Let me help guide you through the buying or selling process. I am a life-long resident of Huntsville and love this city. I have been a realtor for 23 years. I am very passionate about developing lasting relationships with clients. I truly care about them and their families. I strive to make your experience in moving to, within or from Huntsville as quick and stress free as possible.

Jeanne Allen, Owner and Broker Associate

3508 Memorial Pkwy SW, Huntsville (256) 337-7615

www.findinghuntsvillehomes.com

Thank you for making our work possible.

April is National Volunteer Month, so we would like to say a special thank you to everyone dedicated to serving our community through WellStone. We are grateful for all the volunteers who make our work possible. Thank you for spreading the message of hope and healing, and strengthening WellStone’s mission.

More than 70 volunteer professionals serve WellStone across its five advisory committees and Board of Directors.*

Allison Stark

Amy Bailey

Andrea Guillion

Anna Watts

Dr. Annie Saylor

Ashley Jones

Becky Vansant

Brandy Smith

Byrom Goodwin

Caitlin Campbell

Charles Jones

Cheyenne Sandlin

Chris Dayton

Chris Hinson

Clay Martinson

Corey Wimberly

Danielle Groenen

David Kimrey

*WellStone

Debbie Igou

Eddie Sherrod

Dr. Edith Foster

Elizabeth Lomax

Elizabeth Smith

Dr. F. Lee Cook

Frances Huffman

Grace Potter

Jeff Jones

Dr. Jennie Robinson

Jessica Jennings

Jim Holtcamp

Dr. John Braswell

Chief John Gandy

Jonathan Hall

Josh O’Neal

Justin Burney

Karen Mockensturm

Kayla Clark

Kelly Clary

Kenny Anderson

Kinslee Patton

Kyle Jeter

Lady Smith

Leslie Sharpe

Lindsey Pattillo Keane

Lynne Berry

Marilyn Lands

Meredith Payne

Michael Bishop

Michele Armstrong

Nancy Robertson

Rachel Roberts

Rebecca Moore

Robin Reeves

Sara Dillon

Sidney White

Stacey Scherer

Stratton Hobbs

Stuart Maples

Taylor Propst

Rev. W. Temple Richie, Jr.

Todd Floyd

Tom Albright

Vicky Hinton

Dr. Violet Gilbert

National Volunteer Month

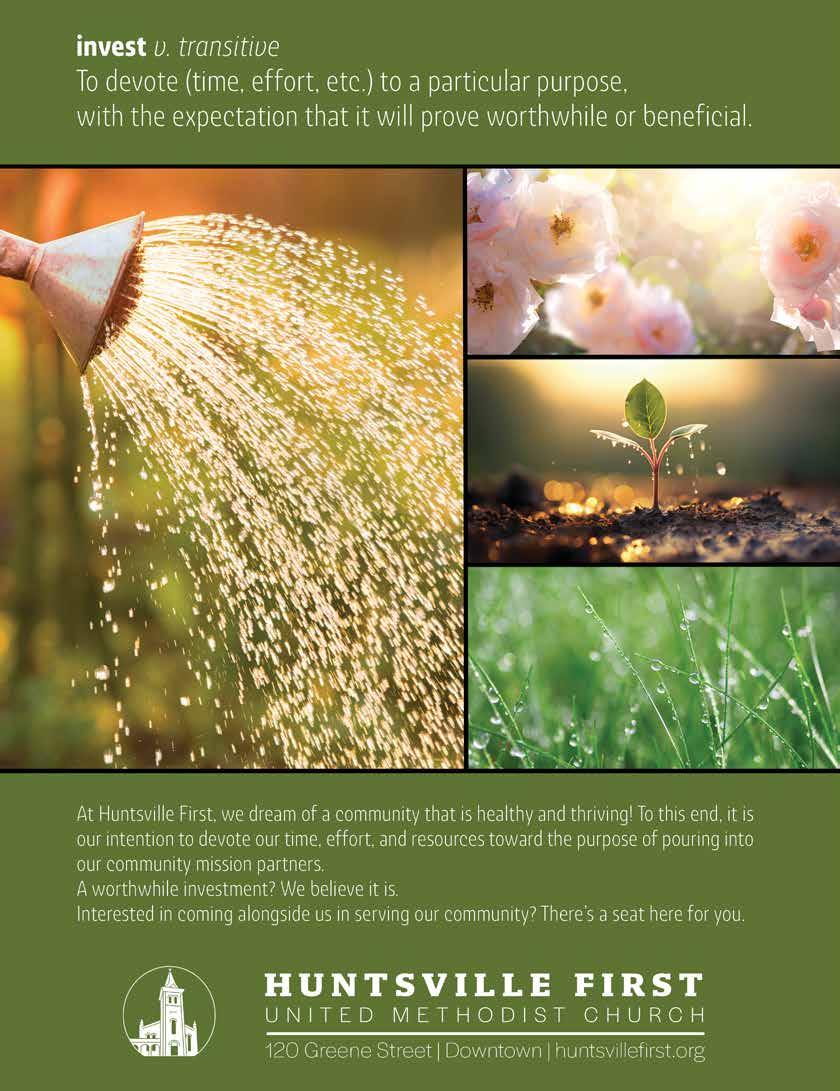

When our communi ty thrives, we all prosper.

Prosperity is about so much more than money. It’s about living well in a community that is healthy and stable. At Morgan Stanley, we feel fortunate to live in a place that is supported by so many worthy service organizations. Their good deeds make everyone’s life richer.

The Mantooth/Pols/Keene Group at Morgan Stanley

Alex Pols

Senior Vice President

Financial Advisor

25 6- 690-5479

Alex.Pols@morganstanley.com

Pennie Keene

Senior Vice President

Financial Advisor

256-690-5801

Penelope.Keene@morganstanley.com

Mark Mantooth

Managing Director–Wealth Management

Financial Advisor

2 5 6- 690-5456

Mark.Mantooth@morganstanley.com

305 Church Street

Huntsville, AL 35801

Imagine living in a community where the outdoors are at your doorstep. Where the sounds of nature surround you as you walk over 10 miles of walking & biking trails. Where you feel tucked away, yet can be at your favorite local restaurants and shops in mere minutes. All of this is possible in Hays Farm. Build your dream home in one of two neighborhoods offering various lot sizes and price points. Contact us today to secure your home and rediscover the nature around you.

Investment is traditionally defined as the commitment of resources to achieve later benefits. By this definition, I cannot help but think of our very own city and the decades of planning, time, and investing that have gone into making Huntsville what it is today - a thriving, bustling hub of businesses big and small, residents who take pride in their home, and young professionals who are choosing Huntsville as their place to build a life.

In this Investment issue we look at what it means to invest in your life. Senior Financial Advisor Alex Pols breaks down how your actions and financial literacy today affect your future. Fitness expert Laken Moore gives us her recommendations for investing in your health. We also discover how one Huntsville woman is following God's calling by investing in other women and this community.

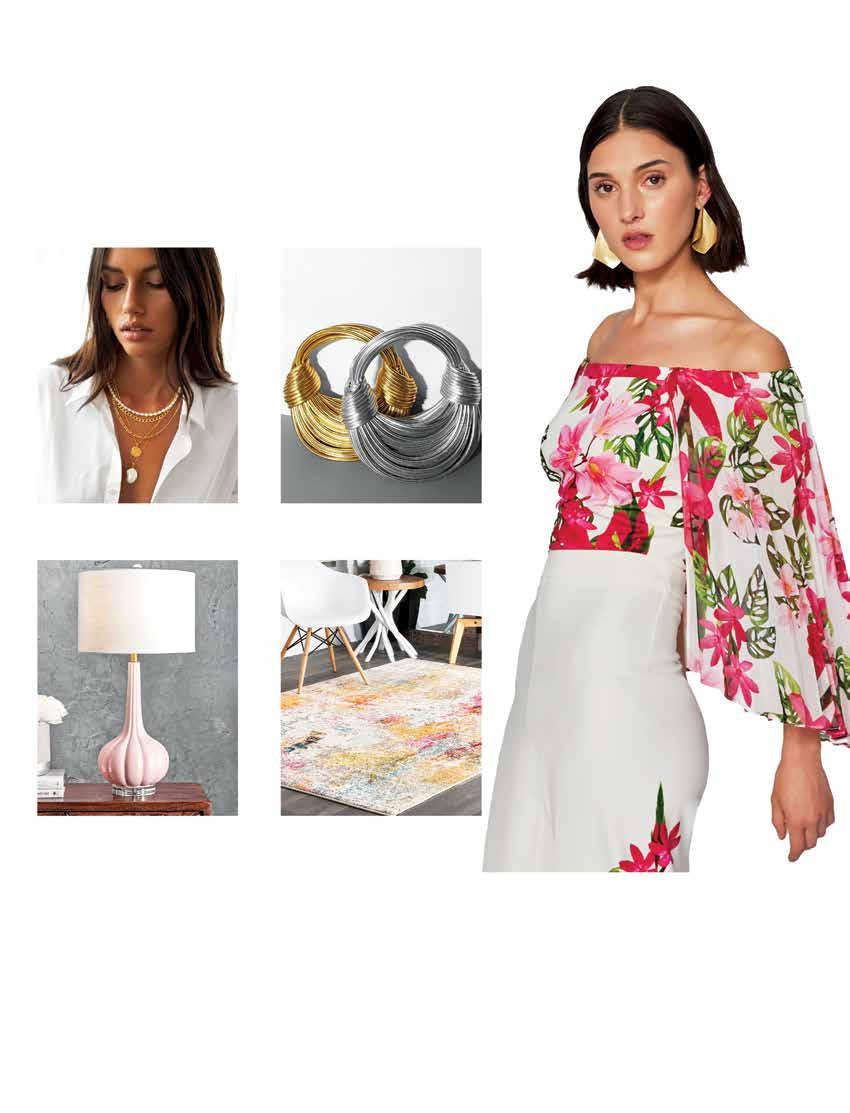

With spring arriving in full force, we have all the Spring Assets to add to your wardrobe from local boutiques. And native Huntsvillian and celebrity stylist Annie Heyward shares her tips on investing in your closet.

Building the life you want starts today. Make good investments in yourself and your community to get there.

You're still taking the time to tell us you love the magazine and we thank you.

"Every month I get so excited to receive this magazine! I just love it!"

"Your one year anniversary party was unlike any party I have ever been to. Everything was on another level."

"Huntsville has never had a publication this elevated. It makes us look so good."

"Not only are the articles something I want to read and feel pulled into reading, the ads are beautiful too."

Long. Live. Print.

Amy Bailey | amy.bailey@citylifestyle.com PUBLICATIONS DIRECTOR

Madeline Sandlin SALES MANAGER

Susan Rogers COPY EDITOR

Mary Nell Cole ACCOUNT MANAGERS

Madeline Sandlin | madeline.sandlin@citylifestyle.com

Susan Rogers | susan.rogers@citylifestyle.com INTERN

Mia Rogers

Nadia Kidd

Sarah Buechler, Sara Covington April 2024

Robinson

1: Abby Knowling, Blair Newman, Beverly Farrington Huntsville City Lifestyle’s ‘Paint The Town Red’ One Year Anniversary Party 2: Hollie Beaver, Dr. Caroline Schreeder Huntsville City Lifestyle’s ‘Paint The Town Red’ One Year Anniversary Party 3: Dr. and Ashley Tomalty Huntsville City Lifestyle’s ‘Paint The Town Red’ One Year Anniversary Party 4: Sonja Enfinger, Amy Bailey, Dennis Kiem, Jennifer Tarkington Huntsville City Lifestyle’s ‘Paint

The Town Red’ One Year Anniversary 5: Ella Reese Selman, Sophie Zeller, Mia Rogers Huntsville City Lifestyle’s ‘Paint The Town Red’ One Year Anniversary Party 6: Nancy Jones, Amy Bailey, Jenifer Pine Huntsville City Lifestyle’s ‘Paint The Town Red’ One Year Anniversary Party 7: Karla Bolin, Kelsey and Rob Buddo Huntsville City Lifestyle’s ‘Paint The Town Red’ One Year Anniversary Party

1: Abby Knowling, Blair Newman, Beverly Farrington Huntsville City Lifestyle’s ‘Paint The Town Red’ One Year Anniversary Party 2: Hollie Beaver, Dr. Caroline Schreeder Huntsville City Lifestyle’s ‘Paint The Town Red’ One Year Anniversary Party 3: Dr. and Ashley Tomalty Huntsville City Lifestyle’s ‘Paint The Town Red’ One Year Anniversary Party 4: Sonja Enfinger, Amy Bailey, Dennis Kiem, Jennifer Tarkington Huntsville City Lifestyle’s ‘Paint

The Town Red’ One Year Anniversary 5: Ella Reese Selman, Sophie Zeller, Mia Rogers Huntsville City Lifestyle’s ‘Paint The Town Red’ One Year Anniversary Party 6: Nancy Jones, Amy Bailey, Jenifer Pine Huntsville City Lifestyle’s ‘Paint The Town Red’ One Year Anniversary Party 7: Karla Bolin, Kelsey and Rob Buddo Huntsville City Lifestyle’s ‘Paint The Town Red’ One Year Anniversary Party

Warren

dedicated

those clients involved in accidents that result in serious personal injury or wrongful death. The number of successful client recoveries alone sets their firm apart. Their case selection and ensuring that each client receives their undivided attention truly make them a cut above.

INVEST IN LOCAL STYLE THIS SEASON IN THESE PASTELS, TWEEDS, SUITS, AND DRESSES

ARTICLE BY AMY BAILEY | PHOTOGRAPHY BY NADIA KIDD

Sophie is wearing a hot pink tweed dress from Serendipity. Sunglasses and bag from Caley Paige.

Jahria is wearing a pink and white tweed short suit from Envy Boutique. Necklace and sunglasses from Caley Paige. Bag from Monkees. Makeup by Nancy Finnegan MUA

Presented by

Thanks to our Tier 1 Sponsors:

WHY DID YOU GET INTO THE BUSINESS?

As a 3rd generation advisor, I grew up watching and hearing about personal investing and insurance. I saw how my grandfather and father helped people manage their financial successes, failure, and encouraged clients to keep investing.

“FOR MANY WHAT YOU DO OR BUY TODAY WILL IMPACT WHEN AND IF YOU CAN HAVE THE RETIREMENT LIFESTYLE YOU REALLY WANT.”

WHAT ARE SOME OF THE BIGGEST CHANGES THAT YOU HAVE SEEN OVER THAT COMBINED EXPERIENCE?

I would say mostly access. When my grandfather (1960s90s) was in the business investing wasn’t easy and was mostly for the well off. Trading stocks and bonds was done by paper tickets and the price you paid for an investment wasn’t clear until after the fact. Access to information was limited and very delayed. You had to go into their office to look at the ticker tape. Where you lived made a difference in terms of the information you received and when. You had to rely on an advisor, investment firm, and analysts to know what was happening inside of a company. During my father’s career access became a little easier on both those fronts. Access for the average person still wasn’t common until the last 1/3 of his career. Access continues to get easier and the information one has access to make decisions has increased. With that said now there is so much information and so many opinions it can be overwhelming for most individuals.

SO IS IT EASIER TO INVEST TODAY?

It certainly is easier to invest. Most people have access to a retirement account through their employer. If not, it is very easy to open an IRA, Roth IRA, or investment account.

Financial literacy to me is the biggest challenge. When my grandfather and father were in the business, they primarily dealt with folks that were interested in investing. Now the blend of investors is different. Because there is so little formal financial education many investors have trouble aligning their choices with their desired outcome.

A great example is when the markets have a big down year like in 2009, 2020, and 2022 I spend a good bit of my time coaching people not to sell. When I should be answering questions like, what I should be buying? Making short term emotional decisions rarely benefits anyone in the long term.

Investing takes effort to do well. Stay organized and follow what you own. The more individual stocks, bonds, funds, or private investments that you own requires more of your time. This is true if you are using a financial advisor or doing it yourself.

CONTINUED >

Literacy also means talking about money. It is a taboo subject in many households and isn’t spoken about enough. I was lucky, my family spoke about it regularly. I remember when my wife was getting to know my family. She was shocked about how open we were about money to each other. What she later learned helped us keep each other accountable.

Alex Pols SENIOR VICE PRESIDENT OF WEALTH MANAGEMENT MANTOOTH POLS KEENE GROUP

Alex Pols SENIOR VICE PRESIDENT OF WEALTH MANAGEMENT MANTOOTH POLS KEENE GROUP

Alex Pols is a husband, father of three, and Senior Vice President of Wealth Management and a Senior Financial Advisor at Morgan Stanley in Huntsville with Mantooth Pols Keene Group. The team manages over 1B in assets for families, Businesses, 401k Plans, and Foundations. The team has over 70 years of combined investment experience, 3 CFPs on staff for planning needs, and access to a risk management and tax management tools through Morgan Stanley.

Let’s take a step back, life now requires mapping out what you want it to look like. The hot topic in my industry is Goals Base Planning and Investing towards your goals. College, Retirement, and other material desires in many cases require years of savings and investing. Just throwing money into your 401k or individual investment account is like jumping in a car to go on a road trip with no destination in mind. Sure you are going somewhere but you might not like your destination once you get there.

College for example, costs have exploded since I went to school. It isn’t something many can fund out of pocket without saving for years. Many will either need to supplement the cost with loans and completely fund it with loans. Covering college for your kids requires planning at a very early stage of parenthood. It also requires one to make some very real decision as to what you can or can afford and educating yourself and your kids on what is financially possible. We all want to give our kids the things they want but in many cases I see parents sacrificing their financial health to send their kids to an extremely expensive school that really won’t change their kids’ career outcomes. The earlier you teach your kids about money the easier those type conversations will go.

Retirement planning is no different. For many what you do or buy today will impact when and if you can have the retirement lifestyle you really want. Planning can help model out these decisions by illustrating how spending and saving today will impact your ability to achieve your goals. We live in a YOLO world today and unfortunately, what I see is many people walking down a path that will lead them to disappointment later in life. As a whole people need to moderate expectations of what thet can have whether it be the house we in live, the car we drive, the college we send our kids to, and the vacations we take.

Put a plan in place. Make a realistic budget and adjust as needed. Plans aren’t static as income, needs, and wants change make adjustment. Understand the impact of large purchase prior to making them. Have fun in life, but you can’t live beyond your means for long.

If you aren’t interested in budgeting, investing and planning hire someone to help you. Teach your kids about these things, be open with them about what you as a family can and can’t afford. Make them work for their allowance. Strong money habits learned early in life can potentially reap huge rewards.

Have an estate plan in place. An estate plan and the appropriate legal documents created with your legal advisor can help ensure your wishes are followed at your passing. Understand who you are leaving in charge.

“Plans to prosper you and not to harm you, plans to give you hope and a future.”- Jeremiah 29:11

From the moment you meet Salley Walker, you feel as if you have met a lifelong friend. She is full of life and energy. She has a glow about her that radiates throughout the room which makes it hard to grasp that it wasn’t that along Salley suffered from immense depression. Following her struggle with God after the death of her son, Sally found herself unable to get out of bed. Until one day when she felt God talking to her about how important it was to tell her son William’s story.

William was diagnosed with bone cancer at the age of 12. His five-year battle was brutal but William was never alone; he knew God intimately. He believed he was going “home “ to God when he died at age 17. William had a powerful story to tell.

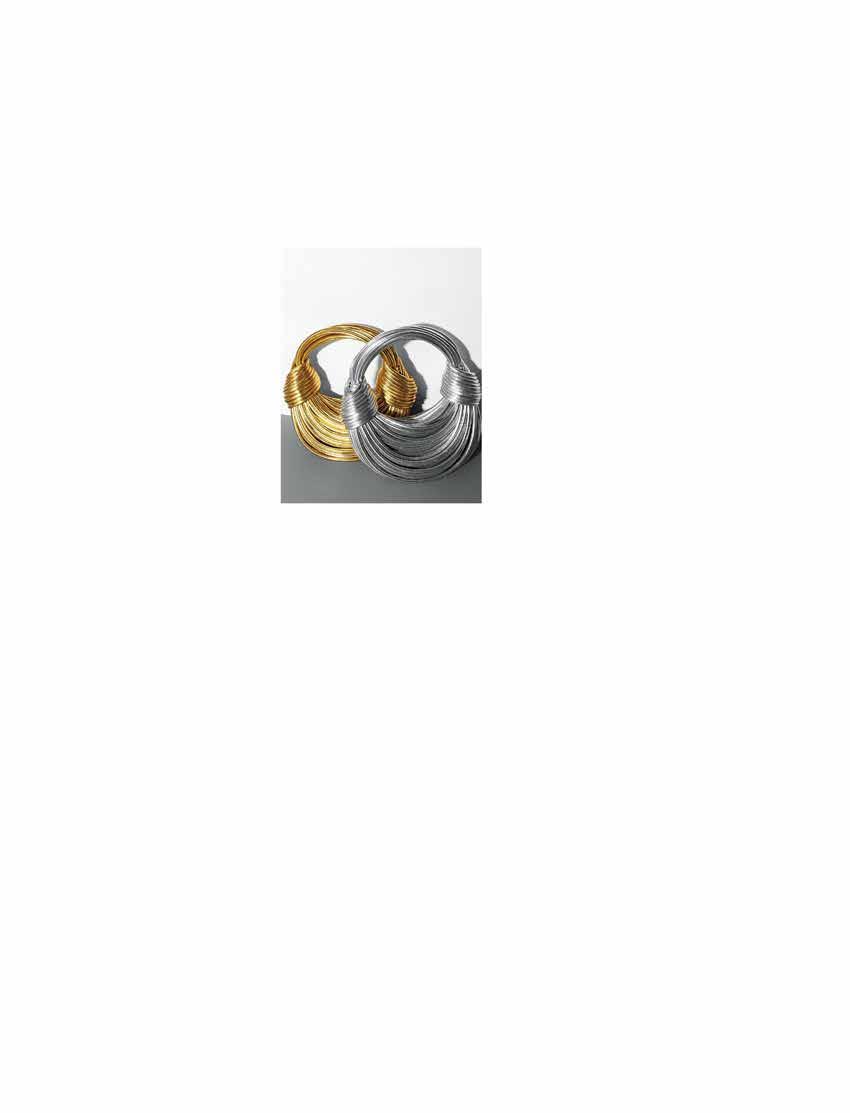

His mother has a powerful story as well, she tells it through the 29:11 Ministry. The ministry has two distinct missions. First, it desires to bring together God’s children, mostly women, of all socioeconomic backgrounds into fellowship. In the 29:11 house, women gather to learn about God‘s plan for their futures. They make beautiful 29:11 jewelry as they share their own individual stories. The house is

CONTINUED >

Salley’s mission is building lives and creating sustainable, steady income for women in the Huntsville community who need a helping hand.

full of laughter and often tears. The women also learn how to run a business. Every day they are learning how to make something of value, market, sell, and decide what to do with the profits of their labors. Much of the profits go back to the women, as the ministry buys the jewelry they create before it goes to market.

The second mission is to spread God‘s Word and His perfect plan as they sell ther 29:11 jewelry collection. Each piece created establishes a spiritual connection between the women, God, and the buyer. These jewelry pieces are reaching beyond their maker’s cottage in Huntsville and being sold in retailers across the United States.

Salley’s mission is building lives and creating sustainable, steady income for women in the Huntsville community who need a helping hand. It is a story of elevating lives that needs to be told near and far. For more information on how to volunteer, donate, or carry The 29:11 Story jewelry collection in your store visit https://www.the2911story.com

Dr. Christopher Parker and his team at Whitesburg Pediatric Dentistry work to create a lifetime of healthy, happy smiles!

Welcoming children 12 months old through the teen years, and offering care for individuals with special needs.

2710

MAY 2024

4:00 - 7:00 pm

Huntsville Museum of Art | Loretta Spencer Hall & Outdoor Terrace

The Derby themed event will have the Derby race on a large screen, live music, and fun filled activities including the ever-popular bourbon-pull and the Bourbon Garden where you can sample bourbons from popular distilleries. There will also be both live and silent auctions that will be filled with exceptionally curated items.

Tickets $95

Includes a souvenir Mint Julep Cup

hsvmuseum.org

4 Celebrate the with the Huntsville Museum of Art Guild Featured

Connect with us on facebook.com/WGHMA hmaguild

Taking care of your physical and mental wellness is a journey, not a checklist! Creating consistency is what will secure your investment.

Find ways to offload and lower your stress. Mentally for me this looks like getting up before my family on the weekdays so I can meditate or spend 10 mins in solitude. Physically for me this means assisted stretching 1x a week. Find what works for you, today we have so many physical wellness modalities in Huntsville. (Examples: Acupuncture, redlight therapy, salt therapy, sound therapy)

Find your tribe or trainer. Accountability is key in staying engaged and committed to a physical fitness routine. It is something most of us love to hate but feel amazing when we have this as a nonnegotiable in our daily/ weekly routine.

Keeping our bodies moving at a low intensity improves so much of our quality of life. Stretching and flexibility improve circulation by increasing blood flow into the muscles and removing the waste and toxins on a cellular level. Benefits from assisted stretching are pain management, increased range of motion, injury prevention, better physical performance, and overall a sustained better quality of life.

1. MANAGE STRESS 2. PHYSICAL FITNESS ROUTINE

Starting the day with water and ending the day with water is important, 2-3 Liters of water a day. I like to add a small amount of sea salt to my water to increase electrolytes and absorption, and I always start each morning with warm lemon water with a dash of cinnamon and honey. This is not just to aid in my gut health and digestive system, but also to prepare my body for the day.

Find a way to keep your circadian rhythm stable. Our bodies crave repetition to restore and rejuvenate.

Sourcing food that is clean and rich in nutrients is a big part of investing in our health and vital in today’s fast society. We are not always able to slow down during busy days, but we can create habits that have lasting impacts on our physical bodies, starting with knowing what we are eating and where it comes from. Spending the extra time to learn about food creates a foundation for overall health.

Hours: Tuesday - Saturday 7am - 4pm

256-808-8163 — www.masondixonbakery.com

415-E Church St NW Suite 5 Huntsville AL 35801

V @masondixonhsv

ANNIE

1. When you look good, you feel good. When we dress with intention and thoughtfully curate our outfit for the day, we will undoubtedly feel more confident in our skin! Taking the time to polish and refine your look by accessorizing; adding the finishing touches will help elevate your outfit overall and add visual impact. When we love how we look, we feel more empowered in our skin and hold our heads higher. Studies have shown it can actually increase self-esteem and improve our posture when we feel confident and comfortable in our clothing!

“When we love how we look, we feel more empowered in our skin and hold our heads higher. Studies have shown it can actually increase self-esteem and improve our posture when we feel confident and comfortable in our clothing!”

2. Planning your outfit in advance saves time and stress. I always tell my clients - dress for your day. What does that look like? Think about where you’re going and who you’re going to see, then dress accordingly. Are you running errands? Corporate presentation then cocktail hour for networking? Work from home then Zoom meetings all afternoon? What’s the venue you’re attending? The dress code? What’s the vibe? Look at the weather prediction for your next day, think about the questions above, and style an outfit around that. Maybe you bring a pair of heels, a statement earring and bold lipstick to throw on to transition your outfit from day to night. The key is - be thoughtful and intentional and plan ahead the night before so you are not stressed and rushed getting dressed the next morning.

3. Clothing tells a story about who we are. How do you want to show up in the world? What the story you want to tell people? How do you want to be perceived? Think of 3-4 adjectives that you would like to be the first impressions others have of you, then dress in a way that communicates those adjectives.

4. Invest in capsule wardrobe pieces. Think about the cost per wear - will you get your return on investment? If you can think of at least 3-5 different ways to style and wear a piece of clothing and/or accessory, it’s worth considering. Can you envision at least three different places you could wear the item? Will the item still feel current and relevant 2-3 years after purchasing? Think classic and timeless, neutral. Stay away from loud prints and trendy design nuances and details. Focus on clean lines, timeless and classic silhouettes and neutral color palettes.

“Remember, not every trend is for everybody, and not every trend is for every BODY. Don’t feel pressured to get on board with all the trends each season - pick a few to incorporate into your wardrobe, but go low-investment.”

5. Go low-investment with trends. Have fun with trends and sample the ones that appeal to you - pass on the others. Remember, not every trend is for everybody, and not every trend is for every BODY. Don’t feel pressured to get on board with all the trends each season - pick a few to incorporate into your wardrobe, but go low-investment.

Annie Heyward is an internationally published celebrity fashion and wardrobe stylist best known for her ability to translate high-end fashion into stunning yet achievable looks for women of all ages, shapes, sizes and body types. Originally launched in Nashville and now based in St. Louis, MO, Annie and her firm work with an exclusive client base across the U.S. with clients in NYC, Dallas, Chicago, Palm Beach, Atlanta, Sarasota, Nashville, Charlotte, San Diego and Los Angeles, just to name a few. Have clothes, will travel!

It’s going to be a great night, gathering with friends, supporting Village of Promise, and hearing the inspiring words of Mae Jemison, MD. Entrepreneur, educator and humanitarian.

Mae Jemison M.D. is at the forefront of integrating the physical and social sciences with art and culture to solve problems and foster innovation.

We have BUYERS actively seeking:

MADISON CITY

5,000+ square feet with pool

Truly looking for a masterpiece!

Budget $1,750,000

BLOSSOMWOOD OR DOWNTOWN

2,000+ square feet with garage

Prefer 3+ bed, 2+ Bath

Budget $850,000

DOWNTOWN HUNTSVILLE OR COVEMONT

2,250+ square feet with garage!

Budget $850,000

FIRST TIME HOMEBUYERS

Livable home

3 bed 2 bath

Budget $180,000 or under

SOUTH HUNTSVILLE

2,500+ square feet

Flat lot

Fixer upper ok!

Budget $350,000

MADISON CITY

2,000 square feet with 2+ garage

3+ bed, 2+ bath

Budget Under $400,000

If you own this home and are even thinking about selling in the next 24 months, call or text Kelsey at (256) 656-6098.

KELSEY ZWACK

kelsey.zwack@kw.com Scan for a tour of properties or visit us on Insta @homehappyhsv

AARTICLE BY SARA COVINGTON

It was the washing machine that did me in the end of January 2023.

Ironically I had prayed for it to break for years so I could get a new one. The GE logo representing General Electric on my once fancy, energy-efficient washer might as well have stood for GENUINELY EXASPERATING as I endured an hour long customer service phone call with the company, where I was instructed to unplug, reset, tap-my-heels-together three times, and in the end, finally accept defeat that after ten years, my machine was, in fact, defunct.

If I were a writer worth my salt, I would have curated a detailed and educational--gentle, but blunt, witty and entertaining, list of self-care tips for a woman in her 40’s for how to manage stress, thrive in mid-life (statistically the demographic reader of this magazine), work, parent, and maintain relationships.

But my washer broke.

And in January of 2023, this simple problem was now a swirling vortex of panic--an irony not un-lost on me as I willed that stupid machine to swirl some suds.

So in truth? I’ve got nothing in the way of sage advice a year later as I now have a new washer, but still mountains of undone laundry. But please... keep reading.

I just know this: at the age of 43, I sat on a Tuesday morning in the floor of my filthy laundry room, willing my washing machine to work. Pressing buttons. Frustrated. Pressing more buttons. And sinking.

And in that mound of dirty laundry, I vaguely remembered a day just a few years earlier when I worked full-time as a sales executive and hiring manager--sitting in my office and being on a conference call, while simultaneously using a breastpump (conference call on mute obviously), sending

multiple emails, handwriting a grocery list, and eating a grilled chicken salad. I’m pretty sure I was sending some snarky texts to friends while all of this was going on as well--my wit still fully intact.

I was quirky and flawed, but calm. I was getting things done.

But on this Tuesday, just a few years later, guilt swirled in my coffee, in place of the dreams Carly Simon famously sang of. Panic peeked out at me from underneath piles of unsorted laundry and mismatched socks. In my messy car full of crumbs, where I used to be able to at least escape my disastrous house after I dropped of the kids in the morning and listen to loud, inappropriate music for a few carefree minutes, despair now seemed to seep from the air vents like a grey fog whispering to me you can’t do this. No place was safe from these unfamiliar, unwelcome emotions. And of all of these new feelings, the guilt was the heaviest. Because I had friends around me shouldering real burdens. The sudden, tragic death of a husband. Divorce. Children with disabilities. The loss of jobs. Health problems. Sick parents. The list went on and on. My children were healthy and thriving. My husband adored me, had all of his hair, and was still the only person in the world I wanted to be married to. I didn’t envy anyone else’s life. I just couldn’t seem to get it together anymore. I could now barely manage to start the dishwasher without needing a nap.

For me, self-care was a predictable list you might find in a women’s magazine or some super cool, always, put together influencer’s latest post--complete with links to her favorite relaxation candles, spa treatments, and affordable Costco cashmere. But now, everything just seemed TOO MUCH.

HOW, do you determine what self-care looks like, when you wake up one day in mid-life and realize you aren’t exactly sure who you are anymore?

CONTINUED >

Because ultimately, it’s unrealistic to assume we can stay the same as we age. Nor should we. Research has shown that chronic stress and trauma changes our brains--affecting our prefrontal cortex, which is the part of our brain that seeks out social interaction. So all those things that used to ease our stress, just don’t do the trick anymore. Girls’ lunches, nights out--for some of us, they can just seem overwhelming. The fact that many of us now have multiple children, careers we attempt to manage from home, houses to help maintain, and let’s be honest--zero tolerance for wasting time, means that the definition of self-care is no longer a pedicure and a glass of Prosecco.

I’m no expert. Truly. Just a woman who has had to learn some new coping and self-care tips. I hope my admittedly rookie advice might help some of you figure out how to take better care of yourself this year. Or at least, help you get out of a funk-because we’ve all been there. So let’s do our best to help each other figure out what self-care looks like. Even if it means using Sud-Share for your laundry for 6 months.

Here are a few of my favorite strategies for taking better care of mid-life Sara: Everyone needs a good counselor. That might mean an actual licensed professional or a really wise friend, someone who knows you well enough to know the difference of when you are just having a bad day and when you are having a certifiably bad day.

Get Rid of the Energy Vampires. The people you surround yourself with should never suck your energy or make you feel less than. If there is a consistent feeling you get with a person or people

where they make you feel wrong, overly-sensitive, or insignificant--Walk away. Life is too short.

Just Say No. I never thought I was a people-pleaser until I entered my 40s. It’s ok to NOT make up an excuse or lie if you don’t want to go to a function. If they are your people, then they will understand when you say, “I love you. But I’m not going. Because I don’t want to.” (It’s also ok to say things like “I would be a terrible room mom at this stage of life because I don’t know how to bake and barely remember my own kid’s birthdays.”)

Forgive and Move On . One of the hardest lessons I’ve learned as someone who worries, is that the people I waste time worrying about, aren’t likely thinking about me at all. It’s true. And it’s ok. Let it go.

Exercise. I have gone through phases of life where I have truly enjoyed the challenges of a good workout where I sweat for a solid 2 hours, and others when it’s all I can do to lace up my sneakers and take a walk around the block. But, the endorphins are mandatory, no matter how minute the activity.

Last but not least...

Surround Yourself with the Goods. Good people. Good activities. Things that bring you joy. That song, “I get by with a little help from my friends”, truer words have never been written. And you don’t need 15 of them. The term “tribe” has become so vastly overrated in my opinion. (Jesus Himself only had like 3 besties..I think?) It simply isn’t possible to build authentic, real, sometimes raw friendships with 15 people. Invest in a few.

If you have a support circle of 1 or 2 or 3 people who get you and love you, keep them close. They will keep you sane. Or at least out of the psych ward.

We believe that rich texture, innovative design and relentless attention to detail are the foundation for every great room. North Alabama’s largest selection of hand-knotted and machine made rugs.

YOU ONLY GET ONE RETIREMENT

Retirement marks the culmination of years of dedication, perseverance and sound financial choices. It's often envisioned as a period of relaxation, exploration and deep connection with family and friends. However, this dream doesn't just manifest. It necessitates forward-thinking and detailed planning, regardless of one's financial status. Amid global economic changes, evolving life expectancies and intricate tax systems, an all-encompassing and strategic retirement plan is more crucial than ever.

A key element of effective retirement planning is diversifying your income sources. While staples like 401(k)s or IRAs are foundational, it's equally important to branch out. Dividend-bearing stocks can provide regular dividends, bonds offer both periodic interest and principal return and real estate, whether directly or indirectly owned, has potential for both rental income and value growth. Private investments can also yield passive income and impressive returns.

Tax considerations significantly influence retirement strategies. Each financial action, from asset sales to account withdrawals, can carry tax consequences. Knowing these details can greatly influence one's overall retirement income. Tactics such as Roth IRA conversions can help distribute tax liabilities over time, allowing for tax-free withdrawals later on. Using strategies like tax-loss harvesting can balance out capital gains, ensuring proactive steps to reduce tax impact.

Annuities have long been recognized as a popular retirement income source. An annuity is essentially a financial contract that can

offer a steady and predictable income, with options that might even extend to lifetime payouts. Available in varieties like fixed, variable and indexed, they often come with tax advantages. However, retirees should also be aware of certain drawbacks. These might include fees and expenses, issues around liquidity, and potential concerns related to inflation.

Delving into the world of Alternative Investments, retirees can consider assets such as hedge funds, private equity and real assets, among others. These investments may promise higher returns and provide diversification away from traditional stocks and bonds. However, the complexities of these investments mean they often come with challenges like illiquidity, higher fees and the need for a thorough understanding of the investment itself.

Delaware Statutory Trusts (DSTs), while not familiar to everyone, can be a potential retirement income source. Historically rooted, DSTs offer a form of passive real estate investment, which can lead to regular distributions. They also open doors to 1031 exchange possibilities, offering tax deferral benefits. But, just like any other investment, DSTs have their limitations, notably the lack of liquidity and the heavy reliance on trust management.

Introduced by the Tax Cuts and Jobs Act of 2017, Qualified Opportunity Zones (QOZs) were designed to spur economic development. Investing in these zones can lead to deferral, reduction and even the potential elimination of certain capital gains taxes. However, they often require a long-term investment horizon, and retirees must be well-versed with the specifics of the chosen opportunity zone.

“USING STRATEGIES LIKE TAX-LOSS HARVESTING CAN BALANCE OUT CAPITAL GAINS, ENSURING PROACTIVE STEPS TO REDUCE TAX IMPACT.”

Rental Income remains a favorite for many looking for consistent returns. Whether through direct property ownership or Real Estate Investment Trusts (REITs), real estate can offer passive income, tax benefits and appreciation. Yet, the responsibilities tied to property management, the uncertainties of market fluctuations and other associated costs must not be ignored.

The backbone of many retirement plans, Social Security Income, provides a safety net for millions. Established with the intent of financial assistance, the amount one receives depends on various factors. There are also strategies retirees can employ to maximize these benefits, such as deciding on the optimal time to claim or considering the implications of working while receiving benefits.

Beyond the immediate realm of retirement, estate planning emerges. This encompasses not just post-retirement arrangements but also asset distribution for future generations or charitable endeavors. Regularly reviewing wills, trusts and beneficiary designations ensures alignment with changing circumstances.

Philanthropy seamlessly integrates with retirement plans. Beyond fulfilling a personal mission to give back, it also carries financial benefits. Using instruments like donor-advised funds or charitable trusts lets individuals make impactful societal contributions while enjoying tax advantages.

You only get one retirement. In the ever-evolving world of finance, staying updated and flexible is essential to ensure the continued relevance and efficiency of one's retirement strategy.

Securities offered only by duly registered individuals of Madison Avenue Securities, LLC (MAS), member FINRA/ SIPC. Advisory services offered only by duly registered individuals of Csenge Advisory Group, LLC. MAS, Csenge Advisory Group, LLC and Impact Wealth, LLC are not affiliated entities. Investing involves risk, including the potential loss of principal. This is intended for informational purposes only. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. Our firm is not permitted to offer and no statement made during this presentation shall constitute tax or legal advice. Our firm is not affiliated with or endorsed by the U.S. Government or any governmental agency.

Every retirement journey is distinct, and each vision merits expert guidance. Impact Wealth is based in Boulder Colorado. You can contact them at Impact@ImpactWealth.com.

APRIL 6TH

Bridge Street Town Centre | 6:00 PM

Fleet Feet Sports and RunningLane are partnering together to make this race bigger and better than ever.

APRIL 7TH

The Royal at Stovehouse | 3:00 PM

Join the Huntsville Ballet Guild for the Third Annual Spring Fashion Soirée on April 7th, 2024 from 3-5pm for an afternoon showcasing the latest fashion from local boutiques and regional designers. For more information visit https://www.facebook.com/huntsvilleballetguild/

APRIL 12TH

VBC Playhouse | 6:30 PM

Jim Parker is the creator and host of the popular series at the VBC Playhouse in Huntsville, AL since 2005 called Jim Parker’s Songwriters Series ® where he showcases the incredible talent of songwriters from Nashville, Muscle Shoals, Atlanta, Los Angeles, Canada and surrounding areas. The dinner-theater atmosphere has created a highly anticipated monthly event where people listen to music.

APRIL 13TH

Mahler and Rachmaninov performed by the Huntsville Symphony Orchestra

Mark C. Smith | 7:30 PM

The Huntsville Symphony Orchestra ends the season with a program of firsts. Performed by Giles Vonsattel, Rachmaninonv's Piano Concerto No. 1 was penned when the pianist-composer was only a teenager. And few debuts have made the impression given by Mahler's ambitious Symphony No. 1, sometimes called The Titan. Visit hso.org for tickets.

APRIL 14TH

Toyota Field | 2:30 PM

Enjoy watching our Trash Pandas take on the Birmingham Barons. It is also Kids Run the Bases night!

APRIL 19TH-21ST

Swan Lake performed by the Huntsville Ballet

Mark C. Smith Concert Hall

Watch our renowned Huntsville Ballet Company perform one of the most beautiful ballets in the world. Visit huntsvilleballet.org for tickets.

APRIL 20TH

MidCity Crawfish Festival

The Camp at MidCity District | 1:00 PM

Enjoy food, music, and games. Thousands of crawfish will be boiled to benefit Kids To Love.

APRIL 21ST

Disney on Ice

Propst Arena | 12:00 PM

Discover the hero inside all of us as Disney on Ice returns with magical adventures from your favorite characters.

APRIL 26TH-28TH

Panoply Arts Festival

Huntsville's Big Spring Park

Huntsville welcomes more than 100 visual artists from various mediums to Big Spring Park for you to browse and shop, along with musical and theatrical acts throughout the weekend.