| JULY/AUGUST 2025

| JULY/AUGUST 2025

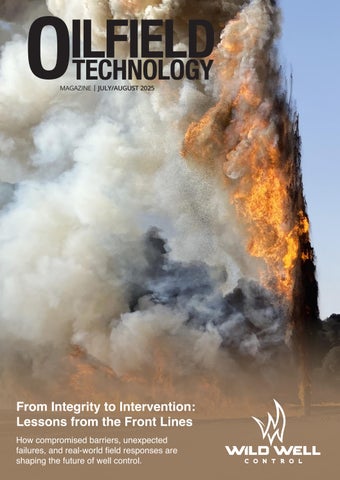

How compromised barriers, unexpected failures, and real-world field responses are shaping the future of well control.

www.worldpipelines.com

13 Precision pre-commissioning

Darrel Sookdeo, Vice President, Process Services, EnerMech, explores the role of pre-commissioning in Guyana’s gas-to-energy future.

05 Balancing growth and complexity

Stewart Maxwell, Technical Director at Aquaterra Energy, explains how the Asia-Pacific (APAC) region is balancing unmatched growth and complexity with the energy transition.

08 Optimising operations in a shifting energy landscape

Brendan O’Leary, Regional Manager, UK, Europe, Africa, Australasia, and Japan, WWT, discusses how to effectively optimise operations in a shifting energy landscape with reference to the UK.

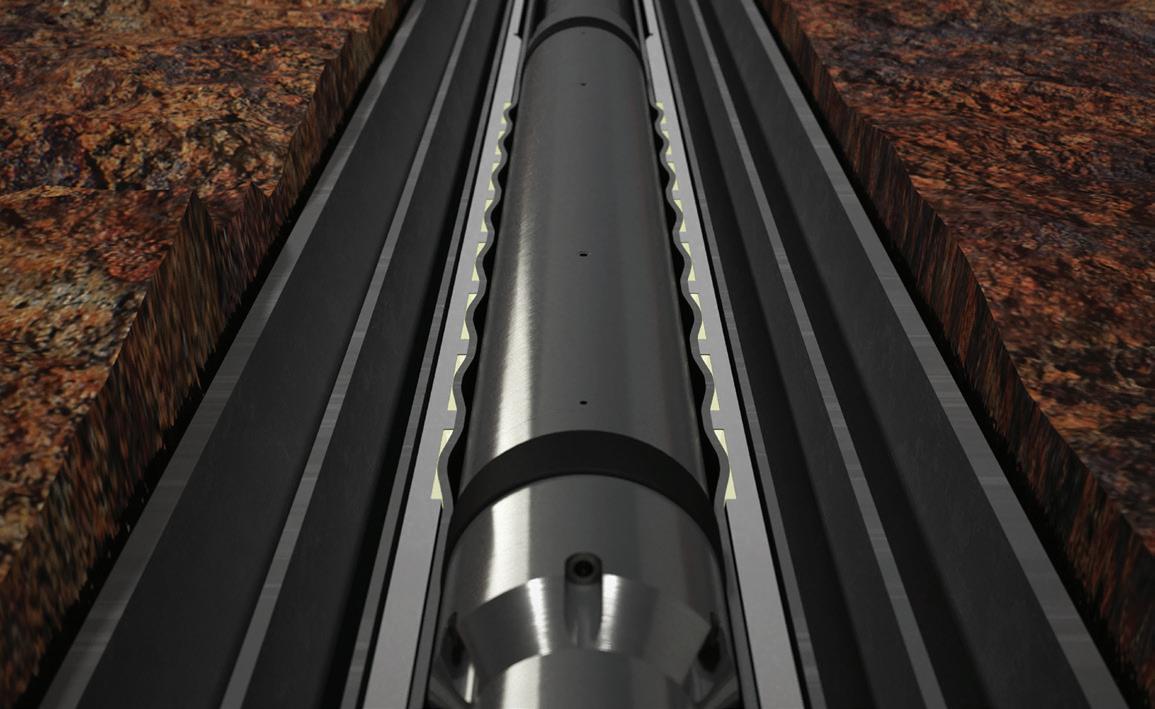

Wild Well Control’s latest feature highlights the critical role of barrier integrity and the far-reaching consequences of well control failures. The front cover image captures an offset well impacted by a nearby well’s compromised integrity, demonstrating how unseen issues can escalate into field-wide emergencies. This real-world event underscores the need for proactive intervention and comprehensive

assessment.

17 Tackling well integrity early

Jace Larrison, Vice President – Well Control Engineering, UIS, and Training, Wild Well Control, USA, examines well integrity and the implications on well control events.

21 Easy button for H2S removal

Jordan Flaniken, Managing Director of Adsorbents, Merichem Technologies, discusses the opportunity for oil and gas production companies to address contaminant removal with ‘easy button’ solutions.

25 Paving the way for CCS

Garry Stephen, Oil States, UK and Asia, discusses how field-proven oil and gas technologies can pave the way forward for carbon capture and storage (CCS).

29 Developing technology in the offshore sector

Calum Dey, Engineering Manager, Decom Engineering, details the development of new technologies designed to meet unique challenges of cutting tasks in challenging environments.

32 Navigating uncertainty

Alan Quirke, Vice President of Well Intervention & Integrity, Expro, discusses the strategic role of well intervention and well integrity management in a capital-disciplined, socially conscious energy supply era.

36 Making strides in subsurface imaging in complex environments

Nick Tranter, STRYDE, analyses new technologies seeking to address the increasing requirements of oil and gas companies to acquire high-resolution 3D seismic data in complex, high-stakes environments.

39 Icing on the cake

Joel Shaw, Silverwell Energy, USA, examines how surface-controlled gas lift systems will play a greater role in maximising the potential of gas-lifted wells while minimising environmental impact and operational costs.

Across energy and critical infrastructure, we bring expertise where complexity is highest, partnering with globally local teams and leveraging unrivalled proprietary technologies. Like the M-500 Single Torch External Welding System, seamlessly integrated with Data 360 our cloud-based digital platform that analyses, and visualises your project performance data in real time. We move projects forward, no matter the challenge. We’re here to partner on how our specialist welding and coating solutions can help you power tomorrow.

SLB has announced that it has closed its previously announced acquisition of ChampionX Corporation. Under the terms of the agreement, ChampionX shareholders received 0.735 shares of SLB common stock in exchange for each ChampionX share.

“This acquisition comes at a pivotal time in the industry as our customers increasingly prioritise advancements in production to maximise recovery of oil and gas,” said Olivier Le Peuch, Chief Executive Officer of SLB. “This move expands SLB’s presence in this important, less cyclical, and growing market that aligns closely with our returns-focused, capital-light core growth strategy. It extends our capability to provide integrated production solutions and provides another platform for accelerating digital adoption, optimising production and reducing total cost of ownership for our customers.”

Perenco has announced the completion of the acquisition of the Greater Angostura producing oil and gas assets and associated production facilities from Woodside Energy in Trinidad and Tobago. The finalisation of the deal, combined with Perenco’s existing operation of the Teak, Samaan, and Poui (TSP) and Cashima, Amherstia, Flamboyant, and Immortelle (CAFI) fields, aligns Perenco as a major oil and gas producer in country.

Following this acquisition Perenco’s operations in Trinidad and Tobago will have a gross gas production base of more than 500 million ft3/d as well as a gross oil production of more than 10 000 bpd, that can both benefit from significant operational synergies, boost value and enable further investment.

Vår Energi ASA has entered into a collaboration agreement with TechnipFMC Norge AS for delivery of subsea projects utilising its integrated commercial model for engineering, procurement, construction, and installation. The agreement pertains to future subsea developments in the Gjøa area in the North Sea.

The Gjøa Nord, Cerisa and Ofelia discoveries are estimated to contain up to a total of 110 million boe gross. If the licence partners decide to proceed, the plan is to coordinate the three developments. This will realise synergies in procurement, engineering, drilling, installation and project follow-up. An investment decision is planned in 2026.

Viridien, in collaboration with joint venture partners, TGS and Axxis Multi-client AS, has announced its successful completion of the final imaging of OMEGA Merge, to deliver a single, seamless and unified high-quality dataset across the Heimdal Terrace, Utsira, and Sleipner Ocean Bottom Node (OBN) multi-client surveys.

McDermott has been awarded a sizeable offshore transportation and installation contract by BRAVA Energia, the most diversified independent oil and gas company in Brazil, for the PapaTerra field in the Campos Basin and the Atlanta field in Block BS-4 within the Santos Basin, both offshore Brazil. Under the contract scope, McDermott will execute the transportation and installation of flexible pipelines, umbilicals, and associated subsea equipment for two new wells at the Papa-Terra field and two new wells for the Atlanta Phase 2 development. The scope also includes pre-commissioning and onshore base support services.

Monumental Energy Corp. has announced its progress on the second workover at the Copper Moki-1 (CM-1) well in the Taranaki Basin, New Zealand.

Seatrium Ltd has announced the impending delivery of the first of a series of turnkey FPSOs, to Brazil’s Petrobras.

Expro has been awarded a three year contract by Woodside Energy, supporting the Trion deepwater oil and gas development, offshore Mexico.

Subsea7 has been awarded an engineering, procurement, commissioning and installation contract, offshore Egypt.

bp has signed an MoU with Libya’s NOC to evaluate redevelopment opportunities in the mature giant Sarir and Messla oilfields in Libya’s Sirte basin.

Shelf Drilling has been awarded a three year contract in India with ONGC.

Dräger Marine & Offshore will support the UK’s first offshore CO2 injection.

2 - 5 September 2025

SPE Offshore Europe Aberdeen, UK

https://www.offshore-europe.co.uk/ 9 - 12 September 2025

Gastech Exhibition & Conference Milan, Italy

https://www.gastechevent.com/visit/ visitor-registration/

Editorial

Managing Editor: James Little james.little@oilfieldtechnology.com

Editorial Assistant: Alfred Hamer alfred.hamer@oilfieldtechnology.com

Editorial Assistant: Emilie Grant emilie.grant@oilfieldtechnology.com

Design

Production Designer: Iona MacLeod iona.macleod@oilfieldtechnology.com

Production Manager: Kyla Waller kyla.waller@oilfieldtechnology.com

Sales

Sales Director: Rod Hardy rod.hardy@oilfieldtechnology.com

Sales Manager: Chris Lethbridge chris.lethbridge@oilfieldtechnology.com

Sales Executive: Daniel Farr daniel.farr@oilfieldtechnology.com

Events

Head of Events: Louise Cameron louise.cameron@oilfieldtechnology.com

Events Coordinator: Chloe Lelliott chloe.lelliott@oilfieldtechnology.com

Digital Events Coordinator: Merili Jurivete merili.jurivete@oilfieldtechnology.com

Junior Video Assistant: Amélie Meury-Cashman amelie.meury-cashman@oilfieldtechnology.com

Digital

Digital Content Coordinator: Kristian Ilasko kristian.ilasko@oilfieldtechnology.com

Digital Administrator: Nicole Harman-Smith nicole.harman-smith@oilfieldtechnology.com

Administration

Administration Manager: Laura White laura.white@oilfieldtechnology.com

Reprints: reprints@oilfieldtechnology.com

Palladian Publications Ltd,

15 South Street, Farnham, Surrey GU9 7QU, UK Tel: +44 (0) 1252 718 999 Website: www.oilfieldtechnology.com

Elizabeth Corner, Senior Editor elizabeth.corner@oilfieldtechnology.com

The keynote article for this issue, written by Stewart Maxwell, Technical Director at Aquaterra Energy, outlines the tightrope that the Asia-Pacific (APAC) region is walking as it attempts to balance growth with decarbonisation. APAC is experiencing surging energy demand, while being one of the world’s biggest carbon emitting regions (APAC will account for 50% of global energy demand, and 60% of emissions, by 2050).1 The challenge for APAC nations is to meet increasing demand while staying on track with global decarbonisation goals, and it’s a diverse region, so there is no ‘one size fits all’ solution. All of this means it has become an interesting testing ground for innovative, tailored solutions. Maxwell writes that, as energy demand continues to rise across APAC, upstream investment is surging to keep pace. The region is expected to invest an estimated US$3.3 trillion into power generation over the next decade, with oil and gas maintaining a vital share of the mix, particularly in China, India, and Southeast Asia (where LNG demand is booming).

But with the most accessible reserves already tapped, operators must work on unlocking smaller, and geographically challenging fields. Increasingly, in place of traditional infrastructure for E&P projects, there is growing reliance on fit-for-purpose, modular technologies designed to unlock value from previously uneconomic assets. These include conductor-supported platforms like Sea Swift (from Aquaterra), which can be installed directly from jack-up rigs.

Subsea drilling from jack-up rigs, a technique well established in other regions, is beginning to gain traction in markets such as China and Japan. It offers access to shallow-water and near-shore resources without extensive subsea infrastructure, helping to minimise environmental impact. Bohai Bay, China’s largest offshore oil-producing area, has shallow waters comparable in scale to the North Sea. Conventional semi-submersible platforms are not practical here, so modular solutions come into their own. By embracing smarter and smaller scale technologies, APAC operators are rethinking how offshore development can be more economically viable in the decade ahead.

Carbon capture and storage (CCS) is often billed as a secret weapon when it comes to decarbonising legacy assets and future-proofing infrastructure. Since 2000, emissions in APAC have risen by 151%, and one of the most promising ways to address this lies in repurposing the region’s ageing oil and gas fields.2 With over 200 offshore fields in Southeast Asia expected to cease production by 2030, these assets represent a ready-made opportunity for CCS deployment.

In Malaysia, Petronas and ExxonMobil are collaborating to unlock the country’s substantial 46 trillion ft3 of potential CO2 storage capacity in depleted offshore gas reservoirs. Indonesia has approved a series of CCS projects involving bp, INPEX, and Repsol. Yet while the commercial and regulatory groundwork for CCS is advancing, technical challenges remain, particularly around legacy well integrity. Read the full keynote article (p. 5) to find out how repurposed wells might safely and securely store CO2 long term.

The region’s most successful projects are being shaped through strategic collaboration, with a growing wave of JVs and long-term partnerships. Petronas is leading the charge, teaming up with Eni to form a Southeast Asian energy major, working with Woodside on long-term LNG supply deals, collaborating with Baker Hughes, and joining forces with TotalEnergies to invest in regional renewables. APAC’s energy transformation will depend on how effectively stakeholders can work together to build new infrastructure that is flexible and future-ready.

1. https://www.woodmac.com/press-releases/2024-press-releases/asia-pacific---energy-transition-outlook/ 2. https://assets.bbhub.io/professional/sites/24/Asia-Pacifics-energy-transition-outlook_FINAL.pdf

Stewart Maxwell, Technical Director at Aquaterra Energy, explains how the Asia-Pacific (APAC) region is balancing unmatched growth and complexity with the energy transition.

In the Asia-Pacific (APAC) region, rapid population growth, industrial expansion, and economic development have propelled energy demand to unprecedented levels, with the region projected to maintain a 50% share of global primary energy demand until 2050. But this growth is accompanied by a parallel challenge. Namely, how to meet surging demand while staying committed to decarbonisation, with APAC also

accounting for an expected 60% share of global carbon emissions until mid-century.

Matching the region’s growth is also its complexity, with huge variance in infrastructure, resources, and policy priorities between nations. Each country has unique challenges shaped by their geography, industrial structure, and regulatory landscape. This means there can’t be a ‘one size fits all’ approach. For example, while Indonesia is pursuing geothermal expansion, hydrogen development, and carbon capture, Vietnam has led the way on the rapid adoption of solar and wind energy.

For those operating in APAC, success means balancing growth with decarbonisation, while adapting, innovating, and working with the unique conditions of each country on the ground and across borders.

To meet rapidly growing demand, energy production across APAC is expanding. Oil and gas continues to play a crucial role, with LNG demand surging – particularly in China, India, and Southeast Asia – driving new investments in exploration and infrastructure. Over the next decade, APAC is expected to invest US$3.3 trillion in power generation, with fossil fuels maintaining a significant share.

At the same time, APAC’s easily accessible fossil fuel reserves are depleting, forcing the industry to turn to smaller, more complex resources. This demands a departure from traditional methods, embracing flexible and modular technologies like conductor-supported platforms, advanced drilling systems, and enhanced riser designs that enable these previously untapped resources to be made technically and economically viable.

Take the shallow waters of Bohai Bay in the Gulf of China, an area comparable to the North Sea in scale and significance. As China’s first offshore oil-producing area, with predominantly shallow depths, conventional infrastructure like semi-submersibles are impractical for developments in the field. Instead, modular solutions such as the Sea Swift platform, which can be installed directly from jack-up rigs, offer an efficient and safe alternative. By reducing the need for heavy-lift vessels, these platforms lower costs and improve project timelines while maintaining rigorous safety standards.

In markets like China and Japan, other technologies such as subsea drilling from jack-up rigs are also gaining traction for this same reason. Although proven in other regions, they represent a new frontier for these countries, offering both operational efficiency and the potential to tap into previously economically infeasible fields, while reducing environmental impact.

With emissions rising 151% since 2000, the need for decarbonisation is also clear. Carbon capture and storage (CCS) is emerging as a critical piece of this puzzle, not only addressing emissions from existing assets, but also shaping the long-term viability of offshore energy. But, while momentum is building, each region must navigate its own regulatory and commercial realities, requiring tailored approaches.

With approximately 200 offshore fields in Southeast Asia expected to cease production by 2030, these could present an opportunity for repurposing as CCS – or even hydrogen –storage facilities.

Malaysia is already taking steps in this direction. Petronas has identified vast storage potential in depleted gas reservoirs offshore Peninsular Malaysia and Sarawak, with over 46 trillion ft3 available. To advance these opportunities, ExxonMobil and Petronas are working together to assess CO2 storage sites and establish viable commercial frameworks.

Similarly, Indonesia has vast offshore storage potential and the country has approved CCS projects involving bp, INPEX, and Repsol, signalling its readiness while also forging international relationships to accelerate deployment.

However, scaling up CCS presents several technical challenges, not least being ensuring the integrity of legacy well formations to prevent CO2 leakage. Advanced well intervention technologies, like Aquaterra Energy’s Recoverable Abandonment Frame are cost-effective solutions to support the efficient re-entry of these wells, to establish an environmental and pressure-retaining barrier, ensuring safe re-abandonment and readiness for their long-term viability for carbon storage.

Equally important is ensuring that once CO2 is stored, it remains securely in place, particularly in a region which is known for being geologically active. Cutting-edge monitoring technologies can provide continuous, remote oversight of storage sites post-injection, detecting potential leaks or seismic activity throughout the lifecycle of a project. These innovations offer comprehensive, long-term assurances that stored carbon remains contained.

By leveraging these technologies, operators across APAC can not only reduce costs but also accelerate offshore CCS development. With greater confidence in carbon security, countries such as Indonesia and Malaysia can transform

depleted oil and gas formations and saline aquifers into reliable CCS storage sites, driving the region toward a lowcarbon future.

The APAC region’s diversity extends beyond geography to include unique regulatory environments and priorities. A unifying theme, however, is the growing emphasis on local content. For instance, Indonesia has introduced an update to PTK 007 which outlines how local companies are to be given preferential treatment during procurement activities, while in China, local sourcing is critical, even if not explicitly legislated.

Foreign companies navigating these markets must do more than introduce advanced technologies; they must invest in local partnerships, transfer knowledge, and build regional capabilities. By aligning global expertise with local insights, they can empower local content to propel APAC’s low-carbon future. This ensures solutions that are not only technically innovative but also culturally and economically resonant. Such an approach strengthens trust and positions international companies as key contributors to both regional progress and national aspirations.

APAC’s offshore energy journey is fundamentally a collaborative endeavour. As the region’s energy demand continues to surge, its leaders face the dual challenge of meeting immediate needs while laying the groundwork for sustainable growth that meets global climate goals. Through technologies like reduced steel platforms and offshore CCS, the region is bridging operational challenges with its

decarbonisation goals. At the same time, prioritising local partnerships will underscore the importance of shared progress.

This balancing act – between growth and sustainability, global expertise, and local insight – defines APAC’s energy transformation. By embracing innovation and collaboration, the region is charting a course that not only addresses its energy demands but also sets a global benchmark for sustainable development.

Stewart joined Aquaterra Energy as Technical Director in May 2013. In this capacity, he spearheads technical innovations across all facets of the business, encompassing wells and riser solutions, offshore analysis, the flagship offshore platform Sea Swift, offshore wind, hydrogen, and offshore CCS.

With a BEng in Mechanical Engineering from the University of Aberdeen and over 30 years of experience in the energy industry, Stewart has held positions in both Asia Pacific and the UK throughout his career. His expertise spans analysis, design, engineering, and installation of riser and conductor systems (shallow and deep water), as well as minimum facilities platforms, bespoke offshore engineering, and offshore problem solving.

Before joining Aquaterra Energy, Stewart spent 13 years with the Acteon Group of companies, in various positions including Regional Director – Asia Pacific and Global Manager – Conductor Systems. He has also worked for several operating companies, as well as establishing his own engineering consultancy in riser and conductor analysis, well integrity, and project management.

Brendan O’Leary, Regional Manager, UK, Europe, Africa, Australasia, and Japan, WWT, discusses how to effectively optimise operations in a shifting energy landscape with reference to the UK.

Refining operations is no longer optional. The oil and gas sector is evolving at a breakneck pace. For professionals in drilling and completions, especially in the UK, the mission is clear: survival through operational excellence. Traditional cyclical fluctuations have sharpened into structural upheavals. Political mandates, cost pressures, and the decarbonisation agenda are fundamentally altering market dynamics.

Consider Norway: its mature industry thrives due to the cohesive national support it receives. In Aberdeen, however, operators and service providers often feel isolated, without a unified industrial backbone. When times are good, there’s a tendency to outsource work, leaving UK skills and infrastructure on precarious footing. But stepping aside is not an option: we must continue pushing boundaries or face irrelevance.

Thankfully, the UK remains a recognised leader in advanced drilling technology, but reputation alone will not suffice. We must apply innovation purposefully, deploying proven tools and smarter digital strategies to deliver value-driven, measurable optimisation. That is exactly what WWT has been doing: not chasing flashy new tech, but using software, refined procedures, and field-proven models to extract more value from every well. Our team recently travelled to South America to support key clients with our expertise in optimising well operations, ensuring that proven solutions are applied where they matter most (Figure 1).

From cycles to seismic change

Gone are the days when oilfield services could rely on predictable boom-bust cycles. The North Sea now grapples with declining production volumes and rising extraction costs, constrained further by environmental imperatives and complex geopolitics. UK operations don’t enjoy the same backing as their Norwegian counterparts, be it tax incentives, policy certainty, or research and development (R&D) grants. This fragmentation places extra burden on regional players.

In times of demand, subsea work is subcontracted abroad and when the market cools, the local supply chain bears the brunt. That lack of resilience hinges on one insight: our competitive edge must come from operational superiority, not cost alone. We pivot by delivering better results, faster, and more sustainably.

Turning digital tools into field gains

The past 30 years have introduced significant digital change, but not necessarily new digital technologies. What has evolved is the strategic application of better torqueand-drag modelling, advanced downhole telemetry, and optimised workflows. WWT doesn’t deploy tech to be trendy; it deploys it to solve known subsurface challenges.

Torque reduction and casing protection: real-world proof

Non-rotating protectors (NRPs) (Figure 1) have delivered measurable benefits in European wells, and especially offshore UK basins:

Ì Offshore directional well (North Sea): running 282 SS3 model NRPs between 300 - 1620 m MD resulted in an 18% torque reduction, low casing wear, and strong model alignment with actual well performance.1

Ì ERD offshore campaign: in drilling a ~9.2 km ERD section, 300 SS3 model NRPs reduced torque by 32%, with real-time torque averaging 55 kNm versus 81 kNm predicted without NRPs.2

Ì Horizontal ERD success: SS model NRPs delivered a 40% decrease in torque and significant vibration reduction; cutting torque from 35 500 ft-lb to 20 000 ft-lb.3

These numbers aren’t theoretical; they are precise, repeatable gains driven through friction reduction and vibration damping. The impact: faster drilling, reduced non-productive time, lower risk of torque-related failure, and improved casing integrity (Figure 2).

Diversification is key

When home markets slow, WWT’s integrated global presence ensures stability. International deployments in the Middle East, the US, continental Europe, Africa, and Asia keep our technical edge sharp and our economics healthy.

Ì In the Middle East, SS3 model NRPs have cut torque by 26 - 37% in ERD builds; one S-shaped well recorded a 30% torque drop.4

Ì In the US Lower 48 states, NRPs supported eight of the ten longest laterals – showing 12 - 16% torque reduction while maintaining high rates of penetration.5

Ì Alaska’s extended-reach liner runs saw smoother deployment and drag optimisation by outfitting liner strings with NRPs.6

These international wins feed back into the North Sea toolkit. We’ve refined best practices tool spacing, casing strategies, that directly translate back into the UK market, reinforcing our local value.

New horizons for old skills

Transition matters. That’s why WWT is proactively engaged in geothermal markets, leveraging the company’s worldwide deepwell abilities in a new energy context (Figure 3).

The company’s geothermal tools already mirror oilfield NRPs and tractors in multi-kilometre lateral runs. High torque and vibration remain major challenges. Our NRPs have proven

casing protection in geothermal wells – over 500 000 drill-pipe revolutions sustained with HT3 500 protectors in the US and CRA casing protected in Asia.

These aren’t diversions; they are convergent applications. Every hour saved, every trip avoided, and every ft-lb of friction eliminated adds up. For geothermal operators, this means fewer failures, faster ramp-up, and lower carbon intensity – all while reusing existing supply chains and skill sets.

Low-hanging fruit for low-carbon impact

Sustainability is not only about alternative energy – it’s also about doing more with less. Every ft-lb or kNm of torque reduced saves energy. Every avoided trip, vibration event, or casing repair avoids carbon emissions – and keeps wells on schedule and budget (Figure 4).

Our approach delivers measured results:

Ì 40% torque reductions equate to substantially lower rig energy consumption and emissions.

Ì NRPs extend casing and drill-pipe life – reducing the carbon intensity tied to equipment manufacturing and transportation.

Ì Smarter planning and digital modelling prevent over-sizing and under utilisation of assets – cutting waste.

The results are quantifiable: lower rig time, fewer failures, less rework, and a smaller emissions footprint.

The survival imperative

The challenge for UK oilfield professionals is stark: either optimisation or obsolescence.. This isn’t about holding ground – it’s about evolutionary transformation. We have seen the proof: torque reductions up to 40%, casing protection proven across 30+ years, and global demand confirming the value of performance-first solutions.

At a time when national frameworks lag, operational excellence remains our strongest asset. WWT don’t wait for policy alignment or market rebound. Instead, they act swiftly, systematically, and informed by data.

To peers in Aberdeen and across the UK: redouble your focus on smart deployment – not flashy tools. Leverage proven field tech, support it with rigorous modelling, measure relentlessly, and iterate. Combine this with digital tooling, data driven insights, and a commitment to efficiency, and you’ll emerge not just intact – but leading.

The truth is simple: in this industry, survival favours the optimised.

1. https://www.wwtco.com/media/kcsmvazh/wwt-nrp-case-historydirectional-europe-11900.pdf

2. https://www.wwtco.com/media/ylejl5sx/wwt-nrp-case-historyerd-offshore-europe-12260.pdf

3. wwt-nrp-case-history-horizontal-europe-6340.pdf

4. wwt-nrp-case-history-directional-middle-east-10433.pdf

5. WWT Case History - Horizontal - North America - 5469

6. https://www.wwtco.com/media/5edmknsl/wwt-nrp-case-historyerd-alaska-11949.pdf

Figure 1. EnerMech has a proven track record in complex offshore and subsea commissioning campaigns.

Darrel Sookdeo, Vice President, Process Services, EnerMech, explores the role of pre-commissioning in Guyana’s Gas-to-Energy future.

Guyana’s ambitious Gas-to-Energy (GtE) initiative represents a significant leap forward in the nation’s energy security and economic transformation.

Central to this effort was the repurposing of the offshore Stabroek Block’s Liza Phase 1 and 2 Projects, as a critical offshore hub enabling

the redirection of natural gas from deepwater reservoirs to a new integrated natural gas liquid (NGL) plant and a 300 MW combined cycle power plant via a 200 km subsea pipeline.

At the heart of this transition was the need for precise, safe and expertly managed pre-commissioning of systems across two FPSO vessels and gas export infrastructure.

With a proven track record in complex offshore and subsea commissioning campaigns, EnerMech was selected to deliver a turnkey pre-commissioning solution. The scope was technically intensive and logistically demanding, yet strategically vital to ensure that the gas export pathway, from the FPSOs to the shores of the Demerara River, was ready to flow safely and reliably, marking the next phase in Guyana’s energy evolution.

The significance of this project cannot be overstated. The Gas-to-Energy programme is a high-profile partnership with the Government of Guyana, intended to reduce domestic electricity costs and lower carbon intensity by switching from imported fuel oil to cleaner-burning natural gas. For EnerMech, the project represented a chance to demonstrate a long-term commitment to Guyana by delivering excellence in a politically sensitive, high-visibility programme that will shape the country’s energy future.

By ensuring the gas export infrastructure on the FPSOs was ready for handover, EnerMech played a pivotal role in unlocking a project that will power industries, reduce household energy bills and accelerate Guyana’s journey toward energy self-sufficiency.

EnerMech’s pre-commissioning work was multifaceted. The included dewatering, line conditioning, air drying, nitrogen packing, and critical valve testing, works that are essential to prepare the gas export lines and associated systems for safe operation. These works were complemented by topsides piping construction, flange management, nitrogen, and leak testing services to ensure gas tightness from source to shore.

A major innovation was the use of low-pressure airdrying techniques and the implementation of dust bag receivers for pigging operations which were selected to reduce environmental impact and mechanical risk. The EnerMech Control of Work System was deployed to provide real-time procedural control and safe execution throughout the operation.

Dedicated mobile nitrogen and high-flow air units were mobilised, including one of the largest high-pressure nitrogen/air packages ever deployed in Guyana. These bespoke assets allowed EnerMech to meet the high technical demands of the project while adapting to the limited infrastructure and logistical restrictions of the region.

While the technical execution was complex, the physical environment made it even more challenging. The project was based on the west bank of the Demerara River – a region without the robust infrastructure found on the east bank, where most oil and gas activity in Guyana has traditionally been concentrated.

Transporting equipment to site was a formidable task. With the Harbour Bridge unable to handle loads over 20 t, heavy packages had to be barged across the river. Even this wasn’t straightforward: tide cycles dictated movement windows, and the west bank had no formal port facilities. Temporary landing zones were created, using mobile cranes and hired trucks to transfer critical gear from barge to jungle paths.

Abaco meets the demand to drill faster, deeper and farther— by creating advanced engineering designs and technologies that enhance power section performance and reliability. Field-proven innovations like OPTIFIT® stators and high temperature 350°- 400°F elastomers. Advances that have successfully powered thousands of runs in harsh drilling environments worldwide.

Explore Abacodrilling.com and learn how our power section innovation can improve performance in the challenging conditions you face downhole.

Access to the pipeline landfall site presented further issues. Located deep in a forested zone, the only access routes were undeveloped, prone to flooding and often impassable.

On top of that, accommodation and catering had to be arranged locally, as daily commuting was unrealistic. EnerMech scouted and leased accommodation in the nearby community, partnering with local vendors to support meals and logistics. The decision to integrate more Guyanese personnel and reduce expat reliance proved essential to operations and for strengthening ties with the local workforce and government stakeholders.

In such a sensitive and high-profile environment, risk mitigation was paramount. EnerMech identified and addressed a range of operational, environmental and community risks prior to mobilisation. Nitrogen venting, for instance, was conducted in remote, downwind locations with hard physical barriers in place to control exposure. For noise impacts near populated border areas, sound blankets and silencers were used in combination with continuous noise monitoring.

Wildlife hazards were another major concern, with the area home to over 50 species of snakes, as well as other reptiles, mammals, and amphibians. A full-time wildlife specialist was embedded with the team to ensure animal safety and compliance with environmental guidelines.

From a safety perspective, the project achieved its core KPIs: zero lost-time incidents (LTIs), zero environmental incidents, and zero instances of non-compliance. This was achieved through the deployment of site-based safety supervisors, a

strict Permit-to-Work system, a medical emergency response team and comprehensive site orientations. Security protocols were also enforced to manage personnel movement and asset integrity throughout the campaign.

The project also demanded real-time problem solving. To prevent overheating of equipment in the hot, humid Guyanese climate, the EnerMech team devised an auxiliary cooling system to counter this issue. The cooling system created a continuous misting loop around the compressors, significantly reducing radiator temperatures and preventing overheating.

This had a large positive impact on the operations, the result being reduced air spread downtime. The solution proved so effective that it has since been adopted as a bestpractice standard on other EnerMech projects, a clear example of how innovation born in adversity can drive long-term operational efficiency.

As Guyana advances its transition from oil export to integrated energy producer, projects like Gas-to-Energy – and partners like EnerMech – will be central to shaping what comes next. The successful pre-commissioning of Liza Phase 1 and 2 Projects for gas export represents what is possible when global expertise meets local opportunity, and when challenges are answered with precision, innovation and purpose.

EnerMech is proud to have contributed to this national milestone and remains committed to supporting Guyana’s energy journey, one project, one community and one breakthrough at a time.

Jace Larrison, Vice President –Well Control Engineering, UIS, and Training, Wild Well Control, USA, examines well integrity and the implications on well control events.

ell control personnel respond to a wide range of issues, many of which are directly related to well integrity. The general definition of well integrity refers to the loss of previously established wellbore barriers. This is typically caused by tubular failures within the wellbore and could also include surface equipment failures. In many of these events, issues within the wellbore may be

unknown or not clearly understood until the final piece falls into place, and the well begins to flow. These events prove to be extremely challenging due to the lack of access to the original wellbore (through some form of tubular failure) or the lack of understanding of the flowpath involved in the flowing system.

In many cases, an intervention on the well would have been substantially less complex if a proactive approach had been taken before the event occurred.

Tubular failures are among the most complex and challenging issues to address when a well is flowing in an uncontrolled state. This uncontrolled state typically occurs because the wellbore barrier (casing or tubing) has failed, and the reservoir pressure cannot be contained by an exposed formation post-failure. If this has occurred, this is referred to as an underground blowout (UGBO) or oftentimes termed as cross-flow. Hydrostatic pressure is the key to an effective kill as most are readily aware of. Depending on the location of the failure, establishing a kill can become increasingly more difficult in these UGBO cases.

In general terms, tubing and casing failures that are shallow have the potential to lead to broaching. Broaching is the term used when flow from the well exits to the surface outside of the wellbore casings. Depending on the severity of the flow, all access can be lost to the wellhead making a relief well (RW) the only viable option for intervention. If access is still feasible, shallow failures may offer the chance to establish a fluid column but typically require some manner of live well intervention to access the well below the exit point (via coiled tubing [CT] or snubbing).

Tubing and casing failures that are deeper generally limit the fluid column that can be established and thus limit the hydrostatic pressure available to generate a kill within the wellbore system. Many times, these situations have only been solved by mechanical barriers in combination with a fluid column. The configuration of the well and the flowpath will ultimately dictate the proper solution.

In order to use the above discussion in context, the following case history will be discussed. The following are some of the important points to note about the well prior to the final integrity failure.

Ì The surface casing was compromised near surface at +/- 164 ft.

Ì The production casing was compromised near surface at +/- 236 ft.

Ì The production tubing had a failure at +/- 383 ft.

Ì The production tubing had a packer set with a plug in the tubing at +/- 4102 ft.

Ì There were perforations within the production casing that had previously been squeezed with cement. The depths were +/- 1771 ft, 2362 ft, and 2559 ft.

Ì The reservoir for this particular well was at +/- 4170 ft.

Ì The well was not actively producing with the plug set in the packer for isolation.

There was no flow associated with this well for years until flow was noted exiting around the well casing at surface. Figure 2 notes the wellbore diagram. The failure mechanism that caused the flow remained unknown for much of the intervention efforts as there were multiple possible flowpaths. Attempts were made to access the tubing string, but nothing was able to reach a depth deeper than +/- 2624 ft. Prior to the involvement of Wild Well Control (WWC), kill attempts were completed but these were unsuccessful. A large area around the wellhead was washed out from the ongoing flow exiting the well casing at the noted surface casing failure point above.

The area around the well was eventually washed out to the point that access to the wellhead was no longer possible. Typically, events with a shallow exit from the casing warrant some type of diversion in an effort to stop or limit the degradation of the surrounding area. In this case, diversion was initiated through the well production tree and lines installed via unconventional mechanisms. It was then proposed to fill in the large crater around the area once the predominant fluid flow was diverted and no longer exiting from the well casing. The crater was successfully filled in and compacted to allow access to the wellhead for personnel. Figure 3 shows the wellhead area prior to full diversion and re-filling.

With access to the well restored, the tubing which provided no real access to the well needed to be removed. With multiple integrity issues associated with the wellhead, a plan was developed to cut and remove the tubing spool – dropping the upper section of the tubing into the well. A capping stack (single BOP dressed with blind rams and a flow cross with valves) would then be installed in order to proceed to further intervention efforts using a snubbing unit. The tubing spool was successfully cut and removed, along with the remaining flange face, exposing the casing spool flange for the installation of the capping stack. The capping stack was landed and 6 in. diverting lines were installed on the flow cross and the blind rams were closed diverting the well flow to the nearby existing pit. Figure 4 notes the well after the tree was cut and removed, and the capping BOP was installed to divert the well flow in preparation for the snubbing operations.

A snubbing unit was installed, and the tubing string was successfully fished from the well allowing for further diagnostics to be completed via logs to determine the flow path. From the logs, it was determined that the primary flow path was inside of the production casing near the bottom of the well. The flow then exited the production casing at +/- 3280 ft and travelling up the annular space outside of the production casing to the exit in the surface casing. From this diagnostic programme and the recovery of the packer, it was deduced that failure of the packer allowed the initiation of the flow from the well through the previously failed casing strings. The well was finally secured by setting a packer on the snubbing work string below the failure point in the production casing. All flow from the well ceased. The well was then fully plugged and abandoned (P&A).

In summary, there were multiple issues with the wellbore integrity prior to the event. It was only after the packer failure occurred that the other issues were realised. This was an extensive intervention operation required to gain access to the well and ultimately stop the flow for P&A.

The subject wellbore was originally a dual completion design (two tubing strings landed in the tubing hanger). The well had been shut-in and had not produced for years. Approximately 10 years prior to the well control event, it had been determined that both tubing strings could no longer be accessed due to fish (previously set plug components) within the tubing. A bridge plug (BP) was set in each tubing string, and the pressure was bled to 0 psi.

The well control event initiated with the notation of flow from the casing spool outlet. The manual gate valve in place

on the tubing spool (C-section of the wellhead) was flowing freely into the well cellar. Upon excavation of the cellar, the casing valve on the casing spool (B-section) was also noted to be flowing. This discovery suggested that the production casing was very likely compromised.

During a review of the well history, it was noted that the intermediate casing string would not pressure test and had to be squeezed with cement. This brought forward immediate concerns about the pressure integrity of this casing. With the

production casing string compromised and suspicion of issues already present within the intermediate casing, the initial plans for this intervention were to divert flow upon capping. Any shut-in could lead to flow to the surface casing shoe and then elsewhere outside of the wellbore system.

The water table in this area was extremely shallow, which would limit the depth of excavation that would be possible. The well flow subsequently caught fire, so this brought additional concerns related to the wellhead integrity. The top of cement (TOC) on the production casing was deep and thus would lead to a substantial length that the casing would drop if the entire wellhead was cut and removed. This casing drop would very likely be deeper than the water table and cause additional complications with any potential excavation for re-heading the well. In summary, the following points were derived for the planned intervention efforts:

Ì Total removal of the wellhead system was not a suitable approach due to the shallow water table.

h The A-section would be left in place for the pending diverting operations. Remember that flow was already present on the intermediate by production annulus. By cutting the casing spool, the production casing would be dropped, and all flow would be now from the intermediate casing at the A-section flange.

Ì Diverting the flow was the only control option given the fire and possible wellhead integrity issues.

Ì A substantial fishing job would be required to kill the well. With limited resources available in the area to execute this, a RW would be the final kill solution.

A significant amount of clearing and preparation was executed in order to prepare the well area for the direct

intervention efforts. A cut was made through the wellhead B-section with a WWC abrasive jet cutter to remove all the wellhead except the A-section. A capping BOP was installed on the original wellhead flange, and all flow was diverted to a nearby gas plant.

A RW was then successfully drilled and intersected with the flowing well just below the production packer on the long string (LS) tubing. The well flow ceased after a brief period even prior to the volume anticipated for the planned dynamic kill (DK). Cement plugs were pumped and tested, and the well was to undergo further P&A from the surface with a conventional rig system.

In summary, the previously noted issues with the casing and tubing strings added considerable complications to this event response. These ultimately led to the use of a RW for the final kill effort. It is not possible to fully confirm this, but the general suspicion was that the failure of the packer on the LS tubing is what led to the event. This suspicion was further supported based on the reaction of the flow after intersection of the RW.

Well integrity continues to have a lasting impact on well control events and how these events are resolved. Generally, the more well integrity issues that are present in a wellbore, the more complex the resolution becomes. The cost of these events is greatly increased once flow is present. Consequently, many of the lessons learned on this subject have been to tackle these integrity issues early, prior to escalation.

A podcast series for professionals in the downstream refining, petrochemical, and gas processing industries

EPISODE 6

Leakhena Swett, President, ILTA, and Jay Cruz, Senior Director of Government Affairs and Communications, ILTA, consider the importance of trade associations and industry collaborations.

EPISODE 7

Susan Bell, Senior Vice President within Commodity Markets – Oil, Rystad Energy, discusses the impact of trade wars on global oil demand and prices, in light of recent US trade tariffs.

EPISODE 8

In this special episode, a panel of experts from Johnson Matthey, A.P. Moller - Maersk, Honeywell, HIF Global and the Methanol Institute provide a clear analysis of the factors influencing e-fuel pricing, the economic challenges, and strategies for cost reduction.

EPISODE 9

Brandon Stambaugh, Owens Corning Director for Technical Services, discusses engineers’ demand for education and training to support three critical phases that affect the performance and longevity of insulating systems.

EPISODE 10

Lara Swett, Vice President of Technical & Safety Programs, American Fuel & Petrochemical Manufacturers (AFPM), explains how the downstream sector continues to improve its process safety record.

Listen and subscribe here

Jordan Flaniken, Managing Director of Adsorbents, Merichem Technologies, discusses the opportunity for oil and gas production companies to address contaminant removal with ‘easy button’ solutions.

xploration and Production (E&P) of oil and natural gas often involves high risk, high investment, and technologically intensive activities. If the industry’s activities aren’t complex enough, environmental concerns, product quality, and the protection of equipment require E&P companies to remove impurities such as hydrogen sulfide and mercaptans before the oil and gas is transported.

E&P operators need an easy button to simplify the hydrogen sulfide (H2S) and mercaptans removal step.

A range of treating systems using liquid and solid solutions and service technology companies are available for H2S and mercaptan removal, each with inherent advantages and disadvantages. The importance of understanding these technologies and how they address E&P requirements cannot be overstated. This knowledge is paramount when considering all operational factors, especially those that contribute to speed to market, maintenance concerns and costs, functionality of the equipment, and making operations more straightforward, all while ensuring the environment is protected, and safety is maintained.

H2S, a highly corrosive and poisonous gas, can be a significant nuisance to upstream production. This contaminant can be generated naturally or produced by technologies used during the E&P process.

Natural synthesis of H2S can happen in the reservoir due to microbial sulfate reduction (MSR) of sulfate-containing minerals and/or thermochemical sulfate reduction (TSR). Processing derived H2S production can happen when using E&P technologies such as steamassisted gravity drainage (SAGD) and hydraulic fracturing used in the production of oil sands and shale oil/gas.

H2S can manifest in all rig areas where drilling fluid and associated equipment are present, including the rig floor, substructure, shale shakers, mud cleaners, mud pit room, mud pump room, and well test equipment. Drilling and well control equipment not designed to mitigate H2S could be subject to structural integrity, impeding functionality and operations.

Upstream operators can anticipate H2S:

Ì Inherently in associated natural gas (‘sour gas’).

Ì During break out, also known as ‘run in the hole’, when the drill pipe has been completed, and bottom fluids are displaced to the surface.

Ì If a drill pipe is extracted from the well too quickly and fluids enter the wellbore.

Ì During the retrieval of core or fluid samples.

Ì During the flow test process when the well flow rate, pressure, and water level are monitored and recorded.

E&P operators are known to pay US$15+ million a year in operating costs to remove H2S, but some existing technologies being

used in production fields are inefficient, uneconomical, and in some cases, unsafe.

A range of regenerative and non-regenerative H2S removal methods are available, all of which vary in how they capture and release H2S. Over the years, scavengers have been pivotal in the removal of lower quantities of H2S. Selecting the most appropriate scavenger involves several factors, including flow rates, H2S quantities, demand, space, CAPEX, OPEX, and other considerations.

Water-based or ‘liquid’ scavengers are commonly used for their effectiveness in removing H2S from various sources. These scavengers are typically amines reacted with formaldehyde to create a triazine chemistry that reacts with hydrogen sulfide to form nontoxic, water-soluble compounds. They are particularly effective in gas phase applications as they can be implemented quickly through direct injection or contact towers but are generally used for small flow rates and low concentrations of H2S. Water-based scavengers are non-regenerable and therefore continuous injection or replenishment of contact towers is needed.

Solid scavengers or adsorbents use solid particulates in a fixed bed system to remove hydrogen sulfide from gas streams through chemical adsorption. The H2S reacts with various types of solid media to form innocuous and typically non-hazardous compounds that are easily disposed of. Solid scavengers are known for their effectiveness in applications where liquid scavenger systems are not feasible, not economical, or where selective H2S removal is a requirement.

Oil-soluble scavengers are additives that typically contain organic compounds that mix well with sour oil and react chemically with H2S to neutralise it. They are useful in crude oil processing, where even low levels of H2S can pose significant safety and corrosion risks. Oilsoluble scavengers help manage H2S without adversely affecting the quality of the crude oil.

Regenerative scavengers, which are amine based, are cost effective and highly sustainable for large gas treating and H2S removal requirements as they reduce resource requirements and overall waste considerations. This category of scavengers captures both H2S and CO2 from sour gas streams in an absorption tower and releases the acidic gas mixture separately under controlled conditions, allowing the amine-based scavenger to be regenerated and reused. Different scavenger types have unique benefits and challenges, and each must be reviewed on a case-by-case basis to determine the best choice for specific treatment needs.

As mentioned above, solid scavengers or adsorbents play a crucial role in H2S removal. They are generally characterised by large surface contact area with evenly distributed active sites where the H2S molecules can bind and be effectively captured from gas streams. Adsorbents are one of the most efficient and widely used methods for H2S removal in downstream, midstream, upstream, and renewables sectors due to their ability to handle a wide range of H2S concentrations and ease of operation.

The choice of adsorbents vs other technologies is a function of many factors, including economics, but can initially be narrowed to applications with <1.5 tpd sulfur. Additionally, efficient operation as well as operator safety should be emphasised in the selection process. An adsorbent with low crush strength or with high powder content will compact or cake throughout the bed life cycle creating high pressure drop (dP) and gas channelling that will lead to short bed life which can become extremely challenging to remove. Changeouts of this type of agglomerated spent media are not only challenging from the operational and economical point of view but also pose safety concerns, especially if the worker needs to enter the vessel. Hydroblasting is normally required to remove the agglomerated spent media from the vessel creating an unnecessary risk of exposure to H2S pockets and potential harm to equipment and personnel.

SULFURTRAP® EX, a 100% active H2S solid adsorbent, differentiates itself from competing technologies through proprietary chemistry as well as state-of-the-art manufacturing techniques that allow it the ability to efficiently decrease the H2S content to <1 ppm with a continuous low-pressure drop (SOR to EOR) while loading 2 - 3 times more sulfur than conventional products. SULFURTRAP® EX is a patented H2S adsorbent with an add on benefit of removing small concentrations of O2 to keep the equipment from corrosion degradation. SULFURTRAP EX also provides a safer turnaround experience for operations and maintenance personnel as the spent material remains loose and can be quickly removed from the vessel leading to lower OPEX costs, something other competing products cannot provide. SULFURTRAP® EX is made in the USA using domestically sourced naturally occurring raw materials.

Operators of all types can choose from modular systems with standard sizing to fully customised SULFURTRAP® systems for a wide range of operating conditions.

Although drilling and reservoir management has the most advanced technologies in the oil and gas industry, particularly with innovations like horizontal drilling, hydraulic fracturing, advanced seismic imaging, and real-time data analysis through the Internet of Things (IoT) and artificial intelligence (AI), refineries have been reducing SO2 emissions through H2S separation and conversion to elemental sulfur since the 1940s. As such, refineries have proven technologies and solutions for removing H2S.

Of all the sulfur recovery solutions, LO-CAT® liquid redox system has emerged over its forty years of history as a predominant solution for H2S removal for treatment of 1.5 tpd up to 20 tpd of sulfur removed from gas streams containing H2S. LO-CAT has traditionally been a go-to for large midstream and refinery applications, but, due its scalability, smaller systems are now being successfully used in upstream and renewables applications.

LO-CAT uses a chelated iron solution to convert H2S to innocuous, elemental sulfur. It does not use any toxic chemicals and does not produce any hazardous waste byproducts. Its environmentally safe catalyst is continuously regenerated, so operating costs are low, and its aqueous-based ambient temperature process applies to any gas stream. The technology’s Auto Circulation design has a small carbon footprint yet achieves more than 99.9% removal efficiency. There are no liquid waste streams, so it does not require treatment and disposal – and it’s far less expensive than the alternative. Its unique design allows for 100% turndown in gas flow and H2S concentrations.

The process chemistry of the LO-CAT technology is embedded in its name: Liquid Oxidation CATalyst. The overall system oxidation reaction is as follows:

H2S (gas) + ½ O2 (gas) → H2O + S0

This is a well-known oxidation reaction. This overall reaction is sub-divided into two parts:

Ì H2S gas absorption, ionisation, and reaction to make solid sulfur in the liquid solution.

Ì The liquid solution is then oxidised using air and regenerated for re-use.

In chemistry terms, the first step is called reduction, and the second step is called oxidation. Therefore, the LO-CAT process is called a redox (reduction-oxidation) reaction process.

Caustic treating is not just for downstream

Caustic treating

Another downstream technology that can be applied to upstream and other sectors is FIBER FILM®, which can be used in systems such as THIOLEX™ and MERICAT™. THIOLEX is a technology for removing H2S and mercaptans from gas and liquid streams using an alkaline solution in an acid-base reaction. MERICAT is a technology used to sweeten mercaptans, specifically those found in heavier streams such as condensate, naphtha, or gasoline.

The choice of technology depends on feed and product specifications. Both use non-dispersive FIBER FILM Contactors as mass transfer devices, with caustic and/or amine as the treating reagent in gas and liquid hydrocarbon streams. The FIBER FILM Contactor is a vertical vessel packed with proprietary fibre that achieves non-dispersive-phase contact without the problems inherent in conventional dispersive mixing devices, such as aqueous phase carryover, hydrocarbon losses, lack of turndown

ability, long settling times, plugging, and flooding. Because the aqueous phase adheres to the fibres rather than being dispersed into the hydrocarbon phase, carryover and uncontrollable emulsions are virtually eliminated.

Historically, sour oil and gas reserves were left undeveloped because of the technical difficulties and costs associated with extraction and processing. Today, a variety of new and improved purification solutions and services are available to help operators quickly and economically remove toxic and corrosive contaminants like H2S and mercaptan sulfurs from hydrocarbons.

The removal of H2S cannot be an afterthought – it’s necessary for productivity, the improvement of end products, safety, and the environment. Removal protects employees, extends equipment life, and ultimately adds to the bottom line.

Fortunately, production companies have a clear opportunity to address the problem of emissions and contaminants removal from their E&P activities with ready-to-implement, costeffective, ‘easy button’ solutions. Drawing insights from the downstream, E&P companies are leveraging the knowledge and resources gained over the years and applying them to their own processes for H2S removal, which is integral to E&P’s success, safety, and regulatory compliance.

Jordan Flaniken is the Managing Director of Adsorbents at Merichem Technologies. With 20 years of experience in the energy industry, he has a focused background in sulfur removal catalysts, adsorbents and integrated systems for oil and gas production and purification.

Garry Stephen, Oil States, UK and Asia, discusses how field-proven oil and gas technologies can pave the way forward for carbon capture and storage (CCS).

As the oil and gas industry seeks to balance legacy infrastructure and sustainability goals, carbon capture and storage (CCS) has emerged as a vital tool in the global push toward decarbonisation, offering a practical pathway to significantly reduce CO 2 emissions. What makes this technology particularly compelling is its

potential synergy with mature and decommissioned oil and gas wells, which present ready-made conduits for carbon storage.

This convergence of existing infrastructure and emerging environmental imperatives creates unique opportunities – and challenges. While thousands of wells worldwide approach the end of their productive lives, some could find new purpose as CO2 storage sites rather than facing traditional abandonment. However, repurposing these wells requires specialised technology and careful engineering considerations to ensure long-term storage integrity.

An examination of the intersection of well abandonment and CCS repurposing reveals how field-proven technologies used for decades in deepwater oil and gas applications can make this possible.

The economic advantages of repurposing existing wells for CCS are substantial. Rather than incurring the significant expense and time investment of drilling new injection wells, operators can retrofit mature wells at a fraction of the cost. This approach not only accelerates CCS implementation but also minimises environmental disruption by utilising wells. The existing wellbores, having proven their integrity through years of hydrocarbon production, offer ready-made pathways for CO2 injection when properly restored and upgraded.

The scale of this opportunity is significant and global. Current projections indicate that more than 20 000 offshore wells will require decommissioning over the next 10 - 15 years. For the United Kingdom Continental Shelf (UKCS) alone, more than 2000 wells are scheduled for decommissioning in the coming decade. This represents not just a decommissioning challenge but a strategic opportunity for operators to transform potential liabilities into valuable assets. By repurposing wells for CO2 storage, companies can create new revenue streams through storage capacity sales while contributing to emissions reduction goals.

The regulatory landscape increasingly supports this transition. Countries such as the UK, Norway, and the Netherlands have implemented stringent requirements for well abandonment and CO2 storage, establishing clear frameworks for CCS operations. These regulations, while demanding, provide the necessary structure for ensuring long-term storage integrity. Industry best practices for plug and abandonment (P&A) continue to evolve, incorporating specific considerations for CO2 storage that address the unique challenges of long-term carbon sequestration.

While the potential for repurposing mature wells for carbon storage is promising, the transformation process presents significant technical and operational challenges. Converting wells that were abandoned decades ago into reliable CO2 storage facilities requires careful consideration of multiple factors.

Many wells were plugged and abandoned using methodologies that, while acceptable at the time, fall short of modern CCS requirements. The variety of well designs encountered, particularly in older fields, necessitates customised approaches for each conversion project. Conductor and casing sizes often vary significantly, requiring bespoke engineering solutions rather than standardised approaches. This variability increases both the complexity and cost of conversion projects, demanding careful evaluation of each well’s specific characteristics.

Perhaps the most demanding aspect of well conversion is ensuring and verifying long-term structural integrity. New plugs and seals must undergo rigorous testing to verify their performance under various temperature and pressure conditions. These components must maintain their CO2-tight integrity not just for years but for centuries, meeting extraordinary durability requirements. Testing protocols must simulate not only initial injection conditions but also the various chemical and physical stresses that could occur over extended time-frames.

The successful transformation of decommissioned wells into CCS assets requires overcoming these technical challenges. While solutions exist for each of these issues,

their implementation demands meticulous planning, advanced engineering, and robust quality assurance protocols. Only by thoroughly addressing these challenges can operators ensure the safe and effective long-term storage of CO2 in repurposed wells.

The evolution of well abandonment technology has yielded sophisticated solutions that effectively address the unique challenges of CCS conversion. Today’s field-proven technologies offer reliable methods for transforming abandoned wells into secure CO2 storage facilities, combining innovative materials with advanced engineering approaches.

The industry has witnessed a significant shift from conventional cementing methods toward more advanced solutions incorporating polymer-modified cement blends. These modern formulations provide enhanced flexibility and durability crucial for long-term CO2 storage. Real-time verification capabilities ensure immediate confirmation of structural integrity, eliminating uncertainty in the conversion process. This advancement represents a crucial step forward from traditional P&A methods, offering the precision and reliability demanded by CCS applications.

The Oil States Hydra-Lok™ system stands as a useful technology in well conversion operations. Its rapid connection capabilities and diverless operation reduce operational time and risk, while providing immediate load-bearing capacity upon installation. Originally developed for offshore infrastructure, including platform jackets and subsea templates, the system could prove particularly valuable in CCS applications. The technology’s ability to establish robust structural connections makes it ideal for reestablishing foundations in previously abandoned wells, providing the secure base necessary for CO2 storage operations.

Building on this structural foundation, Oil States’ formConnect™ technology addresses the critical challenge of casing string reconnection. This innovative system delivers highpressure, high-capacity connections that meet the stringent requirements of CO2 storage. Its particular strength lies in enabling the installation of new wellhead foundations and casing hangers in wells where previous infrastructure has been removed, effectively bridging the gap between abandoned well architecture and modern CCS requirements.

The integration of high-pressure riser systems completes the well conversion package, establishing the vital link between seabed infrastructure and surface operations. These systems work in concert with Hydra-Lok and formConnect technologies to ensure complete well control throughout the conversion process and subsequent injection operations. The pressure-tight conduit they provide is essential for both the initial conversion work and long-term CO2 injection activities.

Supporting these core technologies is a comprehensive suite of services beneficial for well conversion. Advanced well cleaning and cutting tools ensure proper preparation of the wellbore. Equally important is the availability of specialised engineering expertise and project management capabilities, enabling the development of bespoke solutions for each unique well configuration.

The combination of these technologies and supporting services provides operators with a complete toolkit for well conversion. This integrated approach, proven through field applications, offers a reliable pathway for transforming abandoned wells into valuable CCS assets, meeting both current regulatory requirements and future operational needs.

The process of converting an abandoned well into a viable CO2 storage receptacle requires a systematic, carefully orchestrated approach. Each step builds upon the previous one, creating a comprehensive transformation that ensures both operational efficiency and long-term storage durability.

The foundation of any successful conversion begins with thorough evaluation and planning. Engineers must meticulously review existing well architecture documentation, original P&A records, and current regulatory requirements to develop a comprehensive understanding of the well’s condition. This initial phase includes a detailed engineering analysis to design a conversion approach that addresses the specific challenges of a well while meeting modern CCS standards. The resulting plan serves as a roadmap for all subsequent operations.

The installation of new infrastructure begins with the Hydra-Lok swaging system, deployed with a Lynx™ connector crossover. This operation establishes a new wellhead foundation capable of supporting future CCS operations. The swaging process creates a robust metal-to-metal connection that provides immediate and reliable load-bearing capacity, beneficial for long-term stability.

Following wellhead establishment, a high-pressure riser system is installed with careful attention to tension requirements. Detailed riser analysis guides the selection of optimal connectors, ensuring compatibility with both existing infrastructure and planned CCS operations. The riser system provides the critical link between subsea operations and surface control equipment.

The formConnect technology then creates crucial pressure-tight connections within the casing string. This step is vital for ensuring the well’s ability to contain CO2 under injection pressures. Each connection undergoes rigorous pressure testing to verify its integrity, establishing a documented baseline for future monitoring.

Once the new casing connections are made and the wellhead hangers are locked down and their seals energised, comprehensive verification tests are completed to confirm the well’s readiness for either CO2 injection operations or further abandonment procedures, depending on the project timeline.

Successfully converting a well for CCS use depends on the precise execution of each step, with careful attention to quality control and verification throughout the process. This methodical approach helps ensure that converted wells meet or exceed the stringent requirements for long-term CO2 storage.

As global decarbonisation efforts accelerate, it’s anticipated that demand for CCS initiatives will grow. This presents a unique opportunity for the oil and gas industry to leverage its vast infrastructure and decades of subsurface expertise to advance CCS capacity. The thousands of wells approaching decommissioning represent not just a challenge, but a strategic lower-carbon asset as the energy industry diversifies.

The oil and gas sector is uniquely positioned to lead CCS efforts, possessing both the technical knowledge and physical infrastructure required for large-scale carbon storage. Field-proven oil and gas technologies, supported by established supply chains, are key to a cost-effective CCS industry.

Note

Garry Stephen has more than 20 years of expertise in global oil and gas offshore drilling.

In this episode, Juan Caballero, Chair of the AMPP Board of Directors, talks about AMPP’s global efforts to prevent corrosion and to protect assets, offering insight into how the association listens to its members and serves the pipeline industry.

Juan shares his insights on:

• The merger of NACE with SSPC to form AMPP.

• Materials protection challenges in 2025.

• AMPP’s training programmes, including a sneak peek into the newest offerings.

• Industry trends and how AMPP views sustainability.

• Which certifications are currently in demand.

• Digital learning for pipeliners.

• Regulations that we need to pay attention to now.

Episode Seven: UKOPA

Episode Six: TDW

Episode Five: IPLOCA

Calum Dey, Engineering Manager, Decom Engineering, details the development of new technologies designed to meet unique challenges of cutting tasks in challenging environments.

ast year, the introduction of the C1-32 Chopsaw to market – Decom’s first neutrally buoyant tool – was a significant milestone. Capable of cutting up to 32 in. OD materials of any type, this advanced technology was designed to meet the unique challenges posed in a conductor removal scope on the Brent Charlie platform in the North Sea, and sets the foundation for in-built buoyancy integration.

Due to the complexity of the conductor guideframe layout and restricted 3 m width access, the Chopsaw had to be neutrally buoyant in seawater and easily maneuverable with a single ROV. Weighing approximately 6700 kg in air but only 50 kg in seawater and with a blade diameter of 2100 mm, the C1-32 assisted with the cutting of 40 Brent Charlie multi-string conductors with an OD of 30 in., many with the added challenge of loose internal strings.

From neutrally buoyant to ultra-light, this year Decom launched the C1-16UL Chopsaw. The C1-16UL is designed to cut a wide range of materials but excels with its add-on mooring chain retention clamps, allowing for precise cutting without the risk of dropping anything to the seabed. This Chopsaw was specifically engineered to handle the demanding task of cutting flexible risers and mooring chains under tension, Riser Turret Moorings and Deepwater Tensioned Moorings. It incorporates several innovations, including a subsea-grade aluminium frame, replacing traditional steel construction, and a high-torque direct-drive hydraulic motor which has eliminated the need for a gearbox without sacrificing performance.

This tool is currently deployed on a 45 day campaign in the Shenandoah Field, Gulf of Mexico, which includes cutting studless

mooring chains in less than 20 minutes and incorporates a linked retention system to secure severed sections.

Another exciting development is Decom Engineering’s linear cutting C1-10T Tracksaw which is designed for optimal performance in confined spaces and challenging environments. Its compact design allows it to fit into tight areas with minimal headroom, making it ideal for both subsea and industrial projects.

The C1-10T has been engineered to handle complex cutting tasks, further enhancing Decom Engineering’s capabilities in offshore and industrial applications. With its ability to execute linear cuts in limited access areas and remove excess webbing, the C1-10T offers a new level of versatility and whether used for flat plate, gussets, rib

plates, or standard beam sections, this tool delivers precision and efficiency in demanding cutting scenarios.

The continual development and deployment of new tools and technology such as the C1-32, C1-16UL, and C1-10T has enabled Decom Engineering to further capture key markets, positioning the company for a successful expansion into North and South America.

The C1-24 Chopsaw has been instrumental in shaping Decom Engineering’s research and development efforts. Its successful deployment on high-profile global projects has provided critical insights that have driven the refinement of cutting technologies. By overcoming diverse operational challenges in locations such as the North Sea, the Gulf of Mexico, and the Gulf of Thailand, the C1-24 has proven to be an invaluable tool in subsea decommissioning and offshore recovery.

Through experience with the C1-24, Decom has continuously adapted its engineering approach, the necessity of achieving precise yet efficient cutting in extreme depths led to the development of custom retention clamps, reducing seabed impact and improving operational efficiency. This evolution has directly influenced the design philosophy behind the latest additions to Decom Engineering’s Chopsaw lineup, including the C1-16UL and C1-10T, ensuring that each new tool builds upon the successes and advancements of its predecessors.