ENERGY GL BAL

ENERGY GLOBAL

CONTENTS AUTUMN 2025

03. Comment

04. Capped ambitions

Ashutosh Padelkar, Research Lead at Aurora Energy Research, maps out why the wholesale price cap is detrimental to the energy transition in India.

08. Preventive maintenance for healthy onshore wind

Kleopatra Kyrimi, Sarens, illustrates how preventive maintenance forms a crucial aspect of guaranteeing efficiency and reliability in the growing global onshore wind energy sector.

14. Knowledge is key

Jens Wulff, CEO EMEA & India, NEUMAN & ESSER, Germany, outlines how an understanding of the whole hydrogen value chain can help reach the growing demand for high-purity hydrogen.

18. Leading the change

In a conversation with Energy Global, Bruno Melles, Managing Director of Business Unit Transformers at Hitachi Energy, explores how transformer technology is shaping a more resilient, efficient, and sustainable energy system.

24. Digital insights for greener winds

As the offshore wind sector develops, Sarah McLean, Lead Content Manager, and Drashya Goel, Senior Client Success Manager, Spinergie, delve into how digital reporting forms a crucial next step in tackling emissions at each stage of the wind farm lifecycle.

30. Keeping turbines turning: Inside or out?

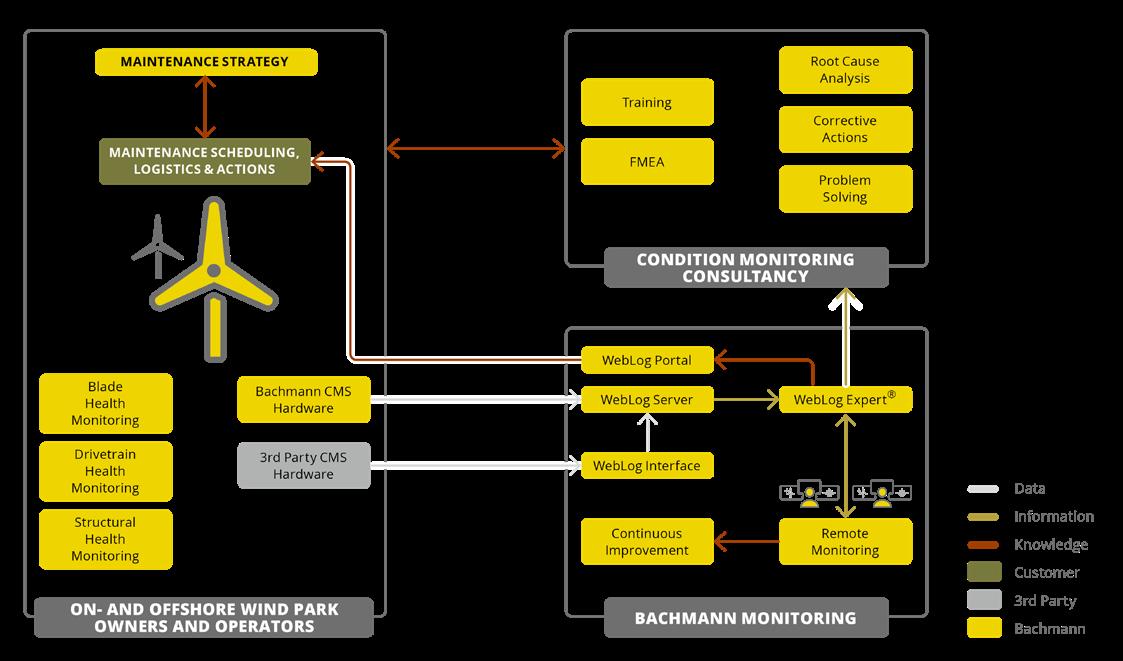

The profitability of wind turbines is determined by productivity and availability. Condition monitoring supports maintenance decisions, identifies potential cost savings, and avoids unforeseen failures. David Futter, Condition Monitoring Consultancy at

Reader enquiries [enquiries@energyglobal.com]

ON THIS ISSUE'S COVER

Bachmann Monitoring GmbH, and Frank Fladerer, Bachmann electronic GmbH, compare the advantages and challenges of doing this in house or through an external partner.

36. Planning aspects for sustainable corrosion protection of offshore wind

Andreas Hoyer, Global Commercial Director of Energy & Infrastructure, Teknos, decodes corrosion protection for the offshore wind industry, surveying coating techniques, reviewing various standards, and evaluating the effectiveness and risks associated with different coating types.

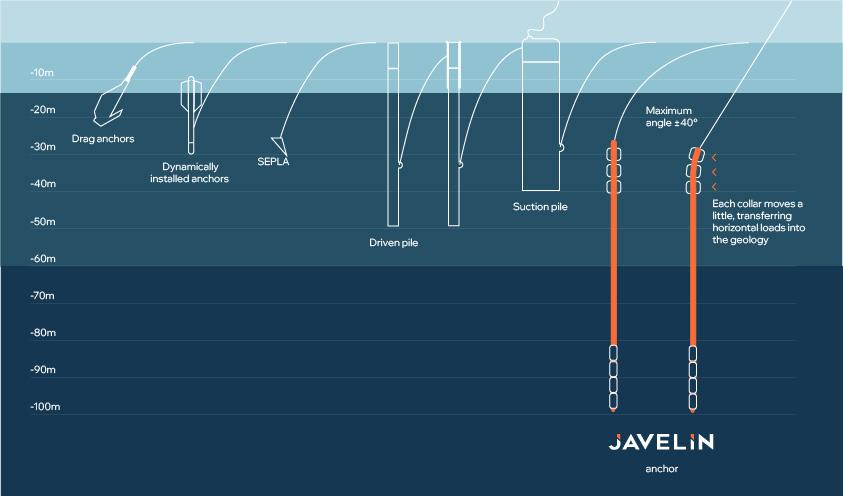

40. Anchoring the future

By 2030, wind power is anticipated to supply the bulk of the UK’s green electricity, with a significant portion of this generated by offshore installations. But innovation could help the UK make use of its exceptional offshore wind resources sooner. Alun Jones, Reflex Marine, and Laurie Thornton, MintMech, discuss a novel anchor system that could set new standards for mooring technology.

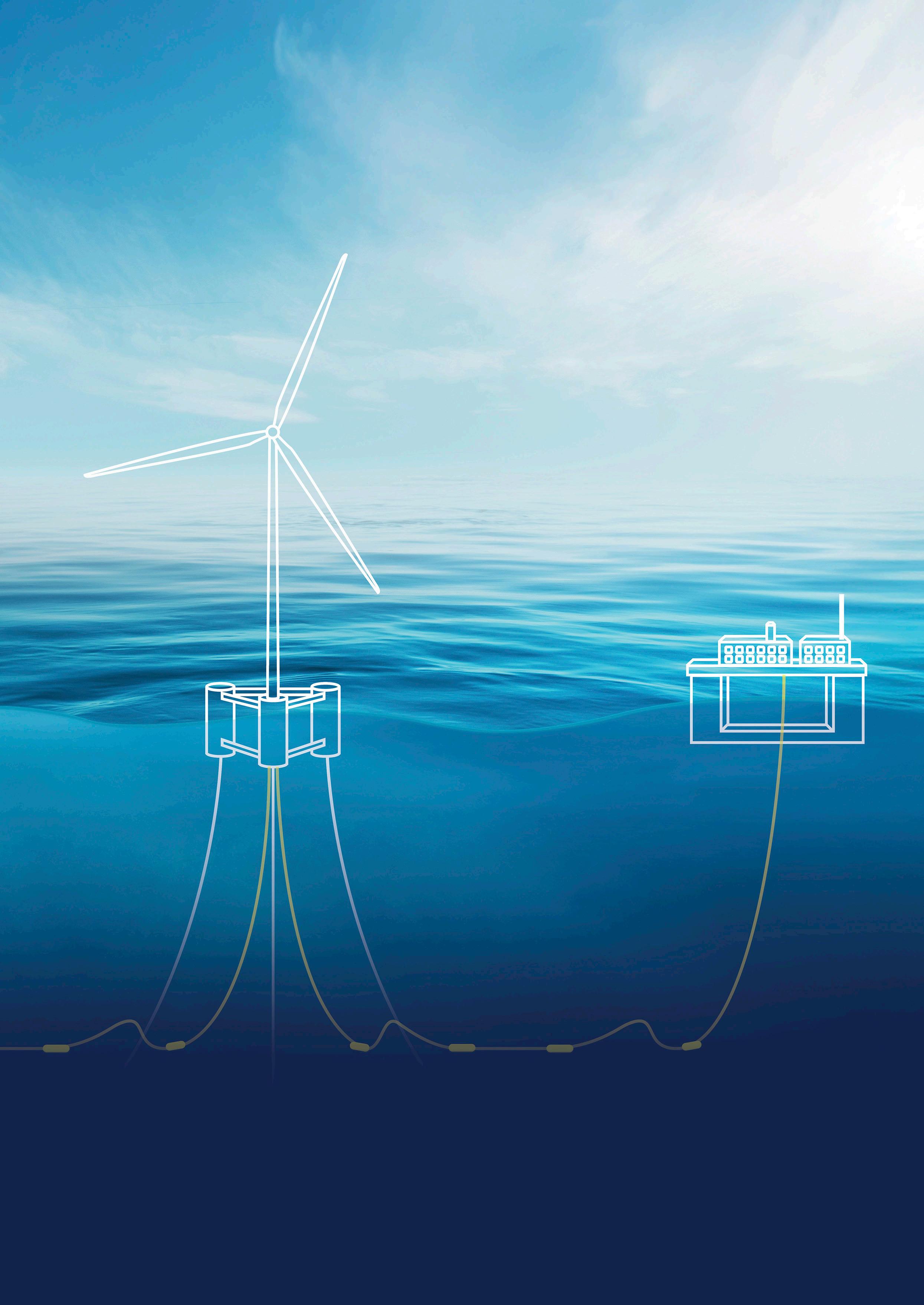

44. Floating offshore wind: Filled with promise and potential

Sille Grjotheim, Global Segment Director, Floating Offshore Wind, and Alireza Bayat, Principal Consultant, Energy Systems, DNV, provide an overview of the evolution of floating offshore wind from concept to deployment.

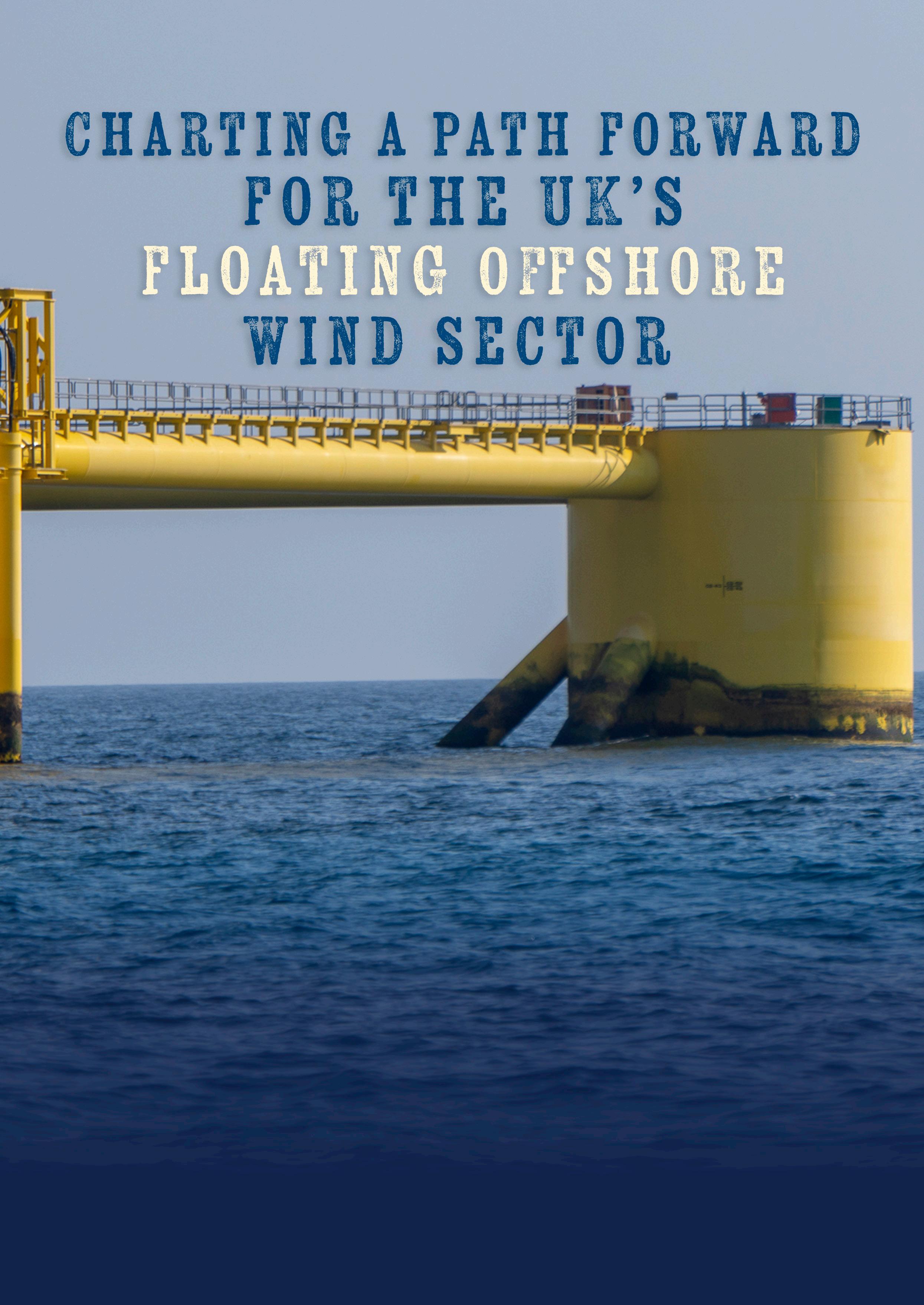

48. Charting a path forward for the UK's floating offshore wind sector

Matt Green, Green Volt Project Director, details the importance of floating offshore wind for the UK’s renewable energy targets and sketches out the path ahead.

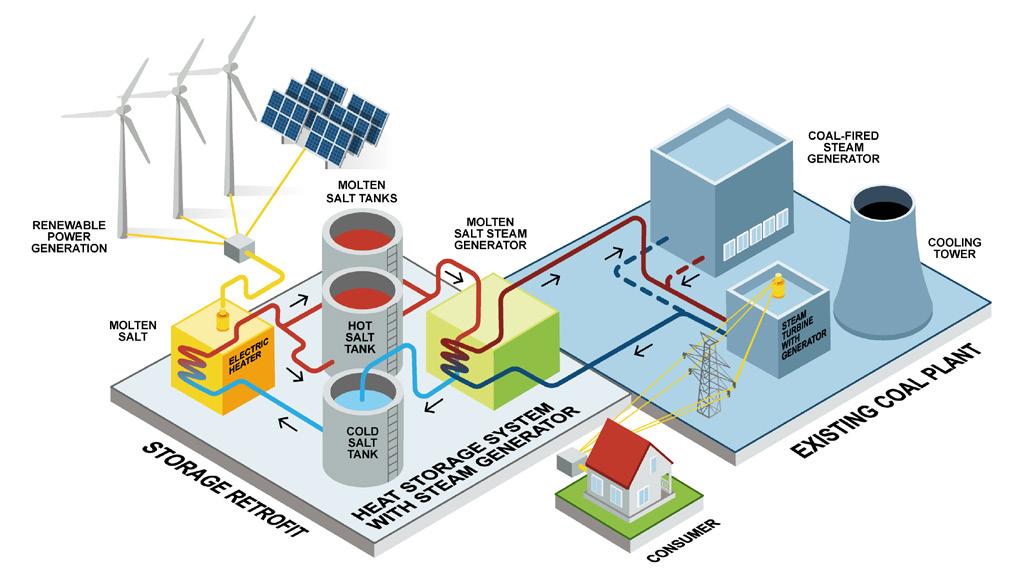

52. A potential power shift: Coal plants to thermal storage

Svante Bundgaard, CEO, and Jens Taggart Pelle, Vice President of Technical Sales, Aalborg CSP, advocate for the conversion of coal-fired power plants into thermal storage facilities for renewable energy, saving time and costs towards advancing the energy transition.

56. Global news

ENERGY GL BAL

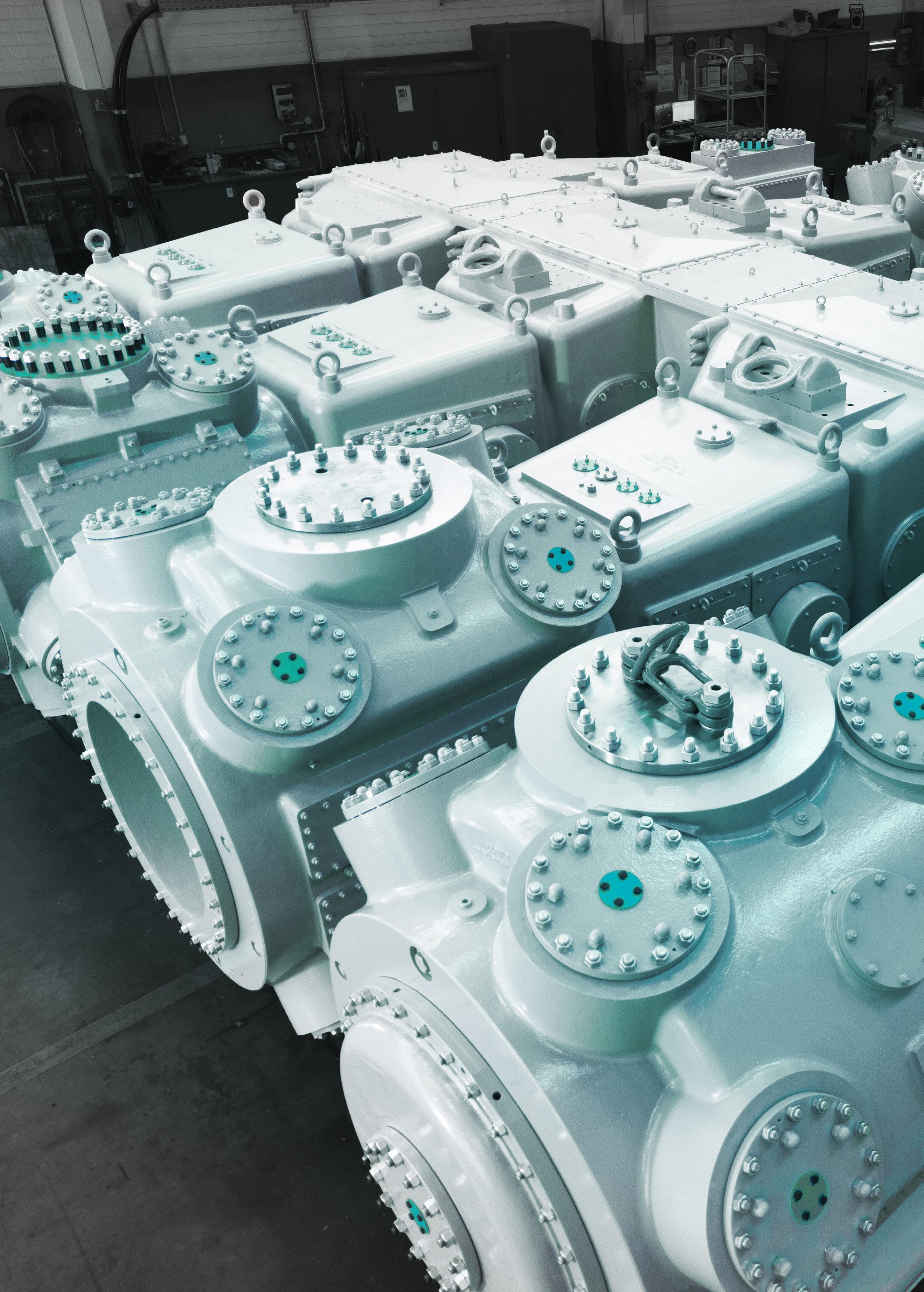

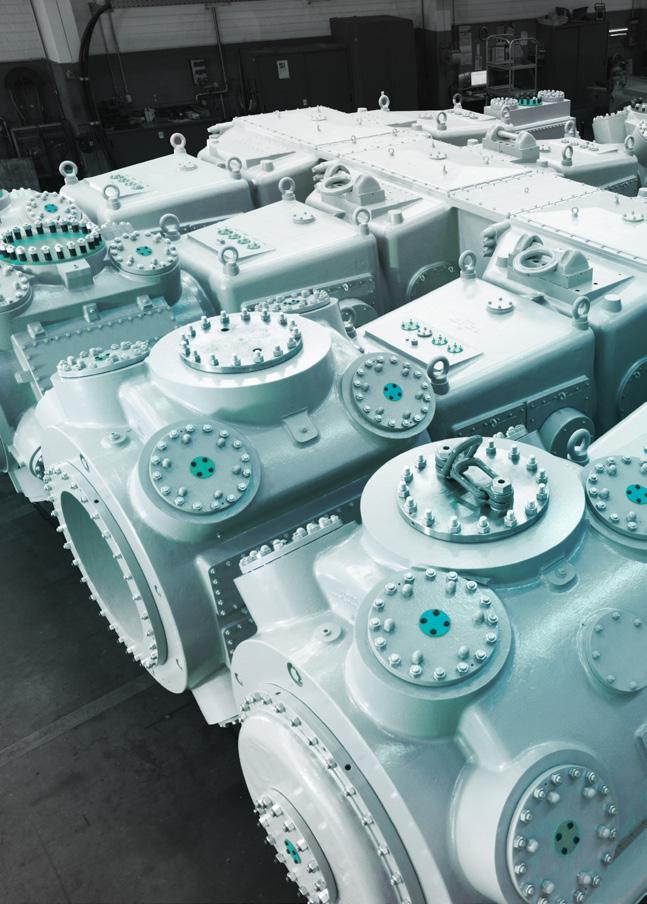

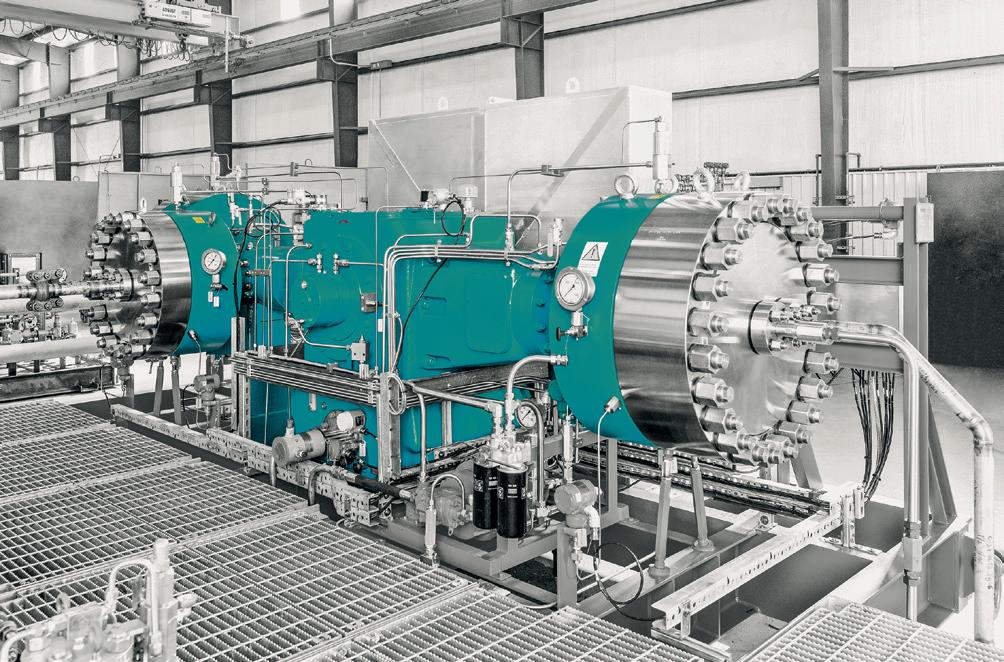

NEUMAN & ESSER stands as the industry’s reliable partner, propelling the energy transition and the circular economy through its integrated solutions for the energy infrastructure of tomorrow.

The product portfolio of NEUMAN & ESSER includes compressor solutions, as well as hydrogen production systems such as electrolysers, steam reformers, holding the key technologies for future demands of clean energy.

Still pioneers.

Across energy and critical infrastructure, we bring expertise where complexity is highest, partnering with globally local teams and leveraging unrivalled proprietary technologies. Like the M-500 Single Torch External Welding System, seamlessly integrated with Data 360 our cloud-based digital platform that analyses, and visualises your project performance data in real time. We move projects forward, no matter the challenge. We’re here to partner on how our specialist welding and coating solutions can help you power tomorrow.

MANAGING EDITOR

James Little james.little@palladianpublications.com

SENIOR EDITOR

Elizabeth Corner elizabeth.corner@palladianpublications.com

EDITOR

Jessica Casey jessica.casey@palladianpublications.com

EDITORIAL ASSISTANT

Abby Butler abby.butler@palladianpublications.com

SALES DIRECTOR

Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER

Will Powell will.powell@palladianpublications.com

PRODUCTION DESIGNER

Siroun Dokmejian siroun.dokmejian@palladianpublications.com

HEAD OF EVENTS

Louise Cameron louise.cameron@palladianpublications.com

EVENT COORDINATOR

Chloe Lelliott chloe.lelliott@palladianpublications.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@palladianpublications.com

JUNIOR VIDEO ASSISTANT

Amélie Meury-Cashman amélie.meury-cashman@palladianpublications.com

DIGITAL ADMINISTRATOR

Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

DIGITAL CONTENT COORDINATOR

Kristian Ilasko kristian.ilasko@palladianpublications.com

ADMINISTRATION MANAGER

Laura White laura.white@palladianpublications.com

Editorial/Advertisement Offices: Palladian Publications Ltd

15 South Street, Farnham, Surrey, GU9 7QU, UK +44 (0) 1252 718 999 www.energyglobal.com

COMMENT

Jessica Casey Editor

Autumn is creeping its way to the UK – the rainy weather, slightly colder temperatures, and the beginning of darker evenings are all signs that the end of the year is coming

Grid stability will remain crucial in helping provide energy in periods of high demand. One way this can be achieved is the use of battery storage and co-location with solar and wind farms to help with grid flexibility and security. The UK in particular has made a recent push towards shining a spotlight on the future role of energy storage. For example, EDF and Ampeak Energy have signed a long-term agreement to optimise the AW1 battery energy storage system in South Wales. The 120 MW/240 MWh facility will store electricity and release it to the grid during periods of high demand, supporting the balance of supply and demand while helping the UK reach emissions targets.1 Moreover, Equitix has formed a consortium with Aware Super and the National Health Fund to invest £500 million into a new UK battery storage platform, Eelpower Energy. The business will build, own, and operate grid scale battery storage assets and aims to deliver over 1 GW of new battery storage capacity for the UK grid in the coming years.2

More widely, 3E has completed a milestone in the flexibly utility scale energy storage (FULLEST) research project, delivering a digital twin technology for battery energy storage systems, with Vrije Universiteit Brussel. The project addresses critical challenges in the expanding European energy storage market.3

Another sector which the UK is investing in to help achieve net zero is floating offshore wind. While newer than fixed foundation technology, the floating offshore wind market has grown in popularity in recent years. The UK is already well-established as a leader in this; floating turbines in British seas alone open up a potential resource of over 1500 TWh/y.4 In addition, building out just the UK pipeline

of floating projects needed to reach net zero could have the potential not only to help meet energy needs, but also contribute £25 billion to the UK economy and employ 100 000 people.4

The Autumn issue of Energy Global touches on this developing technology, with multiple articles from industry leaders. DNV provides an overview of the evolution of floating offshore wind, from concept to development. The article considers some potential barriers to scaling up floating offshore wind, and looks at factors that might help secure a floating future. Green Volt outlines the importance of floating offshore wind for the UK’s renewable energy targets, drawing on how projects such as Green Volt can help pave the way for future projects. Finally, MintMech and Reflex Marine discuss a new anchor system that tackles both the technical obstacles and the practical and economic realities of scaling up floating offshore wind installations.

Whichever direction floating offshore wind takes, Energy Global will be with you every step of the way. I hope you enjoy the issue.

References

1. ‘EDF and Ampeak Energy sign a long-term agreement to optimise flagship AW1 battery project’, EDF, (1 September 2025), www.edfenergy.com/ media-centre/edf-and-ampeak-energy-sign-longterm-agreement

2. ‘Equitix-led consortium with Aware Super and the National Wealth Fund launches a £500 million platform to build, own, and operate UK battery storage assets’, Equitix, (27 August 2025), https://equitix.com/news/equitix-led-consortiumwith-aware-super-and-the-national-wealth-fundlaunches-a-500-million-platform-to-build-own-andoperate-uk-battery-storage-assets/

3. ‘FULLEST project delivers advanced digital twin technology for Battery Energy Storage Systems (BESS)’, 3E, (18 August 2025), www.3e.eu/resources/ news/fullest-project-delivers-advanced-digital-twintechnology-for-battery-energy-storage-systems-bess

4. ‘Floating Wind: Anchoring the next generation offshore’, UK Floating Offshore Wind (FLOW) Task Force Phase 2, (8 October 2024), www.renewableuk. com/media/scccdrxe/floating-offshore-wind-2050vision-final.pdf

Ashutosh Padelkar, Research Lead at Aurora Energy Research, maps out why the wholesale price cap is detrimental to the energy transition in India.

After being shown the profitability potential of utility scale battery energy storage system (BESS) projects that arbitrage the price differences within a day, a lender asks: “Sure, these returns look great – but what if the price cap is revised downwards?” At over INR 7.5/kWh on average throughout 1H25, the spreads (or difference between the highest and lowest prices in the power exchanges in a day) are attractive. However, the banker was right to be concerned: the price cap was initially set at INR 12/kWh in April 2022, but was revised down to INR 10/kWh the following year. If the government were to move the cap down to INR 8/kWh, the spreads would decrease by over 25% – this represents a risk few lenders would take.

Why a price cap?

The price cap in the Indian power market was introduced to help increase the affordability of electricity for consumers,

in response to the high prices seen in early 2022 during the energy crisis. As the average prices in March 2022 exceeded INR 20/kWh, the government stepped in and capped them to INR 12/kWh, a level at which they remained for the following six months. As the Indian government tried to expand access to electricity, concerns around affordability of power rightly drove action. However, prices have since continued to decline. Although the cap was lowered to INR 10/kWh in 2023, there has been no month since September 2022 when the average prices have remained at the cap. While there have been many instances of prices remaining at the cap for several hours on end, the wider trend for the last three years has been a decline in prices.

The rise of renewables

This decline in prices is driven by the deployment of renewables, primarily the expansion of solar energy. The installed capacity of solar photovoltaics in India has doubled

from 54 GW at the beginning of April 2022 to 111 GW as of May 2025. While the business models utilised by these projects would differ – some would be backed by tenders, others might have C&I contracts or sell in the exchange – the common thread is that the generation of solar peaks at the middle of the day. This leads to an oversupply of power in those hours, and consequently the price declines: the prices in the exchanges between 10 am and 2 pm have declined from INR 4.2/kWh in 2022 to INR 2.9/kWh in 2024.

This decline in prices continued into 2025, especially driven by sluggish economic growth leading to a slow rise in power demand and spooked investors and developers alike when prices approached INR 0/kWh for several hours a day in May and June 2025. A range of factors drove prices down: the early arrival of monsoons in India led to lower demand for air-conditioning, DISCOMs had excess power they were selling in exchanges at low prices to avoid paying deviation settlement mechanism (DSM) penalties, and thermal plants were already running at their minimum stable generation levels and could not further decrease their generation if they were to be available for the evenings.

However, even as the prices touched INR 0.30/kWh for several hours a day every day between 22 – 28 May 2025, these days also saw prices touching the cap of INR 10/kWh for several hours around midnight. Essentially, what the Indian power market is facing is not low power prices as has been widely discussed, but rather volatile power prices: the average spreads in that week were INR 9.1/kWh, 21% higher than the average in 1H25. This diagnosis calls for the deployment of storage as the primary solution – the excess power in the middle of the day must be moved to the evenings when there is higher demand.

While the need for storage in India is abundantly clear, the equally obvious barriers preventing its deployment remain; the price cap that prevents exchange prices from exceeding INR 10/kWh being the key obstacle. One solution introduced by the government was the high price market, which has a higher cap, but this market is plagued by much lower liquidity and consequently does not offer a practical solution that would offer comfort to investors.

Building investor confidence is vital as India aims to decarbonise its power system and rapidly scale up renewable energy: by 2030, in addition to expanding thermal generation, solar would need to be doubled again to nearly 230 GW of installed capacity, and the system would need nearly 60 GW/200 GWh of storage according to Aurora’s projections. This represents a CAPEX of nearly INR 6.6 trillion (US$80 billion), and this capital would come from both domestic and international investors seeking stable returns. Regulatory uncertainty in the form of this price cap, particularly with the risk of it being moved down, is detrimental to giving investors confidence in investing in the Indian power sector.

What are the solutions?

The solution that would build investor confidence is the complete removal of the price cap, along with a commitment to not introducing it again. This would bring forward the deployment of batteries that participate in the power exchanges, in contrast with those that are contracted to DISCOMs to help manage the variability in demand. Only those batteries that trade power in the exchanges would help manage the volatility of the power prices, helping prevent prices approaching zero in the middle of the day. Whilst the prices were pushed close to INR 0/kWh in May and June 2025 by a number of causative factors, many of them overlap –low demand, DISCOMs selling excess power in exchanges, and thermal plants running at their minimum stable limit are all closely interrelated. The early monsoon then sealed the outcome.

These low exchange prices are a deterrent to investment not just in batteries, but in the whole spectrum of technologies that are vital in delivering decarbonisation, like the expansion of solar and pumped storage hydro. At an even more fundamental level, such market behaviour is representative of a poorly functioning market that spooks investors. The rationale behind the price cap is to protect consumers from high prices, but if it disincentivises investment, those very consumers may instead face blackouts.

Governments around the world have faced this problem of protecting consumers from high power prices and market manipulation, but the solution broadly takes the form of highly competitive markets that disincentivise manipulation, and a retail price cap for the end consumer that is subsidised through taxes, rather than one in the wholesale market, that stifles investment. At the very crux, the CAPEX required for the deployment of power generation projects must come from somewhere. If one subscribes to the belief that the market can efficiently deploy the appropriate mix of technologies to meet the rising demand optimally, then the market must provide the returns these projects need to be commissioned. If markets are to deliver the energy transition in India, they must be allowed to function. That means permanently scrapping the price cap.

Figure 1 Aurora Energy Research chart shows Day Ahead Market (DAM) price between 22 – 29 May 2025.

Kleopatra Kyrimi, Sarens, illustrates how preventive maintenance forms a crucial aspect of guaranteeing efficiency and reliability in the growing global onshore wind energy sector.

The global energy sector is currently experiencing one of the most exciting moments in its history. Technical and technological advances have led to a world where access to cleaner and more environmentally responsible energy is no longer aspirational but tangible and expanding rapidly – driven in large part by the ongoing growth of solar and wind energy, both onshore and offshore.

Figure 1 . PC 3800-1 crane working in Renkenberge wind farm, Germany.

The numbers are encouraging. In Europe alone, according to WindEurope, 13.8 GW of new onshore wind capacity was added in 2024, representing approximately 84% of the total new wind capacity installed across the continent. This equates to the installation of between 14 000 and 20 000 new onshore wind turbines in Europe, with Spain and Germany leading the way. Globally, the US and China continue to expand wind energy capacity alongside Europe.

This rapid growth is pushing the sector to adopt new techniques and technologies aimed at improving energy efficiency and shortening installation times while maintaining all safety measures. While the first turbines installed in the 1980s and 1990s barely reached 450 kW and stood around 40 m tall with 30-m blades, machines are being seen today that exceed 15 MW in capacity –enough to supply clean and renewable energy to more than 40 000 homes annually – with blades approaching 130 m in length.

This evolution has naturally increased the challenges for installation and transport. Each wind turbine component – whether the tower segments, nacelles, or blades – must be moved over hundreds of kilometres from the manufacturing site to often remote locations. As turbines grow in size, so does the need for heavier, taller lifting capacity and highly specialised logistics to safely and efficiently transport and assemble each part.

Preventive maintenance as a guarantee of an efficient energy sector

The pursuit of higher efficiency, which has led the industry to use increasingly larger turbines, has also brought about greater operational stress and wear. Fortunately, advancements in technology are helping ensure reliable performance – even in hard-to-reach locations or in extreme weather conditions, where each unit can be exposed to particularly extreme conditions of temperature, humidity, or wind.

Preventive maintenance has become essential in reducing downtime and improving overall performance as it is estimated that breakdowns and unscheduled downtime can result in an annual production loss of approximately 3% in an onshore wind farm. Digitisation is a great ally in this regard, not only for scheduling maintenance tasks, but also as a tool for detecting potential faults in advance. Increasingly, tools like predictive analytics powered by artificial intelligence (AI), are being used to address problems even before they occur as they are capable of detecting potential breakdowns or technical limitations that reduce the performance of a given unit in advance. Internet of things (IoT) sensors and digital twins are also playing a key role in helping operators optimise maintenance routines. According to consultancy, Infraspeak, predictive maintenance via process digitalisation could reduce operational costs in the wind sector by up to 20% during 2025. It is worth noting that preventive maintenance typically costs between €10 – €20 per kW installed per year, whereas major corrective repairs can exceed €100 000 in the event of a serious breakdown.

While maintenance intervals depend on variables such as turbine model and environmental conditions, standard checks on major systems like gearboxes, generators, and control systems usually occur every six months. Other activities, such as bearing lubrication, may be required as often as every three months in dusty or high-temperature environments. Blade inspections –aimed at identifying cracks or erosion – are increasingly performed using drones equipped with thermal imaging, LiDAR, or high-resolution cameras. Comprehensive maintenance overhauls are typically scheduled every 5 – 10 years, during which all components subject to wear and tear are thoroughly inspected, and any necessary repairs or replacements are made to the gearbox, rotor, or generator, so that the lifespan of each unit, estimated at approximately 20 years, can be extended. Although predictive maintenance significantly reduces downtime, failures still occur. Risk consultancies such as DNV estimate that a modern wind turbine can expect between 1 – 3 minor failures per year. These usually involve replacing components like blades or bearings, or addressing electrical system issues. While some tasks are completed at height, many require components to be dismantled and lowered for repairs on the ground.

Why a trusted heavy lifting partner is essential

This is where trusted heavy lifting specialists become vital. With turbines growing in both height and complexity, maintenance now demands the same level of expertise and equipment as installation. This has led companies such as Sarens

Figure 2 . Sarens installed one the highest wind turbines in Asmolovichi, Belarus.

The

The Perfect Partner for Your Hydrogen Project

NEUMAN & ESSER is the preferred provider for integrated hydrogen solutions. Get the entire technology as well as consulting, feasibility and implementation from a single source.

Hydrogen is essential for the energy transition, enabling decarbonization in industries, transport, and energy. Its value chain spans generation, storage, transport, and application. Green hydrogen, made with renewables, boosts sustainability, while investments in infrastructure drive innovation and economic growth.

Discover our interactive application and immerse yourself in the fascinating world of the hydrogen value chain.

www.h-of.energy

to frequently update its crane fleet with units. For example, the Liebherr LTM 1500-8.1, which has been used together with the Demag AC220-5 in maintenance work at the Longpark wind farm in Scotland, or the Demag CC6800-1 SH/LH+LF3 S3 with a capacity of 1250 t and a main boom of up to 107 m, which has been used at the Golden South wind farm in Saskatchewan, Canada.

Onshore wind farms located all around the world are often situated in remote or rugged environments with very limited space between turbines. For this reason, it is essential to work with a partner who can not only deliver the right equipment to the site, but also mobilise it efficiently and safely, ensuring minimal disruption to

the environment and surrounding infrastructure especially in spaces surrounded by turbines, where the space needed to manoeuvre is minimal. There is, however, another crucial consideration. As energy providers strive to lower their environmental impact, they increasingly expect the same commitment from their partners. At Sarens, this commitment is real and tangible, with the development of an emissions calculator – an industry first – which is offered during the request for quotation (RFQ) phase to help clients precisely understand their project’s carbon footprint. Unlike generic tools or greenwashing gimmicks, this calculator delivers practical insight to support meaningful green action, enabling clients to compare scenarios and select the most environmentally responsible option tailored to their project’s unique requirements.

Beyond consultancy, Sarens has also invested heavily in green technology. The entire SGC suite of cranes – including the SGC-90 ‘Little Celeste’ and the brand-new SGC-170, the second-largest in Sarens’ fleet – can be configured to operate electrically. In fact, the SGC-170 was designed from the ground up to be electric, reflecting its long-term commitment to clean innovation. These cranes not only operate with zero exhaust emissions but can also feed energy back into the grid, demonstrating that sustainability and world-class performance can go hand in hand. Sarens is also advancing the development of electric motors for its largest cranes and incorporating e-packs in its self-propelled modular transports (SPMTs), used quite often in the logistics of wind turbine components as part of a broader shift towards a low-emission future.

The way forward

As the wind sector continues to evolve and scale, the increasingly demanding development of wind infrastructure will be a key factor in achieving a safer and more sustainable future. However, for this to really happen it will be essential the industry does not let its guard down and continues to rely on the necessary preventive and corrective maintenance and inspection tasks. In this context, Sarens believes that the use of increasingly powerful yet environmentally-friendly machinery, together with innovative digital technologies that allow potential problems to be anticipated, will directly transform the way the energy sector operates in the coming years. Only by placing innovation, safety, and sustainability at the heart of every project can a wind energy sector that is ready to meet tomorrow’s challenges be delivered.

Figure 3 Sarens working in Assiniboia wind farm, Canada.

Figure 4 Sarens works in the Dam Nai wind farm in Vietnam.

Jens Wulff, CEO EMEA & India, NEUMAN & ESSER, Germany, outlines how an understanding of the whole hydrogen value chain can help reach the growing demand for high-purity hydrogen.

Decarbonising or de-fossilising the economy on the path to climate neutrality requires a transition to green technologies across the energy, industry, construction, and mobility sectors. Due to the volatility of electricity generation from renewable energies such as wind and solar power, reliable and cost-effective storage and transportation options for large amounts of energy are of key importance. Hydrogen plays a crucial role for these applications; it can be stored and transported and is a key driver for the decarbonisation of the economy, industry, and energy supply, which contributes to overcoming the climate crisis.

However, it is necessary to take a holistic view on the hydrogen value chain to ensure that technological

transformations are successfully implemented worldwide. Furthermore, an integrated and aligned view of the individual components of the value chain is important to ensure optimal results in terms of overall costs. Only with detailed knowledge of the individual processes from production to storage, transport, and distribution to the end-user, can the best solutions be achieved. As several components are working together in an integrated system, well-designed communication, control, and automation is of paramount importance. An own automation company which takes care of the process logic control of the individual components makes sure they are well aligned under one master automation roof. Additionally, the monitoring for asset management,

predictive maintenance and accelerated troubleshooting are integrated here too.

Production of hydrogen

The method and technology used for hydrogen production depend directly on the energy source of choice. Currently, methane converted into hydrogen by steam reforming (SMR)

is the most common source. This process produces around 10 t of carbon dioxide (CO2)/t of hydrogen, which corresponds to around 300 g/kWh. An alternative method is pyrolysis, in which methane is passed through molten tin in a bubble column reactor. This process produces elemental carbon as a by-product. By using certified biomethane, the CO2 footprint of these processes can be significantly reduced, enabling the production of ‘green’ hydrogen. However, direct CO2 emissions cannot be completely avoided.

Electrolysis produces hydrogen without direct CO2 emissions. There are various technologies that differ in terms of maturity and respective advantages and disadvantages. However, what all processes have in common is that water is split into hydrogen and oxygen molecules through an electrochemical reaction. The two most common methods are alkaline electrolysis (AEL) and proton exchange membrane electrolysis (PEM).

In PEM electrolysis, high-purity water is split using precious metal catalysts. The membrane used prevents the resulting gases from mixing. This ensures high gas purity at a discharge pressure of around 30 bar. In addition, PEM can effectively follow a volatile power profile, although the use of precious metal catalysts leads to higher costs.

In AEL electrolysis, an alkaline electrolyte is used, which reduces the required activity from the catalyst itself. A porous separator is used instead of a membrane, leading to higher cross-contamination. This contamination increases further during partial load operation, making it more challenging for AEL electrolysis to follow a volatile current profile. Additionally, entrained alkaline electrolyte can pass through the electrolyser and must be removed for subsequent processes. Here, the absence of precious metals results in lower investment costs.

Storage of hydrogen

Due to its low volumetric energy density, storing hydrogen under environmental conditions is not practical. The following basic methods are suitable for achieving sufficient energy density:

> Physical binding to a carrier material: This is done, for example, in solid metal hydride storage systems or in organic carrier liquids (LOHC).

> Liquefaction (LH2) by cooling below the boiling point (-252˚C): This achieves a density of approximately 70 g/l.

> Pressure storage at different pressure levels: Depending on the pressure level, mass, and load cycle requirements, different types of tanks are used – from simple steel tanks to composite tanks.

> Chemical bonding in ammonia or hydrocarbons: Depending on the chemical compound, various other storage options are possible.

All methods have limitations in terms of their application. What almost all storage methods have in common is that the hydrogen must be compressed by compressor systems for the storage process.

Transportation and distribution

There are several options for transporting hydrogen as a pure substance to end users or intermediate storage facilities.

Figure 1 NEA|HOFER diaphragm compressor MKZ.

Figure 2 . NEA|HYTRON PEM electrolyser.

Figure 3 . NEUMAN & ESSER piston compressor 8-crank horizontal.

Depending on size and pressure level, quantities ranging from a few kilogrammes to around 1.5 t of hydrogen can be transported in mobile pressure storage units such as trailers or containers. A ‘rolling pipeline’, such as a freight train, can transport around 60 t of hydrogen, which equals approximately 2 GWh of energy. An LH2 trailer can hold about 3 – 4 t of hydrogen, and a large LH2 tanker with a volume of about 150 000 m³ of LH2 could deliver approximately 10 000 t of hydrogen. Pipelines can transport very large quantities of over 30 GW per pipeline.

End user

Hydrogen can be converted back into electrical energy or heat in various ways or used for material conversion. The conversion back into electricity takes place in fuel cells, e.g. for the mobility sector, or in gas turbines, for example as a reserve in the energy system. In processes with high heat and energy requirements (e.g. in the glass or paper industry), hydrogen can be converted directly into suitable burners. Hydrogen is also an important component for high-quality production in the chemical industry. In some areas, such as the steel industry, the functionalities can also be combined. There, hydrogen can be used to generate heat and serve as a reducing agent to produce raw iron from iron ore at the same time, for example. Depending on the application of hydrogen, there are different advantages and disadvantages as well as requirements that hydrogen must meet. When converted into fuel cells, approximately 50 – 60% of hydrogen’s lower caloric value is converted into electrical energy, while the remainder is converted into heat. In contrast to using hydrogen as a fuel in turbines or combustion engines, where an efficiency of around 30 – 40% is achieved at best, fuel cells require hydrogen of the highest purity.

The importance of the right compressor technology

When looking at the individual processes and components of the hydrogen value chain, it becomes obvious that optimal solutions can only be found if there is extensive expertise in the individual steps. Furthermore, hydrogen can only be used if it is compressed. However, the selection of the appropriate compressor technology must always be made in co-ordination with the following steps along the hydrogen value chain. Since hydrogen has a very low molecular weight, compressors based on the displacement principle are the method of choice. These achieve isothermal efficiencies of up to more than 80%. If high-purity hydrogen is required, water-filled screw compressors or dry-running piston and diaphragm compressors are suitable. Water-filled screw compressors achieve final pressures of 15 bar, dry-running crosshead piston compressors over 300 bar, and diaphragm compressors and hydraulically-driven piston compressors well over 1000 bar. For corresponding flow rates, the diaphragm compressor and the hydraulically-driven piston compressor require higher suction pressures. The diaphragm compressor can compress around 1000 Nm3/h from 30 bar to 1000 bar in three stages. In contrast, a large-volume piston compressor with a drive power of 22 MW can compress more than 800 000 Nm3/h from 40 bar to 80 bar. This means that

the output of 4 GW of electrolysis can be transported with a single large compressor. If purity is not such an important factor, oil-lubricated screw compressors can also be used for pressures of up to 50 bar, or piston compressors with cylinder lubrication for final pressures of up to 1000 bar.

It depends on the required pressure

Trailers supplied to refuelling stations typically operate at pressures between 300 – 500 bar. In terms of hydrogen volume, a trailer with 300-bar steel containers can transport around 500 kg of hydrogen, although these are often limited in the number of charging cycles. A 40-ft MEGC gas container with a pressure of 380 bar, on the other hand, can transport around 1000 kg of usable hydrogen and has a significantly longer service life, but at a higher initial cost.

Depending on the type of electrolyser, its typical discharge pressures range from a few millibars to around 30 bar. Consider briefly a system with atmospheric discharge pressure to a system with 30 bar discharge pressure. The filling pressure of the trailer should be 500 bar. With atmospheric suction pressure, pre-compression is necessary due to the low displacement volume of the diaphragm compressor. Four compressor stages are required to achieve a pressure of more than 30 bar. At 30 bar suction pressure, the diaphragm compressor can compress to over 500 bar in two stages. The supposed cost and efficiency advantage of an electrolyser with atmospheric discharge pressure is therefore offset by the four additional compressor stages and the additional use of another compressor. The efficiency of mechanical compression in the piston compressor and that of electrochemical compression in the pressurised electrolyser are almost identical.

The choice of discharge pressure and type of electrolysis also influences the choice of gas drying and oxygen removal. Thus, the selected electrolyser pressure and energy supply have a major influence on the choice, dimensioning, and complexity of the compressor and gas treatment system.

It is therefore crucial to have a good understanding of the properties and limitations of the various components in the hydrogen value chain. The seemingly obvious cost advantages of investing in a low-pressure electrolyser can be negated or eliminated by the higher operating costs of a complex compressor system. Here, providers of integrated solutions, including aftermarket services, can identify and offer the most efficient solution.

Outlook

The demand for high-purity hydrogen will increase sharply with the increasing conversion of mobility, especially in the heavy transportation sector, e.g. truck, bus, and train sectors. This means that compressors for both filling trailers and hydrogen refuelling station will have to cope with larger high-purity flow rates at pressures in the region of 500 bar in the future. For this reason, the development of dry-running piston compressors that can achieve flow rates of over 1000 kg/h at this pressure level must be driven forward. Those who master compression and understand the process environment can drive forward the energy transition and deliver significant added value for the customer.

Figure 1 . Lifecycle services are becoming more critical than ever, as modernising the existing installed base is equally essential as building new infrastructure. Hitachi Energy’s transformer service portfolio has proven to be effective in delivering real value across diverse markets.

In a conversation with Energy Global, Bruno Melles, Managing Director of Business Unit Transformers at Hitachi Energy, explores how transformer technology is shaping a more resilient, efficient, and sustainable energy system.

As the global energy transition accelerates, power systems are facing unprecedented pressure.

The rapid shift to cleaner energy sources, the electrification of traditionally carbon-intensive sectors, and the urgent need to modernise ageing grid infrastructure are redefining the requirements for performance, resilience, and sustainability. By 2040, over 80 million km of grid infrastructure will need upgrades.1

An essential part of grid infrastructure is power transformers. The critical components for reliable, efficient, and scalable power delivery are vital in ensuring that the grid can meet today’s challenges while preparing for the future.

Amid the increasing demand, utilities face another significant challenge: managing an ageing fleet of power transformers. They operate under different conditions that no longer match their initial design specifications. Replacing these assets is expensive, time-consuming, and logistically complex. In response, utilities and grid operators are adopting transformer lifecycle management strategies to improve the performance and reliability of their existing transformers. This approach bridges the gap between operational excellence and long-term sustainability objectives.

Figure 4 In the US, Hitachi Energy custom-engineered a mobile transformer solution, as well as turnkey services for Avangrid, a leader in renewable energy and part of the Iberdrola Group. These innovations ensured swift, reliable, renewable energy transmission even during extreme weather events or supply chain disruptions.

To gather deeper insights on how Hitachi Energy is addressing these challenges, Energy Global (EG) sat down with Bruno Melles (BM) for a one-on-one discussion on the company’s approach to advancing transformer technology and driving innovation in transformer solutions.

Looking towards the global power system of 2050, it is anticipated the world will needing approximately four times the current power generation capacity, and transferring up to three times as much electrical energy compared to 2020. Electricity will become the backbone of the entire energy system. Consequently, the demand for transformers is expected to rise significantly across all applications in the coming years. This growth will vary depending on markets and applications, with annual growth rates estimated to range from 1 – 2% globally to 5 – 10% in fast-growing markets and segments such as renewables and data centres.

Hitachi Energy is at the forefront of this transformation, driving innovation through an integrated strategy that anticipates future demands and accelerates the shift towards a decarbonised future. A key component of the company’s strategy is the expansion of its global manufacturing capacity and the strengthening of supply chains – both critical to ensuring the timely delivery of transformer solutions.

The strategy is deeply rooted in innovation and sustainability. The company is developing eco-efficient transformer designs, integrating digitalisation, and providing end-to-end transformer lifecycle support. By leveraging new technologies and ensuring operational excellence, Hitachi Energy is not only addressing today’s grid challenges but also future-proofing grid infrastructure.

As the world’s largest transformer manufacturer, Hitachi Energy is working closely with customers, suppliers, and other industry stakeholders to address the increased demand for transformers. It is focusing on understanding the market needs across geographies, segments, and applications, and translating that into market demand. In addition, it is closely collaborating with its customers to understand their long-term needs for transformers.

To meet the market demand effectively, Hitachi Energy is leveraging its global transformer footprint, which includes 60 transformer factories and 30 service centres worldwide. The company is investing in its existing factories to increase capacity through productivity enhancements, investments in new machinery and personnel, expansions, and eventually, new factories, product lines, and expanding the service organisation’s footprint and offering. In fact, the company has committed to a US$1.5 billion investment until 2027 to significantly grow capacity.

Throughout its full value chain, the company is securing the availability of necessary materials by maintaining a high level of vertical integration in its transformer manufacturing process. Hitachi Energy’s global footprint allows it to leverage its strategic supplier base to serve multiple markets across geographies.

To specifically address customers’ needs, the company is working together on long-term planning and discussing the best ways to fulfil their transformer needs, including potential investments and co-operation if economically viable for all parties. Additionally, it is investing in its people, expanding its workforce, and ensuring they are trained and properly qualified. This investment in people is essential to keep pace with innovation and the growing demand.

Figure 2 To meet market demand effectively, Hitachi Energy, the world’s largest transformer manufacturer, leverages its global transformer footprint, which includes 60 transformer factories and 30 service centres worldwide.

Figure 3 . In June 2024, the foundation stone for the new Hitachi Energy Park was laid in the Vaasa region in Finland. Expected to be operational in 2027, it will feature a transformer factory that will double the company’s production and testing capacity of transformers in Finland.

In summary, the approach is centred around people, long-term partnerships, and building the right dimensions and capabilities to address the increased demand while leveraging global footprint. Hitachi Energy has record investments underway to expand its capacity and build new factories. To put that in context, all the company’s 60 manufacturing facilities globally are impacted by the announced US$1.5 billion investment in the transformer business.

EG: Why is it important to raise awareness for lifecycle management? What benefit does it bring to customers?

BM: As the energy transition accelerates, lifecycle services are becoming more critical than ever. Modernising the existing installed base is just as essential as building new infrastructure.

Lifecycle management enables a shift from reactive maintenance to a more predictive, data-driven approach, empowering utilities and grid operators to maximise asset reliability, reduce operational risk, and optimise the total cost of ownership. For transformers, this transition is especially critical in sectors such as rail transport, where transformer failures can result in

from reactive maintenance to a more predictive, data-driven approach, empowering utilities and grid operators to maximise asset reliability, reduce operational risk, and optimise the total cost of ownership.

significant service disruptions and financial losses. By embedding lifecycle management into asset strategies, customers gain not only operational resilience but also long-term sustainability and capital efficiency.

At Hitachi Energy, we recently strengthened and will further invest in our service portfolio and capabilities powered by digital technologies by establishing a dedicated Service Business Unit. For example, our robust portfolio of services, including our digitally enabled service through TXpertTM Ecosystem, provides real-time monitoring and data-driven insights. These tools significantly reduce unplanned outages and the total cost of ownership.

Ultimately, lifecycle management is about maximising asset value while aligning with broader operational and sustainability goals. It ensures that transformers continue to perform reliably, safely, and efficiently throughout their intended lifespan –and beyond.

EG: How has Hitachi Energy’s transformer service portfolio helped customers achieve significant business or operational outcomes?

BM: We’ve seen first-hand how our service portfolio delivers real value across diverse markets. In El Salvador, for example, our collaboration with DELSUR focused on modernising their distribution infrastructure. By deploying our eco-efficient EconiQ® transformers alongside the TXpert digital ecosystem, we helped them significantly enhance grid reliability, reduce environmental impact, and make smarter, data-driven decisions.

In the US, we supported Avangrid with a mobile transformer solution and turnkey services – an approach that proved critical in ensuring swift, reliable, renewable energy transmission, even amid extreme weather events and supply chain disruptions.

In Asia, our work with the Provincial Electricity Authority in Thailand enabled the extension of over 250 ageing transformers through targeted refurbishment and condition assessments. This avoided costly replacements and supported a more circular, sustainable energy model. Similarly, in Macau, China, we partnered with CEM to apply our Lumada APM diagnostics, helping them identify high-risk units and maintain grid stability in the face of rising demand.

We’ve also seen excellent results in Europe, where our partnership with Helen in Finland showed how legacy infrastructure can be repurposed for a low-carbon future. By refurbishing two 1970s-era transformers for use in a new electric boiler plant, Helen is on track to cut 440 000 t of carbon emissions over five years, directly contributing to Finland’s carbon-neutrality goals.

Collectively, these partnerships demonstrate how our service portfolio empowers utilities to optimise asset performance, enhance resilience, and accelerate the energy transition.

EG: How does your transformer service portfolio reflect Hitachi Energy’s global leadership?

BM: Our transformer service portfolio is shaped by decades of experience, global reach, and a clear understanding of what our customers need to keep their operations reliable and efficient. We take pride in our ability to apply the right expertise, tools, and technologies to support their needs.

Figure 5 Hitachi Energy’s partnership with Helen in Finland entailed the refurbishment of two 1970s-era transformers for use in a new electric boiler plant. With this, Helen is on track to reduce carbon emissions over five years, directly contributing to Finland’s carbon-neutrality goals.

Figure 6 The establishment of a dedicated Service Business Unit for transformers gives Hitachi Energy a competitive edge. Powered by digital technologies, its service portfolio for lifecycle management enables a shift

We focus on practical outcomes, such as reducing unplanned outages through condition-based maintenance and diagnostics, improving asset performance with real-time monitoring, and supporting long-term planning with data-driven insights. Our service agreements, such as EnCompassTM, are structured to be flexible –enabling them to support both technical and financial goals, whether that involves extending asset life or managing operational risk.

It is also important to note that we have designed our service models to be adaptable. We can support transformers of any brand or age across a wide range of industries. We follow global standards while adapting to local needs, ensuring consistent quality every time.

EG: As the world’s largest manufacturer of transformers, how does Hitachi Energy see its role in shaping the grid of the future?

BM: We see Hitachi Energy as a key driver of the energy transition, and this is demonstrated by the scale of our manufacturing capabilities, continuous innovation, deep technological expertise, and expansive global footprint. We recognise the need to accelerate the delivery of transformers and key components to enable the industry to expand more rapidly and advance critical infrastructure projects.

It is also important to note that our focus goes beyond building new infrastructure. We are equally committed to strengthening and extending the life of existing assets. Hitachi Energy is the world’s largest manufacturer of transformers, and we see it as our responsibility to lead on both fronts: expanding capacity to meet growing demand while also enabling a more resilient and sustainable energy system.

5 - 6 November 2025

In 2024, we announced a major investment of over US$1.5 billion to significantly expand our global transformer manufacturing capacity by 2027. This investment builds on a previously announced US$3 billion commitment and includes the development of new facilities across Europe, the Americas, and Asia. In addition, we invested around US$180 million in a new state-of-the-art transformer factory in Finland’s Vaasa region, reflecting Hitachi Energy’s commitment to innovation, quality, and sustainability.

Recently, we committed to investing over US$250 million through 2027 as a strategic response to the global transformer shortage.

A significant portion of this funding is dedicated to expanding manufacturing capacity in the US, with a particular focus on Virginia, Missouri, and Mississippi. These facilities will increase the production of critical components, such as bushings and insulation, which are essential not only for our own systems but also for supporting the broader industry.

These investments are for building supply chain resilience, reducing lead times, and creating skilled jobs in the communities where we operate. At the same time, we’re investing heavily in our people, digitalisation, engineering, and R&D to extend the life of existing transformer fleets. By applying advanced monitoring, diagnostics, and service models, we help utilities and industries maximise the value of their assets – reducing the need for premature replacements and minimising environmental impact.

References

1. ‘Electricity Grids and Secure Energy Transitions: Executive Summary’, International Energy Agency, www.iea.org/reports/electricity-grids-and-secureenergy-transitions/executive-summary

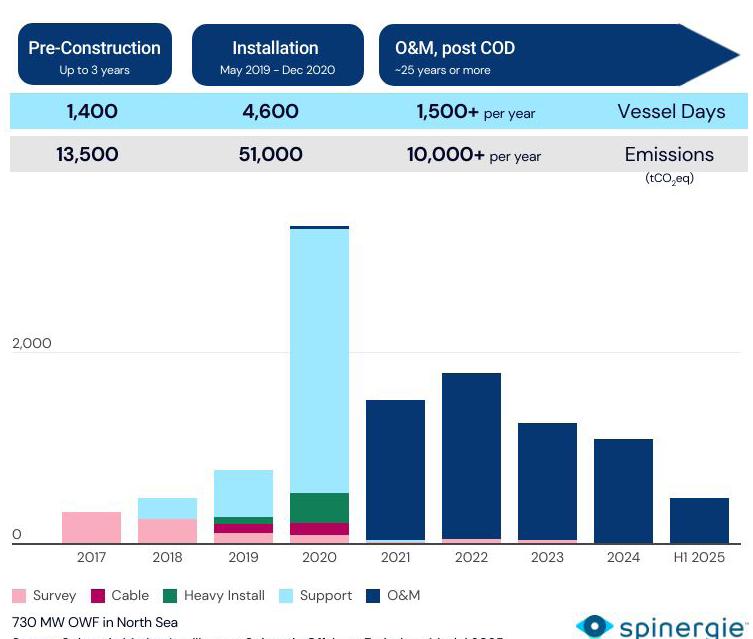

As the offshore wind sector develops, Sarah McLean, Lead Content Manager, and Drashya Goel, Senior Client Success Manager, Spinergie, delve into how digital reporting forms a crucial next step in tackling emissions at each stage of the wind farm lifecycle.

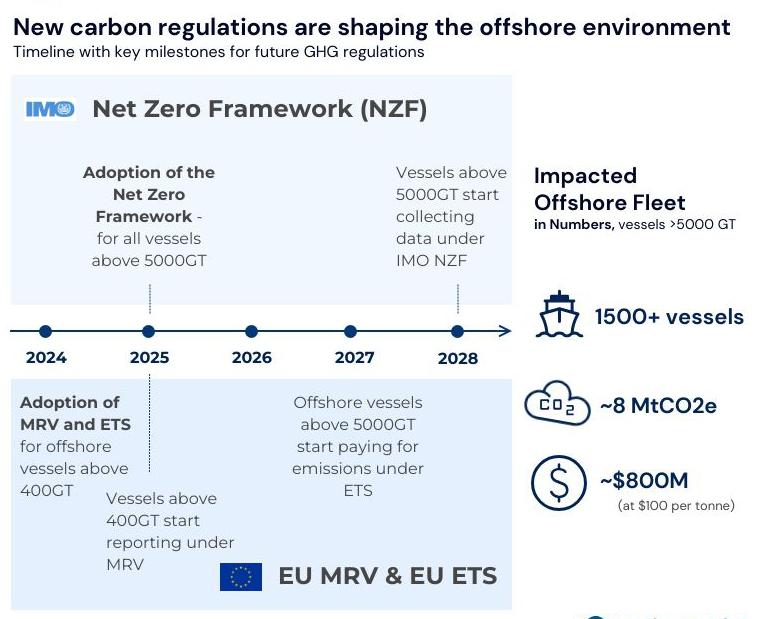

Every stage of the wind farm lifecycle comes with a measurable environmental cost. As the market sees longer supply chain transits and bigger infrastructure and project sizes, greenhouse gas emissions across all operations face increased scrutiny.

Until recently, emissions reduction in offshore wind has been mostly reactive and driven by regulatory compliance and client demands rather than strategy. Charterers are

including lower emissions in tender requirements and expressing a growing preference for upgraded, efficient vessels while vessel owners are pushing their own net-zero requirements in line with local regulations. In response, wind developers have turned to using digital solutions to reduce their operating emissions.

Yet without industry-wide cohesion there is a risk of data silos and players being left with an abundance of data but little insight into how best to use it to improve

their operations. Real emissions reduction requires a sector-wide operational transformation and digital tools are a catalyst for the shift from reactive to proactive.

Equipped with standardised data streams, vessel owners, managers, and charterers gain:

> Access to immediate, actionable insights into activities on a vessel, project, or company-wide basis.

> Benchmarking capabilities, helping set and measure performance baselines.

> Contextual analytics (weather, wave, vessel behaviours, etc.), to inform decision-making and reduce the risk of dispute.

Digitalisation in offshore wind offers multiple benefits to individual players, yet without a broader market adoption, the entire sector risks falling behind. This article

presents the benefits of digital integration across the various lifecycle phases of an offshore wind farm.

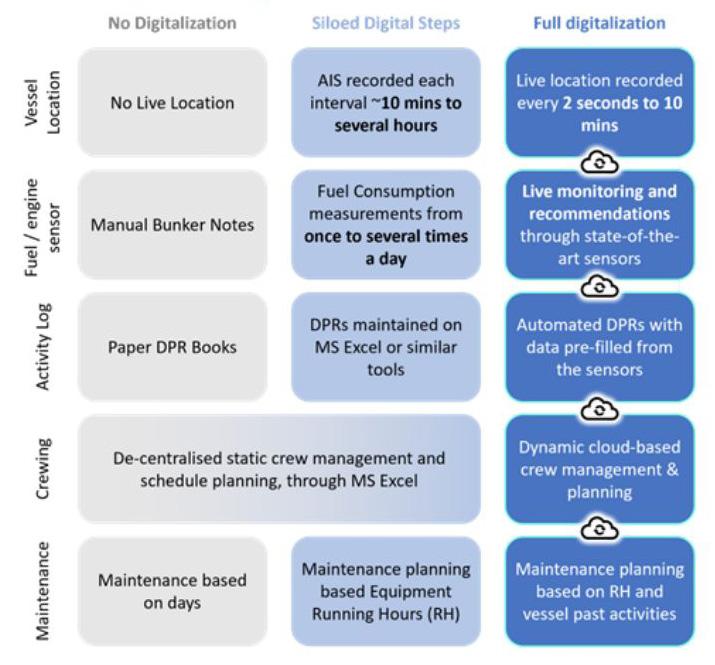

A shift is underway: Digital reporting in the offshore wind sector

The traditional approach to reporting does not fit modern operations. Crews waste their time struggling with multiple, disconnected spreadsheets. Strategy teams are forced to operate with limited or incorrect data which makes it nearly impossible to gain meaningful insights. Meanwhile, onshore teams are faced with having to use multiple data sources just to understand fleet status and to check in on operations – not ideal when quick action is required.

Digitalisation addresses these inefficiencies by consolidating fragmented data and disparate reporting sources into a centralised, accessible system. Currently, the sector has shown varying levels of adoption from low-to-no digitalisation, to those with full adoption of these solutions.

Those who are fully embracing the shift to digital find themselves with an operational and competitive advantage.

With real-time fuel consumption analysis alongside metrics such as vessel speed, digital tools are geared towards addressing the inefficiencies that drive higher fuel consumption and emissions. With automated data coming from sources such as AIS tracking and onboard sensors, it becomes more easily verifiable. Easy verification is something that is becoming increasingly important amid global and regional emissions regulations from the EU Monitoring, Reporting, and Verification (EU-MRV) regulation to the International Maritime Organization (IMO) Data Collection System (DCS) Carbon Intensity (CII) reporting. These increased regulatory requirements are a key driver in the move from traditional systems to digital. The relative speed of the transition to tighter emissions regulations means that there is a high risk of gaps in implementation alongside the potential to turn reporting into a bigger burden than it needs to be.

This means that digital reporting is no longer an abstract concept for the future, it is happening now, and those who take only a passive interest risk being left behind.

Digital reporting across a wind farm lifecycle

For clarity, the wind farm lifecycle has been split into three distinct phases: pre-construction, construction, and post-construction.

Lessons learned in pre-construction and beyond can inform future planning

Digital tools can play an important role long before work on a new project even begins. Sustainability-focused non-priced criteria (NPC), specifically environmental evaluation, is becoming a leading decisive factor in offshore wind auctions. Governments, especially in Europe, have increased the number of carbon footprint criteria

Figure 1 . >10% of the offshore fleet impacted by IMO Net Zero Framework.

Figure 2 Journey to digitalisation.

included in their auction processes. From this, developers are tasked with providing comprehensive plans and strategies to ensure a lower footprint can be achieved.

How can this be demonstrated with accuracy? Well, the data generated, and lessons gathered, from one project will go a long way to informing the strategy of another. If a comprehensive dataset has been obtained from a project of similar scope (seabed conditions, water depths, marine spread etc.), then a developer already has a solid foundation to build their case.

However, without understanding what the main emissions drivers have been in previous projects, it is close to impossible to respond to these auction criteria with any real accuracy. Digital reporting provides standardised data regardless of fleet diversity and offers a continuous feedback loop. With ongoing operational feedback, it is possible to adjust and optimise over time. The improvements generated during this process are most valuable for informing future projects.

With access to real-time recorded data on vessel activity and fuel consumption, market players are moving away from broad assumptions based on limited data sets to evidence-based impact assessments.

Case study: Digital reporting for the survey phase

Digital reporting begins the real work as soon as any vessels are involved – right from the very first survey.

Multiple vessel types, from small scouting vessels to large geotechnical vessels, are required during the survey phase of an offshore wind farm. The scope of this phase is vast as these vessels are used to undertake comprehensive investigations of the seabed, subsoil, and marine environment of the site. Thousands of kilometres will be thoroughly assessed and all of the vessel and operational data must be recorded and assessed.

Previously, survey teams often used vast, complex spreadsheets to track survey activities. However, this method has a number of drawbacks: it is time consuming –for some team members a significant portion of their days is spent solely on reporting; mistakes are easy to make and difficult to correct – often they will cascade through spreadsheets before being found resulting in complicated rework; and finally, while the data was recorded, teams had no way of easily obtaining insights from it. Traditional ‘spreadsheet methods’ are no longer fit for purpose as project sizes increase.

Digital reporting solves each of these issues by providing a centralised source for all vessel data regardless of manager. The developer can see which vessels are operating as expected and which may be lagging behind what was contractually agreed. Data is more accurate and should be blocked from cascading through the system with in-built quality checks. Finally, operational insights are not only more easily identified, but are also significantly easier to share among the team to keep everyone aligned. This saves significant amounts of time both on data compilation and on data analysis.

Avoiding incidents and staying on track during the construction phase

Traditionally, onshore staff have had limited remote monitoring capabilities during the construction phase of a wind farm project. They often had to rely on basic AIS data and voice communication. But with digital tools, data is centralised and accessible to all teams alongside real-time remote monitoring. When alert systems are activated, teams have an additional layer of power and can react immediately to issues such as speed breaches in order to make significant fuel and emissions savings over time.

The historical data captured in such a solution also provides context for any incidents. For example, say a smaller vessel such as a crew transfer vessel (CTV) has had a collision with a wind turbine installation vessel (WTIV), the developer may suspect reckless behaviour on the part of the CTV. Yet, with contextually enriched digital data, the CTV manager will be able to provide proof that the vessel was not speeding, and that there had been unusual and unpredictable wave patterns at the time of the collision. This objective evidence would save a significant amount of time on the part of both parties as they sought to resolve the issue.

Beyond fleet monitoring, digitalisation opens up significant possibilities for project management. The installation phase of an offshore wind project is complicated. Most commercial projects will have a wide marine spread undertaking multiple journeys from marshalling ports to the wind farm site for hundreds of components.

With offshore wind being a growing sector, and many regions yet to enter maturity, any learnings are essential to helping inform future projects. This could look like knowing which vessels are underperforming, and why, or understanding the context behind why one component

Figure 3 Construction of an onshore wind farm can take 6000+ vessel days. Source: Spinergie Market Intelligence, Spinergie Offshore Emissions Model 2025.

took significantly longer than another to install at the same project.

Equipped with this information, wind developers have a significant data bank that will not only inform their future NPC evaluations, but also save time and money on their ongoing operations.

Optimising vessel activity during operations and maintenance

After commissioning, a wind farm enters the operations and maintenance (O&M) phase which focuses on ensuring optimum availability and functionality. During this phase, technicians undertake regular visits to each turbine and foundation for preventative and reactive maintenance. This can be complex to track, especially for those developers who may be managing multiple wind farms across different time zones and regulatory environments. With multiple wind farms comes multiple vessel or equipment designs, which creates a significant problem when it comes to standardisation. Digital reporting helps bridge this gap.

Effective digitalisation during this phase allows charterers multiple optimisation opportunities. They can monitor vessel availability for contractual periods to optimise fleet scheduling, and reduce the impact of weather on operations by proactively planning around inclement weather events. This is all while standardising the data regardless of region or operation to create beneficial learnings.

Once again, previous learnings play an important role in the benefits of digital reporting during O&M as it will unlock insights into fleet and crew optimisation based on previous periods. Digital solutions unlock where crews or vessels have been over or under-utilised and allow for the adjustment of future behaviours to optimise operations, costs, and emissions.

Conclusions

The transition from traditional reporting methods to integrated digital solutions is reflective of the evolving nature of the offshore wind sector. As offshore wind develops, there are an increasing number of projects managed by each developer, who also has to contend with larger and more diverse fleets. This increases the amount of data to collect and process so fragmented reporting and sporadic data collection no longer fits.

Industry players, especially developers and vessel managers, need more efficient operations. Crews need to spend less time on reporting tasks, and onshore teams need granular data that they can rely on to strategise.

As emissions regulations intensify, the widespread adoption of digital integration will be essential for avoiding the steep penalties that lie in wait for non-compliance. Furthermore, it is the only way to ensure that data is accurate and insightful enough to facilitate maximum efficiency and minimal environmental impact through each phase.

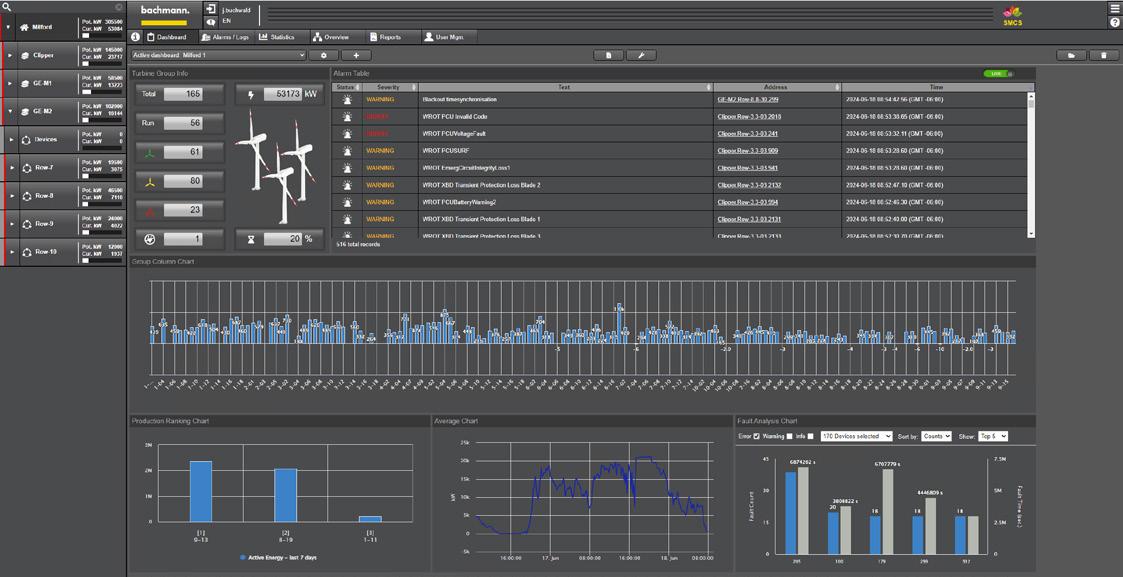

Figure 1 . 165 wind turbines with a total output of 306 MW are part of the Milford wind farm in Utah. After around 15 years of operation, operator Longroad commissioned Bachmann electronic to provide a complete solution that would enable safe and productive continued operation.

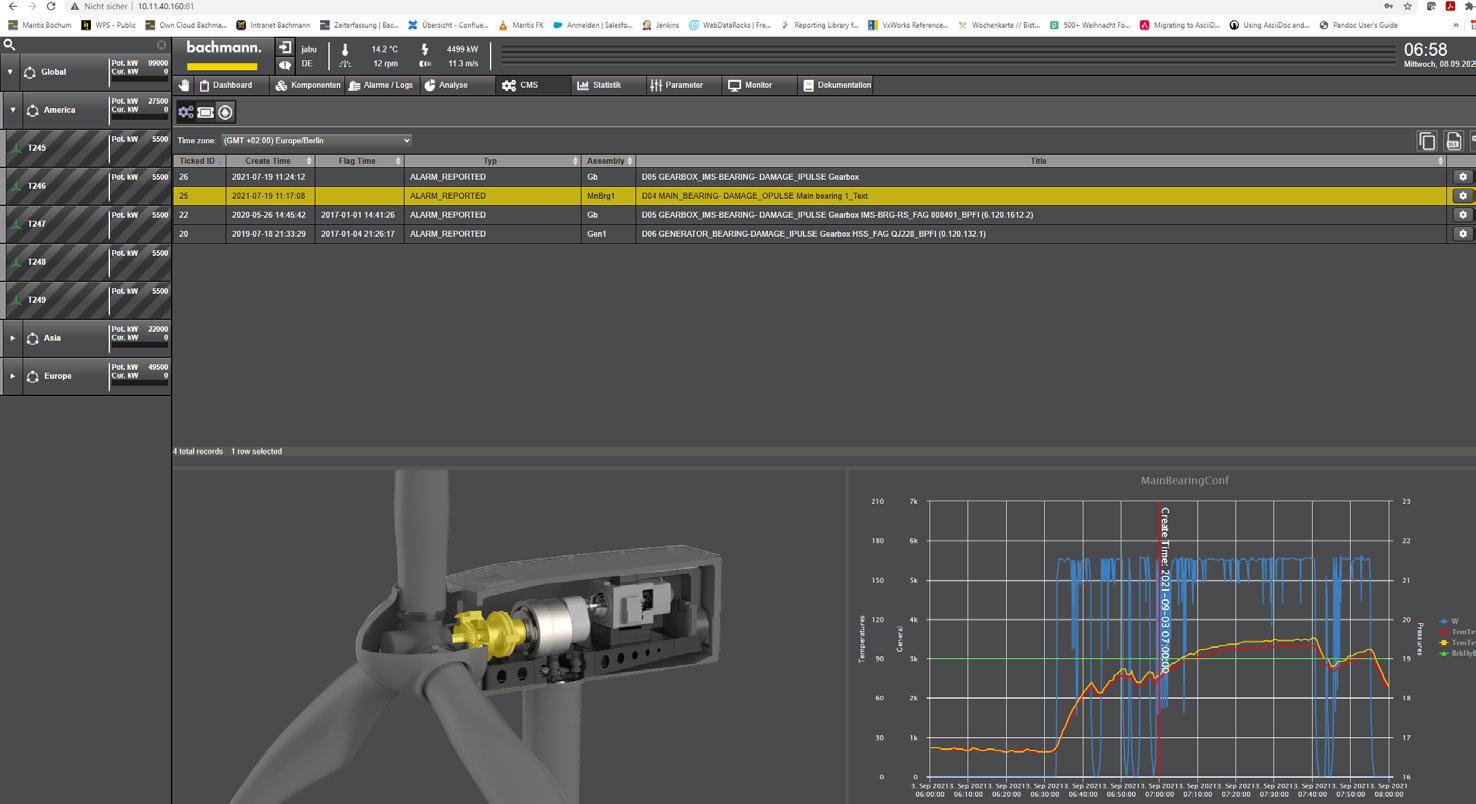

The profitability of wind turbines is determined by productivity and availability. Condition monitoring supports maintenance decisions, identifies potential cost savings, and avoids unforeseen failures. David Futter, Condition Monitoring Consultancy at Bachmann Monitoring GmbH, and Frank Fladerer, Bachmann electronic GmbH, compare the advantages and challenges of doing this in house or through an external partner.

Doing it in house vs employing a third party.

Decision-makers are always faced with this question when a new task lies outside the core competence of an organisation. There is rarely a single answer to this question, as the perfect solution is all too often dependent on many factors. This is also the case with condition monitoring.

Challenging task

Monitoring the condition of wind turbines is a complex art. A wide variety of sensors are installed at selected points on the drive train, rotor blades, and tower. These sensors deliver a continuous stream of raw data. Without appropriate processing, the data is worthless. Only after processing is it possible to visualise and

interpret the numerous possible effects of small changes over time on certain sensor readings, and to assess the potential consequences.

In addition, condition monitoring analysts are working with increasingly complex calculation methods to predict the impact of a small change in measurement data on the wind turbine. These algorithms are trained and continuously checked using years of data from many different wind turbine types.

Complex interaction

In addition to the hardware and software for monitoring, and a suitable visualisation tool, specialist knowledge is also required; above all, this includes expertise in vibration analysis. However, such expertise requires not only advanced training, but also experience working with a large number of turbines over a long period of time to understand the actual meaning and significance of changes in the data. Furthermore, if analysts are familiar with the type of turbine being monitored, they will deliver more precise information about the most likely failure mechanisms. At the same time, prior experience helps to assess whether and, if so, which remedial measures can be implemented, either on site or through a more in-depth remote intervention.

In house or external?

Operators with a large and growing number of turbines usually look for in-house solutions to monitor their installation. However, if there are only a few systems to be monitored, a complete service from an external partner may be the preferred solution. In this scenario, monitoring experts can carry out all condition monitoring processes on behalf of the operator, providing recommendations to the team responsible for on-site maintenance.

A complete retrofit

What it can look like when an operator even orders a complete package for retrofitting old turbine types can be seen in an example from the ‘beehive state’ of the US.

Longroad Energy operates 165 wind turbines at its Milford wind farm in Utah, providing a total power output of 306 MW. After about 15 years of operation, maintenance has become more expensive and spare parts for some turbines are becoming scarce. Longroad was looking for a solution that would promote safe and efficient operations for many more years. To this end, Bachmann was able to implement a comprehensive overall solution with a park controller, a complete controller retrofit of the turbine, a SCADA retrofit with a higher-level control centre SCADA Master Control System (SMCS), and condition monitoring.

Figure 4 Visualisation tools such as forsiteSCADA provide a comprehensive view of the entire wind farm and the individual turbines.

Figure 2 High-precision structural health monitoring measurements can extend the lifetime of wind turbines in many cases. Here is a service team installing an acceleration sensor, which plays an important role in data acquisition.

Figure 3 Transparent monitoring and data security are at the centre of the condition monitoring services offered by service providers such as Bachmann. Customers should have complete access to all condition monitoring system (CMS) data and a complete overview of the status of their systems.

Located near the small town of Milford in Beaver County, Utah, the Longroad Energy wind farm consists of 57 GE 1.5 SLE, 11 GE 1.5 ESS, 39 GE 1.5 XLE turbines, and 58 Clipper Liberty 2.5 turbines. The operator wanted to control and monitor the entire wind farm safely and efficiently from its operations centre. The plan was to use a modern SCADA platform design incorporating the latest cybersecurity measures, while delivering complete access to assets. Bachmann had a good reputation at Longroad due to its control systems in the GE wind turbines.

Higher reliability and productivity in three days

The control system was replaced to ensure continuous and safe turbine operation. The Bachmann M200 control system is now used in combination with the GMP232 module for power monitoring and grid protection. The turbine control system is connected via ‘bluecom’ – an Ethernet-based, real-time protocol from Bachmann – to the master park controller, which was also implemented by Bachmann.

In addition, the goal was to reduce gearbox load and thus increase the reliability of the Clipper turbines. Experience shows that asymmetrical stresses occur on the gearbox of this type of turbine, which can lead to problems after a few years of operation. Therefore, real-time condition monitoring of the entire drive train was integrated into the retrofit solution, with existing sensors remaining in use. The complete renewal of the turbine control system, including commissioning, took a maximum of three days per system.

One for all

Existing Bachmann controllers installed in the GE turbines were updated with a state-of-the-art processor, enabling them to be integrated into the new forsiteSCADA system.

Until now, the number of SCADA servers required was determined by wind park size. With the SMCS, Bachmann facilitates the setup of a cascaded SCADA system. Data from the various park SCADAs is correlated and summarised in a user interface with clear displays. This facilitates for alarms to be assigned to the park and the respective turbine – even if the entire asset comprises several hundred turbines.

In addition, the SMCS also allows detailed analyses of individual park turbines directly from the MCS. Thanks to web technology, it is possible to jump to the underlying forsiteSCADA servers or even directly to the turbine visualisation via quickly accessible links. There, for example, analyses are available via webMI pro using the Scope 3 software oscilloscope. Sophisticated user management and clear rights assignment ensure the highest security standards.

Thanks to the SCADA retrofit, Longroad now maintains a full overview of the entire hybrid park from its operations centre. All GE and Clipper wind turbines, as well as the complete Milford Park cascaded SPPC park controllers, can be conveniently displayed in a common user interface. Key parameters, such as individual turbine yield, are summed and displayed as an overall park key figure. The open solution supports both IEC 61400-25 and IEC 61850, and can compare different plant parameters due to the uniform data format, making it easy to integrate third-party solutions.

Figure 6 Specialised companies such as Bachmann offer services and expertise in condition monitoring and structural health monitoring. Depending on the desired support level, individual CMS services can be combined to create a customised monitoring and consultancy package.

Figure 7 . Bachmann’s SCADA Master Control System shows the status of all systems in a single view, even in hybrid parks. Important characteristic values are automatically summarised.

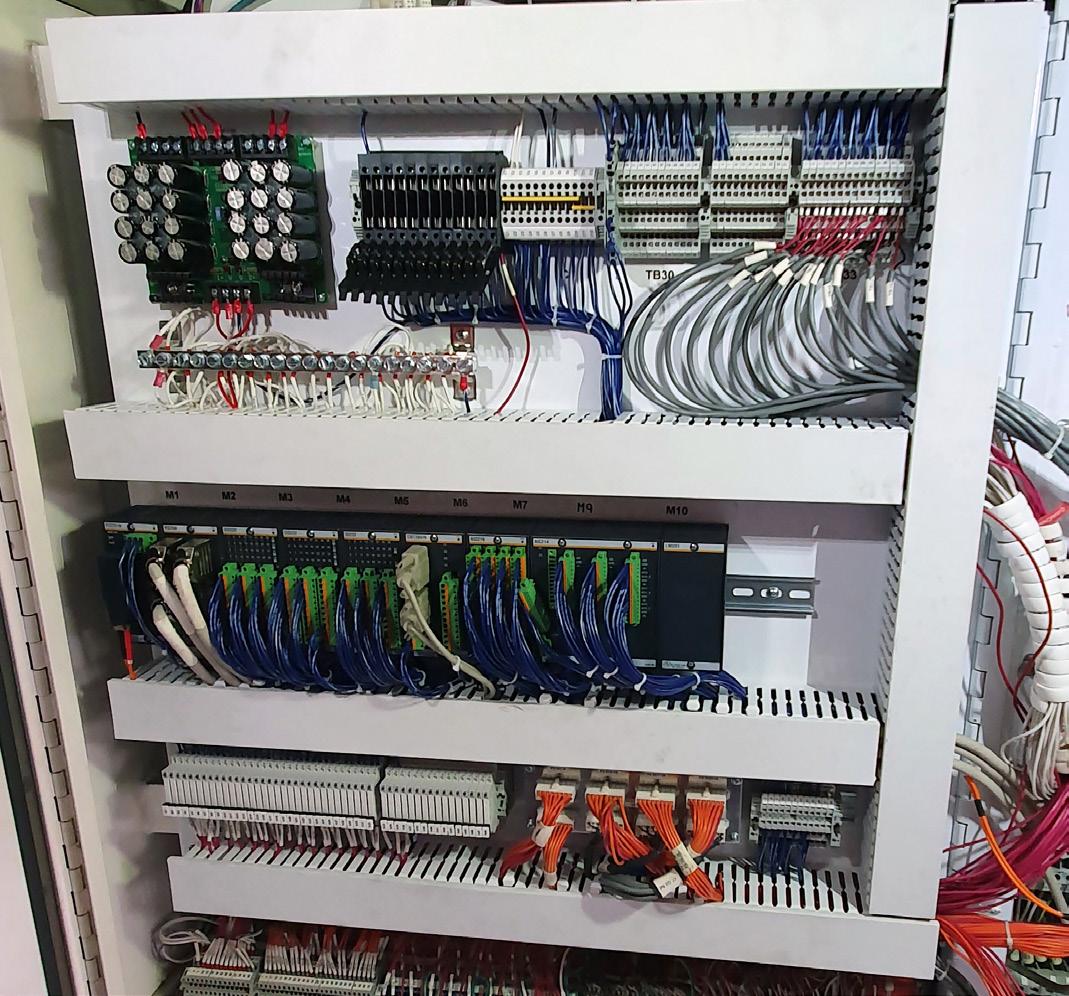

Figure 5 . Thanks to the fully prepared 1x1 m swing panels, the retrofit solution at Milford wind farm was installed quickly, which ensured a safe, reproducible rollout of all systems.

Convenient and secure, near and far

“Bachmann’s solution ensures we can continue to operate Milford 1 and 2 for years to come, while having a controller and partner capable of innovating and improving operations,” said Longroad Energy’s Jeremy Law. Moreover, the team now works in line with the latest cybersecurity standards, utilising two-factor authentication, among other features.

Another major benefit for Longroad: a uniform look and feel for service personnel when maintaining the GE and Clipper plants. Thanks to the M1 WebMI pro visualisation software, engineers no longer encounter various manufacturer-specific interfaces. The open, web-based solution has significantly increased efficiency during maintenance operations.

“With the modular approach and standardised communication of our solution, it will be easy to expand sensors or inputs/outputs for new functions in the future,” concluded Nicholas Waters, Longroad Key Account Manager at Bachmann electronic.

Individual support levels

While Longroad runs condition monitoring in house and was brought up to the latest state-of-the-art by Bachmann electronic, hybrid models are also conceivable. In this case, the operator defines the desired scope of support for condition monitoring by the external provider. After all, there may only be one piece of the puzzle missing for consistent and complete in-house performance – such as sufficient resources, infrastructure and tools, or the corresponding specialist knowledge.

A considerable reduction in the burden on in-house resources can be achieved by outsourcing data screening. For example, Bachmann Monitoring offers a service that includes hosting data and the daily routine processes for checking data quality and eliminating false alarms. Only new information relating to machinery condition are passed to the operator’s support team. An approved training package can help the operator’s team gain the required technical knowledge of vibration analysis.

Alternatively, if operators wish to establish their own monitoring without having to invest in the necessary, cost-intensive IT infrastructure, then pure data hosting is the ideal option. In a cloud solution, operators take full responsibility for their own condition monitoring. If they decide to take on data hosting at a later stage, the service provider offers the necessary tools, including licensing packages and technical support.

Reliable partnership

The decision to bring condition monitoring in house is complex, and there is no one-size-fits-all solution. For an operator who wants to retain control over the condition monitoring of their wind turbines, a hybrid solution could be the best possible option. With specialised providers, they can rely on transparent system monitoring and maximum data security. With full access to all monitoring data, they should have a complete overview of the status of their turbines, can make their own decisions, and implement their own monitoring strategy. In particularly difficult cases, however, they should have the option fall back on the advice or support of a proven service partner.

LNG Industry magazine

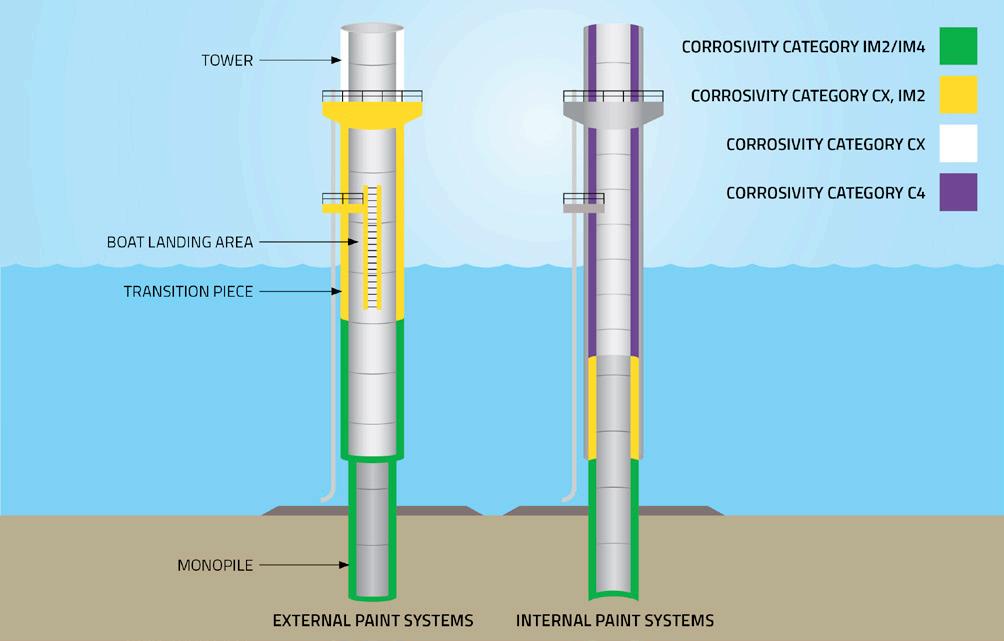

Andreas Hoyer, Global Commercial Director of Energy & Infrastructure, Teknos, decodes corrosion protection for the offshore wind industry, surveying coating techniques, reviewing various standards, and evaluating the effectiveness and risks associated with different coating types.

Offshore turbines are designed for an extended service life of more than 30 years to provide a sustainable form of energy generation. As offshore maintenance is considered a risky and expensive process, asset owners and operators are looking for low or zero-maintenance solutions to protect their capital assets. The challenge for the industry lies in providing coating systems that both meet regulatory requirements and have proven their performance in the field for over as long a period as possible. Of course, technology-related solutions, such as cathodic corrosion

protection and its possibilities, play a role in conjunction with coating systems. This is particularly important in areas of high mechanical stress, such as boat landings.

A new standard –

ISO 24

656: Cathodic protection of offshore wind structures

Cathodic protection (CP), possibly together with a protective coating, is applied to protect the immersed external surfaces of offshore wind farm structures and appurtenances from corrosion caused by seawater or seabed environments.

CP, possibly together with a protective coating, may be applied to protect the internal submerged surface and the seabed and sediment-exposed surfaces from corrosion. CP involves the supply of sufficient direct current to the surfaces of the structure to reduce the steel to electrolyte potential to values where corrosion is considered to be insignificant or rather low. CP is designed to protect the submerged and buried parts of the structure from corrosion. The parts that are not permanently immersed are not permanently protected by the CP system.

ISO 24 656 specifies the requirements for the external and internal CP for offshore wind farm structures. It is applicable to structures and appurtenances in contact with seawater or the seabed. The standard includes:

> Design and implementation of CP systems for new steel structures.

> Assessment of residual life of existing CP systems.

> Design and implementation of retrofit CP systems to improve the level of the protection or extend the life of the system.

> Inspection and performance monitoring of CP systems installed on existing structures.