Trenton has the solution. Corrosion is particularly challenging in the Middle East due to harsh environmental conditions. Trenton’s Anticorrosion Wrap System offers a proven and long-lasting solution.

www.trentoncorp.com

Trenton has the solution. Corrosion is particularly challenging in the Middle East due to harsh environmental conditions. Trenton’s Anticorrosion Wrap System offers a proven and long-lasting solution.

www.trentoncorp.com

03. Editor's comment

05. Pipeline news

Updates from Sempra, Enbridge, TAP, and Plains All American Pipeline L.P.

KEYNOTE: THE MENA REGION

10. Trials and tribulations: a MENA regional report Gord Cope, Contributing Editor, surveys the energy landscape in the Middle East and North Africa (MENA) region, with particular focus on the midstream infrastructure, geopolitical risks, and the transition towards low-carbon energy.

17. Fostering pipeline safety with advancing infrastructure

Kapil Garg, MarketsandMarkets.

INTEGRITY AND INSPECTION

24. Addressing anomalies

Angel Martinez, Engineer, Frederick Mallari, Engineer, Sean Knight, Workgroup Lead, ROSEN Group.

31. A resilient monitoring strategy

Kaidy Kho, Vice President - Business Development (Sales), Atmos International, UK.

35. Turning risk into value

Pushpendra Tomar, Dynamic Risk.

EXTREME OPERATING CONDITIONS

39. From blackout to breakthrough

Carol Johnston, VP Energy, Utilities, and Resources at IFS.

ENGINEERING

45. Engineering excellence

Mike Eason, Chief Technology Officer at John Crane.

PIPELINE SERVICES

49. Modern problems require modern solutions

Stuart Mitchell, CTO, PipeSense.

53. Decisions, decisions, decisions

Trung Ghi, Prakarsa Mulyo, Ir. Syed Fazal, Harish Chhaparwal, and Arindam Das, of Arthur D. Little.

COMPRESSOR TECHNOLOGY

59. Powering compression beyond the grid

Alex Flournoy, Vice President of Business Development, Baseline Energy Services.

TRENCHLESS TECHNOLOGY

63. Enabling offshore pipeline construction

Anne Knour, Tracto Technik.

PIPELINE SENSING

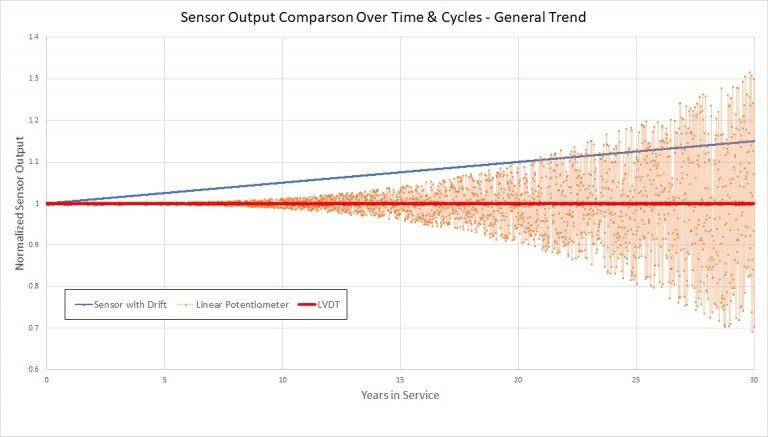

68. LVDTs importance in pipeline applications

Mike Marciante, Applications Engineer, NewTek Sensor Solutions.

AERIAL INSPECTION AND INTEGRITY

75. UAV survey: a Q&A

World Pipelines interviews Aliaksei Stratsilatau, Founder and CEO of UAVOS about transforming UAV-based midstream, survey, and security operations.

Winn & Coales International Ltd has specialised in the manufacture and supply of corrosion prevention and sealing products for over 90 years. The wellknown brands of Denso and Premier offer cost-effective, long-term corrosion prevention solutions, including Viscotaq™: the ultimate range of viscoelastic coatings for effective pipeline protection.

MANAGING EDITOR

James Little james.little@worldpipelines.com

ASSISTANT EDITOR

Emilie Grant emilie.grant@worldpipelines.com

SALES DIRECTOR

Rod Hardy rod.hardy@worldpipelines.com

SALES MANAGER

Chris Lethbridge chris.lethbridge@worldpipelines.com

SALES EXECUTIVE

Daniel Farr daniel.farr@worldpipelines.com

PRODUCTION DESIGNER

Siroun Dokmejian siroun.dokmejian@worldpipelines.com

HEAD OF EVENTS

Louise Cameron louise.cameron@worldpipelines.com

EVENTS COORDINATOR

Chloe Lelliott chloe.lelliott@worldpipelines.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL CONTENT COORDINATOR

Kristian Ilasko kristian.ilasko@worldpipelines.com

JUNIOR VIDEO ASSISTANT

Amélie Meury-Cashman amelie.meury-cashman@worldpipelines.com

SENIOR WEB DEVELOPER

Ahmed Syed Jafri ahmed.jafri@worldpipelines.com

DIGITAL ADMINISTRATOR

Nicole Harman-Smith nicole.harman-smith@worldpipelines.com

ADMINISTRATION MANAGER

Laura White laura.white@worldpipelines.com

Palladian Publications Ltd, 15 South Street, Farnham, Surrey, GU9 7QU, UK Tel: +44 (0) 1252 718 999 Website: www.worldpipelines.com Email: enquiries@worldpipelines.com

Annual subscription £60 UK including postage/£75 overseas (postage airmail). Special two year discounted rate: £96 UK including postage/£120 overseas (postage airmail). Claims for non receipt of issues must be made within three months of publication of the issue or they will not be honoured without charge. Applicable only to USA & Canada: World Pipelines (ISSN No: 1472-7390, USPS No: 020-988) is published monthly by Palladian Publications Ltd, GBR and distributed in the USA by Asendia USA, 701C Ashland Avenue, Folcroft, PA 19032. Periodicals postage paid at Philadelphia, PA & additional mailing offices. POSTMASTER: send address changes to World Pipelines, 701C Ashland Avenue, Folcroft, PA 19032.

SENIOR EDITOR Elizabeth Corner elizabeth.corner@worldpipelines.com

Incentivisation is a crucial part of the midstream sector, whether you’re talking about getting pipeline projects built, attracting companies to operate them, or keeping them safe and efficient. It’s a word that policymakers and industry leaders tend to return to, since pipelines are capital-intensive and safety-critical, and none of the magic happens without financial or regulatory carrots and sticks.

The passage of US President Trump’s signature ‘Big Beautiful Bill’ in July brings changes in how companies, and state and local governments, allocate their capital investments. The new law, along with an extension of the 2017 tax cuts, and new provisions to allow immediate expensing of capital investment in the US including real property, may lead to unlocking projects throughout the US. The emphasis here is on regulatory reform and tax relief as a stimulus to private investment.

Chris Lloyd, Senior Vice President at McGuireWoods Consulting LLC, recently spoke to me about this, saying: “Clearly, the One Big Beautiful Bill sent a strong signal of support for fossil fuel energy sources and deemphasising emerging energy sources like hydrogen, which will boost the need for new pipeline infrastructure to deliver oil and gas to markets. While there are certainly some financial incentives for such projects contained in the bill, the most significant impact is likely to be in the regulatory reform and streamlining activities in the bill and through executive orders issued by President Trump.”

Of course, the US has successfully used this formula before. Look at the LNG build-out of the past decade: Gulf Coast terminals and the pipelines feeding them were unlocked by regulatory streamlining, export authorisations, and favourable tax treatment that made private capital flow more freely. Incentivisation came in the form of clearing bottlenecks and signalling policy certainty. The US has become the world’s largest LNG exporter, a position attained via midstream infrastructure financed largely by private investors responding to clear, consistent incentives. Canada, by contrast, has struggled to replicate the same model. Canada has been slow to capture a share of the global LNG market, despite being the world’s fifth largest gas producer. A mix of high costs, regulatory and permitting hurdles, and persistent opposition (particularly around Indigenous rights and environmental concerns) has delayed projects and raised investor risk. LNG Canada, the country’s flagship liquefaction project, has faced technical problems as it ramps up, while negative gas pricing highlights the strain of oversupply with limited export capacity. Together, these factors have left Canada lagging in the race for global LNG market share. According to a PolicyOptions analysis, Canada is “late to the game” and has infrastructure costs that far exceed industry norms.1

The contrast is even starker when you consider Canada’s troubled Trans Mountain Expansion project (TMX), where the government has already spent more than CAN$35 billion rescuing a pipeline that private investors walked away from. When governments subsidise projects, they seek to ensure energy security but sometimes end up cushioning projects that might otherwise have fallen on harder ground. Incentives can unlock infrastructure but also risk masking projects with weak fundamentals. Recently, some private interests and public officials are calling for government funding to construct more pipelines across Canada to enhance oil export, but Mark Kalegha, IEEFA Energy Finance Analyst argues: “Oil infrastructure development, once seen as a financial boon, is beset by rising costs and lower price trends … As the Canadian government experiences pressure to pay industry infrastructure costs from public coffers, it’s time to step back and take a hard look at the energy questions Canada faces.”

In the US, we can see how domestic policy certainty (even without perfect alignment) helps investors move. In Canada, the ‘unknowns’ make risk margins widen and leave many projects struggling to clear investment hurdles. Internationally, Trump-era policy is unpredictable (tariffs, trade disputes, sanctions) but at home, regulatory streamlining and tax relief have provided enough certainty for private capital to commit to midstream build-out.

1. https://policyoptions.irpp.org/2025/04/lng-exports

Across energy and critical infrastructure, we bring expertise where complexity is highest, partnering with globally local teams and leveraging unrivalled proprietary technologies. Like the M-500 Single Torch External Welding System, seamlessly integrated with Data 360 our cloud-based digital platform that analyses, and visualises your project performance data in real time. We move projects forward, no matter the challenge.

We’re here to partner on how our specialist welding and coating solutions can help you power tomorrow.

Sempra sells US$10 billion infrastructure stake & greenlights Port Arthur LNG Phase 2

Sempra has agreed to sell a 45% equity interest in Sempra Infrastructure Partners, one of North America’s leading energy infrastructure platforms, to affiliates of KKR, a leading global investment firm, with Canada Pension Plan Investment Board (CPP Investments). Subject to adjustments, the transaction proceeds of US$10 billion implies an equity value of US$22.2 billion and an enterprise value of US$31.7 billion for Sempra Infrastructure Partners.

The transaction is expected to close in Q2 - Q3 2026. Upon closing, a KKR-led consortium will become the majority owner of Sempra Infrastructure Partners, holding a 65% equity stake, while Sempra will retain a 25% interest alongside Abu Dhabi

Investment Authority’s (ADIA) existing 10% stake.

In addition, Sempra Infrastructure Partners has reached a final investment decision to advance the development, construction and operation of Port Arthur LNG Phase 2. This new phase will include two natural gas liquefaction trains, one LNG storage tank and associated facilities with a nameplate capacity of approximately 13 million tpa of US-produced LNG. Incremental project capital expenditures at Phase 2 are estimated at US$12 billion, plus an approximate US$2 billion payment for shared common facilities, with commercial operations expected in 2030 and 2031 for Trains 3 and 4, respectively.

Enbridge announces two gas transmission projects, capitalises on growing natural gas demand

Enbridge Inc. has signed commercial agreements for the Algonquin Reliable Affordable Resilient Enhancement project (AGT Enhancement) which is expected to increase deliveries on Algonquin Gas Transmission pipeline to existing Local Distribution Co. (LDC) customers in the US Northeast.

In addition, through its Matterhorn joint venture, the company reached a final investment decision on the Eiger Express Pipeline (Eiger), an up to 2.5 billion ft3/d pipeline from the Permian Basin to the Katy area to serve the growing US Gulf Coast LNG market.

“We continue to deliver on the US$23 billion of gas transmission opportunities we laid out at our Investor Day in March. Today’s project announcements highlight the benefits of Enbridge’s scale and demonstrate our ability to support growing natural gas demand in the US Northeast, and LNG exports from the US Gulf Coast,” said Cynthia Hansen, Executive Vice President and President, Gas Transmission. “These investments add visibility to, and extend, our growth outlook through the end of the decade.”

Once completed, AGT Enhancement will deliver

The EU cut its pipeline gas imports by 9% year on year in the first half (H1) of 2025, as the bloc increased its reliance on LNG and benefited from ongoing efforts to lower demand for the fuel (reports IEEFA).

The latest decline comes after EU piped gas imports fell by more than one-third between 2021 and 2024. Energy efficiency measures and the growth of renewables helped reduce the bloc’s gas consumption in recent years, according to IEEFA’s updated EU Gas Flows Tracker from the Institute for Energy Economics and Financial Analysis.

Combined EU gas pipeline and LNG imports grew 3.4% year on year in H1 2025. IEEFA expects EU gas imports to continue falling from 2026.

“EU gas demand is in structural decline. But this year’s slight rise in gas imports should be a wake-up call for Member States falling short of their energy efficiency and renewables targets,” said Ana Maria Jaller-Makarewicz, Lead Energy Analyst, Europe, at IEEFA.

“Faster deployment of solar, wind and heat pumps, as well

approximately 75 million ft3/d of incremental natural gas, under long-term contracts, to investment grade counterparties in the US Northeast. Natural gas is a key component of the energy mix in the region. This project is designed to increase reliable supply and improve affordability by reducing winter price volatility for customers. Enbridge expects to invest US$0.3 billion in system upgrades within, or adjacent to, existing rights-of-way. Subject to the timely receipt of the required government and regulatory approvals, Enbridge fully expects to complete AGT Enhancement in 2029.

Eiger is designed to transport up to 2.5 billion ft3/d of natural gas through approximately 450 miles of 42 in. pipeline from the Permian Basin in West Texas to the Katy area. Upon anticipated completion of Eiger in 2028, Enbridge expects to own a meaningful equity interest in up to 10 ft3/d of long-haul Permian Basin egress pipeline capacity that is connected to key storage facilities and LNG export hubs along the US Gulf Coast. This project is complementary to the Whistler Parent JV assets and is backed by long-term contracts with predominantly investment grade counterparties.

as rapid grid modernisation, will reduce EU countries’ vulnerability to LNG supply disruptions, improve energy security and protect consumers from volatile gas prices.”

The research reveals that since the beginning of 2022, EU countries have spent about €380 billion on pipeline gas imports, €83 billion of which was from Russia.

The end of Russian gas transit via Ukraine on 1 January 2025 contributed to the decrease in EU gas pipeline imports in H1 2025. Some EU countries shifted their gas flows and used existing infrastructure to guarantee security of supply.

The EU plans to gradually stop the import of Russian oil and gas by the end of 2027. But the bloc’s imports of Russian pipeline gas via Türkiye have increased in recent years.

The top-three sources of EU pipeline gas imports in H1 2025 were Norway (55%), Algeria (19%) and Russia via Türkiye (10%).

EU gas pipeline imports from Azerbaijan, Libya and Norway decreased year on year in H1 2025, while those from Algeria, Russia via Türkiye, Türkiye and the UK slightly increased.

Pembina Pipeline Corp. has announced that the Canada Energy Regulator (CER) has approved the negotiated settlement between Alliance Pipeline Ltd Partnership and shippers and interested parties on the Canadian portion of the Alliance Pipeline.

Northern Territory Chief Minister Lia Finocchiaro announced the finalisation of a pipeline permit for APA to construct and operate the Sturt Plateau Pipeline (SPP).

Energy network SGN and UK tech company Utonomy have completed a six month trial demonstrating how advanced pressure control can significantly reduce methane emissions from Britain’s gas grid.

Egypt’s petroleum minister has affirmed the key role of the state-owned Petroleum Pipelines Company (PPC) in enhancing Egypt’s position as a regional energy trading hub, citing its capacity to transport and store crude oil from the Red Sea to the Mediterranean. He presented a package of projects implemented to replace, renew, and upgrade petroleum product transport lines nationwide, with a total cost of about EGP 3.3 billion (US$69 million).

Aminex announced that Tanzania’s pipeline from the Ntorya gas field to the Madimba plant is progressing, with equipment procurement underway, construction starting in September 2025, and completion targeted for July 2026.

The Trans Adriatic Pipeline (TAP) has transported its 50th billion m3 of natural gas to Europe since the start of commercial operations.

This significant achievement demonstrates TAP’s role in ensuring a reliable, diversified gas supply to Europe, while enhancing competition and contributing to decarbonisation efforts across South-Eastern Europe.

TAP, as the European segment of the Southern Gas Corridor, brings natural gas from Azerbaijan to European markets. Since it began commercial operations in late 2020, TAP has delivered: over 41.7 billion m3 to Italy, over

4.8 billion m3 to Greece, and over 3.2 billion m3 to Bulgaria.

Luca Schieppati, TAP’s Managing Director, commented: “Reaching 50 billion m3 is more than a milestone – it’s a clear demonstration of TAP’s strategic role in strengthening Europe’s energy security and supporting climate goals [...] Looking into the future, we are ready to further contribute to these goals. In fact, the first level of TAP’s capacity expansion – set to add 1.2 billion m3 of longterm capacity per year from the start of 2026 – is already underway and will enable us to do even more.”

The International Energy Agency (IEA) has indicated that global oil supply is set to increase more swiftly this year, with a surplus potentially growing by 2026.

This is due to both OPEC+ members boosting their output and the growth of supply from non-OPEC+ countries.

The IEA, which provides guidance to industrialised nations, noted a projected supply rise of 2.7 million bpd to 105.8 million bpd by 2025, and an additional increase of 2.1 million bpd to 107.9 million bpd the following year.

The OPEC+ group, comprising the eight countries of Algeria, Kazakhstan, Kuwait, Iraq, Oman, Russia, Saudi Arabia and the United Arab Emirates, has agreed to augment its production.

Following a decision on 7 September to commence unwinding its second tranche of supply cuts, the group plans to elevate its output target by 137 000 bpd in October.

At this rate, it would take one year to fully implement the 1.65 million bpd tranche of cuts, leaving 2 million bpd of cuts still in place.

The IEA’s analysis suggests that supply is increasing much faster than demand, even though it has revised its global demand growth

forecast this year to 740 000 bpd, highlighting strong deliveries in advanced economies.

The IEA said: “Oil markets are being pulled in different directions by a range of forces, with the potential for supply losses stemming from new sanctions on Russia and Iran coming against a backdrop of higher OPEC+ supply and the prospect of increasingly bloated oil balances.”

Benchmark crude oil prices experienced a decline in August, with ICE Brent futures dropping by approximately US$2/bbl monthon-month to US$67/bbl.

The IEA anticipates that global inventories will see an ‘untenable’ average increase of 2.5 million bbl/d in the second half of 2025, as supply substantially exceeds demand.

Additionally, China’s continued stockpiling of crude is contributing to keeping Brent crude prices for immediate delivery higher than those for future contracts, a market condition referred to as backwardation.

IEA added: “There are a number of potential twists and turns ahead – including geopolitical tensions, trade policies and additional sanctions on Russia and Iran – that could yet alter market balances.”

Plains All American Pipeline, L.P. and Plains GP Holdings have announced that a wholly owned subsidiary has entered into a definitive agreement to acquire from subsidiaries of Diamondback Energy, Inc. and Kinetik Holdings Inc., a 55% non-operated interest in EPIC Crude Holdings, LP, the entity that owns and operates the EPIC Crude Oil Pipeline.

The transaction is valued at approximately US$1.57 billion, which is inclusive of

approximately US$600 million of debt.

Additionally, Plains has agreed to a potential US$193 million earnout payment should an expansion of the pipeline to a capacity of at least 900 000 bpd be formally sanctioned before year-end 2027.

The EPIC Pipeline provides long-haul crude oil takeaway from the Permian and Eagle Ford basins to the Gulf Coast market at Corpus Christi.

When your pipeline shares a right of way with high-voltage power lines, the electromagnetic field on the power lines can induce unwanted voltage onto the pipeline, creating a safety hazard for personnel and contributing to AC corrosion problems. Dairyland decouplers provide an effective grounding path that mitigates induced AC, while simultaneously maintaining DC isolation to optimize your CP system. With a Dairyland decoupler, your CP system will continue to work efficiently, and the pipeline and personnel will be safe from AC interference.

Let us help you find the right solution for your AC Mitigation problems.

McDermott awarded deepwater subsea contract by PTTEP in Malaysia

8 - 10 October 2025

Carbon Capture, Utilization and Storage (CCUS) Conference

Houston, USA

https://www.woodmac.com/events/carboncapture-utilization-storage-conference/

21 - 23 October 2025

Carbon Capture Technology Expo

Europe

Hamburg, Germany

https://www.carboncapture-expo.com/

3 - 6 November 2025

ADIPEC

Abu Dhabi, UAE

https://www.adipec.com/

11 - 13 November 2025

1st Pipeline Technology Conference

Asia

Kuala Lumpur, Malaysia

https://www.pipeline-conference.asia/

19 - 23 January 2026

PPIM 2026

Houston, USA

https://ppimconference.com/

11 - 15 February 2026

78th Annual PLCA Convention

Phoenix, Arizona

https://www.plca.org/annual-convention-events

15 - 19 March 2026

AMPP Annual Conference + Expo

Houston, USA

https://ace.ampp.org/home

27 - 30 April 2026

Pipeline Technology Conference (PTC)

Berlin, Germany

https://www.pipeline-conference.com/

4 - 7 May 2026

Offshore Technology Conference

Houston, USA

https://2026.otcnet.org/

McDermott has been awarded a large offshore subsea contract by PTTEP Sabah Oil Limited (PTTEP) for the Block H gas field expansion project, located offshore Sabah, in East Malaysia covering the Alum, Bemban and Permai deepwater fields.

Under the scope of the contract, McDermott will deliver engineering, procurement, construction, and installation (EPCI) services for a carbon steel pipeline, along with transportation and installation of key subsea umbilicals, risers and flowlines (SURF) components. The infrastructure is part of a broader system designed to support the delivery of additional feed gas to the Petronas Floating Liquefied Natural Gas Dua (PFLNG DUA) facility, which has been producing from Block H’s Rotan and Buluh fields since 2021.

“This award reflects PTTEP’s continued trust in McDermott’s expertise to deliver

TechnipFMC awarded two flexible pipe contracts by Petrobras

TechnipFMC has been awarded two subsea contracts by Petrobras for flexible pipe for use in multiple basins.

The first award is a substantial contract to design, engineer, and manufacture flexible gas injection risers. This hightechnology solution will sustain reservoir pressure and enhance production efficiency through high-capacity gas reinjection in presalt formations in the Santos Basin.

The second award, which followed a competitive tender, is a significant contract to design, engineer, and manufacture flexible risers and flowlines for deployment on assets in the Campos Basin.

Jonathan Landes, President, Subsea at TechnipFMC, commented: “As Petrobras unlocks Brazil’s energy resources, we are proud to provide technology and expertise that support some of their most technically challenging projects. TechnipFMC is a subsea innovation leader and continues to advance flexible technology to support new projects and enhance value for its clients.”

Manufacturing will be fulfilled exclusively at TechnipFMC’s flexibles manufacturing facility in Açu, Brazil. For more than 40 years, TechnipFMC has delivered advanced technological solutions while supporting the development of local economies in Brazil.

complex subsea infrastructure,” said Mahesh Swaminathan, McDermott’s Senior Vice President, Subsea and Floating Facilities. “Leveraging our proven subsea engineering and marine construction capabilities, we are well-positioned to build on our strong track record of successful project execution for PTTEP. The expansion of Block H represents a pivotal development in Malaysia’s energy landscape, and our work on this project further reinforces McDermott’s strategic presence, anchored by our Kuala Lumpur office – our hub for global deepwater project delivery.”

Engineering and project management will be led from McDermott’s Subsea and Floating Facilities team in Kuala Lumpur, while offshore installation will leverage the company’s versatile marine construction fleet.

• Rystad Energy: China’s oil stockpiling explained

• FET launches new ROV control system

• Wood Mackenzie: Growth in LNG supply running up against concerns over Chinese demand

• EIA: Growing natural gas deficit leads Egypt to ramp up natural gas imports

• Thyssengas begins the realisation of cross-border hydrogen line between Netherlands and Germany

Follow us on LinkedIn to read more about the articles linkedin.com/showcase/worldpipelines

Gord Cope, Contributing Editor, surveys the energy landscape in the Middle East and North Africa (MENA) region, with particular focus on the midstream infrastructure, geopolitical risks, and the transition towards low-carbon energy.

The Middle East and North Africa (MENA) are essential to the world’s energy sector, supplying immense amounts of oil, gas, and refined products to energy-hungry customers. They are also at the vanguard of the surge toward a low-carbon hydrogen economy, touting billions of dollars in potential production investments.

But MENA is also the most volatile region in the world, a hotbed of armed hostilities that continuously threaten disruption to the movement of fossil fuels. While the midstream sector is often the victim of geopolitical aggression, it can also offer solutions to the turmoil and volatility.

Algeria has been a vital ally to Europe as it pivots away from Russian gas supplies. Conventional gas reserves are approximately 159 trillion ft3, with another 230 trillion ft3 of potential shale gas reserves. Gas production, pegged at 9 billion ft3/d prior to the Ukraine war, has risen to 10 billion ft3/d with major expansions in the Hassi Bahamou field and the Hassi R’Mel LD2 complex. Further increases at existing and new fields are in the works.

Algerian production is delivered to the continent through a combination of LNG plants and major gas lines, including the 575 km, 10 billion m3/y MedGaz line from Algeria to Spain and the 2475 km, 32 billion m3/y TransMed line running from Algeria via Tunisia, to Sicily and mainland Italy.

The EU is actively exploring the use of trans-Mediterranean gas lines to reduce its carbon footprint. In June, 2025, the European Climate, Environment and Infrastructure Executive Agency awarded US$24.7 million to the Italian H2 Backbone project, which is part of a 3300 km dedicated pipeline that is expected to deliver up to 4 million tpy of green hydrogen from North Africa to Europe by 2030. The project would source green hydrogen from solar and wind-rich Algeria and Tunisia and transport it via a trans-Mediterranean line that would cross Sicily before connecting up in mainland Italy and extending into Germany. Much of the project would rely on existing gas infrastructure ROW, and Tunisia and Algeria have so far announced plans to create approximately 300 000 tpy of green capacity by 2030. A caveat; studies suggest that unless the EU initiates significant policy support, the cost of producing green hydrogen in Africa (€4.2 kg - €4.9 kg), would be far too expensive to attract European users (who currently spend between €1 kg - €2 kg).

In late 2022, Morocco and Nigeria signed a memorandum of understanding (MOU) to build the Nigeria-Morocco gas pipeline (NMGP). Although the project has been touted for several years, the Ukraine war, higher gas prices (and Morocco’s desire to eliminate Algeria’s strangle-hold on supplies), has given the National Nigerian Petroleum Co. (NNPC) and the Moroccan Office of Hydrocarbons and Mines (ONHYM) new impetus. The ROW for the US$25 billion project would travel offshore for 7000 km through the jurisdictions of 13 African countries, and deliver up to 3 billion ft3/d of gas to Morocco, where it would hook up to the (currently) inactive Maghreb Europe line and the European gas network. In late 2024, Morocco announced that it would be seeking tenders for the initial phases of the project throughout 2025, with further engineering phases in 2026. Greece, Israel, and Cyprus are promoting the Eastern Mediterranean (EastMed) project, an 1800 km gas pipeline. The ROW will start in Cyprus and connect to Greece, and then to Italy, running roughly 1200 km offshore and 600 km onshore. The line would deliver up to 10 billion m3/y from fields discovered over the last decade, including Israel’s Leviathan field (22 trillion ft3), and Tamar field (10 trillion ft3), as well as Cyprus’s Aphrodite field (7 trillion ft3), and the Calypso discovery region (10 trillion ft3). New discoveries continue to bolster the project; in July 2024, ExxonMobil and partners reported penetrating a 350 m gas column at its Pegasus-1 exploration well, located in Cyprus waters.

For several decades, the Kurdistan Regional Government (KRG) had been shipping 450 000 bpd of crude through the Iraq-Turkey pipeline that runs to the latter’s Mediterranean port of Ceyhan, obviating the need to pass through Iraq territory. Iraq filed a complaint with the International Chamber of Commerce, arguing that the flow should have Baghdad’s approval. In March, 2023, the Chamber ruled in favour, which resulted in operators shutting down production in Kirkuk oil fields. In early 2025, Iraq announced that it was ready to allow resumption of crude flow in the pipeline, but operators within Kurdistan are reluctant to contract export space until formal payment agreements are in place. In the meantime, members of the Association of the Petroleum Industry of Kurdistan (Akipur) including UK-based Gulf Keystone and Norway’s DNO, rely on local demand to keep their fields producing.

In April, 2025, Turkey and Iraq announced the Development Road project, a US$17.9 billion initiative to build a major energy logistics infrastructure between the two countries. The largest portion of the project will be a 2.25 million bpd pipeline that will run from Basra in southern Iraq to the border town of Silopi in Turkey, and thence to the Mediterranean port of Ceyhan. Plans are also underway to eventually reverse 5 billion m3/y flows of natural gas along the ROW.

The proposed Basra-Aqaba pipeline between Iraq and Jordan, which has been in limbo for a decade, is suddenly far more viable. The project involves a 1700 km pipeline that would run from Iraq’s oil-producing region in Basra to the Jordanian port of Aqaba, located on the northern end of the Red Sea. The US$9 billion line would carry up to 2.2 million bpd; Jordan would have the right to buy 150 000 bpd as feedstock for the Jordan Petroleum Refinery Co. in Zarqa. The project was opposed by numerous groups, including Iran-backed militias that could pose a threat to the infrastructure. In the last year, Iran has seen its proxy militias crushed but still remains a significant threat to the Strait of Hormuz. In early 2025, the Iraqi federal government earmarked approximately US$5 billion toward advancing the pipeline. While the Trump administration has yet to weigh in on the project as of press time, it would be a viable shipping alternative to the US and its regional allies should Iran close the Strait.

Egypt is a major energy hub in the eastern Mediterranean, with significant domestic production as well as the transportation of oil and gas through both the Suez Canal and a series of pipelines within its jurisdiction. In August, 2025, the country greatly expanded its imports of natural gas for both domestic consumption and eventual LNG exports when it signed an agreement to buy 130 billion m3 of gas from Israel’s Leviathan field. The US$35 billion deal will see expansion of the Leviathan platform by operator NewMed Energy, and the investment of US$400 million by Egypt into increased pipeline capacity.

MENA countries are keen to take advantage of their abundant solar and wind resources to participate in the pivot to renewable fuels. Saudi Arabia is building an immense green ammonia plant in the NEOM project, a futuristic Greenfield development in the

country’s northwest. In June, 2025, NEOM partner Air Products announced that the US$5 billion plant was 80% complete. When it enters production in 2027, the facility will produce up to 650 tpd (240 000 tpy), primarily for export.

Since March,2024, the Egyptian government has signed over US$30 billion in renewable energy investments in the Suez Canal Economic Zone (SCZone), a waterway vital to global marine traffic. The agreements include a deal between Norway’s fertilizer giant Yara and India’s Acme Cleantech, which involves the latter supplying up to 100 000 tpy of renewable ammonia. In June, 2025, Lloyd’s Register and Germany’s DAI Infrastruktur entered into an MOU to develop a large-scale, green ammonia plant in East Port Said, Egypt. Project Ra is expected to produce up to 1.65 million tpy of green ammonia when it starts up in 2029.

Abu Dhabi is positioning itself as a major international player in low-carbon energy by leveraging carbon sequestration. In late 2024, construction began on the greenfield Hail and Ghasha Offshore Development. When it enters production in 2028, the project will yield 1.5 billion ft3/d, which will be piped ashore where facilities will sequester up to 2 million tpy of CO2 while producing low-carbon hydrogen. Also in late 2024, stateowned ADNOC announced the formation of a new firm with a multi-facet business strategy. XRG, with over US$80 billion in financial reserves, will focus on producing specialty petrochemicals, natural gas and low-carbon energy. ADNOC noted that the demand for green ammonia is expected to reach 70 - 90 million t by 2050.

The Omani government’s Hydrom, with a US$49 billion budget and 2300 km2 of land for renewable energy development, has the goal of reaching net-zero by 2050. In May, 2024, the government agency signed two new green hydrogen agreements worth US$11 billion. France’s EDF Group and London-based Yamni will build a 178 000 tpy green hydrogen plant, with an estimated start-up date in 2030. Output from the plant will be used to produce 1 million tpy of green ammonia in a facility to be built in the Salalah Free Zone.

In June, 2025, an Israeli offensive against Iranian nuclear assets also targeted conventional energy infrastructure, striking a fuel depot in northern Tehran and the nearby Shahr Rey oil refinery, as well as the South Pars gas field.

The hostilities between Israel and Iran are changing the geopolitical calculus in the region on an almost daily basis. During its strike against Iran, Israel ordered Chevron to shut down its operations at the giant Leviathan offshore gas field, shutting off supplies to Egypt. The order was in response to Iranian barrages of missiles and drones directed at Israeli assets. The field, which contains almost 23 trillion ft3 of recoverable gas, regularly ships almost 1 billion ft3/d to Egypt through the EMG pipeline. The move left Egypt scrambling to meet high seasonal demand through LNG imports.

But most stakeholders are concerned over the Strait of Hormuz. With a minimum navigable width of 40 km in some points, the Strait serves as a maritime chokepoint for the 20 million bpd of crude that passes through. Iran has long threatened to close off the passage in the event of hostilities,

but even the interference in GPS systems that the vessels use to ensure safety can cause disruptions, as was seen in June, 2025, during the height of Israel’s strikes against Iran’s nuclear facilities.

In order to ensure that its own exports would be safeguarded, Iran built the Goreh Jask crude pipeline, which runs overland for 1000 km from producing fields near Goreh to the port of Jask in the Gulf of Oman. The US$2 billion project, which skirts the contentious Strait of Hormuz, has a capacity of 1 million bpd. Since its commissioning in 2021, however, the terminal has seen limited activity; it wasn’t until late 2024, that the first VLCC supertanker was loaded with 2 million bbl of crude, as Iran was mainly relying on its primary oil export facility on Kharg Island. In any event, should Iran close the Strait, Israel, with over-powering air superiority, has the option to cripple the Jask terminal.

Iran’s opponents are weighing their own pipeline alternatives. Saudi Arabia has the 5 million bpd Petroline crude pipeline that runs from the Abqaiq oilfield on the Gulf coast in the east to the Red Sea port of Yanbu in the west, and the UAE operates the 1.5 million bpd ADCOP pipeline linking its onshore oilfields to the Fujairah oil terminal. The Saudi pipeline is vulnerable to Houthi attacks from Yemen, however; in addition, Kuwait and Qatar have no viable alternatives to the Strait.

Hostilities may also spur major LNG producers like Qatar to seek alternatives for the 85 million tpy of LNG that pass through the Strait. In 2023, New Delhi-based South Asia Gas Enterprise (SAGE) consortium began promoting a 2000 km line that would transport natural gas offshore from Oman to India. The US$5 billion line would gather 11 billion m3/y from Qatar, Iran, UAE and Saudi Arabia. The Indian government is keen on the project, estimating that it would save Indian consumers over US$800 million annually. Up until now the proposal has received little impetus from ME producers, but the route, which would bypass the Strait, greatly reduces geopolitical risk.

While green energy offers tremendous opportunities to MENA, it is also facing uncertainty. The EU, one of the prime potential customers, is struggling to make the transition to a hydrogen economy, primarily due to a lack of firm commitment from industrial and utility customers. The Trump administration is rolling back incentives and subsidies, undermining efforts in the US. The international move towards green ammonia as a marine transportation fuel remains as a bright spot in consumption, however.

In conclusion, MENA’s tremendous energy assets are in a state of flux as countries struggle to deal with regional hostilities, an evolving market and domestic unrest. Some jurisdictions, such as Qatar, Egypt, and Abu Dhabi, are encouraging NOCs and international investors to transition their reliance on traditional fossil fuel exports to green energy. Others, like Iran, must prioritise geopolitics, corruption and domestic unrest. For the coming decade, MENA will offer complicated challenges and enticing opportunities for the midstream sector.

Unmatched accuracy in threat detection, characterization and sizing.

Now featuring Ultra Res MFL, the MDS™ Pro inline inspection system boasts increased sensor density, improving accuracy when detecting and sizing potential anomalies. Upgrade to Ultra Res and see what you’ve been missing.

6,400+ leads collected

3,474 quality attendees

91% of exhibitors gain new and valuable leads attending StocExpo

90% of exhibitors say attending StocExpo strengthens their brand awareness

65+ countries represented for a global impact

Kapil Garg, MarketsandMarkets, examines the role of ultrasonic testing in ensuring safety, compliance, and reliability within the oil and gas industry, with a particular emphasis on pipelines and infrastructure in the Middle East and Africa.

Oil and gas infrastructure includes, among other things, production facilities, liquefaction plants, refineries, pipelines, and storage tanks. As oil and gas companies increasingly prioritise safety and quality, regulatory bodies have implemented rigorous standards to ensure that products meet specific safety

criteria. These regulations mandate regular inspections and non-destructive testing (NDT) methods like ultrasonic testing (UT) to identify material flaws without compromising the integrity of the components. Organisations such as the American Society for Non-destructive Testing (ASNT) and the American Petroleum Institute (API) set high benchmarks for NDT practices, compelling manufacturers to adopt advanced testing techniques to comply with safety standards. This compliance mitigates risks associated with equipment failure and enhances product reliability, fostering consumer trust. The Pipeline and Hazardous Materials Safety Administration (PHMSA), through the Pipeline Safety Act and other regulations, requires regular inspections of pipelines to detect corrosion, cracking, and other structural weaknesses. Additionally, recent amendments, like the 2021 updates to the Pipeline Safety Act, emphasise the need for advanced, NDT techniques, such as UT, to ensure pipelines meet stringent safety standards, especially in high-risk areas near population centres or ecologically sensitive regions. Failure to comply could lead to significant penalties, as was evidenced by a case in 2022 in which a major US pipeline operator faced millions of dollars in fines following a spill attributed to insufficient inspection practices.

Central African Pipeline System (CAPS) 30 billion 6500

Nigeria-Morocco Gas Pipeline 25 billion 5600

Trans-Sahara Gas Pipeline (TSGP) 13 billion 4128 African Renaissance Pipeline Project 6 billion 2600

East African Crude Oil Pipeline (EACOP) 3 billion 1443

Ajaokuta-Kaduna-Kano Gas Pipeline

2.8 billion 614

Source: Secondary Research, and MnM Knowledge Store.

Furthermore, many countries, including the US, Germany, Japan, the UK, and Canada, are enforcing more stringent environmental and safety regulations as global industrialisation accelerates, necessitating ultrasonic testing technologies. The increasing complexity of manufacturing processes and materials and the demand for higher quality assurance have led industries to rely heavily on UT for routine inspections, maintenance, and quality control. As a result, companies are investing in UT equipment and services to meet these regulatory requirements while striving to improve operational efficiency and reduce downtime. This trend is expected to continue as regulatory frameworks evolve and expand across various sectors, solidifying ultrasonic testing’s critical role in ensuring compliance with stringent industry standards and enhancing overall market growth.

Ultrasonic testing provides a reliable means of detecting flaws and assessing material integrity without compromising the structural components. It is essential for maintaining operational safety in offshore settings where environmental conditions can be harsh and unpredictable. Regular ultrasonic inspections identify potential issues before they escalate into catastrophic failures. This proactive approach helps avert costly downtimes and aligns with stringent regulatory frameworks that mandate regular inspections to prevent leaks or accidents that could have severe environmental repercussions.

Ultrasonic inspection requires utilising sound waves that travel through various materials at a constant velocity specific to each material. When these sound waves encounter an interface between two different materials, a portion of the wave is transmitted while the remainder returns to the source. This technique is employed for flaw detection and material evaluation. A beam of ultrasonic sound is directed at the object being tested; if there are any discontinuities in the wave path, energy is reflected as echoes to a receiver.

Three ultrasonic inspection techniques are used to detect flaws in materials. These are pulse-echo, angle beam, and contact and immersion methods.

oil and gas industry.

Among these, the pulse-echo technique is the most widely used for detecting internal defects, assessing material thickness, corrosion inspection, and evaluating full penetration groove welds. Recent developments in inspection services have enhanced the effectiveness of ultrasonic testing in recent years. Companies have begun integrating artificial intelligence into their ultrasonic testing systems to automate data analysis and interpretation, making inspections fast and accurate.

Advancements in ultrasonic testing technologies, such as phased array ultrasonic testing (PAUT) and

TESI Group’s elastomeric pile protection ENVIRAWRAP provides, in half-time and with only one-piece installation, a 30+ years guarantee of corrosion protection for pilings of inshore and offshore marine infrastructures, such as piers, docks, bridges and offshore platforms. It can fit any pile shape, size or material.

automated ultrasonic testing (AUT), enhance inspection capabilities by providing faster and more accurate assessments. These innovations enable operators to conduct comprehensive inspections in real time, which is beneficial in offshore environments where accessibility can be challenging. The combination of increasing exploration activities, stringent safety regulations, and technological advancements is creating a robust demand for ultrasonic testing services in the offshore oil and gas industry. As companies prioritise asset integrity management and preventive maintenance strategies, the ultrasonic testing market is expected to experience sustained growth.

There have been major terrorist activities and cybercrimes in the Middle East and Africa in the last two decades. Military adversaries, organised oil smugglers, and armed rebels also create threatening situations. Political unrest, internal disputes, and governmental instabilities in countries in the Middle East and Africa regions have significantly hampered the overall production of oil and gas and have created potential threats to oil and gas plants and pipelines carrying these media. The majority of conflicts are due to economic issues and the failure of parties to agree on the terms of transit, expenses sharing, and taxes. Cross-border pipeline operators face tax risks, although the governments involved sign pipeline agreements. Also, the government laws proposed internationally for cross-border pipelines are becoming more complex.

Nigeria is world’s seventh largest exporter of oil and is expected to export 1.7 million bpd in 2025. However, in the past few years, oil and gas production has been hampered in Nigeria, due to the attack on oil and gas infrastructure by militants. Oil theft has also been a major issue faced by the oil and gas market in Nigeria, which has led the operating companies in the country to incur huge losses. Lack of infrastructure, uncertainties in regulations, and security concerns have led Nigeria to underutilise its refining capacities, thereby pushing the country to become a net importer of refined petroleum products. Nigeria’s oil and gas sector, facing aging infrastructure, also necessitates regular inspections. The country’s National Oil Spill Detection and Response Agency (NOSDRA) has encouraged non-destructive testing methods to mitigate environmental risks, promoting UT for pipeline integrity assessments.

Nigeria’s 614 km Ajaokuta-Kaduna-Kano (AKK) gas pipeline is the anchor of a north-bound transmission spine aimed at gas-to-power, industry, and city-gas growth. In July 2025, the operator completed the River Niger horizontal crossing – a technically and symbolically significant milestone on the central segment. Another positive news surfaced in mid-2025, authorities and trade outlets highlighted a June ‘100% crude-pipeline availability’ achievement. But the investors and insurers will look for sustained, independently verifiable throughput and lower

loss factors over multiple quarters before they re-price risk. The AKK milestone and reported availability are steps in that direction; the proof will be consistent flow and reduced disruptions.

The region consists of major oil and gas producing countries such as Saudi Arabia, the UAE, Iran, Qatar, and Nigeria which have some of the largest petroleum reserves in the world. Countries such as Saudi Arabia, UAE, Iran, and others export most of their production to neighbouring Asian countries such as China and India, which have high energy demand. Likewise, increasing oil and gas demand in other developing countries and the augmented demand for pipeline monitoring due to improved pipeline infrastructure offer excellent opportunities to this market.

According to a regional analysis of oil and gas construction projects, the Middle East and Africa region has the largest share of projects, by value, with projects worth US$1.23 trillion in the pipeline accounting for approximately 45% of all projects in the pipeline globally. The quest for enhancing safety protocols and ensuring the resilience of energy infrastructure has sparked a revolutionary transformation in the maintaining pipeline integrity. Experts, armed with advanced techniques and technologies, have spearheaded a new era in safeguarding pipelines, thereby significantly mitigating the risks associated with potential hazards.

The African region possesses approximately 140 billion bbls of proven oil reserves as of 2024. There are new exploration activities undertaken in many African countries such as Libya, Namibia, Angola, and Uganda in recent years. Uganda, a country with proven oil reserves for the past 20 years is expected to start oil production from Tilenga project by 2025. The heavy investment in developing the infrastructure will lead ways to pipeline monitoring market.

Middle East being the region with the highest petroleum reserves in the world is poised to maintain its dominating share in exports to Europe and Asian countries in future as well. Saudi Aramco has targeted to produce 0.65 billion m3/d of natural gas by 2028 and is expected to develop unconventional gas reserves in North Arabia, South Ghawar, and the Jafurah Basin, east of Ghawar.

The maintenance of pipeline integrity via monitoring also faces further hurdles in face of skilled workers. Another significant challenge lies in the extensive network of existing pipelines, posing difficulties in conducting comprehensive monitoring. Furthermore, factors such as aging infrastructure, remote locations, and harsh environmental conditions contribute to accessibility challenges. To surmount these barriers, it is imperative to foster collaboration among stakeholders – i.e. Governments, pipeline operators, and technology providers must unite to formulate efficient strategies.

Enhances safety and operations A commitment to a culture of safety and continuous improvement

Provides shared learnings and benchmarking across the industry

Strengthens safety management systems for individual operators

To learn more and take the first step toward your assessment visit:

As transmission pipelines age, the challenge of identifying rogue pipes, outliers, and unknown segments has become a growing concern for operators. These discrepancies – whether undocumented, misidentified, or outside expected specifications – can compromise pipeline safety and reliability. Without proper verification of material properties, as mandated by 49 CFR §192.607, operators risk operating pipelines under unsafe conditions.

To address these risks, pipeline operators are increasingly turning to advanced inline inspection (ILI) technologies for detecting unknown and rogue pipes. This enables operators to accurately assess material properties across their pipeline systems. Services like ROSEN’s RoMat PGS Service can measure key attributes such as diameter, wall thickness, pipe grade, and pipe type – data that is essential for informed decisionmaking and effective risk mitigation. By comparing expected vs measured pipe properties, operators can identify discrepancies and take corrective actions, from adjusting operating parameters to planning targeted repairs or replacing segments altogether. These proactive measures help maintain safe operating conditions and reduce the likelihood of incidents.

This article explores the role of material property verification in modern pipeline integrity management. It outlines a methodology for achieving full verification using ILI and complementary sampling techniques, and highlights how tools like PGS support the identification of rogue pipes and unknown segments – ultimately enhancing the safety and reliability of pipeline operations.

According to the Pipeline and Hazardous Materials Safety Administration (PHMSA), approximately 61% of gas transmission lines and 39% of hazardous liquid lines in the US were installed in 1979 or earlier.1 Most of these pipelines were constructed between 1950 and 1969, making much of the nation’s transmission infrastructure more than 55 years old. This presents

a significant challenge for operators working to maintain safe and efficient systems through their Integrity Management Plans (IMPs).2

As pipelines continue to age, the need for a reliable, efficient, and tailored IMPs becomes increasingly significant. However, without verified knowledge of the pipeline’s material properties, developing an accurate and effective plan becomes difficult. This is especially true when rogue, outlier, or undocumented pipe segments are present, elements that can compromise the integrity of the system and reduce the effectiveness of risk mitigation strategies. Over time, as ownership changes hands and maintenance or replacement activities are carried out, these records can be lost, degraded, or rendered insufficient. Without accurate documentation, operators may be forced to operate at reduced pressures and throughput to maintain safety.

This challenge has been further amplified by the implementation of PHMSA’s ‘Mega Rule’ (49 CFR §192.607), first enacted in 2020 and updated in 2023.3 This is one of the stricter regulations PHMSA has implemented aimed at reducing the likelihood of future incidents after past catastrophes. These regulations include requirements for Maximum Allowable Operating Pressure (MAOP) reconfirmation, expanded compliance standards under CFR 192.9, and improved corrosion control measures. Current regulatory requirements state operators must achieve 50% MAOP reconfirmation (in terms of mileage) by 2028, and 100% by 2035.4

While there are several methods to meet these requirements, including hydrostatic pressure testing and pressure reduction, ILI offers a comprehensive and less disruptive solution. Hydrostatic testing requires the pipeline to be filled with water and taken offline for hours, resulting in costly downtime. A pressure reduction, while less disruptive, limits throughput and prevents full operational capacity. In contrast, ILI tools allow operators to continue normal operations while collecting detailed material property

information in a non-destructive manner. These tools can help to identify rogue and unknown pipes, verify material attributes across the entire line, and support MAOP reconfirmation, all without interrupting service. The data gathered through ILI also contributes to achieving traceable, verifiable, and complete (TVC) documentation, another aspect of the current regulatory requirements and a necessary component of a reliable IMP. By integrating ILI data into their integrity programmes, operators gain a deeper understanding of their pipeline systems.

As previously discussed, technologies like ROSEN’s PGS play a critical role in the material verification process, but how do they actually work? The PGS tool, shown in Figure 1, combines eddy

current principles with magnetic flux leakage (MFL) to create a magnetic field induced in the pipeline.5 This method allows the tool to detect subtle variations in material properties across the pipeline. Once collected, this data is analysed by engineers to delineate pipe segments into populations based on measurable differences in attributes such as yield strength, wall thickness, joint length, and pipe type. Then, the measured properties can be compared to the expected values to help identify rogue or outlier pipes that deviate from expected specifications. Discrepancies may not be evident through visual inspection or legacy records alone, making a tool like PGS a valuable asset in uncovering hidden risks.

The ability to detect and differentiate pipe populations in-line, without interrupting operations, adds significant value to integrity management programmes. It enables operators to validate assumptions about their pipeline systems, reconcile discrepancies in documentation, and build a more accurate understanding of asset conditions. This, in turn, supports MAOP reconfirmation, enhances TVC documentation, and strengthens the overall IMP.

Material property verification process

Verifying miles of pipeline may seem like a daunting task, especially when dealing with ageing infrastructure and incomplete records. However, recent advancements in ILI technology and validation standards have made comprehensive material verification both achievable and cost-effective. When paired with validation in accordance with API 1163, ILI tools enable operators to assess entire pipeline segments with significantly fewer excavations than in years past. This reduces disruption while maintaining confidence in the data.

The material property verification (MPV) process involves analysing the data from the PGS tool to group pipe segments into populations of pipes with similar material properties. This information is then aligned to the information that is stored in the operator’s GIS database to find rogue and unknown pipes, as well as identify discrepancies by comparing what properties the operator expected to what the tool measured. Furthermore, the TVC status can be determined for the properties in each population, which will aid in determining the location and number of field verifications required.

When field verifications confirm the properties measured by the tool, it validates the accuracy of the ILI system and strengthens confidence in the broader dataset. This methodology underpins an API 1163 Level 2 validation, which requires both an ILI run and subsequent field verification to confirm tool performance.6 Performing tests on any populations that have discrepancies or non-TVC material properties will allow the operator to confidently assign the appropriate material properties to every segment of pipe, enabling proactive management and enhanced safety across their pipeline networks. Finally, once all discrepancies have been rectified, the operator can

Built on Trust.

2,000+ Projects delivered 88 Years of contracting excellence

25,000+ Km of pipelines installed worldwide .

catgroup.net

achieve TVC status and meet the regulatory requirements for material properties.

The following case studies illustrate how ROSEN’s RoMat PGS service can be used to identify and trace rogue pipe segments within a transmission system. In this first example, the pipeline in question is an NPS 16 in. line with segments constructed in 1974, 1983, and 1987. The section of line constructed in 1987 was documented as 0.250 in. wall thickness and a grade of X60, operating at 963 psi. After conducting the ILI run using PGS, the majority was confirmed to have a yield strength greater than 60 ksi. However, a single joint of pipe with lower yield strength measured at 55 ksi was identified, shown in Figure 2. This pipe segment was below the SMYS, and when excavated, did not have similar characteristics to population A1. It was a clear outlier that had found its way into the system.

This type of undocumented discrepancy is a prime example of a rogue pipe, one that deviates from expected specifications and lacks traceable documentation. Identifying such segments is critical for maintaining pipeline integrity and ensuring safe operations. With the data provided by PGS, the operator is able to isolate the outlier and follow the verification process to close the gap.

This second example shows another advantage of using ILI technology, as the operator had insufficient records pertaining to the seam type of their line segment. There were two known seam types, Low Frequency Electric Resistance Weld (LF-ERW) and Double Submerged Arc Weld (DSAW), but several verifications resulted in different seam types than expected. It’s imperative to understand the seam types present in vintage pipelines, as certain seam types, like LF-ERW, have unique risks associated with them that must be managed accordingly. After utilising the PGS tool, the different seam types were easily distinguished due to the clear difference in yield strength and other attributes, as shown in Figure 3.

The LF-ERW pipes were populations A2 and B1, with lower strength. Population A4 is the DSAW pipe that the operator had documented. Strength, in this case, shows the distinct difference in seam type for the populations, which then allowed the operator to manage the threat of LF-ERW pipes appropriately. Populations A2 and B1 are different because of wall thickness, but even the strength values are different enough to identify that they are unique populations. Furthermore, the tool was also able to identify a separate population of flash-welded pipe by noticing the characteristic 40 ft joint lengths of the population. The operator did not have any record of this seam type, which is important because flash-welded pipe has its own unique risks separate from LF-ERW, which must be managed. Measuring strength with ILI is critical to determining populations because pipes made to the same WT will not always be different enough to identify, and pipes with similar joint lengths could be separate populations. Therefore, WT and joint lengths alone are not reliable enough to identify populations. However, different heats of steel will give a unique response for the ILI tool to identify. As a result, using additional ILI datasets like wall thickness and differing joint lengths provides further

confidence that populations are unique based on strength measurements.

Both of these cases highlight the value of advanced ILI tools in uncovering hidden risks and supporting compliance with regulatory standards. It also demonstrates how data-driven approaches can enhance IMP execution by providing actionable insights that may not be accessible through traditional recordkeeping or visual inspection alone.

Material property verification is a foundational element of any effective Integrity Management Plan (IMP), directly influencing whether a pipeline can operate safely and efficiently at its intended capacity. With the implementation of PHMSA’s Mega Rule in 2020 and subsequent updates in 2023, accurate material verification has become more critical than ever. The new regulatory requirements’ emphasis on MAOP reconfirmation, with key deadlines approaching in 2028 and 2035, underscores the urgency for operators to fully understand the physical characteristics of their pipeline assets. As the average age of transmission pipelines continues to rise, operators face increasing challenges in verifying material properties. Ownership transfers, reliance on legacy physical records, and inconsistent documentation during repairs or replacements can introduce segments of unknown, rogue, or outlier pipes. These undocumented discrepancies pose risks to safe operations and complicate regulatory compliance. Advanced ILI technologies, such as ROSEN’s RoMat PGS Service, offer a powerful solution to these challenges. By collecting detailed material data without interrupting operations, PGS helps operators identify undocumented segments, verify pipe properties, and detect rogue joints that may otherwise go unnoticed. When paired with API 1163 Level 2 system validation, operators can close the TVC loop, achieving full material verification with significantly fewer excavations.

As the industry continues to evolve toward data-driven integrity management, the integration of ILI technologies and validation standards will play a central role in maintaining safe, efficient, and compliant pipeline operations. By embracing these tools and methodologies, operators are better equipped to meet regulatory demands, mitigate risk, and ensure the longterm integrity of their pipeline networks.

1. Pipeline and Hazardous Materials Safety Administration. (2025, August). By-Decade Inventory. Retrieved from US Department of Transportation: https://www.phmsa. dot.gov/data-and-statistics/pipeline-replacement/decade-inventory

2. Rosenheld, J. F. (2012, November 8). The Role of Pipeline Age in Pipeline Safety. Retrieved from The INGAA Foundation, Inc.: https://ingaa.org/wp-content/ uploads/2012/11/19307.pdf

3. Pipeline and Hazardous Materials Safety Administration. (2022, October). Title 49 CFR Part 192: Pipeline Safety: Safety of Gas Transmission Pipelines: Repair Criteria, Integrity Management Improvements, Cathodic Protection, Management of Change, and Other Related Amendments. Retrieved from Department of Transportation: https://www.federalregister.gov/ documents/2022/08/24/2022-17031/pipeline-safety-safety-of-gas-transmissionpipelines-repair-criteria-integrity-management

4. Title 49 CFR Part 192 Subpart J. (2025, August). Retrieved from Code of Federal Regulations: https://www.ecfr.gov/current/title-49/subtitle-B/chapter-I/ subchapter-D/part-192/subpart-J

5. ROSEN. (2023). RoMat PGS Service Sales Flyer. ROSEN.

6. American Petroleum Institute. (2013, April). API Standard 1163: In-Line Inspection Systems Qualification. Retrieved from API Energy: https://www.api.org/~/media/ files/publications/whats%20new/1163%20e2%20pa.pdf

There’s nothing quite like welding onto a live pipeline. In this high-stakes operation, expertise matters as many factors contribute to your project’s unique set of challenges— flow rate, pipeline diameter, environmental conditions and more—making proper planning and execution essential. Without it, your pipeline’s long-term integrity is at risk.

WeldFit’s API 1104-qualified welders average a decade in the industry, bringing proven expertise to complex, high-flow applications. Backed by both simulation and real-world testing, they follow the most appropriate procedures to reduce pipeline threats and ensure project success. When it’s not just another weld, choose WeldFit. Contact your WeldFit representative to learn more.

Microbial Control and H2S Suppression

Microbiologically influenced corrosion (MIC) poses a significant threat to the integrity of oil and gas pipelines, primarily driven by biofilm formation and hydrogen sulphide (H2S) generation. These microbial processes accelerate corrosion, promote fouling, and disrupt flow assurance, resulting in increased maintenance costs and operational downtime. Controlling MIC typically involves a combination of mechanical cleaning and targeted chemical treatments. MIC is primarily driven by sulphide- and iron-reducing bacteria, resulting in pitting, iron sulphide deposition, and the generation of hazardous hydrogen sulphide (H2S). The formation of biofilm including extracellular polysaccharides (EPS) creates a protective matrix around microbial communities, shielding them from conventional treatments and thereby accelerating corrosion damage while increasing safety and operational risks.

Biocides are a critical component of MIC mitigation strategies; however, their effectiveness depends on their ability to penetrate the biofilm matrix and reach the microbial cells. Mature biofilms consist of complex mixtures of waxes, sediments, minerals, and extracellular polymeric substances that impede biocide access. Consequently, combining mechanical cleaning with biocide application is strongly recommended to ensure optimal microbial control.

Vink Chemicals offers advanced oil- soluble biocide solutions engineered to effectively integrate and disrupt biofilms, inhibit H2S production, and effectively mitigate MIC risks in pipeline systems.

• Broad-spectrum biocides to target SRB, IRB, APB and other biofilm-forming microorganisms

• Synergistic biocide formulations to enhance biofilm penetration and disruption

• Oil-soluble biocide formulations for superior dispersion within crude oil, ensuring effective activity against microorganisms present in water droplets dispersed throughout the oil phase

• Environmentally compliant solutions meeting industry regulations while ensuring high efficacy

Chemicals Biocide Products:

Both products are advanced oil-soluble biocides engineered for long-lasting control of sulphate-reducing and iron-reducing bacteria in oil and gas systems. It penetrates biofilms, suppresses H2S generation, and mitigates MIC. With excellent dispersion in crude oil, grotan® chemistry delivers reliable, environmentally compliant microbial control in challenging pipeline environments.

Vink Chemicals GmbH & Co. KG

Eichenhöhe 29, 21255 Kakenstorf, Germany

Oil & Gas

Phone: +49 4186 – 88 797 0

E-mail: oilgas@vink-chemicals.com www.vink-chemicals.com

Kaidy Kho, Vice President - Business Development (Sales), Atmos International, UK, emphasises the importance of a single-ended leak detection for tanker loading and unloading pipelines, to ensure a resilient monitoring strategy for challenging offshore environments.

Offshore tanker loading and unloading pipelines are a vital link in the global energy supply chain. They operate in some of the harshest and least forgiving environments, often exposed to ocean swells, anchor strikes, corrosion and limited access for maintenance. When these pipelines are compromised by leaks, the consequences can be severe: environmental damage, reputational loss, costly cleanup operations, and regulatory penalties. Leak detection is therefore not simply a technical challenge but a business-critical requirement.

Conventional dual-ended leak detection systems, which rely on synchronised instrumentation at both ends of a pipeline, can be impractical in these contexts. Offshore

monobuoys and single-point moorings rarely provide the necessary infrastructure, power or communications. This is where single-ended leak detection offers a resilient and practical alternative. Building on both simulated and fieldproven performance, single-ended leak detection enables operators to maintain high standards of safety and compliance without the need for costly offshore instrumentation upgrades.

Tanker loading and unloading operations are inherently complex. They involve flexible subsea lines, short transfer distances and transient flow conditions as pumping starts and stops. Conventional monitoring approaches, which compare

measurements at both pipeline ends, are hindered by the absence of offshore instrumentation. This creates blind spots in leak detection, leaving operators exposed to risks.

Single-ended leak detection systems address this challenge by relying solely on measurements at the accessible end, usually located onshore or on a nearby platform. Through advanced signal processing, pressure and flow data can be analysed with sufficient resolution to identify anomalies that indicate leaks. By eliminating reliance on offshore instrumentation, single-ended leak detection provides a pathway to resilience and regulatory compliance in challenging marine environments.

The technical approach to single-ended leak detection builds on well-established pressure and flow monitoring principles. At its core, the system leverages high-frequency data acquisition at the onshore terminal, applying statistical and transient analysis to distinguish leaks from normal operational events.

Key elements of the framework include:

) Data acquisition: capturing flow and pressure signals with sufficient frequency to detect small deviations.

) Signal conditioning: filtering noise to account for turbulence, pump vibrations, and valve operations.

) Event detection: identifying specific signatures that indicate the onset of a leak.

) False alarm minimisation: applying thresholds and adaptive algorithms to avoid unnecessary operational interruptions.

This methodology ensures that even under highly variable conditions, single-ended leak detection maintains sensitivity while delivering reliable results.

One operator in Latin America implemented a leak detection solution for a short offshore to onshore diesel transfer pipeline which presented a number of technical and logistical challenges. The 1 km pipeline, partly subsea and partly onshore, was used for unloading fuel from ships to storage tanks.

The operator originally considered ship-side instrumentation to support monitoring, but this proved impractical due to vessel variability, safety restrictions, and space limitations. Instead, a single-ended system was deployed using instrumentation installed onshore, eliminating the need for offshore equipment and simplifying the project.

Despite the short length of the line and the corrosive marine environment, the solution delivered reliable results by applying negative pressure wave analysis and high-resolution data processing. This approach allowed for accurate leak detection and compliance with international best practice (such as API 1130) without requiring significant modifications to the existing infrastructure.

Key findings included:

) High sensitivity: detection of very small leaks, with a location accuracy of approximately 0.25% of pipeline length.

) Low false alarm rate: ensuring operational confidence and minimising unnecessary shutdowns.

) Rapid implementation: the system was retrofitted without complex or costly modifications.

Operators reported increased assurance in their unloading operations, noting that the system was ready to collect data immediately and optimised their compliance processes.

The adoption of single-ended leak detection brings several operational advantages. These can be grouped into safety, compliance, efficiency and cost:

) Safety: single-ended leak detection reduces the risk of undetected leaks, protecting the marine environment and ensuring public trust.

) Compliance: by meeting and often exceeding regulatory detection thresholds, operators can demonstrate due diligence.

) Efficiency: simplified infrastructure requirements reduce downtime and accelerate deployment.

) Cost-effectiveness: single-ended leak detection avoids the expense of installing and maintaining offshore instrumentation providing long-term savings.

Taken together, these benefits highlight single-ended leak detection as a pragmatic solution that balances technical performance with commercial realities.

Single-ended leak detection aligns with the industry’s push toward operational excellence and sustainability. By lowering the cost barrier to effective leak detection, it enables operators to extend best practices to assets that might otherwise remain vulnerable. The scalability of the approach means lessons learned in one deployment can be applied across multiple facilities, multiplying the impact.

As offshore energy logistics evolve, the demand for resilient, practical and cost-effective monitoring strategies will only increase. Single-ended leak detection has proven itself as a credible alternative to conventional systems in challenging offshore environments. By combining advanced signal processing with pragmatic infrastructure use, it delivers safety, compliance and efficiency without the need for extensive offshore modifications.

For operators facing the dual challenge of maintaining pipeline integrity and controlling costs, single-ended leak detection offers a compelling solution. Its successful deployment in real-world case studies provides confidence that this approach can bridge the gap between technical aspiration and operational reality. As the industry looks to the future, single-ended leak detection is well placed to play a central role in advancing marine logistics safety.

PROTECTIVE OUTERWRAPS

Pipeline operators face a persistent challenge when planning integrity budgets: how to allocate limited capital across competing priorities while safeguarding safety, compliance, and operational efficiency. Integrity management programmes are critical to preventing failures, yet their budgets often struggle to gain approval against growth projects, acquisitions, or operational upgrades. Traditional requests often rely heavily on technical justification, such as risk matrices, inspection data, and regulatory obligations, but these rarely resonate.

Every capital cycle forces executives to weigh investment options:

) Should the company expand its system to capture new throughput?

) Should it acquire an asset to increase market share?

) Or should it prioritise long-term reliability through integrity projects?

Growth and acquisition proposals are supported by clear financial metrics, projected revenues, IRRs, and net cash flows. By contrast, integrity proposals are often presented as technical necessities, framed around safety risk or regulatory compliance, without a clear estimate of financial return.

The result? Integrity projects risk being underfunded or deferred, creating exposure to safety incidents, environmental damage, regulatory fines, and costly unplanned outages.

A more effective approach translates integrity risk into financial outcomes, showing not only why investment is essential but also when it is a sound financial investment.

At its core, risk is the combination of two elements: