ZIEGLER, W. T., ‘A Phase-Equilibrium Apparatus for Gas-Liquid Systems and the Gas Phase of Gas-Solid Systems: Application to Methane-Hydrogen from 66.88˚K to 116.53˚K and up to 125 Atmosphere’, International Advances in Cryogenic Engineering, Vol. 10, Part 2, Timmerhaus, (1965).

22 October 2022

While the current focus is on the decarbonisation of maritime transport, the protection of marine biodiversity remains a major environmental challenge for all stakeholders in the maritime sector.

Even if ballast water is critical to safe and efficient shipping operations, it can pose serious ecological, economic, and health challenges. According to the latest 2017 report The GoBlast Story, co-ordinated by the International Maritime Organization (IMO), the Global Environment Facility (GEF), and United Nations Development Programme (UNDP), more than 7000 organisms are transferred in ballast water every hour of every day.

Every year, 10 billion t of ballast water are transported around the world, dramatically increasing the risk of invasion of unwanted organisms during discharge in the arrival port. The preservation of marine biodiversity is one of the 17 sustainable development goals adopted by the United Nations.

Although the Ballast Water Management Convention (BWM Convention) has set criteria for ballast water treatment to limit the risk of unwanted invasions, these requirements entail significant investments in onboard systems and additional costs for operation and maintenance of ballast tanks.

However, the best pollution is the one humans do not produce. The operator then becomes 100% compliant without any treatment or investment; a ballast-free solution.

Based on this assumption, GTT studied several concepts before presenting a totally reliable and operational solution. The basic idea is to obtain a somewhat higher draft in the design load case, and by that, maintain also a sufficient draft for safe navigation, even when empty.

To overcome these issues, GTT considers that the most suitable form is a V-shaped hull design and has conducted extensive tests on a ballast free bunker vessel. This design takes full advantage of the specific geometry of the membrane: the hull

Lorenz Claes, GTT, France, discusses the possibility of LNG carriers operating without ballast water, highlighting how this would be beneficial both from a technical perspective, as well as the preservation of marine biodiversity.

23

lines and the incorporated membrane tanks are designed to fit perfectly, and the free surface effects of LNG are reduced when the vessel is partially loaded.

A long story of development

For several years, GTT has continued to innovate by offering new solutions to the maritime world. Several projects have been developed in conjunction with various designers and shipbuilders to propose LNG carriers able to operate without ballast water.

Two major studies have led to sloshing test campaigns in GTT’s R&D centre, and some of them have obtained approval in principal (AiP) from classification companies, proving the feasibility of such a concept. These successful results have confirmed the company’s commitment to propose a safe ship concept. The results also confirmed GTT’s decision to choose the containment system

Mark III Flex. The insulation foam density is standard 130 with partial 150 kg/m3. The design boil-off rate with the above values is 0.165%vol./d.

GTT developed a new concept for a vessel through building on the experience gained on the previous ballast-water-free projects, as well as the recently constructed membrane-type LNG bunker vessels. The vessel may serve either as an LNG bunker vessel or as a regional feeder.

The design proposes numerous advantages, such as reduced investment and operating costs, simplified operations, reduced corrosion, and a prolonged lifetime.

The general dimensions are:

Length x beam x draft = 141 x 25 x 7.25 m

For a cargo volume of 18 700 m3 at a design speed of 14 knots.

Two identical cargo tanks are provided for simplified operations, and a very effective anti-roll tank (ART) system is provided in the vessel’s fore part.

The vessel uses a twin-screw azimuth propulsion system, increasing the manoeuvring performance and providing a high-power reserve in harsh conditions when empty.

The ship produces reduced emissions than a conventional vessel, as it has a lower level of consumption. On average, there is a power reduction of over 10% versus a conventional vessel.

Specific issues such as pilot boarding, trim regulation, and dry docking were identified, investigated, and solutions validated by the design.

In coastal trades, with frequent calls to major rivers, the benefits are substantial.

Ship design general aspects

Trim-management is one of the important design issues for such a vessel: careful longitudinal distribution of weight and buoyancy is made by design, and a genuine trim-water system is provided, using some dedicated fresh-water that is permanently on board. The trim can always be managed in a satisfying, rule-compliant way. The vessel is designed in fully loaded condition at zero-trim and in empty condition with some aft-trim, which improves the propeller immersion. In this respect, the use of a bulbous bow shape was not beneficial, also with regard to often changing drafts when operating as an LNG bunker vessel.

The cargo tank filling can be at any level without restriction, as demonstrated by the liquid motion campaign. The operator simply has to ensure the vessel trim is in the required range –from zero-trim to approximately 1.5 m aft or possibly 1 m forward – and compliant with visibility rules.

Roll-motions are effectively reduced by substantial bilge-keels and further by the ART. The installation in the forward part is ‘ideal’, as the space is available without any cargo loss. The ART design is made for the vessel in empty conditions, but it may also be used in loaded conditions with somewhat reduced effect. The operation of the ART is optional, not mandatory, and it uses the onboard trim-water without losing cargo-deadweight.

The question of parametric rolling was assessed by HSVA, the Hamburg ship model basin, and can be totally excluded due to the specific hull shape.

Effective construction is kept in mind for easy assembly and inspection of the hull structure. The full double structure (bottom, sides, and also the upper deck) is mainly composed of void spaces giving substantial advantages compared to a ballasted structure.

24 October 2022

Figure 1. 18 700 m3 LNG feeder and bunker vessel Shear-Water.

Figure

2.

Shear-Water mid-ship section vs conventional vessel.

Figure

3.

Incorporated model tank on board. (Source: HSVA).

Passion for innovation and technological excellence serving a sustainable world

With almost 60 years of experience, GTT is the partner of choice to design cutting-edge technological solutions for an improved energy efficiency. We bring our passion for innovation and our technical excellence to the service of our customers, in order to meet their transformation challenges both for today and tomorrow.

Our expertise goes from LNG ships to LNG-fuelled ships. We support all your LNG related operations, train and assist your crews to optimise your vessel economics. As shipping is turning digital, GTT Digital proposes Shipping Solutions, combining our experiences and skills to offer a wide range of digital services to the maritime industry.

The GTT teams are at the heart of our mission. Committed and united, we are determined to contribute to building a sustainable world.

gtt.fr

Docking is made in the same way as any ship: even in empty condition, the vessel can be put in even keel to avoid hazard, and the provided large keel plate with supporting side girders assures the required transverse stability even when dry, without further side supports.

The vessel outfitting is proposed on a state-of-the-art basis. Latest knowledge from other LNG bunker vessels is considered for user benefit.

The propulsion system is chosen with dual-fuel electric power generation based on three identical gensets and two azimuth propellers (design provided by Schottel) driven by electric motors. Such a configuration gives the best flexibility, high redundancy, and best economics for all operations.

The Shear-Water design is evaluated, based on the present propulsion system, to be EEDI compliant for ordering the vessel before 2030. Further improvements may be incorporated over the detailed design process, in close co-operation with the chosen classification society.

How to address the key concepts for a ballast water free vessel

Some of the key design aspects are the hydrodynamics and in-tank liquid motions (sloshing).

On behalf of GTT, an extensive test-campaign was made by HSVA. It validated the ship’s behaviour in calm-water and the vessel seakeeping in severe sea-states. The membrane system was validated in GTT’s laboratory for worldwide conditions without any filling restrictions.

Both of the campaigns showed results ranging from good to excellent.

Hydrodynamics

The tests were made with a self-propelled model in a scale of 1:18, a length of 7.75 m, and a laden weight of 2.8 t.

Classical calm water tests covered speed-power and manoeuvring. The outcome showed a power reduction of

10 – 15% for the range 10 – 14 knots, when considering average values between fully loaded and empty conditions. All of these were compared with a same size and same function conventional vessel.

Manoeuvring tests showed results exceeding IMO requirements and expectations. The design shows perfect course keeping, combined with excellent manoeuvring capabilities.

Seakeeping performance was tested in selected sea-states up to NATO Sea-State 7 (Hs 7.5 m). No unusual, excessive, or dangerous behaviour in the selected sea-states has been observed. Observations were similar to other ships in such conditions.

Tests and investigations covered motions and accelerations, rolling, including parametric excitation, slamming, propeller immersion, green water, and speed loss in waves.

Course keeping in waves is considered good, and the ship was never found to be out of control.

Further tests were made for pilot transfer operations. Comparative tests with and without ART showed a roll reduction of approximately 60%.

Additional separate tests were made with the incorporated (single) LNG tank, investigating coupling effects between tank liquid motions and external wave excitation.

Cost reductions go with betterenvironment

First estimates show a cost reduction of approximately 5% in terms of CAPEX, as there is no ballast water system (pumps, valves, and pipes, smaller sea-chests) nor treatment system (BWTS) and a reduction of air vents and sounding pipes control.

On the operational side, an annual reduction of approximately US$100 000 – US$200 000 can be expected thanks to fuel savings due to power reduction when empty (smaller displacement), and a reduction of energy consumption with the lack of ballast water system, no pump power consumption, consumables, and spares. Maintenance costs are also reduced by eliminating ballast tank coatings, ballast tank anodes, ballast tank paint, and no more maintenance due to sediments. This saves a lot of time and savings due to less cleaning work during dry-dock. Emissions are also reduced by 10 – 15% compared with a conventional vessel.

Conclusion and outlook

The tests conducted by GTT have shown the feasibility of the concept. In the near future, there will be more and more ships sailing without ballast water. This is great progress from a technical perspective, as well as for the preservation of marine biodiversity.

GTT believes that this concept is completely replicable in other market segments, and the company are convinced that it will see tankers, container ships, and other merchant ships without ballast water in the coming years.

Several classification societies have issued AiP’s, including China Classification Society, Det Norske Veritas, and Bureau Veritas. This development project has demonstrated that this kind of ship is more efficient, more environmentally-friendly, and less expensive to build and operate.

26 October 2022

Figure 4. Side view of the concept design. Figure 5. Test model in the HSVA pool.

Geir Moholt, Høglund Marine Solutions, addresses the importance of system integration as the adoption of new fuels, such as LNG, increases complexity on board ships.

ooking back on 2022, one of the overriding themes when it comes to the future of the global shipping fleet will be ‘keeping options open.’ With a lack of certainty when it comes to the eventual fuel mix of the future, but plenty of pressure to switch away from fossil fuels, the shipping industry is a college student waiting until the last minute to pick their major. And rightly so – after all, it is still far too early to predict how a radically different fuel supply chain will evolve over the lifetime of a vessel. The answer to this dilemma, overwhelmingly, is the option to handle LNG, which keeps the door open for bio- or synthetic LNG, ammonia, or even hydrogen, with some modification. Earlier in 2022, Clarkson Research Services reported that 63% of orders in gt terms have been for alternative fuel-capable units. LNG remains the leading choice of fuel, and many owners are also opting for dual-fuel options.

Managing these fuels effectively will be a challenge in itself. These fuels will require dedicated automated fuel management and supply systems that are far more complex than the current standard shipping is used to, which is based around managing heavy fuel oil (HFO). How shipowners, yards, and equipment

27

suppliers specify and then subsequently use these systems will have a major impact on the overall reliability and performance of future vessels, both newbuilds and those retrofitted to use future fuels. The same goes for LNG carriers and bunkering vessels.

Retrofits of dual-fuel systems can partially de-risk the choices of today and future-proof the investment decisions made amid ongoing fuel uncertainty. By considering how energy can be transferred, stored, and used on board a vessel today and in the future, as well as identifying the similarities and compatibilities across different energy carriers, shipowners can equip their vessels with a multiple use dual-fuel system and eliminate the need for immediately choosing between LNG, ammonia, and methanol from a fuel handling perspective.

A vessel equipped with a dual-fuel system where one fuel system is designed for handling a low vapour pressure combustible liquid at ambient pressures and temperatures, and the other to handle a cryogenic, pressurised combustible and toxic energy carrier – both feeding into an internal combustion engine – will most likely cover any option the future might bring.

With a standard dual-fuel system that can manage HFO/diesel and LNG, the diesel fuel handling side can also be eventually converted to handle synthetic or biofuels, with relative minor impact as long as this is considered from the start. Meanwhile, the other part of the dual fuel system – the one typically handling the LNG – can be made to handle ammonia and hydrogen in the future.

Choosing an integrated automation system (IAS) is more important today than it has been in the past because the number of subsystems with their own control system is increasing and creating huge operational challenges for shipowners. Additionally, system upgrades are becoming especially challenging.

Choosing the right level ofintegrated automation

Modern IAS on board LNG vessels consist of thousands of input and output signals with widespread signal interfaces and functions. The system solves many tasks, which alone can be trivial, but, put together, become complex.

Many onboard systems – such as fuel gas supply systems (FGSS) – are delivered as turn-key solutions that come with their own proprietary control system, which can either become integrated into a vessel’s IAS or run in parallel to it, where only the interface between the two has to be specifically tested on installation. This is a low-risk option for shipyards as it avoids many potential problems during commissioning.

However, using a default control system may not be the best option. Yards and owners can choose a dedicated IAS supplier that provides input/output modules, processing power, and user interfaces. All control functions are delivered within this system, making it easier to fix problems and implement modifications. This can require more effort on the shipyard’s part, as it needs to define the scope of the system – but, ultimately, it can be worth the effort in the long run.

With an updated integrated automation and control system, detailed information from different subsystems is available on a single screen; data logging and storage is simplified, and the crew can access the data banks that detail the day-to-day operations of the ship’s critical systems. Consequently, they can analyse and identify the root cause of faults and make decisions that will improve reliability. One person can debug a problem all the way down to input/output level, rather than finding that a bug exists within a proprietary control system which they cannot access, and needing to await support form the company that supplied it.

In addition, it means that just one company is responsible for the IAS, and there is a single point of contact for all automation concerns in the event that further support is needed – there is no need to work with multiple suppliers to fix a problem that might exist in any of their products. Hardware, spare parts, and user interfaces are also consistent, which makes replacements and upgrades easier, and training is simplified.

Unexplained events

When a ship is sailing, troubleshooting and repair capabilities depend on the training and tools available to the crew. Systems reliant on programmable logic controllers can experience unexplained events from within various sub-systems, and it can be difficult for crews to recreate problems and fix them.

With outdated automation systems, expensive engineer callouts are often required to mend periodic system faults. The engineers will ‘patch’ the system, but will often not find the root cause of the problem because the data outputs from system logs are outdated, unreliable, and inaccessible.

Even more modern subsystems may appear to be working, but there is no guarantee they are operating properly or optimally. Crews may accept this if they cannot find the problem but can find a workaround.

Having invisible unreliability within an automation system can be a significant financial burden for shipowners, often without them even knowing about it. With time, the cost

28 October 2022

Figure

1.

Høglund engineers at work.

of maintaining an old system will outweigh the expense of an entirely new automation system on board.

Update with care

Shipowners looking to update their automation system should consider their approach carefully or risk spending more money on a method that initially seems cost-effective but ultimately comes with considerable overheads. One suggested measure is to start with an upgrade of the ‘top-system’, which includes operator stations and graphics. Then, at the next yard stay, providers upgrade the ‘bottom-system’, including major hardware components such as computer processing units and input/output cabinets.

While this approach may seem reasonable as the cost is spread over a number of years, owners can effectively pay twice for automation refits and get locked into contracts with hardware suppliers with no flexibility on upgrade options. The complete refit of an overarching integrated automation and control system will amount to approximately 60 – 80% of the cost of the step-by-step approach.

By combining the automation systems into an overarching integrated automation and control system, owners also get the financial benefits of automation in much the same way they would by buying a modern newbuild. Complexity is reduced, reliability is increased, and day-to-day maintenance is made significantly easier. Owners and crew are then also able to leverage other cost-saving benefits through improved energy management performance.

Efficiency gained from integrated automation provides a gateway to big data utilisation. Many onboard systems need to interact with each other and generate huge amounts of data while doing so. This information can either be a burden for crew or shoreside teams to manage or a source of valuable operational insights. If handled correctly, it can be used to optimise operations, diagnose faults, and ensure more reliable operations.

Teamwork is critical

Due to the specific regulatory requirements for LNG as a fuel, it is more important than ever that designers, yards,

engineers, automation experts, and system integrators understand the benefits of working together to meet the high safety and reliability standards that shipping demands. There are considerable engineering challenges to effectively integrating automation and gas handling systems on gas newbuilds, for example. Without properly considering automation and integration, the vessel is at risk of becoming difficult to operate and maintain.

Overcoming technical challenges

LNG bunkering vessel design has presented a series of technical challenges that have required specialist expertise. Høglund Marine Solutions delivered the IAS to the MV Cardissa, an LNG bunkering vessel operating for Shell Western LNG. 1 Back in 2017, this was a new type of small scale LNG vessel, and it was necessary to change many details from initial specifications as Høglund worked with its clients to develop the best solutions for this emerging segment.

While most of the components installed on board were standard, the way they were to be used differentiated from typical operation principles. Høglund used its software knowledge to customise the system to give the operators an overview of the plant while also ensuring control loops were working as intended. In this instance, Høglund’s playback functions were particularly important, which allowed crew and operators to analyse events on the level of individual inputs and outputs. On such a complex vessel, this was essential.

Another challenge was how to measure and report fuel consumption from boilers, engines, and gas combustion units when calculating delivered LNG fuel for bunkering LNG-powered vessels. Since the custody transfer system was a standard delivery, it was not that easy to add another calculation to the system, but the equation was known, and the IAS had the data – therefore, the function was implemented there.

Better performance

A large part of the world’s fleet sails with non-optimal systems when it comes to automation and control. Driven by environmental regulation, the number of systems on board modern vessels is rapidly increasing and becoming more diverse and complex. By giving more care and attention to the fields of integration and automation, owners and operators will be able to more effectively drive fuel savings, improve environmental performance, and provide owners and operators with a more accurate overview of a ship’s performance and operational data in compliance with regulations.

References

1. ‘Høglund forges new partnerships in LNG and chemical tanker automation’, Ship&Offshore, (2017), www.shipandoffshore. net/news/shipbuilding/detail/news/ hoeglund-forges-new-partnerships-in-lngand-chemical-tanker-automation.html

30 October 2022

Figure

2. Høglund designs, develops,

and delivers integrated marine

solutions for all types of vessels worldwide.

Cryogenic

Valves Standard and special materials SS 316/316L Nace XM-19 Inconel 718 Monel Others on demand rev.02021 E xcellence in Performance & Reliability www.indra.it indra@indra.it Test All tests are carried out in house Magenta MILANO 4000 sqm of which 3000 sqm of production area Headquarters SAMPLING & INJECTION DBB VALVES MONOFLANGE CUSTOMIZED COMPANY CERTIFICATIONS UNI EN ISO 9001:2015 BS OHSAS 18001:2007 Health & Safety Management UNI EN ISO 14001:2015 Environmental Management CONNECTIONS From NPT, RATING 6.000 SCH. BONNET Screwed, Extended CONNECTIONS From 1/2” to 8” Threaded Flanged Welded (BW or SW) Hub RATING ASME Class – 150lb to 2500lb API 3000 / 5000 / 10000 / 15000 DESIGN Single or Double Block with optional Bleed (SB-SBB-DB-DBB) Integral Ball Design: Soft & Metal Seat BONNET Screwed, O.S.&Y. Bolted, Antitamper, Extended Locking device, Cryogenic service These DBBs are used for sampling & Injection purpose and for further analysis of the process. Valves are designed with Integral Body and Integral Sampling Probe (Not Welded). Probe length is defined in acc. to the application requirements and the pipeline diameter - upon indication. Indra can supply Wake Frequency and Bending Stress Calculations to ensure the correct selection of the Probe Length and the valve optimum performance in time. CONNECTIONS Inlet: Outlet: RATING ASME API BONNET Screwed, Extended Cryogenic BALL & DBB SPLIT BODY FLOATING, TRUNNION & ACTUATED VALVES INTEGRAL ONE PIECE FLOATING BALL & DBB VALVES INSTRUMENTATION CONSTRUCTION NORMS REGULATIONS PRODUCT CERTIFICATIONS Fire Safe ISO 10497–API 607–API 6FA Fugitive Emission EN ISO 15848-1 EN ISO 15848-2 PED 2014/68/EU ATEX 2014/34/EU CRN for Canada EAC-CU-TR 010/2011 For EAC Countries EAC-CU-TR 012/2011 For EAC Countries EAC-CU-TR 032/2013 For EAC Countries Engineering Manufacturing 3D Checking NDT Testing • ASME Class – 150lb to 2500lb • API 3000 / 5000 / 10000 • Low Temperature on demand SAMPLING & INJECTION DBB VALVES MONOFLANGE VALVES CUSTOMIZED CONFIGURATION COMPANY CERTIFICATIONS UNI EN ISO 9001:2015 BS OHSAS 18001:2007 Health & Safety Management UNI EN ISO 14001:2015 Environmental Management CONNECTIONS From 1/8 ” to 2” NPT, BSPP, BSPT, BW, SW RATING 6.000 - 10.000 PSI (threaded types) SCH. 40, 80, 160, XXS (BW-SW BONNET Screwed, O.S.&Y. Bolted, Antitamper, Extended Locking device, Cryogenic CONNECTIONS From 1/2” to 8” Threaded Flanged Welded (BW or SW) Hub RATING ASME Class – 150lb to 2500lb API 3000 / 5000 / 10000 / 15000 DESIGN Single or Double Block with optional Bleed (SB-SBB-DB-DBB) Integral Ball Design: Soft & Metal Seat BONNET Screwed, O.S.&Y. Bolted, Antitamper, Extended Locking device, Cryogenic service These DBBs are used for sampling & Injection purpose and for further analysis of the process. Valves are designed with Integral Body and Integral Sampling Probe (Not Welded). Probe length is defined in acc. to the application requirements and the pipeline diameter - upon indication. Indra can supply Wake Frequency and Bending Stress Calculations to ensure the correct selection of the Probe and the valve optimum performance in time. CONNECTIONS Inlet: 1/2” to 4” flanged Outlet: Threaded & Flanged RATING ASME Class – 150lb to 2500lb API 3000 / 5000 / 10000 BONNET Screwed, O.S.&Y. Bolted, Antitamper, Extended Optional locking device, Cryogenic service SPLIT BODY FLOATING, TRUNNION & ACTUATED VALVES INTEGRAL ONE PIECE FLOATING BALL & DBB VALVES INSTRUMENTATION VALVES CONSTRUCTION NORMS & REGULATIONS ASME/ANSI ASME/ANSI ASME/ANSI ASME ASME PRODUCT CERTIFICATIONS Fire Safe ISO 10497–API 607–API 6FA Fugitive Emission EN ISO 15848-1 EN ISO 15848-2 PED 2014/68/EU ATEX 2014/34/EU CRN for Canada EAC-CU-TR 010/2011 For EAC Countries EAC-CU-TR 012/2011 For EAC Countries EAC-CU-TR 032/2013 For EAC Countries Bunker “High PressureManufacturing 3D Checking NDT Testing 150lb to 2500lb 10000 (FB & RB) Metal Seated Actuated Range -46°C to +240°C on demand on demand SAMPLING & INJECTION DBB VALVES MONOFLANGE VALVES – SLIM LINE SB - SBB - DB - DBB CUSTOMIZED CONFIGURATION UNI EN ISO 9001:2015 BS OHSAS 18001:2007 Health & Safety Management UNI EN ISO 14001:2015 Environmental Management CONNECTIONS From 1/8 ” to 2” NPT, BSPP, BSPT, BW, SW RATING 6.000 - 10.000 PSI (threaded types) SCH. 40, 80, 160, XXS (BW-SW version) BONNET Screwed, O.S.&Y. Bolted, Antitamper, Extended Locking device, Cryogenic service CONNECTIONS From 1/2” to 8” RATING ASME Class – 150lb to 2500lb API 3000 / 5000 / 10000 / 15000 DESIGN Single or Double Block with optional Bleed (SB-SBB-DB-DBB) Integral Ball Design: Soft & Metal Seat BONNET Screwed, O.S.&Y. Bolted, Antitamper, Extended Locking device, Cryogenic service These DBBs are used for sampling & Injection purpose and for further analysis of the process. Valves are designed with Integral Body and Integral Sampling Probe (Not Welded). Probe length is defined in acc. to the application requirements and the pipeline diameter - upon indication. Indra can supply Wake Frequency and Bending Stress Calculations to ensure the correct selection of the Probe Length and the valve optimum performance in time. CONNECTIONS Inlet: 1/2” to 4” flanged Outlet: Threaded & Flanged RATING ASME Class – 150lb to 2500lb API 3000 / 5000 / 10000 BONNET Screwed, O.S.&Y. Bolted, Antitamper, Extended Optional locking device, Cryogenic service INTEGRAL ONE PIECE FLOATING BALL & DBB VALVES INSTRUMENTATION VALVES & MANIFOLDS CONSTRUCTION NORMS & REGULATIONS MATERIALS SS 316/316L, Duplex F53/F55, A105, LF2, Monel, Alloy 625/Incoloy Titanium, 6MO, Others ASME/ANSI B16.34 ASME/ANSI B1.20.1 ASME/ANSI B16.5 ASME VIII ASME B16.10 API 598 API 6D API 602 NACE MR 01-75 / MR 01-03 Norsok PRODUCT CERTIFICATIONS Fire Safe ISO 10497–API 607–API 6FA Fugitive Emission EN ISO 15848-1 EN ISO 15848-2 PED 2014/68/EU ATEX 2014/34/EU CRN for Canada EAC-CU-TR 010/2011 For EAC Countries EAC-CU-TR 012/2011 For EAC Countries EAC-CU-TR 032/2013 For EAC Countries Bunker “High Pressure Test”3D Checking NDT Testing 100% Pressure Testing SAMPLING & INJECTION DBB VALVES MONOFLANGE VALVES – SLIM LINE SB - SBB - DB - DBB CUSTOMIZED CONFIGURATION UNI EN ISO 9001:2015 OHSAS 18001:2007 Health & Safety Management UNI EN ISO 14001:2015 Environmental Management CONNECTIONS From 1/8 ” to 2” NPT, BSPP, BSPT, BW, SW RATING 6.000 - 10.000 PSI (threaded types) SCH. 40, 80, 160, XXS (BW-SW version) BONNET Screwed, O.S.&Y. Bolted, Antitamper, Extended Locking device, Cryogenic service CONNECTIONS From 1/2” to 8” RATING ASME Class – 150lb to 2500lb API 3000 / 5000 / 10000 / 15000 DESIGN Single or Double Block with optional Bleed (SB-SBB-DB-DBB) Integral Ball Design: Soft & Metal Seat BONNET Screwed, O.S.&Y. Bolted, Antitamper, Extended Locking device, Cryogenic service These DBBs are used for sampling & Injection purpose and for further analysis of the process. Valves are designed with Integral Body and Integral Sampling Probe (Not Welded). Probe length is defined in acc. to the application requirements and the pipeline diameter - upon indication. Indra can supply Wake Frequency and Bending Stress Calculations to ensure the correct selection of the Probe Length and the valve optimum performance in time. CONNECTIONS Inlet: 1/2” to 4” flanged Outlet: Threaded & Flanged RATING ASME Class – 150lb to 2500lb API 3000 / 5000 / 10000 BONNET Screwed, O.S.&Y. Bolted, Antitamper, Extended Optional locking device, Cryogenic service INTEGRAL ONE PIECE FLOATING BALL & DBB VALVES INSTRUMENTATION VALVES & MANIFOLDS CONSTRUCTION NORMS & REGULATIONS MATERIALS SS 316/316L, Duplex F51, F53/F55, A105, LF2, Monel, Alloy 625/Incoloy Titanium, 6MO, Others on demand ASME/ANSI B16.34 ASME/ANSI B1.20.1 ASME/ANSI B16.5 ASME VIII ASME B16.10 API 598 API 6D API 602 NACE MR 01-75 / MR 01-03 Norsok PRODUCT CERTIFICATIONS Fire Safe ISO 10497–API 607–API 6FA Fugitive Emission EN ISO 15848-1 EN ISO 15848-2 PED 2014/68/EU ATEX 2014/34/EU CRN Canada EAC-CU-TR 010/2011 For EAC Countries EAC-CU-TR 012/2011 For EAC Countries EAC-CU-TR 032/2013 For EAC Countries Bunker “High Pressure Test”3D Checking NDT Testing 100% Pressure Testing SAMPLING & INJECTION DBB VALVES MONOFLANGE VALVES – SLIM LINE SB - SBB - DB - DBB CUSTOMIZED CONFIGURATION Management Management CONNECTIONS From 1/8 ” to 2” NPT, BSPP, BSPT, BW, SW RATING 6.000 - 10.000 PSI (threaded types) SCH. 40, 80, 160, XXS (BW-SW version) BONNET Screwed, O.S.&Y. Bolted, Antitamper, Extended Locking device, Cryogenic service CONNECTIONS From 1/2” to 8” RATING ASME Class – 150lb to 2500lb API 3000 / 5000 / 10000 / 15000 DESIGN Single or Double Block with optional Bleed (SB-SBB-DB-DBB) Integral Ball Design: Soft & Metal Seat BONNET Screwed, O.S.&Y. Bolted, Antitamper, Extended Locking device, Cryogenic service These DBBs are used for sampling & Injection purpose and for further analysis of the process. Valves are designed with Integral Body and Integral Sampling Probe (Not Welded). Probe length is defined in acc. to the application requirements and the pipeline diameter - upon indication. Indra can supply Wake Frequency and Bending Stress Calculations to ensure the correct selection of the Probe Length and the valve optimum performance in time. CONNECTIONS Inlet: 1/2” to 4” flanged Outlet: Threaded & Flanged RATING ASME Class – 150lb to 2500lb API 3000 / 5000 / 10000 BONNET Screwed, O.S.&Y. Bolted, Antitamper, Extended Optional locking device, Cryogenic service INTEGRAL ONE PIECE FLOATING BALL & DBB VALVES INSTRUMENTATION VALVES & MANIFOLDS CONSTRUCTION NORMS & REGULATIONS MATERIALS SS 316/316L, Duplex F51, SuperDuplex F53/F55, A105, LF2, Monel, Alloy 625/Incoloy 825, C-276, Titanium, 6MO, Others on demand ASME/ANSI B16.34 ASME/ANSI B1.20.1 ASME/ANSI B16.5 ASME VIII ASME B16.10 API 598 API 6D API 602 NACE MR 01-75 / MR 01-03 Norsok PRODUCT CERTIFICATIONS Fire Safe ISO 10497–API 607–API 6FA Fugitive Emission EN ISO 15848-1 EN ISO 15848-2 PED 2014/68/EU ATEX 2014/34/EU CRN for Canada EAC-CU-TR 010/2011 For EAC Countries EAC-CU-TR 012/2011 For EAC Countries EAC-CU-TR 032/2013 For EAC Countries Bunker “High Pressure Test”3D Checking NDT Testing 100% Pressure TestingEngineering Manufacturing 3D Checking NDT Testing Cryogenic test 100% Pressure Testing Application LNG

ased on the International Maritime Organization’s strategy, the world will have the opportunity to reach the goal of decarbonisation in the future through green fuels. However, to date, the sustainable production of these green fuels is still under development, and thus natural gas remains the most solid solution available to be used in the near term to address the issue of emissions. Both from a logistical, flexible, and geopolitical point of view, the transport of LNG is deemed the most efficient type of supply. In this context, the containment on board ships plays a fundamental role for the supply of LNG: tanks must be built in such a way as to guarantee the best performance from the point of view of weights and dimensions, where the basic material has a key role. Thanks to their performance, the type of steel widely used for this application are those of the nickel steel and 300 series austenitic steel; however, due to their high nickel content, these materials are not economically advantageous.

The most popular steel is the 9% nickel (Ni). It has been used from the very beginning of the LNG transportation as an alternative material to aluminium.

This material shows the following peculiarities:

� There is no parent welding material available in the market; thereby the only chance to weld it is to use 625 alloy.

�

Plates and welding materials are very expensive and subject to an unpredictable price volatility due to the high percentage of Ni.

� Due to the plate’s high mechanical values of the plates, the head sectors forming is a lengthy and expensive process, which is to be performed only by very experienced suppliers.

� Welding of 9% Ni plates may result in magnetic susceptibility, which makes it very difficult to perform the welding bath. A de-magnetisation system must then be used to weld again.

Alternative material in the codes

The codes for the LNG minimum carriage design temperatures also accept some specific austenitic materials such as 304, 316, and 321.

Looking at the mechanical properties of these austenitic steels, it can be easily realised that they are very weak, resulting in a large thickness increase compared to 9% Ni. These grades are also very expensive and susceptible to Ni price fluctuation. Therefore, it is not the ideal material for this use.

Alternative material out of the codes

The search for an alternative material out of the codes took into consideration that a special grade austenitic steel having a lower percentage of Ni and higher percentage of manganese (Mn), would better fit the carriage conditions.

The innovative material ensured the following peculiarities:

� Good deformation under pressing (tank heads).

32

Marco Di Nicola, Sara Evangelisti, and Alessandra Isetto, Gas and Heat, Italy, detail the use of special grade austenitic steel for LNG and alternative fuels tank applications.

� Plates availability in such sizes to perform the most efficient tank construction.

� Good mechanical properties.

� Welding material availability.

� Plates and welding material price competitiveness.

� Low-susceptibility to magnetism.

Because of its mechanical performance and low nickel content, this material allows for both a reduction in the thickness of the containment system, and therefore a considerable reduction in weight and in the cost of materials compared to other alternative austenitic materials listed in the code.

In the design and manufacturing of a tank, the first step is the selection of the base material and welding procedure; these two inputs are very important as they will define the rest of the tank manufacture.

In order to perform the welding on a material such as this special grade austenitic steel, it is important to consider the following features:

� The base material characteristics.

� The consumable material.

� Weldability characteristic.

The base material characteristic