3 minute read

LOCAL STORIES

Financial Adviser Standards and Ethics Authority (FASEA) is a Commonwealth entity that was established in April 2017 to set standards for the ethical conduct, educational qualifications and ongoing training of licensed financial advisers in Australia.

One of the new laws that was introduced for all financial advisors, existing as well as those entering the financial planning industry, was to sit the FASEA exam. Since the introduction of the exam and the requirement to update financial planning qualifications from a diploma to at least a bachelor standard, the profession as seen a increase in the numbers of those leaving. No longer is this a place for salespeople.

The pass rate of the FASEA exam has been on a downward trend since the inaugural sitting in June 2019 which had 90 per cent of 579 candidates pass. That dropped down to 79 per cent in April 2020 (the first to include remote proctoring), 69 per cent in May 2021, and only 328 candidates (52 per cent) passed in July and August exams.

ASIC confirmed that 76 per cent of the candidates were resitting the exam for at least the second time.

Of those who have passed so far:

• Over 15,800 are recorded as current financial advisers on ASIC’s Financial

Adviser Register (FAR), representing 95% of current advisers on the FAR. • Over 2,500 are ceased advisers on the FAR and may be re-authorised in the future. • Over 700 were new to the industry. • Over 3,300 unsuccessful candidates have re-sat the exam, with 74% passing at a re-sit.

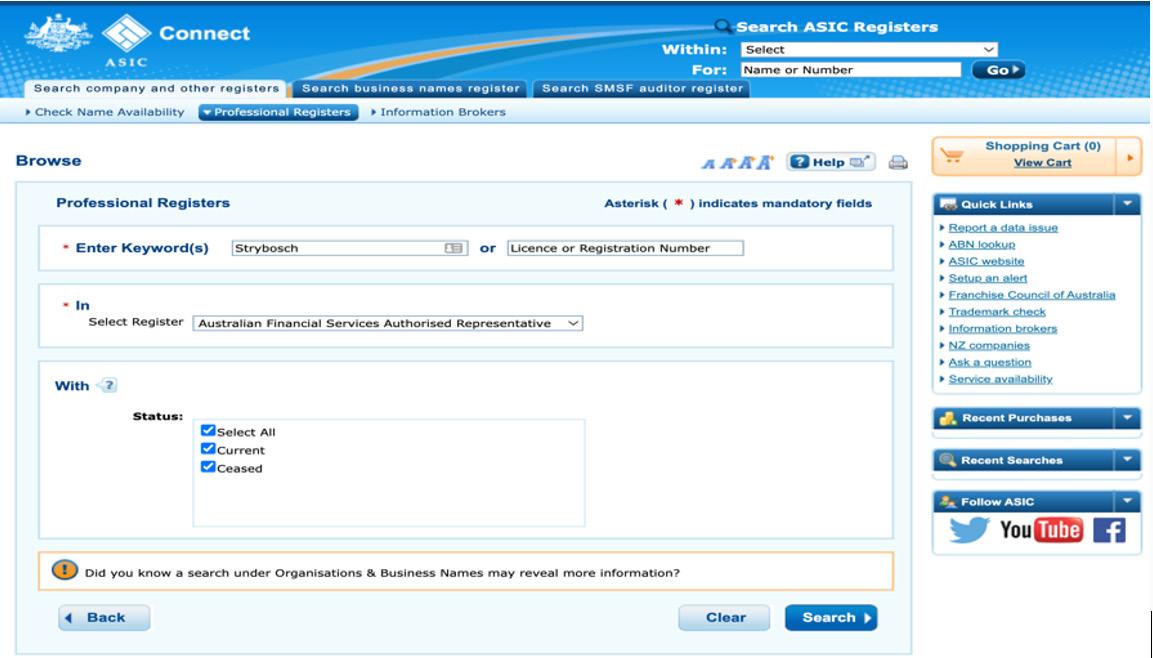

Note: Currently, you cannot view who has or has not passed the FASEA exam. All you can do is check the ASIC website to see if the advisor is still registered as a financial planner. Go to asic.gov.au and selecting the ‘Professional Registers’ on the right. You then type in the Surname of the advisor and choose the appropriate registry e.g., Australian Financial Services Authorised Representative (example provided).

The latest sitting was the last opportunity for advisers who are operating under the nine-month exam extension to pass the exam. From 1 October 2022, all financial advisers must have passed the exam to continue to provide personal advice. ASIC has confirmed anyone eligible for the extension who has not passed in any of the three cycles this year will not be able to provide personal advice from 1 October.

“For financial advisers who are eligible for the exam extension, but have not passed the exam in 2022, there is an opportunity for you to take steps with your Australian financial service (AFS) licensee to limit the effect of this outcome,” ASIC said in a statement.

“If your licensee ceases your authorisation on or before 30 September 2022, you will still need to pass the exam before you can become re-authorised and re-commence providing personal advice. However, you will not need to complete a professional year and you will have until 1 January 2026 to obtain an approved degree.

“If your licensee does not cease your authorisation on or before 30 September 2022, it will cease by operation of the law and you will no longer be able to provide personal advice. To become re-authorised and re-commence providing personal advice you will need to complete a professional year and obtain an approved degree in addition to passing the exam.”

It is important as consumers to ask the following questions of the advisors you sit down with: 1. Have you passed the FASEA exam? 2. Have you completed your education requirements or are on track to do so?

If the advisor has not passed the exam and is not likely to meet their education requirements by 2026, then you need to consider whether they are the right advisor you want to be dealing with. Otherwise, you might start off with the first advisor only to find you have no choice but to move onto another advisor. This is not an ideal situation for anyone especially retirees. Also, moving to another advisor might require you to start all over again and who wants to pay all those initial fees again?

At Find Wealth, all our advisors have passed their FASEA exam and either have completed all their studies or will have well before the 2026 deadline. You can have peace of mind when dealing with Find Wealth that you won’t have to start all over again.