3 minute read

Iridium’s Profitability “Thesis”

To understand Iridium’s thesis, let’s look at a couple simple profitability questions:

Question TraditionalAnswers

We collected $60,000 this month from Client X for Richard’s work. Whatwas our profit for Client X on those collections?

• Option1:That$60K represents 150 hours collected. Richard’s cost rate this month is $300/hour. Therefore, thecosts should be $45K, and the profit is $15K. • Option 2: Richard’s costs this month were $40K. The total collections this month were $120K. So, the $60K in collections should get half of this month’s costs. So, the costs are $20K, and therefore the profit is $40K • Many otheroptions areavailable, but they all have the same flaw that the work cost is based on Richard’s current cost rate. Richard did $100K in Billable • Richard’s costs this month are $40K, so the profit is $60K. We understand that

Iridium Best Practice Answer

• That work was performed 4-6 months ago. We will go back and get the cost of the work based on

Richard’s costs in those prior months. We come up with an exact cost for the work performed of $25K, so theprofit is $35K. That is the only correct way to determine profitability.

• We will notknowtheexact profit until we see how much is billed and how

Work this month. What is the profit on that work?

What wasour profiton Richard in 2014?

this is just an estimate, but it is the best we can do. Once we know the final collections we can tell you the profitability. • But the problem is we will then use the traditional method above and the costs will becalculated based on

Richard’s cost rate at the time of collections.

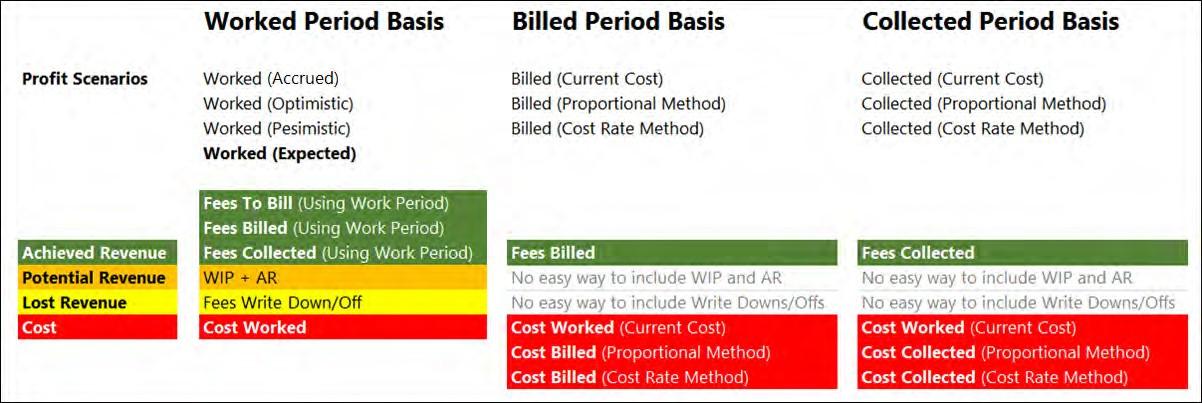

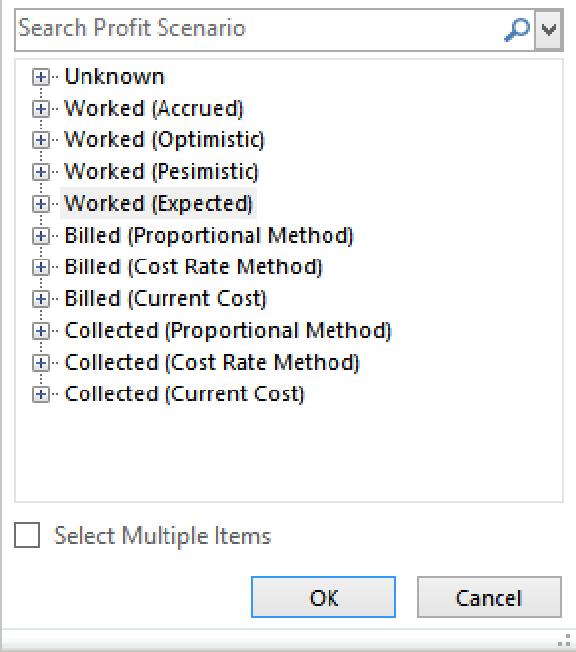

• Option 1: We collected $800K, and his costs in theyear were $380K, so the profit was $420K • Option 2: Richard had $900K in billable/billed work,and hiscosts were $380K, so the profit is $520K. • Again, therearemany options but they all have the similar mismatch between costs and collections. much the client pays. But in the interim wecan offer youfour profit scenarios to analyze possible profitability outcomes: Super Optimistic,Optimistic, Pessimistic and Expected.

• We can do thosetraditional methods – no problem. We understand why you might want to use them for the annual review of your timekeepers and other scenarios. • We also offer other scenarios which offer four choices for projecting/ estimatingfutureprofit. And we wantto emphasize that these scenarios are especially applicable when looking at client or matter profitability.

The biggest problem with the traditional methods is the time shift between costs and revenue, and this is manifested in several unwelcome side effects:

— If you look at a timekeeper’s profitability for the year based on collections, a large percentage of the collections may have incorrect costs since the costs are from this year’s work and a large percentage of the collections are from the previous year’s work

— Departed timekeepers can overstate client or matter profitability, since the departed timekeeper may have zero costs in the period the revenue was collected (etc.) — Note that we classify all of these side effects as “time shift” issues.

So how does Iridium solve the time shift issues? The key element is being able to break down the collections to “super time slips” where we can read the work period. This works in both directions:

— If you are starting with the costs, for revenue we only bring in the collections that are associated with the work period that the work was done — If you are starting with the revenue (collections), we go back to the work period when the work was done to get the costs

— Note, Iridium recommends to start with costs because it is possible to work easily with the revenue that is still in WIP/AR phase. This is not possible when you start with revenue (collections).

In conclusion, we urge clients to avoid the traditional methods, and if they are going to use them to be sure to be aware of the shortcomings.