MAROONDAH

By Joe Lam

Every year, as November approaches, a unique energy fills the air in Melbourne’s eastern suburbs. It’s not solely the anticipation of warmer weather—it’s the onset of the Maroondah Festival, one of Victoria's largest community events. On Sunday, 9 November 2025, Town Park and Civic Square in Croydon will once again become a vibrant center for music, food, culture, and creativity. From 10 am to 4 pm, the festival will invite families, friends, and visitors to enjoy a day full of excitement, joy, and a

COLUMNIST CONTRIBUTORS

COPYWRITER / ACRREDITED EDITOR

Are you our next Copywriter? ?

Are you our next Wedding Planner? ? ?

Are you our next Life Coach?

Are you our next Bookkeeper?

CLUB SPONSORS

joanna srtybosch erryn langley

JODIE

About the Find Maroondah

By Warren Strybosch

The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

The

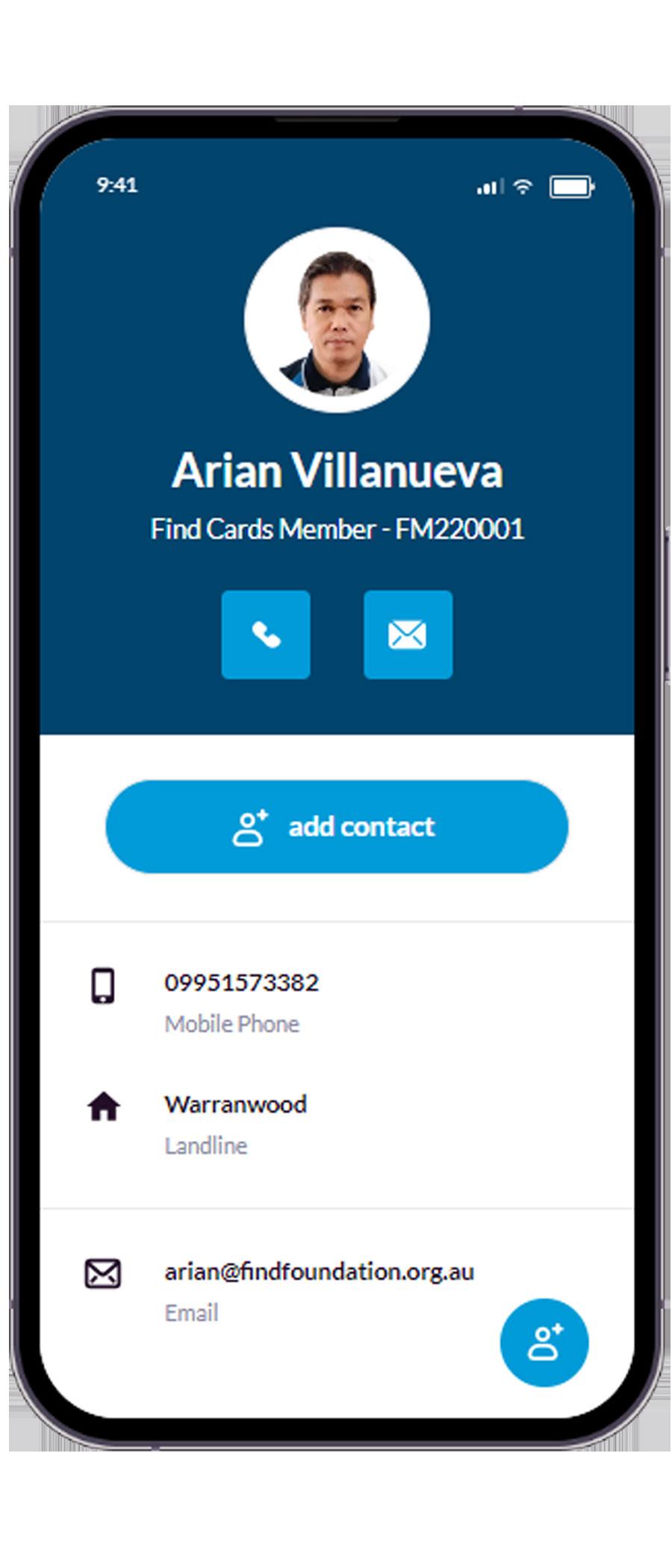

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

Maroondah

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

OUR NEWSPAPER

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

ALL THINGS MAROONDAH

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

ACKNOWLEDGEMENT

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

DISCLAIMER

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in

Maroondah Festival 2025: A Day of Culture, Fun & Community

By Joe Lam

Every year, as November approaches, a unique energy fills the air in Melbourne’s eastern suburbs. It’s not solely the anticipation of warmer weather—it’s the onset of the Maroondah Festival, one of Victoria's largest community events. On Sunday, 9 November 2025, Town Park and Civic Square in Croydon will once again become a vibrant center for music, food, culture, and creativity. From 10 am to 4 pm, the festival will invite families, friends, and visitors to enjoy a day full of excitement, joy, and a strong sense of local pride.

A Festival with Heart and History

The Maroondah Festival isn’t just another event on the community calendar— it’s a tradition that’s been running since 1990. What started as a modest gathering to bring neighbors together has now grown into one of the largest council-run festivals in Victoria. Over the years, it’s drawn crowds of up to 30,000 people, proving that its mix of culture, entertainment, and inclusivity is something the community can’t get enough of.

For many locals, the festival is more than a day out—it’s a chance to reconnect with the neighborhood, discover new artists, support small businesses, and celebrate everything that makes Maroondah unique. It’s the kind of event that creates lasting memories for kids and adults alike.

What’s Happening in 2025?

If you’ve been before, you’ll know that no two Maroondah Festivals are ever quite the same. The lineup for 2025 promises to be one of the most vibrant yet, with something for absolutely everyone.

Live Performances

The main stage is always the beating heart of the festival, and this year, it’s set to showcase a diverse mix of talent. Expect everything from local school choirs and dance troupes to emerging indie bands and well-known headline acts that will have the crowd singing and dancing along. Think toe-tapping jazz, high-energy pop, soulful ballads, and maybe even a surprise DJ set to close out the afternoon.

Food Heaven

Let’s be honest—no festival is complete without incredible food. And Maroondah Festival always delivers. Foodies can look forward to an array of food trucks and cultural stalls serving up everything from classic Aussie barbecue and woodfired pizzas to dumplings, curries, churros, and vegan delights. The famous community cake stall, run by local volunteers, will be back as well—so get in early before the homemade slices sell out!

Market Stalls

Love a good browse? The festival marketplace is a treasure trove of local creations. Handmade jewelry, sustainable fashion, artisan candles, quirky homewares—you’ll find it all here. It’s also the perfect place to pick up some early Christmas gifts while supporting small businesses and makers.

Family Fun & Kids’ Activities

Families are truly spoiled at Maroondah Festival. Younger visitors can jump into craft workshops, storytelling sessions, face painting, and interactive games. The carnival rides always pull a crowd, while the petting zoo is guaranteed

to melt hearts. This year, there’s also a dedicated “Junior Stage” where kids can show off their talents, from singing to magic tricks.

Community & Culture

At its essence, the Maroondah Festival focuses on honoring diversity and the spirit of the community. Civic Square will once again serve as the venue for the Community Hub, where non-profit organizations, local clubs, and cultural groups will set up booths to showcase their initiatives. This offers an opportunity to learn, engage, and even sign up for volunteer work. Throughout the day, various workshops will be conducted, allowing attendees to explore activities ranging from drumming and dance to sustainable living practices. The Cultural Precinct will showcase performances by various cultural groups, providing a vibrant insight into the traditions and narratives that shape Maroondah's identity.

Why You Shouldn’t Miss It

The enchantment of the Maroondah Festival is found in its unique vibe. It’s the image of children clutching fairy floss, the melodies floating through the park, the aroma of grilled delicacies, and the cheerful sounds of families lounging on picnic blankets. It’s a gathering place for old pals to reconnect, new relationships to blossom, and everyone to feel part of a larger community. Whether you’re drawn in by live performances, delicious food, unique shopping, or simply the pleasure of a sunny day out, the Maroondah Festival has a knack for delighting visitors. It’s one of those occasions where you can stroll in without a set itinerary and depart with a satisfied stomach, a collection of goodies, and a grin that lingers well beyond the event.

Isn’t our foliage better left in the trees?

By Liz Sanzaro

A question that many have asked as the chainsaw gang arrive with the chipper to do mandatory Line Clearance, leaving

It is frustrating when a limb falls onto lines interrupting power to regrowth is more prone to do this than the original growth, because each pruning generates “recovery growth”.

When epicormic sprouts are removed, it triggers more of them to grow as the tree will need more photosynthetic tissue to compensate for the wounding, thus defeating the purpose of removing them in the first place.

A compromise solution is now on the table in New South Wales. Ausgrid, which controls large swathes of powerlines in Sydney, has proposed a $20 million jointly funded program to use aerial cable bundling.

City of Sydney councillor Jess Scully is backing the proposal, which would require councils to chip in between 30 to 50 per cent of the cost.

"Anyone who has seen a tree that they love on their street receive the giant bonsai treatment and get hacked to within an inch of its life has felt that pain," Cr Scully said.

Adopting aerial bundling will significantly reduce the space needed as the twisted cables with heavy duty covering are

2021 possums caused 441 power outages.

Recently CCS heard from Dr Greg Moore who has been frustrated by Victoria hanging onto the code of practice that determines the unnecessary pruning. Below is a direct transcript from this link. https://makevictoriagreener.org.au/

The Victorian Government is seeking to overturn an overwhelmingly endorsed recommendation from its own expert review committee (ELCCC) comprised of industry and technical experts and globally recognised botanist and ecologist,Victorian, Dr Greg Moore OAM. The proposal, at no cost to taxpayers,aims to reduce the amount of tree trimming around power lines across urban and regional areas and around transmission lines.

However, this unanimously endorsed proposal is being opposed by Electricity Safe Victoria (ESV), under portfolio Minister Lily D’Ambrosio, Minister for Climate Action. Despite 6 months of interaction between the committee and the ESV, no explanation has been offered for the opposition.

Maroondah Council along with Boroondara and other treed municipalities are working through the Municipal Association of Victoria to achieve a much better outcome, since trees on private land are likely to be reduced due to increased density housing. This is the type of issue that CCS takes on, lobbying for a better future.

Contact your Councillor to discuss this topic if you are concerned at the loss of foliage in your street trees.

By the way, there has been no incidence of fire caused by branches contacting low voltage power lines, it only applies to high voltage lines according to Dr Moore a well informed member of the committee.

https://www.maroondah.vic.gov.au/About-Council/ Councillors-and-wards/Your-Councillors

Liz Sanzaro

ACCOUNTANT

By Warren Strybosch

Recently I had a discussion with a new client regarding income earned from overseas sources. It turns out the client had assumed she did not need to declare the income in their Australian return because it was already being taxed within the country where the income was being generated. However, this is not the case.

Each year, thousands of Australians inadvertently make a costly mistake when lodging their tax returns — they forget to include income earned overseas. Whether it’s salary from a shortterm posting, rental income from an investment property abroad, dividends from international shares, or pensions from a foreign government, the Australian Taxation Office (ATO) has made it clear: all worldwide income must be declared.

ATO Reminder: Worldwide Income

The ATO recently issued a timely reminder for taxpayers and their advisers. When preparing tax returns, it’s important to check if any foreign income has been earned. This income needs to be converted into Australian dollars and reported in the return, regardless of whether it has already been taxed in another country.

The good news is that if tax has already been paid overseas, taxpayers may be entitled to a foreign income tax offset, reducing or eliminating the risk of being taxed twice. This is designed to ensure fairness for Australians who earn legitimately from global sources.

Common Situations Where Foreign Income Is Missed

Foreign income is often overlooked because people assume that:

• It doesn’t need to be declared if it was already taxed overseas.

• Small amounts, such as dividends or bank interest, are insignificant.

• Pensions or social security payments from foreign governments don’t count.

• Temporary work contracts abroad aren’t relevant once back in Australia.

However, under Australian tax law, residents for tax purposes must declare income earned both domestically and internationally. Even small amounts are required to be reported.

What Happens If You Forget?

Forgetting to include foreign income can have serious consequences. The ATO has sophisticated data-matching systems and receives information from foreign tax authorities under global agreements such as the Common Reporting Standard (CRS). This means that overseas income is increasingly visible to the ATO, even if the taxpayer does not disclose it.

If unreported income is discovered, taxpayers could face amended assessments, interest charges, and in some cases, penalties. The best approach is to be upfront and disclose all relevant income when lodging your return. If you realise you’ve made an omission in a past year, it’s better to make a voluntary disclosure to the ATO — which often reduces penalties.

Practical Steps for Taxpayers

1. Gather Documentation: Collect all foreign income statements, dividend notices, rental records, or pension payment slips.

2. Convert to AUD: Use the ATO’s published exchange rates to convert foreign currency amounts into Australian dollars.

3. Consider Offsets: If tax was paid overseas, speak to your adviser about eligibility for the foreign income tax offset.

4. Seek Advice: Foreign income rules can be complex. Professional tax or financial advice can help ensure compliance and maximise your entitlements.

With more Australians working, investing, and retiring overseas, foreign income is becoming increasingly common. The ATO’s message is clear: worldwide income should not be overlooked. By taking the time to accurately declare all foreign earnings — and claiming the appropriate offsets where available — taxpayers can avoid unnecessary stress, penalties, and costs, while staying on the right side of the law.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au / www.findaccountant.com.au

Important Information

This information is of a general nature only. It does not take into account your particular financial needs, circumstances and objectives. You should obtain professional financial advice if you have not already done so before acting on this information. You should read the Product Disclosure Statement (PDS) before making a decision to buy or sell a financial product. Any case studies,graphs or examples are for illustrative purposes only and are based on specific assumptions and calculations.Past performance is not an indication of future performance. Superannuation, tax, Centrelink and other relevant information is current as at the date of this document. This information contained does not constitute legal or tax advice.

MORTGAGE BROKERING

By Reece Droscher

Did you know that seven out of 10 borrowers use a mortgage broker?

During the December 2024 quarter, mortgage brokers wrote 76% of all new home loans in Australia – the highest result on record.

When it comes to refinancing, many borrowers choose to use a mortgage broker for peace of mind that switching is the right move for them.

Here’s why many borrowers are using a mortgage broker to refinance, rather than going direct to a lender.

Professional advice you can trust

Australians are in the midst of a cost-ofliving crisis and money is tight for many. When it comes to your home loan, you want to know that it’s competitive and has the features you need.

A mortgage broker is a trained finance specialist who can offer support and guidance about whether refinancing is suitable for you. We understand the different home loans and can narrow down your options to find one that marries with your specific financial situation and goals.

Mortgage brokers are bound by a best interests duty. What that means is we are governed to always act in the best interests of our clients, so you can rest assured we’re on your team.

A streamlined refinancing process

Do you remember when you took out your existing home loan?

Maybe you had to jump through a few hoops to get to the finish line? Perhaps it felt like there was A LOT of paperwork to wade through and it all seemed overwhelming at times?

Mortgage brokers streamline the refinancing process. We liaise with the lender, oversee the paperwork and provide ongoing assistance.

Bottom line: you’ll have someone to support you throughout the entire refinancing journey.

Tailored finance solutions

There’s no one-size-fits-all mortgage. Everyone’s financial situation and goals are different, which is why you need tailored finance solutions.

WHY USE A MORTGAGE BROKER TO REFINANCE?

A mortgage broker will take the time to understand your financial circumstances and goals. If we think you could benefit from an offset account or redraw facility, we’ll explain why, but we won’t push extras on you that you don’t actually need.

A panel of lenders

If you go directly to a lender, they’ll try to sell you their home loans. Naturally.

We have access to a full panel of lenders, so we can compare the market and find a mortgage that’s suitable for you. Borrowers are spoilt for choice these days, and we will help you pick your home loan from the hundreds of options out there.

What about commissions? The commissions we receive are pretty similar across lenders. This ensures there’s no incentive for a broker to recommend one lender over another. Our job is to act with our clients’ best interests at heart.

A holistic approach to your finances

Banks are generally focused on the here and now. Their primary goal is to secure your business and lock you in.

Mortgage brokers, on the other hand, take a holistic approach to your finances. We’ll take into account your current financial situation and future financial aspirations, then line you up with finance to support those goals.

Common reasons to refinance

If you haven’t reassessed your mortgage recently, now is the time to do it. Refinancing could help you to:

• Secure a more competitive interest rate

• Benefit from interest-saving features like offset accounts or redraw facilities

• Access equity for renovations, additional properties or other financial goals

• Consolidate debt.

Like to explore your options? Interest rates may be on the move again in early 2025, so it makes sense to shop around now to see what lenders are offering. Contact Reece on 0478021757 for more information.

Please call Reece Droscher on 0478 021 757 to discuss all of your Home Loan needs.

reece@shlfinance.com.au www.shlfinance.com.au

By Jodie Moore

Bookkeeping is the backbone of any successful business. It provides a clear record of financial activities and ensures that all transactions are accurately tracked and reported. One of the most fundamental concepts in bookkeeping is understanding how debits and credits work. These terms can be confusing for beginners, but with a bit of explanation, their role in maintaining balanced financial records becomes clear.

BOOKKEEPING

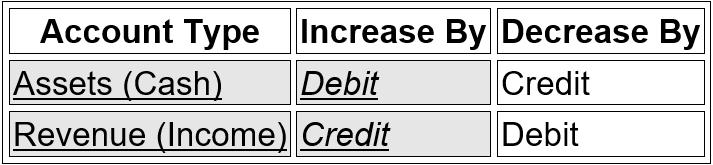

What Are Debits and Credits?

In accounting, debits (Dr) and credits (Cr) are the two sides of every financial transaction. Rather than referring to increases or decreases in value directly, they represent movements in accounts within the accounting system. Each transaction affects at least two accounts — this is known as double-entry bookkeeping. The key principle is that for every debit, there must be an equal and opposite credit, keeping the books balanced.

The Basic Accounting Equation

To fully understand debits and credits, it's helpful to start with the basic accounting equation:

Assets = Liabilities + Equity

This equation must always remain in balance. Debits and credits help maintain this balance by recording increases and decreases to the various accounts.

We can take this a step further by including income and expenses.

Assets + Expenses = Liabilities + Revenue + Equity

Here’s how debits and credits affect the five major types of accounts:

How It Works in Practice

Let’s say a business purchases office supplies for $500 in cash. This transaction affects two accounts:

• Office Supplies (an expense) – increases by $500 ---->Debit

• Cash (an asset) – decreases by $500 ---->Credit

Understanding Debits and Credits in Bookkeeping

This entry maintains the balance because the increase in expenses (debit) is offset by the decrease in cash (credit).

Now, consider a customer paying $1,000 for a service:

• Cash (an asset) – increases by $1,000 --->Debit

• Service Revenue (income) –increases by $1,000 ---> Credit

Again, both sides of the transaction are recorded, keeping the books balanced.

Common Misunderstandings

One common mistake is assuming that debits always mean money coming in and credits always mean money going out. This isn’t true. The effect of a debit or credit depends entirely on the type of account involved. For example, a debit increases an asset account but decreases a liability or revenue account.

Another confusion arises from personal banking. Have you noticed on your bank account statement that your Balance column shows as a Credit when you have money in the account? But your bank account is an asset, and we’ve just said that Assets are a Debit when they increase. So, what’s going on?

When you put money into the bank, the bank is now holding that money for you and it is effectively a liability to them but an asset to us (opposite transaction in a double-entry system).

With this in mind, now look at your bank statement but from the point of view of the bank. The liability, the money they now owe us, is increasing so it is a Credit. The bank statement, although it is for your bank account, is actually a bank record, showing your account from their perspective, not yours. When you then say you are in credit, it means you have money in your bank account, and the bank owes you that money.

The Role of a Trial Balance

To ensure accuracy, businesses regularly prepare a trial balance, which lists all ledger accounts and their balances. The total of debits should equal the total of credits. If they don't, it signals an error in the bookkeeping, such as a transaction being recorded only once or with the wrong amount.

Why It Matters

Understanding debits and credits is crucial for accurate financial reporting. Mistakes can lead to incorrect financial statements, which can affect business decisions, tax reporting, and investor trust. Even if software handles most of the work today, a solid grasp of these concepts allows business owners and finance professionals to detect errors and make informed financial decisions.

Final Thoughts

While debits and credits may seem daunting at first, they are simply tools to ensure that every financial transaction is recorded correctly. By understanding how they function within different account types, anyone can gain greater confidence in bookkeeping and financial management. Mastering this foundational concept paves the way for deeper financial literacy and better business decisions.

Financial Planning Basics

Financial Planner

By Erryn Langley

Financial planning involves working with a professional to navigate through the complexities of investment, taxation and changing rules and regulations. By working together, you can navigate a pathway to reach your specific goals, preferences and aspirations.

Financial planning can help you through all stages of your life. The financial planning process involves the following six steps:

To gain the most value out of the financial planning process, there are three fundamental issues that are important for you to consider and understand. These key components are discussed below.

Goal Setting

The starting point for any plan is to set your personal goals. Financial goals are likely to be different for each person and need to reflect your specific preferences, aspirations, and needs. Your goals may vary from short-term goals (less than one year), like buying a car, paying off your debt, or going on a holiday, medium-term goals (1-3 years), such as saving for your children’s education, or long-term goals (5 years or more), like saving for a comfortable retirement and leaving behind a legacy.

Your goals will be more real and achievable if you can apply the following attributes:

• Specific: Make them specific to you and your family.

• Measurable: Ensure there is a measurement in place to determine whether the goals have been met.

• Achievable: The goals need to be achievable, so while you may set a stretched target that requires you to be diligent, don’t set the target too high.

• Realistic: Your goals can be an aspiration, but must still be grounded.

• Time-targeted: You need to set time targets to achieve your goals.

Once you have determined where you are heading, you can work with your financial planner to develop the pathway to achieving your goals.

Budgeting

To put you on the path to building your wealth, you need to start saving money. This may mean working out how to find more money. The best way to do this is to set yourself a budget.

Setting a budget is important for everyone, no matter your age or how much money you have. It is especially important for people who are struggling to meet their goals or who keep building up debt.

A budget is not just about cutting expenses. It is about finding a good balance between your income and your expenses and deciding what is important to you so that you have money left over to save. A budget is not a fixed, forever plan. You can continue to make adjustments over time until you reach a comfortable outcome and have a good strategy in place that will meet your goals.

There are two sides to a budget:

• Your income – includes income from all sources such as salary, interest, rental income and dividends, but only include your regular income and make sure you use aftertax income or allow for tax payable in your expenses.

• Your expenses – include mortgage repayments, bills and general living expenses.

Tip

Go through the following documents to check you have captured all of your income and expenses:

• Bank account statements

• Credit card statements

• Pay slips (for both income and deductions)

• Cheque book details

• Expense receipts

• Bills and insurance certificates

You could also consider keeping a diary to record all your expenses – and don’t forget all the little ones as this is where you can often make some significant savings.

Setting a budget is a simple step but sticking to the budget can be harder.

Below are ten tips for setting a good budget:

1. Make it realistic or you will never stick to it

2. Budget an amount for fun, leisure and personal expenses so you can avoid impulse buying

3. Save your pay rises, bonuses, special payments or tax refund

4. Look for small savings – for example, take your lunch to work, or use internet banking to reduce bank fees.

5. Pay by cash or EFTPOS to avoid credit card fees (and also avoid accumulating debt)

6. Reduce fees and charges – combine bank accounts to reduce fees

7. Put your change into a savings jar at the end of every day

8. Shop around and compare prices on insurance policies. Look for companies that offer discounts for multiple policies

9. Use lay-by options instead of debt and credit cards

10. Update your budget each year

Understanding Debt

When used properly, debt can be an effective tool that may help you to achieve your financial goals. Debt can be used to purchase a range of items before you have saved the full purchase price.

It is important to understand the difference between ‘good’ debt and ‘bad’ debt. Debt can help you buy the family home, purchase a car or consumer goods and also enable you to purchase investment assets such as shares, managed funds or a rental property.

Where debt is used to acquire investments such as shares or property, this is known as gearing. This is often referred to as ‘good’ debt because it gives you the potential to claim a tax deduction for borrowing expenses and assets that will hopefully appreciate in value over time.

Borrowing to invest (gearing) simply allows you to use a combination of your own money and borrowed funds to accelerate wealth over the long term. However, it is a higher risk strategy that magnifies both the gains and losses from your portfolio. The higher the proportion of borrowed funds compared to your equity, the greater the associated risks. Options to gear into investments include margin lending, home equity loans or geared managed funds that borrow internally.

‘Bad’ debt is non-deductible debt, like borrowings for consumer goods such as cars and holidays. Even though a loan for the family home is non-deductible, it should not necessarily be viewed as ‘bad’ debt because the value of the home can grow over time. But looking at strategies to pay off this debt as quickly as possible will increase your wealth.

In any case, paying off non-deductible debt before deductible debt will usually be the most appropriate course of action for many people.

The cost of borrowing can be high, so you need to be disciplined and consider strategies to reduce the total interest cost, reduce the term of the loan and improve your cash flows.

Some of these strategies may include:

• Making loan repayments more often

• Making additional payments

• Repaying non-deductible debt first

• Combining loans into one account with a lower interest rate

Erryn Langley

Director and Financial Adviser - GradDipFinPlan Authorised Representative No 1269525

T:1300 557 144 Email: erryn@cherrywealth.com.au

Website: www.cherrywealth.com.au

Office Address: Suite 4 / 4 - 6 Croydon Road, Croydon 3136

Postal Address: PO Box 657, Croydon VIC 3136

Financial Planning is offered via Cherry Wealth Pty Ltd Ltd ABN 14 653 375 458

Cherry Wealth is a Corporate Authorised Representative (No. 1314769) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221). Part of the Centrepoint Alliance group https://www.centrepointalliance.com.au/

Erryn Langley is Authorised representative (No. 1269525) of Alliance Wealth Pty Ltd.

Thisinformationhasbeenprovidedasgeneraladvice.Wemaynothaveconsideredyour financial circumstances,need or objectives.You should consider the appropriateness of the advice.You should obtain and consider the Product Disclosure Statement (PDS) andseekassistancefromanauthorisedfinancialadviserbeforemakinganydecisions regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material. It is based on our understanding of current regulatory requirements and laws as at the publication dates. As these laws are subject to change you should talk to an authorised adviser for the most up to date information.No warranty is given in respect of the information provided and accordingly neitherAllianceWealth nor its related entities,employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

DIGITAL MEDIA

By Ethan Strybosch

Determining the appropriate price for your goods or services is an essential choice that can greatly influence your business's success and growth. Although some might think that lower prices draw in more customers, the reality is that accurately pricing your services, even at a premium, can provide many benefits that lead to increased profitability and success. In this article, we will discuss the advantages of setting the right price for your service and why opting for higher pricing can be a more effective strategy for your business.

1. Perceived Value:

One significant benefit of elevated pricing is that it suggests a level of superior quality and worth. Consumers frequently link higher costs to enhanced products or services, which can foster a perception of exclusivity and appeal. When your products or services are priced at a premium, prospective customers are more inclined to see your

business as a source of high-quality solutions, thereby boosting the chances of transforming them into dedicated, long-term clients.

2. Improve Profit Margins:

Increased pricing naturally results in enhanced profit margins, enabling your business to sustain solid financials and fund its expansion. With improved margins, you can allocate resources back into marketing, research and development, as well as enhancements in customer service, which ultimately boosts your competitive edge and overall business performance.

3. Better Customer Relationships:

Many people assume otherwise, but customers frequently choose to pay extra for outstanding service and an improved experience. By setting higher prices, you can invest additional resources in bolstering customer support and offering individualized care, which fosters better connections with your customers. These happy clients are more inclined to become advocates for your

brand, sharing positive feedback and attracting more business to you.

4. Targeting the Right Audience:

Pricing your service correctly allows you to target the right audience effectively. A higher price point can attract clients who value quality over affordability, and who are willing to pay for the unique benefits your service provides. This targeted approach not only simplifies your marketing efforts but also helps build a loyal customer base that aligns with your business's values and offerings.

5. Distancing from Competitors:

Setting a higher price strategically can differentiate your business from others, creating an impression of exclusivity in the marketplace. Competing on lower prices often leads to price wars and discounting, which can harm profitability and weaken the perceived worth of services. By opting for a higher pricing model, you showcase your belief in the value you provide and motivate customers to select you for your quality rather than solely for cost.

Is vitamin B6 safe?

NATUROPATHY

By Kathryn Messenger

You may have heard of vitamin B6 being in the spotlight lately, as an overdose can cause peripheral neuropathy. The symptoms of this include numbness and pain in the limbs and healing can be slow. An overdose usually occurs when someone is taking multiple supplements, or food products that have added B6.

But the answer is not as simple as limiting B6, let me explain:

There are different forms of B6, just like there are different types of dwellings: caravans, bungalows and houses. Imagine you live in a caravan and a storm causes it to roll down the road and hit a tree, causing the rain water to come pouring through the roof. There, in the middle of the night, in rain and wind, your neighbour offers shelter in their house.

It would be crazy to decide as a result of this that all types of dwellings are unsafe.

The main forms of Vitamin B6 are Pyridoxine, Pyridoxamine, and Pyridoxal5-Phosphate (P5P). Pyridoxine has been shown to cause peripheral neuropathy, whilst P5P is actually protective against it.

The problem with the B6 supplementation arises due to very little distinction between these different forms by the governing body in Australia (aka we don’t distinguish between the different types of dwellings, as they have been shown to be unsafe). This is seen in the labelling requirements on a B6 supplement, where B6 must be listed as the equivalent dose of Pyridoxine, even if it doesn’t contain that form of B6.

A recent European study has found that even a low dose of Pyridoxine can cause nervous system issues in some people, however, Pyridoxamine, and P5P have been studied to find that they can heal the nervous system.

So, firstly aim to get your B vitamins from meat (red, white and fish), and if you do choose to supplement, make sure you check the form of B6, and always choose Pyridoxamine, or P5P. If you would like a safe B vitamin supplement, Whole Naturopathy can help with that, or if you’re suffering peripheral neuropathy as a result of a Pyridoxine overdose, I have successfully treated that, and would be happy to help you heal.

Council is pleased to be supporting the Maroondah Rotary Club’s inaugural Lift the Lid Walk

One in fi ve Australians experience mental illness every year, and 45 per cent of Australian adults will be affected by mental illness at some time in their life. Lift the Lid Walk is not a race, but an opportunity to have open discussions about mental illness and promote understanding and support for those facing mental health challenges.

Walk with us to raise awareness of mental health issues in our communities, schools, homes, and workplaces and break down the barriers and stigma associated with mental health.

FOGO Bio Gro Tour - Bayswater North Pick Up

Maroondah City Council will be hosting a site tour of our FOGO processors, Bio Gro in Dandenong South. A bus will pick up registered residents from the front of Glen Park Community Centre and return participants back to the same spot (Glen Park Community Centre) around 12.30pm.

Participants need to be able to manage stairs to get onto the bus as well as a fl ight of stairs at Bio Gro in Dandenong South. As Bio Gro is a working facility of organic materials, those with allergies to grasses, plants and other organic materials may need to consider if the tour is appropriate for them. Please be aware that the site can be quite loud at times, those with sound sensitivity may want to bring ear plugs to the site to manage this.

Event details

• Date: Thursday 18 September 2025

• Time: 9am to 12.30pm

• Venue: Pick up and drop off from Glen Park Community Centre, Bayswater North

• Cost: Free

• Bookings are essential

Weeding and Mulching along Mullum Creek

We will be weeding (mostly) and maybe mulching around the track adjacent 56 Jeffrey Drive. This area has become very overrun with weeds and our focus will be the areas immediately adjacent to the track.

What to bring

• gardening gloves, if you have them (we have some spares if you don't)

• knee pads if you don't like kneeling on the ground

• sunscreen and insect repellent (as per your requirements)

• water as it is thirsty work regardless of the weather.

If you are bringing along younger helpers, please bring any tools they may like to use and gloves as we only have tools and gloves suitable for teens and adults.

Something to share at morning tea is always welcome but entirely optional. Tea, coffee, milk, mugs, spoons and hot water provided.

Yarra Hills S.C. - College Concert

It is that time of the year again where we highlight the talents of our music students at the College Concert, on Monday 15 September, 7:30pm, at the Karralyka Theatre in Ringwood.

The concert will feature performances by the Senior and Intermediate Bands, and our Year 7 musicians will be performing for the very first time as the Junior Band. There will also be performances from the Saxophone and Woodwind ensembles, Vocal Group and various other soloists.

Croydon Hills Primary SchoolCharlie And The Chocolate Factory

Croydon Hills Primary School Year 4 students invite you to explore a world of 'Pure Imagination' with Charlie and the Chocolate Factory.

Croydon Hills Primary School Year 4 students present to you, 'Charlie and the Chocolate Factory'. Charlie Bucket comes from a poor family and spends most of his time dreaming about the chocolate that he loves but usually can’t afford. Things change when Willy Wonka, head of the very popular Wonka chocolate empire, announces a contest in which five golden tickets have been hidden in chocolate bars and sent throughout the world.

The children who find the tickets will be taken on a journey far beyond their wildest dreams on a tour of Wonka’s Chocolate Factory; and get a special glimpse of the wonders within. Charlie miraculously finds a ticket, along with four other children. The tour of the factory will hold more than a few surprises for all involved.

When Wednesday, 17 September 2025 | 07:00 PM - 08:30 PM Thursday, 18 September 2025 | 07:00 PM - 08:30 PM

not-for-profit of

VICTORIAN FOLK MUSIC CLUB INC.

The Victorian Folk Music Club (VFMC) is believed to be Victoria’s longest running folk music club. It started in 1959 in Melbourne and has been based principally in Ringwood East since the late 1980’s. It is registered as a not-for-profit incorporated organisation.

The roots of the Club lie in the formation of the original Bushwackers' Band in Melbourne in 1955, which appeared with great success in the second production of the play ‘Reedy River’. After a change of name to the Billabong Band, the Band built up an audience of fans around Melbourne and began to hold regular monthly Singabouts to cater for them. Band members along with some of their most enthusiastic followers launched the Victorian Bush Music Club June, 1959.

In 1963, the name was changed to the Victorian Folk Music Club to emphasise that the Club's interests included urban

Over the ensuing years, the Club has been based at various locations in and around Melbourne. Activities have been held principally in Maroondah / Ringwood East area since the late 1980s. Regular Club functions include a monthly Concert and a monthly Family Bush Dance, traditional ‘ Woolshed Balls’ held twice a year, and weekly Tuesday evening Sessions for singing and playing in a ‘round robin’ style. Sessions, Dances and Concerts are open to all, and people may participate as they feel inclined or just observe if they prefer.

Newcomers are welcome and encouragement is given to novices, so Dances tend to be called by experienced callers. Sessions are convened and often involve constructive coaxing on instruments. And members may take part in spot acts on the Concert nights. Folk instruments of any kind are encouraged, such as guitars, mandolins, accordions, ukes, fiddles, concertinas, squeeze boxes, etc. The repertoire promotes the traditional

Week 1 Bush Dance the first each month, all ages welcome

Week 1 Round Robin singing, reciting, yarns, solos Week 2 Concert Night top acts from the folk music plus spot acts

Week 3 Round Robin singing, reciting, yarns, solos Week 4 ‘All-In’ Session group set tunes, dance sets, singing

Week 5 Theme Nights workshops, Spots’ or open stage

Admission is $6 for members, members, (except Bush Concerts). Cash or card at accompanied children are free.

For the Week 2 Concerts performers from the folk music floor spots are featured, commencing 7:45pm and running to 10pm for supper. Admission is $11 to $13 for concessions, $15 Cash or card at the door be purchased online from Accompanied children have is held Saturday of the month (except 7.30pm to 10.00pm at the same different band is featured each dances are called. Admission members to $12 for general,

The VFMC has an extensive for information on forthcoming CONCERTS . All information found at www.vfmc.org.au vast collection of traditional

of the month

INC.

first Saturday ages are

singing, playing, solos or group etc.

top line Main music scene,

singing, playing, solos or group etc. group playing of sets, group

workshops, ‘Hot stage nights

members, $7 for nonDances and the door and free.

top acoustic music world plus commencing at 10pm with a break for members $15 for general. or tickets can from Humanitix. have no charge.

held on the 1st (except January), same venue. A each month, and Admission is $10 for no charge for

extensive website forthcoming weekly CONCERTS information can be It also has a traditional Australian

Learn, Connect &Thrive in Retirement

Whether you are preparing to retire, newly retired or looking to re-energise your lifestyle, U3A Ringwood offers a friendly, inclusive environment to explore new interests, stay active, and meet like-minded people.

We are a community of lifelong learners offering a wide range of classes, activities and social events for curious minds aged 55 and over.

DISCOVER SOMETHING NEW

At U3A Ringwood learning never stops. Choose from our courses and presentations across areas like:

• Arts and Crafts - Art Appreciation, Card Making, Quilting etc

• Languages - French and Italian

• Literature - Creative Writing, Poetry

• Technology Help - any device, any operating system

• Fitness and Well-being - Tai Chi, Yoga, Exercise toe Music, Shi Ba Shi, Garden Group, Bike Group etc

• Games - Mahjong, Scrabble, Book Club, Rummikub

• Life Skills - History, Family History, Current Affairs, Elders and the Law, Armchair Travel, Chess, Share Market, Coffee Club, Film Appreciation and Music Appreciation No tests, no pressure - just the joy of learning together.

Why join Ringwood U3A?

• Stay Active and Engaged

• Keep your mind and body active in Retirement

• Make new friends Family

• Meet people who share your passions and hobbies Ringwood U3A offer informal classes led by passionate and knowledgeable tutors.

A low annual membership fee for access to all classes We are a non-profit, volunteer run organisation and whether you are interested in becoming a class member or leading a class there is a place for you. Contact us by email info@u3aringwood.org.au or our website u3aringwood. org.au

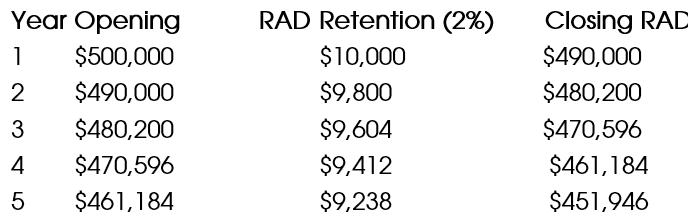

To Pay or Not to Pay the RAD? What You Need to Know About Aged Care Costs

AGED CARE

By Warren Strybosch

Moving into aged care is a big life change, and one of the biggest questions families face is whether to pay the Refundable Accommodation Deposit (RAD) up front, or to hold onto assets and instead pay the Daily Accommodation Payment (DAP).

From 1 November 2025, new aged care rules will apply, including a 2% retention fee on RADs for up to 5 years. Many people are now asking: does it still make sense to pay the RAD? The short answer: for most people who have the money available, paying the RAD is still the smarter choice. Here’s why.

The short answer: for most people who have the money available, paying the RAD is still the smarter choice. Here’s why.

What is a RAD and a DAP?

• RAD (Refundable Accommodation Deposit): A lump sum paid to the aged care home. Most (but not all) is refunded when you leave or pass away.

• DAP (Daily Accommodation Payment): An ongoing “rentstyle” payment charged if you don’t pay the RAD in full.

If you only pay part of the RAD, you’ll also pay a DAP on the unpaid amount.

New 2% Retention Fee

From November 2025, aged care homes will keep 2% of the RAD each year for up to 5 years. After that, no more is deducted. The remaining balance is refunded to you or your estate.

Example – Maree’s RAD of $500,000

After 5 years, Maree’s estate would be refunded $452,381.

The Cost of Not Paying the RAD

If you don’t pay the RAD, you must pay the DAP. This is calculated using the Maximum Permissible Interest Rate (MPIR), which is set by the Government. For example, if the MPIR is 7.78%, and you don’t pay a $500,000 RAD, you’ll be charged around $38,900 a year.

From 1 November 2025, DAPs will also increase with inflation (CPI).

Example – Maree with no RAD paid

The DAP starts high and keeps increasing, which can put pressure on cashflow.

Other Things to Consider

• Centrelink impacts: A RAD is not counted in the Age Pension assets test, but it does count for aged care fees.

• Tax: Paying a RAD might reduce your taxable income if it replaces investments earning income.

• Estate planning: RAD refunds are part of your estate. By contrast, money in joint accounts often goes directly to the surviving owner.

• Government protection: All RADs are guaranteed by the Commonwealth, even if the aged care home fails.

Case Study – Maddy

Maddy, aged 85, needs aged care after November 2025. She has chosen a home that requires a $750,000 RAD. She owns a house worth $1.7m and has $50,000 in the bank.

Comparing outcomes (simplified example)

Paying the RAD results in smaller ongoing costs and a higher estate value for her family.

How to Decide – A Simple Checklist

When weighing up whether to pay the RAD, consider the following:

• Do you have the cash available? If you need to sell your home or investments, think about timing and market conditions.

• What’s your cashflow like? Paying a RAD reduces ongoing fees (DAPs), which can make budgeting easier.

• Do you receive the Age Pension? Paying a RAD may increase your entitlement, as it’s not counted under the pension asset test.

• What are your estate goals? A RAD refund will go into your estate. If you prefer assets to pass directly to a spouse or joint owner, this might influence your choice.

• How important is certainty? Paying a RAD gives peace of mind by avoiding rising DAPs linked to inflation.

• Do you want flexibility? You don’t always have to pay the full RAD upfront—you can start with a smaller amount and top it up later.

So, Should You Pay the RAD?

While every family’s situation is different, paying the RAD is usually better if you have the money available. The 2% retention fee slightly reduces the refund, but the savings from avoiding ongoing DAPs (which grow with inflation) usually outweigh the cost.

Planning for aged care is about more than just covering fees— it’s about reducing financial stress, protecting your estate, and giving peace of mind for both you and your family.

Bucket Lists: Why Planning Is Important in Retirement

RETIREMENT

By Warren Strybosch

When I meet with a new retiree client for the first time, we go through a Client World Map meeting. The meeting helps me to better understand their financial situation, but it also gives me an opportunity to understand what their future goals and interests are.

Retirement is more than an end to working life—it’s the beginning of a new chapter filled with freedom, purpose, and the opportunity to enjoy long-awaited goals. Whether your post-work dreams include extended travel, picking up new hobbies, or simply savouring quiet moments with loved ones, weaving these aspirations into your retirement modelling is crucial for achieving the lifestyle you desire.

The Dreams That Define Us

Retirement is the perfect time to pursue passions put on hold: a grand tour of Europe, finally writing that novel, volunteering abroad, or learning to paint. These aren’t just activities; they’re the experiences that bring meaning and joy. Without incorporating such personal goals into financial planning, retirees risk underfunding their aspirations—or worse, compromising on them entirely.

I personally have several ‘bucket list’ items I wish to achieve in life, and these may happen in retirement. One is to go to the Superbowl, and another is to write children’s books. Also, I want to see if I can get Wallballs off the ground...that was for you Tim (if by chance you ever happen to read this article –sorry people, that was in reference to a long standing in joke between me and a friend of mine).

Using Benchmarks to Guide Your Vision

The Association of Superannuation Funds of Australia (ASFA) Retirement Standard provides a trusted benchmark of what retirement costs look like in Australia. For a comfortable lifestyle—one that includes private health insurance, a reliable car, dining out, domestic vacations, and even occasional international trips—ASFA estimates annual expenses of around $73,077 for couples and $51,805 for singles. To fund that lifestyle, a retiree would typically need a superannuation balance of about $690,000 for a couple or $595,000 for a single person (ASFA, 2023).

These figures are invaluable—but they reflect a generalized view of comfortable living. True contentment often lies in the bespoke: the trip of a lifetime, pursuing creative fulfilment, or simply more meaningful moments. That’s why your own goals should sit at the heart of retirement modelling.

Bridging Aspirations and Realism

Start by identifying your key goals: travel plans, lifestyle habits, family support, or bucket-list adventures. Estimate the costs, then compare them to the ASFA benchmarks. For instance, adding an annual trip overseas may stretch your budget beyond ASFA’s comfortable baseline—but aligning your super, pension, and savings to account for that ensures you don't have to compromise experiences for safety.

Moreover, retiree spending tends to decrease over time—but the early years can be the most vibrant, and expensive—as retirees tend to prioritise lifestyle while they’re fitter and more mobile. Factoring in timing can help you balance spending and longevity, so you enjoy life now without risking your financial future.

Tailored Planning for Fulfilment

True retirement planning isn’t one-size-fits-all. It should start with:

• Clarifying personal goals—what matters most to you. We do this in our Client World Map meetings.

• Mapping costs—compare these to ASFA’s modest and comfortable budgets.

• Adjusting strategies—ensure your savings and income sources can fund both essentials and dreams. We provide several retirement modelling scenarios for clients to consider before the leap into retirement. This helps clients have peace of mind that they can afford their goals in retirement and not run out of money.

• Timing considerations—some goals are time-sensitive; others can wait.

Financial advisers often note that many retirees are overly cautious, underspending and leaving unused wealth behind. Your money should serve you—helping you live richly, not just last securely. We believe in leaving the house to the kids but everything else is yours to spend.

Lastly: Live Your Bucket List, Intentionally

Retirement is ultimately about freedom—the freedom to enjoy life and fulfill dreams. By incorporating personal goals into your financial modelling—and comparing them with trusted benchmarks like the ASFA Retirement Standard—you ensure your retirement isn’t merely “comfortable,” but deeply meaningful. Savour the journey, embrace your bucket list, and live the retirement you’ve earned.

If you are not sure whether or not you will be able to afford your goals in retirement, then consider booking an initial FREE retirement meeting with Warren Strybosch, an award winning financial advisor and speaker, who can help you Find Retirement (www.findretirement.com.au) with ease.

Warren Strybosch Award winning Financial Adviser and Accountant

Part of the Find Group of Companies

Financial Planning, SMSF, Super, Insurance, Pre-Retirement & Retirement Planning (Financial Planning) are offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth, Find Insurance and Find Retirement. Find Wealth Pty Ltd is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221). Part of the

Centrepoint Alliance group (www.centrepointalliance.com.au/fsg/aw).

Warren Strybosch

Authorised Representative (No. 468091) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice.You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

•

Special Tax Return Offer

$99 Returns - PAYG Only

We

Here are the steps involved:

1. Email to info@findaccountant.com.au requesting your PAYG return to be completed. Provide us with your full name, D.O.B and address

2. A Tax engagement letter will be emailed to you for signing via your mobile (no

3. You will be then sent a tax checklist to complete online. Takes less than 5 minutes.

4. We will then require you to upload your documents to our secure portal.

5. Once we have received all your documentation, we will complete the return.

6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf.

1300 88 38 30

•

•

We specialise in the following:

• Biz Pack Insurance

• Landlord Insurance

• Public Liability Insurance

• Professional Indemnity Insurance.

We DO NOT provide advice or quotes for the following (you need to go direct and save):

• Car Insurance

• Home & Contents

• Caravan

• eBikes

We work with only the most reputable insurers to bring you a range of insurance options for you to choose from:

HELPING TO PROTECT YOU AND YOUR FAMILY

At Find we can help you find the ‘right’ personal insurance. Our aim is to help you obtain and retain the personal insurances that are appropriate for you and at cost that you can afford.

• Income Protection (IP)

• Life Insurances or Death Cover

• Total and Permanent Disability (TPD) Personal Insurances Include:

When your insurance are in place, our services do not stop there. We will provide you with an after care service that includes policy notifications, insurance report, help desk, reviews and help at claim time. We provide ourselves in providing honest advice that you can rely on.

warren@findinsurance.com.au

www.findinsurance.com.au

•

Best Kept Parenting Secret

INDEX

PROFESSIONAL SERVICES

• Lactation Consultant ----------- 35

• Swen Pouches ---------------------- 00

• Hair Dresser --------------------------- 00

• Chiropractor ------------------------- 00

• Beauty Therapy -------------------- 00

• Gym --------------------------------------- 00

• Massage Therapy ---------------- 00

DR JOANNA STRYBOSCH

|

OSTEOPATHY

Osteopathy in Australia is a government registered, allied health profession. Osteopaths focus on improving the function of the neuro-musculoskeletal system (bones, muscles, nerves and connective tissues) to optimise health and well-being.

Joanna is highly qualified and experienced in the osteopathic assessment and treatment of babies and infants.

She can assist with the following assessments:

• Gross motor development (milestones)

• Primitive reflexes

• Tongue function and it’s relation to sucking skills

• Biomechanics of the jaw and mouth

• Help increase or decrease milk supply ADVANCED PAEDIATRIC OSTEOPATH & LACTATION CONSULTANT PROVIDING PERSONAL & CARING SUPPORT FOR YOU & YOUR BABY

LACTATION CONSULTING

IBCLC lactation consultants are recognised around the world as the experts in lactation care. They provide evidencebased knowledge to assist mothers to establish and maintain breastfeeding. As professionals, they are charged with promoting, protecting and supporting breastfeeding.

Joanna can help with a broad range of lactation consulting services, including:

• Teaching a new mum how to hold and position her baby to breastfeed

• Assess the suck, swallow and breathing of an infant

• Assess for tongue function and determine any evidence of restriction (tongue tie)

• Pre and post-frenectomy breastfeeding support

2 for $18 Indulgent Blends

Introducing our Indulgent Range featuring an upgraded Matcha Tiramisu Smoothie and all-new limited Tiramisu Smoothie!

Following the fantastic success of Sharetea's Matcha Tiramisu and Matcha Cheesecake Smoothies during Easter, Sharetea are bringing back the Indulgent Range for a limited time with a delicious new addition.

Brand-New Store & Piercing Location Unlocked!

We’ve had a glow-up! Lovisa Eastland (located near Strandbags) has re-opened with a fresh new look and service, offering ear and nose piercing with a complimentary aftercare pack to keep your new sparkle shining

Whether you’re curating the ultimate ear stack, going bold with a brand-new style, or browsing our latest jewellery collections, there’s something for everyone. We can't wait to welcome you in-store!

Discover more

Blueberry is BACK!

The berry best news is here! Sharetea’s beloved Blueberry Fruity Tea and Blueberry Crush are BACK!

Hello Blueberries! Sharetea are bringing back their popular Blueberry Fruity Tea and Blueberry Crush drinks. The Blueberry Fruity Tea is a classic blend of refreshing tea and sweet blueberry fl avour, while the Blueberry Crush is a delicious frozen treat.

Limited Time! 20% Off Lenses at Eye Trend

Save Up to $200 on ZEISS or E-Lentes Lenses

Thinking of upgrading your lenses? Now’s the perfect time at Eye Trend Eastland.

Enjoy 20% off ZEISS & E-Lentes lenses when you spend $350 or more at Australia's fi rst certifi ed ZEISS Vision Expert store. T&Cs apply. Don’t wait, book your upgrade today!

In-Kind Sponsorship with Find Maroondah Community Paper

We invite a representative from each sporting club to submit team selections, results and any interesting stories relating to your club/sports.

For more information contact: Warren on 1300 88 38 30 or Email: editor@findmaroondah.com.au

Norwood Football Netball Club

2025 PRESENTATION NIGHT

Join us as we celebrate the standout performances and unforgettable moments from the 2025 season!

Date: 20th September

Time: 7:00pm – 12:00am

Location: Eastwood Golf Club

Tickets: $80 – Includes 3 Course Dinner

Women's Coach Wanted

Norwood Football Netball Club is seeking a Senior Women’s Coach for 2026.

Fresh from a premiership, our Senior Women’s program boasts an exciting young list with genuine depth and talent coming through. You’ll be supported by an excellent coaching and offfield team already in place, and given the chance to help shape the next chapter of women’s football at Norwood.

If you’re ready to lead a hungry, ambitious group and build on recent success, we’d love to hear from you.

For information and applications: norwood@efnl.org.au

We’re pleased to announce that Noah Thorpe has re-signed with Norwood Football Netball Club for 2026.

Known for his skill and speed, Noah is just as effective running off the back flanks as he is working through the midfield. Another of our talented young players, he has a bright future ahead and we’re proud he’ll be continuing in the black, purple and gold.

Great to have you on board again, Noah.

Vale Neal “Thommo” Thompson

Norwood

Football Netball Club is deeply saddened by the tragic passing of Neal Thompson, who was killed in the line of duty at Porepunkah on Tuesday.

Thommo was a premiership player with our club in 1999, proudly wearing the number 4 jumper across 17 games that season. He will be remembered not only for his contribution on the field but also for the friendships and bonds he built with teammates and supporters.

We extend our heartfelt condolences to his partner Lisa, his family and friends, and the many past players who shared the field and the changerooms with him. Once part of Norwood, always part of Norwood.

Registrations are open for Juniors, Seniors and our first ever Women's team!

Get in early to be ready for the October 4th start of the season!

We are super excited to announce the signing of Sascha Kelly for Season 2025/26!

A talented young cricketer joined us from Croydon and has played for Eastfield in the U18 T20 competition. Sascha has already proven to be a valuable middle order run scorer in his career, including a 41not out in the T20’s and averaging 42.25 in his last season at Croydon.

Sascha is excited to get stuck in and help take Eastfield forward.

Please help us in making him feel welcome at Eastfield as we gear up for the season ahead.

Ringwood Bowls Club Inc.

Six weeks until pre-season training starts. Book the dates in your calendars to get ready for a big season ahead.

Lots of excitement for the season ahead with more great things coming in the next couple of weeks, stay tuned as we gear up for the season ahead.

Simply upload your ad at www.findmaroondah.com.au/nfp-free-advertising or you can email the ad to the editor@findmaroondah.com.au and we will do the rest for you.

Senior

Karen

NextGen

Worship

Transform

Community

Children's

Religious Groups and Churches