A podcast series for professionals in the downstream refining, petrochemical, and gas processing industries

A podcast series for professionals in the downstream refining, petrochemical, and gas processing industries

Sponsored by

EPISODE 4

Rasmus Rubycz, Market Manager for New Energy at Atlas Copco Gas and Process, considers how heat pumps as an industrial technology are gaining greater attention as a result of the increased drive for sustainability, and the challenges and opportunities of electrification of process heat.

EPISODE 5

Mike Logue, Owens Corning Business Director – Specialty Insulation, delves into factors that can support the performance, safety, and longevity of insulating systems installed in hydrocarbon processing environments, including cryogenic facilities.

EPISODE 6

Leakhena Swett, President, ILTA, and Jay Cruz, Senior Director of Government Affairs and Communications, ILTA, consider the importance of trade associations and industry collaborations.

EPISODE 7

Susan Bell, Senior Vice President within Commodity Markets – Oil, Rystad Energy, discusses the impact of trade wars on global oil demand and oil prices, in light of recent US trade tariffs.

Chris

Francisco

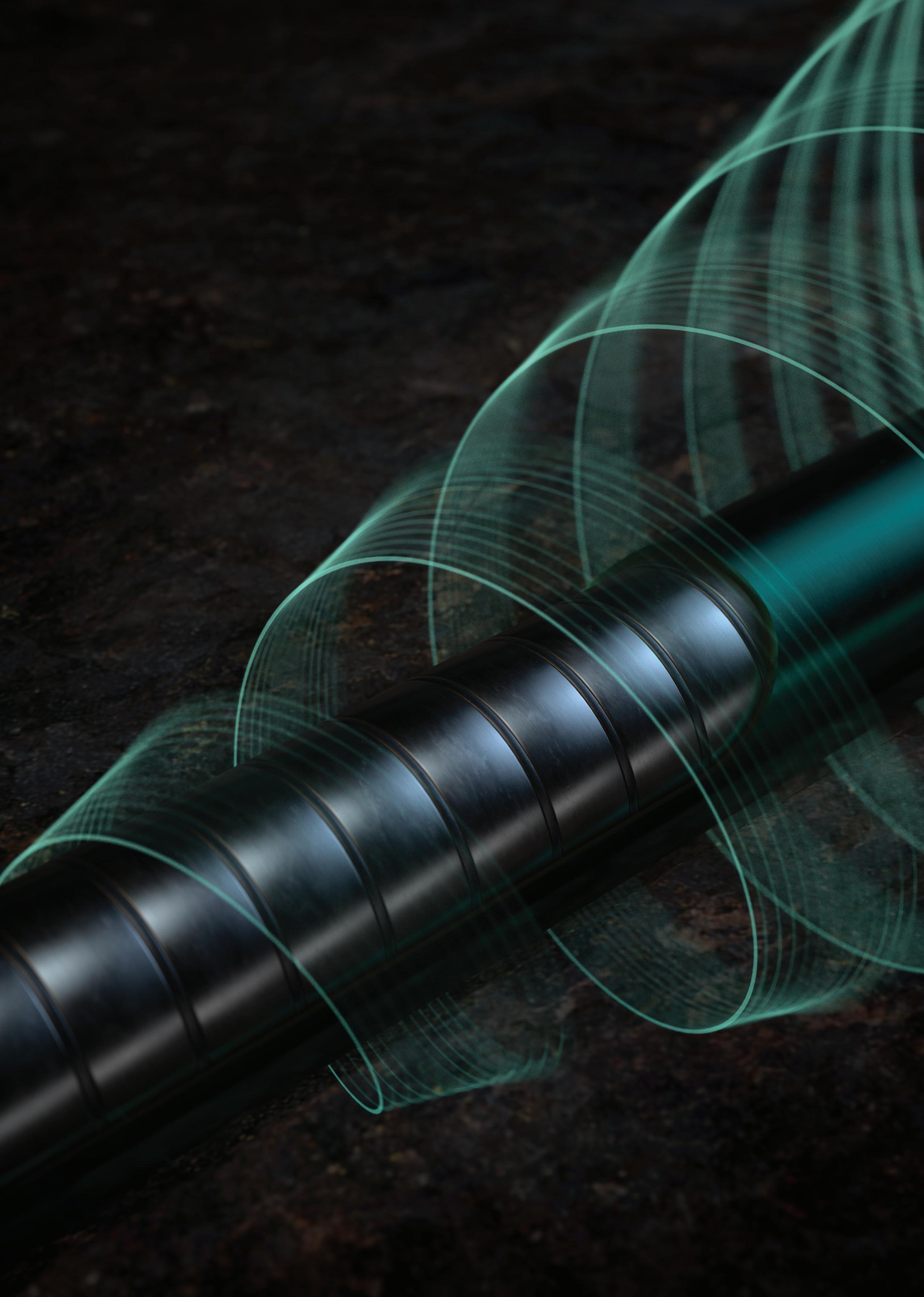

Drilling through hard, aggressive rock formations can generate excessive torsional vibrations in your bottomhole assembly (BHA). Left unchecked, these vibrations can limit penetration rates, shorten tool life, and lead to wellbore instability. The GuardVibe™ high-frequency torsional oscillation dampener from Baker Hughes takes a holistic system approach to eliminate critical torsional vibrations throughout the BHA. By dissipating vibrational energy in the BHA, GuardVibe benefits your drilling operations in several ways.

Across energy and critical infrastructure, we bring expertise where complexity is highest. With globally local teams and proprietary technologies unmatched in the sector, we move projects forward, no matter the challenge.

We’re here to partner on how our specialist welding and coating solutions can help you power tomorrow.

ADNOC has announced multiple agreements with US energy majors during the UAE-US business dialogue with US President Donald Trump. The agreements will potentially enable US$60 billion of US investments in UAE energy projects across the lifespan of the projects. They include a landmark field development plan with ExxonMobil and INPEX/JODCO to expand the capacity of Abu Dhabi’s Upper Zakum offshore field through a phased development. ADNOC also signed a strategic collaboration agreement with Occidental to explore increasing the production capacity of Shah Gas field’s capacity to 1.85 billion ft3/d of natural gas, from 1.45 billion ft3/d, and accelerating the deployment of advanced technologies in the field.

The agreements reinforce the shared commitment of the UAE and US to maintaining global energy security and the stability of energy markets. The enterprise value of UAE energy investments into the US is set to reach US$440 billion by 2035, as part of the UAE’s US$1.4 trillion investment plan into the country.

bp Trinidad and Tobago (bpTT) has announced that the Mento development has safely delivered first gas through connection of the initial discovery well and the drilling campaign for the remaining seven gross wells on the platform will now begin. Mento is a 50/50 joint venture between EOG Resources Trinidad Ltd (EOG) and bpTT, with EOG as the operator. The development features a 12-slot, attended facility that is located in acreage jointly licensed by bpTT and EOG off Trinidad’s southeast coast. Mento is one of bp’s 10 major projects expected to start up worldwide between 2025 and 2027 that bp announced earlier this year as part of its strategy to grow the upstream. Production from Mento will make a significant contribution towards the 250 000 boe/d combined peak net production expected from these 10 projects.

CNOOC Ltd has announced a major oilfield discovery of Huizhou 19-6 in the deep and ultradeep plays of the South China Sea, which adds over 100 million t of oil equivalent in-place. Huizhou 19-6 oilfield is located in the eastern South China Sea, with an average water depth of approximately 100 m. The main oil-bearing plays are Paleogene Enping Formation and Wenchang Formation, and the oil property is light crude. The discovery well HZ19-6-3 was drilled and completed at a depth of 5415 m, which encountered a total of 127 m oil and gas pay zones. The well was tested to produce 413 bpd of crude oil and 2.41 million ft3/d of natural gas. Through continued exploration, the proved in-place volume of Huizhou 19-6 oilfield has exceeded 100 million t of oil equivalent.

Amplus has selected the Astican Shipyard in Las Palmas de Gran Canaria to undertake a major multi-million-dollar work scope in preparation for the redeployment of one of the offshore industry’s most iconic FPSO units. The Petrojarl I – most recently in operation offshore Brazil –will undergo a critical reactivation and readiness programme. As the most frequently redeployed FPSO in the industry, the vessel continues to attract strong market interest.

EIA estimates that the average number of wells completed simultaneously at the same location in the Lower 48 states has more than doubled, increasing from 1.5 wells in December 2014 to more than 3.0 wells in June 2024. By completing multiple wells at once rather than sequentially, operators can accelerate their production timeline and reduce their cost per well. The increasing number of simultaneous completions reflects significant technological advances in hydraulic fracturing operations, particularly in equipment capabilities and operational strategies.

AIS Bardot has secured another successful award from Saipem Group for Total’s Kaminho project in Angola. The award is for the manufacture and supply of three complete hybrid riser lines of 100 m each.

TotalEnergies announced first oil from the fourth development phase of the Mero field on the Libra block, located 180 km off the coast of Rio de Janeiro, Brazil, in the pre-salt area of the Santos Basin.

Rhino Resources has announced the delivery of two exploration wells on Block 2914 within Petroleum Exploration License (PEL) 85 offshore Namibia. These exploration wells are the first to be completed entirely from in-country infrastructure through Halliburton’s newly established operational bases in Walvis Bay, Swakopmund, and Lüderitz.

MOL Group and Turkish Petroleum have signed concession agreements with the Ministry of Energy of Hungary, granting rights for joint hydrocarbon exploration in two Hungarian concession areas, Tamási and Buzsák.

EnerMech will provide pre-commissioning services at the Salamanca Platform in the Gulf of Mexico.

10 - 11 June 2025

Gas, LNG & The Future of Energy 2025 London, United Kingdom

https://www.woodmac.com/events/gaslng-future-energy/

9 - 12 September 2025

Gastech Exhibition & Conference Milan, Italy

https://www.gastechevent.com/visit/ visitor-registration/

Editorial

Managing Editor: James Little james.little@oilfieldtechnology.com

Editorial Assistant: Alfred Hamer alfred.hamer@oilfieldtechnology.com

Design

Production Designer: Iona MacLeod iona.macleod@oilfieldtechnology.com

Production Manager: Kyla Waller kyla.waller@oilfieldtechnology.com

Sales

Sales Director: Rod Hardy rod.hardy@oilfieldtechnology.com

Sales Manager: Chris Lethbridge chris.lethbridge@oilfieldtechnology.com

Sales Executive: Daniel Farr daniel.farr@oilfieldtechnology.com

Events

Head of Events: Louise Cameron louise.cameron@oilfieldtechnology.com

Events Coordinator: Chloe Lelliott chloe.lelliott@oilfieldtechnology.com

Digital Events Coordinator: Merili Jurivete merili.jurivete@oilfieldtechnology.com

Junior Video Assistant: Amélie Meury-Cashman amelie.meury-cashman@oilfieldtechnology.com

Website

Digital Content Coordinator: Kristian Ilasko kristian.ilasko@oilfieldtechnology.com

Digital Administrator: Nicole Harman-Smith nicole.harman-smith@oilfieldtechnology.com

Marketing

Administration Manager: Laura White laura.white@oilfieldtechnology.com

Reprints: reprints@oilfieldtechnology.com

Palladian Publications Ltd,

15 South Street, Farnham, Surrey GU9 7QU, UK

Tel: +44 (0) 1252 718 999 Website: www.oilfieldtechnology.com

Elizabeth Corner, Senior Editor elizabeth.corner@oilfieldtechnology.com

Energy markets used to hinge on OPEC meetings. When OPEC meetings were the main event, twice a year we’d ritualistically pore over the reports coming out of Vienna. Analysts would dissect the quota news like it was gospel and markets would react immediately. Traders would mull over production targets vs actual output, speculate about compliance and make estimates about spare capacity. It was all about decoding OPEC’s body language, and what that meant for global supply/demand balance going forwards.

In 2025, it seems the energy markets swing on tariff tweets and trade disputes. Now, we find ourselves decoding presidential social media posts, watching customs data and monitoring LNG shipping routes, to see how the latest tariffs are playing out. Supply and demand models that forecast wellhead output also need to simulate global chess moves. We must now consider concepts such as ‘tariff pass-through’ and ‘retaliation windows’ when we forecast market behaviour. How have we got here, to a place where tariffs are now a frontline force shaping the energy landscape? Tariffs are a tax on imports, commonly used to protect domestic industry or to counteract ‘unfair’ trade practices imposed by another country. When tariffs are applied to commodities like oil and gas (or the steel, machinery and technology they rely on), those taxes ripple through entire value chains. In the late 2010s, the US imposed sweeping tariffs on key trading partners, including China, under the banner of economic nationalism; this has now become a long-term trade policy. In the early months of 2025, President Trump announced a raft of new tariffs, including tariffs on steel imports. US tariffs have now become a rolling feature of global energy negotiations.

A new report from GlobalData states that tariff-related disruptions will outweigh other oil and gas themes in 2025.1 ‘Top 20 oil & gas themes - 2025’ asserts that “tariff-induced trade tensions might exert downward pressure on the US and global economy in the near term, potentially affecting the energy demand. It is therefore important for the industry to assess the impact of macroeconomic themes of tariffs, along with geopolitics, and supply chain while charting out its growth plans”.

Wood Mackenzie released a modelling scenario in May (‘Trading cases: Tariff scenarios for taxing times’) that presents three distinct futures for the global energy landscape, highlighting the farreaching implications of ongoing trade tensions for the energy and natural resources sectors.2 The report presents three possible outlooks for the global energy and natural resources industries: Trade Truce (the most optimistic), Trade Tensions (the most likely) and Trade War (the worst outcome). Each paints a different picture for global GDP, industrial production and the supply, demand, and price of oil, gas/LNG, renewable power and metals to 2030. The modelling shows how divergent trade paths could create oil demand swings of nearly 7 million bpd by 2030.

Investors in upstream projects must now consider things like: will this rig get hit by a steel import tax? Will China retaliate by pulling its LNG demand? Will essential technology be delayed at customs?

Of course, for some domestic producers, tariffs will be a windfall. Protectionist trade policy can act as a buffer against foreign competition, driving demand for local resources and equipment, and renewing interest in homegrown business. Regardless, upstream players can no longer afford to be passive: trade policy is now energy policy, and those who read the tea leaves fastest may just stay ahead of the curve.

1. https://www.globaldata.com/store/report/top-20-oil-and-gas-theme-analysis

2. https://www.woodmac.com/horizons/tariff-scenarios-taxing-times/

how new digital solutions can offer enhanced efficiency, performance and collaboration within the upstream industry.

n the ever-evolving landscape of the oil and gas industry, efficiency, collaboration, and innovation stand as pillars of success. Yet, conventional approaches often fall short, leading to inefficiencies and missed opportunities. This is why digital solutions are poised to revolutionise operations in this sector. This article explores the essential features and impacts of the IDEX Collaboration Platform, exploring its effects on well planning and execution

workflows, and the industry’s sustainable future. The article will also analyse a case study detailing how operations can be streamlined, driving notable improvements in both productivity and cost-effectiveness.

Given the evolving challenges within the industry, embracing digital innovation is crucial for ensuring a sustainable future. Digital solutions such as the

IDEX Collaboration Platform offer operational efficiency, increase production rates, and reduce nonproductive time throughout the well lifecycle.

By leveraging such solutions, digital technologies empower organisations to reach new heights of operational performance. This results in efficiency gains and enhanced collaboration among industry stakeholders, fostering the exchange of knowledge and

best practices for optimised, sustainable, and consistent operations.

A notable success story is on the horizon for AkerBP in the North Sea, as the company aims to slash average well planning time from seven days to just one day by utilising the IDEX Collaboration Platform. This represents an 86% reduction, demonstrating the platform’s efficacy in optimising workflows and expediting project delivery.

IDEX Planner, the job planning app on the platform, improves the efficiency of well planning workflows in the oil and gas sector. Working on a cloud-enabled platform with on-premise capabilities for secure collaboration, facilitates teamwork from any location, allowing for adjustments to meet evolving project needs. This collaborative environment fosters better communication and decision making amongst stakeholders, resulting in streamlined planning processes.

A key feature of the platform is its ability to automate data integration, removing the need for redundant data entry. Essential information like trajectory and casing details can be imported directly, saving time and improving accuracy. Preformatted final well programme outputs also minimise manual formatting, allowing engineers to focus more on optimising designs and mitigating risks.

Moreover, the platform’s traceability of any edits made during the programme preparation process helps ensure accountability and transparency.

The IDEX Collaboration Platform Performer app integrates with Planner to share the approved programme with the operations team. Performer is then used to capture how the job is actually performed against the planned programme, reporting all activities directly. With new digital solutions, companies can see savings of nearly 60% of their daily reporting effort by automating the generation of draft reports using available data and sensor information, allowing field personnel to focus their efforts on critical tasks, enhancing efficiency rather than the administrative burdens which can sometimes interfere with the ongoing operations.

In addition to optimising execution workflows throughout well operations, the platform can enable field personnel to capture real-time insights and lessons learned, essential for continuous improvement through reviews, discussions, and the refinement of future well plans.

An important aspect of the platform is its capability to maintain a database of experiences and lessons learned on a global, field, or well level. This facilitates the identification of trends, anticipation of challenges, and driving continuous improvement by enabling cross-project learnings. Furthermore, it streamlines change management processes by ensuring prompt documentation and addressing deviations from planned activities.

By optimising operations and supporting ongoing improvement, companies utilising new digital solutiOns can heavily improve their operational uptime. Capturing real-time insights, experiences and lessons learned and centralising them in a cloud-based database is projected to yield a significant decrease in non-productive time, estimated between 10 - 25%. This approach not only improves

performance but also enhances risk management and amplifies continuous learning within and across teams.

Shell has leveraged the IDEX Collaboration Platform to streamline its operations and enhance efficiency across the company’s global projects. Through the implementation of Planner and Performer, Shell has improved its well planning and execution processes, resulting in notable enhancements in productivity and cost-effectiveness.

In a specific case study, Shell utilised IDEX Planner to standardise well planning procedures and automate repetitive tasks. By centralising planning activities on the platform, Shell’s engineering teams achieved more effective collaboration, leading to faster decision making and more accurate well programmes. Consequently, the company reduced its well planning time by up to 50%, facilitating quicker project delivery and cost savings, whilst allowing engineers to focus on robust risk planning.

Furthermore, the company is currently in the process of implementing IDEX Performer to streamline execution processes and enhance real-time reporting capabilities. By digitising daily reporting tasks and capturing lessons learned, the company has identified areas for improvement and is driving operational excellence across its projects. The platform’s database of experiences and lessons learned is set to enable Shell to continuously optimise its operations and effectively mitigate risks.

The platform places an emphasis on collaboration, which in an industry where projects often involve multiple stakeholders, is vital for success. It provides a centralised hub for teamwork, irrespective of geographical locations or different domains. This helps improve communication and decision making, fostering a sense of unity among project members and eliminating silos amongst organisations.

All stakeholders, including service companies, have access to the latest data and information in real-time due to the platform’s cloud-based nature, eliminating the need for email chains or manual updates. This streamlines the workflows and reduces the likelihood of errors by maintaining a single source of truth.

By automating repetitive tasks like data entry and reporting, the platform frees up valuable time for engineers and field personnel to concentrate on critical aspects of their work. This boosts productivity and reduces the risk of human error, enhancing overall efficiency and accuracy.

Additionally, the platform’s risk management capabilities are essential for ensuring safe and compliant operations. By maintaining detailed risk registers and facilitating change management processes, companies can identify and mitigate potential hazards before they escalate into costly train wrecks.

These features and functionalities enable companies to streamline operations, improve collaboration, and promote performance – all essential for long-term success in a competitive market.

As the oil and gas industry continues to evolve, so will new digital solutions. With ongoing technological advancements and an expanding user base, the platform is poised to play an even greater role in shaping the industry’s future.

Continued development is ongoing in artificial intelligence and machine learning, enabling the platform to analyse vast

amounts of data, identify trends, optimise processes, and make predictive insights. This will improve efficiency and allow companies to make informed decisions based on data-driven evidence.

As the industry navigates increasingly complex environments, robust risk management solutions will become even more critical. The IDEX platform will therefore continue to enhance its risk management capabilities to help companies identify and mitigate uncertainties effectively, ensuring the safety and compliance of their operations.

Furthermore, it will adapt to meet the evolving needs of its users. Whether expanding capabilities to support new project types or integrating with other industry-leading software solutions, the platform will remain at the forefront of innovation in the oil and gas sector.

The widespread adoption of the platform across the global oil and gas industry holds immense potential. So, how do companies worldwide embrace the platform and its impact on their operations? One key word here is scalability. It has been crucial to tailor the solution to organisations of all sizes, from small independent operators to multinational corporations. The software solution offers flexibility that allows companies to streamline operations and drive efficiency, regardless of their scale.

Additionally, the platform helps to facilitate partnerships and alliances between industry players. By providing a common platform for teamwork, it promotes a sense of community and cooperation, vital for addressing common challenges and driving collective progress.

Looking ahead, the global adoption of the platform is expected to accelerate as companies recognise the value of digital transformation and collaboration. This will drive further innovation and development within the platform and fuel broader industry-wide transformation.

Industry leaders are spearheading a digital revolution in the oil and gas sector. Their strategic adoption of the platform to transform well planning, workflows, and data analytics positions them to enhance operational efficiency, increase production rates, and minimise non-productive time across the well lifecycle.

Shell’s implementation of the Planner and Performer has streamlined well planning and execution processes, yielding significant improvements across the company’s global projects. By reducing well planning time by up to 50% and integrating the Performer to enhance real-time reporting capabilities, Shell is driving operational excellence and fostering improvement. Similarly, AkerBP’s continuous achievements in well planning and the company’s target to reduce average well planning time from seven days to one day highlights the platform’s importance in optimising workflows and expediting well delivery.

With enhanced collaboration and digitised workflows, the IDEX Collaboration Platform is paving the road for a dynamic and more efficient future for oil and gas operations. As more companies embrace this digital transformation, the platform’s momentum is poised to accelerate, driven by the recognition of its value in enhancing performance and collaboration. This collective momentum will fuel further innovation and development, unlocking new levels of performance and efficiency.

Chris Hardy, Rotork, USA, explains how reliable and advanced automation solutions can help operators reduce emissions, improve process efficiencies and increase production output.

ethane is a powerful greenhouse gas that traps heat in the atmosphere. It is the second most abundant human-made greenhouse gas, after carbon dioxide (CO2), and is more than 28 times as potent at trapping heat in the atmosphere over a 100 year period. It has, therefore, become increasingly important for governments and companies internationally to try and reduce their overall methane emissions throughout industrial processes.

The oil and gas industry is responsible for approximately 80 million tpy of methane, representing about 40% of methane emissions from human activity. These emissions can be reduced by over 75% with solutions such as leak detection, repair programmes, and upgrading leaky equipment. Methane abatement in oil and gas is very cost-effective to achieve. Around 40% of methane emissions could be avoided at no net cost.

Automation in upstream oil and gas operations and processes helps reduce emissions while delivering advanced control, lower power consumption, high reliability, and easy field serviceability. An effective method of reducing upstream methane emissions is installing electric actuators over pneumatic ones.

Electric actuators vs pneumatic actuators relative to overall performance

Electric actuators use electricity as their power source instead of well-stream natural gas. Upstream production process control valves have traditionally been operated by pneumatic diaphragm actuators that use the well-stream gas for their motive power, releasing methane every time the valve is stroked. Electric actuators do not vent during operation.

Maintenance requirements for electric actuators are significantly lower than those for pneumatic actuators and control instruments. Rotork electric actuators deliver selfcontained one-piece actuation solutions, which reduces the risk of failure.

Servicing a self-contained electric actuator vs a pneumatic solution with multiple parts and systems also results in cost savings and increased operational efficiency.

These electric actuators, feature userfriendly interfaces and software tools that

simplify the commissioning process, making them a solution for valve applications in the oil and gas industry.

There are significant advantages to electric actuator technologies vs pneumatic. Pneumatic actuators consist of multiple parts, not just an actuator, which can all suffer from air quality fluctuations, temperature variations, and other environmental factors.

Electric actuators are less susceptible to these influences. They are more energy efficient as they only consume electricity when in operation. In contrast, pneumatic actuators and controls require a constant supply of either motive pipeline gas or locally produced compressed air.

Many electric actuators are available with fail-to-position options that automatically return valves to a predetermined position in case of power loss or emergencies, which enhances safety and prevents potential damage to equipment.

They feature advanced diagnostics, allowing remote monitoring of condition, performance, and potential issues. This proactive approach allows early identification and resolution of problems, preventing unexpected failures and associated downtime.

It is vital for actuators and controllers to provide superior performance and reliability. Intelligent flow control solutions deliver:

Ì Advanced control: actuators can achieve all the necessary torques and thrusts, as well as operate at required speeds for choke valves and process control valves in upstream oil and gas applications. Additionally, they provide the highest resolution output and a modulating duty for precise pressure and flow rate control.

Ì High reliability: designed for reliable and repeatable performance in the dynamic and tough environments of remote oil and gas well sites, actuators are built on selfprotection technology, which guards the unit’s integrity and operating performance by continuously monitoring temperature, torque and voltage, thereby ensuring a longer product lifespan.

Ì Low power consumption: whether to optimise in-field solar power infrastructure in remote locations or effectively manage an escalatory environment of higher-priced available grid power, actuation solutions are energy efficient and consume low levels of electric power.

Ì Field serviceability: in-field interventions such as commissioning and recalibration procedures should be fast and seamless, whether conducted remotely, in control rooms, or through direct physical interaction with the actuator. Actuation solutions provide the most user-friendly experience for upstream oil and gas operators.

Ì Electric actuators are well-suited for upstream applications in the oil and gas industry, such as production trees, processing, gas metering, LACT skids, gas lift systems, and saltwater disposal systems.

Read more at p.19

The production tree (or Christmas tree) is an assembly of valves, spools and fittings that regulate the flow of oil or gas from a well.

In case of overpressure, a surface safety valve (SSV) is a fail-safe/shutdown valve installed at the upper wellbore for emergency shutdown to protect the production tunings. To control the flow of well fluids being produced and to regulate the downstream pressure in the flowlines, a production choke valve is used.

Specifically designed electric actuators, deliver advanced production choke valve actuation with non-intrusive operation, easy setup, proportional control, high accuracy, and low power 24 VDC power configuration. They are lightweight, compact and resilient, designed for long-life applications in the field.

Rotork Modular Electro-Hydraulic Solution combines the simplicity of electrical operation with the high torque/thrust and fail-safe fast-action capabilities of hydraulic high-pressure control for both rotary and linear valve actuation for fail-safe operation of the SSV valve.

Pneumatic diaphragm actuators have traditionally actuated upstream production process control valves. These mostly use well-stream process gas as their power medium and release methane whenever the valve is stroked.

To reduce methane emissions, many operators have replaced well-stream process gas with compressed air by deploying air compressor units at production sites.

An advanced, energy-efficient solution, are suitable for dump valves and back-pressure control valves that are common across upstream production processing applications. They not only help in achieving net zero emissions with a solar-powered 24 VDC supply option but also help reduce the overall life cycle costs compared to the instrument air actuator alternative.

Natural gas production metering and lease automatic custody transfer (LACT) for oil production metering represent a commonly accepted pivot between upstream operations and midstream gathering infrastructure.

Pipelines and valves are usually larger than those across the upstream production processing infrastructure and require higher torque/thrust ranges for valve actuation.

Multiple flow control systems operate together on a custody transfer metering skid to ensure low measurement uncertainty and high metering accuracy. Flow control on metering skids must be highly accurate, reliable and always provide safe valve operation.

To enable the automation of large control valves with high-pressure ratings, a high-output actuator, like the CML, can deliver increased linear thrust and stroke length.

CVA (quarter-turn and linear) delivers an accurate and responsive method of automating control valves without the complexity and cost of a pneumatic supply.

For applications that require lower modulating duty, the IQT3M Pro (multi-turn) has a duty cycle of 1800 starts/hour and provides a torque range and speed suited to the requirements of LACT valve actuation.

The gas lift uses high-pressure gas to lift the well fluids. Injecting gas into the tube causes the fluids’ density to reduce, and the bubbles’ ‘scrubbing’ effect on the liquids lowers the bottomhole pressure that flows through it. Due to gas continuously being injected into the production conduit, a reliable, adequate supply of good quality high-pressure lift gas is mandatory. The control valve requires continuous modulation to adjust the flow and pressure of injected gas.

An electric actuator, is designed for a 100% duty cycle and can operate with precision even for continuous modulating applications. It provides accurate and repeatable position control with up to 0.2% accuracy and S9/Class D continuous modulation capability. It is ideal for back-pressure lines in gas compressors and throttling valves on gas lift metering skids to ensure the required injection flow rates and pressures.

Produced water is the largest liquid produced in the oil and gas industry. The water from the well can be between 4 – 5 times the volume of produced gas or oil from the same well. The produced water is trucked or transported to water recycling tanks or saltwater disposal wells via extensive gathering lines. Across the entire produced water gathering, transportation, and disposal infrastructure are many actuated valves that ensure safe, reliable and efficient flow control of produced water.

Most control valves across the produced water infrastructure system need a high degree of controllability to prevent water hammering, while back-pressure control valves need to operate with the necessary high-level frequency and modulation duty to ensure optimal performance of water injection pumps. The CMQ and IQT3M Pro product lines offer adjustable speed, including slow mode for accurate positioning, high accuracy and high-resolution micro-step movement and adjustable torque/thrust protection.

Reliable and advanced automation solutions can help operators reduce emissions, improve process efficiencies and increase production output. Electrification of valve actuation will help reduce emissions from oil and gas operations. Selecting smart, low-power solutions that are perfectly suited for upstream oil and gas processes will help operators achieve emission reduction goals.

preventive maintenance, and safety in upstream oil and gas operations.

As energy consumption grows annually by more than 2%, society seeks responses to improve well-being, with the environmental aspect playing an increasingly significant role. The solution to this balance of addressing growing energy demand and demonstrating societal responsibility lies in emerging technologies, which enable clean energy sources, sustainable mobility solutions, and improved operational efficiency in the oil and gas sector, whose contribution to the energy ecosystem is absolutely essential. Enhancing operational efficiency means, among other things, maintaining productivity without emitting pollutants that contribute to poor air quality and global warming, therefore implying environmental regulation compliance while simultaneously reducing operational costs and increasing safety.

The sensorisation of assets enables operations to be optimised with minimal human intervention, or even fully autonomously. Operators can trust these sensors to anticipate component failures and take preventive corrective actions, as well as to detect early signs of gas leaks, fire outbreaks, or vandalism.

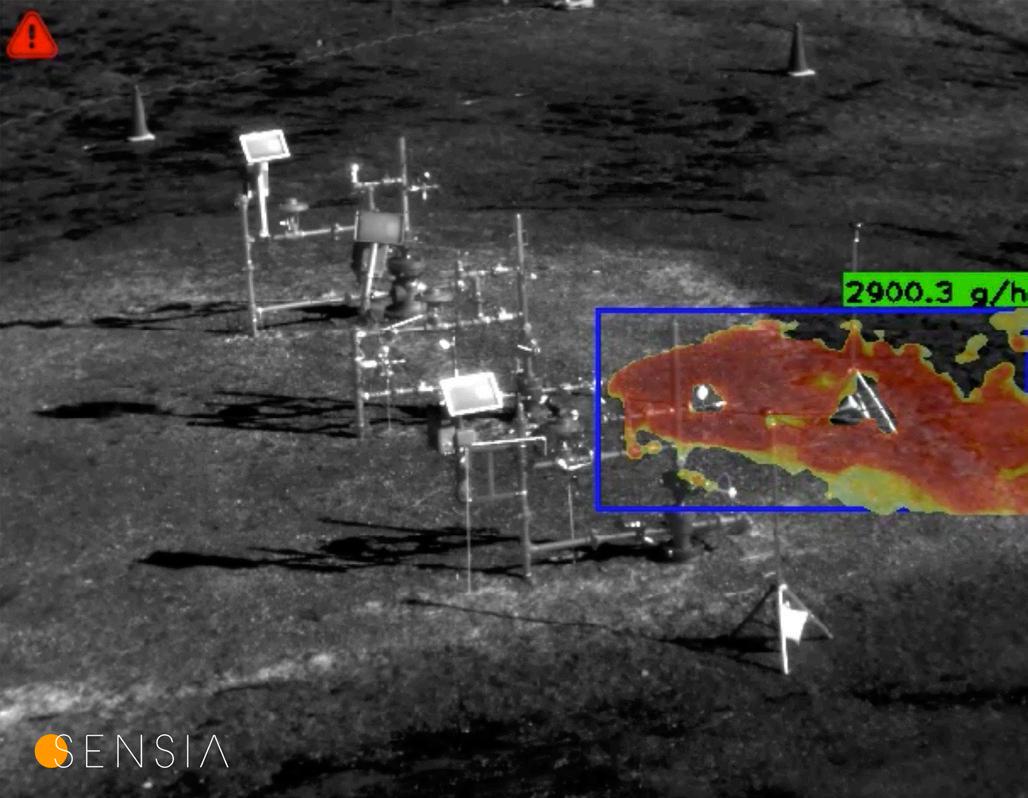

One of the most essential sensing technologies providing the highest level of multi-response capability is intelligent infrared (IR) imaging. Until recently, IR imaging has added significant value to industrial operations by enabling the remote detection of hot spots, gas leaks, and more, but under human supervision. However, advancements in microprocessor computational power and the breakthrough of artificial intelligence (AI) have now made it possible to automate real-time detection in IR cameras.

Smart IR imaging systems, as seen in Figure 1, are already transforming industrial operations with a particular added value in oil and gas operations through methane emissions monitoring at both onshore well sites and offshore platforms around the world. With the integration of AI-powered leak detection and quantification (LDAQ) algorithms to optical gas imaging (OGI) cameras, smart, IR continuous monitoring systems are helping operators meet critical methane emissions reporting under the Oil and Gas Methane Partnership (OGMP) 2.0 framework and regulation from the European Union and the United States while boosting health, safety and environment (HSE) standards. This gamechanging solution for continuous monitoring in upstream oil and gas is already playing a pivotal role in real-world projects, such as measuring flare combustion efficiency and gas leak monitoring at wells in the Permian Basin and autonomous methane emissions monitoring on sustainable platforms in the North Sea and platforms off the coast of Nigeria. This article will explore how smart IR monitoring systems are redefining methane emissions detection and quantification, the role the technology plays in compliance with international regulatory requirements for methane, and how it supports ongoing global efforts toward safer, more sustainable, and more efficient oil and gas production.

Recognising the implied urgency due to increasingly worrying climate reports, regulatory bodies and climate initiatives around the world have increased the pressure on the oil and gas industry to monitor and mitigate methane emissions. This is where advanced technologies like smart continuous infrared monitoring systems come into play, offering precise and reliable solutions that help operators not only identify and manage methane leaks but also comply with increasingly stringent regulations.

One of the key frameworks that smart infrared monitoring systems address is the OGMP 2.0 (Oil and Gas Methane Partnership 2.0) initiative, launched by the United Nations Environment Programme (UNEP). The OGMP 2.0 member framework sets a benchmark for methane emissions reporting for its signees, requiring operators to provide source and site-level quantitative methane emissions data at the highest reporting level. This reporting system is rigorous, given that it requires operators to provide direct quantitative measurements and reconciliation of site-level versus source-level data. Under OGMP 2.0, operators are expected to report methane emissions from five key source categories: equipment leaks, venting, flaring, incomplete combustion, and pneumatic devices, among others. Moreover, upstream operators must also collect this data from both onshore and offshore sites, with an emphasis on reducing methane emissions to meet the broader goals of the Paris Agreement.

Beyond the OGMP 2.0 framework, operators in the oil and gas sector must also contend with a rapidly evolving landscape of national and international methane regulations, particularly in the EU and the Americas. In Europe, the European Commission has rolled out EU Regulation 2024/1787

aimed at significantly reducing methane emissions from the energy sector, requiring quantitative measurements of all aspects of oil and gas operations and will eventually be extended to all oil and gas imports into the EU. Similarly, in the US, methane emissions from the oil and gas sector are under scrutiny. The Environmental Protection Agency (EPA) has introduced sweeping methane regulations OOOOa, OOOOb, and OOOOc requiring operators to use advanced technologies for leak detection and quantification and flare combustion efficiency, including OGI cameras.

Smart IR imaging technology, with its advanced methane leak detection and quantification capabilities, is ideally suited to help operators comply with both EU, US, and other national emissions regulations and paint a more truthful picture of operator emissions. Its ability to detect and quantify methane emissions in real-time not only ensures compliance but also helps operators mitigate leaks before they become environmental, safety, or regulatory nightmares rather than awaiting periodic inspections.

The basics of smart IR imaging technology and the role of AI

Smart IR imaging systems require state-of-the-art IR cameras supported by AI-powered processing software and analytics, forming a complete, autonomous solution very few companies offer and even fewer have mastered. As is widely known, IR imaging is used in a wide variety of applications from surveillance to gas detection. A multitude of gases normally

invisible to the naked eye have an absorption presence in the IR spectrum, including most hydrocarbons like methane. There are clearly defined IR adsorption levels of methane (CH4) and other hydrocarbons in mid-wave (MWIR) and long-wave (LWIR), although SWIR is so similar to visible light that it requires sunlight to perform detection of only very big leaks whereas cameras based in other regions of the IR spectrum can operate day and night detecting smaller leaks as well. OGI cameras are equipped with spectrally tuned IR detectors to see just in narrow IR bands. To summarise, these detectors reveal in infrared what is invisible for the naked eye like the temperature of the components, invisible flames and gases, but that is only the beginning.

AI analytics and the proper electronic components are responsible for the last steps in smart IR imaging, the actual detection confirmation of gas, flame, temperature, people, flares, pilot flames etc. which is then followed by alarm generation and communication to the distributed control system (DCS), report creation, and other preset actions. AI utilised in smart infrared monitoring systems is trained with various laws of physics, hundreds of real scenarios of different detection targets, resulting in faster, more accurate and reliable performance without the need of human oversight. In addition to real-time gas detection and quantification at site and component levels, intelligent infrared imaging technology can perform flame detection, intelligent thermography, surveillance, flare efficiency monitoring, adding even more safety and environmental benefits for operators. Figure 2 and Figure 3 show detection and gas leak quantification examples from the field.

Incomplete combustion of flares is labelled by regulatory bodies and environmental groups as another main source of methane emissions. Smart infrared imaging is able to address new minimum flare efficiency requirements by not only visualising unburned hydrocarbons such as methane, but also simultaneously comparing the unburned input gases to the resulting carbon dioxide output. As carbon dioxide and hydrocarbons are both present in the infrared spectrum but at different wavelengths, a bi-spectral camera such as the system shown in Figure 4, is needed to assess the gases at different infrared bands. As seen in Figure 5, operators are granted realtime reports of flare conditions and efficiency changes in terms of destruction and removal efficiency or combustion efficiency according to operator needs, drastically improving measurement accuracy and frequency to meet regulatory requirements.

Upstream sites, onshore and offshore alike, continue to adopt and consider this new approach to methane emissions monitoring and quantification. From new sustainable platforms in the North Sea, other platforms off the Nigerian coast and in Southeast Asia, to well sites in the Permian Basin, and more regions of the globe, operators from oil and gas majors are acting on the advantages of smart infrared monitoring systems for methane emissions measurements, surveillance, and preventive maintenance. In one offshore case, an intelligent infrared system was implemented in one specific compressor room in an offshore platform. The system offered a real-time view of methane emissions, facilitating quick response to any anomalies with visual confirmation. It resulted in the complete mitigation of leaks, upgrading the safety and environmental standards to the

next level. In addition, the intelligent thermography functionality spotted components that were operating above maximum temperature thresholds and created alerts to anticipate a component failure.

On another offshore case, an explosion-proof camera and panand-tilt system for autonomous emissions monitoring of multiple areas was installed on a sustainable platform running completely off wind power in the North Sea. The system continues to perform at the highest caliber even in the harsh offshore environment, where traditional methane detection methods can be difficult to deploy and maintain. The technology’s ability to provide realtime, site-level emissions data is essential for both regulatory compliance and operational efficiency, allowing the operators to further minimise its environmental impact while maximising production on a sustainable platform.

In the Permian Basin, well site operators from several majors are opting for a semi-continuous monitoring system mounted

on a mast and trailer that autonomously monitors a large area of well sites for a pre-determined period ranging from several weeks to several months around the clock. The system autonomously performs tours of key well sites, spotting, quantifying and recording any leaks it finds. The lower required investment of well operators for this approach and added flexibility due to the ability to transport the system to different locations after a campaign made it even more ideal. Although this is a semi-permanent approach and isn’t considered fully continuous monitoring, the length of the campaigns and 24 operation allows operators to conduct leak detection and quantification campaigns as the conditions change at the site, a major difference from alternative solutions.

As most flaring in the oil and gas sector takes place in upstream sites, flare efficiency monitoring solutions using smart infrared are of the upmost interest. Even capable of observing multiple flares from the ground or a mast with the correct supporting equipment, operators program tours and presets to monitor flares around the clock completely unattended. The continuous readings over long periods of time offer a plethora of valuable information regarding efficiency that before simply were assumed or estimated.

The oil and gas industry is at a crossroads, facing increased pressure to reduce its environmental footprint while maintaining operational efficiency with demand projected to continue increasing. Technologies like smart infrared imaging with AI-powered software and analytics with cutting-edge IR cameras are helping operators navigate regulatory and safety challenges by providing the tools they need to monitor, report and reduce methane emissions and accidents in real-time. As methane regulations continue to tighten, both at the international and national levels, the importance of reliable, precise methane emissions monitoring will only increase. The versatility of intelligent IR systems provides real-time data at both source and site levels and makes it an indispensable tool for any operator looking to stay ahead of the regulatory curve as well as boost operational efficiency and safety. Moreover, as more operators adopt advanced technologies like smart infrared monitoring systems, society as a whole will move closer to achieving its sustainability and digitalisation goals, reducing contributions to global methane emissions, mitigating the impacts of climate change while also overcoming health, safety and environment challenges.

Smart infrared technology for continuous methane emissions monitoring, preventive maintenance, and personnel surveillance represents a significant step forward in digitalisation for the upstream oil and gas sector. By providing real-time, AI-driven insights into methane leaks over longer periods of time compared to intermittent technologies, smart infrared helps operators meet the stringent requirements of frameworks like OGMP 2.0 while also complying with new EU and US methane regulations. Successful deployments and increased adoption at well sites and platforms of oil and gas majors in Europe, the Americas, Africa and Asia highlights its potential to enhance methane emissions monitoring in terms of fugitive emissions and flare efficiency. Smart infrared truly is a game-changer for emissions monitoring, preventive maintenance and safety in upstream oil and gas.

Volker Peters (Germany) and Daniel Bell (USA), Baker Hughes, describe the challenge of HFTO, and how a new torsional dampener tool can suppress oscillations and improve operation.

he ability to drill longer horizontal wells and laterals improves well economics but pushes the technical limits of bottomhole assemblies (BHAs) in complex well designs. A key challenge introduced is high-frequency torsional oscillation (HFTO): self-excited vibration resulting from bit/rock interaction that can cause premature damage to drilling tools and components, leading to increased capital costs and unplanned downtime. Engineers have been working for decades to understand and resolve HFTO, but until recently, tools designed to mitigate vibration have been only marginally successful.

Figure 1. Depth based averaged surface and downhole data. (Image courtesy of Baker Hughes). Graphic is from SPE-217677-MS ‘Effectiveness of HFTO-Dampener Assembly Proven by Extensive Case Study in Permian Basin’ presented at the IADC/SPE International Drilling Conference and Exhibition, Galveston, Texas, March 2024, https://doi.org/10.2118/217677-MS

Figure 2. Depth based averaged surface and downhole data. (Image courtesy of Baker Hughes). Garphic is from SPE-217677-MS ‘Effectiveness of HFTO-Dampener Assembly Proven by Extensive Case Study in Permian Basin’ presented at the IADC/SPE International Drilling Conference and Exhibition, Galveston, Texas, March 2024, https://doi.org/10.2118/217677-MS

HFTO and traditional solutions

HFTO typically occurs in the BHA, generating dynamic oscillations in the range of ~50 Hz to ~400 Hz. The vibration motion-induced twist in the drill string causes dynamic torque, which increases the load on drill string components. One of the unfavourable consequences is premature fatigue damage of tools and components, resulting in slower drilling for mitigation and more nonproductive time (NPT). Another is damage to sensitive components – such as sensors, electronics and even connectors and electrical wires –caused by acceleration.

Many tools that claim to address HFTO have had limited success because they focus exclusively on managing bit induced stick-slip, which is caused by the bit-rock cutting interaction and results in drill bit rotation alternating between periods of slowing down and suddenly accelerating. Stick-slip tools, placed above the BHA, reduce stick-slip vibration between axial and torsional degree of freedom via a mechanical coupling (a spline connection or wire ropes) to initiate axial motion when torque changes occur. The tools themselves mitigate vibration by reducing the depth of cut through reduction of weight on bit (WOB).

If HFTO is not mitigated properly, WOB and/or bit rpm has to be reduced to limit vibrations to acceptable levels, which in turn reduces rate of penetration (ROP). Costly reductions in ROP are impediments for achieving optimal field economics, but an equally significant problem with such axial-torsional coupling tools is that they focus primarily on stick-slip, and only occasionally reduce levels of HFTO. The result is that, although these tools have proven marginally successful in reducing HFTO, in instances where downhole conditions demand higher dampening, the tools are unable to resolve it.

The shortcomings of traditional tools that address HFTO led Baker Hughes to invest in research to better understand what happens downhole to incite excessive vibration and how models could be developed to better comprehend it. Employing the results of this research, engineers designed a torsional vibration dampener tool that is purpose built to suppress all modes and instances of HFTO for all drilling parameters employing a novel design with no load bearing components that have differential motion, unlike the axial - torsional coupling.

The unique tool is one rigid piece that is affixed to the BHA. It has no parts requiring grease-filled compartments that need to be protected with dynamic seals like some stick/ slip solutions. This design eliminates reliability concerns because there are no moving mechanical parts, bearing drilling load. Torque and drilling nodes are fed through rigidly connected collars.

The function principle is based on an internal inertia mass that can freely rotate with respect to the centre of the drilling system but is connected to the BHA by a dissipative force. When no torsional vibrations are present, the inertia mass rotates together with the BHA. In the presence of HFTO, inertia mass resists the motion of the vibration. Designed and built to suppress HFTO holistically, this tool creates sufficient dampening in a frequency band of 50 – 500 Hz.

The dampening tool is most commonly run on top of the BHA, although in cases where a downhole motor is used, the dampener is placed below the motor. In either configuration, the tool is handled like a regular drilling tool, with no need for special setups or electrical configurations. Due to its design and placement on the BHA, the dampener does not compromise formation evaluation sensor positioning or the steerability of the rotary steerable system.

Figure 3. This chart shows the amount of HFTO time per circulating time for runs using the two competitor vibration mitigation tools and the GuardVibe HFTO tool. (Image courtesy of Baker Hughes). Graphic is from SPE-217677-MS “Effectiveness of HFTODampener Assembly Proven by Extensive Case Study in Permian Basin” presented at the IADC/SPE International Drilling Conference and Exhibition, Galveston, Texas, March 2024. https://doi.org/10.2118/217677-MS

This unique technology enables dampening of high-frequency torsional oscillations for the entire BHA, which provides several benefits to the drilling operation. It extends the operating life of the BHA, improves stability, efficiency, and directional control while drilling through transitions, achieves higher ROPs by not holding back ROP because of vibration, and extends run life downhole. It also expands the drilling envelope by allowing harder formations to be drilled without reducing the drilling parameters.

Figure 4. Mean Time between Failure (MTBF) of the BHA. Graphic is from SPE-217677MS ‘Effectiveness of HFTO-Dampener Assembly Proven by Extensive Case Study in Permian Basin’ presented at the IADC/SPE International Drilling Conference and Exhibition, Galveston, Texas, March 2024, https://doi.org/10.2118/217677-MS

To ensure vibration dampening is sufficient, specifications for the entire BHA string that will be used on the drilling job are entered into a software model, and a piece of code adapted for the software optimises the placement and the performance of the dampening devices. The software tries different numbers of devices and all possible configurations and selects one in which the efficiency of the dampeners is maximised for all anticipated scenarios. Tools are positioned according to dampening demand, and engineers can tailor parameters and performance outputs as HTFO levels increase and can dampen them appropriately, so they are not damaging or obstructive. This level of performance is not achievable with other vibration mitigation tools.

All Baker Hughes dampener tools are laboratory tested to extremes for durability and reliability using cyclic bending, shock and vibration, temperature, pressure testing methods. Functional testing of dampening performance is executed with scaled lab samples using multiple sensor elements.

The entire BHA, with the torsional vibration dampener attached at the top of the drilling BHA (but below the

mud motor if one is used) is preconfigured for the job. The appropriate vibration dampening configuration is delivered to the rig site as one piece ready to install. The presence of the tool on the BHA does not restrict drilling in any way. The only noticeable difference between a BHA without the tool and a BHA with the tool is HFTO suppression.

Field tests over the course of more than 350 drilling runs, primarily in harsh environment conditions in the Midland and Delaware sub-basins in the Permian Basin – where extended reach drilling is common – delivered 98% of the circulation time free of HTFO.

Results from two of these field implementations illustrate how the torsional vibration dampening technology performed in real-world conditions in comparison to other HTFO management tools on the market.

In the first application, the Baker Hughes GuardVibeTM high-frequency torsional oscillation dampener technology was employed in the first instance in the curve and drilled the first part of the lateral section (Figure 1). The BHA was tripped because of bit wear and low ROP, and in a second run, the proprietary HFTO tool was used again in the lateral section. In both runs, the BHA experienced

nearly no HFTO and maintained an ROP between 300 ft/hr and 120 ft/hour. In the second run, there were slightly increased levels of tangential acceleration between 13 000 ft and 14 000 ft, indicating that the GuardVibe HFTO tool was dissipating energy to prevent HFTO from rising to its plateau amplitude.

In Figure 1, the green tracks represent data acquired from runs with the GuardVibe HFTO tool. The yellow tracks represent data from a run with a commercially available stick-slip tool. Tangential acceleration (HFTO), represented in the second track from above, is mitigated and suppressed using the GuardVibe HFTO tool. Conversely, HFTO is largely present using the commercially available stick-slip tool. For reference, ROP, WOB and rock formation properties are displayed as well, in the three bottom tracks.

After a motor failure at the end of the second run, a different vibration mitigation tool was deployed (Competitor 2). The results using this traditional tool were suboptimal, with high HFTO levels throughout the run, which negatively impacted ROP. Using the traditional tool also required WOB to be reduced to mitigate vibration. The formation values in this run were similar to those where the GuardVibe HFTO tool had been deployed, indicating that downhole conditions like these are likely to produce high HFTO levels, which can be successfully suppressed using the proprietary technology.

In a second application, the GuardVibe HFTO tool was benchmarked against vibration mitigation tools from two other vendors (Figure 2). A load sensor mounted on the BHA measured dynamic torque, while accelerometers positioned in two areas – one next to the load sensor and the other farther up the BHA – measured tangential acceleration amplitude and dominant frequencies.

The first run was drilled with the tool from Competitor 1, the second run was drilled with the tool from Competitor 2. The third and fourth runs were drilled with the GuardVibe HFTO tool. All runs were conducted in the lateral section.

In Figure 2, the blue and yellow tracks represent data from separate runs using two commercially available stick-slip tools. The green track represents data acquired from runs with the GuardVibe HFTO tool. Tangential acceleration (HFTO), represented in the second track is mitigated and suppressed using the GuardVibe HFTO tool, but HFTO is largely present using the two commercially available stick-slip tools. For reference, ROP, WOB and rock formation properties also are displayed in the three bottom tracks.

The BHAs for both Competitor 1 and Competitor 2 experienced high HFTO-related loads, with different levels/ plateaus of tangential acceleration measured. This was caused by different dominant HFTO frequencies between 200 Hz and 300 Hz. The GuardVibe HFTO tool, on the other hand, mitigated HFTO to amplitudes close to zero. Even in formations that were tougher to drill, represented for example by the section between 14 000 and 16 000 ft, indicating a harder rock formation, where WOB was set to high levels but resulted in comparably low ROP, the GuardVibe HFTO tool eliminated HFTO altogether.

To carry out benchmarking, 44 runs were drilled using the proprietary tool, 113 runs were drilled with

the vibration mitigation tool from Competitor 1, and 39 runs were drilled with the vibration mitigation tool from Competitor 2 (Figure 3 and Figure 4).

In this case, the vibration mitigation tools were placed between the mud motor and the wired part of the BHA. All the runs were carried out in comparable target formations, with similar PDC bits and BHAs.

The duration of HFTO in hours per 1000 hr circulating time for the vibration mitigation tools is shown in Figure 3. The GuardVibe HFTO tool experiences close to zero time with HFTO. The runs with Competitor 1 experienced an average of more than 26 hours/1000 hours drilled, and the runs with Competitor 2 experienced an average of more than 138 hours/1000 hours drilled.

It is important to recognise that the reliability of this tool and the reliability of the other BHA components are all important for project economics. In this drilling programme, the runs using the GuardVibe HFTO tool had a significantly higher reliability with Mean Time Between Failures (MTBF) at least 100 % higher than Competitor 2 and about 50 % higher than Competitor 1 for the complete BHA, including the dampener tool (Figure 4, MTBF).

MTBF is a key performance indicator of NPT and represents cost drivers in drilling operations. Figure 4 shows that mitigation of HFTO exposure directly correlates to reliability measures of the drilling BHA. The runs using the GuardVibe HFTO tool experienced close to zero HFTO (eg ~twice MTBF achieved using the tool from Competitor 2, which had the highest percentage of HFTO). The intrinsic, high reliability of the dampener tool design, along with its ability to mitigate HFTO, are key to the excellent overall performance in the application.

Thus far, nearly all of the tool installations have been in the Permian Basin using 4.75 in. tools, which creates a compelling case for employing the technology elsewhere. Already, the technology is being used extensively in drilling applications in Argentina, and there are opportunities in the Eastern Hemisphere – in drilling programmes in areas like China and Saudi Arabia where HFTO is a challenge – where this technology could significantly improve performance.

Designed to be agnostic, this tool can be used in all rotary steerable drilling applications. Recent field deployments in Saudi Arabia have proven effective in conjunction with complex MWD/LWD (Triple Combo) drilling BHAs. Unlike the deployments in the Permian Basin, the drilling runs carried out in Saudi Arabia were performed using a rotary from surface, without a drilling motor. This is a significant achievement because in Saudi Arabia, where drilling with advanced LWD tools is common and drilling programmes are non-motor assisted, traditional HFTO solutions have been either inefficient (stick-slip mitigation tools) or have displayed other deficiencies, like reducing torque throughput or increasing sensor offset.

As more data is gathered from more drilling environments, it will be possible to tailor solutions for a broader range of applications and in time, develop additional tool sizes to enable more efficient drilling programmes in every corner of the world.

Mariano Guerrico, Global Technology Manager, Tracerco, describes how cutting-edge technology has transformed flow control and monitoring, showcasing a case study from the Santos basin offshore Brazil.

nsuring consistent, efficient production in offshore oil and gas operations has never been more challenging. As reservoirs mature and fields become increasingly complex, operators must contend with issues such as slugging, hydrate formation, and sand production, all of which can compromise flow assurance and pipeline integrity.

Traditional measurement and inspection methods are often intrusive and disruptive, and don’t provide the real-time insights needed to optimise production and maintain regulatory compliance. Non-intrusive, real-time diagnostics help operators maximise uptime, reduce costs and enhance safety.

Overcoming flow assurance challenges through nonintrusive monitoring

Flow assurance issues pose a constant risk to production efficiency. Severe slugging can cause unstable production rates and increase wear on equipment, while hydrate formation can lead to blockages that require costly shutdowns to

resolve. Sand production further complicates operations, risking erosion damage and compromising pipeline integrity.

Historically, identifying and diagnosing such problems relied heavily on intrusive monitoring tools or required halting production to conduct inspections – both of which not only impact operational efficiency, but can also expose personnel to greater safety risks during physical intervention.

Operators today face ever-tighter regulatory scrutiny, making continuous, accurate monitoring essential not only for production optimisation, but also for environmental and safety compliance.

A recent collaboration with Brava Energia in the Atlanta Field, located in the northern Santos Basin approximately 185 km southeast of Rio de Janeiro, perfectly illustrates the benefits of Tracerco’s approach. The field holds an estimated 1.8 billion bbls of original oil in place (OOIP). Discovered in 2001, this ultradeepwater field sits beneath 800 m of overburden at a water depth of 1550 m. It is operated by a consortium led by Brava Energia (80%) and Westlawn (20%).

This case study showcases the evolution of oil and water contribution by using Tracerco tracers and also Autonomous Inflow Control Devices (AICD). Atlanta Field is a post-salt heavy oilfield. Several challenges of the field needed to be considered: unconsolidated sandstone, heavy/viscous oil (14˚ API, 228 cP), high water cut risks, and no injection wells - making precise reservoir management critical.

The primary reservoir, located in the Eocene interval, comprises high-quality sandstone with net-to-gross ratios between 82 - 94%, porosity averaging 36%, and permeabilities ranging from 4 to 6 Darcy. However, despite its favourable rock properties, the oil is heavy (14˚ API), viscous (228 cP), and acidic (TAN = 10 mg KOH/g). The reservoir benefits from a strong bottom aquifer, eliminating the need for injection support.

To manage technical and economic risks, the field development was phased in two parts:

Ì Early production system (EPS) from 2018 to 2024, with four horizontal producers and a 30 000 bpd capacity FPSO. Ì Full field development (FFD) to expand to 12 producers connected to a new FPSO (ATLANTA FPSO) capable of handling 50 000 bpd.

To optimise production and mitigate water breakthrough risks, Tracerco deployed oil and water polymer tracers across multiple horizontal wells. These were paired with AICDs (wells ATL-4HB and ATL-5H) and Open Hole Horizontal Gravel Pack completions. The goal was to assess oil inflow distribution along the wellbore, early water ingress, and AICD effectiveness

in moderating flow and extending well performance.

The EPS was projected to de-risk reservoir uncertainties such as: well productivity, inflow performance along the horizontal section of the well, and aquifer support.

Mariano Guerrico, Global Technology Manager at Tracerco, said: “Understanding these unknowns was essential to define the drainage strategy and Full Field Development (FFD) design. To improve economic results, long Open Hole Horizontal Gravel Pack wells were required. After the completion of the first two wells, the decision was made to integrate Autonomous Inflow Control Devices (AICDs) into the screens. To evaluate oil inflow distribution, water breakthrough, and AICD performance along the horizontal well sections, oil and water tracers were strategically placed at different positions along the screens.

“Tracer production data, combined with EPS dynamic data such as PDG pressures, build-up tests, water cut trends, and Gasto-oil Ratio (GOR) behaviour, delivered a new level of insight into aquifer drive dynamics, water production, and well productivity index performance. This robust dataset was instrumental in shaping the updated FFD plan for Brava Energia at the Atlanta Field.

“The successful application of tracers played a vital role in mitigating reservoir risk and optimising the development of this heavy oil deepwater asset with a significant underlying aquifer. With encouraging first results from the Atlanta FPSO’s full production phase, the Early Production System project stands as a clear success that de-risked and accelerated the path to full-field execution.”

Tracers were installed in four key EPS wells and high-frequency oil sampling along with lab GC-MS analysis were used to track flow from individual zones. Tracer results were used to refine the Full Field Development (FFD) design, including artificial lift (seabed multiphase pumps). To understand the behaviour of each sand zone identified in the Atlanta reservoir, the tracers were strategically positioned considering at least one oil and water tracer per each sand zone. Also, at least one oil and water tracer was positioned in the well heel and toe.

Tracer results and flow behaviour are presented for wells ATL-2HP, 3H, 4HB, and 5H.

ATL-2HP

Ì Oil flowed from all tracer points.

Ì Initial flow favoured toe region (3332 - 3462 m).

Ì After shut-in, flow contributions shifted, and production became more evenly distributed.

Ì Water flow also initiated from toe zone, declining post shut-in.

ATL-3H

Ì Oil flowed from all sections.

Ì Early flows were toe-dominant, later shifting to the heel.

Ì This dynamic inflow shift indicates evolving pressure and saturation patterns over time.

ATL-4HB

Ì Heel (2819 - 2996 m) contributed most of the oil production (63%).

Ì Water ingress was highest at tracer T-931 (3458 m), activating AICDs and limiting flow there.

Ì Adjacent oil tracer T-701 became undetectable, confirming AICD effectiveness in high-water zones.

Ì Heel-mid zones dominated oil production; toe flow declined in later samples.

Ì Water entry was highest in the heel; toe water increased over time.

Ì This evolution reflected the balancing effect of AICDs in response to rising water saturation.

This strategy proved highly beneficial - equalised inflow and water breakthrough delay was observed in the wells equipped with AICDs and tracers. Well ATL-4HB, located at the reservoir’s structurally highest point, showed the slowest water production increase and strongest AICD effect. The non-intrusive insight into fluid dynamics helped optimise completion design and de-risk the FFD strategy - directly improving productivity and reducing OPEX.

In order to enable the inflow tracer analysis, oil samples were collected after the startup of the wells or expected shutdowns usually for a 48 hour high frequency sampling campaigns. For the water tracer analyses, when absent of free water, the oil samples were submitted to the procedure of extraction using mainly proper demulsifiers. Then, the oil and water samples could be analysed for chemical tracers at the Tracerco laboratory in Rio de Janeiro by gas chromatography with mass spectrometry (GC-MS).

The project delivered a clear, quantifiable impact: the EPS phase alone yielded 30.7 million bbls of oil and informed a refined full field development plan involving 12 producers. By providing real-time, zone-specific inflow and water data without the need for intervention, Tracerco helped reduce operational uncertainty and supported more confident, data-driven decision-making.

Overall, the Atlanta EPS phase achieved its main objective: de-risking the reservoir and informing the FFD strategy. Key takeaways include:

Ì AICDs significantly enhance water control and flow uniformity.

Ì Tracer data validated inflow behaviour and confirmed well productivity trends.

Ì Multiphase seabed pumps outperformed in-well ESPs in terms of reliability and economic efficiency.

Ì The FFD wells maintain strong productivity with no observed design-related performance issues.

Future tracer data from ATL-6H and 7H will further refine the understanding of Atlanta’s reservoir performance, supporting ongoing production optimisation and field longevity.

Beyond specific case studies, the broader advantages of Tracerco’s non-intrusive flow monitoring solutions are clear. Operators benefit from faster diagnostics, allowing for immediate decisionmaking and remediation before problems escalate. Production efficiency is significantly enhanced by optimising flow rates and separation processes without the need for interruption. Cost savings are achieved not only by reducing downtime but also by limiting the frequency and cost of maintenance interventions.

sampling period during the clean out.

As offshore fields become more complex and production systems more demanding, the role of advanced, non-intrusive monitoring will only continue to grow. By offering real-time, accurate, and safe solutions for flow monitoring and integrity assurance, Tracerco is helping operators in North America, the UK, Europe, and South America stay ahead of operational challenges, optimising production while safeguarding both people and assets.

Kostas Sklikas, MBA, Global Product Marketing Manager, Brooks Instrument, summarises the roles and advantages of variable area flowmeters in offshore drilling.

Offshore oil platforms face some of the most demanding environmental and operating conditions. There is constant exposure to extreme temperature ranges, saltwater, severe storms and corrosive spray. These rigs typically operate roundthe-clock, reaching thousands of feet down into the water and then drilling through multiple geologic layers for well exploration and production.

Under these hazardous and challenging conditions, offshore rig operators need rugged and reliable instruments to help measure, monitor and safely control all their complex systems. Accurate flow measurement of the delivery of drilling fluid at controlled high pressures is one of the most critical drilling rig system requirements. Variable area (VA) flowmeters offer that performance. They are proven, reliable, well-engineered flow measurement devices used in a wide range of oilfield and offshore platform applications.

Drilling fluid, also called mud, is a complex, often proprietary chemical mixture that performs multiple functions when drilling

a well. It is typically a heavy, viscous mixture, with many types of fluids used on a day-to-day basis. Some are water-based, some are oil-based or synthetics, and all can incorporate a range of additives, such as lubricants, shale inhibitors and fluid loss materials.

Different types or combinations of fluids are used as substrate conditions change. Fluid management involves a complex delivery and recirculation system that performs several functions during drilling. These include:

Ì Cleaning the hole by transporting drilled cuttings to the surface, where they are removed from the fluid before it gets recirculated down the bore hole.

Ì Supporting and stabilising the walls of the wellbore until casing can be set and cemented into the wellbore.

Ì Preventing or minimising damage to the producing formation.

Ì Cooling and lubricating the drill string and bit.

Ì Transmitting hydraulic horsepower to the bit.

Ì Providing rig operators with information about the producing formation through cuttings analysis, logging-while-drilling data and wireline logs.

VA flowmeters offer rugged reliability and accuracy

While there is a range of options for monitoring drilling mud flow, one of the most effective and reliable tools is the metal tube VA flowmeter. VA flowmeters are extremely versatile and widely used in a range of industrial applications, particularly in chemical plants, oil refineries and offshore rigs, to measure and control applications involving high fluid flowrates and pressures. The basic technology, first developed over a century ago, provides a simple and reliable means to measure fluid flow.

The main elements of a VA flowmeter include the tube and the float. The tube is fixed vertically, and the fluid is fed from the bottom. The float inside the tube moves in proportion to the rate of fluid flow and the area between the tube wall and the float. When the float moves upward, the area increases while the differential pressure decreases. A stable position is reached when the upward force exerted by the fluid is equal to the weight of the float. This enables measurement of the flowrate by a scale, or a mechanical or magnetic follower connected to the float and driving a meter display external to the tube.

Due to the conditions in offshore drill rig applications, metal tube VA flowmeters are typically specified. They

Figure 1. Variable area flowmeters like the MT3809G from Brooks Instrument are durable and accurate for high-pressure and extreme temperature applications. For offshore applications, well-constructed VA flowmeters typically use 316/316L Dual Certified stainless steel with Alloy 625, Hastelloy C-276 or Titanium GR II.

are suitable for temperatures and pressures common in these environments and are generally manufactured of stainless steel, aluminum or brass. For offshore applications, well-constructed VA flowmeters typically use 316/316L Dual Certified stainless steel with Alloy 625, Hastelloy C-276 or Titanium GR II.

Easy to install, use and maintain, VA meters offer many benefits in flow metering solutions:

Ì No power required – a majority of VA applications are mechanical indicator-only, and therefore no power is needed to measure flow. Costly wiring is not required and the VA meter can be installed in any hazardous area.

Ì Low pressure drop – VA meters can be installed in multiple locations over one process line without significant pressure loss.

Ì Repeatability – VA meters are often used for flow measurement due to high repeatability of measurement.

Ì Cost-efficiency – VA meters are generally lower in initial cost as well as lifetime costs, with little need for maintenance.

Ì Versatility – manual control valves are available, from very small meter sizes to 2 in. line size meters.

Ì Material availability – options are available for different types of metal tubes.

Given these key functional and operational features, many offshore rigs utilise metal tube VA flowmeters to monitor and control drilling fluid flowrates. Devices like the MT3809G VA flowmeter from Brooks Instrument offer key advantages for consistent, repeatable pumping of drill mud under severe process conditions.

They are engineered and manufactured for years of use, with corrosion-resistant and stainless-steel housings that can withstand high pressures up to 885 bar. They are also designed for reliable performance, regardless of the range of drilling fluid mixtures used throughout the drilling process, which can change as conditions change in the producing formation.