WARREN STRYBOSCH

We are looking for business owners who would like to be part of the Find Manningham Network Group.

• Accounting Services

• Acupuncture

• Architect

• Architectural Interior Design

• Attorney- Family

• Auctions- Real Estate

• Bookkeeper

• Bowen Therapy

• Builder- Commercial

• Business Coach

• Business Equipment Financing

• Business Insurance

• Cabinets

• Caterer

• Graphic Designer

• Chinese Medicine

• Chiropractor

• Commercial Mortgage

• Computer Repair

• Computer Web Design

• Concrete

• Copywriting/Copy Editing

• Counselor/ Psychotherapist

• Dentist

• ELECTRICAL OPERATIONS

• Electrician

• FINANCE BROOKER

• FINANCIAL PLANNER

• Fitness Trainer

• Flooring

• Florist

• Garage Doors

• Health & Wellness Coach

• Homeopathy

• Lawn Care

• LAWYER

• Life Coach

• Loans

• MARKETING

• Massage Therapist

• Meditation/Yoga

• Naturopathic Medicine

• Nutrition

• Osteopathy

• Painter

• PERSONAL TRAINER

• Photographer

• Pilates

• Plasterer

• Plumber

• Podiatrist

• Printer

• Project Management

• Psychologist

• Real Estate Rentals

• Real Estate Sales

• Reiki

• Residential Cleaning

• Residential Mortgage

• Security

• Signs

• Solar

• SOLICITOR

• Travel Agent

• WEBSITE DEVELOPER

• Wedding Planner

The Find Manningham is a community paper that aims to support all things Manningham. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Manningham for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local businesses owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

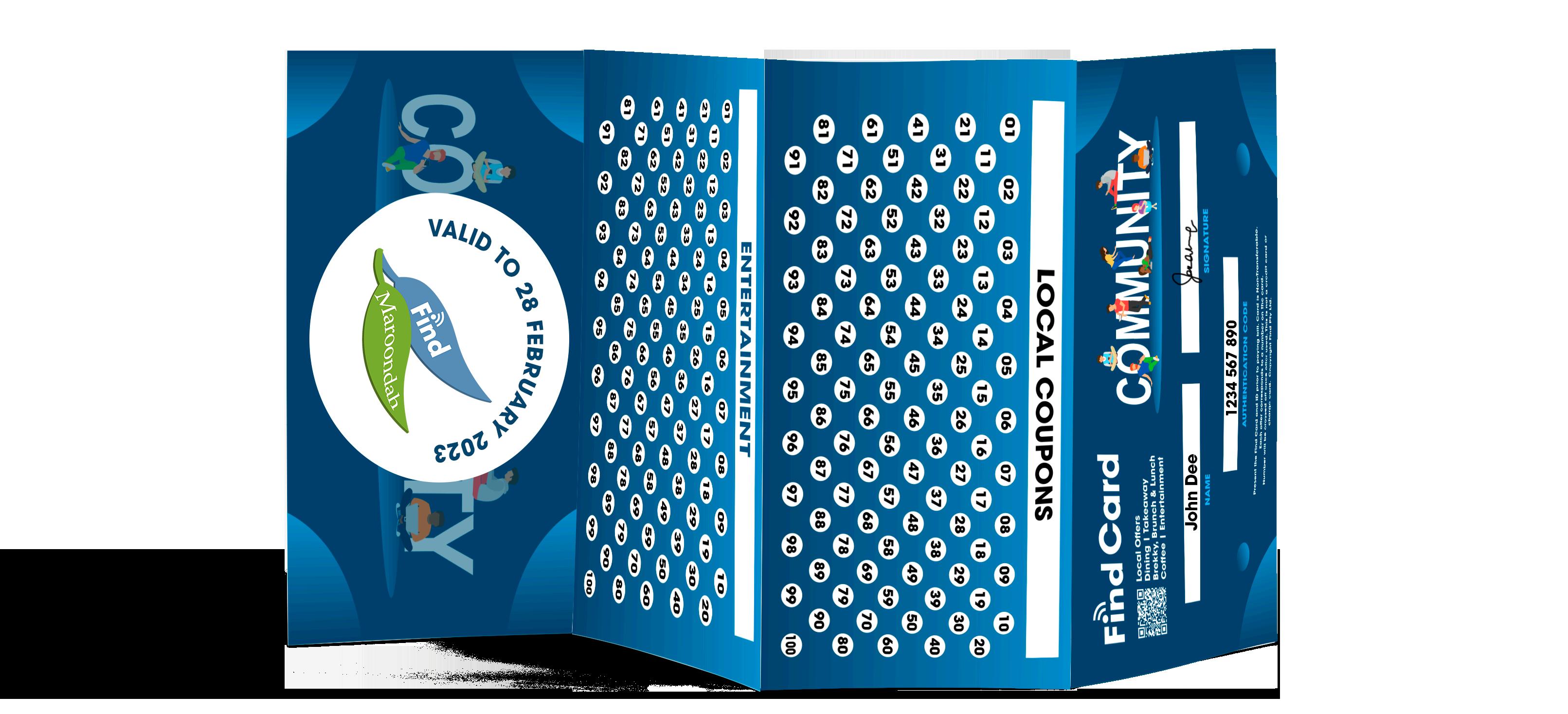

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmanningham) so you keep up to date with what we are doing.

We value your support,

The Find Manningham Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 warren@findnetwork.com.au

PUBLISHER: Issuu pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmanningham.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: sport@manningham.com.au

WEBSITE: www.findmanningham.com.au

The Find Manningham was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with is core focus of helping other Not-ForProfits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Manningham has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Manningham is a local government area in Victoria, Australia in the north-eastern suburbs of Melbourne. Manningham had a population of approximately 125,508 as at the 2018 Report which includes 27,500 business and close to 45,355 households. The Doncaster and Templestowe Council administered the area until December 15, 1994.

The Find Manningham acknowledge the Traditional Owners of the lands where Manningham now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Manningham accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

Next

closes Monday October 3, 2022.

Financial Adviser Standards and Ethics Authority (FASEA) is a Commonwealth entity that was established in April 2017 to set standards for the ethical conduct, educational qualifications and ongoing training of licensed financial advisers in Australia.

One of the new laws that was introduced for all financial advisors, existing as well as those entering the financial planning industry, was to sit the FASEA exam. Since the introduction of the exam and the requirement to update financial planning qualifications from a diploma to at least a bachelor standard, the profession as seen a increase in the numbers of those leaving. No longer is this a place for salespeople.

The pass rate of the FASEA exam has been on a downward trend since the inaugural sitting in June 2019 which had 90 per cent of 579 candidates pass. That dropped down to 79 per cent in April 2020 (the first to include remote proctoring), 69 per cent in May 2021, and only 328 candidates (52 per cent) passed in July and August exams.

ASIC confirmed that 76 per cent of the candidates were resitting the exam for at least the second time.

Of those who have passed so far:

• Over 15,800 are recorded as current financial advisers on ASIC’s Financial Adviser Register (FAR), representing 95% of current advisers on the FAR.

• Over 2,500 are ceased advisers on the FAR and may be re-authorised in the future.

• Over 700 were new to the industry.

• Over 3,300 unsuccessful candidates have re-sat the exam, with 74% passing at a re-sit.

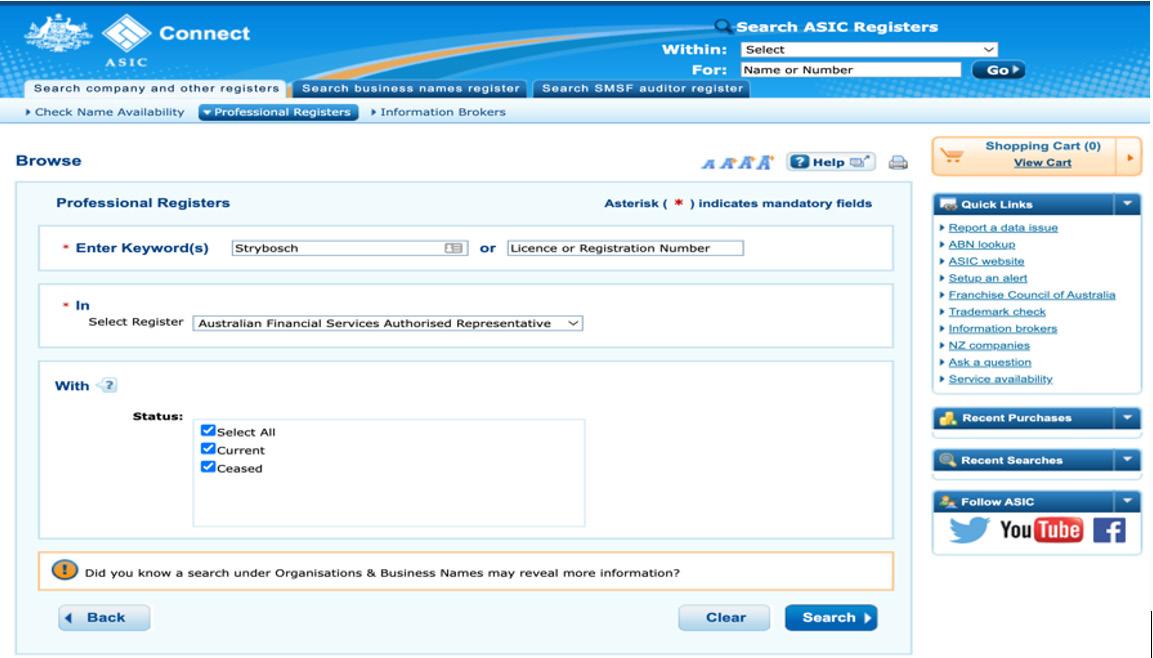

Note: Currently, you cannot view who has or has not passed the FASEA exam. All you can do is check the ASIC website to see if the advisor is still registered as a financial planner. Go to asic.gov.au and selecting the ‘Professional Registers’ on the right. You then type in the Surname of the advisor and choose the appropriate registry e.g., Australian Financial Services Authorised Representative (example provided).

The latest sitting was the last opportunity for advisers who are operating under the nine-month exam extension to pass the exam. From 1 October 2022, all financial advisers must have passed the exam to continue to provide personal advice.

ASIC has confirmed anyone eligible for the extension who has not passed in any of the three cycles this year will not be able to provide personal advice from 1 October.

“For financial advisers who are eligible for the exam extension, but have not passed the exam in 2022, there is an opportunity for you to take steps with your Australian financial service (AFS) licensee to limit the effect of this outcome,” ASIC said in a statement.

“If your licensee ceases your authorisation on or before 30 September 2022, you will still need to pass the exam before you can become re-authorised and re-commence providing personal advice. However, you will not need to complete a professional year and you will have until 1 January 2026 to obtain an approved degree.

“If your licensee does not cease your authorisation on or before 30 September 2022, it will cease by operation of the law and you will no longer be able to provide personal advice. To become re-authorised and re-commence providing personal advice you will need to complete a professional year and

obtain an approved degree in addition to passing the exam.”

It is important as consumers to ask the following questions of the advisors you sit down with:

1. Have you passed the FASEA exam?

2. Have you completed your education requirements or are on track to do so?

If the advisor has not passed the exam and is not likely to meet their education requirements by 2026, then you need to consider whether they are the right advisor you want to be dealing with. Otherwise, you might start off with the first advisor only to find you have no choice but to move onto another advisor. This is not an ideal situation for anyone especially retirees. Also, moving to another advisor might require you to start all over again and who wants to pay all those initial fees again?

At Find Wealth, all our advisors have passed their FASEA exam and either have completed all their studies or will have well before the 2026 deadline. You can have peace of mind when dealing with Find Wealth that you won’t have to start all over again.

Has your

passed their

If not, they CANNOT provide advice from October 2022 onwards until they meet new requirements

I get regular calls from people who are in the process of starting a new business. Many are after a “ball-park” figure for insurance costs so they can flesh out a business plan and budget for outgoings. No matter how the conversation starts, the outcome is largely dependent on the quality of the information provided by the client, and this can be… to put it politely, “a little thin” at times.

To maximise your chances of getting a fair and accurate insurance quote:

Be Qualified. I can’t tell you how many times people have been unaware of the qualifications, licenses, registrations, or tickets which are essential not only to do the job they plan to do, but to convince the insurer they are a “good risk”. This is particularly the case if we are trying to get you Professional Indemnity cover. Best to do your research before telling the boss you’re leaving. We can’t insure the uninsurable.

Clearly Define your Activities. If you describe yourself as a “glazier” but forget to tell us you are abseiling from the 40th floor to replace windows in a multi-storey office block, the insurer will incorrectly rate you and will decline any claims. Remember to describe and disclose your activities properly. We can’t provide accurate quotes without a correct description. An inaccurate quote could lead a worthless policy if care is not taken at this stage.

Tell Us About Future Plans. The selection of insurers may depend on whether they can accommodate all of the required cover sections. A Business Pack PL (Public Liability) Policy may be more appropriate than a stand-alone PL policy if—in a couple of months—you might need to add contents, business interruption, and machinery breakdown cover sections for example. You may need a stand-alone PL Policy if your activity is “non-preferred” by Business Pack Policy Insurers. Your broker might have to place you with a specialty underwriter who understands that specific occupation. It’s better to know from the start what you plan on doing later, so a flexible insurance programme can be put in place.

Provide Correct

Name. One fellow—insured with a direct insurer—had insured another company (not his own) with similar spelling for 6 years before realising that it was wrong from the very beginning. Details do matter. Double check this, otherwise you

may take out an entirely worthless policy when you go ahead. Again, facts have to be right from the beginning.

Consider Advice. We understand no one has an unlimited budget, but don’t cut corners that may put you out of business before you’re off the ground. For example, If you handle and store people’s details like phone numbers, names and addresses, you need cyber protection for yourself. If employing people, you may need Management Liability Insurance, if you give advice, you may need Professional Indemnity and so on. Take the time to familiarise yourself with the risks, so you aren’t taken by surprise, and so you can write a realistic budget. Deciding in advance you need the “bare minimum” may be a costly financial error.

Read All of the Paperwork. When we ask you to read through and confirm the details are correct, you must check! Once a quote turns into a policy, this is a legal contract between you and the insurer. If you fail to read it, and later have an issue caused by a failure to correct your answers, it’s too late once a claim has occurred. Read the Schedule and read the PDS. Ask your broker questions, as the answers could make a big difference to the cover selected, and to how you manage risk within your business.

Be Patient. Often insurers and their underwriters are overwhelmed with the volume of inquiry, so be prepared to wait for a quality answer to come back. Speed doesn’t always equate to efficiency or deliver accuracy. Not everything can be done using online quoting tools, and this is particularly the case for complex risks. So perhaps start your research well before you quit your job to allow ample time to get it right.

You can thank me later.

For a health check of your business insurance, contact Small Business Insurance Brokers via email: sales@ smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives,needs and financial situation).

The Andrews Labor Government is backing Victoria’s healthcare system with free university and specialist training for thousands of nurses and midwives. In a $270 million boost to the health system, more than 17,000 nurses and midwives will be recruited and trained as part of a massive hiring and upskilling initiative – building an army of homegrown health workers to care for Victorians.

More than 10,000 students will have the cost of their nursing or midwifery undergraduate studies paid for, while scholarships will be available for thousands more who complete postgraduate studies in areas of need including intensive care, cancer care, paediatrics and nurse practitioner specialities.

All new domestic students enrolling in a professional-entry nursing or midwifery course in 2023 and 2024 will receive a scholarship of up to $16,500 to cover course costs.

Students will receive $9,000 while they study and the remaining $7,500 if they work in Victorian public health services for two years.

More midwives will join the workforce through an expanded postgraduate midwifery incentive program, which will provide scholarships to cover course costs and salary support for 150 existing nurses to continue working while they complete their specialist studies in midwifery.

The initiative, together with the $12 billion Pandemic Repair Plan brings the number of nurses and midwives being supported to more than 20,000, including funding 13,000 nursing and midwifery positions and scholarships, and funding the upskilling of 8,500 nurses.

The package also includes:

• Scholarships for postgraduate nurses to complete studies in specialty areas such as intensive care, emergency, paediatrics and cancer care – worth an average of $10,000

• $11,000 scholarships for enrolled nurses to become registered nurses, covering course costs and boosting the number of registered nurses

• $12,000 scholarships to support training and employment of 100 new Nurse Practitioners in both acute and community settings

• More than $20 million to provide more support to the growing numbers of graduates and postgraduates as they transition to working in our hospitals – ensuring they have access to the clincial educators, preceptors and study time they need.

The package recognises that the cost of study is a financial burden for prospective and existing nurses and helps our health services maximise the recruitment of new nurses and midwives in key areas of need.

In the past eight years, the number of nurses in the public system has risen by more than 26 per cent – increasing by 9,400 to more than 45,000 nurses. The Labor Government has overseen a net increase of more than 22,000 healthcare workers in the system since 2014 – up by 27.6 per cent.

Quotes attributable to Premier Daniel Andrews

“If you’re in Year 12 and you’ve been thinking about studying nursing or

midwifery – go for it.We’ve got your HECS fees covered.”

“Every health system in the country is under enormous pressure due to the pandemic. The best thing we can do to support our hardworking staff is give them more support on the ground –that’s why this package will train and hire more nurses than ever before.”

Quote attributable to Minister for Health Mary-Anne Thomas

“You can’t deliver a health system with empty hospitals, which is why we are investing in hardworking nurses and midwives that are helping Victorian patients every single day.”

Quote attributable to Minister for Training and Skills and Higher Education Gayle Tierney

“By providing more pathways and incentives to education, we’re giving our nurses and midwives the practical support that they need to continue caring for Victorians.”

Jean Hailes Women’s Health Week is a week dedicated to all women across Australia to make good health a priority.

Women's Health Week is a nation-wide campaign of events and online activities – all centred on improving women's health and helping you to make healthier choices.

Every September, for one week, Women’s Health Week is a reminder to set aside time for your health and wellbeing. Make an appointment for a health check, get active, join an event or simply connect with other women. You don't have to do it alone.

In the lead up to the week, you’ll receive helpful information on how you can participate. Either getting together with friends, community and colleagues or maybe hosting an online event.

Then, on each day of Women’s Health Week, we focus on an important women’s health topic.

You’ll receive a daily email with videos, recipes, quizzes, articles and tools to help you unlock your own powers for good health. All the health information we produce is based on research and reviewed by our expert medical team.

Women, communities and workplaces are encouraged to get involved by hosting an event, sharing the health information and encouraging women, girls and gender diverse people from all corners of Australia to put good health first.

In 2013, realising that there was no event dedicated to women's health in Australia, Jean Hailes for Women's Health ran the very first national Women's

APRA have announced that Five superannuation products have failed the latest superannuation funds’ performance test, with four of them doing it for the second time in a row.

The Australian Prudential Regulation Authority (APRA) announced today the five funds that failed included four which had failed for a second time.

The four funds which failed a second time are therefore no longer able to recruit new members.

The second time failures are the Australian Catholic Superannuation and Retirement Fund Lifetimeone product, the Energy Industries Super Scheme-PoolA Balanced (MySuper)

Health Week. Thousands of women across Australia subscribed to take part in a week of events and online activities, learning more their health.

Now in its 10th year, Women's Health Week is a celebration of women in Australia, women from all walks of life. In 2021 (despite a second year impacted by lockdowns and restrictions), more than 128,000 women participated in 2277 events, over 54,000 women subscribed to the online campaign and we reached over 3.6 million people via social media.

We are proud that Women's Health Week attracts the support of organisations, high profile ambassadors, businesses, community, sporting and media groups across the country.

Women's Health Week is recognised as the biggest week for women’s health and wellbeing in Australia and takes place annually in the first week of September.

product, the BT Super MySuper Retirement Wrap and the AMG Super, AMG MySuper product.

The first-time failure was the Westpac Group Plan MySuper Retirement Wrap.

The number of failures is lower than was expected from the performance test, the criteria for which is now subject to review by Treasury.

If you are a member of one of the above superannuation funds who is approaching retirement, we encourage to you speak to Warren Strybosch of Find Wealth t/a Find Retirement. Warren is a retirement planning specialist who has one of the best superannuation offerings in Australia especially when it comes to fees. He has helped preretirees and retirees save thousands in fees each year without sacrificing on service and advice.

You can call Warren Strybosch, one of Australians most reputable financial planners, on 1300 88 38 30.

Our Donate Blood app is app-solutely the easiest way to manage your appointments!

Scan the code below with your smart phone to download the Donate Blood app from your device’s app store.

Giving blood has got to be one of the most rewarding things you can do to help another person — there’s no other feeling like it. Donated blood can be used in many life-giving ways. The person receiving it could have cancer, be going through a difficult pregnancy, or they could be someone who relies on regular transfusions to live a healthy, happy life — or even to live.

To do the most good, every donation needs to be as safe as possible for the donor and the person receiving it. You should be good to give if:

you’re aged 18–75, if it’s your first time (you can be older than 75 if you’ve donated in Australia before) you feel fit and healthy, and don’t have a cold, flu or any other illness you weigh at least 50 kg

• you’ve got your photo ID, donor card or the Donate Blood app on the day before your donation, you’ve had 8 glasses of fluid if you’re a woman and 10 glasses if you’re a man, as well as plenty to eat

• you’ve had at least 750 mL (3 large glasses) of fluids in the 3 hours before your donation you’ve completed the Donor Questionnaire and met any eligibility criteria, and you’ve been assessed at the blood donor centre (we’ll check you have suitable veins and haemoglobin levels).

There are some cases where we may have to re-schedule. Like, if you take certain medication, you’re pregnant, you’ve travelled recently, you’ve had dental treatment in the last week, or you’ve had a tattoo in the past 4 months. However, if the tattoo was done on licensed or regulated premises in Australia (like a commercial tattoo parlour or a cosmetic clinic) and is healing well, you can book in to donate plasma instead.

Unsure if you can give blood?

Find out more at donateblood.com.au or give us a call on 13 14 95

Don’t worry, you’re in safe hands. But so you know what to expect, here’s a walk-through of what’s involved:

1. When you arrive, you’ll need to complete our Donor Questionnaire. It’s totally confidential and designed to protect you and the person who receives your blood.

2. Before we get going, you’ll be asked to have two more glasses of water and we’ll give you some information on easy muscle tensing exercises that can help stop you feeling faint during your donation.

3. You’ll then have a private, confidential interview with a trained staff member and we’ll check your haemoglobin level (a protein that carries oxygen around your body and contains iron) and take your blood pressure. If it’s your first time donating, we’ll also ask for your height and weight. Safety is our top priority, so these health checks are for everyone.

4. You’ll be with us for about an hour, but the actual giving process takes just 15 minutes (sometimes less!). Our team will be on hand to help the whole way through, so if you’re feeling unwell or uncomfortable, let someone know straight away.

You’ll have done something genuinely life-saving and we hope you’ll be feeling great about it. However, it’s really important to relax, refresh and follow our advice.

• Rest in the chair for five minutes and, when you’re ready, sit up with your legs dangling over the edge.

• Take a seat in our refreshment area. It’s important to rehydrate and have something to eat, so help yourself to a cool drink and a savoury snack.

• You’ll need to stay at the donor centre for at least 20 minutes (even if you feel fine). It’s a great time catch up on some reading, listen to music, or make the most of our free Wi-Fi.

There is a chance that you’ll get a bruise or feel faint after your donation. To help stop this from happening, be sure to follow the advice below.

For the next 2 hours:

• keep the bandage on your arm, and stay hydrated.

For at least 8 hours:

don’t do any heavy lifting

• drink plenty of water (at least another three large glasses)

• eat regular meals don’t stand up for long periods

• stay cool — avoid hot showers, sitting or standing in the direct sun and choose cold drinks rather than hot drinks, and

• don’t drink alcohol.

For at least 12 hours

Avoid strenuous exercise (e.g. riding, jogging, or going to the gym) or hazardous activities, including activities or jobs where public safety may be affected. You should check any employment or safety requirements you have. If unsure, please ask us at your interview.

If you start to feel unwell, or if you’re worried about anything at all, don’t hesitate to give us a call on 13 14 95

We use brand new equipment for every donation — that includes the needle, tubing and bags.

Most people give less than 10% of their blood volume in one donation, which is usually replenished in just two days. But, because it takes longer to replace the iron in your blood, you’ll need to wait 12 weeks before you can give again.

After you give blood, your body needs iron to help replace the haemoglobin and red cells you give in your donation. Over time, giving blood can contribute to low iron levels, so we’ve put together some helpful tips on replacing your iron at donateblood.com.au/iron-health

Women aged 18–45 are especially susceptible to becoming low in iron, which is why we recommend a short course of iron supplements after each donation. For more about looking after your iron levels, head to donateblood. com.au/iron-health-women

We’ll always check that you have enough haemoglobin to give before you donate. However, this test is different to checking your iron levels (you can have normal haemoglobin but low iron), so if you’re worried, speak to your doctor before donating.

We work hard to protect the people receiving your blood and test every donation for blood type as well as HIV, human t-lymphotropic virus (HTLV), syphilis and hepatitis B and C. Remember, we’re testing to protect the people who receive your blood donation. We’ll tell you if we find anything, but for your personal health, you need to get checked by a doctor.

Your blood can be made into many different life-giving medical treatments — with a third of all donated red cells going to people fighting cancer. Each blood donation you make is separated into three parts, each used in different ways.

Red cells

• 34% cancer and blood diseases

• 19% anaemia

• 18% heart surgery and severe burns

• 13% heart, stomach and kidney diseases

• 10% fractures and joint replacements

• 4% help pregnant women, new mothers and young children

• 2% road incidents and trauma

Plasma

Used in 18 life-giving ways, including: Protecting people with immune deficiencies Protecting against tetanus Treating brain disorders

• Protecting newborns against Rh disease

Platelets

Treats serious bleeding, often in patients with leukaemia and other cancers.

When someone is given blood (called a transfusion), it’s best to give them the same blood type as their own. Some blood types are more compatible than others, and some are universal, like O negative. Because it can help people with any blood type, O neg can save the day when there’s no time, or it isn’t possible, to find out a patient’s blood type — like in a life-threatening emergency.

Learn more about your blood type and how it can help at donateblood.com.au/ learn/about-blood

Remember, every donation gives life. So, whatever type you give, someone out there will be truly grateful.

To find your nearest donor centre, book a donation, or learn more about giving blood, get in touch on 13 14 95 or head to donateblood.com.au

Climate Change Minister Chris Bowen insists Australia is now on a track to reduce emissions following a change of government, after new figures showed a rise in greenhouse gases.

The latest update of Australia’s National Greenhouse Gas Inventory saw emissions rise 1.5 per cent in the year to March 2022.

The figures represented the last full quarter before a change of federal government. Mr Bowen said the figures were not surprising. “Even a global recession could only interrupt the LNP’s decade of climate policy neglect for so long,” he said.

“While the impact of this neglect can’t be turned around overnight, the Albanese government is getting on with the job of creating the market signals and reforms necessary for a booming Australian economy on a trajectory to net-zero by 2050.”

When asked if the Nationals would consider backing legislating climate targets, leader David Littleproud said the path to net-zero was not a “linear one” and said his party would consider the advancement of new technologies.

“That’s why we took the pragmatic step of wanting to have a discussion about small scale modular nuclear, about reducing emissions in our energy sector,” he said. Mr Littleproud said Australia had lived up to “every international commitment” it had made on climate change action.

Opportunities for the workforce from increased climate action and clean energy are set to be a focus of the government’s two-day jobs and skills summit, which starts on Thursday.

The first day of the program will include a panel discussion on climate change jobs and skills, and is expected to include a virtual address from Mr Bowen.

The panel is expected to include energy sector representatives and climate action advocates. Australian Conservation Foundation chief executive Kelly O’Shanassy, who is speaking at the event, said the summit would be an opportunity to examine how jobs would look with a bigger focus on climate.

“Our greatest contribution to a net zero world would be to rapidly transition our exports from dirty to clean,” she said.“We’re going to need a national energy plan and a national exports plan that align with net zero, co-investment to accelerate clean exports and a transition

authority to make sure the transition is fast and fair.” Ms O’Shanassy said there were economic advantages from climate change solutions.

“The job opportunities are not limited to tackling the climate crisis. Australia also faces an extinction crisis. Looking after nature generates jobs, especially in rural Australia,” she said.

“From sustainable farming to Indigenous rangers caring for country to accountants helping businesses understand their reliance on nature, caring for nature generates abundant jobs.”

The government has already moved to enshrine a 43 per cent emissions reduction target by 2030, with its climate bill passing the lower house.

Mr Bowen said more work needed to be done in order for emissions targets to be reached.

“Australia’s greenhouse gas emissions are now at 21.6 per cent below June 2005 levels, the base year for our 2030 Paris Agreement target,” he said.

“2030 is only 88 months away, and the Albanese government will continue to work hard with industry, the states and territories and the broader community, to turn this ship around.”

The Superannuation Guarantee contributions (SGC) have increased since 1st July 2022. However, there are many employers who don’t know what the correct amount is that they should be paying and who should be getting SGC.

SGC is an important part of every person’s financial position. It represents, for most people, the key asset they will have leading into retirement. As such, it is important to understand if you are entitled to it, if your employer should be paying it and how much you should be receiving.

Thankfully, the rules around SGC were made a little simpler, with most employees able to receive it.

SG contributions is a legislative requirement that all employers must pay to most employees. It is contribution of money, paid by the employer, on top of the employee’s salary or wages, into the employee’s superannuation account of choice.

The government introduced mandatory 3 per cent contributions (or 4 per cent for employers where their payroll was above $1 million) into an employee’s superannuation fund. In the early days, the employer would set up the superannuation fund on behalf of the employee, whereas now the employee can choose their own superannuation fund and provide that information to the employer. The employer ‘must’ place the SGC into the employee’s superannuation fund if the employee so directs.

Most employers choose to remit the SGC on a quarterly basis when they do their BAS however some employers will pay it monthly or even fortnightly.

For most people who retire in the next 20 to 30 years, their superannuation balance will likely be their largest asset, apart from the family home, and provide an income stream for them in retirement. Will ever increasing uncertainty regarding the age pension, it will be an important asset to have.

Currently the SG rate is 10.5% and increasing over time until it reaches 12%. SG payments is paid as a percentage of an employee’s salary and wages or ordinary time earnings (OTE). Ordinary time earnings (OTE) is the amount your employees earn for their ordinary hours of work. It generally includes leave (annual, sick or long service), commissions, allowances and shift loadings, but doesn’t include overtime payments.

There is no minimum amount you have to earn. Prior to 1st July 2022, you had to earn more than $450 per month to be eligible. This has now been removed.

If you are a full-time, part-time or casual employee, and over 18 years of age, you are eligible.

Employees aged under 18, or those classified as a private or domestic worker (like a nanny), must work for their employer more than 30 hours per week to qualify for SG payments.

Temporary residents are also entitled to receive SG payments into their super account.

Your employer is not required to make SG contributions if you are a non-Australian resident and are paid to do work outside Australia, are an Australian resident but paid by a non-resident employer for work done outside the country, a senior

(Source: ato.gov.au)

foreign executive on certain visas, or temporarily working in Australia for an overseas employer and are covered by super provisions in a bilateral social security agreement.

Is there a limit on the SG contribution I can receive?

The current SG contribution rate is 10.5% of your gross earnings up to a limit called the maximum super contribution base (MSCB). If you earn above that amount in a particular quarter, your employer does not have to make SG contributions for the part of your earnings over the limit.

The MSCB for 2022–23 is $60,220 per quarter ($240,880 per year), which equals a maximum SG contribution by your employer of $6,323 per quarter ($25,292 per year).

If you’re a trustee of a Self-Managed Super Fund (SMSF) it is important to make sure all members of the SMSF are receiving their required SG contributions and they are being allocated correctly.

All SMSF must now be registered via SuperStream. Self-managed super funds (SMSFs) must be able to receive employer contributions and the associated data electronically using the SuperStream standard.

From 1 October 2021, you can only rollover into or out of your SMSF using SuperStream.

For SuperStream, you will need:

• an electronic service address (ESA) – you can get an ESA from an SMSF messaging provider

• an Australian business number (ABN), and

• to ensure your SMSF’s details held by the ATO are up to date, including your SMSF’s unique bank account.

If you are employed by your family business and your super guarantee contributions go to your SMSF, these related-party employer contributions are exempt from the SuperStream standard.

SuperStream doesn’t apply to personal contributions made to your SMSF by its members.

At Find Accountant, we provide SMSF tax advice. Our senior accountant is also an award-winning financial advisor. If you require SMSF advice or are considering whether or not to wind up your SMSF, then speak to Warren Strybosch at Find Accountant Pty Ltd.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au www.findaccountant.com.au

The founder of the Find Group of companies draws on his diverse background, which ranges from teaching, to serving in the army, to taxation and accounting, to coach and help clients live their best financial lives. A multi-award winner, Warrens’s innovative approach in business means he was a champion of virtual financial advise long before the pandemic. Warren established the Find Foundation, which owns and operates acroos Victoria.

The financial advisers featured in this guide are a diverse group: some specialise in responsible investment advice, some provide financial advise to specific professions, and some focus on addressing market gaps, mwith several finding themselves on the list for the very first time. But they all have one thing in common: they all wield influence that can create the blueprint for the future of financial advice in Australia. Not all of them are faniliar names but just because they are not making a lot of noise doesn’t mean they are not making waves. Meet our Power 50.

With Father’s Day this month, it’s a great time to talk about men’s health. We’ll take a look at two conditions: teenage acne and Benign prostatic hyperplasia (BPH). These are both caused (at varying degrees) by male hormone imbalance. Androgens are a group of hormones of which testosterone (the predominant male reproductive hormone) is the most common. Testosterone levels increase for young men in their late teens, and the excess androgens contribute to acne. The sebaceous glands which secrete oil onto the skin, produce androgens, along with other glands, and in excess are converted to a hormone called dihydrotestosterone which promotes acne. Research has found herbs such as Serenoa repens (Saw palmetto) effective in treating hormonal acne, especially when combined with other androgen regulating herbs is. As a naturopath, I would also address elimination of waste products, inflammation, the liver (as detailed below) and any other factors contributing to the acne.

BPH is increasingly common in men as they age and is estimated to be present in 70% of men over the age of 70. Due to hyperproliferation (excess growth) of prostate tissue, the enlargement of the

prostate gland obstructs urinary flow, resulting in poor urinary flow, increased urgency, and incontinence.

Similarly to with teenage acne, excess androgens are a major culprit in contributing to hyperproliferation of prostate tissue. This enlargement of the prostate gland also leads to BPH and prostate cancer. Once again Saw palmetto is an important herb in regulating androgen levels, and additional benefits have been found when used in combination with Urtica dioica (stinging nettle).

Recreational lifestyle activities which reduce stress can also be helpful as chronic stress increases inflammation, leading to many disease states. Exercise can help by increasing blood flow and also reducing stress.

Naturopathic treatment of hormonal imbalance often includes strengthening and detoxifying the liver. The liver is where hormones are metabolised, are transformed into different forms, and excess hormones are removed from circulation. If the liver is not functioning well, this process will be impaired. Prescription drugs, alcohol, exposure to toxins, and poor diet all contribute to reduced liver function. Herbal medicine is highly effective in improving the liver, but below are some tips to get you started.

To improve liver function:

• Increase dietary fibre, particularly through vegetables

• Increase ‘green leafy’ vegetables such as kale, spinach, broccoli, cabbage, etc

• Eat bitter foods such as roquette (rocket), and sour foods such as fresh lemon juice.

Whole Naturopathy can treat your hormonal imbalance naturally with herbs formulated specifically for you, together with dietary changes that will best target your health issues.

Kathryn Messenger

Kathryn Messenger

BHSc (Naturopathy) kathryn@wholenaturopathy.com.au

An employer who provides an employee with an electric vehicle will not be liable for fringe benefits tax on the employee’s private use. The new legislation comes into effect for electric vehicle first held by employers on or after 1 July 2022. To be eligible for the exemption, the electric vehicle must be below the luxury car limit, which is currently sitting at $84,916.

The exemption provides a viable option for employees to reduce their tax bill by salary packaging.

Announcement(27-Jul-2022)

Consultation

Introduced(27-Aug-2022)

Passed Royal Assent

Date of effect(1-Jul-2022)

Small businesses (aggregated turnover less than $10 million) will be able to apply to the Administrative Appeals Tribunal (AAT) to pause or modify ATO debt recovery action for debts being disputed in the AAT.

Currently, small businesses are required to go through the court system to pause or modify ATO debt recovery action. Taxpayers are otherwise required to pay disputed tax liabilities by the due date or enter into a 50/50 arrangement with the ATO to defer recovery action.

In the 2021 federal budget, it was announced that the AAT would be empowered to pause or modify ATO debt recovery action until the underlying dispute is resolved.

Downsizer contributions have been available to members of complying superannuation funds since 1 July 2018. From that date, a person aged 65 years or older has been able to make a contribution up to $300,000 from the proceeds of selling their main residence. A legislative amendment originally from the 2021 Federal Budget reduced the age limit from 65 to 60 from 1 July 2022. Further, another legislative amendment has been issued by the new government in August 2022 to reduce the age limit again from 60 to 55. The change will not come into effect until after the new Bill receives royal assent. To be eligible to make a downsizer contribution, an individual must have owned their main residence for at least 10 years. It is available to both members of a couple for the same home, even if only one is on the title deed.

Downsizer contributions are in addition to existing rules and caps and are exempt from the: age test, and $1.7 million total superannuation balance test for making non-concessional contributions.

Individuals may soon have the ability to claim a higher deduction for self-education expenses from the 2022–23 income year. New legislation has been tabled into parliament following the original announcement by the former government in the 2021 Federal Budget.

Currently, a self-education deduction is limited to costs above $250 each income year. This limitation, known as the s 82A limitation, will be repealed from the tax laws. This requires legislative approval.

The announcement is somewhat related to a Treasury discussion paper released in December 2020. However, other matters addressed in the paper, such as deductions for expenses unrelated to current employment, have not been taken further at this stage.

Announcement(8-May-2021)

Consultation(12-Jan-2022)

Introduced(3-Aug-2022)

Passed Royal Assent Date of effect

Announcement(10-May-2017)

Consultation

Introduced(3-Aug-2022)

Passed Royal Assent

Date of effect(1-Jul-2018)

Announcement(11-May-2021)

Consultation

Introduced(3-Aug-2022)

Passed Royal Assent Date of effect(1-Jul-2022)

Starting from 1 July 2023, operators of sharing economy platforms will be required to report transactional information to the ATO.

The Taxable Payments Reporting System already applies to some businesses in industries where noncompliance is deemed to be high risk. By adding operators of sharing economy platforms to the regime, taxpayers who hold or use assets for short-term lease or contract work will have their information collected.

The identification of users of sharing economy platforms means that, as an adviser, you should be informing taxpayers who earn income off these platforms of their tax obligations. This includes short-term accommodation, ride-sharing transport and food delivery platforms.

Also, other task or time-based service platforms will be required to report for income years beginning on 1 July 2024.

The start date of the proposed changes have been delayed after the former Bill was prorogued at the last federal election.

Announcement(25-Aug-2021)

Consultation

Introduced(3-Aug-2022)

Passed Royal Assent

Date of effect(1-Jul-2023)

The Commissioner of Taxation will be given new powers to direct a taxpayer to undertake a record-keeping education course in lieu of an administrative penalty.

The new directive will be initially limited to small business owners in order to assist them in keeping up to date with tax obligations.

The individual must then provide the Commissioner with evidence of completion of the course in order to avoid financial penalty. The new directive will be available after the Bill receives Royal Assent.

A business with aggregated turnover of less than $50 million will be entitled to a 20% bonus deduction for expenditure relating to a digital business adoption.

The bonus deduction will be available for expenditure incurred from 7:30pm (AEDT) on 29 March 2022 (2022 Federal Budget night) until 30 June 2023.

There is a limit of $100,000 of eligible deductions able to be claimed by a business each income year but can be claimed on both business expenses and depreciating assets.

Small businesses will get a bonus tax deduction on top of the allowable deduction for training their employees.

Businesses with aggregated turnover of less than $50 million will be entitled to claim a 120% deduction for eligible expenditure. Eligible expenditure refers to external training courses delivered to a business’s employees by a registered training organisation in Australia.

The skills and training boost is available from 7:30pm (AEDT) on 29 March 2022 until 30 June 2024.

Announcement(3-Aug-2022)

Consultation

Introduced(3-Aug-2022) Passed Royal Assent Date of effect

Announcement(29-Mar-2022)

Consultation(29-Aug-2022)

Introduced Passed Royal Assent Date of effect

Announcement(29-Mar-2022)

Consultation(29-Aug-2022)

Introduced Passed Royal Assent

Date of effect

Manningham Council recently endorsed its plan for improving the liveability of Manningham from now through to 2040 with its Liveable City Strategy.

The Liveable City Strategy 2040 is Council’s plan to enhance access to local activity centres, housing choice, employment opportunities, active and public transport options, parks and community spaces.

The strategy has been finalised following extensive community consultation on the draft strategy late last year. A key objective of the strategy is to improve the liveability of Manningham by achieving a network of 20-minute neighbourhoods.

A 20-minute neighbourhood is a place where you have the ability to meet most of your needs locally within a 20-minute journey from your home – by walking, cycling or local public transport.

Manningham Mayor, Cr Michelle Kleinert said the strategy provides a plan for Manningham into the future.

“Our Liveable City Strategy has been developed to help ensure Manningham continues to evolve for all of our community as a liveable, resilient and desirable place to be.

“Whether you live, work or play in Manningham, we know maintaining and enhancing liveability and connecting our community is important to everyone,” Cr Kleinert said.

The implementation of the strategy will now begin with a variety of initiatives for our activity centres, recreational links, a housing strategy, ‘Design Excellence Program’ and more.

For more information on Manningham’s Liveable City Strategy, visit yoursay.manningham.vic.gov.au/liveable-citystrategy-2040

National Tree Day was bigger than ever this year, with over 400 people turning up to Ruffey Lake Park to give a gift back to the environment.

“We normally see around 200 people at this event, so this year the event really exceeded our expectations. We were blown away by the turnout and thank every community member who came along to join the fun.”, says Mayor Cr Michelle Kleinert.

Council’s target of 1200 seedlings were planted along the Ruffey Lake corridor, all in around 1 hour and 45 minutes. The indigenous plants will play a critical role in restoring the park’s natural environment, building a healthy understory habitat for many smaller species, including lizards and skinks. Council hosts the annual event, providing all volunteers with the necessary tools, equipment and plants. Council thanks the Rotary Club of Doncaster, who provided a free sausage sizzle.

“It’s a very wholesome event. It feels good to give back, get outside and be hands-on in the dirt! I think that’s why we always see such a diverse crowd; it’s an event that everyone can enjoy.”, says Michelle. For further information about National Tree Day, go to https://treeday.planetark.org/.

Manningham Council congratulates the 2022-23 Annual Community Grant Program recipients, who were announced at the Council meeting late last month.

Council’s Annual Community Grant Program offers funding opportunities for not-for-profit and community organisations under three categories: Community Development, Arts, and Festivals and Events.

“The Program allows us to support our community to provide activities that benefit our communities, strengthening connections and improving their quality of life”, said Mayor Cr Michelle Kleinert.

Applications for the 2022-23 Grant Program opened on Monday 7 February 2022, and closed on Tuesday 15 March 2022. Council received 23 grant applications across

the three categories. Of these, 17 have been successful.

“Due to the high quality of applications which all demonstrated a great benefit to the Manningham Community, Council endorsed the request for an additional $27,034 in funding to support these great initiatives.” said Mayor Cr Kleinert.

The Program received a total funding of $217,034 from the budgeted $190,000 for 2022-23.

The 2022-23 recipients represent various disciplines, including community services, disability, health, multicultural services, gender equity, arts and culture and sport and recreation.

For further information and to see our complete list of 202223 recipients, go to http://www.manningham.vic.gov.au/ community-grant-program

No Lights No Lycra, is the original dance in the dark movement that’s proven to make you feel better!

Come along and dance without limits or judgement as we turn off the lights and crank up the tunes during this casual, free-form dance class.

All you need to bring is your water bottle and comfortable clothes to dance in.

Release all your inhibitions and work up a sweat, all while completely sober.

Free Basketball clinic hosted by Michele Timms and supported by some of the best local female players in Manningham. This training session is guaranteed to make you smile and sweat in the best way possible! Open to females of all abilities and fitness levels. Bring your mum, daughter, sister, girlfriend or friend. There will be an opportunity at the end of the session for a Q and A with Michele Timms.

Celebrating women and girls of all shapes, sizes, skill levels and abilities. Women supporting women in their pursuit of mind and body wellness, giving it a go and setting the example to our girls about maintaining an active lifestyle.

As Manningham Council gets ready to launch its Food Organics Garden Organics (FOGO) service in July 2023, Councillors last week got to see how Manningham’s food and garden waste will be processed.

The FOGO service will allow residents to place household food waste into their green lid garden bin to be recycled into compost for use in gardens and farms across Victoria.

Council’s organic waste processing contractor, Bio Gro, will receive the food and garden waste from kerbside FOGO collection and turn it into compost. Last week some of Manningham’s Councillors toured Bio Gro’s organic waste facility in Dandenong South to see the process first-hand.

After seeing the process, Manningham Mayor Cr Michelle Kleinert said that FOGO is one of the most effective and achievable ways we can all reduce our impact on our environment.

“By having household food and garden waste collected and processed, it can be recycled into compost which can be used to enrich our soil.

“If you can eat it or grow it – you will be able to put it in your FOGO bin. On the tour, we saw first-hand how problematic it is when plastics bags are placed into our garden bins and how it contaminates the composting process.

“Removing food waste from Manningham’s red lid garbage bin is set to divert up to 20,000 tonnes of waste from landfills per year,” Cr Kleinert said.

From 3 July 2023, Manningham’s green lid FOGO bins will be collected weekly and red lid garbage bin will be collected fortnightly.

“Over the coming months we look forward to getting out and about and speaking with residents about the benefits of FOGO in the lead up to the service starting in July 2023,” Cr Kleinert said.

All residents with a Council residential waste service will receive a free kitchen caddy for their food waste along with supply of compostable liners, as part of the implementation of this new service.

For more information on FOGO, visit manningham.vic.gov.au/ FOGO

On behalf of Manningham Council, I offer my sincere condolences to His Majesty King Charles III, The Royal Family and our residents mourning the loss of Her Majesty Queen Elizabeth II.

I share the grief experienced by many in our community, who woke to news of The Queen’s passing overnight, having never experienced a world without her presence, a presence which will undoubtably stay with us throughout our lives.

The Queen’s strength and compassion transcended geographic borders, languages, cultures, and times of peace and turmoil.

Our Queen was affectionately treasured and respected as a symbol of hope and endless possibilities, particularly for girls and women inspired by her historic reign, and our adoration lives on. May she rest in peace.

Our young people have struggled to access headspace youth mental health services for far too long.

Young people have faced wait times of up to six months for headspace services outside of Manningham and travel times of up to 80 minutes to their closest headspace facility.

ung people can access mental health services wit hout transport barriers,” said Mayor Cr Michelle Kleinert.

In June, we ran our #manninghamneedsheadspace campaign where we and our community advocated for a local headspace.

We held nine pop-up information stalls around Manningham and gathered your thoughts using surveys, polls, social media, Your Say, and ideas boards.

We received feedback from over 1,000 young people, their parents, and other supporters who told us why they desperately need a headspace service located right here in Manningham. One young resident said,

“There’s already enough difficulty getting help for young people, for [headspace] to be easily accessible means there’s less resistance for us to get help”.

Through our campaign activities, we discovered the top three reasons for why our community needs a local headspace:

1. To provide our young people with additional mental health support.

2. To make accessing youth mental health services easier via public transport.

3. To offer our young people more affordable options (headspace services are free and low-cost).

We’ve listened to your personal stories and understand the challenges associated with accessing youth mental health services. Thank you to everyone who got involved!

While we’ve been promised a headspace in the Menzies electorate (which is to be operational July 1, 2023) we need clarity about the location and the type of service offered.

We need to ensure that headspace is on the ground in Manningham, where we believe the demand is greatest and the impact most beneficial.

We’ll be discussing this with the government as we continue advocating for better health outcomes for our young people in an accessible location for Manningham residents. We are open to partner with any organisation that is expressing an interest in delivering this service in Manningham. Learn more about the campaign: yoursay.manningham.vic. gov.au/ youth-mental-health

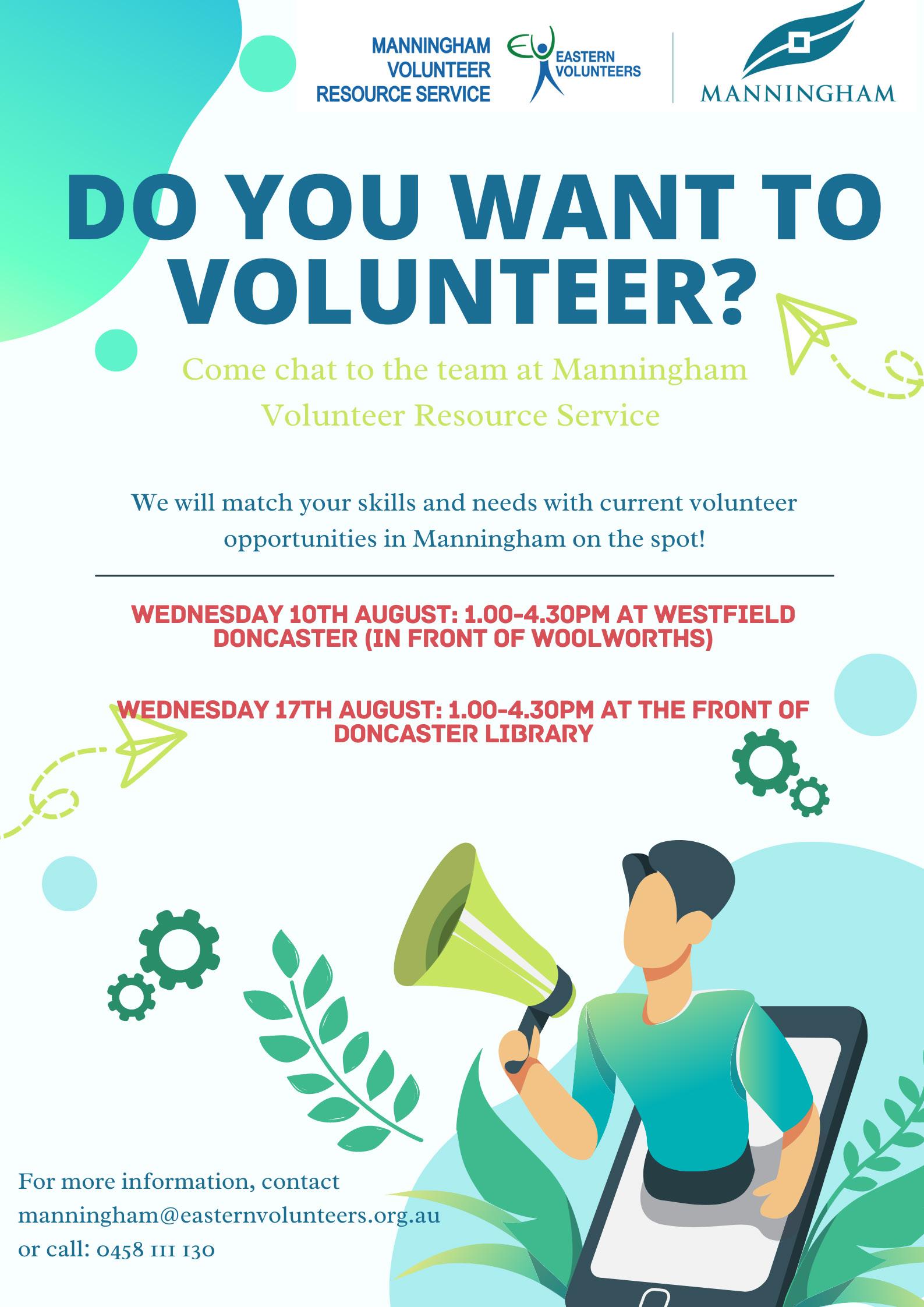

Thursday,

Thursday, 8 September 2022

Manningham

•

Friday,

Westfield Doncaster is a shopping centre 50% owned by Scentre Group and 25% owned by ISPT and 25% owned by Asia Property Fund located in Doncaster, a suburb of Melbourne, Victoria, Australia. As of July 2014, the Westfield Group became two companies Scentre Group and Westfield Corporation.

Please note, due to COVID-19 certain centre services are currently unavailable

Honey Birdette, Level 1 1 Sep - 27 Sept

Mid-season SALE is on now! Shop 50% OFF selected styles.

Terms and conditions

50% Off selected Lingerie styles, swimwear and accessories. Discount applied at cart. Sale valid from 01/09/2022 - 27/09/2022. Offer cannot be used in conjunction with other promotions. Offer cannot be applied to previous purchases and cannot be redeemed for cash. Terms of offer are subject to change.

Cotton On Kids is doing good for people, the planet, and the things that matter most. How? By giving discarded materials new life through transforming them into swimwear. Do good, wear good, and feel (really) good with their new recycled swim range that’s being offered at Buy One, Get One 50% Off.

Available in a range of colours, prints and styles that say: Summer is c.o.m.i.n.g. Cotton On Kids has also partnered with Citizens of The Great Barrier Reef. During the month of September, this will see 100% of proceeds from the sale of Cotton On Foundation items support Citizens of the Great Barrier Reef to deliver a first-of-its-kind conservation model. So we can all believe in a better tomorrow.

Kathmandu, Level 1 1 Sep - 19 Oct

Spend and Save!

Spend $150, Save $50

Spend $250, Save $100

Member exclusive offer. Free to join. Offer ends 19 October. Discount is off the total purchase

Inspired by combat and workwear garments, utiliity is the trend that’s here to stay. Think structured cargos, carpenter pants, overshirts and shackets with a fashion forward spin. Shop in stores and online now at Universal Store.

At Find we can help you find the ‘right’ personal insurance. Our aim is to help you obtain and retain the personal insurances that are appropriate for you and at cost that you can afford.

Personal Insurances Include:

• Income Protection (IP)

• Life Insurances or Death Cover

• Total and Permanent Disability (TPD)

• Trauma Insurance or Critical Illness Insurance

• Business Expense Cover

• Child Trauma Cover

When your insurance are in place, our services do not stop there. We will provide you with an after care service that includes policy notifications, insurance report, help desk, reviews and help at claim time. We provide ourselves in providing honest advice that you can rely on.

General Insurance

We specialise in the following:

• Business Pack Insurance

• Professional Indemnity

• Public Liability - Business related only

• Landlord Insurance

• Height Safety Insurance

We DO NOT provide advice or quotes for the following (you need to go direct and save):

• Car Insurance

• Home & Contents

• Caravan

• eBikes

We work with only the most reputable insurers to bring you a range of insurance options for you to choose from:

When it comes to General Insurance, Find Insurance provides a referral service to Find Business Insurance. Find Insurance provides general information only and we do not offer general insurance advice. We refer all general insurance enquiries to Craig, a licensed Authorised Representative (No. 001248230) of Focus Insurance Brokers AFSL 426797. Craig is able to provide general insurance advice to you. You should always seek professional advice before making financial decisions. This material is not intended to constitute personal advice and must not be relied on as such. This material is of a general nature only and has been prepared without taking into account your individual objectives, financial situation or needs. You should consider the appropriateness of this material having regard to your objectives, financial situation and needs and consider obtaining independent advice. We endeavour to ensure that the information on this site is current and accurate but you should confirm any information with the product or service provider and read the information they can provide. If you are unsure you should get independent advice before you apply for any product or commit to any plan.

We invite a representative from each sporting club to submit team selections, results and any interesting stories relating to your club/sports.

For inquiries call 1300 88 38 30 or email editor@findmanningham.com.au

Donvale Bowls Club is indeed indebted and beholden to many of our beloved characters which define and distinguish it.

One such character at Donvale is Ian Heap

A brief insight into Ian’s working life, his involvement at Donvale Bowls Club, and the successful experiences it has provided.

He was born in Cohuna northern Victoria in 1952, his early childhood spent in Eildon and Penrith NSW before moving to Fairfield Vic in 1957.

It was here he attended the Fairfield Primary School before furthering his education at Thornbury High.

He attended Monash University and on to Rusden Teachers College, where he trained as a High School Science teacher. Teaching training needed to be put on hold when his father passed away necessitating the work in the family earth moving business.

He returned to complete his teaching qualifications in 1974. During this time, he met Leisa Hallam (Curl) at a friend’s 21st birthday party, he soon realized that he had found his soul mate and they were married in 1976.

Their relationship continued on a long-distance basis, in 1975 he took up a teaching position at St Arnaud High School in the Mallee district.

He took classes in Science, Physics and Biology before transferring back to a Melbourne based position at Lakeside High School in Reservoir in 1976.

He and Leisa moved into their first home at McLeod where in 1981 their first daughter Emily was born.

They subsequently moved to Red Plum Place Doncaster in 1981 (where he still lives today), in 1983 their second daughter Victoria was born.

Ian enrolled in further part time study in I.T. and Mathematics after which he moved from secondary teaching to the TAFE sector taking classes in the IT department before transferring to the international office of Northern Melbourne TAFE which included student recruitment trips to New Zealand, India, Sri Lanka, Taiwan, South Korea, Bangladesh, and Vietnam.

Sadly, Ian’s wife Curl passed away at the beginning of 2005, and he decided to take a break from the education sector.

Shortly after, a friend asked if he could help out with his landscape gardening business which continued for several years.

A further opportunity presented itself, he was asked by a friend to “fill in” for a few weeks at a spare parts store at VISY in Broadmeadows. 5 years later he was still there.

His sporting interests over the journey are many and varied, baseball for Alphington baseball club, weekly round of golf, regular game of squash and participation in fun runs leading up to competing in the Melbourne Big M marathon in 1986.

He decided one Marathon was enough, turning to bike riding with friends and riding mates which has continued up to this present day, now mostly on an electric bike following two knee replacements (can I add, at the same time)!

Four years ago, at the clubs New Members Day, Ian joined Donvale Bowls Club.

In a short period Ian has been successful in having an important position at our club, being not only a Pennant and Social bowler, but also a Selector, and Winter Social Bowls Coordinator.

Importantly, always at the forefront, volunteering should a task around the club need addressing. How fortunate we are to have him in our company, our club, his friendly disposition endears him to all who share his friendship and contribution.

Part of the secret of success is to eat what you like and let the food fight it out inside.

The best memories are made when gathered around the table

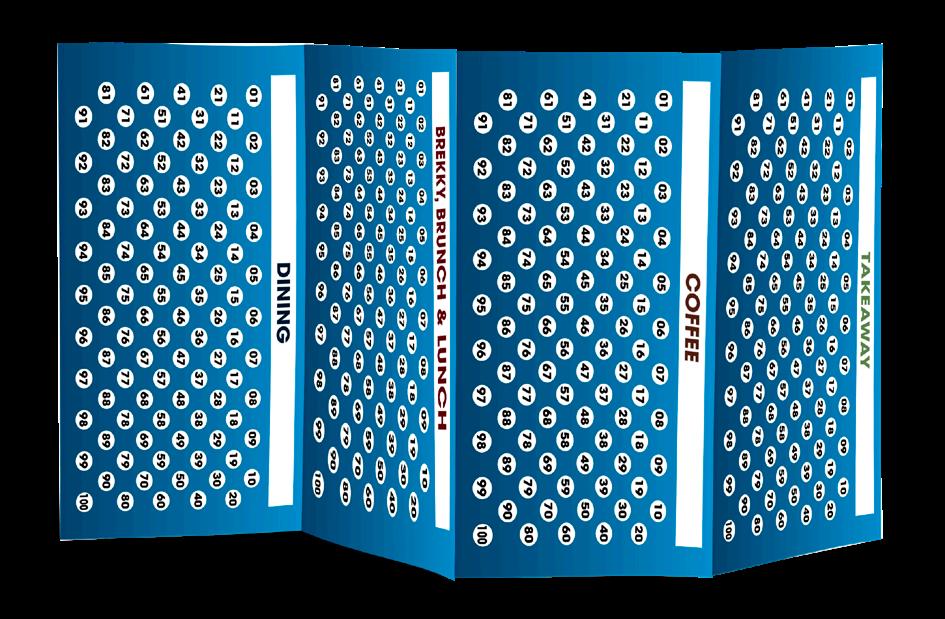

Any changes or updates to these ‘Terms of Use’ of the Find Cards and/or Find Coupons can be found here.

The barter trade, sale, purchase, or transfer of the Find Coupons &/or Find Cards, by any person or entity, including but not limited to business placing offers in the Find Paper, printers, publishers, and distributors of the Find Coupons /Find Card, is strictly prohibited, unless expressly authorized by Find Pty. Ltd. Find reserves the right to make changes to the participants and their offers at its sole discretion. Members will be notified of these changes via email or via the Site.

The Find Coupons and its Offers are intended for the non-profits use of the individual purchaser of the Find Cards &/or Find Coupons. Additionally, the use of the Find Coupons &/or Find Cards or any of the Offers placed in our Find Paper, for advertising purpose, in any form of fashion, is strictly prohibited. Any use of a Offers in violation of these Rules will render the Offer VOID, and violators will be prosecuted. Offers may not be reproduced and are void where prohibited, taxed, or restricted by law. Find, will not be responsible if any establishment breaches its contract of refuses to acccept the Find Cards / Offers with in the Find Paper: we will however, use our best efforts to secure compliance, Find, will not be responsible in the events beyond its control. © 2022 Find.

Find Restaurant, Find Cafe & Find Coffee offers can be used at participating businesses any time except the following days:

*Christmas Eve *Christmas Day

*Boxing Day * New Year’s Eve

*New Year’s Day * Valentine’s Day

*Good Friday *Easter Sunday *Mother’s Day. Some restaurant/Cafe/Coffe establishments will have additional terms and conditions on the page where the business is advertising their offer).

You are required to present your Find Card at any participating businesses if you wish to secure the discount or goods/service being offered.

All Find Cards must display an Authentication Code, Regions Sticker and a members name and signature to be deemed VALID. If your Find Cards does not display your signature and the correct code, the business can refuse to provide the discount offer advertised. You will receive your Authentication code after registering your Find Card.

Valid Find Cards have four folds and contain six different categories. Valid Find Cards will have its Regions logo sticker placed in the circle at the back and has an Authentication code display in front of the Find Cards

Find Cards that DO NOT display its Regions Sticker in the circle at the back and DO NOT display an Authentication code in front of the Find Card are INVALID. They will not be accepted at any participating businesses. Also, your signature must be present. You may be asked to present ID to verify that Find Card belongs to you. Present