We are looking for business owners who like to join the

Manningham Network Group and Community Paper.

• Accounting Services

• Acupuncture

• Architect

• Architectural Interior Design

• Attorney- Family

• Auctions- Real Estate

• Bookkeeper

• Bowen Therapy

• Builder- Commercial

• Business Coach

• Business Equipment Financing

• Business Insurance

• Cabinets

• Caterer

• Graphic Designer

• Plasterer

• Chinese Medicine

• Chiropractor

• Creative Director

• Commercial Mortgage

• Computer Repair

• Computer Web Design

• Concrete

• Copywriting/Copy Editing

• Counselor/ Psychotherapist

• Dentist

• Digital Media

• Electrical Operations

• Electrician

• Finance Bookeeper

• Financial Planner

• Fitness Trainer

• Flooring

• Pilates

• Garage Doors

• General Insurance

• Health & Wellness Coach

• Homeopathy

• Lactation Consultant

• Lawn Care

• Lawyer

• Life Coach

• Loans

• Marketing

• Massage Therapist

• Meditation/Yoga

• Mortgage Broker

• Naturopathic Medicine

• Nutrition

• Osteopathy

• Painter

• Personal Trainer

• Photographer

• Plumber

• Podiatrist

• Printer

• Project Management

• Psychologist

• Real Estate Rentals

• Real Estate Sales

• Reiki

• Residential Cleaning

• Residential Mortgage

• Security

• Signs

• Solar

• Solicitor

• Travel Agent

• Website Developer

• Wedding Planner

By Warren Strybosch

The Find Manningham is a community paper that aims to support all things Manningham. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Manningham for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 warren@findnetwork.com.au

PUBLISHER: Issuu Pty Ltd

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmanningham) so you keep up to date with what we are doing.

We value your support,

The Find Manningham Team.

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmanningham.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: sport@manningham.com.au

WEBSITE: www.findmanningham.com.au

The Find Manningham was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-ForProfits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Manningham has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Manningham is a local government area in Victoria, Australia in the north-eastern suburbs of Melbourne. Manningham had a population of approximately 125,508 as at the 2018 Report which includes 27,500 business and close to 45,355 households. The Doncaster and Templestowe Council administered the area until December 15, 1994.

The Find Manningham acknowledge the Traditional Owners of the lands where Manningham now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Manningham accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

By Joe Lam

Like it or not, you or someone you know is going to need aged care advice. That is why we believe every adviser should be knowledgeable about aged care advice. There are three great reasons we incorporate aged care advice into your service offering.

1. The critical third phase: By breaking retirement into three distinct phases, (active, quiet, and frailty years) we help our clients understand and plan for their future.

2. Growing demand: There are now more than half a million Australians who are aged 85 and over and at age 65, a person’s chance of needing aged care during their lifetime is also high. Aged care is complicated, and great advice can make a big difference.

3. Meeting the Code of Ethics: The Code of Ethics, while initially causing stress, aims to strengthen the advice profession by prioritising clients. Given the high probability of clients experiencing frailty, aged care planning is crucial.

Ready to get the right aged care advice? Get in touch with us today to learn how we can help you get things right when it comes to your Aged Care needs.

Find Cards is a fundraising initiative set up by Warren Strybosch who wanted to help as many Charities, Not-For-Profits, Schools, Sporting Clubs and other organisations in his local community and other regions throughout Victoria.

By Warren Strybosch

In today’s increasingly digital world, protecting sensitive financial information is more important than ever. For tax clients, this means moving away from outdated practices like emailing tax documents and embracing secure online portals designed to safeguard personal data.

The Australian Taxation Office (ATO) has made it clear: emailing tax documents is no longer considered a secure method of communication. Tax returns, identification documents, and financial statements sent via email are vulnerable to interception, phishing, and data breaches. As cybercrime becomes more sophisticated, the risks to both clients and tax agents have grown significantly.

The revenue generated from the Find Cards will support the above organisations as well as provide the necessary funding to support the Find Foundation, a Not-ForProfit organisation that is setting up and operating community papers across Victoria.

The community papers provide a place where those above organisations can tell their story via the ‘NFP of the Month’, and enables those organisations to promote themselves for Free, let the community know what services they provide, and when they will be holding fundraising events in the future.

With the Find Cards, everyone wins. Become a Find Card Member today for less than a coffee($4.99) a month and help everyone win. Businesses gain more business through offers. Members save money and can access giveaways. NFPs, clubs, schools, and charities receive revenue. Local community papers provide information and benefit the community.

For more details go to www.findcards.com. au and check out how to register and become a member,

Ensure Your National Disability Insurance Scheme (NDIS) Plan Management Remains Compliant - Partner with Experts You can Trust.

With the changes that occurred in April 2025, the NDIS now requires Plan Management to be conducted by qualified and currently practicing accountants and/or bookkeepers. For those currently providing Plan Management services who are not practicing

accountants and/or bookkeepers, it is highly likely that after the business' next audit, which occurs annually, those Plan Management providers will be required to become practicing accountants/bookkeepers otherwise they will have their authorities by the NDIS to operate in this space revoked.

At Find Wellbeing, we’re already ahead of the changes. As qualified and practising accountants and bookkeepers - and with our founder, Warren Strybosch, an award-winning accountant and financial advisor - you can trust that your Plan Management is in expert hands. We’re also on track to becoming a registered NDIS Provider, ensuring full compliance now and into the future.

Book a time with Find Wellbeing today and secure your Plan Management with professionals who meet the NDIS’s new standards.

At Find Group, we’re committed to creating services that empower individuals, support communities, and provide peace of mind at every stage of life. Whether planning for aged care, supporting local causes through Find Cards, or ensuring NDIS compliance with Find Wellbeing, we're here to make a meaningful difference. Get in touch with us today to learn how our solutions can help you and your community thrive.

To combat these threats, more accounting and tax professionals are using secure client portals—encrypted online platforms that allow for the safe upload and download of sensitive files. These portals not only comply with the ATO’s expectations but also protect client data, offer audit trails, and streamline communication.

Adopting a secure portal is not just about compliance—it's about peace of mind. By using encrypted platforms for document exchange, both clients and professionals can focus on what matters most: accurate and timely tax outcomes, with confidence their data is protected. As the ATO continues to prioritise cybersecurity, secure document sharing is quickly becoming the new industry standard.

At Find Accountant, we encourage all clients to upload their documents via

our online secure portal so as to protect their data and personal information. In the coming financial year, we are trialling a new secure portal called Advisor Logic. Advisor Logic will not only enable our tax clients to upload and download documents securely, but it will enable clients to see their financial position in real time. As a business that provides both tax and financial planning services, we see this move to Advisor Logic as a necessary one. We believe it will add value to our accounting clients and be of benefit to our current financial planning clients who will be able to view their data online.

If you are looking for a proactive accounting firm that looks after both tax and financial planning clients, then book an appointment with the Find Group which consists of Find Accountant, Find Wealth, Find Retirement, and Find Aged Care.

reece@shlfinance.com.au www.shlfinance.com.au

By Liz Sanzaro

Mullum Mullum is a precious resource starting in Croydon, south of Birt’s Hill (the high spot above Richardsons Road). Runoff from this part of the Wicklow ridgeline collects behind the Yarra Valley School to begin the creek. Once a small stream is formed it then flows south downstream passing both bushland and parks through Ringwood and behind Eastland Shopping Centre, and eventually into the Yarra River in the City of Manningham.

The other 3 creeks are also of significance are Tarralla Creek (at the top of the map), Bungalook Creek and Dandenong

So, what are these species, and more importantly what do they look like? They are the Mistletoebird, the Blue-Banded bee, the Galaxias fish, the Glossy Grass skink, Sugar Gliders and the Superb Fairywren.

The Blue-Banded bee is a solitary bee so it does not live in a colony, but will happily live in its own chosen hole, like a bee hotel. It is a great pollinator.

Bungalook, in the middle between Tarralla and Dendenong Creeks, has its origins around Montrose where it runs off the ranges at the foothills travelling through Dr Ken Leversha Reserve, then following the low contours of Sheffield Road, across Liverpool Road into the Colchester retarding basin, where it goes underground at Canterbury Road and emerging across Dorset Road in land previously known as the Healesville freeway reserve.

The Superb Fairywren is seen around Montrose, in gardens free of pesticides and where cats are not allowed to roam. We used to have them in Croydon, but now they are very patchy, probably due to cat and fox predation. This photo is courtesy of Jules Farquhar who is an iNaturalist contributor.

The Galaxias fish is about the length of your hand and should be a common fish in freshwater. It had been reintroduced into Dandenong Creek but chemicals washed down stormwater drains resulted in them dying.

In Australia, Galaxias are found in coastal streams in southern Queensland, New South Wales, Victoria, Tasmania, eastern South Australia, and parts of southern Western Australia. Reintroducing them should therefore be viable but is heavily dependent on widespread education about water quality.

Once on flattish land it then flows behind the industrial areas that front onto Canterbury Road, veers south going under Bayswater Road near Anaconda, before heading under Canterbury Road again at Greenhill Road. There it joins with Tarralla Creek and both then flow into Dandenong Creek.

Creek lines are areas of great significance to our Environment as a permanent water supply is of paramount importance to wildlife. Maroondah Council is working with a wide group of people from all these areas, some of whom are members of the Friends of Dandenong Creek – our local Environmental Scientist Dr Graeme Lorimer and Shea, also a member of Croydon Conservation Society.

This working party aims to protect, enhance and keep safe all of these three corridors with an added bonus of attempting to provide the exact conditions required for several species. We will know that the work and care has been successful when we begin to see these species appear.

iNaturalist is a worldwide group that anyone can add to their phone as an app and upload evidence of seeing these animals in a particular location which you have to identify with a pin on a map.

Sadly, some think streams are suitable for waste like petrochemicals, paint etc. For industry, there are some companies that will collect this waste, just like we have a residential collection offered by Maroondah Council. Never be tempted to wash anything out near stormwater drains.

Last is the spotted marsh frog. A sculpture of this species is to be found in the park opposite the old Croydon Council facility offices in Civic Square. Opened in 2018 the sculptor, Ian Bracegirdie, has provided these three sculptures to create an awareness of the species as well as adding interest to the park.

As the calendar flips to July, a new financial year begins — and with it, a fresh opportunity to take stock, realign your goals, and build strong financial habits for the year ahead. Whether you're planning for retirement, growing your wealth, or simply trying to get better control of your cash flow, July is the ideal time to get organised.

Here are seven smart steps to set yourself up for a financially successful 2025–26.

1. Review the Year That Was

• Assess income, expenses, savings

• Did you meet your financial goals? What surprised you?

2. Reassess Your Financial Goals

• Update your short- and long-term goals

• Consider life changes (job, family, health, retirement plans)

3. Rebalance Your Portfolio

• Consider your preferred risk profile, do you need to rebalance your investments so that they are in line with your preferred asset allocation?

4. Plan Your Super Contributions Early

• Do you wish to set up monthly contributions (such as a salary sacrifice) to spread out cash flow?

• Consider carry-forward and bring-forward rules – if you are not sure what these are do you need to seek professional financial advice?

5. Budget Refresh and Spending Audit

• Review your monthly cash flow

• Identify your planned budget, do you need to review your spending in any areas?

• Consider reviewing providers for things like car insurance, home insurance and health insurance. Could you save money by taking time to go through this process?

6. Documentation

• Would it help you to start the year off by keeping better records this year?

• Ensure you're keeping accurate records from the beginning of the financial year. Digital tools or apps can make this easy and efficient.

7. Estate Planning and Insurance Check

• Do you need to review beneficiaries, wills, powers of attorney?

• Check personal insurance cover (which may include Total and Permanent Disablement, Life cover, income protection and trauma cover), are these still appropriate for your circumstances?

The start of a new financial year is more than a date on the calendar — it’s an opportunity to take control of your finances and build momentum toward achieving goals.

Director and Financial Adviser - GradDipFinPlan Authorised Representative No 1269525

T:1300 557 144 Email: erryn@cherrywealth.com.au

Website: www.cherrywealth.com.au

Office Address: Suite 4 / 4 - 6 Croydon Road, Croydon 3136

Postal Address: PO Box 657, Croydon VIC 3136

Financial Planning is offered via Cherry Wealth Pty Ltd Ltd ABN 14 653 375 458

Cherry Wealth is a Corporate Authorised Representative (No. 1314769) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221). Part of the Centrepoint Alliance group https://www.centrepointalliance. com.au/

Erryn Langley is Authorised representative (No. 1269525) of Alliance Wealth Pty Ltd.

This information has been provided as general advice.We may not have considered your financial circumstances, need or objectives. You should consider the appropriateness of the advice.You should obtain and consider the Product Disclosure Statement (PDS) and seek assistance from an authorised financial adviser before making any decisions regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material. It is based on our understanding of current regulatory requirements and laws as at the publication dates. As these laws are subject to change you should talk to an authorised adviser for the most up to date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

By Jodie Moore

When it comes to running a successful business, profit often takes the spotlight. However, there’s another equally—if not more—important financial metric that can make or break a company: cash flow. While profit is a measure of success, cash flow is the lifeblood of day-to-day operations. Understanding cash flow and how to manage it effectively is a key skill in bookkeeping and financial management.

Cash flow refers to the movement of money in and out of a business over a given period. It includes all sources of income (cash inflow) and all payments or expenses (cash outflow). The goal is to maintain a positive cash flow meaning more money is coming in than going out.

There are three main types of cash flow:

1. Operating Cash Flow – Money generated from a company’s core business activities, such as sales of goods or services.

2. Investing Cash Flow – Cash related to the buying or selling of long-term assets, like equipment or property.

3. Financing Cash Flow – Cash received from or paid to investors and creditors, such as loan repayments, dividends, or capital injections.

Even a profitable business can fail if it doesn’t manage cash properly. For example, you might have strong sales and show a net profit on paper, but if customers are slow to pay invoices, you might not have enough cash on hand to pay your bills or employees. This is where cash flow becomes critical.

Positive cash flow allows you to:

• Pay suppliers, rent, and wages on time

• Reinvest in your business

• Weather financial setbacks

• Plan for growth

On the other hand, negative cash flow— when expenses exceed income—can quickly lead to debt or insolvency if not addressed.

Bookkeeping is the foundation of good cash flow management. Accurate, up-todate records help you understand where your money is going, where it’s coming from, and how much cash is available at any time.

A bookkeeper tracks every financial transaction and classifies it correctly— ensuring that inflows and outflows are recorded in real time. This detailed recordkeeping makes it possible to:

• Generate cash flow statements, which summarise cash movements over a period

• Monitor accounts receivable and accounts payable

• Forecast future cash needs

• Identify trends and potential shortfalls

Bookkeepers also play a key role in reconciling bank statements and ensuring that your recorded cash balance matches what’s actually in the bank.

1. Invoice Promptly and Clearly: Delays in billing mean delays in payment. Send invoices as soon as a job is completed and make sure payment terms are clear.

2. Follow Up on Late Payments: Don’t be afraid to chase overdue invoices. Consider offering discounts for early payment or charging late fees.

3. Monitor Expenses: Regularly review your spending. Look for areas to cut costs without sacrificing quality.

4. Plan for Seasonality: If your business is seasonal, plan ahead by saving surplus cash during peak months.

5. Build a Cash Reserve: A buffer of a few months’ operating expenses can provide security during lean periods.

Cashflowismorethanjustabookkeeping buzzword—it’s a vital component of financial health. Bookkeepers provide the structure and accuracy necessary to track, analyse, and improve cash flow. By keeping a close eye on where money is coming from and going to, businesses can make smarter decisions, avoid cash shortages, and create a more stable financial future.

In short, managing cash flow well doesn’t just keep the lights on—it keeps your business moving forward.

By Ethan Strybosch

I just watched The Diary of a CEO episode featuring Amjad Masad, Bret Weinstein, and Daniel Priestley, and one idea stopped me in my tracks:

AI agents, digital employees that think, search, decide, and act on their own.

They’re already being used to replace thousands of jobs in some of the world’s biggest companies. And you can build one in minutes.

It’s hard not to feel overwhelmed by that.

But working in the not-for-profit space, my mind went somewhere else entirely:

What if this same technology, so disruptive to business, could actually unlock capacity for the organisations doing the most good?

Most NFPs don’t have 100 staff. Some don’t even have 10.

They’re underfunded, overworked, and still out here changing lives.

Imagine if they had access to smart, ethical AI agents that could:

· Write donor emails

· Analyse data

· Draft reports

· Schedule campaigns

· Handle admin

· Run operations 24/7

Not to replace staff, but to give them time back.

Time to connect. To build. To breathe.

At Good Cause, we haven’t rolled out AI agents for our clients (yet). But we’re watching closely. Testing the waters. Asking better questions.

How can we make this accessible to small teams?

How do we protect ethics and data?

And how do we use this power to lift people, not just profits?

Because the future isn’t waiting.

But we can shape how it shows up.

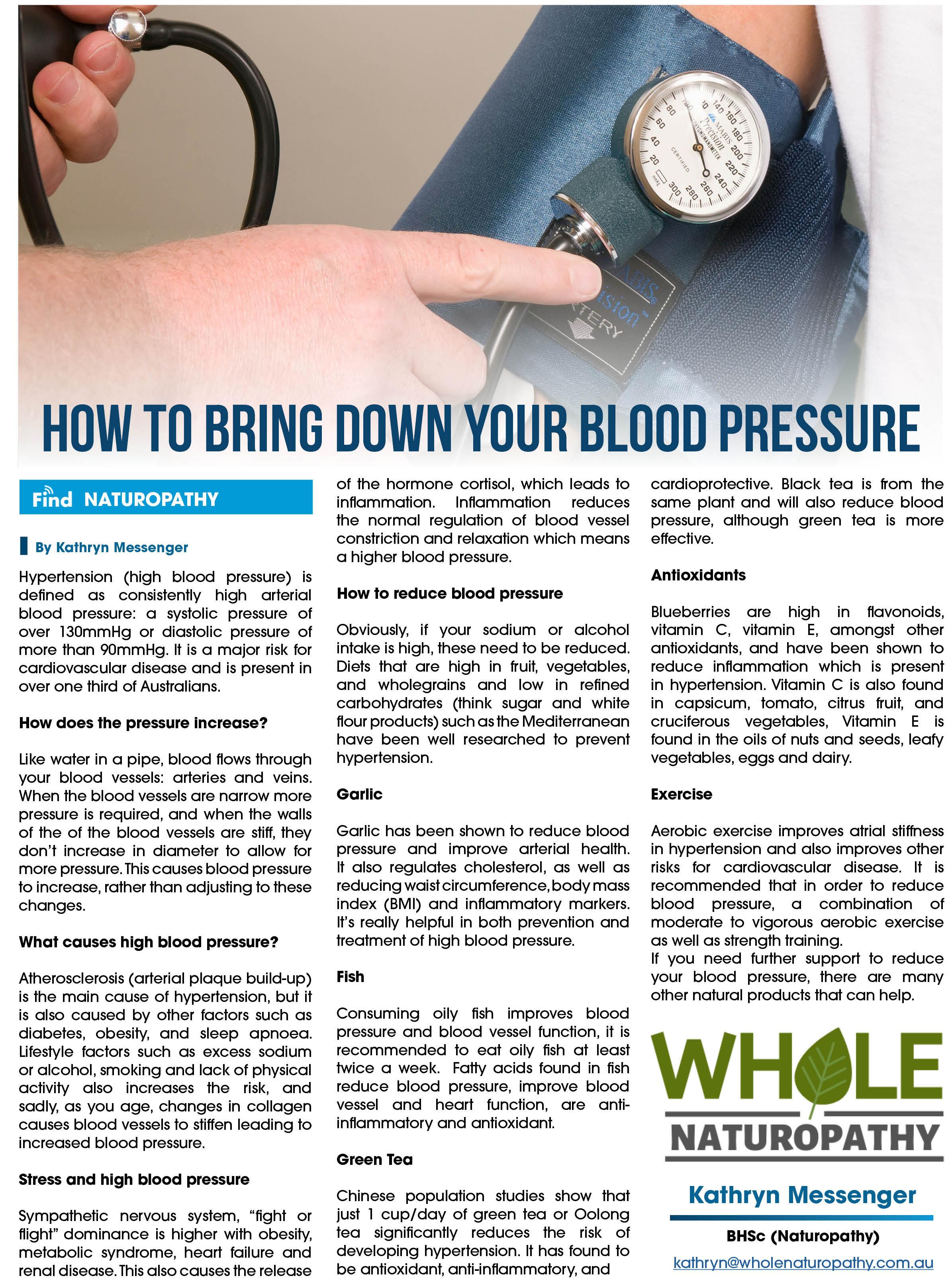

Chinese population studies show that just 1 cup/day of green tea or Oolong tea significantly reduces the risk of developing hypertension. It has been found to be an antioxidant, anti-inflammatory, and

Aerobic exercise improves atrial stiffness in hypertension and also improves other risks for cardiovascular disease. It is recommended that in order to reduce blood pressure, a combination of moderate to vigorous aerobic exercise as well as strength training should be incorporated into your routine. If you need further support to reduce your blood pressure, there are many other natural products that can help.

By Warren Strybosch

In aged care, both RAD and DAP are ways of paying for accommodation, but they differ in how the cost is structured:

• A RAD is a lump sum payment made to an aged care provider when someone enters residential aged care.

• It is fully refundable when the resident leaves or passes away, minus any agreed-upon deductions.

• Think of it like an interest-free loan to the aged care home, which helps them fund infrastructure and services.

• A DAP is a daily fee calculated from the RAD amount using a government-set interest rate called the Maximum Permissible Interest Rate (MPIR).

• Instead of paying the RAD upfront, the resident can pay the equivalent cost over time as a non-refundable daily charge.

• This suits residents who prefer to keep their assets invested or don’t have access to large cash reserves.

• Residents can also choose a part RAD, part DAP arrangement.

Significant changes to RADs are set to commence on 1 November 2025 under the new Aged Care Act. From this date, aged care providers will be permitted to retain 2% per annum of the RAD as a daily rate, capped at five years, totaling a maximum of 10% retention . Additionally, the maximum accommodation price that providers can charge without prior approval has increased from $550,000 to $750,000, effective from 1 January 2025, with annual indexation to follow .

These reforms aim to enhance the sustainability and fairness of the aged care system, ensuring that providers can continue to offer quality care while maintaining financial viability.

Warren Strybosch Award winning Financial Adviser and Accountant

Part of the Find Group of Companies

Financial Planning, SMSF, Super, Insurance, Pre-Retirement & Retirement Planning (Financial Planning) are offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth, Find Insurance and Find Retirement. Find Wealth Pty Ltd is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221). Part of the

Warren Strybosch

Authorised Representative (No. 468091) of Alliance Wealth Pty Ltd. Centrepoint Alliance group (www.centrepointalliance.com.au/fsg/aw).

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice.You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

How much do I need and where does the money go?

By Warren Strybosch

The average amount retirees spend in retirement in Australia depends on their lifestyle and whether they are single or part of a couple. The Association of Superannuation Funds of Australia (ASFA) provides a widely used benchmark:

As of 2024, ASFA estimates:

Comfortable Retirement (per year):

• Single: Around $51,000

• Couple: Around $72,000

Modest Retirement (per year):

• Single: Around $34,000

• Couple: Around $49,000

These figures assume retirees own their home outright and are relatively healthy. A comfortable lifestyle includes things like private health insurance, regular leisure activities, some travel, and eating out. A modest lifestyle covers basic living costs but with less room for discretionary spending.

Total Spending Over Retirement

Assuming a 25-year retirement:

• Comfortable couple: ~$1.8 million

• Modest single: ~$850,000

Of course, individual spending varies based on health, housing, and personal choices.

Retirees in Australia spend most of their money on the essentials, with some variation depending on their lifestyle and health needs. According to ABS data and ASFA research, the main spending categories for retirees are:

1. Housing and Utilities

• Even if the home is owned outright, costs like council rates, home maintenance, and utilities (electricity, gas, water) are significant.

• Renters face higher ongoing housing costs.

2. Food and Groceries

• This remains a consistent expense, though many retirees adjust spending by cooking at home more often.

3. Health Care

• Includes private health insurance, out-of-pocket medical costs, pharmaceuticals, and dental care

• Health costs tend to increase with age.

4. Transport

• Includes car expenses, fuel, registration, and public transport

• Those in regional areas often rely more heavily on private vehicles.

• Many retirees allocate funds for domestic or international travel, hobbies, and dining out, especially early in retirement.

6. Insurance

• Health, home, car, and in some cases life insurance are ongoing costs.

Spending patterns typically decrease as retirees age, particularly after 75, when travel and discretionary spending reduce and health costs often rise.

At Find Retirement, we help clients to answer the important question as to how much money they need in retirement and whether or not they will be able to afford all of their future gaols.

Ifyouareabouttoretire,considerspeakingtooneofAustralia’s top retirement specialists about your retirement needs.

Warren Strybosch Award winning Financial Adviser and Accountant

Financial Planning, SMSF, Super, Insurance, Pre-Retirement & Retirement Planning (Financial Planning) are offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth, Find Insurance and Find Retirement. Find Wealth Pty Ltd is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221). Part of the

Warren Strybosch

Authorised Representative (No. 468091) of Alliance Wealth Pty Ltd. Centrepoint Alliance group (www.centrepointalliance.com.au/fsg/aw).

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-todate information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

With almost 800 local people taking part in the consultation on this year’s Budget and 10 Year Financial Plan, Manningham Council is set to deliver for the community in 2024/25 and beyond!

Councillors endorsed the key documents at their meeting last night (25 June).

With an operating budget of $155 million, Council will provide more than 100 valuable services for residents, businesses and visitors. This incorporates maintaining and enhancing community assets with a $55 million capital works program, including:

• $12 million for roads and bridges

• $6 million for footpaths and cycleways

• $4 million for drainage

• $3.1 million for the Schramm’s Cottage Museum Complex Visitor Centre

• $1.6 million for playspace renewals

• $1.2 million for Ruffey Lake Park Masterplan implementation

• $1.1 million for Rieschiecks Reserve Management Plan

• $1.0 million to commence works on a co-working hub

• $1.0 million for a battery for Mullum Mullum stadium

• $0.3 million for a youth hub

Council will also continue to deliver on its Climate Emergency Action Plan to reduce the impacts of climate change, having allocated $11 million in the capital works program (over the next ten years) for Circular Economy, sustainability initiatives.

Conscious of cost-of-living pressures, Council will continue to support rate payers through:

Freezing the waste service charge well below the 4.80 per cent increase in the cost of waste services to Council.

• Financial hardship provisions including rates rebates for Low Income (LI) Health Care Card holders.

• $2.25 million for community grants and contributions programs.

• Continued financial support to agencies that provide emergency relief to those in need in the community.

• Funding for the provision of food relief for those in need in the community.

• Subsidies for school holiday programs.

• An average general rate increase in line with the State Government’s rate cap of 2.75 per cent.

Manningham Mayor, Councillor Carli Lange thanked everyone who contributed.

“We’re proud of the Budget and 10 Year Financial Plan and feel we’ve managed to balance delivering on our community’s needs while sustaining our commitment to being a financially responsible Council.

“We started working on the Budget back in November and had an incredible number of residents take part in our three different stages of consultation. Thank you all for your valuable insights.”

• $21 million for a healthy community

• $40 million for liveable places and spaces

• $19 million for a resilient environment

• $6 million for a vibrant prosperous economy

• $33 million for a well governed Council

Budget highlights

$3.1 million to build the Schramm’s Cottage Museum Complex Visitor Centre in Doncaster East

Council will build a new, multipurpose visitor centre in Rieschiecks Reserve as part of the Waldau Precinct Master Plan. The Visitor Centre will include spaces for exhibitions and meetings, as well as accessible public toilets. Council will also upgrade the paths surrounding the centre and expects the project to be completed in early 2025.

$1.35 million to deliver the main phase of works for the Templestowe Route upgrade in Templestowe

The Templestowe Route is a 1.8km series of important local link roads between Templestowe Road and Williamson Road, including Parker, Swilk, James and Anderson streets. The upgrade will improve safety, pedestrian connectivity and the quality of infrastructure along the route.

$1.0 million to start work on a co-working hub at MC Square in Doncaster

The co-working business hub at MC Square will be far more than a professionally designed and operated space to conduct business. It will support a healthy economy and the business community, with a concierge and tailored calendar of events to create excitement and stimulate cooperation, as well as spaces for 30 to 40 users. Council expects the co-working business hub to open in July 2025.

Local home-based and small businesses will benefit from a vibrant new coworking business hub located at MC Square Doncaster from mid-next year.

Manningham Council is investing $1.6 million from the 2024–2025 and 2025-2026 Council Budgets to redevelop existing, underutilised space to create a highend, well-resourced and accessible work destination for local business operators. Recent studies show that, while demand for co-working environments has grown post-COVID, there is a significant shortage of available spaces in the eastern region.

An estimated 80 per cent of all registered Manningham businesses are homebased and Manningham Mayor, Cr Carli

Lange said the hub will play an important role in supporting these businesses.

“We know there are significant, proven benefits to co-working spaces, including opportunities to grow your networks, collaborate with other entrepreneurs and access professional high-end facilities without the usual overhead,” Cr Lange said.

“Small business owners and operators are a crucial part of our local economy and we are passionate about helping them to succeed.

“Our new co-working business hub will be an investment in the future of small business,” the Mayor added.

The development and operation of the co-working business hub is a Council Plan 2021–2025 priority and a key part of the Economic Development Strategy 2023–2028.

The Hub will be a contemporary space with everything on hand, including day and evening networking and upskilling events and a virtual receptionist, enabling members to have a dedicated business address for correspondence.

Filled with natural light, the space overlooks the leafy environment of Doncaster and beyond to the mountains. A vibrant café space downstairs provides a place for coffee and chats with clients and business connections.

Manningham Council will open a new youth hub at MC Square in Doncaster this August to support young people across Manningham.

MY Hub will open its doors on Thursday 8 August 2024 as a dedicated space for young people aged 10 to 25 in Manningham to find support, resources, and referrals from Manningham’s Youth Services (EACH) team.

Manningham Mayor, Councillor Carli Lange said Council is committed to supporting all young people in our community.

“Our young people are the future of Manningham. We want to make sure everyone has the resources and support they need to thrive locally,” Cr Lange said.

“MY Hub will be a welcoming and empowering space where young people can find the help they need to grow, connect, and thrive in our community.”

The services available at MY Hub will include:

• Free mentoring support, guidance, and advice for young people aged 10 to 25

• Leadership and community engagement opportunities

• Youth programs for schools and local community groups

• Support for community service providers and businesses

“In my discussions with Manningham Deputy Mayor and chair of the Manningham Youth Advisory Committee Councillor Laura Mayne, she said it will be a great new space for Manningham and encourages everyone to check out the new youth hub” Cr Lange said.

“Our goal is to create a welcoming space where young people can access the support they need, engage with their community, and build a bright future,” Cr Lange saidThe youth hub is a key action in Council’s 2021-2025 Council Plan, which prioritises better support and services for young people.

“Creating a youth hub is a major initiative that reflects our community’s desire for better youth support services. We are committed to ensuring everyone can access these resources easily and be part of a healthy and safe community,” Cr Lange said.

Located on level one of MC Square in Doncaster, MY Hub will join a range of other community services that make MC Square a central hub for the Manningham community, including Whitehorse Manningham Libraries, Manningham Art Gallery, Doncare, Doncaster Maternal and Child Health Service, Doncaster Kindergarten, and Early Years at MC Square.

For young people, parents, or carers looking for support, visit MY Hub at MC Square in Doncaster or reach out via the website below. each.com.au/manninghamyouth

Manningham resident and trailblazing interdisciplinary artist Grace Dlabik is presenting her latest exhibition titled kose karu kin at the Manningham Art Gallery from 26 June to 10 August.

Grace has over 25-years’ experience and has been highly sought after for her vision and work in future thinking and community building. Grace’s work has been deeply informed by her Melanesian heritage as she creates connected environments with community care and culture at its core.

Manningham Mayor, Councillor Carli Lange, said the exhibition is a fantastic opportunity to experience the works of local resident and distinguished artist Grace Dlabik.

“This immersive exhibition explores the themes of culture, connection and

community and I encourage everyone to visit the gallery and enjoy.” Cr Lange said.

Grace was awarded the 2023 Mordant BLAK C.O.R.E Fellowship, during which she led karu kin, a project focused on connecting indigenous women and nonbinary folk through clay making. This project informed her current exhibition at the Manningham Art Gallery, titled kose karu kin.

“This exhibition is a combination of my own art, titled kose, and a special project karu kin that I led during my fellowship.” Grace said.

“kose is comprised of limestone sculptures that represent pillars of strength in community, kinship systems of care and nourishment.

“A reminder of who I am, who we are and

where we come from and honouring my matrilineal bloodline.

“karu kin is the project that speaks to the kinship relationality and ways of connection through gathering and sharing through clay making. This involved seven indigenous women and non-binary people.

“Both projects of work use nature as a way of deeply connecting to our culture and the body of work that combines the use of both materials of the earth, limestone and clay.”

To see Grace’s incredible exhibition and experience her inspired work in person, visit the Manningham Art Gallery, located Ground Level, MC Square, 687 Doncaster Road, Doncaster.

For more details, visit manningham.vic. gov.au/events/kose-karu-kin.

Are you looking for a creative way to show someone how much you appreciate the difference they make to the Manningham community?

Nominations are open for the 2024 Manningham Civic Awards. The awards recognise individuals and community organisations improving the local area through volunteer, paid or unpaid work. Manningham Mayor, Councillor Carli Lange encouraged the community to nominate.

“Nominating a friend, family member or someone you work with is a great way to show how much you value and appreciate the difference they make,” Cr Lange said.

“Civic Awards are important because they raise awareness of all the good things happening in our community and acknowledge individual and group contributions.”

There are five award categories:

1. The Citizen of the Year Award –recognises a Manningham resident whose outstanding contribution has improved the lives of the local community.

2. The Young Citizen of the Year Award – for an outstanding contribution made by a young Manningham resident to improve the lives of the local community.

3. The Doreen Stoves Volunteer of the Year Award – recognises the contribution made by a volunteer in the local community.

4. Sports Volunteer of the Year Award – for individuals who demonstrate leadership in the Manningham sporting community.

5. Community Organisation of the Year Award – acknowledges community organisations, clubs or groups who have gone ‘above and beyond’ to improve the lives of the Manningham community.

Hear from last year’s winners 2023 Sports Volunteer of the Year Award recipient, Caroline Clarkson, was awarded a Civic Award for her devotion to the Doncaster Dolphins Masters Swimming club. Caroline held various roles on the committee at the swimming club, including registrar, recorder, secretary and president.

Caroline was nominated by Dee Sheffrin, who said “Caroline has enriched the lives of our members working tirelessly and professionally. She has made many positive changes and improvements for the benefit of their health, fitness, wellbeing, and social connection.”

Manningham’s 2023 Citizen of the Year, Dennis Clarke, was diagnosed with polio after returning from the Vietnam war. Dennis has since become a pillar within the community through his work with Doncaster RSL as the Senior Vice President, Secretary of RAEME Vietnam Southern Chapter (previously Inaugural President), Anzac and Poppy Appeals, active participant of committees such as VVAA Box Hill Committee, ALPGA, VACC, RACV and more.

Surprised and honoured to receive his award, Dennis said “It feels amazing – a total surprise. I have never needed anything like this. It was a lovely gesture.”

Manningham’s 2023 Young Citizen of Year, Berry Eain, received her award for her commitment to bridging the gap between local and international

students within her school and the wider community.

Berry,an advocate for student voice,shared her gratitude for receiving an award.

“Growing up, I have always had strong intentions of striving for the betterment of myself, my family and my community. Unfortunately, this was not the reality in my home country, Myanmar.” Berry said.

“I was genuinely surprised by the emphasis on student voices and youth engagement in Manningham. It was a whole new concept to me to see young people actively undertaking volunteering and leadership roles.

“I am honoured to be able to use my agency and voice for those in my home country, spreading awareness that despite lack of opportunities, we can still be leaders for ourselves one day.”

Nominations are now open for the Civic Awards and close Monday 22 July 2024. Winners will be announced at the 2024 Ceremony on Thursday 22 August 2024. To find our more or to nominate visit, manningham.vic.gov.au/civic-awards.

Last night Council endorsed Manningham’s suite of key strategic documents, marking a decisive step toward building a vibrant and sustainable future. This included its Council Plan 20252029 and 2025/26 Budget.

Manningham Mayor, Councillor Deirdre Diamante said: “It’s essential that Council’s actions reflect what truly matters to the people who live here – what they value, what they want improved and what kind of future they envision for our neighbourhoods.

“Endorsing these strategic documents is more than a procedural step. It’s a commitment to delivering real and lasting outcomes for our community.

“Together, they set a clear direction for the future – one that is community-led, inclusive and focused on delivering meaningful outcomes for everyone who calls Manningham home,” Cr Diamante said.

At its meeting on Monday 30 June, Council formally endorsed the following documents:

• Council Plan 2025-2029 (including the Municipal Public Health and Wellbeing Plan) and supporting Action Plan

• 2025/26 Budget (an annual document)

• 10-Year Financial Plan 2025/26 to 2034/35

• Revenue and Rating Plan 2025/26 to 2028/29

• Asset Plan 2025–2035 and Asset Management Policy

The endorsed documents are the result of extensive community engagement. They have been shaped by the Manningham Community Panel’s recommendations, the Community Vision 2040, and feedback from the broader community, advisory bodies, partners, Councillors and Council officers.

“We’ve listened to our community’s concerns, priorities and aspirations for Manningham. From the rising cost of living, community safety, access to transport and open spaces, and protecting the unique character of our neighbourhoods as we grow – we understand what matters most to you.

“Together, we’ve created a roadmap that reflects our shared values and sets us on a path toward a healthier, more connected and resilient future,” Cr Diamante said.

At the heart of the Council Plan is a strong focus on building a healthier, more vibrant city.

For the first time, Council has integrated its Municipal Public Health and Wellbeing Plan into the Council Plan to ensure a unified approach to achieving the highest possible standard of public health and wellbeing, while meeting legislated obligations.

“We know that building a great city isn’t just about infrastructure and services. It’s about the health, happiness and resilience of our people. This integrated approach ensures that every decision we make supports the wellbeing of our community, now and into the future.

“Together, all these strategic documents lay the foundation for a stronger, more inclusive Manningham – one that reflects our community’s voice and is ready to meet the challenges and opportunities ahead,” Cr Diamante said.

To view Council’s full suite of strategic documents, including the Council Plan 2025-2029, 2025/26 Budget, visit www. manningham.vic.gov.au/about-council/ strategies-and-action-plans.