9 minute read

Allocation Process

BEST PRACTICES

— It is suggested to stick with just a couple of allocation methods, and many Iridium clients are satisfied using only the method “Title Points” for all allocations

— Note that you can still filter groups of timekeepers out of cost allocations. For example, you can allocate partner retreat costs using Title Points, but limit the recipients to equity partners (2 points) and income partners (1 point).

TITLE PROFILES

Many firms want to define allocations where different Titles get different allocations, for example “partners get 3 points, associates get 2 points, and other timekeepers get 1 point. Here is a sample set of Title Points:

Notes:

— Instead of Title (Rank), ADERANT clients can use Personnel Type or Work Type. — These title points are implemented as multiple allocation factors (as described previously)

Title Point Profiles are the mechanism to define and apply title points to allocations. Each firm can define as many Title Point profiles as they need, and then assign point values to each Title in the profile. For example, a firm might define two Title Point Profiles: “All Timekeepers”, and “Lawyers Only”. The power of having multiple point profiles is that you can set up allocations where only partners or only lawyers receive costs. It is not a requirement that a title has the same points in all profiles; i.e. partners can have 3 points in one profile and 2 points in another.

These are the examples of common Title Point Profiles:

Title Point Profile

ALLTK

LAWYERS

PARTNERS

Details

• All timekeepers will receive costs based on their assigned points

• Only lawyers will receive costs

• Only partners will receive costs

Note that the granularity of the Title Point Profiles is based on the Titles that your firm has chosen. So, if you are loading two types of partners such as equity and non-equity, then you can assign them different points within Point Profiles, or even have separate Title Point Profiles for PARTNERS-EQUITY and PARTNERS-NON-EQUITY.

Allocation Matrix

The Allocation Matrix allows the firm to define allocation directives for any given Profit Account to load costs from one or more of the sources and allocate it to timekeepers in a specific allocation group using a specific allocation factor (method). If the allocation matrix is empty and no directive exists, then no cost will be allocated to anyone and the cost table will remain empty.

Examples of the allocation directives:

— For Profit Account “IT” load the cost from GL and allocate it to the timekeepers in the respective office using a “Partner 2, Others 1” method (factor)

— For the Profit Account “Training” see if the timekeeper ID is stamped on the GL record and in that case directly load the cost to this timekeeper. Otherwise allocate it to all timekeepers in the respective office + department combination using a “headcount” method (factor).

— After all directives have been applied, there should be no costs that remain unallocated. If there are leftover costs, then the firm will want to define a “wash-up rule” to make sure that any costs that were skipped are allocated to timekeepers. (The wash-up rule is covered in detail in a separate section below).

SOURCES OF COSTS

Currently there are 6 sources which can be used to load the costs from:

— IMP – (“IMPORT”) this represents an external source from which the costs can be loaded.

Technically there is a table called bi.ProfitCostImport that needs to be pre-loaded with the exported data – typically from an external payroll system.

— GL-WA – this represents the portion of the GL journal entries that are stamped with working attorney. This method (if used) will have priority over the remaining methods.

Please note, the cost will only be picked up if the person is defined as timekeeper in the

Profit module.

— GL-PP – this represents the portion of the GL journal entries where both office and department are practicing (“P”) offices/departments.

— GL-PS – this represents the portion of the GL journal entries where office is a practicing (“P”) office AND the department is support (“S”) department

— GL-SP – this represents the portion of the GL journal entries where office is a support (“S”) office AND the department is a practicing (“P”) department — GL-SS – this represents the portion of the GL journal entries where both office and department are support (“S”) offices/departments.

You can define separate allocation directives (in the allocation matrix) to handle the costs in each source differently. The following picture presents this information graphically:

ALLOCATION GROUPS

An “Allocation Group” defines a business unit that will receive allocations but also constrains the source of the cost to the same unit.

For example, the “OD” allocation group represents a combination of offices and departments. If you use this group, then all costs in each Profit Account will be grouped by office and department and each unit will only be allocated to the people in the same office and department combination. E.g. Training costs in the San Francisco office, Intellectual Property department will be only allocated to the 10 attorneys working in that office and department. If the cost exists in GL but in HR no one is assigned to that unit in that period, no allocation will take place; in which case, we will be relying on the wash-up rules to allocate the cost to someone either in the office or department or firm-wide.

These are the default Allocation Groups:

— Firm-wide: Allocate the costs to all timekeepers across the firm, regardless of the office or department where the costs originated

— Office: Allocate these costs to all timekeepers within the office (as defined in HR) where the costs originated — Department: Allocate these costs to all timekeepers within the department (as defined in

HR) where the costs originated

— Office + Department: Allocate these costs to all timekeepers within the office and department combination (as defined in HR) where the costs originated

— Team: Allocate these costs to all timekeepers within the team (as defined in HR) where the costs originated (Team represents either profit center or cost center) — Company, Office Group (“super office”) and Department Group (“super department”) are also supported.

Firms can also define other allocation groups, but we have found that the above allocation groups cover the needs of the vast majority of firms.

BEST PRACTICES

— Since the entire Allocation Process is customizable there can be other rules and pre/post processing defined

— It is strongly suggested to stick to simple rules

The “Residual/Wash-up” Rule

You can say that the allocation directives are working like a sieve: As each allocation rule is applied another portion of the costs are assigned to timekeepers. In some cases, there will be some costs left in the sieve after all the directives have been applied. This typically occurs in allocations by office + department, where there are no timekeepers in an office + department combination during a period. To make sure that all costs from the GL will be allocated to timekeepers, we can define a wash-up rule. A typical example of a wash-up rule would be “take any costs that were not allocated and push them out firm-wide using Title points”.

Please note that in the case where we are loading the direct costs from an external payroll system, we do not call this a wash-up – we refer to this as a “residual”. Apart from the different name, there are no other variances. In other words, no matter how we load the cost whether from GL or from payroll we always try to match the GL balance as the last step for the selected profit accounts.

BEST PRACTICES

— For firms that have simple allocations and rules, a wash-up rule is typically not necessary.

This also provides for a good validation: if there are any costs not allocated then we need to investigate why. — As your firm defines more granular allocation rules, the chances of requiring a wash-up rule go up. Specifically, when you have rules that are doing allocations within the office + department combination, then there is a good chance that you will get unallocated costs.

— The wash-up rule is predefined to be using firm-wide allocation. The reasoning behind this is that if the regular allocation directives are defined reasonably well and the quality of the data is good, then there should be a zero balance or only a small amount in this account that needs to be allocated. If the amount is relatively large, then we will work with the firm to add/refine allocation directives and/or improve the data quality to reduce the wash-up amount.

Dimensions for Analysis

Once the allocations have been applied, users can analyze and report on profitability using the following dimensions that are defined in the profit cube:

Dimension

Office

Department

Team

Title

WorkingAttorney

Matter

ParticipatingAttorney

Payor

Additionally, you can slice/filter by manyother attributesonthe clients, matters, attorneys, etc.

Arethereanyadditional groups or filters that your firm requires?

Description

• Included in core product. This includes Office Grouphierarchy

• Included in core product. This includes Department Group hierarchy.

• Included in core product

• Included in core product

• Included in core product. Although the dimension contains all personnel in the firm, only timekeepers should have data (revenue, cost, hours, etc.) • Included in core product. This includes hierarchies: Parent

Client, Client, Matter BillingAttorney, Matter Responsible

Attorney, Client Responsible Attorney, and many others…

• Included in core product

• Included in core product

• Included in core product: Matter Type, Client Type, Open Date, etc.

• Iridium can configure/customize thedimensions and attributes supported based on your firm requirements

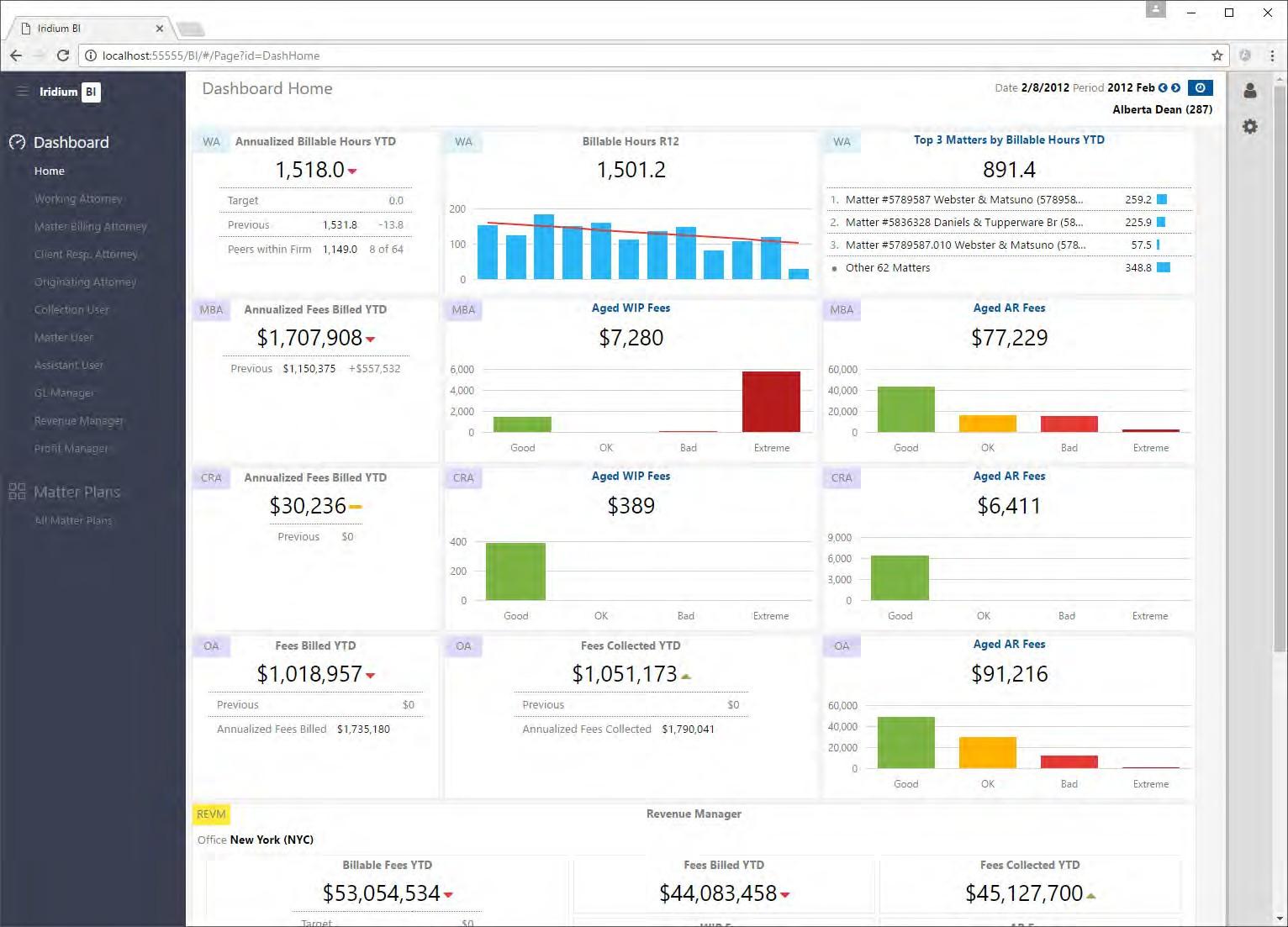

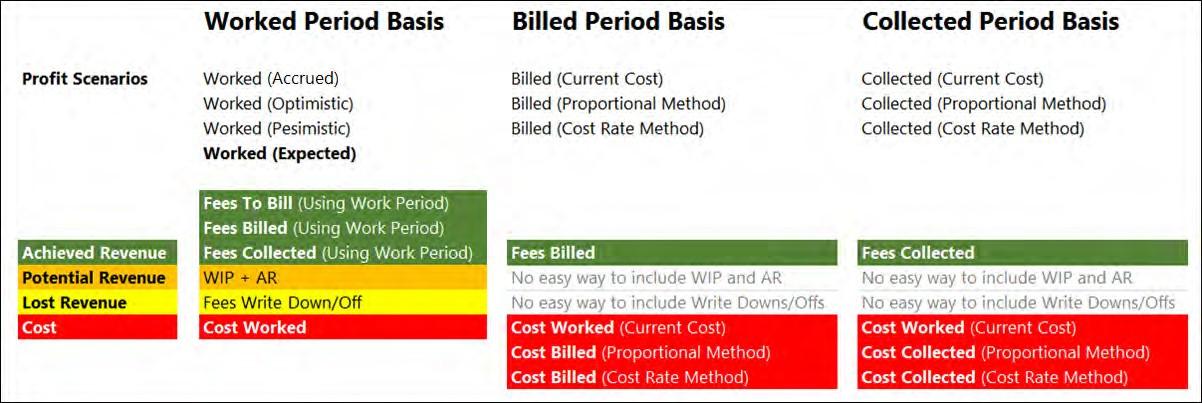

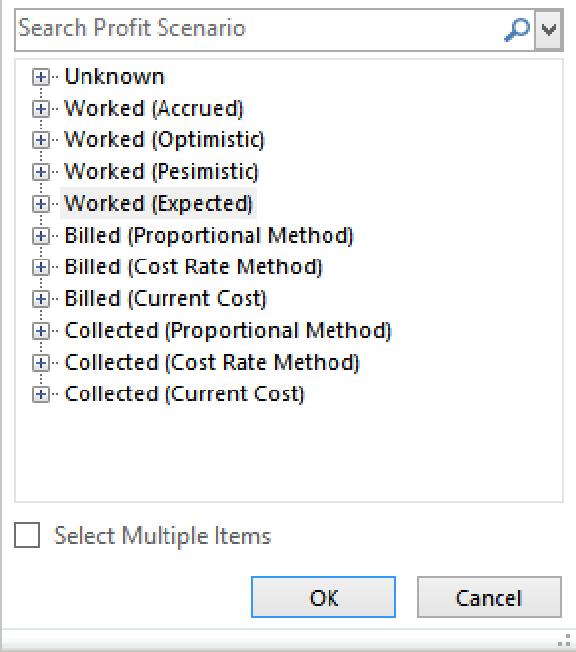

Iridium’s Profitability “Thesis”

Law firms have been doing detailed profitability analysis for decades, and they have always been limited by the capabilities of their systems and applications. This has resulted in the adoption of “best practices” methods that in many cases have severe shortcomings and distort the true profitability statistics.

Iridium is pleased to offer a solution that offers multiple scenarios for how firms can calculate profitability, and we will cover those scenarios in detail in the next section. But before we introduce you to the profitability scenarios that are available, we want to have a general discussion about our best practices methods which enable law firms to calculate profitability with far greater accuracy than has been previously achieved.

This is our thesis for law firm profitability calculations:

— Every worked hour has a single cost, and it should only be calculated in the work period

— The revenue generated by the hour of work can become collected revenue many months later

— There are two basic profitability approaches:

o Start with the Costs

§ If you start with the costs, then you must find all your associated collections and shift them back to the periods where the costs occurred

§ This is because the collected revenue in any period in your GL is mostly unrelated to the costs in the same period

o Start with the Collected Revenue

§ If you start with the collected revenue, then you must find all your associated costs and shift them forward to the periods where the collections occurred

§ This is because the costs in any period in your GL are largely unrelated to the revenue in the same period

§ Variant: Start with the Billed Revenue. Conceptually this is identical to starting with the collected revenue.

— Any method that calculates profitability where the costs are not strongly tied to the collected revenue is inherently flawed