Adur Photographic Society

Tuition without Competion HERE’S EQUITY RELEASE: WHY THE RIGHT TO MAKE REPAYMENTS COULD CUT THE COST OF BORROWING Equity release can help boost your finances later in life. The way that interest is rolled up often means that people ended up with high levels of debt, but the new right to repayment could change that. Equity release allows you to access some of the wealth that’s tied up in your property, most commonly through a lifetime mortgage. Traditionally, you wouldn’t make any repayments. Instead, the interest accrued would be rolled up and paid once you passed away or moved into long-term care. It means the total amount of debt can quickly increase. Now, the right to make repayments could provide older homeowners with even more flexibility. What does the “right to repayment” mean? Equity release customers taking out a lifetime mortgage from a provider that meets the Equity Release Council standards from 28 March 2022 will be guaranteed the right to make penalty-free partial repayments of their loans. As a result, new customers will be able to offset the interest the debt is accruing and reduce their borrowing if they wish to. Rolling up interest can drastically increase how much you owe during your lifetime One of the drawbacks of equity release is that you can end up owing far more than you originally borrowed because of the way that interest is rolled up. The below table shows how interest adds up if repayments aren’t being made on an equity release loan of £50,000 that has an interest rate of 5%. As the interest is added to the loan amount each year, you go on to pay interest on the interest that T. 01273 774855 E. advice@pembrokefs.co.uk W. www.pembrokefinancial.co.uk

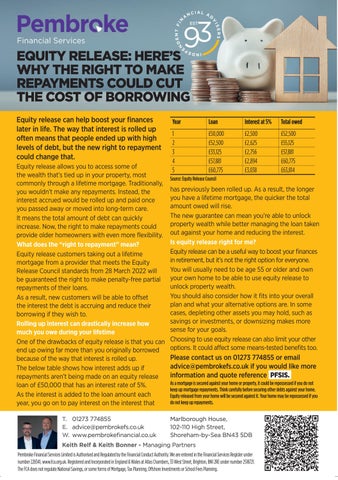

Year

Loan

Interest at 5%

Total owed

1 2 3 4 5

£50,000 £52,500 £33,125 £57,881 £60,775

£2,500 £2,625 £2,756 £2,894 £3,038

£52,500 £55,125 £57,881 £60,775 £63,814

Source: Equity Release Council

has previously been rolled up. As a result, the longer you have a lifetime mortgage, the quicker the total amount owed will rise. The new guarantee can mean you’re able to unlock property wealth while better managing the loan taken out against your home and reducing the interest. Is equity release right for me? Equity release can be a useful way to boost your finances in retirement, but it’s not the right option for everyone. You will usually need to be age 55 or older and own your own home to be able to use equity release to unlock property wealth. You should also consider how it fits into your overall plan and what your alternative options are. In some cases, depleting other assets you may hold, such as savings or investments, or downsizing makes more sense for your goals. Choosing to use equity release can also limit your other options. It could affect some means-tested benefits too.

Please contact us on 01273 774855 or email advice@pembrokefs.co.uk if you would like more information and quote reference PFSIS. As a mortgage is secured against your home or property, it could be repossessed if you do not keep up mortgage repayments. Think carefully before securing other debts against your home. Equity released from your home will be secured against it. Your home may be repossessed if you do not keep up repayments.

Marlborough House, 102-110 High Street, Shoreham-by-Sea BN43 5DB

Keith Relf & Keith Bonner - Managing Partners Pembroke Financial Services Limited is Authorised and Regulated by the Financial Conduct Authority. We are entered in the Financial Services Register under number 228341, www.fca.org.uk. Registered and Incorporated in England & Wales at Atlas Chambers, 33 West Street, Brighton, BN1 2RE under number 2518721. The FCA does not regulate National Savings, or some forms of Mortgage, Tax Planning, Offshore Investments or School Fees Planning.