We are looking for business owners who like to join the

Manningham Network Group and Community Paper.

• Accounting Services

• Acupuncture

• Architect

• Architectural Interior Design

• Attorney- Family

• Auctions- Real Estate

• Bookkeeper

• Bowen Therapy

• Builder- Commercial

• Business Coach

• Business Equipment Financing

• Business Insurance

• Cabinets

• Caterer

• Graphic Designer

• Plasterer

• Chinese Medicine

• Chiropractor

• Creative Director

• Commercial Mortgage

• Computer Repair

• Computer Web Design

• Concrete

• Copywriting/Copy Editing

• Counselor/ Psychotherapist

• Dentist

• Digital Media

• Electrical Operations

• Electrician

• Finance Bookeeper

• Financial Planner

• Fitness Trainer

• Flooring

• Pilates

• Garage Doors

• General Insurance

• Health & Wellness Coach

• Homeopathy

• Lactation Consultant

• Lawn Care

• Lawyer

• Life Coach

• Loans

• Marketing

• Massage Therapist

• Meditation/Yoga

• Mortgage Broker

• Naturopathic Medicine

• Nutrition

• Osteopathy

• Painter

• Personal Trainer

• Photographer

• Plumber

• Podiatrist

• Printer

• Project Management

• Psychologist

• Real Estate Rentals

• Real Estate Sales

• Reiki

• Residential Cleaning

• Residential Mortgage

• Security

• Signs

• Solar

• Solicitor

• Travel Agent

• Website Developer

• Wedding Planner

By Warren Strybosch

The Find Manningham is a community paper that aims to support all things Manningham. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Manningham for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 warren@findnetwork.com.au

PUBLISHER: Issuu Pty Ltd

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmanningham) so you keep up to date with what we are doing.

We value your support,

The Find Manningham Team.

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmanningham.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: sport@manningham.com.au

WEBSITE: www.findmanningham.com.au

The Find Manningham was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-ForProfits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Manningham has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Manningham is a local government area in Victoria, Australia in the north-eastern suburbs of Melbourne. Manningham had a population of approximately 125,508 as at the 2018 Report which includes 27,500 business and close to 45,355 households. The Doncaster and Templestowe Council administered the area until December 15, 1994.

The Find Manningham acknowledge the Traditional Owners of the lands where Manningham now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Manningham accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

By Joe Lam

Every winter, Melbourne transforms into the beating heart of Australian cinema through the Melbourne International Film Festival (MIFF), one of the oldest and most iconic film festivals in the world. In 2025, MIFF continues its proud tradition, celebrating its 73rd year as a beacon of cultural excellence, creativity, and community engagement.

A Festival with a Storied Legacy Established in 1952, MIFF has evolved into Australia’s largest and most prestigious film festival. What began as a modest gathering of cinephiles has grown into a globally recognised platform that showcases the best of international cinema while championing Australian filmmakers. The festival’s enduring success can be attributed to its steadfast commitment to innovation, diversity, and artistic integrity.

Over the decades, MIFF has screened thousands of films from around the world and has become a key date on the global film calendar. It is a founding member of the Melbourne-based Film Festivals Australia and one of the few festivals accredited by the Academy Awards®, the BAFTAs, and the AACTAs.

The People Behind the Magic Behind the scenes of MIFF is a passionate team of programmers, curators, artists, and executives who make the festival a resounding success year after year. One of the most influential figures in MIFF’s recent history is Artistic Director Al

Cossar, whose tenure brought a renewed focus on emerging talent and bold storytelling.

Past programmers and advocates such as Michelle Carey and Richard Moore helped shape MIFF’s voice as a fearless presenter of cutting-edge and often provocative cinema. The festival has also gained international attention thanks to the participation of luminaries such as Cate Blanchett, David Michôd, Gillian Armstrong, and Rolf de Heer—Australian icons whose works have featured prominently at MIFF over the years.

The 2025 edition promises an extraordinary lineup of over 300 films, special events, forums, and immersive experiences. This year’s festival includes a vibrant focus on Indigenous storytelling, environmental documentaries, and a spotlight on Southeast Asian cinema. World premieres from both acclaimed directors and rising stars ensure that MIFF remains a place of discovery and dialogue.

MIFF XR (Extended Reality), the festival’s digital innovation arm, returns with boundary-pushing VR and AR installations. The MIFF Schools program and industry initiatives like the Accelerator Lab and MIFF Premiere Fund continue to nurture young creatives and independent producers across the country.

A Catalyst for Culture and Commerce

Beyond its cinematic prestige, MIFF is

a cultural cornerstone with a profound economic and social impact. Each year, the festival attracts tens of thousands of local and international visitors to Melbourne’s CBD and surrounding suburbs, generating millions in tourism revenue and stimulating the hospitality, retail, and arts sectors.

MIFF also serves as an incubator for Australian film talent. Through programs like the MIFF Premiere Fund, the festival supports the production and international release of homegrown films, several of which have gone on to critical acclaim at Cannes, Berlin, and Sundance.

For the local community, MIFF is more than just a film festival—it’s a shared experience. From red carpet premieres at the iconic Regent Theatre to popup screenings in laneways and rooftop cinemas, MIFF brings people together to celebrate storytelling in all its forms.

As MIFF 2025 unfolds, it remains a vital thread in Melbourne’s cultural fabric. It honours its rich history while boldly embracing the future of film. More than a festival, MIFF is a movement—one that continues to inspire, provoke, and unite audiences across generations.

In a world constantly in flux, MIFF stands as a testament to the enduring power of cinema to illuminate, challenge, and connect us all.

By Reece Droscher

Did you know that 7 out of 10 borrowers use a mortgage broker?

During the December 2024 quarter, mortgage brokers wrote 76% of all new home loans in Australia – the highest result on record.

When it comes to refinancing, many borrowers choose to use a mortgage broker for peace of mind that switching is the right move for them.

Here’s why many borrowers are using a mortgage broker to refinance, rather than going direct to a lender.

Australians are in the midst of a cost-ofliving crisis and money is tight for many. When it comes to your home loan, you want to know that it’s competitive and has the features you need.

A mortgage broker is a trained finance specialist who can offer support and guidance about whether refinancing is suitable for you. We understand the different home loans and can narrow down your options to find one that marries with your specific financial situation and goals.

Mortgage brokers are bound by a best interests duty. What that means is we are governed to always act in the best interests of our clients, so you can rest assured we’re on your team.

Do you remember when you took out your existing home loan?

Maybe you had to jump through a few hoops to get to the finish line? Perhaps it felt like there was A LOT of paperwork to wade through and it all seemed overwhelming at times?

Mortgage brokers streamline the refinancing process. We liaise with the lender, oversee the paperwork and provide ongoing assistance.

Bottom line: you’ll have someone to support you throughout the entire refinancing journey.

There’s no one-size-fits-all mortgage. Everyone’s financial situation and goals are different, which is why you need tailored finance solutions.

A mortgage broker will take the time to understand your financial circumstances and goals. If we think you could benefit from an offset account or redraw facility, we’ll explain why, but we won’t push extras on you that you don’t actually need.

If you go directly to a lender, they’ll try to sell you their home loans. Naturally.

We have access to a full panel of lenders, so we can compare the market and find a mortgage that’s suitable for you. Borrowers are spoilt for choice these days, and we will help you pick your home loan from the hundreds of options out there.

What about commissions? The commissions we receive are pretty similar across lenders. This ensures there’s no incentive for a broker to recommend one lender over another. Our job is to act with our clients’ best interests at heart.

Banks are generally focused on the here and now. Their primary goal is to secure your business and lock you in.

Mortgage brokers, on the other hand, take a holistic approach to your finances. We’ll take into account your current financial situation and future financial aspirations, then line you up with finance to support those goals.

If you haven’t reassessed your mortgage recently, now is the time to do it. Refinancing could help you to:

• Secure a more competitive interest rate

• Benefit from interest-saving features like offset accounts or redraw facilities

• Access equity for renovations, additional properties or other financial goals

• Consolidate debt.

Like to explore your options? Interest rates may be on the move again in early 2025, so it makes sense to shop around now to see what lenders are offering. Contact Reece on 0478021757 for more information.

Please call Reece Droscher on 0478 021 757 to discuss all of your Home Loan needs.

reece@shlfinance.com.au www.shlfinance.com.au

By Kathryn Messenger

I thought I’d share 2 examples of how working with a naturopath can make a difference in your health. I have chosen 2 very different examples from my clinic in the last 12 months. Sometimes the journey is very straightforward, other times, there can be a few bumps in the road (names have been changed).

Case 1

Emma, late 30’s, works, school aged kids.

She presented with anxiety (with panic attacks), fatigue, insomnia, and frequent colds.

Upon questioning:

• Energy 2/10

• Stress 7/10

• Too tired to exercise

• Daily nausea and bloating

• Poor concentration and memory

• Sleep waking 3x/night

I first prescribed an individual herbal medicine formula, a specific homeopathic, a mineral supplement, and a few foods to add to her diet.

2nd appointment (2 weeks later)

• Anxiety has improved – no panic attacks

• Energy was a little better

• Sleep, waking just once/night

• Stress 5/10

• No cold/flu

Added an additional nutritional supplement

3rd appointment (4 weeks later)

• Anxiety – not a problem anymore

• Energy – feeling a lot better

• Sleep – wakes very occasionally, falls straight back to sleep

• Stress no longer a problem

• Still no cold/flu

4 weeks later – Feeling really good, took products for another 4 weeks, and takes some of the products ongoing as she needs them.

Case 2

Rob, early 60’s semi-retired

He presented with constant nausea with bloating and constant indigestion.

He had eliminated many foods to try and find the cause and had an extremely limited diet for 18 months.

History of stomach ulcers, and bowel disease.

Upon questioning:

• Loss of appetite

• loss of weight

• Frequent bowel movements (6/day)

• Energy 4/10

• Diet: Low fodmap, extremely limited variety of food, 1 meal and 1 snack each day

I prescribed an individual herbal medicine, 1 nutritional product, 1 homeopathic.

2nd and 3rd appointments (each 2 weeks later)

• Nausea – decreased

• Bowel movements – decreased

• Appetite improved, able to increase food intake

We worked at slowly introducing a greater variety of foods

4th and 5th appointments (each 2 weeks later)

• Tolerated new foods and enjoyed them

• Appetite - feels hungry, but very full after eating

• No longer losing weight.

• Bowel motions down to 3/day

2 additional homeopathics were introduced

6th and 7th appointments (each 1 month later)

• Feeling so good that he worked with his doctor to reduce medications.

• Nausea gone, very slight gut pain

• looks forward to eating

• Able to eat a wide variety of foods without any symptoms

• Learnt that there are 2 foods to avoid that exacerbate his symptoms

• Energy is much higher and able to function well

Kathryn Messenger

By Warren Strybosch

I have been working in the accounting and financial planning profession for nearly 25 years and it still amazes me that people think they can commit fraud or set up a scheme believing they will not get caught.

The Australian Taxation Office (ATO) continues to rely on sophisticated data matching tools to help safeguard the integrity of the tax system. Updated in June 2025, ATO data-matching programs draw on over 600 million third party transactions annually—from banks, employers, property records, online platforms, health funds, cryptocurrency providers, and more—to prefill tax returns, identify discrepancies, and spark compliance reviews or investigations, while also helping honest taxpayers lodge returns more easily.

A standout use of data-matching is in uncovering GST refund fraud. Under the ATO’s Operation Protego, individuals masquerading as fake businesses lodged bogus Business Activity Statements (BAS) to claim fraudulent GST refunds. The fraud was often promoted on social media and facilitated by easy ABN registration via myGov. As of mid2025 more than 57,000 alleged offenders had been flagged; the ATO recovered or blocked billions in refunds and secured dozens of prosecutions—with jail terms up to three years, convicted individuals ordered to repay funds, and heavy penalties imposed by the ATO.

Taxpayer alerts and the new GST fraud warning

In July 2025 the ATO issued Taxpayer Alert TA 2025/2, targeting arrangements where related party companies collude to inflate or invent invoices and claim improper GST refunds. Though these schemes differ from social-media driven rorts, they still pose serious risk— especially in property, construction and closely held corporate groups.

Directors and advisers involved may face personal, promoter or criminal liability Australian Taxation Office.

Monday night’s Four Corners GST fraud exposé

A recent Four Corners episode (aired Monday night) revisited the Plutus Payroll tax fraud—the largest such scheme in Australian history—where an operator diverted GST and PAYG funds held on behalf of clients, depositing only part of them to the ATO. The program detailed how intercepted communications and documents exposed a sophisticated network of dummy directors and shell entities, raising fresh scrutiny on ATO enforcement and regulatory oversight.

This ATO approach—blending largescale data matching, targeted alerts and robust enforcement—reflects a sharpened strategy to deter GST abuse and uphold trust in the system.

When it comes to money, the best approach is the black and white approach. If you feel you are unsure about a situation or that it might seem a bit of a grey area or if it sounds too good to be true…then stay well, clear of it. Only deal with those situations where you know it is all in the ‘white’ so to speak.

If you are still not sure, then please pick up the phone and ring your accountant or financial planner as well as a couple of other people before making any large money commitments. A couple of phone calls could save you thousands.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au / www.findaccountant.com.au

This information is of a general nature only. It does not take into account your particular financial needs, circumstances and objectives. You should obtain professional financial advice if you have not already done so before acting on this information. You should read the Product Disclosure Statement (PDS) before making a decision to buy or sell a financial product. Any case studies, graphs or examples are for illustrative purposes only and are based on specific assumptions and calculations. Past performance is not an indication of future performance. Superannuation, tax, Centrelink and other relevant information is current as at the date of this document. This information contained does not constitute legal or tax advice.

By Erryn Langley

As they age, many Australians begin reassessing their retirement lifestyle. One option that often comes up is downsizing the family home in order to reduce costs, freeing up equity and simplifying life. Beyond lifestyle benefits, there’s a valuable financial planning strategy that could help strengthen your retirement income: downsizer contributions to super.

What is a Downsizer Contribution?

If you're aged 55 or over, you may be eligible to contribute up to $300,000 per person (or $600,000 per couple) into your superannuation from the proceeds of selling your home. This contribution doesn’t count toward your standard contribution caps and doesn’t require you to meet the work test.

Key Eligibility Criteria:

• You must be 55 years or older at the time of making the contribution.

• The property must have been owned by you or your spouse for at least 10 years, and it must be your main residence.

• You only have 90 days from the date of settlement to make your downsizer contribution into super. Missing this deadline may mean you lose the opportunity entirely.

• You must submit the ATO downsizer contribution form before or when the contribution is made.

Why Consider It?

• Boost Retirement Savings: It’s a one-off opportunity to significantly grow your super balance, especially if you’ve reached other contribution limits.

• Tax-Effective Income: Once contributed, the funds can be used to start a tax-free income stream via an accountbased pension.

• Downsizer contributions do count towards the transfer balance cap (currently $1.9 million).

• Selling your home may affect your Age Pension entitlements due to the asset and income tests.

• You cannot use this rule multiple times, it’s a once-perlifetime strategy.

• Don’t miss the 90 day window.

As you can see timing and making sure that you meet the requirements is critical, if you are considering downsizing, before you do so is a great time to speak with a Financial Adviser. Feel free to give us a call on 1300 557 144 to make an appointment to discuss how the use of a downsizer contribution could assist your overall retirement strategy.

Director and Financial Adviser - GradDipFinPlan Authorised Representative No 1269525

T:1300 557 144 Email: erryn@cherrywealth.com.au

Website: www.cherrywealth.com.au

Office Address: Suite 4 / 4 - 6 Croydon Road, Croydon 3136

Postal Address: PO Box 657, Croydon VIC 3136

Financial Planning is offered via Cherry Wealth Pty Ltd Ltd ABN 14 653 375 458

Cherry Wealth is a Corporate Authorised Representative (No. 1314769) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221). Part of the Centrepoint Alliance group https://www.centrepointalliance. com.au/

Erryn Langley is Authorised representative (No. 1269525) of Alliance Wealth Pty Ltd.

This information has been provided as general advice.We may not have considered your financial circumstances, need or objectives. You should consider the appropriateness of the advice.You should obtain and consider the Product Disclosure Statement (PDS) and seek assistance from an authorised financial adviser before making any decisions regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material. It is based on our understanding of current regulatory requirements and laws as at the publication dates. As these laws are subject to change you should talk to an authorised adviser for the most up to date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

By Jodie Moore

When it comes to managing finances, one of the most important decisions a small or medium-sized business (SME) in Australia must make is whether to use cash accounting or accrual accounting. Each method has its advantages and is better suited to different types of businesses. Understanding the pros and cons of each can help you make an informed decision and ensure compliance with Australian Taxation Office (ATO) requirements.

Understanding the Basics

Cash accounting records income and expenses only when money changes hands. For example, you record a sale when the customer pays, not when the invoice is issued. Similarly, expenses are recorded only when you actually pay a bill.

Accrual accounting, on the other hand, records income and expenses when they are earned or incurred, regardless of when the money is actually received or paid. So, if you invoice a client in June but they don’t pay until July, the income is still recorded in June.

The method you choose impacts more than just bookkeeping. It affects how you manage cash flow, report income, pay taxes, and make business decisions. The ATO allows most small businesses with a turnover of less than $10 million to choose between cash and accrual

accounting, giving you some flexibility to pick the best fit.

Pros and Cons of Cash Accounting

Advantages:

• Simplicity: It’s straightforward and easier to manage, especially for sole traders or micro businesses.

• Better cash flow tracking: Since transactions are recorded only when money is received or paid, you have a clearer picture of your actual cash on hand.

• Tax timing benefits: You may defer paying tax on income until it's actually received, which can be helpful for cash flow.

Disadvantages:

• Limited financial insight: It doesn't show money you’re owed or owe to others, which can make it hard to plan ahead.

• Not ideal for growing businesses:

As your operations become more complex, this method may not provide sufficient financial visibility.

Pros and Cons of Accrual Accounting

Advantages:

• More accurate financial picture: It reflects earned income and incurred expenses, even if cash hasn't changed hands.

• Better for long-term planning: It shows outstanding invoices and bills, which helps in forecasting and managing obligations.

• Required for some businesses: Larger businesses or those that carry inventory may be required by the ATO to use accrual accounting.

Disadvantages:

• More complex: You may need a professional accountant or accounting software to manage it properly.

• Cash flow disconnect: Because income is recorded when earned, not received, you may appear profitable even if you’re low on cash.

Which Method Is Best for Your

Here are a few guiding questions to help you decide:

• Do you operate on a small scale with straightforward transactions? If so, cash accounting may be the simpler and more manageable option.

• Do you offer credit terms to customers or deal with inventory? Accrual accounting is better suited to businesses with delayed payments and stock management.

• Do you need a more accurate financial picture for investors, banks, or strategic planning?

Accrual accounting provides a more complete view of your business performance.

• Are you close to the $10 million turnover threshold?

You may need to switch to accrual accounting as your business grows, so it’s worth planning ahead.

The ATO permits small businesses to choose their accounting method, but once you select a method, consistency is key. You must apply it across your financial year and for GST reporting if you’re registered.

For GST purposes:

• Cash accounting allows you to pay GST only when you receive payment.

• Accrual accounting requires you to pay GST when you issue the invoice.

The choice can affect your GST liability, especially if customers pay late or early.

Choosing between cash and accrual accounting isn’t just about compliance — it’s a strategic decision that can impact your business’s cash flow, tax obligations, and growth potential. If you're unsure which method suits your SME, it's wise to consult a qualified accountant who understands both your industry and ATO requirements.

Whether you’re a start-up sole trader or a growing enterprise, understanding these accounting methods helps you take control of your finances and make more informed decisions.

By Ethan Strybosch

When we started Good Cause, our goal was simple:

Help charities and not-for-profits grow through great marketing, and make it as affordable as possible.

We knew the sector was full of passionate teams doing world-changing work on tight budgets. So we set our prices low, not because we undervalued ourselves, but because we genuinely wanted to make a difference.

And for a while, that worked. But over time, we realised something important: Staying affordable shouldn't come at the cost of impact, for our clients or for us. Our hearts were in the right place. But we were often juggling too much, taking on more than we realistically had capacity for, all to try and “do the right thing.”

We weren’t cutting corners, but we were stretched thin, and that meant we couldn’t always be as strategic, fast, or proactive as we wanted to be.

It became clear that if we wanted to serve notforprofits well, we needed to give ourselves the time and space to do the job properly, not just affordably.

So we made a change, We restructured our pricing model to better reflect the value we provide, and to give every project the time, care, and strategic thinking it deserves.

We’re still far more affordable than most commercial agencies. But now we’re also sustainable, which means we can:

• Be more hands-on and available

• Focus on long-term success, not short-term fixes

• Deliver high-quality work, on time, every time

• Support our clients like a true extension of their team

The outcome? Better results for everyone. Since making the shift, we’ve had some of the best feedback we’ve ever received. Clients have noticed the difference, in the quality of our work, the speed of delivery, and the level of strategic guidance we’re able to bring to the table.

And for our team, it’s made a massive difference. We’re more focused, more energised, and more committed than ever to helping NFPs grow their reach, donations, and impact.

We still believe in making great marketing accessible for charities. That hasn’t changed, and it never will. But we’ve learned that accessibility doesn’t mean “as cheap as possible.” It means pricing fairly, working sustainably, and delivering work that actually moves the needle for the causes we care about.

If you're a not-for-profit looking to grow, fundraise, or reach new audiences, we'd love to help. Let’s make something meaningful together.

By Warren Strybosch

Income received from a superannuation “account based” or “allocated” pension is often favourably assessed under the income test used by Centrelink and the Department of Veterans Affairs to determine a person’s entitlement to government income support benefits. Such benefits might include the Age Pension, Disability Support Pension, Newstart Allowance, and the like. This means that a person currently receiving income support benefits may often be able to draw a reasonably significant amount of income from their account based pension without it having a detrimental effect on their government income benefit.

Legislation was passed in March 2014 that changed the way in which account based pensions are assessed for income test purposes. The change took effect from 31 December 2014. Account based pensions were brought into line with other “financial Investments”.

There are two groups of people who are affected by this change:

1. People who commenced receiving government income support benefits after 31 December 2014, whether or not they had an account based pension is place before January 2015; and

2. Those receiving government income support benefits before 1 January 2015, and they transfer their existing account based pension to a new superannuation provider, or commence a new account based pension after 31 December 2014.

Those people receiving income support as at 31 December 2014 and had an account based pension in place as at that date, will not be affected by the changes unless:

• Their income support benefit ceases for any reason, and is then recommenced, or

• they change pension providers, or

• stop and recommence an account based pension with their current provider.

There are no changes currently being made to the way the assets test applies to account based pensions.

Financial investment

Financial investments include money on deposit with banks, building societies, and credit unions, shares, managed funds and unit trusts, and money held in superannuation funds by a person of age pension age, where they have not yet commenced an account based pension.

When applying the income test, Centrelink or Department of Veterans Affairs will total up the value of a person’s financial investments and then “deem” an amount of income to be applied to those investments. The deeming rates change from time to time and are reflective of current interest rates. There are two deeming rates that apply depending on the amount of a person’s financial investments. The current deeming rates are:

Put simply, a pensioner couple have financial investments of $150,000, their deemed income, for income test purposes will be:

Deemed income is used when applying the income test. The actual income earned on financial investments, whether it is above or below the deemed income, is ignored when assessing eligibility for income support benefits.

However, income received from account based pensions under the pre 1 January 2015 rules are assessed on a different basis.

Income assessment of account based pensions –grandfathering provisions

When an account based pension commences, the amount of capital used to commence the pension is divided by the life expectancy of the pension recipient (or the longer of the two pension recipient’s life expectancies, where a reversionary pensioner is nominated). The resultant amount is referred to as the “deductible amount”. This amount remains constant for the life of the account based pension unless a lump sum withdrawal is made from the pension account, at which time the deductible amount is recalculated.

The amount of account based pension income assessed under the income test is the actual income drawn from the account based pension, after subtracting the deductible amount.

Let’s further consider the example of our pensioner couple mentioned previously. They also have an account based pension with a value at commencement of (say) $200,000. For the sake of the example we will assume the account based pension is held in the name of the wife who is 65. Her husband is 67. Her life expectancy is 21.62 years, and his is 16.99 years. In this example, it is irrelevant whether the husband was nominated as a reversionary pensioner or not, as his life expectancy is the lesser of the two. The deductible amount, in this example, is $9,250 ($200,000 ÷ 21.62). If this couple were to draw $10,000 income from their account based pension, only $750 of that will be counted under the income test ($10,000 - $9,250).

If we now extrapolate the income assessable under the income test for our pensioner couple, their assessable income under the income test will be:

Applying the January 2015 rule

If our pensioner couple were:

• not to commence receiving their age pension until after 31 December 2014; or

• to move their existing account based pension from one pension provider to another after that date; or

• to stop their existing account based pension, perhaps to add more superannuation savings, and then start a new account based pension after 31 December 2014;

Then their new account based pension will be treated as a financial investment and will be subject to deeming. If this were to occur, their financial investments will now total $350,000 and their deemed income will now be:

Whether a person will be better or worse off if their account based pension falls under the deeming rules or grandfathering provisions will depend on personal circumstances. For example, anyone drawing an account based income stream that is significantly more than their deductible amount may actually benefit by having their account based pension treated as a financial investment and subject to deeming.

In addition to the income test,government income support entitlements may also be affected by the assets test. The test that results in the lower income support benefit is the test that is used.We have not taken the potential assets test implications into account for the purposes of this review.

Warren Strybosch Award winning Financial Adviser and Accountant

Total Deemed Income

$5, 751 ($221 per fortnight)

Based on deemed income of $221 per fortnight, this couples assessable income is still below the income free amount available under the income test, so their pension is unaffected, based on current deeming rates. However, as deeming rates increase over time, and given that they are currently at historically low levels, this couple may see a reduction in the amount of age pension they receive in the future.

When legislation to have account based pensions included as financial investments for deeming purposes was enacted, the income test treatment of existing account based pensions was grandfathered. That is, provided the following conditions are met, the former income test treatment of account based pensions (i.e. actual income received, less the deductible amount) will continue to apply.

To qualify for grandfathering, the pensioner receiving government income support must:

1. Be in receipt of a continuous government income support benefit as at 31 December 2014; and

2. Be receiving income payments from a continuing account based pension as at 31 December 2014.

Where a person holding a grandfathered account based pension passes away, and their account based pension was structured to automatically revert (transfer) on their death to a surviving spouse, then the original account based pension will continue to be grandfathered provided the reversionary pensioner was also in receipt of a government income support benefit at the time the pension transferred.

Part of the Find Group of Companies

Financial Planning, SMSF, Super, Insurance, Pre-Retirement & Retirement Planning (Financial Planning) are offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth, Find Insurance and Find Retirement. Find Wealth Pty Ltd is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221). Part of the

Warren Strybosch

Authorised Representative (No. 468091) of Alliance Wealth Pty Ltd. Centrepoint Alliance group (www.centrepointalliance.com.au/fsg/aw).

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-todate information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

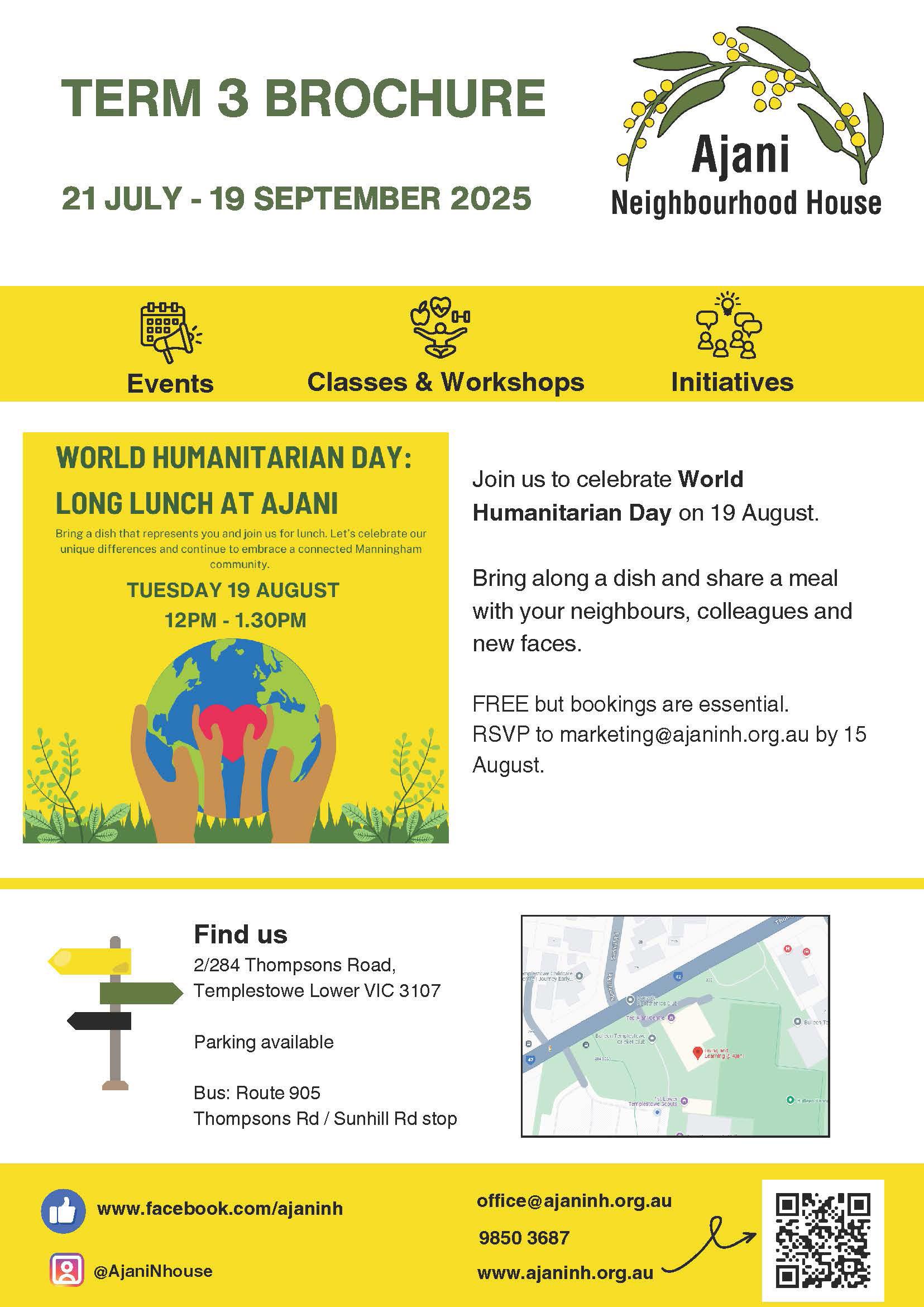

Ajani Neighbourhood House: Building a Connected, Inclusive Manningham

Ajani Neighbourhood House is a vibrant, community-based not-for-profit dedicated to creating a healthy, inclusive and empowered community. Formerly known as Living and Learning at Ajani, we changed our name in late 2024 to better reflect who we are and the depth of what we offer.

Each school term, we deliver more than 40 quality courses and activities designed to bring people together, build skills and foster lifelong learning. From educational classes and social groups to essential support services, Ajani continues to be a welcoming space for everyone.

Our core program includes 14 regular courses each term, ranging from health and fitness classes like yoga and circuit training, to creative art sessions in painting and drawing, and hands-on gardening workshops.

We’re also constantly adapting to community needs by trialling 2–3 new classes each term. If there’s enough interest, these often become permanent fixtures in our program.

Ajani is also proud to deliver Adult and Community Further Education (ACFE) programs, offering pre-accredited training that helps learners transition to work, further study or volunteering. These courses are tailored to meet the specific needs of our participants, rather than following a set national curriculum.

Open to adults over 18 who are citizens, permanent residents, or asylum seekers with study rights, our ACFE classes provide a valuable pathway to confidence, capability and connection. Participants also receive a Certificate of Participation upon completion.

In addition to structured classes, Ajani is home to a range of social groups that run on a low-cost, self-managed basis. These include knitting, sewing, and appliqué groups, as well as the Bridge Club, Coffee Club, and Walking Group. Our International Women’s Group provides a warm and supportive space for women from diverse cultural backgrounds, and we also host a monthly Carers Catch-Up for unpaid carers in the community.

We also offer free or low-cost workshops throughout the year in response to community needs or aligned with key calendar events. Recent workshops have included topics like gardening, financial literacy for women, wills and estates planning, and ageing well at home.

Since 2015, The Hub Café @ Ajani has been a cornerstone of our community, offering a welcoming place for locals to gather. Open Monday to Thursday from 9:30am to 1:30pm, the café also provides valuable training and volunteering opportunities in hospitality and customer service.

Our Food Relief Pantry supports around 130 individuals in Manningham each week, helping those experiencing food insecurity. The pantry is open three days a week and is made possible through partnerships with CareNet, Manningham Council, Bendigo Bank, Viva La Fruit, and the generous support of local food drives.

Ajani couldn’t do what we do without the dedication of our incredible volunteers. Over 70 volunteers contribute across various roles—supporting the café, running programs, helping in the office, maintaining our gardens, or assisting with events and fundraising. Their commitment is vital to the daily life and long-term success of our centre.

We also host between 10 and 14 student placements each year, giving emerging community service workers the chance to gain real-world experience. These placements are a valuable two-way exchange—providing students with practical skills while injecting fresh ideas and energy into our organisation.

At Ajani Neighbourhood House, we believe in the power of the local community, lifelong learning, and the strength that comes from working together. Whether you want to learn a new skill, find support, or simply connect with others, there’s always a place for you at Ajani.

Health and social support services organisation, Each, has been re-awarded the contract to deliver Manningham Youth Services on behalf of Manningham Council, following a competitive open tender process.

Manningham Mayor, Councillor Deirdre Diamante said the partnership reflects a shared commitment to delivering highquality, inclusive and youth-centred services that respond to the needs of young people across Manningham.

“We’re proud to continue working with Each to deliver vital services to young people in Manningham. This partnership ensures continuity and a strong foundation for youth engagement, health and wellbeing into the future,” Cr Diamante said.

“Young people are facing increasing pressures, including mental health challenges, figuring out what to do after school or how to find a job and the growing experience of social isolation.

“It’s essential that we support them with access to safe spaces and trusted support services, as well as meaningful opportunities to grow, connect and contribute,” she said.

Acting CEO of Each, Sally Hines said Each is ready to continue providing support to young people in Manningham.

“We’re excited to continue working with Council to support young people and their families in Manningham,” Sally said.

Manningham Youth Services will continue to be delivered from the Manningham Youth Hub (MY Hub), located at MC Square in Doncaster.

MY Hub is a safe, accessible and welcoming space where young people can connect, access support and participate in programs that support their wellbeing, leadership and development.

“MY Hub provides young people with a safe, welcoming space to connect with community, their peers and find the support they need.

We look forward to building on these strong foundations, connecting young people, families and schools with services that make a difference,” Sally added.

Manningham Youth Services supports young people aged 12 to 25 through a range of programs and initiatives, which align with the strategic priorities of the Manningham Council Plan and Municipal Public Health and Wellbeing Plan. Learn more about Manningham Youth Services at www.each.com.au/services/manningham-youth-service

Want to get involved and see how you can help shape the decisions of Manningham Council? Council is now seeking ideas and input to help inform a review of its Community Engagement Policy.

The policy outlines how Council seeks community feedback and ideas to inform its strategic plans, infrastructure projects, programs, new initiatives and more.

Manningham Mayor, Cr Deirdre Diamante, said involving and engaging our community is essential to how Council makes decisions and good governance for Manningham.

“We are committed to listening and understanding our community and want to make sure all residents and community members have opportunities to help shape decisions on what’s important locally.

“Our Community Engagement Policy guides how we seek your feedback and input. As we review this important policy, we want to hear from you to make sure it continues to meet the needs of our diverse community,” Cr Diamante said.

Community members can have their say by completing an online survey before Friday 8 August at yoursay.manningham. vic.gov.au/engagement-policy

Focus groups are also planned for late August, residents can register their interest in attending a session on the website.

Council’s current Community Engagement Policy was endorsed in 2021 and is being reviewed to ensure it continues to meet community needs.

The policy is guided by the International Association of Public Participation’s (IAP2) spectrum of engagement and the Local Government Act 2020.

For more information and to have your say, visit yoursay.manningham.vic.gov. au/engagement-policy

Manningham Council has announced the finalists for the inaugural Manningham Community Awards.

The winners will be revealed at our Awards Ceremony on Tuesday 16 September at the Manningham Function Centre.

Manningham Mayor, Cr Deirdre Diamante, said an incredible 70 nominations were received for the 8 award categories.

“I’ve been so impressed by the exceptional calibre of the nominations, which made my role as a judge extremely challenging,” Cr Diamante said. “It’s been no easy task to narrow down our finalists – our community is filled with so many outstanding groups and individuals.

“I would like to congratulate our finalists and thank all nominees for their dedication and innovation in making Manningham a better place for everyone.

“A huge thanks to everyone who took the time to nominate these deserving groups and individuals. Your support helps shine a light on the incredible work being done in our community.”

Three finalists have been selected for each of the 8 award categories. One of the award category winners will also be named Manningham Citizen of the Year.

The Manningham Community Award finalists

Doreen Stoves Excellence in Volunteering: Recognising an individual who has demonstrated an ongoing commitment to volunteerism.

• Brenda Humphreys

• Leon Moore

• Sandrajane Vincent-Corry

Active Community: Recognising an individual or group who has contributed to community participation in active lifestyles, sports or physical activity.

• Bulleen Tennis Club

• Ruffey Runners

• Tony Gibson

Ageing Well: Recognising an individual or group who has contributed to enhancing the lives of older residents, fostering social connection, safety or active ageing.

• Chinese Seniors Citizens Club of Manningham

• Richard Davis

• Scones Together

Artistic Achievement: Recognising an individual or group who has contributed to Manningham’s creative community, sparking artistic, cultural or creative expression.

• Jazz in the Park

• Now and Not Yet Gallery

• Warrandyte Arts Association

Community Excellence: Recognising a community organisation or group that has delivered outstanding programs or initiatives contributing to the wellbeing, development and cohesion of the Manningham community.

• Ajani Neighbourhood House

• United Muslim Migrants Association of Victoria

• Warrandyte Pink Ladies

Community Health and Wellbeing: Recognising an individual or group who has enhanced health, wellbeing or resilience in the community, whether through advocacy, program development or direct service delivery.

• Bulleen Men’s Shed at the Veneto Club

• CareNet

• Kathy Monley

Inclusive Community: Recognising an individual or group who has actively contributed to community accessibility, inclusivity or diversity.

• Catalyst Training and Disability Services

• Kevin Heinze Grow

• Zakir Fakhri

Young Achiever: Recognising a young person aged under 25, who has made a positive impact within the Manningham community through demonstrated leadership, innovation, or commitment to helping others.

• David Edgecombe

• Niosha Khademideljou

• Sina Emadi

“I’m looking forward to celebrating our finalists and winners at our Awards Ceremony in September,” Cr Diamante said.

Tickets to our Awards Ceremony on Tuesday 16 September are now available to purchase at a subsidised cost for Manningham community members. Book now at manningham.vic.gov.au/ community-awards