1 minute read

Quick Introduction

The question is “for these two GL accounts what are the reporting and analysis requirements?”. There are several basic options:

— Report on them as individual line items (rows)

— Combine them into a single line item (row) for “Professional Insurance”

— Roll them up into a more generic line item (row) for “Insurance” and add 5 other GL

Insurance accounts

— Roll them up into an even more generic line item for “Firm Business Expenses”, combining them with 50+ other GL accounts.

— So how do we determine which solution is best? There are two basic questions:

1. Will both costs use the same allocation method? If not, then they should be in separate

Profit Accounts. (Alternatively, we can define a Profit Account variant and leave it defined as a single Profit Account)

2. Will the firm want to see these costs broken out as separate line items when reporting on profitability? If “No” and they have the same allocation method, then we will want to combine them.

BEST PRACTICES

— Choose “Aggressive Rollup”, and keep the number of Profit Accounts to around 20 or less.

— A key benefit of aggressively rolling up is that your cube is more “defensible”. Think of it this way: the more profit accounts and allocations that you have, the more opportunities that there are for the lawyers in your firm to question the allocations and request more exceptions. So once again, we strongly recommend that you keep it simple by limiting the number of Profit Accounts.

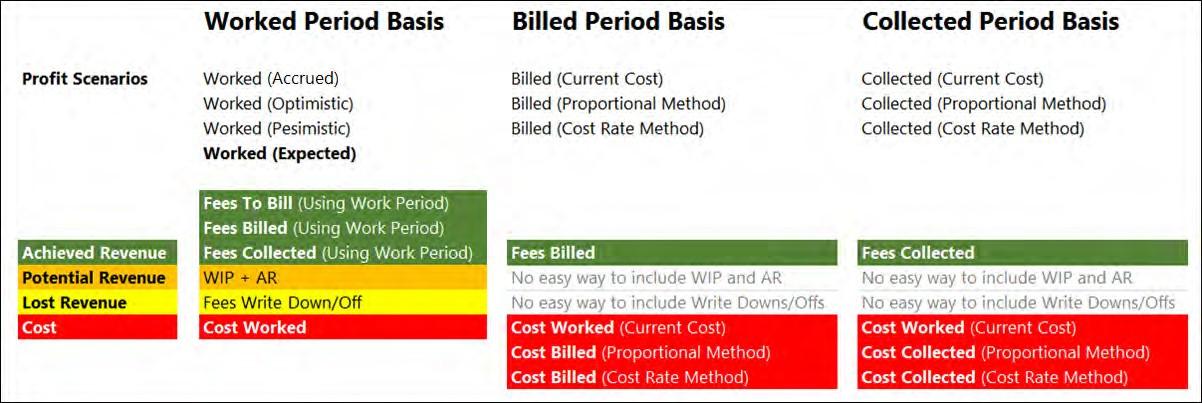

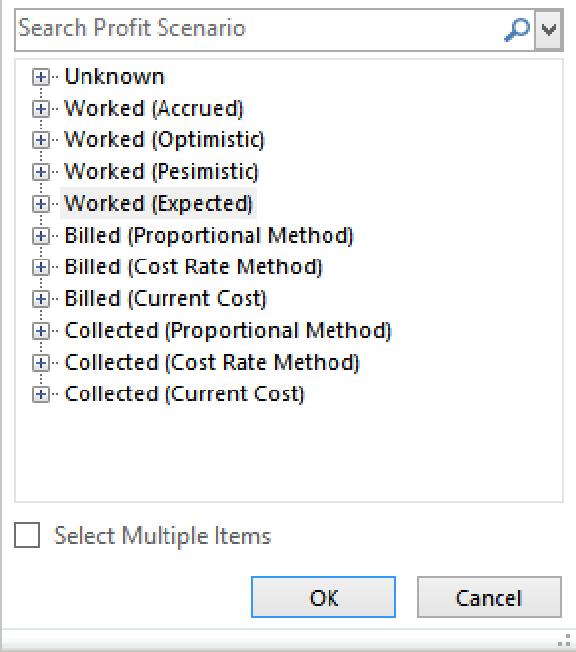

Profit Account Types

Each Profit Account is assigned to a Profit Account Type. This is a high-level grouping of Profit Accounts that defines the first tier of the Profit Account hierarchy. The list of the types is defined by Iridium and cannot be changed. But you still have the choice to assign every Profit Account to one of the Profit Account Types.

Please note for each Profit Account Type, there is a measure in the cube with the same name. So, assigning the Type to each Profit Account controls what value will be calculated in the associated measure.