1 minute read

Profit Accounts

BEST PRACTICES:

Sticking with the mantra of “Keep it Simple”, we encourage clients to limit the granularity of payroll costs to 4-6 Profit Accounts. So, if you are thinking about creating a Profit Account for “Benefits”, think about how this will be represented when reporting on profitability. Do you really need to know that $16 of the partners $360/hour cost rate was for Benefits? If so, then define a Profit Account for Benefits.

Revenue Data

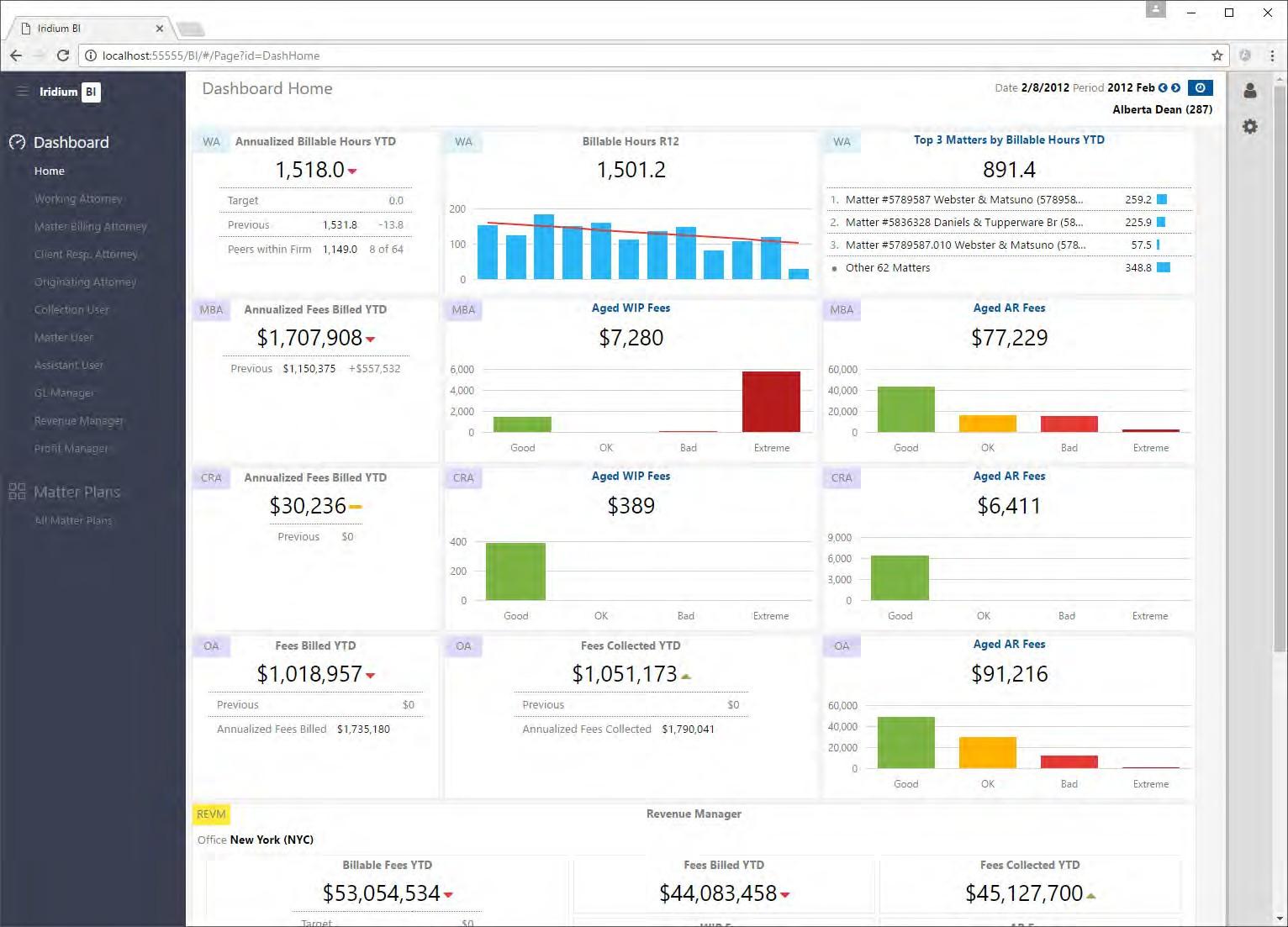

Revenue data is typically loaded directly from the Iridium BI Revenue module. This assures that the Profit module and the Revenue module will reconcile. We do not require you to purchase the Iridium BI Revenue module to load revenue into Profit module.

Revenue Data Granularity

Revenue is typically copied directly from the Iridium BI Revenue module, including many of the detailed metrics available e.g. Billable Hours, Billable Fees, Fees To Bill, Fees Billed, Fees Collected, Fees Write Up (Down), Fees Write Off etc.

The detailed revenue data is aggregated to the granularity of period + timekeeper + matter. So, if an attorney had ten time entries in January on three different matters, then the Profit module would roll that up into three entries for the period (one per matter).

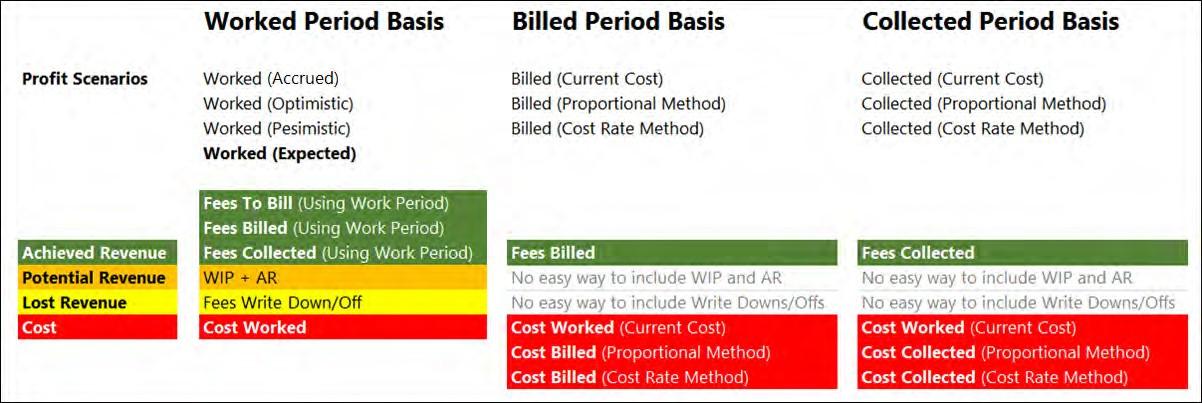

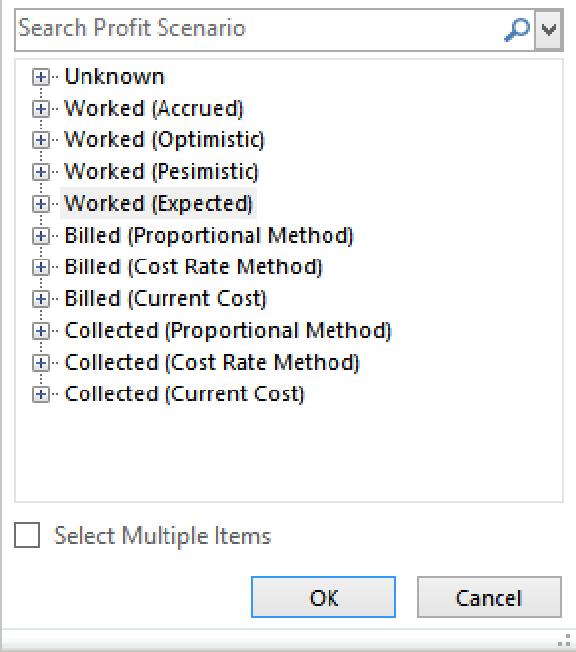

While there is no limit on how many different types of revenue your firm can track in the Profit module, typically firms go with one of these options:

— A single revenue account for “Revenue – Fees”

— Two revenue accounts: “Revenue – Fees”, and “Revenue – Fees Non-timekeeper”