03

05 World News

10 A Bump In The Road

David Kurtz, GlobalData, Australia, explores the prospects for the global iron ore market.

15 Uncovering Hidden Potential

Nadia Haseeb, Shell, explains how combining premium fuel and lubrication could be an efficient solution for an evolving sector.

19 Get More For Less

John McNulty, Weir Minerals, Australia, reviews how pumps and valves can help mining customers produce more for less.

24 The A To Z Of IPCC

Boris Frankenreiter, thyssenkrupp Mining Technologies GmbH, Germany, outlines some of the best operational practices for in-pit crushing and conveying (IPCC) operations.

John Schellenberg, Hitachi Construction Machinery, Canada, emphasises the importance of energy management to zero-emissions technologies and describes how mines can implement such advancements, particularly in relation to loading and haulage.

34 Purpose-Built Power Sources

Jess Stephen, Komatsu, discusses haul truck power sources that are purpose-built for a sustainable future.

Dmitry Lukovkin, Zyfra Robotics, Finland, answers the question, ‘how do you make a dump truck autonomous?’, and explores what the future might hold for automation in opencast mining.

44 Stay Safe, Stay Connected

Marnus Kruger, Rajant Corporation, South Africa, provides an overview of some of the latest advancements that are bringing high-bandwidth, flexible, reliable, self-healing networks to mining.

Colleagues Matrixx, Australia and North America, considers how cloud-based platforms can help resource and drilling companies better communicate.

John Geasa, Speedcast, USA, evaluates how IoT and connectivity are changing modern mining.

Ahead of bauma 2022 in October, Global Mining Review previews some of the companies that will be exhibiting at the Trade Fair Center Messe München.

For the last 20 months, the global pandemic has rocked every single sector globally, and Australia’s mining, oil, and gas sectors have not been immune from this. From Australia’s international border closure to several state lockdowns impacting the sector’s fly-in fly-out working arrangements, the industry has been challenged in more ways than one. And this is on top of other key issues, including the nation’s productivity crisis, as well as the ongoing push for decarbonisation and a ‘greener’ and more socially conscious approach to mining.

Despite ongoing pressures faced by the sector, the future for the mining, oil, and gas industries is very bright. However, there are several challenges keeping mining leaders up at night, including: CAPEX squeezes; rising environmental, social, and governance (ESG) concerns; and the need for robust digital architecture to facilitate automation and data analytics.

According to the Equinix Mining Technology Report 2021 – 2022, 93% of mining leaders plan to ramp up their digitalisation efforts in 2022, with almost 44% saying they will significantly increase technology investments. More importantly, technology has been identified as crucial to overcoming critical challenges in mining, including driving the ESG agenda and CAPEX management.

Digitalisation is making mines safer for miners by reducing the need for human input in high-risk processes. More advanced data analytics and artificial intelligence (AI) are also providing increasingly sophisticated insights to improve efficiency, safety, and compliance.

However, in order for these benefits to be realised, miners need fast, reliable connectivity. This is partially due to the highly remote nature of mining sites, and partially because the majority of projects today require co-operation and collaboration between multiple parties, who are often distributed geographically. Robust digital architecture is vital to successful automation and real-time data analysis, as mine sites generate and capture significant volumes of data daily.

According to Equinix’s research, Australia’s mine expansions are being fuelled by collaboration. Partnerships – whether in the form of acquisitions, joint ventures, or other forms of collaboration –are expected to contribute 25% of projected growth in 2022.

The adoption of hybrid and multi-cloud services has been critical to enabling increased local and cross-border collaborations for Australian miners. The Industrial Internet of Things (IIoT), digital twins, and other collaborative technologies that deliver greater visibility to mining partnerships benefit from the flexibility and scalability of hybrid and multi-cloud environments. In today’s cloud environment, mining, oil, and gas companies can easily connect, transfer and share data, whether with headquarters, remote operating centres or partners, in order to facilitate smoother collaboration.

This is a huge boon to companies facing ore replacement challenges and ESG concerns. Increased collaboration means Australian miners can look forward to the discovery and development of new ore bodies to meet surging demand. Furthermore, with regard to ESG goals, strategic partnerships with providers of cutting-edge green technologies have helped Australia’s resources sector accelerate decarbonisation efforts and meet community and investor expectations for sustainability.

For the Australian mining industry to continue to move forward and grow, mining, oil, and gas companies need to ensure they are in the best place possible to make the most of emerging market opportunities through better connectivity, smart adoption and implementation of technology, and collaboration with partners. This way, miners can hone a competitive edge by taking a digital-first approach to the future.

BHP Group Ltd, Caterpillar Inc., and Finning International Inc. have announced an agreement to replace BHP’s entire haul truck fleet at the Escondida mine, the world’s largest copper producer, located in the Antofagasta Region, northern Chile.

This agreement is part of the strategic equipment renewal process developed by Escondida. The new Caterpillar 798 AC electric drive trucks will feature technology that delivers significant improvements in material-moving capacity, efficiency, reliability and safety, and generate a positive impact in key initiatives for the future; such as decarbonisation, diversity and inclusion, autonomous technologies, and the development of local capabilities.

The first trucks are expected to arrive at the mine in 2H23, with delivery of the remaining trucks to extend over the next 10 years as the three companies work to replace one of the largest fleets in the

industry worldwide, currently comprised of over 160 haul trucks. Maintenance and support services provided under the agreement advance BHP’s local employment and gender balance strategies. Finning’s Integrated Knowledge Center, located in Antofagasta, will provide top of the line industry technical support for the fleet.

The agreement also allows Escondida | BHP to accelerate the implementation of its autonomy plans by transitioning the fleet to include technology that enables autonomous operation. In addition, the agreements set forth a technological path that helps Escondida | BHP meet its decarbonisation goals, through the progressive implementation of zero-emission trucks.

BHP, Caterpillar, and Finning uphold their commitment of contributing to the economic and social development of Antofagasta, through the generation of local capabilities related to the development of mining equipment technologies.

Epiroc, a leading productivity and sustainability partner for the mining and infrastructure industries, has signed an agreement to acquire AARD Mining Equipment, a South African mining equipment manufacturer.

AARD, based near Johannesburg, South Africa, designs, manufactures, services and supports a wide range of mining

equipment, specialising in low-profile underground machines for mines with low mining heights. The high-quality products include drill rigs, bolters, loaders, scalers, and more. The company’s customers are mainly in the Southern Africa region. AARD has approximately 200 employees and had revenues in the fiscal year ending 30 June 30 2022 of approximately SEK 650 million.

Leading vehicle automation provider, ABD Solutions, has signed a memorandum of understanding (MOU) with AIM and TSX listed Amaroq Minerals Ltd to investigate the potential for the introduction of vehicle autonomy systems for various mining vehicles at the Nalunaq site in Greenland.

The long-term goal of the MOU is to provide a framework for ABD Solutions to deliver the support, software, and hardware solutions needed for the company to operate a diverse range of automation equipment and retrofittable mining vehicles on the Nalunaq site in Greenland. These vehicles would be operated autonomously and supervised from a central control room, therefore, improving safety and streamlining the mining process, both operationally and financially.

ABD Solutions offers a modular technology eco-system to build the various elements required for vehicle automation; including vehicle management, vehicle control actuation, communication, sense and detect, health and diagnostics, and third-party integration. This provides a flexible autonomy solution that can be tailored to a specific vehicle, environment or operational scenario, and then fully integrated into any existing operational and fleet management system.

Vehicle automation can bring significant improvements to safety by removing people from high-risk areas, as well as providing increased operational efficiency, resulting in a reduction in fuel consumption and vehicle emissions. A retrofittable solution also maximises the investment of existing high-value assets by significantly extending their usable life.

Mining Indonesia

14 – 17 September 2022 Jakarta, Indonesia www.mining-indonesia.com

Discoveries

04 – 06 October 2022 Hermosillo, Mexico www.discoveriesconference.com

China Mining Expo 2022 18 – 21 October 2022 Xi’an, China www.chinaminingexpo.com

International Mining and Resources Conference (IMARC) 2022

02 – 04 November 2022 Sydney, Australia www.imarcglobal.com

Mines and Money @ IMARC

02 – 04 November 2022 Sydney, Australia www.minesandmoney.com/imarc

Resourcing Tomorrow, brought to you by Mines and Money

29 – 01 December 2022 London, UK www.minesandmoney.com/london

CONEXPO-CON/AGG 2023

14 – 18 March 2023 Las Vegas, USA www.conexpoconagg.com/conexpo-conagg-construction-trade-show

China Coal & Mining Expo 2023 25 – 28 October 2023 Beijing, China www.chinaminingcoal.com

To stay informed about upcoming industry events, visit Global Mining Review’s events page: www.globalminingreview.com/events

ordgold Group, an internationally diversified gold producer, has launched a new 33 MW power plant at its Lefa mine – one of the largest gold mines in Guinea. The US$30 million project was designed and constructed by China’s leading manufacturing service group, SUMEC, a key member of China National Machinery Industry Corp. (SINOMACH).

The new heavy fuel oil (HFO) power plant has replaced the old facility, in turn reducing both fuel consumption for electricity production by 15% and engine oil by 30%. This will result in a 17 000 tpy reduction of greenhouse gas emissions, which is in line with Nordgold’s climate change objectives, as well as its commitments to the United Nations’ Sustainable Development Goals.

Hyundai Heavy Industries, the world’s largest shipbuilding company and leading manufacture of heavy industry machinery, provided the power plant’s main generating equipment. The power plant will enable a significant reduction in operating costs, in addition to enhancing the stability of the electricity supply for over 15 years of Lefa’s life of mine. Moreover, the installation of the latest fire detection systems will increase employee safety.

During construction, hundreds of additional jobs were created and main essential construction materials including sand, cement and gravel, amongst others, were sourced locally from Guinean suppliers.

AUSTRALIA Australia’s critical minerals to drive the US’ EV battery programme

Australia’s critical minerals will drive the US’ electric vehicle battery programme, following the announcement by the US to grant Australia preferred status.

The Inflation Reduction Act is a major step forward for the Australian government’s manufacturing agenda and will help underpin the demand for high quality Australian battery minerals.

Under the Act, 40% of the value of the critical minerals in the battery must be sourced from a country that has a free-trade agreement with the US, increasing to 80% by 2027.

Driving investment in local processing and manufacturing will also ensure the demand for Australian mined minerals including lithium, cobalt, nickel, and copper.

Importantly, it will also strengthen the case for investment capital into mining. Australian mining needs approximately US$20 billion/yr to sustain current production. If it is going to increase the capacity of existing mines, or open new mines – including in the commodities needed for the global transition to net zero emissions – capital investment will need to be increased by an order of magnitude.

The Bank of America estimates that US$150 billion/yr will be needed in global mining to produce the minerals needed to achieve the global transition to net zero.

Australia needs to position itself as a competitive destination for this capital in order to realise its full potential.

Sandvik Mining and Rock Solutions has received a large order in Chile for surface mining equipment and its AutoMine® Surface Drilling solution from Movitec, a contractor on Codelco’s Rajo Inca opencast project. The order includes two LeopardTM DI650i down-the-hole (DTH) drill rigs and two Sandvik DR412i rotary blasthole drill rigs, including AutoMine Surface Drilling systems for fully autonomous operations.

AutoMine Surface Drilling is an autonomous solution for a wide range of Sandvik iSeries surface drill rigs, designed to improve safety, reduce costs, and increase productivity. It enables an operator to control multiple rigs remotely from a comfortable location in line-of-sight or a distant control room – improving working conditions and safety.

Sandvik iSeries drill rigs are equipped with iDrill technology, a scaleable automation platform that provides automation options

and digital services designed to speed up the production process and support mining operations. Performance and navigation iDrill technologies work together to produce accurately placed, consistently clean, and precision-drilled holes – delivering improved fragmentation, downstream throughput, and asset utilisation.

The new order also includes one Sandvik D75KX rotary blasthole drill rig with added intelligence and improved operator ergonomics. Delivery will take place in two phases before year-end 2022, with fully autonomous operations ramping up in 2023.

In addition, Sandvik Mining and Rock Solutions will also provide contractor Movitec with remote operation training and six months’ on-site service to ramp up support as they transition to autonomous operations.

Hudson Resources Inc. and Neo Performance Materials Inc. have executed a binding agreement whereby Neo will acquire from Hudson an exploration license covering the Sarfartoq Carbonatite Complex in southwest Greenland. The project hosts a mineral deposit that is enriched in neodymium (Nd) and praseodymium (Pr), two essential elements for rare earth permanent magnets used in electric vehicles, wind turbines, and high-efficiency electric motors and pumps that help reduce greenhouse gas emissions.

The project is close to tidewater and a major port facility and is directly adjacent to some of the best hydroelectric potential in Greenland.

Neo, through a special purpose entity, plans to explore and develop the Sarfartoq Project to further diversify its global sourcing of rare earth ore, and to expand the rare earth supply chains that feed Neo’s rare earth separation facility in Estonia. That facility was recently awarded a Gold Medal for its sustainable practices by EcoVadis, the well-respected global sustainability auditor.

Neo is also pursuing plans to break ground on a greenfield rare earth permanent magnet manufacturing plant in Estonia that is intended to provide European manufacturers with the permanent magnets needed for electric and hybrid vehicles, wind turbines, and energy-saving electric motors

and pumps. The Sarfartoq Project also is a key element of Neo’s ‘Magnets-to-Mine’ vertical integration strategy.

Completion of the sale of the license is subject to various conditions, including approval from the Government of Greenland for the transfer of the license, expected to take approximately six months, and approval of the TSXV on the part of Hudson.

Neo intends to assign its rights under the agreement to an SPE controlled by Neo that would hold the license and continue exploration and ultimately extraction of the rare earth elements on the project.

The license covers the large Sarfartoq carbonatite complex that hosts Hudson’s ST1 REE project and the Nukittooq Niobium-Tantalum project. The REEs on the property have a high ratio of Nd and Pr at 25 – 40% of total rare earth oxides (TREO). Hudson completed a preliminary economic assessment on the ST1 project in November 2011, which outlined a National Instrument 43-101 compliant resource containing 27 million kg Nd oxide and 8 million kg of Pr oxide.

Neo and the SPE expect to conduct additional exploratory drilling and other work to move the project forward to eventual commercial operation. Neo also intends to enter into an offtake agreement with the SPE with rights to purchase 60% of the ore or mineral concentrate produced from the project.

MMD remains at the forefront of In-Pit Sizing and Conveying (IPSC) technology, developing bespoke mobile and semi mobile sizing solutions large and small for many types of applications around the world.

Our latest relocatable IPSC stations have successfully been combined with ore diverting solutions and new ore sensor technologies, to enable separation of ore from waste in the pit whilst uplifting ore grades through fines recovery. Introducing an automated ore sorting solution into your existing system ensures only the pay material is hauled to the process plant – meaning your mine can improve production whilst reducing energy usage, water consumption and tailings requirements.

Whether you have an underground or open pit operation, our network of technical experts can help develop a tailor-made in-pit sizing and sorting solution to boost productivity and deliver a leaner, greener mine.

Typical Bulk Ore Sorting Solution

Typical Bulk Ore Sorting Solution

After recording output growth of 6.4% in 2021, iron ore production is expected to decline by 2% in 2022; falling to 2.4 billion t. This is despite marginal growth in Brazil, whose production is expected to reach 427 million t; and in Australia, whose output is forecast to rise to 932 million t – helped by the opening of Rio Tinto’s Gudai-Darri mine in June 2022, and the ramp up of Fortescue Metals Group’s Eliwana mine and BHP Billiton’s South Flank mine. However, steep declines in production

in Russia and Ukraine will lead to an overall fall in total global output, with a drop also forecast in China. At the same time, declining steel demand and slower economic growth in China will keep prices lower than in the previous year, while rising input costs, from fuel to manpower, will place further pressures on margins.

Through to 2026, however, GlobalData expects production to recover, helped by the ramp up of recently opened mines and additional production

coming onstream, with total global production rising by a compound annual growth rate (CAGR) of 2.8% to reach 2.7 billion t.

The COVID-19 outbreak in 2020 had a mixed impact on iron ore, with output flattened for the year. In many major steel-producing countries, demand fell due to lower steel production, with output in Japan and the US falling

by 16.2% and 17.2% respectively, according to the World Steel Association. However, crude steel output in China, which accounts for more than 60% of the global consumption of iron ore, grew by 5.2% in 2020, with high growth in the second half of the year, helped by the government’s investments in infrastructure to stimulate the economy. While output fell elsewhere, the growth in China limited the overall annual decline in steel production to only 0.9% to 1864 million t in 2020. In China,

David Kurtz, GlobalData, Australia, explores the prospects for the global iron ore market.

steel production rose to over 1.05 billion t, 56.5% of the global total.

At the same time, supply constraints, due not just to COVID-19-related impacts, but also operational disruption caused by tropical cyclones in Australia and tailings dam restrictions and bad weather in Brazil, led to a steep rise in the iron ore price. Having been just US$78/t in February 2020, the price rose to US$156/t by the end of 2020, spurred on by China’s push for higher steel output.

In 2021, production recovered, rising by 6.4% to 2.4 billion t. Production from Australia rose by 0.4% to 922 million t, helped by an increase of 18% from Fortescue, whose Eliwana mine opened in December 2020, although output from Rio Tinto fell by 3% and BHP’s production was flat. Output from Brazil was up by 8.1% to 423 million t.

The iron ore price continued to rise as well, peaking at US$219.77/t in July 2021. Seasonal weather disruption in the early part of 2021 led to underwhelming output from the large producers and a consequent increase in prices, which were also pushed up by rising demand from steel mills and infrastructure growth in China. However, in 2H22, the Chinese government enforced curbs on steel production in order to reduce greenhouse gas emissions, with mills in many regions cutting production based on their emissions levels as part of a winter air pollution campaign, from October to March. After rising in the first part of the year, steel production in China fell by 9.4% in July and 13.2% in August, with the Chinese government looking to maintain steel production in 2021 at the same

Table 1. Iron ore production by company (million t), 2020 – 2021 Company 2020 2021 Change

Vale SA 300.4 315.6 5.1%

Rio Tinto 285.9 276.6 -3.3%

BHP 245.1 245.4 0.1%

Fortescue Metals Group Ltd 207.5 236.5 14.0%

Anglo American plc 61.1 63.9 4.6%

Mitsui & Co. Ltd 57.8 58.2 0.7%

ArcelorMittal SA 58.0 50.9 -12.2%

Companhia Siderurgica Nacional 30.7 36.3 18.2%

NMDC Ltd 31.2 34.5 10.6%

Metinvest BV 30.4 31.3 3.0%

Company reports, GlobalData

level as in 2020, in part to help reduce emissions. Economic activity in China was also impacted by lower construction activity amidst a reducing government stimulus and property market concerns, with the country’s second-largest property developer, Evergrande, struggling to service its debts. Overall, in 2021 steel production in China fell by 3% to 1.03 billion t, the first decline since 2016. Having risen by 12% in 1H21, production in 2H21 was 16% lower, helped by tighter government controls as well as a rise in power costs. Linked to this, the iron ore price fell to US$92/t in November 2021, but recovered to US$112/t by the end of the year.

Global iron ore production is predicted to decline by 2% in 2022. The ongoing Russia-Ukraine war is expected to reduce Russia’s iron ore output, with only slight (1%) growth in Brazil and Australia unable to offset this fall, while production from China is also expected to decline.

Of the major producers, as of July 2022, Rio Tinto’s guidance was for shipments of 320 – 335 million t vs 322 million t in 2021 (100% owned basis) for the calendar year. BHP, whose fiscal year (FY) runs from July to June, has provided iron ore production guidance for FY23 of 249 – 260 million t, the mid-point of which would be growth of less than 1% vs FY22. Vale, meanwhile, lowered its initial guidance for 2022 from 320 – 335 million t to 310 – 320 million t, partly due to the sale of its Midwestern System to J&F Mineração Ltda, which produced 2.7 million t of iron ore in 2021. The sale is being made in order to focus on value over volume, and includes iron ore, manganese, and logistics companies.

Demand for iron ore will be negatively impacted by declining steel production in China. From January – May, output from China fell by 8.1% y/y, dragging the overall global production down by 5.5%, according to the World Steel Association.

As a result, the iron ore price, which was US$130/t at the end of June 2022, is expected to remain subdued over the remainder of the year. With costs increasing, this will in turn put pressure on margins for miners.

Through to 2026, global iron ore production is forecast to reach 2.7 billion t, a CAGR of 2.8% from 2022. Growth is expected to average 3.4% annually in Australia and 3.8% in Brazil, with output reaching 1.06 billion t and 496 million t, respectively.

Contributing to output from 2023 onwards will be Fortescue’s US$3.6 – 3.8 billion, 22 million tpy Iron Bridge, which is due to see production in the March 2023 quarter. Meanwhile, commercial production is due to commence at the end of 2022 at Champion Iron Ltd’s Bloom Lake Phase II expansion project, with an increase in capacity from 7.4 million tpy to 15 million tpy of 66.2% iron ore concentrate.

Other major developments may be a few years away, only impacting output in the middle to latter part of the decade. Rio Tinto has the potential to develop the 20 – 25 million t Western Range project, for example, as well as having a share in two of the tenements in the huge Simandou iron ore mine in Guinea. There have been challenges at the latter in 2022, however, with the country’s mines minister ordering for construction work to be stopped, requesting a solution to the development of a 670 km-long rail line and port between Rio Tinto and China-backed SMB-Winning Consortium. Rio Tinto has a 45% share in a consortium that owns two of Simandou’s iron ore tenements, with Chinalco owning 39.95%, while the SMB-Winning Consortium owns the other two. In 2020, the SMB-Winning consortium announced plans to start production at blocks 1 and 2 by 2025, but this could slip now given these delays.

The newly-opened Gudai-Darri mine will continue the trend towards the use of autonomous trucks in iron ore mines. The mine will have 23 CAT 793F autonomous haul trucks, as well as three CAT MD6310 autonomous drills, autonomous water trucks and autonomous trains, and will also employ digital twin technology.

As of May 2022, GlobalData was tracking over 1000 autonomous haul trucks in operation globally, of which 544 were at iron ore mines, 495 of which were in Australia. The increasing use of autonomous equipment has led to rising productivity amongst iron ore miners, which will prove critical as rising inflation begins to impact costs for all inputs, from fuel and consumables to maintenance and manpower.

As well as being amongst the most technically advanced mining companies, iron ore producers such as BHP, Rio Tinto, Vale and Fortescue are also some of the most ambitious when it comes to decarbonisation and a shift to net zero mining. They are also supporting a reduction in carbon emissions further down the value chain in steel production, helping to improve the environmental impact of the overall iron and steel sector, which, according to the International Energy Agency, accounts for approximately 6.7% of global carbon dioxide (CO2) emissions, with 1.9 t of CO2 emitted per tonne of steel produced.

Fortescue is aiming to be carbon neutral by 2030, as well as achieving net zero Scope 3 emissions by 2040. The company is connecting its mine sites with renewable power and battery storage, replacing stationary diesel and gas-fired power. Of its emissions, 26% are from haul trucks, which will be abated using battery and hydrogen power, while green ammonia and battery storage is used to remove diesel from locomotives (11% of emissions), and electric motors and hydrogen fuel cells are used for other heavy mining equipment (36% of emissions). In June 2022, the company announced a partnership with Liebherr for the development and supply of 120 green mining haul trucks, to be integrated with its zero emission power system technologies being developed by its subsidiary

Fortescue Future Industries (FFI) and Williams Advanced Engineering. FFI is a global green energy and product company focused on producing zero-emission green hydrogen, acting as a developer, financier, and operator. It is in the process of building a global portfolio of renewable green hydrogen and green ammonia operations, and is targeting the supply over 15 million tpy of green hydrogen by 2030.

Rio Tinto, meanwhile, is targeting a 15% reduction in Scope 1 and 2 emissions by 2025, a 50% reduction by 2030 (vs a 2020 base year), and to be carbon neutral by 2050. Renewables are key to the company achieving its 2025 targets, and will make a substantial impact on reducing emissions from 2020 – 2035. Mobile diesel represents 16% of emissions on a managed basis and the company is targeting diesel displacement between 2030 and 2045, phasing out the purchase of diesel haul trucks and locomotives by 2030. Meanwhile, it is aiming to decarbonise process heat between 2025 and 2050, with the development of low-emission process heat technology, including the trialing of plasma torches at its iron ore business in Canada.

Like Rio Tinto, BHP has made 2050 its target year for net zero, although it has a more moderate short-term target to reduce operational Scope 1 and 2 emissions by 30% by 2030 (2020 base year).

Electricity represents approximately 40% of baseline emissions, with the company looking to secure renewable energy through PPAs, or installing renewable power generation where grid connectivity is limited, as well as optimising demand side energy use. Similar to electricity, diesel accounts for 40% of emissions, with the timeframe for diesel displacement ranging from 2025 to 2040.

Lastly, Vale is targeting a 33% reduction in Scope 1 and 2 emissions by 2030 (base year 2017), and a 15% reduction in Scope 3 net emissions by 2035 (base year 2018). A key driver for their emissions reductions will be renewable power. In 2020, 87% of Vale’s power was sourced from renewable power and the company is targeting 100% renewable electricity consumption in all operations by 2030, and in Brazil by 2025. To achieve its Scope 1 and 2 emission reduction commitment (33% by 2030), the company announced in 2021 that it would invest US$4 – 6 billion until 2030. In 2020, US$81 million was invested in projects to reduce emissions, including pilots for bio-oil and biocarbon use in pelletising furnaces, underground battery electric vehicles, and electric locomotive pilots.

After record iron ore prices helped deliver a collective 40% rise in revenues and 136% increase in net income for the four major iron ore producers in 2021, 2022 will inevitably be more challenging; with cooler demand from China, rising costs, and a shortage of workers. While there will be short term impacts for the iron ore market, in the medium term, growth in infrastructure spending will support further investment in production, while continued investment in automation and other technology will help deliver increasingly efficient and safe operations.

Mining businesses need to maximise equipment utilisation, boost their output, and decrease costs – all while advancing their decarbonisation efforts. Offering improved productivity and reduced operational costs, premium fuels and lubricants are solutions that operators cannot afford to overlook as they work to meet shifting global demand and disruption to supply chains.

With the mining industry facing extreme global disruption, operational efficiency has become even more vital than ever. Current geopolitical events mean that some nations are swiftly switching to alternative sources for commodities.1

And, where this has not been possible, it is causing a slowdown in production across many industries and sectors.

While rising energy costs have been front and centre in the minds of most people, the disruption has also led to sharp price increases in several metals – such as gold, nickel, and palladium – due to fears of shortages.1 In fact, nickel prices more than doubled in the two weeks following the beginning of the war in Ukraine.2

In the short term, these price rises will likely drive growth in the mining industry. However, businesses will still need to address the challenges facing them as they look to meet the shifting demands of countries trying to maintain the fluidity of their supply chains.

Nadia Haseeb, Shell, explains how combining premium fuel and lubrication could be an efficient solution for an evolving sector.

This makes it essential to enhance productivity across every area of operations by reducing equipment downtime and increasing system efficiency as much as possible.

Maximising equipment utilisation in the demanding mining environment is a difficult job at the best of times, but with the impact of COVID-19 and geopolitical pressures resulting in further cost pressures and tighter margins, there is now a much greater need for mining site managers to unlock efficiencies wherever possible.

That is in addition to some important emerging trends that are shaping approaches to operations across the sector, including:

n Alternative fuels: As mining looks to transition towards a net-zero future, alternative fuels are a means of maintaining operational efficiency while meeting sustainability targets. However, they will place different demands on equipment and require effective management to reach their potential.

n Changing equipment designs: To meet output needs, mining equipment is becoming bigger, which means unplanned downtime can have an increasingly detrimental impact. New original equipment manufacturer (OEM) designs also mean higher loads, increased temperatures and smaller oil sumps, raising the pressure even further on maintenance programmes to keep machines running smoothly.

n Tightening regulation: Equipment emissions standards increased with the advent of Tier 4 diesel engine requirements, and more recently, industry-wide targets have emerged. For example, the International Council on Mining and Metals has committed its members to net-zero Scope 1 and Scope 2 greenhouse gas emissions by 2050.

Businesses will need to adapt quickly to these trends to avoid the potential for disruption and, instead, unlock new opportunities for growth.

Improving efficiency and profitability while adapting to changing trends and global disruption might seem like a

near impossible task, but it can be achieved by going back to basics and focusing on the variables that are in one’s control, such as consumables.

It is vital that businesses do not lose sight of some of the most significant inputs (such as fuel and lubrication) when it comes to protecting operational fundamentals. Ultimately, it is these fundamentals – equipment health, uptime, and efficiency – that will dictate the strength of the bottom line for years to come.

After all, the fuels and lubricants selected can have a big impact on equipment and, in turn, business performance, with studies showing better fuel economy and improved fuel system technology can deliver up to a 5.5% reduction in fuel consumption.3

The right combination of fuels and lubricants has the power to drive efficiency across equipment operations and help reduce running costs. This has been demonstrated by professional experts putting consumables to the test under real-world conditions, making sure they can meet evolving industry requirements.

For example, Shell collaborated with Deutsche Landwirtschafts-Gesellschaft (DLG) to measure the total cost of ownership (TCO) savings and efficiency gains that can be achieved when using premium fuel and lubricants together.

Situated in Gross-Umstadt, Germany, DLG has a rich history of promoting the technical and scientific progress of off-highway equipment. Engaging a facility at the standard of DLG allows precise testing and close monitoring of test conditions.

Over the course of more than four months, and across nearly 600 hrs, the DLG team tested Shell FuelSave Diesel (known as Shell Diesel Extra in some countries) in combined use with Premium Shell Rimula Lubricants, against regular diesel and standard lubricants. The premium consumables were first put through DLG’s PowerMix test procedure using test frames and parameters designed by an independent expert commission, a format regularly used by leading global manufacturers to assess the quality of their machines.

Next, the two companies designed a new power take off (PTO) testing programme, combinining a series of assessments to verify the quality of premium fuels compared to standard ones. The result was a real-world measurement of how the tested fuels can impact the overall performance of an engine.

While there is a growing awareness across the mining sector of the benefits that either a premium fuel or a premium lubricant can have on equipment performance, the DLG test demonstrates the additional efficiencies that can be unlocked by combining the two.

The testing showed that, when used together, Shell’s premium diesel and premium lubricants can deliver up to 472 more operating hours as a combined efficiency benefit,4 a figure that could have significant cost-saving potential for the 24/7 schedules that are not uncommon for mining projects.

The results also highlight the increased productivity that these fuels can offer, with DLG measuring up to 2.7% better fuel economy5 and 5.6% more load-pulling power when compared with regular diesel.6

Turning back to fuel, this idea of an interlinked value chain is in full view, since fuel represents an important share of operating costs for mining businesses, with the average large mine hauling truck using 900 000 l/yr of diesel.7 Therefore, any improvement in fuel economy can have a significant impact on the bottom line, releasing savings that can be redirected to other parts of the business or used to protect financial health during periods of extended uncertainty.

A key factor in this is the ability to maintain engine efficiency while operating with heavy loads or on uneven terrain, especially with equipment that is consistently running at high capacity. And much of this comes down to the health of the injection system, particularly injector cleanliness. Shell and DLG’s test, for instance, showed that Shell FuelSave Diesel was able to achieve clean-up of up to 100% of performance-robbing deposits (linked to power) in less than three working days, which can significantly reduce downtime and maintenance costs.6

As more solutions become available to operators, being able to rely on products with performance proven under real-life conditions by independent test experts (such as DLG) will be key to ramping up operations. After all, the efficiency gains that once offered a competitive edge may now be essential for survival as mining businesses shake off the lasting effects of the COVID-19 pandemic.

Another important element for a business is the ability to not only drive efficiency and growth, but also to do it sustainably. This is especially important given that mining currently accounts for 4% of total global energy consumption8 and is responsible for up to 7% of greenhouse gas emissions worldwide.9

Moreover, these factors are not just useful for contributing to the sector’s decarbonisation but can also help bring external stakeholders along on the journey too – something that holds its own significant value considering how important an operation’s license to operate (LTO) can be to the wider business.

And this has npt gone unnoticed by mining executives either, with six out of 10 citing their LTO as the biggest risk facing their business.10 Why? Because ultimately, they know that strengthening their LTO transcends societal and environmental factors, becoming critical for renewing existing business and winning new contracts as well.

In this context, any potential improvements around fuel efficiency or fuel consumption could be a massive driver of responsible growth. Even before thinking about the transition to alternative fuels, significant differences can be made by using the right combination of premium fuels and lubricants. The more efficient operations are and the less fuel is consumed, the fewer emissions are generated –helping companies take an important step towards the

decarbonisation of their business, while demonstrating to new and existing customers that they can deliver in this area.

Given the disruption facing global supply chains, operational efficiency is more important than ever. Which is why operators are looking across the board for opportunities to claw back marginal gains, be it through their consumables, digital technologies, or stronger collaboration.

Closing this gap will take time and investment, but once businesses are equipped with the right solutions and staff are given the correct skillsets, the potential benefits are clear. The important thing to remember, however, is that –just as the DLG testing shows – it is not always enough to have the right product, service or equipment on its own.

Rather, to deliver consistent performance when it is needed most, mining operators must connect the various dots from around their business, whether that is through: combining digital technology with staff upskilling; understanding that an LTO is a societal and business imperative; or unlocking efficiency potential by using premium fuel and lubricant in tandem.

1. ‘Russian invasion of Ukraine: Potential impact on supply chains of mineral commodities,’ GlobalData, (2022), www.mining-technology. com/comment/supply-mineral-commodities

2. ‘Supply of Critical Minerals Amid the Russia-Ukraine War and Possible Sanctions’, Center on Global Energy Policy, (2022), www.energypolicy. columbia.edu/research/commentary/supply-critical-minerals-amidrussia-ukraine-war-and-possible-sanctions

3. YUKSEL, A., ‘Digging Deeper: Increasing Mining Equipment’s Efficiency’, Cummins, (2021), www.cummins.com/news/2021/03/03/increasingmining-equipments-efficiency

4. For the same amount of fuel compared to regular diesel without fuel economy formula and to standard lubricant. Baseline of 100 000 l/hr and 50 l/hr fuel consumption per equipment. Based on demonstration tests with off-highway heavy-duty Tier 4 engines in collaboration with DLG Germany.

5. Shell FuelSave Diesel is designed to help provide by up to 3% fuel economy, compared to regular diesel without fuel economy formula. Actual savings may vary according to vehicle, driving conditions, and driving style. Internal Shell tests and with customers have shown a range of fuel savings depending on age of vehicle and type of operations.

6. Compared to regular diesel without fuel economy formula. Based on demonstration tests with off-highway heavy-duty Tier 4 engines in collaboration with DLG Germany. Achieved within 50 hrs of engine operations and four tankfuls.

7.

MURALIDHARAN, R., KIRK, T., and BLANK, T. K., ‘Pulling the weight of heavy truck decarbonization: Exploring pathways to decarbonize bulk material hauling in mining’, Rocky Mountain Institute, (2019), www.rmi. org/insight/pulling-the-weight-of-heavy-truck-decarbonization

8. ‘Largest end-uses of energy by sector in selected IEA countries’, International Energy Association, (2021), www.iea.org/data-andstatistics/charts/largest-end-uses-of-energy-by-sector-in-selected-ieacountries-2018

9. DELEVINGNE, L., GLAZENER, W., GRÉGOIR, L., and HENDERSON, K., ‘Climate risk and decarbonization: What every mining CEO needs to know’, McKinsey & Company, (2020), www.mckinsey.com/ business-functions/sustainability/our-insights/climate-risk-anddecarbonization-what-every-mining-ceo-needs-to-know

10. ‘Top 10 business risks and opportunities for mining and metals in 2022’, EY, (2021), www.assets.ey.com/content/dam/ey-sites/ ey-com/en_gl/topics/mining-metals/ey-final-business-risks-andopportunities-in-2022.pdf

Weir Minerals is focused on mining safely, sustainably, smarter, and more efficiently. It is not that production is any less important than it has always been; rather, by looking at processes holistically and taking time to plan, test and implement well-designed flowsheets, the company believes that it can help miners produce more for less.

In many instances, this requires a willingness to think differently – to be less fixated on the outcome and more focused on how to get there. Take, for instance, valves. Compared to a lot of other mining equipment, valves are lower cost, haver a shorter lead time, and, for that reason, operators often under appreciate their value.

Yet, valves enable operators to isolate and shutdown other equipment safely, preventing small problems from becoming plant-wide disasters – they are key to safe and reliable operation. However, because they are often only installed as an afterthought, poorly selected valves can end up shutting down operations instead of keeping the plant running.

Weir Minerals recently expanded its range of valves with the Isogate® WR knife gate valve. Drawing on decades of wear analysis, Weir Minerals’ engineers have optimised its body design by reinforcing the areas subjected to the harshest wear and pressure, while reducing the weight elsewhere to produce a robust, long-lasting mining valve that is significantly lighter than comparable products.

The gate has also been redesigned with stronger materials, resulting in a thinner gate that can still withstand

John McNulty, Weir Minerals, Australia, reviews how pumps and valves can help mining customers produce more for less.

the pressure of mining slurries. This combines with the valve’s unique gate guide, reducing deflection by ensuring smooth gate movement and less stress on the sleeve elastomer during blade transition.

The Isogate WR knife gate valve utilises Weir Minerals’ new Isogate WSL sleeve, which uses the proprietary Linard® HD 60 silica-reinforced natural rubber to solve the three most common problems with sleeved knife gate valves: leakage during cycling, tearing, and load distribution ring (LDR) failure due to corrosion and erosion.

Leveraging the Linard HD 60 rubber’s high resilience against cut, tear and abrasive wear to improve wear life, the new Isogate WSL sleeve fully encloses the LDR to prevent corrosion. By allowing the rubber to move with the blade cycles, the design reduces the chance of tearing while reducing slurry discharge by up to 75%.

But valves are only one piece of the puzzle, and this same commitment to innovate engineering underpins Weir Minerals’ approach more generally, including pump and pipeline design.

The amount of energy a pumping installation consumes depends on the pump efficiency, the drive train losses and

the motor and/or motor controller electrical efficiency. Pump efficiency is the biggest determinant of power costs. A slurry pump’s efficiency is reduced by the presence of solids, and an efficiency ratio (ER) is used to correct the published water performance curve; pump design also has an influence on the ER. The Warman® MCR® rubber-lined slurry pump features a large-diameter, low-speed, high-efficiency impeller, which reduces energy consumption.

Weir Minerals’ team of slurry pump experts work closely with operators to provide guidance on how to improve efficiency depending on their specific application. For example, at flow rates less than 60% of the standard impeller best efficiency point, utilising a reduced-eye impeller and low-flow volute will improve pump efficiency. And where pumps may be prone to cavitation, operators should consider maximising the use of low-NPSH-style impellers. Pump and component selection helps reduce wear, which, in turn, minimises additional maintenance expenses.

By extending wear life, operators can significantly lower the total cost of ownership (TCO); the Warman MCR slurry pump has a number of innovative features that have been designed with this in mind.

For instance, it features patented shrouds that extend past the periphery of the pumping vane and expelling vane, providing improved flow and reduced wear at the expelling vane tips. Its large, open internal passages reduce internal velocities and, thus, reduce wear.

Nevertheless, pump performance is not just about the equipment – close collaboration between miners and original equipment manufactures (OEMs) is an often overlooked factor.

Case study: Australia Weir Minerals understands that no two operations are the same, so it works closely with its customers to develop tailored solutions based on their specific requirements and conditions. Evolution Mining’s Cowal Gold Operations in New South Wales, Australia, wanted to increase production and reach a service life of 24 weeks uninterrupted production to align with major shutdowns and other equipment on site.

The Weir Minerals team installed a Warman MCR pump with R55® rubber liners, A65 full face adjustment throatbush and A61 impeller. Because of power limitations from the existing motors on site, they used rapid pattern prototyping to manufacture a custom 82% trimmed impeller for the application. The team also 3D scanned the site to ensure a trouble-free installation and finalised the custom design of connected Linatex® pipework, new cyclone feed line, and Isogate valves.

Cowal Gold Operations increased production and extended the pump’s wear life; the incumbent pump’s 12 weeks of continuous operation was significantly improved upon by the Warman MCR 550 pump, which achieved 29 weeks. Over one year, the incumbent pump’s TCO was AUS$2.2 million compared with the Warman MCR 550 pump’s AUS$1.7 million – saving Cowal Gold Operations nearly half a million dollars.

Operating costs often vary depending on where the mine and pump installation is located; local climatic and regulatory conditions have to be factored in when working out the TCO. The cost of water, for instance, varies greatly across regions.

The costs associated with the use of water to flush the gland of a slurry pump can be split into two components: the supply cost and the removal cost. The former depends on the type of pump – its size and gland type – while the latter depends on the particular process and commodity being handled.

The amount of water consumed by the pump depends on the type of seal. The mechanical seal and expeller or centrifugal seal can be operated without any water injection, but sometimes use small amounts to help reduce wear in particularly erosive duties.

The Warman MCR pump has a low flow design stuffing box that is also able to be centred. The adjustable stuffing box allows for centring of the stuffing box and lantern restrictor to the shaft sleeve, which increases packing life and decreases gland seal water consumption.

The Warman MCR slurry pump’s low flow stuffing box is made with tungsten-carbide-coated J221 shaft sleeves. The stuffing box also features close clearance split lantern restrictors with a harder non-galling coated inside diameter. The upgraded materials and design reduce gland water consumption.

The actual consumption of water also needs to be factored in. In remote areas, the supply of suitable gland water may be very costly due to the need for sinking bores and the long-distance pipeline pumping. Even when more readily available from mains supply, water can be relatively expensive to purchase in large quantities.

At a Latin American iron ore mine, the operator wanted to increase its energy savings in all their processes, focusing particularly on reducing the consumption of process water. It had Warman MCR 250 pumps installed in one of its mills to transport slurry from the mill discharge to the hydrocyclone cluster. The installed Warman pump seals were wet seals with an average life of 3200 hrs.

Weir Minerals suggested trialling a Warman mechanical seal on the Warman MCR 250 pump; the mechanical seal requires a small amount of water to be injected to assist with lubrication and cooling of surfaces.

At the conclusion of the successful trial period, the time between maintenance intervals tripled and the customer’s water consumption costs decreased by 65% with the mechanical seal.

Inventory costs are something of balancing act. On the one hand, holding stock ties up capital that could

otherwise be spent on revenue-earning activity; on the other, having stock on hand ensures spare parts are available immediately in the case of an unplanned shutdown or to ensure supply in the case of extended lead times.

Weir Minerals’ team of slurry pump experts works closely with mining customers to understand their equipment’s wear performance, maintenance schedules, and inventory requirements. It has a global network of service centres in all major mining regions to support its customers with all their inventory needs.

Capstone Pinto Valley Copper Mine has two spare Warman MCR pumps; when a pump needs to be repaired, it is pulled out of the line and shipped to the Tucson Service Centre. Here, Weir Minerals service technicians pull it apart, laser scan it to determine where the wear locations are, provide a wear report and recommendations, and put it back together according to OEM specifications. Weir Minerals then ships the pump back to Pinto Valley within 5 – 7 days. This reduces downtime, saves Capstone Pinto Valley money by removing the need for a full inventory of spares to be kept, and frees up its maintenance staff to carry out work on other equipment.

Reducing spare parts consumption can significantly lower the TCO. At an Australian gold mine, for instance, Weir Minerals

configured all their Warman MCR 550 pumps with composite throatbushes comprising half alloy and half rubber to address the localised recirculation wear around the eye of the throatbush. This resulted in a significant increase in the length of the Warman MCR pump life cycle.

This increase has reduced shutdowns from four per year down to a maximum of two per year, depending on tonnage throughput. This, in turn, has allowed the site to modify the maintenance plan and contributed to a reduction in spare parts consumption, which has saved the customer over AUS$2.1 million, while also increasing plant operation time.

As wear monitoring improves, so too will pumping efficiency.

Weir Minerals wants to go beyond the traditional role of OEMs and become a digital end-to-end solutions provider to its customers. One important development in the realisation of this vision is the recent launch of Synertrex® IntelliWearTM digital wear monitoring system for spools and hoses in slurry pipelines.

The system is comprised of a digital sensor integrated into Weir Minerals’ Linatex and Vulco® hoses and spools. A central control panel captures information in a single location and a dashboard allows for visualisation and analysis of the equipment data via the Synertrex digital ecosystem. Digitalisation enables Weir Minerals’ customers to continue their normal operational duties, while large amounts of data are automatically analysed and interpreted in the background, via the Synertrex intelligent platform.

A conductive wire is installed in the rubber lining at various levels of thickness. As the lining wears, it activates sensors to indicate the extent to which the rubber liner has been worn and, in turn, how much life is left. An easy-to-use traffic light system has been developed which enables quick visual identification of the condition of the hose or spool. Less than 50% wear is green, between 50% and 70% wear is yellow, and greater than 75% wear is red – indicating it is time for preventative maintenance. The conductive wire is installed along the entire Linatex or Vulco spool or hose, throughout its diameter.

The central monitoring panel collects data from the sensors in the field and sends it to the Synertrex intelligent platform, which can then be viewed by operators and maintenance personnel. Information collected can also be uploaded to the cloud to be viewed on a live dashboard, which is automatically updated every two minutes. The intelligent system enables operators to view real-time wear information from any device remotely – ensuring continual monitoring and better control over their equipment.

With declining ore grades and increased regulatory pressure, miners have to increasingly rely on plant optimisation if they are going to meet the growing demand for many minerals. As a trusted OEM partner, Weir Minerals tries to understand each site’s specific challenges and develop bespoke solutions. It is something that is only possible because the company has a portfolio of products across the entire flowsheet, as well as the expertise to support them.

Bulk materials, whether coal, ores or rock, still play a major role in the extraction of natural resources.

Today more than ever, the shortage of certain raw materials on the world market highlights the demand that is to be met.

Many deposits are located just below the earth’s surface, which makes extraction from the vicinity of an opencast mine a sensible option.

In opencast mine operations, once crushed to the required size, the product must be transported to the next downstream process step. The scope of this article is focused on the crushing interface to mining, and hence only the features relating directly to the immediate transport of materials are considered.

Boris Frankenreiter, thyssenkrupp Mining Technologies GmbH, Germany, outlines some of the best operational practices for in-pit crushing and conveying (IPCC) operations.

In the case of higher throughputs and coarser particle size product, it is often a requirement to have a product vault or pocket under the crusher that has the capacity to hold approximately two to three truck payloads. Material is then drawn away from the vault by a feeder that discharges onto a main conveyor belt.

On the largest scale, the materials handling of the product requires a range of equipment, including belt wagons, bridge conveyors, and, in some cases, custom systems. Belt wagons (Figure 3) are essentially mobile transfer conveyors, mostly used to provide a connection between mobile crushing plant and a fixed bench conveyor. In most cases, belt conveyors are statically located at the mining face, but are designed to be shiftable. The utilisation of a belt wagon enhances the flexibility during operation of the crushing plant in combination with the belt conveyors and, additionally, the amount of shifting procedures can be reduced.

An even more flexible solution for the material transfer between a crushing plant and a mine face conveyor is formed by mobile conveyor bridges. Principally, they are a further development of belt wagons with the advantage

of further improved flexibility. Conveyor bridges, as shown in Figure 1, can operate across one or more mine benches, and further optimise travelling and shifting of the crushing plant and the face conveyors, in order to minimise system downtimes.

Beyond these specialised units for in-pit crushing and conveying (IPCC), conveyors in general form the arteries of the system. Although, these can be deployed as fixed installations in some instances, there is also the need to move the conveyors to optimise material movement. The main movement options for such conveyors are usually referred to as portable, shiftable, or semi-fixed. Portable conveyors are mostly wheel-based and are often designed in a traditional grasshopper style. Shiftable conveyors are designed to be moved periodically, so they are often skid-mounted and have attachment points to allow dragging via dozers. Semi-fixed conveyors are modular, mostly mounted on concrete sleepers, and relocation involves disassembly and movement of the modules.

For the extraction of various mineral resources in mining operations throughout the world, depending on the thickness of the material to be extracted, the movement of smaller or larger quantities of overburden is necessary. This becomes more lucrative the larger the deposits of natural resources are in the mine, located under layers of soil. Once the location and size of the raw material to be extracted have been determined by test drilling, it becomes necessary to remove the overburden layers before extraction of the resources. The overburden is commonly dumped at a suitable location in the mine, at a distance from the extraction site. In many smaller mine activities, the simple truck and shovel method is still useful, as this method is easily scalable. A small fleet of mine trucks, driving the overburden from the excavation face to the overburden dump, often represents the basic

equipment of a small or medium mining operation.

In the event of an increase in mine activities, for example due to the increase of production rates or to move larger quantities of overburden, the use of specialised machinery for continuous transportation and dumping becomes economically more favourable. After crushing the overburden into a product size, which can be handled by conveyors at the mine face, the material is transported by belt conveyors to the overburden dump area where tripper cars and spreaders are used in the dumping process. Often, the conveyors at the beginning and at the end of the complete conveyor line are designed as relocatable or shiftable. This way, the specific single conveyors can be moved close to the operation radius of the mining and dumping machinery, thus optimising travel and handling times of excavators and dumping equipment.

Many worldwide mining applications in medium and large scale rely on semi-mobile or fully-mobile crushing

plants at the beginning of the conveying line. The dumping equipment itself is independent from the type machinery used at the mine face. Tripper cars are the first unit of dumping machinery and are used to receive the overburden from the dump conveyors. Therefore, tripper cars are equipped with travel mechanisms either of the rail-type, or – more rarely – the crawler-type. They travel along the relocatable dump conveyor and lift off the belt to a specific transfer point, where the material is transferred to the spreaders. The spreaders form the last member of the conveying chain and dump the overburden in a controlled manner at the designated area. To achieve a maximised flexibility in operation and

Figure 4. Spreader and tripper car, with tripper car on crawlers.

Figure 4. Spreader and tripper car, with tripper car on crawlers.

minimise shifting-downtimes, spreaders are commonly designed as two-flight units with travel mechanisms consisting of crawlers. Capacities of spreaders and tripper cars may vary between 3000 m³/hr up to 18 000 m 3 /hr (Figure 2), and in special cases even more.

Especially in operations where spreaders and tripper cars are intended to drive on freshly filled ground, the crawler–based travel mechanisms of the spreaders are a proven, state of the art technology. Due to the lower weight of the tripper cars, their travel mechanism often consists of a travelling system on rails, which are attached to the dump conveyor, as they always are centred over the conveyor. Special applications with the demand of a very high flexibility also incorporate tripper cars on crawlers, combining with an additional discharge boom with a conveyor (Figure 4), while the spreader is equipped with a support car for the receiving of the conveyor boom.

For the application of continuous dumping equipment in smaller mines, a single operating tripper car on crawlers or on rails can also form a standalone solution without a spreader.

Low energy consumption and carbon dioxide reduction are becoming more and more important, even in the mining business. With this in mind, thyssenkrupp has worked to make sure its products are operated entirely electrically.

While discontinuous transport systems are based on a large number of individual transport units like haul trucks, a continuous system minimises the number of operators. While in truck transport systems, each vehicle is operated by at least one person, combined with multiple work shifts per day, a continuous system can be operated by fewer personnel during the same time. A significant increase in operational safety and economic savings is the result of the innovative control and monitoring systems. Implementing these solutions on a

large scale optimises the number of personnel needed for safe and economic operation of the transport system even further.

The continuous mining equipment recently installed in an opencast mine, located in Bulgaria, is the latest state-of-the-art technology designed for operations. After initial mine planning activities, conducted by thyssenkrupp Mining Technologies, the optimal combination of equipment has been installed inside the mine. The technical solutions adopted for the engineering of the specified continuous mining equipment operations have prioritised the stability and safety of the equipment, whilst maintaining a high degree of robustness to ensure easy and secure operations, as well as good accessibility to the components of the equipment in the event of maintenance.

The complete system, which is designed for a capacity of 3000 tph of overburden, consists of the following equipment: n Semi-mobile crushing plant of the type 63 x 89 in., fed by apron feeder, up to 150 t truck class. n Multiple stationary belt conveyors leading from the crushing plant to one shiftable dump conveyor in the dumping area – total length approximately 3200 m. n Tripper car on rails and spreader on crawlers –ARs 1600 50+70/17 – forming the dumping equipment with a maximum capacity of 5000 tph.

In normal operations, the system is interlocked and runs in an automatic mode, controlled by programmable logic controllers.

Since commissioning in 2011, the complete IPCC system, as shown in Figure 5, is in continuous operation and has proven to be a reliable, high-performance transport system.

When comparing the benefits of a continuous transport system with the characteristics of using trucks, the advantages are obvious: improved capacity, reliability, lower maintenance costs, increased safety in operation, and, not to be overlooked, better environmental prospects. The operation of mobile machines with belt conveyors becomes more economical the larger the mine grows and the larger the quantities that are transported.

Figure 1. Reducing emissions in haulage fleets is more complex than it first appears as these fleets are very diverse, with differing haul profiles being influenced by geography and environmental factors.

In the mining industry, fossil fuels are consumed in almost every process.

Loading and hauling account for around 50% of a mine’s overall usage of fossil fuels today, according to Hitachi Construction Machinery (HCM) data and other industry reviews. That number can be much higher depending on the particular application.

At first glance, it appears the loading and hauling segment is positioned as a quick win for emissions-reduction efforts. However, the reality is there are much more complex loading and hauling requirements that also represent a very broad scope of the mining segment.

Globally, surface mining haulage fleets are very diverse, with differing haul profiles being influenced by geography and environmental factors. Copper, coal, iron ore, gold, diamonds, phosphorus, and even oil are all surface mined. These mines are in climates ranging from the equator to the Arctic Circle, and from sea level to mountain tops.

Their diversity means there is no silver bullet to solve the entire issue. Currently, both traditional mining technology groups and non-traditional mining groups are striving to put solutions forward.

This article will first look at the technologies available to help solve the problem, and then how to apply them. Some groups are pursuing e-fuels and second-generation biofuel options, but HCM views these as bridge solutions. They simply do not address the root issue of eliminating carbon from haulage activities.

Hybrid power solutions (smaller diesel engines with battery energy storage) are also a bridge technology, but they do provide advantages over simple fuel substitutions. The battery pack allows

energy-capture during braking and reduces energy loss associated with operational inefficiencies.

Traditional trolley technology available today, including from HCM, is also an effective bridge solution. Electrifying high-demand segments of the haulage route helps achieve significant carbon reductions. In some applications, more than 50% of emissions can be eliminated with current proven technology, providing significant short-term benefits with minimal impact. The ability to offer a retrofittable diesel trolley solution for battery trolley technology in the future is a viable pathway; the same infrastructure can be used for charging batteries and providing energy to power the truck.

For HCM, the road to zero emissions is not just about reducing a mine site’s carbon footprint; it is about increasing the efficient use of energy.

For example, a traditional 220 t haul truck will carry 4000 – 5000 l of fuel on board, which equates to roughly 40 000 – 50 000 kWh of energy. However, the diesel engine’s energy efficiency is only around 40%, at best, when compared to battery/electricity energy conversion.

It is important to note that substitute fuels do not increase these efficiencies. Hybrid systems decrease fuel usage by increasing engine fuel burn efficiency by a couple percent, as the small onboard battery energy storage systems can be used to optimise the engine’s operation.

When compared to a traditional engine configuration, the hybrid system may yield a 20% energy savings through braking regeneration and reduced operational energy losses. HCM sees this as an opportunity for improvement.

HCM has identified two key development pathways that allow more

John Schellenberg, Hitachi Construction Machinery, Canada, emphasises the importance of energy management to zero-emissions technologies and describes how mines can implement such advancements, particularly in relation to loading and hauling.

effective energy use in haulage applications: electrification and energy management.

HCM believes mine electrification will be crucial in the early adoption of zero-emission technology. Electrification is a key segment of Hitachi’s overall business, and the company is very comfortable with it; viewing it as a solution to the haulage operation challenge.

Through electrification, energy efficiency can be increased. Energy can be captured and reused during braking, and energy use can be limited when the vehicle is not travelling. This helps offset operational practices that consume energy but are not contributing to material movement.

A battery electric vehicle (BEV) system is capable of more than 70% efficient use of energy when calculating from ‘generation to material moved’. While electrification will increase efficiency, the technology available today has some constraints compared to diesel. This is where energy management becomes critical to success.

If that standard 220 t haul truck carries 40 000 – 50 000 kWh of energy, at 35% efficiency, that would equate to 14 000 – 17 000 kWh of energy used to actually move material.

With today’s technology, a battery-powered truck can store approximately 500 – 1000 kWh. If the best battery option is compared against the worst diesel option, there is still 14-times more energy on the conventional diesel vehicle.

This is where energy management becomes critical to success. The ability to move electrical energy quickly from the grid to mobile vehicles is required if electrified haulage is to be competitive with current technology. Couple that with the increased volatility in the renewable energy supply, and energy management moves to the forefront.

Hydrogen is another option on the electrification pathway. Hydrogen has an on-board kilowatt-hour energy storage capacity similar to batteries, so refuelling is just as important for hydrogen as it is for batteries. Hydrogen infrastructure is not as developed as electrification systems, so technology maturity will limit short-term adoption rates.

One challenge with hydrogen is its efficiency compared to BEV technology. An automotive industry study conducted in Europe compared hydrogen and BEV technology. It was found that with battery-powered e-cars, only 8% of the energy is lost during transport before the electricity is stored in the vehicle’s batteries. In the case of a hydrogen-powered e-car, the losses are much greater: 45% of the energy is already lost during the production of green hydrogen –through electrolysis – and another 55% is lost when converting hydrogen into electricity within the vehicle. This means that the hydrogen-powered e-car only achieves an efficiency of between 25 – 35%, depending on the model. A hydrogen car consumes two to three times more electricity for the same distance travelled compared to a battery car.

The efficiency argument is quite compelling, but it does not cover all the variables faced in the mining sector. The complexity of the global haulage environment makes energy management a key focus. In some applications, a round trip will be less than 4 km with elevation variances of less than 50 m. In other applications, a haul cycle may be more than 20 km with an elevation variance of close to 1 km. Depending on the commodity, there may be a centralised loading and dumping point with little change annually, or shallow loading faces that are continually moving. These different conditions provide a variety of challenges for onsite electrification.

In some cases, the in-pit and main haulage routes are static. Electrification of these routes is the best choice. In other applications, in-pit and main haulage routes are dynamic. Here, electrification infrastructure would need to be more flexible and more mobile. The question is: at what point does the mobility of in-pit/main haulage route electrification outweigh the efficiency losses observed in hydrogen ecosystems?

A combination of these technologies will likely be required to solve most haulage and energy-storage issues when combined with renewable energy and energy storage.

By comparing off-site energy generation to onsite energy management, companies can choose a preferred pathway.

For HCM, the development of the haulage unit is the easiest part of the equation. The company already has a solid

modern electrified platform. Its development challenge consists of re-powering the current product. To help overcome this challenge, HCM has entered into an agreement with ABB Ltd to develop a battery-powered model for its current product line. The company is also monitoring developments with hydrogen, as it feels that this technology will form part of future mining requirements.

The first steps any mining organisation should take when considering a transition away from diesel are education and evaluation.

This article has outlined several technologies in the decarbonisation space, but not all of them. Traditional technology will continue to dominate the industry for some time to come, but alternatives are gaining ground. In some cases, they provide a better economic outcome than conventional practices.

HCM would like to see more customers investigate the alternatives because it is possible that currently available options will provide improved economic and environmental outcomes quickly.

Understanding what potential ‘green’ energy supply is available would be a first step. Energy availability and cost will drive the decision-making process and dictate which technology pathway is most suited to a customer’s needs.

participating in activities sponsored by the International Council on Mining and Metals (ICMM). ICMM is using its broad membership to collect information globally and store it online in a ‘knowledge hub’ dedicated to decarbonisation.

Contributors are not only end-users, but also mining equipment original equipment manufacturers, so there is information from both sides of the industry.

HCM’s technology pathway is based on the evaluation of its own core company strengths, however this does not mean that it ignores other solutions. One of the company’s social commitments is to achieve both a higher quality of life and a sustainable society in collaboration with stakeholders. HCM’s unique industry conditions need to be communicated to investment stakeholders and governments, so that informed decisions can be made based on industry needs, rather than the perceived needs based on unrelated applications.

Renewable energy will increase volatility in the power supply. Coupling this with increased electrification on the mine site and the supply vs demand equation can be very chaotic. Therefore, Hitachi feels electrification, mine plan designs, and, specifically, energy-management tools will be critical for successful green energy implementation.

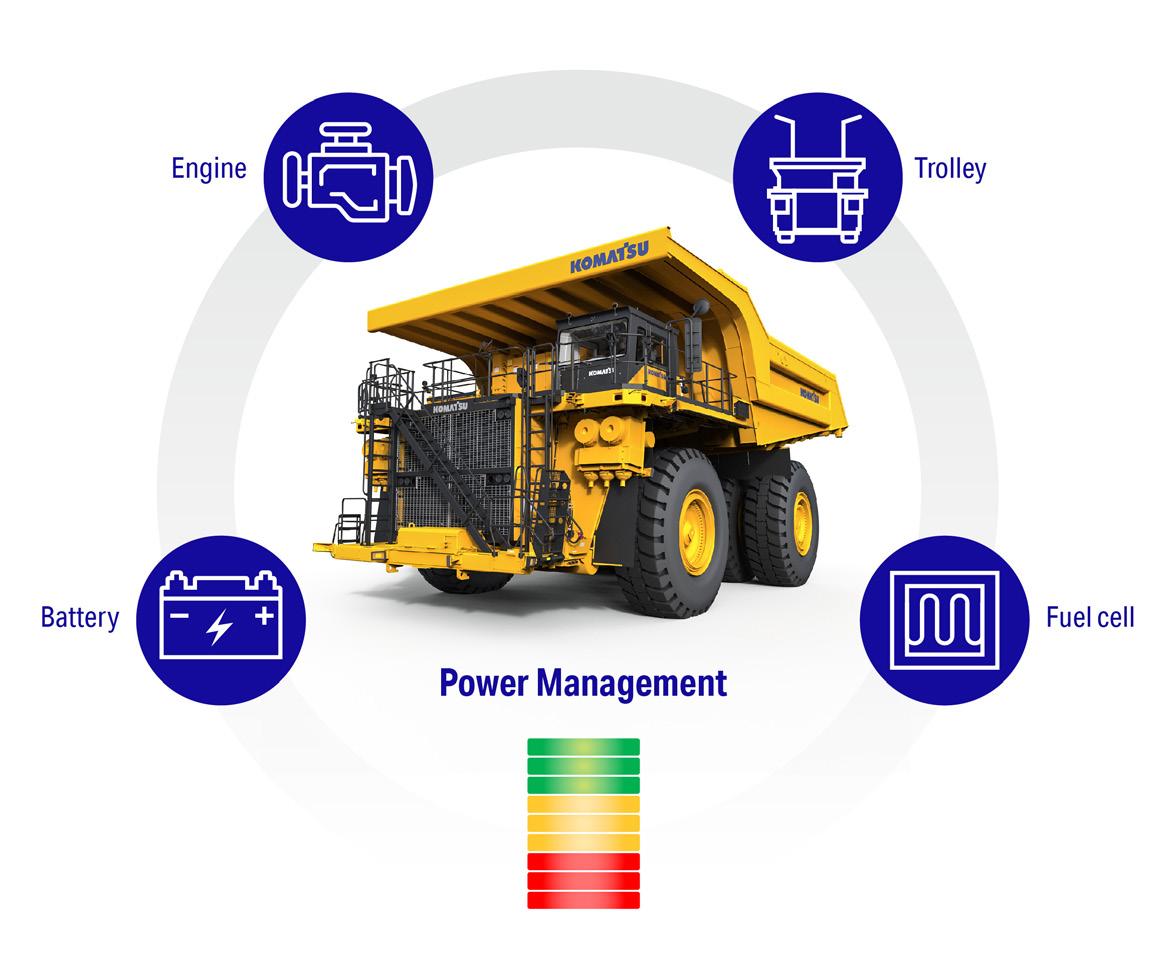

Jess Stephen, Komatsu, discusses haul truck power sources that are purpose-built for a sustainable future.

Agrowing sense of urgency now drives equipment planners as they work toward their 2030 emissions reduction targets. In a departure from past development programmes, some original equipment manufacturers (OEMs) offer engagement and collaboration

to mining professionals overloaded with many questions, inspirational product developments and new operational challenges, where prolonged machine lives extend the carbon impact of today’s choices out to their corporate 2050 net-zero emissions goals.

Many questions haunt leaders and the planners charged with achieving emission reductions: How are these goals reached? What equipment and operational changes are necessary? What will this cost? How does the mining industry answer those questions?

International expectations help create a clear vision of the long-term future: the technologies are under development, but specifications for practical solutions remain elusive.