It is mandatory for a Real Estate Agent, who is dealing with a potential buyer or seller, to hand a copy of this Information Guide to the buyer or seller, and to explain the guide.

(Full copy will be sent separately)

Buying a home can seem a little overwhelming. Allow me to make the whole process easier and smoother every step of the way. By listening carefully to what you need and want in a home, I will become familiar with all your housing and financial needs. I will advise you all the way so you can make informed decisions when you need to.

Fully inform you about the home buying process and traditional real estate practices

Explain the costs incurred in your home purchase and all necessary documents

Work with you as a Client to represent your best interests

Familiarize you with the various forms of financing, refer you to good Mortgage Specialist and Financial Advisors if you wish

Locate the widest possible range of properties for sale

Builders – ask about my money saving clauses when buying a new home

For sale by owners, Knock on doors, Call possible home sellers, Direct target mail

E-mail you daily or immediately any new listings on a personalized ”Property Portal”

Supply you with property addresses for drive-by previews (No need to go through a property you don’t like from the street)

Notify you of price changes on listings already listed

Update you on sales prices on the homes we view to enable you to understand the market

If necessary, pre-qualify all homes for you prior to showing at suitable times to you

Provide expertise on opinion of value of properties of interest, and ability to resell when needed

Advise on positive and negative property influences

Point out material facts on the property including my personal assessment of the home

Before the presentation of your offer, show you a list of all relevant comparable sales before you make your Offer

Advise you on what to Offer, and draft the best possible agreement for your needs

Represent you and present your offer in person, sell you as the best Buyer for the property!

Steer you through conditions necessary to firm up on your offer

Co-ordinate home inspections, status certificates, etc...

Accompany you on extra visits and sort out any problems we see to ensure a smooth closing

Handle any problems that may occur on closing or after closing

Recommend other successful professionals to aid in your move into your new home

Whether you are a first-time home buyer, 10th time home buyer, or an investment property buyer, the best first step in the process is to speak to a good mortgage specialist.

Here are some financing mistakes buyers often make:

1. Thinking you won’t qualify for a mortgage

2. Not knowing all of the down payment choices and first time home buyer programs

3. Focusing on the interest rate too much, rather than the overall financing

4. Not knowing how to calculate a realistic budget

5. Not getting a pre-approval before placing an offer

6. Not knowing all of the closing costs

7. Not having a credit check completed

Second time Buyers who have a home to sell often do not speak with their mortgage specialist before starting their search. It is just as important, if not more, for current home owners and investors, to get advice ahead.

Here are some financing questions for repeat buyers:

1. Can you firm up on a purchase before selling?

2. What is bridge financing?

3. How much does bridge financing cost?

4. Has my credit changed since I last purchased?

5. Can I afford to hold onto my current home as an investment property?

If you haven’t already done so, you should speak with a Mortgage Specialist regarding your price range, and how much you can afford to spend on a home. This information is to help you budget for the costs relating to buying a home. We can refer a great Mortgage Specialist to you!

This estimate hasbeen prepared to assist the Buyer in computing costs. Lenders and other related services will vary in their charges; therefore, these figures cannot be guaranteed.

Most lawyers charge a flat fee (including the title-searching fee), and may charge extra for the mortgage. Make sure you ask what the legal fee includes (more specifically, does it include the title searching fee?) If not, how much will that be? Also, ask the lawyer if he/she will charge extra to act on behalf of the mortgagee and if so, how much. It is most upsetting to find out on the closing date that you do not have sufficient money to close the deal because of legal fees.

DISBURSEMENTS:

(If no title insurance)

There will be other costs that the lawyer will have to pay on your behalf. These include things like photocopies, tax certificate, zoning clearances and work orders, couriers, registering of deed and mortgages, searching title (but not the fee), searching executions, mortgage schedules, status certificate (for condominiums), and other incidentals.

Taxes - if the Seller has paid taxes after the closing date, you would be responsible for repayment to the Seller. Fuel - if the property is heated by oil, then the tank will be filled by the Seller on or before closing, and you will be charged on the adjustments for a full tank of oil (usually 900 litres or $400-$500).

Utilities - all utilities and gas that is metered will be read on closing and the Seller will be responsible up to the date of closing. You will be responsible for the closing date itself.

CLICK HERE FOR GOVERNMENT INCENTIVES

□ The First-Time Home Buyers Incentive

□ New Home HST Rebate

□ The Home Buyer’s Plan

□ First Home Savings Account (FHSA)

CLICK BELOW FOR REGION OF WATERLOO PROGRAMS

□ Funding to Help Buy a Home Program

□ Affordable Home Ownership Program

Up

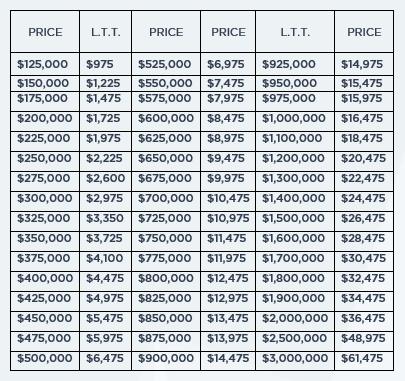

The following numbers are for reference only. Your individual land transfer tax calculation should be calculated and verified by your solicitor. The following chart is based on the Land Transfer Tax (LTT) levied by the Province of Ontario as at May 1996, with updates that commence January 1, 2017. Please note that the provincial land transfer tax can be amended by the Province.

Buying a home is a process, just like learning to drive a car or planning a wedding. If done correctly, it can be a rewarding experience. If not, it can be stressful. We have developed this questionnaire to help us, help you. As a doctor says, "proper diagnosis is half the cure." Please take a few moments to fill out this form so we can do our best to help you make your home or property purchase a rewarding one.

Why are you moving:

When would you like to move in and why?

Do you have a house to sell? Yes No

Is there anything that would keep you from buying a home:

Have you been pre-approved for a mortgage?

Bank/Financial institution:

Do you have a deposit and down payment available if we should find your home quickly?

Price Range:

Is there any reason why you wouldn't purchase a home now?

Have you purchased a home before: Yes No

Was it is good experience: Yes No

If no, why not?

What did the agent do that you liked/disliked:

Do you visit model homes: Yes No

Do you attend Open Houses: Yes No

Do you understand how the MLS system works?

What do you think a Realtors job is?

Do you understand how real estate agents get paid?

Who else is involved in your ultimate decision (parents/friends/ relative)?

What are your must haves in a property:

Where do you not wish to live and why?

What size of home?

Required # of Bedrooms: _______

Required # of Bathrooms: _______

What features are of interest to you, but not must haves: Ensuite bathroom, pool, greenspace, separate entrance to basement, etc

Garage: Yes No

If yes, what size: Double Single Triple Other

School Requirements:

Public: Yes No

Separate: Yes No

French Immersion: Yes No

Are you open to carrying out any work in a home, and if so, how much?

Do you require public transportation nearby: Yes No

What is/are the best time/times for all involved to see homes?

Number of family members who will be living in the same house:

How long do you expect to live in this home?

Try to imagine your needs during this time period. Here are some things to consider.

How many bedrooms do you need?

How many bathrooms do you need?

Do you need space for a home office?

What kind of parking facilities do you need?

For how many cars?

Do you want air conditioning? If so, what type?

Do you want storage or hobby space?

Is a fireplace or a swimming pool high on your list?

Do you have family members with special needs?

Do you want special features to save energy, enhance indoor air quality, and reduce environmental impact?

No matter what type of housing you choose, you must have a clear idea of your needs today, as well as your possible future needs. These are some examples of questions home Buyers might ask:

Do I plan to have children?

Do I have teenagers who will be moving away soon?

Am I close to retirement?

Will I need a home that can accommodate different stages of life?

Do I have an older relative who might come to live with me?

Location is a critical factor. A home with everything you need, in the wrong location, is probably not the right home for you. Here are some things to consider about location.

Do you want to live in downtown, in the suburbs, a small town or in the countryside?

How easy will it be to get to where you work? How much will the commuting cost?

Where will your children go to school? How will they get there?

Do you need a safe walking area, a recreational facility or a park nearby?

How close would you like to be to family and friends?

How well do you know the neighbourhood(s) you are looking in?

Is the walk score for the home important to you?

A sustainable neighbourhood meets your needs, while protecting the environment. Homes in a sustainable neighbourhood are located near shops, schools, recreation, work and other daily destinations. This helps reduce driving costs and lets residents enjoy the health benefits of walking and cycling. Land and services, like roads, are used efficiently. Sustainable neighbourhoods also feature a choice of homes that are affordable.

With affordability being harder and harder to meet, buyers are looking to alternative ownership options to get them into the home owner market.

Here are some alternative home ownership options that may be a consideration and that I can advise you on.

Do you know a family member, friend, business partner looking to buy with you and live with you, or just as an investor. This is a great way to split the cost of buying a home.

If your mortgage approval is $250,000 and your “partner” is $250,000, you now have a combined mortgage of $500,000. If you both have $50,000 saved for a down payment, you now have a price range of $600,000!

This may put you into a 2 bedroom condo or small house.

This market has evolved a lot! There are great programs on the market that help you if you have bad credit, no down payment, or new to Canada.

1. Set up a plan and price range.

2. Search for a property you want to buy.

3. The Rent to Own company buys it.

4. Agree a price to buy it after a set # of years.

5. You live in it and pay monthly.

6. After an agreed upon time, you buy it.

You will need a minimum small down payment and a minimum income.

Most lenders will consider rental income as income toward your mortgage approval. This can change your affordability quite a bit.

Consider renting to a friend, family member, Air BnB, etc...

For every $10,000 rent per year can add approx. $50,000 to a mortgage amount you can apply for.

Whether you rent a room or a complete separate unit, this is an easy way to raise your affordability.

This is for the owner who only needs to live in their home for a set number of days a week, month or year.

If you only use the property on week days for work and find someone who only needs the property on weekends.

You only need the property for one week a month, or one week on and one week off, etc…

This is more common for vacation properties, but can sometimes work for residential properties.

Wondering whether or not condominium living really is the right choice for you? You may love the idea of ditching your snow shovel and lawn mower when you move into a condo, but you might not be so happy about leaving your satellite dish behind to comply with a by-law.

Like most types of accommodation, condominiums have their advantages and disadvantages. Carefully consider all of these pros and cons when deciding whether or not a condo fits with your lifestyle, personality and financial situation. I have noted some pros and cons below…..

THINK OF CONDO FEES AS A MONTHLY BUDGET FOR A FREEHOLD HOME, WHERE YOU SAVE FOR WINDOWS, DOORS, ROOF, PAVING, LANDSCAPING, AND FOR HELP WITH THE SNOW REMOVAL AND LANDSCAPING.

Maintenance and Repair – Fewer large responsibilities financially and personal time.

Amenities - Sauna or swimming pool, extra parking, gym, tennis courts, etc...

Security - Some condominium units have underground parking and controlled entry. Peace of mind while you’re on vacation or at home knowing your neighbours are close.

Budgeting - Monthly maintenance or condo fees are usually predictable.

Price - Townhouse or single detached condos can be less expensive than freehold.

Restrictions - These may sound repressive, but the rules and extra condo by-laws often mean an enjoyable environment, no excessive noise, clean common areas, etc

Maintenance and Repair - You aren’t always in control of when these are done.

Amenities - You may pay for these in your fees and not really use them.

Security - Although nice to have close by neighbours, could be noisier and less private.

Budgeting - Sometimes there are special assessments or other unforeseen expenses that you will have to pay whether you agree or not.

Enhancements - You can be restricted to what changes you are allowed to make to your home externally. Internally, you are usually allowed to do most changes esthetically.

Restrictions - There are more rules and by-laws that come with condominiums such as pets, smoking, BBQs, noise, parking

Click on the 2 Guides below from the CONDOMINIUM AUTHORITY OF ONTARIO for lots of information on condo ownership.

Accessibility - High rise condos can mean carrying groceries up elevators, down hallways, bikes have to be taken to a bike room, not so easy for friends and family to park and get to your home, etc

When the home already exists, you can see what you are buying. Since the neighbourhood is established, you can see how easy it is to access services such as schools, shopping malls, libraries, etc.

Previously owned homes may have extras like central air, decks, patios, window coverings, landscaping, fencing, central vac, appliances, finished basements or swimming pools.

You may need to budget for decorating, renovations or to carry out repairs such as replacing the roof, windows, doors and other mechanicals.

You can negotiate a closing date and know when you are moving in.

A new home has up-to-date design elements that might reflect the latest trends, materials and environmental efficiency.

You may be able to choose certain features such as style of siding, flooring, cabinets, plumbing, electrical fixtures and more.

A new home will have lower maintenance costs because everything is new, and many items are covered by a warranty.

You may have to pay extra if you want to add features, such as a fireplace, finished basement, central air, deck, a paved driveway, etc... Make sure you know exactly what's included in the price of your home.

Taxes (HST) apply to a new home. However, you may qualify for a rebate of part of the HST. For more information about the HST New Housing Rebate program, CLICK HERE

By law, all new homes built in Ontario are provided with a warranty by the builder. Tarion’s role is to ensure that buyers of newly built homes in Ontario receive the coverage they are entitled to under their builder’s warranty. For more information, CLICK HERE

Neighbourhood amenities, schools, shopping malls and other infrastructure may not be completed for years. You may find yourself living with a lot of dirt and dust before the final grading is passed and you are able to have a paved driveway or a lawn.

Buying a new condominium can be years away from being completed. Very often you will have to pay “rent” until the builder is allowed to register the building and condominium. Your circumstances may change in the meantime and you are not always able to assign the agreement of purchase and sale. Speak to your realtor about all of these scenarios.

If you are looking at new homes, be sure to click on the guides to the left to learn about the coverage

TARION offers. It is very important to search the builder to make sure they are registered and are in good standing.

This is a common dilemma for many homeowners who are planning a move. I have summarized some points for you to consider.

Pros: Allows you to search for a new home at a leisurely pace. You are assured of locating your next home before your present property is sold.

You will know how much your new home will cost.

Cons: Offers on your next home may need to be conditional on the sale of your present property, reducing your bargaining power.

You could be “bumped” and lose your dream home (a very frustrating experience).

You will not know exactly how much you will receive from the sale of your present property before purchasing.

You may have less time to sell your present property. The pressure of having to sell by a certain date could result in a lower sale price.

Pros: While your present property is being marketed, you can search for your next home.

You know exactly what you will receive from the sale of your present property.

You'll be in a position to make a better offer on your next home and strengthen your bargaining position.

Cons: Depending on how quickly your present property sells, you may have less time to find a replacement. However, you are still in control and can make provisions in any offer you accept for sufficient time to find a replacement home.

“Together, we can set a plan that ensures your interests are protected at all times.”

1. BE PUNCTUAL - When booking an appointment to view a property, your agent will be given a 30 or 60 minute window to be in the property. You are not permitted to stay outside of these booked times. When viewing numerous properties, it is important to keep an eye on the time. A good agent will make a route of the properties along with the viewing times that have been confirmed by the seller.

2. “SMILE!” YOU MAY BE ON CAMERA! - Many home sellers have door and internal cameras that can monitor what you are saying and doing! Be mindful to keep to constructive criticism and not indulge in personal disparaging remarks about the sellers. Conversations about the features, condition, presentation, any concerns about the property or what you like or dislike about a property is always encouraged.

3. REMOVE SHOES - Sellers usually clean and usually make an effort to show their home to their best ability. Also, in many religions and cultures it is disrespectful to leave on any outdoor shoes when entering a home. You are always welcome to bring slippers for your viewings.

4. BE PREPARED - 30 or 60 minutes is not a long time to view a home if you have to place an offer right away or without a second viewing. Therefore, use your time wisely, have a list of things that are important to you, and go through your list to make sure you look at them all and make a note of any questions that you have for your agent or the seller.

5. NO FOOD OR DRINKS - Many people have very sensitive food allergies and bringing in food could be devastating to the seller or other buyers behind you. Spilling food or drinks could cause damage to the furnishings/carpets in the home, and a disruption to the viewing.

6. NO PETS - Many people have allergies to pets, whether the seller or other buyers behind you. Some pets may be disorientated or excited by something in the home and make a mess. If it cannot be avoided, and your pet has to be brought in, then tell your agent and they will have to get permission from the seller. Sellers will usually insist on a leash and/or carry the pet.

7. EXTRA FRIENDS/FAMILY - Sellers often have limits on how many people they want in their home at a time. If you plan to bring any extra adult family members, please advise your agent. They may need to get permission from the sellers.

8. CHILDREN - It is always best to try to not bring children to your viewings, especially if you have a tour of homes booked, they are usually a distraction from what you need to be focusing on. If you do need to bring children, please coach them on the rules for viewings, to stay next to you at all times, not run around ior touch any personal items, sit on any furniture, etc

9. NO “SNOOPING”! - Sellers expect that a potential buyer will want to inspect anything that they are buying, so opening cabinets, cupboards, appliances, etc… is appropriate. However, opening personal furniture items, or touching clothing, etc is not acceptable. We may have to move certain furniture or boxes, etc… to see walls, but ask your agent before doing so.

10. PHOTOS AND VIDEOS - Most properties for sale have good videos and photos available online, however, if you do want to take extra ones, you must ask for permission ahead of time.

11. DOOR LOCKS - If you unlock a door, please ensure you lock it again. If you turn anything on or move anything to inspect it, please ensure you leave a home as you find it.

1. FAILING TO CHOOSE A GOOD, FULL TIME, EXPERIENCED REALTOR. Not all REALTORS are the same! Interview a few, or ask a friend or relative for a referral, and ask why. Research your Realtor online, read their reviews, check www.reco.on.ca for any complaints against the them. For many, many, Realtors, real estate is their 2nd job! If so, you will not be able to get a hold of them when you need them, and they don’t have time to keep properly educated. Ask any Realtor you are considering if they have any other job.

2. NOT HAVING A COMPARATIVE MARKET ANALYSIS PREPARED BEFORE OFFERING

Before you make an offer to purchase that special home, you should have a good idea what the market value is to ensure that you do not overpay. This is the same information the Seller receives when deciding on an asking price. Wouldn't you like to have access to the same information?

3. FAILING TO RECOGNIZE DIFFERENT NEGOTIATING STYLES AND STRATEGIES. Many Buyers think that the way to achieve a fair purchase price is by starting the offer too low. This is the strategy of the Buyer who is not in possession of all the facts essential to negotiating the best possible deal. Many times, that type of strategy will frustrate negotiations and lead to inflexibility on the part of the Seller - or worse yet - failed negotiations!

4. FAILING TO HAVE THE HOME INSPECTED BY A COMPETENT HOME INSPECTOR.

Buying a home is a major purchase usually made after spending just half an hour looking at the home. It is worth ensuring you will not be surprised later with deficiencies costing thousands.

5. NOT READING AND UNDERSTANDING ALL OF THE PAPERWORK.

It is important to understand completely the terms of the Offer to Purchase. Wrong assumptions, poorly written or missing clauses, and not understanding how the clauses affect the purchase, can lead to increased costs or a void contract.

6. LETTING EMOTION CLOUD REASON.

Buying a home is an exciting time and is usually an emotional decision. It is important that facts and reason validate those emotions. An experienced REALTOR will help to remove the emotion from the negotiating process and provide you with the information you need to make the right decisions.

7. FAILING TO TAKE THE STEPS TO BE FINANCIALLY PRE-APPROVED….

Having an interest rate guarantee before looking at homes and knowing how much you can comfortably afford will ensure you are looking in the right price range and prevent you from buying a home that will strain you financially and emotionally. It can be heartbreaking to negotiate an accepted agreement only then to find there are problems with your financing.

8. FIGHTING FOR THE LAST “PENNIES”.

No one wants to feel they are paying too much, or letting their home go for too little. Buyers find it hard to step back and accept that last $1,000 or $2,000 higher sign back. Try to remember how much those last few thousands are going to cost you per month over the next 10-20 years. Is it worth losing the home for that small difference?

“

1. There is a lot of time that goes into assisting a Buyer when buying a property. A lot of hours in explaining the paperwork, showing homes, conducting market research, arranging mortgage pre-approval, liaising with lawyers, home inspectors, property managers, seller’s agents, City departments, drafting all of the paperwork, negotiating the offer, etc

2. If, when buying private, you believe the Seller, who doesn’t know you, wants to save you money, you’ve probably got it wrong! A Seller selling privately wants to save himself money –not you, and sometimes he robs himself in the process. Majority of Private Sellers are selling privately as they believe their home is worth more than Realtors have told them.

3. However, the big question is, when you buy private, who’s representing your interests? A Realtor must adhere to a rigorous code of ethics set forth by CREA and RECO. A Private Seller is not so constrained or under any obligations, including your privacy when dealing with other buyers. The have no time restraints, especially as they are usually dealing with their lawyer, which can be days to get a response when negotiating an offer.

4. Your lawyer will handle the legal paper work and protect you, but what about the home you’re buying? Lawyers do not visit the property, so they can’t give any expertise or advice on the property. You may like its physical appearance, but there are other things which must be sound before you make the purchase. External and internal influences that you may not be able to be objective about.

5. A Realtor can help eliminate red tape, speed up the process, and keep legal costs to a minimum. If you are not using a Realtor to draw up your contracts and collect other legal documents, a lawyer will have to do it for you, and they will charge you accordingly.

6. Buyers can remain secure in the thought that although a Seller may leave town, your Realtor will be there to help out should a problem arise after closing.

7. Realtors look after your interests – right up to the end and beyond. If problems crop up at the time of closing, they are there as buffers, and will leave no stone unturned to set things right. They will also advise on useful alternatives – all at no cost to Buyers.

8. It has become more and more “risky” for Mortgage Companies to lend on Private Sales, and there is often the added expense of a full appraisal when a property is not listed through a Licensed Real Estate Brokerage.

9. There are many people out there who mistakenly believe that buying a house privately means saving money. This is certainly not so, no matter how much the Seller tells you that you’ll be saving money together with him. The rationale is simple – why will someone who doesn’t know you, want to save you money?

“IF YOU SEE A PRIVATE SALE, LET ME KNOW, MOST SELLERS WILL WORK WITH A BUYER AGENT“

MAKE A NOTE OF THE DATES THAT THE CONDITIONS ARE DUE AND BE SURE YOU UPDATE US WITH HOW TO CONTACT YOU AT ALL TIMES.

BE AVAILABLE TO SIGN ANY PAPERWORK NECESSARY.

Contact and notify your mortgage specialist/company and make sure that they have all financing approved by the date of the condition, if there is a condition. We will forward any paperwork necessary to your mortgage specialist.

Make yourself available for any home inspection necessary, and remember to bring your wallet. The cost ranges from $400-$700. I will arrange the Inspection for you.

Who will be your lawyer? You need to arrange for a lawyer.

Contact your lawyer to notify them that you have purchased a home and wish them to act on your behalf in the transaction. We will ensure all your paperwork reaches your lawyer’s office.

Contact your mortgage company to notify them.

Book a moving van and/or company.

Make a list of everyone you need to notify with your new address, friends, family, insurance, clubs, doctor, dentist, schools, utilities, etc (see list included in this handbook)

4 weeks before you close, notify post office and fill out change of address forms.

Arrange to disconnect utilities, phone and cable at current home and to connect utilities at new home.

2 weeks before closing, arrange for home insurance on new home and cancel old home insurance.

1 week before closing we will call you to arrange a final inspection of the home you have purchased. This is usually carried out 1 or 2 days before closing.

Home Inspectors

Kevin Green - 519.590.1227 www.greentrustservices.ca

Carson Dunlop - www.carsondunlop.com

Rick Clayton – Real Home Inspections - www.realhomeinspectionsontario.com

Lawyers

Don Travers - 519.744.2281 www.traverslaw.ca

Victor Hussein - 519.744.8585 www.vhlaw.ca

Mark Weisleder - 1.855.466.3801 www.realestatelawyers.ca

Richard Cooper - 519.579.2250 www.richardcooperlaw.ca

Home organization, décor, event planning, staging, downsizing

Christine - 519.222.2468 - 4bidding downsizing support, cleaning, organizing, movingwww.4bidding.com

Bank and Mortgage Brokers

Dan Simpson - Dominion Lending - 519.570.8807 www.dansimpson.ca

Stephen Green - 519.500.1789 - www.thefinancialcollective.ca

Kathy Clemens - 519.572.5836 www.scotiabank.com

Handyman, Electrical, Plumbing

Chad Lovell Electrician - 519.588.7750 - www.fopalelectric.ca

B J Electric - 519 885 5030 - www.bj.electric.ca

Andrew Karpenko- plumbing/general maintenance - 519 745 0997 arkarpenko@hotmail.com

Martin Comfort Zone - Gas line installation - 519.546.7570

Moe Mota – tile/builder/handyman - 519.572.9957

Markle Heat & Air - 519.885.9191 - www.markleheating.ca

Insurance Brokers

Reg Voisin – North Blenheim Mutual - 519.744.5119 www.northblenheim.com

Chris McCullough - Ayr Farmers Mutual - 519.279.1371 www.ayrmutual.com

Canadian Mortgage and Housing Corporation (CMHC) - Guides for Buying/Owning A Home

Waterloo District School Board

Waterloo Catholic District School Board

Region of Waterloo School Boundaries

Which School Will My Child Attend and Student Transportation Services Waterloo Region

City of Waterloo - Planning, Zoning, By-Laws, Surveys, etc...

City of Kitchener - Planning, Zoning, By-Laws, Surveys, etc...

City of Cambridge - Planning, Zoning, By-Laws, Surveys, etc...

Wellesley Township - Planning, Zoning, By-Laws, Surveys, etc...

Woolwich Township - Planning, Zoning, By-Laws, Surveys, etc...

Wilmot Township -Planning, Zoning, By-Laws, Surveys, etc...

Service Ontario for Driver’s License, Health Card, License Plates, etc...

Canada Post - Change my address or forward my mail

Grand River Transit (GRT) Bus Schedules

Grand River Transit (GRT) Ion (LRT) Schedules

Go Transit - Kitchener Station

Cycling & Walking trails, E-Scooter & E-Bikes Information - Waterloo Region

Grand River Conservation Authority (GRCA) - Map My Property

Region of Waterloo Waste Management and Recycling Guide

Enbridge Gas

ENOVA - Kitchener Wilmot, Waterloo North, Wellesley and Woolwich Hydro

Kitchener Utilities for Natural Gas, Water, Stormwater, Sewer and Hot Water Heater Rentals

Grandbridge Energy+ - Cambridge and North Dumfries Hydro

Reliance Home Comfort - Hot Water Heater Rental

St Mary’s General Hospital

Grand River General Hospital

City of Waterloo Residential Rental Licensing Information

Region of Waterloo - Before You Dig

Waterloo Regional Police including City of Kitchener, Waterloo, Cambridge and Townships

Explore Waterloo Region - Festivals, Attractions, Things To Do, etc...

The best answer is everybody and anybody who is remotely interested in knowing your new telephone number and home address. If you notify the post office only, they will simply forward your mail (at a cost, for a maximum period only). The post office will not notify others of your new address. That is your responsibility.

Home/Auto/Life Insurance

Cell Phones and Landline Provider

Cable and Internet Provider

Hydro/Water/Gas and other Utilities

Hot Water Heater rental or other rented item company

Service Ontario for Driver’s License and Health Card

Revenue Canada

Your Employer

Children’s Schools/Babysitter/Day Care etc. – ensure that your children’s records are transferred.

Banks/Financial Institutions/Credit Cards

EMPLOYERS:

HOME DELIVERY AND OTHER SERVICES:

□ BOTTLED WATER

□ WATER SOFTENER

□ PAPER CARRIER

NEWSPAPERS AND MAGAZINES:

□ LANDSCAPER/SNOW REMOVAL

□ SATELLITE TV

□ INTERNET SERVICE PROVIDER

(Hint: Magazines usually require 4-6 weeks notice. They also like you to send them the mailing label that they affix to your magazine)

CLUBS, AFFILIATIONS, UNIONS, AND OTHER MEMBERSHIPS:

(Hint: Don’t forget Buying club cards, Outdoorsman cards, Gym memberships, Your favourite club mailing list, Children’s sport teams and clubs, Automobile registration for recall notices, etc.)

SCHOOLS, DAY CARE, BABYSITTERS AND CHURCHES:

(Hint: Once you know the name, address, telephone number, principal of the new school, ensure that your children's school records are transferred)

BANKS, FINANCIAL INSTITUTIONS, CREDIT CARDS:

(Hint: Don’t forget those annual insurance policies, forgotten savings accounts, RRSP, RESP, Revenue Canada, etc.)

□ Call Charities for pick-up of unwanted clothes.

□ Check to make sure you have returned all rented items.

□ Transfer or resign club memberships.

□ Verify your moving in date with your new landlord/estate agent.

□ Repair minor damages to home

□ Prepare a list of items you'll need immediately at destination, such as a flashlight, light bulbs, toilet paper, cleaning supplies, snacks and drinks.

□ Get packing paper, pad for inventory, and marking pens, boxes, and twine for packing belongings.

□ Drain fuel from the lawnmower and other machinery. Safely dispose of all gasoline, matches, paints, aerosol cans listed in our booklet Handling Dangerous Goods.

□ Complete Change of Address form

□ Confirm hotel/ motel reservations for your trip.

□ Ask your bank to transfer your accounts to the branch nearest your new location.

□ Set aside and label items such as luggage that you do not want packed or moved.

□ Notify existing services i.e. Hydro, Gas, water, Phone, Cable/Satellite, lawn service

□ Take down curtains, blinds, rods, shelves. Unfasten any fixed carpets that are to be moved.

□ Notify Doctor, Dentist, Lawyer

□ Clean fridge one day before move; clean stove.

□ Notify Finance & Loan institutions, Credit Card, Insurance Clean rugs and drapes.

□ Notify Non-government supplementary health plan

□ Set aside things you will carry in car in carton marked "Do not load".

□ Notify loyalty programs

□ Take down any fixtures fastened to wall.

□ Notify Canadian Revenue Agency (CRA)

□ Get utilities turned on, or meters read.

□ Notify Vehicle registration and licensing agency

□ Arrange to have sufficient cash and/or travellers' cheques to cover expenses until you're in your new home.

□ Make sure you have your Passport(s)

□ Notify Cell Phone company

□ All meters read

□ Notify existing & New Internet Supplier

□ Furnace turned down in the colder months or off in the warmer months

□ Notify Library, Book & music clubs

□ Make sure you have your children's school records.

□ Arrange for a yard sale for unnecessary belongings.

□ Make sure you have your Insurance policies.

□ Arrange for work that has to be done at new home.

□ Prepare a floor plan of your new home and make extra copies.

□ Keys left as agreed with new residence

□ Plan a going-away party for your children and their friends.

□ List claims for lost or damaged articles.

□ Plan a going-away party for you and your friends

□ Get appliances hooked up.

□ Collect items being cleaned, repaired, stored and loaned to friends.

□ Double check rooms, closets, drawers, shelves, outdoor areas and garage to make sure you've taken everything.

□ Return library books.

□ Give your new phone number and an alternate contact to your mover before they leave.

□ Notify Schools

□ Pack your former town's phone book for future correspondence

□ Notify Subscriptions including Newspaper

□ Make sure you have your moving related documents.

□ Make sure you have your Medical and Dental records.

□ Assure you have adequate insurance for goods in transit. Make sure you have your Automobile ownership.

□ Notify new services i.e. Hydro, Gas, water, Phone, Cable/

□ Satellite, lawn service

□ Notify Garbage (special pick-up)

□ Lights turned off

□ Notify Lawn/garden services

□ Windows and doors locked

Let us know which lawyer you will be using. Advise your lawyer that you have a firm Agreement of Purchase and Sale. We will forward your paperwork to them.

If buying, contact your insurance company and provide them with the details of your new home. Your insurance broker/company will give you a ‘binder’ letter certifying that you are covered. You cannot get a mortgage without this letter.

If selling, advise your insurance company of your closing date. We suggest that you not cancel your insurance until a couple of days after closing, just in case there are any delays or complications with your closing. (This almost never happens, but better safe than sorry)

□ Contacted movers for free estimates (domestic and international)?

□ Sorted through basement, loft and garage?

□ Resolved what to do with prohibited items?

□ Planed ahead for air travel.

□ Disposed of the things you don’t want to take?

□ Considered having a garage sale?

6 WEEKS BEFORE YOU MOVE, HAVE YOU…

□ Called the mover and reserved your move date?

□ Separated favorite toys?

□ Advised carrier if you purchased any new household goods?

□ Decided which clothes travel with you?

□ Started to dismantle outdoor play equipment?

□ Started to make list of items to take with you (documents, medical records, etc.)?

□ Made arrangements of connection of services at your new home?

□ Found new homes for your plants.

□ Depleted the food from your refrigerator/freezer?

□ Planned simple meals for moving day to avoid using appliances? (Paper plates/plastic utensils)

□ Separated luggage items you need for personal travel.

□ Cleaned garden tools, bicycles and any other gardening equipment.

□ Emptied the tanks of powered tools such as mowers.

□ Checked to see if you have enough medication for at least two weeks, and ensure you have copies of any necessary prescriptions for use at destination.

□ Obtained travelers checks?

□ Arranged for someone to look after the children and/or pets on moving day.

Please take the time to familiarize yourself with the paperwork that you will be required to sign throughout your home purchase. Being familiar with all of the preset clauses and type will allow us more time to focus on what we add to your Agreement. The paperwork is updated regularly to meet updated and new legislation, I will send you the paperwork separately.