4 minute read

HR Data

Allocation Process

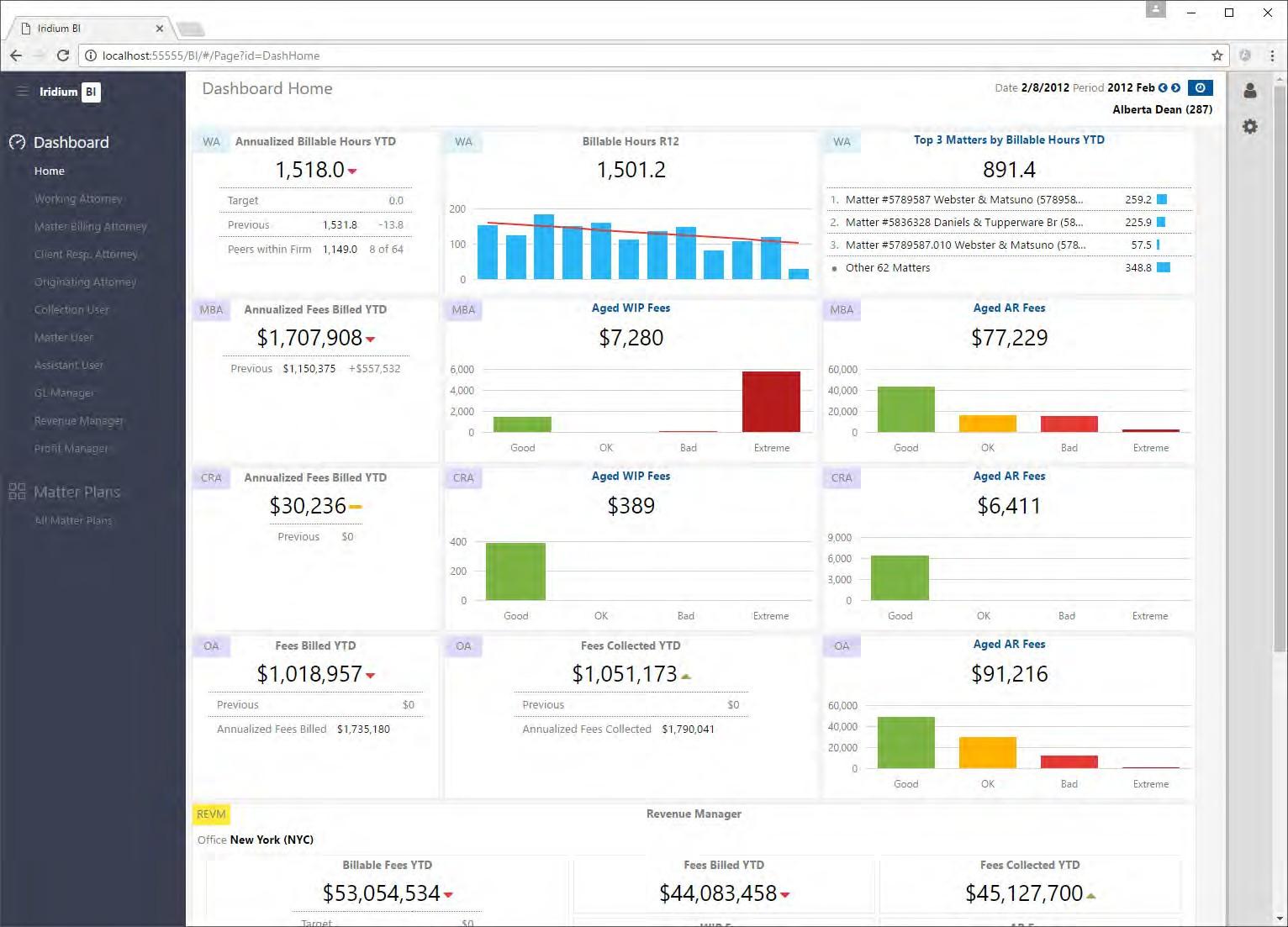

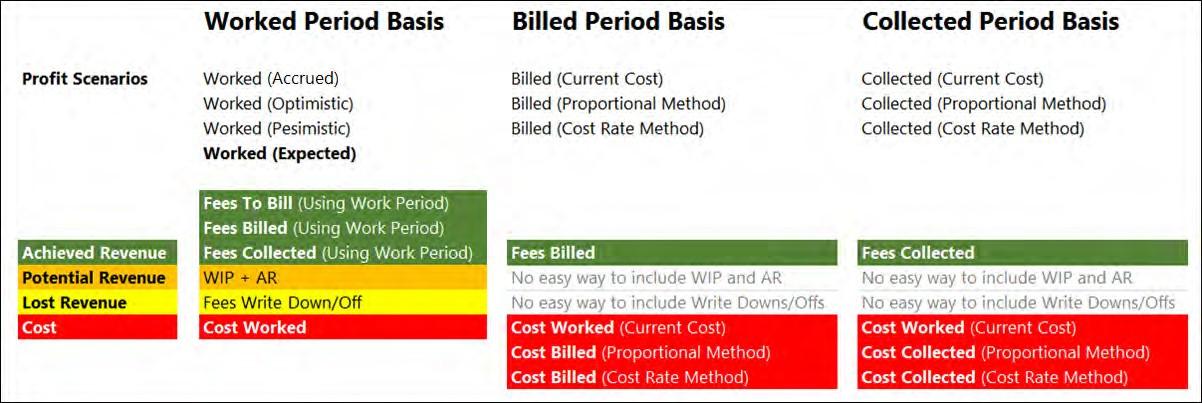

At this point we have determined the sources of our revenue and costs and who we consider timekeepers for profitability purposes. If every aspect of revenue and cost could be directly assigned to a timekeeper, the profitability calculation would be mostly complete. In practice, much of the costs and perhaps also some of the revenue cannot be directly assigned to timekeepers and instead must be allocated.

Cost is primarily calculated from the GL journal and payroll costs. Some cost may be assigned to timekeepers as direct costs with a minimum of allocation (mostly compensation or direct support staff costs), but a large portion of the cost is allocated from organizational units (offices, departments or the firm as a whole) to the timekeepers in them as overhead costs.

Generally, the assignment of traditional fee revenue to active timekeepers is straightforward. They did the work, so they are assigned the revenue. The problem is that not all revenue comes from active timekeepers. Collections revenue may arrive after the person who did the work departs the firm and some revenue will normally be generated by non-timekeepers. Occasionally, there are practices that operate under non-traditional fee agreements where revenue may accrue to the practice or a team and not individual timekeepers. In these cases, some type of revenue allocation may be required.

Though there are typically revenue allocation decisions that the firm must make, the overwhelming work of allocations in profitability still relates to the fair allocation of cost. This section covers the allocation process in detail, and introduces the key concepts of allocation factors, the allocation matrix, title points, etc. While these factors are discussed in terms of their use in cost allocation, the same mechanisms may be used for revenue allocation as well, either as revenue allocated to timekeepers or as offsets to cost.

Allocation Factors

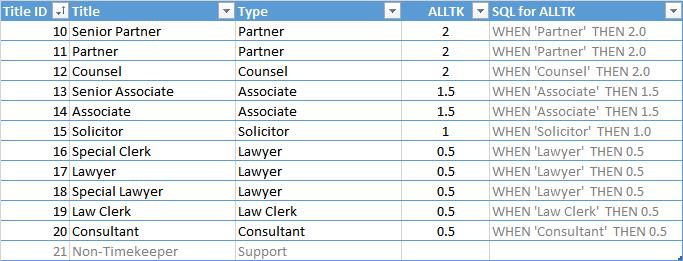

An “Allocation Factor” defines a numerical value for each timekeeper in each period that is used to proportionally allocate costs to him/her. These factors are calculated and stored in the HR table (measure group). They are also available in the cube for browsing. For example, if a timekeeper has an allocation factor of 0.5 in a period, and the total of the allocation factors for all timekeepers in their department is 10.0, then that attorney will be allocated 5% of the department expenses.

You can say that if a timekeeper has one or more non-zero allocation factors then they are a timekeeper receiving cost allocations. On the other hand, non-timekeepers should have all allocation factors set to zero.

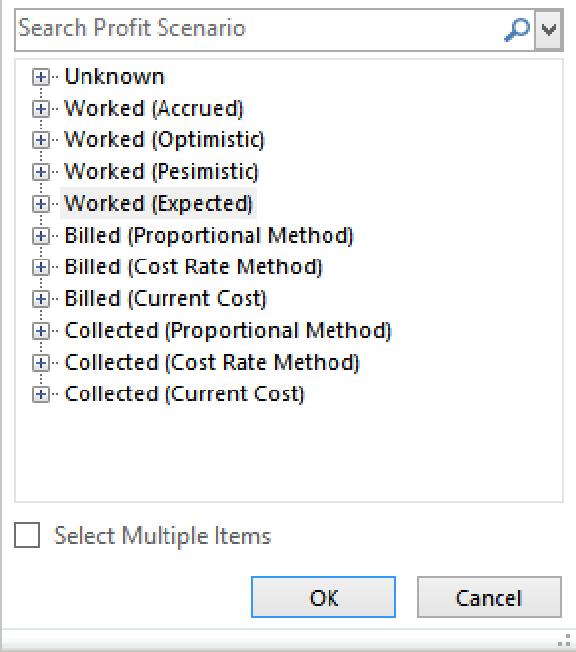

Each factor can be conceptually associated with an allocation method based on a weight calculated from Title Points (weightings), FTEs, Headcounts, or any other value. Your firm is provided with a “blank whiteboard”: there are no restrictions on how many methods (and factors) can be defined,

and you can define new allocation methods.

The methods listed below have been pre-defined in the Iridium BI Profit Module. Again, consider this list to be a starting point. If your firm requires a custom allocation method such as “based on shareholder points” then Iridium can implement that method for you. Note that Iridium has done dozens of custom allocation methods for our clients, and we have never been stumped.

The allocation process is typically a two-level allocation. Technically this may happen in one step, but conceptually we allocate the costs first to timekeepers and then to their matters. Please note that all the following allocations methods are related to timekeepers only. The matter allocation is almost always based on hours worked on each matter.

Method Details

TitlePoints – FTE • This method defines points for each Title. For example: Partners 3, Associates 2, Paralegals 1 • Thecosts are then further adjusted by FTE, so a 0.5 FTEtimekeeper will only receive half of the points/costs that a full-time timekeeper with the same rank will receive. • Note Title can be substituted with Personnel Type or other dimension TitlePoints – Headcount • Same as above, but with no FTE adjustment

BillableFees • Timekeepers with larger billablefees will receive morecosts • Example: We think that attorneys with higher billable fees use more accounting resources, so we will allocateAccounting Department costs based on percentageof billable fees.

BillableHours

(No Allocation) • Timekeepers with larger billable hours will receive more costs • Example: Wethink that attorneys with higher billable hours use more IT resources, so we will allocate IT Department costs based on percentage of billable fees.

• This is not actually a method, but is included here to indicatethat somecosts will pass directly through the profitability processing engine and remain with their associated timekeepers • While this method is typically only used for direct costs such as compensation, occasionally clients will directly assign overhead costs. As an example, training might be considered as overhead, but the training cost for an individual might be loaded and assigned only to that individual.

Assistant (Secretary) Assignment • Allows you to define percentage shareof assistant assignment for allocation of costs/revenue • “That assistant is assigned 30% to partner Jane, so Jane will receive 30% of that assistant’s cost”

Office Square Footage • Allows you to define percentage shareof occupancy costs based on office square footage for each timekeeper • “Partner X has an office of 200 square feet. The total office space is 1000 square feet, so partner X will receive 20% of the occupancy cost for the office.”

Other (Custom) • For example: Allocate by partner shares. If you require custommethods, Iridium is glad to discuss options with you. And again, we have not been stumped yet…