By Joe Lam

By Joe Lam

COPYWRITER / ACRREDITED EDITOR

Are you our next Copywriter? ?

WEDDING PLANNER

Are you our next Wedding Planner? ? ?

Are you our next Life Coach?

Are you our next Bookkeeper? ?

By Warren Strybosch

The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

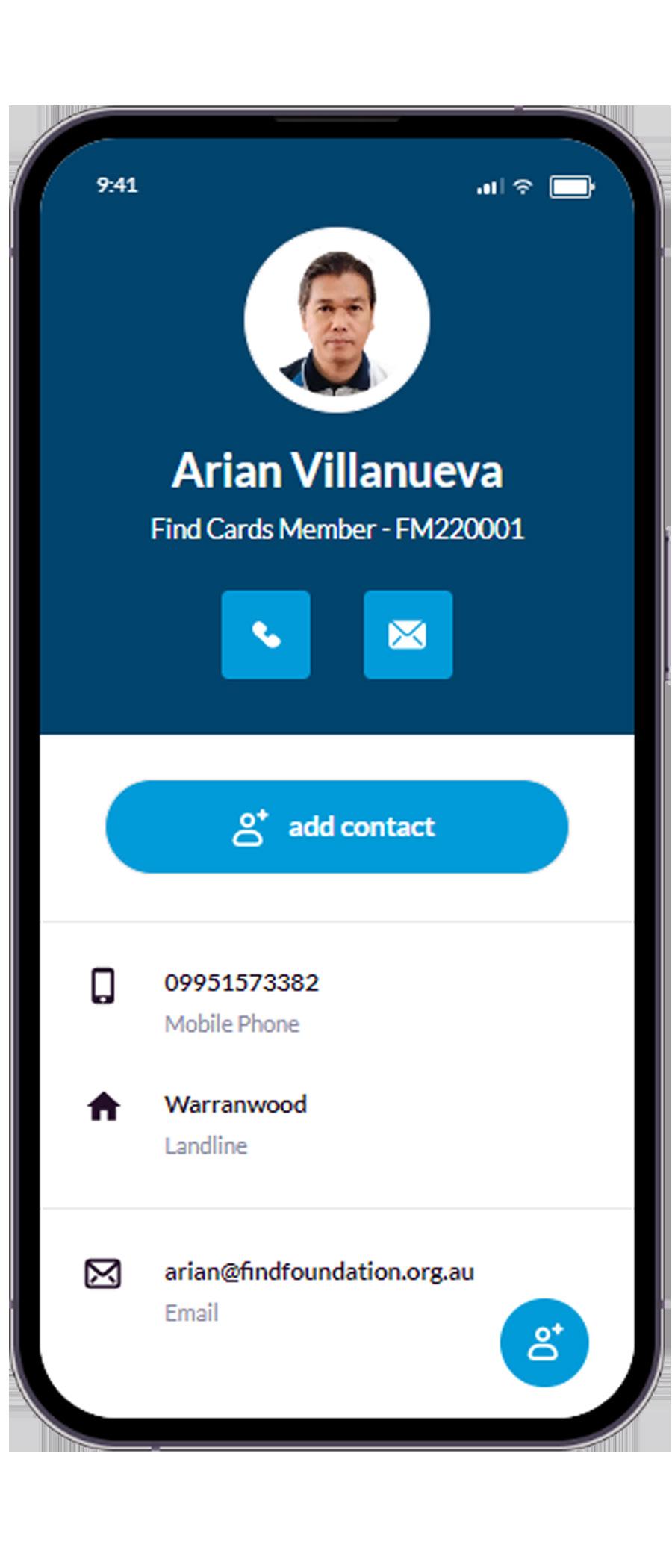

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SUPPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays respect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written

By Joe Lam

Brisbane Lions surpass Geelong with a commanding performance in the Grand Final, securing consecutive Premierships.

On Saturday, September 27, 2025, the Brisbane Lions emphatically defeated the Geelong Cats in the AFL Grand Final by 47 points—18.14 (122) to 11.9 (75)—to claim back-to-back premierships. What had appeared a tight contest through the first half became a one-sided rout after half-time, as Brisbane’s experience, depth and willingness to gamble paid off. Here’s how the game went quarter by quarter, who stood above all others, and what went wrong for Geelong.

Geelong led 2.3 (15) to Brisbane's 1.6 (12) at quarter time. The second quarter was tight, ending in a 5.6 (36) tie, but Jeremy Cameron suffered a suspected fractured arm. Brisbane brought in Lachie Neale as a substitute at half-time. Brisbane kicked three quick goals to lead 9.9 (63) to 6.8 (44) at three-quarter time. In the final quarter, Brisbane dominated, scoring seven consecutive goals to win by 47 points, with Charlie Cameron kicking four majors.

By unanimous acclaim, Will Ashcroft claimed his second consecutive Norm Smith Medal, confirming his status as the game’s best. The 21-year-old midfielder produced a highimpact performance across all facets: high disposal numbers, clearances, involvement in thrusts into attack, and composure

under

balance in Brisbane’s favour, especially after half-time.

Other Lions also starred: Harris Andrews ran an exceptional aerial defence display, intercepting at will and starving Geelong of options. Charlie Cameron returned to form with four goals. Hugh McCluggage also played a major part in ball movement and forward thrusts.

The Grand Final Drew over 4.076 million viewers. Will Ashcroft cemented his legacy as a multi-Norm Smith medalist and future face of the sport. With players like Dayne Zorko highlighting the Ashcroft brothers’ motivational impact. Conversely, Geelong faced fan frustration and speculation about a roster reset, needing younger talent to replace aging stars. Geelong is the 13th team since 2000 to lose a decider by 40+ points, with none immediately returning to a Grand Final the following year. Brisbane, with its balanced youth and experience, is predicted to dominate upcoming seasons.

In conclusion, what began as a close, hard-fought battle through two quarters became a one-sided statement by Brisbane. Geelong’s fate was sealed by misfortune, injury, and an inability to match the Lions’ firepower and composure after half-time. Brisbane now stands not just as champions, but as the benchmark in Australian football—and Geelong must rebuild confidence and structure if they hope to blunt a Lions juggernaut in seasons to come.

Sourced from: The Guardian, The Australian, ABC, Herald Sun, Australian Football League, Wikipedia.

By Warren Strybosch

If you were wondering if you should consider paying off that ATO debt, then the answer is a resounding yes!!

The Australian Taxation Office (ATO) has published the applicable interest rates for the final quarter of 2025, covering the period from 1 October to 31 December 2025. These rates apply across a number of circumstances where taxpayers either owe money to the ATO, have late or underpaid tax obligations, or are entitled to compensation where the ATO has delayed refunds.

For this period, the General Interest Charge (GIC) has been set at 10.61%. The GIC is the rate most commonly applied when a taxpayer has an outstanding tax debt. This charge accrues daily on the amount owing until the balance is paid. Its purpose is twofold: firstly, to encourage timely payment of tax obligations; and secondly, to ensure that taxpayers who pay on time are not disadvantaged compared with those who delay. At 10.61%, the GIC remains relatively high, reflecting both market interest rate movements and the ATO’s policy of applying a premium to encourage prompt payment. Taxpayers with outstanding debts should be mindful of how quickly such charges compound and may wish to consider negotiating a payment plan with the ATO to avoid further escalation.

For business owners, this rate also raises important considerations around debt management. Many businesses that fall behind on tax obligations may find that the GIC quickly becomes more expensive than traditional financing options. In some circumstances, refinancing the debt through a commercial loan—or even a secured facility such as using the family home as collateral—can significantly reduce the effective interest cost. For example, a business loan or mortgage-backed facility might attract an interest rate of 6–8%, far below the ATO’s 10.61% rate. However, this approach is not without risks. Using the home as security can place personal assets on the line, which requires careful assessment of the business’s cash flow and repayment capacity. Business owners should weigh the potential savings against the increased exposure and ideally seek professional advice before restructuring debt in this way.

The ATO has also set the Shortfall Interest Charge (SIC) at 6.61% for the same quarter. The SIC applies in situations where an amended assessment reveals

Owing the ATO money just got more expensive - GIC and SIC rates for

that a taxpayer has underpaid their tax, often because of an error or omission in their original return. Unlike the GIC, the SIC is generally lower because it is not designed as a penalty but rather as compensation to the government for the time value of money lost due to the shortfall. It also recognises that shortfalls may arise without deliberate intent. Importantly, the SIC accrues from the date the tax should have been paid until the date the liability is corrected. While lower than the GIC, at 6.61% the SIC is still significant enough to reinforce the importance of accuracy and completeness in tax reporting.

On the other side of the ledger, the ATO has announced that the interest rate on overpayments and delayed refunds will be 3.61%. This rate applies when a taxpayer has overpaid their tax or when the ATO takes longer than the statutory timeframes to issue a refund. While the rate is considerably lower than the GIC, it provides taxpayers with a measure of fairness by compensating them for funds held by the ATO beyond the time required. This mechanism helps maintain confidence in the system by ensuring taxpayers are not unduly disadvantaged when excess payments are tied up within the tax administration process.

The disparity between the GIC and SIC rates compared with the overpayment and delayed refund interest rate highlights an intentional asymmetry in the system. The ATO deliberately sets higher rates on taxpayer liabilities to encourage compliance and deter late payments, while applying more conservative rates to refunds to limit the fiscal impact on government revenue.

This structure underscores the principle that timely compliance is rewarded, while delays in meeting obligations attract a financial cost.

In summary, for the period 1 October to 31 December 2025, the GIC is 10.61%, the SIC is 6.61%, and the overpayment/delayed refund rate is 3.61%. Taxpayers should remain attentive to their lodgement and payment obligations, not only to avoid the steep impact of interest charges but also to ensure efficient cash flow management in their dealings with the ATO.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au / www.findaccountant.com.au

This information is of a general nature only. It does not take into account your particular financial needs, circumstances and objectives. You should obtain professional financial advice if you have not already done so before acting on this information. You should read the Product Disclosure Statement (PDS) before making a decision to buy or sell a financial product. Any case studies,graphs or examples are for illustrative purposes only and are based on specific assumptions and calculations.Past performance is not an indication of future performance. Superannuation, tax, Centrelink and other relevant information is current as at the date of this document. This information contained does not constitute legal or tax advice.

By Jodie Moore

Pricing a product or service is one of the most critical decisions a business owner must make. Charge too much, and you risk scaring away potential customers. Charge too little, and you might not cover your costs or earn the profit you need to sustain and grow your business.

Here’s a step-by-step guide to help you understand how to determine the right price for your product or service using smart pricing strategies.

The first step in pricing is understanding all of the costs involved in delivering your product or service. These costs typically break down into two categories:

• Fixed Costs: These are costs that remain constant, regardless of how much you produce or sell. They include things like rent, utilities, software subscriptions, and salaried employees.

• Variable Costs: These fluctuate depending on how much you produce or sell. Materials, hourly wages, packaging, and shipping costs all fall under this category.

Once you’ve calculated both fixed and variable costs, you can figure out your break-even point—the minimum number of sales you need to cover both types of costs. This is crucial, as it ensures that your pricing will at least allow you to avoid losses.

Next, you’ll want to research the market. Understanding what your competitors charge is an essential part of the pricing strategy. However, just copying your competitors isn’t always the best approach. Look at:

• Direct Competitors: These are businesses offering similar products or services. What price range do they offer, and how does your product compare in terms of quality and features?

• Indirect Competitors: These may not be offering exactly what you do,

but they still capture your potential customers’ attention. For example, a local bakery might compete with a coffee shop that offers prepackaged pastries.

• Customer Expectations: What do your customers value most? Are they looking for premium quality, or are they more focused on affordability? This can help you position your price in a way that aligns with what your target market expects.

One of the biggest mistakes small business owners make is not accounting for the profit margin. After covering all your costs, you need to ensure that you’re making a profit. Profit margin is typically calculated as a percentage of the cost of goods sold (COGS). A common rule of thumb for small businesses is to target a profit margin between 10% and 20%, though this can vary depending on the industry. For instance, if your total cost per product is $50, and you want a 20% profit margin, you would add $10 to the cost (for a total price of $60). This ensures that your pricing strategy not only covers costs but also allows for sustainable growth.

Psychological pricing can have a powerful impact on your sales. For instance, pricing something at $99.99 instead of $100 can trigger a perception of a better deal, even though the difference is just one cent.

In addition to this “charm pricing,” consider tiered pricing strategies, bundling, or offering discounts for bulk purchases. Offering multiple price points or subscription-based pricing can also appeal to different customer segments and encourage repeat business.

Even with all the research and calculations in place, pricing is not a one-time decision. Over time, customer behaviour, market conditions, and your business costs can change. That’s why it’s important to test your pricing strategy. You might try offering a new product at a slightly higher price to see how customers respond or provide limitedtime discounts to see if they increase sales volume.

By tracking your sales data and monitoring customer feedback, you’ll be able to adjust your pricing strategy as needed, ensuring long-term profitability.

Pricing is both an art and a science. By carefully calculating costs,understanding market conditions, factoring in profit margins, and considering psychological pricing techniques, you can find a price point that supports your financial goals. In the end, the right price isn’t just about what customers are willing to pay—it’s about creating a balanced strategy that ensures your business can thrive in both the short and long term.

By Ethan Strybosch

What if your next fundraising campaign didn’t just meet expectations—but shattered them?

If you’re aiming to boost donations, expand your reach, or build lasting donor relationships, it’s not about working harder—it’s about working smarter.

These five powerful campaigns aren’t just ideas—they’re proven strategies that inspire action and deliver real, measurable results.

Peer-to-Peer Fundraising: Empower your Supporters

Peer-to-peer (P2P) fundraising isn’t just a trend—it’s one of the most effective ways to organically grow your NFP’s donor base. It empowers your supporters to fundraise on your behalf as individuals reach out to friends, family and colleagues, tapping into personal networks to spread your non-for-profit’s message. 92% of people trust recommendations from friends and family over any other form of advertising (Nielsen), making P2P fundraising a fantastic avenue for successful NFP campaigns. Plus, peerto-peer campaigns typically raise twice as much as traditional fundraising efforts because they reach wider audiences.

The key to success is equipping your fundraisers with the right tools, such as social media templates, email scripts, and easy-to-use donation pages, to make the process accessible and enjoyable. Recognising top fundraisers with shoutouts or small rewards can also keep motivation high.

“Movember’s global campaign is a great example,raising over $1 billion worldwide by turning personal stories into powerful fundraising tools. The combination of humour, personal connection,andglobalparticipation makes it one of the most effective peer-to-peer campaigns ever.”

Seasonal giving campaigns align with key dates like Giving Tuesday, EOFY appeals, and the holiday season are times when people are naturally more inclined to give. Giving Tuesday alone raised over $3.1 billion in the U.S. in 2022, and 30% of all annual donations happen in December, with 10% occurring in the final three days of the year. By leaning into seasonal giving campaigns, your NFP can use these giving trends to increase fundraising throughout the year.

Creating urgency through countdowns, limited-time donation matches, or highlighting specific goals can significantly boost results.

Success Story:

The Salvation Army’s Red Kettle Campaignisaseasonalstaple,raising over $100 million annually during the holidays through both physical donation kettles and online giving platforms. Its recognisable branding and community engagement make it a model for successful seasonal giving.

As we discussed in our January Newsletter, social media is a powerful tool for non-profits, especially when it’s used to tell compelling stories. Story-driven campaigns can humanise your NFP’s cause which in turn creates emotional connections that inspire action. Focusing on real people and authentic stories that reflect the heart of your non-forprofit’s mission engages audiences. Short, emotional videos perform extremely well on social media such as TikTok, Instagram, and Facebook. You can further engagement with your fundraising campaign by encouraging followers to share their own stories and use dedicated hashtags to spread your NFP’s reach.

Success Story:

“Charity:Water’s#WhyWatercampaign is a perfect example, using personal stories from communities impacted by clean water projects to create a global movement that has helped over 15 million people. Their simple, powerful storytelling approach turns donors into passionate advocates.”

While one-time donations are important, recurring giving campaigns create a steady, reliable stream of income. Over one year, monthly donors give 42% more than one-time donors and have a retention rate of 90%, compared to 46% for one-time contributors.

Highlighting the convenience and longterm impact of monthly donations can turn casual supporters into lifelong advocates of your non-for-profit. Offering exclusive updates or behind-the-scenes content on projects occurring within your NFP helps keep these donors engaged.

Success Story:

World Vision’s Child Sponsorship Program is a shining example of a successful recurring giving campaign. Donors receive regular updates, photos, and personal stories about the child they’re sponsoring, creating an emotional connection that fosters long-term support—often lasting for years.

Event-Based Fundraising: Create Memorable Experiences

Events, whether in-person or virtual, are another fantastic way to raise funds for your NFP and strengthen community ties. Fundraising events can account for up to 35% of annual donations for many organisations, including NFP’s and 84% of attendees say they’re more likely to donate after participating. The rise of virtual events has expanded reach even further, increasing participation by 30% in many cases.

Combining ticket sales with activities like raffles, auctions, or donation challenges for projects or a mission in your NFP can maximise revenue while fostering a sense of belonging among supporters.

Success Story:

The Global Citizen Festival blends entertainment with activism, attracting millions of participants worldwide. By leveraging celebrity influence, live music, and powerful advocacy messages, it drives not just donations but also policy changes and global awareness for critical causes.

Key Takeaways for Campaign Success in Your Non-for-profit

• Personal Connections Matter: Authentic, emotional stories resonate more than generic appeals.

• Urgency Drives Action: Campaigns with time-sensitive goals or donation matches perform better.

• Diversify Your Channels: Combine email, social media, events, and paid ads for maximum reach.

• Consistency Builds Trust: Regular communication with your audience keeps your cause top of mind and strengthens donor relationships over time.

Ready to Elevate Your Next Fundraising Campaign?

If you’re looking to launch campaigns that drive donations and build lasting donor relationships, we’re here to help.

By Erryn Langley

As they age, many Australians begin reassessing their retirement lifestyle. One option that often comes up is downsizing the family home in order to reduce costs, freeing up equity and simplifying life. Beyond lifestyle benefits, there’s a valuable financial planning strategy that could help strengthen your retirement income: downsizer contributions to super.

What is a Downsizer Contribution?

If you're aged 55 or over, you may be eligible to contribute up to $300,000 per person (or $600,000 per couple) into your superannuation from the proceeds of selling your home. This contribution doesn’t count toward your standard contribution caps and doesn’t require you to meet the work test.

Key Eligibility Criteria:

• You must be 55 years or older at the time of making the contribution.

• The property must have been owned by you or your spouse for at least 10 years, and it must be your main residence.

• You only have 90 days from the date of settlement to make your downsizer contribution into super. Missing this deadline may mean you lose the opportunity entirely.

• You must submit the ATO downsizer contribution form before or when the contribution is made.

Why Consider It?

• Boost Retirement Savings: It’s a one-off opportunity to significantly grow your super balance, especially if you’ve reached other contribution limits.

• Tax-Effective Income: Once contributed, the funds can be used to start a tax-free income stream via an accountbased pension.

• Downsizer contributions do count towards the transfer balance cap (currently $1.9 million).

• Selling your home may affect your Age Pension entitlements due to the asset and income tests. You cannot use this rule multiple times, it’s a once-per-lifetime strategy.

• Don’t miss the 90 day window.

As you can see timing and making sure that you meet the requirements is critical, if you are considering downsizing, before you do so is a great time to speak with a Financial Adviser. Feel free to give us a call on 1300 557 144 to make an appointment to discuss how the use of a downsizer contribution could assist your overall retirement strategy.

Director and Financial Adviser - GradDipFinPlan

Authorised Representative No 1269525

T:1300 557 144 Email: erryn@cherrywealth.com.au

Website: www.cherrywealth.com.au

Office Address: Suite 4 / 4 - 6 Croydon Road, Croydon 3136

Postal Address: PO Box 657, Croydon VIC 3136

Financial Planning is offered via Cherry Wealth Pty Ltd Ltd ABN 14 653 375 458

Cherry Wealth is a Corporate Authorised Representative (No. 1314769) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221). Part of the Centrepoint Alliance group https://www.centrepointalliance.com.au/

Erryn Langley is Authorised representative (No. 1269525) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We may not have considered your financial circumstances, need or objectives. You should consider the appropriateness of the advice.You should obtain and consider the Product Disclosure Statement (PDS) and seek assistance from an authorised financial adviser before making any decisions regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material. It is based on our understanding of current regulatory requirements and laws as at the publication dates. As these laws are subject to change you should talk to an authorisedadviserforthemostuptodateinformation.Nowarrantyisgivenin respect of the information provided and accordingly neither Alliance Wealth nor its related entities,employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

Council is seeking Expressions of Interest from passionate community members and business representatives who would like to join a range of advisory committees.

Mayor of Maroondah, Councillor Kylie Spears, encouraged community members to apply and make a difference.

“At our July meeting, Council was pleased to confi rm that six advisory committees will operate from 1 January 2026. The advisory committees have been reviewed to ensure they align with our recently adopted Maroondah 2050 Community Vision and Council Plan 2025-2029.

“At the heart of these advisory committees is building partnerships that enhance arts and culture, community wellbeing, natural environment, and liveability and inclusion in Maroondah as we work towards delivering the Maroondah 2050 Community Vision,” Cr Spears said.

“This is a great opportunity to build your community, speak up on behalf of others, invest in your area of passion and make a real difference through policy, programs and actions. If you are keen to get involved, you can fi nd out more and submit your Expression of Interest via Council’s website.”

The advisory committees provide advice and recommendations on local issues and matters relating to the delivery of strategies, services, activities and projects.

The alignment with the recently adopted Maroondah 2050 Community Vision and Council Plan 2025-2029 will further enhance the contributions of the advisory committees, ensuring they continue to provide effective stakeholder input to inform Council’s service delivery, partnerships and advocacy activities.

The following Council advisory committees will operate from 1 January 2026:

• Maroondah Arts Advisory Committee

Do you know an inspiring young leader making a difference in the Maroondah community? Nominate them for Young Citizen of the Year!

Council is looking for young individuals that have made a significant contribution or achievement to the community over the past year.

By nominating a young individual, you not only acknowledge their dedication and positive impact, but also inspire both the nominee and their peers to continue to strive for excellence.

Nominations close Sunday 19 October, with the winners presented at Council’s Australia Day event in January 2026.

Submit your nomination today!

https://maroondahcctinyurl.com/Australia-Day-awards

#Maroondah #MaroondahCityCouncil #MaroondahYouth #MaroondahCommunity #YoungCitizenOfTheYear #LocalHeroes Maroondah City Council Youth Services

• Maroondah Business Advisory Committee

• Maroondah Community Health and Wellbeing Advisory Committee

• Maroondah Disability Advisory Committee

• Maroondah Environment Advisory Committee

• Maroondah Liveability, Safety and Amenity Advisory Committee.

Council is currently accepting Expressions of Interest from community members and business representatives who would like to join our advisory committees.

Council advisory committees typically consider in-depth issues that are related to Council policy, programs, advocacy issues or service delivery activities.

Members will have a genuine voice, working with Councillors and Council offi cers, participating in four meetings per year. New members will join these committees for an initial twoyear period, with the potential for further extension.

Expressions of Interest will close at 5pm on Sunday 12 October.

Find out more about the advisory committees or submit your Expression of Interest.

Council has endorsed an update to the Maroondah Liveability, Wellbeing and Resilience Strategy 2021-2031.

Mayor of Maroondah, Councillor Kylie Spears, thanked community members for their input.

“As Council’s key social environment strategic plan, the Maroondah Liveability, Wellbeing and Resilience Strategy 20212031 describes how Council and its partners will work towards improving the health, wellbeing, liveability and resilience of our community until 2031. It also outlines a vision for the future social environment of the municipality, supporting the desired outcomes within the Maroondah 2050 Community Vision.

“Council has updated the Strategy to ensure it remains current and relevant, with the 2025 update including current data from our engagement, consultation and research. This data helped to inform key priorities, community aspirations and needs and gaps in service provision and community support,” Cr Spears said.

“Thank you to everyone who provided feedback on the draft update document earlier this year. Your feedback has helped to confi rm that the six focus areas and strategic priorities of the 2021 Strategy remain important and relevant for our community and we were pleased to receive a high level of support for the strategy, with more than 87 per cent of respondents strongly supporting the key focus areas.

“Through this Strategy and supporting action plans, Council and its partners will work towards a common agenda that is evidence-informed, community-driven, and seeks to improve the health and wellbeing of Maroondah residents. This will help ensure Council continues to respond to our community’s health and wellbeing needs and aspirations over the coming years, holistically and sustainably.”

The original Maroondah Liveability, Wellbeing and Resilience Strategy 2021-2031 was developed through extensive community engagement, stakeholder consultation and background research. It was endorsed by Council in October 2021 and submitted to the Victorian Minister for Health as the Municipal Public Health and Wellbeing Plan 2021-2025 for Maroondah.

In accordance with the Public Health and Wellbeing Act 2008, Council is required to prepare a health and wellbeing planning document every four years, within 12 months of general Council elections. The 2025 update of the Strategy meets these statutory requirements and will also serve as Maroondah’s Municipal Public Health and Wellbeing Plan 2025-2029.

On Thursday 16 October, permaculture and sustainability educator Anna the Urban Nanna will be running a Composting and Worm Farms workshop at Maroondah Federation Estate in Ringwood.

In this free, hands-on workshop, Anna will help you understand how to get your compost ratios right in simple, straightforward language. She will also explain the basics of different composting systems to find the right one for your needs.

But that’s not all – did you know that Compost Revolution offers Maroondah residents up to 60 per cent off the cost of a new composting system, as well as free delivery? For a green cone solar composter or tumbler composter, that’s a saving of over $100!

So come along to our composting workshop, get inspired to start composting, work out which composting system is right for your home, and take advantage of your Compost Revolution discount to get ready for this growing season!

Urban Nanna’s Composting and Worm Farms Workshop | Maroondah City Council

Fifty years ago, a small group from the Holy Spirit Parish in North Ringwood came together with a vision. They imagined a place where people from all walks of life could connect— not just through worship, but through learning, support, and a shared sense of community. What began as a simple idea has grown into the vibrant and much-loved North Ringwood Community House—a place thousands have come to know as their second home.

Our story began in 1972, guided by then parish priest Jim Nippard and supported by passionate locals. By 1975, the North Ringwood Community Development Council had formed, and in 1977, the generous Milne family donated a weatherboard home that became our first physical base at 120 Oban Road Ringwood North. Officially renamed in 1982 to the simpler and more familiar “North Ringwood Community House.”

That humble weatherboard house was our base for decades - small but full of heart - until we eventually outgrew it and relocated to the Parkwood Community Hub in 2015 thanks to the support of Maroondah City Council, where we continue to thrive today.

Over the past five decades, the real story of North Ringwood Community House has always been about people. We've supported thousands on their journey toward education, employment, and connection—often beginning with a quiet step through our doors and growing into renewed confidence and opportunity.

As the only community house Registered Training Organisation (RTO) in Maroondah, we’ve helped hundreds gain nationally recognised qualifications and take real steps into the workforce—especially in areas such as Aged Care and Disability. Many learners arrive unsure of their potential and leave with not only a qualification but a stronger sense of self.

We’ve welcomed culturally and linguistically diverse (CALD) learners seeking to build English skills and settle into the community. We have helped at risk and neurodiverse young people achieve their VCAL students, and our occasional childcare and playgroup programs supported local families for many years—giving parents a space to learn while their children thrived in a caring environment.

Today, North Ringwood Community House is a modern, inclusive hub where people come to learn, connect, and grow. While our services have evolved with the times, our mission remains clear: to provide a welcoming and inclusive environment creating opportunities for lifelong learning and social connection.

Our accredited training programs continue to offer clear employment pathways, especially for those re-entering the workforce or starting fresh. We also run English language and digital skills classes, supporting people from diverse backgrounds to participate confidently in community and work life.

Beyond formal education, our calendar is filled with opportunities to engage—health and wellbeing programs, creative arts, practical work skills, languages, and social groups like the Bush Nomads, Fab 50s, and Book Club. The Community Library, free workshops, and food drives are all part of our practical approach to community care.

Volunteering is central to our identity. Many of our volunteers have been with us for years, giving their time generously to create the warm, welcoming culture we’re known for. Whether someone joins a class, contributes as a volunteer, or simply drops in for a cuppa, they become part of something bigger—a place that feels like home.

The answer is simple: belonging.

North Ringwood Community House isn’t just about services or programs—it’s about people. It’s about being greeted by name, being listened to, and feeling like you matter. Whether someone joins a creative class, seeks a new career path, or just stops by for a cuppa, they’re met with warmth, respect, and real community spirit.

NRCHI will continue to be a welcoming and supportive place for anyone who walks through the doors and meeting the needs of people will continue to be at the forefront of everything we do!

We've also long been a place of creativity, connection, and practical support. From digital literacy, art and craft, fitness classes, and community meals to volunteering, social groups and free workshops, our programs have always aimed to reflect the real, day-to-day needs of the people in the local community.

To mark this incredible milestone, North Ringwood Community House will be hosting a 50th anniversary celebration on Sunday 16 November from 10am to 2pm at the Parkwood Community Hub. It will be a wonderful opportunity to reconnect, share memories, and celebrate the people and stories that have shaped the North Ringwood Community House over the past five decades. Everyone is welcome—we’d love to see past and present participants, staff, volunteers, and local community members join us for this special occasion.

within the group. Our instructor Suzanne is a delight, and we always have a laugh trying to keep up with left and right feet! We even head to a local café for coffee afterwards. Everyone misses it when there’s a break—it’s just that good.” — Heather, Zumba Gold participant

"A great place to learn—especially if you're nervous" “As an older student returning to study, I’ve now completed three courses at NRCHI and highly recommend it. The staff are friendly, the trainers are supportive, and I’ve felt encouraged every step of the way. I’ve gained new skills, built confidence, and made great friends. For anyone feeling unsure about getting back into learning—this is the place to start.” — Lisa, Accredited Training student

"Craft, coffee, and community" “Our craft group started with just a few people and has grown into a caring, creative community. We meet weekly to chat over coffee and work on our own projects—many of which are donated to charities and health organisations. Everyone is welcome, and members are always happy to share skills and ideas.” — Eileen, Coffee and Craft participant

"Learning a language with laughter and support" “Learning Italian is a challenge—but doing it with a supportive group and a knowledgeable teacher makes it fun. We’re encouraged to ask questions (even the silly ones!) and take our time. I’m progressing slowly, but I’m enjoying the journey and love the learning.”

— Nick, Italian Advanced participant

"From Refugee to Aged Care Professional—Thanks to NRCH" I’m a Chin-speaking Burmese person who came to Australia as a refugee in 2007. Life was challenging—especially with language and cultural differences. I never thought I could have a real career here.

But joining the Aged Care course at NRCH changed everything. The trainers were patient and compassionate, and they helped arrange my placement—where I was eventually hired. I’m so grateful for the support and encouragement I received. I highly recommend NRCH to others in my community.”Mangpa – Aged Care Graduate & NRCH Student

Ringwood Church of Christ are creating a beautiful place for you to be on Saturday 15 November. The annual market event held at the church has been rejuvenated with a new date, many new stallholders, and a Chrismassy atmosphere.

This market has often happened in October but this year the re-energised committee have some fresh faces who are super keen to create a delightful space and happy event as we lead into Christmas. The team are eager for you to come along, wander the market and browse the fabulous stalls on offer. There will be heaps of hand-made, beautiful items like jewellery and cushions, as well as yummy food.

Grab a sausage from the BBQ and peruse the plants. Or sit down with a cup of tea or coffee and cake while you catch up with a friend. Listen to the music as you browse the books. The kids can have some fresh popcorn as they have a go at the Lucky Dip. There will be lots to see and do.

External stallholders retain any profits to support their own small business. The remaining funds go towards the work Ringwood Church of Christ does to support the local community, such as through Little Stars Playgroup, Oasis Community Meal, an Emergency Food Relief Pantry, English Conversation Corner and Kids Hope Mentoring.

It’s easy to get to, being a short walk from Ringwood Railway Station and Eastland Shopping Centre, there is a bus stop out the front on Bedford Rd, and some car parking in their Pitt St car park.

Follow along on their socials @ tomarkettomarketchristmas.

Put the To Market, To Market Christmas event in your calendar now, Saturday 15 November 9am-2pm, as it will be a beautiful place to be!

By Warren Strybosch

In last month’s article we discussed the RAD and DAP. This month we think it is important to discuss the Basic Daily Care Fee. We will explore what the Basic Daily Care Fee covers, how it is calculated, how it is paid, and what Australians need to know when planning for this cost.

Moving into residential aged care is a significant life transition for many older Australians and their families. Alongside the emotional considerations of leaving a long-term home, financial planning becomes a crucial part of the process. One of the most important components of residential aged care costs is the Basic Daily Care Fee. This fee applies to all residents, regardless of their financial position, and is designed to contribute to the everyday living costs within aged care facilities.

Everyone pays a Basic Daily Care Fee. This fee helps pay for a resident’s share of day-to-day services such as:

• Meals and nutrition

• Cleaning and laundry services

• Facilities management and utilities (heating, cooling, water, and electricity)

• Basic furnishings and maintenance of communal spaces

Importantly, this fee applies for every day you are a resident, even on days you may be away overnight—for example, if you go on holiday or spend time in hospital.

The Basic Daily Care Fee is set at 85% of the single person rate of the basic Age Pension. The federal government updates the fee on 20 March and 20 September each year in line with pension increases, ensuring it rises with the cost of living. Prices are published on the Department of Health, Aged Care and Disability website for transparency.

Based on current rates, the maximum Basic Daily Care Fee is $63.82 per day, or $23,294.30 per year. While this figure changes periodically, it provides a clear indication of the cost families need to plan for when moving into aged care.

Residents pay the Basic Daily Care Fee directly to their aged care home, usually on a fortnightly or monthly basis. For many pensioners, the fee is deducted from their Age Pension, making

the process straightforward. For others, it may be funded through private income streams such as superannuation pensions, annuities, or investment income.

This regular payment structure ensures aged care facilities receive consistent contributions to help cover the ongoing costs of providing everyday services.

Every resident in government-subsidised aged care pays the Basic Daily Care Fee. This applies regardless of whether a person is a full or part pensioner, or whether they are self-funded retirees with significant assets. The universality of the fee reflects its role in ensuring fairness and shared responsibility for basic living costs in residential aged care.

The Basic Daily Care Fee serves several important purposes:

1. Shared Responsibility: It ensures all residents contribute to their daily living expenses, just as they would if living independently.

2. Government Sustainability: By asking residents to cover basic living costs, government subsidies can be directed toward clinical care and accommodation support.

3. Predictability: Because it is universally applied and updated twice yearly, families can plan ahead with greater financial certainty.

The Basic Daily Care Fee is only one part of the overall cost structure of residential aged care. Other potential costs include:

• Accommodation Payments: Such as the Refundable Accommodation Deposit (RAD) or Daily Accommodation Payment (DAP).

• Means-Tested Care Fee: An additional charge based on assessed income and assets.

• Additional Services Fees: Optional charges for lifestyle or premium services beyond the standard package.

Together, these components form the complete financial picture of aged care, with the Basic Daily Care Fee acting as the essential foundation.

Given that the Basic Daily Care Fee is ongoing, unavoidable, and payable every day of residency, it is vital to factor it into long-term financial planning. Key considerations include:

1. Cash Flow Management: Ensuring regular income sources can cover the $63.82 daily fee without exhausting savings too quickly.

2. Pension Interaction: For Age Pension recipients, the link between the fee and the pension ensures affordability and indexing over time.

3. Budgeting for Increases: Families should expect adjustments twice yearly in line with pension changes.

4. Asset consideration and Protection: If and when to sell the home and what to do with the proceeds to ensure the Power of Attorney and other family members interests are protected.

Professional financial advice can help structure income streams and asset management to comfortably meet this regular obligation.

Many families misunderstand the Basic Daily Care Fee, especially when comparing facilities. Common misconceptions include:

• “The fee covers everything.” In fact, it only covers daily living expenses, not nursing or clinical care.

• “Wealthy residents don’t pay.” Every resident pays the fee, regardless of financial position.

• “It can be waived.” The fee is set nationally and cannot be negotiated by individual facilities.

The Basic Daily Care Fee is a cornerstone of Australia’s aged care funding model. At $63.82 per day, or just over $23,000 annually, it represents a resident’s contribution toward meals, cleaning, laundry, utilities, and other daily living services. Paid directly to aged care homes on a regular basis, and applying every single day of residency, the fee ensures fairness, sustainability, and predictability across the aged care sector.

By understanding how the fee is calculated, when it applies, and how it interacts with other aged care costs, Australians and their families can plan more effectively for the financial realities of residential aged care. Careful planning not only helps to meet the cost with confidence but also allows families to focus on what truly matters—the quality of care and support their loved one receives in this important stage of life.

Part of the Find Group of Companies

Financial Planning, SMSF, Super, Insurance, Pre-Retirement & Retirement Planning (Financial Planning) are offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth, Find Insurance and Find Retirement. Find Wealth Pty Ltd is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221). Part of the

Warren Strybosch

Authorised Representative (No. 468091) of Alliance Wealth Pty Ltd. Centrepoint Alliance group (www.centrepointalliance.com.au/fsg/aw).

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice.You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

By Warren Strybosch

When I meet with a new retiree client for the first time, we go through a Client World Map meeting. The meeting helps me to better understand their financial situation, but it also gives me an opportunity to understand what their future goals and interests are.

Retirement is more than an end to working life—it’s the beginning of a new chapter filled with freedom, purpose, and the opportunity to enjoy long-awaited goals. Whether your post-work dreams include extended travel, picking up new hobbies, or simply savouring quiet moments with loved ones, weaving these aspirations into your retirement modelling is crucial for achieving the lifestyle you desire.

Retirement is the perfect time to pursue passions put on hold: a grand tour of Europe, finally writing that novel, volunteering abroad, or learning to paint. These aren’t just activities; they’re the experiences that bring meaning and joy. Without incorporating such personal goals into financial planning, retirees risk underfunding their aspirations—or worse, compromising on them entirely.

I personally have several ‘bucket list’ items I wish to achieve in life, and these may happen in retirement. One is to go to the Superbowl, and another is to write children’s books. Also, I want to see if I can get Wallballs off the ground...that was for you Tim (if by chance you ever happen to read this article –sorry people, that was in reference to a long standing in joke between me and a friend of mine).

The Association of Superannuation Funds of Australia (ASFA) Retirement Standard provides a trusted benchmark of what retirement costs look like in Australia. For a comfortable lifestyle—one that includes private health insurance, a reliable car, dining out, domestic vacations, and even occasional international trips—ASFA estimates annual expenses of around $73,077 for couples and $51,805 for singles. To fund that lifestyle, a retiree would typically need a superannuation balance of about $690,000 for a couple or $595,000 for a single person (ASFA, 2023).

These figures are invaluable—but they reflect a generalized view of comfortable living. True contentment often lies in the bespoke: the trip of a lifetime, pursuing creative fulfilment, or simply more meaningful moments. That’s why your own goals should sit at the heart of retirement modelling.

Start by identifying your key goals: travel plans, lifestyle habits, family support, or bucket-list adventures. Estimate the costs, then compare them to the ASFA benchmarks. For instance, adding an annual trip overseas may stretch your budget beyond ASFA’s comfortable baseline—but aligning your super, pension, and savings to account for that ensures you don't have to compromise experiences for safety.

Moreover, retiree spending tends to decrease over time—but the early years can be the most vibrant, and expensive—as retirees tend to prioritise lifestyle while they’re fitter and more mobile. Factoring in timing can help you balance spending and longevity, so you enjoy life now without risking your financial future.

True retirement planning isn’t one-size-fits-all. It should start with:

• Clarifying personal goals—what matters most to you. We do this in our Client World Map meetings.

• Mapping costs—compare these to ASFA’s modest and comfortable budgets.

• Adjusting strategies—ensure your savings and income sources can fund both essentials and dreams. We provide several retirement modelling scenarios for clients to consider before the leap into retirement. This helps clients have peace of mind that they can afford their goals in retirement and not run out of money.

• Timing considerations—some goals are time-sensitive; others can wait.

Financial advisers often note that many retirees are overly cautious, underspending and leaving unused wealth behind. Your money should serve you—helping you live richly, not just last securely. We believe in leaving the house to the kids but everything else is yours to spend.

Retirement is ultimately about freedom—the freedom to enjoy life and fulfill dreams. By incorporating personal goals into your financial modelling—and comparing them with trusted benchmarks like the ASFA Retirement Standard—you ensure your retirement isn’t merely “comfortable,” but deeply meaningful. Savour the journey, embrace your bucket list, and live the retirement you’ve earned.

If you are not sure whether or not you will be able to afford your goals in retirement, then consider booking an initial FREE retirement meeting with Warren Strybosch, an award winning financial advisor and speaker, who can help you Find Retirement (www.findretirement.com.au) with ease.

Warren Strybosch Award winning Financial Adviser and Accountant

Part of the Find Group of Companies

Financial Planning, SMSF, Super, Insurance, Pre-Retirement & Retirement Planning (Financial Planning) are offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth, Find Insurance and Find Retirement. Find Wealth Pty Ltd is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221). Part of the

Centrepoint Alliance group (www.centrepointalliance.com.au/fsg/aw).

Warren Strybosch

Authorised Representative (No. 468091) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice.You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

•

Here

1.

2.

3. You will be then sent a tax checklist to complete online. Takes less than 5

4. We will then require you to upload your documents to our

5. Once we have received all your documentation, we will complete the return.

6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf.

We specialise in the following:

• Biz Pack Insurance

• Landlord Insurance

• Public Liability Insurance

• Professional Indemnity Insurance.

We DO NOT provide advice or quotes for the following (you need to go direct and save):

• Car Insurance

• Home & Contents

• Caravan

• eBikes

We work with only the most reputable insurers to bring you a range of insurance options for you to choose from:

At Find we can help you find the ‘right’ personal insurance. Our aim is to help you obtain and retain the personal insurances that are appropriate for you and at cost that you can afford.

• Income Protection (IP)

• Life Insurances or Death Cover

• Total and Permanent Disability (TPD) Personal Insurances Include:

When your insurance are in place, our services do not stop there. We will provide you with an after care service that includes policy notifications, insurance report, help desk, reviews and help at claim time. We provide ourselves in providing honest advice that you can rely on.

warren@findinsurance.com.au

www.findinsurance.com.au

•

• Lactation Consultant ----------- 35

• Swen Pouches ---------------------- 00

• Hair Dresser --------------------------- 00

• Chiropractor ------------------------- 00

• Beauty Therapy -------------------- 00

• Gym --------------------------------------- 00

• Massage Therapy ---------------- 00

|

Osteopathy in Australia is a government registered, allied health profession. Osteopaths focus on improving the function of the neuro-musculoskeletal system (bones, muscles, nerves and connective tissues) to optimise health and well-being.

Joanna is highly qualified and experienced in the osteopathic assessment and treatment of babies and infants.

She can assist with the following assessments:

• Gross motor development (milestones)

• Primitive reflexes

• Tongue function and it’s relation to sucking skills

• Biomechanics of the jaw and mouth

• Help increase or decrease milk supply ADVANCED PAEDIATRIC OSTEOPATH & LACTATION CONSULTANT PROVIDING PERSONAL & CARING SUPPORT FOR YOU & YOUR BABY

IBCLC lactation consultants are recognised around the world as the experts in lactation care. They provide evidencebased knowledge to assist mothers to establish and maintain breastfeeding. As professionals, they are charged with promoting, protecting and supporting breastfeeding.

Joanna can help with a broad range of lactation consulting services, including:

• Teaching a new mum how to hold and position her baby to breastfeed

• Assess the suck, swallow and breathing of an infant

• Assess for tongue function and determine any evidence of restriction (tongue tie)

• Pre and post-frenectomy breastfeeding support

Save up to 50% in Bed Bath N' Table's Mid Season Saleon now!

Mid Season Sale

Save up to 50%

Bed Bath N’ Table’s Mid Season Sale is now on! Save up to 50% and explore new season product arrivals; from calming, nature-inspired designs to bold patterns and prints. Shop now, online or in-store.

Dental for Kids These School Holidays

Your child may be eligible for up to $1,132 in free dental care* through the Child Dental Benefi ts Schedule (CDBS).

This program helps cover the cost of basic dental services for eligible children under 18 and is available for another year at Pacifi c Smiles Dental.

School Holiday Fun at Strike and Holey Moley Strike: Short Social Copy (50–100 words): These holidays, let ‘em roll wild for just $14 at Strike! A full game of bowling with their mates, cousins, and chaos crew. Lanes are open, pins are up. Book now and lock it in.

Long Web/Email Copy (100–200 words): No screens. No boredom. Just strikes.

Gelatissimo New Mont Blanc flavour + Giveaway

Introducing Mont Blanc – Limited Edition Coffee-Infused Gelato + Your Chance to WIN a $500 Coffee Prize!

Indulge in our newest creation – Mont Blanc – a rich and vibrant fusion of Espresso gelato layered with velvety Marmalade cream, fi nished with orange zest, grated nutmeg, and fresh orange slices. Inspired by Melbourne’s iconic Mont Blanc cold brew, this limited-edition fl avour launches accross all Gelatissimo Victoria stores on Friday 12 September.

In-Kind Sponsorship with Find Maroondah Community Paper

We invite a representative from each sporting club to submit team selections, results and any interesting stories relating to your club/sports.

For more information contact: Warren on 1300 88 38 30 or Email: editor@findmaroondah.com.au

The Norwood Sporting Club is coming together for one epic night of fright! Join us on Saturday, October 25th at 7PM for the ultimate whole-club Halloween Party. Costumes are mandatory – so bring your scariest, funniest, or most creative look and battle it out for the Best Dressed Awards.

Headlining the night will be Norwood’s own DJ Joel Richards, bringing the beats that will keep you dancing until dawn. Supporting DJs are still to be announced – so expect plenty of music, energy, and Halloween chaos!

Norwood Sporting Club

7:00PM – Late Theme: Halloween (Costumes a Must!)

This is one party you don’t want to miss. Step into the shadows and join us for a night full of scares, style, and sound… Welcome to the Nightmare in the Wood.

With the new season only weeks away it is great to be able to announce some great coaches for our Junior program.

For the U12's we have Clarko and Blake taking the reigns this season. Clarko coming off winning the club championship last year and Blake cementing himself in the 2nd XI. These guys bring great cricket knowledge and energy to the U12's.

In the U14's we have Ben Taylor leading the way this season. Coming off coaching the U12's last season and the U16's the year before, Ben is a great coach with plenty of 1st and 2nd XI cricket experience to share with the juniors.

We thank our senior players for stepping up and assisting in our junior program to help develop the next wave of Eagles.

Junior training resumes on Sunday this week. 10am: Mini bash, Girls and U12's 11am: U14's and U16's

Season launch 25/26

Great to see players and families back at the nest on Sunday

Thank you to those who took time out of their busy schedule to be there It was good to see our regulars back, but it was great to see New players.. especially some of the Ladies from our Inaugural Senior Ladies Team WELCOME ! Best Guess will be here for the season.

Stay tuned to our socials for updates we have lots of fun functions and events on for the season as well as information for match day and the results

Jazz On Sundays at the Ringwood Bowls Club NEW VENUE!

Join us for a swinging afternoon at the Ringwood Bowls Club.

Ringwood Bowls Club 2-12 Loughnan Rd, Ringwood VIC 3134

1:30 PM to 5:00 PM

WHAT'S ON:

• D.R. Big Band: A 17-piece band performing big band favorites, old and new, with guest singers.

• Jazz Notes–Caught In The Act!: jazz standards, funky Latin tunes and special guests.

OPEN JAZZ JAM

• End the day with a jam session open to singers and instrumentalists!

BOOKING INFO:

• $15 + $0.50 fee (online until 9 AM on event day).

• Tables seat 8. Call 0412 063 603 for larger groups.

• Tickets available at the door (seating near the band is limited)

• Empty seats may be allocated.

FOOD:

The Ringwood Bowls Club will be providing lunches: chicken and salad plus dessert ($25).

Charcuterie platters, desserts and some snack options will also be available.

The bar will be open, as usual.

Ringwood Bowls Club 2-12 Loughnan Rd, Ringwood Victoria 3134 https://www.trybooking.com/events/landing/841364

Simply upload your ad at www.findmaroondah.com.au/nfp-free-advertising or you can email the ad to the editor@findmaroondah.com.au and we will do the rest for you.

Senior

Karen

NextGen

Worship

Transform

Community

Children's