Summer 2025

ENERGY GLOBAL

CONTENTS SUMMER 2025

03. Guest comment

04. Shaping the Americas' future

Glenn Kangisser, Partner, Shu Shu Wong, Counsel, and Grace Kaplow, Associate, Haynes Boone, look at energy trends and transformation across the Americas.

10. Adapting as fast as the sea

Sahil Kochhar, Miros, explains how forecasts vs real-time monitoring can aid smarter decision-making in offshore operations.

14. Feasibility and financing to forecasting

Harry Woods, Solcast, a DNV company, Australia, discusses how bankable power models and data can help empower energy decision-making.

20. Improving wind speed forecasts: A machine learning approach

Esa-Matti Tastula, StormGeo, evaluates how advanced machine learning systems can improve the accuracy and usefulness of numerical weather prediction models for the offshore wind industry.

26. Whatever the weather

Renny Vandewege, General Manager, Weather and Climate Intelligence, DTN, details five ways weather intelligence helps renewable energy mitigate weather risks.

Reader enquiries [enquiries@energyglobal.com]

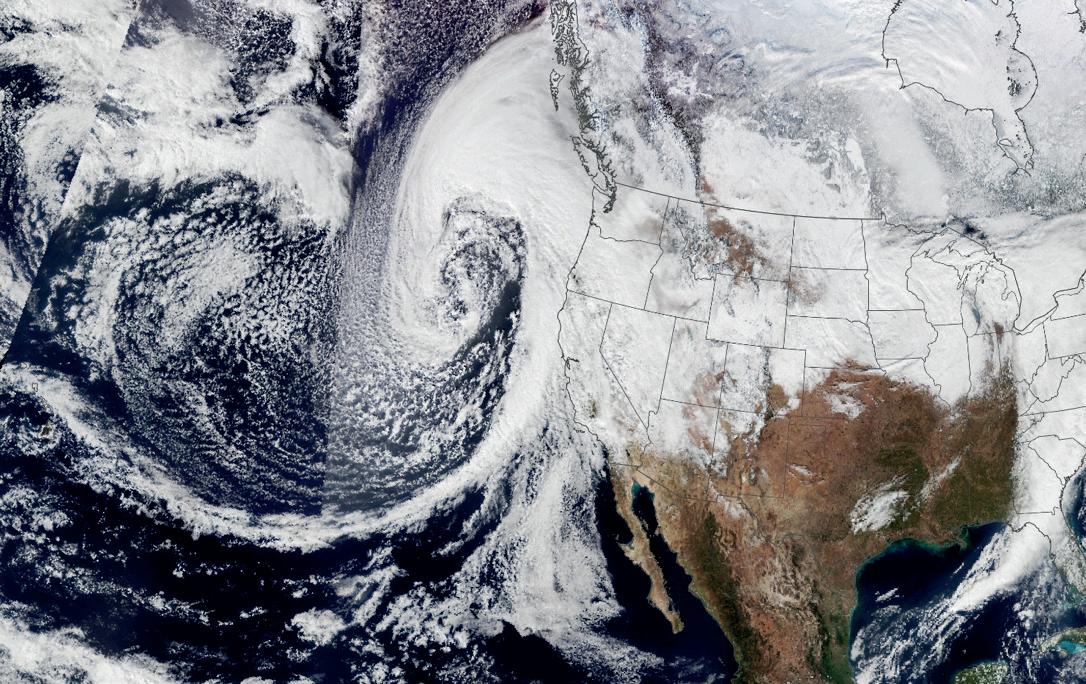

ON THIS ISSUE'S COVER

30. A blueprint for future offshore wind projects

Luke Bridgman, Ørsted, outlines some recent milestones for the world’s largest offshore wind farm: Hornsea 3.

36. Leveraging welding for floating offshore wind

Stephane Allain, Director of Renewables, CRC Evans, champions the development of mechanised welding systems as a crucial tool in the ever-expanding UK offshore wind sector.

40. Floating offshore wind: The five limiting factors

Francisco Siro, Head of Advisory at R&D consultancy, Sagentia Innovation, proposes that a blend of cross-sector learnings and novel approaches will help floating offshore wind achieve its potential.

44. Beyond the mother ship

In a Q&A with Jessica Casey, Editor of Energy Global, Robin Saunders, Concept Naval Architect, Chartwell Marine, highlights how new designs of daughter crafts can help meet the rapidly growing demand for offshore wind vessels in Europe and Asia Pacific.

50. Has the summer of energy storage only just begun?

Dr James Li, Director for Europe, Sungrow ESS, explores how recent advancements in battery energy storage systems have elevated the technology’s status from ‘nice-to-have’ to ‘must-have’ in the global energy transition.

54. Event news

55. Global news

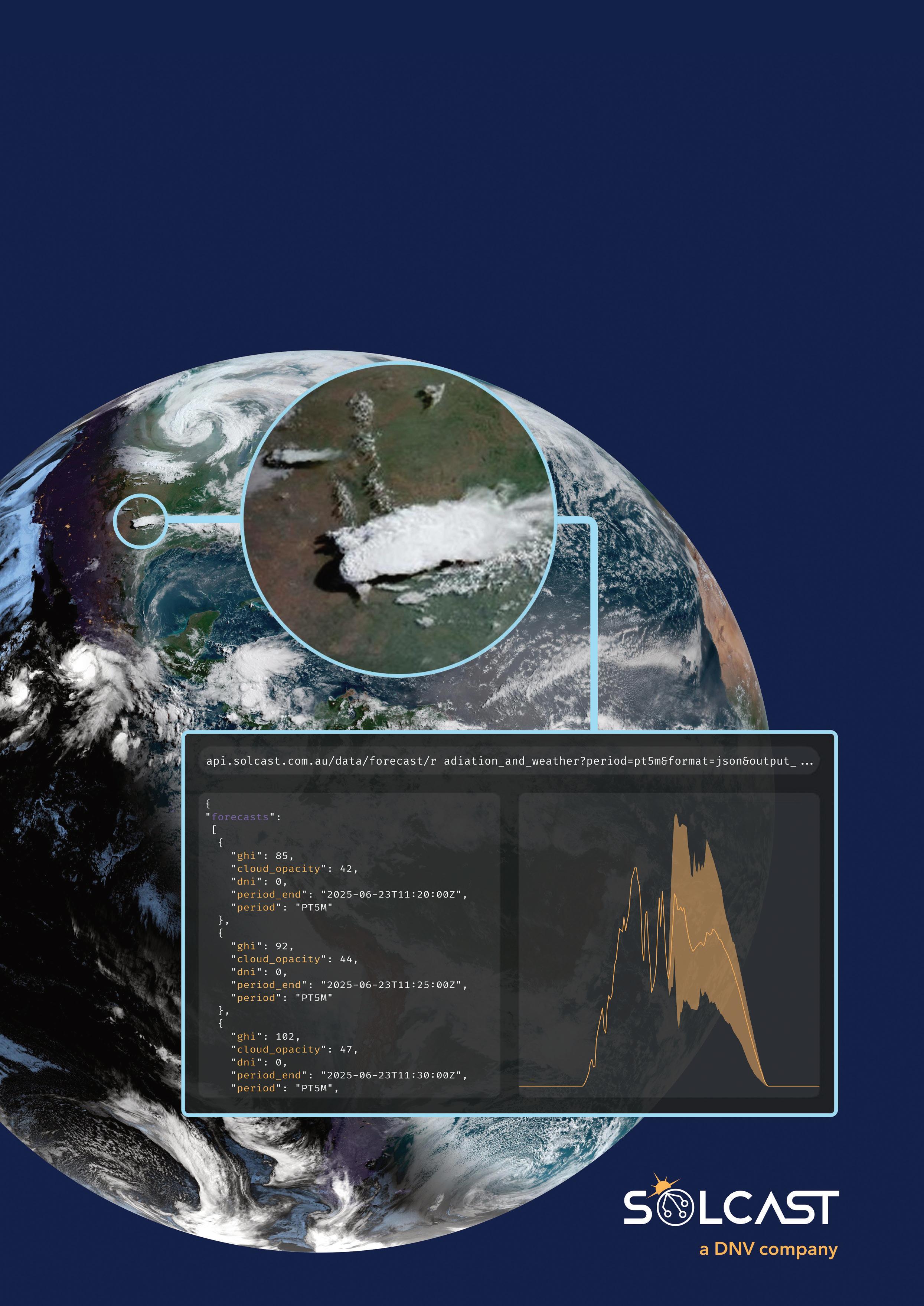

Solcast, a DNV company, delivers historical, real-time, and forecast solar irradiance and weather data as one of DNV Green Data Products. Using satellite cloud tracking, global weather data, and DNV expertise, Solcast delivers high-resolution historical datasets and forecasts for every location on Earth. Energy analysts, grid operators, and asset owners use the Solcast API for planning, performance, and trading workflows to optimise output, manage risk, and unlock new revenue. Learn more: http://www.solcast.com/

Because we’re pioneers.

Across energy and critical infrastructure, we bring expertise where complexity is highest. With globally local teams and proprietary technologies unmatched in the sector, we move projects forward, no matter the challenge.

We’re here to partner on how our specialist welding and coating solutions can help you power tomorrow.

MANAGING EDITOR

James Little james.little@palladianpublications.com

SENIOR EDITOR

Elizabeth Corner elizabeth.corner@palladianpublications.com

EDITOR

Jessica Casey jessica.casey@palladianpublications.com

EDITORIAL ASSISTANT

Abby Butler abby.butler@palladianpublications.com

SALES DIRECTOR

Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER

Will Powell will.powell@palladianpublications.com

PRODUCTION DESIGNER

Siroun Dokmejian siroun.dokmejian@palladianpublications.com

HEAD OF EVENTS

Louise Cameron louise.cameron@palladianpublications.com

EVENT COORDINATOR

Chloe Lelliott chloe.lelliott@palladianpublications.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@palladianpublications.com

JUNIOR VIDEO ASSISTANT

Amélie Meury-Cashman amelie.meury-cashman@palladianpublications.com

DIGITAL ADMINISTRATOR

Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

DIGITAL CONTENT COORDINATOR

Kristian Ilasko kristian.ilasko@palladianpublications.com

ADMINISTRATION MANAGER

Laura White laura.white@palladianpublications.com

Editorial/Advertisement Offices: Palladian Publications Ltd

15 South Street, Farnham, Surrey, GU9 7QU, UK +44 (0) 1252 718 999 www.energyglobal.com

COMMENT

Mark Green

Founder and CEO, Change Rebellion

Businesses are required to adapt constantly, but there are perhaps few industries currently undergoing such seismic changes as the global energy sector.

Against a backdrop of a worldwide sustainability focus and inter-governmental targets for carbon emission reduction, there is also an extraordinary demand for energy, and regulatory requirements around clean technologies are ever evolving.

By 2030, the World Energy Outlook predicts there will be almost 10 times as many electric cars on the world’s roads, renewable energy will account for 50% of electricity share globally (up from 30% in 2023), and offshore wind projects will be attracting three times the level of investment as new fossil-fired power plants.

So, it’s only natural that business leaders are focused on exactly how they are going to meet these demands: planning and implementing ambitious projects such as grid upgrades, renewable integrations, and decarbonisation efforts.

But for these projects to truly succeed, it’s not solely about ensuring the right technology is in place; according to the International Energy Agency, there are 67 million people working in the global energy sector and all of them need to be on board when it comes to the immense changes their businesses are undergoing, or we will simply never achieve the targets needed to keep on powering the world.

That’s why change management is so essential when business leaders are approaching today’s global energy challenges. Put simply, the people who design, implement, and manage all of this new technology are the difference between success and failure.

Visionary strategies are just the start of the process; companies also need to ensure that the day-to-day operations work efficiently and effectively, that diverse teams are aligned, that resistance is mitigated, and that a shared purpose is embedded throughout every team – otherwise, there’s a real disconnect between the plans being put in place and the ability of the sector to implement them effectively.

Change management experts are the bridge between idea and implementation, and their input helps C-suite executives ensure they retain a positive company culture despite any pressure.

While there is huge importance attached to

achieving global targets and ensuring demands are met, ultimately every company needs to ensure it remains profitable and justifies spending based on return on investment (ROI). This is never more true than when large scale investment is required in order to complete the sorts of projects energy companies are undertaking.

Finding between £60 – £120 million to build an onshore wind farm is no small feat, so it needs to be assured that the money isn’t going down the drain and will deliver an ROI as swiftly as possible.

To achieve the required ROI, specialists in change management set out to speed up the adoption of new processes, to increase utilisation, and to ensure teams have the skills and knowledge needed to complete projects proficiently – reducing errors and other inefficiencies which can result from a lack of understanding or training.

If people are willing to adapt, innovate, and embrace new ways of working – and if they understand what is being asked and why the changes have been implemented – then a project is much more likely to succeed and the ROI materialise.

Implementing such ambitious projects without carefully considering the ‘people’ element and expecting that team to deliver results and cross the finish line first is essentially a hopeless dream. By contrast, putting together a comprehensive training programme is the equivalent of implementing a change management strategy, and provides a much higher chance of winning.

At a time when stakes are so high globally, and the timelines for achieving targets are so tight, it’s never been more important to be able to guide people through the changes they’re facing. The global energy sector is evolving so quickly that transformational success is vital, and delays must be avoided.

The ability to guide people through change can and does result in a much higher chance of a healthy ROI, a completed project, and a challenge triumphantly navigated. Ignoring people in favour of a 100% focus on the technology behind the project really could spell disaster, hampering the global efforts to meet rising energy demands and clean technology targets – and potentially even risking the very survival of businesses within the sector.

Glenn Kangisser, Partner, Shu Shu Wong, Counsel, and Grace Kaplow, Associate, Haynes Boone, look at energy trends and transformation across the Americas.

he energy sector across the Americas is currently undergoing a significant transformation, characterised by a dual emphasis on traditional hydrocarbon development and a rapid acceleration towards renewable energy initiatives in some countries. In North America, Canada is continuing to balance the expansion of conventional energy infrastructures with significant investments in clean energy technologies. This transition is influenced by evolving energy security concerns, geopolitical factors, and shifting market dynamics. In the US, the new President (supported by his party’s control of the House and Senate) has shifted policy firmly away from energy transition and towards oil and gas. The growing energy demand, especially from data centres, is driven by market expectations

of strong demand from artificial intelligence (AI) and other cloud computing applications. The ever-changing regulatory hurdles make for a complex landscape in North America. In addition, the US is expected to relax regulatory restrictions on cryptocurrency, which consumes a tremendous amount of electricity. Meanwhile, South American countries continue to emerge as global leaders in renewable energy, with Brazil, Chile, and Argentina spearheading advancements in solar, wind, and lithium-based battery storage. Additionally, increased regional collaboration and foreign direct investments are helping accelerate clean energy adoption across the continent. As global energy needs evolve, these regions are adapting to ensure the economic stability and, in some cases, the environmental sustainability of their respective energy industries.

Current projects in the Americas

In the US, the upstream oil and gas sector is experiencing major consolidations among several of its key players. This consolidation trend works to increase the financial stability of large upstream oil and gas companies, which has been improving ease of access to capital as banks perceive these consolidated entities as lower-risk borrowers.1 Tight lending criteria among traditional US banks has led to a rise in alternative financing methods, including private credit funds, structured finance mechanisms like securitisations, and family offices stepping in to support drilling operations.1 Under the

new administration, the US is reducing its investment in renewable technologies, reversing emission standards and cutting other green programmes put in place under the previous administration.

Canada remains a leader in both fossil fuel production and renewable energy. Canada has solidified itself as a global leader in renewable energy with the majority of its electricity generated from hydro, wind, and solar power.2 Recently, Canadian provinces have seen surges in renewable energy production outputs. Canada houses roughly 240 data centres, which are leading corporate renewable energy adoption.3 This is particularly the case in the provinces of Québec and British Columbia, where hydroelectricity is abundant and relatively affordable. Despite this, Canada remains a major producer of oil and gas – it is the world’s fourth largest producer of crude oil and fifth largest producer of natural gas, with the province of Alberta housing many of the country’s main hydrocarbon reserves.4 Alberta is known for its oil sand deposits, which has led to projects including the Athabasca Oil Sands project, the Horizon Oil Sands project and the Cenovus’ Foster Creek project.5 Recently, the expansion of AI and the growth of cryptocurrency mining have significantly increased energy demands and consumption throughout the continent. This increased demand has led to new challenges regarding grid stability, transmission capacity, and energy pricing models, prompting investments in renewable energy sources to meet these rising demands.6

In South and Central America, numerous countries are experiencing a significant shift towards renewable energy. Brazil continues to dominate the continent’s clean energy transition, emerging as a regional leader with roughly 85% of its electricity production coming from various renewable sources.7 This dominance is due in part to Brazil’s hydropower infrastructure from its many powerful rivers, extensive wind energy capacity, and recent advancements in solar technology. Some of Brazil’s hydropower projects include the world’s second-largest hydroelectric power plant, Itaipu,8 and others like Belo Monte, Tucuruí, and Santo Antônio.9 Brazil is expected to continue expanding its transmission lines with a planned investment of US$20 billion into its electricity transmission sector by 2029.7 Chile and Argentina are rapidly expanding solar and wind energy thanks to favourable policies and abundant natural resources, including lithium, which is critical for battery storage. In 2024, the Chilean government selected six areas for new lithium extraction projects and asked private companies to submit development proposals.10 Additionally, Chile’s Atacama Desert, which has the highest solar irradiation on Earth, has become a focal point for significant investment.11 Smaller nations like Panama and Costa Rica are notable for generating nearly all of their electricity from renewable sources.12 Mexico has been focusing on expanding its renewable energy sector, particularly emphasising solar and wind power.13 Some noteworthy Mexican renewable energy projects include the 1000 MW Tarafert La Laguna solar photovoltaic (PV) park in Durango, the 1000 MW Puerto Penasco 1 solar PV park in Sonora, and the 357 MW Hidalgo 1 & 2 solar PV park in Hidalgo.14 Meanwhile, Mexico is balancing its renewable energy initiatives with a continued reliance on oil and gas production. This balance has

We pioneer solutions for the world’s largest industries, focusing on reducing hard-to-abate emissions. With future-facing technologies, digital solutions, and a continuously developing core portfolio, we have the experience, technology, and passion to drive sustainable progress. We move big things to zero with our cutting-edge technologies.

everllence.com

created policy debates surrounding energy sovereignty and private-sector participation. South America is a major global supplier of the raw materials that are essential for energy storage, particularly lithium. Countries like Chile, Argentina, and Bolivia are among the largest lithium producers in the area, while Brazil is currently working to invest heavily in biofuels and low-emission hydrogen production.15

Upcoming projects in the Americas

In Canada, experts expect to see a further expansion of renewable energy combined with substantial growth in oil and gas production. In the US, the U.S. Energy Information Administration (EIA) had previously forecasted that utilities and independent power producers would add 26 GW of solar capacity in 2025, following a record addition of 37 GW in 2024.16 The EIA had also anticipated that wind capacity would increase by 5%, which would have translated to a projected wind capacity of roughly 162 GW by the end of 2025 in the US alone. The EIA had also projected that US crude oil production would experience only a modest increase from 13.2 million bpd in 2024 to 13.5 million bpd in 2025.17 This growth would be primarily driven by the Permian Basin, which is expected to account for more than 50% of US crude oil production by 2026. However, all these projections have been called into question based on recent policy changes and the plans of the new administration to significantly increase US oil production. In Canada, high energy consumption driven by extreme weather, a dispersed population, and rapid immigration growth is straining the national energy systems. Nevertheless, provinces are working to boost wind and solar generation in 2025, as recent drought conditions have impacted the reliability of hydropower energy. The Canadian Association of Petroleum Producers projects that oil sands production will increase by approximately 4% in 2025, contributing to overall stability in North American hydrocarbon output.18

In South America, the renewable energy sector is expected to continue expanding rapidly. Argentina and Chile are setting aggressive target goals for expanding their solar and wind energy capacities, which are supported by favourable domestic policies and generous foreign investments. Brazil is continuing to make substantial investments in hydrogen hubs and biofuel production, positioning itself as a major global supplier. Additionally, as demand for battery storage increases, Latin American lithium production is set to expand with investments targeting sustainable mining practices. Governments in this region are also working on improving infrastructure and transmission networks to ensure that renewable energy can be efficiently integrated into national grids.16

Significant legal and regulatory developments over the last two years

Recent regulatory changes across the Americas have played a pivotal role in shaping energy markets, directly impacting investment flows, project feasibility, and overall energy strategies. The past two years have been full of important shifts that the industry has had to learn to navigate.

Governments and regulatory bodies have implemented new policies to encourage or restrict various energy initiatives, balancing economic growth with environmental commitments.

In the US, federal investment in hydrogen and long-duration energy storage has driven technological advancements and infrastructure development over the past couple of years.19 However, recent shifts in federal policy – including the suspension of new federal offshore wind leasing20 – and discussions on revising or repealing key aspects of the Inflation Reduction Act could impact the pace of renewable energy expansion in the US.21 Meanwhile, in Canada, regulatory hurdles are slowing down renewable energy projects, particularly related to transmission and large scale energy loads. As a result, the Canadian government has increased its focus on protecting its energy security through a mix of renewables and traditional fossil fuel production.22 These challenges have sparked debate over the necessity of streamlining approval processes and increasing incentives for private-sector participation. Mexico’s energy policies remain in flux, balancing its historic state-owned energy dominance with increasing private sector investments.23

By contrast, in South America, countries like Brazil, Chile, and Argentina are implementing more aggressive renewable energy policies, offering financial incentives for investors who support green technologies.24 These incentives include tax breaks, subsidies, and favourable tariff structures to encourage private investment. For example, the president of Brazil signed a new law that will provide up to US$3.36 billion in tax credits for companies producing or consuming low-carbon hydrogen.25 The electricity sector is waiting for the green light in regulatory changes that have been under discussion for almost two years. These changes would tackle the capacity payments needed to mitigate the higher intermittency deriving from solar and wind, including large scale batteries, the approval of regulation for offshore wind, and the increased activity of solar distributed generation.26

Outlook

The Americas are navigating a complex energy landscape wherein they must balance the continuing importance of traditional hydrocarbon energy sources with an accelerating transition towards the world of clean, renewable energy technologies amidst shifting policy directions in the US. The consolidation of oil and gas entities in the US, the rising demand for alternative financing, and the growing energy consumption of data centres are shaping North America’s energy future. In South and Central America, countries are capitalising on their renewable resources, lithium reserves, and biofuel potential to drive sustainable growth. In the upcoming years, both regions are poised to play critical roles in the global energy transition. Market forces, regulatory frameworks, and technological advancements will continue to shape the region’s energy trajectory and the future of energy consumption worldwide.

References

A list of this article’s references can be found on the Energy Global website at: www.energyglobal.com/special-reports

Develop

Lead

Strengthen

Advantages of Corporate Team Rates

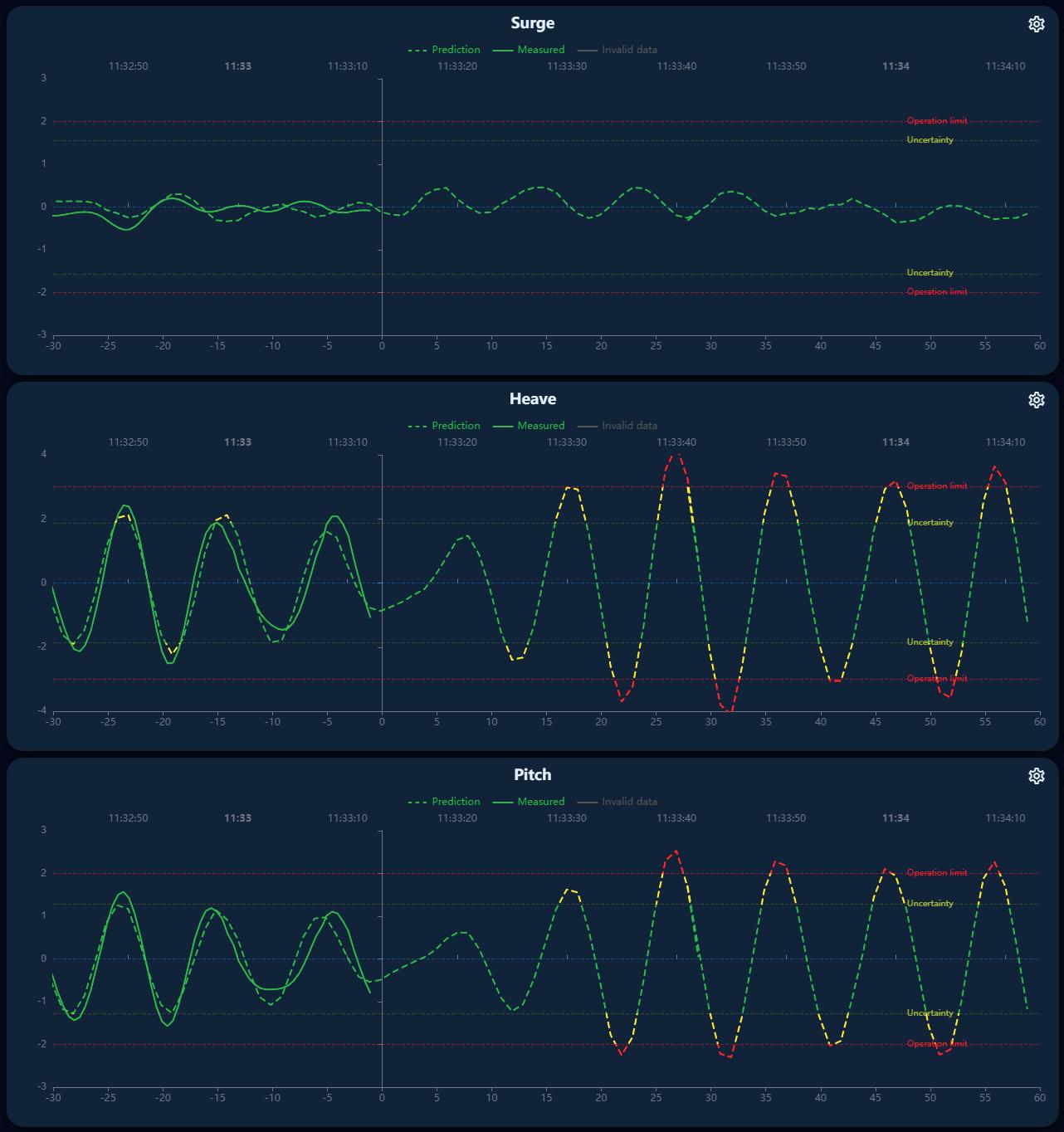

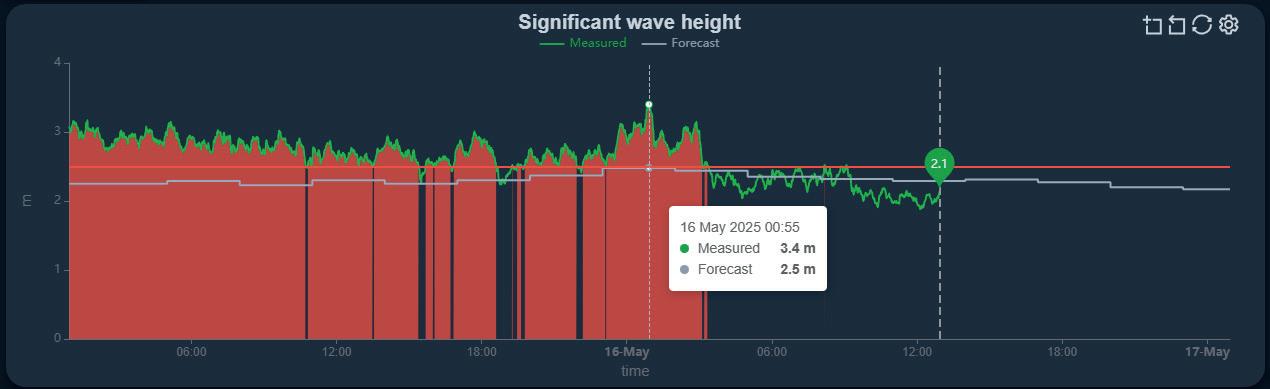

Sahil Kochhar, Miros, explains how forecasts vs real-time monitoring can aid smarter decision-making in offshore operations.

n the offshore industry, where conditions can shift unpredictably and at short notice, making the right decision at the right time is more than just crucial – it is the difference between a successful operation and a potential disaster. Whether it is oil and gas drilling, installing wind turbines, or conducting heavy lifts, the ability to accurately predict and respond to environmental changes is key to ensuring safety and maximising efficiency.

Traditionally, forecasts have been the primary tool for planning offshore operations, but with advancements in real-time monitoring, there is now a new way to make smarter, data-driven decisions by combining both to eliminate uncertainties.

Role of forecasts in offshore operations

For decades, forecasts have been the backbone of offshore planning. These forecasts, provided by national meteorological agencies and private weather providers, predict weather and sea conditions over a period – usually ranging from 1 – 7 days.

The models that power these forecasts use vast amounts of data, including satellite imagery, oceanic data, and atmospheric patterns. They help operators plan operations, like drilling or lifting, around anticipated weather conditions.

However, forecasts are not perfect. While short-term forecasts can be relatively accurate, typically around 80 – 90% for up to three days, their accuracy drops as the forecast period extends. For example, forecasts for 7+ days might only be accurate 50 – 70% of the time.

They also often struggle to account for sudden, extreme weather events like storms or rapid changes in sea states, especially in regions with complex coastal geographies. Still, forecasts are the best tool available for planning operations in advance, as they provide the closest possible estimation of what conditions might be.

Offshore operators rely on forecasts from major weather providers, both national and private, with around 4 – 5 companies dominating the global market. Nearly all offshore operations use

Figure 1 Determining vessel operability is one of the most critical aspects of offshore operations. A vessel’s ability to perform under varying sea conditions is vital to ensuring both safety and operational success. Source: Jan Rune Smenes Reite.

one or more forecast services, which are updated several times daily. Despite their limitations, forecasts remain indispensable for planning operations, offering an essential glimpse of what lies ahead.

The emergence of real-time monitoring

While forecasts offer a predictive look into the future, real-time monitoring offers a live snapshot of current conditions. This technology is rapidly transforming offshore operations by

Figure 2. Radar-based systems like Miros WaveSystem give operators the ability to track conditions directly at the vessel’s location, ensuring that the team is responding to the actual conditions at the site – not the conditions forecasted for a broader area. Source: Miros WaveSystem.

Figure 3 . PredictifAI can predict both sea conditions and vessel motions up to 2 mins. in advance. Additionally, PredictifAI also visually presents ‘Predictions vs Experienced Vessel Motion’ without using any models into its analysis. Source: Miros PredictifAI.

providing continuous, up-to-the-minute data on sea states, wind speeds, and other environmental factors. Real-time monitoring systems use sensors and radar-based technology to measure conditions directly at the site of operation, ensuring that the data is not just accurate but highly specific.

The beauty of real-time monitoring lies in its accuracy. Unlike forecasts, which can provide a broad picture of predicted conditions, real-time systems measure the exact conditions experienced by the vessel or platform at that precise location. These systems allow operators to monitor wave heights, currents, wind speed, and direction in real time, adjusting operations on the fly to account for changes in weather that might not have been anticipated. By continuously collecting and analysing this data, operators can make informed decisions that optimise safety and minimise risks.

For example, radar-based systems like Miros WaveSystem give operators the ability to track conditions directly at the vessel’s location, ensuring that the team is responding to the actual conditions at the site – not the conditions forecasted for a broader area. This ability to make data-driven, real-time adjustments significantly enhances the safety and efficiency of offshore operations.

Today’s best practices for determining vessel operability

Determining vessel operability is one of the most critical aspects of offshore operations. A vessel’s ability to perform under varying sea conditions is vital to ensuring both safety and operational success. Traditionally, this has been determined using response amplitude operators (RAO) – a mathematical model that predicts how a vessel will react to waves, wind, and other environmental factors. RAO is based on sea trials and vessel characteristics, offering a very qualified estimation of a vessel’s operability. However, it is not perfect. While RAO provides a good theoretical framework, real-world conditions often diverge from the model’s predictions.

Today, determining vessel operability requires a combination of RAO, weather forecasts, and historical data. Weather forecasts give operators an outlook on potential sea and wind conditions, while RAO models simulate how the vessel will respond to those conditions. Historical data adds another layer by providing insights from past operations under similar conditions.

However, all these tools, while useful, have limitations. The predictions made by RAO models may not fully capture the impact of extreme weather, or they might not account for minor yet critical variations in real-time conditions. As a result, the accuracy of vessel operability predictions can be improved by combining all these methods with real-time data, which allows for immediate adjustments based on the actual conditions at the site.

Data-driven elimination of uncertainties and conservatism

Real-time monitoring has the potential to drastically reduce the uncertainties and conservatism that often accompany offshore operations. Traditionally, operators have tended to overestimate the risks of certain operations, applying conservative safety margins to account for the unpredictable nature of the sea. While this is a safety measure, it often leads to missed operational opportunities, increased downtime, and wasted resources.

This is where Miros’ PredictifAI® comes into play. By integrating radar-based, real-time monitoring systems with artificial intelligence (AI), PredictifAI offers predictive capabilities that go beyond just reporting current conditions. It analyses real-time data and uses it to predict near-future conditions, enabling operators to make decisions based on what is likely to happen next. It can predict both sea conditions and vessel motions up to 2 mins. in advance. Additionally, it also visually presents ‘Predictions vs Experienced Vessel Motion’ without using any models into its analysis. This is an innovative way to look at RAO’s and verify their relevance while conducting operations allowing for more accurate planning and better-informed decisions about when to continue operations or when to pause them.

By combining real-time data with AI-powered predictions, operators can eliminate much of the conservatism that arises from uncertainty. Instead of relying on broad safety margins based on forecasts or RAO models, operators can make more precise decisions, reducing unnecessary downtime and improving overall operational efficiency. PredictifAI’s ability to predict vessel motion and wave behaviour in real-time means that operators can adjust their plans on the fly, ensuring that operations are as efficient and safe as possible, even in challenging conditions.

From reactive to ready in real time

In offshore operations, where the stakes are high and the environment is unpredictable, making the right decisions is essential. While forecasts have served as the primary tool for planning operations for decades, the rise of real-time monitoring technology offers a more accurate, responsive way to operate in dynamic conditions. By integrating real-time data with traditional forecasting methods, offshore operators can make smarter, data-driven decisions that optimise safety, efficiency, and operational success. Technologies such as PredictifAI are helping to eliminate the uncertainty and conservatism that have traditionally characterised offshore decision-making, opening the door to more agile, precise, and proactive operations. As the industry continues to evolve, embracing this new wave of technology will be key to unlocking greater operational excellence in offshore activities.

Wind

Centralised monitoring and control

Wind Power SCADA offers comprehensive monitoring and control for individual wind turbines and entire wind farms. Reduce complexity, increase efficiency.

Convenient turbine controller

The parameters at the turbine can be intuitively displayed using our WebMI. Flexibly expandable and browser-based for remote access.

Harry Woods, Solcast, a DNV company, Australia, discusses how bankable power models and data can help empower energy decision-making.

decade ago, renewable energy decisions were chained to static spreadsheets, sparse ground station measurements and months-long consultant loops. Today, any project stakeholder – from an analyst scouting land in Brazil to a control-room engineer fine-tuning reserves in Victoria – can pull a bankable, sub-hourly irradiance or wind time-series with a single application programming interface (API) call. That simple capability is quietly rewiring the energy industry’s economics:

> Developers unlock more sites, faster, with less risk.

> Financiers can quantify uncertainty, rather than smoothing it over.

> Operators isolate performance issues in minutes rather than quarters.

> Traders, energy management system (EMS) vendors, and system operators have live actuals and forecasts built into their dashboards.

Global decarbonisation schedules, volatile power markets, and rising capital costs are driving changes in the energy industry as renewable generation increases, and the pace of growth accelerates. In increasingly competitive markets, renewable developers, operators, and investors have little margin for error. The most effective operators are now making decisions that once relied on Excel spreadsheets and sparse measurements with high-fidelity, validated irradiance, and weather

data APIs. Access to bankable actuals and power models and accurate forecasting data, such as those delivered through DNV’s Green Data products, deliver key inputs to digital tooling. Those that adopt these tools are reducing uncertainty, accelerating project timelines, and sharpening operational choices from planning to portfolio optimisation.

This article explores lessons from working with partners and customers across the energy industry. It is a guided tour of how access to trustworthy data is changing decision-making at four pivotal stages of the renewable asset lifecycle – and the impact those shifts are having to those organisations delivering on the energy transition.

Trust begins with the data

Every gigawatt of new renewable capacity must compete for limited capital and increasingly constrained grid infrastructure. In this environment, the differentiator is decision-grade environmental intelligence: knowing, not guessing, how much irradiance or wind a site will receive over its lifetime, in the next hour, or next five minutes. Irrespective of technology –photovoltaics, wind, hybrids, or battery storage – engineering and finance teams are starting to build their cases on detailed, bias-corrected resource models delivered through an API rather than a spreadsheet.

DNV, through their investment in green data products like Solcast, is translating more than 160 years of risk-management experience into cloud-native datasets, power models, and analytics that can be queried instantly and delivered digitally. Access to digitally native data and models is benefiting work across the lifecycle of a modern renewable asset – feasibility, design, monitoring, optimisation, and grid operation. At every decision point, innovation is driving progress by those who are already using high-fidelity weather and power-models in their day-to-day workflows and design their processes around those data.

Feasibility and site selection: Getting the map right

Speed and scale

Developers who once performed painstaking desktop studies on a handful of prospects each month now screen thousands of parcels and configurations. Scripts tap irradiance and wind APIs directly, feeding high-resolution terrain, albedo, and cloud-motion layers into automated layout engines; yield estimates return in minutes rather than weeks. That velocity produces a larger, better-ranked funnel – critical when auction portals open and competition is fierce. Legacy requirements for 8760 files, and static, clunky systems, serve to slow down the feasibility process, and force analysts to swap and manipulate data between systems.

Granular accuracy through variability analysis

Quality is keeping pace with speed. Contemporary workflows can combine typical meteorological year analyses with multi-decadal time-series and long-term averages so that analysts can quantify inter-annual variability and tighten P50 and P90 spreads even in a changing climate. Instead of assuming a static resource baseline, feasibility teams should be considering how factors such as El Niño frequency, aerosol loading, or storm-track drift are altering risk profiles. Bankable power models built for this level of detail, like DNV’s SolarFarmer, include local shading engines, 3D terrain losses, and sub-hourly resolution to reduce model bias over legacy hourly models, but need high-resolution irradiance inputs. DNV’s Solar Resource Compass uses the same SolarFarmer power model, and supports analysts to quickly select the most appropriate source of irradiance data, then implements DNV’s methodology for solar resource assessment. This gives developers results in minutes, supporting fast site-selection decision making, using investor-ready models and delivering the confidence to act from day one.

Outcome

Better data at the outset eliminates avoidable financing failures, accelerates permitting, and builds lender confidence. In competitive procurement, even a single percentage-point reduction in uncertainty can narrow the debt-service coverage ratio and tilt project economics decisively.

Design and bankable resource assessment: From guesswork to guarantees

Seamless workflows

Transitioning from prospect to detailed design should not require bouncing among siloed applications. Bankable irradiance and power-model APIs can, and are already starting to be, applied directly to the digital asset design tools that are being used for designing assets of all sizes. Adjusting row spacing, layout, tilt, and panel choice should result in a swift recalculation of uncertainty-weighted yields without needing to

re-download a CSV or replicate geometry in a different tool. Requiring a handoff from design tool to yield assessment not only interrupts workflows, but adds untraceable bias corrections and reduces the fidelity of yield calculation.

Transparent uncertainty

For years, investment in renewables has been based on hourly data that folds decades of climate variability into an estimated year. But the output of the design and resource assessment process can be more than just a P50 number. Investors, owners, and stakeholders expect detail behind the relationship between their financial performance and the real weather-adjusted performance

of the asset. Savvy investors in renewable energy understand that the climate is changing, and that impacts financial performance of renewable assets – they need more than just a bias correction. For lenders, the provenance of each number is as important as its magnitude; automated audit trails and independent third-party data sources can serve to stabilise this uncertainty risk. Establishing a trusted data source, and an open, transparent way of measuring relative performance, is key to giving investors the confidence needed to drive investment in the energy transition.

Performance monitoring and reporting: Understanding weather losses

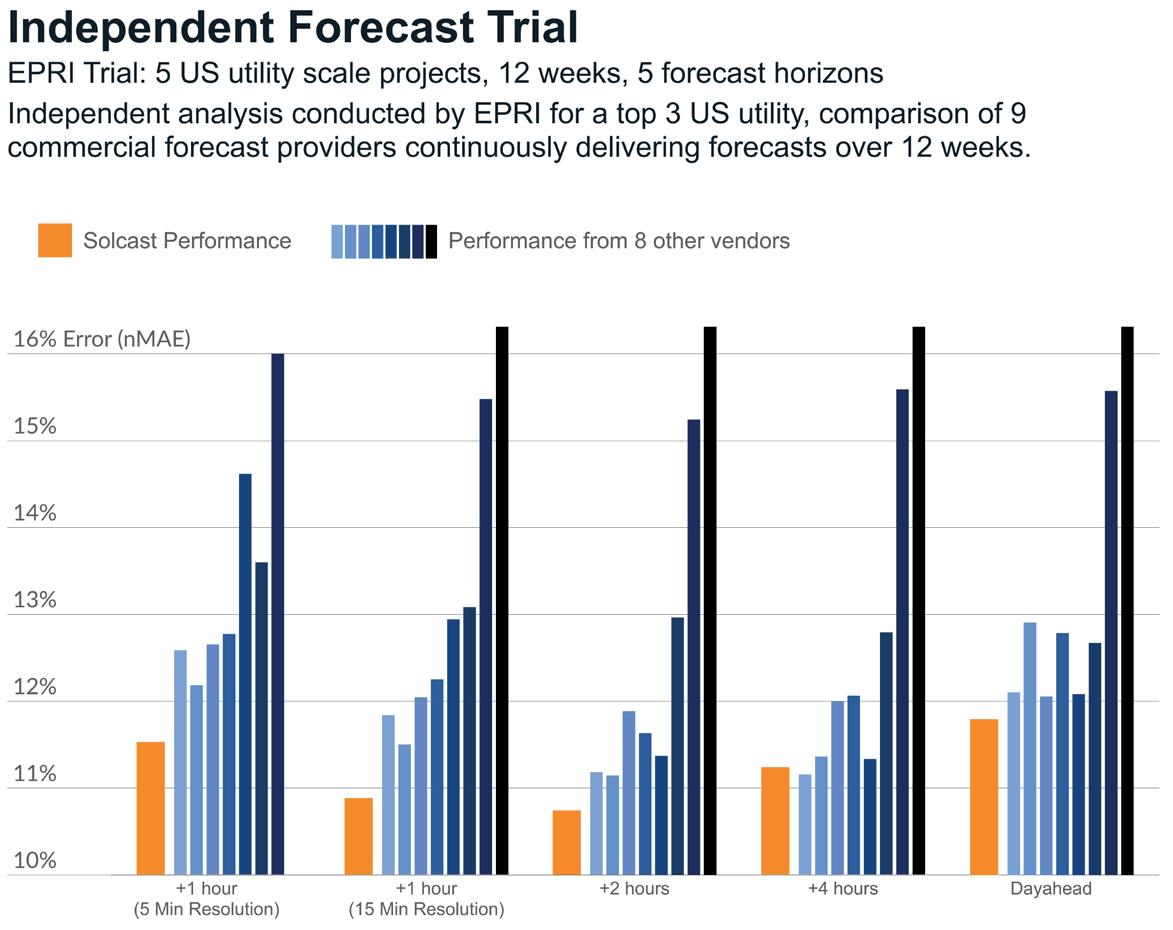

Figure 3 . Results from a solar forecasting trial run by independent US non-profit Electric Power Research Institute (EPRI). Of the nine vendors participating, Solcast had the lowest forecast error overall. Solcast also had the lowest error in four of the five forecast horizons, and was the only provider to achieve <11% normalised mean absolute error (nMAE) in any time horizon.

Live baselining

Many owners discover under-performance only after month-end when SCADA data are reconciled against local sensors that may or may not have been properly installed, cleaned, or calibrated. Today, SCADA feeds can align automatically with real-time irradiance and wind inputs so that verifiers can distinguish weather-driven variance from curtailment events or equipment anomalies while the data are still actionable. DNV’s Solar Resource Compass is embedding that logic: benchmarking output actuals against the P50 and flagging deviations that exceed expectations.

Visualising weather losses

When a plant’s energy delivery falls short, owners want to see where the losses originate. A real-time fusion of SCADA with minute-scale satellite and numerical weather data tells an O&M engineer, within the hour, whether a 4% shortfall is down to passing cloud, inverter tripping, or unreported curtailment. That clarity shortens root-cause investigations, strengthens performance guarantee claims, and sharpens insurance negotiations.

Portfolio-level perspective

Asset managers and infrastructure funds juggling hundreds of projects across continents need to speak a common language. A globally-consistent dataset can bring assets in São Paulo, San Francisco, and Seoul onto the same analytical canvas, enabling true apples-to-apples benchmarking.

In the residential and commercial-rooftop segments sensors are rare, yet asset owners still demand performance transparency. High-resolution cloud data are excellent backfill sources – high quality satellite derived irradiance data approaches the expected accuracy of on-site pyranometer data and beats fleets of sensors.

Optimisation and forecasting: Predicting power generation

Cloud nowcasts

A 2024 independent competitive forecasting trial conducted by EPRI found a small group of commercial irradiance forecasters delivered improved forecasts in the 0 – 4 hour range. The Solcast data science team, having spent 12 weeks

continuously optimising their cloud nowcast to improve short-term accuracy, were pleased to have won that trial, but agree that, without cloud modelling, one cannot expect to forecast cloud movement. It is a highly competitive space, and artificial intelligence (AI) and machine learning (ML) improvements mean that all vendors in the space are improving their quality. Industry partners are already benefitting from accuracy improvements, as short-term forecasts are used across the industry to improve operations, financial optimisations, and manage dispatch with fewer penalties and less stress on equipment.

Hybrid plant and BESS dispatch

Battery energy storage systems (BESS) prosper when they know what the sun or wind will do next. Forecast-driven energy management software can stack arbitrage, frequency-control, and curtailment-avoidance revenue streams while respecting state-of-charge limits. Wärtsilä directly integrated Solcast Forecasts into their GEMS EMS platform, needing a forecast that could be relied on for EMS management in islanded grids. When looking for a data source, the company needed an API it could rely on to integrate to its product and give five-minute data to closely manage ramp rates of renewable generation assets.

ML upgrades

ML models that have been trained on generation data from connected SCADA systems consistently outperform pure numerical-weather-prediction baselines. Use of ML enables models to go beyond the theoretical accuracy of physics-based

models that require complex inputs to create fine-tuned digital twins, and run fast, functional models that deliver accurate forecasts based on the reality of production conditions. Connecting these systems together with a live, high-resolution weather API supports the portfolio scale management, forecasting, and trading of hybrid renewable fleets at a grid level – and the high-speed decision-making that demands.

Delivering data one can bank on

The ongoing pace of the energy transition rests on the trust of investors – and in a digital world they expect trustworthy, traceable data on the performance of their investments. From prospecting to grid dispatch, the market leaders will be those who replace assumptions with evidence, manual interfaces with APIs, and static spreadsheets with living dashboards of connected data.

DNV’s Green Data product team are using decades of measurement science and global advisory experience to build tools, models, and platforms in a format that any analyst can query with a single line of code. Whether tightening a P50, reporting on asset performance, or bidding a hybrid plant, stakeholders armed with bankable data gain credibility, compress transaction costs, and move first.

Satellite innovation, ground-station expansion, Internet-of-Things instrumentation, and AI will continue to shrink error bars, but the tools available today are already good enough to start moving. The challenge, and the opportunity, is straightforward: audit data pipelines, patch the weak links, and let trusted numbers accelerate the energy transition.

+44 (0)1252 718999 reprints@energyglobal.com

Improving forecast accuracy

One such ML system is DELFI (Deep Learning Forecast Improvement), developed by StormGeo and designed to enhance NWP forecasts by automatically correcting errors. This system applies various ML techniques, ranging from simple statistical models to deep neural networks,

to identify and reduce forecast inaccuracies. Each week, DELFI evaluates multiple forecasting methods against real-world observations and selects the most accurate approach for the following week, continuously improving its accuracy over time.

Unlike traditional forecasting, which relies on meteorologists to recognise and compensate for model weaknesses, DELFI learns from past errors and minimises inaccuracies on its own. This results in a more precise starting point for forecasts. By providing a more reliable forecast baseline, DELFI helps meteorologists make faster, more informed decisions, ultimately improving overall forecast accuracy.

A case study

Recently, a new module was introduced to DELFI, allowing wind speed correction at different heights, not just at the standard 10 m height. This is achieved by correcting windspeeds individually at all observation heights. Then, based on these predictions, windspeeds at any level of interest are calculated.

This article presents a case study of this new setup. LIDAR-based wind observations at several different heights from the Esbjerg harbour site in Denmark are utilised to create corrected wind profile forecasts at heights of 10 m and 100 m. The results are then compared to the performance of the top global NWP model, the IFS model from the European Centre for Medium-Range Weather Forecasts (ECMWF).

The observation site

The case study site, Esbjerg, is Denmark’s largest port. In the past few decades, it has evolved into one of the world’s premier offshore wind hubs. Since supporting Denmark’s first large scale offshore wind farm, Horns Rev 1, in 2002, the Port of Esbjerg has been involved in over 60 offshore wind projects. The port’s strategic location and specialised infrastructure have been pivotal in advancing Europe’s renewable energy initiatives.

LIDAR technology for wind observations

The wind observations at this location employ LIDAR technology. These sensors work like radars, but use laser light instead of radio waves to measure wind speed at different heights. The LIDAR sends up pulses of laser light and, when this light encounters tiny obstacles like dust or water vapour in the atmosphere, it scatters. Some of the scattered light makes it back to the LIDAR device and, by analysing how the wavelength of the light changes (a phenomenon called the Doppler effect), the system calculates how fast the air is moving at different altitudes. This technique allows LIDAR sensors to create a detailed representation of how wind speed changes with height without needing a physical tower or sensors at multiple heights. Wind farms typically use LIDARs to measure wind conditions before installing turbines and to optimise power generation by adjusting turbine blades in real time.

Switzerland’s leading solar energy exhibition

16-17 September, 2025 | Messe Zürich

150+ speakers

will share cutting-edge insights, realworld case studies, and forwardthinking strategies shaping the future of solar energy in Switzerland.

100+ exhibitors

will showcase the latest innovations in solar and energy storage products, technologies, and solutions.

Show Features :

Startup Zone

Meet the Installers

Networking events

Research poster zone

Register for your Free Ticket now

https://www.terrapinn.com/solarzurich/energyglobal

What the data tells us

To measure forecast accuracy, this case study uses mean absolute error (MAE), which tells how far off the predictions are from reality on average. The DELFI results presented in the figures come from the best-performing DELFI models selected using the MAE statistics.

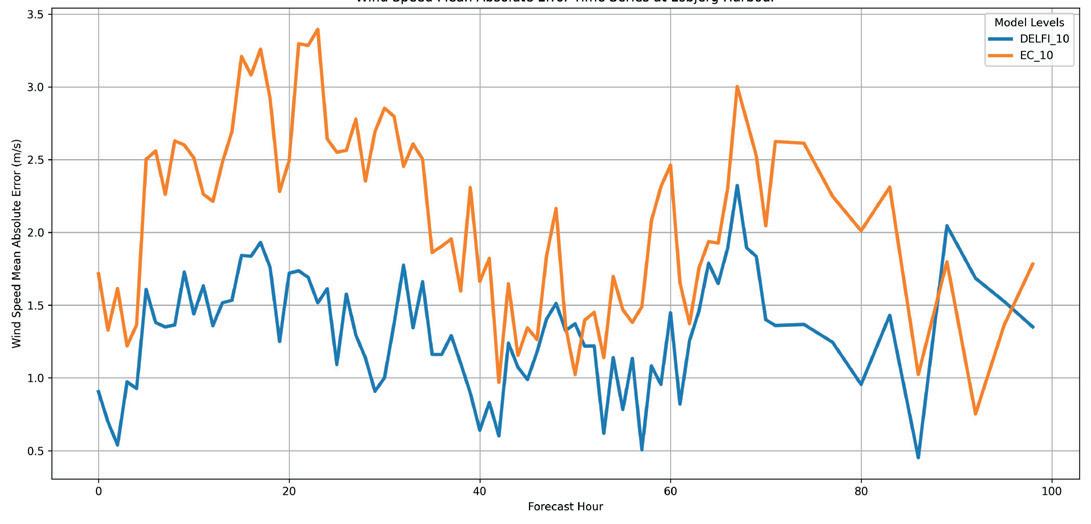

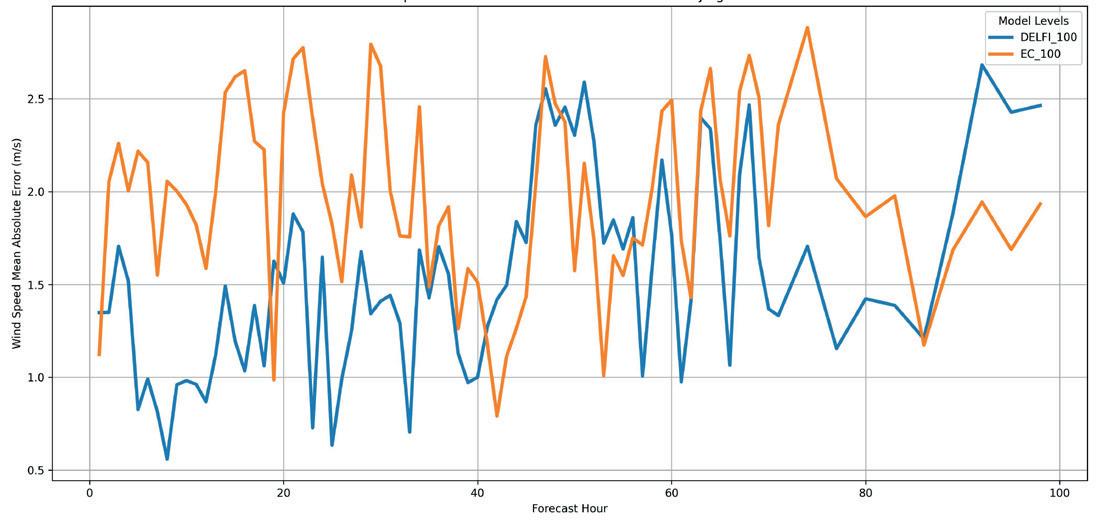

Based on the time evolution of MAE at 10 m and 100 m heights (Figures 1 and 2), DELFI consistently outperforms ECMWF, particularly for shorter forecast horizons. At 10 m, DELFI shows lower MAE values across the forecast period, demonstrating the usefulness of the ML approach in capturing near-surface wind variations in the data. ECMWF model data shows greater fluctuations and higher errors, suggesting it struggles more with local scale wind variability at this height. At the 100 m level, both models exhibit a

higher degree of variability with MAE. The ECMWF model data both under and over-estimates wind speed at times, which indicates the global model’s limitations in resolving boundary-layer processes. DELFI’s performance at 100 m suggests that ML techniques help refine forecast accuracy, particularly for wind speeds at turbine hub heights.

The MAE bar charts for 10 m and 100 m heights in Figure 3 summarise forecast performance over different forecast horizons. At 10 m, DELFI maintains significantly lower errors across all horizons, with a MAE of 1.2 m/sec. for 0 – 12 hours compared to 2.1 m/sec. for ECMWF. This pattern holds across longer forecast lead times where DELFI consistently provides better predictions.

At 100 m, a similar trend is observed. DELFI maintains an advantage across all forecast horizons, with MAE values remaining lower than those from ECMWF. However, as the forecast horizon increases, the gap between the two models narrows slightly, suggesting that DELFI’s learning process benefits most from shorter-term forecasts where ML corrections can be most effective.

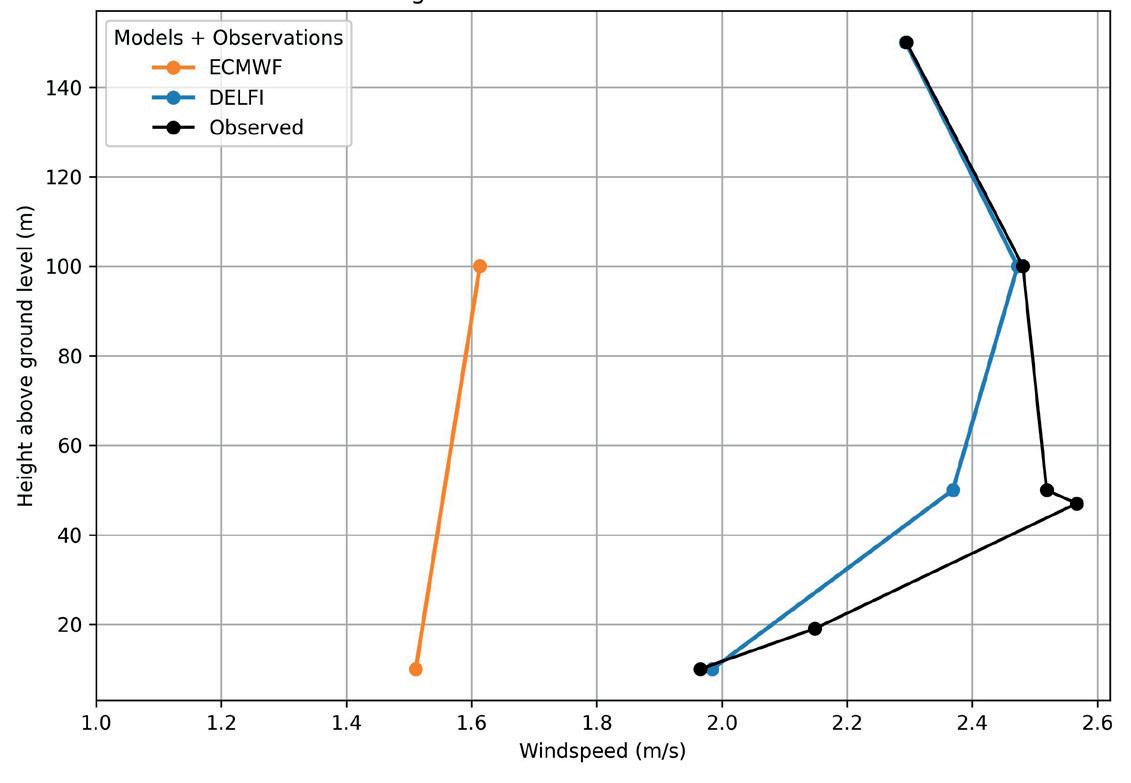

Furthermore, two examples of vertical wind profile forecasts are provided. The first example, a 12-hour forecast in a light wind situation, displays the strength of DELFI in its ability to correct the underprediction of wind speed associated with the ECMWF and its success with the shape of the observed profile (Figure 4).

The profile example for a 48-hour forecast (Figure 5) provides insights into a situation with stronger winds in which ECMWF exhibits a significant overprediction. DELFI reduces this error by half at all levels while overpredicting by 1 – 2 m/sec.

Conclusions

This demonstrates the significant improvements ML can bring to wind speed forecasting at different heights. Traditional numerical weather prediction models, such as ECMWF’s IFS, struggle to capture fine scale wind variations in the ABL, particularly near the surface. By leveraging ML, DELFI can effectively reduce forecast errors and provide more accurate wind predictions at both 10 m and 100 m heights, particularly for shorter forecast horizons. Wind forecast comparisons further highlight DELFI’s ability to better match ground truth wind conditions, correcting underprediction in light wind situations or overestimation in stronger wind conditions.

These findings underscore the value of integrating ML with traditional forecasting approaches to enhance wind energy forecasting. More accurate wind predictions at key turbine heights allow wind farm operators to optimise energy production, reduce mechanical stress on turbines, and improve grid reliability. As ML models continue to evolve with more data and improved algorithms, they hold great promise for further advancements in wind energy forecasting, helping the industry move towards more efficient and sustainable operations.

RENEWING WHAT’S POSSIBLE

SEPTEMBER 8-11, 2025

LAS VEGAS, NV

Join conversations with industry buyers, suppliers, distributors, consultants, and more to explore solutions, exchange ideas, and discover new technologies

REGISTER NOW | re-plus.com

Renny Vandewege, General Manager, Weather and Climate Intelligence, DTN, details five ways weather intelligence helps renewable energy mitigate weather risks.

y its very nature, the renewable energy industry is highly weather-dependent for the generation of power. It is also highly dependent on protection from weather impacts. To address these risks, the industry is increasingly turning to advanced weather intelligence. This includes real-time weather data, long-term climate forecasts, and AI-powered analytics. Integrated data systems bring it all together. These tools

help strengthen infrastructure, protect personnel, and ensure reliable energy flow into the grid.

The impact of extreme weather on renewable energy

Extreme weather events can cause significant damage to renewable energy infrastructure. For instance, wind turbines are vulnerable to high winds that can cause

mechanical stress and damage to turbine blades. According to new research, this can happen in a relatively short amount of time. The Netherlands Organization for Applied Scientific Research study in 2025 found approximately one-third of leading-edge erosion on wind turbine blades happens within just 12 hours of the year when strong winds and intense rainfall coincide.

Hydroelectric plants are affected by intense droughts that reduce water availability, while heavy rainfall and flooding can damage dams and powerhouses. In addition, while solar generation is one of the fastest growing sources of energy, so are the weather risks to the photovoltaic panels. According to the

GCube Insurance Services, 70% of solar losses in the US over the last 10 years have occurred since 2017.

Extreme weather events like these, coupled with the global growth of renewable energies, are driving an increased interest in granular and reliable weather data, not just in short-term forecasts, but also long-range and anticipated energy output.

Here are five ways that weather intelligence can help renewable energy mitigate weather risks.

1. Keeping assets safe

Weather intelligence plays a crucial role in reducing maintenance downtime and managing risk in the energy sector. Since both

weather and risk are data-driven, layering weather information with operational planning significantly improves decision-making. Nearly every aspect of a weather forecast can be quantified, allowing site managers to set specific thresholds for risk. This enables real-time assessment of potential downtime across different parts of a project.

Hindcasting – analysing past weather patterns – also helps identify the most suitable times of year for routine maintenance or construction, reducing disruptions and improving efficiency. Accurate forecasting is vital for protecting equipment and personnel.

The growth of renewable energy farms, in size and output, brings new considerations to balancing maintenance and asset protection. Wind turbines and rotors are growing taller and larger across the globe. For instance, the GE Haliade-X turbines planned for the Dogger Bank wind farm off the UK coast have a hub height of around 150 m and a rotor diameter of 220 m – making the total height nearly 260 m, taller than the London Eye.

Weather intelligence with taller turbines becomes significantly more complex – and more critical – for safe and efficient operations. Taller turbines interact with atmospheric conditions at higher altitudes, which can differ substantially from those

near the ground. This means standard surface-level weather forecasts are no longer sufficient; operators need high-resolution, multi-level weather data to understand conditions across the entire rotor sweep zone, which now spans over 200 m in many modern turbines.

At these heights, wind shear becomes more pronounced and can lead to uneven loading on blades. This asymmetry increases stress on the turbine structure and accelerates wear. Advanced weather intelligence helps identify shear zones, turbulence intensity, and directional shifts – allowing operators to fine-tune yaw and pitch controls for optimal performance and reduced fatigue.

2. Protecting crew

Weather intelligence is essential for ensuring crew safety in the renewable energy sector, where work environments often involve exposure to harsh and unpredictable elements. Whether operating on offshore wind platforms, remote solar farms, or mountainous hydroelectric sites, workers face significant risks from extreme weather conditions like high winds, lightning, icy surfaces, and intense heat.

Real-time weather data allows operations managers to make informed decisions about when it is safe for crews to work at height, perform maintenance, or transport equipment. For example, lightning detection systems can provide early warnings that prevent technicians from climbing wind turbines, while wind speed monitoring helps determine whether rope-access or drone inspections can proceed safely.

3. Maintaining a steady source of energy

Maintaining a steady flow of energy from nature is different from using a fuel source where there is more control, like coal or natural gas. With alternative energy, the goal for utility companies is to compensate for source fluctuations, rather than control the flow of the resource.

Many utilities depend on private weather companies that use an ensemble of weather models, statistical forecasting, and filtering techniques to gain keen insight into the amount of potential power.

Predicting winds for energy use poses a number of challenges. The geography around a wind farm can have a major influence on local wind speeds, so traditional weather-prediction models are less useful for accurate wind forecasts. Wind farms operate at peak efficiency when using hub-height wind forecasts at turbine-level to measure wind speed, direction, and gusts.

Weather intelligence plays a crucial role in helping solar farms maintain a steady and reliable source of energy by reducing the uncertainty associated with weather-driven variability. Through high-resolution forecasts of solar irradiance, operators can anticipate fluctuations in sunlight caused by cloud cover, storms, or atmospheric haze. This foresight allows them to better manage energy storage systems, discharging batteries when production dips and recharging when sunlight is abundant. It also enables more accurate power scheduling and grid balancing, helping utilities adjust demand-response strategies or activate backup generation to maintain grid stability.

4. Improve long-term strategic planning

While real-time data is crucial for immediate operational responses, long-term weather forecasting allows energy providers to build resilient infrastructure and plan for future climate conditions. Developers can analyse historical climate data to choose locations less prone to extreme weather. Engineers can build more durable solar panels and wind turbines to withstand severe conditions. Anticipating seasonal variations allows for better battery storage integration to provide backup power when renewable sources are disrupted.

For instance, in response to increasing heatwaves, Norway’s hydroelectric sector is using predictive weather analytics to optimise water storage in reservoirs, preventing drought-related power shortages. Hydroelectric plants can adjust water release strategies to maximise power generation while preventing overflows by monitoring snowmelt patterns and precipitation trends.

According to the International Energy Agency, incorporating climate projections into energy planning can reduce infrastructure vulnerability and improve the efficiency of renewable investments. For every US$1 invested in climate-resilient infrastructure, US$6 can be saved by mitigating damage and losses from climate-related events.

5. Reduce risk to reputation and profit

Weather intelligence is critical even before a renewable energy farm is developed. Solar farm developers will analyse the historical solar trends for multiple potential farm locations to pick the best location for development. The more accurate the wind measurements are for a proposed site, the more likely the wind farm is to deliver on its expected energy yield. Even small miscalculations can have long-term effects on the valuation of company stock and profitability.

Government regulations and utility standards also impact profit by specifying a small error variance from the predicted to the actual amount of energy supply and demand. If actual supply falls outside the variance, the utility company can face financial penalties, lose profitability, and have reputational damage. Some states in the US have legislation that penalise utilities for large outages, even when caused by weather events. For example, the February 2021 ice storm in Texas led to widespread blackouts, highlighting vulnerabilities in the state’s energy infrastructure. Regulatory agencies responded with penalties and new weatherisation requirements across all energy sectors to prevent future crises.

Future innovations in weather intelligence for renewable energy resilience

As climate change accelerates, the demand for more advanced weather intelligence solutions in renewable energy continues to grow.

Drones and satellite imaging will continue improving high-resolution, real-time weather intelligence that enhances renewable energy operations. Drones equipped with advanced sensors can monitor wind turbine performance, assess solar panel conditions, and detect potential damage from extreme weather events. Meanwhile, satellites from organisations such as the National Aeronautics and Space Administration and the

European Space Agency provide critical weather insights, including storm tracking, cloud cover analysis, and precipitation forecasts.

Artificial intelligence (AI) and machine learning are already driving advancements in hyperlocal forecasting, which provides detailed, site-specific, and even asset-specific, weather predictions. AI models are increasingly becoming more accurate at filling in data gaps where little to no weather data is available. Predictive analytics integrated with weather and operational data can help plan work schedules in advance, reducing last-minute exposure to dangerous conditions.

Quantum computing is set to revolutionise weather forecasting by processing massive datasets faster and more accurately than traditional computers. Quantum algorithms can analyse patterns more efficiently to provide faster updates to dynamic environmental conditions while reducing forecasting errors.

As technology evolves and climate risks intensify, the integration of advanced weather intelligence will be key to building a resilient and sustainable energy future. By leveraging weather intelligence to better plan for weather impacts, renewable energy providers are better positioned to mitigate risks to crew and assets while reliably maximising output.

Luke Bridgman, Ørsted, outlines some recent milestones for the world’s largest offshore wind farm: Hornsea 3.

he offshore wind sector is undergoing a significant transformation, and at the forefront stands Hornsea 3 – the world’s single largest wind farm currently under construction. With a planned capacity of 2.9 GW, this project is more than just another milestone for Ørsted; it represents a defining moment in the renewable energy transition. As part of the broader Hornsea Zone, Hornsea 3 is set to become one of the world’s largest renewable energy installations, surpassing its North Sea neighbour and sister project, Hornsea 2.

A legacy of innovation: From Vindeby to Hornsea 3

Located 120 km off the Norfolk coast, this £8.5 billion project will feature 197 turbines spanning nearly 700 km2 – an area larger than Greater Manchester. Once operational, it will generate enough electricity to power over 3.3 million UK homes, making it a cornerstone of the country’s net-zero ambitions. To fully appreciate the significance of Hornsea 3, one must look back at how far offshore wind has come.

More than 30 years ago, offshore wind was an untested concept. Vindeby, developed by Ørsted in Denmark in 1991 and the world’s first offshore wind farm, consisted of just 11 turbines generating a modest total output of 5 MW – enough to power 2200 homes.

At the time, the industry was in its infancy, but Vindeby crucially proved that offshore wind was viable.

Fast forward to today, and a single turbine at Hornsea 3 will easily surpass Vindeby’s total capacity. This progress highlights relentless advancements in turbine technology, engineering, and large scale project execution.

Yet, developing the world’s largest offshore wind farm is about more than just installing turbines – it requires the seamless integration of offshore and onshore infrastructure to deliver clean energy efficiently to the UK grid.

The backbone of Hornsea 3: Onshore infrastructure

When people think of offshore wind, they often picture vast arrays of turbines standing tall over the waves. However, what happens onshore is just as vital to a project’s success and is where the hard work begins – there are many moving parts to get right before offshore construction can start. The integration of large scale offshore wind farms requires sophisticated onshore infrastructure to ensure electricity reaches consumers efficiently and reliably.

Hornsea 3’s onshore infrastructure consists of several key components:

> Cable landfall: Subsea cables will make landfall near Weybourne, Norfolk, connecting to an underground onshore cable network.

> Onshore cable route: A carefully planned 55-km underground corridor through Norfolk, designed to minimise environmental impact and community disruption.

> Onshore converter stations: Two high-voltage direct current (HVDC) converter stations at Swardeston, south of Norwich, will convert power from HVDC to alternating current (AC) for efficient grid integration.

> Onshore substation: Also located near Swardeston, this facility will be where the electricity enters the National Grid.

The onshore phase of Hornsea 3 is well underway. Construction of the HVDC system began in 2022 and is progressing steadily. Steelwork and foundations for the converter stations are largely in place, and work on the HVDC valves will begin later in 2025. Meanwhile, trenching and tunnelling for the onshore cable route is advancing, with cables transported from Sweden via the Port of Boston in Lincolnshire. The logistics are complex – cables must be cut to manageable lengths and transported under police escort to the site.

At Weybourne in North Norfolk, where the export cable will make landfall, preparations for the horizontal directional drill (HDD) have nearly been completed – utilising a jack-up barge, stationed 600 m offshore, to facilitate work on the connection between onshore and offshore cables. By early 2026, subsea cables will be pulled through, establishing the crucial link between the wind farm and the grid.

Harnessing the power of HVDC technology

Given Hornsea 3’s considerable 120 km offshore distance, it will be Ørsted’s first UK project to use HVDC technology, which is more efficient for long-distance power transmission.

In partnership with Hitachi Energy and Aibel, Ørsted is installing four HVDC converter stations – two offshore and two onshore – to convert electricity between AC and DC. The HVDC system, in development since 2022, adds an extra layer of technical complexity to the project.

A global collaborative effort

Delivering a project of this magnitude requires a worldwide supply chain. Key components are being manufactured across multiple locations:

> Array cables: Manufactured in Italy and Greece.

> Export cables: Manufactured in Sweden.

> HVDC platforms: Two massive HVDC topsides are under construction in Thailand, with the first about to set sail to Norway for final outfitting before installation in the UK in early 2026.

As well as drawing on international expertise, boosting domestic supply chains remains a priority for the government and Ørsted’s construction strategy reflects this commitment. North East England-based JDR won the array cable testing and termination contract. JDR will prepare and connect the cables between the turbines and offshore convertor stations.

Severfield, headquartered in York, is the largest steel fabricator in the UK, but this is their first contract on an offshore renewable energy project. Severfield will work with their strategic key contractor Hutchinson Engineering in Widnes.

Smulders is a leading steel fabricator in the offshore wind industry and, since 2016, has operated the UK-based facility in Wallsend (Newcastle). Together with Severfield, Smulders will supply a large proportion of secondary structures for Hornsea 3’s foundations from the UK. This includes the suspended internal platforms (SIPs), key internal parts of the foundations on which the wind turbines sit. In addition, the company will build the boat landings where smaller vessels will arrive, allowing technicians to directly access the turbine foundation. Work on Hornsea 3 will help support more than 300 jobs across the three UK firms.

With offshore construction ramping up in 2026, the installation of export cables and monopiles will mark the final push towards completion. By the end of 2026, turbines will start arriving, and over the following 12 months, the wind farm will be fully erected and commissioned.

Executing a project of this scale demands a team of top industry experts. Hornsea 3 directly employs around 400 people, with thousands more engaged throughout the supply chain. At peak construction, over 5000 workers will be on site, and once operational, the wind farm will support around 1200 permanent jobs.

Shaping the future of offshore wind

As the UK transitions to a low-carbon economy, Hornsea 3 stands as a beacon of innovation and ambition. It represents the next generation of offshore wind farms – larger, smarter, and more integrated into the broader energy network. From pioneering HVDC transmission to cutting-edge turbine technology, it embodies the future of clean energy.

Ørsted’s mission at Hornsea is to build the world’s largest offshore wind farm – safer, leaner, and greener than ever before. With full commissioning expected by the end of 2027, Hornsea 3 is more than just an offshore wind farm – it is a bold statement about the future of energy.

Aligning with the UK government’s clean energy ambitions

As one of the largest offshore wind developments in history, the project aligns closely with national energy policies designed to phase out fossil fuels, enhance energy security, and reduce electricity costs.

It is clear the UK government recognises the role of offshore wind as the backbone of Britain’s energy mix – setting ambitious targets to expand offshore wind capacity to 50 GW by 2030. Hornsea 3 alone will contribute nearly 6% of the total offshore wind target. Alongside future projects such as Hornsea 4, it reinforces the UK’s position as a global leader in offshore wind energy.

However, a key challenge in deploying offshore wind at the scale and speed required will be ensuring efficient grid connections. The industry is already working with government, local, and national stakeholders to address these challenges. The government’s Offshore Transmission Network Review (OTNR) seeks to optimise the way offshore wind farms link to the national grid, and it is clear that battery storage has a role to play.

Work is also ongoing as the UK government seeks to streamline planning and permitting processes for new wind farms, therefore lessons learned from the successful execution of Hornsea 3 may well help provide a blueprint for future offshore wind projects.

Powering the future

The construction of Hornsea 3 stands as a defining moment in the UK’s renewable energy journey – showcasing the immense complexity, skill, and co-ordination required to build a project of this scale. As construction continues, it sets the stage for a cleaner, more secure energy future in the UK and beyond.

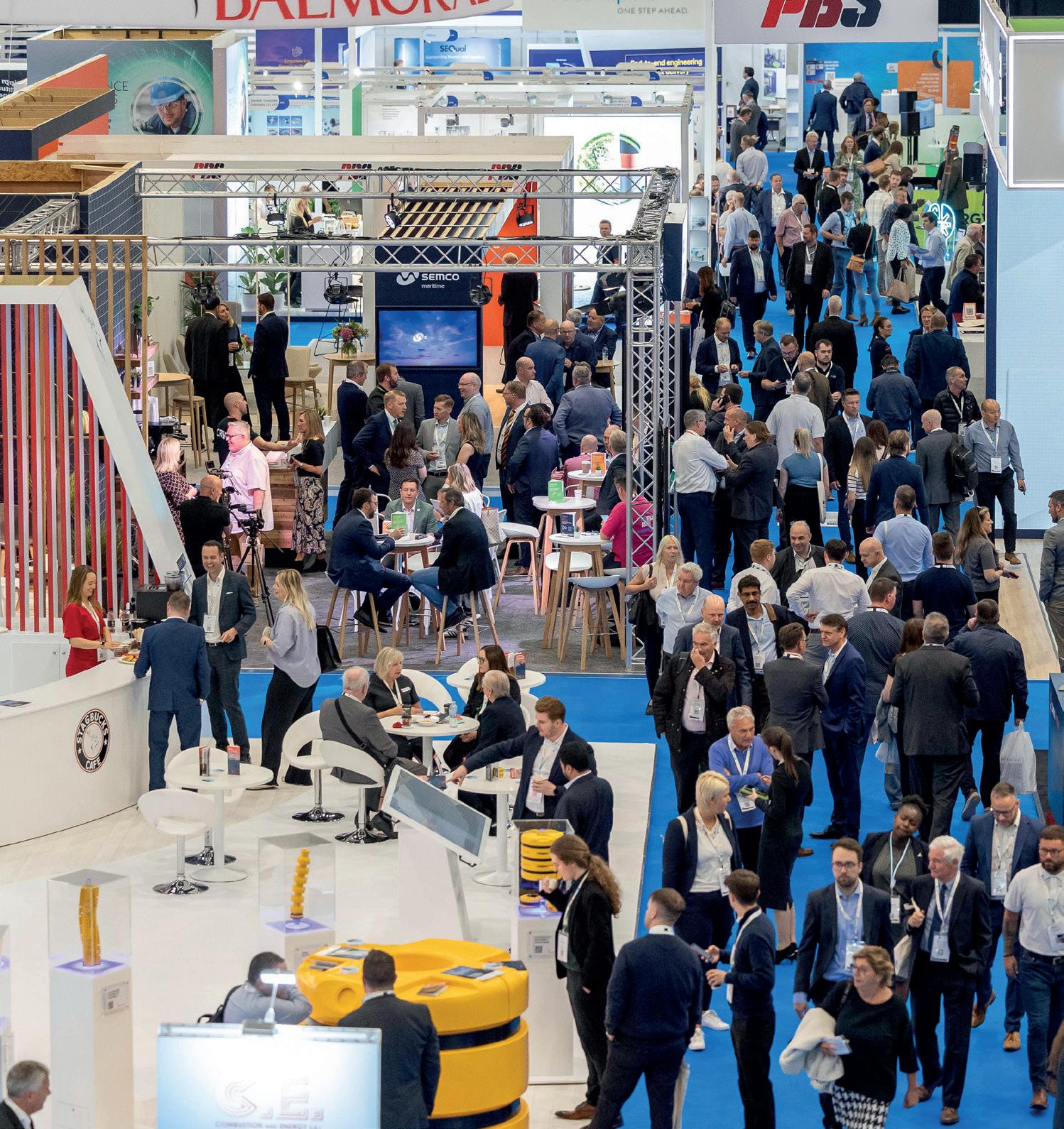

The NEC, Birmingham

The UK’s largest solar and energy storage exhibition

ENTER THE GROWING UK MARKET ENTER THE GROWING UK MARKET

Exhibit at the UK’s largest solar and energy storage exhibition to connect with buyers who are seeking solutions to deliver and optimise their solar and energy storage projects.

20,000+ buyers

500+ global exhibitors

200+ speakers

Scan the QR code or visit the event website for your exclusive opportunities

Stephane Allain, Director of Renewables, CRC Evans, champions the development of mechanised welding systems as a crucial tool in the ever-expanding UK offshore wind sector.

s net-zero targets approach, governments and businesses are turning to offshore wind energy as a renewable power source to meet the demand for clean energy.

Wind energy is well established in the UK, both onshore and offshore, and the sector continues to bring market developments in larger turbines and structures to improve

efficiency and increase capacity. The offshore wind industry is actively exploring new technologies and solutions. CRC Evans expects that commercial floating offshore wind farms will be deployed in the following few years and located further offshore in deeper waters.

Challenges in welding

The floating offshore wind sector currently faces two challenges: the need for more skilled welders and increased welding productivity. Both will be required to meet the sector’s demands in order to fabricate structures every few weeks. CRC Evans are addressing these industry needs by investing in product research and development and personnel. Over the years, the company has amassed extensive expertise in the oil and gas sector, including proficiency in offshore operations, complex project management, and infrastructure development. Experience, state-of-the-art technology, and an international reach allow the company to develop transferable skills that can be applied to support the emerging floating offshore wind sector.

Mechanised welding

With experience in mechanised welding, CRC Evans can apply lessons learned from the oil and gas and infrastructure industries to floating offshore wind. The company is developing and enhancing welding systems for the quayside fabrication of these massive floating offshore wind structures.

The floating offshore wind market is pushing for mechanised welding systems and the benefits that they can bring, which include:

> Increased productivity: Mechanised welding systems can operate faster and more continuously than manual welders. This leads to increased production rates and shorter project timelines, with the possibility of working 24 hours per day with minimal downtime.

> Consistency and quality: These systems can provide consistent and repeatable welds, reducing the risk of human error. This leads to higher-quality welds with fewer defects, reducing costly repairs and interruptions and improving completion schedules. A digital record of all parameters is logged for quality reports and integrity management.

> Reduced fatigue: Manual welding can be physically demanding leading to fatigue, which can affect the quality of work. Mechanised welding alleviates the physical strain on workers, leading to more consistent results over long periods.

> Better control over welding parameters: Mechanised welding offers precise control over welding parameters such as travel and wire speed, amperage, voltage, oscillation, and arc stability, ensuring optimal conditions for each weld.

> Reduced labour costs: Fewer skilled operators/welders are required on site.

Earlier this year, CRC Evans was awarded a grant from the Offshore Wind Growth Partnership (OWGP) to improve the company’s mechanised welding systems for the offshore wind sector, working closely with the OWGP on this project. The company’s research and development programme is making good progress in creating mechanised welding solutions specifically designed for the construction and assembly of large structures. After collaborating with designers and developers, there is a focus on enhancing welding productivity with the aim of achieving a 50% increase. The Floating Offshore Wind research and development programme is proceeding as planned and expected to be completed in 2Q25.

Fabrication demands

The second industry challenge is the need for welders to meet the fabrication demand. CRC Evans is committed to investing in developing and training skilled welders and continues to offer its well-established and comprehensive apprenticeship programme. Together, both initiatives will help ensure that the company is able to increase its welding team from 250 welders to 400 welders.

Conclusion

Skilled welding crews, along with proven mechanised and innovative welding systems, will enable the company to complete the final assembly of floating offshore wind structures. CRC Evans has extensive experience mobilising teams and equipment where the floating offshore wind project is located, whether in the North Sea, Celtic Sea, Brazil, the US, or Australia, for example. It is important that companies develop the resources and capabilities to meet future challenges in the assembly of floating offshore wind assets.

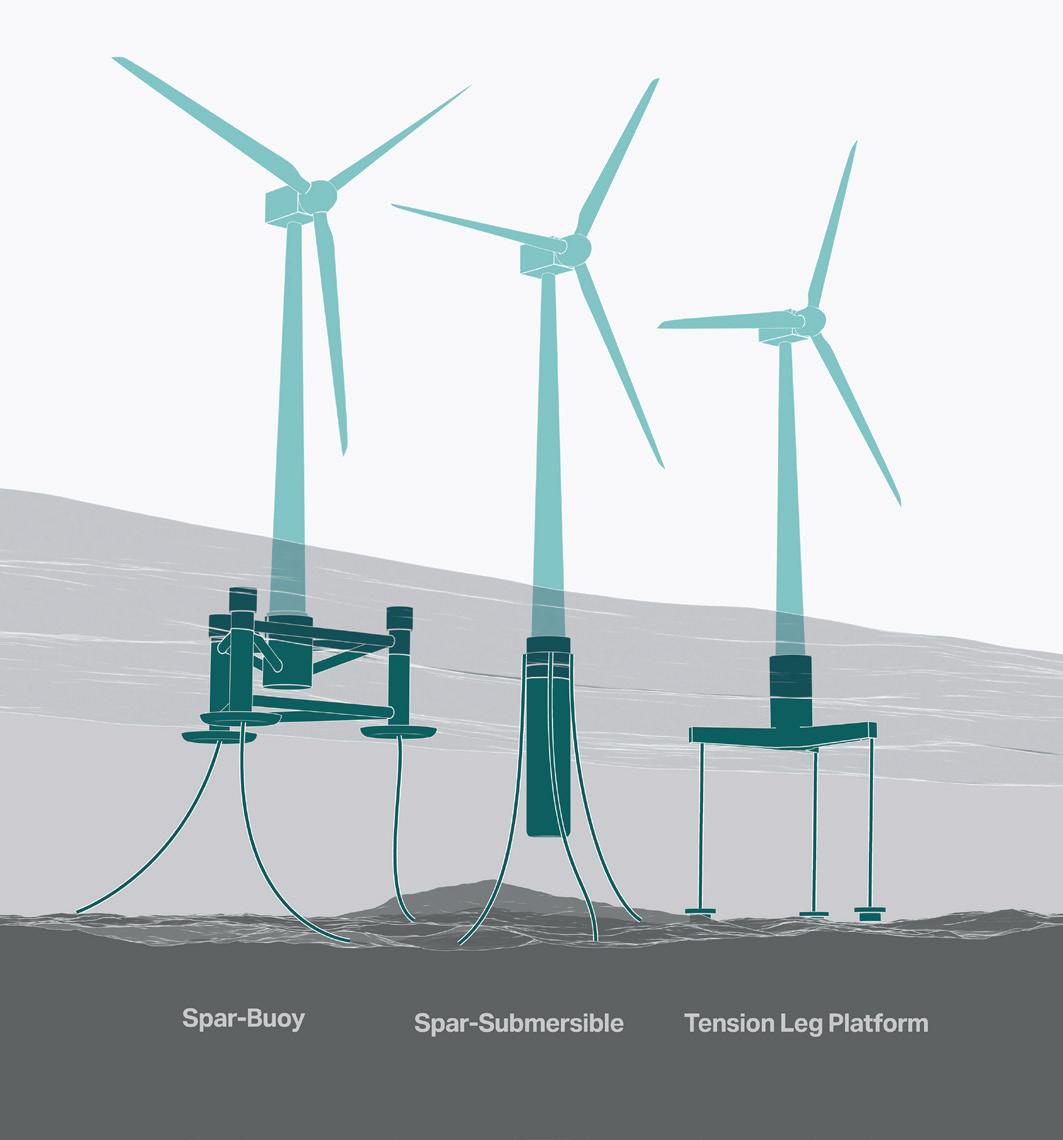

Francisco Siro, Head of Advisory at R&D consultancy, Sagentia Innovation, proposes that a blend of cross-sector learnings and novel approaches will help floating offshore wind achieve its potential.

loating offshore wind installations could play a critical role in the global energy transition, but significant challenges and obstacles remain. This subsector of offshore wind is still in its infancy, and scaling from demonstration projects to gigawatt scale developments involves a steep learning curve. Five key factors are hindering progress at present: technical issues, industrialisation and supply chain, operations and maintenance, end of life, and asset management. They all impact levelized cost of energy (LCOE), or the price at which energy must be sold for a system to break even at the end of its lifetime.

Technical issues

While publicly available reliability data for offshore wind is limited, there are well known technical issues that impact LCOE.

Several of these are exacerbated in floating applications. For instance, a common cause of failure in offshore wind relates to poor performance and reliability of subsea cables, often due to environmental factors. With floating platforms, oscillation is likely to compound these environmental challenges.

Erosion and delamination of turbine blades is another technical concern. As blades slice through the wind at high speed, fine particulates (e.g. dirt and dust carried in rain) impact their surface. Over time, these microscopic collisions, combined with centrifugal forces and dynamic loads from vibrations, cause erosion. Thin-walled components are also vulnerable to delamination caused by issues such as moisture ingress, temperature fluctuation, bonding failure, mechanical stress, and poor manufacturing quality.