14 minute read

Best Practices Topics

Estimated Cost Rate

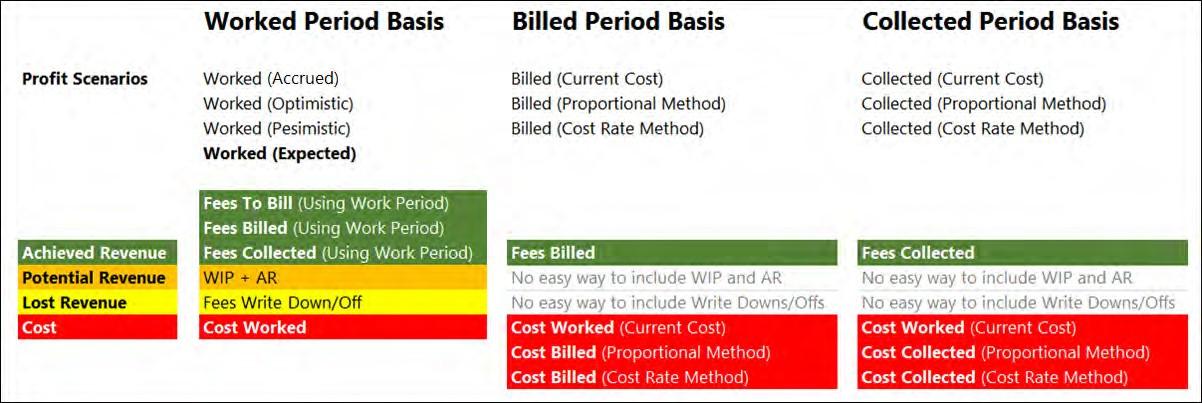

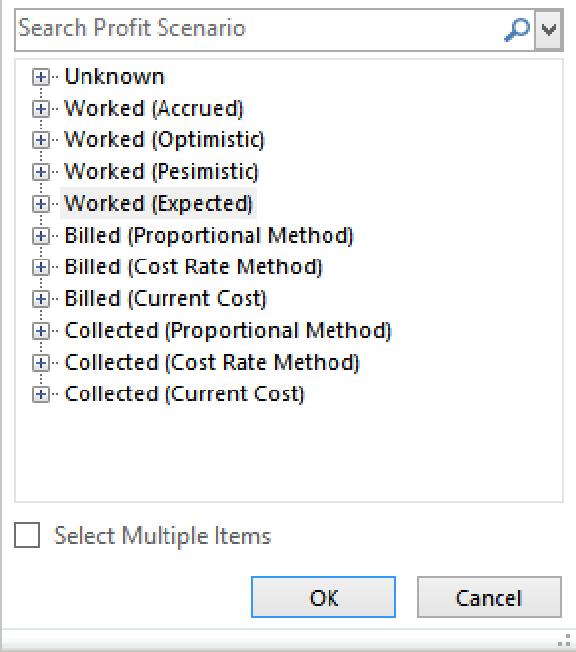

Estimated cost rates can be used to apply costs to matters. This only applies to the Collected (Cost Rate Method) and Billed (Cost Rate Method) profit scenarios. In the Cost Rate method, you can choose which type of cost rate you want to use for calculating collected (billed) costs. Multiple cost rate data sets allow firms to perform reporting and analysis using multiple sources for hours such as “Monthly”, “Annual”, or “R12”. There are dimensions “Cost Rate Type” and “Cost Rate Period” that can be used to switch the cost rate calculation when using the Cost Rate method.

Additionally, firms have the option of defining additional estimated cost rate data sets.

Estimated Realization

This only applies to the Worked (Expected) profit scenario. In this profit scenario, you can choose which type of realization you want to use for calculating potential revenue from WIP and AR. Multiple realization data sets allow firms to perform reporting and analysis using multiple sources for data set such as “Monthly”, “Annual”, or “R12”.

Additionally, firms have the option of defining additional estimated realization data sets.

Best Practices Topics

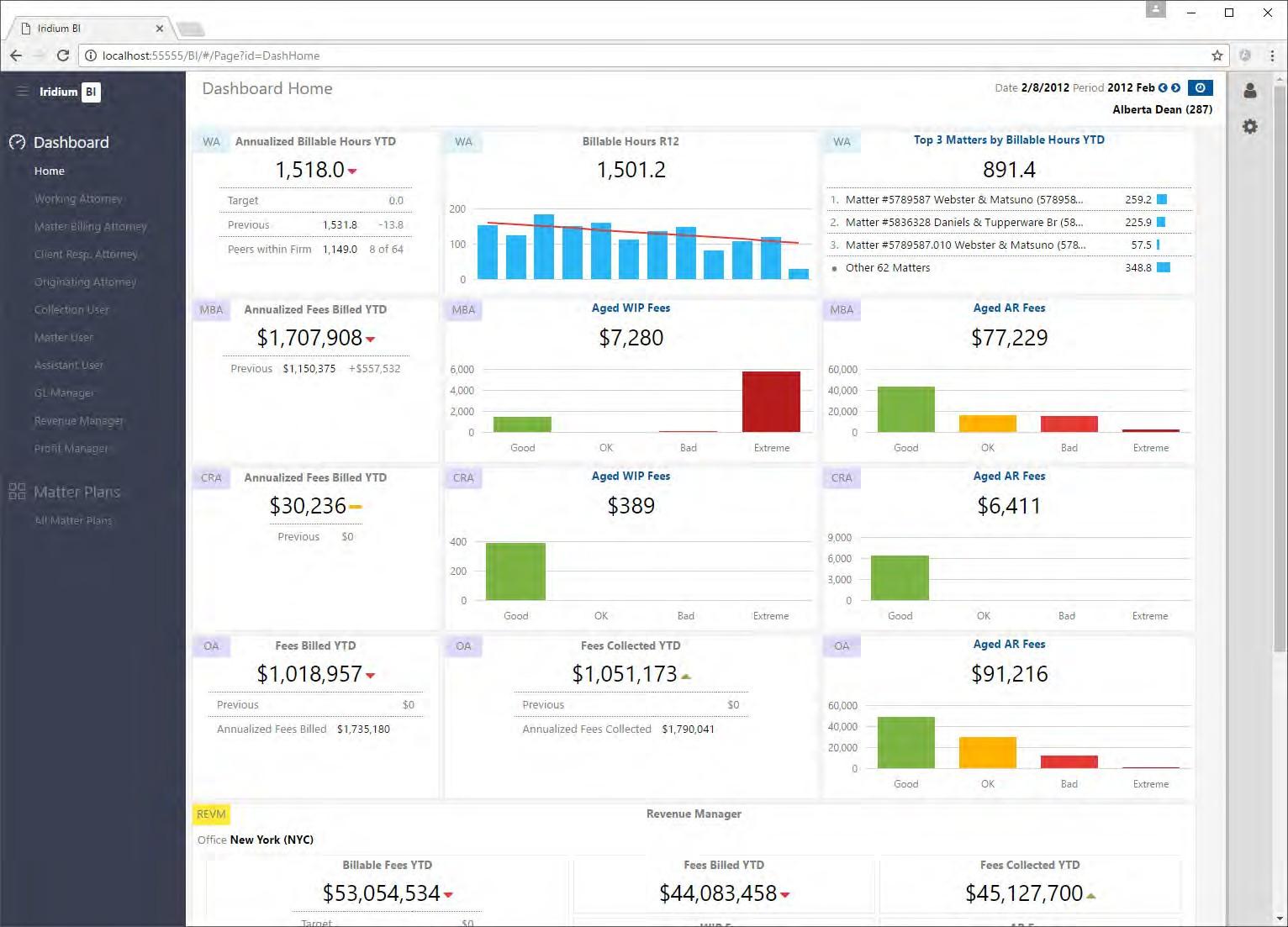

As the number of implementations of Iridium BI grows, our knowledge of best practices implementations also grows. Clients regularly ask our advice on best practices. This section covers the most common topics for discussion. For each topic, we summarize the issue, discuss the options, and identify our preferred solution.

Should your Profit Cube Reconcile to your Income Statement?

If your Income Statement shows $100.3M in revenue and $60.3M in costs for a profit of $40.0M, should you see the same numbers in your profit cube? This is a key question which impacts many or most of your profit implementation decisions. Let’s look at the pros and cons of each strategy…

Strategy Details

ReconciletoGL: Pros • There is only really one benefit: you can show the partners that your profit cube reconciles to the same firm-wide profit number as the GL produces

ReconciletoGL: Cons • You will be required to load ALL costs into the Profit cube – you cannot exclude costs that might not apply to profitability analysis • If you allocatecosts between office, departments, or teams then the GL and the cube will not reconcile by those slices • Specifically: if you allocate any journal entries to a timekeeper in different Office + Department + Team versus what are stamped on thetransaction then your “reconciliation to the GL” has been broken • Since almost all firms will do at least a couplefirm-wide allocations, it is not a valid goal to say that your profit cube will tie to the GL at slices such as Office, Department, Office + Department, etc. • You cannot take advantageof strategies such as negative (contra) costs and cost smoothing because then your revenue and costs will not tie to the GL • In summary, you are placing restrictions on your ability to choose appropriate costs and allocate costs across entities

DoNotReconcileto GL: Pros

DoNotReconcileto GL: Cons • No limits on allocating or moving costs (or revenue) between offices, departments, teams, etc. • No limits on strategies likenegative (contra) costs, one-time reassignment of costs, putting in a plug for Partner Draws, etc.

• None really. You just need to be able to explain the strategies and differences to the firm partners

BEST PRACTICES:

— First of all, if the firm policy is that the profitability cube must tie to the GL, then of course you will do it — In our opinion, reconciling with the GL-based income statement is overrated, because you are limiting your implementation choices. For example: many firms decide to reallocate non-timekeeper revenue as a negative (contra) cost, resulting in differences versus the GL in both costs and revenue. If you have set the goal of reconciling with the income statement, then this option is not available to you. — Do not set expectation of reconciliation. If someone questions this decision, then your response is that “We already have financial reports – the profit cube is optimized for profitability reporting and analysis”. — Important: Only Collected/Billed (Current Cost) scenarios will tie to cash basis (annual) financial reports under certain conditions. The other profit scenarios will almost never tie to the GL.

Cost Smoothing – Timekeeper Level

Smoothing at the timekeeper level can be used to evenly distribute costs across multiple periods. This allows you to avoid the situation where (for example) a partner gets a $200K bonus in June and then all work in June has higher costs and looks less profitable.

The only problem with cost smoothing across periods is that we will not be able to reconcile the cost with GL on a period by period basis for those Profit Accounts where smoothing was applied. You will only be able to reconcile on a period range basis – typically a financial year.

Typically, the smoothing takes the whole cost in the year in the unit that we are applying the smoothing to (e.g. timekeeper or office) and re-distributes the cost to periods either equally or using some weight e.g. hours worked or revenue generated in each period.

Smoothing the cost at the timekeeper level has a positive impact on the cost smoothing applied at the matter level which is discussed in the next section.

BEST PRACTICES

— We recommend smoothing only some costs – especially for making sure that large costs like partner bonuses are spread across all months

— Note that if costs are smoothed, then the profit cube costs in each month will no longer reconcile to the GL costs in each month

— If you do not smooth, then the costs will tie to the GL but you will see large variations in monthly cost rates

— Note that since the smoothing is done before the cube is processed, you cannot switch between smoothed and original costs while working with the cube.

Cost Smoothing – Matter Level

After all the costs are allocated to all timekeepers, the Profit engine allocates the timekeeper costs to all his/her matters in the period based on the hours worked on each matter in that period and average cost rate for that timekeeper. Most clients choose to use cost rates based on the rolling 12 periods average. By using this R12 average cost rate we naturally smooth the cost allocated to matters in each period. This obviously leads to situation where total allocated cost to all matters in each period is higher or lower that the cost of the timekeeper in the same period. The Profit engine injects correction records associated with PLACEHOLDER matter to force it back to the original timekeeper total cost. Essentially, this protects each matter to be penalized for high timekeeper cost in some period.

The cost smoothing at the timekeeper level, as described in the previous section, would lead to smaller variations of the timekeeper’s cost rate period by period thus lowering the amount that is allocated to PLACEHOLDER matter. The PLACEHOLDER matter is designed to take the hit rather than the actual matters without interfering in any way with the timekeeper and organization unit’s profitability.

BEST PRACTICES

— The cost rate based on the rolling 12 periods average is recommended for matter cost allocation. This cost rate can be changed in configuration variable

“ProfitMatterAllocationCostRateTypeId”. The options for the cost rate are: MTD, YTD,

R12, LTD, YEAR, Standard Hours R12, Adjusted Hours R12 etc.

— Note, if you select MTD cost rate no smoothing will occur and no amount will be allocated to the PLACEHOLDER method

— Note, Adjusted Hours R12 would use standard hours in periods where actual worked hours were lower than the standard hours. This is a popular option that guarantees the cost rate used is relatively smooth and does not jump up and own too much.

— The PLACEHOLDER matter allocated amount should be kept low (5% or less) through tuning the whole profit calculation model. There is a possibility to implement cube calculations that soft-allocates this amount to other matters if necessary.

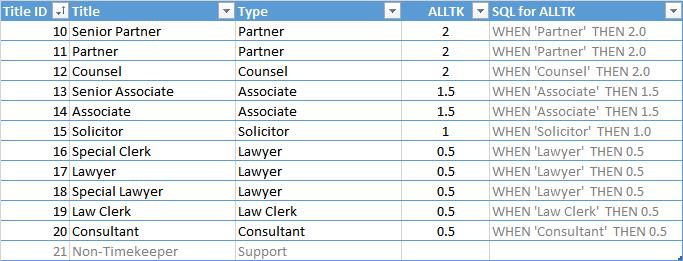

Calculating Cost Rates based on Alternate Hours

Many firms would like to have the capability to calculate cost rates based on an alternate hours value instead of using the actual hours. The most common scenario is to define a minimum hours “floor” so that timekeepers with low hours are not getting unreasonably high cost rates: “for any timekeepers with under 1200 hours in the year, calculate their cost rates as if they had worked 1200 hours”. Another variation is to calculate cost rates based on standard hours.

Iridium BI fully supports the creation of additional scenarios based on alternate hours. Additionally, multiple scenarios are supported simultaneously, so you can compare the results of the scenarios side-by-side. Another scenario where adjusted hours are sometimes used is for new hires. Since they need to “get up to speed”, the firm may give them (for example) 50 hours of credit during their first two months. Please note these alternate scenarios are only effective in the Cost Rate based

methods.

Part-Time Timekeepers

Most firms want to avoid having part-time timekeepers get more than their share of the cost allocations. Iridium offers multiple options to accomplish this, with the most common being that allocations are FTE-adjusted. For example, a 2-day per week employee would only receive 40% of the allocation of a full-time employee.

For timekeepers with very low hours, many firms choose to just treat them as non-timekeepers, and allocate away both their revenue and cost.

Some firms are already calculating a second “cost FTE” value specifically to determine cost allocations, and we can load these into the profit module while still preserving the standard FTE values. In theory, this translates to an allocation factor except we support more than one.

BEST PRACTICES

— Modify their Allocation Factor to reflect their part-time status, and they will receive a prorated (smaller) allocation of costs.

— Design your allocation methods to make sure that part-time employees are getting fulltime cost assignments where appropriate. For example, if you firm thinks that a part-time employee uses the same HR cost as a full-time employee, then the allocation method for

HR costs can be headcount-based instead of FTE adjusted.

Calculating Profitability based on Standard or Adjusted Hours

As mentioned above we can use various cost rates when we allocate cost from timekeepers to matters. The hours of choice will be used to calculate timekeeper’s cost rate and multiplied with the actual hours worked on the matter. This will lead to the amount allocated to PLACEHOLDER matter in order to protect the actual matters from getting penalized.

Certain timekeepers will always have low revenue/hours, and the best example is probably rainmakers. Making it worse, in many cases the rainmaker is a highly-compensated individual (cost is high). Iridium BI offers three strategies for properly costing timekeepers with low hours:

Strategy Details

Cost Exceptions • This feature allows firms to increase profitability of timekeepers by reducing their costs • Typically, this scenario is used to decrease costs for timekeepers with low revenue/hours, but it could also be used to decrease/increase costs for any timekeeper • There are two methods to adjust thecosts: rules and manual adjustments. Here are samples of each: o Rule: Decreasecosts by $400,000 for all partners with morethan $1 million in originations during the fiscal year o Manual adjustment: DecreaseJennifer’s costs by $50K in 2014,and decrease Joseph’s by $80K • The cost exceptions are all associated with two firm-defined Profit Accounts, for example for origination credit they might be “CREDIT-ORIG” and “ALLOC-CREDITORIG”. In the example above with Jennifer, she would receive a -$50K cost CREDIT, and the+$50K “debit” would be pushed (allocated) out to other timekeepers (the firm determines the rule). • Once the cost exceptions are loaded into the cube, the firm can include/suppress them in profitability calculations by including/suppressing the associated profit account in queries and reports

Reduce Allocation Points • Assign the rainmakers or other timekeepers with low revenue/hours a lower valuefor allocations points, which will reduce their share of the costs • Example: As a partner, William should get 3 points for allocations. However, we are changing William and two other rainmakers to only receive 1 points, thereforecutting their costs down to 33% of the normal amount for partners. • One shortcoming of this method is that it does not reduce the direct costs, which in many cases may be the biggest costs.

BEST PRACTICES

We have seen both of these methods in use at our clients. Our preference is for the Cost Exception strategy.

Split Assignments

Split assignments are the situation when you have a timekeeper that is assigned to two departments, offices, teams, or titles. For example, James is a partner, and he is split between the San Francisco and Palo Alto offices on a 60/40% ratio at the same time (in the same period).

Iridium BI does natively support split assignments.

Non-Timekeeper Revenue

Most law firms have situations where a non-timekeeper may occasionally bill some time. Typically, non- timekeeper (“NTK”) revenue is only going to be 1-2 percent of total firm revenue, but you still need to have a strategy to account for it in your profitability analysis. It is always associated with a special profit account called Revenue Fees NTK. Here are several strategies for handling NTK revenue:

Strategy Details

Allocateto other TKs • Pro: Total Revenue will tie to the GL • Con: Revenuefor individual timekeepers will beoverstated • Con: It is very complex and sometimes impossible to find TKs that should receive the revenue while keeping the revenue on the same matter

AllocatetootherTKsas negative cost • Pro: Total Revenue for individual timekeepers will becorrect. Costs for timekeepers will be reduced, but in a subtle way • Con: Total Revenue will not tie to the GL • Con: It is very complex and sometimes impossible to find TKs that should receive the revenue while keeping the revenue on the same matter

Assignto“PLACEHOLDER” timekeeper

Treatthenon-timekeepers as timekeepers (not recommended)

Suppress It • Pro: Individual timekeeper revenue and costs are not changed • Pro: this is simple and straight forward. This is also the default out of the box strategy • Con: You will have the“PLACEHOLDER” timekeeper in all your reports

• This means that the non-timekeepers will betracked as timekeepers in your reports and the cube • Pro: You seetheactual hours and collections of the non-timekeepers • Con: Your cube and reports will include distracting/non-essential employees

• Do not load the revenuefor non-timekeepers • Pro: non-timekeepers do not show up on your reports • Cons: You cannot tie out revenueby total firm, client, matter, etc.

BEST PRACTICES

These are the two best practices options that we like, listed in order of preference

— (1) Assign to “PLACEHOLDER” timekeeper — (2) Assign it to other timekeepers

Departed Timekeepers

How should we treat revenue and costs for timekeepers that have YTD values but are no longer with the firm? Departed timekeepers are a recurring source of data discrepancies since they are still getting collections credit, and sometimes they also have costs. There are two basic options:

— “The Reality Option”: If the timekeeper was there for part of the year, then they should be left in the profit cube and the revenue and costs will stay with the timekeeper. They will receive cost allocations for the periods where they were active at the firm. After they leave the firm they will no longer have an FTE or assignment, so any future data will be handled as a non-timekeeper. Specifically, any future collections or direct costs that are loaded will be assigned to the PLACEHOLDER timekeeper. There are several advantages to this option: (1) it reflects what actually happened, (2) there is no re-writing of history; i.e. reports that were distributed before the timekeeper left are still valid, and (3) any future data loaded for collections or costs will be handled using the same methodology that is used for other nontimekeepers.

— “The Disappearing Act Option”: When the timekeeper leaves the firm the FTE and assignment records in the YTD prior periods are overwritten, so it appears that that the timekeeper was not at the firm this year. All of their revenue is treated as non-timekeeper revenue and reallocated by whatever rule was set up for NTK revenue. All of their costs are pushed to other timekeepers based on the cost allocation rules that your firm has configured. This method is not recommended, since it is taking you further from the truth of what really happened.

BEST PRACTICES

We recommend the Reality Option.

Partner Compensation/Draws

Partner compensation and draws are major items on the profit income statement. They look like costs similar to salary and bonus, but we believe the partner compensation is not a true cost. However, we also recognize the importance to see the impact partner compensation and draws have on the profit income statement. The key is having the flexibility to include or exclude the partner compensation in your firm’s profitability analysis in a way that fits the need of your firm.